1. Introduction

Multiple-Criteria Decision-Making (MCDM) is a subsection of operations research that assesses various conflicting criteria used to make decisions in disparate scenarios (

Gohari et al. 2022;

Nabeeh et al. 2019). Such decisions can relate to personal, business, scientific, or government policy. Before reaching a decision, analyzing all conflicting criteria is essential. For instance, in the business sector, managers must make decisions to increase their returns while reducing associated risks. Some types of investments promise high returns but pose a high risk of losses. Management decisions regarding investments are challenging (

Moradi et al. 2022). In today’s data-rich environment, an abundance of corporate and financial data permits unprecedented insights into the potential of investments. Given the volume of data, conflicting criteria, and demands for outstanding performance, evaluating investment choices encourages the use of extraordinary assistance in rendering decisions regarding investments. Readily available MCDM tools are well-suited to assist in selecting potential investments through the tools’ structuring of complex problems so that multiple criteria can be considered (

Papathanasiou and Ploskas 2018).

Several types of MCDM techniques work well in the financial sector. The tools include Technique for Order of Preference by Similarity to Ideal Solution (TOPSIS), Analytic Hierarchy Process (AHP), Decision-Making Trial and Evaluation Laboratory (DEMETAL), Best–Worst Method (BWM), VlseKriterijuska Optimizacija I Komoromisno Resenje (VIKOR), and Simple Additive Weighting (SAW). The most appropriate tool depends on whether the available data is highly qualitative or quantitative. While quantitative data is often preferred, qualitative data can be highly valuable in decision-support tools. Among MCDM techniques, BWM is highly prized and more efficient when compared to another popular approach, AHP (

Guo and Qi 2021).

While highly prized, financial forecasting is both a science and an art. The practice is fraught with challenges due to ever-changing world events, the complexities and vagaries of intertwined national economies, and bewildering swings in investor sentiment, all of which impact financial markets (

Wang et al. 2018). Many economic scholars and practitioners apply MCDM decision support tools to address complex financial problems that often lack a clear-cut, single optimal choice or solution. The value and uses of MCDM tools to assist in selecting competing viable solutions are multifold. First, MCDM tools are presently the best means to identify the optimal solution or alternative among available choices (

Aouni et al. 2018). Second, MCDM tools effectively and efficiently assist in selecting a small group of highly favored options from many alternatives. The third valuable feature of MCDM tools is their efficiency in narrowing choices to the most viable options.

1.1. Impetus for the Study

The use of MCDM techniques in the financial sector, particularly in analyses of global stock markets, is pervasive due to the method’s capabilities to determine the best alternative when conflicting criteria exist (

Ferreira et al. 2019). Selecting the most viable securities from the array of stocks represented in stock markets is a fundamental and critical aspect of investing. Investors use financial ratios found in financial statements to assist in choosing stocks. However, multiple financial ratios exist and require consideration. MCDM is particularly well-suited for such complexity. A review of the scholarly literature yields many studies that have employed various MCDM techniques for financial sector topics.

MCDM techniques are represented by dozens of tools, each dedicated to one of two assessment types: criteria assessment or alternatives assessment. The scope of MCDM tools ranges from those with general applicability to highly specialized products embedded in decision-making software.

This paper integrates the use of two well-known general-purpose MCDM techniques, the Best–Worst Method (BWM) to assist in the weight of the criteria and Ranking Alternatives by Perimeter Similarity (RAPS) to assist in ranking the stock companies (alternatives). A literature review verifies that researchers have yet to use these methods to enhance decision analysis in the financial sector. Throughout this paper, BWM–RAPS identifies the integrated use of these techniques.

Jafar Rezaei introduced BWM in 2015 to increase the consistency of criteria weights in MCDM methods when using robust mathematical programming to derive optimal outcomes in a decision-making problem (

Yazdi et al. 2019). RAPS, on the other hand, was only recently introduced. It quickly earned a reputation as a credible and powerful logic tool incorporating a valid MCDM approach (

Bafail et al. 2022;

Urošević et al. 2021).

As noted, such an integrated approach (BWM–RAPS) does not appear in the literature, let alone in evaluating the most favorable equities to include in a long-term investment portfolio. To test the applicability of this MCDM technique, the authors chose the Saudi Arabian stock market, which is the largest in the Middle East and is on an expansion trajectory. In addition, the literature review demonstrated a paucity of studies using an integrated approach to ranking stocks in the Saudi stock market using MCDM techniques.

1.2. Assets Allocation Process Used in This Study

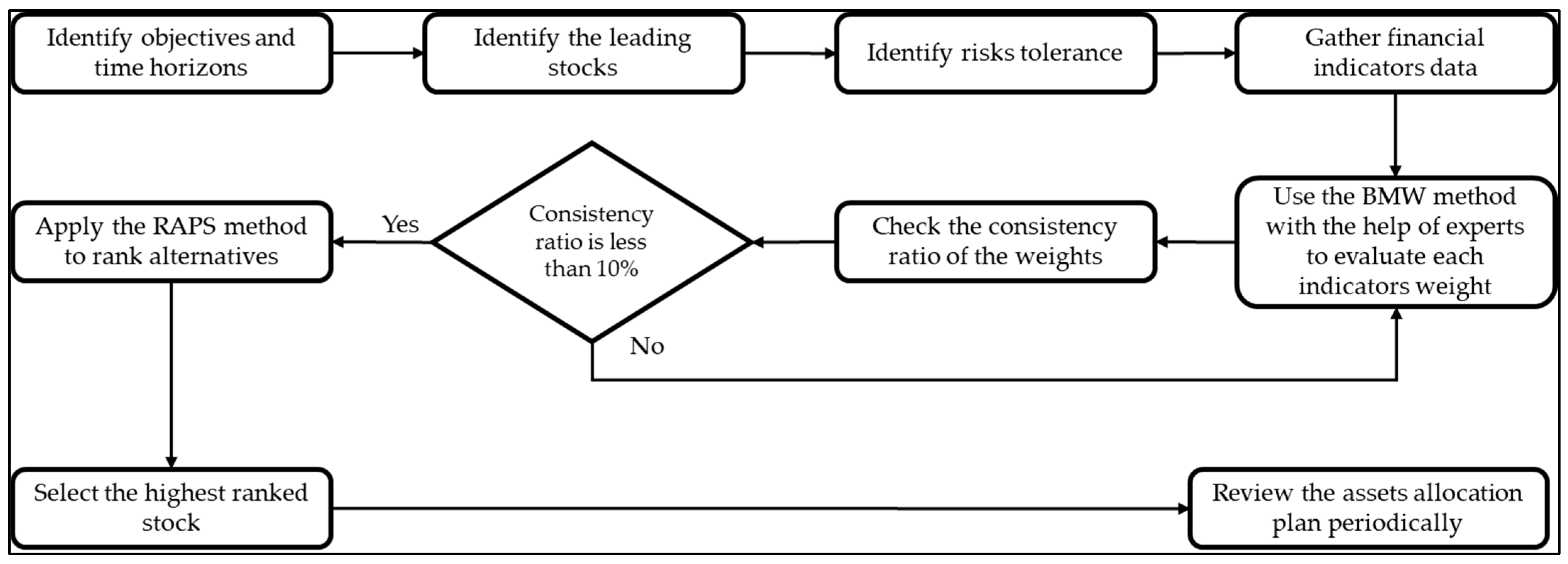

Asset allocation is an investment strategy that aims to diversify investments by distributing them across various options to balance risk and reward according to an individual’s goals, risk tolerance, and investment horizon. The main advantage of diversification is to help mitigate investment portfolios from the market’s volatility of a single stock. It is not a one-time decision. Therefore, the asset allocation plan should be revisited periodically to check if it is still meeting the goals. Determining the stock to invest in is not an easy step. Therefore, integrating the assets allocation process with the proposed MCDM model will help investors to invest in top-performing stocks. The first step in the asset allocation process is to identify objectives and time horizons. Investors’ goals might be to have economic growth, periodical dividends, or both. The time horizon indicates the total period of time that the funds will be invested. The second step is to identify the leading stocks. Leading stocks are the stocks that are growing fast and performing well in the stock market with a superior status in their sector, scope, market share, and competitive advantages. The third step is identifying risk tolerance. Risk tolerance is the degree of risk that an investor is willing to endure, given the volatility in the value of an investment. Several factors affect investors’ risk tolerance, such as stock volatility, market swings, economic or political events, and regulatory or interest rate changes. An investor may also want to review historical records for different assets to determine their volatility. The fourth step is collecting financial indicators data, such as valuation, liquidity, and other indicators, to measure financial performance. A company’s financial performance tells investors about its general well-being. These indicators measure many different factors that influence how markets move. They usually rely on past data that can be used to make predictions on future movements or trends. The fifth step is applying the BWM–RAPS model proposed in this paper. The paper applies the BWM to calculate the weight of each criterion involved in the study and RAPS to rank the alternatives using the weights derived from the BWM technique. Five financial experts participated in evaluating the criteria. The sixth step is selecting the highest-ranked stocks. The final output of the BWM–RAPS model is a set of alternatives sorted according to their finical performance in the proposed model. The final step is reviewing the assets allocation plan periodically. Since the stock market is volatile and the financial indicators fluctuate daily, the asset allocation plan should be reviewed in order to adapt to the changes.

Figure 1 below shows a complete roadmap of the steps of the asset allocation process used in this paper.

1.3. Investment and the Saudi Arabian Stock Market

Investment in the stock market ranks as one of the best opportunities for individuals to increase their assets without directly owning companies. The purchase of stock is accessible to both low and high-income earners. However, stock selection requires a thorough analysis and understanding of many criteria to determine a preferred investment for a specific portfolio. Although conditions and data resources may differ, the same complex analysis applies to investment decisions whether a stock is traded on the New York Stock Exchange or in the Saudi stock market.

“TADAWL” is the only stock market certified to conduct securities exchange in Saudi Arabia (

Aljifri 2020). TADAWL began as an informal financial market in 1954 but became the official national securities exchange market in 2007 and today trades securities of international and local companies (

Sharif 2019). From its modest origins, TADAWL listed 203 publicly traded companies by December 2020 and held a market capitalization of SAR 8.23 trillion (USD

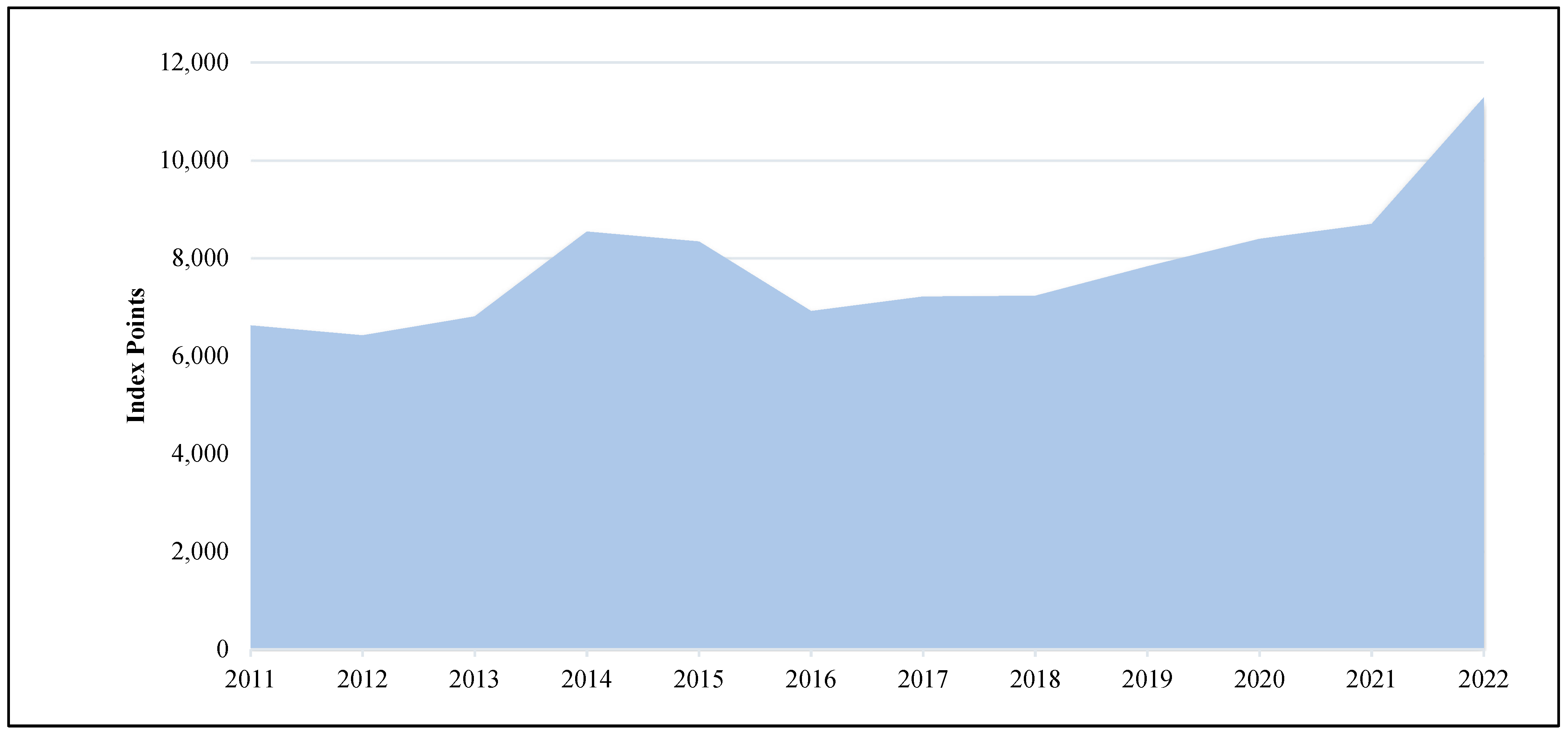

$2.22 trillion) on its primary index, Tadawul All Share (TASI). TASI’s market index has increased over the past ten years from 6620 in 2011 to 11,280.35 in 2022 (see

Figure 2) (

Saudi Exchange 2022).

Following the recognition of TADAWL as the authorized Saudi company for official share registration in 1980, TADAWL became a joint stock company when it assumed its role as the sole Saudi official securities exchange in 2007. This development and the emergence of the Saudi Capital Markets Authority (CMA) resulted in a formalization and expansion of the Saudi stock market. CMA is a regulatory body with extensive powers to control and manage all facets of Saudi Arabia’s securities market (

Sharif 2019).

With more than 200 companies listed on the TADAWL exchange, the question of where to invest funds for the best long-term returns can be challenging. Standard advice suggests selecting companies from different financial sectors to provide a balanced long-term investment. However, individual stocks’ performance may conflict with other salient selection factors in such decisions (

Smith et al. 2016). An investor must evaluate stocks from various companies using multiple criteria (

Kartal 2020;

Pätäri et al. 2018). Selecting stocks for investment represents a multi-criteria decision-making problem (

Gupta et al. 2021) that is highly suitable for evaluating and ranking investment alternatives. A panel of five experts participated in evaluating the criteria. It is worth noting that this paper neither recommends any stock or sector in which to invest nor to avoid.

1.4. Structure of the Study

The remainder of the paper is structured as follows:

Section 2 presents the background and an overview of important financial indicators in investment.

Section 3 reviews previous studies that used different MCDM techniques in the financial sector.

Section 4 describes the step-by-step methodological use and interactions of the BWM and RAPS techniques.

Section 5 depicts the case study’s numerical phases and the decision-making process inherent in the application methodologies. The discussion section of the paper presents the study’s findings. Recommendations, as well as conclusions, constitute the last section.

2. Background and Overview of Investment Financial Indicators

Decisions in finance are complex, usually multidimensional, and require the application of appropriate models to provide effective solutions (

Govindan and Jepsen 2016;

Kabašinskas et al. 2019). Numerous long-practiced ways to make investment decisions compound inherent difficulties in investment selection. In the stock market, investors tend to diversify their investment selections to reduce risks, such as investing in portfolio investments or ETFs. According to Modern Portfolio Theory (MPT), the performance of an individual stock is not as important as the overall performance of an investor’s portfolio (

Harry 1952). The MPT is a mechanism that risk-averse investors can use to build diversified portfolios that optimize returns while maintaining acceptable levels of risk. The MPT can be valuable for investors attempting to build efficient and diverse portfolios utilizing ETFs. One of the most fundamental influences on individuals to invest in the stock market is confidence, which is one of the principles related to behavioral finance (

Hirshleifer 2015). Combining confidence with little knowledge may result in poor performance (

Meier 2018). They may result in little stock selection diversity due to a tendency to invest too much in what one is familiar with (

Kapoor and Prosad 2017). Moreover, they compel investors to shift their beliefs more frequently, giving them more reasons to trade and, as a result, higher turnover, which harms their performance (

Hoffmann and Post 2016;

Fu et al. 2015).

While numerous factors contribute to investor confidence, one of the most compelling is a company’s performance as measured by financial indicators (

Tey et al. 2019). One critical financial indicator is Earnings Per Share (EPS). When an investor buys a stock, that investor participates in the company’s future earnings or losses. EPS measures a company’s profitability based on the growth or decline of its earnings. An investor can use this measure to assess a firm’s worth, a factor in investing in a given company. EPS information is readily available in a company’s financial reports and economic analyses. If a company’s EPS is zero or negative, the company’s value is declining. A higher EPS indicates growing company value (

Mohammed et al. 2014;

Jordan et al. 2007).

Another critical financial indicator for stock market investors is the Price/Earnings (P/E) ratio, calculated by dividing the company’s stock price by the firm’s earnings per share. Speculators use a valuation ratio to determine how much worth they will get for the money they are paying for a stock. Profitable companies with ordinary or below-average growth potential have lower P/E ratios than companies that are likely to develop rapidly (

Pu 2000;

Dayag and Trinidad 2019).

A crucial financial indicator is the Return on Equity (ROE) ratio. ROE, or a firm’s earnings on its investors’ money, is one of the most crucial statistics to observe when investing in stocks. ROE measures a company’s ability to transform money into a higher value for its stockholders. This indicator is determined by dividing a firm’s net income by its shareholder equity. Generally, the higher ROE of a company reflects a more robust business (

Peterse and Schoeman 2008;

Noor and Rosyid 2018).

The debt-to-capital ratio is important to investors who wish to know about a company’s funding. The debt-to-capital ratio sums up short- and long-term debt and divides it by the firm’s total capital. This ratio provides a practical way to examine the firm’s finances before investment. The greater the debt-to-equity ratio, the more leveraged a corporation is. Debt-to-capital ratios of more than 40% require further investigation to ensure that the firm can handle its debt. The nature of funding that a business chooses is highly variable. More volatile companies should use less debt financing to minimize defaults during recessions when earnings and profits are lower. When an investor determines this ratio, they understand it to be an indicator of the level of investment risk (

Madiha and Rehman 2016;

Muhammad et al. 2013).

The stock dividend yield is another financial indicator that deserves consideration when investigating investments. Dividend yield refers to a ratio that illustrates the dividend a company pays every year based on the price of its shares. This statistic is a ratio of the dividends paid to the share price. When all other factors are constant, the dividend can indicate how much cash flow the investor can expect upon investing their money in the shares of a given company. The current ratio measures the liquidity of a company. In other words, it determines the ability of the company to pay its short-term debt. Moreover, it shows how a company can enhance its current assets to satisfy its obligations (

Jiang and Lee 2007;

Filbeck and Visscher 1997).

Financial indicators related to stock evaluation are numerous.

Table 1 illustrates each financial indicator involved in this study. Additional indicators include:

The Price-to-Book ratio (P/B) compares a share’s market value to its book value, derived by dividing a company’s stock price by its book value. The market value is the share price on the stock market. The book value represents all of a company’s assets minus any liabilities—generally, the lower P/B of a company, the better the investment value (

Jordan et al. 2011;

Roberto et al. 2020).

Asset turnover is the ratio of total revenues relative to the company’s assets. This metric assists in determining how effective the company is in applying its assets to generate revenues (

Johan 2019;

Huang and Liu 2019).

The mean percentage is an indicator that calculates the average percentage change of a stock’s price over a specific period. Moreover, beta measures the systematic risk of a stock by how volatile it is relative to the market’s volatility. If the beta is greater than 1, the stock is considered more volatile than the overall market (

Zhaunerchyk et al. 2020).

Standard deviation measures how far a company’s stock price deviates from its average price. A small standard deviation indicates low volatility because of the narrow range between its price and average price value (

Mihail et al. 2021;

Li et al. 2020).

3. Review of MCDM Use in Financial Sector Studies

Decision-making methodologies and techniques have undergone many advancements since the early 1960s. Today, many different MCDM approaches are available. The various techniques are effective in different scenarios. None is perfect, and few can be considered the best in every situation (

Kolios et al. 2016). As a result, using alternative multi-criteria methods may result in different decision outcomes and recommendations. Thus, the application of MCDM methodologies in many areas attracted scholars’ attention, especially in the financial sector. The uses of MCDM techniques in finance date back to the 1990s when

Mareschal and Mertens (

1992) used PROMETHEE to rank different banking institutions based on their performances. Over the years, numerous researchers have applied MCDM to examine stock markets due to their high volatility, uncertainty, and diversity of factors influencing investment decisions. These previous studies used various MCDM techniques to elaborate on the factors that affect the success of organizations and investors in the stock market. One such study was by

Gómez-Navarro et al. (

2017), who evaluated the market worth of firms based on their financial and social responsibility.

Gómez-Navarro et al.’s (

2017) research deployed AHP and goal programming to improve the calculations of companies’ values. The technique took into account the firm’s investment guidelines of social obligation.

Rahiminezhad

Galankashi et al. (

2020) used a fuzzy-ANP (Analytic Network Process) approach to identify these different factors. The issue of how best to select securities to construct an investment portfolio has undergone extensive research. However, most studies have focused on revenue and risk relating to primary decision-making variables. To close a possible gap between evaluating the primary and lesser variables, Rahiminezhad

Galankashi et al. (

2020) conducted a literature analysis to extract the primary factors used in stock selection in other studies and ranked them by influence. Based on 10 Tehran stock exchange portfolios, Rahiminezhad

Galankashi et al. (

2020) ranked the criteria using a fuzzy-ANP set theory and found that market, profit, expansion, and risk proved to be the most critical factors in successful portfolio selection.

Makui and Mohammadi (

2019) argued that the star additive utility method was more effective as it helped analyze stock selection’s behavioral aspects. Since financial decision-making comprised a foundational financial market activity, scholars undertook extraordinary research efforts to develop enhanced techniques for assessing and analyzing stocks.

Makui and Mohammadi’s (

2019) research sought to isolate the utility function of an investor in selecting stocks.

Narang et al. (

2022) used a successful MCDM technique, Combined Compromise Solution (CoCoSo). The goal was to select stocks that would yield the highest returns with minimal risk. According to

Narang et al. (

2022), the methodology presented a selection of equities for evaluation despite uncertainty and a lack of quantitative data.

According to

Kumaran (

2021), initial public offering (IPO) investments are increasingly challenging to evaluate due to the ambiguous information and contradictory criteria that an investor must examine throughout the decision-making process. The principal objective of

Kumaran’s (

2021) research was to use MCDM techniques to enhance the efficiency of financial decision-making and the value of the choices that arose. Kumaran’s paper carefully assessed the effectiveness of IPO firms listed on the Saudi stock exchange using financial reporting and value-based financial metrics.

Kumaran (

2021) scored the stocks using the objective weighting methodology, Criteria Importance Through Inter-criteria Correlation (CRITIC), combined with the MCDM technique, VIKOR (ViseKriterijumska Optimizacija I Kompromisno Resenje), a multi-criteria optimization and compromise solution.

Mehregan et al. (

2019) evaluated existing approaches used in stock portfolio selection. The analysis recognized the inherent difficulties investors faced in making these decisions, given that no single technique worked in all situations. The author compared ELECTRE-TRI and FlowSort approaches, which were among the most well-known. However, despite their popularity in decision-making, these approaches provided different outcomes when used in the same case. The researchers used different methods for both ELECTRE–TRI and FlowSort techniques to compare them in various aspects. However, the conclusion remained that no particular approach was more favorable than the other.

Pattnaik et al. (

2021) analyzed the insurance industry and its place in the global economy. According to scholars, managers must develop and apply better methods to understand how to attain organizational goals in today’s complicated and changing world. As a result, an evaluation methodology for an organization’s success is necessary. This article employed a mixture of multi-criteria decision-making procedures to analyze the performance of insurance businesses on the Tehran Stock Exchange. In addition, the study identified liquidity as the most relevant factor in assessing the efficiency of insurance businesses on the Tehran Stock Exchange (

Özdemir et al. 2020). After setting relative weights of selected financial ratios, the authors gathered financial data from the companies’ respective financial statements and computed each financial ratio. The authors found that organizations were graded based on financial success using the Prometheus approach.

Lombardi

Netto et al. (

2021) applied MCDM techniques to assist in resolving complex problems related to selecting the most appropriate “green” bonds to invest in a rapidly growing market. The researchers used a combination of MCDM techniques to analyze potential investments in support of specific climate-related or environmentally sensitive projects, including AHP (Analytic Hierarchy Process), COPRAS (Complex Proportional Assessment), and SWARA (Stepwise Weight Assessment Ratio Analysis).

Gupta et al. (

2021) examined sectoral indices of India’s national benchmark index (Nifty) of that country’s stocks using MCDM techniques to rank them and provide a holistic overview of their performance.

Türegün (

2022) applied VIKOR and TOPSIS to analyze tourism companies’ stocks traded in Istanbul’s capital market.

Kocadağlı and Keskin (

2015) used a fuzzy portfolio selection approach to identify portfolio returns, better coefficients, and risk in stock investing.

Lamata et al. (

2018) applied the Fuzzy-AHP-TOPSIS approach to analyze firms’ corporate social responsibility (CSR) activities to determine the criteria most desirable in guiding investment decisions. The term CSR is a comprehensive set of policies, procedures, and programs that are incorporated into business operations to address issues such as business ethics, community investment, environmental concerns, governance, human rights, and marketplace competition. In other words, CSR may be defined as efforts that go above and beyond the minimal legal requirements to benefit the welfare of its stakeholders. These actions will boost the company’s credibility, public image, reputation, and trust. Customers are attracted to brands and enterprises that have a high reputation in CSR-related concerns. Moreover, CSR would promote a company’s reputation in the marketplace by increasing its ability to acquire finance and trading partners. Companies with adequate CSR are also less likely to have negative rare events. Companies that follow CSR principles are more transparent and have less risk of financial issues. Research studies have found strong associations between a CSR index and financial performance indicators such as ROA in the following year (

Waddock and Graves 1997;

Barauskaite and Streimikiene 2021). Moreover, a study found that 61% of investors consider CSR as an indicator of ethical corporate behavior, which lowers investment risk (

Chastity 2020).

Petrillo et al. (

2016) used AHP to inform mutual fund investors regarding firms’ corporate social responsibility activities and support their investment decisions in such stocks.

Bilbao-Terol et al. (

2016) applied goal programming with fuzzy hierarchies as a guide to determine feasible investment opportunities when faced with two criteria types: sustainability and financial performance.

Majumdar et al. (

2021) applied value-based multi-criteria decision analysis and value averaging to identify the best stock in the Indian investment market based on India’s market capitalization and performance. More recently,

Baydaş et al. (

2022) analyzed 10 MCDM methods to determine the best performer in producing higher returns.

Mehregan et al. (

2019) applied ELECTRE-TRI in share portfolio selections.

Vuković et al. (

2020) compared modern portfolio and MCDM techniques in examining share selection in Croatian capital markets.

Hatami-Marbini and Kangi (

2017) applied fuzzy MCDM techniques to select undervalued stocks.

Song and Peng (

2019) used an MCDM TOPSIS technique to classify three imbalanced classifiers to forecast risk and bankruptcy.

No study of portfolio stock selection using MCDM methods has mentioned using BWM and RAPS in an integrated manner. BWM is a robust MCDM technique that requires fewer steps to calculate selection criteria weights compared to such other MCDM techniques as AHP. On the other hand, RAPS, one of the most recent MCDM techniques, has quickly earned widespread application and acceptance. This paper uses BWM–RAPS in evaluating and ranking different stocks in the banking sector of the Saudi stock market. Various well-known techniques will serve as a baseline to assess the results of introducing the MWM–RAPS novel technique.

4. Step-by-Step Using the Combined MCDM Model

The MCDM approach integrates alternative performance measures into conflicting options and seeks feasible solutions (

Marqués et al. 2020). MCDM involves assessing several available choices for complex situations in areas as diverse as medicine, social sciences, technology, and engineering.

This paper integrates MCDM techniques, BWM and RAPS. The BWM assists in identifying the weights of each criterion involved in this study. RAPS assists in ranking the alternatives using weights derived from the BWM technique.

BWM can evaluate data in a structured manner requiring less input than comparable methods (

Van de Kaa et al. 2019), such as those offered by the AHP technique. Researchers have used the BWM technique in various sectors and fields (

Khan et al. 2022). It helps assess alternatives to existing criteria and determine the relevance of criteria used to find a solution to address a problem’s primary objective(s). BWM involves fewer data points and pairwise comparisons in contrast to other MCDM techniques and is recognized primarily by its reference pairwise comparison (

Liu et al. 2020;

Youssef 2020). The most significant advantage of BWM is that it significantly improves data consistency even though it is considered a subjective method (

Fan et al. 2020). As a relatively new technique, RAPS’ methodological strength is to help overcome noted critical shortcomings of earlier MCDM tools.

4.1. Best-Worst Method (BWM)

As indicated earlier, this paper uses BWM to calculate the weight of each criterion involved in the study. According to

Rezaei (

2015), the steps should be as follows:

Step 1. Determine the evaluations criteria set {C1, C2, Cn} by the decision-makers.

Step 2. Select the best (e.g., the most important or influential) and the worst (e.g., the least important or influential) criteria determined by decision-makers.

Step 3. Find the preferences of the best criterion using a number from {1, 2, 3, ..., 9}. The obtained Best-to-Others vector is: = () where represents the preference of the most important or influential criterion , over criterion , j = 1, …, n.

Step 4. Find the preferences of all criteria over the least important or influential criterion using a number from {1, 2, 3, ..., 9}. The obtained Others-to-Worst vector is: = (), where represents the preference for criterion over the worst criterion , j = 1, …, n.

Step 5. Calculate the weights (

) using the following model:

Step 6. Check the consistency ratio using the steps presented in the 2015 Rezaei paper (

Rezaei 2015). When the consistency ratio is near 0, it means there is more consistency in the evaluation matrix. The consistency values near 1 means there is less consistency in the evaluation matrix (

Çelikbilek et al. 2022;

Rezaei 2015).

4.2. Ranking Alternatives by Perimeter Similarity (RAPS)

Step 1. The input data is normalized, which is necessary to convert from a multidimensional into a nondimensional decision space. Equation (2) serves to perform normalization for max criteria and uses the min criteria Equation (3) to perform normalization:

where:

is the decision-making matrix of m alternatives and n criteria, i = 1, …, m and j = 1, …, n.

is the maximization criteria set.

is the minimization criteria set.

Step 2. The normalization process leads to the normalized decision matrix as shown in Equation (4):

Step 3. Weighted normalization. For each normalized assessment

, weighted normalization in Equation (5) is used. The result value of the normalized weight is the weighted normalized matrix, and its shown in Equation (6).

Step 4. Determine the optimal alternative by identifying each element of the optimal alternative using Equation (7), which results in the optimal alternative set in Equation (8).

Step 5. Decomposition of the optimal alternative implies the process of arriving at two subsets or components. Set Q is the union of the two subsets, as shown in Equation (9). If k represents the total number of criteria to maximize, then

h =

n −

k represents the total number of criteria to be minimized. The optimal alternative results in Equation (10).

Step 6. The decomposition of the alternative is similar to the procedure in step 5. Equations (11) and (12) demonstrate the decomposition of each alternative.

Step 7. This step is related to the magnitude of the component required to calculate each component of the optimal alternative. Thus, calculate the magnitude using Equations (13) and (14) and for each alternative using Equations (15) and (16).

Step 8. Ranking the Alternatives by Perimeter Similarity (RAPS). The right-angle triangle perimeter represents the optimal alternative perimeter. Components

and

are the base and perpendicular sides of this triangle, respectively, as expressed in Equation (17). Equation (18) calculated each alternative. Equation (19) represents the ratio between the perimeter of each alternative and the optimal alternative. Arrange and rank alternatives according to the descending order of

values of each alternative.

6. Discussion

As one of the best-performing sectors in the Saudi stock market over the past five years, the ten companies (see

Table 8) that comprise the fast-growing banking sector are attractive to investors. Conducting an in-depth market evaluation to assess and rank the value of its component investments required a rigorous analysis based on numerous criteria.

Extracts from earlier relevant studies supplied the criteria used in this analysis. Five experts reviewed the weights assigned in the study. As shown in

Table 6, profitability and market criteria were deemed the most critical and weighted at 31%. Valuation, liquidity, and other indicators were 18%, 12.5%, and 6%, respectively.

This study evaluated 13 criteria for the Saudi stock market, which has never been discussed in the literature using the BWM method. Moreover, in this study, the consistency ratios have been checked to make sure the evaluation matrix is consistent together. Using the weights derived from the BWM method as input to the RAPS technique, the RAPS technique placed ALRAJHI Bank in the top ranking. Based on their financial performance, ALINMA Bank and ALBILAD Bank were the two top alternatives.

Return on equity was one of the most heavily weighted criteria for profitability. By the end of 2021, ALRAJHI Bank was one of the best banks when evaluating equity, with a return of 22.6%. By contrast, SAB ranked last with a return of 6.1% on assets. In addition, ALRAHHI Bank’s return on assets was measured at 2.6% at the end of 2021, outdistancing all other banks. SAIB had the lowest return on assets, with 1.1%.

At 32%, RIBL held the most liquid assets of all the banks examined, followed by SAIB, 19%; BSFR, 18%; SNB, 18%; and ANB, 16%. ALRAJHI Bank and ALIN.

MA Bank had the fewest liquid assets, only 12%.

ALRAJHI Bank was the leader in earnings per share among the banks, with 3.69%. SNB, BSFR, and RIBL followed with 3.69%, 2.99%, 2.87%, and 2.01% earnings per share, respectively. Asset turnover among the banks was similar.

All other criteria weightings were distributed among other indicators, as illustrated in

Table 6. To assist in assessing conflicting criteria, the authors deployed the RAPS technique to rank the listed banks using weights derived from BWM. As a result, ALRAJHI Bank emerged as top-ranked, followed by ALINMA Bank, BJAZ, and SNB. In contrast, SAB was at the bottom of the list.

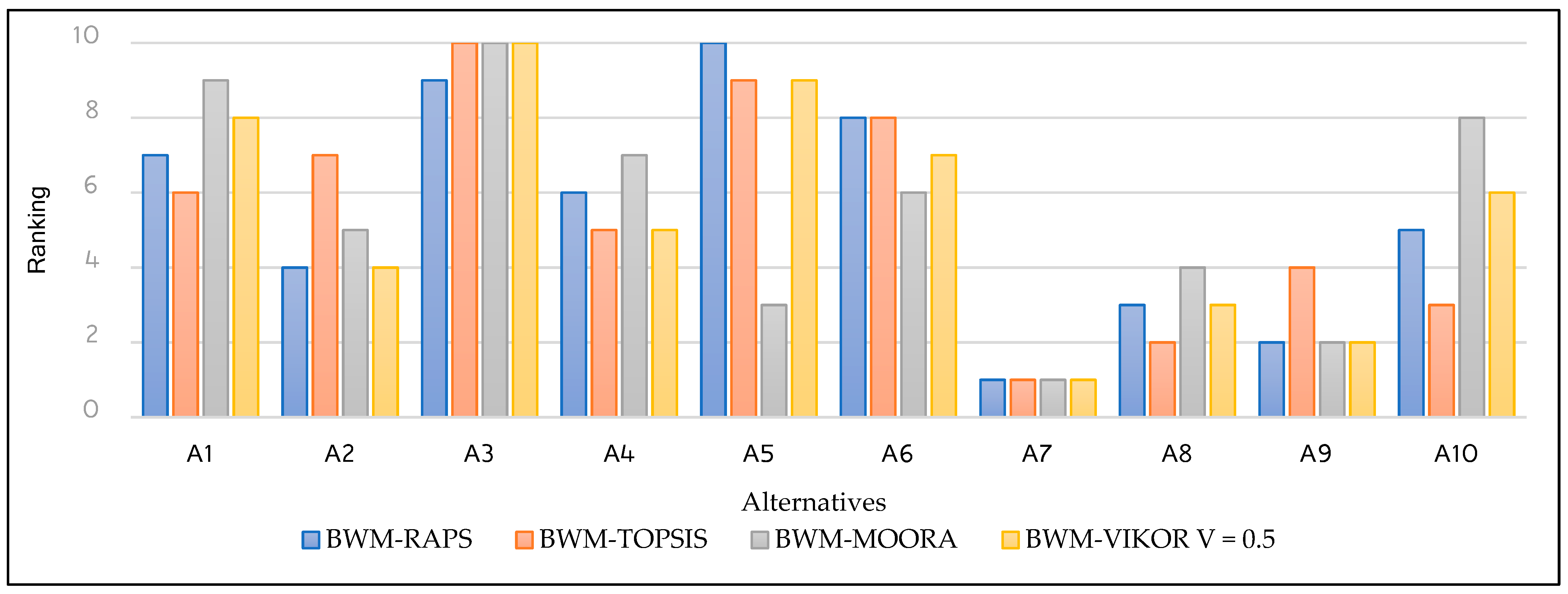

7. Comparative Analysis of Different MCDM Methods

Numerous MCDM methods are presently available, each with advantages and disadvantages. This study used the BWM method over other criteria assessment methods because of its strengths in arranging the criteria’s importance and its embedded test for evaluation consistency. On the other hand, BWM is more subjective than other criteria assessment methods, offering a means to quantify emotions and produce numerical judgments.

The study chose to use the RAPS method over the other assessment methods due to its logical procedure, justification, generalization, validity, and credibility. While RAPS is widely considered a robust method, it is procedurally highly complex.

Given the many available methodologies encompassed by MCDM, comparing this study’s results with other MCDM methods is appropriate. Not surprisingly, different MCDM techniques derived a slightly different order in the resultant rankings. Still, the combined BWM-RAPS methods used in this study were comparable to the results of other well-known MCDM methods, including TOPSIS, MOORA, and VIKOR. The outcome of the comparison is available in

Table 9 and

Figure 3. All tested MCDM methods examined found ALRAJHI as the highest-ranking bank. The differences emerged largely between A8 and A9. Such core commonality reinforces the viability of the combined techniques used in this study and makes a case for continued examination of MCDM techniques for continuous improvement.

8. Conclusions and Recommendations

Over the long term, most financial experts agree that stock market investing presents one of the best opportunities to increase assets for both low and high-income people. However, such investing requires careful analysis and sophisticated decision-making to assemble a preferred investment portfolio. MCDM techniques offer valuable tools to rank the best investment methods and, more specifically, classify and rank companies traded in stock markets. MCDM techniques have been widely used in the financial field during the past decade due to their ability to reach an optimal solution despite conflicting criteria.

This paper used a combined technique of BWM and RAPS to rank banks listed on the Saudi Arabian stock exchange. The criteria used to select the best investments among these companies’ stocks reflected reports of criteria importance from authors of earlier studies. Thus, the weights were calculated with the help of experts, and the most important weight ratios were asset turnover at 18.7%, current ratio at 12.5%, EPS at 9.6%, ROA at 9.3%, Dept-to Capital at 6.4%, and net profit margin at 6.2%, respectively. The remaining weights were distributed among other criteria involved in this study.

The examination found that the clear top-ranking banking stock for investment was the ALRAJHI Bank, based mainly on its stellar financial performance. ALINMA Bank and ALBILAD Bank were also deemed potential high-performing investments within the banking sector of the Saudi stock market. More importantly, as a study evaluating the performance of MCDM decision support techniques, the results of using the combined techniques of BWM and RAPS were highly encouraging and deserve further investigation as to their appropriateness for broader use in Saudi finance and perhaps for similar applications in other nations.