Abstract

The Russia–Ukrainian war, which began in 2014 and exploded with the invasion of the Russian army on 24 February 2022, has profoundly destabilized the political, economic and financial balance of Europe and beyond. To the humanitarian emergency associated with every war has been added the deep crisis generated by the strong energy and food dependence that many European countries, and not only European, have developed over decades on Ukraine (especially for wheat) and Russia (especially for natural gas). The aim of this article is to verify the existence of a link between the performance of the Eurostoxx index and the price of wheat futures and TTF natural gas, from 25 February 2019 to 28 September 2023. Through a quantile VAR analysis, a link is sought between the Eurostoxx 50 index, and wheat and TTF gas futures prices. Furthermore, the analysis intends to understand whether the presence of such relationship only manifested itself following the war events, or whether it was already present in the market. The analysis carried out also shows that the relationship between the stock market and raw material prices was present even before the conflict.

1. Introduction

On 24 February 2022, the diplomatic-military clash that had been going on between Russia and Ukraine since February 2014 resulted in an invasion. The Russia–Ukraine conflict, in all its three dimensions, military, humanitarian and economic, produced cascading effects on the world economy, with particularly dramatic impacts on developing countries. Food, energy and financial markets have undergone sudden changes since the start of the war; in fact, both contending countries are among the world’s leading wheat exporters. According to (), “they provide around 30 percent of the world’s wheat and barley, one-fifth of its maize, and over half of its sunflower oil. At the same time, the Russian Federation is the world’s top natural gas exporter, the second-largest oil exporter and the largest exporter of wheat, pig iron, enriched uranium, natural gas, palladium and nickel”. It also holds a significant share of coal, platinum, crude oil and refined aluminum exports. Finally, we can conclude this brief examination by analyzing how Russia and Belarus, together, are important suppliers of fertilizers, including nitrogen and potash. On the other hand, Ukraine is also an important exporter of numerous raw materials including wheat, pig iron, maize and barley. Furthermore, it is the world’s largest exporter of sunflower seed oil and of neon gas, which is a critical input used to manufacture electronic chips. Given the numbers of goods exported and the size of the exports, the Russian invasion of the Ukraine was a very traumatic event for the commodity markets, as many nations rely on raw materials from these two countries. In this situation, there was a notable increase in the prices of energy and food, including wheat. This, in turn, has given rise to concerns about energy and food security, especially for the poorest families. Food production, at the global level, must also adapt to changes in relative prices, and it is for this reason that the volatility of commodity prices has increased. In this context, food prices have reached levels similar to or higher than those reached in 2007–2008. At that time, many authors attributed the high values of agricultural commodity prices to the financialization of derivatives markets (; ; ; ). Others have shown that the causes of the increases were also to be found in other factors (; ; ). The increased volatility in commodity prices recorded since February 2022 is based on concerns about the short- and long-term consequences of the war on the production and trade of commodities, in particularly those for which Russia and Ukraine play a key role. The effects of the war in Ukraine on commodity markets occur through two main channels: the physical impact the destruction of productive capacity, and the impact on trade and production due to sanctions.

As a result, commodity prices are reaching record highs across the board. In April 2022, the United Nations Food and Agriculture Organization (FAO) published its third consecutive record food price index. According to FAO food prices was 34% higher than that time previous year and had never been that high since FAO started recording them. Likewise, crude oil prices, gas and fertilizer prices have more than doubled. The FAO Cereal Price Index averaged 169.78 points in May 2022, with an increase of 27.65 percent compared to the same period of 2021. Given the significant contribution of the two countries to global food and energy supplies, the war produced consequences not only for neighboring countries but throughout the world. Regarding Europe, it imports a significant share of energy from Russia, including natural gas (35 percent), crude oil (20 percent) and coal (40 percent). Furthermore, Russia is similarly dependent on the European Union for its exports. In fact, around 40 percent of crude oil and natural gas is exported to the EU. Regarding food supplies, advanced economies (e.g., Australia, Canada, EU, US) and emerging economies are not dependent on Russia and Ukraine, being major producers of agricultural raw materials, the former being among major suppliers of grains and oilseeds. However, many smaller emerging markets and developing economies are almost exclusively dependent on agricultural raw materials from Russia and Ukraine. In fact, more than half of wheat imports into many countries in Africa, developing Europe and the Middle East came from Russia and Ukraine. In Europe, the demand for natural gas had already suffered due to price increases, and as a result many energy-intensive businesses such as fertilizer plants and refineries have reduced production. Most important of the territories at war are the greaten southern ports of Ukraine, such as Mariupol and Odessa, essential for the transit of agricultural and industrial goods in the country. Soon after the war began, in March 2022, rail and road corridors saw limited quantities of Ukrainian grain exports pass through. However, grain exports from Russia have not been affected. The interruption of wheat exports from Ukraine has affected several importing countries, especially in the Middle East and North Africa, including Egypt and Lebanon. As a result, several countries have introduced trade policy measures or banned wheat exports. By the end of March 2022, just one month after the start of the war, 53 new policy interventions had already been imposed affecting the trade of food commodities. However, the trade restrictions imposed were not as extensive as those that occurred during periods of tension in commodity markets in 2007–2008 and 2011–2012.

The consequences of the conflict in terms of increased prices of raw materials and energy sources are tangible and there for all to see. On the other hand, the link between these aspects and the dynamics of financial markets may appear less linear and more complex. From this perspective, the present work aims to verify if there is a link between stock market performance and the prices of wheat and natural gas, i.e., the commodities that have shown the greatest volatility since the beginning of the war.

The research questions to be answered are therefore the following:

- Is there a relationship between the Eurostoxx 50 index and real market variables, such as the wheat futures price and the TTF gas futures price?

- If such a relationship exists, in which direction and with which characteristics does it manifest?

- If such a relationship exists, did it arise after the conflict broke out, or was it already present before?

The article is divided as follows: Section 2 offers a review of the literature on energy, food and financial links between Russia and Europe, and more generally on the impact of commodity prices on financial markets; Section 3 presents the statistical analysis methodology followed, while the main results and their discussion are presented in Section 4; Section 5 concludes.

2. Literature Review

The economic link between Russia and Europe has been analyzed by numerous authors in different aspects: energy, food and financial. () show the relationship between the price of agricultural commodities and the use of bioethanol as a fuel. In fact, while traditionally the relationship between food and energy prices was linked to production and transportation costs, if demand increases to produce ethanol, this determines a stronger link between the energy and agricultural markets. They indicate how many products necessary for agricultural are energy-intensive, especially fertilizer, and in this way the rising energy prices increase the production costs. In addition, transportation costs raise oil prices, which can also cause an increase in raw material prices. Agricultural prices not only increase, but given the link between oil and food prices volatility shocks in fuel prices will also produce larger shocks in food price volatility. Economic literature has long studied the transmission of price shocks between different markets, especially financial and energy markets and, starting from 2008, also food. With reference to the 2008 crisis, () analyze the spreading of price shocks between the food, energy and financial markets and show how volatility spillovers increase considerably after that date, when stock markets become net transmitters of shocks and crude oil becomes a net receiver. In fact, their results identify the presence of low volatility spillovers from crude oil to most food yields. Their findings highlight the main role played by the 2007–2008 financial crisis in focusing the spreading of shocks from crude oil or equity markets to food. In a recent analysis, () when analyzing food and energy markets consider the weak-form efficiency of spot and daily futures prices. The results indicate that all commodities show long-term efficiency and short-term inefficiencies whose explanation can be found in global economic conditions such as the global financial crisis of 2008, the financialization of commodity markets and the fluctuations in crude oil prices. () indicate how the rapid growth of biofuel production has led to a choice between food and fuel. In fact, the use of agricultural commodities as inputs to produce fuels increases prices and volatility in both the food and fuel markets. () examines the linkages between crude oil, ethanol and sugar prices in Brazil. Since the levels of all the prices of the commodities examined are linked in the long term by an equilibrium parity, she shows that these links cause ethanol prices to rise with the increase in both crude oil and sugar prices. () investigate the risk of contagion from commodity markets to the entire economy and between different sectors. This is because the financialization and integration of commodity markets expose the economy to potential contagion risks, for example adverse shocks affecting one or more commodity markets. Their results show that for energy and metal markets contagion risks are triggered primarily by financial factors, while for food markets they are triggered by financial and economic factors. Furthermore, they indicate how a transmission mechanism occurs from energy to food markets: oil is more important than biofuels in influencing food markets. Finally, they conclude by stating that tail events tend to spread from the commodity markets to the rest of the economy, both when risks derive only from financial factors and when they derive jointly from financial and economic fundamentals. In contrast, when risk measures are derived from economic fundamentals, only commodity markets can lead to economic instability. () investigate the return and volatility link between the S&P 500 index and commodity price indices, like energy, food, gold and beverages, in the turbulent period 2000–2011. In terms of yield and volatility, the results show an important transfer between the S&P 500 and raw material markets. In the analysis of volatility spillover mechanisms between the markets, they show a significant correlation and the transmission of volatility between commodity and stock markets. Instead, () examine the dependence structure between pars of energetic and non-energetic goods at different frequencies and quantiles in joint returns distribution, and illustrate a significant low dependence between the energy commodities, like coal, crude oil and natural gas, and non-energy, such as metals, agriculture and fertilizers, on different frequencies and quantiles, between 1960 and 2019. Furthermore, some non-energy commodity markets have a neutral relationship with global energy markets.

The link between energy and financial markets in EU has been analyzed in recent years. () study the impact of different oil shocks on oil price and show that oil inventories and speculative demand have more significant effects on price fluctuation than aggregate demand and supply of oil. () show how the Russia–Ukraine conflict significantly increases the volatility of agricultural, metals and energy markets through both economic and financial channels. () jointly studies the efficiency and connection of the commodity market. He examines the link between energy (Brent and TTF futures), industrial metals (aluminum, copper, lead, nickel, tin and zinc futures) and financial markets in the EU (FTSE 100, CAC 40, DAX and Bitcoin). The analysis shows that as markets “become turbulent, the flow of information increases in both efficient and less efficient markets, but efficient markets capture and send more information than less efficient markets”.

() examine the Russian–Ukrainian war from the point of view of the financial market’s performance. The war led to a shock in the supply of crude oil and a consequent increase in its price. They show how the connection is greater during the war than before. () analyze the stock price of energy companies and show that these companies during the conflict outperformed the stock market. () analyze the effects of the conflict on the dynamic connection between five commodity markets, the G7 and the BRIC markets, showing how the impact on returns and behavior in terms of volatility are dissimilar between neighboring, EU, and non-neighboring markets. However, they indicate a market connection between all raw materials and markets, G7 and BRIC. (), (), () and () analyze the market reaction to the Russia–Ukraine conflict using event study methodology. () find an adverse event day impact on EU stock market indices. Furthermore, () show that abnormal losses in the initial period of the conflict were large and persistent in the G7 market and volatility persistence was widely present. () compare the market responses of foreign and US firms to the outbreak of war, and show that foreign stocks listed in the US suffer a greater deterioration in market quality than US stocks. They note how this effect is strong for companies from countries considered closer to Russia, and attribute these results to the information asymmetry hypothesis regarding the quality of the market which is more vulnerable to international geopolitical risk. In the same field, () examine the market impact of the onset of war on major European listed banks by observing a negative and statistically significative reaction in stock prices at and around the conflict. In addition, they indicate that the reaction is more negative for Russian-listed banks and for foreign banks with exposure to Russia. () analyze the effects of increase in crude oil prices on the stock returns and currency exchange rates in the G7 countries and show how the continued increase in hostilities between Russia and Ukraine and the resulting conflict has had a global impact in terms of its long-term effect in the volatility of stock price returns and exchange rates.

() document a statistically and economically significant market sanction imposed by investors on Reminders, which they attribute to “negative sentiment regarding companies that maintained their trade ties with Russia” after the February 2022 invasion. The Russian–Ukrainian military conflict resulted in a marked increase in geopolitical risk, and the economic sanctions imposed on Russia have damaged its economy. This uncertainty has spread to the global economy, as is evident from a sharp rise in global energy and commodity prices.

() investigate the impact of geopolitical risk, GPR, generated by the Russia–Ukrainian conflict on both European and Russian bond, equity and commodity markets. The results “indicate that most assets show a mix of negative and positive relationship with GPR” and therefore this produces changes in asset returns under normal market conditions. () evaluate the transmission of yields and commodity volatility in the period of war in Ukraine and show that return spillovers increase. During conflict, crude oil was a net transmitter of the return, while wheat and soybeans clearly receive the return spillovers. The spillover index volatility rises from less than 35% to 85% immediately after the start of the war.

3. Materials and Methods

Quantile regression, starting from the fundamental work of (), is an increasingly used tool for risk analysis in many economic fields (; ; ). Quantile regression estimates model conditional quantile functions. It presents a mechanism for estimating models for the conditional median function, and other conditional quantile functions (). The objective function to be minimized is the following:

QVAR is a generalization of the univariate quantile autoregression model proposed by (). We combine the model of () and the triangular structure proposed by () to address the multivariate quantile issue. Wei’s approach is important because it provides the multivariate quantile counterpart of Cholesky decomposition. The dynamic properties of the systems change through the quantiles that describes the univariate distributions. () review the literature on extensions of traditional single-output quantile regression methods to the multiple-output setting.

We say that follows a QVAR (1) process if the recursive quantile of can be written as:

for any When , this simplifies to the quantile autoregressive process of ().

For a sequence of n-vectors of i.i.d. standard uniform random variables , the QVAR process (1) can be written as:

such that each , given the recursive information set of Definition 1, is monotonically increasing in . Defining the terms and , the QVAR process can equivalently be written as .

To further understand the link with the traditional VAR, the QVAR model (2) can be interpreted as a VAR model with time series dependence in the error structure:

where , for . If the data-generating process was a standard VAR with i.i.d. innovations, then the innovations would simplify to , which in fact is an i.i.d. sequence.

4. Results

The QVAR(1) models the interaction between wheat and TTF commodity market and financial variables in Europe, Eurostoxx 50 index. In the analysis, to estimate the contribution of Russia’s most exported commodity markets we use daily data from 25 February 2019 to 28 September 2023, for 1156 observations. All data are taken from Datastream.

The variables used are the EuroStoxx50 index, given that it is a benchmark to quantify European economic activity, and the daily closing futures prices of energy (TTF Dutch gas markets) and food (wheat). We restrict analysis to a small set to avoid overfitting the data and to analyze possible link to Russia. The structural identification assumption we impose on the model implies that financial variables can react simultaneously with real variables, but the latter react to financial developments only with a lag. This is consistent with Cholesky’s identification, according to which shocks to real economy variables can have an immediate impact on financial variables, while shocks to financial variables can affect real variables only with a lag.

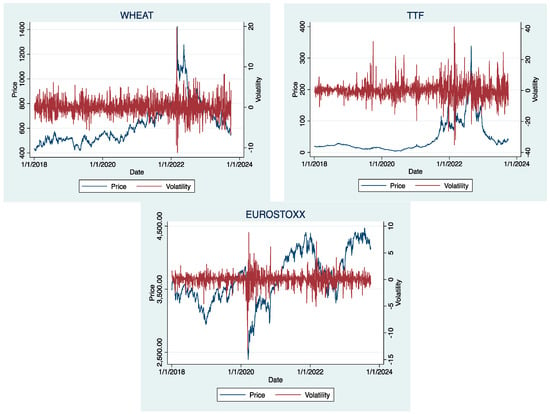

Figure 1 shows the trend of the wheat and Dutch TTF prices. It is possible to note how starting from the end of 2021, a few months before the start of the invasion of 24 February 2022, the prices of the two commodities begin to increase, although more markedly for gas. As mentioned in the introduction, Russia and Ukraine are both high-exporting countries for wheat, and the Russian gas, which represent a prominent percentage for Europe, mainly reaches the latter through Ukraine.

Figure 1.

Wheat, TTF and Eurostoxx 50 prices and volatility.

Table 1 shows that the prices of commodities, wheat and Dutch TTF gas, are both able to significantly determine the value of the Euro index, both in the lower (0.01 and 0.05) and in the higher (0.95 and 0.99) quantiles. The relationship is positive, although it is stronger for wheat futures. However, both commodities are able to positively determine the value of the euro index even if with different intensity, higher for wheat and lower for gas. On the other hand, analyzing the inverse relationship, if and how the Euro index is able to change the price of the two commodities, it can be seen that also in this case the relationship is direct. In general, an increase in the index determines an increase in commodity futures, albeit with one exception, wheat at quantile 0.01, but the result is not significant. In this case, it can be concluded that the index determines the value of wheat futures only for higher quantiles (price increases), and of the TTF only for lower quantiles (price decreases). The Wald test confirms the validity of the model.

Table 1.

Quantile regression between Eurostoxx and wheat, Dutch TTF.

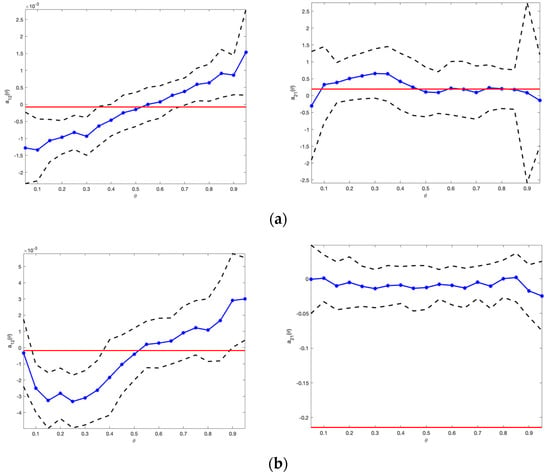

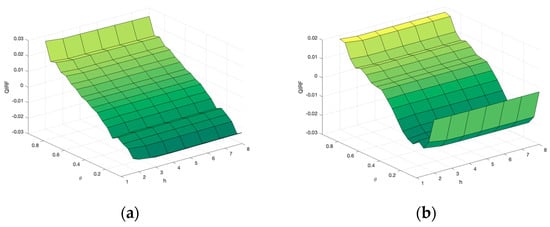

The estimated quantile coefficients of QVAR and the corresponding OLS estimates are reported on Figure 2. In the interaction between commodities and Euro index variables, we note the presence of asymmetries in wheat and Dutch TTF coefficients, which cannot be detected with standard OLS model and show how commodity markets affect the left and right tail of financial markets. In Figure 3, we report a three-dimensional quantile impulse response function. This shows how the effects of the shock are limited and positive for upper quantile and negative for lower, both for wheat and Dutch TTF.

Figure 2.

QVAR and VAR estimates. (a) Wheat; (b) TTF.

Figure 3.

Impulse response function. (a) Wheat; (b) TTF.

5. Conclusions

The Russia–Ukraine conflict has affected commodity markets through both economic and financial channels and has significantly increased the risk of volatility. In fact, this is greater for raw materials, agricultural products and energy, with a higher global share of exports. Secondly, the impact of the conflict and the risk of volatility on commodity markets is further amplified for those countries, such as EU, neighboring and showing greater trade with the two adversaries.

The results obtained from the QVAR analysis show the presence of a positive and direct relationship between the variables considered: the wheat futures prices and the TTF gas futures prices determine the trend of the Eurostoxx 50 index. In particular, the wheat futures prices show a greater effect on the stock market index than the TTF gas futures prices. The inverse relationship also appears to be confirmed, and therefore the Eurostoxx 50 index determines the price trend of the two commodities. The validity of the model is confirmed by the Wald test. The analysis carried out also shows that the relationship between the stock market and raw material prices was present even before the conflict: however, it emerges that the direct relationship (influence of wheat and natural gas futures prices on the Eurostoxx 50 index) has grown stronger starting from March 2022. This trend is confirmed above all with reference to the highest quantiles, i.e., those relating to price increases.

These results are important for both investors and politicians to be able to make informed decisions, especially when geopolitical tensions make supply of many commodities discontinuous and consequently exacerbate their global prices, as happened with the price of TTF gas, making its impact dissimilar. Moreover, the analysis shows that countries closely associated with the nations with geopolitical tensions have an immediate and explicit impact. This is because the actions of countries with geopolitical tensions have crucial implications on the performance of countries that depend on them (). We can hypothesize interventions that allow us to mitigate the distorting effects deriving from this correlation. The interventions and the tools to avoid a growing spiral of commodity prices, which then spill over onto the stock markets, could be traced back to a careful use of derivative financial instruments, which, by fixing the future price of commodities, allow an interruption of the tautology. There are still many necessary areas to examine for further studies, because the Russia–Ukraine conflict can also impact other financial markets in countries that are geographically distant but have significant trade with those in conflict. For policymakers, analyses suggest that the role of the commodity market during periods of geopolitical tensions, if well governed, can ensure better stock market performance.

Author Contributions

Conceptualization, M.L. and A.M.; methodology, M.L.; software, M.L.; validation, M.L., R.P. and A.M.; formal analysis, M.L.; data curation, M.L.; writing—original draft preparation, M.L. and R.P.; writing—review and editing, M.L., R.P. and A.M.; supervision, A.M. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

The data presented in this study are available on request from the corresponding author. The data are not publicly available due to piracy.

Conflicts of Interest

The authors declare no conflicts of interest.

References

- Adekoya, Oluwasegun B., Johnson A. Oliyide, OlaOluwa S. Yaya, and Mamdouh Abdulaziz Saleh Al-Faryan. 2022. Does oil connect differently with prominent assets during war? Analysis of intra-day data during the Russia-Ukraine saga. Resources Policy 77: 102728. [Google Scholar] [CrossRef]

- Adekoya, Oluwasegun B., Mahdi Ghaemi Asl, Johnson A. Oliyide, and Parviz Izadi. 2023. Multifractality and cross-correlation between the crude oil and the European and non-European stock markets during the Russia-Ukraine war. Resources Policy 80: 103134. [Google Scholar] [CrossRef]

- Adrian, Tobias, and Makus Brunnermeier. 2016. CoVar. American Economic Review 106: 1705–41. [Google Scholar] [CrossRef]

- Alam, Md. Kausar, Mosab I. Tabash, Mabruk Billah, Sanjeev Kumar, and Suhaib Anagreh. 2022. The impacts of the Russia-Ukraine invasion on global markets and commodities: A dynamic connectedness among G7 and BRIC markets. Journal of Risk and Financial Management 15: 352. [Google Scholar] [CrossRef]

- Algieri, Bernardina, and Arturo Leccadito. 2017. Assessing contagion risk from energy and non-energy commodity markets. Energy Economics 62: 312–22. [Google Scholar] [CrossRef]

- An, Henry, Feng Qui, and James Rude. 2021. Volatility spillovers between food and fuel markets: Do administrative regulations affect the transmission? Economic Modelling 102: 105552. [Google Scholar] [CrossRef]

- Bagchi, Bhaskar, and Biswajit Paul. 2023. Effects of crude oil prices shocks on stock markets and currency exchange rates in the context of Russia-Ukraine conflict: Evidence from G7 countries. Journal of Risk and Financial Management 16: 64. [Google Scholar] [CrossRef]

- Chavleishvili, Sulkhan, and Simone Manganelli. 2019. Forecasting and Stress Testing with Quantile Vector Autoregression. Working Paper Series No. 2330; Frankfurt: European Central Bank. [Google Scholar]

- Clancey-Shang, Danjue, and Chengbo Fu. 2023. The Russia-Ukraine conflict and foreign stocks on the US market. Journal of Risk Finance 24: 6–23. [Google Scholar] [CrossRef]

- De Cesari, Amedeo, Alberto Manelli, Roberta Pace, and Maria Leone. 2018. The sustainability of the interaction between financial and commodity markets. Rivista di Studi sulla Sostenibilità 2: 133–53. [Google Scholar] [CrossRef]

- Fang, Yi, and Zhiquan Shao. 2022. The Russia-Ukraine conflict and volatility risk of commodity markets. Finance Research Letters 50: 103264. [Google Scholar] [CrossRef]

- Garderbroek, Cornelis, and Manuel A. Hernandez. 2013. Do energy prices stimulate food price volatility? Examing volatility transmission between US oil, ethanol and corn markets. Energy Economics 40: 119–29. [Google Scholar] [CrossRef]

- Glauben, Thomas, Soren Prehn, Tebbe Dannemann, Bernhard Brummer, and Jens-Peter Loy. 2014. Options Trading in Agricultural Futures Markets: A Reasonable Instrument of Risk Hedging, or a Driver of Agricultural Price Volatility? IAMO Policy Brief No. 919-2016-72756. Halle: Institute of Agricultural Development in Transition Economies (IAMO). [Google Scholar]

- Gong, Xu, Kequin Guan, Liquing Chen, Tangyong Liu, and Chengbo Fu. 2021. What drives oil prices?—A Markov switching VAR approach. Resources Policy 74: 102316. [Google Scholar] [CrossRef]

- Guilleminot, Benoit, Jean-Jacques Ohana, and Steve Ohana. 2014. The interaction of speculators and index investors in agricultural derivatives markets. Agricultural Economics 45: 767–92. [Google Scholar] [CrossRef]

- Hallin, Marc, and Miroslav Siman. 2017. Multiple-output quantile regression. In Handbook of Quantile Regression. Boca Raton: CRC Press LLC. [Google Scholar]

- Hardle, Wolfgang Karl, Weining Wang, and Lining Yu. 2016. TENET: Tail-Event driven NETwork risk. Journal of Econometrics 192: 499–513. [Google Scholar] [CrossRef]

- Huchet, Nicolas, and Papa G. Fam. 2016. The role of speculation in international futures markets on commodity prices. Research in International Business and Finance 37: 49–65. [Google Scholar] [CrossRef]

- Jebabli, Ikram, and David Roubaud. 2018. Time-varying efficiency in food and energy markets: Evidence and implications. Economic Modelling 70: 97–114. [Google Scholar] [CrossRef]

- Jebabli, Ikram, Mohamed Arouri, and Frederic Teulon. 2014. On the effects of world stock market and oil price shocks on food prices: An empirical investigation based on TVP-VER models with stochastic volatility. Energy Economics 45: 66–98. [Google Scholar] [CrossRef]

- Khalfaoui, Rabeh, Eduard Baumohl, Suleman Sarwar, and Tomas Vyrost. 2021. Connectedness between energy and nonenergy commodity markets: Evidence from quantile coherency networks. Resources Policy 74: 102318. [Google Scholar] [CrossRef]

- Koenker, Roger. 2005. Quantile Regression. Cambridge: Cambridge University Press. [Google Scholar]

- Koenker, Roger, and Gilbert J. Bassett. 1978. Regression quantiles. Econometrica 46: 33–50. [Google Scholar] [CrossRef]

- Koenker, Roger, and Zhijie Xiao. 2006. Quantile autoregression. Journal of the American Statistical Association 101: 980–1006. [Google Scholar] [CrossRef]

- Kumari, Vineeta, Gaurav Kumar, and Dharen Kumar Pandey. 2023. Are the European Union stock markets vulnerable to the Russia-Ukraine war? Journal of Behavioral and Experimental Finance 37: 100793. [Google Scholar] [CrossRef]

- Martins, Antonio Miguel, Pedro Correia, and Ricardo Gouveia. 2023. Russia-Ukraine conflict: The effects on European banks’ stock market returns. Journal of multinational Financial Management 67: 100786. [Google Scholar] [CrossRef]

- Masters, Michael W. 2008. Testimony before the Committee on Homeland Security and Governmental Affairs United States Senate. Available online: https://www.hsgac.senate.gov/wp-content/uploads/imo/media/doc/052008Masters.pdf (accessed on 1 January 2024).

- Mensi, Walid, Makram Beljid, Adel Boubaker, and Shunsuke Managi. 2013. Correlations and volatility spillovers across commodity and stock markets: Linking energies, food, and gold. Economic Modelling 32: 15–22. [Google Scholar] [CrossRef]

- Nerlinger, Martin, and Sebastian Utz. 2022. The impact of Russia-ukraine conflict on energy firms: A capital market perspective. Finance Research Letters 50: 103243. [Google Scholar] [CrossRef]

- Obi, Pat, Freshia Waweru, and Moses Nyangu. 2023. An event study on the reaction of equity and commodity markets to the onset of the Russia-Ukraine conflict. Journal of Risk and Financial Management 16: 256. [Google Scholar] [CrossRef]

- Sanders, Dwight R., and Scott H. Irwin. 2011. New evidence on the impact of index funds in U.S. grain futures markets. Canadian journal of Agricultural Economics 59: 519–32. [Google Scholar] [CrossRef]

- Serra, Teresa. 2011. Volatility spillovers between food and energy markets: A semiparametric approach. Energy Economics 33: 1155–64. [Google Scholar] [CrossRef]

- Tang, Ke, and Wei Xiong. 2012. Index investment and the financialization of commodities. Financial Analysts Journal 68: 54–74. [Google Scholar] [CrossRef]

- Tosun, Onur K., and Arman Eshraghi. 2022. Corporate decisions in times of war: Evidence from the Russia-Ukraine conflict. Finance Research Letters 48: 102920. [Google Scholar] [CrossRef]

- Umar, Zaghum, Ahmed Bossman, Sun-Yong Choi, and Tamara Teplova. 2022. Does geopolitical risk matter for global asset returns? Evidence from quantile-on-quantile regression. Finance Research Letters 48: 102991. [Google Scholar] [CrossRef]

- UNCTAD. 2022. The Impact on the Trade and Development in the War in Ukraine. Available online: unctad.org/system/files/official-document/osginf2022d1_en.pdf (accessed on 1 January 2024).

- Wang, Xiaoyang. 2022. Efficient market are more connected: An entropy-based analysis of the energy, industrial metal and financial markets. Energy Economics 111: 106067. [Google Scholar] [CrossRef]

- Wang, Yihan, Elie Bouri, Zeeshan Fareed, and Yuhui Dai. 2022. Geopolitical risk and the systemic risk in the commodity markets under the war in Ukraine. Finance Research Letters 49: 103066. [Google Scholar] [CrossRef]

- Wei, Wen H. 2009. On regression model selection for the data with correlated errors. Annals of the Institute of Statistical Mathematics 61: 291–308. [Google Scholar] [CrossRef]

- White, Halbert, Tae-Hwan Kim, and Simone Manganelli. 2015. VAR for VAR: Measuring tail dependence using multivariate regression quantile. Journal of Econometrics 187: 169–88. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).