1. Introduction

Scenario analysis is a tool for strategic planning, as highlighted in the seminal work of

Schoemaker (

1993,

1995). It is a process used for identifying and assessing the potential implications of a range of future states under conditions of uncertainty (

Bishop et al., 2007). In this sense, scenarios are hypothetical constructs, not representing forecasts or accurate predictions, but instead consisting of plausible pathways of future developments (

Postma & Liebl, 2005;

Georgiou & Pantos, 2022, p. 76). Scenario analysis and planning is a process widely used in strategic management (

van der Heijden, 2005) and, as an extension, in strategic risk management (

Andersen & Schrøder, 2012). It is a qualitative analytical tool to support risk management, with this technique employed to understand uncertainty in an “unpredictable world” (

Andersen & Schrøder, 2012, p. 159). It provides insights to the “what if?” questions (

Chapman, 2011;

Andersen & Schrøder, 2012) and thus often is also referred to as the “what if?” analysis. It is also used as a futures thinking tool within policymaking in the UK, applied in different contexts and setups, such as for the COVID-19 pandemic (

Georgiou & Pantos, 2022). It is a core policy-making tool, part of the UK’s futures thinking toolkit (

SOIF, 2021;

Government Office for Science, 2024). A special case of scenario analysis in UK policy-making is the stress testing for financial services (

Georgiou & Pantos, 2022).

Stress testing is used as a tool of a quantitative nature within financial risk management (

Hull, 2015;

Hassani, 2016). Stress testing involves the use of severe but plausible scenarios (

Hull, 2015, p. 463). It is a risk management tool to measure the resilience of financial institutions in relation to hypothetical adverse scenarios (e.g., severe recessions) (

Dent et al., 2016). The results of stress and scenario testing are used by supervisors and regulators to measure risks and manage them through setting policy. Stress tests have different characteristics in terms of their background, assumptions, limitations, methodological approach, and modelling. They could be employed to evaluate financial stability (

Marcelo et al., 2008) and could be considered in a bottom-up (

Quagliariello, 2019) or top-down setup (

Kapinos & Mitnik, 2016). Stress testing is primarily connected to the banking system and macroeconomic stresses (

Quagliariello, 2009), with studies on the calibration and design of scenarios for banking institutions (

Isogai, 2009). Stress testing is often linked to previous crises and systemic events, such as the Great Depression (

Varotto, 2012), with the use of historical scenarios from prior crises shaping bank stress testing (

Dent et al., 2016). There is a plethora of studies focusing on types and components of stress testing, covering certain risks and examples of exercises with novel modelling approaches linked to regulation. In particular about macroprudential stress testing and frameworks (

Anderson et al., 2018;

Aikman et al., 2023). Most papers focus on the quantitative angle, with particular emphasis on macroprudential stress testing and its principles (

Greenlaw et al., 2012) and testing for system risks under different scenarios (

Breuer & Summer, 2020;

Vodenska et al., 2021). Quantitative studies on the macroprudential stress testing methodology have focused on modelling approaches (

van den End et al., 2006;

Buncic & Melecky, 2013) and the stress testing frameworks (

Kwiatkowski & Rebonato, 2011;

Varotto, 2012). Other studies have focused on the capital position of bank stress testing and the modelling on the bank balance sheet (

Schuermann, 2014), with the capital adequacy implications (

Kapinos et al., 2015) and the role of stress testing disclosures in affecting banks’ risk profile (

Goncharenko et al., 2018;

Goldstein & Leitner, 2018). Linked to the type of scenarios is the macro-financial stress testing framework for credit risk (

Maino & Tintchev, 2013), with frameworks and approaches to macro stress tests for banks discussed in the literature (

Borio et al., 2012). Risk factors and scenario selection are elements of bank stress testing for credit risk modelling (

Breuer & Summer, 2020), with certain macroprudential stress tests integrating liquidity and solvency risks beyond credit and macroeconomic implications, capturing financial distress and systemic risks (

Bakoush et al., 2022).

Overall, bank stress testing has been developed significantly in the past three decades and has evolved to become a core part of the regulatory toolkit (

Dent et al., 2016). It is considered a key innovation and reform introduced in the post-global financial crises (GFC) world (

Kohn, 2020). Studies on UK regulatory prescribed stress tests have focused primarily on the bank stress tests. These have been covered extensively in Dowd’s four “no stress” reports, commenting on flaws in the BoE’s bank stress testing programme, based on previous exercises, such as the 2015 and 2018 iterations (

Dowd, 2015a,

2015b,

2017,

2019), and more recently regarding stress testing during COVID-19 (

Buckner & Dowd, 2022). Consequently, this paper seeks to add to the stress testing literature after presenting a critical analysis of a particular type of stress test: the ones prescribed by regulators in the UK for financial services, covering simultaneously the exercises for banks and for insurers, plus other financial institutions. This qualitative study looks at the regulatory prescribed stress test characteristics and components to provide insights in relation to their identified trends and associated challenges for future exercises, offering policy recommendations for financial services preparedness.

The focus of this paper is placed on the regulatory prescribed scenarios, which are designed and developed by prudential supervisors/regulators and are imposed on certain financial institutions. These are usually the systemic financial services, meaning the largest banks

1, asset managers, and reinsurance undertakings. In this case, attention is placed on the regulatory prescribed stress tests for UK financial services, as developed by the UK prudential regulators, the Bank of England (BoE) and the Prudential Regulation Authority (PRA), often supported by the Financial Conduct Authority (FCA). Stress tests are widely discussed in the literature, as mentioned above, but mostly focusing on their quantitative components. Moreover, often emphasis is placed on stress testing approaches and models outside the exercise run by supervisory and regulatory bodies. Plus, it is common to focus on a specific type of stress testing in relation to a use, risk considered, and/or applicable sector (i.e., for credit risk, for banks only). Therefore, there is a gap in providing a combined critical analysis of stress testing practices for all financial services within a specific jurisdiction. This paper seeks to offer insights in that area, commenting on regulatory prescribed stress tests for UK financial services after conducting a qualitative analysis regarding their characteristics, key elements, and components.

Regulatory prescribed stress testing is a core element of prudential supervisory objectives. It is an example of rules-based supervision of a prudential nature, since its dimensions are pre-defined, with an expected approach for quantification, contrary to micro-prudential stress tests (principles-based regulation (

Armour et al., 2016)) developed by the entities themselves. There are different regulatory requirements underpinning stress testing and scenarios, conditional on their use and purpose, for each type of financial services entity, such as under the Solvency II Directive for re-insurance undertakings. These are not described in this paper, since attention is placed on a special case of stress testing, the ones developed and designed by regulators, complementing scenarios examined at the entity level. Regulatory prescribed stress tests have specific objectives and aims, in line with the supervisory approach underpinning them. In the UK, this is in alignment with the Bank of England’s approach to banking and insurance supervision (

BoE, 2023f,

2023g). The exact objectives of each regulatory- prescribed stress test linked to its nature and the risks covered (i.e., cyber risks), are usually stated in the letter announcing the exercise. Different stress and scenario tests are considered in financial services for various uses and purposes, and are part of an overarching stress and scenario testing framework (SSTF). The regulatory prescribed stress tests led by the prudential supervisors are also part of the SSTF. The following figure (

Figure 1) attempts to depict these types of stress and scenario tests, to support the development of the SSTF. The core supervisory objectives of regulatory prescribed stress tests created based on the PRA’s and BoE’s approach to supervision (

BoE, 2023f,

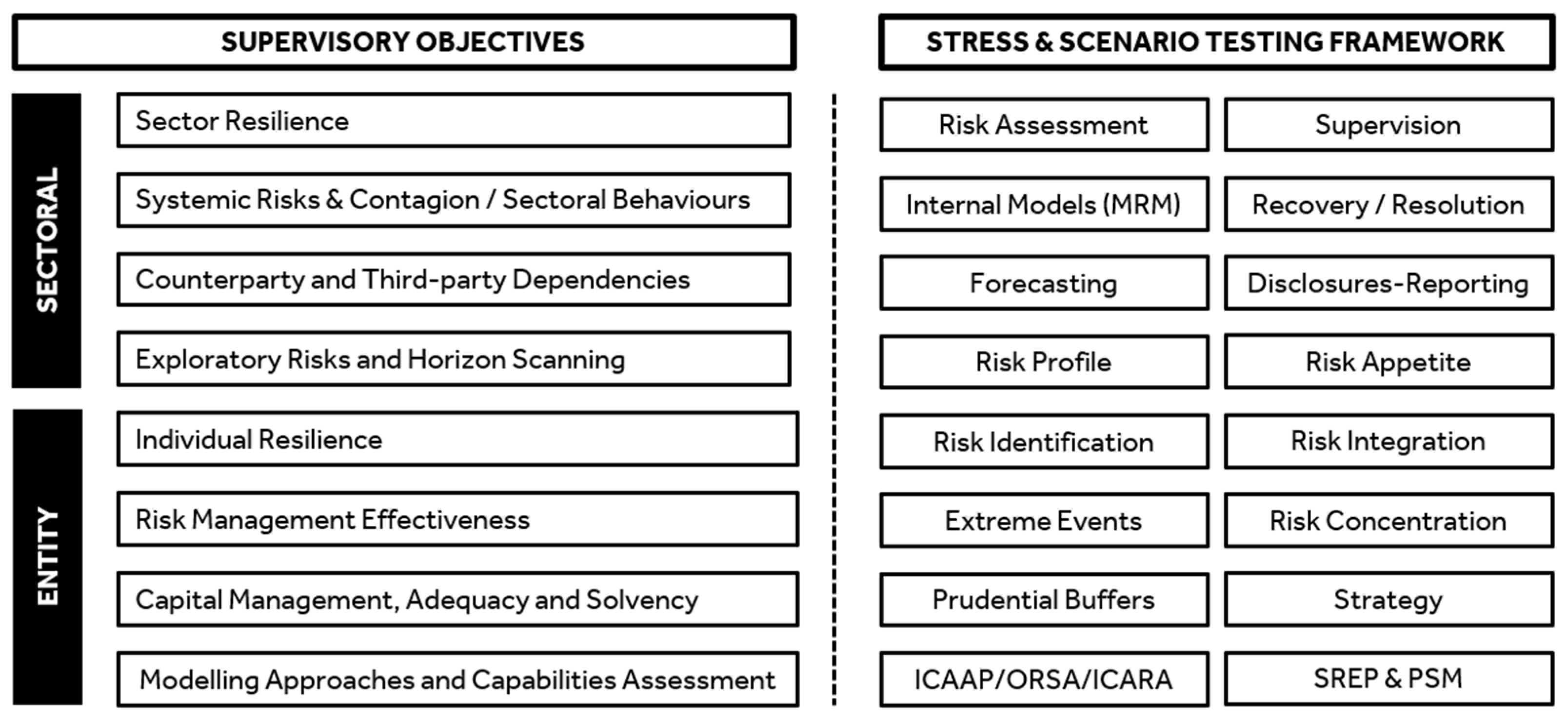

2023g) also shape the SSTF. These are presented on the left-hand side (LHS) part of the figure, segmented into sectoral (i.e., for the entire financial sector) and entity-specific objectives. There is a direct link between those supervisory objectives and the different requirements for examining a range of stress and scenario tests. The purpose and underlying reason of for examining them is are presented on the right-hand side (RHS) part of the figure. Regulatory prescribed stress tests are the key linking the supervisory objectives of the LHS with the uses from the RHS, explaining their importance in creating the SSTF.

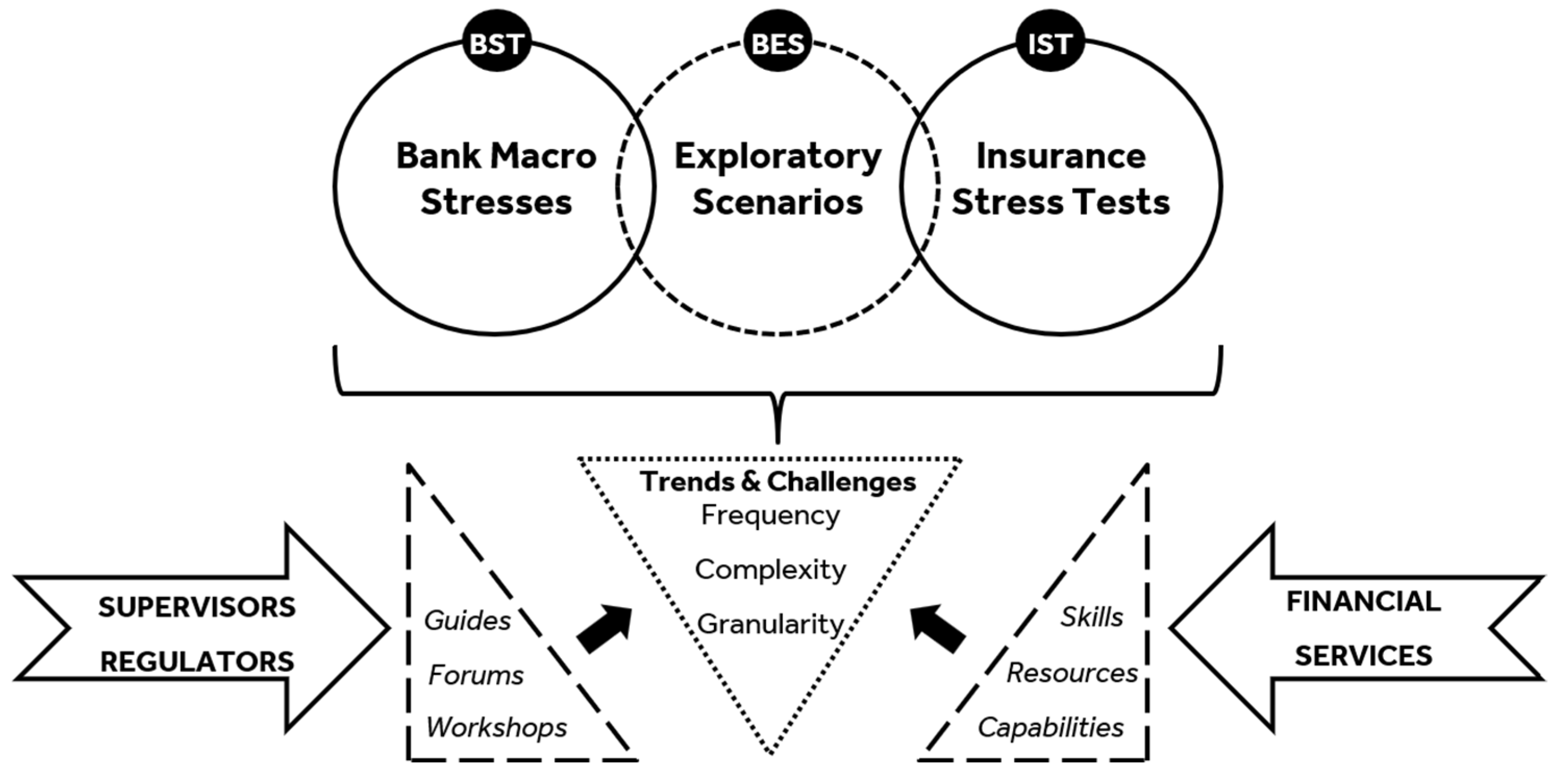

In this paper the different regulatory prescribed stress tests for UK financial services are presented, split by sector, for banks initially and for insurers, and then by purpose and type, such as the exploratory scenarios. The (main) regulatory prescribed stress tests for UK financial services in the scope of this paper are presented in the figure (

Figure 2) below. The three categories of regulatory prescribed stress tests graphically depicted in that figure are the bank stress tests (BST), the insurance stress tests (IST), and the (biennial) exploratory scenarios (BES). The timeline for the different types of regulatory prescribed stress tests is captured, with each scenario comprising the BST, IST, and BES

2 by the year of each corresponding exercise, discussed in the main part of this paper.

The key elements of each regulatory prescribed scenario are briefly discussed, covering the main assumptions, data, timelines, participants with entities in scope, and the lessons learnt from the obtained results. This critical analysis supports the identification of trends and future challenges, discussing policy recommendations. The five trends describing regulatory prescribed stress tests based on the previous exercises, referring to the regulatory collaboration, cross-industry stresses, exploratory scenarios with their reporting/disclosures, and modelling and tools, are discussed and explained. Linked to the challenges underpinning future exercises, covering governance, frequency, individual disclosures, data/modelling, and capabilities/skillset, recommendations for regulators and participating entities are noted. The proposals for policy developments aim to enhance the supervisory framework to account for those challenges while at the same time supporting financial institutions in improving their internal stress testing practices. Practical suggestions on stress testing advances are presented in the study originating from the critical review and qualitative analysis conducted.

The paper is structured as follows. After briefly covering the methodological approach followed, the main part of this paper is divided into four sections. The first part with

Section 3 discusses the macroeconomic scenarios for banks dedicated to BST. The second part, with

Section 4, presents insurance stress testing for the IST, covering the stresses for general insurers, life insurers, and the realistic disaster scenarios for Lloyd’s of London. This is followed by the exploratory scenarios, the third part and

Section 5 for the BES, with a sub-section dedicated to each scenario for financial services, presenting the climate, liquidity, cyber, and system-wide exercises. Stress testing developments with proposals and recommendations are discussed in the final

Section 6 and fourth part. The conclusion,

Section 7, summarises the key findings, highlighting directions for future research and further extensions.

2. Methods and Approach

This doctrinal legal research critically examines the risk management tool of stress testing in terms of its development, use, and application from a regulatory and supervisory perspective of prudential nature for UK financial services. A socio-legal approach is adopted (

Halliday & Schmidt, 2010) to conduct this empirical legal research of financial regulation (

Black, 2010). Attention is placed on the design and practice of financial regulation, capturing the UK financial services stress and scenario testing regime (

Black, 2010). The underlying regulatory framework comprises both rules and principles underpinning supervision for financial system stability and individual institution safety, soundness, and overall solvency (

Moosa, 2015;

Kokkinis & Miglionico, 2021). This consists of the legislative, regulatory, and soft-law rules and principles applied to financial institutions (

Kokkinis & Miglionico, 2021, p. 13) in relation to stress testing as a supervisory tool of solvency financial regulation and its use (

van Greuning & Bratanovic, 2009;

Moosa, 2015). Focuses on the prudential supervision of financial institutions and the prudential provisions (

Armour et al., 2016) and the risk-related financial requirements (

Kokkinis & Miglionico, 2021, p. 21), as triggered by crises (

Cranston, 2002). Stress testing linked to capital adequacy requirements with ‘buffers’ for banks (

Cranston, 2002;

Armour et al., 2016) is instrumental within the context of (bank) supervision and analytical review, which is part of the supervisory process (

van Greuning & Bratanovic, 2009). The objective is to comment on developments post the GFC 2008/09, strengthening the prudential regulation, with emphasis on stress testing that is considered a tool utilised in preparation for future major crises (

Buckley et al., 2016;

Benjamin, 2025). Stress testing as a measure of prudential regulation and supervision and how it supports their function and objectives for advances to financial regulation (towards optimality) (

Herring & Santomero, 2000) are examined in this study.

Studies in law and financial regulation, as mentioned above, have focused on prudential regulation and supervision without looking in detail at the characteristics of regulatory prescribed stress tests, thus providing the theoretical background adopted in this case. Additionally, most financial economics studies have focused primarily on banks stress tests and often in a cross-comparison across different jurisdictions (

Baudino et al., 2018). A comparative analysis of bank stress testing from

Baudino et al. (

2018) is of a qualitative nature, similar to this study, but captures different regulators, with the UK being one of the frameworks examined. Plus, the most recent stress testing developments at the UK level with the updated BoE’s approach (

BoE, 2024c) are not reflected. The propositions of

Borio et al. (

2012) are for macro stress tests only, for the macroprudential framework considerations, and for banks at the global level. Similarly, for macroprudential stress testing for banks only (at the US level primarily), elements of macroprudential stress testing, covering the purposes, scope, and output, with asset and liability considerations, are discussed in

Greenlaw et al. (

2012).

Schuermann (

2014) has developed a framework for stress testing banks after reviewing other macroprudential stress tests from different jurisdictions, covering risks considered and the volume of participating banks.

Vodenska et al. (

2021) have modelled the European Banking Authority (EBA) stress test results for system risks where UK banks previously participated.

Kolari et al. (

2019) have used the bank risk dimension as a determinant of predicting pass or fail of bank stress tests for European Banks. Other studies on UK stress tests have focused only on banks and the bank macroeconomic stress test, such as Dowd’s reports from the Adam Smith Institute (

Dowd, 2015a,

2015b,

2017,

2019), and equally not commenting on the latest exercises. Consequently, there are no studies commenting on the entire stress testing framework across financial services, with this paper providing key insights from the critical review of the UK regulatory prescribed stress tests. On the basis that the focus of this study is the financial regulation and prudential angle of stress testing for financial services, a qualitative (document) analysis is conducted to understand their differences and provide insights for future developments. This methodological approach allows the comparison of the characteristics of the regulatory prescribed stress tests for UK financial institutions, looking at their core elements (i.e., how their results were published, how many entities were in scope, etc.) and how these have evolved in line with the approach to supervision from UK regulators.

The methodological approach adopted comprises conducting a critical analysis of the stress testing publications from the BoE, the PRA, and the FCA

3. This refers to the prudential regulation and supervision regarding stress and scenario testing, with secondary data from the UK financial services regulators and supervisors. Specifically, the scenario guidelines and specifications, with the accompanying announcements and the published results, are reviewed and critically examined. The document analysis involves reviewing the BoE’s approach to stress testing, based on its bank-specific publication (

BoE, 2015,

2024c) and the overarching approach to banking and insurance supervision (

BoE, 2023f,

2023g). The focus is placed on the qualitative characteristics of the regulatory prescribed stress tests. Commenting on their design and calibration (

Isogai, 2009) and their definitions and main components, as anticipated in stress tests for the financial system (

Quagliariello, 2009). This involves examining their scope, risks considered, timelines, and entities in scope (volume, type, list) with the published results and the format of their output. These dimensions for the key regulatory prescribed stress tests for financial services in the UK are described in the subsequent sections of this paper.

In relation to the research content and innovation, this is obtained from ‘joining the dots’ (

Benjamin, 2025) between the different types of regulatory prescribed stress tests summarised. This is based on their critical examination, even if in a qualitative format, covering the exercises developed for different types of financial institutions (i.e., insurance stress tests), as well as combining the joint exercises (i.e., the exploratory scenarios). As there is a gap in the literature regarding those types of scenarios prescribed by the regulators for different purposes, characteristics, and entities in scope. Most stress testing studies are quantitative and focus on banks mainly, presenting the different modelling components of stress tests. Examples include studies performed at the global level and for macro stress tests and the macroprudential framework (

Borio et al., 2012;

Schuermann, 2014;

Baudino et al., 2018). Therefore, this paper attempts to capture the qualitative characteristics of regulatory prescribed stress tests for all financial services, banks and insurers, asset managers and funds, all from the same jurisdiction, the UK, simultaneously in the same study. This is an advance on previous studies that have focused on UK bank stress testing only (

Dent et al., 2016;

Dowd, 2015a,

2015b,

2017,

2019;

Buckner & Dowd, 2022). In this paper, the key differences and similarities of those types of scenarios are discussed, providing valuable insights to (a) entities in scope, (b) entities not in scope so they could advance their own stress testing practices, and (c) other regulators to learn from the approach of the BoE/PRA/FCA in the UK. As a risk management tool, scenarios and stress are widely referenced in legal, regulatory, and policy requirements. Therefore, understanding their core elements and evolution is of high importance for both policy-makers and financial institutions. Especially from a qualitative perspective and the legal and regulatory angle, examining and commenting on their characteristics. Scenario analysis as a technique is also linked to the PESTEL analysis and framework

4 (

Johnson et al., 2017). For this reason, a PESTEL

5 analysis based on

Johnson et al. (

2017, pp. 34–47) and

Andersen and Schrøder (

2012, pp. 149–150) should be conducted as part of the critical analysis of regulatory prescribed stress tests. This supports the review of their characteristics, as discussed in detail in the subsequent sections of this paper. The following table (

Table 1) presents the PESTEL analysis for the regulatory prescribed stress tests for UK financial services, showing how these issues and associated risks are reflected at each type for the BST, IST, and BES, respectively.

3. Macroeconomic Scenarios for Banks

The approach to stress testing the UK banking system is documented in the BoE’s guidance initially issued in 2015, followed by an update last year in 2024 (

BoE, 2015,

2024c). This guide details the approach, supervisory objectives, and scenario characteristics of the regulatory prescribed stress tests for UK banks (

BoE, 2024c). Until the recent update on the guidance, the macroeconomic

6 scenarios for banks were captured in the concurrent

7 stress test run annually, the ACS (

BoE, 2015). In addition to the ACS, in 2021 a Solvency Stress Test (SST) was examined, followed by the 2024 desk-based stress test (D-BST). From 2025, the frequency of the ACS will be reduced, transitioning into an exercise run every other year, referred to as the Bank Capital Stress Test (BCST) (

BoE, 2024c). In-between this cyclical scenario exercise, a macroeconomic stress differing in nature, scope, and granularity, more akin to the D-BST, is going to take place (

BoE, 2024c). Bank stress testing focuses on the stability of the sector, assessing key financial risks

8. These typically are credit, market, counterparty, and interest rate risks on the banking book (IRRBB), in line with the regulatory capital requirements and the Basel regime. Their evaluation under stressed conditions provides insights on the capital and liquidity adequacy of the banking institution. The impact on banks is conditional on the type of shock under macroeconomic stress tests (

Quagliariello, 2009, Fig. 2.1). Reporting of those assessments with further detail describing the banks’ risk profile is provided under the Internal Capital and Liquidity Adequacy Assessment Processes (ICAAP/ILAAP). How these risks are considered and shape regulatory prescribed stress tests is explained in the Basel Committee of Banking Supervision (BCBS) principles for sound stress testing practices and supervision (

BCBS, 2009,

2018).

On the basis that the ACS exercises are of a similar nature, only the latest stress is examined below. The results of the ACS provide insights on the appropriate balance between sector and individual bank resilience, used to inform the FPC and RPC on the resilience of the banking system to cyclical risks (

BoE, 2015). The ACS of 2022/23 was the first exercise since 2019 and the start of COVID-19 for the UK banking sector (

BoE, 2022c). The systemic banks are usually invited to participate, referring to the largest UK banks and building societies

9 accounting for ~75% of lending to the UK real economy (

BoE, 2022c, Section 4). It consisted of a macroeconomic stress that is calibrated by design as more extreme than the GFC and is based on the current macroeconomic outlook (

BoE, 2022c). The baseline scenario is broadly consistent with the central projections in the report of the (August 2022) Monetary Policy Committee (MPC) Report (

BoE, 2022c). The ACS assesses the resilience of the UK banking system to deep simultaneous recessions in the UK and global economies, large falls in asset prices and higher global interest rates, and a separate stress of misconduct costs consisting of (a) a UK and global five-year macroeconomic stress (2022 Q3 to 2027 Q2), (b) traded risk stress, linked to a financial market scenario consistent with the content and calibration of the macroeconomic stress, and (c) misconduct costs stress (

BoE, 2022c). Quantitative templates were available with the evolution of the macroeconomic environment and economic conditions underpinning the forecasts employed in the scenario about relevant parameters, such as spreads, interest rates, foreign exchange currency rates, etc. (

BoE, 2022c). The assessment completion consists of quantitative templates submitted with the inclusion of a qualitative review of banks’ stress-test capabilities, a new angle, and similar to the insurance requirements as discussed in Section 4 of this paper (

BoE, 2022c). In terms of the results reporting, they were published in aggregate and individual format in July 2023 after the exercise was completed (

BoE, 2023d). In the results, a comparison with the 2019 ACS and the GFC was presented to provide insights on the participating banks’ performance (

BoE, 2023d, Table A). The detailed results and post-stress financial position of each participating systemic bank are captured in an annexe with the granular disclosures (

BoE, 2023d,

2023h). This level of detail is aligned with the prior ACS exercises. Considering the importance of the ACS and to support participating banks, the BoE has published different data templates, a manual, and a dictionary, detailed in the Stress Test Data Framework (STDF) (

BoE, 2022b).

During the start of the coronavirus pandemic in 2022, the BoE cancelled the concurrent stress test in 2022 and instead launched the Solvency Stress Test (SST) in 2021, which was different than the ACS (

BoE, 2021d). The objective of the SST was to test the resilience of the UK banking system against a much more severe evolution of the pandemic and consequent economic shock (

BoE, 2021d). The aim of the SST was to move beyond the capital buffer adequacy assessment and rather refine the ‘reverse stress test’ (RST) exercise assessment the PRA conducted in August 2020 (

BoE, 2021d). Note that the RST was discussed at the August 2020 FPC’s Financial Stability Report but limited to aggregate results and themes, based on its nature (

BoE, 2020, pp. 48–59). The participating banks of the SST were disclosed

10, with the results published in both aggregate and individual format (

BoE, 2021d, Section 3, 7,

2021e). The SST results were published in Q4 of the same year the exercise was launched, mirroring the format and granularity of the ACS, with the results and financial position detailed in a separate annexe (

BoE, 2021e).

In 2024 the PRA prescribed the desk-based stress test (D-BST), including two hypothetical severe but plausible combinations of adverse shocks to the UK and global economies (

BoE, 2024b). The two D-BST scenarios, referring to the supply shock and the demand shock, are countercyclical and originated from the vulnerability assessment of the Financial Policy Committee (FPC) (

BoE, 2024b). According to the BoE’s description of the D-BST scenarios, the supply shock assumed a severe negative global aggregate supply shock based on rising geopolitical tensions and commodity prices, with disrupted supply chains resulting in higher inflation, whereas the demand shock was based on a severe negative global aggregate demand shock with global recession and dropping inflation (

BoE, 2024b). The pathway of macroeconomic variables was provided, in comparison to the previous ACS and the GFC, as a benchmark (

BoE, 2024b, Table A). Contrary to the previous ACS and SST exercises, the list of participating banks was not disclosed. However, it was stated that the major banks and building societies, representing three-quarters of the lending activity in the UK, took part (

BoE, 2024b). The results were published in the November 2024 Financial Stability Report (

BoE, 2024a, Section 6, pp. 66–83). Again, comparing them against the ACS and SST results, it included slightly less detail and reported on an aggregate level, without individual disclosures from participating banks. The insights of the obtained results will be used to inform the 2025 exercise on the Bank Capital Stress Test (

BoE, 2024a) in line with the new approach to bank stress testing (

BoE, 2024c).

Finally, not ACS participating firms perform their own stress testing based on the PRA guidance, using a published scenario every six months to serve as a guide for banks and building societies designing their own scenarios. Beyond the ACS, SST, and D-BST, the PRA also publishes stress and scenario tests for smaller banks and building societies that do not participate in the concurrent stress testing. For these stresses, only the pathways of the relevant macroeconomic variables are provided and disclosed. These scenarios are usually utilised for the ICAAP purposes. More information is available directly from BoE’s dedicated website on stress testing.

4. Insurance Stress Test

The Insurance Stress Test (IST) is (usually) a biennial exercise, asking the largest regulated life and general insurers to provide information about the impact of a range of stress scenarios on their business (

PRA, 2023a). The IST is a key priority for the PRA and insurers, with the objective to (1) assess sector resilience to severe but plausible adverse scenarios, (2) guide supervisory activity, and (3) enhance PRA’s and firms’ ability to respond to future shocks (

PRA, 2022b). The IST exercise is split into separate scenarios for life insurers and for general insurers, denoted as LIST and GIST, respectively. In terms of objectives and purpose, similar to bank stress tests, it is to evaluate the resilience of the sector and inform policy setting. Specifically, the PRA uses the GIST and LIST to (1) assess sector resilience, (2) guide supervisory activity, and (3) support capacity building in risk management (

PRA, 2023a).

The IST exercise was initially launched back in 2015 for general insurers. The IST 2022 was the fourth PRA exercise for general insurers and the second for life insurers since the introduction of Solvency II. Therefore, there have been four GIST exercises, in 2015, 2017, 2019, and 2022, with the last two accompanied by a LIST exercise too. There have been three LIST exercises to date with the current 2025 scenarios since starting back in 2017, followed by the 2022 exercise, both run in parallel with the equivalent GIST. The IST is a core element of the insurance supervision, with its results published in aggregated format, usually a few months after the IST is completed. However, contrary to the bank stress test, individual results are not disclosed. Indeed, in the initial GIST and LIST exercises, not even the participating entities in scope are listed. Only in the 2022 and 2025 exercises is the list of insurers invited to participate captured (

PRA, 2022a,

2022d,

2025b).

Another unique feature of the IST is the qualitative return to accompany the spreadsheet template, which was first introduced in 2022, the “Results and Basis of Preparation” (RBP), capturing the internal approach in quantifying the IST (

PRA, 2022c). The RBP report requires a firm to provide a narrative of its scenario results, including perspectives on the conclusions, limitations, data and modelling issues, and any management actions taken and assumptions made beyond those set out by the PRA (

PRA, 2022c). It is used by the PRA to assess the comparability and robustness of the results and hence the plausibility of forming an assessment of sector resilience based on aggregating firm results (

PRA, 2022c). The purpose of the RBP report is to provide information on the level of governance and quality assurance as well as additional information required to support the quantitative results (

PRA, 2022c). The similarity with the bank stress testing is that the RBP reports are used to gather information about firms’ risk management capabilities and thus inform the PRA’s supervisory approach (

PRA, 2022c,

2025b). The RBP was also included as a requirement in the most recent LIS 2025 (

PRA, 2025a).

Finally, another interesting point in relation to the IST is the international supervisory collaboration, as it happened back in 2019 with the support of the Bermuda Monetary Authority (BMA) (

PRA, 2019b,

2020). This was the first joint exercise with the BMA, after recognising the reliance on Bermuda-based reinsurers and the focus of the exercise on natural catastrophe scenarios (

PRA, 2019b,

2020). This was conducted in accordance with the Insurance Core Principles (ICPs) of the International Association of Insurance Supervisors (IAIS) (

PRA, 2020).

It should also be noted that the PRA usually shares the initial IST with scenario specifications, descriptions, and assumptions with participating entities in scope, inviting feedback before finalising the IST and officially launching the exercise. The key highlights from the seven GIST and LIST exercises are presented in the following two sub-sections as below. An overview of the insurers that participated in the recent GIST and LIST exercises is presented in

Appendix A (

Table A1).

4.1. General Insurance

The first GIST exercise was launched in 2015, where the largest general insurers of Category 1 and 2, 26 in total across 39 legal entities, inclusive of Lloyd’s syndicates, were invited to participate; however, they were not specified publicly (

PRA, 2016). The GIST 2015 consisted of three different scenario categories: (a) five market-wide stress tests, (b) four difficult-to-assess scenarios focusing on emerging risks, and (c) two-firm specific defined scenarios (

PRA, 2016). In the first category, denoted as “Type A”, eleven stress tests of severe but plausible events were included (

PRA, 2016). These stresses consisted of natural catastrophes

11, three synchronised terrorism events, a motor lability stress, and an economic shock linked to the bank’s stress test, as in the previous section (

PRA, 2016). The emerging risk-related scenarios, denoted as “Type B”, which include less detail in terms of their specification and flexibility in their application, consisted of a supply chain disturbance, a liability stress scenario, a solar flare, and a cyber loss (

PRA, 2016). The final category of firm identified future stress tests as “Type C”, including an idiosyncratic scenario considered to be a 1-in-200-year event and also one reverse stress test with an assumed return period beyond that (

PRA, 2016). The results with the findings from each scenario of the GIST 2015 were detailed in the “Dear CEO” letter issued in April of 2016 (

PRA, 2016). In the Annexe of that letter, the aggregate market-level impact was disclosed, along with insights from PRA’s interpretation of the market results (

PRA, 2016). Even for Type B and C scenarios, which were defined flexibly, PRA’s observations were noted to provide a market-wide view (i.e., return period of reverse stress tests in Table 11) (

PRA, 2016).

The second exercise for general insurers was the GIST 2017, two years after the GIST 2015. As in the GIST 2015, the 26 largest GI firms, with the addition of the largest 16 Lloyd’s syndicates, participated (

PRA, 2017a). The GIST 2017 consisted of fewer scenarios, split into two sections: Section 1 with defined severe but plausible scenarios and Section 2 with an exposure-gathering exercise for UK risks by sector (

PRA, 2017b). As explained earlier in the first section, the IST serves different supervisory objectives, with the GIST 2017 designed to support the PRA for both insurance sector (macro) and individual entity (micro) level supervision

12 (

PRA, 2017c). Given the significant reduction in the volume of scenarios compared to the GIST 2015, the GIST 2017 was concluded within that year, publishing the feedback and results in December, after the April launch of the exercise (

PRA, 2017b,

2017c,

2017a). Section 1 consisted of defined scenarios, comprising a set of four natural catastrophe scenarios as Part A, with Part B an economic downturn scenario, again linked to the BoE’s ACS for 2017, similar to the approach of the GIST 2017 (

PRA, 2017c). The four natural catastrophe scenarios include a European windstorm and flood set of events at the EU and UK level, a Pacific North-West earthquake and associated tsunami, a California earthquake, and a set of US hurricane events, all examined separately in isolation (

PRA, 2017c). Section 2 captured the exposures of general insurers to different sectors of the UK economy in terms of number of policies, gross written premiums, and total limits, segmented by main lines of insurance business (

PRA, 2017c). The results of the GIST 2017 were published in aggregate format, with more detail in the area of reinsurance interconnectedness and overall resilience of the sector as key findings of the exercise (

PRA, 2017a). Areas for improvement were also highlighted in relation to exposure management, natural catastrophe modelling, post-loss planning, and accounting (

PRA, 2017a). Finally, the output of Section 2 was noted under consideration to support the development of liability scenarios for future exercises (

PRA, 2017a).

The third GIST was the 2019 exercise and the first to be jointly coordinated with the BMA (

PRA, 2019b). The PRA clarified that entities were invited to participate on a voluntary basis (

PRA, 2019b), with the GIST 2019 not being a pass vs. fail exercise and not designed to set capital buffers, but instead covering PRA’s sectoral and firm supervisory objectives

13 (

PRA, 2019a). As in the previous two GIST exercises, the entities invited to take part were not disclosed; however, the PRA again noted that the largest 20 general insurers and the 15 largest Lloyd’s syndicates participated, representing 75% of the UK GI sector (

PRA, 2020). As in the previous exercise, the GIST 2019 was split into separate parts: the core stress tests of Section A with a severe economic downturn scenario (insurance asset shock) and Section B with four natural catastrophe liability shock scenarios

14, superimposed onto the Section A scenario, plus a liability scenario with assumed deterioration in technical provisions because of claims inflation examined in isolation (

PRA, 2019b,

2019a). The final part, Section C, is of an exploratory nature and not a stress test, with climate change scenarios (C1); the exposure-gathering information for liability exposure management (C2), similar to GIST 2017, and lastly, a cyber underwriting loss scenario (C3) (

PRA, 2019a,

2019b). The GIST 2019 specifications were detailed, providing the scenario background with key assumptions and input for modelling (

PRA, 2019a). The GIST 2019 was the first regulatory prescribed stress test at the UK level that included the initial exploratory climate change scenario (

PRA, 2019a). The cyber risk scenario was also new for the GIST, but variations of it have been included in the Lloyd’s RDS since the 2016 exercise (

Lloyd’s, 2016). The increased level of detail also characterises the results of the GIST 2019, published the year after, again in aggregated format, capturing the feedback and key findings (

PRA, 2020). Coinciding with COVID-19, the PRA noted three areas for further work at the industry level in relation to data quality, allowance for risks outside standard models, as well as allowance for secondary perils based on recent events (

PRA, 2020). Postponing the next GIST to 2022 (instead of 2021) because of COVID-19 was a key supervisory development, with statements about follow-up work on cyber stress tests (as in GIST 2022) and the BoE’s CBES discussed in

Section 4.1 below (

PRA, 2020).

The final and most recent set of scenarios was the GIST 2022, in line with earlier exercises, to assess sector resilience to severe but plausible adverse scenarios, guide supervisory activity, and enhance regulatory and entity ability to respond to future shocks, according to the PRA (

PRA, 2022a,

2022b,

2023a). The GIST 2022 comprised two scenario categories: Section A with three natural catastrophe scenarios and Section B with three cyber underwriting scenarios (

PRA, 2022a). The natural catastrophe scenarios included a set of US hurricane events, similar to GIST 2019; California Earthquakes, like the Lloyd’s RDS; and windstorm plus flooding events happening in the UK, like GIST 2017 (

PRA, 2022a). Note that the natural catastrophe scenarios with the CAT vendor model output (i.e., from RMS and Verisk-AIR) are closer to the Lloyd’s RDS explained in

Section 4.3 below. At that same GIST exercise, cyber risk scenario considerations were introduced, building from the GIST 2019 exercise on the cyber exploratory scenario, focusing on the underwriting of this risk (

PRA, 2022a). Specifically, the three cyber scenarios prescribed were a cloud down, a data exfiltration, and a systemic ransomware (

PRA, 2022a). In the scenario specification, guidelines, and instructions underpinning the GIST 2022, the PRA provided in detail the responses participating entities provided as part of their feedback for the first and second rounds of technical input requests (

PRA, 2022a, Annex 1). This was the first time in the IST that the feedback from insurers invited to take part was publicly disclosed, improving the level of transparency (

PRA, 2022a). Actually, it was reported that upon receiving feedback from the insurance industry, the cyber-attack on the shipping navigation system, which was the further scenario, was dropped eventually (

PRA, 2022a, Annex 1, 13, p. 54). The full list of the entities invited to participate was also disclosed, listing the 17 large UK general insurers but without naming the 21 selected managing agents from the Society of Lloyd’s (

PRA, 2022a, Annex 2, p. 59). That was another positive development that further improved the level of transparency of the GIST exercise. The feedback from the GIST 2022 exercise was detailed in the “Dear CEO Letter” published by the PRA a few months post its completion in early 2023 (

PRA, 2023a). Obtained results were disclosed in aggregate format again, with key findings, and overall followed the trend of increased level of detail (

PRA, 2023a). The increased level of detail also characterises the results of the GIST 2019, published the year after, again in aggregated format, with movements in aggregate solvency coverage ratio post each scenario (

PRA, 2023a). Key findings were also noted by scenario, highlighting modelling gaps (primarily about the natural catastrophe scenarios) and (inter)dependencies with reinsurers (

PRA, 2023a).

Finally, following from the 2022 GIST, the PRA published their intention to run a dynamic general insurance stress test in 2025, denoted as the DyGIST (

PRA, 2023b). Based on the PRA’s initial statement, the objectives of the DyGIST are to assess the industry’s solvency and liquidity resilience to a specific adverse scenario, involving a simulation of sequential adverse events over a short period of time, to evaluate the effectiveness of insurers’ risk management and management actions following that, as well as to inform PRA’s supervisory response post that scenario (

PRA, 2023b). The DyGIST is the extension of the GIST, an evolution of exploratory nature, which has been eventually delayed with amended timelines and an anticipated start in May 2026 (

PRA, 2024d).

4.2. Life Insurance

There have been three LIST exercises to date with the current 2025 scenarios since starting back in 2019, followed by the 2022 exercise, both run in parallel with the equivalent GIST. The first LIST was published in 2019, consisting of two parts with four scenarios: the economic and life-insurance-specific stress (Parts A and B) and the exploratory climate change scenario (Part C), as for the equivalent GIST (

PRA, 2019c). The first core scenario included a downturn and deterioration in the economic environment (Part A), with three life insurance-specific scenarios imposed on the first core scenario (Part B) (

PRA, 2019b,

2019c). The life insurance-specific stresses refer to a credit spread with a credit quality step rise as the insurance asset shock with spread increase, an increase in longevity with a fall in base mortality rates, and a more severe base mortality rate stress, resulting in a breach of the minimum SCR of 100%, all (separately) added to the first core scenario (

PRA, 2019c). The LIST shares in common all the characteristics with the GIST exercise of the same year (

PRA, 2019a,

2019b,

2019c). The entities invited to participate are not disclosed, the scenario specifications are provided in detail, and the key feedback points from the request for technical input that resulted in changes are noted in the “Dear CEO Letter” announcing the IST 2019 exercise (

PRA, 2019a,

2019b,

2019c). The same applies to the reporting of the LIST results, captured in the same “Dear CEO letter” issued by the PRA the year after the IST 2019, presented in an aggregated format, with the key findings and learnings (

PRA, 2020, Annex 3). From the published results, it is clarified that 17 large life entities across 12 groups were invited to complete the LIST 2019, but without naming them (

PRA, 2020, Annex 3). Limitations around data and methods because of approximations and simplifications are noted, mirroring the modelling comments accompanying the GIST, revealing a common theme across the insurance industry on data and modelling (

PRA, 2020).

The second LIST exercise was issued in 2022, the same year in which a GIST was also performed (

PRA, 2022b,

2022d). The LIST 2022 scenario consisted of four stages: initial market shock (stage 1), developing market shock (stage 2), protracted market shock (stage 3), and protracted market and longevity shock (stage 4) (

PRA, 2022d). At each stage, the different underlying economic conditions and market characteristics (i.e., interest rate drop by −50 bps) were provided to capture the impact from the stress, conditional on the insurers responses for the asset side (no trading vs. trading post stress) and the liabilities (Transitional Measures on Technical Provisions—TMTP) (

PRA, 2022d). In terms of the scenario dimensions and parameters, the same approach was followed as for the GIST 2022, showing the feedback participating insurers provided to the PRA (

PRA, 2022d, Annex 1). The entities invited to participate, referring to the 16 largest UK life insurers across 12 insurance groups, were listed and publicly disclosed in a similar manner as for the GIST 2022 (

PRA, 2022d, Annex 2, p. 41). The reporting of the obtained findings with feedback was on an aggregate basis, mirroring the reporting for the GIST, presented in the same “Dear CEO letter” published, focusing on management actions (

PRA, 2023a).

The current LIST 2025 is the latest life-specific exercise, prescribed without an equivalent GIST (

PRA, 2025a,

2025b). It was announced in 2024 where the preparatory work took place, with entities invited to participate responding to the request for technical input (

PRA, 2024c). Indeed, an initial publication from the PRA detailing the approach to the LIST was issued, providing additional insights and further detail for each scenario component (

PRA, 2024a). This is a crucial development to note under the IST exercises, notifying earlier invited entities in scope while at the same time setting the tone and being prescriptive for all scenario dimensions. It was formally launched in early 2025, listing the firms in scope, the 11 largest life insurers, as detailed in

Appendix A (

Table A1) (

PRA, 2024a;

2025b, Annex). The objectives of the LIST 2025 were sector and individual firm resilience to severe but plausible events, improved insight into risk management vulnerabilities, and strengthened market understanding and discipline through individual publication (

PRA, 2024a). The exercise consisted of three parts: a three-stage evolving financial market stress as the core scenario (Section A), an exploratory downgrade stress on the material matching adjustments considered on top of the core (Section B), and another exploratory scenario added to the core scenario on the material funded reinsurance arrangements (Section C) (

PRA, 2024c). The anticipated results of LIST 2025, which is currently ongoing, will be published on an aggregate basis for all scenarios and on an individual entity for the core scenario, under Section A (

PRA, 2024a, paras. 4.33–4.35). This is the first IST exercise where the publication of individual results is planned, in line with PRA’s supervisory expectations, anticipated in Q4 2025 (

PRA, 2024a, Figure 1). It would be interesting to critique this when it becomes available in 2025, evaluating the quality, completeness, and detail underpinning individual disclosures for the LIST 2025, along with the key findings and feedback from participating entities. Following from the IST 2022, the LIST 2025 includes the ‘Results and Basis of Preparation’ Report as a requirement, covering the governance, quality assurance, data, assumptions, and modelling in general and for each scenario with specific sub-sections (

PRA, 2025a). Guidance on the regulatory submission is detailed for the first time in the scenario guidance and specification (

PRA, 2025b, Section E, p. 29). The overall LIST requirements noted about data and the quantitative submission are also introduced in this exercise (

PRA, 2025b, Section D, p. 24).

4.3. Lloyd’s Realistic Disaster Scenarios

In addition to the PRA’s GIST, where often certain syndicates participate, Lloyd’s of London publishes a list of compulsory stress tests for all syndicates every year. This set of mandatory stress tests, focusing on catastrophic risks and defined as Realistic Disaster Scenarios (RDS), is designed to test both the London market and individual syndicates. Contrary to the more recent PRA IST exercises, the Lloyd’s RDS have been around a lot longer, by around two decades, starting back in 1994, even if in a different format with fewer scenarios (

Orr et al., 2003). Specifically, in a paper produced by the Institute and Faculty of Actuaries (IFoA) in the UK, the history of RDS is briefed, mentioning the bulletins back in 1994 and in 1995 where the disaster plan and respective disaster scenarios were first introduced (

Orr et al., 2003). The RDS has evolved, with the last ten exercises from 2015 being available from Lloyd’s of London

15. To ease the comparison with the rest of the regulatory prescribed stress tests, the focus is placed on those last eleven RDS exercises, despite the fact that some of the pre-2015 RDS might also be publicly available.

According to Lloyd’s of London, based on the most recent RDS, the exercise consists of three sets and categories: (a) Compulsory Event Scenarios, (b) Syndicate-defined scenarios, and (c) Syndicate specific scenarios (

Lloyd’s, 2025). The RDS are based on catastrophic risks at a global level, though mostly in the US, with the exact RDS list by year and category presented in detail in

Appendix A (

Table A2). The scenarios cover windstorms, a typhoon, a UK flood, earthquakes, terrorism events, and cyber incidents (

Lloyd’s, 2025). For the compulsory scenarios, the scenario description, assumed losses (at industry level) with implications, causes, and information required to produce the quantification are provided (

Lloyd’s, 2025). There are also alternative scenarios A & B

16, with managing agents required to report two from that list, on the basis of materiality, capturing the largest accumulation of risks not already covered in the compulsory or in the de minimis scenarios (

Lloyd’s, 2025). An overview with assumptions and background is provided for the alternative scenarios A & B (

Lloyd’s, 2025). Similarly, for the de minimis scenarios, the description and type of the event are provided, along with additional information and the underlying assumptions, if applicable (

Lloyd’s, 2025). The de minimis scenarios include a loss of major complex, aviation collision, satellite risks, liability risks, political risks, and marine scenarios (

Lloyd’s, 2025). Specifically, there are two different marine scenarios (marine collision and cruise incident), two liability risks (professional vs. non-professional lines) scenarios, and four different satellite risk scenarios (

Lloyd’s, 2025). The different scenarios for political risks are the only ones not detailed in the generic RDS specification but instead are detailed in a separate publication

17 provided by Lloyd’s directly to the syndicates in scope (

Lloyd’s, 2025). A scenario ID is provided for all scenarios under (a) and (c), referring to the Compulsory Event Scenarios and the (c) Syndicate-specific scenarios (

Lloyd’s, 2025). This allows the comparison of output from prior RDS exercises since almost all RDS scenarios and their respective IDs remain the same. Linked to exposure management, industry-simulated losses are provided, with the exposure at market level, usually based on simulated output from catastrophe models, allowing managing agents and syndicates to estimate their individual exposure and gross/net loss. Looking at the previous eleven RDS exercises, the key differences to note refer to cyber, political, and marine risk scenarios. The four cyber scenarios

18 became part of the Compulsory Event Scenarios from the 2022 RDS exercise (

Lloyd’s, 2022). Previously there was only one cyber-related risk scenario, the “Cyber Major Data Security Breach” (ID: 76), that was included in the RDS exercises for six years since 2016 under the Syndicate-specific Scenarios (

Lloyd’s, 2016,

2017,

2018,

2019,

2020,

2021). The political risk scenarios are not detailed, and only in the past two exercises are their IDs (29, 31, 49, 81) disclosed (

Lloyd’s, 2024,

2025). Finally, the two marine scenarios remain identical; however, in 2015-16 their ID was different

19, with slight variations in the exact scenario assumptions (

Lloyd’s, 2015,

2016).

Finally, Lloyd’s also publishes certain systemic risk scenarios

20, beyond the RDS. By design these scenarios capture systemic risks, effectively the probability of the financial system failing (

Selody, 2011;

LaBrosse et al., 2011). With systemic risk defined as the risk of threats to financial stability triggered by sudden and unexpected events in any part of the financial system (

Freixas et al., 2015). Interaction among financial firms, insurance companies in this case, and the London market specifically, leads to systemic risk under crisis conditions (

Acharya, 2013;

Fouque & Langsam, 2013). This explains the rationale of those stresses, capturing systemic shocks (

Schwarcz, 2016). These are more akin to the exploratory scenarios described in the subsequent section, focusing on the risk drivers, narrative, and qualitative description of their systemic nature, based on hypothetical but plausible events. An assumed return period, in the form of the probability of a 1-in-X-years event, is noted, with a severity description and any historical reference, if applicable, plus a high-level view of scenario effects. Examples of these systemic risk scenarios include a volcanic eruption and a human pandemic. Note that the results of the Lloyd’s RDS and exploratory systemic risk scenarios are not published.

6. Stress Testing Developments

The final section of this paper presents the proposed developments and recommendations around regulatory prescribed stress testing. These are based on the analysis and presentation of existing regulatory prescribed stress and scenario tests for financial services, as covered in the previous three sections. They are linked to existing regulatory requirements in relation to stress and scenario testing practices and advances. The first part covers the proposals and developments of a regulatory and supervisory nature, including proposals for future exercises. The second part documents the future challenges based on the trends around regulatory prescribed stress testing from the perspective of the entity participating in them. The third part discusses further the policy recommendations to consider in updating the regulatory prescribed stress testing framework.

6.1. Trends and Proposals

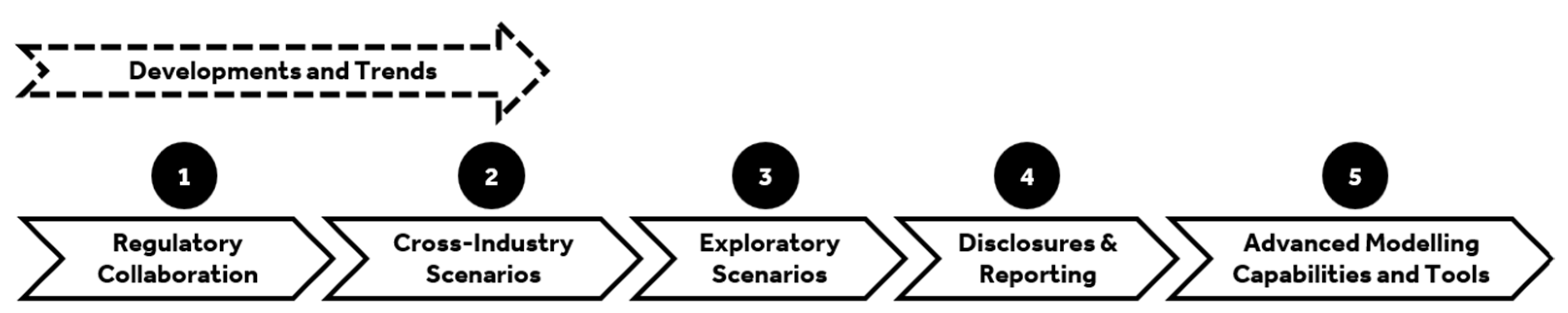

The stress testing developments discussed in this section are segmented into five themes, as graphically depicted in the figure (

Figure 3) below. These trends comprise the regulatory collaboration (#1), cross-industry stress testing (#2), exploratory scenarios (#3) with their reporting and disclosure requirements (#4), and finally the underlying modelling capabilities and tools (#5).

Regulatory collaboration is the first theme observed. Examples include the jointly run exploratory scenarios co-developed between the FCA and the PRA and also the GIST 2019 jointly developed by the PRA and the BMA, showcasing the collaboration from different jurisdictions. Considering certain new and emerging risks, an intensified level of collaboration is anticipated, involving UK supervisors joining forces to design, develop, and perform regulatory prescribed stress testing exercises. Especially considering operational risks and the exploratory scenarios, where comprehensive joint assessments led by multiple regulators and supervisors could address the gaps in technical components. For instance, the ICO collaborated with the PRA and the FCA on scenarios for ICT risks, capturing the data loss, use, and information security compromise angle. The more complex scenarios become, for emerging risks and of an exploratory nature, the more regulatory collaboration and coordination are required to strengthen supervisor’s approach in understanding and assessing adequately those risks. Beyond collaboration with other UK regulators for joint assessments, cross-border options should also be considered. Building on the relationship between regulators and supervisors from other jurisdictions, capitalising on joint memberships at global consortiums (i.e., members of the International Association of Insurance Supervisors-IAIS). Perhaps the starting point could be looking at EU-level regulatory prescribed stress tests, on the basis of the pre-Brexit involvement, to understand developments, deviations from the UK approach, and any findings that could be transposed for supervising UK-based financial services. Therefore, linking EU-wide and other global scenario exercises to analyse differences, incorporate lessons learnt, and target synergies to gain technical expertise in certain areas could transform regulatory prescribed stress testing. This regulatory collaboration could also be facilitated under a supervisory college in cases of global financial services with multiple supervisors. An extension to regulatory collaboration is the development of cross-industry scenarios. Again, certain exploratory scenarios are market- or industry-wide, such as the CBES and SWES, including different types of financial services as their participants. Building on those exercises, developing regulatory prescribed stress tests for multiple financial services should be considered to enhance cross-sectoral learnings and, most importantly, evaluate the linkage between sectors (i.e., how insurance losses could affect non-performing exposures of banks, etc.).

Increasing the understanding about certain risks is, by design, inherent in the nature of regulatory prescribed stress tests. Especially for the exploratory scenarios, where often the focus is placed on non-financial, new, and emerging risks. This objective about exploring and understanding those risks is a common characteristic shared between the themes of regulatory collaboration and cross-sectoral scenarios. Exploratory scenarios, as detailed in the previous section, examined under different objectives, are utilised by regulators and supervisors to inform setting their policy. These exercises have a lot of unknowns and are in ongoing development, though they reveal key areas of concern that could be addressed via policy implementation. The Bank of England is leading the development and application of exploratory scenarios, with these stresses becoming a core element of its bank stress testing approach (

BoE, 2024c). In that direction, the design and development of additional scenarios for emerging risks is anticipated (i.e., what about pandemic-related stresses?). Building on the regulatory collaboration and cross-industry scenarios, exploratory scenarios for operational risks could be prescribed, linking operational resilience with cyber, data, and ICT risks. In general, using the stress testing tool for emerging risks is an approach that has reached momentum and will be intensified further. However, these exploratory scenarios should be accompanied by further guidance. Special guides should be published on exploratory scenarios, with future developments for the methodological approaches and modelling of stress tests.

With more regulatory prescribed stress and scenario tests, the question of increased reporting and disclosures comes naturally. Currently, there is a dual approach to disclosing the stress testing results: on an aggregate basis for some scenarios or on an individual basis for other stresses. Often individual reporting is accompanied by the aggregate view as a benchmark. In the macroeconomic bank stress tests, the results are presented in aggregate format for the entire banking sector and on an individual basis for the systemic banks participating in them. For the IST, until the current LIST 2025 exercise, where for one component the individual results are anticipated (

PRA, 2024d), only the aggregate view has been reported in the past. Similarly, for the exploratory scenarios, the aggregated view is disclosed. For the RDS, no reporting is available at all. Reporting requirements with increased levels of detail, plus publication of results in both aggregate and individual formats, should be considered as the norm to increase the level of transparency. Trialling individual disclosure of results, as in the existing scenarios and based on other regulatory prescribed stress tests outside the UK (e.g., such as the IST from EIOPA, where participating entities who gave consent published individual scores), is a parameter anticipated in future exercises. Beyond the individual vs. aggregate view of results, including more detail in the obtained results to provide further insights is expected. This will reinforce the findings and lessons learnt from each stress-testing exercise.

The final development, which correlates with the above four themes, captures the modelling, data, capabilities, and tools. Financial services face the “perfect storm” in terms of stress testing; additional scenarios to run, which are more complex, are requested more frequently and require more advanced modelling techniques. A core objective of stress testing beyond understanding policy developments and individual and sectoral resilience is the enhancement of risk management capabilities. Therefore, the evolution of stress testing requirements aims to support financial services in evaluating their own scenario modelling capacity and capability. However, without support and supervisory guidance, there is a danger of over-reliance on third-party providers, as highlighted in certain regulatory prescribed stress testing exercises and discussed in the next sub-section. Further guidance on regulatory prescribed stress testing exercises should be provided to support participating entities. This could take the form of detailed guides with specific examples, modelling approaches, and technical information, such as the publications from the Climate Financial Risk Forum (CFRF) with the scenario analysis tool for climate, linked to the CBES. Alternatively, providing insights on supervisory expectations and noting the gaps and the steps to achieve improvements is the other option. For instance, the RBP requirement from the recent IST exercises serves that purpose, with participating insurers strengthening their governance, modelling, and overall documentation accompanying the quantified results. Especially in the area of management actions, their applicability, usability, and effectiveness. Since gaps are often observed around management responses and remedial actions, consider that regulatory prescribed stress tests are hypothetical exercises and cannot be tested in practice (apart from exceptions, of course). The increased frequency of regulatory prescribed stress testing influences the deployment of stress testing capabilities. More regular stress tests, which are more severe (but plausible), with longer horizons and complex risk transmission channels, require advanced modelling capabilities and overall robust stress testing practices. The horizon-, short-, medium-, and long-term, if applicable- adds to the complexity, with more assumptions and advanced considerations to be made in the modelling and the actual quantification of results. The same applies to the nature of risks captured for financial vs. non-financial risks of primary and secondary impact. Modelling systemic risks and contagion effects creates more challenges, especially under exploratory scenarios. The regulatory prescribed stress test setup introduces another layer of challenge, with amplified and cancelled risks based on the underlying drivers. These risks should be accounted for in the modelling approach and overall scenario quantification.

6.2. Future Challenges

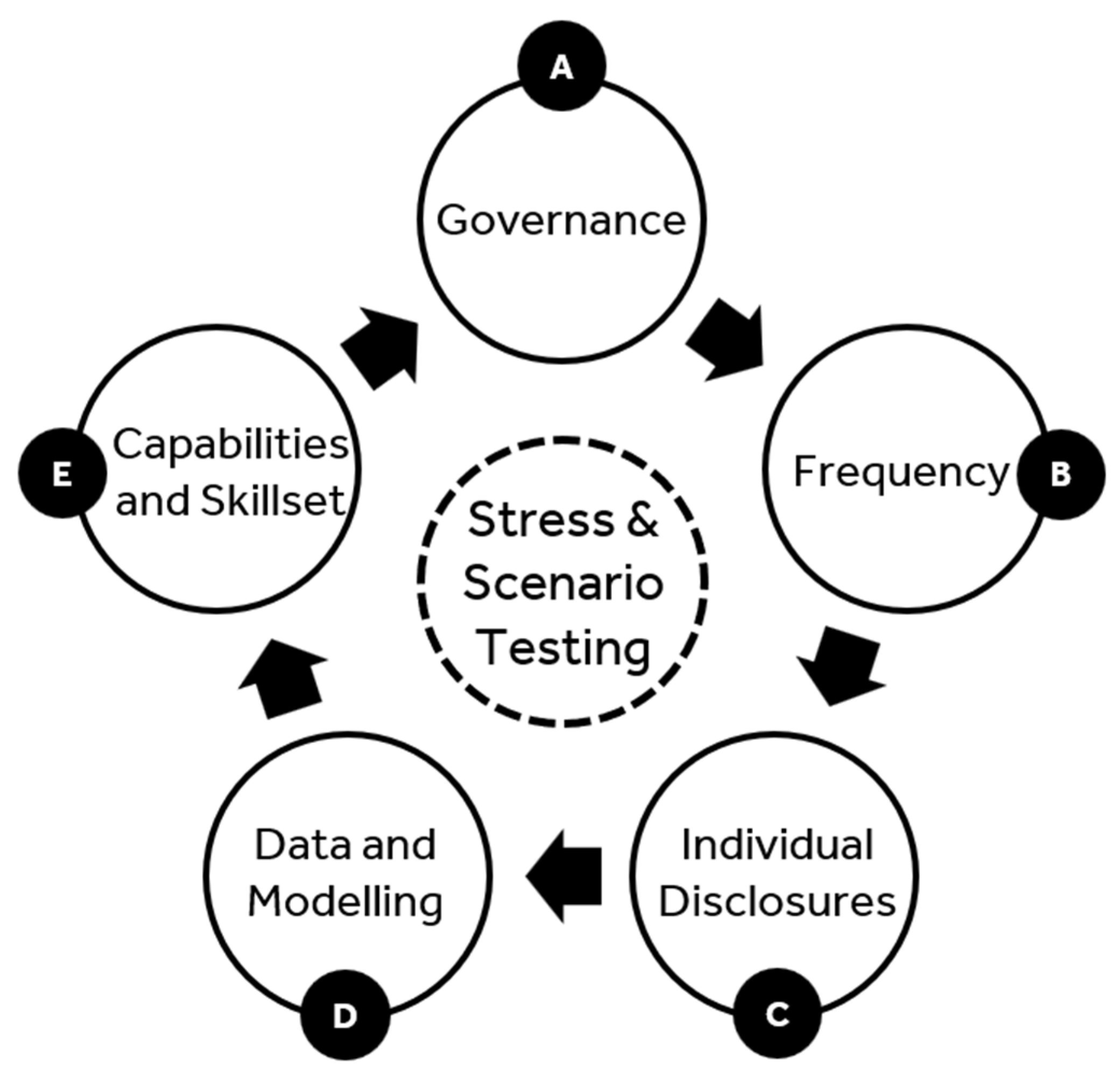

The developments explained earlier in this section arise from the future challenges in relation to stress and scenario testing practices from regulatory exercises identified and noted. The future challenges and trends discovered are linked to the characteristics of the regulatory prescribed stress test exercises. Contrasting to the proposals and recommendations described earlier, these challenges are mostly aimed at the financial services participating in the regulatory prescribed stress tests. These future challenges and trends of stress and scenario testing practices and activities, which are all interconnected, are graphically depicted in the figure (

Figure 4) below. These refer to the governance (A), frequency (B), individual disclosures (C), and data and modelling (D), with capabilities and skillset required from participating institutions (E), all underpinning regulatory prescribed stress tests.

The first challenge is around the governance of regulatory prescribed stress testing. The governance is an angle captured by the PRA in the Insurance Stress Tests, with the introduction of the Results and Basis of Preparation Report, the qualitative return accompanying the quantitative stress testing submission. Governance refers to the oversight and documentation around stress and scenario testing practices. Firstly, about the documentation, with adherence to the internally developed process and procedure documents and ideally the Stress & Scenario Testing Framework. Secondly, about the different types of reviews, checks, and audits of the stress testing results and their underpinning modelling processes. Then, in terms of the formal governance process, with reviews and outcomes sign-off at the relevant Committee/Board level.

Following from the governance and oversight of stress testing and its different underlying steps and components, a core challenge influencing it, in effect, is how often the regulatory prescribed stress tests are run. Considering the effort, time, and resources required, their frequency is crucial in determining the appropriate governance approach, oversight, and overall stress testing practices. Note that beyond regulatory prescribed stress tests issued by the regulators inviting entities to participate, either on a voluntary or not basis, there are additional stresses, scenarios, sensitivities, etc., performed concurrently by each entity as part of business-as-usual activities. These tests are often linked to existing regulatory requirements and supervisory expectations (i.e., ICAAP, ORSA, etc.). At the same time, depending on the entity under supervision, specific scenarios—in isolation or as part of a risk assessment—might be requested by the regulators. Therefore, an increased frequency of regulatory-prescribed stress tests could potentially adversely impact the delivery of other tests and regulatory returns. It is anticipated to have a scenario to complete every year, and in certain cases there might be two scenarios happening simultaneously: one macroeconomic/financial risk stress plus an exploratory scenario based on the exploratory scenarios. Finding the right balance is key and already underlined in the latest Bank of England’s approach to stress testing (

BoE, 2024c). A pragmatic approach, decreasing the burden on financial services and primarily on banks, is noted by the Bank of England, recognising the strain these exercises create (

BoE, 2024c). This should be considered in combination with external factors and risks. A good example in that area is COVID-19, with some regulatory prescribed stress tests being postponed eventually.

The third challenge, perhaps concerning some financial institutions only, is the reporting of the results. Individual disclosures and granular reporting requirements increase the level of governance and oversight. Currently, the results of the macroeconomic stress tests for the systemic banks show the results at the entity level. Therefore, for the top UK banks, individual results are already reported for some regulatory prescribed stress tests. For instance, this is not the case for the exploratory scenarios. For insurers, the LIST 2025 is the first exercise where the publication of entity-level results is anticipated in late 2025. This actually follows from the EU equivalent exercise, where, from the 2018 IST for EU-level insurers from the European Insurance and Occupational Pensions Authority (EIOPA) onwards, the individual entity results are published, on a voluntary basis, upon providing consent. The rise in regulatory-prescribed stress tests will ultimately result in more detailed results reported at both the aggregate and entity levels if the former remains on a voluntary basis. These requirements around reporting of the results challenge the governance around stress testing practices. Thus, robust processes and procedures around stress testing practices should be in place to ensure that these are fully met.

The fourth challenge, about data and third-party vendor policy, has already been flagged by the Bank of England and the PRA in previous exercises, for the exploratory scenarios, but also for the IST. This refers to the reliance on external parties to support with data, models, and modelling of financial and non-financial impact. Especially considering the exploratory scenarios with uncertainties and unknowns. Plus, commenting on the oversight and governance as part of the overall model risk management (MRM) approaches underpinning stress testing practices. Associated with the strain on resources are the monetary implications and costs attached to that external support. Interlinked to the increased frequency of regulatory-prescribed stress testing, the reliance on third-party providers for support should be considered as part of the long-term risk management strategy. In the short-term dependencies might exist as the initial phase, but in the long-term financial services should be looking to minimise this, bringing in-house components of the stress and scenario testing cycle. Arguably this might be neither cost-effective nor achievable. External support is probably needed in certain areas with advanced modelling, which cannot be substituted by internal methodologies and data. As well as in auditing results and providing assurance, as this is often covered externally.

Nevertheless, in the long-term financial services should consider strategic developments around resourcing and capabilities as the final challenge, connected to the reliance on external support. Investments in skillset, modelling techniques, methodological approaches, and overall, in strengthening stress testing practices, are a challenge with the increasing number of regulatory prescribed stress tests with the additional reporting requirements. At the same time, this presents an opportunity and solution to external support since ultimately certain stress-testing activities should be developed internally and maintained for future exercises, transitioning into BAU. This long-term approach towards championing the SSTF will allow us to overcome these challenges arising from the regulatory prescribed stress testing developments. Targeted focus on human capital to empower technical capabilities with the use of technological advancements to support modelling and scenario quantification should be the ultimate goal to counter existing hurdles and prepare for future regulatory developments. This should be accompanied by novel approaches to testing, combining quantitative and qualitative techniques, to understand the associated risks and implications from regulatory prescribed stress tests. For instance, in addition to the financial modelling, conducting a PESTEL and a SWOT

28 analysis (

Chapman, 2011;

Andersen & Schrøder, 2012;

Johnson et al., 2017), particularly for the exploratory scenarios, could strengthen their examination. These qualitative approaches could be utilised to understand the dynamics and characteristics of the different regulatory prescribed stress tests, with their output utilised to inform the modelling and the qualitative regulatory returns. This approach could also be adopted by non-participating financial institutions. A combined PESTEL and SWOT analysis could be deployed to support them in interpreting the regulatory prescribed stress tests and then replicating them in a pragmatic and proportionate way.

6.3. Policy Recommendations

After highlighting the trends and challenges associated with regulatory prescribed stress tests, to discuss the associated practical recommendation with the policy contribution of this paper. To present some overarching suggestions for both the supervisors and regulators, prescribing the stress tests and also for the financial services participating in those exercises. The increased frequency, complexity, and granularity of the regulatory prescribed stress testing exercises create challenges for the participating financial institutions. To address these while at the same time preparing for future scenarios, financial services should focus on strategic investments to improve their practices internally. They should target building capabilities and technical skills and allocating adequate resources as ultimate objectives. At the same time, regulators and supervisors should work closely with financial services to support them in completing the stress-testing exercises, given the challenges introduced. The continuation of support with dedicated guidance, workshops, and forums is recommended. Especially for non-banking institutions, publishing equivalent guides documenting the approach to stress testing. In relation to exploratory scenarios in particular, developing a ‘stress testing sandbox’ to provide assistance in a live environment could also be considered. The following figure (

Figure 5) depicts the overarching recommendations in relation to regulatory prescribed stress testing for UK financial services. The three categories, BST and IST, with their overlapping BES, are driving the trends and challenges associated with regulatory prescribed stress tests, as shown in the upper part of the figure. To address these, supervisory and regulatory bodies could provide more support to participating entities from financial services and the improvements required at their entity level, as shown in the lower part of the figure.

Based on the above, amendments to the PRA Rulebook should be considered, introducing the regulatory prescribed stress tests and their requirements. Currently the approach to bank stress testing is documented in a separate publication from the Bank of England (

BoE, 2024c). However, there is no equivalent documentation for the rest of the financial services, such as insurers and asset managers. Therefore, introducing sector-specific guidance should be considered, or alternatively, expanding the scope of the bank stress testing approach, since it partially covers the BES (