Factor-Based Investing in Market Cycles: Fama–French Five-Factor Model of Market Interest Rate and Market Sentiment

Abstract

1. Introduction

2. Literature Review

2.1. Factor-Based Investing

2.2. Five-Factor Model

2.2.1. Size Factor

2.2.2. Value Factor

2.2.3. Profitability Factor

2.2.4. Investment Factor

2.3. Market Cycles

3. Data and Methodology

3.1. Data

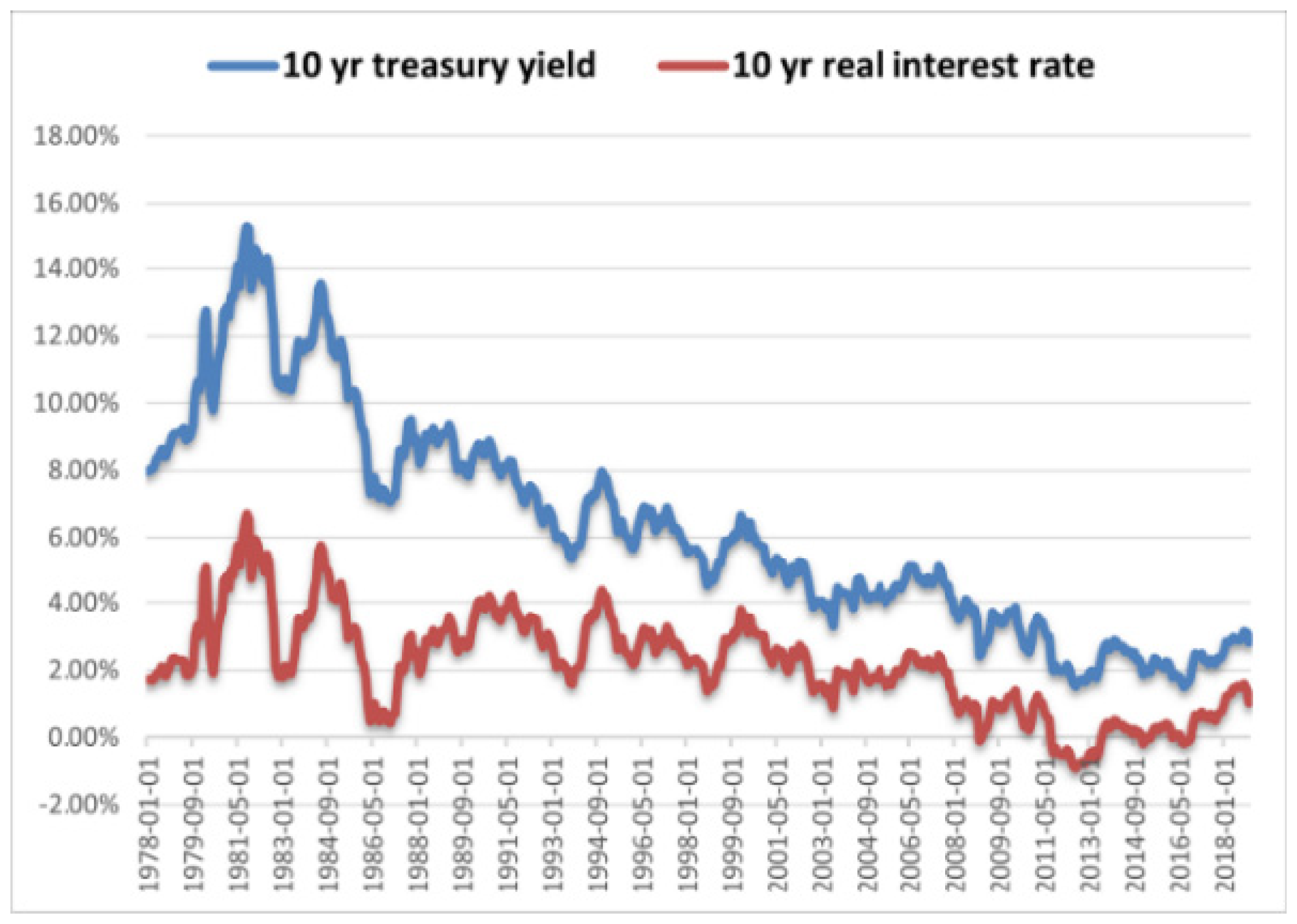

3.1.1. Market Interest Rate

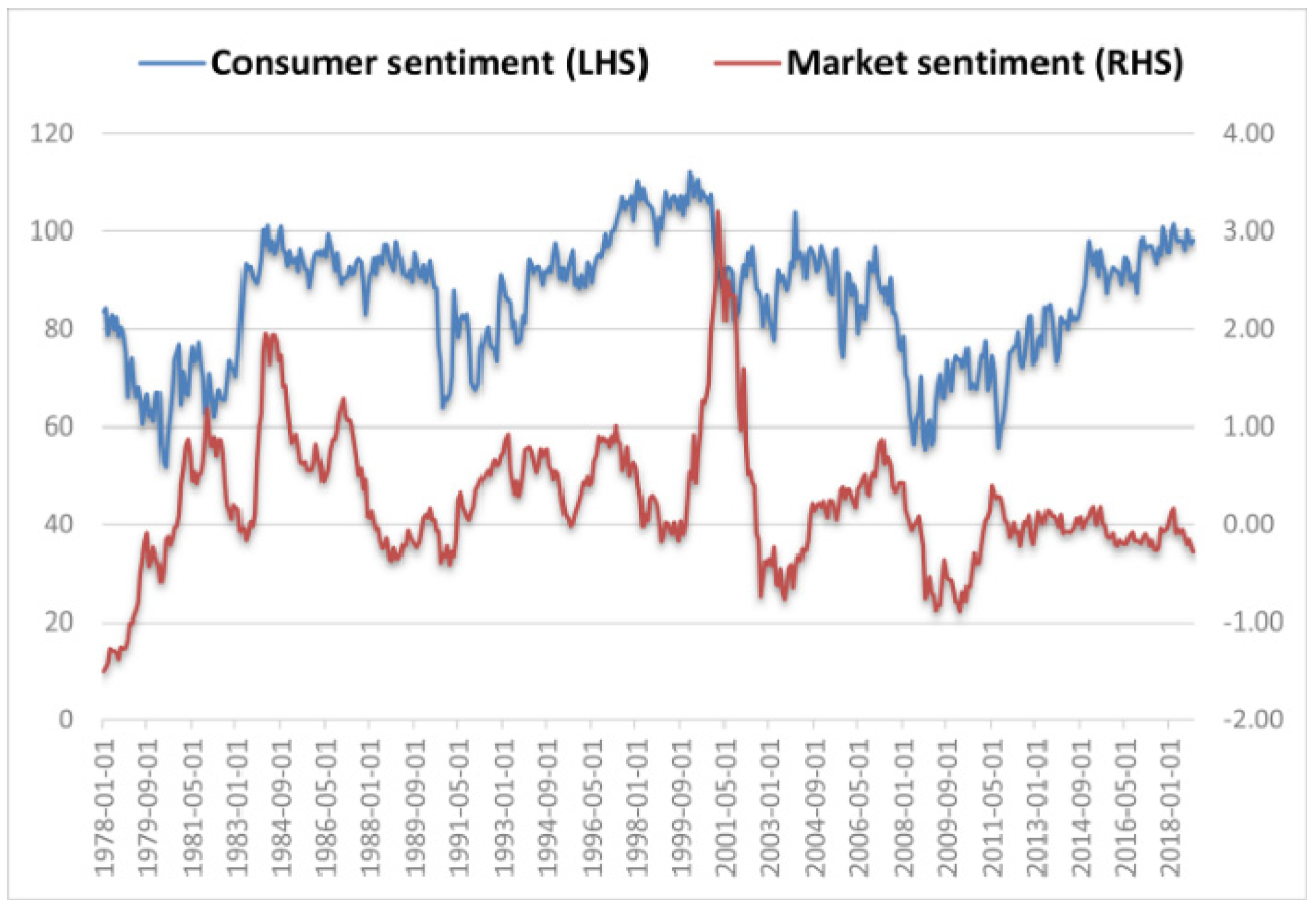

3.1.2. Market Sentiment

3.1.3. Five-Factor Returns

3.2. Construction of Asymmetric GARCH Model on Five-Factor Returns

3.3. Five-Factor Model of Bivariate Market Cycles

4. Empirical Results and Analyses

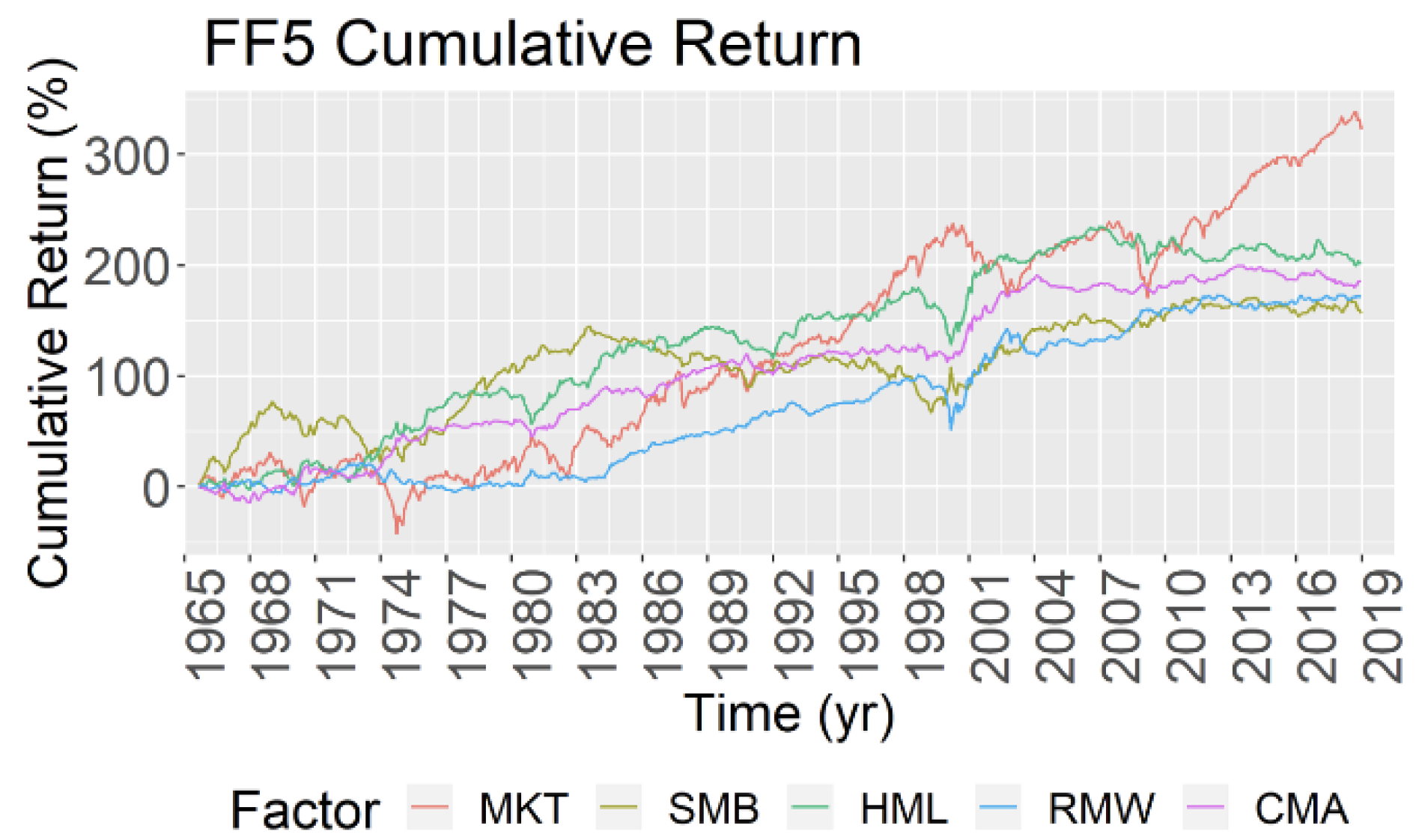

4.1. Results of Asymmetric GARCH Model on Five-Factor Returns

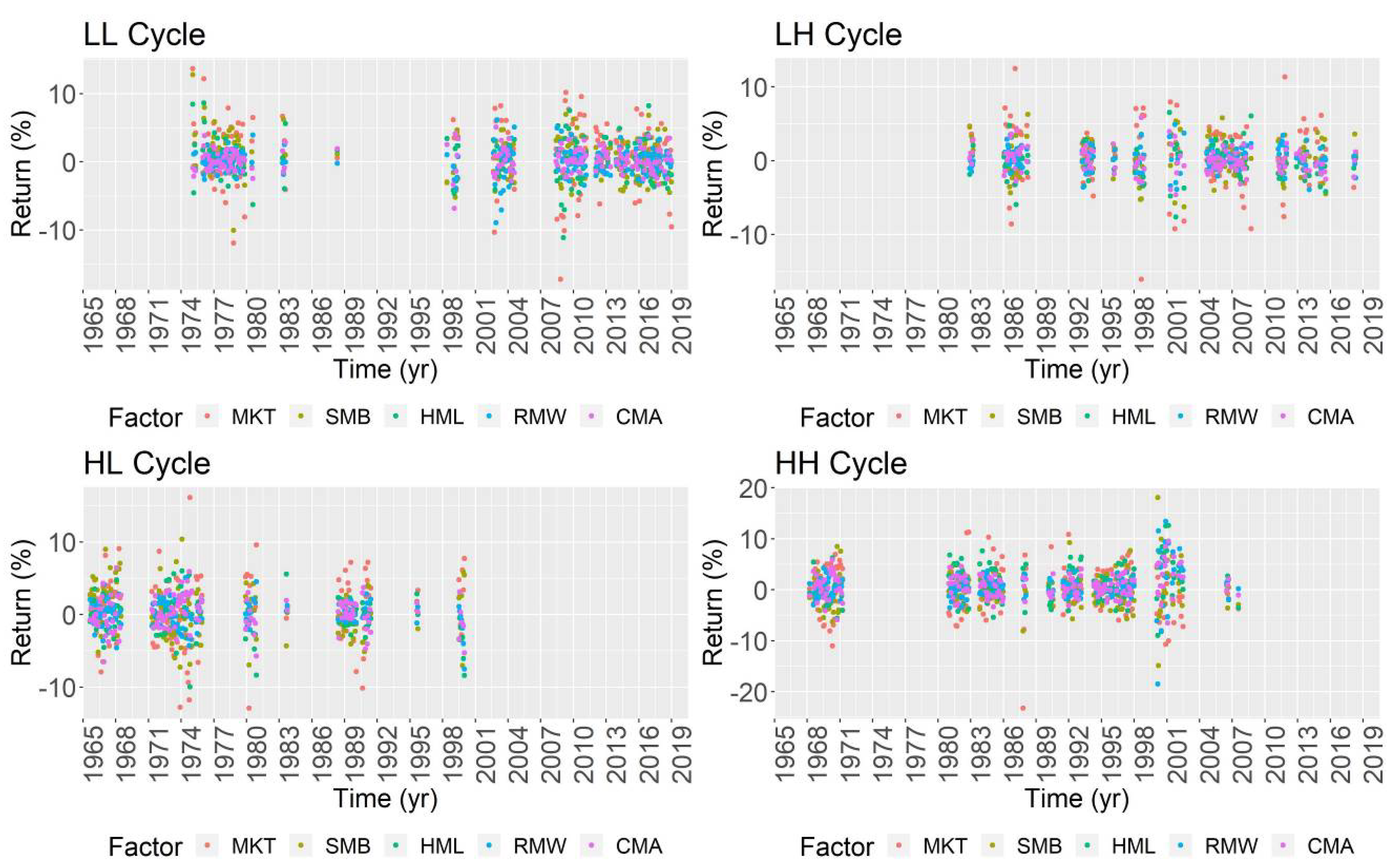

4.2. Results of Interest Rate Cycles and Sentiment Cycles on Five-Factor Returns

4.3. Results of Interest Rate Cycles and Sentiment Cycles on Stock Returns

4.4. Results of Five-Factor Adjusted Stock Returns in Market Cycles

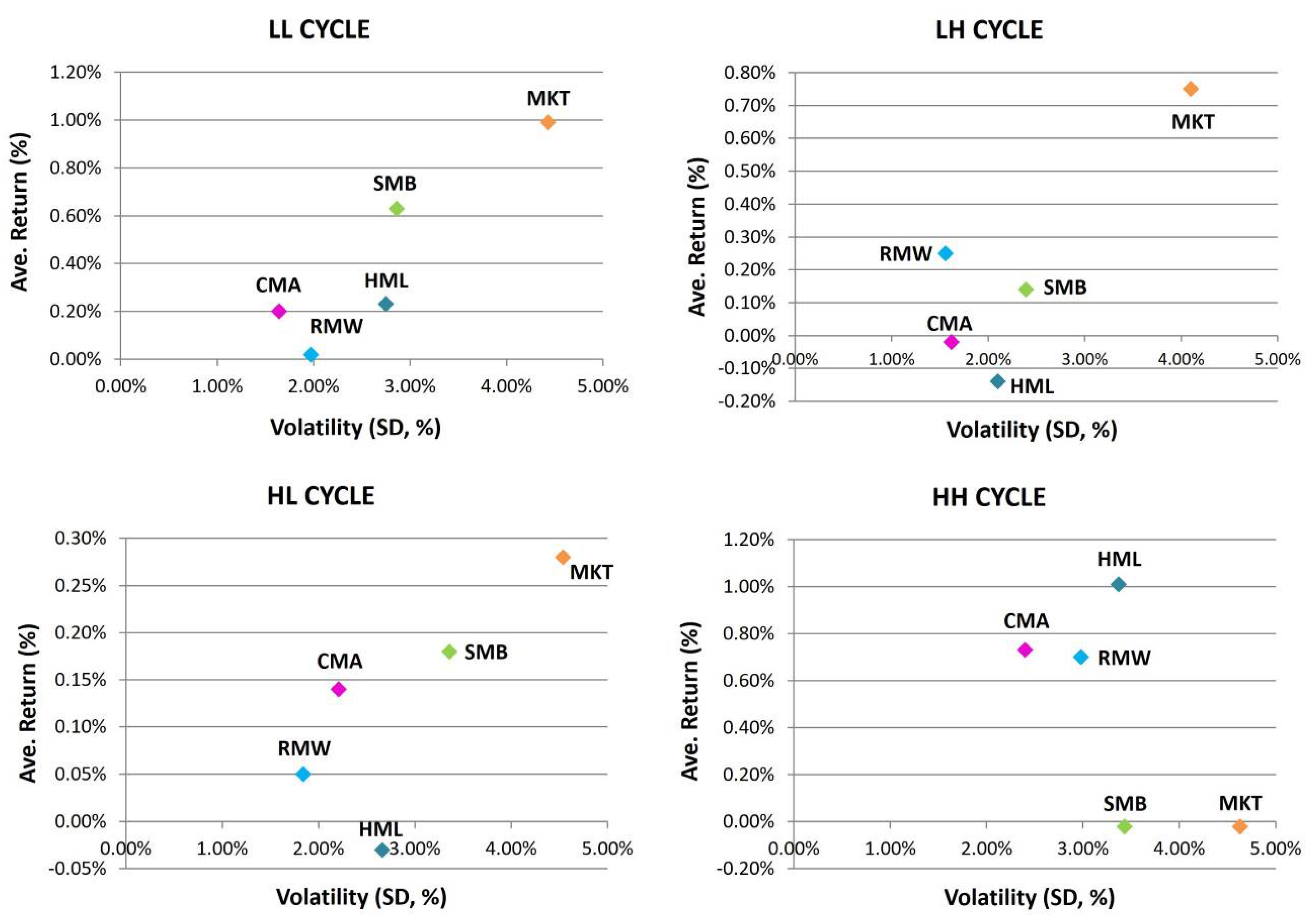

4.5. Factor-Based Investing in Market Cycles

5. Discussions

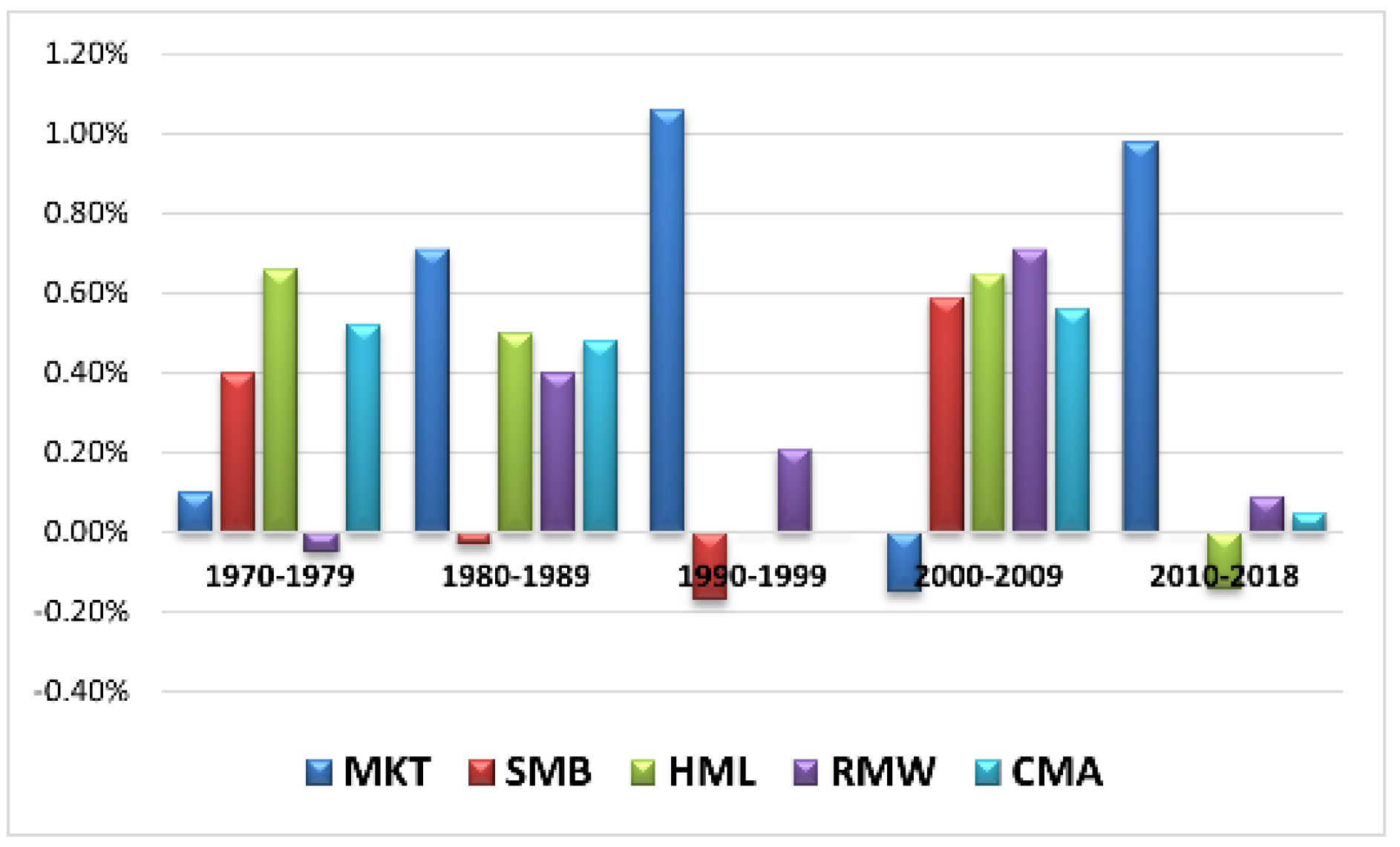

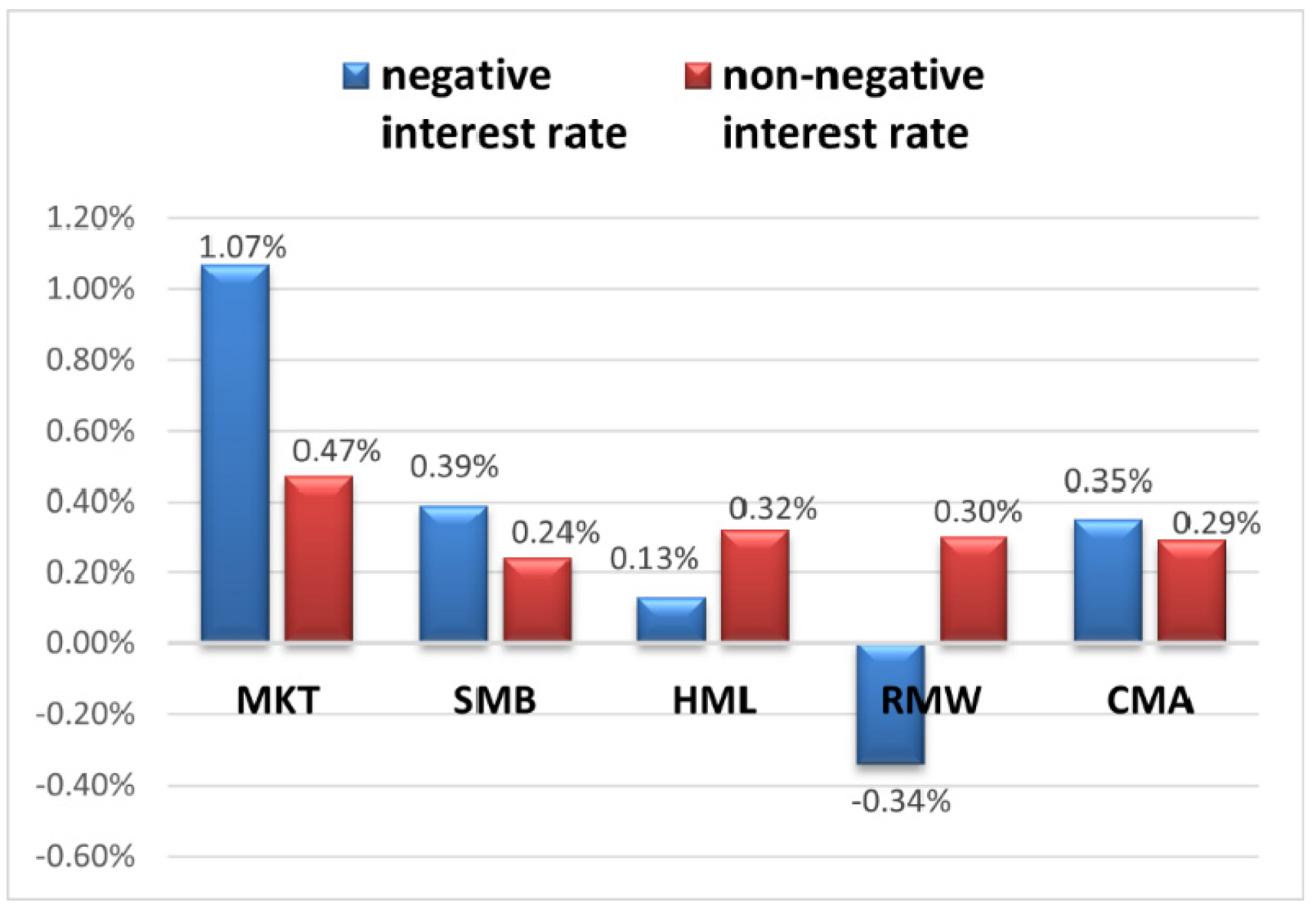

5.1. Five-Factor Returns Based on the Decade

5.2. Five-Factor Returns in Negative Real Interest Rate Cycle

6. Robustness

7. Conclusions

Author Contributions

Funding

Data Availability Statement

Acknowledgments

Conflicts of Interest

Appendix A

Appendix B

| 1 | Shiller Online Data can be found at http://www.econ.yale.edu/~shiller/data.htm (accessed on 28 December 2021). The long-term real interest rate is calculated by subtracting the 10-year average inflation rate from the US 10-year Treasury yield, which is the geometric average of the consumer price index in the past 10 years. |

| 2 | Jeffrey Wurgler’s online data are from http://people.stern.nyu.edu/jwurgler/ (accessed on 28 December 2021). These data differ from the study by Baker and Wurgler (2006) in which the authors remove New York Stock Exchange turnover from the sentiment variables. The current sentiment index is composed of five other variables. |

| 3 | The Fama–French online data library can be found at https://mba.tuck.dartmouth.edu/pages/faculty/ken.french/data_library.html (accessed on 28 December 2021). |

| 4 | The construction of the Fama–French five factors is available at https://mba.tuck.dartmouth.edu/pages/faculty/ken.french/Data_Library/f-f_5_factors_2x3.html (accessed on 5 March 2022). |

| 5 | The high- and low-interest rate cycle is classified by the median of the long-term real interest rate, and the high-and low-sentiment cycle is classified by the median of the sentiment index, which is consistent with the literature (Stambaugh et al. 2012). |

| 6 | A broad factor model gauges the risk-free adjusted return of the investment portfolio. As the market factor of the FF5 model has been measured relative to the risk-free interest rate of the U.S. stock market (including the New York Stock Exchange, American Stock Exchange, and Nasdaq), we employ the S&P 500 return as the dependent variable for the regression estimate. |

| 7 | The data of the US Federal Reserve are from https://fred.stlouisfed.org/graph/?g=EfGN (accessed on 15 February 2022). |

References

- Abdullah, Dewan A., and Steven C. Hayworth. 1993. Macroeconometrics of Stock Price Fluctuations. Quarterly Journal of Business and Economics 32: 50–67. [Google Scholar]

- Amenc, Noël, Mikheil Esakia, Felix Goltz, and Ben Luyten. 2019. Macroeconomic Risks in Equity Factor Investing. The Journal of Portfolio Management 45: 39–60. [Google Scholar] [CrossRef]

- Ang, Andrew, Ked Hogan, and Sara Shores. 2018. Factor Risk Premiums and Invested Capital: Calculations with Stochastic Discount Factors. Journal of Asset Management 19: 145–55. [Google Scholar] [CrossRef]

- Arnott, Robert D., Campbell R. Harvey, Vitali Kalesnik, and Juhani T. Linnainmaa. 2021. Reports of Value’s Death May Be Greatly Exaggerated. Financial Analysts Journal 77: 44–67. [Google Scholar] [CrossRef]

- Arnott, Robert D., Jason Hsu, and Philip Moore. 2005. Fundamental Indexation. Financial Analysts Journal 61: 83–99. [Google Scholar] [CrossRef]

- Asness, Clifford, Andrea Frazzini, Ronen Israel, and Tobias Moskowitz. 2015. Fact, Fiction, and Value Investing. The Journal of Portfolio Management 42: 34–52. [Google Scholar] [CrossRef]

- Asness, Clifford S., Jacques A. Friedman, Robert J. Krail, and John M. Liew. 2000. Style Timing. The Journal of Portfolio Management 26: 50–60. [Google Scholar] [CrossRef]

- Asness, Clifford S., Tobias J. Moskowitz, and Lasse Heje Pedersen. 2013. Value and Momentum Everywhere. The Journal of Finance 68: 929–85. [Google Scholar] [CrossRef]

- Baker, Malcolm, and Jeffrey Wurgler. 2006. Investor Sentiment and the Cross-Section of Stock Returns. The Journal of Finance 61: 1645–80. [Google Scholar] [CrossRef]

- Baker, Malcolm, and Jeremy C Stein. 2004. Market Liquidity as a Sentiment Indicator. Journal of Financial Markets 7: 271–99. [Google Scholar] [CrossRef]

- Baks, Klaas, and Charles Frederick Kramer. 1999. Global Liquidity and Asset Prices: Measurement, Implications, and Spillovers. IMF working paper. SSRN Electronic Journal 99: 168. [Google Scholar] [CrossRef]

- Banz, Rolf W. 1981. The Relationship between Return and Market Value of Common Stocks. Journal of Financial Economics 9: 3–18. [Google Scholar] [CrossRef]

- Barberis, Nicholas, and Andrei Shleifer. 2003. Style Investing. Journal of Financial Economics 68: 161–99. [Google Scholar] [CrossRef]

- Barberis, Nicholas, and Ming Huang. 2008. Stocks as Lotteries: The Implications of Probability Weighting for Security Prices. American Economic Review 98: 2066–100. [Google Scholar] [CrossRef]

- Black, Angela J., Bin Mao, and David G. McMillan. 2009. The Value Premium and Economic Activity: Long-Run Evidence from the United States. Journal of Asset Management 10: 305–17. [Google Scholar] [CrossRef]

- Blitz, David, Eric Falkenstein, and Pim van Vliet. 2014. Explanations for the Volatility Effect: An Overview Based on the CAPM Assumptions. The Journal of Portfolio Management 4: 61–76. [Google Scholar] [CrossRef]

- Blitz, David. 2015. Factor Investing Revisited. The Journal of Index Investing 6: 7–17. [Google Scholar] [CrossRef]

- Blitz, David. 2020. Factor Performance 2010–2019: A Lost Decade? The Journal of Index Investing 11: 57–65. [Google Scholar] [CrossRef]

- Bollerslev, Tim, Ray Y. Chou, and Kenneth F. Kroner. 1992. Arch Modeling in Finance. Journal of Econometrics 52: 5–59. [Google Scholar] [CrossRef]

- Brown, Gregory W., and Michael T. Cliff. 2004. Investor Sentiment and the near-Term Stock Market. Journal of Empirical Finance 11: 1–27. [Google Scholar] [CrossRef]

- Brown, Gregory W., and Michael T. Cliff. 2005. Investor Sentiment and Asset Valuation. The Journal of Business 7: 405–40. [Google Scholar] [CrossRef]

- Campbell, John Y. 1987. Stock Returns and the Term Structure. Journal of Financial Economics 18: 373–99. [Google Scholar] [CrossRef]

- Campbell, John Y., and Robert J. Shiller. 1988. Stock Prices, Earnings, and Expected Dividends. The Journal of Finance 43: 661–76. [Google Scholar] [CrossRef]

- Campbell, John Y., and Robert J. Shiller. 1998. Valuation Ratios and the Long-Run Stock Market Outlook. The Journal of Portfolio Management 24: 11–26. [Google Scholar] [CrossRef]

- Carhart, Mark M. 1997. On Persistence in Mutual Fund Performance. The Journal of Finance 52: 57–82. [Google Scholar] [CrossRef]

- Daniel, Kent, and Sheridan Titman. 1998. Characteristics or Covariances? The Journal of Portfolio Management 24: 24–33. [Google Scholar] [CrossRef]

- Daniel, Kent, David Hirshleifer, and Avanidhar Subrahmanyam. 1998. Investor Psychology and Security Market under- and Overreactions. The Journal of Finance 53: 1839–85. [Google Scholar] [CrossRef]

- De Bondt, Werner F., and Richard Thaler. 1985. Does the Stock Market Overreact? The Journal of Finance 40: 793–805. [Google Scholar] [CrossRef]

- Dimson, Elroy, Paul Marsh, and Mike Staunton. 2017. Factor-Based Investing: The Long-Term Evidence. The Journal of Portfolio Management 43: 15–37. [Google Scholar] [CrossRef]

- Engle, Robert F., David M. Lilien, and Russell P. Robins. 1987. Estimating Time Varying Risk Premia in the Term Structure: The ARCH-M Model. Econometrica 55: 391. [Google Scholar] [CrossRef]

- Fama, Eugene F., and Kenneth R. French. 1993. Common risk factors in the returns on stocks and bonds. Journal of Financial Economics 33: 3–56. [Google Scholar] [CrossRef]

- Fama, Eugene F., and Kenneth R. French. 2006. Profitability, Investment and Average Returns. Journal of Financial Economics 82: 491–518. [Google Scholar] [CrossRef]

- Fama, Eugene F., and Kenneth R. French. 2015. A Five-Factor Asset Pricing Model. Journal of Financial Economics 116: 1–22. [Google Scholar] [CrossRef]

- Fama, Eugene F., and Kenneth R. French. 2017. International Tests of a Five-Factor Asset Pricing Model. Journal of Financial Economics 123: 441–63. [Google Scholar] [CrossRef]

- Fama, Eugene F., and Kenneth R. French. 2021. The Value Premium. The Review of Asset Pricing Studies 11: 105–21. [Google Scholar] [CrossRef]

- Flannery, Mark J., and Christopher M. James. 1984. The Effect of Interest Rate Changes on the Common Stock Returns of Financial Institutions. The Journal of Finance 39: 1141–53. [Google Scholar] [CrossRef]

- Glosten, Lawrence R., Ravi Jagannathan, and David E. Runkle. 1993. On the Relation between the Expected Value and the Volatility of the Nominal Excess Return on Stocks. The Journal of Finance 48: 1779–1801. [Google Scholar] [CrossRef]

- Gompers, Paul A., and Andrew Metrick. 2001. Institutional Investors and Equity Prices. The Quarterly Journal of Economics 116: 229–59. [Google Scholar] [CrossRef]

- Gregoriou, Andros, Jerome V. Healy, and Huong Le. 2019. Prospect Theory and Stock Returns: A Seven Factor Pricing Model. Journal of Business Research 101: 315–22. [Google Scholar] [CrossRef]

- Harvey, Campbell R., Yan Liu, and Heqing Zhu. 2015. … And the Cross-Section of Expected Returns. Review of Financial Studies 29: 5–68. [Google Scholar] [CrossRef]

- Hirshleifer, David. 2001. Investor Psychology and Asset Pricing. The Journal of Finance 56: 1533–97. [Google Scholar] [CrossRef]

- Horowitz, Joel L., Tim Loughran, and N. E. Savin. 2000. Three Analyses of the Firm Size Premium. Journal of Empirical Finance 7: 143–53. [Google Scholar] [CrossRef]

- Israel, Ronen, Kristoffer Laursen, and Scott Richardson. 2021. Is (Systematic) Value Investing Dead? The Journal of Portfolio Management 47: 38–62. [Google Scholar] [CrossRef]

- Jegadeesh, Narasimhan, and Sheridan Titman. 1993. Returns to Buying Winners and Selling Losers: Implications for Stock Market Efficiency. The Journal of Finance 48: 65–91. [Google Scholar] [CrossRef]

- Jensen, Gerald R., and Jeffrey M. Mercer. 2002. Monetary Policy and the Cross-Section of Expected Stock Returns. Journal of Financial Research 25: 125–39. [Google Scholar] [CrossRef]

- Jensen, Gerald R., and Robert R. Johnson. 1995. Discount Rate Changes and Security Returns in the U.S., 1962–1991. Journal of Banking & Finance 19: 79–95. [Google Scholar]

- Lakonishok, Josef, Andrei Shleifer, and Robert W. Vishny. 1994. Contrarian Investment, Extrapolation, and Risk. The Journal of Finance 49: 1541–78. [Google Scholar] [CrossRef]

- Lee, Charles M. C., and Bhaskaran Swaminathan. 2000. Price Momentum and Trading Volume. The Journal of Finance 55: 2017–69. [Google Scholar] [CrossRef]

- Liu, Ryan. 2015. Profitability Premium: Risk or Mispricing. Working Paper. Berkeley: University of California at Berkeley. [Google Scholar]

- Lucas, André, Ronald van Dijk, and Teun Kloek. 2002. Stock Selection, Style Rotation, and Risk. Journal of Empirical Finance 9: 1–34. [Google Scholar] [CrossRef]

- Novy-Marx, Robert. 2013. The Other Side of Value: The Gross Profitability Premium. Journal of Financial Economics 108: 1–28. [Google Scholar] [CrossRef]

- Novy-Marx, Robert, and Mihail Velikov. 2016. A Taxonomy of Anomalies and Their Trading Costs. Review of Financial Studies 29: 104–47. [Google Scholar] [CrossRef]

- Peng, Yulei, and Anastasia Zervou. 2022. Monetary Policy Rules and the Equity Premium in a Segmented Markets Model. Journal of Macroeconomics 73: 103448. [Google Scholar] [CrossRef]

- Rupande, Lorraine, Hilary Tinotenda Muguto, and Paul-Francois Muzindutsi. 2019. Investor Sentiment and Stock Return Volatility: Evidence from the Johannesburg Stock Exchange. Cogent Economics & Finance 7: 1600233. [Google Scholar]

- Ryan, Nina, Xinfeng Ruan, Jin E. Zhang, and Jing A. Zhang. 2021. Choosing Factors for the Vietnamese Stock Market. Journal of Risk and Financial Management 14: 96. [Google Scholar] [CrossRef]

- Schmeling, Maik. 2009. Investor Sentiment and Stock Returns: Some International Evidence. Journal of Empirical Finance 16: 394–408. [Google Scholar] [CrossRef]

- Shiller, Robert J., Laurence Black, and Farouk Jivraj. 2020. Cape and the COVID-19 Pandemic Effect. SSRN Electronic Journal. [Google Scholar] [CrossRef]

- Stambaugh, Robert F., Jianfeng Yu, and Yu Yuan. 2012. The Short of It: Investor Sentiment and Anomalies. Journal of Financial Economics 104: 288–302. [Google Scholar] [CrossRef]

- Yogo, Motohiro. 2006. A Consumption-Based Explanation of Expected Stock Returns. The Journal of Finance 61: 539–80. [Google Scholar] [CrossRef]

- Zhang, Lu. 2005. The Value Premium. The Journal of Finance 60: 67–103. [Google Scholar] [CrossRef]

| Panel A: Summary Statistics | |||||||

| Factor | Mean | Std Dev | Skewness | Kurtosis | Min. | Max. | J-B p-Value |

| MKT | 0.50% | 4.46% | −0.53 | 4.86 | −23.24% | 16.10% | 0 *** |

| SMB | 0.24% | 3.06% | 0.36 | 5.94 | −14.89% | 18.08% | 0 *** |

| HML | 0.31% | 2.84% | 0.18 | 4.88 | −11.12% | 12.58% | 0 *** |

| RMW | 0.27% | 2.22% | −0.36 | 14.91 | −18.48% | 13.38% | 0 *** |

| CMA | 0.29% | 2.02% | 0.29 | 4.57 | −6.86% | 9.56% | 0 *** |

| Panel B: Correlation | |||||||

| Factor | MKT | SMB | HML | RMW | CMA | ||

| MKT | 1 | ||||||

| SMB | 0.2753 | 1 | |||||

| HML | −0.2628 | −0.0720 | 1 | ||||

| RMW | −0.2276 | −0.3497 | 0.0749 | 1 | |||

| CMA | −0.3868 | −0.1094 | 0.6982 | −0.0208 | 1 | ||

| Panel A: Market Interest Rate | ||||||||||

| Mean equation | MKT | sig. | SMB | sig. | HML | sig. | RMW | sig. | CMA | sig. |

| α0 | 0.006795406 | *** | −0.003629754 | −0.003479769 | 0.00052994 | −0.000456219 | ||||

| α1 | −0.973851351 | *** | 0.286024613 | 0.107339715 | 0.152218445 | −0.187890021 | ||||

| α2 | 0.997752256 | *** | −0.229988333 | 0.081121286 | 0.034077168 | 0.34468827 | ||||

| θ | −0.604867658 | 6.22177931 | ** | 8.803958089 | ** | 5.15587362 | 8.646080338 | ** | ||

| Variation equation | MKT | sig. | SMB | sig. | HML | sig. | RMW | sig. | CMA | sig. |

| c | 0.000117513 | 1.36498 × 10−5 | *** | 5.6773 × 10−5 | 2.03594 × 10−5 | ** | 1.59796 × 10−5 | *** | ||

| β0 | 0.782318086 | *** | 0.900480245 | *** | 0.769263822 | *** | 0.76033416 | *** | 0.805079476 | *** |

| β1 | 6.32604 × 10−7 | 0.041221065 | ** | 0.136872996 | *** | 0.099573185 | *** | 0.165594664 | *** | |

| γ | 0.237598736 | ** | 0.06034208 | ** | 0.03500549 | 0.119326942 | *** | −0.015304667 | ||

| δ1 | 3.72661 × 10−8 | 2.39482 × 10−8 | 1.14986 × 10−9 | 1.64954 × 10−8 | 1.23424 × 10−8 | |||||

| δ2 | 0.000153546 | * | 2.76056 × 10−5 | ** | 7.49583 × 10−11 | 1.3496 × 10−5 | *** | 2.05207 × 10−14 | ||

| Q (1) | 0.4017 | 0.3313 | 0.1469 | 0.2168 | 0.01182 | |||||

| Q2(1) | 1.131 | 2.983 | * | 0.1331 | 0.001119 | 0.02039 | ||||

| LR | 1120.5735 | 1361.4760 | 1449.7505 | 1691.6370 | 1663.4572 | |||||

| Panel B: Market Sentiment | ||||||||||

| Mean equation | MKT | sig. | SMB | sig. | HML | sig. | RMW | sig. | CMA | sig. |

| α0 | 0.005186875 | *** | −0.0036223 | −0.004262586 | * | 0.000387967 | −0.000322223 | |||

| α1 | −0.968695186 | *** | 0.29744931 | 0.051987334 | 0.146189831 | −0.203586676 | ||||

| α2 | 0.99756942 | *** | −0.23678886 | 0.134076416 | 0.039879886 | 0.36061074 | ||||

| θ | 0.174393636 | *** | 6.063753787 | ** | 9.956908309 | ** | 5.533532516 | 8.466187894 | *** | |

| Variation equation | MKT | sig. | SMB | sig. | HML | sig. | RMW | sig. | CMA | sig. |

| c | 0.000299818 | 3.18093 × 10−5 | * | 2.77249 × 10−5 | *** | 1.76581 × 10−5 | 1.29522 × 10−5 | |||

| β0 | 0.710886661 | ** | 0.885483718 | *** | 0.767125912 | *** | 0.715696254 | *** | 0.80590199 | *** |

| β1 | 1.57348 × 10−5 | 0.052530383 | *** | 0.143508512 | *** | 0.124978501 | ** | 0.168393785 | *** | |

| γ | 0.267358116 | 0.058797585 | * | 0.020556351 | 0.125660482 | −0.029136122 | *** | |||

| δ1 | 1.51625 × 10−7 | 8.06477 × 10−12 | 2.47578 × 10−6 | *** | 3.92106 × 10−6 | *** | 4.24528 × 10−6 | *** | ||

| δ2 | 3.12517 × 10−15 | 9.93627 × 10−9 | 6.01189 × 10−5 | * | 3.12318 × 10−5 | 8.21522 × 10−6 | *** | |||

| Q (1) | 0.6886 | 0.2647 | 0.1391 | 0.342 | 0.01711 | |||||

| Q2(1) | 1.154 | 1.923 | 0.1197 | 0.1714 | 0.003999 | |||||

| LR | 1119.4598 | 1361.1512 | 1451.0504 | 1692.7932 | 1664.2625 | |||||

| Panel A: Interest Rate Cycles | Panel B: Sentiment Cycles | ||||||||

|---|---|---|---|---|---|---|---|---|---|

| FF5 | High-Interest Rate | Low-Interest Rate | FF5 | High-Sentiment | Low-Sentiment | ||||

| αH | p-Value | αL | p-Value | βH | p-Value | βL | p-Value | ||

| MKT | 0.0011 | 0.6653 | 0.0089 | 0.0002 *** | MKT | 0.0031 | 0.2142 | 0.0069 | 0.0058 *** |

| SMB | 0.0006 | 0.7339 | 0.0042 | 0.0049 *** | SMB | 0.0004 | 0.7977 | 0.0044 | 0.0106 ** |

| HML | 0.0056 | 0.0015 *** | 0.0007 | 0.6053 | HML | 0.0052 | 0.0018 *** | 0.0012 | 0.4438 |

| RMW | 0.0042 | 0.0040 *** | 0.0012 | 0.2321 | RMW | 0.0051 | 0.0003 *** | 0.0003 | 0.7426 |

| CMA | 0.0047 | 0.0003 *** | 0.0011 | 0.2469 | CMA | 0.0041 | 0.0007 *** | 0.0017 | 0.105 |

| Panel A: Interest Rate Cycles | Panel B: Sentiment Cycles | ||||||

|---|---|---|---|---|---|---|---|

| Variables | Coefficient | t-Statistics | p-Value | Variables | Coefficient | t-Statistics | p-Value |

| DrH | 0.0024 | 8.864 | 0.0000 *** | DsH | 0.0018 | 6.9912 | 0.0000 *** |

| DrL | 0.0001 | 0.4152 | 0.6781 | DsL | 0.0008 | 2.8437 | 0.0046 *** |

| MKT | 0.9987 | 194.0783 | 0.0000 *** | MKT | 0.9974 | 191.0676 | 0.0000 *** |

| SMB | −0.1658 | −23.3289 | 0.0000 *** | SMB | −0.1663 | −23.1701 | 0.0000 *** |

| HML | 0.0375 | 4.002 | 0.0001 *** | HML | 0.0383 | 3.9306 | 0.0001 *** |

| RMW | 0.0515 | 4.2948 | 0.0000 *** | RMW | 0.0518 | 4.2941 | 0.0000 *** |

| CMA | 0.0307 | 1.9104 | 0.0565 * | CMA | 0.0326 | 1.9933 | 0.0467 ** |

| Adj. R² | 0.9902 | Adj. R² | 0.9897 | ||||

| Obs. (N) | 641 | Obs. (N) | 641 | ||||

| Low-Interest Rate, Low-Sentiment (LL) | Low-Interest Rate, High-Sentiment (LH) | ||||||

| Coefficient | t-Statistics | p-Value | Coefficient | t-Statistics | p-Value | ||

| α0 | −0.0004 | −1.2063 | 0.2293 * | α0 | 0.0007 | 2.5669 | 0.0114 ** |

| MKT | 1.0045 | 100.7429 | 0.0000 *** | MKT | 1.0103 | 135.173 | 0.0000 *** |

| SMB | −0.1608 | −10.8232 | 0.0000 *** | SMB | −0.1617 | −12.3898 | 0.0000 *** |

| HML | 0.0214 | 1.4297 | 0.1545 | HML | −0.0043 | −0.2074 | 0.836 |

| RMW | 0.0211 | 0.8392 | 0.4025 | RMW | 0.0162 | 0.9154 | 0.3617 |

| CMA | 0.0378 | 1.348 | 0.1793 | CMA | 0.1082 | 5.0722 | 0.0000 *** |

| High-Interest Rate, Low-Sentiment (HL) | High-Interest Rate, High-Sentiment (HH) | ||||||

| Coefficient | t-Statistics | p-Value | Coefficient | t-Statistics | p-Value | ||

| α0 | 0.0022 | 5.4594 | 0.0000 *** | α0 | 0.0028 | 6.5045 | 0.0000 *** |

| MKT | 0.9908 | 73.4711 | 0.0000 *** | MKT | 0.9796 | 72.2565 | 0.0000 *** |

| SMB | −0.1467 | −11.3989 | 0.0000 *** | SMB | −0.1826 | −12.7264 | 0.0000 *** |

| HML | 0.0657 | 3.1738 | 0.0019 *** | HML | 0.0397 | 1.9107 | 0.0577 * |

| RMW | 0.1067 | 4.5282 | 0.0000 *** | RMW | 0.0522 | 2.7324 | 0.0069 *** |

| CMA | 0.0286 | 0.88 | 0.3805 | CMA | −0.0079 | −0.2086 | 0.835 |

| Panel A: Low-Interest Rate, Low-Sentiment (LL) | Panel B: Low-Interest Rate, High-Sentiment (LH) | ||||||

| Mean | Std Dev | Sharpe ratio | Mean | Std Dev | Sharpe ratio | ||

| MKT | 0.99% | 4.43% | 0.1759 | MKT | 0.75% | 4.10% | 0.1167 |

| SMB | 0.63% | 2.86% | 0.1461 | SMB | 0.14% | 2.39% | −0.0585 |

| HML | 0.23% | 2.75% | 0.0041 | HML | −0.14% | 2.10% | −0.1979 |

| RMW | 0.02% | 1.97% | −0.0969 | RMW | 0.25% | 1.56% | −0.0137 |

| CMA | 0.20% | 1.64% | −0.0099 | CMA | −0.02% | 1.62% | −0.1841 |

| Panel C: High-Interest Rate, Low-Sentiment (HL) | Panel D: High-Interest Rate, High-Sentiment (HH) | ||||||

| Mean | Std Dev | Sharpe ratio | Mean | Std Dev | Sharpe ratio | ||

| MKT | 0.28% | 4.54% | −0.0507 | MKT | −0.02% | 4.63% | −0.1221 |

| SMB | 0.18% | 3.36% | −0.099 | SMB | −0.02% | 3.43% | −0.1658 |

| HML | −0.03% | 2.66% | −0.2049 | HML | 1.01% | 3.37% | 0.1381 |

| RMW | 0.05% | 1.84% | −0.252 | RMW | 0.70% | 2.98% | 0.0508 |

| CMA | 0.14% | 2.21% | −0.171 | CMA | 0.73% | 2.40% | 0.0782 |

| Variables | Coefficient | t-Statistics | p-Value |

|---|---|---|---|

| α0 | 0.0015 | 7.5624 | 0.0000 *** |

| Dn | −0.0041 | −8.0967 | 0.0000 *** |

| MKT | 0.9981 | 195.3209 | 0.0000 *** |

| SMB | −0.1671 | −23.5883 | 0.0000 *** |

| HML | 0.038 | 4.1087 | 0.0000 *** |

| RMW | 0.0515 | 4.2983 | 0.0000 *** |

| CMA | 0.035 | 2.1701 | 0.0304 ** |

| Adj. R² | 0.9898 |

| Panel A: Nominal Interest Rate Cycles | Panel B: Consumer Sentiment Cycles | ||||||

|---|---|---|---|---|---|---|---|

| Variables | Coefficient | t-Statistics | p-Value | Variables | Coefficient | t-Statistics | p-Value |

| DrH | 0.0026 | 8.5855 | 0.0000 *** | DsH | 0.0016 | 5.0312 | 0.0000 *** |

| DrL | −0.0003 | −1.1637 | 0.2451 | DsL | 0.0006 | 2.081 | 0.0380 ** |

| MKT | 0.9997 | 168.7748 | 0.0000 *** | MKT | 1.0016 | 159.0878 | 0.0000 *** |

| SMB | −0.1801 | −20.7159 | 0.0000 *** | SMB | −0.1798 | −20.1159 | 0.0000 *** |

| HML | 0.0267 | 2.6221 | 0.0090 *** | HML | 0.0281 | 2.5414 | 0.0114 ** |

| RMW | 0.0502 | 3.6999 | 0.0002 *** | RMW | 0.0489 | 3.6333 | 0.0003 *** |

| CMA | 0.0455 | 2.3713 | 0.0181 ** | CMA | 0.0475 | 2.4752 | 0.0137 ** |

| Adj. R² | 0.9904 | Adj. R² | 0.9894 | ||||

| Obs. (N) | 491 | Obs. (N) | 491 | ||||

| Low-Interest Rate, Low-Sentiment (LL) | Low-Interest Rate, High-Sentiment (LH) | ||||||

| Coefficient | t-Statistics | p-Value | Coefficient | t-Statistics | p-Value | ||

| α0 | −0.001 | −4.0213 | 0.0001 *** | α0 | 0.0005 | 1.1502 | 0.2527 |

| MKT | 1.0079 | 160.7171 | 0.0000 *** | MKT | 0.9847 | 46.8232 | 0.0000 *** |

| SMB | −0.1554 | −12.0788 | 0.0000 *** | SMB | −0.1239 | −6.7069 | 0.0000 *** |

| HML | 0.015 | 1.0614 | 0.2905 | HML | 0.0253 | 0.8877 | 0.3767 |

| RMW | 0.0243 | 1.7982 | 0.0745 * | RMW | 0.0416 | 1.0272 | 0.3067 |

| CMA | 0.0293 | 1.5436 | 0.1252 | CMA | 0.0202 | 0.5362 | 0.593 |

| High-Interest Rate, Low-Sentiment (HL) | High-Interest Rate, High-Sentiment (HH) | ||||||

| Coefficient | t-Statistics | p-Value | Coefficient | t-Statistics | p-Value | ||

| α0 | 0.0028 | 5.3776 | 0.0000 *** | α0 | 0.0024 | 5.6847 | 0.0000 *** |

| MKT | 0.9842 | 72.9481 | 0.0000 *** | MKT | 0.9991 | 59.0599 | 0.0000 *** |

| SMB | −0.2137 | −12.6005 | 0.0000 *** | SMB | −0.1918 | −7.2861 | 0.0000 *** |

| HML | −0.026 | −0.9459 | 0.3463 | HML | −0.0084 | −0.3709 | 0.7113 |

| RMW | 0.0515 | 1.6182 | 0.1086 | RMW | 0.0911 | 3.2039 | 0.0017 *** |

| CMA | 0.1031 | 2.5057 | 0.0137 ** | CMA | 0.0912 | 2.6977 | 0.0079 *** |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Kuo, Y.-S.; Huang, J.-T. Factor-Based Investing in Market Cycles: Fama–French Five-Factor Model of Market Interest Rate and Market Sentiment. J. Risk Financial Manag. 2022, 15, 460. https://doi.org/10.3390/jrfm15100460

Kuo Y-S, Huang J-T. Factor-Based Investing in Market Cycles: Fama–French Five-Factor Model of Market Interest Rate and Market Sentiment. Journal of Risk and Financial Management. 2022; 15(10):460. https://doi.org/10.3390/jrfm15100460

Chicago/Turabian StyleKuo, Yu-Shang, and Jen-Tsung Huang. 2022. "Factor-Based Investing in Market Cycles: Fama–French Five-Factor Model of Market Interest Rate and Market Sentiment" Journal of Risk and Financial Management 15, no. 10: 460. https://doi.org/10.3390/jrfm15100460

APA StyleKuo, Y.-S., & Huang, J.-T. (2022). Factor-Based Investing in Market Cycles: Fama–French Five-Factor Model of Market Interest Rate and Market Sentiment. Journal of Risk and Financial Management, 15(10), 460. https://doi.org/10.3390/jrfm15100460