Determinant Factor of Individual Taxpayer Compliance in Indonesia: Integrates of TPB Theory and Social Identity Theory

Abstract

1. Introduction

- What are the behavioral and psycologycal factor that influence that influence individuals’ intention to pay tax in Indonesia?

- How can the theory of planned behavior be combined with social identity theory to explain this phenomenon?

2. Literature Review

2.1. Tax Compliance Theory

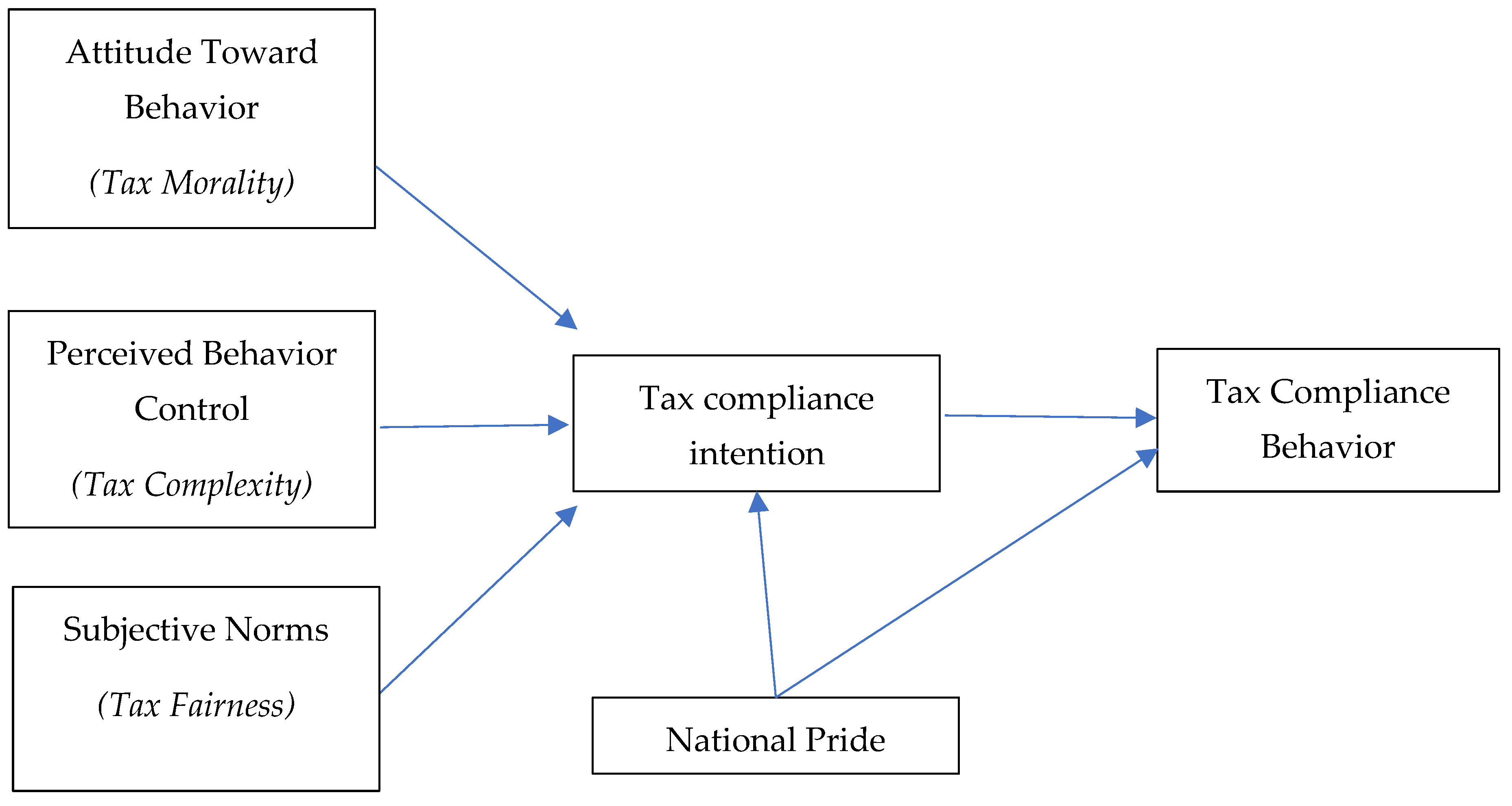

2.2. Theory of Planned Behavior

2.3. Social Identity Theory

2.4. Previous Studies and Hypothesis Development

2.4.1. Tax Morality

2.4.2. Tax Complexity

2.4.3. Tax Fairness

2.4.4. National Pride

2.4.5. Tax Compliance Intention

3. Reseach Methodology

3.1. Data Collection

3.2. Empirical Model

3.3. Data Analyzed

4. Result and Discussion

4.1. Respondent Profile

4.2. Measurement Model Evaluation

4.3. Structural Model Evaluation

4.4. Discussion

5. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

| 1 | Interview with taxpayer. |

References

- Abodher, F. M., Elmagrhi, M., & Shlof, M. A. (2025). National pride, trust in government and tax compliance: Evidence from an environment of severe political instability. Journal of Applied Accounting Research. [Google Scholar] [CrossRef]

- Ahnan, Z. M. (2021). Effect of tax payer behavior moderation on taxs reporting systems. Saudi Jurnal of Economics and Fiance, 5(7), 312–320. [Google Scholar]

- Ajzen, I. (1991). The theory of planned behavior. Organizational Behavior and Human Decision Processes, 50(2), 179–211. [Google Scholar] [CrossRef]

- Ali, M., Fjeldstad, O.-H., & Sjursen, I. H. (2014). To pay or not to pay? Citizens’ attitudes toward taxation in Kenya, Tanzania, Uganda, and South Africa. World Development, 64, 828–842. [Google Scholar] [CrossRef]

- Alm, J., & McClellan, C. (2012). Tax morale and tax compliance from the firm’s perspective. Kyklos, 65(1), 1–17. [Google Scholar] [CrossRef]

- Alshira’h, A. F., & Abdul-Jabbar, H. (2020). Moderating role of patriotism on sales tax compliance among Jordanian SMEs. International Journal of Islamic and Middle Eastern Finance and Management, 13(3), 389–415. [Google Scholar] [CrossRef]

- Amanah, R. B. (2016). Tax compliance among small and medium scale enterprises in Metropolis, Kumasi. Journal of Economics and Sustainable Development, 7(16), 5–16. [Google Scholar]

- Amoh, J. K., & Ali-Nakyea, A. (2019). Does corruption cause tax evasion? Evidence from an emerging economy. Journal of Money Laundering Control, 22(2), 217–232. [Google Scholar] [CrossRef]

- Andini, M., & Rahmiati, A. (2021). Tax and compliance of individual taxpayers. Journal of Security and Sustainability Issues, 10(34), 426–437. [Google Scholar] [CrossRef]

- Bagozzi, R., & Yi, Y. (1988). On the evaluation of structural equation models. Journal of the Academy of Marketing Science, 16(1), 74–94. [Google Scholar] [CrossRef]

- Bani-Khalid, T., Alshira’h, A. F., & Alshirah, M. H. (2022). Determinants of tax compliance intention among Jordanian SMEs: A focus on the theory of planned behavior. Economies, 10(2), 30. [Google Scholar] [CrossRef]

- Belahouaoui, R., & Attak, E. H. (2023). The importance of perceived fairness regarding tax burden in compliance behavior: A qualitative study using the Delphi method in Morocco. Journal of Financial Reporting and Accounting. [Google Scholar] [CrossRef]

- Callan, T., Coleman, K., & Walsh, J. (2006). Assessing the impact of tax/transfer policy changes on poverty: Methodological issues and some European evidence. Research in Labor Economics, 25, 125–139. [Google Scholar]

- Chan, E. Y. (2019). Exposure to national flags reduces tax evasion: Evidence from the United States, Australia, and Britain. European Journal of Social Psychology, 49(2), 300–312. [Google Scholar] [CrossRef]

- Chau, G., & Leung, P. (2009). A critical review of fischer tax compliance model: A research synthesis. Journal of Accounting and Taxation, 1(2), 34–40. [Google Scholar]

- Dao, L. T., & Hang, N. P. T. (2022). Factors affecting tax compliance of enterprises during the COVID-19 pandemic in Vietnam. Montenegrin Journal of Economics, 18(4), 7–17. [Google Scholar] [CrossRef]

- Dawkins, C. E., & Frass, J. W. (2005). Decision of union workers to participate in employee involvement: An application of the theory of planned behavior. Employee Relations, 27(5), 511–531. [Google Scholar] [CrossRef]

- DDTC. (2025). Tax gap Indonesia masih tinggi, world bank beri catatan ke pemerintah. Available online: https://news.ddtc.co.id/berita/nasional/1807591/tax-gap-indonesia-masih-tinggi-world-bank-beri-catatan-ke-pemerintah (accessed on 30 September 2025).

- Devos, K. (2014). Factors influencing individual taxpayer compliance behaviour. Springer. [Google Scholar]

- Dlamini, B. (2017). Determinants of tax non-compliance among small and medium enterprises in Zimbabwe. Journal of Economics and Behavioral Studies, 11(1), 92–105. [Google Scholar]

- Efebera, H., Hayes, D. C., Hunton, J. E., & O’Neil, C. (2004). Tax compliance intentions of low-income individual taxpayers. In Advances in accounting behavioral research (Vol. 7, pp. 1–25). Emerald Group Publishing Limited. [Google Scholar] [CrossRef]

- Etzioni, A. (1975). A comparative analysis of complex organizations: On power, involvement, and their correlates. Free Press. [Google Scholar]

- Feldman, N. E., Katuščák, P., & Kawano, L. (2016). Taxpayer confusion: Evidence from the child tax credit. American Economic Review, 106(3), 807–835. [Google Scholar] [CrossRef]

- Frey, B. S. (1992). Tertium datur: Pricing, regulating and intrinsic motivation. Kyklos, 45(2), 161–184. [Google Scholar] [CrossRef]

- Gangl, K., Torgler, B., & Kirchler, E. (2016). Patriotism’s impact on cooperation with the state: An experimental study on tax compliance. Political Psychology, 37, 867–881. [Google Scholar] [CrossRef]

- Górecki, M. A., & Letki, N. (2021). Social norms moderate the effect of tax system on tax evasion: Evidence from a large-scale survey experiment. Journal of Business Ethics, 172(4), 727–746. [Google Scholar] [CrossRef]

- Hair, H. G. M., Ringle, C. M., & Sarstedt, M. (2014). A primer on partial least squares structural equations modeling (PLS-SEM). SAGE Publications. [Google Scholar]

- Hair, J. F., Risher, J. J., Sarstedt, M., & Ringle, C. M. (2019). When to use and how to report the results of PLS-SEM. European Business Review, 31(1), 2–24. [Google Scholar] [CrossRef]

- Hanno, D. M., & Violette, G. R. (1996). An analysis of moral and social influences on taxpayer behavior. Behavioral Research in Accounting, 8, 57–75. [Google Scholar]

- Harinurdin, E. (2011). Corporate taxpayer compliance behavior. Journal of Administrative and Organizational Sciences, 16(2), 96–104. [Google Scholar]

- Hayat, N., Salameh, A. A., Mamun, A. A., Helmi Ali, M., & Makhbul, Z. K. M. (2022). Tax compliance behavior among Malaysian taxpayers: A dual-stage PLS-SEM and ANN analysis. SAGE Open, 12(3), 1–14. [Google Scholar] [CrossRef]

- Huddy, L., & Khatib, N. (2007). American patriotism, national identity, and political involvement. American Journal of Political Science, 51(1), 63–77. [Google Scholar] [CrossRef]

- Inasius, F. (2019). Factors influencing SME tax compliance: Evidence from Indonesia. International Journal of Public Administration, 42(5), 367–379. [Google Scholar] [CrossRef]

- Jackson, B. R., & Milliron, V. C. (1986). Tax compliance research: Findings, problems and prospects. Journal of Accounting Literature, 5, 125–161. [Google Scholar]

- Jamshidi, D., & Kazemi, F. (2019). Innovation diffusion theory and customers’ behavioral intention for Islamic credit card: Implications for awareness and satisfaction. Journal of Islamic Marketing, 11(6), 1245–1275. [Google Scholar] [CrossRef]

- Jimenez, P., & Iyer, G. S. (2016). Tax compliance in a social setting: The influence of social norms, trust in government, and perceived fairness on taxpayer compliance. Advances in Accounting, 34, 17–26. [Google Scholar] [CrossRef]

- Kaulu, B. (2021). Determinants of tax evasion intention using the theory of planned behavior and the mediation role of taxpayer egoism. Fudan Journal of the Humanities and Social Sciences 15, 63–87. [Google Scholar] [CrossRef]

- Kehelwalatenna, S., & Soyza, B. (2020). Determinants of tax compliance behavior: The case of sri lankan taxpayers. Global Review of Accounting and Finance, 11, 42–61. [Google Scholar]

- Kiconco, R. I., Gwokyalya, W., Sserwanga, A., & Balunywa, W. (2019). Tax compliance behaviour of small business enterprises in Uganda. Journal of Financial Crime, 26(4), 1117–1132. [Google Scholar] [CrossRef]

- Kirchgüassner, G. (2011). Tax morale, tax evasion and the shadow economy. In F. Schneider (Ed.), Handbook on the shadow economy (pp. 347–374). Edward Elgar Publishing. [Google Scholar]

- Kirchler, E., & Hoelzl, E. (2017). Tax behavior. In Economic Psychology (pp. 255–271). John Wiley & Sons, Inc. [Google Scholar] [CrossRef]

- Kiria, L., James, M., & Masunga, F. J. (2020). The Influence of behavioral intention to use the ICT tax system on tax compliance behavior: The efficacy of mediating effect. Journal of Business Management and Economic Research, 4(4), 351–370. [Google Scholar] [CrossRef]

- Lim, S. (2018). Perceptions of unfairness and a weak universal welfare state in South Korea. Japanese Journal of Political Science, 19(3), 376–396. [Google Scholar] [CrossRef]

- Lois, P., Drogalas, G., Karagiorgos, A., & Chlorou, A. (2019). Tax compliance during fiscal depression periods: The case of Greece. EuroMed Journal of Business, 14(3), 274–291. [Google Scholar] [CrossRef]

- MacGregor, J., & Wilkinson, B. (2012). The effect of economic patriotism on tax morale and attitudes toward tax compliance. In T. Stock (Ed.), Advances in taxation (Vol. 20, pp. 159–180). Emerald Group Publishing Limited. [Google Scholar] [CrossRef]

- Mei Tan, L., & Chin-Fatt, C. (2000). The impact of tax knowledge on the perceptions of tax fairness and attitudes towards compliance. Asian Review of Accounting, 8(1), 44–58. [Google Scholar] [CrossRef]

- Milgram, S. (1963). Behavioral study of obedience. The Journal of Abnormal and Social Psychology, 67(4), 371–378. [Google Scholar] [CrossRef] [PubMed]

- Musimenta, D., Nkundabanyanga, S. K., Muhwezi, M., Akankunda, B., & Nalukenge, I. (2017). Tax compliance of small and medium enterprises: A developing country perspective. Journal of Financial Regulation and Compliance, 25(2), 149–175. [Google Scholar] [CrossRef]

- Nartey, E. (2023). Tax compliance of small and medium sized enterprises in Ghana. International Journal of Sociology and Social Policy, 1–21. [Google Scholar] [CrossRef]

- Onu, D. (2016). Measuring tax compliance attitudes: What surveys can tell us about tax compliance behaviour. In Advances in taxation (Vol. 23, pp. 173–190). Emerald Group Publishing Limited. [Google Scholar] [CrossRef]

- Pajak. (2018). Bersiap untuk generasi emas Indonesia sadar pajak. Available online: https://stats.pajak.go.id/id/artikel/bersiap-untuk-generasi-emas-indonesia-sadar-pajak (accessed on 30 September 2025).

- Qari, S., Konrad, K. A., & Geys, B. (2012). Patriotism, taxation and international mobility. Public Choice, 151, 695–717. [Google Scholar] [CrossRef]

- Ravand, H., & Baghaei, P. (2016). Partial least squares structural equation modeling with R. Practical Assessment, Research & Evaluation, 21(11), 1–16. Available online: http://pareonline.net/getvn.asp?v=21&n=11 (accessed on 30 September 2025).

- Richardson, G. (2006). The impact of tax fairness dimensions on tax compliance behavior in an Asian jurisdiction: The case of Hong Kong. International Tax Journal Winter, 32(1), 29–42. [Google Scholar]

- Saptono, P. B., & Khozen, I. (2023). What determines the tax compliance intention of individual taxpayers receiving COVID-19-related benefits? Insights from Indonesia. International Journal of Sociology and Social Policy, 43(11/12), 1190–1217. [Google Scholar] [CrossRef]

- Shafer, W. E., & Wang, Z. (2018). Machiavellianism, social norms, and taxpayer compliance. Business Ethics, 27(1), 42–55. [Google Scholar] [CrossRef]

- Strumpel, B. (1968). Contribution of survey research in quantitative analysis in public finance. In A. Peacock (Ed.), Quantitative analysis in public finance. Praeger. [Google Scholar]

- Taing, H. B., & Chang, Y. (2020). Determinants of tax compliance intention: Focus on the theory of planned behavior. International Journal of Public Administration, 44(1), 62–73. [Google Scholar] [CrossRef]

- Tajfel, H. (1981). Human groups and social categories: Studies in social psychology (CUP archive). Cambridge University Press. [Google Scholar]

- Tajfel, H., & Turner, J. (1979). An integrative theory of intergroup conflict. In W. G. Austin, & S. Worchel (Eds.), The social psychology of intergroup relations (pp. 33–47). Brooks Cole. [Google Scholar]

- Tehulu, T. A., & Dinberu, Y. D. (2014). Determinants of tax compliance behavior in Ethiopia the case of Bahir Dar City taxpayers. Journal of Economics and Sustainable Development, 5(15), 268–274. Available online: https://www.academia.edu/download/81055921/15327-17542-1-PB.pdf (accessed on 30 September 2025).

- Timothy, J., & Abbas, Y. (2021). Tax morale, perception of justice, trust in public authorities, tax knowledge, and tax compliance: A study of Indonesian SMEs. eJournal of Tax Research, 19(1), 168–184. [Google Scholar]

- Trianto, B., Nik Azman, N. H., & Masrizal, M. (2023). E-payment adoption and utilization among micro-entrepreneurs: A comparative analysis between Indonesia and Malaysia. Journal of Science and Technology Policy Management, 16(2), 314–343. [Google Scholar] [CrossRef]

- Twum, K. K., Amaniampong, M. K., Assabil, E. N., Adombire, M. A., Edisi, D., & Akuetteh, C. (2020). Tax knowledge and tax compliance of small and medium enterprises in Ghana. South East Asia Journal of Contemporary Business, Economics and Law, 21(5), 222–231. [Google Scholar]

- Wenzel, M. (2004). The social side of sanctions: Personal and social norms as moderators of deterrence. Law and Human Behavior, 28(5), 547–567. [Google Scholar] [CrossRef] [PubMed]

- Xin-Li, S. (2010). Social identities, ethnic diversity, and tax morale. Public Finance Review, 38(2), 146–177. [Google Scholar] [CrossRef]

- Zhang, K. (2018). Theory of planned behavior: Origins, development and future direction. International Journal of Humanities and Social Science Invention, 7(5), 76–83. [Google Scholar]

| Variable | Code | Description | Source |

|---|---|---|---|

| Tax Morality | TMR1 | All tax obligations that I have submitted are correct | Taing and Chang (2020); Saptono and Khozen (2023) |

| TMR2 | All the income I earn has been taxed | ||

| TMR3 | I have never violated any tax regulations | ||

| Tax Complexity | TCM1 | For me, it is very difficult to understand and follow tax laws | Taing and Chang (2020); Saptono and Khozen (2023) |

| TCM2 | I don’t understand how to determine the tax I have to pay | ||

| TCM3 | The tax payment system is very complicated | ||

| TCM4 | The tax reporting system is less simple | ||

| TCM5 | The tax system in Indonesia is still too complex | ||

| Tax Fairness | TFR1 | Unfair tax regulations | Taing and Chang (2020); Saptono and Khozen (2023) |

| TFR2 | Tax rates are less proportional for individual taxpayers | ||

| TFR3 | Unfair tax system | ||

| TFR4 | Everyone has the same tax burden | ||

| TFR5 | A person with a low income will also have low taxes. | ||

| Tax Compliance Intention | TCI1 | I have never been late paying taxes because it is important for government services. | Kaulu (2021); Saptono and Khozen (2023) |

| TCI2 | I will continue to pay taxes even if there is misuse of tax money by the government. | ||

| TCI3 | There is a big chance that tax money will be embezzled but I still pay taxes | ||

| National Pride | NTP1 | I am immensely proud of my country | Abodher et al. (2025); Bani-Khalid et al. (2022); MacGregor and Wilkinson (2012) |

| NTP2 | Saya tidak akan pernah menghianati negara saya | ||

| NTP3 | I love being Indonesian | ||

| NTP4 | I will pay taxes for the progress of the country | ||

| Tax Compliance Behavior | TCB1 | I always fill out all tax reporting forms | Twum et al. (2020) |

| TCB2 | I always pay my taxes on time | ||

| TCB3 | I always report my annual taxes on time. |

| Description | N | % |

|---|---|---|

| Sexuality | ||

| Male | 252 | 63 |

| Female | 149 | 37 |

| Age | ||

| 21–30 | 59 | 15 |

| 31–40 | 164 | 41 |

| 41–50 | 119 | 30 |

| >50 | 50 | 15 |

| Education | ||

| Senior High School | 44 | 11 |

| Diploma | 9 | 2 |

| Undergraduate | 245 | 61 |

| Post graduate | 95 | 24 |

| PhD | 8 | 2 |

| Profession/Occupation | ||

| Doctor | 114 | 28 |

| Judge | 11 | 3 |

| Entrepreneurs | 129 | 32 |

| Lawyer | 9 | 2 |

| Notary Public | 6 | 1 |

| Senators | 84 | 21 |

| Consultant | 13 | 3 |

| Commissioner | 23 | 6 |

| Auditor | 1 | 0 |

| Director | 7 | 2 |

| Supervisory Board | 4 | 1 |

| Variables | Code | Loading | Alpha | CR | AVE |

|---|---|---|---|---|---|

| Tax Morality | 0.767 | 0.865 | 0.681 | ||

| TMR1 | 0.838 | ||||

| TMR2 | 0.826 | ||||

| TMR3 | 0.811 | ||||

| Tax Complexity | 0.944 | 0.952 | 0.690 | ||

| TCM1 | 0.824 | ||||

| TCM2 | 0.770 | ||||

| TCM3 | 0.841 | ||||

| TCM4 | 0.873 | ||||

| TCM5 | 0.828 | ||||

| Tax Fairness | 0.934 | 0.948 | 0.753 | ||

| TFR1 | 0.859 | ||||

| TFR2 | 0.840 | ||||

| TFR3 | 0.901 | ||||

| TFR4 | 0.901 | ||||

| TFR5 | 0.873 | ||||

| Tax Compliance Intention | 0.895 | 0.934 | 0.826 | ||

| TCI1 | 0.904 | ||||

| TCI2 | 0.908 | ||||

| TCI3 | 0.914 | ||||

| National Pride | 0.894 | 0.921 | 0.702 | ||

| NTP1 | 0.898 | ||||

| NTP2 | 0.860 | ||||

| NTP3 | 0.769 | ||||

| NTP4 | 0.787 | ||||

| Tax Compliance Behavior | 0.902 | 0.924 | 0.671 | ||

| TCB1 | 0.749 | ||||

| TCB2 | 0.822 | ||||

| TCB3 | 0.816 |

| Relationships | Estimate | t-Statistic | p-Value | Remarks |

|---|---|---|---|---|

| Tax Morality → Tax Compliance Intention (H1) | 0.414 | 8.003 | 0.000 | Accepted |

| Tax Complexity → Tax Compliance Intention (H2) | 0.054 | 0.894 | 0.372 | Rejected |

| Tax Fairness → Tax Compliance Intention (H3) | 0.288 | 2.764 | 0.006 | Accepted |

| National Pride → Tax Compliance Intention (H4a) | 0.036 | 0.278 | 0.781 | Rejected |

| National Pride → Tax Compliance Behavior (H4b) | 0.204 | 3.107 | 0.002 | Accepted |

| Tax Compliance Intention → Tax Compliance Behavior (H5) | 0.460 | 8.155 | 0.000 | Accepted |

| Variable | R2 | Adjusted R2 |

|---|---|---|

| Tax Compliance Intention | 0.404 | 0.397 |

| Tax Compliance Behavior | 0.345 | 0.342 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Nurhayati; Maksum, A.; Siregar, N.B.; Nasution, F.N. Determinant Factor of Individual Taxpayer Compliance in Indonesia: Integrates of TPB Theory and Social Identity Theory. J. Risk Financial Manag. 2025, 18, 595. https://doi.org/10.3390/jrfm18110595

Nurhayati, Maksum A, Siregar NB, Nasution FN. Determinant Factor of Individual Taxpayer Compliance in Indonesia: Integrates of TPB Theory and Social Identity Theory. Journal of Risk and Financial Management. 2025; 18(11):595. https://doi.org/10.3390/jrfm18110595

Chicago/Turabian StyleNurhayati, Azhar Maksum, Narumondang B. Siregar, and Fahmi Natigor Nasution. 2025. "Determinant Factor of Individual Taxpayer Compliance in Indonesia: Integrates of TPB Theory and Social Identity Theory" Journal of Risk and Financial Management 18, no. 11: 595. https://doi.org/10.3390/jrfm18110595

APA StyleNurhayati, Maksum, A., Siregar, N. B., & Nasution, F. N. (2025). Determinant Factor of Individual Taxpayer Compliance in Indonesia: Integrates of TPB Theory and Social Identity Theory. Journal of Risk and Financial Management, 18(11), 595. https://doi.org/10.3390/jrfm18110595