Abstract

This paper explores how geopolitical risk impacts small and medium-sized enterprises (SMEs), focusing on the COVID-19 pandemic and the Russia–Ukraine war. Using daily return data from the ECPI Italy SME Equity and Shenzhen SME Composite indexes, as well as the Global Geopolitical Risk Index, this study employs a Dynamic Conditional Correlation GARCH model to analyze how correlations change over time. The results show that Asian SMEs, represented by China, exhibit higher short-term volatility but stronger long-term resilience than their European counterparts. Notably, Asian markets react consistently across crises, while European markets distinguish between different events. These findings provide important insights for policymakers, suggesting the need for standardized crisis response frameworks and emphasizing short-term mitigation efforts. This study adds to SME theory by highlighting the complex relationship between geopolitical shocks and SME performance, with important implications for risk management and regulatory strategies in emerging economies.

1. Introduction and Literature Review

The world has faced a major series of challenges over the past five years. While economies were preparing for BREXIT (Arnorsson & Zoega, 2018; Bachmann & Sidaway, 2016), COVID-19 struck, impacting not only health but also the financial sector (Batten et al., 2023; Hassan et al., 2022a). This was followed by the Russian-Ukrainian war (Chen et al., 2023; Osiichuk & Shepotylo, 2020), and more recently, the ongoing Middle Eastern crisis. These successive crises have affected businesses worldwide—regardless of size, industry, or impact—by transmitting risk across global markets and financial micro- and macrostructures (Batten et al., 2023; Hasan et al., 2023). For instance, the International Monetary Fund has stated that COVID-19’s impact surpasses that of the previous global financial crises (Batini & Li, 2023). Additionally, the scholarly literature suggests that COVID-19 and the Russo-Ukrainian War share certain similarities despite their different origins and characteristics (Saâdaoui et al., 2022). Both have had profound global impacts beyond their initial scope (Lo et al., 2022; Rossouw & Greyling, 2022). Furthermore, each event has significantly affected global diplomatic relations (Mendez et al., 2022) by shaping the formation and maintenance of alliances and diplomatic ties (Hennessy, 2023; Vo et al., 2023).

The term SME refers to Small and Medium Enterprises, representing companies with limited staff and moderate revenue compared to larger corporations (Marconatto et al., 2022; Smith et al., 2022). These businesses are vital for promoting economic growth, creating jobs, and fostering innovation across various countries worldwide (Chaudhuri et al., 2022; Sohal et al., 2022). Industry experts and prominent researchers have also noted that these small and medium enterprises (SMEs) experienced the shock more severely than their larger counterparts due to their size during the crises discussed (Khalil et al., 2022; Robertson et al., 2022). The closure or temporary shutdown of many SMEs was driven by a combination of factors, including lockdowns, supply chain disruptions, decreased consumer spending, and ongoing financial uncertainty (Sarker et al., 2022). This is especially troubling for the modern economy, as SMEs have become a key driver of social and economic progress worldwide (Beck et al., 2005; Beck & Levine, 2003). Additionally, restrictions on mobility and public gatherings have heavily impacted the retail, hospitality, and entertainment sectors, presenting significant challenges (S. Liu & Yamamoto, 2022; M. Zhang et al., 2022). Regarding the Russo-Ukrainian War, although its immediate effects on SMEs outside the region may be somewhat limited compared to COVID-19, it still affected businesses through geopolitical and economic channels. The current literature needs to be refreshed, especially by learning from both COVID-19 and the Russian-Ukrainian conflict, to better prepare future SME stakeholders, particularly in Asia.

In this paper, we examine how to fill this gap in the literature. As such this study investigates the dynamic relationship between global geopolitical risk and the SME indices of China and Italy. As previous research has shown, COVID-19 was an unavoidable health crisis that halted global logistics (Ghadir et al., 2022; Panwar et al., 2022). However, the ongoing Russian-Ukrainian war exemplifies a modern geopolitical conflict that has become a worldwide disruption (Agyei, 2023; Shahzad et al., 2023). Therefore, understanding the connection between SME sectors and geopolitical risk can improve modern SME theory. We will collect daily return data for ECPI Italy SME’s Equity and Shenzhen SE SME Composite indices from the Datastream platform, using them as key indicators for the SME sectors in China and Italy. To assess how global geopolitical factors influence these variables, we will perform regression analyses utilizing the Global Geopolitical Index developed by Caldara and Iacoviello (2022). Our data collection will span fourteen years, from 2010 to 2023, ensuring comprehensive coverage and reliable results. Building on established methodologies, we will apply a time-varying multivariate Dynamic Conditional Correlation GARCH model, as outlined by previous researchers (Hassan et al., 2022b). This approach will enable us to examine the evolving correlations during the first 100 days of the COVID-19 pandemic and the Russo-Ukrainian War period.

The findings of our study have several key implications for the small and medium-sized enterprise (SME) industry in Asia. Our analysis indicates that the Asian market, as reflected in the Chinese SME index, exhibits higher volatility than its European counterpart. However, this temporary fluctuation is expected to result in a strong recovery over time. While the Asian approach remains steady throughout the crisis, Europe exhibits noticeable variation. These findings offer valuable opportunities for policymakers in Asia to incorporate into their regulatory sandbox. One potential strategy is to establish a standardized crisis response for all emergencies, as Asian markets tend to react similarly. The available data also suggest that, over time, the market tends to self-correct. Therefore, focusing on short-term crisis management and trusting in the market’s ability to recover is advisable. Strategic asset-liability offsetting is recommended for small and medium-sized corporate and financial enterprises to mitigate risks related to interest rates, foreign currency, and liquidity. Additionally, investors are encouraged to adopt dynamic portfolio management techniques.

2. Methodology

In this section, we explain the methodology used in this research, specifically the Dynamic Conditional Correlation (DCC) Generalized Autoregressive Conditional Heteroskedasticity—GARCH (p,q) model, enhanced with an autoregressive (AR)—n term. This modeling approach has gained widespread recognition and adoption among respected academic scholars and regulatory authorities (Celık, 2012; Y. Zhang & Choudhry, 2017). It has proven to be an essential tool for analyzing the changing correlations within different sectors of the global economy (Basher & Sadorsky, 2016). This choice is supported by the model’s strong analytical capabilities, allowing for a detailed investigation of the time-varying relationships within the targeted areas of interest (R. F. Engle & Sheppard, 2001; Ghosh et al., 2021).

At first, we theorize the bivariate model with daily log returns of SME indices, R_(s,t), and Geopolitical risk GRP’s one-day log changes, R_(GRP,t), by a DCC-AR(n)-GARCH(p,q) model in the spirit of R. Engle (2002):

The vector e_t is a 2 × 1 vector composed of independent and identically distributed (i.i.d.) innovations. These innovations are assumed to follow a bivariate normal distribution, i.e., e_t~N(0,H_t). The conditional covariance matrix H_t^ can be expressed as the product of a diagonal matrix D_t, which has dimensions 2 × 2. The elements of this matrix correspond to the conditional standard deviations h_(i,t)^0.5, where i belongs to the set (s, GRP). Additionally, there is a conditional correlation matrix C_t involved in the decomposition of the following:

It is suggested that the conditional mean μ_(i,t) = E(R_(i,t) |F_(t − 1)) can be modeled as an autoregressive process of order “n.” Therefore, the univariate conditional mean equation can be derived as follows:

The equation involves the unstandardized innovations, and h_(i,t) represents the conditional variance with a mean of zero. The coefficient λ_1 measures the potential Granger causality relationship between the lagged GRP return and the returns of the SME indices. In the next step, following Bollerslev (1986), we calculate the conditional variance for which can then be converted into the following covariance matrix for .

Using the explanation of Batten et al. (2017) we denote u_(i,t) = e_(i,t)/√(h_(i,t)). From this, the following can be derived.

where a and b are limited to a total value of 1. Next, we calculate the conditional correlation using the equation below, where q_(s,GRP,t) is the conditional covariance q_(s,GRP,t) = Cov(R_(s,t),R_(GRP,t) |F_(t − 1)) between SME index s and GRP, and q_(s,s,t) = Var(R_(s,t) |F_(t − 1)) and q_(GRP,GRP,t) = Var(R_(GRP,t) |F_(t − 1)) represent the conditional variances in the SME index s and GRP, respectively.

ρ_(s,GRP,t) = q_(s,GRP,t)/(q_(s,s,t) q_(GRP,GRP,t))^0.5

We can estimate the DCC-AR(n)-GARCH(p,q) model for our baseline results using these estimates.

3. Data and Preliminary Analysis

The daily closing prices P_(i,t) of two important SME indices were collected from Thomson Reuters Datastream. The data covers from 1 July 2010 to 23 October 2023. The variables include (with DataStream codes in parentheses) daily and weekly log-returns of the Ecpi Italy SME Index (ECAISME) and the Shenzhen Stock Exchange SME Prime Market Index (CHZSMEP), as well as daily and weekly log-changes in Geopolitical Risk gathered from Caldara and Iacoviello (2022). Based on the precedent set by previous researchers in our field, we argue that these SME indices possess the necessary features to serve as reliable indicators of the SME sector (Hall et al., 2009; Singh et al., 2010). In this regard, this study has a specific limitation, as other SME sector indices could be validated or might only apply to certain audiences. Therefore, this study only looks at the effect of geopolitical risk on these two SME indices.

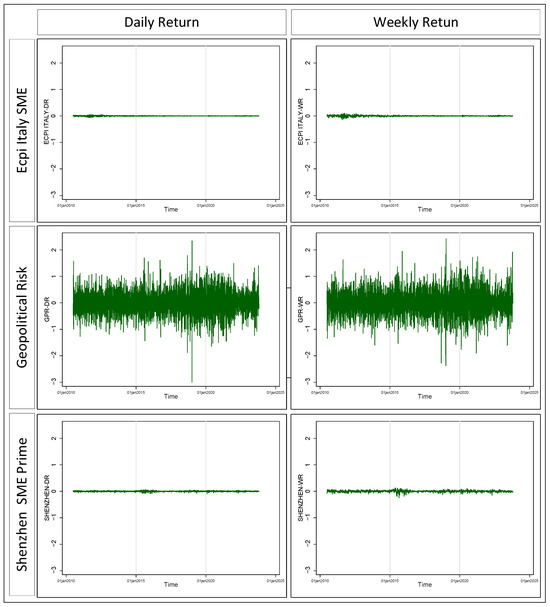

Table 1 shows the descriptive statistics for the overall sample in Panel A, followed by the Pearson correlations in Panel B. In Panel B, correlations are color-coded according to their strength (green to yellow to red). The highest correlation is indicated by dark red, while the strongest negative correlation appears in dark green. The full sample suggests that both SME index returns and changes in the GPR have acceptable kurtosis. Additionally, the Jarque-Bera test applied to all return series rejects the null hypothesis of normality at a 1% significance level. The weekly and daily variation samples support this main conclusion. Moreover, most samples exhibit negative skewness in the data. Negative skewness indicates a higher likelihood of experiencing severe declines during crises, such as a significant drop of about 30% in stock markets of industrialized countries over a short period. Therefore, negative skewness appears to be a typical feature of the crisis sample. This difference is also reflected in the skewness of weekly GPR changes, which is 0.082, compared to −0.021 for daily changes. Figure 1 offers a visual representation of volatility in the baseline data. Within the same range, the SME indices fluctuate similarly; however, their variation is smaller than that of the GPR, as noted by previous authors (Li et al., 2023; Z. Zhang et al., 2022).

Table 1.

Descriptive Statistics and Pearson Correlation: This table presents the descriptive statistics for the overall sample in this study, including mean, standard deviation, kurtosis, skewness, and the Jarque-Bera normality test with p-value, along with the ADF test with its p-value in Panel A. Following this, Panel B shows the Pearson correlation coefficients, which are color-coded based on the strength of their relationships (green to yellow to red). The variables include (with DataStream codes in parentheses) daily and weekly log-returns of the Ecpi Italy Sme Index (ECAISME) and the Shenzhen Stock Exchange Sme Prime Market Index (CHZSMEP), as well as daily and weekly log-changes in Geopolitical Risk. The sample period spans from 1 July 2010 to 23 October 2023.

Figure 1.

Graphical representation of the baseline sample data volatility: The figure shows the baseline sample data volatility. The variables include (with DataStream codes in parentheses) daily and weekly log-returns of the Ecpi Italy SME Index (ECAISME), Shenzhen Stock Exchange SME Prime Market Index (CHZSMEP), along with daily and weekly log-changes in Geopolitical Risk. The entire sample period of this study runs from 1 July 2010 to 23 October 2023.

4. Discussion

The baseline results are shown in Table 2. The estimated coefficients come from the bivariate DCC-AR (n)-GARCH (p,q) model applied to daily and weekly log-returns of the Ecpi Italy SME Index (ECAISME) and the Shenzhen Stock Exchange SME Prime Market Index (CHZSMEP), along with daily and weekly log-changes in Geopolitical Risk (shown with DataStream codes in parentheses). The full sample period runs from 1 July 2010 to 23 October 2023. The COVID-19 period runs from 2 February 2020 to 19 June 2020, while the war period runs from 1 February 2022 to 20 June 2022. Panel A shows the DCC-GARCH correlation for the entire COVID-19 and war periods, followed by the model specifications in Panel B. The diagnostic results include the Log-Likelihood, AIC, BIC, ARCH-LM test statistic, and Durbin–Watson d-statistic.

Table 2.

Baseline DCC-AR(n)-GARCH(p,q) Model Results: The baseline results are shown in Table 2 above. The estimated coefficients come from the bivariate DCC-AR(n)-GARCH(p,q) model between daily and weekly log-returns of the Ecpi Italy Sme Index (ECAISME) and Shenzhen Stock Exchange Sme Prime Market Index (CHZSMEP), with data (DataStream code in parentheses) and weekly log-changes in Geopolitical Risk. This study’s overall sample period runs from 1 July 2010 to 23 October 2023. The COVID-19 sample covers 2 February 2020, to 19 June 2020, while the war period spans from 1 February 2022 to 20 June 2022. Panel A presents the DCC-GARCH correlations for the overall, COVID-19, and war periods, followed by the model specifications in Panel B. The diagnostics include the Log-Likelihood, AIC, BIC, ARCH-LM test statistic, and the Durbin–Watson d-statistic. AIC and BIC stand for Akaike’s Information Criterion and Bayesian Information Criterion, respectively.

The results show consistent patterns throughout the entire sample and sub-sample analysis. These findings are also indirectly supported by previous researchers examining the GRP and other sectors (Asgary et al., 2020; Le & Tran, 2021). Overall, the Ecpi Italy SME Index has a negative relationship, while the Shenzhen Stock Exchange SME Prime Market Index shows a positive relationship in our DCC model. The results remain valid during the COVID-19 and war periods examined in this study. The only exception is seen in the weekly return of the Shenzhen Stock Exchange SME Prime Market Index, where the correlation decreased by a notable sixty percent. This can be explained by the fact that the Chinese SME sector is larger and more structured than its counterparts, allowing for long-term market adjustments based on balance (Huang, 2009; Lin et al., 2021). Subsequently, all diagnostic tests confirmed our findings. The AIC and BIC values fall within acceptable ranges, along with the log-likelihood.

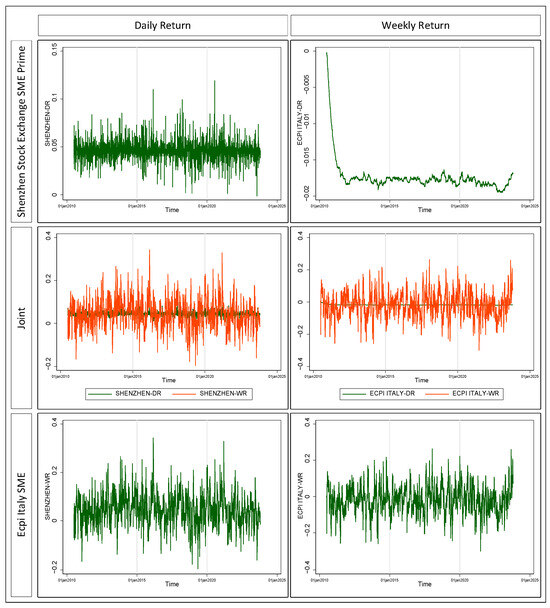

Next, following previous researchers in our field (Hassan et al., 2022a; Kinateder et al., 2021), Figure 2 shows the time-varying conditional correlations (see Equation (6)) derived from our earlier bivariate DCC-AR(n)-GARCH(p,q) model. The middle row displays a combined view of both daily and weekly correlations for the two indices. We can clearly identify a generally similar pattern for both countries across both weekly and daily data over the long term. This indicates that SME indices are more volatile than daily geopolitical risk; however, they tend to manage these risks better over a longer period. As discussed in the previous section, we observe a slightly different pattern in the weekly Chinese market, supported by prior evidence. Moreover, it appears that both patterns remain relatively consistent over the long run, although the correlation range differs between the Chinese market and its Italian counterpart.

Figure 2.

Overall Sample Correlation: This figure shows the time-varying conditional correlations (see Equation (6)) derived from our previous bivariate DCC-AR(n)-GARCH(p,q) model between (with DataStream code in parentheses) the daily and weekly log-returns of the Ecpi Italy SME Index (ECAISME) and the Shenzhen Stock Exchange SME Prime Market Index (CHZSMEP), along with the daily and weekly log-changes in Geopolitical Risk. This study covers the period from 1 July 2010 to 23 October 2023. The middle row presents a combined view of both daily and weekly correlations for both indices.

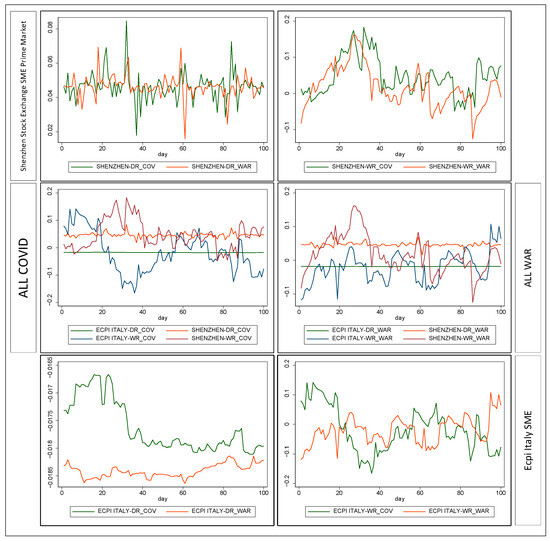

Next, we further examine the impact of sub-sample crisis periods on the SME-GPR correlation during the first 100 days to gain a clearer understanding. Previous researchers have also used this method to evaluate their ongoing effects (Batten et al., 2022; Choudhury et al., 2022). Figure 3 shows the time-varying conditional correlations (see Equation (6)) that result from our earlier bivariate DCC-AR(n)-GARCH(p,q) model for the first 100 days of the COVID-19 vs. WAR sample. The middle row displays the combined illustration of the COVID-19 and WAR correlations for both indices. First, the Italian market experiences significantly lower volatility from GPR than China. However, in both intervals (daily and weekly data), the upper and lower bounds differ for the daily data but are the same for the weekly data. This indicates that the market responds and adjusts its trajectory in the long term across the SME sector. Interestingly, in the Chinese market, volatility transmission is relatively similar in both crises, especially in a comparable way (H. Liu et al., 2020; Sun et al., 2021); however, the Italian market differs greatly in daily data, with a notable gap between COVID-19 and WAR. This suggests that the Asian market perceives all crises as similar, while the European market tends to distinguish between them (Lee & Jeong, 2014; Rhee & Posen, 2013).

Figure 3.

COVID-19 vs. WAR Sample Correlation for Significant 100 Days: This figure displays the time-varying conditional correlations derived from our previous bivariate DCC-AR(n)-GARCH(p,q) model over the first 100 days of the COVID-19 vs. WAR sample. It shows data (with DataStream codes in parentheses) of daily and weekly log-returns of the Ecpi Italy Sme Index (ECAISME) and Shenzhen Stock Exchange Sme Prime Market Index (CHZSMEP), along with daily and weekly log-changes in Geopolitical Risk. The COVID-19 sample period spans from 2 February 2020 to 19 June 2020, while the war period runs from 1 February 2022 to 20 June 2022. The middle row presents a joint illustration of COVID-19 and WAR correlation for both indices.

5. Conclusions and Policy Recommendations

This research aims to fill a gap in the existing literature by adopting a more comprehensive perspective on the SME sector’s response to geopolitical risks, specifically COVID-19 and the ongoing Russian-Ukrainian war. In this context, understanding the relationship between small and medium-sized enterprises (SMEs) and geopolitical risk may help contextualize current SME theories. This study plans to expand our understanding by analyzing the effects of COVID-19 and the Russian-Ukrainian war and comparing them with the impacts of the global financial crisis. This approach will offer new insights for improving performance and risk management in SMEs and provide valuable policy guidance for regulators in this field.

Our results have many exciting and valuable implications for the Asian SME market. We have concluded that the Asian market, represented by the Chinese SME index, is more volatile than its European counterpart. However, this short-term phenomenon is expected to recover well in the long run. Yet, the Asian response does not differ from the crisis, whereas Europe’s does. These findings open significant opportunities for policymakers in Asia to incorporate into their regulatory sandbox. First, they can apply a standard crisis response for all crises, as Asian markets tend not to differ significantly. The evidence also suggests that, in the long term, the market corrects itself; so, the focus should be on the short-term crisis mechanism, trusting the market to self-correct. Corporate and financial SMEs should use strategic asset-liability offsetting to reduce interest rate, foreign exchange, and liquidity risks, and investors should adopt dynamic portfolio management. Future research could broaden the geographical scope to include more Asian and European economies for wider comparative insights. Sector-specific analyses and the role of digital transformation in SME resilience during geopolitical crises merit further exploration. Additionally, investigating long-term recovery patterns and the effectiveness of financial and policy interventions can improve crisis preparedness for SMEs.

Author Contributions

Conceptualization, T.C.; Validation, T.C.; Investigation, T.C.; Writing—review and editing, T.C., A.A.F., N.B. and A.F.; Supervision, T.C.; Project administration, T.C. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

The data used in this study were obtained from the Datastream (LSEG) database. These data are proprietary and cannot be shared publicly due to licensing restrictions. Researchers may access the data through Datastream with an appropriate institutional subscription.

Conflicts of Interest

Author Abubaker Fadul was employed by the company Saudi Aramco. The remaining authors declare that this research was conducted in the absence of any commercial or financial relationships that could be construed as potential conflicts of interest.

References

- Agyei, S. K. (2023). Emerging markets equities’ response to geopolitical risk: Time-frequency evidence from the Russian-Ukrainian conflict era. Heliyon, 9(2), e13319. [Google Scholar] [CrossRef] [PubMed]

- Arnorsson, A., & Zoega, G. (2018). On the causes of Brexit. European Journal of Political Economy, 55, 301–323. [Google Scholar] [CrossRef]

- Asgary, A., Ozdemir, A. I., & Özyürek, H. (2020). Small and medium enterprises and global risks: Evidence from manufacturing SMEs in Turkey. International Journal of Disaster Risk Science, 11, 59–73. [Google Scholar] [CrossRef]

- Bachmann, V., & Sidaway, J. D. (2016). Brexit geopolitics. Geoforum, 77, 47–50. [Google Scholar] [CrossRef]

- Basher, S. A., & Sadorsky, P. (2016). Hedging emerging market stock prices with oil, gold, VIX, and bonds: A comparison between DCC, ADCC and GO-GARCH. Energy Economics, 54, 235–247. [Google Scholar] [CrossRef]

- Batini, N., & Li, J. (2023). The role of IMF financial support in mitigating the COVID-19 shock (IEO Background Paper No. BP/23-01/01). International Monetary Fund. [Google Scholar]

- Batten, J. A., Boubaker, S., Kinateder, H., Choudhury, T., & Wagner, N. F. (2023). Volatility impacts on global banks: Insights from the GFC, COVID-19, and the Russia-Ukraine war. Journal of Economic Behavior & Organization, 215, 325–350. [Google Scholar] [CrossRef]

- Batten, J. A., Choudhury, T., Kinateder, H., & Wagner, N. F. (2022). Volatility impacts on the European banking sector: GFC and COVID-19. Annals of Operations Research, 330, 335–360. [Google Scholar] [CrossRef]

- Batten, J. A., Kinateder, H., Szilagyi, P. G., & Wagner, N. F. (2017). Can stock market investors hedge energy risk? Evidence from Asia. Energy Economics, 66, 559–570. [Google Scholar] [CrossRef]

- Beck, T., Demirguc-Kunt, A., & Levine, R. (2005). SMEs, growth, and poverty: Cross-country evidence. Journal of Economic Growth, 10, 199–229. [Google Scholar] [CrossRef]

- Beck, T., & Levine, R. (2003). Small and medium enterprises, growth, and poverty: Cross-country evidence (Vol. 3178). World Bank Publications. [Google Scholar]

- Bollerslev, T. (1986). Generalized autoregressive conditional heteroskedasticity. Journal of Econometrics, 31(3), 307–327. [Google Scholar] [CrossRef]

- Caldara, D., & Iacoviello, M. (2022). Measuring geopolitical risk. American Economic Review, 112(4), 1194–1225. [Google Scholar] [CrossRef]

- Celık, S. (2012). The more contagion effect on emerging markets: The evidence of DCC-GARCH model. Economic Modelling, 29(5), 1946–1959. [Google Scholar] [CrossRef]

- Chaudhuri, A., Subramanian, N., & Dora, M. (2022). Circular economy and digital capabilities of SMEs for providing value to customers: Combined resource-based view and ambidexterity perspective. Journal of Business Research, 142, 32–44. [Google Scholar] [CrossRef]

- Chen, Y., Jiang, J., Wang, L., & Wang, R. (2023). Impact assessment of energy sanctions in geo-conflict: Russian–Ukrainian war. Energy Reports, 9, 3082–3095. [Google Scholar] [CrossRef]

- Choudhury, T., Kinateder, H., & Neupane, B. (2022). Gold, bonds, and epidemics: A safe haven study. Finance Research Letters, 48, 102978. [Google Scholar] [CrossRef]

- Engle, R. (2002). Dynamic conditional correlation: A simple class of multivariate generalized autoregressive conditional heteroskedasticity models. Journal of Business & Economic Statistics, 20(3), 339–350. [Google Scholar]

- Engle, R. F., III, & Sheppard, K. (2001). Theoretical and empirical properties of dynamic conditional correlation multivariate GARCH. National Bureau of Economic Research Cambridge. [Google Scholar]

- Ghadir, A. H., Vandchali, H. R., Fallah, M., & Tirkolaee, E. B. (2022). Evaluating the impacts of COVID-19 outbreak on supply chain risks by modified failure mode and effects analysis: A case study in an automotive company. Annals of Operations Research, 1–31. [Google Scholar] [CrossRef]

- Ghosh, I., Sanyal, M. K., & Jana, R. K. (2021). Co-movement and dynamic correlation of financial and energy markets: An integrated framework of nonlinear dynamics, wavelet analysis and DCC-GARCH. Computational Economics, 57, 503–527. [Google Scholar] [CrossRef]

- Hall, B. H., Lotti, F., & Mairesse, J. (2009). Innovation and productivity in SMEs: Empirical evidence for Italy. Small Business Economics, 33, 13–33. [Google Scholar] [CrossRef]

- Hasan, F., Al-Okaily, M., Choudhury, T., & Kayani, U. (2023). A comparative analysis between FinTech and traditional stock markets: Using Russia and Ukraine war data. Electronic Commerce Research, 24, 629–654. [Google Scholar] [CrossRef]

- Hassan, M. K., Djajadikerta, H. G., Choudhury, T., & Kamran, M. (2022a). Safe havens in Islamic financial markets: COVID-19 versus GFC. Global Finance Journal, 54, 100643. [Google Scholar] [CrossRef]

- Hassan, M. K., Kamran, M., Djajadikerta, H. G., & Choudhury, T. (2022b). Search for safe havens and resilience to global financial volatility: Response of GCC equity indexes to GFC and COVID-19. Pacific-Basin Finance Journal, 73, 101768. [Google Scholar] [CrossRef]

- Hennessy, A. (2023). The impact of Russia’s war against Ukraine on Sino-European relations. Journal of European Integration, 45(3), 559–575. [Google Scholar] [CrossRef]

- Huang, X. (2009). Strategic decision making in Chinese SMEs. Chinese Management Studies, 3(2), 87–101. [Google Scholar] [CrossRef]

- Khalil, A., Abdelli, M. E. A., & Mogaji, E. (2022). Do digital technologies influence the relationship between the COVID-19 crisis and SMEs’ resilience in developing countries? Journal of Open Innovation: Technology, Market, and Complexity, 8(2), 100. [Google Scholar] [CrossRef]

- Kinateder, H., Campbell, R., & Choudhury, T. (2021). Safe haven in GFC versus COVID-19: 100 turbulent days in the financial markets. Finance Research Letters, 43, 101951. [Google Scholar] [CrossRef]

- Le, A.-T., & Tran, T. P. (2021). Does geopolitical risk matter for corporate investment? Evidence from emerging countries in Asia. Journal of Multinational Financial Management, 62, 100703. [Google Scholar] [CrossRef]

- Lee, G., & Jeong, J. (2014). Global financial crisis and stock market integration between Northeast Asia and Europe. Review of European Studies, 6, 61. [Google Scholar] [CrossRef]

- Li, X., Guo, Q., Liang, C., & Umar, M. (2023). Forecasting gold volatility with geopolitical risk indices. Research in International Business and Finance, 64, 101857. [Google Scholar] [CrossRef]

- Lin, F., Ansell, J., & Siu, W.-s. (2021). Chinese SME development and industrial upgrading. International Journal of Emerging Markets, 16(6), 977–997. [Google Scholar] [CrossRef]

- Liu, H., Wang, Y., He, D., & Wang, C. (2020). Short term response of Chinese stock markets to the outbreak of COVID-19. Applied Economics, 52(53), 5859–5872. [Google Scholar] [CrossRef]

- Liu, S., & Yamamoto, T. (2022). Role of stay-at-home requests and travel restrictions in preventing the spread of COVID-19 in Japan. Transportation Research Part A: Policy and Practice, 159, 1–16. [Google Scholar] [CrossRef]

- Lo, G.-D., Marcelin, I., Bassène, T., & Sène, B. (2022). The Russo-Ukrainian war and financial markets: The role of dependence on Russian commodities. Finance Research Letters, 50, 103194. [Google Scholar] [CrossRef]

- Marconatto, D. A. B., Teixeira, E. G., Peixoto, G. A., & Faccin, K. (2022). Weathering the storm: What successful SMEs are doing to beat the pandemic. Management Decision, 60(5), 1369–1386. [Google Scholar] [CrossRef]

- Mendez, A., Forcadell, F. J., & Horiachko, K. (2022). Russia–Ukraine crisis: China’s Belt Road Initiative at the crossroads. Asian Business & Management, 21(4), 488–496. [Google Scholar]

- Osiichuk, M., & Shepotylo, O. (2020). Conflict and well-being of civilians: The case of the Russian-Ukrainian hybrid war. Economic Systems, 44(1), 100736. [Google Scholar] [CrossRef]

- Panwar, R., Pinkse, J., & De Marchi, V. (2022). The future of global supply chains in a post-COVID-19 world. California Management Review, 64(2), 5–23. [Google Scholar] [CrossRef]

- Rhee, C., & Posen, A. S. (2013). Responding to financial crisis: Lessons from Asia then, the United States and Europe now. Columbia University Press. [Google Scholar]

- Robertson, J., Botha, E., Walker, B., Wordsworth, R., & Balzarova, M. (2022). Fortune favours the digitally mature: The impact of digital maturity on the organisational resilience of SME retailers during COVID-19. International Journal of Retail & Distribution Management, 50(8/9), 1182–1204. [Google Scholar] [CrossRef]

- Rossouw, S., & Greyling, T. (2022). Collective emotions and macro-level shocks: COVID-19 vs. the Ukrainian war. Global Labor Organization (GLO). [Google Scholar]

- Saâdaoui, F., Jabeur, S. B., & Goodell, J. W. (2022). Causality of geopolitical risk on food prices: Considering the Russo–Ukrainian conflict. Finance Research Letters, 49, 103103. [Google Scholar] [CrossRef]

- Sarker, M. R., Rahman, S. A., Islam, A. H., Bhuyan, M. F. F., Supra, S. E., Ali, K., & Noor, K. A. (2022). Impact of COVID-19 on Small-and Medium-sized Enterprises. Available online: https://sage.cnpereading.com/paragraph/article/?doi=10.1177/09721509221093489 (accessed on 13 November 2025).

- Shahzad, U., Mohammed, K. S., Tiwari, S., Nakonieczny, J., & Nesterowicz, R. (2023). Connectedness between geopolitical risk, financial instability indices and precious metals markets: Novel findings from Russia Ukraine conflict perspective. Resources Policy, 80, 103190. [Google Scholar] [CrossRef]

- Singh, R. K., Garg, S. K., & Deshmukh, S. (2010). The competitiveness of SMEs in a globalized economy: Observations from China and India. Management Research Review, 33(1), 54–65. [Google Scholar] [CrossRef]

- Smith, H., Discetti, R., Bellucci, M., & Acuti, D. (2022). SMEs engagement with the Sustainable Development Goals: A power perspective. Journal of Business Research, 149, 112–122. [Google Scholar] [CrossRef]

- Sohal, A., Nand, A. A., Goyal, P., & Bhattacharya, A. (2022). Developing a circular economy: An examination of SME’s role in India. Journal of Business Research, 142, 435–447. [Google Scholar] [CrossRef]

- Sun, Y., Wu, M., Zeng, X., & Peng, Z. (2021). The impact of COVID-19 on the Chinese stock market: Sentimental or substantial? Finance Research Letters, 38, 101838. [Google Scholar] [CrossRef]

- Vo, T. P. T., Ngo, H. H., Guo, W., Turney, C., Liu, Y., Nguyen, D. D., Bui, X. T., & Varjani, S. (2023). Influence of the COVID-19 pandemic on climate change summit negotiations from the climate governance perspective. Science of the Total Environment, 878, 162936. [Google Scholar] [CrossRef]

- Zhang, M., Wang, S., Hu, T., Fu, X., Wang, X., Hu, Y., Nguyen, D. D., Bui, X. T., & Liu, H. (2022). Human mobility and COVID-19 transmission: A systematic review and future directions. Annals of GIS, 28(4), 501–514. [Google Scholar] [CrossRef]

- Zhang, Y., & Choudhry, T. (2017). Forecasting the daily time--varying beta of European banks during the crisis period: Comparison between GARCH models and the Kalman Filter. Journal of Forecasting, 36(8), 956–973. [Google Scholar] [CrossRef]

- Zhang, Z., He, M., Zhang, Y., & Wang, Y. (2022). Geopolitical risk trends and crude oil price predictability. Energy, 258, 124824. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).