3.1. The Catalyst for Subnational Interest: Rising Challenges to Globalization in the Pre-Pandemic Era

The public health crisis caused by the COVID-19 pandemic has been an external shock to the world economy. In the short run, it caused an unprecedented drop in demand and income due to the lockdowns and stay-at-home orders, which further led to a mix of accommodative monetary policies and automatic fiscal stabilizers in many countries. In the long run, the ongoing COVID-19 crisis is likely causing supply chain disruptions that call for more sustained and coordinated monetary and fiscal policies, as well as efforts to promote the movement of goods, services, and investments across borders (

UNCTAD 2020a). Therefore, it is important to examine international trade and FDI situations in the year prior to the outbreak of COVID-19, which serve as benchmarks to reveal the short-run effects of the pandemic in its first year.

The year 2019 witnessed rising risks in the globalization process. On one hand, the number of trade disputes between the U.S. and its major trading partners have soared. These disputes are persistent. According to a CRS report, as of January 2022, the U.S. has been involved either as a complainant or a respondent in a total of 280 trade disputes addressed through the WTO (

Congressional Research Service 2022). In 2019 alone, 54 developments in which the U.S. was a party were entered into the WTO dispute settlement system (

The U.S. International Trade Commission 2019). The U.S. also initiated or responded in 14 cases of trade disputes in 2019 with its NAFTA/ USMCA partners and six of these cases remain active as of December 2020 (

The U.S. International Trade Commission 2020a). As a consequence of the tensions with trading partners, U.S. merchandise exports to the world and imports from the world dropped for the first time since 2016 by 1.2 percent and 1.6 percent compared to 2018, respectively (

The U.S. International Trade Commission 2020a).

On the other hand, the global-wide movements of financial resources across borders, as measured by the FDI inflows, continued to decline since 2015. The global FDI flows totaled

$1.39 trillion in 2019, marking a one percent decrease from

$1.41 trillion in 2018 and the fourth consecutive annual decline. There were country-by-country variations, but the general trend of FDI growth remained sluggish. This is mainly because the FDI flows to developed economies decreased by 6 percent to a record low level of

$643 billion, and FDI flows to developing countries did not grow in 2019. Moreover, both the announced greenfield projects and the cross-border Mergers and Acquisitions (M&As) projects, an indicator of future FDI trends, dropped by 22 percent and 40 percent from the previous year, respectively (

UNCTAD 2020b).

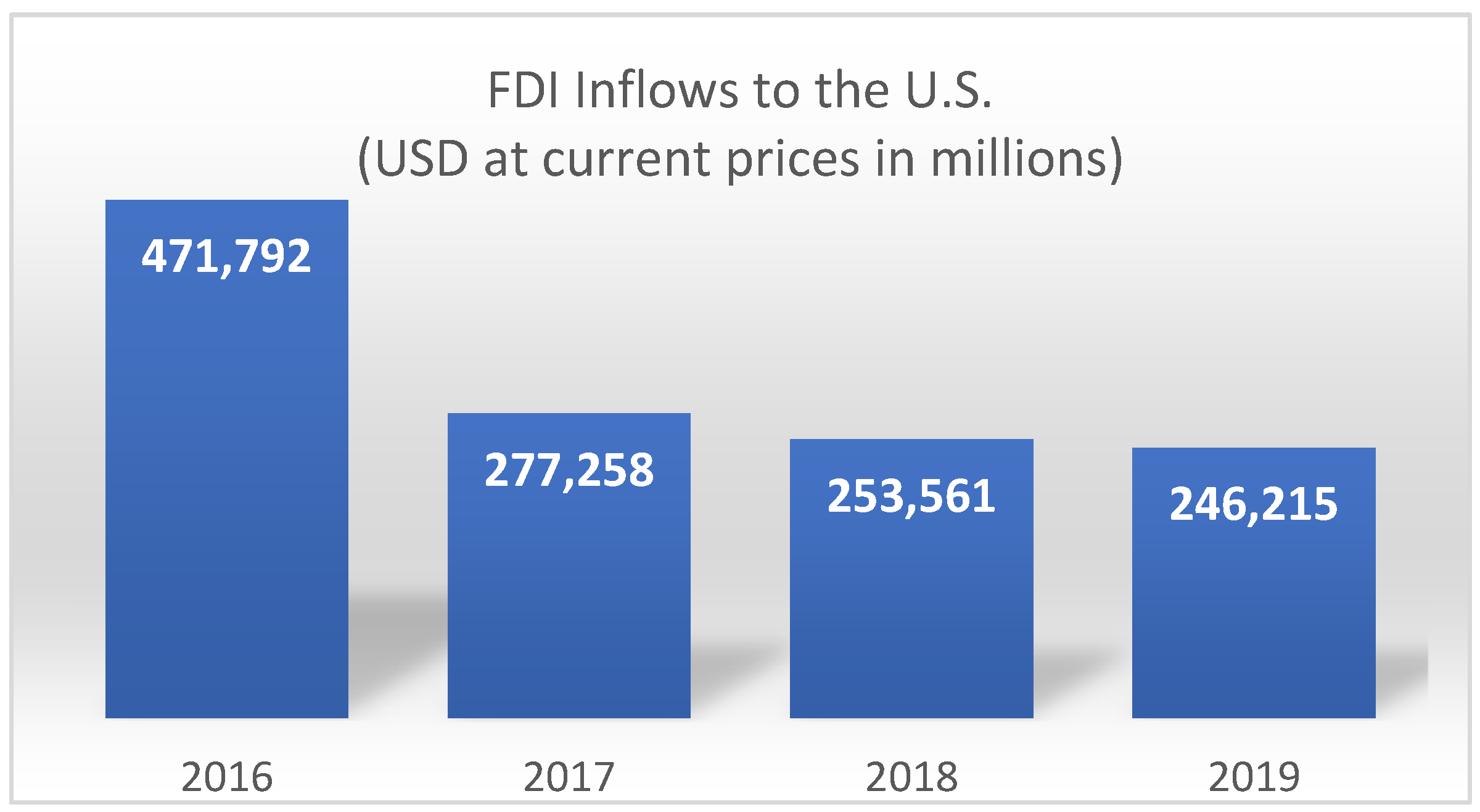

3.1.1. Pre-Pandemic FDI Outcomes in the U.S.: Decreased Overall Inflows but International Ties Remained Strong

Although the U.S. continued to be the world’s largest recipient of FDI flows in 2019, the FDI inflows here dropped by 2.9 percent from the 2018 value to

$246.2 billion in 2019, leading the runner-up China by

$105 billion. As shown in

Figure 1, this was the fourth consecutive annual decline.

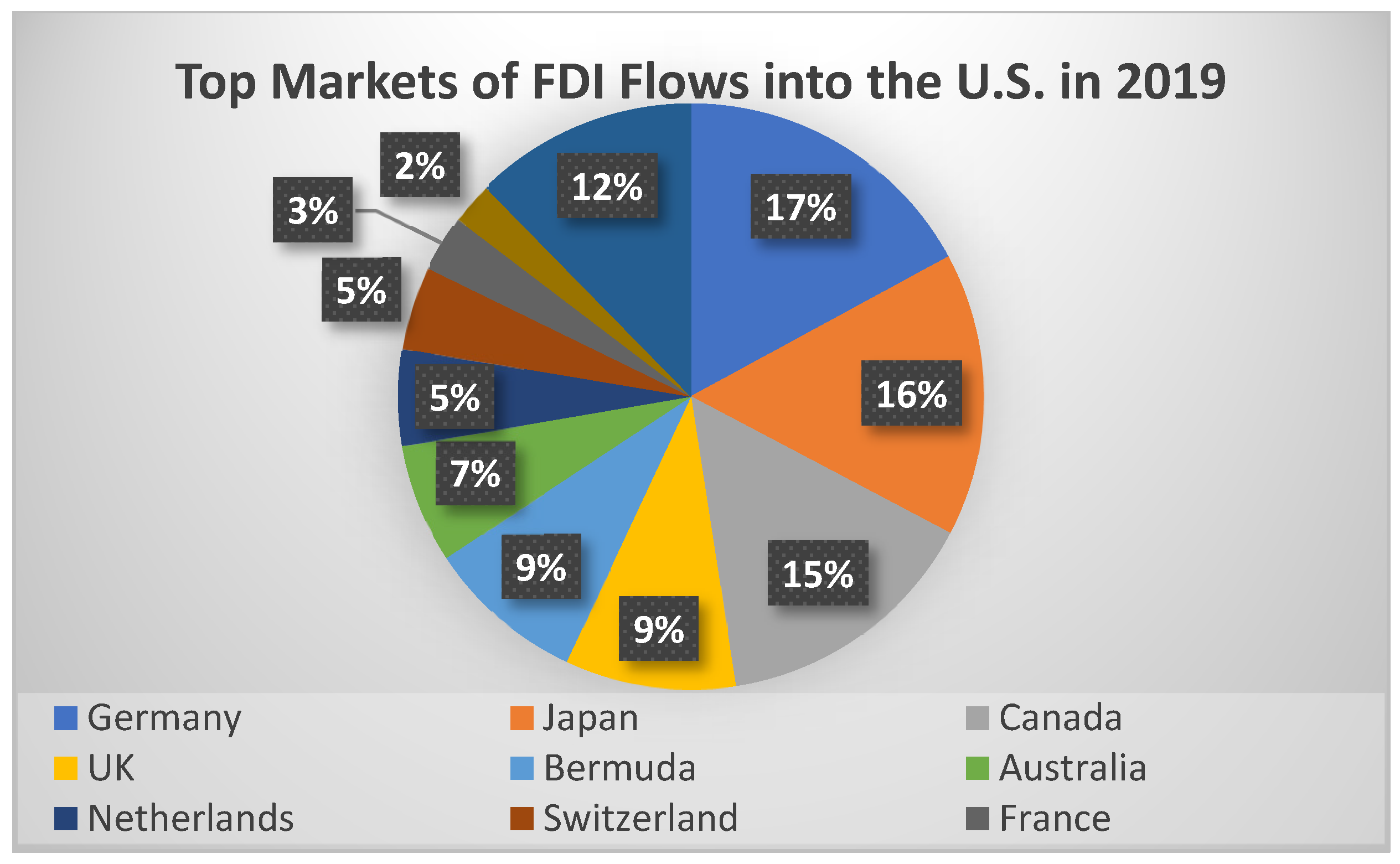

Figure 2 illustrates the top sources of FDI flows into the U.S. in 2019. Two-thirds of the inflows came from five markets, namely Germany (17%), Japan (16%), Canada (15%), the United Kingdom (9%) and Bermuda (9%).

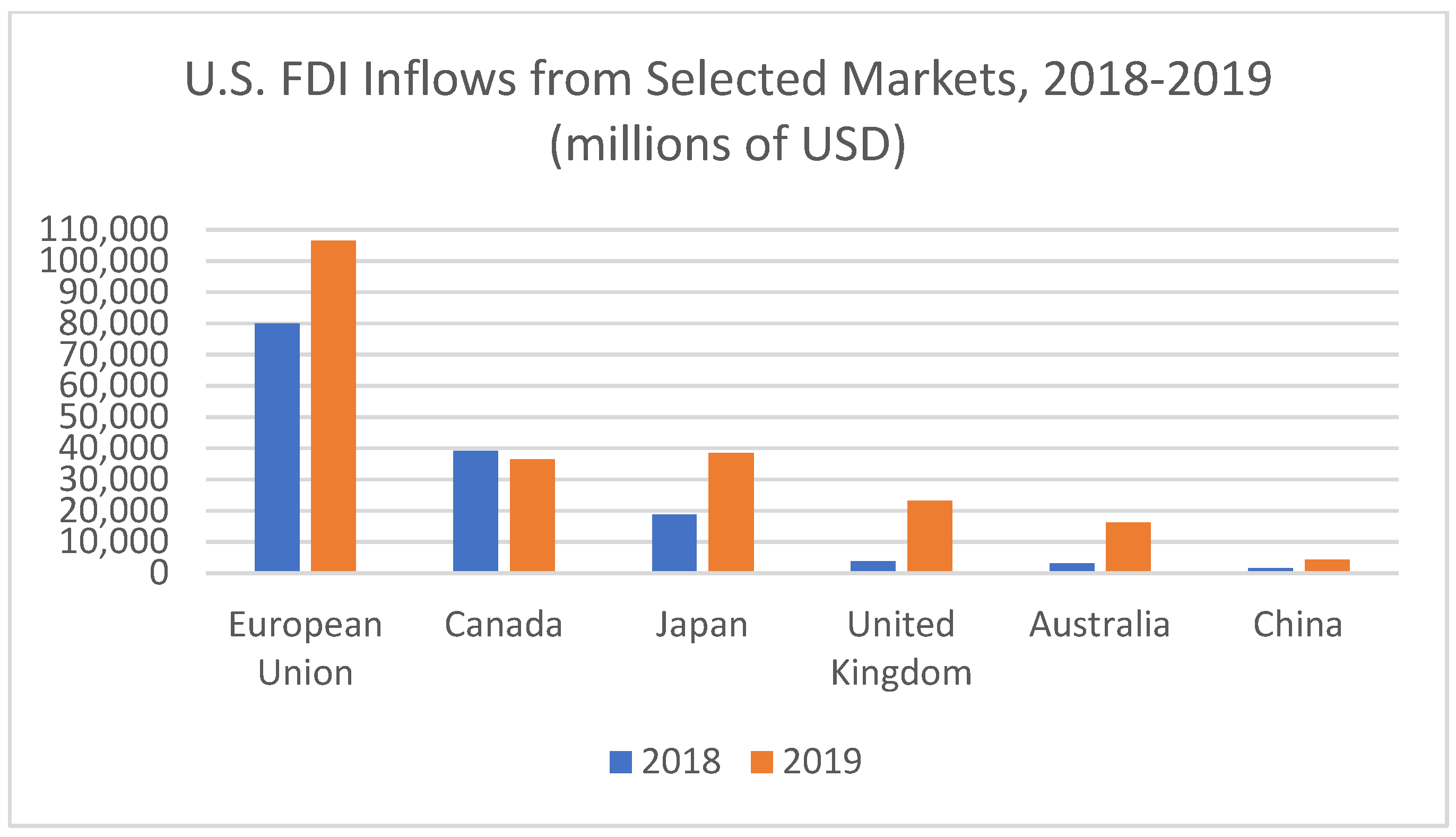

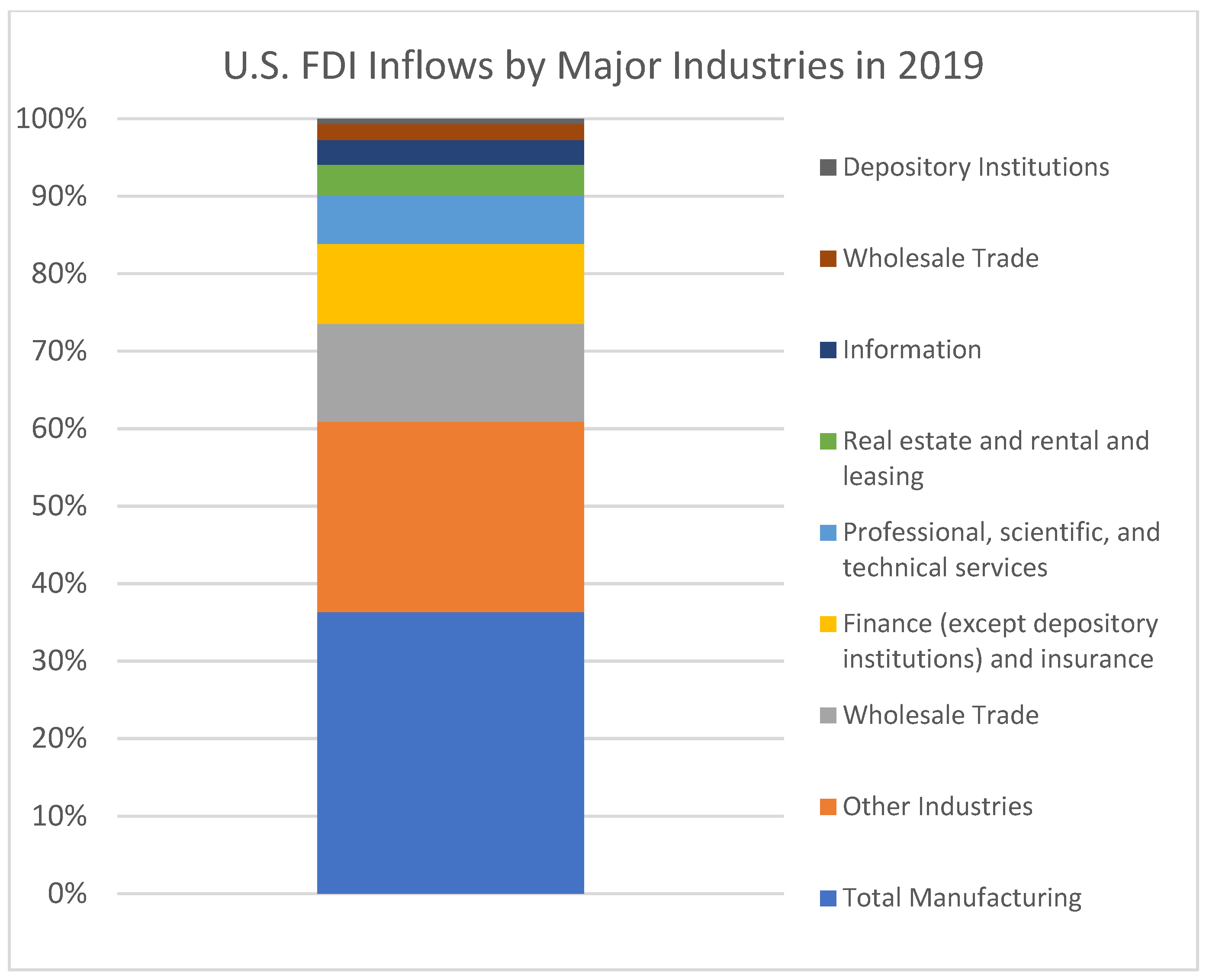

Figure 3 compares the U.S. FDI inflows from selected markets between 2018 and 2019. While the FDI flows from Canada declined, investments from the European Union, the United Kingdom, and the Asia Pacific (Australia, Japan, etc.) significantly increased. It is interesting to note that, albeit the rising tension in the U.S.-China relationship around the investigations and disputes focusing on China’s multinational companies including ZTE and Huawei, the FDI flows from China into the U.S. grew by 168 percent. Manufacturing continued to receive the largest share of 36% of the FDI flows into the U.S., followed by wholesale trade (13%) and finance and insurance (10%), as shown in

Figure 4.

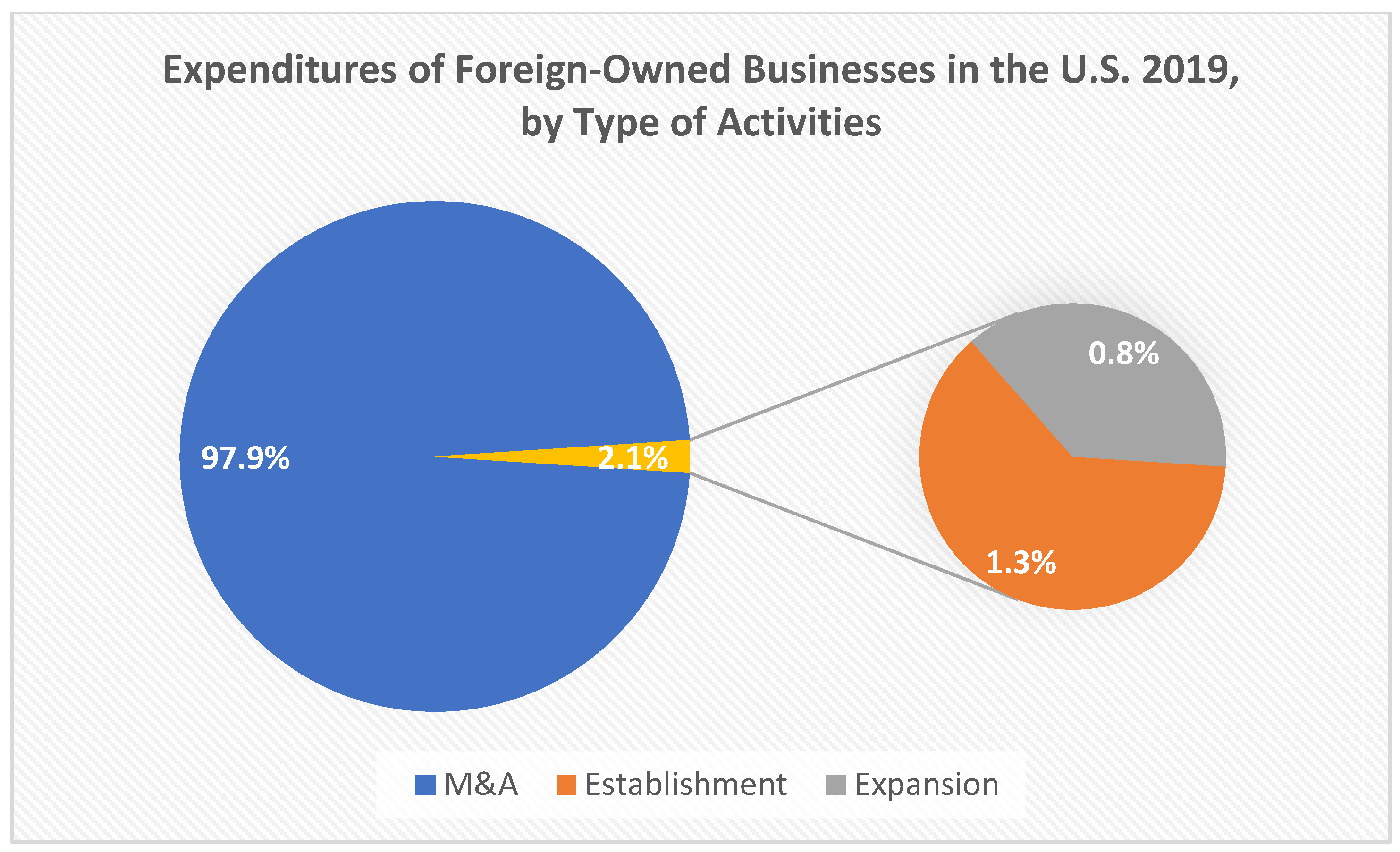

Not only had less foreign capital flown into the U.S. in 2019, but the expenditures by the country’s foreign-owned businesses in activities of Merger & Acquisition (M&A), new establishment, and business expansions also went down by 37.7 percent from the 2018 value (

$312.5 billion) to

$194.7 billion.

Figure 5 illustrates that the M&A of existing businesses retained dominance by capturing 98 percent of the total expenditures of foreign-owned businesses. Among all greenfield expenditures, the amount to establish a new U.S. business was higher than that of expanding an existing foreign-owned U.S. business. This structure has been observed for the previous years. It is worth noting that greenfield expenditures are considered “new blood” to an economy and represent the potential for growth in investment. For the U.S., most of the “new blood” was infused into chemical manufacturing (

$0.6 billion) and utilities (

$0.5 billion) by FDI inflows from Japan (

$1.1 billion) and Canada (

$1.0 billion) (

U.S. Bureau of Economic Analysis 2020a).

3.1.2. Pre-Pandemic Subnational FDI Trends: Interstate and New Hampshire In-Focus Perspective

In 2018 the U.S. started a trade war with the world (

Bown and Kolb 2022). As discussed above, from 2018 to 2019 the U.S. trade disputes with China as well as the American allies, and the subsequent retaliations by trading partners, had significantly hampered U.S. trade and FDI. In contrast, the situation was more optimistic at the subnational level, because most states experienced increases and outperformed the nation in the FDI activities and outcomes. For example, employment by foreign subsidiaries went up for 40 out of the 47 states (whose data are available from the U.S. Bureau of Economic Analysis) in 2019. The increases ranged from 0.5 percent (California) to 34.5 percent (Vermont) and averaged at 5.4 percent, compared to the nation’s 2.2 percent increase. The Gross Property, Plant, and Equipment of foreign subsidiaries also increased at paces varying from 0.6 percent (Utah) to 36.2 percent (Maryland) and averaging at 8.3 percent in 35 out of the 41 states whose data are available from the U.S. Bureau of Economic Analysis, whereas the national increase in this measure was 6.7 percent.

Different from the national situation of declined activities in 2019, as shown in

Table 1, the New Hampshire foreign-owned businesses’ expenditures in activities of M&A, new establishment, and business expansions increased from

$111 million in 2017 to

$123 million in 2019. The investment activities by foreign-owned businesses created 1000 jobs in New Hampshire in 2016 and since then the job creation number went down until 2019 when nearly 500 jobs were created by the FDI activities (see

Table 2). Same with the national trend, M&A expenditures had absolute dominance over greenfield investment.

The recent literature reveals that within the U.S., there are considerable heterogeneities across states in both international trade (

Wu and Demir 2017) and foreign direct investments (

Wu and Rogers 2018). Our analysis of data contributes to this literature by showing differences in the FDI outcomes at the subnational versus national level within the context of the U.S. trade war prior to the pandemic disruption.

3.2. Escalation of Globalization Risks in the First Year of Pandemic: National vs. Subnational

After the start of the year 2020, the shock from the COVID-19 pandemic to the global economy further escalated risks in the globalization process. Meanwhile, the trade and economic tensions with the U.S. since 2018 alerted China on its vulnerability in the global value chain. China shifted to a “dual circulation” strategy in May which was seen by many researchers as the beginning of China’s Turning Inward Movement aiming to increase the independence of its domestic supply chains from the overseas markets and technologies (which have been realized mainly via FDI) in the long-term development (

Yao 2020). These two events, along with others, inevitably influenced the international movement of FDI in 2020 and perhaps the years to come.

The global FDI collapsed in 2020, falling 42% from

$1.5 trillion in 2019 to an estimated

$859 billion (

UNCTAD 2021). Such a low level was last seen in the 1990s and was more than 30% below the investment trough that followed the 2008–2009 global financial crisis. The decline in FDI was concentrated in developed countries, where flows plummeted by 69% to an estimated

$229 billion. The U.S. recorded a 49% drop in FDI, falling to an estimated

$134 billion. The decline took place in wholesale trade, financial services and manufacturing. Cross-border M&A sales of US assets to foreign investors fell by 41%, mostly in the primary sector. Although FDI flows to developing economies decreased by 12% to an estimated

$616 billion, they accounted for 72% of global FDI–the highest share on record. China was the world’s largest FDI recipient, with flows to the Asian giant rising by 4% to

$163 billion. High-tech industries saw an increase of 11% in 2020, and cross-border M&As rose by 54%, mostly in ICT and pharmaceutical industries. China’s outperformance was largely attributed to, as reported by

UNCTAD (

2021): “A return to positive GDP growth (+2.3%) and the government’s targeted investment facilitation programme helped stabilize investment after the early lockdown,” India, another major emerging economy, also recorded positive growth (13%), boosted by investments in the digital sector (

UNCTAD 2021).

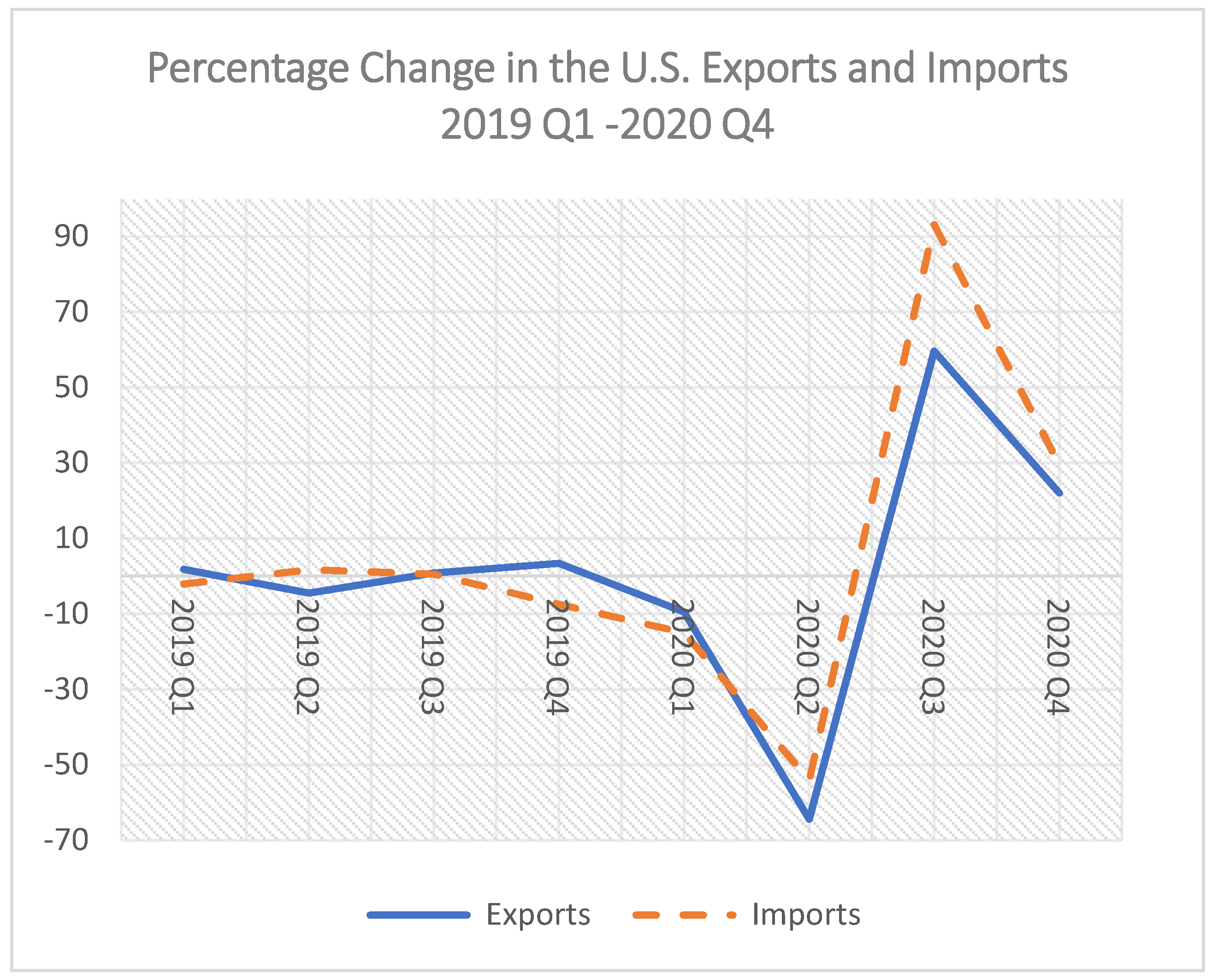

The COVID-19 pandemic significantly hampered both the demand and the transportation of goods and services across borders. As illustrated in

Figure 6 below, the U.S. total exports (imports) of goods and services dropped by 9.5 (15) percent in the first quarter as the travel bans started to kick off between the U.S., China and Europe, and then sharply fell by 64.4 (54.1) percent when the cross-border transportations of passengers and goods almost froze in the second quarter of 2020. In the third quarter, the U.S. remained the epicenter of the COVID-19 pandemic but many of its trade partners in Asia and Europe started to observe decreasing COVID cases and thus eased their restrictions on business activities. As these economies started to recover, their demand for American goods and services began to rise. Therefore, the U.S. exports of goods increased by 104.3 percent and service exports almost stopped the declining trend (−0.5 percent). Meanwhile, the U.S. imports of goods and services boosted by 110.2 percent and 24.9 percent, respectively, reflecting the increasing demand of both U.S. businesses for imported resources and parts, and U.S. households for imported goods, as the country continued to reopen its economy (

U.S. Bureau of Economic Analysis 2020b). The U.S. trade performance continued to improve in the fourth quarter, with its total exports of goods and services increasing by 22 percent and its total imports increasing by 29.5 percent. The pace was slower than the third quarter, but still outperformed the other times since 2019.

Unlike the pre-pandemic year in which most states outperformed the nation in all measures of FDI outcomes, the interstate trend showed a mixed picture at the subnational level in 2020. On one hand, 33 out of the 47 states (whose data are available from the U.S. Bureau of Economic Analysis) moved in the same downward direction with the nation in terms of the employment by foreign subsidiaries. The declines ranged from 0.03 percent (North Carolina) to 6.7 percent (Kansas) and averaged at 2.9 percent, worse than the nation’s 1.9 percent decrease. On the other hand, the Gross Property, Plant, and Equipment of foreign subsidiaries went down by 0.5 percent for the country, but it went up in 26 of the 41 states whose data are available from the U.S. Bureau of Economic Analysis fr. The increases ranged from 0.04 percent (Minnesota) to 9.3 percent (Washington) and averaged at 3.6 percent.

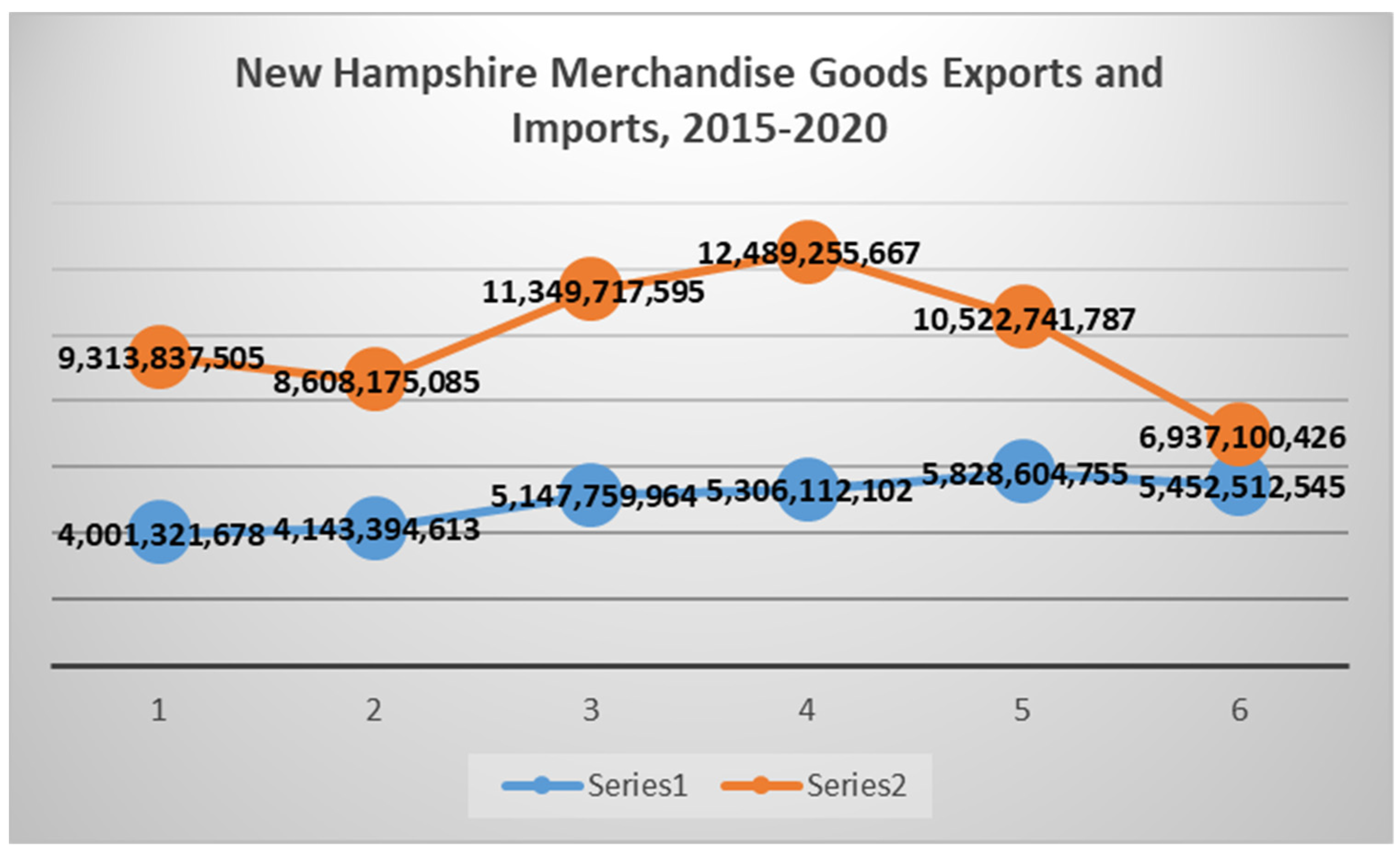

For our subnational focus perspective, we note how the international movements in the state of New Hampshire differed from the national trends in 2020 during the pandemic. As shown in

Figure 7, both New Hampshire’s merchandise imports and exports declined from their 2019 values. However, compared with the 34.3 percent drop in imports, the state’s exports only dropped by 7 percent and remained higher than its pre-pandemic values. The annual merchandise trade deficit of New Hampshire declined to

$1.48 billion in 2020, the lowest value in the past six years.

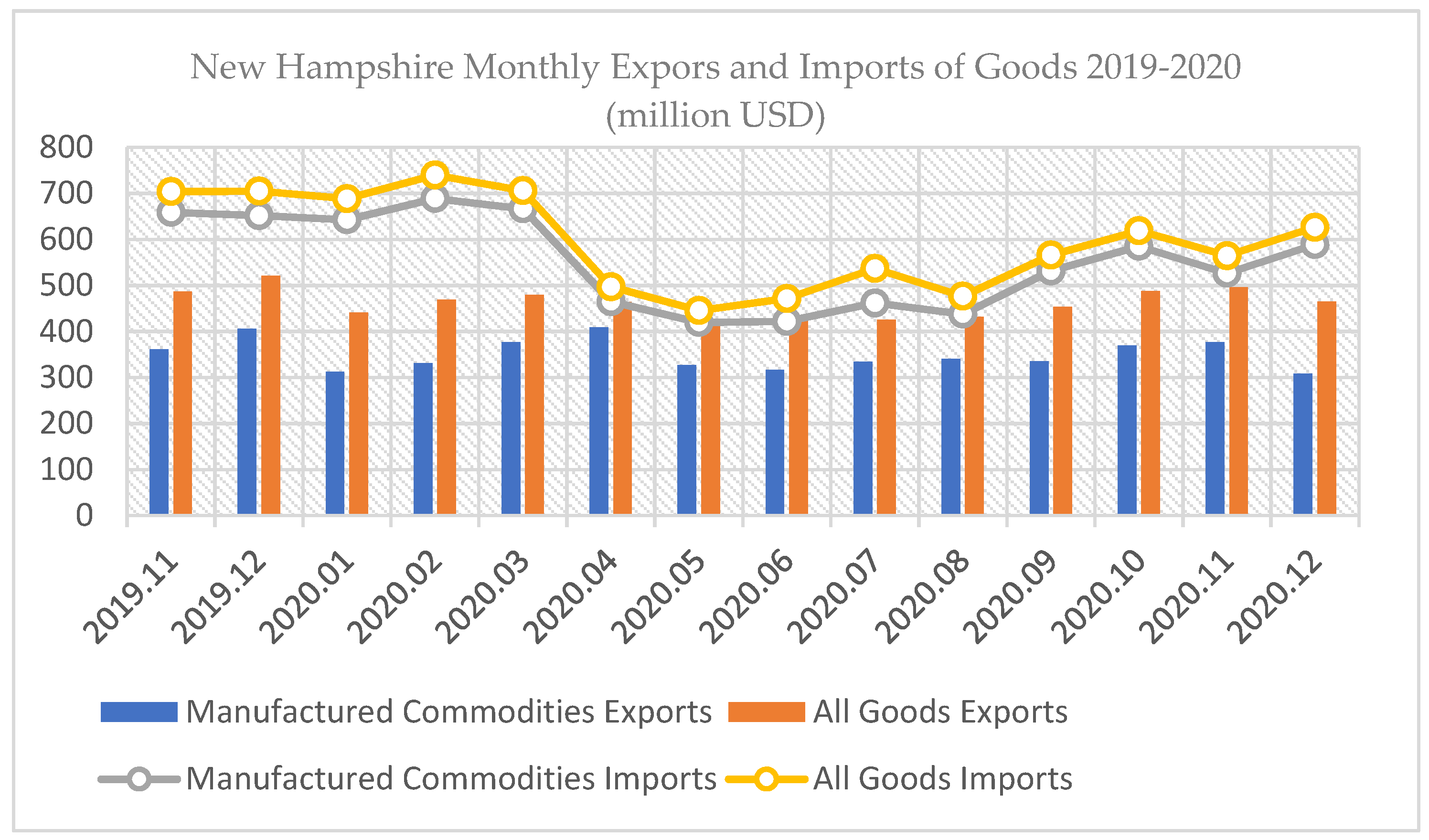

Figure 8 reveals further details about the monthly dynamics of New Hampshire’s imports and exports of goods in 2020. Specifically, the downhill of imports started in February 2020 and the sharpest drop occurred in April immediately after the issuance of the Stay-at-home order as a response to the COVID-19 outbreak. This seems to have triggered a downward shift of the state’s imports of goods from around

$700 million per month between November 2019 and March 2020, to around

$500 million per month since April 2020 and throughout the summer. Starting the third quarter, especially since August, within the context of reopening the state’s economy, the demand of New Hampshire residents and businesses for overseas resources and goods has been climbing up to a higher level of around

$600 million per month, reaching

$618.7 million in October.

In contrast, the New Hampshire exporters were more stable and demonstrated stronger resilience during the pandemic. The state’s exports of goods increased every month from $440.7 million in January to $479.7 million in March during the time when the COIVD first broke out in China and Europe. It dropped by 12.6 percent from March to May after the COVID outbreak in the U.S., but has been since then steadily recovering, reaching 487.1 million in October, the highest value this year. Due to the downward shift in the level of imports, the state’s month-added merchandise trade deficit contracted from $270.7 million in February to $28.9 million in May 2020. It then expanded to $131.6 million in October but was still way below the pre-pandemic level.

The pre-pandemic heterogeneity of FDI is well documented, with states such as California and New York ranking high in FDI-supported jobs, and other states, like Florida and Kentucky, recording fast FDI job growth rates (

Global Business Alliance 2020). New Hampshire is a state with a high concentration of FDI jobs (FDI jobs as a share of total private-sector employment). This situation explains some of the findings we report on in the subsequent sections showing strong representation of foreign subsidiaries with good interconnections with local firms and diversity in business activities. In states with similar conditions, market motivations and supply chain characteristics may determine foreign firms to take similar actions in the short run of disruption. In states with a varying presence of foreign subsidiaries, strategic priorities may differ. Drawing from the FDI and trade data, we identify significant differences in the national vs. subnational starting conditions and immediate outcomes of the COVID-19 pandemic as a global disruption. As a result, we set forth:

Proposition 1. In the short-term following global disruption, FDI outcomes at the start of disruption will determine post-disruption international-oriented activities at a subnational location.

Based on our first proposition, we expect that existing FDI and trade in U.S. states likely impacts short-term FDI outcomes post disruption. For example, the state of Washington, with high representations of aerospace exports, has recorded sharp decreases in exports, both due to the pandemic and non-retaliatory tariffs and events prior to the pandemic. Other exports in this state remained more stable in the short-term of the pandemic disruption. The predominant sources of FDI remained largely unchanged for this state: the U.K, Canada, Japan and China (

Washington State Department of Commerce 2021). In Illinois, a state with relatively high economic activity (

Barklie et al. 2022), key projects have attracted FDI during the pandemic in software, business and financial services, and industrial equipment. Previously strong sources of FDI continued to add to the state economy: the U.K., Germany, Japan, Canada, and France (

Illinois Department of Commerce & Economic Opportunity 2022). In Indiana, sources of FDI are changing (

Slaper 2022). Unlike in New Hampshire and Washington, Japan has been the country-of-origin of most FDI in Indiana. Countries-of-origin relevant to the FDI in New Hampshire and Washington, such as Germany, the U.K., and Canada are also represented in Indiana. India is also represented, which is different from New Hampshire and Washington. Indiana has had slightly decreasing FDI pre-pandemic (from its main sources) and did not record a sharp decrease in foreign investments and jobs post-pandemic. The least represented sources of FDI have been growing. Thus, FDI in Indiana may have been on a trend of diversification that continued in the short-term post-disruption and may continue in the long term. The source diversification trend situation may have led to a change in the foreign companies’ strategic priorities and activities in the short term of disruption, in support of our first proposition.

3.3. FDI-Related Activities during the COVID-19 Pandemic: The Subnational Location Perspective

Drawing from our data analysis of international movements and FDI, we suggest that local specific characteristics are behind distinct FDI outcomes at a locality and, furthermore, that local characteristics influence post-disruption economic and business recovery at that location. Specifically, the interconnection between domestic and foreign firms and the existence of supply chains that are strong regionally are among the key factors that determine sources of subnational economic strength and business resilience in the locality. Geographic advantages such as border effects may also determine recovery.

The sudden shock of the pandemic gave businesses limited room for full adaptions but provided an impetus for companies to take immediate short-run responses. These responses show new business priorities, but also a continuation of pre-disruption activities. Despite the lower-than-normal levels of business activity during the first year of the pandemic, foreign firms engaged in a number of noteworthy projects and activities with a significant meaning for the state. We reviewed business activity involving foreign businesses in New Hampshire from the start of the pandemic (mid-March, 2020) to the end of the year 2020. Most activities were in electronics, information technology and financial services. Some activities also took place in the energy and life sciences sectors. The tables below show a few defining features of these initiatives (see

Table 3 and

Table 4).

The origins of companies engaged in activities were diverse, despite the pandemic conditions and the relatively reduced intensity of business activity. Countries that have traditionally been sources of direct investment inflows (Canada, UK, European countries) for the state, have continued to provide FDI outcomes for the state, as shown in

Table 5.

As detailed in

Table 6, foreign firms’ activities were new contracts, projects and investments, projects and investments with existing partners or expansions of current facilities. The activities counted are not mutually exclusive. Each instance represents an activity in which a foreign company was engaged during the pandemic, either on its own or in partnership with another company (N.H., U.S. or non-U.S. based). One instance may represent more than one classification in the new or existing category.

All initiatives involving investments would be defined as strategic-e.g., long term actions to establish operations in New Hampshire; U.S. firm acquiring foreign assets in order to gain considerable more market power in the U.S. market; or foreign company operating in N.H. acquiring companies for specific strategic purposes.

Our brief observations for our in-focus location show diversity in activities in the small state of New Hampshire. We do not expect the same characteristics to be present across U.S. locations. We anticipate that, as a short-run effect of global disruption, FDI-related strategic activities will be unequally affected across subnational locations and relative to the national level. The unequal effect of the disruption phenomenon may be due in part to the fact that access and proximity to markets are strong determinants of business activities in times of disruption. The motivations behind New Hampshire business activities involving foreign firms during the pandemic appeared to have been the same as in other times. Whilst the pandemic has hindered and at some point, even stopped business operations in the state, strategic initiatives continued to be in play. Some of the patterns of expansion matched findings from extant literature (

Wright 2020). The rationales listed below show a variety of purpose and large scale, multiple-year commitments. These rationales include the following. First, foreign companies’ access to the local market and market reach in the region appeared to have been a determinant motivation for some activities. In several instances, agreements with foreign companies allowed New Hampshire companies to expand their distribution outside the state or outside the U.S. Interactions between foreign and local firms not only strengthened the market position of the foreign companies but also gave domestic companies access to international markets. In all cases, the new initiatives offered entrance into significant markets in terms of scale and direct applicability of the companies’ competencies. Second, in all acquisition cases, the purchase added to the company’s market segments, new products and capabilities. In most cases, foreign N.H. and non-N.H. companies acquired U.S. companies. In two of the instances, the purchase was a direct acquisition of a local company by a foreign company looking to operate in the state. Third, about one-third of the business actions in the state were direct outcomes of foreign business strategies to access or expand reach into the U.S. market, initiated or accompanied by contracts or investments in other states. These findings support the concept that market proximity and access are predominant motivations of firms’ activities at a particular subnational location, during disruption. Hence, we put forward the following expectation:

Proposition 2. In the short-run of global disruption, FDI-related activities are likely to remain strong at subnational locations that offer superior access to markets.

Market-seeking FDI is not surprising, as the U.S. has the largest consumer market in the world, with a GDP of over

$23 trillion and more than 330 million people (

Santander 2022). Our data and second proposition confirm the importance of market access as a source of business and economic resilience in the local economy. Access to markets differs across U.S. states. For example, an analysis of the relationship between a U.S. city’s core industry and the city’s vulnerability to the pandemic found that local economies with industries that depend on the movement of people, such as Las Vegas, faced high unemployment in the aftermath of the pandemic (

Klein and Smith 2021). Foreign companies relying on access to markets where the movement of people is important may thus have seen some of their advantages degraded in the short term after the pandemic onset. Conversely, expansion and market-seeking are strong motivators of post-disruption FDI in other states, with similar dynamics or even stronger access to markets than New Hampshire. In the U.S. Southeastern states, FDI as acquisitions have been increasing as compared to other types of FDI. In alignment with what we found for New Hampshire, in the short term of disruption, some international companies have continued to acquire locally as part of larger expansion initiatives across states (

Guarnieri et al. 2021).

Our unique state-specific firm-level activity data also highlight the importance of local ties with foreign firms. The business activity involving foreign firms in N.H. was generated mostly by actions targeting U.S. expansion or an increase in market presence. The international reach of companies also generated activities in our state. To a lesser extent, an activity involving foreign firms in N.H. was part of local or regional business moves (see

Table 7).

New capability development and research & development appear to be a significant motivation behind foreign firms’ subnational actions during the COVID-19 pandemic. Our New Hampshire data shows that the majority of expansion and other activities added to the initiating company’s portfolio of products and innovations. In some cases, the initiatives complemented existing product lines and opened more possibilities for the commercialization of innovations. There were also distinguishable actions to strengthen the supply chain. These actions were accompanied by clear goals of improving networking and pulling more or specific product types through the chain. The amount of FDI outcomes and FDI-related activities at a subnational location during disruption may depend on the foreign firms’ abilities to manage value chains.

According to

McKinsey Global Institute (

2020a), supply chains are being disrupted with greater frequency. Part of that is due to the fact that multinationals are more exposed. As value chains have grown in length and complexity, companies based in relatively stable countries now operate and source from many more places with higher risk profiles. The previous era of globalization created intricately interconnected supply chains, data flows, financial flows, people flows, and idea flows—all of which offer more “surface area” for risk to penetrate.

The factors of production that are central to a given industry will influence how a particular unexpected shock affects it. Capital-intensive value chains face the possibility of heavy losses if their specialized plants and equipment are damaged by conflict or natural disasters. Pandemics are a particular threat to labor-intensive industries such as textiles and apparel. Looking at industries in which foreign businesses operate in the state of New Hampshire, we see that most of these companies are in finance, retail and manufacturing (

Wright and Wu 2018). Whilst it is likely that these foreign firms have been affected by the pandemic, the value chains are likely to resist fairly strongly.

Wright and Wu (

2018) showed that the majority (31%) of foreign manufacturers of durable goods in N.H. are making computer and electronic products. The McKinsey investigation (

McKinsey Global Institute 2020a) finds that this industry relies on global innovation. However, other industries where N.H. foreign manufacturers are significantly represented (such as fabricated metal products, 9% of foreign manufacturers) are relying on regional processing. For non-durable goods, N.H. foreign manufacturers are represented more extensively in chemicals (around 50%), an industry with declining global innovation reliance, and also in food and beverage (27%), an industry with expanding but still predominantly regional supply chains. These data may indicate that supply chains and foreign firms are more resistant to global disruption at this subnational location.

Based on our in-focus state illustration, we propose that the industry sectors and their supply chain features impact the short-term effects of disruption. It is expected that various industries attract FDI across U.S. states: innovation centers, high-tech, aerospace and defense technologies on the West Coast, life sciences and pharma on the East Coast, automotive and consumer product manufacturing in the Midwest, and chemicals in the Southeast (

Smith 2021). Each of these industry sectors rely on various levels of local, regional, and global processing and innovation, thus realizing varying extents of supply chain network reach. Subsequently, international companies across subnational regions will likely behave differently in their approach to adding to their portfolio of products, and to generating capacity and improved networking in their supply chains. Based on this reasoning, we imply:

Proposition 3. Established regional supply chains will reduce the short-run effects of global disruption on FDI-related activities at a subnational location.

In support of this hypothesis, following global disruption, geographic advantages of a subnational location are likely to impact short-run FDI- and supply chain-related resilience actions. Sharing a national border with a key source of FDI and global value chain activities site will lead to low vulnerabilities of transportation and logistics networks. In a 2019 McKinsey survey of global executives, almost 16% percent recognized transportation as a top cause of supply chain disruptions (

McKinsey Global Institute 2020a). The regionalization of trade and supply chains may mitigate transportation and logistics vulnerabilities. This study also showed that the trade occurring in the same region has been on an increase since 2012, with intraregional representing more than half of trade in Asia and Europe.

Gale (

2020) noted that 45% of executives are currently re-evaluating supply chains and concluded that the next year will be marked by “changes to the supply chain, industry consolidation and a smaller manufacturing footprint.” Even before the pandemic, only 13% of globally traded goods are exported from low-wage to high-wage countries, as referenced by McKinsey. This suggests that companies are no longer seeking low-cost locations for their operations. The unencumbered flow of materials and data plays an important role in FDI-related development. Based on geographical location, our example state of New Hampshire is uniquely positioned for trade and supply chain networks with Canada, a key location where FDI outcomes in the state originates. Canada is a significant source of FDI and FDI-related investments on the state, including in manufacturing and high-tech (

Wright and Wu 2018).

Border effects on FDI outcomes are likely to be similar for other U.S. states. The strong political and economic relationship between the U.S. and Canada contributes to the efficiency of cross-border trade. Canadian markets are some of U.S. companies’ largest customers and distributors (

Inbound Logistics 2021). Conversely, many Canadian firms look at bordering U.S. states as access points to U.S. markets. Just like in New Hampshire, leaders in these states enjoy business and economic benefits from maintaining consistency in relationships with Canadian supply chain providers and partners. Branch locations or fulfillment centers could be part of networked expansion and increased capacity building in supply chains. Physical location is important. Along with location, across U.S. states, industries and supply chain activities distributions may determine varying levels of negative impact of disruption. For instance, the pandemic and ensuing trade breaks in the state of Washington have led to significant declines in aerospace and aerospace-related exports. Washington State has an extended overseas footprint. Partially due to reliance on complex global processing and supply chains, the disruption in this state had a significant short term negative effect on FDI (

Washington State Department of Commerce 2021).