Abstract

In this work, we examine the correlation between financial inclusion and the Environmental, Social, and Governance (ESG) factors of sustainable development with the assistance of an exhaustive panel dataset of 103 emerging and developing economies spanning 2011 to 2022. The “Account Age” variable, standing for financial inclusion, is the share of adults owning accounts with formal financial institutions or with the providers of mobile money services, inclusive of both conventional and digital entry points. Methodologically, the article follows an econometric approach with panel data regressions, supplemented by Two-Stage Least Squares (2SLS) with instrumental variables in order to control endogeneity biases. ESG-specific instruments like climate resilience indicators and digital penetration measures are utilized for the purpose of robustness. As a companion approach, the paper follows machine learning techniques, applying a set of algorithms either for regression or for clustering for the purpose of detecting non-linearities and discerning ESG-inclusion typologies for the sample of countries. Results reflect that financial inclusion is, in the Environmental pillar, significantly associated with contemporary sustainability activity such as consumption of green energy, extent of protected area, and value added by agriculture, while reliance on traditional agriculture, measured by land use and value added by agriculture, decreases inclusion. For the Social pillar, expenditure on education, internet, sanitation, and gender equity are prominent inclusion facilitators, while engagement with the informal labor market exhibits a suppressing function. For the Governance pillar, anti-corruption activity and patent filing activity are inclusive, while diminishing regulatory quality, possibly by way of digital governance gaps, has a negative correlation. Policy implications are substantial: the research suggests that development dividends from a multi-dimensional approach can be had through enhancing financial inclusion. Policies that intersect financial access with upgrading the environment, social expenditure, and institutional reconstitution can simultaneously support sustainability targets. These are the most applicable lessons for the policy-makers and development professionals concerned with the attainment of the SDGs, specifically over the regions of the Global South, where the trinity of climate resilience, social fairness, and institutional renovation most significantly manifests.

Keywords:

financial inclusion; ESG framework; developing countries; instrumental variables; sustainable development JEL Classification:

G21; O16; Q56; I38; H55; O44; C33

1. Introduction

In the past decades, financial inclusion has become the center stage in the world development agenda as a principal force in the way people are expected to reduce the level of poverty, achieve economic stability, and stability in growth and sustainable development. Financial inclusion is widely defined as access and use of financial services provided through the organized financial system by the entire populace—more so the poor and the vulnerable—has taken position in international policymaking documents such as the Sustainable Development Goals, specifically SDG 8.10. Formidable attention and academic enthusiasm addressed to financial inclusion notwithstanding, large chasms still lay in the understanding of the deeper systemic and structural determinants and mechanisms propelling and constraining financial inclusion in developing economies (Zulkhibri, 2016). Of great concern is the nexus between financial access and the Environmental, Social, and Governance (ESG) aspects of development, and this still remains a poorly covered area in extant scholarship. This study bridges this significant research gap by developing and testing a new framework to analyze financial inclusion in developing countries using disaggregated ESG measures. Contrary to the mainstream use of the aggregate or unified concept of ESG in the study of sustainability, this study breaks up ESG and its components and estimates their respective contributions to access to finance. More recent scholarship also brings attention to the moderating role played by poverty in the ESG-financial inclusion linkage and the complexities entangled with such interactions (Jain et al., 2024). Drawing samples from 103 developing countries over a 12-year time frame using comprehensive longitudinal panels from the World Bank and other international institutions’ related datasets, we explore the respective contributions made individually to access to finance by environmental sustainability, social infrastructure, and good governance quality.

The research guiding framework used in this research is

- In what way do the Environmental, Social, and Governance components of the ESG framework individually contribute to financial inclusion in developing economies, and how can each such effect reliably be quantified through econometric and machine-learning methods?

We resolve this issue through the adoption of a mixed methodological approach based upon the application of conventional panel econometrics supplemented with instrumental variables methods and advanced machine learning algorithms in order to apply them to regression and cluster analysis purposes. The econometric model allows us to manage the issues related to endogeneity and causality, while the machine learning models, both supervised type (e.g., Random Forest regression) and unsupervised type (e.g., Fuzzy C-Means clustering), reveal profound non-linear relationships and allow countries’ classification according to policy-related categories (Park et al., 2024).

Our lead financial inclusion indicator is Account Age, the share of adults in a nation who say they have an account at a bank or with a mobile money service provider. This measure has achieved broad consensus as a quantitative proxy for access to the formal financial system and reflects both the penetration of established financial system infrastructure and new digital finance innovations. By considering the effect each of the ESG pillars has separately on Account Age, we will endeavor to build a more nuanced view of the determinants driving financial inclusion in developing economies.

Environmentally, we look at the part played by ecological modernization through proxies such as the use of renewable energy, agricultural production levels and biodiversity conservation, and sensitivity to climatic stress. The concept being that green infrastructure (like solar energy off the grid) can actually promote financial access via facilitation of digital payments in remote areas, while increasing climate risk can increase savings or insurance product take-up (Xie, 2024). While at the same time, agrarian institution resilience—reflected in high proportions of agricultural land—may indicate structural impediments to financial access in off-grid rural economies.

Along with this, ESG-based analyses have also helped identify risk-mitigated and credible behaviour in individuals and institutions and lending legitimacy to the application of such variables to economic models (Aghaei et al., 2024). Blending this with our model helps to promote the analytical depth of our machine-learning models and predictive ability in the estimation of access dynamics in the Global South.

On the social side, we apply human development indicators such as education expenditure, internet penetration rates, life expectancy at birth, access to sanitation, and female labor market participation. They are the social capacities upon which financial inclusion depends—i.e., literacy, access to digital technologies, health and well-being, and gender equality. The more advanced the human development in a nation is, the more it is expected to achieve better financial inclusion performance through improved public awareness, institutional trust, and improved ability to make use of financial products and services (Khalil & Siddiqui, 2020). Social infrastructure is a trigger to access to formal financial services if the digital expansion remains in place.

The governance factor assesses the extent to which institutional quality facilitates or deters access to financial services. Control of corruption, regulatory framework quality, rule of law, and voice and accountability are the measures used to test the hypothesis that good governance creates a facilitative environment for the financial sector to flourish. Governance is at the core of the role played in deciding if citizens are able to access identification systems, if contracts are enforceable or otherwise, and if protection mechanisms work or do not work for consumers, each being a need for a sustainable and inclusive financial system (Maket, 2024).

To estimate the empirical relations between the aforementioned ESG pillars and financial inclusion, we apply panel data regressions complemented with instrumental variables (IV) in order to counter concerns of simultaneity, measurement errors, and omitted variables. This is particularly imperative in the governance-financial inclusion nexus, where causality might run both ways. Our instruments are drawn from a universe of exogenous ESG-linked variables—such as climate indicators, demographic measures, and environmental stressors—that are correlated with the endogenous regressors but not the error term in the inclusion equation.

We estimate two econometric models: Generalized Two-Stage Least Squares (G2SLS) with random effects and Two-Stage Least Squares with fixed effects. Both are used over a balanced panel of more than 1200 observations to enable robust inference across countries. The need to account for the interdependencies between the variables is further emphasized in recent evidence revealing that income inequality, institution quality, and human development co-determine financial depth and breadth of inclusion in developing countries like Africa (Kebede et al., 2023).

The econometric evidence is supplemented with a parallel alternative analytical pathway: machine learning modeling, predicting, and classifying financial inclusion levels based on ESG attributes. In this case, we apply a combination of supervised regressions, including Random Forest, Neural Networks, Support Vector Regression, and the use of the Boosting techniques to model predictive performance using the common measures, including Mean Squared Error (MSE), R2, and Mean Absolute Percentage Error (MAPE). Of the models, Random Forest Regression performs the best and extracts leading non-linear relations and key importances across the variables. More importantly still, the strongest predictors include agricultural productivity (AGVA), renewable energy use (RENE), and the share of areas protected (PROT)—a result eminently derivable from the recent work based on advanced use of machine learning to uncover ESG-finance interlinkages (K. Li, 2025). In parallel, we apply Fuzzy C-Means clustering—a type of unsupervised use of machine learning—enabling countries to be grouped based on ESG and financial inclusion variables according to soft clusters. This method enables flexible segmentation and the identification of typologies such as “green but excluded,” “socially advanced and inclusive,” and “institutionally weak and financially marginalized.” Such nuanced designations enable both interpretative depth and policy design since countries in the same cluster can, in turn, be addressed with interventions proportionate to their context. The clustering framework also extends the use of the classical econometric analyses since the complex interdependencies and latent patterns characterising the cross-country development context can be accommodated. In yet a further improvement, the use of stacked generalisation techniques using the ensemble methods to aggregate predictive models collectively and achieve greater aggregate robustness is also proving to be beneficial when the aim is to uncover nuanced ESG-finance interaction across different national contexts (K. Xu et al., 2024). This ensemble method extends the utility in the use of AI-informed insights within financial inclusion analysis, in particular, where policy differentiation according to ESG type is the objective

We recognize each ESG factor to have a distinct and measurable impact on financial inclusion performance. Environmental modernisation—captured through investment in renewables and protection of biodiversity—has a positive relation with financial access, and agrarian economies have a negative relation. Socially, digital access and gender equality measures are the robust positive predictors capturing the reality that digital connectedness and gender-inclusive labor markets are robust enablers of access to the financial system (Jain et al., 2024). Governance and financial inclusion have a positive relationship, and access to regulation in new forms is where weak regulation remains the inhibitor.

These findings are consistent both across econometric and machine learning methods and are thus more widely applicable across a broad array of developing-country situations. More current innovation in predictive modeling based upon data, such as the inclusion of ESG attributes in financial outcome projections, further legitimizes our approach (Park et al., 2024).

This research makes three key contributions. First, we provide the first big-data, disaggregate financial inclusion analysis over developing countries based on panel data econometrics and sophisticated machine learning techniques. Second, this study bridges methodological paradigms via the integration of causal inference and predictive modeling to make more nuanced and rich insights available. Third, this study provides recommendations to direct the work of development practitioners, central banks, and multilateral institutions towards the development of context-specific and ESG-driven governance practices to promote financial inclusion. With sustainability, resilience, and inclusion increasingly recognized as interconnected pillars reinforcing one another, it is more and more important to understand the interlinkages between environmental-social-governance and financial access. By incorporating a structured and evidence-based perspective, this study encourages a more holistic understanding of development policy, and financial inclusion is addressed and considered as part of the very core of sustainable development systems rather than as a distinct outcome in itself (K. Li, 2025).

The article continues as follows: Section 2 presents the literature review, Section 3 contains the methodology, Section 4 presents the relationship between financial inclusion and the E-Environmental component within the ESG model, Section 5 investigates the relationship between the S-Social component and the ESG model, Section 6 shows the relationship between financial inclusion and the G-Governance component within the ESG model, Section 7 analyses the policy implications, the Section 8 presents conclusions. Appendix A, Appendix B, Appendix C and Appendix D contain further materials, data, summary statistics, hyper-parameters, and abbreviations.

2. Literature Review

This paper fills basic gaps from the literature at the intersection of financial inclusion and sustainable development by reimagining inclusion as a natural endogenous component of the ESG (Environment, Social, and Governance) framework, rather than a marginal socio-economic end. Financial inclusion has, with almost complete exemption, been studied singly or dyadically with social or environmental indicators. This paper makes a timely addition by providing an integrated ESG-based analytical framework. The literature is notably scarce in theorizing and empirically validating the two-way causal relationships between financial access and all-encompassing sustainability indicators, notably from the perspective of developing regions.

The paper fills the empirical void by employing an extensive macro-panel dataset of 103 emerging markets over 12 years (2011–2022) and therefore permits the temporal dynamics and intra-country heterogeneity to be appropriately controlled. Earlier work is typically cross-sectional or limited-panel specifications, often with poor geographic generalizability. The richness and the breadth of the dataset beget a stronger foundation upon which the structural connection between ESG factors and financial inclusion can be estimated.

Methodologically, the paper makes a contribution by combining instrumental variable techniques with a panel 2SLS approach, using ESG-compatible instruments to control for endogeneity—an issue frequently observed, but hardly forcefully addressed, in the literature. Additionally, the employment of machine learning methodologies, either for regression purposes or for clustering, permits the model to capture complex, non-linear interactions and heterogeneous country configurations better. This blending of approaches distinguishes the study from standard econometric analyses, which assume homogeneity and linearity.

Overall, the paper makes an important contribution by theorizing financial inclusion as a complex vector stimulated by environmental modernization, socio-institutional capability, and the effectiveness of governance. Its findings are in favor of the hypothesis that integrative ESG-financial frameworks are central to the achievement of resilience and fairness in development financing, particularly in the Global South.

The nexus between ESG and financial inclusion in developing countries is a complex and dynamic relationship that acts as a vehicle for sustainable and inclusive development and sustainable finance. Originally conceived as a social goal, financial inclusion as a concept emerged as a cross-cutting force behind all the ESG elements—Environmental, Social, and Governance—where structural disparities and access to finance are weak. According to Buckley et al. (2021), FinTech innovations can fill the financial gaps effectively and map financial access with the UN SDGs, while Chafai et al. (2024) demonstrate empirically through their evidence that institutional quality through audit quality enhances the ESG impact of financial access in the MENA region. Bibliometric analysis of scholarly fascination with this point of meeting has been presented by F. Ahmad et al. (2024), but they do not deeply embed the Global South-specific issues concerned. The emergence of digital technologies accelerated inclusive financing through the confluence of various digital innovations, as noted by Austin and Rawal (2023) and Dhanabhakyam and Suresh (2024), but innovation creates exclusion and algorithms risks and raises rollout and dissemination ethics concerns as well as fairness concerns over outreach.

Meanwhile, researchers such as Al-Baraki (2022) and Anwar et al. (2023) stress impact measurement and targeted capital flows and persistent bottlenecks such as gender disparity and lack of formality. Gonzalez et al. (2025) emphasize ambitious and comprehensive action at the nexus between climate change, social responsibility, and e-finance access, but their normative perspective might overlook low-capacity bottlenecks. Work such as Jain et al. (2024) illustrates the potential through empirical research in ESG and financial inclusion to promote sustainable growth, if the systemic moderator of poverty is addressed. W. Li and Pang (2023) and Khalid et al. (2024) support the corporate aspect with evidence of digital inclusion mitigating ESG-related conflicts, though W. Li et al. (2024) also find that the more pronounced role of greenwashing persists, lowering the efficacy of ESG disclosers. Halim (2024) expands the coverage to crowdfunding as a financing conduit and finds disparity across benefits’ distributions. Macro-level research, such as Hassani et al. (2024) and Kiran et al. (2025), is correlated with financial development and good ESG integration, and Khan et al. (2025) explore the enabling role of blockchain and green tech, albeit depending upon international financial integration and equitable infrastructure.

Further operational takeaways are provided by J. Liu and Naser (2024), noting increased bank performance—vital in weak economies—as a result of more inclusive finance, reflecting the views of Malik et al. (2022), recognizing social sustainability as a stabilizer in the case of Asia. Governance capacity, mentioned by H. Lu and Cheng (2024), acts as a mediator between the digital finance ESG effect and X. Liu et al. (2024) and R. Liu (2024) explore the use of AI by China in order to broaden ESG output, with governance ethics still unresolved as a contradiction. Portfolio-level applications are mentioned by Lindquist et al. (2022), with the focus being the incorporation of ESG information within developing economies, and Mirza et al. (2025) establishing the connection between ESG-based lending and techno-investments and stability in banks within BRICS economies. Y. Lu et al. (2022) recognize the role played by digital inclusion in increasing ESG transparency in the case of China and the EU but warn that those benefits are policy contingent.

On the firm or corporate level, Pan (2025) warns of the need for SME-oriented financial tools in digital environments Roy and Vasa (2025), using bibliometric analysis, document the trend towards FinTech-powered ESG financing in resource-constrained environments. Rajunčius and Miečinskienė (2024) outline a more comprehensive framework blending payment innovation, socially focused equity, and ESG evaluation, and Shala and Berisha (2024), Ravichandran and Rao (2023) both highlight FinTech’s pivotal role towards ESG progress, but also the potential digital illiteracy risk. Legal foundations are weak institutionally, Schwarcz and Leonhardt (2021) remind us and and therefore policy coordination across regions is difficult. Tekin (2025) finds Islamic finance to be a culturally resonant model of inclusive ESG in the OIC economies. More advanced ways forward, require the incorporation of well-being goals such as happiness in ESG risk models and require a broader reimagining of the social impacts. Empirical work from Suresha et al. (2022) reports financial evidence from Indian markets and illustrates the way in which ESG-matched firms have better financial performance and liquidity, and this supports the materiality of inclusive ESG strategies.

Recent research supports the “S” of ESG—so woefully underrated—is key to sensitive and inclusive financial transformation. Ubeda et al. (2023) make this case in the context of the Global South and promote socially-responsible financial models. In the Indian context, M. Yadav et al. (2024) and R. A. Yadav et al. (2024) discuss the ability of FinTech innovations to diffuse ESG-compatible services to remote zones and lead operations towards sustainability. Empirical evidence from J. Xu (2024) and Xue et al. (2023) ascertains this alteration in China, too, where ESG performance shifts through the use of AI-guided financial instruments and risk in domains of digitization and accessibility. Rework by Thomas (2023) takes a critical analysis of the greenwashing drift in ESG investment and reiterated by W. Li et al. (2024), warns that more ESG action will prove pointless if left without accountability mechanisms. Cumulative analysis through bibliometrics by Trotta et al. (2024) and Upadhya et al. (2024) charts a fractured yet fast-growing body of work wherein FinTech emerges as a key enabler in re-locating the arena of ESG debate. Though momentum gathers, M. Yadav et al. (2024) warn that without coordination through policy and enabling infrastructures, and importantly in the remote areas, the transformational potential of digital financial expansion through ESG models remains unrealized.

A synthesis of the literature review is presented in the following Table 1.

Table 1.

Synthesis of the literature by macro-themes.

3. Methods and Data

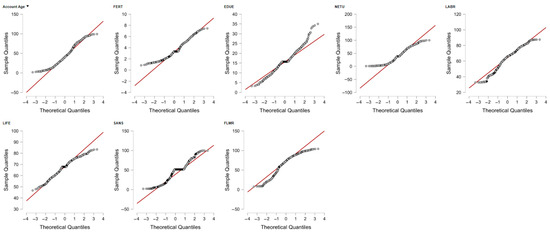

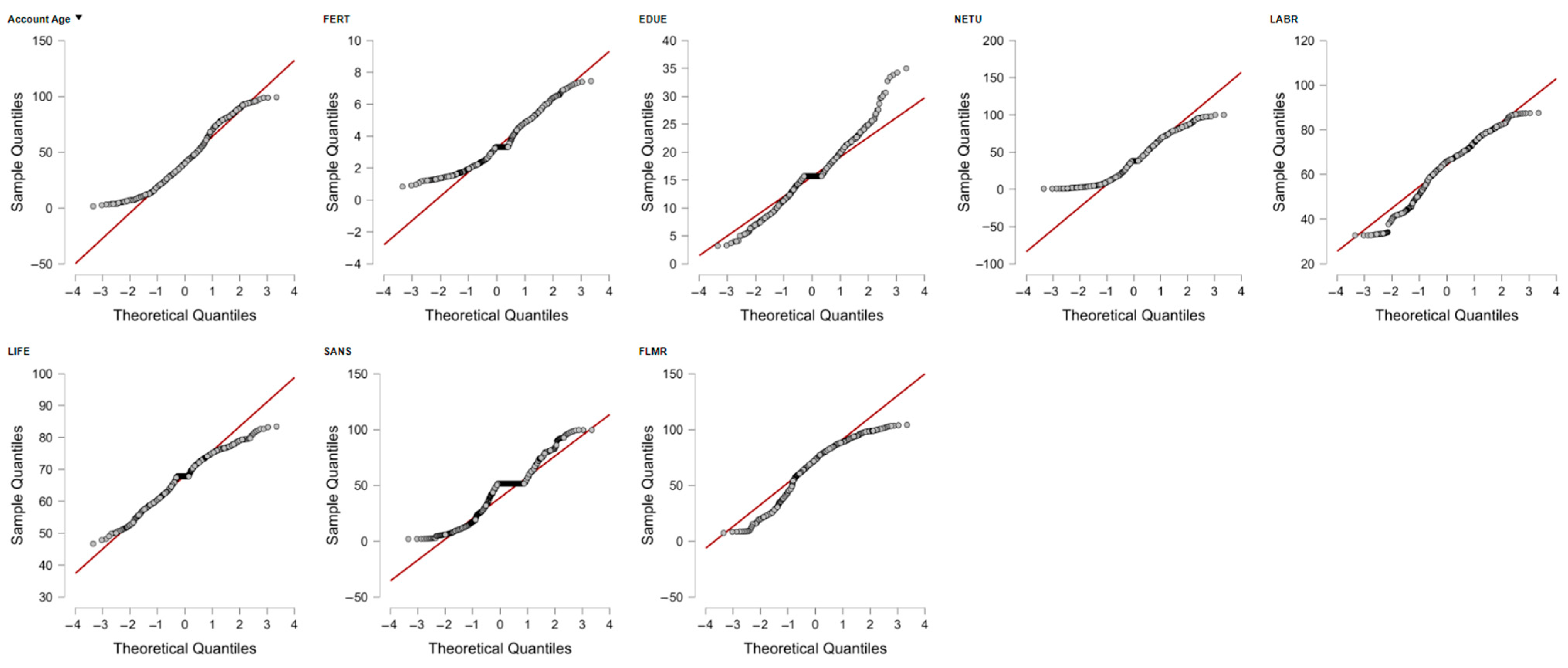

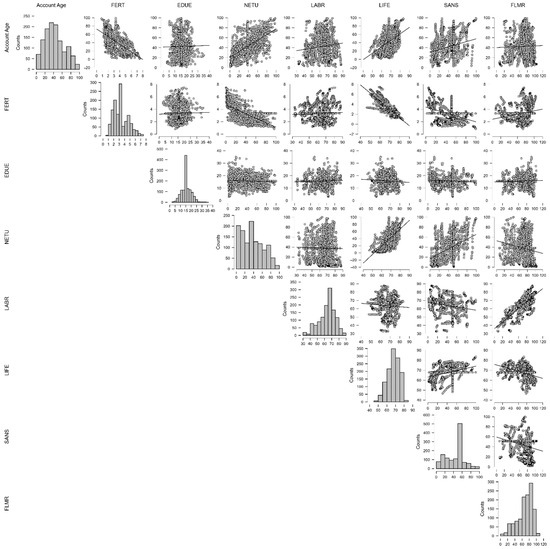

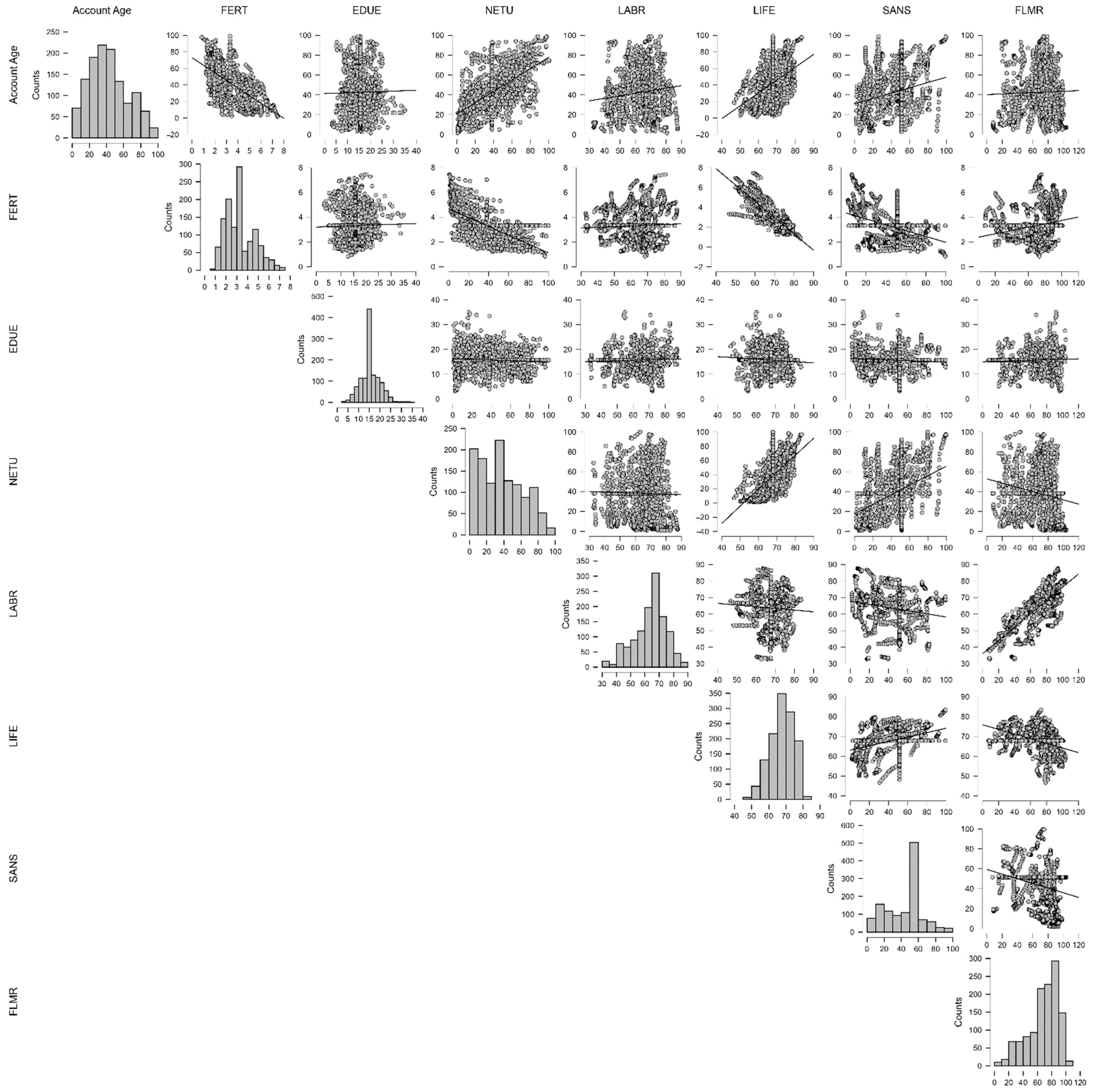

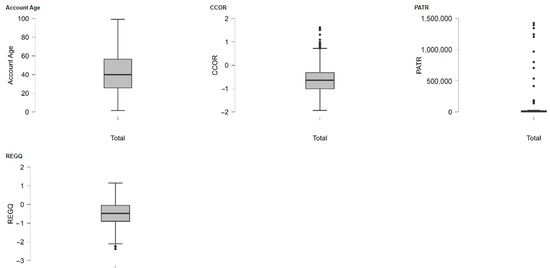

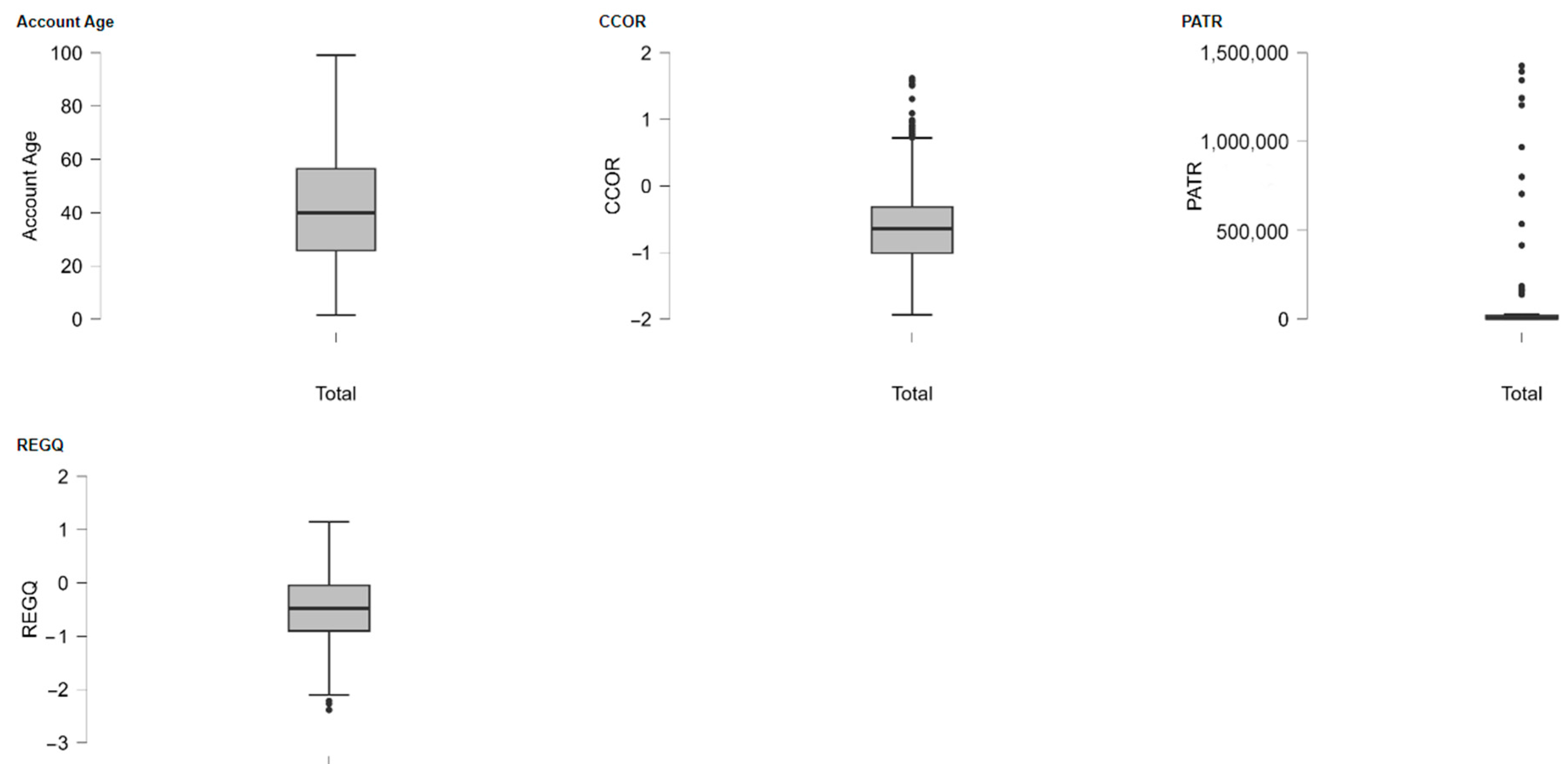

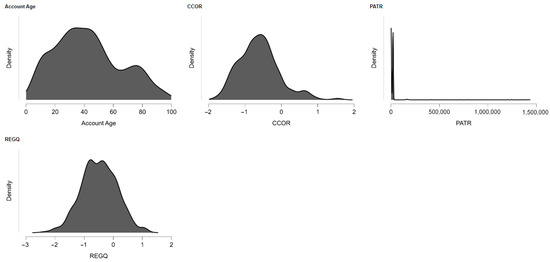

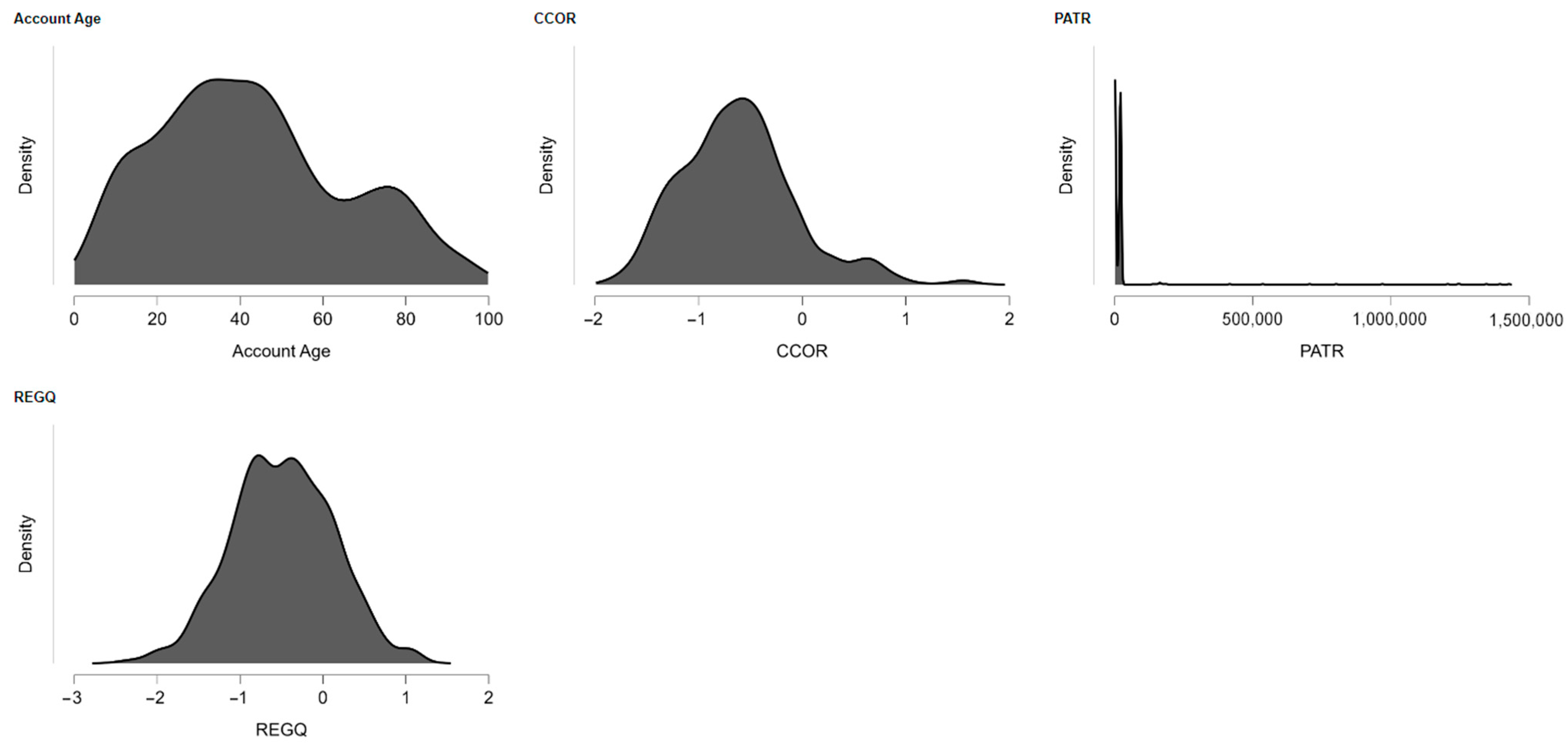

The study selects a hybrid methodological design involving econometric estimation with instrumental variables (IV) and machine learning (ML) techniques for the purpose of assessing the relationship between financial inclusion and ESG (Environmental, Social, and Governance) dynamics for 103 developing countries over the period 2011–2022. Due to the extensive and complete set of variables utilized over the entire investigation, detailed descriptions, definitions, and sources are placed in the Appendix A, Appendix B, Appendix C and Appendix D, with the aim of simplicity over the entire primary text. The dependent variable, financial inclusion, has been proxied by the “Account Age” indicator, the share of adults with an account maintained at a formal financial institution, or with a cell money service. The variable was obtained jointly from the World Bank Databank and the Sovereign ESG Data Portal with the aim of ensuring accuracy and cross-country comparability (Hicham & Hicham, 2020; Eldomiaty et al., 2020). The World Bank’s harmonized ESG dataset provides the ESG indicators, also disaggregated by the environment, social, and governance pillars. The econometric estimation utilizes both the Generalized Two-Stage Least Squares (G2SLS) and Fixed Effects Two-Stage Least Squares (FE-2SLES) estimators while overcoming endogeneity, measurement error, and simultaneity bias, common problems at the macro level of development research (Jain et al., 2024). Instrumental variables such as climate stress measures, sanitation infrastructure, and demography-based controls have been selected for their exogeneity. Diagnostic tests indicate strong model performance, with the levels of R2 reaching 35% in the environment specification and statistically significant Wald χ2 tests (p < 0.001), supporting strong explanatory strength and instrument credibility (Chininga et al., 2023; Gidage & Bhide, 2025). For the machine learning approach, supervised regression models have been implemented towards the discovery of a non-linear relationship between ESG dimensions and financial inclusion. An evaluation has been performed comparatively between eight algorithms: Boosting Regression, Decision Tree Regression, K-Nearest Neighbors Regression, Linear Regression, Neural Networks, Random Forest, Regularized Linear Regression, and Support Vector Machine. This supports the reliability of ensemble-based models towards the discovery of non-linear, hierarchical associations pervasive with ESG-based datasets (K. Li, 2025). For unsupervised learning, the five clustering analyses implemented were Fuzzy C-Means (FCM), Hierarchical Clustering, Model-Based Clustering, Neighborhood-Based Clustering, and Random Forest-based proximity clustering. As the most appropriate approach, FCM was selected by optimal performance from an exhaustive set of cluster validation indices: R2, Akaike Information Criterion (AIC), Bayesian Information Criterion (BIC), Silhouette Score, Maximum Diameter, Minimum Separation, Pearson’s γ, Dunn Index, Entropy, and the Calinski-Harabasz Index. FCM’s soft clustering properties are well-suited for extracting the overlapping ESG-financial inclusion characteristics ubiquitous in most developing economies, therefore enabling finer policy segmentation (Waliszewski, 2023). Merging causal econometric models with machine-learning-based classification permits an inclusive, scalable, and evidence-based framework for questioning financial inclusion with regard to ESG configurations. It offers explanatory rigor and tractable knowledge through the determination of archetypal country profiles, thus informing the generation of more tailored, context-sensitive policy interventions designed to support sustainable development.

Approximately 12% of the dataset, covering 2011–2022, exhibited missingness. These were imputed by cross-sectional mean imputation. For the fairly limited panel duration of 11–12 years, the approach was considered a pragmatic compromise, avoiding significant loss of data while maintaining continuity for the dataset. While appropriately noted that imputation by the mean can attenuate variance and distort correlations, in turn potentially reducing coefficient estimates or suppressing associations between variables, it also possesses the advantages of simplicity, transparency, and computational ease. In the case of sample size maintenance, the top priority and the missingness not being structured in a systematic manner, mean imputation can be a fair compromise. Accordingly, while we take note that with the use of advanced approaches such as multiple imputation or time-series imputation, there are potential improvements by way of robustness, the approach selected is commensurate with the structure and scope of the current dataset.

4. Sustainable Finance and Environmental Resilience: Modelling Financial Inclusion Through the “E” in ESG

This empirical analysis investigates the relationship between environmental sustainability and financial participation in developing nations through the proxy Account Age as a measure of participation in financial services. As financial access is rapidly emerging as a central driver of inclusive growth, it has become imperative to investigate the manner in which the environment and environmental considerations shape such access. Under the ESG (Environmental, Social, Governance) framework, the current study focuses on the “Environmental” pillar and examines the effect of six significant environmental variables on a multi-period panel dataset. To address the possible issue of simultaneity or endogeneity, both G2SLS (Generalized Two-Stage Least Squares) and TSLS (Two-Stage Least Squares) specifications are used in estimation and yield statistically reliable results. Prior research supports the use of environmental indicators such as renewable energy use and land quality in studying the financial inclusion-environment nexus (Jain et al., 2024). The overall goal is to provide empirical insight helpful for sustainable policy making and show that well-designed environmental policies can also enhance financial participation. Recent findings show that digital financial inclusion can inhibit greenwashing while strengthening authentic ESG performance, supporting the idea that financial access and environmental responsibility can reinforce each other (W. Li et al., 2024). Moreover, inclusive finance is shown to improve environmental quality through enhanced service accessibility and reduced household vulnerability, especially when financial systems are aligned with ecological priorities (Wang et al., 2022). The findings establish positive synergies between economic access and climate resilience and suggest that environmental stewardship will not be a restraint but rather a facilitator of sustainable and inclusive development (Table 2).

Table 2.

Environmental Determinants of Financial Inclusion: G2SLS and TSLS Estimates for Developing Economies.

The principal goal of this empirical research involves investigating the connection between financial inclusion, as captured by the measure used here for this research—namely, the Account Age variable—defined as the proportion of those who reported having an account (in their own right or jointly) at a bank or other type of financial organization or who used a mobile money service themselves in the previous year—against a set of environmental variables collected together as representing the “Environmental” part of the ESG approach (Environmental, Social and Governance). The analysis will be confined exclusively to developing countries since their countries present specific differences in their structural, socio-economic, and institutional contexts in relation to high-income economies and since their levels of financial inclusion and success or prominence of environmental policies largely depend on them.

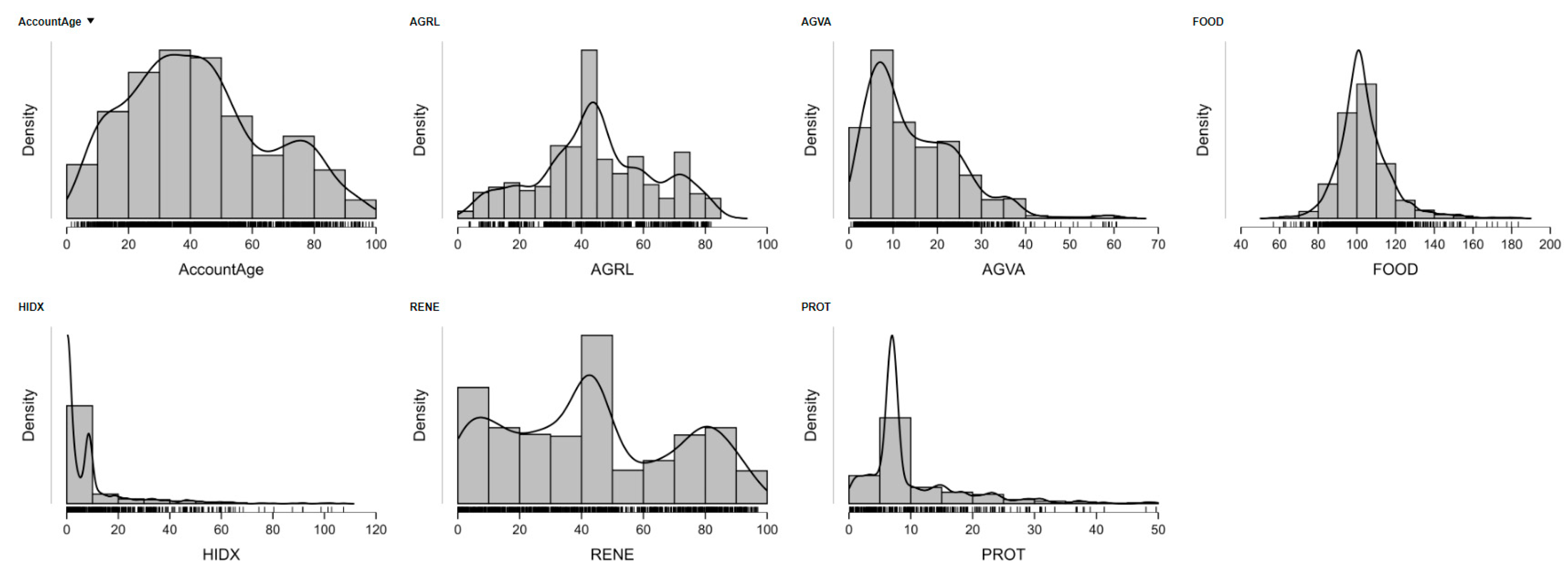

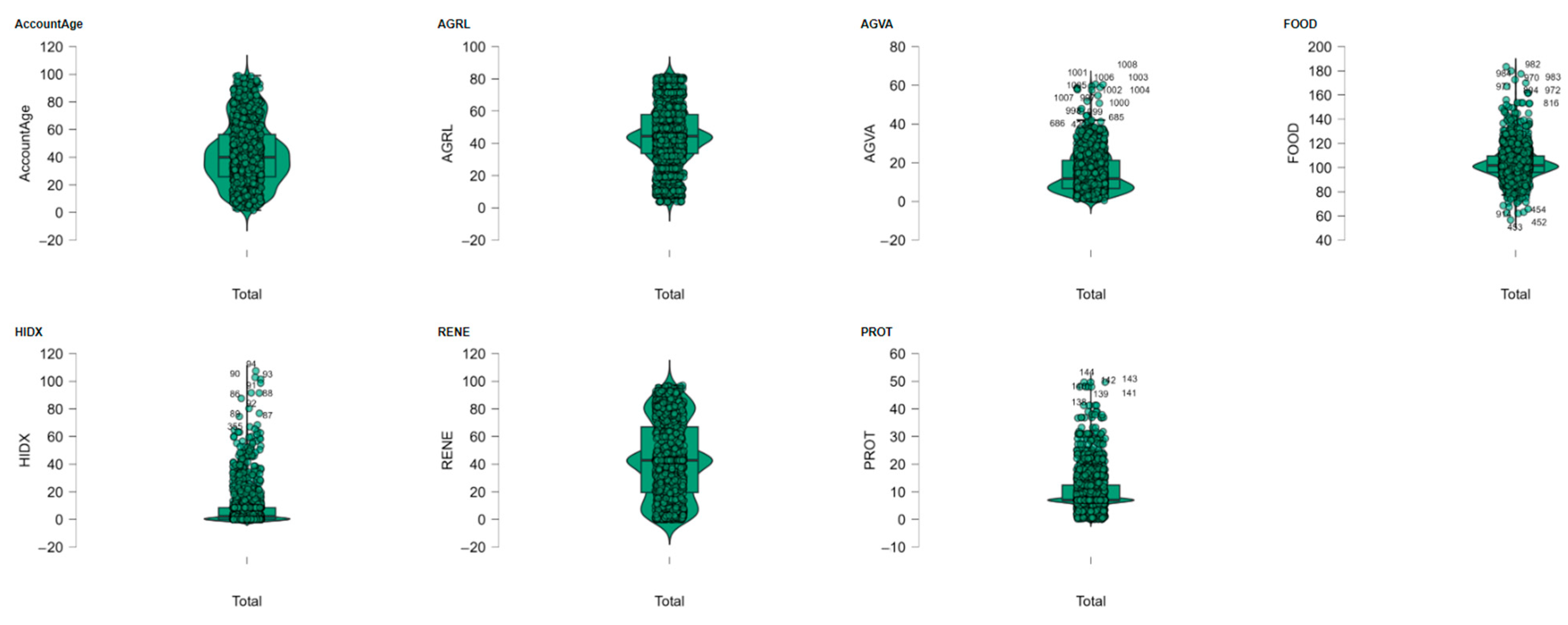

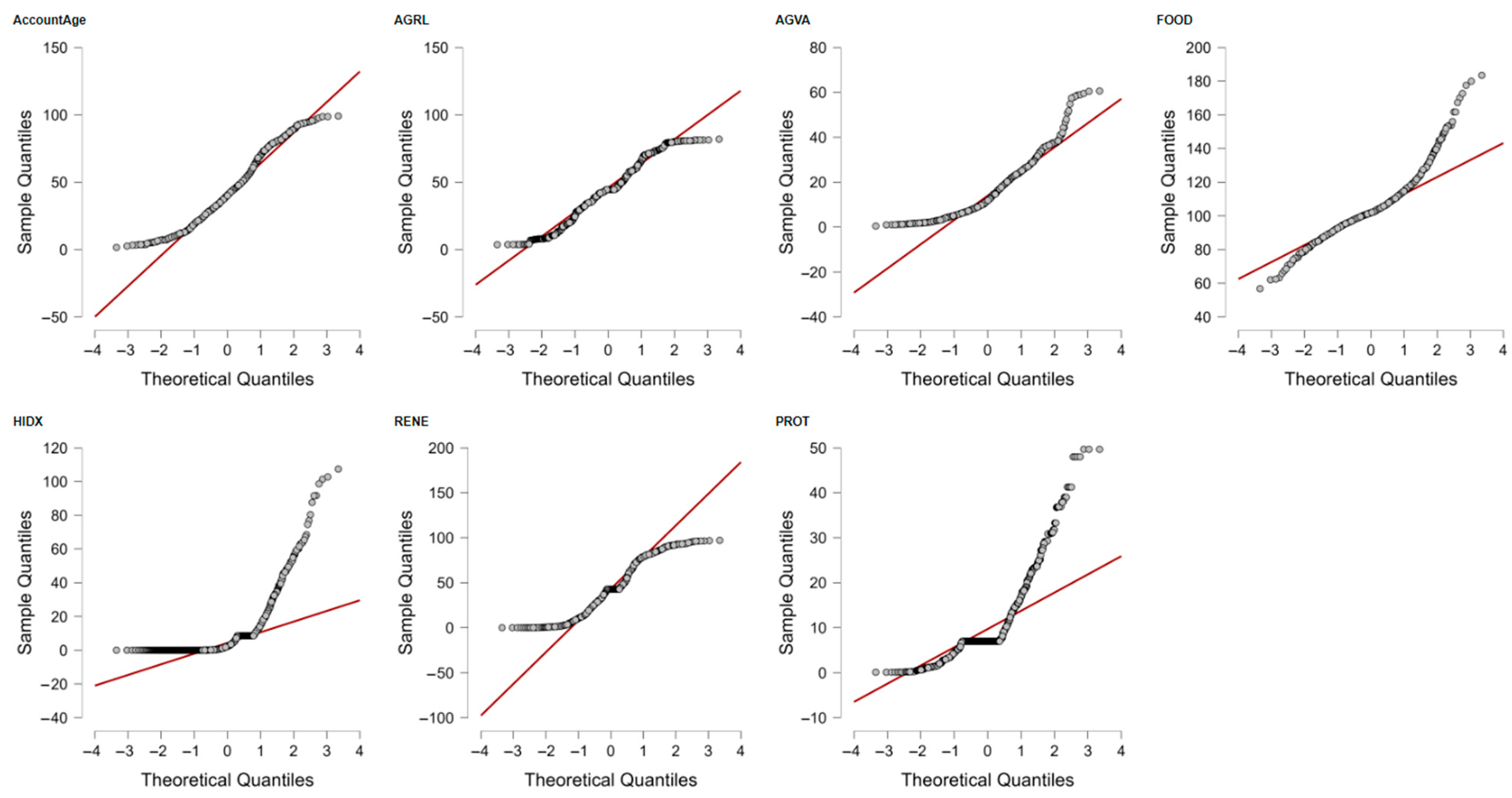

The empirical approach employs six explanatory variables with close links to the Environmental pillar of ESG: (1) AGRL—agricultural land as a percentage of total area, (2) AGVA—value added in agriculture, forestry, and fisheries as a percentage of GDP, (3) FOOD—food production index, (4) HIDX—heat index of the number of days on which the apparent temperature rises above 35 °C, (5) RENE—share of consumption of renewable energy as a percentage of total energy consumption, and (6) PROT—protected areas on the land and seabed as a percentage of total territorial area. The variables were employed since they capture key environmental dynamics for developing countries and should impact financial inclusion directly or indirectly.

The empirical specification employs two instrumental variable forms in order to take account of potential endogeneity: a G2SLS (Generalized Two-Stage Least Squares) random effects and a TSLS (Two-Stage Least Squares) fixed effects specification. The two specifications share a balanced panel of 1235 observations covering 103 countries over a time series ranging from 11 years to 12 years in duration. The use of instrumental variables serves as a necessity in order to address issues related to simultaneity-based endogeneity concerns, omitted variable bias, or measurement error. The instruments used are diverse and potent and include human development proxies (e.g., access to electrification and the internet, literacy rate, school enrolments), public health indicators (e.g., access to sanitation and clean water and under-5 mortality rate), demographic variables (e.g., crude population density and proportion of the age group 65 and above), and governance-quality variables (e.g., control of corruption sub-indices and sub-indices of rule of law, regulatory quality, and voice and accountability).

Both models yield the same results and are statistically significant, and consistently depict a clear understanding of the effects of environmental variables on financial inclusion in developing countries. The AGRL (land area used for agriculture) variable has a negative and highly significant relationship to financial inclusion in both models (G2SLS: −0.593, z = −4.213 and TSLS: −0.698, z = −4.814). It reflects countries with large agricultural land areas having lower financial inclusion. It may be a reflection of domination by agrarian economies and informal economies, where financial institutions remain underdeveloped and formal financial services and instruments remain limited. The same holds true for the AGVA variable—value added through agriculture, forestry, and fish—referring a negative and significant relationship (G2SLS: −1.975, z = −6.406 and TSLS: −0.735, z = −1.887), supporting the argument that agrarian economies without integration or modernization do not integrate or become included in financial systems.

On the other hand, other environmental variables show a positive and significant relationship. The FOOD variable (index of food production) has a positive and significant relationship in both models above (G2SLS: 0.412, z = 5.704; TSLS: 0.444, z = 7.250). It reflects the fact that in countries where levels of agricultural productivity tend to be stronger, the inhabitants tend to be in contact with financial institutions more often. This can be justified by the reasoning that a higher food production level may foster well-organized value chains, contract farming, agricultural insurance, and microcredit availability, and thus encourage demand for financial products and services as well as both demand- and supply-push motives for financial institutions. Likewise, the HIDX variable (heat index) also shows a positive and significant relationship (G2SLS: 0.376, z = 2.933; TSLS: 0.481, z = 3.565). This may be less intuitive and may be a sign of adaptation behavior: in countries with high frequencies of extreme weather conditions, investment in resilience may be enhanced, and thus, maybe the take-up of digital financial means such as climate insurance or environmental shock coping savings accounts.

The other significant finding relates to RENE (consumption of renewable energy), which has a positive and statistically significant coefficient on both specifications (G2SLS: 0.140, z = 3.125; TSLS: 0.120, z = 2.919). The correlation might be driven by the increasing penetration of renewable energy facilities, such as off-grid mini-grids and photovoltaic panels, in remote villages and small towns. These systems would be based on digital payment systems (e.g., pay-as-you-go solar) and funded by microfinance or leasing schemes, which in turn create an incentive for opening a financial account or the use of mobile money services on the part of the consumers (Ababio et al., 2023).

The PROT variable, which accounts for the proportion of protected areas, has the strongest positive correlation with financial inclusion (G2SLS: 1.505, z = 7.389; TSLS: 1.376, z = 7.652). The finding can be explained through the prism of inclusive environmental governance: if active conservation policies take effect, they tend to be grounded on community participation, formalized funding channels, and coordination between NGOs and external institutions, which may stimulate access to financial services in local communities (Paliienko & Diachenko, 2024).

Both estimations from a model performance perspective hold good explanatory power. The R2 measure of determination approximates 34.5% for the G2SLS and approximately 34.7% for the TSLS fixed effects method, hence explaining a good percentage of variance in the Account Age indicator. Additionally, the Wald test for the collective explanatory significance of the explanatory variable produces highly significant values (χ2 = 457.6 for G2SLS and χ2 = 491.9 for TSLS; both p < 0.001), confirming the statistical validity of the models.

In short, this analysis offers systematic and strong empirical evidence that the environmental dimension of ESG has a crucial impact on the level of financial inclusion in developing countries. Precisely, those traditional and underdeveloped agricultural system-related variables tend to behave in a negative correlation manner vis-à-vis formal access to financial services. However, those environmental variables related to productivity, resistance, accessible sustainable energy, and policy enforcement of conservation efforts tend to be correlated in a positive manner vis-a-vis better levels of inclusion (Dovbiy, 2022).

These findings are most directly relevant for policymakers and development institutions as they reveal the complementarities between access to finance and environmental sustainability. Encouragement of environmentally sustainable behavior may not only be beneficial from an environmental angle but also may entail economic and societal spillovers through enhanced coverage of financial services by previously under-banked groups.

With regard to the 2030 Agenda of Sustainable Development and in particular in relation to SDG 8 (Decent Work and Economic Growth) and SDG 13 (Climate Action), this study contributes to an emerging literature on the means through which environmental factors may be leveraged as drivers of inclusive economic growth. The cross-cutting ESG approach taken by this research calls for a holistic development comprehension whereby environmental stewardship is not a constraint but an accelerator of inclusive, resilient, and sustainable financial ecosystems in the Global South. The determined correlation between the “E” of ESG and financial inclusion means policies must be couched so they may address simultaneously both climate resilience and economic access, and consequently achieve synergies that promote both ecological integrity and social equity.

To gauge the strength and relevance of the instrumental variables used for the 2SLS estimates, first-stage regressions were performed separately for each of the six endogenous variables: AGRL, AGVA, FOOD, HIDX, RENE, and PROT. These first-stage regressions yielded some valuable diagnostics--R-squared measures, F-statistics, and the number of statistically significant instruments--that represent a good check of the quality of the instruments. The results are that the instruments have substantial explanatory power for the great majority of the regressors. For five of the six, the F-statistics are well over the standard 10 threshold, with particularly high values for AGVA (55.56), HIDX (34.32), and RENE (95.76), definitively ruling out the potential for weak instruments. The only exception here is the situation of FOOD, with an F-statistic value of 9.27, just below the threshold, indicating a low probability of weak instrument bias, for whose respective second-stage estimate(s) some interpretive circumspection is merited.

The instruments also have substantial explanatory power through the course of models, with R-squareds from 0.19 for FOOD to 0.70 for RENE. At least eleven 5 percent significant instruments are reported for each regression, while between five and thirteen instruments are 1 percent significant. For instance, the instruments EDUE, CFTC, LIFE, PDEN, and REGQ are significant predictors for AGRL, while RENE is associated with a long list of highly significant instruments like CFTC, LABR, POP6, and some of the governance indicators. These patterns confirm the observation that the instruments are not only statistically significant, but also strongly associated with the endogenous regressors they try and illuminate. Complete first-stage regression tables are also reported in the Appendix B to aid transparency and the ability to replicate (Table 3).

Table 3.

First-Stage Diagnostics for Instrumental Variable Regressions of Environmental Determinants on Financial Inclusion.

4.1. Financial Access in the Climate Era: A Cluster-Based Exploration of Environmental-Economic Interactions

This section presents advanced clustering analysis aimed at revealing dynamics between environmental and financial variables in developing countries through the use of the Fuzzy C-Means method. The countries were grouped by similarity in the six environmental indicators and the Account Age measurement as a proxy measure of access to financial services. The nine-cluster solution based on the best statistical fit as well as interpretability was finalized. The cluster analysis presents divergent profiles and illustrates ways in which environmental participation, agricultural organization, and proportion of renewables intersect with participation stages in the economy. The results offer actionable insights in the complex and sometimes patchwork relationship between economic participation and sustainability in the Global South (Table 4).

Table 4.

Clustering Model Comparison for Environmental-Financial Profiles: Fuzzy C-Means and Alternatives.

Among the cluster algorithms we experimented with—Density-Based Clustering, Hierarchical Clustering, Model-Based Clustering, Neighborhood-Based Clustering, Random Forest Clustering, and Fuzzy C-Means Clustering—the latter’s Fuzzy C-Means method emerged as the best-placed and efficient method based on a multi-metric performance assessment (Kaushal et al., 2024). By normalizing and comparing twelve performance measures—compactness measures and cluster validity and separation measures alike—FCM produced the highest mean performance score, pointing towards FCM as the method typically superior in this use case.

One of the great strengths of FCM as a technique is its ability to accommodate data points being part of several groups to any extent of membership. This soft type of clustering method is very useful with complex data where different groups may lack distinct boundaries. In contrast with hard clustering methods such as k-means, where each point is assigned exclusively to a particular group, FCM captures more subtle patterns in the data and provides more interpretability and flexibility (L. Zhang et al., 2020). FCM’s flexibility is evident in the very high performance across all significant parameters, such as the R2 value (0.84), reflecting the variance accounted for in the case model, and the silhouette score (0.56), reflecting good cluster separation and cohesion.

FCM achieved a 1.0 normalized value in our comparison experiment in terms of the Calinski-Harabasz index, Entropy, and Clusters. The measure of the Calinski-Harabasz index measures the ratio of between-cluster variance and the within-cluster variance, and a high value reflects well-separated and compact clusters. Achieving a 1.0 value in this case provides a clue that FCM developed compact and well-separated clusters. Entropy measure in clustering can reflect randomness or uniformity in cluster assignment distribution, and also achieves a maximum score in the FCM case. A value of 1.0 means FCM achieved high consistency in the clustering structure. That it also scored 1.0 in Clusters means the number of achieved clusters lies at the optimum or very near the optimum value to be expected in the dataset (Shen et al., 2021).

In addition, FCM performed comparably on other key measures, too. On the measure for the minimum between-clusters distance and the maximum within-clusters diameter in the form of the Dunn index, FCM value at 0.04 can also be considered low but comparable, since the maximum value 1.0 could only be achieved by the Density-Based Clustering method alone. FCM scored 0.54 at Pearson’s γ, the measure of the distance between points and the degree to which the points belong to the same cluster or different ones, being behind Hierarchical Clustering alone at 1.0 when it comes to its score in this measure. This reflects good geometric form preservation of the data through FCM. Even in the case of Minimum Separation and Maximum Diameter, measuring the distance between the clusters and the size of the largest cluster, respectively, FCM retained a good measure and proved to have good compactness and well-separateness simultaneously.

Both Neighborhood-Based Clustering and Hierarchical Clustering did well on both measures—a silhouette score of 0.68 and 0.84, respectively—but were far from as reliably high-performing as FCM. The levels of R2 were lower both times (0.53 and 1.0, respectively), but both algorithms scored 0.0 on important measures such as the Calinski-Harabasz index, AIC, and BIC, indicative of their potential inefficiencies in model selection and complexity penalty. FCM’s mean overall score of 0.58 is indicative of a well-balanced performance without falling low on any of the measures provided (Paliienko & Diachenko, 2024).

The key point also resides in good interpretability in high-dimensional spaces, and this makes FCM a good choice for exploratory analysis in bioinformatics, segmentation of the market, and image classification. Its use of fuzzy logic also aligns with the reality of the overlapping classes and imprecise groupings in the real world. In practical terms, this can lead to actionability over strict partitioning algorithms.

Fuzzy C-Means Clustering outperforms in performance based on good cluster compactness and separability, and model validity, as well as being more flexible and interpretative. Its highest mean score of the algorithms considered speaks volumes about the flexibility and potency of the algorithm. No cluster method is its best across all measures, yet since FCM performs well across a range of measures over and over again, it is the optimum method for this dataset. This conclusion, based upon empirical performance, is further enriched through the theoretical advantages of the algorithm’s capacity to accommodate fuzzy boundaries and preserve the internal organization of the data. (Table 5).

Table 5.

Comparative Evaluation of Clustering Algorithms: Fuzzy C-Means as the Optimal Method for ESG-Finance Segmentation.

Fuzzy C-Means clustering outputs reveal a sharp segmentation of countries (or regions) based on the interaction between financial inclusion in terms of Account Age and a range of environmental variables within the E (Environment) corner of the ESG framework. Cluster analysis, within the developing country context, shows the nexus between financial infrastructure and environmental engagement, resilience, and sustainability (Zioło et al., 2022). The variables employed are AGRL (land used for agriculture), AGVA (agriculture, forestry, and fishery value added), FOOD (% food production index), HIDX (% heat index 35), RENE (% renewable energy consumption), and PROT (% terrestrial and marine protected areas). The overall goodness of fit of the clustering model as a ratio of BSS/TSS at circa 44.3% reflects significant but relative capture of the heterogeneity and supports significant overlapping country profiles (López-Oriona et al., 2022). Financial inclusion perspective-wise, Cluster 2 (with the highest proportion explained at 25%) possesses a moderately high Account Age (0.450) and high environmental responsibility through PROT (1.100), but low values in RENE (−0.903) and AGVA (−0.813). This might reflect the regions with good institutions and conservation systems, but poorly developed renewables and agri-economies. Cluster 4, with its high values in both AGRL (1.417) and AGVA (1.592), overtly reflects regions with a high agrarian core. The Account Age in this case surprisingly emerges as negative (−0.667), and this reflects that even agri-advanced areas and financial service bottlenecks might arise. This contrast indicates an economic activity-financial access mismatch and a key development bottleneck. Cluster 9 comprises the smallest number of companies (only 25) but is striking in the high level of environmental responsibility: PROT (1.593), RENE (−1.115), and positive Account Age (0.317). Its relatively low renewable energy consumption is inconsistent with high levels of biodiversity conservation. The fit may be the result of conservation policies advocated and pursued by the state within those contexts where green technologies are still inaccessible. Group 1 possesses a clear profile of weaknesses: very low Account Age (−1.512), lower usage of renewable energy (−1.412), and minimal protection of the environment (−1.146). It has moderately high AGVA (0.995) but extremely low financial cover and heat stress (HIDX = 0.779), corresponding to climate-vulnerable and institutionally undercovered locales. Cluster 6 is a very interesting paradox. It has the largest RENE (1.914) and positive PROT value (0.317), yet very low Account Age (−0.848) and AGRL (−1.577). This corresponds to green transformation at the nascent stage—possibly driven by donors or technologically enabled—in a context of limited classical agriculture and minimal access to finance. This might reflect the case of countries turning to renewables while no overall financial safety net exists for their populations (Azkeskin & Aladağ, 2025). Cluster 3 shares the middle Account Age (−0.546) and relatively evenly distributed environmental values, specifically RENE (0.207), and therefore can be deemed middle-ground segment with lower variablity since it also witnessed lower explained heterogeneity (4.1%) and highest silhouette value (0.222), being a dense and homogeneous segment. Cluster 5, being the largest cluster with 326 units, contains mixed attributes: Account Age (−0.185), AGVA (−0.569), and barely better-than-average FOOD (0.596), yet both negative RENE (−0.370) and PROT (−0.364). These contradictory bits of information suggest a type of profile of the “developing majority”—economies with modest food-producing capacity but low ecological and financial inclusion levels. Cluster 8 possesses low FOOD (−1.943) and Account Age (0.302) and below-average readings in all other measures. Its small size (N = 62) and low value of the silhouette (0.128) indicate it might include outliers or the economies in the process of transforming towards the outside conditions. Finally, Cluster 7, whose values are close to the mean, specifically in RENE and PROT measures (0.255 and −0.365), might serve as a “benchmark” profile—neither too underdeveloped and yet high performances are below its level yet also far from the highest level and thus it still has room to develop and improve both the fiscal and the environmental fronts. On the whole, the clustering shows financial access does not have high intercorrelation across environmentally varied segments in developing countries. Conditions in agriculture and the environment do not directly correlate with high financial access and vice versa. The framework pushes the importance of the integration planning financial access and the environment in the first place in areas exposed to climate risk or sustainability transitions. The findings support the unified ESG strategy where social infrastructure (i.e., access to banks) should never be decoupled from green investment, particularly in emerging and vulnerable economies (Table 6).

Table 6.

Profiling the Environment-Finance Nexus: Cluster Characteristics from ESG-Based Fuzzy C-Means Analysis.

The outcomes from Fuzzy C-Means clustering present a refined breakdown of countries (regions) according to the interaction of financial inclusion, as quantified by Account Age, and a set of environmental variables taken from the E (Environment) pillar of the ESG framework. The clustering analysis in the developing countries context shows the relationship between environmental engagement, resilience, and sustainability, and financial infrastructure (Latifah, 2022). The variables used comprise AGRL (agricultural area), AGVA (agriculture, forestry, and fishing value added), FOOD (index of food production), HIDX (heat index 35), RENE (consumption of renewable energy), and PROT (land and ocean and island protected areas). The global fit of the clustering model, wherein the ratio of the Between Sum of Squares (BSS) and the Total Sum of Squares (TSS) is about 44.3%, shows that the nine-cluster solution accounts for a considerable but not full extent of the heterogeneity and therefore indicates meaningful although overlapping country profiles (Sasmita et al., 2023).

From a financial inclusion viewpoint, Cluster 2 (the largest proportion explained at 25%) has a moderately high Account Age (0.450) and high environmental concern through PROT (1.100), but low scores on RENE (−0.903) and AGVA (−0.813). This may indicate those regions with good institutions and conservation policies, but not well-developed renewable infrastructures and agricultural economies. Cluster 4, having high scores in AGRL (1.417) and AGVA (1.592), evidently locates regions having a well-established agricultural base. The Account Age here remains surprisingly negative (−0.667), however, and may indicate that even agriculturally developed regions will be encumbered by access to financial services. This gap reflects a disconnect between economic activity and access to finance, a key development bottleneck.

Cluster 9 has the lowest number (only 25) but has a strong environmental orientation: PROT (1.593), RENE (−1.115), and positive Account Age (0.317). Paradoxically, although it has minimal use of renewables, it has excellent biodiversity preservation. The cluster might be a reflection of government-run policies for conservation in areas where green technologies remain inaccessible.

On the other hand, Cluster 1 has a definite outline of vulnerability profile: extremely low Account Age (−1.512), low levels of renewable energy consumption (−1.412), and low levels of environmental protection (−1.146). It has a moderately high AGVA (0.995) but low levels of financial inclusion and heat stress (HIDX = 0.779), reflecting climate-vulnerable, institutionally underserved areas.

Cluster 6 presents a very interesting contradiction. It has the largest RENE (1.914) and a positive PROT (0.317) score, but very low Account Age (−0.848) and AGRL (−1.577). This indicates an early-stage green transition—potentially technologically enabled or donor-driven—wherein there is low traditional agriculture and limited financial coverage. This may be representative of those countries adding or embracing renewables without a general financial cushion of safety in their populations (Bondarenko et al., 2025).

Cluster 3 has a medium Account Age (−0.546) and fairly well-balanced environmental values, primarily RENE (0.207), and thus appears a middle-of-the-way group with minimal variability, as also reflected through low explained heterogeneity (4.1%) as well as maximum silhouette score (0.222), qualifying it as a close-knit, stable segment.

Cluster 5 is the largest cluster at 326 units but has mixed features: Account Age (−0.185), AGVA (−0.569), and modestly above-average FOOD (0.596), but negative RENE (−0.370) and PROT (−0.364). These contradictory signs indicate a profile of a “developing majority”—modest food productivity economies but not ecologically and financially inclusive economies.

Cluster 8 stands out for having a low FOOD (−1.943) and Account Age (0.302), along with below-average scores on all other indicators. Its modest size (62 units) and low silhouette measure (0.128) suggest it may be comprised of outliers or transit economies.

Lastly, Cluster 7, at levels close to the mean in RENE (0.255) and PROT (−0.365), can be called a “baseline” profile—neither highly underdeveloped nor high performers but having space for advancement both on the economic and environmental sides.

By and large, the clustering indicates uneven distribution of financial inclusion over environmentally differentiated regions in developing nations. Strong agriculture and environmental performance by regions do not necessarily translate to high financial access and vice versa. The model emphasizes the necessity of aligning financial inclusion policies with environmental policy, particularly in those regions under environmental risk or undergoing sustainability transitions. These observations justify a holistic ESG approach in which social infrastructure (such as access to banks) must not be differentiated from environmental investment, especially in vulnerable and emerging economies (Duan & Sun, 2020) (Figure 1).

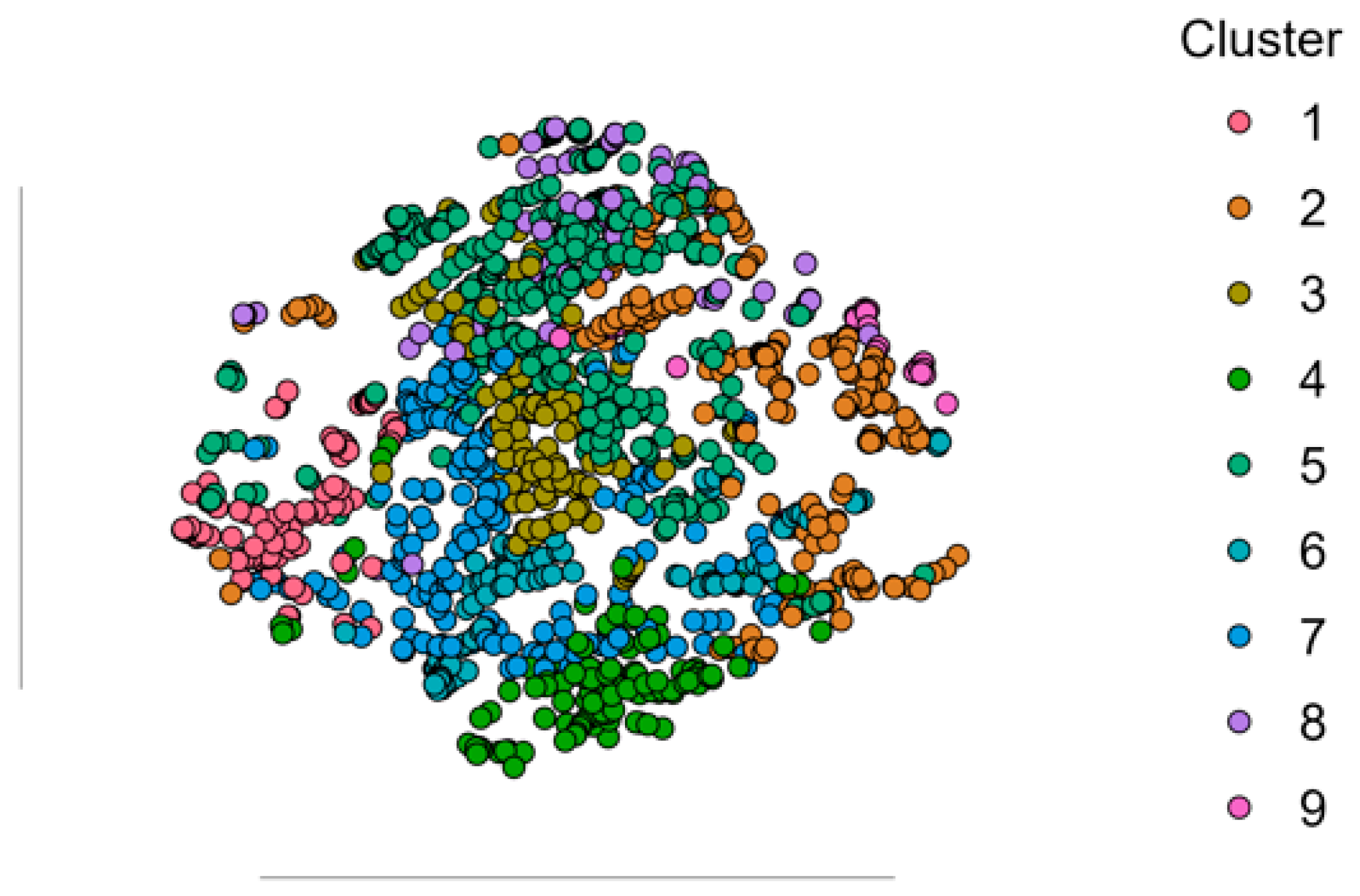

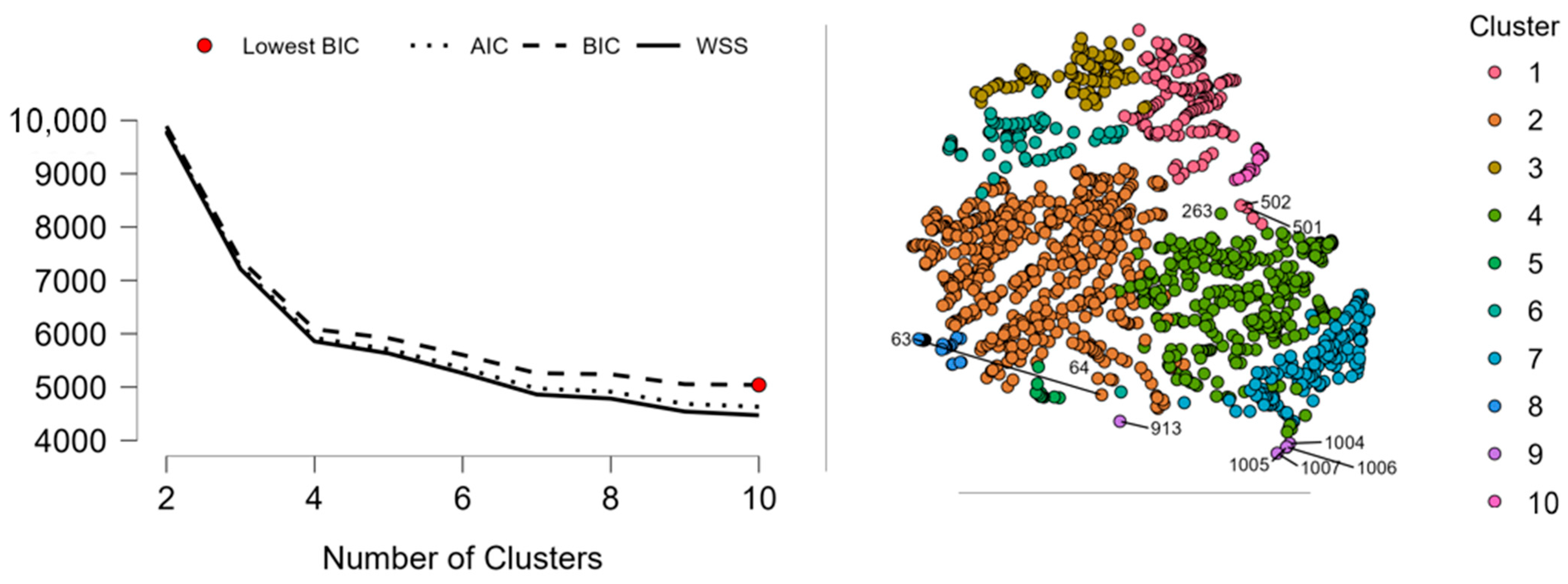

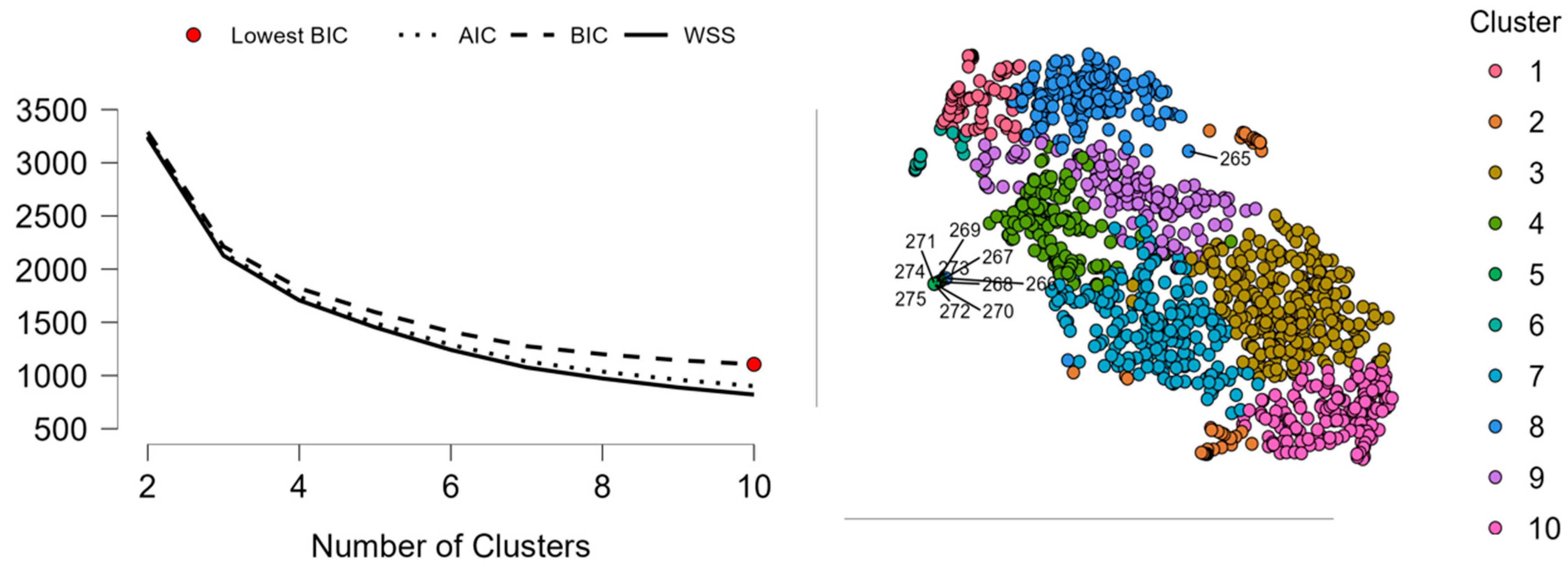

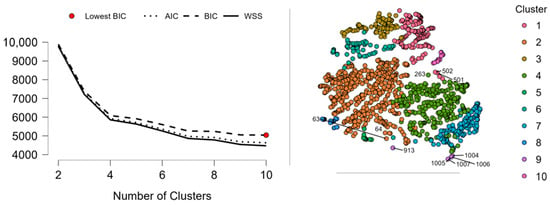

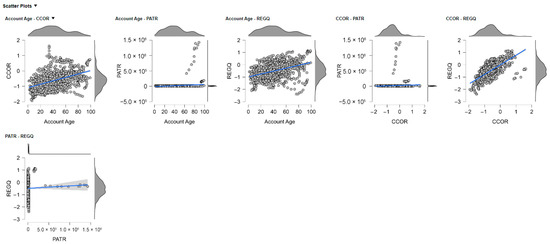

Figure 1.

Fuzzy C-Means Clustering of Developing Economies: Optimal Cluster Determination and Profile Mapping.

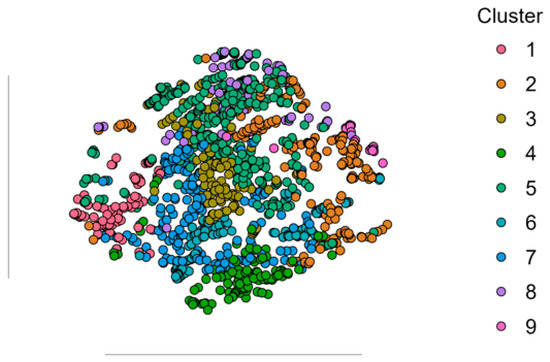

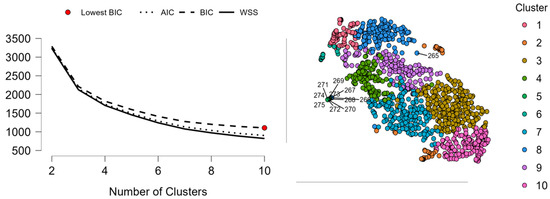

The figure displays the outcome of Fuzzy C-Means cluster analysis through a combination of statistical evaluation of the clustering model and visualization through cluster assignments inspection. On the left figure in the illustration, the model performance using cluster numbers two through ten is shown by taking the evaluation of the three important measures, namely, Within Sum of Squares (WSS), Akaike Information Criterion (AIC), and Bayesian Information Criterion (BIC). These measures direct the choice of the ideal number of clusters through a compromise between fit and model complexity. Due to heavier penalization against complexity than AIC, BIC plays a pivotal role in the choice between competing models. Here, the red marker point on the curve is put at the point where the corresponding solution is a nine-cluster value; this means nine clusters since it provides the best compromise between maintaining the structure of the data and overfitting the data. The declining WSS and flattening of BIC and AIC support this choice as it shows a sign of approaching the point where marginal improvement in the quality of the clustering in returning more than nine clusters will be extremely minimal. Having nine units thus remains statistically warranted and parsimonious compared to the complexity of the data (Kaushal et al., 2024).

On the right-hand side of the figure, we have a two-dimensional visualization of the clustering result. The two-dimensional representation, presumably produced through the use of dimension reduction techniques such as t-SNE or PCA, diminishes high-dimensional data to a format permitting visual interpretation. Each marker marks a single record, and coloring illustrates cluster membership according to the Fuzzy C-Means function. The clustering appears typically coherent and dense aggregations of points and discrete color-coded sets of clusters occupy the plot area. There is undoubtedly some overlap—especially in the middle of the plot—due to the fuzzy approach to the method, where each and every marker will belong in part to two or more collections of clusters (Shen et al., 2021). However, visual patterning assures success in segment capture by the function in the data. Large clusters labeled 2, 3, 4, and 6 dominate the visual area and correspond to the size range of the clusters the researcher had been working with earlier. Small cluster 8 and 9 cluster at the edge, and this will possibly reflect those occupying niche or specialist portions of the population.

On average, the image demonstrates good supportive evidence of the suitability of a nine-cluster solution for this analysis. Statistical assessment assures nine clusters offer the optimal compromise between model fit and model complexity, and the map illustrates the fact that the clusters are not just sensible but also are quite well-separated from each other (Sunori et al., 2023). While potentially some fuzziness across boundaries is apparent—a typical concomitant feature of the Fuzzy C-Means algorithm—clusters are revealed with internal coherence and external differentiation. It validates the ability of the model to reveal complex and overlapping patterns in the dataset, and in the majority of real-world datasets, usually reflects a situation where categories do not tend to demarcate each other with sharp boundaries. The combination of the model diagnostics and visual inspection reflects the robustness and explanatory potential of the nine-cluster solution and renders it a good point of commencement for further interpretation, segmentation, or decision-making over the revealed groups (Figure 2).

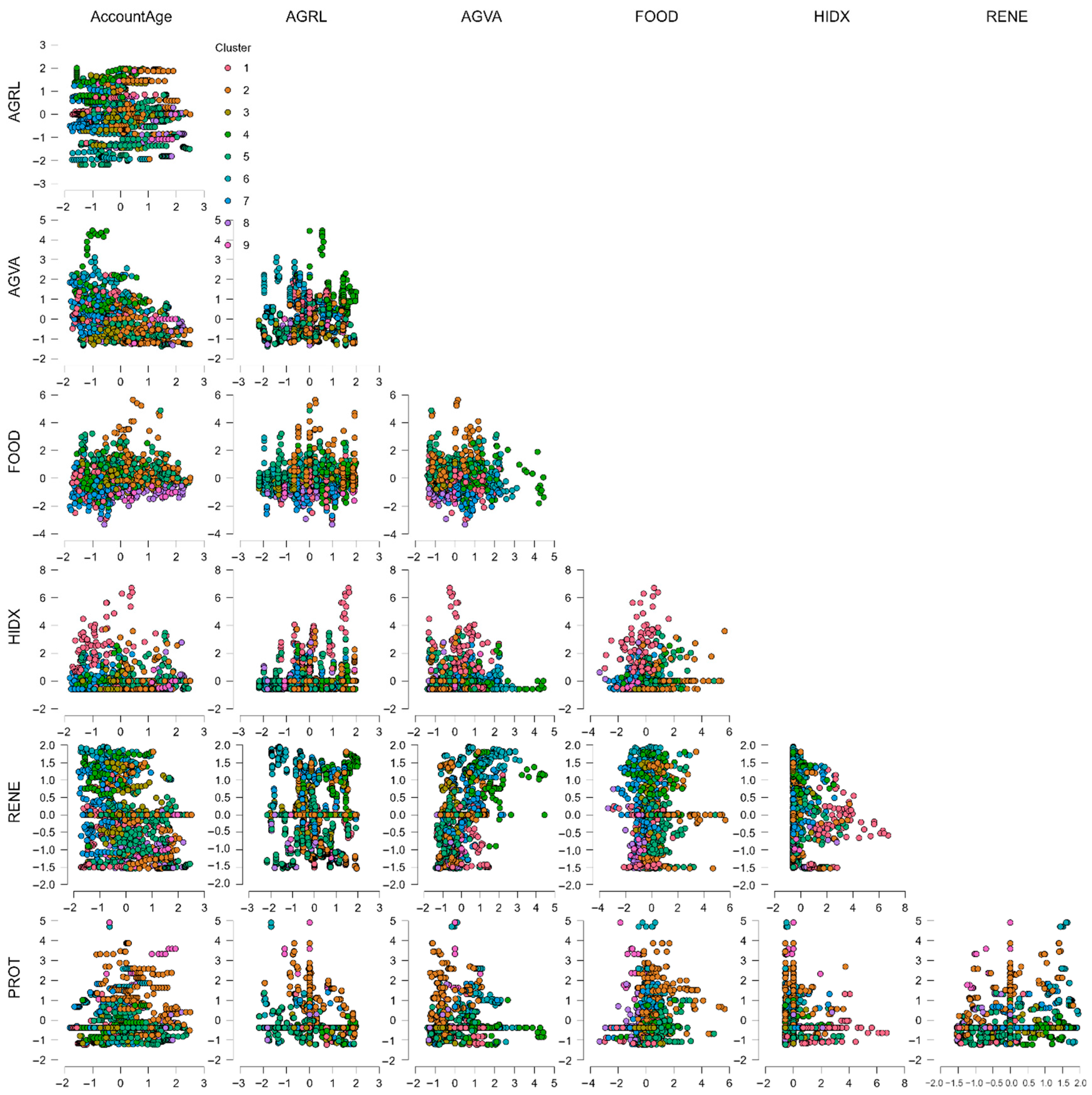

Figure 2.

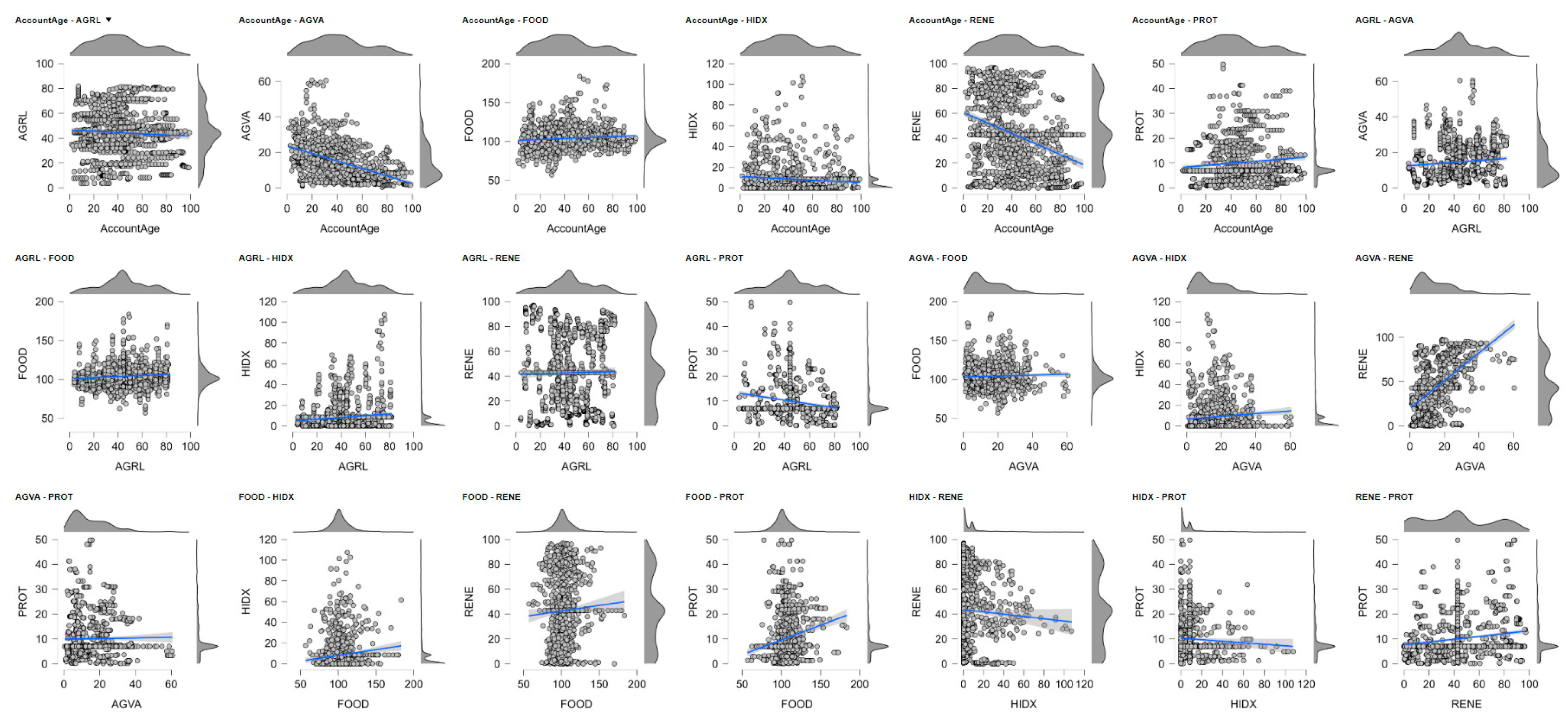

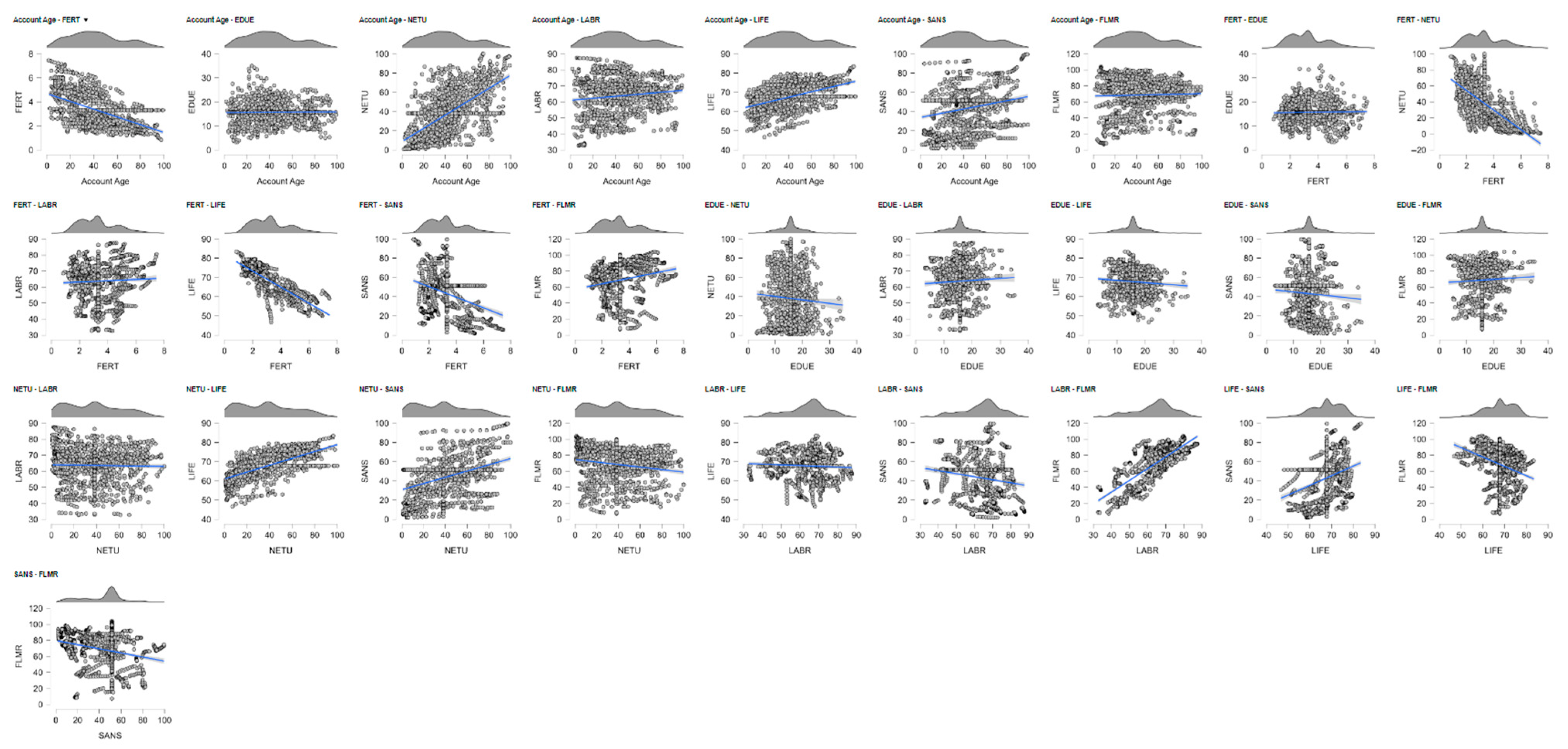

Exploring ESG Interactions in Developing Economies: Cluster-Based Pair Plot of Account Age and Environmental Metrics. The colors correspond to the clusters indicated in Figure 1.

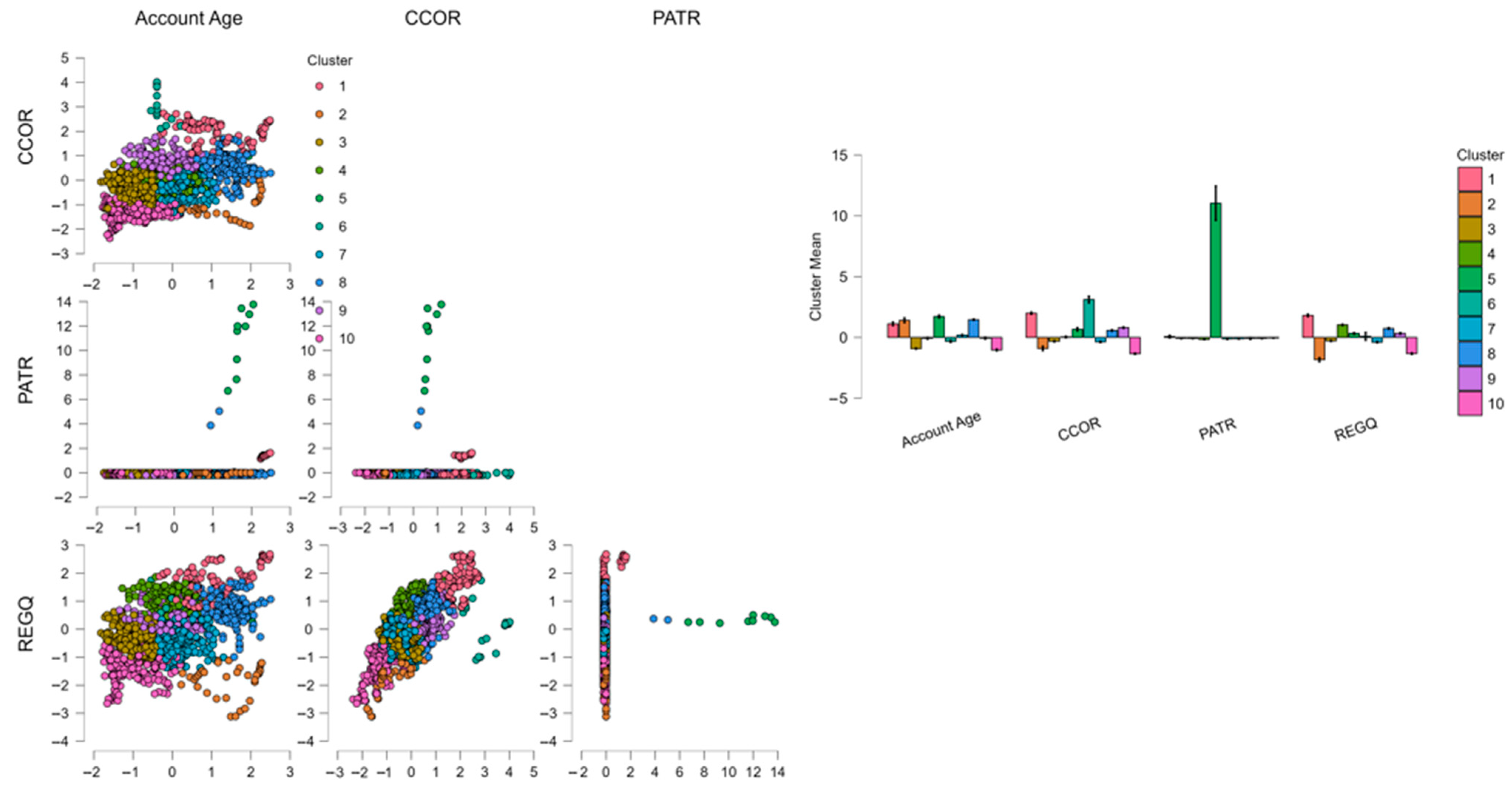

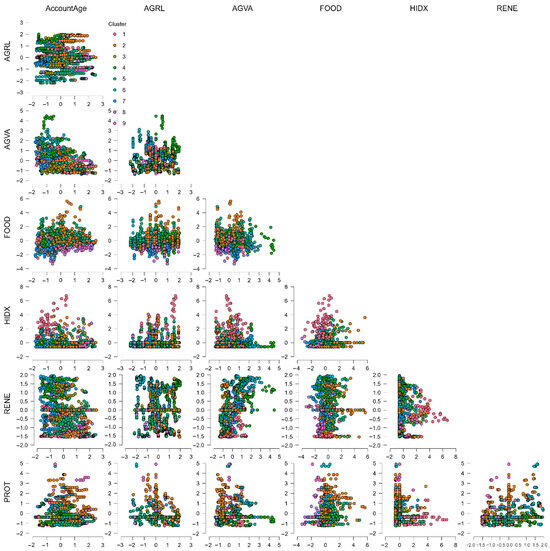

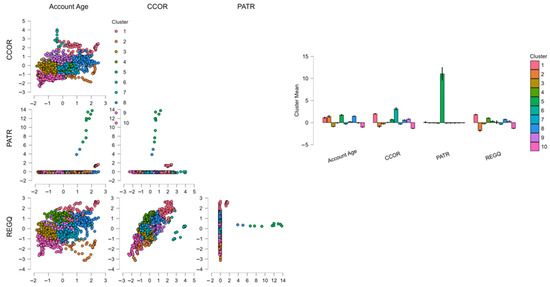

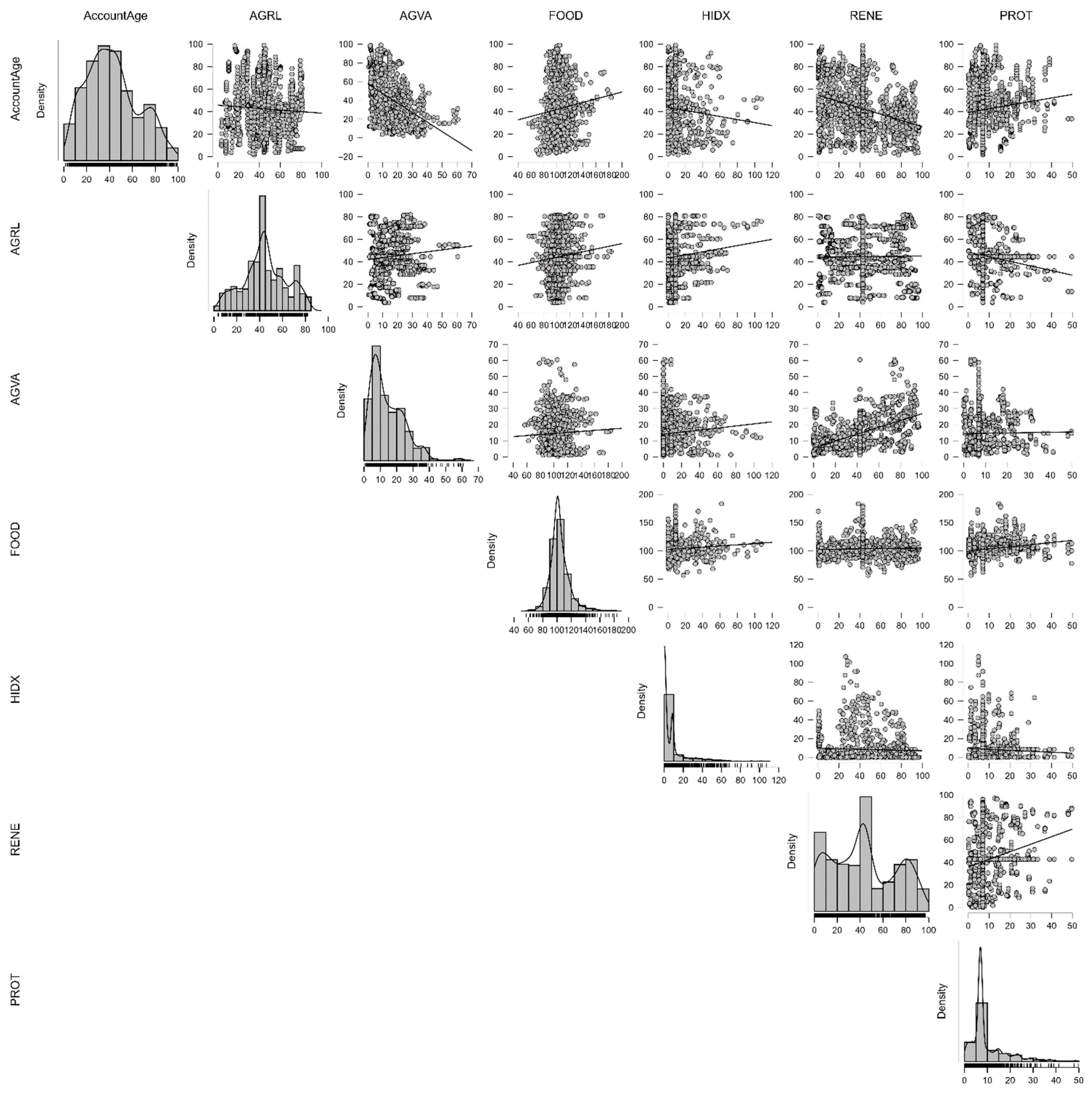

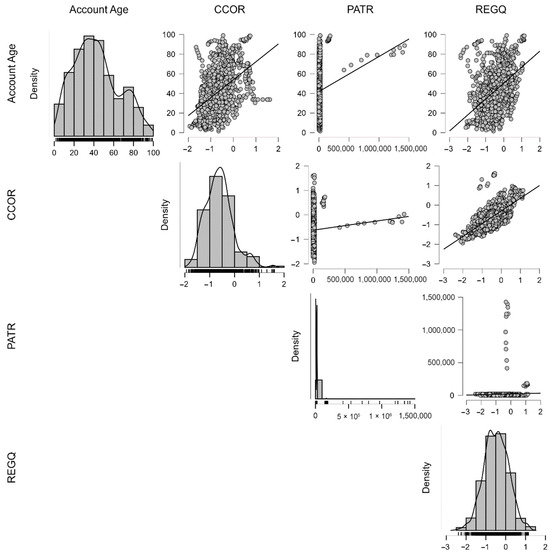

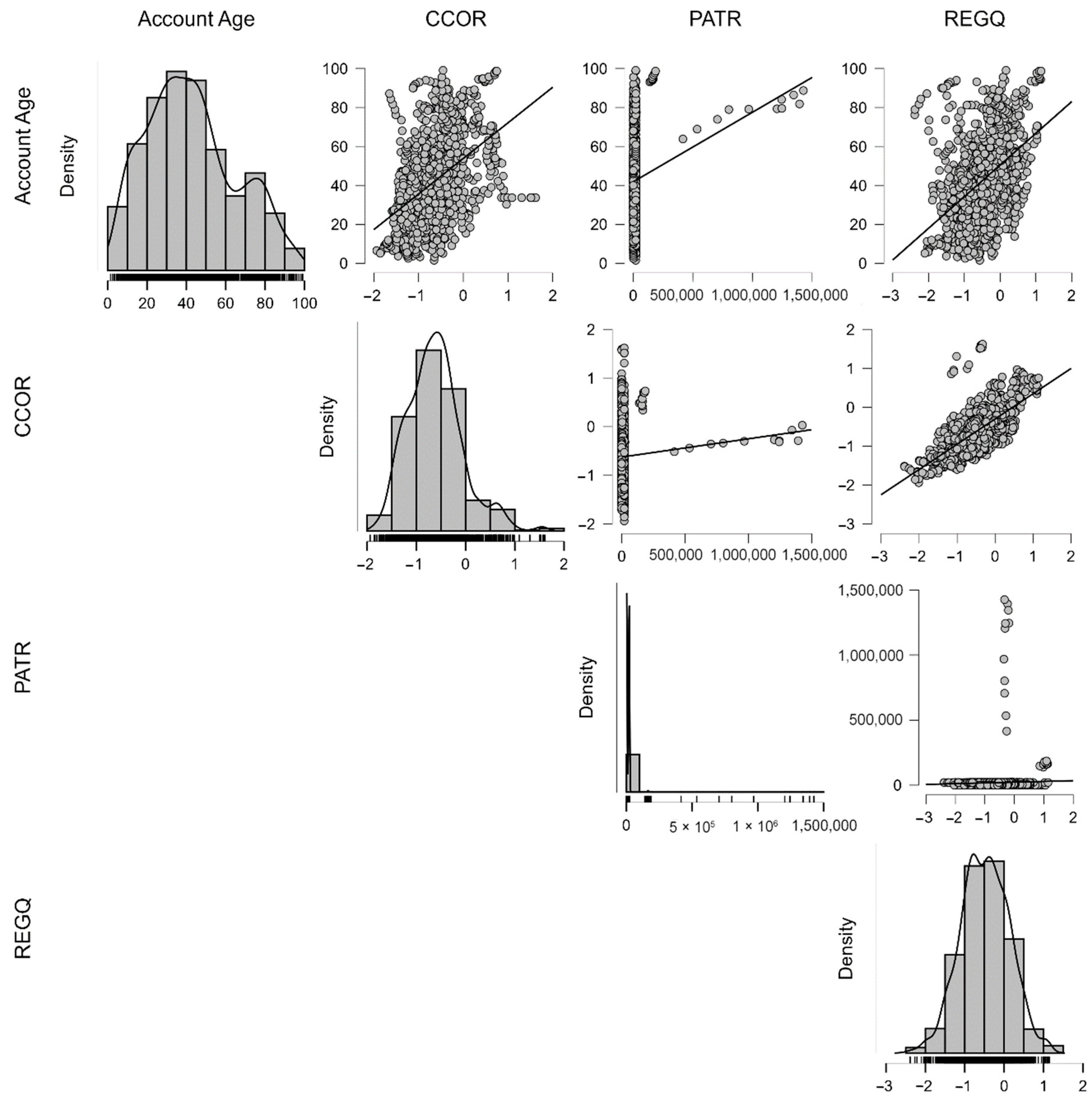

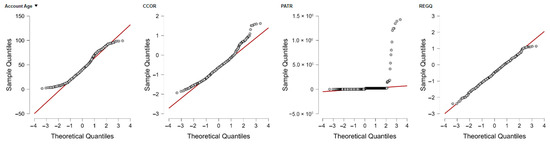

The figure displays a pairplot matrix examining the interaction between the level of financial inclusion as captured through Account Age—the proportion of individuals who own a bank account or a mobile money service—against a group of variables representative of the E (Environment) component of the ESG framework for developing economies. The included environmental variables used in the time series analysis were Agricultural Land (AGRL), Agriculture, Forestry, and Fishing Value Added (AGVA), Food Production Index (FOOD), Heat Index 35 (HIDX), Renewable Energy Consumption (RENE), and Terrestrial and Marine Protected Areas (PROT). The observations are color-coded by cluster membership from the Fuzzy C-Means clustering since each cluster defines a segment or profile of observations.

As part of this ESG framework emphasizing development, Account Age behaves as a surrogate measure of financial participation and access, essential elements of inclusive growth. A central question here is whether higher financial inclusion also correlates with better environmental performance or engagement. The distribution of Account Age is highly varied between clusters. Clusters 2, 4, and 9 show relatively high financial inclusion levels, and others like 6 and 8 cluster at the lower levels. These tendencies indicate that in developing nations, financial inclusion is not evenly spread and possibly correlated with dissimilar levels of environmental capacity and policy engagement (Essel-Gaisey & Chiang, 2022).

Examining AGRL and AGVA in particular, which capture land use and economic productivity in agriculture—key sectors in many developing economies—higher Account Age clusters tend to have medium and high values. Illustratively, Cluster 4 has a high proportion of account holders and high agricultural participation. This could be taken as a reinforcing relationship: higher financial access may be generating agricultural productivity through loans, insurance coverage, and investments in technology, or vice versa, whereby higher productivity areas may be drawing better financial infrastructure (Supartoyo, 2023).

The Food Production Index (FOOD) also offers added depth. Clusters 2 and 4 show a crossover between better financial inclusion and food production and thus could mean food security and access to finance complement each other. Conversely, both low FOOD values and low Account Age in Cluster 8 might reflect underserved areas having both production challenges and a lack of financial access, typical of more vulnerable segments in developing nations.

Renewable Energy Consumption (RENE) emerges as a very insightful variable. Cluster 9 stands out, having both a high score for renewable energy consumption and financial inclusion, which indicates a correlation between environmentally innovative policies or infrastructure and improved access to financial services (Ababio et al., 2023). This trend confirms the assumption that green transition investment—e.g., off-grid solar or micro-financing for clean energy—may be concurrent with or promote financial inclusion.

PROT, a measure of the percentage of protected environmental areas, also displays a somewhat parallel trend. More affluent Account Age clusters like 4 and 6 also report above-average PROT levels, possibly as a result of policies at the local or national level combining financial access and environmental conservation efforts (Said, 2024). In contrast, low-protection clusters like cluster 8 also report limited access to finance, supporting a trend of developmental weakness.

The function of HIDX (Heat Index 35), as an indicator of climatic stress, seems less specific, although cluster 1, which indicates high heat exposure, also has medium Account Age values. This could be a sign that a portion of the population experiencing climatic adversity may not always enjoy proportionate financial assistance and thus present equity concerns in climatic resilience planning.

As a whole, the pairplot verifies that financial inclusion—here measured through Account Age—crosses meaningfully with environmental variables at the heart of the E dimension of ESG. In developing nations, increased financial inclusion seems to co-occur alongside higher agricultural productivity, enhanced food security, the consumption of renewables, and the preservation of the environment. Conversely, areas of limited access to finance tend to coincide with economic and environmental deprivation. These findings reinstate the essence of aligning financial inclusion policy in the contexts of environmental sustainability policy, especially in emerging and under-resourced areas where ESG alignment presents both developmental and environmental returns on investment.

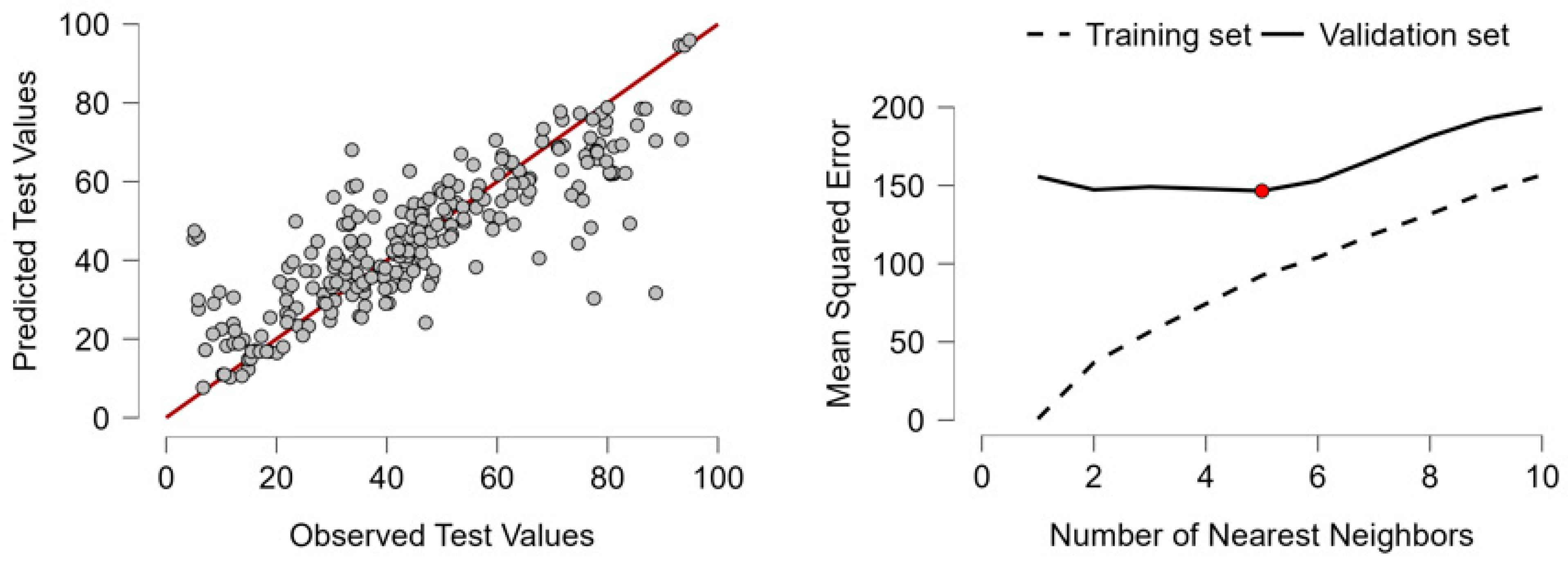

4.2. From Land to Finance: Machine Learning Insights on Environmental Determinants of Inclusion

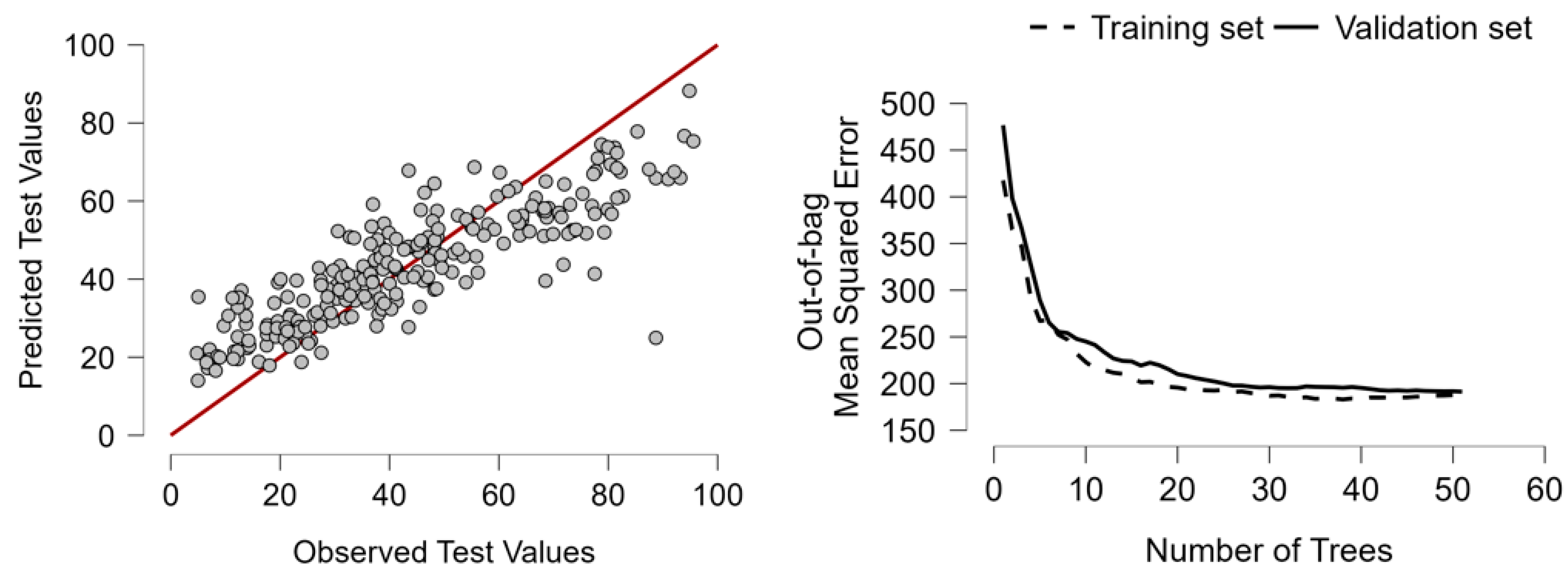

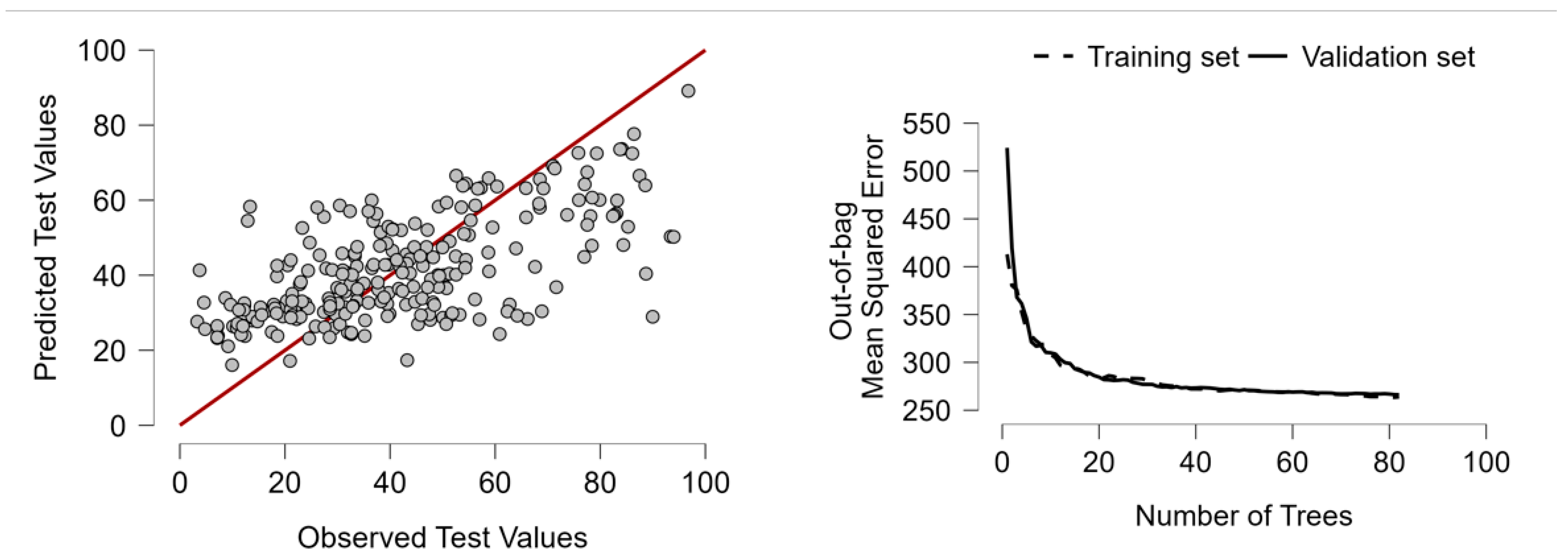

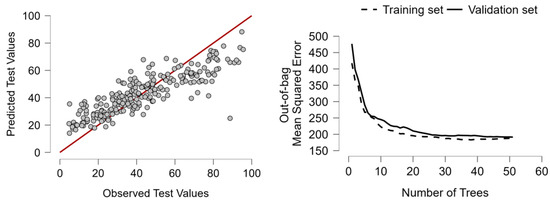

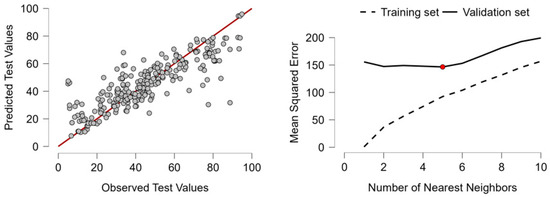

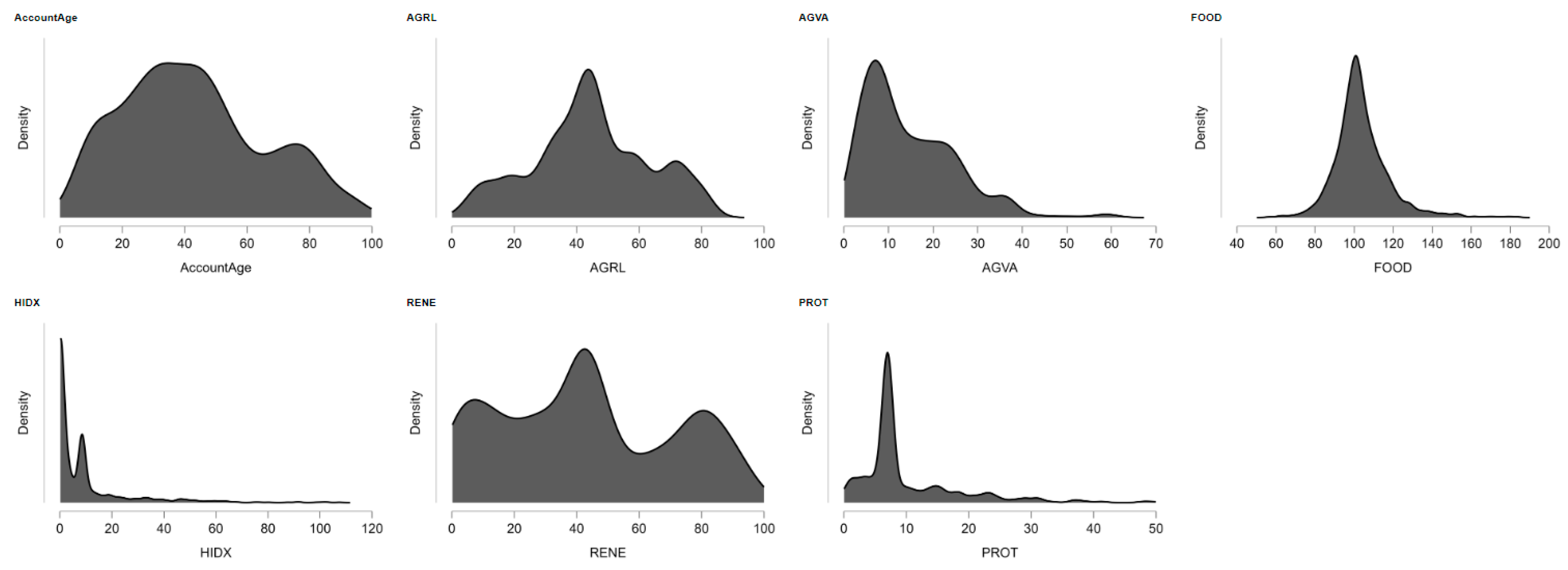

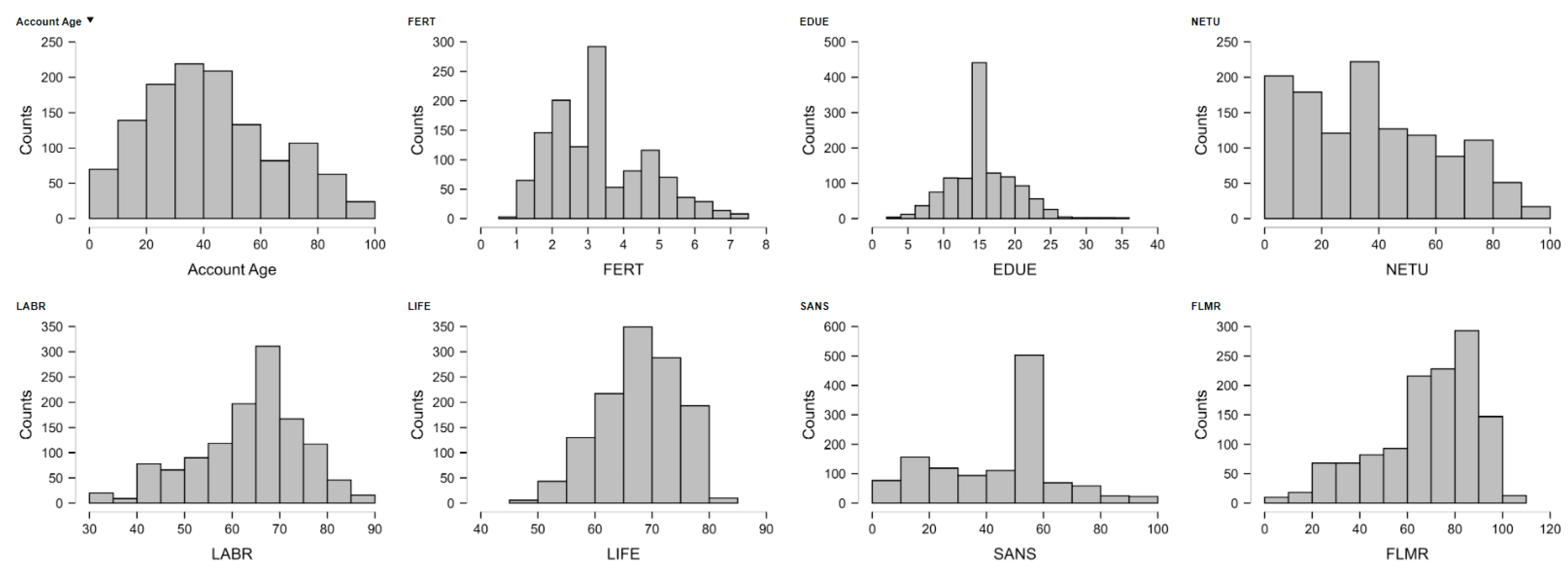

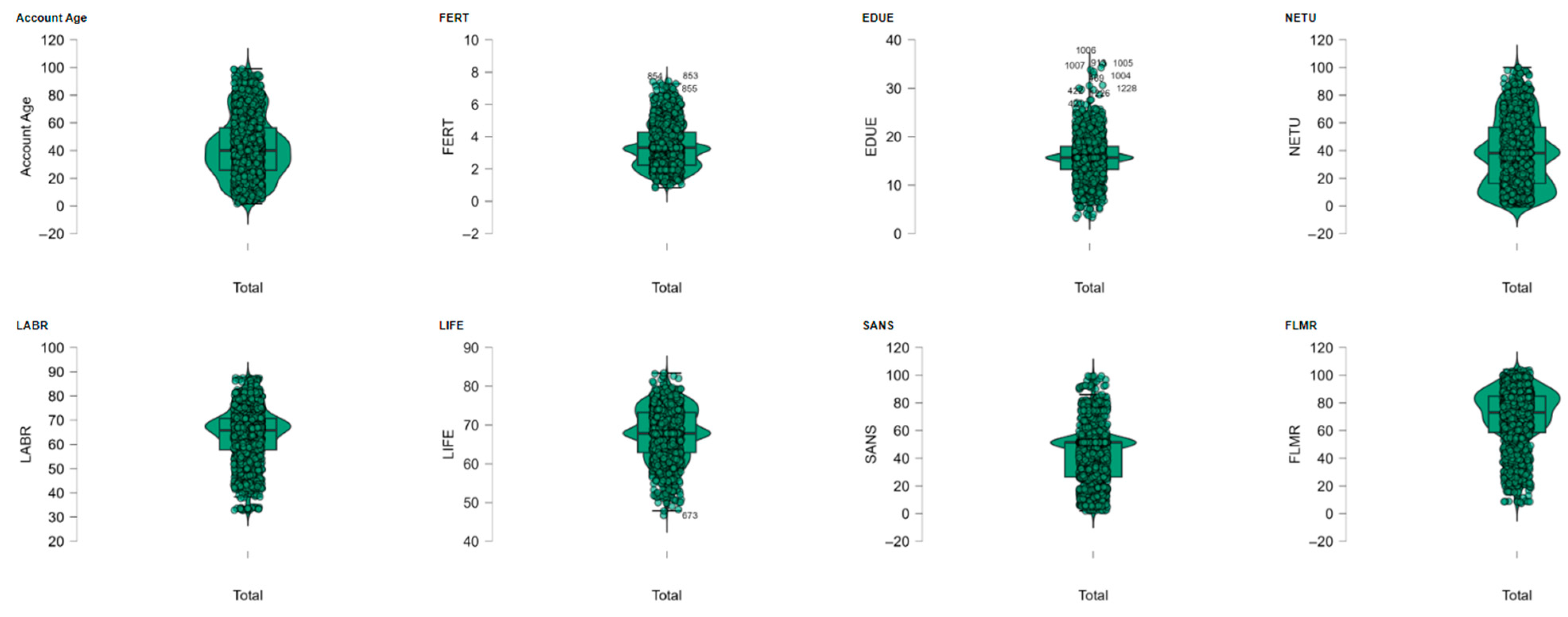

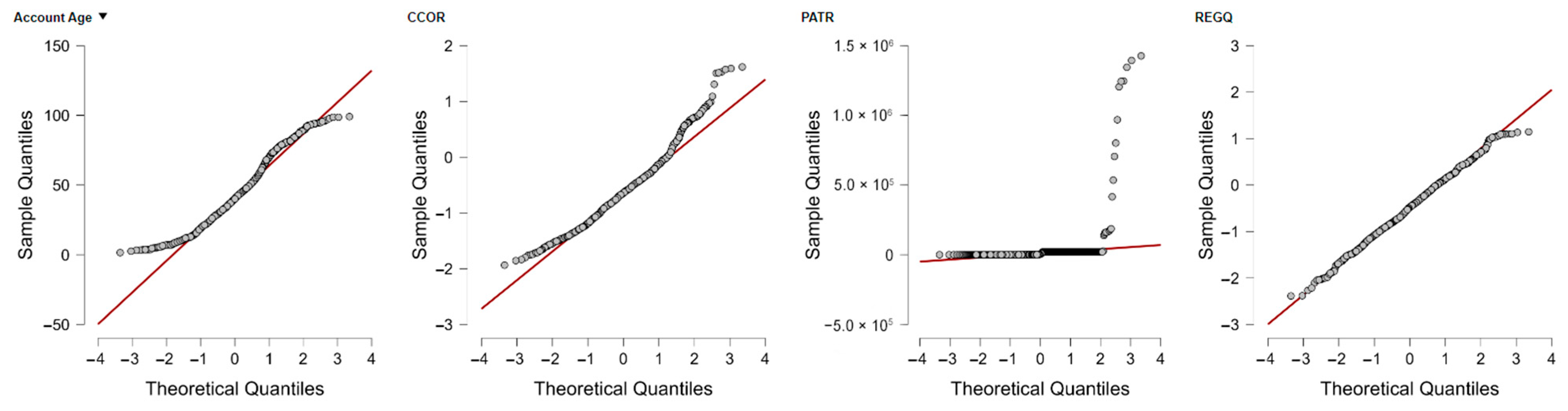

We used eight regression models: Boosting Regression, Decision Tree Regression, K-Nearest Neighbors Regression, Linear Regression, Neural Network Regression, Random Forest Regression, Regularized Linear Regression, and Support Vector Machine Regression. These models were compared based on an extensive set of performance metrics: Mean Squared Error (MSE), Scaled MSE, Root Mean Squared Error (RMSE), Mean Absolute Error/Median Absolute Deviation (MAE/MAD), Mean Absolute Percentage Error (MAPE), and R2 (coefficient of determination). To make the results comparable, results from all models were normalized based on Min-Max scaling, enabling us to map a 0–1 value range to each metric on all models (Table 7).

Table 7.

Model Evaluation of Predictive Algorithms on Financial Inclusion Using Environmental Indicators.

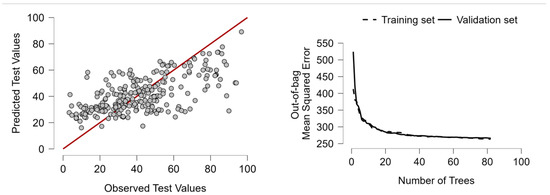

After normalization and aggregation of performance scores, Random Forest Regression came out on top as the best-performing model with a normalized average score of only 0.048, far below any other method. It also boasted the lowest MSE (162.916), lowest RMSE (12.764), and highest R2 (0.689), which clearly placed it as the best at explaining variance in financial inclusion on the basis of environmental predictors. Its performance stood far above conventional methods like Linear Regression (R2 = 0.226) or even sophisticated techniques like Neural Networks (R2 = 0.164), which, although possessing the theoretical advantage of being able to model non-linear patterns, did poorly on error scores.

These outcomes are theoretically in line with what would be expected from Random Forests. As a decision tree ensemble method based on bagging decision trees, Random Forest lends itself well to capturing non-linear, hierarchical, and interactive relationships between variables—properties found in environmental systems. The interaction between climate vulnerability (HIDX) and natural capital (AGRL, PROT), e.g., may be poorly captured through linear models. Likewise, the relationship between renewable energy take-up (RENE) and access to finance may be dependent on intervening conditions such as agricultural productivity or land use intensity, upon which a model like Random Forest can learn without specification in advance.

Furthermore, Random Forest has strong resistance against overfitting, particularly when compared to single decision trees or boosting models. This has a critical application in modeling environmental indicators between countries or regions that can differ significantly in size, resources endowed, as well as in institutional capacity. The capacity of the model in managing missing data, ranking feature importances, as well as the facility to accommodate noise, also makes it highly useful when dealing with imperfect real-world environmental data.

Conversely, other models in the comparison suffered from considerable weaknesses. As an example, K-Nearest Neighbors performed competitively on a few of the metrics but were sensitive to the presence of outliers and unsuited for the large environmental dimensionality. Boosting and Neural Networks, as strong performers generally, exhibited high error rates—likely as a result of overfitting or poorly optimized hyperparameters. Linear and Regularized Regression models, as easy-to-interpret models, performed poorly as a result of their failure to identify complex non-linearities inherent in the environmental space. The Support Vector Machine model also performed middling on all of the metrics and needs heavy tuning in order to perform at a peak level—less ideal for exploratory policy modeling.

From a policy and interpretability viewpoint, Random Forest also has other benefits. It allows for the estimation of the importance scores of features, giving insight into which environmental variables most significantly affect financial inclusion outcomes. As a case in point, initial model results indicate protected areas (PROT) and the consumption of renewably generated energy (RENE) carry high predictive weight, identifying the possible effect of conservation policy and green infrastructure on participation in the financial system. Such insight has particular utility in development planning, where the allocation of resources and environmental reform can be aligned with socio-economic inclusion on a strategic level.

The consequences of what we’ve found are significant. By showing that environmental factors can be used to predict financial inclusion at high levels of accuracy, and particularly when a Random Forest framework is used as the approach, we’re helping create a better-integrated view of sustainability. Financial inclusion is not simply a social or economic issue—it’s strongly rooted in the environmental situation of a country. In developing countries, where access to banks and the spread of mobile money increases at a very high rate, the environmental conditions of a region—whether it’s a high heatwave exposure, the take-up of renewable energy sources, or the degree of ecological preservation—will either facilitate or obstruct those changes.

Also, this research highlights the necessity of connecting ESG areas and not addressing them as disparate variables. The E component, so often dealt with as discrete from societal and governance institutions, here proves highly correlated with economic access and financial infrastructure. In the wider debate on sustainable growth, this finding lends credibility to the policy argument that efforts to make the environment more sustainable—such as conservation of resources or investments in green energy—ought not be merely regarded as climate actions but also as interventions having good spillovers in financial access and inclusion.

Ultimately, our thorough examination validates that Random Forest Regression is the most reliable and efficient approach for modeling the relationship between environmental variables and financial inclusivity in developing nations. Its theoretical flexibility, statistical performance, and empirical interpretability make it exceptionally suitable for ESG modeling, especially in rich data but structurally complex areas like the E component. As the worldwide community encourages enhanced, integrated, and fact-driven ESG disclosure, Random Forest presents a grounded and actionable solution path toward modeling and predicting environmental-socioeconomic linkages critical to ESG decision-making.

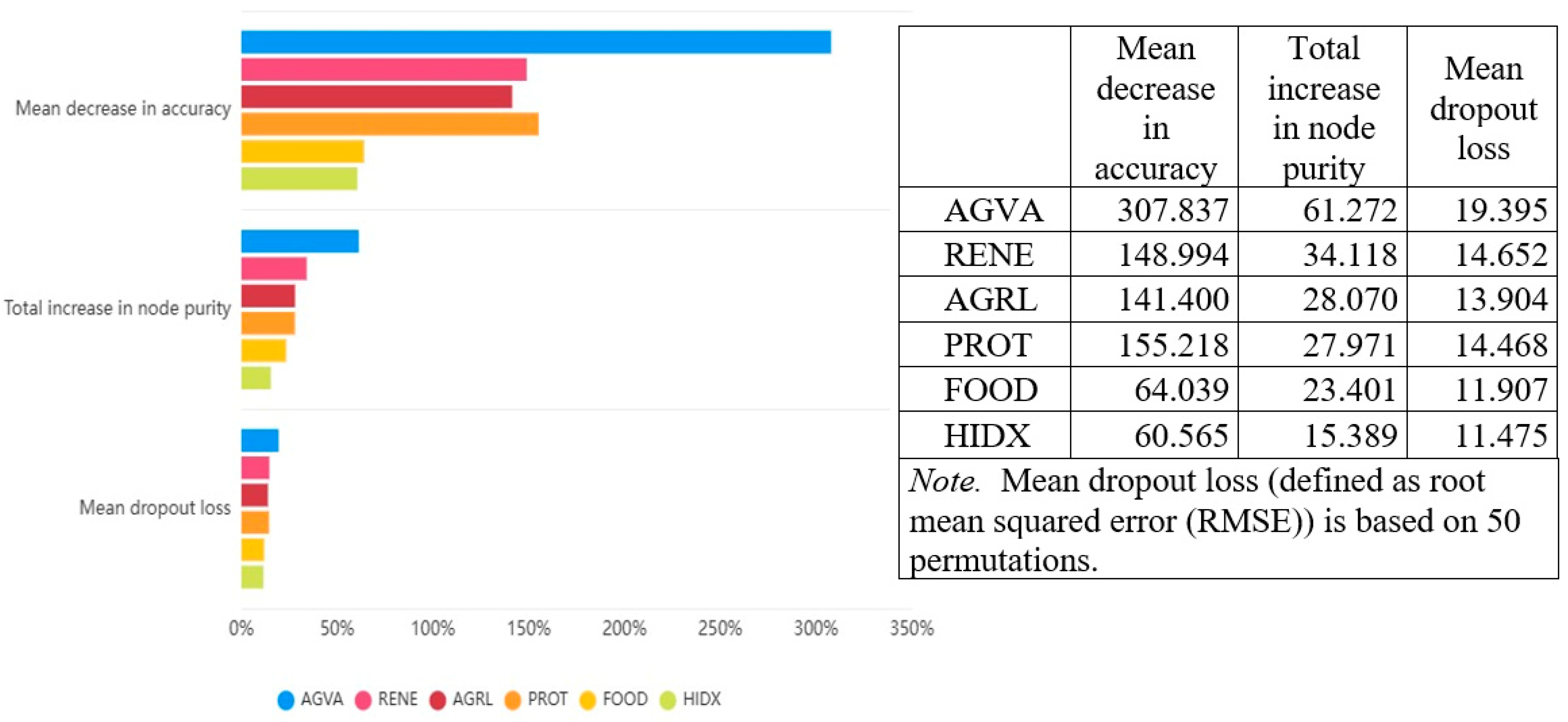

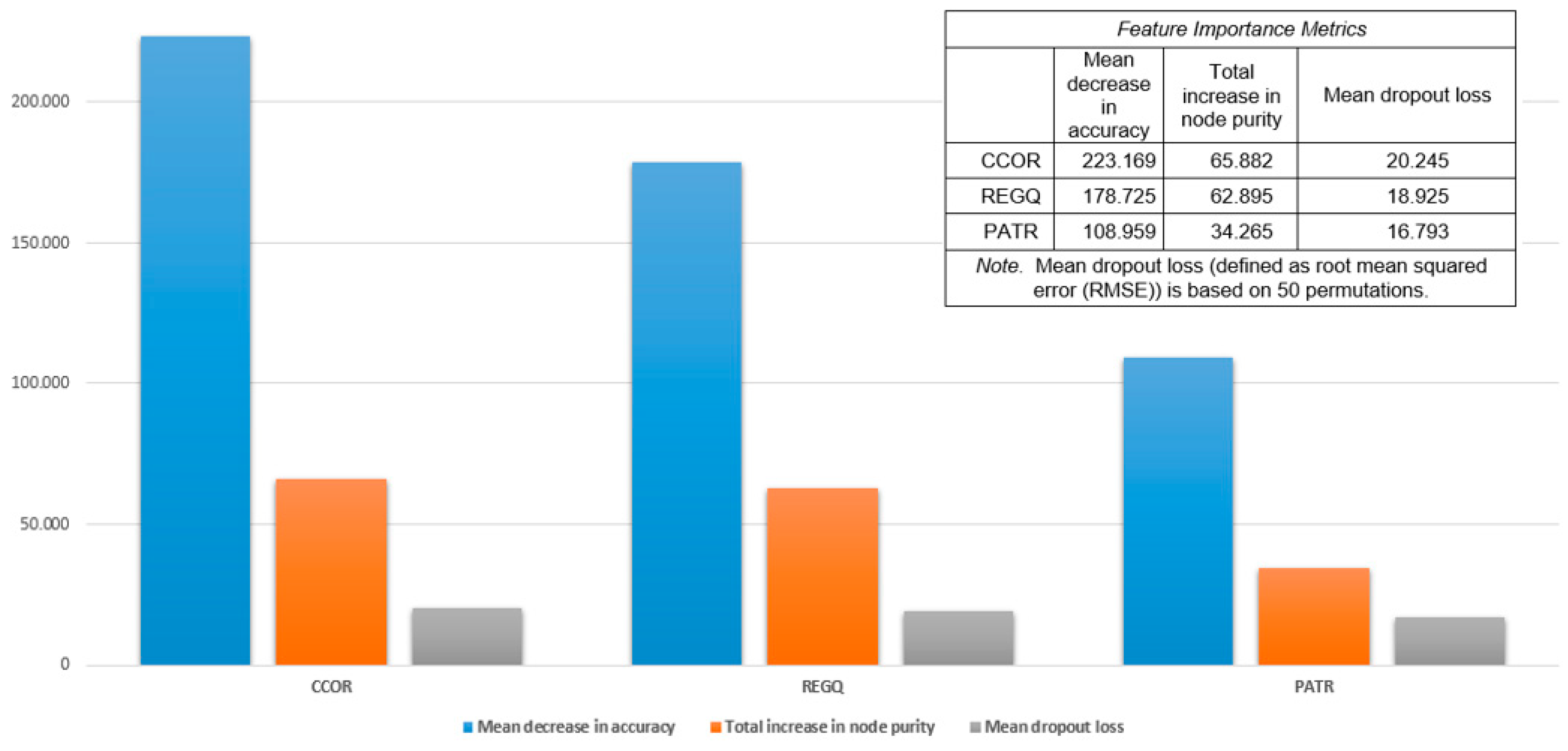

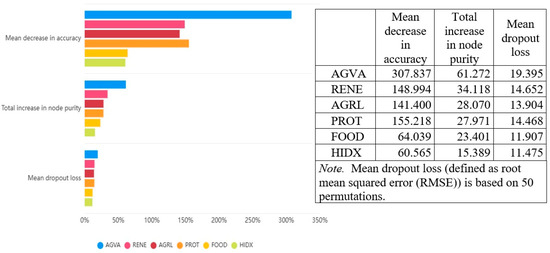

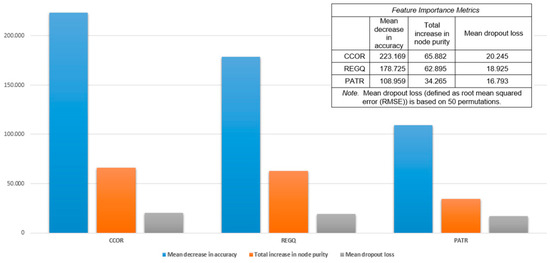

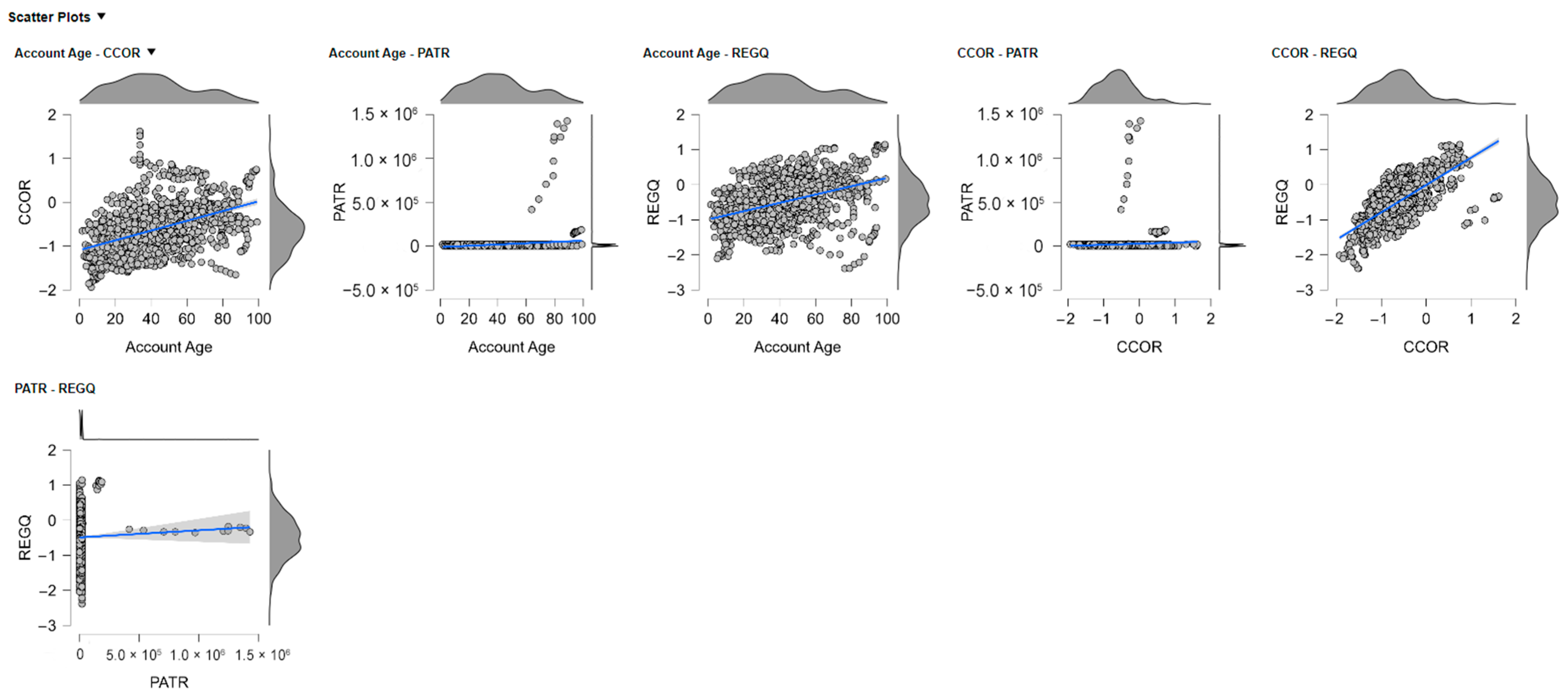

The application of Random Forest Regression as a means of explaining the link between environmental and financial inclusion, as reflected through the Account Age measure, offers insightful information on the interface between sustainability and financial access in developing economies. Account Age as a proportion of individuals who report having a financial institution or receiving money services in the last year can be taken as a good proxy for financial access. In this regard, a set of explanatory variables representing the most critical elements of the Environmental (E) pillar of the ESG approach was subjected to analysis. Such variables included Agricultural Land (AGRL), Agriculture, Forestry, and Fishing Value Added (AGVA), Food Production Index (FOOD), Heat Index 35 (HIDX), Renewable Energy Consumption (RENE), and Terrestrial and Marine Protected Areas (PROT). By explaining the impact of those environmental variables on financial access, the model provides a precise insight into development dynamics, bridging eco-resources and infrastructures, and socio-economic accessibility (Figure 3).

Figure 3.

Feature Importance Scores from Random Forest Regression: Environmental Predictors of Financial Inclusion.

Among the environmental predictors, the most important contributor to the predictive performance of the model came from AGVA. This was seen on all three importance metrics: mean reduction in accuracy, total boost in node purity, and mean dropout loss. The dominance of AGVA in the model indicates that areas of stronger economic production in the agriculture and agribusiness sectors experience increased levels of financial inclusion. The relationship may be explained by the fact that agricultural value chains tend to demand financial services like credit, savings, and insurance as well as production inputs and intermediation services, where smallholder farmers and local enterprises are involved and engaged in production for part or full cash payments. The relationship between economic production in agriculture and access to financial systems looks fairly strong and may indicate that investment in productive agriculture can simultaneously advance financial inclusion on a larger scale.

The second most powerful variable, renewable energy consumption, emphasizes the facilitating role of energy infrastructure in supporting financial participation. Renewable energy, and especially decentralized sources of it, such as wind and solar, have proven a key facilitator of digital finance and mobile money in areas without traditional access to electricity. Studies have shown that financial development and inclusion can significantly enhance renewable energy adoption, especially in developing countries (Shahbaz et al., 2021). The framework’s identification of RENE as a key driver confirms the proposition that environmental sustainability and financial inclusion do not act at cross purposes and work best together. By making energy available, renewables indirectly facilitate the utilization of financial technologies and promote inclusive development (Feng et al., 2022). Agricultural land, another critical predictor, points toward the role of land availability and utilization in determining economic conditions affecting financial behavior. Areas with larger agricultural land areas may enjoy higher involvement in agriculture and related industries, prompting interaction with financial institutions. Although less impactful than AGVA or RENE, AGRL’s significance indicates physical land resources continue to be central to development pathways, especially in agrarian economies. The performance of protected areas also deserves mention. PROT performed similarly to AGRL and RENE on the accuracy and dropout loss of the models. This might mean that environmental conservation policies may be linked to higher levels of financial inclusion, possibly due to stronger institutional arrangements or locally based approaches to natural resource management involving participation in formal systems. Or protected areas at higher levels may encourage sustainable investment or development financing, containing financial services as a part of wider socio-ecological resilience.

Food production index and heat index, although useful, were less impactful on the strength of the model’s predictions. FOOD, a measure of agricultural production, indicated modest significance, possibly because subsistence and food security may be supported by food production, but isn’t necessarily directly converted to financial participation unless linked to wider economic activity as captured in a more direct manner by AGVA. The lower significance of HIDX as a measurement of climate stress indicates that heat-associated impacts of the climate may be crucial for long-run sustainability, but less immediately impactful on financial participation. The implication here isn’t that climate variables don’t matter, but their impacts might be intermediated through other channels not captured in this model, e.g., migration, productivity losses, or effects on health.