1. Introduction

The rapid digital transformation of financial systems has placed central banks at the forefront of one of the most significant monetary innovations of the twenty-first century: central bank digital currencies (CBDCs). In less than a decade, CBDCs have moved from a largely theoretical concept to a concrete policy consideration for virtually every central bank in the world (

Dionysopoulos et al., 2024). According to the Bank for International Settlements (BIS), over 90 percent of central banks are now actively exploring CBDCs, ranging from preliminary research and proof-of-concept projects to pilots and full-scale launches. This unprecedented level of engagement highlights how the digitalization of money is reshaping both domestic monetary systems and the international financial architecture (

Tronnier, 2021). While CBDC development has become a global phenomenon, the motivations driving central banks to pursue such projects vary considerably across countries and remain only partially understood.

One of the most salient factors shaping the CBDC debate is the rise in private cryptocurrencies. Since the introduction of Bitcoin in 2009, cryptocurrencies have proliferated both in terms of technological diversity and adoption levels (

Allen et al., 2022;

Belke & Beretta, 2020;

Ozili, 2022;

Raskin & Yermack, 2018). What began as a niche experiment in decentralized digital money has grown into a global market with millions of users, thousands of crypto-assets, and an expanding ecosystem of exchanges, wallets, and decentralized finance platforms (

Pelagidis & Kostika, 2022). In many economies, particularly those with weak currencies, unstable macroeconomic environments, or limited access to traditional banking, cryptocurrencies have gained traction as both speculative assets and alternative means of payment. The main objective of this study is to empirically examine the relationship between CAR and the development of CBDCs across countries. Specifically, it investigates whether higher cryptocurrency adoption accelerates CBDC progression, how this relationship differs across income groups and levels of financial inclusion, and how institutional and macroeconomic factors shape it.

Research on the impact of cryptocurrency adoption on CBDCs has emerged as a critical area of inquiry due to the rapid evolution of digital financial technologies and their profound implications for monetary systems worldwide (

Ozili, 2023b;

Pelagidis & Kostika, 2022). Since the inception of Bitcoin in 2009, digital currencies have challenged traditional notions of money and payment systems, prompting central banks to explore CBDCs as a response to maintain monetary sovereignty and financial stability (

Belke & Beretta, 2020;

Raskin & Yermack, 2018). The increasing market capitalization of cryptocurrencies, which as of October 2025 is approximately USD 3.71 trillion (

CoinMarketCap, 2025), alongside the growing number of CBDC pilot projects globally, underscores the practical and theoretical significance of this research area (

Abdullah, 2024;

Atteh, 2024). Moreover, the social and economic importance of this inquiry is highlighted by the potential of CBDCs to enhance payment efficiency, financial inclusion, and policy effectiveness (

Heitmann et al., 2025;

Ozili, 2023b).

Despite the growing interest, a specific problem remains in understanding how cryptocurrency adoption influences the development, design, and implementation of CBDCs (

Afolabi & Olanrewaju, 2023;

Köse & Köstekçi, 2024). Existing literature has predominantly focused on the technical and monetary policy aspects of CBDCs or the regulatory challenges posed by cryptocurrencies, yet the interplay between these two phenomena is underexplored (

Cesaratto & Febrero, 2023;

Malherbe & Montalban, 2022;

Hou, 2024). Controversies persist regarding whether cryptocurrencies undermine central bank authority or whether CBDCs can coexist with private digital currencies without destabilizing financial markets (

Cesaratto & Febrero, 2023;

Ozili, 2023a,

2023b).

The knowledge gap is further accentuated by divergent regulatory approaches across countries and the varying impacts on emerging versus developed economies (

Guo et al., 2025;

Huang & Mayer, 2022;

Le, 2025;

Podder, 2023). Countries differ in their stance from restrictive bans to measured oversight and supportive regulation, and these differences influence whether CBDCs are developed as defensive or complementary tools. For instance, China’s restrictive regime on private cryptocurrencies has coincided with rapid progress in its e-CNY CBDC, reflecting a strategy to maintain monetary control and limit private competition (

Bai et al., 2025;

Chen et al., 2022;

Huang & Mayer, 2022). In contrast, the European Union’s Markets in Crypto-Assets (MiCA) regulation promotes coexistence by integrating private digital assets within a harmonized framework, encouraging CBDCs as instruments of innovation rather than control (

Carata & Knottenbelt, 2024). In emerging economies, regulatory capacity gaps often result in fragmented or evolving policies, which influence the motivations behind CBDC adoption. For example, Nigeria’s launch of the eNaira followed restrictions on crypto trading, signaling a shift toward formalizing digital transactions (

Ozili, 2023b). These varied regulatory paths highlight that CBDC development is not solely an economic response to cryptocurrency adoption but also a policy choice shaped by governance and regulatory philosophy, underscoring the importance of contextual heterogeneity in understanding global CBDC dynamics.

While the link between cryptocurrency adoption and CBDC development has been widely discussed in policy and theoretical literature, empirical evidence remains scarce. Much of the current understanding is derived from case studies or central bank reports, which offer valuable insights but limited generalizability. Few studies have systematically examined whether and under what conditions rising cryptocurrency adoption actually influences the pace of CBDC development at the global level. This gap is critical because cryptocurrencies now represent one of the most visible challenges to central bank authority and monetary policy effectiveness. If private digital assets reduce reliance on sovereign currencies or complicate payment regulation, central banks may view CBDCs as both defensive and strategic tools to preserve financial stability and extend their monetary reach.

This paper addresses this gap by providing the first large-scale empirical assessment of the relationship between cryptocurrency adoption and CBDC development. Using a panel dataset of 109 countries from 2020 to 2024, the study employs pooled OLS, fixed effects, and ordered logistic regression models to examine how variations in cryptocurrency adoption measured by the Chainalysis Global Crypto Adoption Index (CAR) affect CBDC progression across five development stages. The models include robust controls for macroeconomic, institutional, and technological factors, allowing for a nuanced understanding of the global drivers of CBDC initiatives.

Our results demonstrate that higher cryptocurrency adoption is consistently associated with advancement to more developed CBDC stages, even after accounting for country-specific heterogeneity. This finding supports the view that crypto adoption is not merely correlated with CBDC development but actively pressures central banks to accelerate digital currency initiatives. Moreover, heterogeneity analysis reveals that this relationship is strongest in low- and middle-income economies and in countries with low levels of financial inclusion, where cryptocurrencies often substitute for underdeveloped financial systems. These results imply that the policy motivations behind CBDC adoption differ across income groups, reactive in emerging economies but strategic in advanced ones.

The contribution of this research is both empirical and conceptual. Empirically, it provides robust cross-country evidence linking cryptocurrency adoption to CBDC progression, a relationship previously treated mainly as theoretical. Conceptually, it offers a policy-oriented interpretation: in financially constrained economies, CBDCs serve as developmental tools for financial inclusion and stability; in advanced economies, they represent strategic innovations to enhance efficiency and competitiveness in digital payments. By framing CBDC adoption as a response to private digital currency diffusion, the paper highlights the complex interdependence between market-driven and policy-driven forms of monetary innovation.

2. Literature Review

2.1. Background of CBDCs

While the theoretical and policy discussions around CBDCs have expanded rapidly, the empirical evidence explaining why and how central banks advance their CBDC initiatives remains limited. In particular, the interaction between cryptocurrency adoption and CBDC development is often discussed conceptually but rarely quantified across countries. As private digital currencies increasingly challenge monetary sovereignty, central banks may view CBDCs as strategic responses to preserve control and ensure financial stability. However, the extent to which rising cryptocurrency adoption rates (CAR) directly influence CBDC progression across varying institutional, economic, and technological contexts remains an open empirical question. The following section reviews the existing literature to situate this study within broader debates on the determinants of CBDC adoption and the role of cryptocurrencies as both catalysts and competitors in the evolution of sovereign digital money.

2.2. Motivations for CBDC Development

CBDCs have evolved rapidly from theoretical constructs to policy priorities. Surveys by the BIS reveal that over 90 percent of central banks are actively exploring CBDCs (

Auer et al., 2021). The literature identifies three dominant motivations: monetary and financial stability, financial inclusion, and payment system efficiency.

First, CBDCs are viewed as instruments to preserve monetary sovereignty in the face of declining cash use and growing competition from private digital currencies. The

BIS (

2021) underscores that CBDCs could serve as a counterweight to cryptocurrencies and stablecoins that might otherwise displace sovereign money.

Bindseil (

2020) and

Adrian and Mancini-Griffoli (

2021) argue that by providing a digital liability of the central bank, CBDCs can strengthen monetary policy transmission and ensure continued access to risk-free public money. Second, CBDCs promote financial inclusion, particularly in developing economies where access to formal financial institutions is limited.

Auer and Boehme (

2020) highlight that CBDCs could extend digital payment access to unbanked populations, complementing findings by

Demirguc-Kunt et al. (

2018) on the role of digital payments in reducing financial exclusion. Third, CBDCs promise gains in payment system efficiency and security. By improving settlement times and reducing transaction costs, CBDCs can enhance domestic payment systems and facilitate interoperable cross-border payments

Auer and Boehme (

2020). For small and open economies, CBDCs also reduce reliance on foreign payment infrastructure.

2.3. Cryptocurrencies as Catalyst and Competitor

The rise in cryptocurrencies has fundamentally altered central banks’ policy landscape. Since Bitcoin’s 2009 debut, the global cryptocurrency market has grown exponentially, reaching approximately USD 3.71 trillion in October 2025 (

CoinMarketCap, 2025) with millions of users and expanding DeFi ecosystems. Scholars widely agree that this expansion has pressured central banks to innovate.

Garratt and Wallace (

2018) argue that cryptocurrencies introduce competition that could weaken demand for central bank money.

Brunnermeier et al. (

2019) emphasize that stablecoins pose even greater risks by offering price-stable alternatives to fiat currencies.

Chiu and Koeppl (

2019) frame CBDCs as a defensive policy response to maintain monetary sovereignty, while

Pelagidis and Kostika (

2022) warn that rising crypto use can erode monetary policy control and liquidity management.

At the same time, researchers highlight the context-dependence of this relationship.

Ozili (

2023b) finds mixed global evidence: crypto interest spurred Nigeria’s eNaira but dampened CBDC activity in the Bahamas and Eastern Caribbean.

Dionysopoulos et al. (

2024) and

Zelmer and Kronick (

2021) note that CBDCs may emerge not only as defensive tools but as adaptive platforms for innovation, allowing coexistence between private and sovereign digital money.

2.4. Determinants of CBDC Development

Recent research highlights several potential determinants of CBDC development, spanning technological, institutional, and socio-economic dimensions.

Bijlsma et al. (

2024), using survey evidence from the Netherlands, find that public trust in central banks, price incentives, privacy protection, and digital literacy are key factors enhancing public acceptance of CBDCs.

Lee et al. (

2021), in their analysis of China’s Digital Currency Electronic Payment (DCEP) system, categorize the drivers of successful adoption into three broad areas: (i) supportive infrastructure, including data privacy and interoperable transfer systems; (ii) global cooperative standards and compliance frameworks, ensuring transparency and accessibility; and (iii) inclusivity of storage and exchange, emphasizing user experience and security. These findings underscore that CBDC adoption depends not only on central bank design choices but also on the public’s technological readiness and confidence in institutions.

From a macro-financial perspective, cost efficiency and policy design are also decisive.

Davoodalhosseini (

2022) demonstrates that the success of CBDC implementation in the United States and Canada depends on the relative cost of using CBDCs compared to cash. Low-cost CBDC systems increase adoption potential, whereas coexistence with cash may slow uptake. At the household level, user perceptions of performance, convenience, and institutional credibility strongly affect CBDC acceptance.

Söilen and Benhayoun (

2021), through structural equation modeling, identify performance expectancy, social influence, and facilitating conditions as key adoption determinants. This resonates with

Allen et al. (

2022), who emphasize that the widespread use of virtual currencies and effective cryptocurrency regulation can foster public trust in central bank digital money.

Beyond micro-level factors, broader macroeconomic and institutional conditions also matter. Cross-country analyses such as

Alfar et al. (

2023) and

Dong et al. (

2024) show that institutional quality, economic development, and financial inclusion are significant predictors of CBDC adoption. Similarly,

Maryaningsih et al. (

2022) find that monetary policy frameworks, payment system efficiency, and technological readiness shape the probability of CBDC implementation.

Mohammed et al. (

2023) emphasize the importance of governance quality and blockchain readiness in shaping countries’ adoption of blockchain-enabled CBDCs. These studies suggest that CBDCs emerge from a complex interaction of policy intent, economic capacity, and institutional strength.

2.5. Theoretical Framework

This study is anchored in two complementary theoretical frameworks: Diffusion of Innovation Theory and Institutional Theory. Together, these frameworks provide a conceptual foundation for understanding how technological and institutional forces shape the progression of central bank digital currencies (CBDCs) in response to rising cryptocurrency adoption.

The first framework, Diffusion of Innovation Theory (

Rogers, 1962;

Rogers et al., 2014), explains how new technologies and practices spread across populations and institutions through processes influenced by relative advantage, compatibility, complexity, trialability, and observability. Within this framework, cryptocurrencies can be conceptualized as disruptive financial innovations that diffuse rapidly among users due to their perceived benefits, such as decentralized control, lower transaction costs, and accessibility. However, this diffusion challenges traditional monetary systems by diminishing the role of sovereign money and eroding public reliance on central bank liabilities. Consequently, CBDCs emerge as adaptive policy innovations, enabling central banks to restore monetary authority, maintain financial stability, and respond to shifting public expectations in the digital economy. In this context, the adoption of CBDCs can be viewed as a reactive innovation triggered by the diffusion of cryptocurrencies. The competitive and social pressures generated by cryptocurrency adoption create an environment in which central banks must innovate to preserve legitimacy and relevance. The rate of CBDC progression across countries, therefore, reflects varying degrees of institutional readiness, technological capability, and perceived necessity to respond to this disruptive innovation. From a diffusion perspective, countries with higher CAR experience stronger “innovation pressure,” leading to faster transitions from research to pilot and launch stages of CBDC implementation.

The second framework, Institutional Theory (

DiMaggio & Powell, 1983;

Scott, 2008), complements this view by emphasizing how organizations respond to coercive, mimetic, and normative pressures within their institutional environments. Central banks operate within a global institutional field characterized by policy interdependence, international norms, and reputational considerations. As more countries experiment with CBDCs, others face mimetic pressures to follow suit, either to maintain competitiveness or to align with global standards in digital finance. Similarly, coercive pressures arising from domestic regulatory challenges, financial instability, or public demand for secure digital payments further accelerate CBDC initiatives. Institutional theory thus provides a broader explanation for why central banks’ responses to cryptocurrency adoption vary across countries. In high-income economies, institutional legitimacy, robust financial infrastructure, and established payment systems may dampen the urgency to develop CBDCs, leading to slower adoption despite technological capability. Conversely, in low- and middle-income countries, where cryptocurrencies often substitute for weak financial systems, institutional pressures to preserve monetary sovereignty and financial inclusion are stronger, driving faster CBDC development.

2.6. Study Hypothesis

Building on the theoretical perspectives of Diffusion of Innovation Theory and Institutional Theory, this study proposes that the adoption and progression of CBDCs are shaped by both technological diffusion pressures and institutional adaptation mechanisms.

From the Diffusion of Innovation perspective, the spread of cryptocurrency adoption reflects the speed and intensity of digital financial innovation within a society. Countries with higher CAR values are more exposed to the benefits and risks of decentralized digital money, such as faster transactions, reduced intermediation, and increased volatility. This technological diffusion increases public familiarity with digital finance and, simultaneously, heightens regulatory concerns. As a result, central banks are more likely to advance their CBDC initiatives to maintain relevance and monetary control.

From the Institutional Theory perspective, central banks operate under normative and coercive pressures to sustain monetary sovereignty and policy credibility. In countries with weak financial infrastructure or low institutional trust, rising cryptocurrency adoption may threaten financial stability and government legitimacy. Under these conditions, CBDC initiatives serve as institutional responses designed to reassert control and restore public confidence. Conversely, in economies with well-developed financial systems and strong governance, central banks may pursue CBDCs more strategically, emphasizing long-term innovation and payment system modernization rather than reactive control. Together, these frameworks predict that cryptocurrency adoption will positively influence CBDC development, but the magnitude of this effect will vary across income and institutional contexts. Based on this reasoning, the following hypothesis is proposed:

H1. There is a positive relationship between the cryptocurrency adoption rate (CAR) and the progression of central bank digital currency (CBDC) development.

2.7. Research Gap and Contribution

Despite rapid scholarly and policy progress, critical gaps persist. First, while conceptual arguments abound, few studies have systematically quantified the effect of cryptocurrency adoption on CBDC development across countries. Existing work is either theoretical (e.g.,

Brunnermeier et al., 2019) or descriptive (e.g.,

Ozili, 2023b), without rigorous econometric analysis. There is limited quantitative evidence linking cryptocurrency adoption to CBDC development across a global sample. Second, contextual heterogeneity, how income levels, institutional quality, and financial inclusion shape this relationship, remains underexplored. Third, most empirical studies overlook the ordinal nature of CBDC progression, ranging from initial research to full implementation, thus limiting analytical precision.

This study seeks to fill these gaps by providing a systematic, cross-country econometric analysis of the relationship between CAR and CBDC development. Using a panel dataset of 109 countries (2020–2024), it measures CBDC progression on a five-point ordinal scale and links it to CAR, as measured by the Chainalysis Global Crypto Adoption Index. Employing pooled OLS, fixed effects, and ordered logistic regressions, the study provides robust estimates of this relationship. Margins analysis further translates coefficients into predicted probabilities, while heterogeneity tests examine differences across income groups and financial inclusion levels.

The study contributes to the literature in three ways. First, it provides the first large-sample empirical assessment quantifying how cryptocurrency adoption affects CBDC progression. Second, it demonstrates that the relationship is conditional on financial inclusion and income level, advancing understanding of heterogeneity in digital monetary evolution. Third, it proposes a novel theoretical framework integrating innovation diffusion with financial access constraints, offering a foundation for future research on digital currency ecosystems.

4. Results

4.1. Descriptive Statistics

Table 2 shows that CBDC (Central Bank Digital Currency) is 1.509 on a scale from 0 to 4. This suggests that, on average, the entities in the sample are in the early to intermediate stages of CBDC development or adoption. The standard deviation (1.178) is high relative to the mean, indicating considerable disparity in CBDC progress across the sample. The dataset is heterogeneous, containing entities with very different economic conditions, from stable to crisis-level (e.g., hyperinflation, zero capital). It highlights the diversity and key characteristics of the dataset, providing an essential foundation for any subsequent econometric analysis. The mean CAR is relatively low (0.121), reflecting modest but growing global adoption. EXR variable shows high dispersion, as expected in a heterogeneous cross-country sample. Regarding distribution, CAR exhibits positive skewness (2.604) and high kurtosis (10.991), indicating that while most countries show low adoption, a few display exceptionally high levels of crypto use. Similarly, INTRR and INF are highly skewed, consistent with the economic diversity of the sample. In contrast, institutional and governance indicators (e.g., EFI, COC, GEFF, and RQ) show near-normal distributions, supporting their stability across observations. Overall, the descriptive results suggest that variations in financial inclusion, governance quality, and macroeconomic performance may explain cross-country differences in CBDC progression and cryptocurrency adoption.

4.2. Pairwise Correlations

Table 3 reports the pairwise correlations among all variables, with significance levels indicated. The correlation between CBDC progression and CAR is positive and statistically significant (r = 0.116,

p < 0.01), suggesting that countries with higher levels of crypto adoption tend to advance further in their CBDC development. This provides preliminary evidence supporting the study’s main hypothesis. Most macroeconomic variables, including IN), EXR, and FI, show moderate correlations, indicating balanced relationships without excessive interdependence. However, the institutional variables, COC, GEFF, and RQ exhibit very strong positive correlations with one another (r > 0.90), revealing substantial multicollinearity among governance indicators. Overall, the correlation analysis supports the theoretical expectation that technological and institutional environments jointly shape CBDC adoption, while confirming the need for careful treatment of overlapping institutional measures in econometric estimation.

4.3. Baseline Regression Analysis

Table 4 reports the baseline regression results examining the effect of CAR on CBDC development. Three specifications are estimated: pooled OLS (Model 1), country fixed effects with year controls (Model 2), and a saturated specification with both country and year fixed effects (Model 3). Across all models, the coefficient on CAR is consistently positive and statistically significant, providing robust evidence that higher levels of cryptocurrency adoption are associated with more advanced stages of CBDC development.

In the pooled OLS specification (Model 1), a one-unit increase in CAR is associated with a 0.78 increase in the CBDC stage index, significant at the 1% level. When controlling for unobserved country heterogeneity through fixed effects (Model 2), the magnitude of the coefficient increases to 1.11, significant at the 5% level. The fully saturated model with both country and year fixed effects (Model 3) yields a somewhat smaller coefficient (0.55) but remains significant at the 5% level, suggesting that the relationship is not driven by country-specific or time-specific confounders. Several control variables also exhibit consistent patterns.

In Model 4, we report robustness estimates after excluding governance-related variables (COC, CORR, GEFF, and RQ) to address potential multicollinearity concerns identified in the correlation matrix. The results continue to show a positive and statistically significant association between CAR and CBDC, consistent with the findings from earlier models. This stability in coefficient magnitude and significance confirms that the observed relationship is not driven by overlapping effects of institutional or governance quality.

Overall, the results demonstrate a strong and robust association between cryptocurrency adoption and CBDC development, providing support to our hypothesis 1 (H1). The persistence of CAR’s significance across different specifications, even after accounting for country and year fixed effects, lends credibility to the argument that rising cryptocurrency use is an important catalyst pushing central banks to accelerate their digital currency initiatives.

4.4. Heterogeneity Analysis

To investigate whether the effect of CAR on CBDC development differs across levels of economic development, we estimate fixed-effects regressions separately for high-income, low- and lower middle-income, and upper middle-income countries. The income classification follows the World Bank’s gross national income (GNI) per capita thresholds based on the Atlas method, which smooths exchange rate fluctuations and adjusts for inflation. For analytical clarity and sample balance, countries are divided into three categories: (1) high-income economies (GNI per capita ≥ US$13,846), (2) low- and lower middle-income economies (GNI per capita ≤ US$4465, combined into one group), and (3) upper middle-income economies (GNI per capita between US$4466 and US$13,845).

Table 5 reports fixed effects estimates by income group. For high-income countries, the CAR coefficient is small and insignificant, suggesting that CBDC initiatives in advanced economies are driven more by strategic policy considerations than by domestic crypto adoption. By contrast, low- and lower middle-income and upper middle-income countries show large and highly significant CAR effects (1.979 and 2.050, respectively), indicating that CBDC progression in these economies is strongly responsive to rising cryptocurrency use. These results highlight that while CBDCs in advanced economies are policy-driven, in emerging and developing economies, they are more directly a response to competitive pressures from cryptocurrencies.

Next, we examine whether the relationship between CAR and CBDC development differs by the level of financial inclusion (

Table 6). Countries are classified into high and low financial inclusion groups using indicators from the IMF Financial Access Survey, with the sample median serving as the cutoff point.

The results show a stronger effect of CAR in low-financial-inclusion countries (1.587, p < 0.01), suggesting that in economies where traditional banking penetration is limited, the rise in cryptocurrency adoption exerts greater pressure on central banks to advance CBDCs. By contrast, in high-financial-inclusion countries, the CAR effect remains positive but weaker (0.682, p < 0.10), implying that well-developed financial systems may mitigate some of the disruptive impact of cryptocurrencies. Overall, these findings highlight that CBDCs are more directly responsive to crypto adoption in financially underserved economies, where digital alternatives play a more prominent role in filling institutional voids.

4.5. Ordered Logistic Regression and GMM Results

To account for the ordinal nature of the dependent variable (CBDC stage), we re-estimate the baseline models using ordered logistic regression.

Table 7 reports the results across three specifications. In all cases, CAR remains positive and statistically significant, reaffirming the baseline finding that higher crypto adoption is strongly associated with progression to more advanced stages of CBDC development.

In Model (1), the coefficient on CAR is 1.87 (p < 0.05), indicating that higher levels of crypto adoption significantly increase the likelihood of being in a higher CBDC category. When adding further controls (Model 2), the CAR coefficient increases to 2.32 and is significant at the 1% level, suggesting a robust effect even after accounting for broader economic, institutional, and technological factors. In the fully specified model (Model 3), the CAR effect remains large (1.98) and significant at the 5% level.

Model (4) extends the ordered logistic regressions by incorporating a dynamic specification estimated via the Generalized Method of Moments (GMM). This approach controls for endogeneity and dynamic persistence, recognizing that a country’s current CBDC status is likely influenced by its past stage of development and by feedback effects between cryptocurrency adoption and CBDC progression. Importantly, the coefficient on cryptocurrency adoption (CAR) remains positive and statistically significant, even after controlling for both dynamics and endogeneity. This result reinforces the robustness of the earlier findings that higher levels of cryptocurrency adoption continue to exert upward pressure on CBDC advancement.

Several control variables also display consistent effects. The pseudo R2 values rise substantially between Model (1) (0.026) and Models (2) (3) (0.195–0.205), indicating improved explanatory power once institutional and technological covariates are included. Taken together, the ordered logit results corroborate the baseline OLS and FE estimates while offering a more appropriate treatment of the ordinal CBDC stage variable. The consistency of results across modeling strategies strengthens confidence in the conclusion that rising cryptocurrency adoption is an important driver of CBDC progression.

4.6. Margins Analysis

To complement the ordered logistic regressions and provide a more intuitive interpretation of the results, we calculate marginal effects to assess how changes in CAR influence the probability of being in each CBDC development stage. While the log-odds coefficients reported earlier establish direction and significance, marginal effects translate these into changes in predicted probabilities, offering a more policy-relevant perspective.

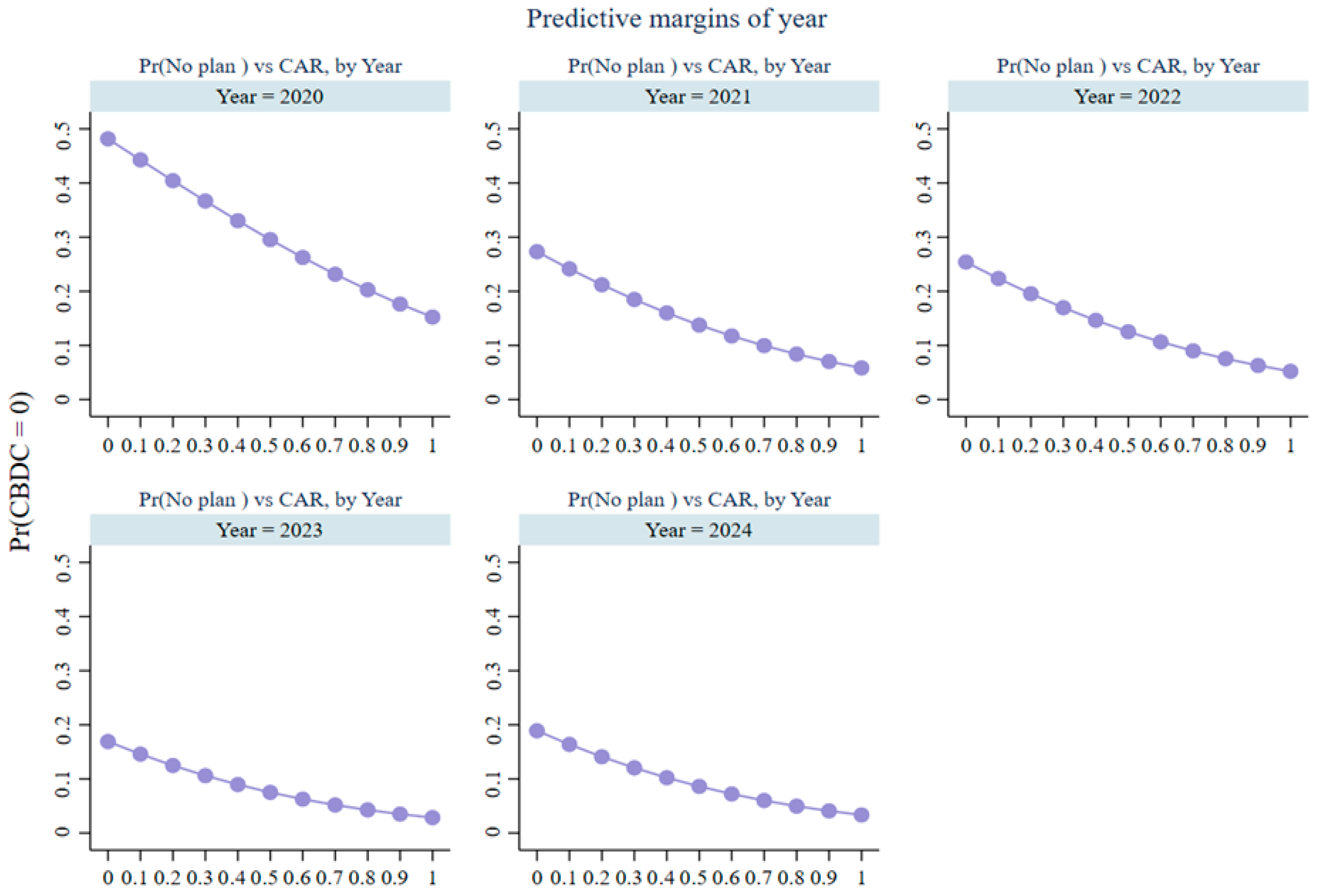

Figure 1 provides the predictive margins of CBDC stage No Plan (CBDC = 0) across values of cryptocurrency adoption (CAR) for different years. In this case, across all years (2020–2024), higher CAR is associated with a sharp decline in the probability that a country has no CBDC plan. For example, in 2020, countries with CAR = 0.1 had about a 45–50% chance of having no plan, falling below 20% as CAR approaches 1. Over time, the baseline probability of having no plan shrinks markedly in 2023–24; even low-CAR countries have <20% probability of being in the “no plan” category.

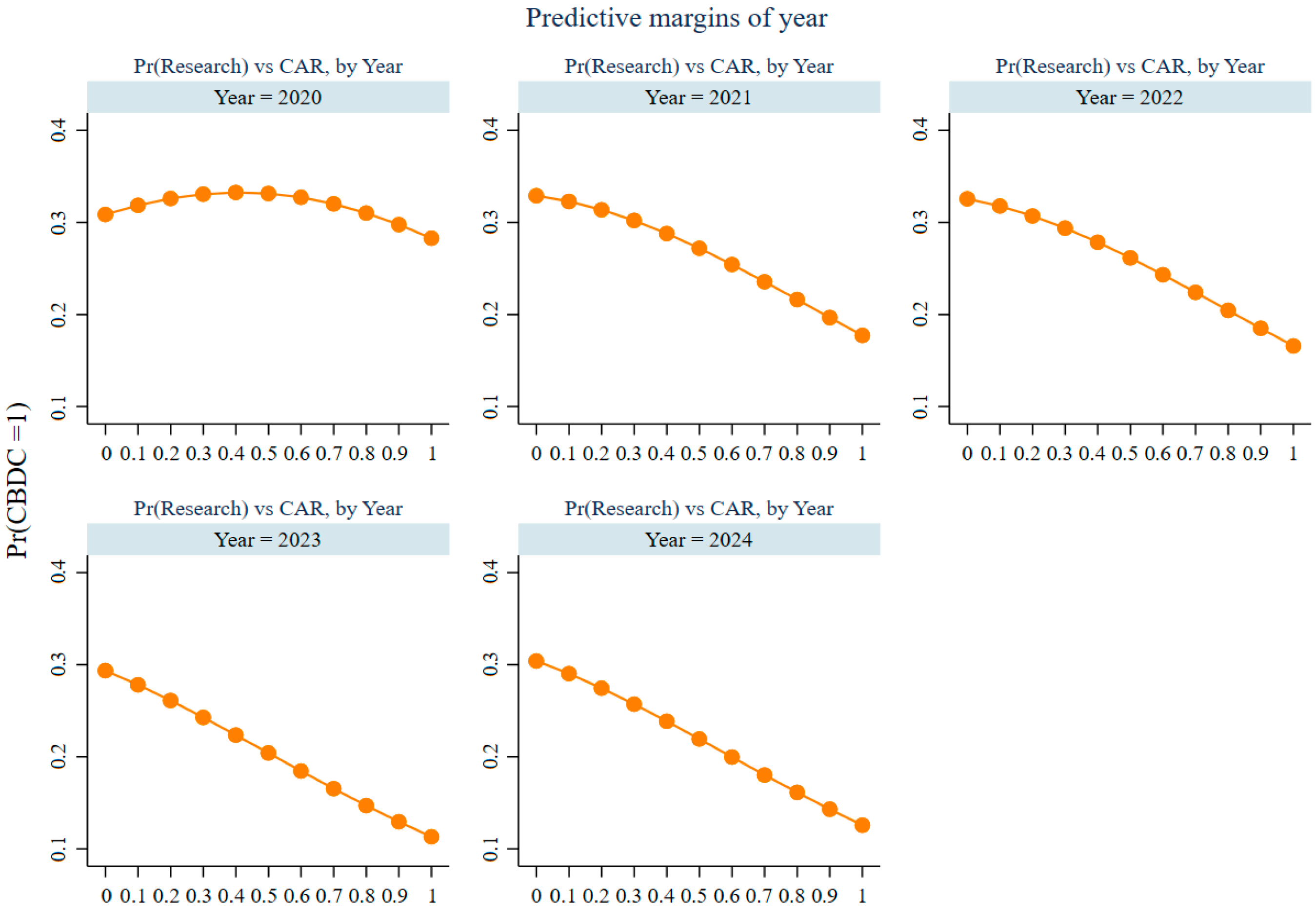

Figure 2 provides the predictive margins of CBDC stage “Research Stage (CBDC = 1)” across values of cryptocurrency adoption (CAR) for different years. In 2020–21, the relationship is mildly inverse-U shaped: probabilities rise at low-to-mid CAR but then decline as CAR increases further. From 2022 onward, the curve becomes strictly downward sloping: higher CAR is associated with a lower probability of remaining stuck at the research stage. By 2023–24, high-CAR countries are much less likely to be in “Research” compared to low-CAR countries. Crypto adoption may initially stimulate exploratory research, but sustained adoption accelerates transition beyond research to more advanced stages.

Figure 3 provides the predictive margins of CBDC stage “Developing/Proof-of-Concept (CBDC = 2)” across values of cryptocurrency adoption (CAR) for different years. In early years (2020–21), the probability of being in the “Developing” stage rises with CAR, peaking around mid-values (0.4–0.6), before tapering off at higher CAR. In later years (2022–24), the peak flattens or shifts, with probabilities starting to decline more clearly at high CAR. Mid-level CAR countries are most likely to be in the development stage, while high-CAR countries tend to skip forward to pilot/launch.

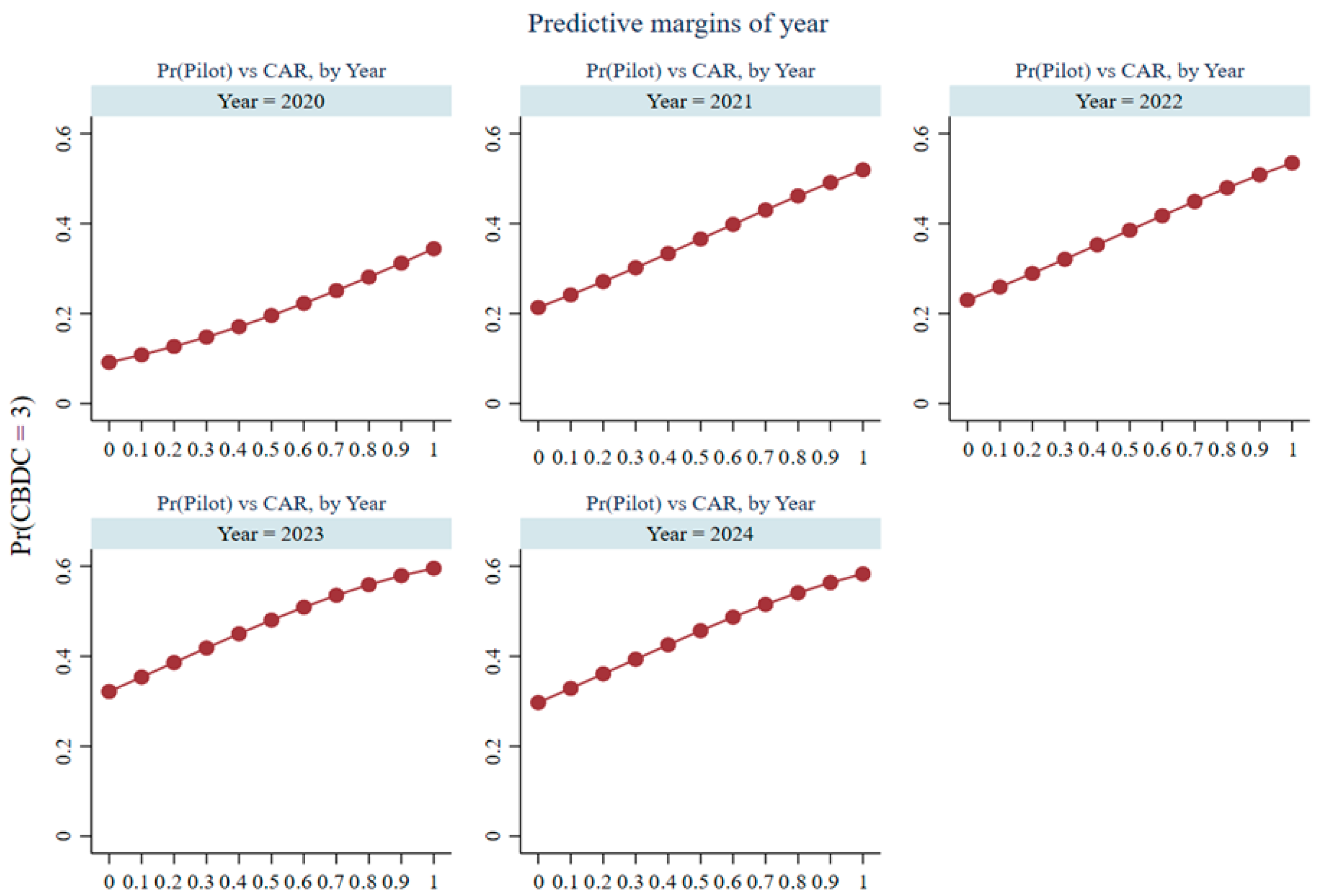

Figure 4 provides the predictive margins of CBDC stage “Pilot (CBDC = 3)” across values of cryptocurrency adoption (CAR) for different years. Across all years, higher CAR increases the probability of being in the pilot stage in a nearly linear fashion. In 2020, the probability of being in pilot rises from about 10% at low CAR to nearly 40% at high CAR. By 2023–24, this range shifts upwards: high-CAR countries have >60% predicted probability of being in the pilot stage. Pilot implementation is the most likely outcome for countries with strong crypto adoption, especially in recent years.

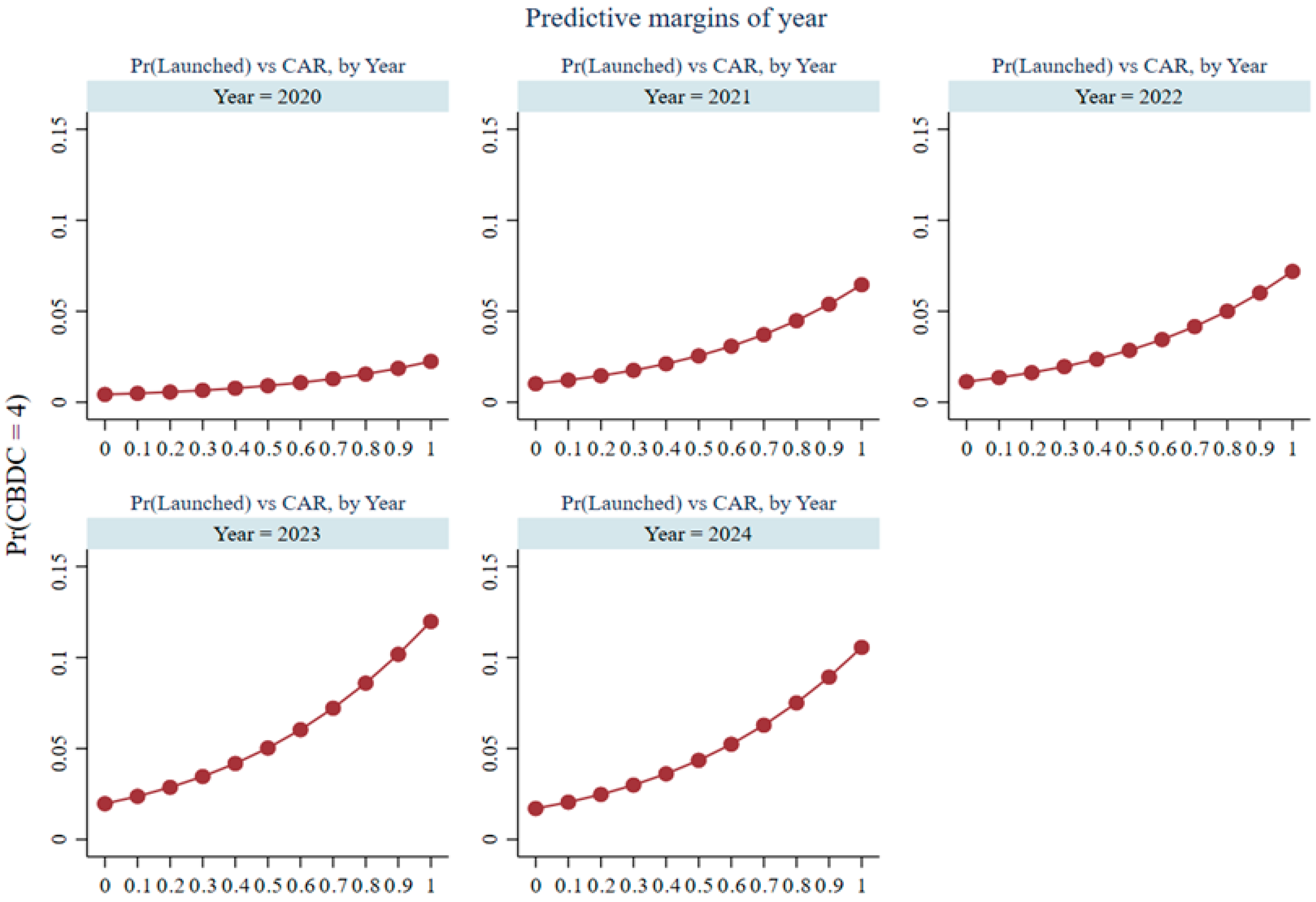

Figure 5 provides the predictive margins of CBDC stage “Launched (CBDC = 4)” across values of cryptocurrency adoption (CAR) for different years. The probability of having a fully launched CBDC is very low in 2020, even at high CAR (<5%). Over time, the slope steepens. In 2022–24, high-CAR countries have a substantially higher chance (10–15%) of having launched a CBDC. Although full launch remains rare, crypto adoption is a clear predictor of which countries are most likely to launch, particularly in the later years of the sample.

4.7. Discussion

The results consistently demonstrate that cryptocurrency adoption is a significant and robust predictor of CBDC progression. Across pooled OLS, fixed effects, and ordered logistic specifications, higher levels of CAR are strongly associated with advancement to more developed stages of CBDC implementation. This effect remains stable after accounting for country-specific heterogeneity and year effects, underscoring the robustness of the findings. The margins analysis provides further insight into the substantive importance of these results: increases in CAR substantially reduce the probability of a country remaining in the “no plan” or “research” stages while sharply increasing the likelihood of moving into the “pilot” or “launched” categories. These results lend strong empirical support to the argument that rising cryptocurrency adoption not only correlates with but actively pressures central banks to accelerate CBDC initiatives.

Beyond this baseline association, the heterogeneity analyses reveal important contextual differences. In high-income economies, the effect of CAR is weak and statistically insignificant. This suggests that CBDC projects in advanced economies are driven primarily by strategic policy objectives such as enhancing cross-border settlement, strengthening payment system resilience, or safeguarding monetary sovereignty rather than by competitive pressures from domestic cryptocurrency use. By contrast, in upper middle-income and low- and lower middle-income countries, CAR exerts a strong and statistically significant effect on CBDC progression. A further layer of heterogeneity emerges when financial inclusion is considered. The analysis shows that the effect of CAR is much stronger in countries with low levels of financial inclusion. In economies where large segments of the population remain outside the formal banking system, cryptocurrencies provide alternative channels for payments and savings, thereby intensifying the competitive pressure on central banks. CBDCs in such environments appear as policy tools not only to counterbalance crypto adoption but also to promote broader access to secure and affordable financial services. Conversely, in countries with high levels of financial inclusion and mature financial sectors, the disruptive impact of cryptocurrencies is more limited. Here, CBDC development appears to be shaped less by grassroots adoption of crypto and more by long-term strategic considerations linked to payment efficiency, financial stability, and international competitiveness.

The findings reveal that the progression of CBDC development is influenced not only by cryptocurrency adoption but also by broader institutional, political, and technological conditions. Countries with stronger governance and regulatory quality are more capable of translating rising crypto adoption into formal CBDC initiatives, reflecting institutional capacity to manage digital transformation. Conversely, in countries with weaker institutions or political instability, the diffusion of innovation is constrained by limited trust, fragmented policy coordination, and inadequate legal frameworks. Politically, the results suggest that CBDC adoption can become a strategic instrument for reinforcing monetary sovereignty and public trust, particularly in contexts where private digital currencies challenge state authority. Technological readiness, as reflected in mobile connectivity and digital infrastructure, further accelerates CBDC progression by enabling practical implementation and public accessibility. Collectively, these findings underscore that successful CBDC adoption is not merely a technological or financial outcome, but a policy process shaped by political legitimacy, institutional effectiveness, and adaptive regulatory governance.

These findings align closely with existing theoretical and policy-oriented arguments while extending them with systematic empirical evidence. Theoretically, this pattern aligns with the Diffusion of Innovation Theory (

Rogers, 1962). In low-inclusion contexts, technological adoption capacity is limited, but policy motivation is high because the need for inclusive and secure digital payment systems is urgent. Thus, CBDCs in such economies are proactive, developmental responses, while in advanced, high-inclusion economies, CBDCs are strategic innovations driven by efficiency and competitiveness rather than direct crypto competition.

5. Conclusions

This paper examined whether cryptocurrency adoption pressures central banks to advance their CBDC initiatives. Using a cross-country dataset and multiple econometric approaches, including pooled OLS, fixed effects, and ordered logistic regressions, it provides the first large-sample empirical assessment of this relationship. The results show that higher cryptocurrency adoption is consistently associated with progression to more advanced CBDC stages. Margins analysis confirms that as adoption rises, countries are significantly less likely to remain in early stages and more likely to move toward pilot projects or full launches, underscoring the substantive importance of the effect.

The results have several important policy implications. First, they suggest that the global spread of cryptocurrencies is not merely a speculative trend but a structural force accelerating monetary innovation. Central banks, particularly in emerging and developing economies, appear to respond to crypto-induced pressures by advancing their CBDC initiatives to safeguard monetary sovereignty and improve financial inclusion. Second, for high-income economies where the effect of CAR is weaker, CBDC exploration seems more strategically motivated, driven by goals of cross-border efficiency, payment resilience, and technological competitiveness rather than immediate crypto competition. Policymakers should therefore tailor CBDC design frameworks to domestic contexts, ensuring that implementation complements existing financial systems while addressing privacy, trust, and regulatory integrity.

From a theoretical standpoint, the findings lend support to the Diffusion of Innovation and Institutional perspectives, suggesting that CBDCs represent both technological and institutional responses to disruptive financial innovations. This dual dynamic underscores that monetary authorities act as adaptive institutions, balancing innovation with stability in the face of evolving digital ecosystems.

While this study provides important empirical insights into the relationship between cryptocurrency adoption and CBDC development, several limitations should be acknowledged. First, the analysis relies on available cross-country data, which may mask within-country variations and the evolving nature of CBDC projects. Second, the measure of CAR is based on Chainalysis estimates, which, though comprehensive, may not fully capture informal or peer-to-peer transactions. Third, institutional and technological variables, while controlled for, are subject to data availability and periodic revisions. In addition, this study did not include a country’s tax burden, as its effects are largely captured by institutional variables such as Control of Corruption and Government Effectiveness, which reflect fiscal transparency and administrative efficiency. Moreover, reliable cross-country tax data is limited. Future studies could incorporate fiscal policy indicators such as tax efficiency or government spending quality to further examine how national fiscal structures shape CBDC adoption and digital currency dynamics. Finally, the study focuses on association rather than causality, and future research could employ dynamic or instrumental variable approaches to better establish directionality. Expanding country coverage, incorporating survey-based behavioral insights, and exploring post-launch CBDC impacts would further enrich this line of inquiry. Overall, this study contributes to an emerging understanding of how digital transformation reshapes monetary systems and provides a foundation for future empirical and policy-oriented research on the coexistence of cryptocurrencies and CBDCs.