1. Introduction

Each transaction should be based on underlying assets in the real sector under Islamic principles; any transaction traded in a malicious market, or the purchased item is not clear in terms of possession, including size and delivery, categorized as

riba and invalid in Islam. With the expansion of economics globally, derivative transactions are unavoidable in this modern era, where every agricultural transaction and other commodity involves a forward, option, swap, and future contract market. The derivative is a financial instrument where trade value is measured based on the underlying asset, such as commodity, currency, or security (

Somanathan and Nageswaran 2015). These types of transactions are not new to the Muslim community. The fact that for over centuries, Muslims have used transactions that can be seen resembles sales with immediate repurchase (

bai’ ‘inah), to buy on credit and sell at spot value (

bai’ tawaruq), future delivery (

salam), manufacturing finance (

istisna’), downpayment (

bai’ urbun), general or limited partnership (

mudarabah), join enterprise (

musyarakah) (

Saidu et al. 2018).

In statistics, the notional amount outstanding of OTC derivatives in Indonesia is USD 81 billion in 2019, which is too small to compare to the notional value of global outstanding derivatives in 2019 at USD 610 trillion, or only 0.20% (

Bank for International Settlements 2021a). There are several issues pertaining to the slow growth of Indonesian OTC derivatives, such as the lack of central clearing or central counterparty CCPs for OTC derivatives trading in Indonesia and there are uncertainties in the functioning of the current legal framework in bankruptcy that may hinder the introduction of efficient central clearing and margin requirements (

Bank for International Settlements 2021b). In terms of Islamic derivatives, more than 30% of Islamic banks do not use derivatives; this is due to the fact that Indonesian Islamic scholars limit the use of these instruments to only OTC foreign exchange (

Al Natoor 2020). However, there is an increased demand for Islamic hedging by Indonesian investors. This study thus aims to develop the Islamic derivatives transactions in the Indonesian OTC market.

The modern way of the transaction using derivatives could be seen from the 1970s when development in pricing methodology spurred spectacular growth, causing the derivative instrument to grow 100-fold over the past 30 years, and it’s developed rapidly over recent decades (

Bank for International Settlements 2012). However, derivatives have caused some important companies to collapse to some critics, such as Lehman Brothers and American International Group (AIG) 2008. There is also a critique described in (

Mariyani-Squire 2013, p. 10) which says that Islamic derivatives are not meant to assist local businesses, but rather tailored to facilitate wealth generation and meet the need of the economic elite. In derivatives, one party can transfer the risk to another party in the form of futures through the financial exchange, normally on an over-the-counter basis or in the case of swaps. Most of the derivative’s investors are pragmatic and driven by a profit motive; thus, the actual want and need are to gain a surplus out of fluctuating market prices (

Mariyani-Squire 2013, p. 11).

In the literature, the use of derivatives in Islamic finance has been the subject of various studies. Some highlighted how the derivatives interact with the global economic activity (

Bodnar et al. 2017), while in others, the empirical evidence on the importance of the financial derivatives to economic development (

Vo et al. 2019). Due to the non-genuine use of derivatives in Islamic finance, there are many users who commercially use these instruments to gain more money by taking the advantage of market price fluctuation in derivatives which is similar to gambling (

Kunhibava and Shanmugam 2010;

Rizvi et al. 2014). However,

Andreas (

2013) indicated that the existence of derivatives in Islamic finance can improve the risk management in Islamic finance and arise the investor’s confidentiality toward the Islamic market. Additionally,

Agha and Sabirzyanov (

2015) criticized that Islamic hedging should only be applicable to tolerable financial risk, as it could also lead to failure in the financial system rather than benefit if proceeded without proper investigation. Several studies have examined the core causes of the global financial crisis in 2008, and the economists believed that derivatives were the core cause of the 2008 Global Financial Crisis (GFC) (

Blundell-Wignall et al. 2008). However, the derivatives can still bring substantial economic benefits if managed and properly handled in a fair market (

Somanathan and Nageswaran 2015), such as preventing excessive risk-taking, improving market management, fostering financial innovation, and market development.

This paper will analyze the derivatives transactions in the OTC market in Indonesia from the sharia and conventional perspectives. In Indonesia, Islamic financial transactions are subject to sharia-compliant, which bans interest

(riba), and activities akin to gambling (maysir) such as short selling and excessive speculation. The profit should derive from risk-sharing in business rather than guaranteed return. Although to some extent, from Islamic jurisprudence (

fiqh mu’amalat) point of view, the derivatives are engaged in risk-shifting and are not readily accepted in Islamic principles due to their excessive speculation and conventional nature, the use of derivatives remains controversial. As Islamic financial industries continue to develop, questions have been raised regarding the limitation of using derivatives. Furthermore, there is a demand from Islamic finance to manage risks using the existing conventional derivatives (

Andreas 2013). For example, in Malaysia, the Islamic Scholars, Bank Muamalat Malaysia Berhad, and Bank Islam Berhad have agreed to use derivative transactions such as cross-currency swaps, profit rate swaps, total return swaps, and fund index-linked that are considered sharia-compliant (

Andreas 2013). Conversely, in Indonesia, the National Sharia Board of Indonesian Ulama Council still holds the use of derivatives, which causes a lack of competitiveness for Islamic products in the OTC market (

Jefriando 2016).

There are still limited studies conducted specifically in Indonesia on the Islamic derivatives in the OTC market. Therefore, this paper makes several contributions to the literature. First, this study extends the limited research on the understanding of Islamic derivatives and provides more effective sharia-compliant derivatives in the OTC market, based on the evidence of the legal cases between Indonesia and Malaysia. Second, the results of this study help provide better insight for researchers and regulators on how to develop the Islamic derivatives transaction in the OTC market in Indonesia. Finally, the approach used in this study is distinct from similar studies and the use of evidence of certain legal cases in Islamic derivatives may broaden this knowledge that can be used to build a flourishing financial system for future generations of Muslims, both in Indonesia and around the world.

2. Literature

There is no doubt there has been much research on the development of Islamic banking today. These inferred that the current world had seen the Islamic financial institutions as vital in the economy. This development also means the Islamic Financial Institutions (IFI) cannot be detached from the prevailing hedging instrument and risk diversification through derivatives. However, this wide range of hedging products for managing risks often clashes with legal issues related to sharia aspects, which often put the investors at a disadvantage (

Andreas 2013). In Indonesia, the NSB-ICU (National Sharia Board of Indonesian Council of Ulama) often states that their body will not approve the derivative instruments. The reason is based on their opinion that the current derivatives transactions contain the elements of gambling (

maysir) and uncertainty (

gharar) and are in conflict with Islamic principles (

Jefriando 2016). However, the NSB-ICU also calls for further enhancement of Islamic derivatives studies from several private sector initiatives and the Islamic international standard body, such as ISDA (International Swaps and Derivatives Association) and IIFM (International Islamic Financial Market), to enhance the application of Islamic derivatives and enhance their standardization.

Before looking into the argumentations of the sharia scholars on conventional derivative contracts and the sharia-compliant alternatives, knowledge of principles in Islamic financial transactions is needed as the basic in exploring this.

Presley and Sessions (

1994) found that there is a shift in knowledge in the West towards recognition of a new paradigm of Islamic economics. Since Islamic economics is a new paradigm, understanding the theoretical studies in Islamic finance is indeed highly efficacy before entering into the in-depth analysis. The objective of Islamic economics is taking benefit from lending money by adding a prohibition of taking interest (

riba) in all forms of lending money is not permissible in Islam. These apply to individuals or banks, either on saving accounts or financing. Instead, Islamic finance is based on profit–loss sharing and profit from business transactions (buying and selling) (

Nurhadi 2017). In an Islamic transaction, the buyer and the seller should come into a binding contract. The contract should be clear and have no hidden agenda and information (gharar) to avoid information asymmetry and deception. Therefore, the profit of a project in an Islamic contract is stochastic and depends on the state of nature.

Presley and Sessions (

1994) follow

Holmstrom and Weiss (

1985) in determining the model of Islamic contract, they assume that the outcome of a project depends upon managerial effort, e, the amount of capital investment,

I, and the state of nature, 0. The two states of nature are assumed: bad, denoted by

and good

. The function for project outcome is denoted as below:

Apart from

riba,

gharar (providing information asymmetric) is also prohibited in Islam, the transactions should not contain the element of highly speculative, and the characteristic of items to be sold should meet the Islamic tenet. A Muslim cannot sell commodities proscribed by Islamic law (

haram). For example, the upfront price determination of a commodity is not permissible if the seller does not own a product and does not know yet its exact size, space and price. Again,

Presley and Sessions (

1994) impose the following function for the incentive compatibility constraints:

where the constraints (10

a) and (10

b) simply ensure that the manager will report 0 =

when state

i occurs (

Presley and Sessions 1994, p. 591).

According to

Najeeb (

2014, p. 45), any commercial transactions can be considered valid (

shahih) in Islamic law if it is categorized as below:

Islamic law upholds the legality and the right to contract in the transaction (Ijab qobul). All parties in the transaction should agree to determine the price that should be fixed in the negotiation time. The price should be based on the agreed condition and not forcible or imbalance amongst the parties. The upfront price determination is allowed for future delivery, but the payment should be made at least 2 × 24 h from the on-the-spot agreement.

The characteristic of underlying assets and time of delivery should be cleared. This clarity is important to avoid dishonesty. It is also a means of moral commitment, where all types of goods proscribed in Islamic law are considered unethical. This includes the business that causes environmental degradation. The clarity of time delivery and good specifications is necessary to avoid exploitation against another party. The item sold should be able to be delivered and in existence or will exist, and the delivery could be estimated based on the previous deal. This clarity avoids ignorance (jahl), and no one party will feel deceived and disappointed.

The seller must have owned the goods. Selling an item that is not owned is prohibited in Islamic law. It is also applied to the leverage system in trading, where the trader has owned only a small capital of money in the market, but, in the leverage system, the trader can trade in the market with a larger amount of capital which he does not own, it is the broker’s money which is borrowed to the trader with interest and should be repaid upon maturity.

All contracts and instruments in Islamic transactions must be based on real transactions and not on assumptions. In this regard, any financial instrument should be able to represent an actual real transaction. Thus, the trading should be based on the underlying asset and ownership of assets so that the real transaction could prevail.

Derivatives transactions can occur both over-the-counter and on-the-counter of the stock exchange (

U.S. Securities and Exchange Commission 2000). Investors use derivative instruments to protect the risk from the fluctuation of interest, currency, effect, and commodities (

Syz 2008). Each market (either OTC or stock exchange) has different risks so the type of derivatives and the regulations are also diverse from another.

The stock exchange is the regulated form of market, where the producers, traders, and hedgers are transacting in the market to gain profit from the price fluctuations in supply and demand. If more people want to buy a stock, its market price will increase. Likewise, it will fall if more people try to sell a stock. Only the members who meet the requirements and standards are allowed to do the trading in the stock exchanges, and all transactions should be done through the brokerage, margin account, future, option, and warrant are facilitated (

Karim et al. 2014).

The derivatives transaction on the over-the-counter (OTC) is a commercial contract privately made between the two parties; both determine the value of the price based on the reference rate or index (

Rae 2008, p. 77). The products traded in the OTC market are normally based on the customers’ needs; both parties have the flexibility to decide the price, end of the agreement, and quantity of the commodity. The derivatives transaction occurred in OTC when the party decided to hedge the risks of price fluctuation, and the hedger can use forward, swap, option, and future. The OTC market has flexibility but is also a nightmare for the customers as it could be a disadvantage for them. In OTC, there is no transparency of price and possible complex requirements in the contract, which is often very costly for customers (

Garber et al. 1994). In fact, in most cases in Indonesia, the customers in the OTC market do not understand the contract’s content, which may cause deception and uncertainty (

Rae 2008, p. 78). Under the OTC market, it is hard to identify the nationality, membership, and type of products, unlike in the stock market, where the address, membership of traders, and products are specified. There is no physical meeting between dealers and customers, and all transactions are done through telephonic conversation or computer.

The dealers are often looking at the OTC market as speculation and gaining profit. When the demand at the OTC market is high, the dealers purchase more stocks in the stock market which cause the increased price in the stock exchange; the dealers then trade the stock using the derivatives at the OTC market to gain the differ as the demand is high (

Garber et al. 1994). According to

Redhead (

1996), these four derivatives instruments discussed below are commonly used in the OTC, which are forward contracts, futures contracts, options, and swaps:

Forward contracts are agreements between two parties (buyer and seller), where both commit to the transaction of a commodity at a future date, with the price set and negotiated today. The uniqueness of this transaction is that the seller sold the product to a willing buyer before it was produced. By deciding the price today, both parties agreed to face the risk of price fluctuation at a future date. However, each party has to be ready to face future losses because one will win at the expense of the other.

In the financial transaction, futures contracts are the standard agreement between two parties or more, where both commit to buy or sell the commodity at a future date and the set price. Both parties must complete the transaction at the final settlement date. A futures contract enhances a forward contract where the contract size, maturity, product quality, and place of delivery are standardized. The pricing of a forward contract is locked based on negotiation. Still, the price could be refined in the future contract, and fair price prevails in commodity futures or financial futures markets.

Options are one of the derivative instruments where the holder of this contract can have two options in the transactions: call options and put options. A call option gives the holder the right to buy the underlying asset at a predetermined price before maturity. A put option entitles the holder to the right to sell the underlying asset at a predetermined price before maturity. Under the option, the holder has the right but not the obligation to sell and buy based on the holder’s need, as the holder can exercise whether there is an advantage or not to sell or buy. This flexibility gives a key advantage for the option over future and forward contracts. The holder of the options pays for this privilege by paying the seller a non-refundable premium. So, the maximum loss for the option holder is limited to the amount paid for the premium if the holder chooses not to exercise the option.

Swap is necessary for companies dealing with international currencies and often face the risk of currency fluctuations and interest rates. A swap contract is an alternative technique to hedge a potential risk embedded in the currency rate and interest rate fluctuations. A swap is a derivative instrument where both parties agree to exchange the cash flows or liabilities from two different financial instruments. Most swaps are traded in the OTC market, which involves cash flows based on a notional principal amount.

Islamic scholars such as

Rizvi et al. (

2014) argue that the object of a transaction may not exist when a contract is signed, and there is an absence of predetermined object characteristics on the derivative. These cause the state-contingent pricing that leads to uncertainty (gharar) and excessive speculation (maysir) where there is possible exploitation of the ignorant. However, what if the object characteristic and the underlying asset are standardized and the market is controlled by the supervisor? These arguments may become invalid. Another type of transaction is the right but not obligation to buy and sell for the protection against downside risk via premium payments, where the buyer’s risk is limited to the cost of the premium of such an option cannot be categorized as excessive as risk is fixed to premium (

Andreas 2013). Again, the question was raised on how far uncertainty and excessive speculation could be reconciled in this matter.

Kunhibava and Shanmugam (

2010) criticize that the involvement of a derivative transaction in a non-existent asset or the asset is not in the seller’s possession is against the sharia and leads to the counterparty risk. However, the derivative does not resemble selling goods that are not in the seller’s possession.

Andreas (

2013) described derivatives supplement cash markets as alternatives to underlying trading assets by providing hedging instruments and low-cost arbitrage opportunities. The core reason for ulama to limit the use of derivatives lies in the excessive speculation in the derivatives market, where the holders use it to gain profit by looking into the possibility of future fluctuation in the short period.

Another argument presented against derivatives is pertaining to legal ownership because the derivative involves the unfunded or partially funded transaction, which means the asset is not fully paid and is not legally owned yet. Thus, there is no guarantee that the asset could be delivered and no certainty at a future date (

Usmani 1996). Although another scholar argues that the forward contract in the contemporary forms of futures trading may be akin to the forward contract during the prophet Muhammad, the risk arising from the practice of speculation and exploitation over another expense could be excessive in it and that there is a lack of physical ownership in the derivatives contract (

Khan 1997).

The deferment of asset delivery and the final payment in a futures contract has also raised another criticism by Islamic scholars. In the futures contract, the traders are allowed to lock in a price of the underlying asset or commodity, but the price could be re-fitted based on the market-to-market condition (

Rizvi et al. 2014). These contracts have expirations date and set prices that are known upfront. In the futures market, the investor benefited from leverage using the margin call, and the investor could gain a higher profit with a minimum of capital. The price determination in the futures is generally priced market to market (MTM), and the cash transaction is settled upon maturity (

Rizvi et al. 2014). This means in the future contract, each party will settle both the payment and the delivery in the future (

bay’ al-inah) (

Bhatti 2018, p. 155). This type of transaction is deemed non-compliant with sharia because the commodity cannot be exchanged between two parties for a future date if the price is different from the first commitment. The transaction cannot be made if both payment and delivery are delayed.

There is also a controversial issue in options in the OTC market, which has not been answered conclusively. Islamic scholars consider options a promise (

wa’ad) to buy and sell a thing at a specific price and specified period. This is because the holder of options has to pay an upfront non-refundable premium to obtain this access in the derivative transactions, which violates the sharia law, as the holder of the option may or may not use its right. The promiser is prohibited by sharia to charge a fee upfront in this matter (

Usmani 1996). Other scholars argue that options are primarily used for speculative gains and not genuine hedging, and thus it could be possibly a ground reason for excessive speculation and presumably gambling (

Bacha 1999).

In conclusion, the failure of asset ownership in the derivative transaction and no linkage of the transaction to the underlying asset seems against the principle of Islamic finance, which upholds risk-sharing and the delayed payment and delivery in the settlement period. Uncertainty in the contract has become the condition for Islamic scholars to consider derivatives as non-sharia-compliant instruments. However, there are several types of instruments akin to derivatives and regarded as accepted by the moral tenets of Islam. It could be the hope for Islamic derivatives instruments in future development.

4. Results and Discussion

In Indonesia, the OTC market is used by traders and buyers who do not wish to join the transaction at the stock market. Both buyers and traders are met at the OTC Market to negotiate the price of the underlying assets, (e.g., securities, stocks, currencies). Not all the stocks are listed on the stock exchange, and those unlisted stocks can be traded in the OTC market without restrictions. Some traders feel that they can boost their profit in the OTC market more than in the stock market. For some reason, the buyers who have less capital would be more enthusiastic about the OTC market due to the negotiability of the price of the portfolios, and the buyers and traders do not require to meet face to face at the OTC market. The transactions are normally either via phone or computerized system. The transaction system in the OTC market involves the charging of interest, hedging risks, and no standardization.

Bank for International Settlements (

2021b) reported that the Indonesia’s OTC derivatives market is relatively small compared to its economy but has had a steady growth over the past five years. The number of outstanding national OTC derivatives in Indonesia reached USD 81 billion in 2019 (0.7% of gross domestic products (GDP) and annual turnover reached USD 559 billion (51% of GDP). Turnover in IDR-denominated derivatives grew by an annual average of 13% between 2015 and 2019. OTC foreign exchange derivatives (Indonesia’s largest derivative class) accounted for 0.06% of the global trading volume in 2019, and turnover in IDR-based onshore foreign exchange derivatives grew by an annual average of 7% between 2015 and 2019.

Currently, there are three classes of derivatives traded in the OTC market: foreign exchange, commodity, and interest rate. Foreign exchange is the highest traded class conducted in OTC with the turnover reaching up to 97% in 2019 (see

Table 1). Commodity derivatives account for 2% of total turnover, and interest rate derivatives for 1% (

Bank for International Settlements 2021b).

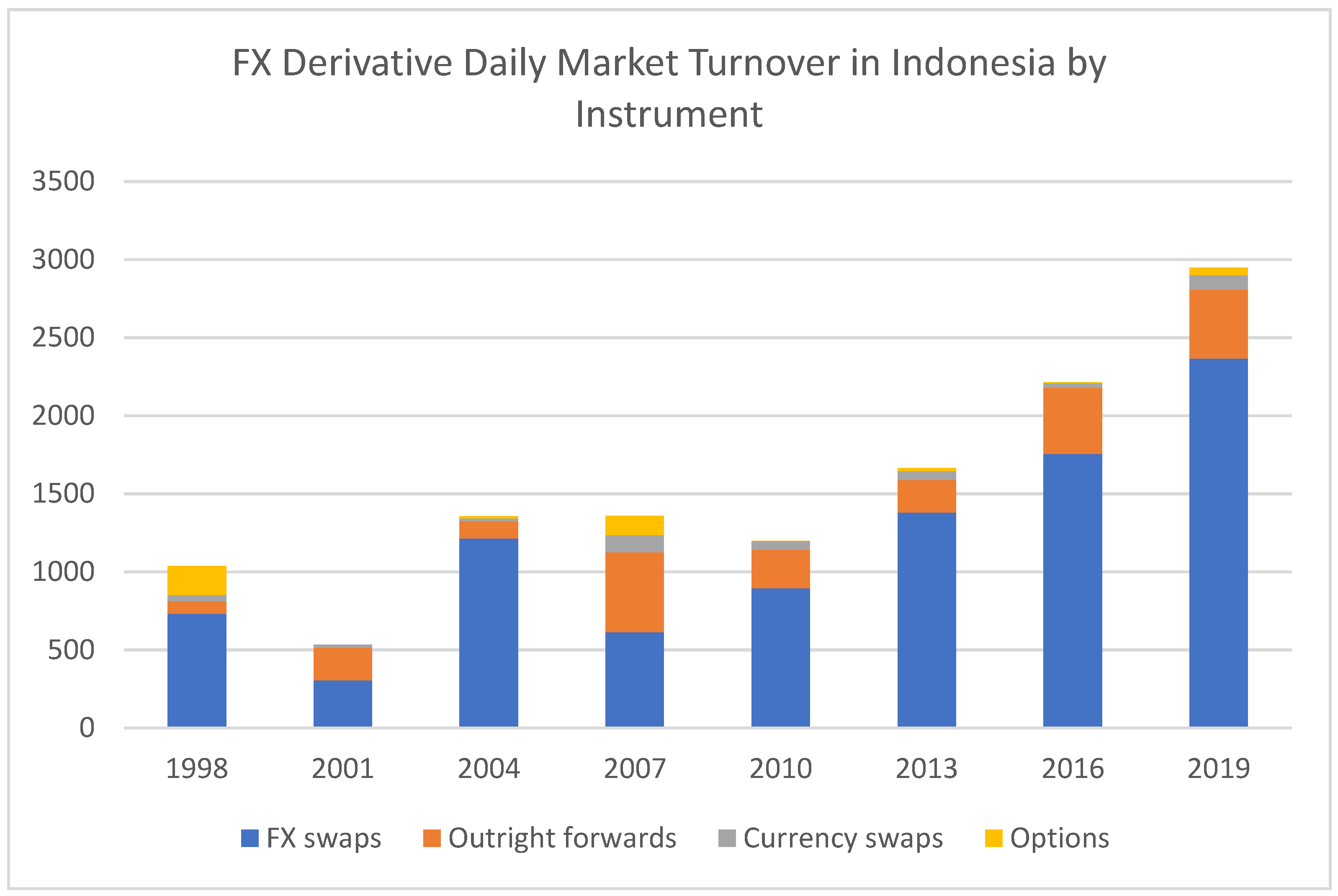

As of 1998 to 2019 the statistic shows that, the foreign exchange swaps make up the highest share in the OTC market in Indonesia, followed by foreign exchange forward (see

Figure 2). It is very clear that foreign exchange swaps are an important part of money market instrument in Indonesia.

Indonesia’s financial sector is dominated by banks that are only allowed to trade OTC foreign exchange and interest rate derivatives. The domestic banks including local foreign banks are the largest participants in OTC foreign exchange and interest rate derivatives which account for 52% market share in 2019, followed by foreign clients of 31% and the rest are the domestic non-bank clients of 17% (

Bank for International Settlements 2021b). Although there is a steady growth of derivatives trend in Indonesia, the use of derivatives in Islamic banks is smaller than their conventional rivals. However, the use of derivatives is still limited due to sharia-compliant reasons. More than 30% of Fitch-rated Islamic banks do not use derivatives. Most of the remaining 70% use it in a limited capacity, which is still considered a big constraint for Islamic finance development (

Al Natoor 2020). This limited use of derivatives by Islamic Financial Institutions is due to sharia-compliant reasons, where only OTC foreign exchange product is permissible by Islamic scholars. However, there is an increasing trend of Islamic hedging within the periods 2004–2019 from 56% to 68% (

Ismal 2022). The only remaining issues of sharia-compliant at OTC derivatives are the permissibility of using interest-bearing transactions in derivatives, the deferral of payments, legal ownership, and clarity of contract. The heterogeneity of scholastic opinion on the derivatives at OTC is largely motivated by the personal interpretations of the mechanism and structures of derivatives from their Islamic perspective.

The legal position of derivative transactions in Indonesia has been continually updated, and it can be seen from the Indonesian regulations that regulate the OTC market as follows:

Capital Market Law of the Republic of Indonesia No. 8 of 1995 concerning the Capital Market;

The Government Regulation of the Republic of Indonesia No. 45 of 1995 concerning the Capital Market Organization;

The Decision of the Chairman of Bapepam No. Kep.07/PM/2003 dated 20 February 2003 concerning Futures Contract on Security Index as Security;

The Bapepam Rules No. III. E. 1 dated 31 October 2003 concerning Futures Contract and Option on Securities or Securities Index;

Circular Letter from the Chairman of Bapepam No. SE-01/PM/2002 dated 25 February 2002 concerning Futures Contracts Index in the Net Adjusted Working Capital Report of Securities Company;

Approval Letter of Bapepam No. S-356/PM/2004 dated 18 February 2004 concerning the Agreement of Foreign Futures Contracts (DJIA & DJ Japan Titans 100).

Although the derivatives had been legally allowed by the Indonesian government at the Indonesian stock exchange, the fact that NSB does not permit the use of derivatives due to sharia-compliant issues. In Indonesia, banks are mostly used OTC in transacting financial derivatives. The non-existence of sharia-compliant derivatives caused this market to become less attractive for Muslim investors who felt against their religious beliefs, even though this tool is very powerful to boost economics, especially to attract foreign investors to hedge their risk (

Azmat et al. 2020).

The Indonesian Islamic scholars, through the NSB-IUC, had issued fatwa pertaining the hedging. Fatwa number: 96/DSN-MUI/IV/2015 on Islamic hedging on foreign currency/Transaksi lindung nilai syariah atas nilai tukar (al-tahawwuth al-islami). The purpose is to hedge the risk of currency fluctuation, but this hedging is limited to; 1. forward agreement, where both parties (buyer and seller) have to do the on-spot transaction, and on the settlement, the money should be delivered. 2. On the spot and forward agreement, where the payment should be made on the spot. 3. Islamic stock markets exchange where the first transaction is done in Indonesian and then foreign currency. These limitations opposed the conventional forward contract where either money or commodity can’t be settled upfront and must be settled at the settlement time.

Islamic scholars limit the use of forward transactions for genuine hedging and not for non-hedging purposes. This differing opinion on derivatives at the international level is one of the reasons for the NSB-IUC to issue a fatwa to limit the use of on-the-spot foreign exchange the over-the-counter within two days of settlement. The international transaction normally takes place for two working days to settle the payment process. Below are the derivatives instruments that are still debated by scholars and how the NSB-IUC of Indonesia responded to them.

4.1. Promise (Waad) in Commercial Dealings

Promise (Wa’ad) in Islamic financial transactions is not prescribed in the Qur’an and Sunnah, and therefore, it falls within the domain of the jurists to discover its binding nature. This triggers the differing views on the binding nature of wa’ad among the Muslim jurists. However, the Muslim jurists agree with their opinion on certain aspects: 1. A person must not agree to wa’ad for doing prohibited (haram) things, 2. Wa’ad can only be made to do permitted things based on Islamic principles. The controversies lay on whether wa’ad is morally and legally binding or not binding.

Wa’ad is the promise issued by one counterparty to another. In short, it is a unilateral promise. In contrast,

muwa’ad is a bilateral promise where two parties are at a mutual promise on the same subject with the intention to conclude a contract in the future. Many jurists believe that

wa’ad is not binding, but performing

wa’ad is a noble quality; thus, it is highly encouraging for the promisor to perform it for moral matters (

Qazi 2012). However, it is not binding and not mandatory, even not enforceable through the courts. According to this opinion, when a man makes a promise to his brother to fulfill it and does not come to accomplish it or not do so, he is guilty but does not sin (

Qazi 2012).

Other jurists opined that fulfilling promises are binding and obligatory for religious reasons, and thus failure to perform it is considered a sin (

Qazi 2012). According to this opinion,

wa’ad can be enforced through the court. Fulfilling the promise is considered a good character of Muslims, and the prophet PBUH always used to fulfill the promises. Thus,

wa’ad must be fulfilled, and failure to do it without any acceptable excuse is considered prohibited (

haram).According to the Fatwa of Islamic Fiqh Academy (IFA), Regulation No. 40–41 on the binding nature of promise and Murabaha transaction, a wa’ad is binding in the context of a cost-plus contract (murabahah), and the fulfillment is enforceable in a sharia court. Wa’ad is normally also used for mitigating risks associated with Islamic financial transactions. For example, wa’ad in murabahah, the borrower must enter into a promise with the bank that he must buy a specific property, and then a bank buys that property and sells it back to the borrower with added cost. Without wa’ad, the bank will be at risk if the borrower cancels to buy the property.

4.2. Forward Contract in Islamic Finance

Most Islamic scholars agree that a forward contract is valid if it is done at time zero, which means one part of the contract should be settled on the spot and the rest on a future date (

Rizvi et al. 2014). For example, the money is settled on the spot and the delivery of a commodity in a future period. This argument is based on the Islamic principle of deferred sale (

Salam) contract. However, a forward contract in derivative falls under the category where both money and delivery of a commodity are settled in the end, making this type of transaction impermissible.

Another opinion is that the forward contract could be similar to a commitment to buy and sell at a future date. Islam is referred to as

wa’ad (promise) and

muwa’ad (mutual promise). The major Islamic scholars and the Islamic Fiqh Academy prefer to use

wa’ad than

muwa’ad. The reason is

Muwa’ad can only be permissible when both agree to make a mutual promise which leads to a binding contract, and the transaction should be on the spot. Future sale is not allowed (

Rizvi et al. 2014) Others opined that a forward contract is permissible as long as there are no other prohibitions (such as excessive

gharar and speculations) (

Rizvi et al. 2014).

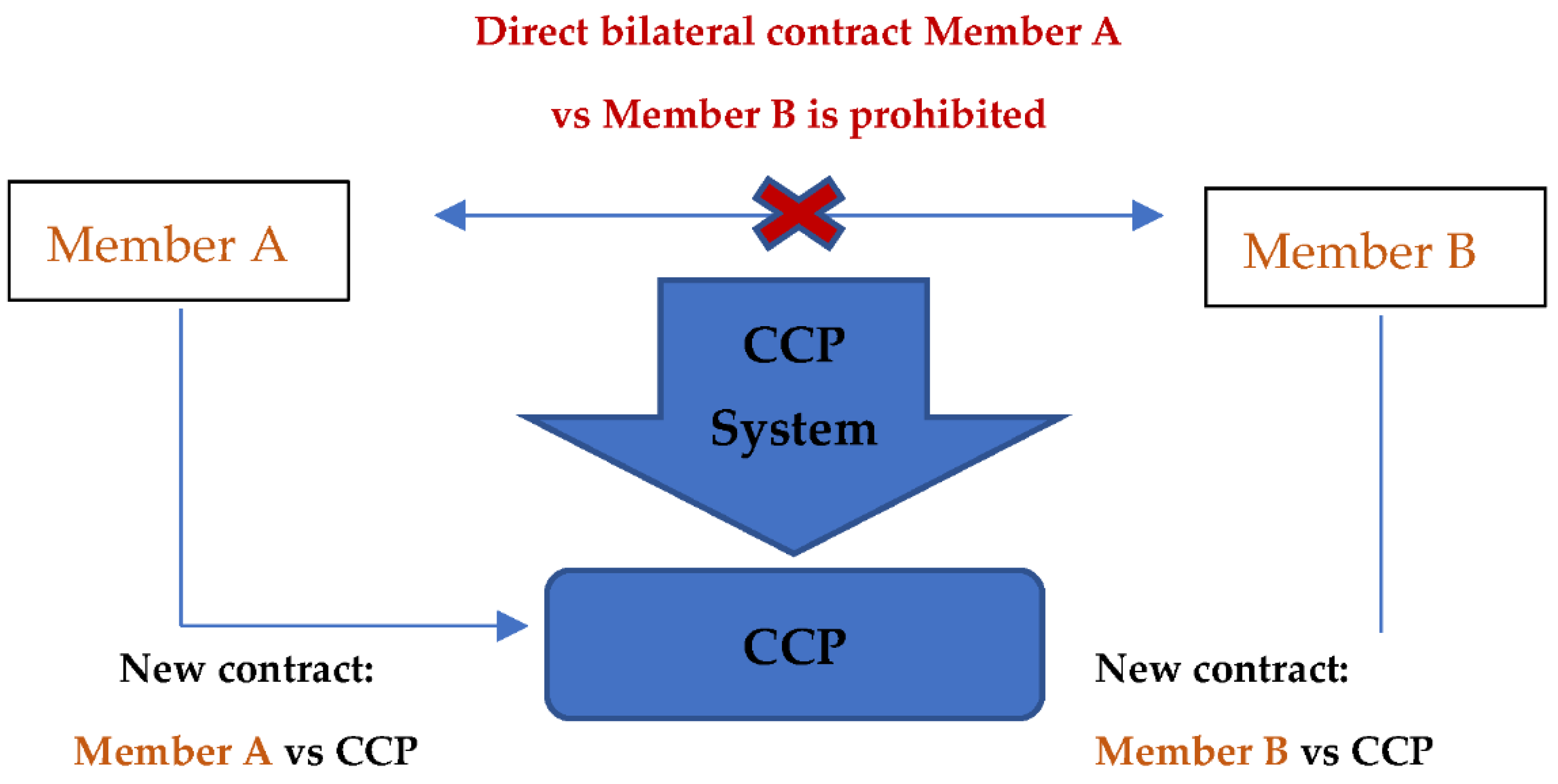

In short, scholars are mostly in controversies in a forward contract for non-hedging purposes. There should be supervision to avoid

gharar in the contract, as the forward contract in the OTC market lacks a centralized clearinghouse, which leads to a higher degree of default risk and

gharar (

Bhatti 2018). However, at present, according to the Regulation of Bank Indonesia Number: 21/11/PBI/2019 on Central Counterparties For Over-The-Counter Interest Rate and Exchange Rate Derivative Transactions, the Indonesian OTC market does not seem to be in lack of clearinghouse because it is regulated by government regulation concerning the Implementation of the Central Counterparty (CCP) for derivatives market to prevent the risk of failure in the transaction, the regulation will be effective from 1 June 2020. The aim is to prevent the credit risks faced by the seller and buyers and increase efficiency in the derivative transactions; CCP also acts as the third party who ensures transparency, efficiency, and that the payment is made between the parties (

Winosa 2019).

With the establishment of CCP, the forward contract at the OTC market cannot be said to lack clarity anymore (see

Figure 3). Thus, it opposed the above statements, which consider forward contract is

gharar.

All standardized OTC derivatives should be traded on exchanges or electronic trading platforms, and they should be cleared through CCP. All OTC derivatives should be reported to trade repositories. (See the graphic above). As the third party, the CCP is responsible for looking after the clarity of price negotiation and transparency to limit the possibility of information asymmetry. The CCP also ensures the settlement of both money and asset delivery.

4.3. Future Contract in Islamic Finance

Most Islamic scholars opined that the futures contract contains an element of uncertainty

gharar and excessive speculation

maisir (

Uddin and Ahmad 2020;

Usmani 1996;

Khan 1997). In a future contract, most of the transaction is not for genuine hedging; the hedger, in this case, only intended to earn a profit from the settlement of difference in prices, like some sort of gambling. Another reason for prohibiting this is that the volume of future contracts is a huge multiple of the actual underlying asset, which is against the actual amount of commodity available or pledged with the exchange (

Usmani 1996). This opinion is based on a hadith from Prophet Muhammad PBUH that a sale or purchase cannot be affected for a future date. In contrast, in a futures contract, the delivery of money and commodity will be done at a future date.

In Malaysia, the future derivative contract is approved by Sharia Advisory Council for the crude palm oil futures contract traded on Bursa Malaysia Derivatives. The investor and the businessman feel the necessity to use future contracts for crude palm oil commodities to manage and distribute risk. Still, its uses are limited to genuine hedging purposes, and speculation is prohibited (

Nordin et al. 2017). In Indonesia, futures contracts are limited to foreign exchange currency. The National Sharia Board of Indonesian Ulama Council approved using a futures contract for the necessity

(li al-hajah) purposes where the exchange of foreign currency is allowed to be delivered on a future date with a maximum of 3 days for the International transferring process (

Jefriando 2016).

However, Indonesian Islamic scholars are still in a debate on finding the alternative in the corridors of sharia permissibility for future contracts, some points for further acknowledgment can be discussed below.

When both seller and buyer are compromised for a future transaction to settle for both money and commodity delivery at a future date, both come into mutual benefit or interest where the seller agrees to deliver the commodity on a future date. The buyer agrees to pay money to the seller after the delivery, and thus the transaction is valid for the benefit (

maslahah) reason they enjoyed (

Rizvi et al. 2014, p. 186).

Maslahah is one of the important sources in the Islamic legal framework in considering the permissibility of Islamic transactions (

Ghani et al. 2011).

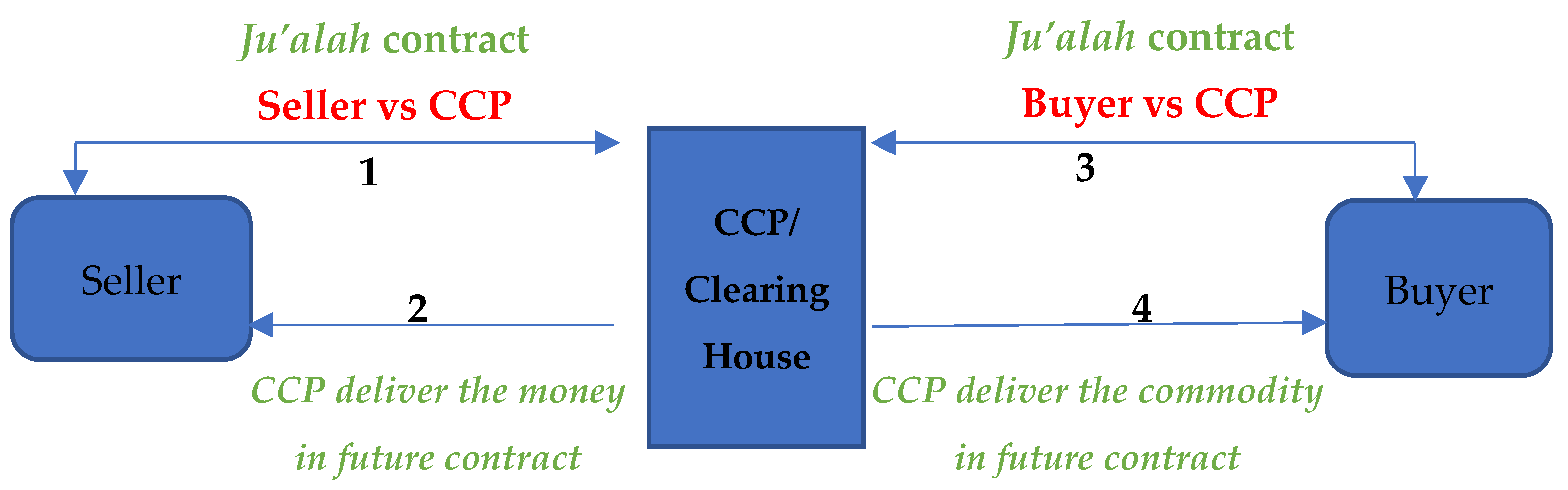

Another alternative is using the reward/commission (

ju’alah) based transaction. According to Fatwa of National Sharia Board

No. 62/DSN-MUI/XII/2007 concerning

Ju’alah, Ju’alah means a person is ready for compensation for a job that he asked to do (

National Sharia Board of Indonesian Ulama Council 2007). For example, if a person requests for who so ever able to stitch my worn old shoes, I will compensate him with USD 10. It is noticeable that this transaction is not based on selling but on compensation. Therefore, the value or amount of compensation should be clear (the amount can still be altered before the job is finished), and so do the job (

National Sharia Board of Indonesian Ulama Council 2007). The owner and the worker

(amil) can discontinue the

ju’alah akad before the job is finished because this contract is not binding (

National Sharia Board of Indonesian Ulama Council 2007). When the worker finishes their job, the owner must provide commensurate compensation.

Figure 4 shows that, in the Indonesian OTC market, the CCP acts as the agent for the clearing house; both the hedger who wants to minimize risk when selling a commodity and the hedger who want to hedge risk when buying a commodity have to negotiate through the CCP as the third party, here the CCP acts as the worker (

amil) for completing the request from buyer and seller. The contract

ju’alah is created between the CCP and buyer and the CCP and seller, where the buyer and the seller must give the compensation to CCP upon the completion of delivering the money and commodity in the future date.

Regarding the future contract, the

ju’alah contract can be used where the buyer (

ja’il) requests that if the seller can deliver the commodity at a determined time in the future, the buyer will provide compensation for this job (

Rizvi et al. 2014).

4.4. Option Contract in Islamic Finance

The practice of option can be categorized into two types; call option and put option. A call option is the right to buy an asset at the strike price and the agreed period and involves a buyer and a seller in the financial transaction. In comparison, the put option is the right to sell an asset at the strike price and the determined period. The hedger who requests for option contract must pay the premium fee, which must be paid in advance.

Some scholars resemble options with a down payment (

urburn) and promise

(wa’ad).

Urburn is a transaction where the buyer intends to buy the commodity by putting a down payment if the buyer proceeds with the transaction, the amount will be added to the price at the settlement, but if the buyer discontinues buying the transaction, the down payment fee will belong to the seller (

Rizvi et al. 2014). However, another scholar who rejects the use of urburn in the option practice opined that the conventional option contracts are independent and detached from the underlying asset. Therefore, the charging of premium by the seller is unjustified (

Rizvi et al. 2014). Because there is no legal ownership of the reference asset, which would guarantee the delivery of the contractual asset, in other words, the hedger of an option pays the premium not directly to the owner of the stock. Thus, it does not imply legal possession because the inherent leverage in options remains controversial.

Another scholar emphasized the exchange contract

(al-khiyar) as the alternative option (

Rizvi et al. 2014).

Al-khiyar refers to a legal contract based on the equity of the contract and transaction. The buyer uses

al-khiyar or the right of choice whether to buy or not buy a good based on certain circumstances, (e.g., quality, durability, price, etc.) that could benefit the buyer (

Rizvi et al. 2014). It is also aimed at reducing the possibility of

gharar in the transaction.

The only remaining issues in the option are the availability of leverage and owning the underlying stock using leverage. One option in the leverage system is equal to one hundred shares of the underlying stock while costing only a fraction of the price, making the price a bit cheaper to purchase than the actual stock. As a result, it gives a chance for the investor to make bigger gains using a small amount of capital to control a larger amount of share. It can be illustrated assuming an investor has USD 1000 and wants to invest in XYZ company shares. XYZ’s company share price is USD 50, while the strike price for call options asks for USD 2. In this scenario, the Investor could buy shares of XYZ company with all the money he has and own 20 shares, or the investor can buy five contracts of USD 50 strike call options on XYZ company shares which control 500 shares, with the same amount of money. Using options leverage, this investor can control 25 times more shares of XYZ company than buying shares in normal trading.

There are a lot of benefits taken from options for long-term investors to hedge their positions. However, non-genuine hedging traders take a lot of risk for high reward, using options to profit from the difference in market price. This kind of transaction has become a serious reason for Islamic scholars to prohibit options because it resembles elements of excessive speculation and the virtual amount of money in leverage. However, if the leverage system in an option is eliminated, there is still no alternative to the permissible derivative that provides a system of leverage in an option. Basically, it is not true to say that such options activity is considered bad at all, just because only a handful of people are doing non-genuine hedging for taking advantage of others. At the same time, some other people need options in protecting their business activities. Fitch rating says that the recent volatility in key Islamic finance markets caused by the coronavirus pandemic, oil price hikes, and cuts in central bank’s repo rates highlights the need to use effective sharia-compliant derivatives as hedging tools (

Al Natoor 2020). However, the use of derivatives is still limited due to sharia-compliant reasons. More than 30% of Fitch-rated Islamic banks do not use derivatives. Most of the remaining 70% use it in a limited capacity, which is still considered a big constraint for Islamic finance development (

Al Natoor 2020).

4.5. Swap Contract in Islamic Finance

The Islamic swap is based on the profit rate or fixed profit rate instead of the conventional interest rate. The basic structure of interest rate swap in conventional is a hedging arrangement with the aim to limit the possibility of losses of expected income due to interest rate movements. In a conventional interest rate swap, although the trade is linked to the value of an asset, it does not require ownership risk in the asset itself, and the profit is earned independently from the trading because each party does not exchange the cash (

Latif and Crawford 2010). While in Islamic finance, the swap is transacted via a cost-plus sale (

Murabahah) and deferred sale (

musawamah) structures. The first one is based on the cost-plus transaction, where the price is determined upfront and fixed. In contrast, the cost is not determined yet for the latter one and will only be executed at the settlement date (

Rizvi et al. 2014).

In Indonesia, the

National Sharia Board of the Indonesian Ulama Council (

2002) has declared

fatwa No. 28/DSN-MUI/III/2002 regarding the foreign exchange currency transaction. This

fatwa has prohibited future non-delivery trading or margin trading, and it also prohibits the transaction of currency using leverage. This fatwa allows the swap transaction based on the spot price and term and condition, where the currency should be traded based on the spot price and delivered within two days maximum. However, in Malaysia, the currency and profit rate swaps by Bank Islam and Bank Muamalat in Malaysia were successfully introduced as early as 2006 and showed promising results (

Andreas 2013). Even the International Swap and Derivative Association (ISDA) and the International Islamic Financial Market (IIFM), in cooperation with the International Capital Markets Association (ICMA), have signed a memorandum of understanding to develop a mater agreement protocol for Islamic derivatives, which then issued various Islamic compliance products including hedging (

tahawwut) Master Agreement on Swap Transactions which was introduced in March 2010. The Central Bank of Malaysia also legalized this product through binding market rules (

Bank Negara Malaysia 2010).

The calculation system between the Islamic profit-sharing swap and the conventional interest rate swap is quite similar because the Islamic one also uses the interest rate as the benchmark in the calculation. The only difference is that it should only be done within the corridor of Islamic principles of the transaction (

Rizvi et al. 2014), such as the clarity of initiation in

akad and the swap period.

Implementing Islamic swap in the OTC market could become more essential but also contested. Both parties could negotiate in the OTC market and negotiate about price and clarity of the delivery. The only remaining issues could be the potential of speculative use as this is not accepted in the tradition of Islamic finance and the clarity about the rationale of their restrictive use. As most banking practitioners are recruited from conventional bankers, there is a potential to misuse the Islamic swap in its application. Thus, it remains an issue for the clarity of how wide the Islamic swap standard will be used and what measures should be taken for risk management in the practice of Islamic swap.

5. Conclusions

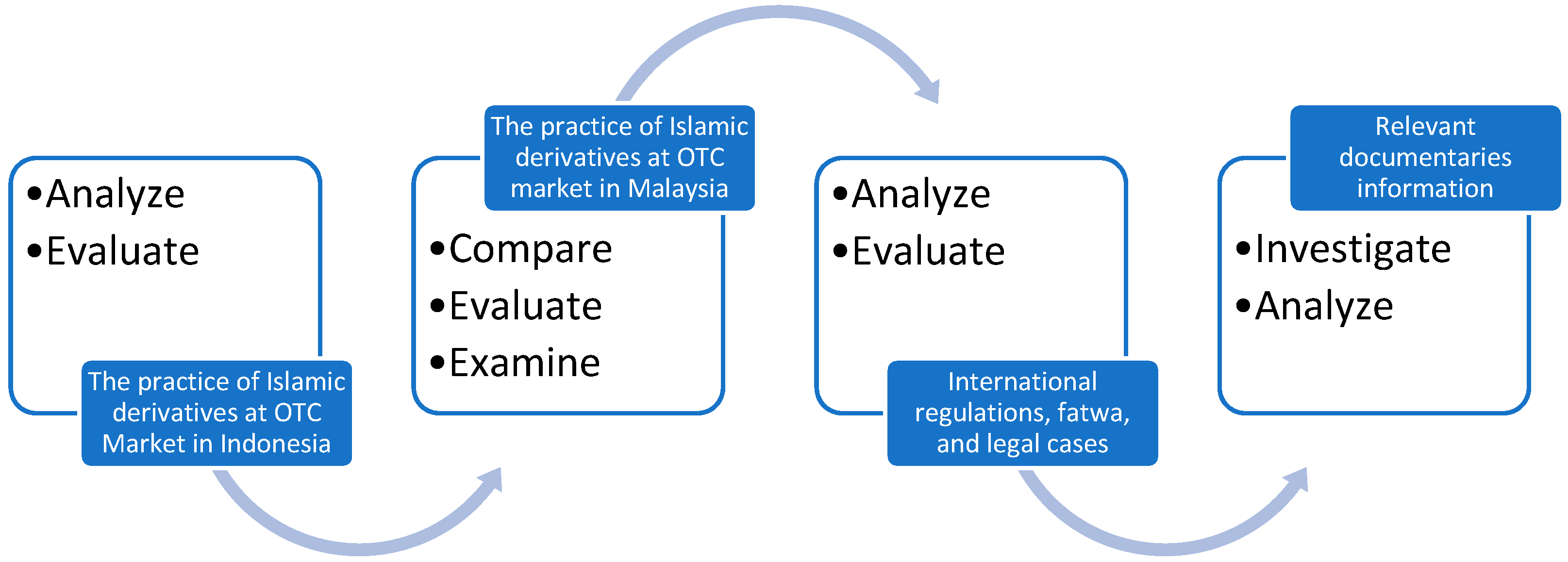

This study analyzed and examined the derivatives transactions in the OTC market in Indonesia from the sharia and conventional perspectives. It also examined and evaluated the relevant regulation and standard use of derivatives by IFI in Malaysia and Indonesia for comparative purposes.

The results confirm that the derivative instruments in the OTC market are essential for IFI to efficient risk management. However, the current practice of derivative instruments is very controversial. These include the potential of high speculation, the uncertainty of the payoffs, and the absence of underlying assets which are not accepted in the tradition of Islamic finance. By comparing the legal cases of Malaysia’s derivative application to Indonesia, the result shows that all kinds of Islamic derivatives instruments issued by ulama in Malaysia as well as in Indonesia should only be applied for risk management in financial transactions and not for speculation purposes. The hesitation of Islamic scholars over the use of derivatives, where the market players took an excessive risk and manipulated the accounting rules such as in the case of the conventional finance experience during the Global Financial Crisis in 2008 must have been answered by the launch of CCP to prevent the risk of failure and excessive speculation in the transaction. Due to this, Islamic scholars are suggesting that the investors consider the problem of misuse of the derivatives that could severely hit the risk management practice in Islamic finance as there are not fully developed.

This study also suggests that, rather than just copying the conventional instruments and prohibiting certain conventional instruments, the Indonesian Islamic financial industries should consider innovating their products using the sharia-compliant derivatives, such as murabahah and musawamah in the swap, al-khiyar in option, ju’alah in future contract, and wa’ad and muwa’ad in a forward contract. Indonesian Islamic scholars should consider the availability of these instruments further to develop the Islamic Financial Industries in the OTC market. The Indonesian scholars, through the NSB-ICU, still limit derivatives to only future and forward agreements in applying foreign exchange transactions. However, other types of derivatives are still impermissible. The release of fatwa by the ISDA/IIFM on tahawwuth (hedging) Master Agreement (TMA) and the success of modernizing Islamic banking in Malaysia should become a reference for derivatives development in Indonesia. Provided the operative principles of sharia derivatives transaction in the OTC market should be clearly articulated to ensure the consistency of application and how widely this instrument can be used.

Lack of comparative work in other jurisdictions is the limitation of this study, as it would further clarify the way in which the modern Islamic derivatives system is evolving across jurisdictions, especially in the countries where a dual banking system has also been adopted such as Malaysia and MENA regions. Future research on empirical studies and tests relating to the Islamic derivatives in the OTC market, such as the relationship between the risk indicators of Islamic hedging and the financial stability of the banking system may attract greater scholarly attention and will be imperative for visualizing the use of Islamic derivatives instruments in Islamic Financial Institutions.