1. Introduction

Throughout life, individuals face adversities that influence their health and overall functioning. Resilience—the capacity to cope with and adapt to challenging situations—is recognized as a central factor in promoting well-being and self-efficacy (

Hephsebha & Deb, 2024;

Werner, 1995). In recent years, this concept has gained particular relevance in the financial domain, where financial resilience enables individuals to absorb shocks, adapt to uncertainty, and maintain economic stability. While prior research highlights its role at both individual and household levels, debates remain regarding whether financial resilience should be primarily conceptualized as an individual skill, a family-level capacity, or a systemic phenomenon influenced by institutions and social structures (

Lusardi & Mitchell, 2007,

2014;

Sreenivasan & Suresh, 2023). This theoretical tension illustrates the need for studies that examine both personal and contextual determinants of financial resilience, integrating behavioral, cognitive, and institutional perspectives. Financial resilience has been linked not only to personal well-being but also to broader socioeconomic stability. Empirical evidence indicates that access to financial resources, literacy, and planning strategies can reduce economic vulnerability, particularly among populations facing structural disadvantages (

Hamid et al., 2023;

Oppong et al., 2024). Nevertheless, the conceptual boundaries of financial resilience remain underdeveloped (

Salignac et al., 2021), and context-specific evidence is scarce, particularly in occupational settings in emerging economies.

Moreover, key contributions from behavioral economics and household finance provide important theoretical grounding for this study. Pioneering research by

Lusardi and Mitchell (

2007,

2014) demonstrates that financial literacy is a critical determinant of saving behavior, retirement planning, and the ability to cope with economic shocks. From a lifecycle perspective,

Merton (

1990) emphasizes how households manage consumption, savings, and risk across different stages of life, highlighting the importance of long-term planning in sustaining financial well-being. Integrating these perspectives allows us to situate financial resilience not only as a short-term coping mechanism but also as part of broader behavioral and structural processes that shape household decision-making over time.

This study addresses this gap by examining employees of a sugarcane company in Oaxaca, Mexico, a context that, given its socioeconomic importance in the region, offers an ideal setting to explore the multidimensional nature of financial resilience within a real-world organizational environment. To operationalize this investigation, we focus on three interrelated dimensions: individuals’ perceptions of their financial health, their lived financial experiences, and the strategies they employ to cope with economic challenges. Building on this framework, we first formulate general hypotheses concerning financial resilience in this context:

Workers with higher financial literacy and access to financial products will report greater financial resilience. Financial resilience is positively associated with proactive coping strategies in response to adverse financial situations. In addition, the perception of financial health mediates the relationship between access to financial resources and financial resilience.

This study also emphasizes a preventive approach to financial resilience, highlighting strategies to avoid adverse financial outcomes before they occur—complementing existing literature that primarily addresses recovery after crises (

Sreenivasan & Suresh, 2023;

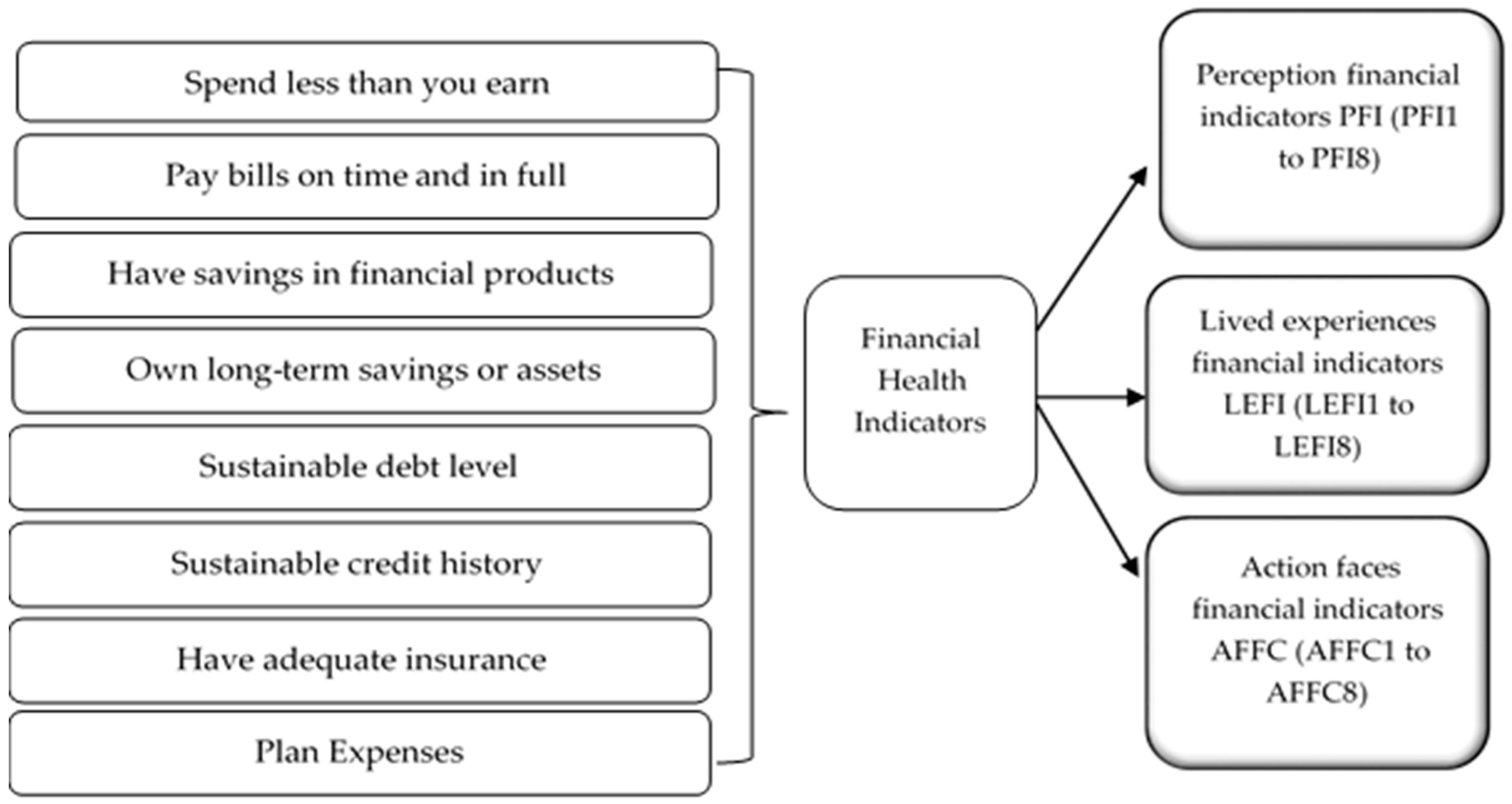

Alam et al., 2024). These considerations lead us to ask the following questions: How do workers perceive financial health indicators? What experiences have they had in relation to these indicators? And what actions have they taken to cope with adverse situations linked to financial health? Therefore, the main purpose of this study is to evaluate financial health indicators based on workers’ perceptions, lived experiences, and coping actions. The goal is to identify and validate the conceptual model that best fits the data according to the theoretical criteria of absolute fit, structural fit, and parsimony. Building on these considerations, the study specifies more precise, testable hypotheses corresponding to the conceptual model illustrated in

Figure 1:

Hypothesis 1. Perceptions of financial indicators (PFI) will positively predict actions to face financial crises (AFFC).

Hypothesis 2. Lived experiences with financial indicators (LEFI) will mediate the relationship between perceptions (PFI) and coping actions (AFFC).

Hypothesis 3. Stronger financial health indicators (budgeting, savings, debt management, insurance) will be associated with higher perceived financial security and stability.

The conceptual model underlying these testable hypotheses is illustrated in

Figure 1.

Operational meaning of the variables in the conceptual model

1.1. Financial Practices for Maintaining Financial Health

Spend less than you earn: Maintain a balanced budget where expenses do not exceed income.

Pay bills on time and in full: Avoid late payments to maintain a good credit reputation and prevent additional fees.

Have savings in financial products: Keep liquid funds in savings accounts or other accessible financial instruments.

Own long-term savings or assets: Possess investments or savings that provide future financial security, such as real estate or retirement funds.

Maintain a sustainable debt level: Keep debt manageable so it does not compromise financial stability.

Sustainable credit history: Maintain a good credit record to facilitate access to financing under favorable conditions.

Have adequate insurance: Possess policies that protect against unexpected economic risks (health, home, life insurance).

Plan expenses: Create budgets and spending plans to avoid unexpected costs and maintain financial control.

1.2. Financial Health Indicators (FHI)

Financial Indicators Perception (FIP): How individuals perceive their own financial health in terms of security, control, and stability.

Lived Experiences Financial Indicators (LEFI): Real-life accounts and situations that reflect how individuals have managed their financial health over time.

Actions to Face Financial Crises (AFFC): Strategies and measures adopted to overcome economic difficulties, such as reducing expenses, refinancing, or seeking additional income.

2. Methodology

The study population consisted of individuals aged 18 or older employed at a sugar production company located in San Juan Bautista Tuxtepec, Oaxaca, Mexico. This company is one of the most representative sugar mills (ingenios azucareros) in southeastern Mexico and is situated in a traditional zona cañera (sugarcane-growing region). It plays a key socioeconomic role in the area, employing approximately 600 unionized and 200 non-unionized workers. A total of 311 valid responses were collected through a non-probabilistic, self-selection sampling method. This approach was chosen due to accessibility and feasibility within the specific organizational context. It is acknowledged that this sampling method may have introduced systematic bias, as the sample could be overrepresented by employees particularly interested in financial well-being (“financial health followers” or “willing performers”), and may not fully reflect the dynamics of the broader workforce. Consequently, the observed patterns of financial resilience might be specific to this volunteer group rather than generalizable to all employees of the company. While this limitation affects the generalizability and intrinsic validity, the study still provides valuable insights into latent relationships and mechanisms of financial resilience within a motivated subgroup, which can inform theory development and guide future research in similar contexts. Non-probabilistic sampling remains consistent with recommended practices for psychometric validation in new populations (

Hair et al., 2019;

Tabachnick & Fidell, 2013).

The questionnaire was administered electronically via Google Forms, with access distributed internally by the human resources department. Respondents participated voluntarily and provided informed consent prior to completing the survey. The questionnaire remained open over an extended period to allow greater diversity of responses. However, it is acknowledged that the voluntary nature of participation may have introduced systematic bias, potentially overrepresenting employees who are particularly attentive to their financial well-being. While this may limit the generalizability of the results to the broader workforce, the instrument, based on previously validated models from

BBVA (

2020), in accordance with the Center for Financial Services Innovation [CFSI] and

García-Santillán et al. (

2024), and including items developed by

Flores et al. (

2024) provides meaningful insights into the patterns of financial resilience among motivated participants.

Given the absence of a fully validated instrument in this specific context, the study employed a sequential exploratory factor analysis (EFA)–confirmatory factor analysis (CFA) strategy. EFA was first used to empirically identify underlying dimensions, with item removal conducted for low communalities or cross-loadings to improve factor structure and reliability. These modifications reflect refinement rather than conceptual instability. CFA was then used to assess model fit and construct validity. Post hoc modifications were limited and theoretically justified, such as correlating error terms between items measuring similar aspects of financial behavior, consistent with best practices in structural equation modeling (

Byrne, 2016;

Kline, 2016). A complete version of the questionnaire—including original Spanish wording, English translations, and item order—is provided in

Appendix A. Estimated completion time was approximately 12 min, with access available on mobile or desktop devices during or outside working hours. Potential disparities in technology access are acknowledged as a source of sampling bias.

In addition to the core items, the survey collected demographic and occupational data to contextualize the findings, including employment type (unionized vs. non-unionized), job role (production vs. administrative), educational attainment, housing status (owned or mortgaged), and access to financial products (bank accounts, credit, insurance). Although not all of these variables were included in the measurement model, they help characterize the sample and understand how the composition of the group may have influenced the observed results. It is acknowledged that voluntary participation may have introduced systematic bias, limiting the representativeness of the sample relative to the entire workforce of the company. These aspects are discussed in the limitations section and are considered relevant for guiding future research that aims to extend the findings to broader or different populations.

2.1. Statistical Analysis and Psychometric Assessment

To validate the measurement model and ensure internal consistency, the following indicators were used: Cronbach’s alpha (α) and McDonald’s omega (ω) to assess reliability, and Composite Reliability (CR) and Average Variance Extracted (AVE) to evaluate convergent validity (

Fornell & Larcker, 1981). McDonald’s ω provides robust estimates when factor loadings vary across items (

McDonald, 1999;

Tavakol & Dennick, 2011).

The CFA model’s goodness-of-fit was assessed using the Comparative Fit Index (CFI), Tucker-Lewis Index (TLI), Root Mean Square Error of Approximation (RMSEA), and Standardized Root Mean Square Residual (SRMR). Multivariate normality was evaluated using skewness and kurtosis (Fisher criteria) with interpretive guidance from

Kim (

2013),

George and Mallery (

2010), and

Field (

2013). Inter-factor correlations between FR, LEF, and FIP were also calculated to support discriminant validity. Sequential EFA–CFA allowed for a deeper analytical understanding of latent relationships, beyond descriptive reporting. We note that weaker loadings in some dimensions (Factors 3 and 5) may indicate potential second-order or hierarchical structures for future modeling.

2.2. Ethical Considerations

This study received approval from the Ethics Committee of the Business School at Universidad Cristóbal Colón (Project ID: P-04/2025), and complies with the Research Ethics Code of the Graduate Studies and Research Division at the National Technological Institute of Mexico. All procedures were conducted in accordance with the Declaration of Helsinki. Participation was voluntary, and informed consent was obtained electronically. Respondents were informed of the study’s purpose, confidentiality measures, and data usage.

2.3. Participant Characteristics

The sample consisted of males (57.9%, n = 180), females (39.9%, n = 124), and LGBT+ individuals (2.3%, n = 7). Regarding age, the participants were primarily distributed across the following ranges: 26 to 33 years (26.4%, n = 82), 34 to 41 years (30.9%, n = 96), and 42 to 49 years (19.3%, n = 60). The smaller groups were 18 to 25 years (12.9%, n = 40) and over 49 years (9.6%, n = 30), with a small percentage in the 6 years (1.0%, n = 3) category. Regarding financial decision influences, participants indicated that their parents (30.2%, n = 94) were the main influence, followed by their spouses (16.4%, n = 51) and children (15.1%, n = 47). Others mentioned being influenced by friends (11.6%, n = 36) or siblings (7.1%, n = 22), while 19.6% (n = 61) indicated that they were not influenced by anyone in particular. Regarding living arrangements, most participants live with their partners (34.1%, n = 106), followed by those living with their parents (17.4%, n = 54) or in family settings (30.2%, n = 94). Only 12.5% (n = 39) live alone, and 4.5% (n = 14) live with friends. A small percentage live in other circumstances (1.3%, n = 4).

In terms of marital status, 34.1% (n = 106) of participants are married, 32.5% (n = 101) are single, and 24.1% (n = 75) are in a common-law relationship. 5.5% (n = 17) are separated, 2.3% (n = 7) are divorced, and 1.6% (n = 5) are widowed. Regarding work type, a large portion of participants are in a union (71.1%, n = 221), followed by those in trusted employment (27.0%, n = 84), and a small percentage work in category 3.00 (1.9%, n = 6). For work tenure, 29.9% (n = 93) have been in their position for more than 12 years, followed by 23.8% (n = 74) with 5 to 8 years, and 25.1% (n = 78) with 1 to 4 years. Those with less than 1 year represent 5.8% (n = 18) of the sample. Finally, regarding income, most participants earn between $8000 and $12,999 MX (30.9%, n = 96), followed by those earning $5000 to $7999 MX (24.8%, n = 77) and $3000 to $4999 MX (11.9%, n = 37), 10.3% (n = 32) earn less than $3000 MX, while 5.5% (n = 17) earn more than $20,000 MX.

3. Data Analysis and Discussion

Preliminary Data Analysis and Correlations: The dataset demonstrated high internal consistency, with Cronbach’s alpha (α = 0.936) and McDonald’s omega (ω = 0.935) indicating excellent reliability. Measures of sampling adequacy and inter-item correlations further supported the suitability of the data for factor analysis. The Kaiser-Meyer-Olkin (KMO) index was 0.922, and Bartlett’s test of sphericity was significant (χ

2 = 4229.498, df = 276,

p < 0.001), confirming that correlations among variables were sufficient for factor extraction. The correlation matrices revealed meaningful relationships among items within each construct. For financial improvement practices (FIP1–FIP8), most inter-item correlations were moderate to strong, with the strongest observed between FIP1 and FIP2 (r = 0.493,

p < 0.01). For lived economic fragility indicators (LEFI1–LEFI8), robust correlations were found, notably between LEFI1 and LEFI2 (r = 0.504,

p < 0.01). Financial resilience items (AFFC1–AFFC8) also showed significant interrelations, including AFFC1–AFFC2 (r = 0.572,

p < 0.01). Measures of sampling adequacy (MSA) for individual items ranged from 0.836 to 0.960, indicating that all variables were suitable for factor analysis. Overall, these results indicate that the items coherently measure their respective latent constructs, with sufficient intercorrelations and sampling adequacy to proceed with exploratory factor analysis. Full correlation matrices and MSA values are provided in

Appendix B for reference.

Prior to conducting the factor analysis, data suitability was assessed using the Kaiser-Meyer-Olkin (KMO) index and Bartlett’s test of sphericity. The KMO value exceeded 0.90 (0.922), indicating excellent sampling adequacy (

Kaiser, 1974). Additionally, Bartlett’s test of sphericity was significant, with a Chi-square value of 4229.498, 276 degrees of freedom (

p < 0.001), suggesting that the correlations among variables were sufficiently strong to justify factor analysis (

Hair et al., 2019). Once data adequacy was confirmed through the KMO index and Bartlett’s test, an exploratory factor analysis (EFA) was conducted. Given the assumption of correlation among latent factors and in line with previous studies (

Flores et al., 2024), an oblique Promax rotation was applied following the method of

Hendrickson and White (

1964). This technique begins with an initial orthogonal solution (such as Varimax) and adjusts it to allow for correlations between factors, which is particularly appropriate in fields like psychology, where constructs are rarely independent. Moreover, Promax rotation facilitates a simpler and more interpretable factor structure by encouraging each item to load primarily onto a single factor and is also computationally efficient.

3.1. Exploratory Factor Analysis and Rotated Structure

Exploratory factor analysis extracted five factors that together explained 65.48% of the total variance, indicating that these underlying constructs effectively summarize the variability observed across the items. The application of Promax rotation revealed a well-defined factorial structure, with each item loading primarily on a single factor (≥0.50), while allowing for correlations among factors, which is appropriate given the psychological nature of the constructs.

Table 1 presents the rotated factor loadings, along with composite reliability (CR), average variance extracted (AVE), and communalities (h

2). Factors 1 and 2 meet the recommended psychometric thresholds. Factor 3 could be improved by removing either PFI3 (0.593) or LEFI1 (0.600) to increase the AVE. Factor 4, with three items, is acceptable but could benefit from additional items. Factor 5, comprising only two items, does not meet minimum requirements and may be merged with another factor or removed, depending on theoretical justification.

To calculate composite reliability and average variance extracted (AVE), the following parameters are used according to the formulas:

where:

λ: Standardized factor loadings,

n: number of items per factor;

Based on the CR and AVE results, the theoretical criteria suggest that Factors 1 and 2 are adequate. For Factor 3, it is recommended to remove either PFI3 (0.593) or LEFI1 (0.600) to improve the AVE. Factor 4 is acceptable, although it only has three items; therefore, adding at least one more item would be advisable to enhance the values. Factor 5, with only two items, is not recommended as it does not meet the minimum psychometric requirements. It would be advisable to merge it with another factor if theoretically justified or, alternatively, to remove it from the model. As a future recommendation, developing additional items for this factor would be beneficial.

3.2. Confirmatory Factor Analysis and Model Refinement

A confirmatory factor analysis (CFA) was conducted to evaluate the factorial structure derived from the exploratory factor analysis (EFA). In this study, the term “estimators” refers to the standardized regression weights (λ), which indicate the strength of association between observed indicators and their latent constructs. In the EFA, items were retained based on a threshold of ≥0.50, consistent with commonly accepted exploratory analysis standards (

Hair et al., 2019;

Kline, 2016). For the CFA, a stricter threshold of ≥0.70 was applied to ensure convergent validity and reliability of the constructs, as recommended in confirmatory studies (

Byrne, 2016). During model refinement, some items exhibited cross-loadings in the EFA and were reassigned to the factors with which they showed the strongest conceptual and statistical alignment. For instance, LEFI1 and PFI3, initially associated with Factor 3, were reassigned to the Financial Planning factor due to higher standardized loadings (λ ≥ 0.70) and better theoretical coherence with this construct.

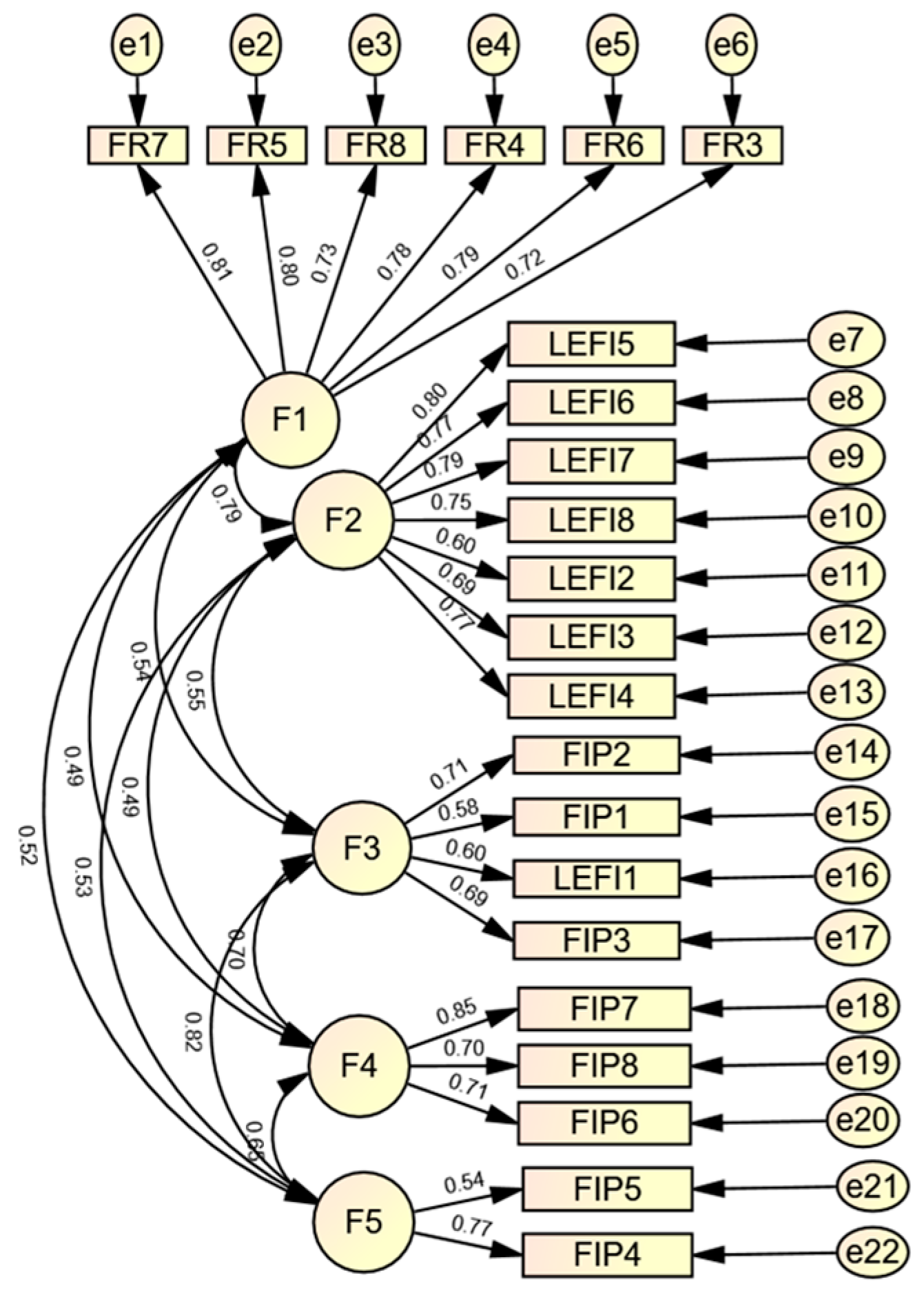

The initial CFA model based on the five-factor EFA structure (

Figure 2) demonstrated suboptimal fit (χ

2/df = 4.89; GFI = 0.817; AGFI = 0.767; RMSEA = 0.094; CFI = 0.884; TLI = 0.865; SRMR = 0.082). After excluding low-loading items and reassigning selected indicators, the refined four-factor model showed substantially improved fit (χ

2/df = 2.57; GFI = 0.917; AGFI = 0.879; RMSEA = 0.071; CFI = 0.962; TLI = 0.952; SRMR = 0.057).

The results of the confirmatory factor analysis indicate that the global fit indices of the initial five-factor modeldid not reach the thresholds typically considered acceptable in the specialized literature. This suggests that the initial measurement model, derived from the rotated EFA structure, did not adequately fit the observed data. Therefore, adjustments were necessary to refine the proposed model. Modifications included the exclusion of items with standardized loadings below 0.70 and the reassignment of certain indicators to the factors with which they aligned better both conceptually and statistically. In

Figure 3 show the adjusted final model of fincncial health indicators.

After the adjustements,

Table 2 now shos a comparison of the fit indices before and after these modifications, clearly demonstrating the improvement achieved through the model refinement process.

These results indicate that the refined four-factor structure provides a parsimonious, theoretically coherent, and statistically robust representation of the constructs under study. The modifications, exclusion of low-loading items, and reassignment of indicators were necessary to achieve satisfactory absolute, incremental, and parsimony fit indices, ensuring the validity and reliability of the final model.

As shown in

Figure 3, the resulting four-factor model reveals the following insights: Participants emphasized that financial resilience is key to facing economic challenges. In this context, they mentioned that when adequate insurance is lacking, it is essential to establish a plan that allows them to adjust their financial approach and protect their assets in the face of unexpected situations. They also highlighted the importance of managing debt sustainably, with a clear strategy that enables them to meet their obligations without compromising financial stability. Several participants noted that planning expenses (both short- and medium-term) is crucial to avoid financial surprises that could lead to stress. In addition, they expressed the need to maintain sufficient savings or long-term assets to serve as a financial safety net. Regarding those without a strong credit history, participants pointed out the importance of taking steps to improve it, as a good credit profile facilitates access to financing in critical moments. Finally, participants indicated that increasing savings in liquid financial products is an essential strategy for ensuring quick access to funds when unforeseen events arise.

About their lived experiences, participants shared that their financial well-being is reflected in how they have managed their finances over time and the decisions they have made. Many emphasized that maintaining a manageable level of debt is essential, as it allows them to meet their obligations without negatively affecting other areas of their lives. Regarding credit history, several participants agreed that having a good credit record not only provides access to credit under better conditions but also reflects responsible financial management. Additionally, participants stressed the importance of having adequate insurance coverage, as it provides a safety net in the face of unexpected events. They also mentioned that planning short-term expenses is key to avoiding financial stress and making more informed decisions. Lastly, they highlighted that having long-term savings or assets gives them peace of mind about the future and allows them to handle unforeseen situations with greater confidence.

When it comes to how they perceive these indicators of financial health, participants agreed that factors such as having appropriate insurance and a solid credit history are essential to their financial stability. They expressed that these elements are not only critical for their financial security but also reflect their ability to make smart decisions that protect them and offer peace of mind. In summary, participants stated that adopting a comprehensive approach to their finances—one that includes both financial planning and an awareness of their overall situation—enables them to face adversity with confidence and build a strong foundation for the future. Statistically, the final model presented in

Figure 3 reflects the best absolute, structural, and parsimonious fit, according to the theoretical criteria suggested. The following section explains in detail the different fit measures considered:

Absolute Fit Indices: The relative Chi-Square statistic (χ2/df) was 2.571, falling within the acceptable range (between 2 and 5), indicating that the model fits the data well. The RMSEA (Root Mean Square Error of Approximation) value was 0.071, below the critical threshold of 0.08, which also suggests a good fit. The GFI (Goodness-of-Fit Index) reached 0.917, exceeding the recommended minimum of 0.90, supporting the model’s overall fit quality. The AGFI (Adjusted Goodness-of-Fit Index) was 0.879, above the 0.80 threshold, reaffirming adequate model fit. Finally, the SRMR (Standardized Root Mean Square Residual) was 0.057, an acceptable value given the sample size (reference: ≤0.08).

Incremental Fit Indices: Regarding the NFI (Normed Fit Index), the value was 0.940, surpassing the minimum threshold of 0.90, indicating a satisfactory fit. The CFI (Comparative Fit Index) was 0.962, also above the recommended level of 0.90, demonstrating excellent model fit. Similarly, the TLI (Tucker–Lewis Index) yielded a value of 0.952, also exceeding the 0.90 threshold, further confirming the quality of the incremental fit. Parsimony Fit Indices: The PGFI (Parsimonious Goodness-of-Fit Index) reported a value of 0.751, above the generally accepted minimum of 0.50, suggesting reasonable model fit in terms of parsimony. The PNFI (Parsimonious Normed Fit Index) reached 0.734, also surpassing the required minimum of 0.50, indicating adequate fit. Finally, the PCFI (Parsimonious Comparative Fit Index) showed a value of 0.751, also exceeding the established threshold, reflecting an acceptable fit consistent with parsimony criteria.

4. Theoretical Discussion

Financial resilience, understood as the ability to adapt to and overcome economic crises, has been widely discussed in the literature. The results of this study largely align with theoretical approaches that emphasize the importance of financial planning, debt management, and protection against unforeseen events as key strategies for strengthening economic resilience at both individual and organizational levels. In this regard, participants highlighted the importance of having adequate insurance, long-term savings, and a clear debt management strategy—elements that are consistent with recommendations from previous studies.

According to

Sreenivasan and Suresh (

2023), financial resilience involves anticipating and preparing for both gradual changes and unexpected crises. This is reflected in the practices reported by participants, who noted that planning short- and medium-term expenses is crucial for avoiding financial surprises and maintaining economic stability. A key finding of this study was the importance of maintaining a good credit history, which also aligns with the work of various authors such as

Oyadeyi et al. (

2024), who argue that access to credit, when combined with proper resource management, enhances financial resilience. However, this study specifically highlights that improving one’s credit profile is viewed by participants as fundamental—particularly during times of crisis—adding a practical dimension to existing theories on financial resilience. In turn, the ability to manage debt sustainably reinforces the assertions of

Alam et al. (

2024), who emphasize the importance of strategic resource management to avoid economic vulnerability.

Another important theme that emerged, closely aligned with theoretical frameworks, is the focus on long-term financial security. Participants agreed that having savings and assets is essential for dealing with economic crises in a more resilient manner. This resonates with the work of

Sreenivasan and Suresh (

2023), who underscore that financial resilience is not only about managing immediate resources but also about the ability of individuals or institutions to remain stable over time. The broader literature on economic resilience (e.g.,

Gong, 2023) also highlights the importance of having a financial buffer to cope with unexpected situations, which is evident in participants’ responses that valued the existence of long-term assets.

Regarding the emotional well-being associated with financial resilience, the study results open a new line of reflection. Participants expressed that having a solid credit history and appropriate insurance coverage not only provides economic stability but also contributes to peace of mind. This well-being dimension, though not yet deeply explored in the financial resilience literature, appears to play a crucial role in how people perceive their financial security. Studies such as that of

Özyeşil et al. (

2024) suggest that financial resilience is linked to mental health, particularly in professional contexts, supporting the notion that financial stability has a significant impact on emotional and psychological well-being.

Regarding psychological well-being, the literature shows that proactive financial behaviors are a key determinant of mental health and life satisfaction. Strategies such as systematic financial planning, responsible debt management, maintaining savings, and seeking financial advice help individuals cope more effectively with economic challenges, reduce finance-related stress, and enhance perceived financial security (

Shim et al., 2010;

Prawitz et al., 2006;

Norvilitis et al., 2006). These findings suggest that financial self-regulation not only contributes to economic stability but also promotes overall well-being, establishing a clear link between financial literacy, proactive economic behavior, and life satisfaction.

On the other hand, while theoretical foundations emphasize recovery and adaptability in the face of economic crises, the findings of this study place additional emphasis on prevention. The dominant literature, such as that of

Sreenivasan and Suresh (

2023), tends to focus on how organizations and individuals can bounce back from crises. However, in this study, participants stressed that a preventive approach—such as expense planning and debt management—helps them face adversity with greater confidence and less stress. This suggests that while financial resilience certainly involves the capacity for recovery, anticipatory preparation is also crucial for mitigating the impact of economic shocks.

Finally, a unique aspect of this study is the strong sense of autonomy that participants associate with financial resilience. Throughout the survey, it was evident that making informed decisions about debt, savings, and insurance not only provided economic stability but also gave them a sense of personal control over their financial well-being. This perception of autonomy is linked to self-efficacy, which, according to

Hephsebha and Deb (

2024), is fundamental to the development of resilience. The ability to make responsible financial decisions contributes to a sense of empowerment, further strengthening individuals’ capacity to face future adversity.

5. Theoretical Implication

Building on these empirical findings, the theoretical implications underscore how participants’ proactive financial behaviors, anticipatory strategies, and intertwined psychological mechanisms—encompassing self-efficacy, emotional well-being, and a sense of autonomy—collectively shape financial resilience. This evidence advances a more comprehensive, dynamic, and multidimensional framework, extending and refining existing theories while highlighting dimensions often overlooked in prior research.

First, the findings broaden the understanding of financial resilience not only as the ability to recover from economic crises but also as a proactive and preventive process. Existing literature, such as

Sreenivasan and Suresh (

2023), has tended to focus on resilience from a reactive perspective. In contrast, this study highlights the importance of planning, sustainable debt management, and building long-term financial buffers, demonstrating that preventive interventions can be as critical as recovery strategies. Second, the results emphasize the emotional and psychological dimensions of financial resilience, which have often been underrepresented in prior research. Participants’ reports that peace of mind directly results from sound financial management introduce a novel component into the study of financial resilience. Future theoretical models could incorporate this aspect, acknowledging resilience not only as an economic phenomenon but also as a process influencing overall individual well-being. Finally, this study provides evidence that complements and extends existing theory on the relationship between self-efficacy and financial resilience. According to

Hephsebha and Deb (

2024), self-efficacy—the belief in one’s capacity to manage challenging situations—is essential for resilience. Participants demonstrated that making informed financial decisions fosters a sense of control and empowerment, suggesting new avenues for research into how self-efficacy interacts with financial practices to strengthen economic resilience.

6. Practical Implications

Building on the theoretical insights and empirical evidence, the practical implications of this study highlight strategies that can tangibly enhance financial resilience at individual, organizational, and policy levels. Participants’ experiences demonstrate that proactive financial planning, sustainable debt management, and the accumulation of long-term savings are not only theoretical constructs but actionable behaviors that significantly improve economic stability. These findings suggest that financial education programs should emphasize prevention and forward-looking strategies, equipping individuals with tools to reduce financial stress and enhance their capacity to face unexpected economic challenges. Moreover, integrating emotional and psychological dimensions into financial interventions is critical. Participants reported that a strong sense of control, peace of mind, and confidence in financial decision-making play a pivotal role in resilience, highlighting that financial stability is intrinsically linked to mental well-being. Consequently, programs and policies should consider these aspects, promoting not only economic literacy but also fostering self-efficacy and stress reduction through structured guidance and support.

At the organizational and policy level, access to financial products, responsible credit management, and adequate insurance coverage emerged as essential mechanisms for mitigating economic vulnerability. Employers, governments, and financial institutions can leverage these insights to design interventions and incentives that facilitate proactive behaviors, ensuring employees and citizens are better prepared for financial shocks. In addition, integrating preventive measures into workplace programs or community initiatives can generate broader societal benefits by reducing systemic financial stress and enhancing collective resilience.

Ultimately, this study provides actionable evidence that bridges the gap between theory and practice, offering a roadmap for interventions that not only strengthen financial skills but also empower individuals to take control of their financial futures with confidence and foresight.

7. Limitations

This study presents several limitations that should be considered when interpreting the results. First, the use of a non-probabilistic, self-selected sample may have introduced systematic bias. Participants were volunteers who may be particularly interested in or attentive to financial well-being (financial health followers or willing performers), which could have influenced the observed patterns of financial resilience. Consequently, the findings may not fully represent the broader workforce of the sugar production company, and the so-called “contextual depth” should be understood within this specific group rather than generalized to all employees. Second, the study was conducted in a single sugar production company in San Juan Bautista Tuxtepec, Oaxaca, Mexico. While this context provides valuable insights into financial behaviors within a traditional sugarcane-growing region, it may limit the applicability of results to other industrial or socio-economic contexts. Third, although the survey was administered electronically to allow greater flexibility, potential disparities in technology access, social interaction, or peer influence may have affected participation and responses.

Finally, despite these limitations, the study provides meaningful contributions by revealing mechanisms of financial resilience within a motivated group of employees. The findings offer theoretical insights into the relationships between financial management, self-efficacy, and emotional well-being, and they may guide future research aimed at testing these patterns in broader or different populations.

8. Conclusions

Despite the limitations related to the voluntary, self-selected sample, this study demonstrates that financial resilience is a multifaceted concept encompassing not only the ability to adapt to economic crises but also proactive preparation and strategic resource management. The research highlighted the importance of factors such as expense planning, sustainable debt management, insurance protection, and long-term savings as key elements contributing to greater financial stability. Additionally, participants emphasized the relationship between financial resilience and emotional well-being, suggesting that proper financial management not only promotes economic stability but also greater peace of mind.

The study also showed that self-efficacy, understood as the belief in one’s ability to make responsible financial decisions, is fundamental to strengthening economic resilience. This finding opens new theoretical perspectives on how the perception of personal control can influence financial resilience, an area that has been less explored in existing literature. Overall, the results provide meaningful insights into the mechanisms of financial resilience within a motivated group of employees and offer a foundation for future research in broader or different populations.

9. Future Research Directions

This study proposes several future research avenues that could contribute to a deeper understanding of financial resilience. First, it would be interesting to explore how different sociocultural factors, such as educational level, gender, or family situation, influence the financial resilience strategies adopted by individuals. This approach could help identify personalized interventions that address the specific needs of different population groups.

Another promising line of research concerns the relationship between financial resilience and psychological well-being. While better financial management has been shown to reduce stress, further research is needed to understand how mental health and emotional well-being are influenced by economic resilience, especially in contexts of prolonged crises or high uncertainty.

Finally, it would be valuable to investigate how financial resilience strategies are applied at organizational and macroeconomic levels, particularly in the context of vulnerable or developing economies. Studying how public policies and government strategies can enhance the economic resilience of specific sectors could help design more effective interventions aimed at reducing the financial vulnerability of entire communities.