Using Data Analytics in Financial Statement Fraud Detection and Prevention: A Systematic Review of Methods, Challenges, and Future Directions

Abstract

1. Introduction

- How have data analytics methods enhanced the identification of fraudulent activities in financial statements compared with traditional auditing methods?

- What are the key methodological challenges and limitations concerning the use of data analytics to prevent financial reporting fraud?

- How do sophisticated data analytics techniques, including machine learning and network analytics, strengthen the effectiveness of organizational strategies to avert fraud?

2. Methodology

2.1. Literature Review Protocol

2.2. Analysis of the Literature Search Strategy

2.2.1. Defining the Research Question and Search Terms

- Fraud Identification and Mitigation: Terms such as “financial statement fraud,” “fraud detection,” “fraud mitigation,” “forensic accounting,” and “earnings manipulation.”

- Data Analysis Methodologies: Terms like “data analysis,” “large collections of data,” “algorithmic learning methods,” “artificial intelligence,” “predictive analytics,” “quantitative methods,” and “outlier identification.”

2.2.2. Database Selection

2.2.3. Search Limitation Criteria

2.2.4. Inclusion and Exclusion Criteria

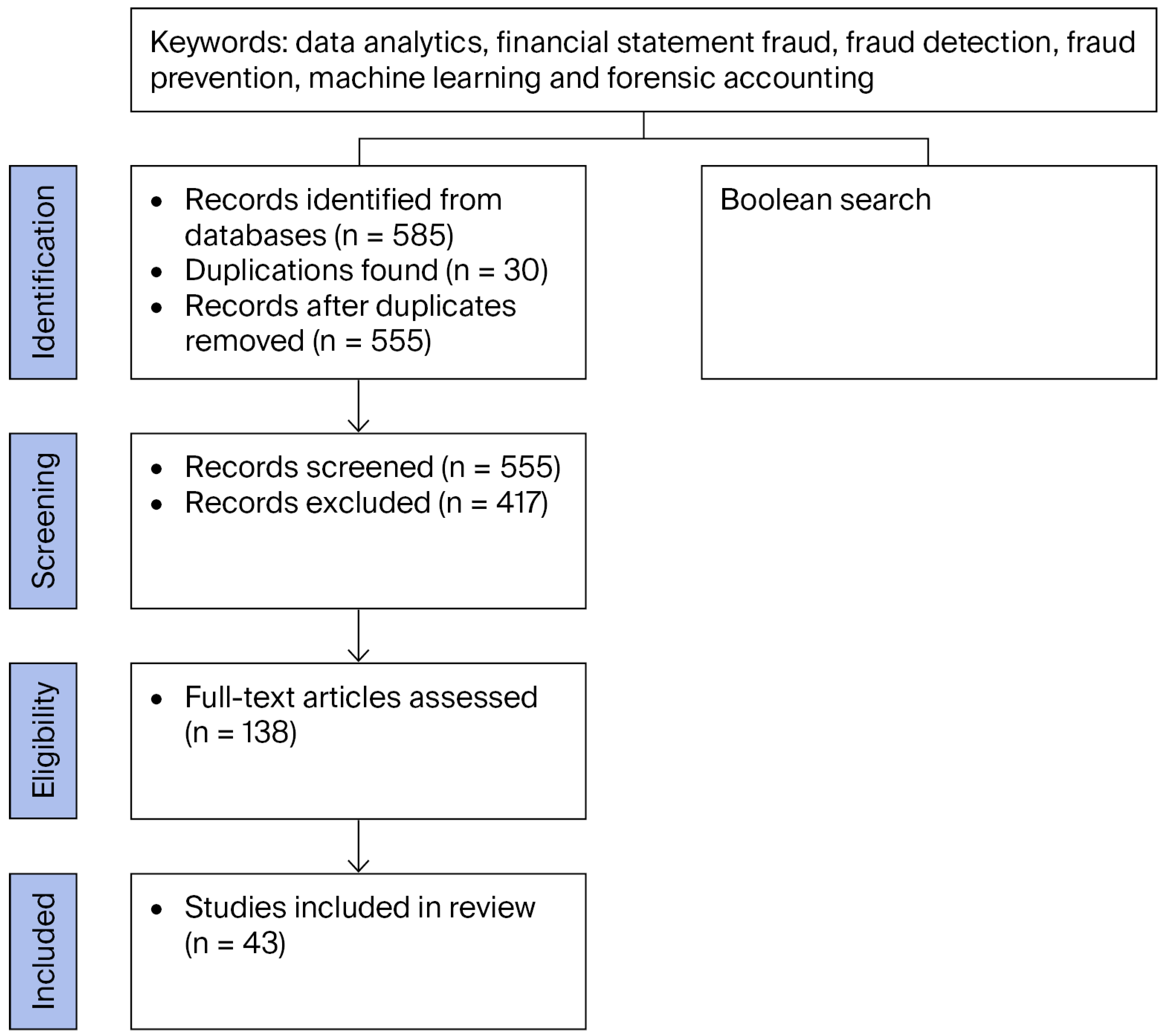

2.2.5. Data Management and Screening Protocols

- Identification

- Data gathered through database queries (Scopus, ScienceDirect, Web of Science, Google Scholar): n = 585;

- Total duplications found and removed: n = 30;

- Total records for evaluation (after duplication removal): n = 555.

- Evaluation

- Records screened by title and abstract: n = 555;

- Records excluded (irrelevant topic, not peer-reviewed, wrong fraud type, etc.): n = 417.

- Eligibility

- A total of 138 full-text articles were assessed for eligibility;

- Full-text articles were excluded, with reasons given (e.g., lack of methodological transparency, anecdotal data, focus on cybersecurity fraud only): n = 95.

- Included

- Studies included in qualitative synthesis (systematic review): n = 43.

3. Refining and Elaborating on the Results

3.1. A Review of the Study Selection Process

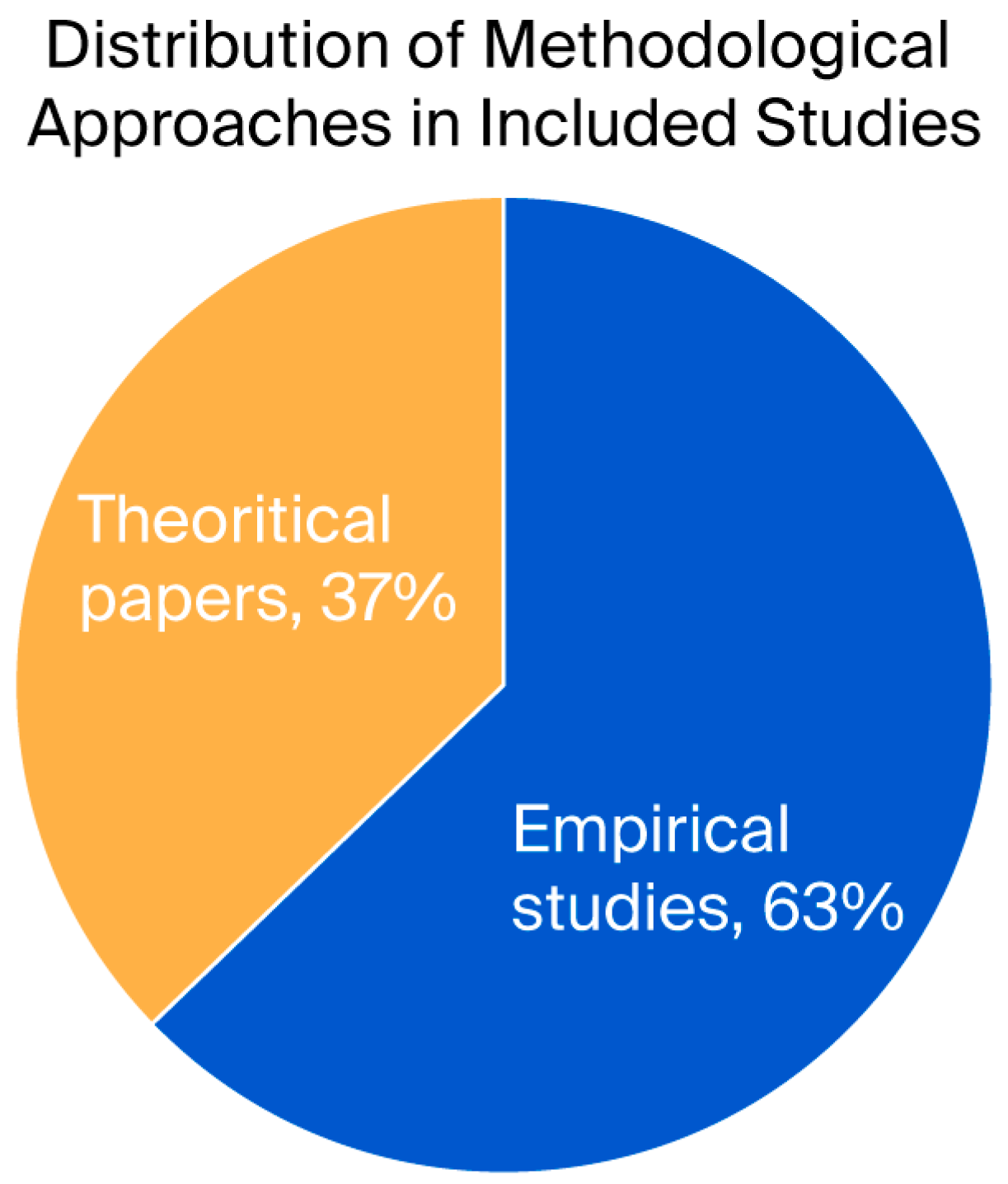

3.2. Distribution of Articles Across Methodological Approaches

3.3. Key Themes and Findings from the Selected Studies

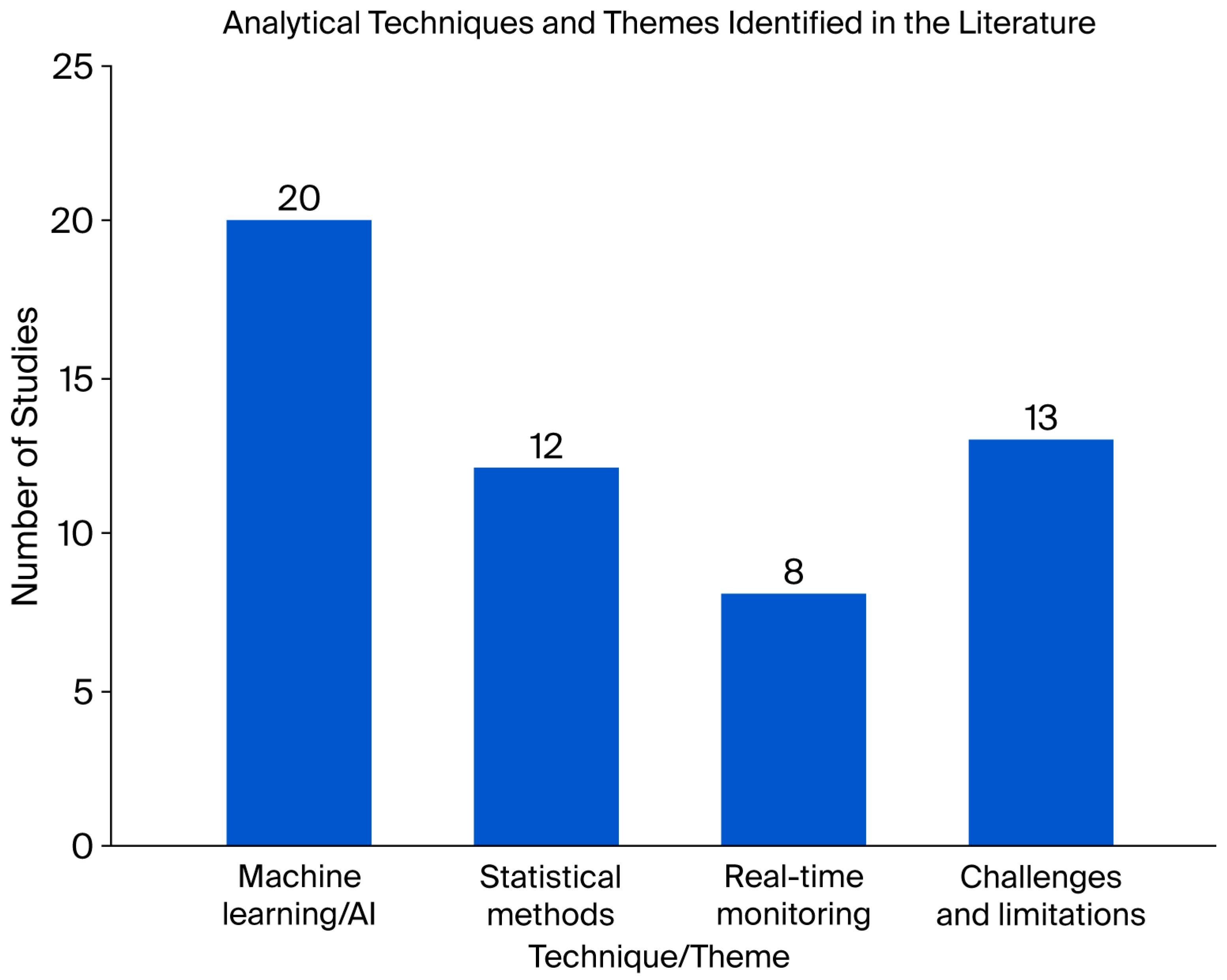

3.3.1. Artificial Intelligence and Machine Learning

3.3.2. Statistical and Anomaly Detection Methodologies

3.3.3. Prompt Fraud Remediation

3.3.4. Obstacles and Constraints

3.3.5. Summary of Results

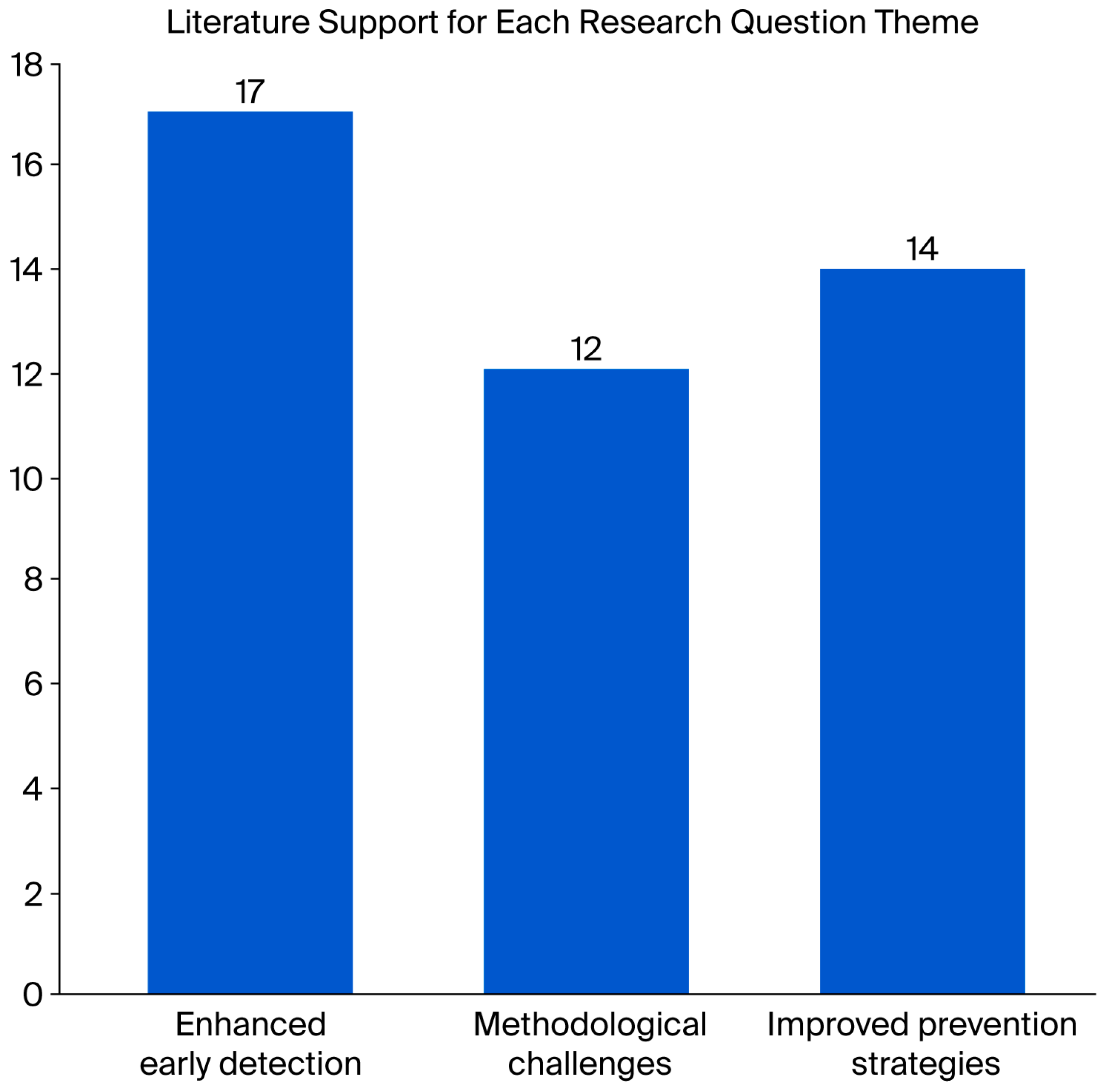

3.4. Analysis of Literature Review Results Against Research Questions

3.4.1. Research Question 1

3.4.2. Research Question 2

3.4.3. Research Question 3

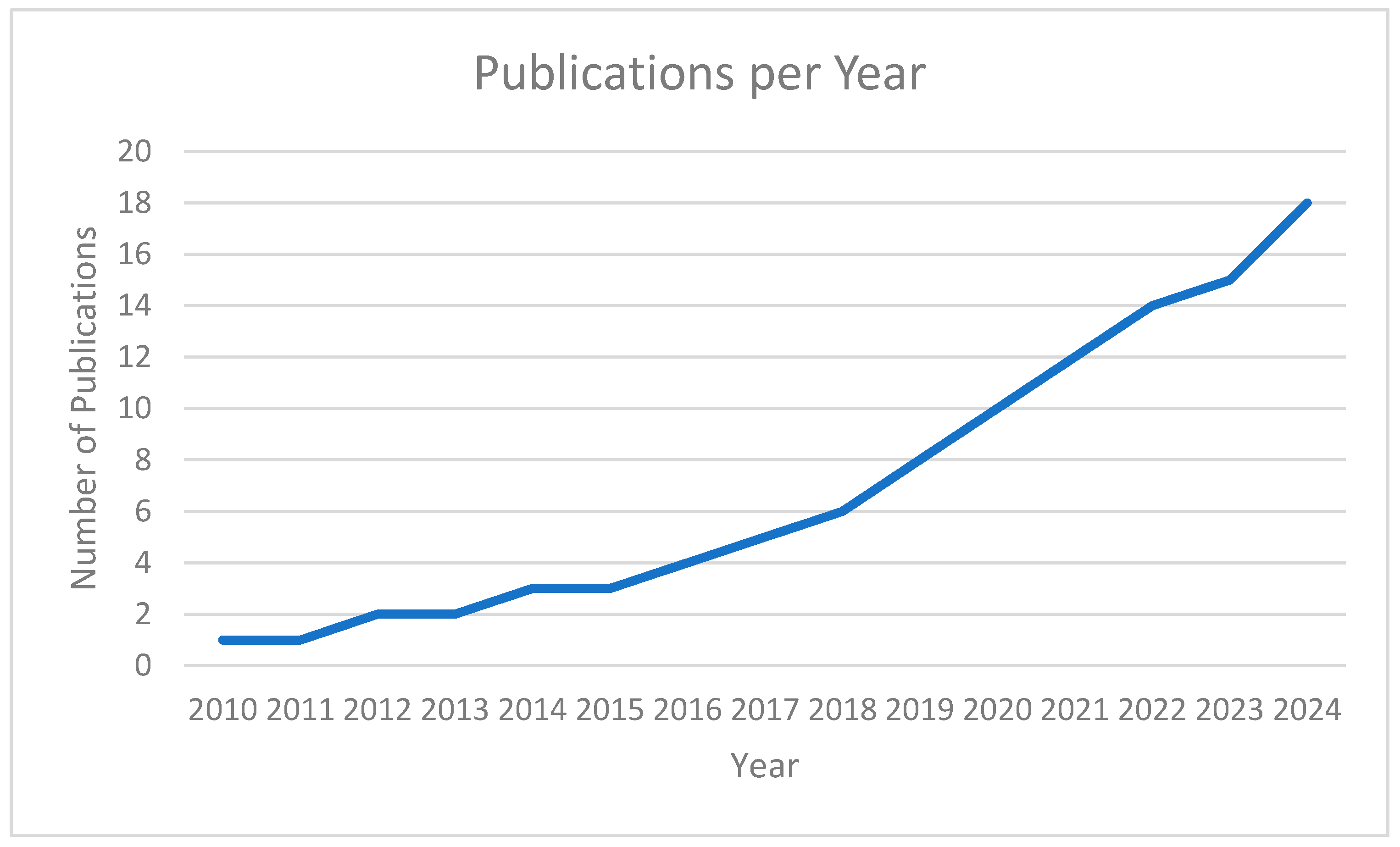

3.5. Annual Publication Trends

3.6. Journal Dissemination

3.7. Analysis of Citation Counts

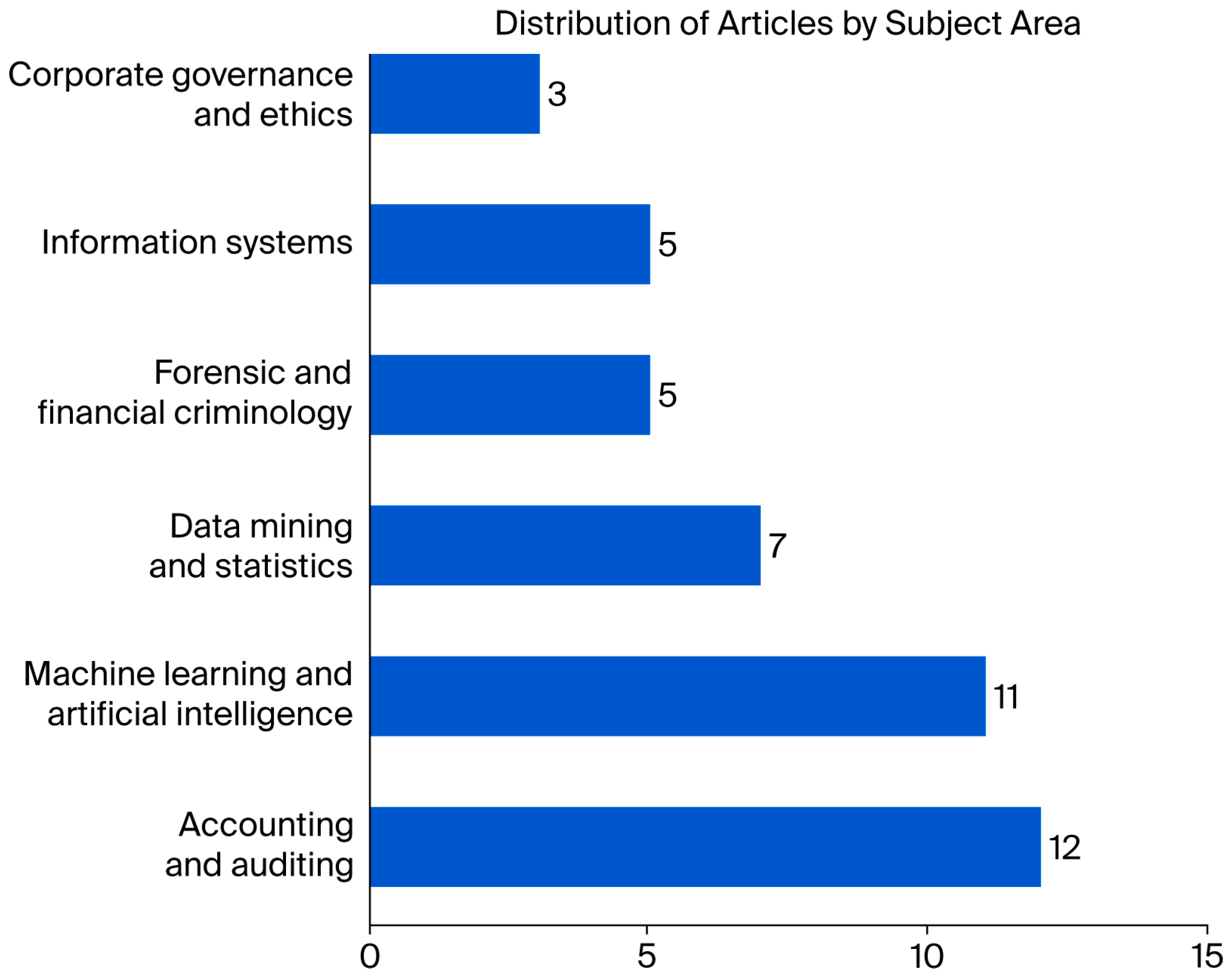

3.8. Distribution of Publications by Research Area

4. Comparative Insights

5. Conclusions

6. Future Research and Practical Applications

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Aboud, A., & Robinson, B. (2022). Fraudulent financial reporting and data analytics: An explanatory study from Ireland. Accounting Research Journal, 35(1), 21–36. [Google Scholar] [CrossRef]

- Albashrawi, M. (2016). Detecting financial fraud using data mining techniques: A decade review from 2004 to 2015. Journal of Data Science, 14(3), 553–569. [Google Scholar] [CrossRef]

- Ashtiani, M. N., & Raahemi, B. (2021). Intelligent fraud detection in financial statements using machine learning and data mining: A systematic literature review. IEEE Access, 10, 72504–72525. [Google Scholar] [CrossRef]

- Association of Certified Fraud Examiners (ACFE). (2022). Report to the nations: 2022 global study on occupational fraud and abuse. ACFE. [Google Scholar]

- Banarescu, A. (2015). Detecting and preventing fraud with data analytics. Procedia Economics and Finance, 32, 1827–1836. [Google Scholar] [CrossRef]

- Bello, O. A., Folorunso, A., Ejiofor, O. E., Budale, F. Z., Adebayo, K., & Babatunde, O. A. (2023). Machine learning approaches for enhancing fraud prevention in financial transactions. International Journal of Management Technology, 10(1), 85–108. [Google Scholar]

- Booth, A., Martyn-St James, M., Clowes, M., & Sutton, A. (2021). Systematic approaches to a successful literature review. Sage Publications. [Google Scholar]

- Brown, N. C., Crowley, R. M., & Elliott, W. B. (2020). What are you saying? Using topic to detect financial misreporting. Journal of Accounting Research, 58(1), 237–291. [Google Scholar] [CrossRef]

- Chen, Y. J., Liou, W. C., Chen, Y. M., & Wu, J. H. (2019). Fraud detection for financial statements of business groups. International Journal of Accounting Information Systems, 32, 1–23. [Google Scholar] [CrossRef]

- Cheng, C. H., Kao, Y. F., & Lin, H. P. (2021). A financial statement fraud model based on synthesized attribute selection and a dataset with missing values and imbalanced classes. Applied Soft Computing, 108, 107487. [Google Scholar] [CrossRef]

- Craja, P., Kim, A., & Lessmann, S. (2020). Deep learning for detecting financial statement fraud. Decision Support Systems, 139, 113421. [Google Scholar] [CrossRef]

- Dechow, P., Ge, W., & Schrand, C. (2010). Understanding earnings quality: A review of the proxies, their determinants and their consequences. Journal of Accounting and Economics, 50(2–3), 344–401. [Google Scholar] [CrossRef]

- Dutta, I., Dutta, S., & Raahemi, B. (2017). Detecting financial restatements using data mining techniques. Expert Systems with Applications, 90, 374–393. [Google Scholar] [CrossRef]

- Fotoh, L. E., & Lorentzon, J. I. (2023). Audit digitalization and its consequences on the audit expectation gap: A critical perspective. Accounting Horizons, 37(1), 43–69. [Google Scholar] [CrossRef]

- Gaganis, C. (2009). Classification techniques for the identification of falsified financial statements: A comparative analysis. Intelligent Systems in Accounting, Finance & Management: International Journal, 16(3), 207–229. [Google Scholar]

- Gepp, A., Kumar, K., & Bhattacharya, S. (2021). Lifting the numbers game: Identifying key input variables and a best-performing model to detect financial statement fraud. Accounting & Finance, 61(3), 4601–4638. [Google Scholar]

- Goel, S., & Gangolly, J. (2012). Beyond the numbers: Mining the annual reports for hidden cues indicative of financial statement fraud. Intelligent Systems in Accounting, Finance and Management, 19(2), 75–89. [Google Scholar] [CrossRef]

- Gupta, S., & Mehta, S. K. (2024). Data mining-based financial statement fraud detection: Systematic literature review and meta-analysis to estimate data sample mapping of fraudulent companies against non-fraudulent companies. Global Business Review, 25(5), 1290–1313. [Google Scholar] [CrossRef]

- Hamal, S., & Senvar, Ö. (2021). Comparing performances and effectiveness of machine learning classifiers in detecting financial accounting fraud for Turkish SMEs. International Journal of Computational Intelligence Systems, 14(1), 769–782. [Google Scholar] [CrossRef]

- Hasan, M. M., Popp, J., & Oláh, J. (2020). Current landscape and influence of big data on finance. Journal of Big Data, 7(1), 21. [Google Scholar] [CrossRef]

- Hernandez Aros, L., Bustamante Molano, L. X., Gutierrez-Portela, F., Moreno Hernandez, J. J., & Rodríguez Barrero, M. S. (2024). Financial fraud detection through the application of machine learning techniques: A literature review. Humanities and Social Sciences Communications, 11(1), 1–22. [Google Scholar] [CrossRef]

- Innan, N., Khan, M. A. Z., & Bennai, M. (2024). Financial fraud detection: A comparative study of quantum machine learning models. International Journal of Quantum Information, 22(02), 2350044. [Google Scholar] [CrossRef]

- Islam, T., Islam, S. M., Sarkar, A., Obaidur, A., Khan, R., Paul, R., & Bari, M. S. (2024). Artificial intelligence in fraud detection and financial risk mitigation: Future directions and business applications. International Journal for Multidisciplinary Research, 6(5), 1–23. [Google Scholar]

- Ismail, M. M., & Haq, M. A. (2024). Enhancing enterprise financial fraud detection using machine learning. Engineering, Technology & Applied Science Research, 14(4), 14854–14861. [Google Scholar] [CrossRef]

- Kassem, R., & Omoteso, K. (2024). Effective methods for detecting fraudulent financial reporting: Practical insights from Big 4 auditors. Journal of Accounting Literature, 46(4), 587–610. [Google Scholar] [CrossRef]

- Kokina, J., & Davenport, T. H. (2017). The emergence of artificial intelligence: How automation is changing auditing. Journal of Emerging Technologies in Accounting, 14(1), 115–122. [Google Scholar] [CrossRef]

- Leonov, P., Kozhina, A., Leonova, E., Epifanov, M., & Sviridenko, A. (2020). Visual analysis in identifying a typical indicators of financial statements as an element of artificial intelligence technology in audit. Procedia Computer Science, 169, 710–714. [Google Scholar] [CrossRef]

- Lin, C. C., Chiu, A. A., Huang, S. Y., & Yen, D. C. (2015). Detecting the financial statement fraud: The analysis of the differences between data mining techniques and experts’ judgments. Knowledge-Based Systems, 89, 459–470. [Google Scholar] [CrossRef]

- Lokanan, M. E., & Sharma, K. (2022). Fraud prediction using machine learning: The case of investment advisors in Canada. Machine Learning with Applications, 8, 100269. [Google Scholar] [CrossRef]

- Lokanan, M. E., Tran, V., & Vuong, N. H. (2019). Detecting anomalies in financial statements using machine learning algorithm: The case of Vietnamese listed firms. Asian Journal of Accounting Research, 4(2), 181–201. [Google Scholar] [CrossRef]

- Lu, Q., Fu, C., Nan, K., Fang, Y., Xu, J., Liu, J., & Lee, B. G. (2023). Chinese corporate fraud risk assessment with machine learning. Intelligent Systems with Applications, 20, 200294. [Google Scholar] [CrossRef]

- Moher, D., Liberati, A., Tetzlaff, J., & Altman, D. G. (2009). Preferred reporting items for systematic reviews and meta-analyses: The PRISMA statement. BMJ, 339, b2535. [Google Scholar] [CrossRef]

- Ngai, E. W., Hu, Y., Wong, Y. H., Chen, Y., & Sun, X. (2011). The application of data mining techniques in financial fraud detection: A classification framework and an academic review of literature. Decision Support Systems, 50(3), 559–569. [Google Scholar] [CrossRef]

- Ngai, E. W., Leung, T. K. P., Wong, Y. H., Lee, M. C., Chai, P. Y. F., & Choi, Y. S. (2012). Design and development of a context-aware decision support system for real-time accident handling in logistics. Decision Support Systems, 52(4), 816–827. [Google Scholar] [CrossRef]

- Page, M. J., McKenzie, J. E., Bossuyt, P. M., Boutron, I., Hoffmann, T. C., Mulrow, C. D., Shamseer, L., Tetzlaff, J. M., Akl, E. A., Brennan, S. E., Chou, R., Glanville, J., Grimshaw, J. M., Hróbjartsson, A., Lalu, M. M., Li, T., Loder, E. W., Mayo-Wilson, E., McDonald, S., … Moher, D. (2021). The PRISMA 2020 statement: An updated guideline for reporting systematic reviews. BMJ, 372, n71. [Google Scholar] [CrossRef]

- Papík, M., & Papíková, L. (2022). Detecting accounting fraud in companies reporting under US GAAP through data mining. International Journal of Accounting Information Systems, 45, 100559. [Google Scholar] [CrossRef]

- Perols, J. (2011). Financial statement fraud detection: An analysis of statistical and machine learning algorithms. Auditing: A Journal of Practice & Theory, 30(2), 19–50. [Google Scholar]

- Petticrew, M., & Roberts, H. (2008). Systematic reviews in the social sciences: A practical guide. John Wiley & Sons. [Google Scholar]

- Pizzi, S., Venturelli, A., Variale, M., & Macario, G. P. (2021). Assessing the impacts of digital transformation on internal auditing: A bibliometric analysis. Technology in Society, 67, 101738. [Google Scholar] [CrossRef]

- PRISMA Statement. (2021). PRISMA transparent reporting of systematic reviews and meta analysis. Available online: http://www.prisma-statement.org/prisma-2020-flow-diagram (accessed on 14 April 2025).

- Putra, I., Sulistiyo, U., Diah, E., Rahayu, S., & Hidayat, S. (2022). The influence of internal audit, risk management, whistleblowing system and big data analytics on the financial crime behavior prevention. Cogent Economics & Finance, 10(1), 2148363. [Google Scholar] [CrossRef]

- Qatawneh, A. M. (2024). The role of artificial intelligence in auditing and fraud detection in accounting information systems: Moderating role of natural language processing. International Journal of Organizational Analysis, 33(6), 1391–1409. [Google Scholar] [CrossRef]

- Rahman, M. J., & Zhu, H. (2023). Predicting accounting fraud using imbalanced ensemble learning classifiers—Evidence from China. Accounting & Finance, 63(3), 3455–3486. [Google Scholar]

- Ravisankar, P., Ravi, V., Rao, G. R., & Bose, I. (2011). Detection of financial statement fraud and feature selection using data mining techniques. Decision Support Systems, 50(2), 491–500. [Google Scholar] [CrossRef]

- Rezaee, Z. (2002). Financial statement fraud: Prevention and detection. John Wiley & Sons. [Google Scholar]

- Rezaee, Z., Dorestani, A., & Aliabadi, S. (2018). Application of time series analyses in big data: Practical, research, and education implications. Journal of Emerging Technologies in Accounting, 15(1), 183–197. [Google Scholar] [CrossRef]

- Rosnidah, I., Johari, R. J., Hairudin, N. A. M., Hussin, S. A. H. S., & Musyaffi, A. M. (2022). Detecting and preventing fraud with big data analytics: Auditing perspective. Journal of Governance and Regulation, 11(4), 8–15. [Google Scholar] [CrossRef]

- Roszkowska, P. (2021). Fintech in financial reporting and audit for fraud prevention and safeguarding equity investments. Journal of Accounting & Organizational Change, 17(2), 164–196. [Google Scholar]

- Sadgali, I., Sael, N., & Benabbou, F. (2019). Performance of machine learning techniques in the detection of financial frauds. Procedia Computer Science, 148, 45–54. [Google Scholar] [CrossRef]

- Siering, M., Clapham, B., Engel, O., & Gomber, P. (2017). A taxonomy of financial market manipulations: Establishing trust and market integrity in the financialized economy through automated fraud detection. Journal of Information Technology, 32(3), 251–269. [Google Scholar] [CrossRef]

- Sood, P., Sharma, C., Nijjer, S., & Sakhuja, S. (2023). Review the role of artificial intelligence in detecting and preventing financial fraud using natural language processing. International Journal of System Assurance Engineering and Management, 14(6), 2120–2135. [Google Scholar] [CrossRef]

- Sun, T. (2019). Applying deep learning to audit procedures: An illustrative framework. Accounting Horizons, 33(3), 89–109. [Google Scholar] [CrossRef]

- Tang, J., & Karim, K. E. (2019). Financial fraud detection and big data analytics–implications on auditors’ use of fraud brainstorming session. Managerial Auditing Journal, 34(3), 324–337. [Google Scholar] [CrossRef]

- Tranfield, D., Denyer, D., & Smart, P. (2003). Towards a methodology for developing evidence-informed management knowledge by means of systematic review. British Journal of Management, 14(3), 207–222. [Google Scholar] [CrossRef]

- Warren, J. D., Moffitt, K. C., & Byrnes, P. (2015). How big data will change accounting. Accounting Horizons, 29(2), 397–407. [Google Scholar] [CrossRef]

- Yi, Z., Cao, X., Chen, Z., & Li, S. (2023). Artificial intelligence in accounting and finance: Challenges and opportunities. IEEE Access, 11, 129100–129123. [Google Scholar] [CrossRef]

| No. | Author (s) | Title | Journal |

|---|---|---|---|

| 1 | (Islam et al., 2024) | Artificial Intelligence in Fraud Detection and Financial Risk Mitigation: Future Directions and Business Applications | International Journal for Multidisciplinary Research |

| 2 | (Gupta & Mehta, 2024) | Data mining-based financial statement fraud detection: Systematic literature review and meta-analysis to estimate data sample mapping of fraudulent companies against non-fraudulent companies | Global Business Review |

| 3 | (Kassem & Omoteso, 2024) | Effective methods for detecting fraudulent financial reporting: practical insights from Big 4 auditors | Journal of Accounting Literature |

| 4 | (Qatawneh, 2024) | The role of artificial intelligence in auditing and fraud detection in accounting information systems: moderating role of natural language processing | International Journal of Organizational Analysis |

| 5 | (Ismail & Haq, 2024) | Enhancing enterprise financial fraud detection using machine learning | Engineering, Technology & Applied Science Research |

| 6 | (Fotoh & Lorentzon, 2023) | Audit digitalization and its consequences on the audit expectation gap: A critical perspective | Accounting Horizons |

| 7 | (Yi et al., 2023) | Artificial intelligence in accounting and finance: Challenges and opportunities | IEEE Access |

| 8 | (Sood et al., 2023) | Review the role of artificial intelligence in detecting and preventing financial fraud using natural language processing | International Journal of System Assurance Engineering and Management |

| 9 | (Rahman & Zhu, 2023) | Predicting accounting fraud using imbalanced ensemble learning classifiers–evidence from China | Accounting & Finance |

| 10 | (Lu et al., 2023) | Chinese corporate fraud risk assessment with machine learning | Intelligent Systems with Applications |

| 11 | (Bello et al., 2023) | Machine learning approaches for enhancing fraud prevention in financial transactions | International Journal of Management Technology |

| 12 | (Aboud & Robinson, 2022) | Fraudulent financial reporting and data analytics: an explanatory study from Ireland | Accounting Research Journal |

| 13 | (Putra et al., 2022) | The influence of internal audit, risk management, whistleblowing system and big data analytics on the financial crime behavior prevention | Cogent economics & finance |

| 14 | (Papík & Papíková, 2022) | Detecting accounting fraud in companies reporting under US GAAP through data mining | International Journal of Accounting Information Systems |

| 15 | (Rosnidah et al., 2022) | Detecting and preventing fraud with big data analytics: Auditing perspective | Journal of Governance and Regulation |

| 16 | (Lokanan & Sharma, 2022) | Fraud prediction using machine learning: The case of investment advisors in Canada | Machine Learning with Applications |

| 17 | (Cheng et al., 2021) | A financial statement fraud model based on synthesized attribute selection and a dataset with missing values and imbalanced classes | Applied Soft Computing |

| 18 | (Hamal & Senvar, 2021) | Comparing performances and effectiveness of machine learning classifiers in detecting financial accounting fraud for Turkish SMEs | International Journal of Computational Intelligence Systems |

| 19 | (Gepp et al., 2021) | Lifting the numbers game: identifying key input variables and a best-performing model to detect financial statement fraud | Accounting & Finance |

| 20 | (Roszkowska, 2021) | Fintech in financial reporting and audit for fraud prevention and safeguarding equity investments | Journal of Accounting & Organizational Change |

| 21 | (Pizzi et al., 2021) | Assessing the impacts of digital transformation on internal auditing: A bibliometric analysis | Technology in Society |

| 22 | (Ashtiani & Raahemi, 2021) | Intelligent fraud detection in financial statements using machine learning and data mining: a systematic literature review | IEEE Access |

| 23 | (Hasan et al., 2020) | Current landscape and influence of big data on finance | Journal of Big Data |

| 24 | (Brown et al., 2020) | What are you saying? Using topic to detect financial misreporting | Journal of Accounting Research |

| 25 | (Leonov et al., 2020) | Visual analysis in identifying a typical indicators of financial statements as an element of artificial intelligence technology in audit | Procedia Computer Science |

| 26 | (Craja et al., 2020) | Deep learning for detecting financial statement fraud | Decision Support Systems |

| 27 | (Sun, 2019) | Applying deep learning to audit procedures: An illustrative framework | Accounting Horizons |

| 28 | (Chen et al., 2019) | Fraud detection for financial statements of business groups | International Journal of Accounting Information Systems |

| 29 | (Tang & Karim, 2019) | Financial fraud detection and big data analytics–implications on auditors’ use of fraud brainstorming session | Managerial Auditing Journal |

| 30 | (Sadgali et al., 2019) | Performance of machine learning techniques in the detection of financial frauds | Procedia computer science |

| 31 | (Lokanan et al., 2019) | Detecting anomalies in financial statements using machine learning algorithm: The case of Vietnamese listed firms | Asian Journal of Accounting Research |

| 32 | (Rezaee et al., 2018) | Application of time series analyses in big data: practical, research, and education implications | Journal of Emerging Technologies in Accounting |

| 33 | (Dutta et al., 2017) | Detecting financial restatements using data mining techniques | Expert Systems with Applications |

| 34 | (Kokina & Davenport, 2017) | The emergence of artificial intelligence: How automation is changing auditing | Journal of Emerging Technologies in Accounting |

| 35 | (Siering et al., 2017) | A taxonomy of financial market manipulations: establishing trust and market integrity in the financialized economy through automated fraud detection | Journal of Information Technology |

| 36 | (Albashrawi, 2016) | Detecting financial fraud using data mining techniques: A decade review from 2004 to 2015 | Journal of Data Science |

| 37 | (Warren et al., 2015) | How big data will change accounting | Accounting horizons |

| 38 | (Lin et al., 2015) | Detecting the financial statement fraud: The analysis of the differences between data mining techniques and experts’ judgments | Knowledge-Based Systems |

| 39 | (Banarescu, 2015) | Detecting and preventing fraud with data analytics | Procedia economics and finance |

| 40 | (Goel & Gangolly, 2012) | Beyond the numbers: Mining the annual reports for hidden cues indicative of financial statement fraud | Intelligent Systems in Accounting, Finance and Management |

| 41 | (Perols, 2011) | Financial statement fraud detection: An analysis of statistical and machine learning algorithms | Auditing: A Journal of Practice & Theory |

| 42 | (Ngai et al., 2011) | The application of data mining techniques in financial fraud detection: A classification framework | Decision Support Systems |

| 43 | (Ravisankar et al., 2011) | Detection of financial statement fraud and feature selection using data mining techniques | Decision Support Systems |

| Rank | Journal Title | CiteScore (2023) | Number of Papers | Publisher |

|---|---|---|---|---|

| 1 | Decision Support Systems | 12.5 | 6 | Elsevier |

| 2 | Journal of Accounting and Economics | 15.3 | 3 | Elsevier |

| 3 | Expert Systems with Applications | 10.2 | 4 | Elsevier |

| 4 | Accounting Horizons | 6.4 | 2 | American Accounting Association |

| 5 | Journal of Emerging Technologies in Accounting | 4.3 | 2 | American Accounting Association |

| 6 | Managerial Auditing Journal | 3.6 | 3 | Emerald Publishing |

| 7 | Journal of Financial Crime | 2.1 | 2 | Emerald Publishing |

| Author & Year | Title | Citations | Domain | Journal |

|---|---|---|---|---|

| (Perols, 2011) | Financial statement fraud detection: An analysis of statistical and machine learning algorithms | 500 | Accounting, Machine Learning | Auditing: A Journal of Practice & Theory |

| (Ngai et al., 2011) | The application of data mining techniques in financial fraud detection: A classification framework | 450 | Data Mining, Fraud Detection | Decision Support Systems |

| (Ravisankar et al., 2011) | Detection of financial statement fraud and feature selection using data mining techniques | 380 | AI, Financial Fraud | Decision Support Systems |

| (Kokina & Davenport, 2017) | The emergence of artificial intelligence: How automation is changing auditing | 320 | Auditing, AI | Journal of Emerging Technologies in Accounting |

| (Warren et al., 2015) | How big data will change accounting | 250 | Big Data, Accounting | Accounting Horizons |

| (Goel & Gangolly, 2012) | Beyond the numbers: Mining the annual reports for hidden cues indicative of financial statement fraud | 200 | Text Mining, Financial Reporting | Intelligent Systems in Accounting, Finance and Management |

| (Craja et al., 2020) | Deep learning for detecting financial statement fraud | 165 | Machine Learning, Forensic Accounting | Decision Support Systems |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Gkegkas, M.; Kydros, D.; Pazarskis, M. Using Data Analytics in Financial Statement Fraud Detection and Prevention: A Systematic Review of Methods, Challenges, and Future Directions. J. Risk Financial Manag. 2025, 18, 598. https://doi.org/10.3390/jrfm18110598

Gkegkas M, Kydros D, Pazarskis M. Using Data Analytics in Financial Statement Fraud Detection and Prevention: A Systematic Review of Methods, Challenges, and Future Directions. Journal of Risk and Financial Management. 2025; 18(11):598. https://doi.org/10.3390/jrfm18110598

Chicago/Turabian StyleGkegkas, Michail, Dimitrios Kydros, and Michail Pazarskis. 2025. "Using Data Analytics in Financial Statement Fraud Detection and Prevention: A Systematic Review of Methods, Challenges, and Future Directions" Journal of Risk and Financial Management 18, no. 11: 598. https://doi.org/10.3390/jrfm18110598

APA StyleGkegkas, M., Kydros, D., & Pazarskis, M. (2025). Using Data Analytics in Financial Statement Fraud Detection and Prevention: A Systematic Review of Methods, Challenges, and Future Directions. Journal of Risk and Financial Management, 18(11), 598. https://doi.org/10.3390/jrfm18110598