Do ESG Ratings Reduce the Asymmetry Behavior in Volatility?

Abstract

1. Introduction

2. Literature Review

2.1. Asymmetric Effect and Leverage Effect in Volatility

2.2. ESG Ratings and Financial Performance of Firms

3. Methodology

3.1. Conditional Mean

3.2. Conditional Variance

3.2.1. GJR-GARCH

3.2.2. AGARCH and NAGARCH

3.2.3. Stochastic Volatility with Leverage

3.3. Fixed Effects Regression

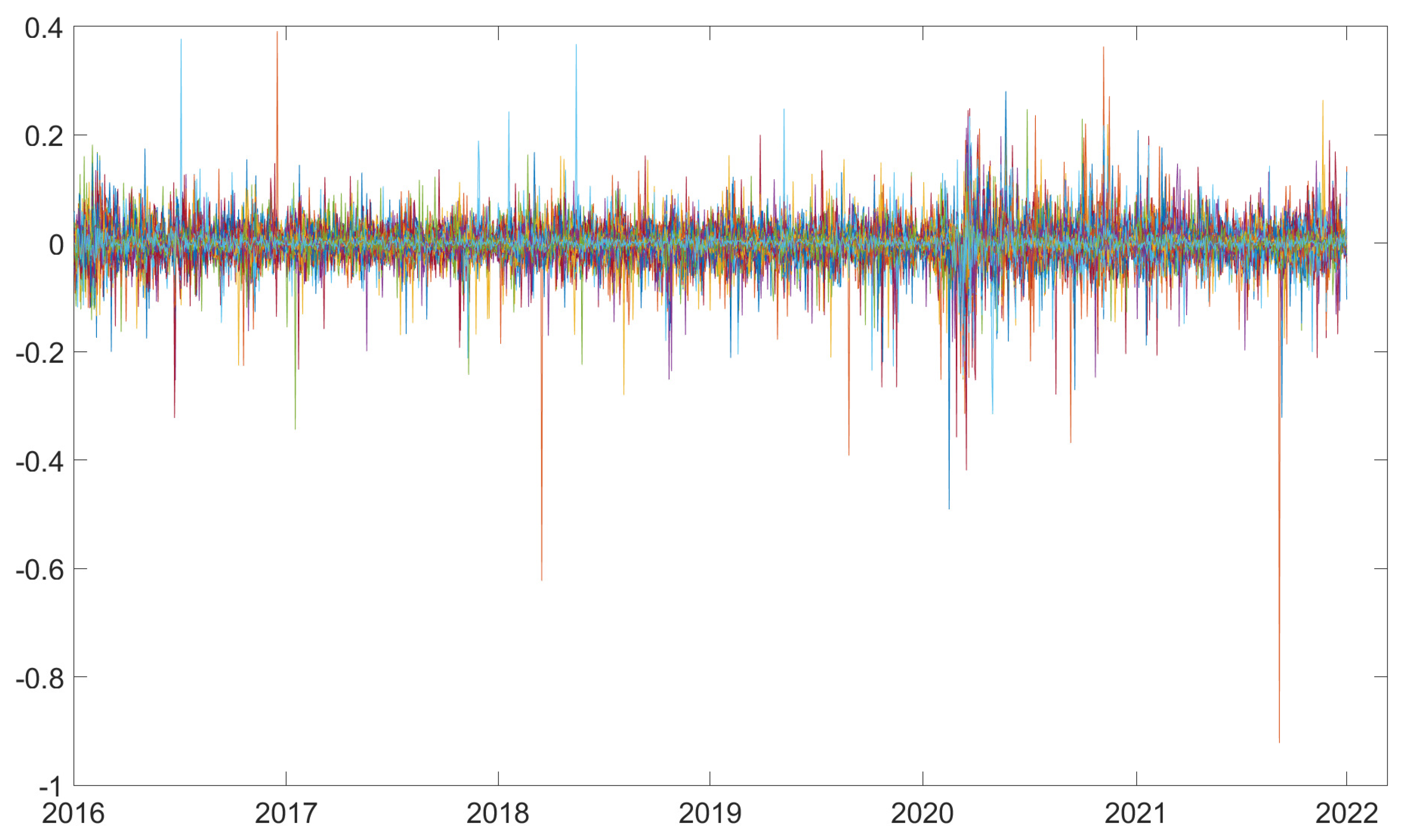

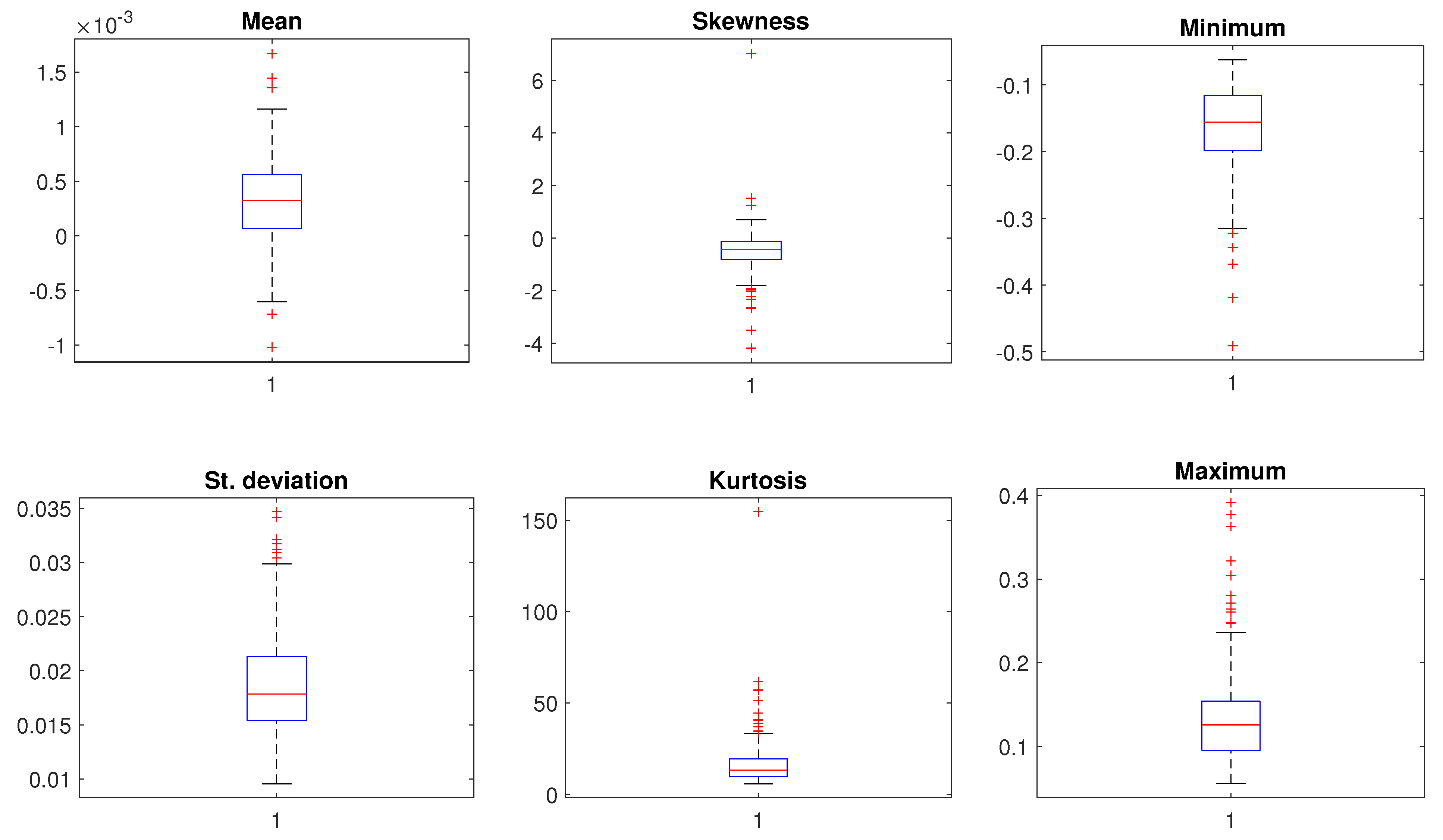

4. Data

5. Results

5.1. Asymmetry Coefficients

5.2. The Impact of ESG Ratings

6. Robustness Analysis

7. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

Appendix A

Appendix A.1. Results of the LFD-GLS Estimation Method

| LFD-GLS | AGARCH | NAGARCH | ||||

|---|---|---|---|---|---|---|

| All Firms | Southern | Non-Southern | All Firms | Southern | Non-Southern | |

| Beta | 0.00032 | 0.00738 *** | −0.00022 | 1.02073 ** | 0.84128 | 1.01664 ** |

| ESG | −0.00000 | −0.00005 * | −0.00000 | 0.00310 ** | −0.00122 | 0.00314 ** |

| Solvency R. | 0.00000 | −0.00022 *** | 0.00002 | −0.04138 *** | −0.05175 | −0.04138 *** |

| Beta.ESG | 0.00000 | −0.00006 | 0.00001 | −0.01336 ** | −0.00971 | −0.01324 ** |

| ESGSolv | 0.00000 | 0.00000 | −0.00000 | 0.00045 *** | 0.00067 | 0.00045 *** |

| COVID | 0.00082 | −0.01175 | 0.00170 | 0.42901 | 1.28019 | 0.02021 |

| ESG.COVID | 0.00001 | 0.00008 | −0.00000 | −0.00705 * | 0.00147 | 0.00209 |

| Beta.COVID | −0.00549 *** | 0.00072 | −0.00630 *** | −0.30962 | -1.21798 * | −0.33188 |

| SolvCOVID | −0.00006 * | −0.00001 | −0.00005 | 0.01146 ** | −0.00464 | 0.01259 * |

| N. obs. | 1016 | 256 | 760 | 1016 | 256 | 760 |

| R2 | 0.0944 | 0.1350 | 0.1028 | 0.3433 | 0.0556 | 0.3493 |

| Ftest_Pval | 0.00000 | 0.00000 | 0.00000 | 0.00000 | 0.00000 | 0.00000 |

| BC.MEM. ESG | 0 | −0.00005 | 0 | 0.00589 | 0 | 0.00747 |

| AC.MEM. ESG | 0 | −0.00005 | 0 | −0.00115 | 0 | 0.00747 |

| LFD-GLS | GJR-GARCH | SVL | ||||

|---|---|---|---|---|---|---|

| All Firms | Southern | Non-Southern | All Firms | Southern | Non-Southern | |

| Beta | 0.04087 | −0.02972 | −0.00612 | 0.07064 | 0.47665 ** | −0.00181 |

| ESG | 0.00173 *** | 0.00011 | 0.00201 *** | 0.00332 * | 0.00609 * | 0.00255 |

| Solvency R. | −0.00144 | 0.00147 | −0.00226 | 0.00427 ** | −0.00319 | 0.00492 ** |

| Beta.ESG | −0.00209 * | 0.00032 | −0.00073 | −0.00150 | −0.00749 ** | −0.00007 |

| ESGSolv | 0.00003 | −0.00002 | 0.00001 | −0.00003 | 0.00000 | −0.00003 |

| COVID | 0.18039 *** | −0.14648 | 0.16638 *** | 0.15451 | −0.01744 | 0.13012 |

| ESG.COVID | 0.00063 | 0.00148 | 0.00075 | −0.00189 * | 0.00059 | −0.00124 |

| Beta.COVID | −0.14185 | 0.02061 | −0.18603 | 0.07204 | 0.05346 | 0.07612 |

| SolvCOVID | −0.00424 *** | 0.00000 | −0.00224 | −0.00003 | −0.00209 | 0.00014 |

| N. obs. | 1016 | 256 | 760 | 1016 | 256 | 760 |

| R2 | 0.4087 | 0.0240 | 0.4206 | 0.0841 | 0.0884 | 0.0927 |

| Ftest_Pval | 0.00000 | 0.00310 | 0.00000 | 0.00000 | 0.00530 | 0.00000 |

| BC.MEM. ESG | −0.00031 | 0 | 0.00201 | 0.00332 | −0.00177 | 0 |

| AC.MEM. ESG | −0.00031 | 0 | 0.00201 | 0.00143 | −0.00177 | 0 |

| Sectors | ESG | Beta.ESG | ESG.Solv. | ESG.Covid | Nr. Obs. | MEM. of ESG |

|---|---|---|---|---|---|---|

| AGARCH: IND | . −0.00016 *** | . . | . 0.00001 *** | . . | . 212 | . 0.00015 |

| NAGARCH: CDISC CSTAP FIN IND UTIL | . 0.03599 *** . −0.00844 * −0.00226 *** . | . −0.03178 ** . . −0.00701 *** −0.02342 * | . . 0.00119 * . 0.00029 *** . | . . . . . . | . 108 92 176 212 64 | . 0.00135 0.04693 −0.00844 −0.00050 −0.01598 |

| GJR-GARCH: IND IT | . . 0.00177 * | . . . | . 0.00014 * . | . . . | . 212 52 | . 0.00439 0.00177 |

| SVL: COMM CDISC ENG HC IND IT | . . . . . 0.01424 *** . | . −0.00901 * 0.00624 ** . 0.01334 ** . . | . . . −0.00083 * −0.00036 *** −0.00045 ** 0.00049 * | . . . . 0.00727 * . . | . 72 108 28 68 212 52 | . −0.00685 0.00680 −0.03773 −0.00731/0.00004 0.00009 0.02129 |

Appendix A.2. List of Stocks and Their Inclusion in Panels

| Ticker | Firm | Country Code | Sector Code |

|---|---|---|---|

| III.L | 3I Group | GB | FIN |

| ABBN.SW | ABB Ltd | CH | IND |

| AC.PA | Accor | FR | CDISC |

| ACS.MC | ACS Actividades de Construccion y Servicios SA | ES | IND |

| ADS.DE | Adidas AG | DE | CDISC |

| AGN.AS | Aegon NV | NL | FIN |

| AENA.MC | Aena SA | ES | IND |

| AGS.BR | AGEAS | BE | FIN |

| AIR.PA | Airbus SE | FR | IND |

| AKZA.AS | Akzo Nobel NV | NL | MAT |

| ALFA.ST | Alfa Laval AB | SE | IND |

| ALV.DE | Allianz SE | DE | FIN |

| ALO.PA | Alstom | FR | IND |

| AMS.MC | Amadeus IT Group SA | ES | IT |

| AAL.L | Anglo American Plc | GB | MAT |

| ABI.BR | Anheuser Busch Inbev NV | BE | CSTAP |

| MT.AS | ArcelorMittal Inc | LU | MAT |

| AKE.PA | Arkema | FR | MAT |

| AHT.L | Ashtead Group | GB | IND |

| ASML.AS | ASML Holding NV | NL | IT |

| G.MI | Assicurazioni Generali SpA | IT | FIN |

| ABF.L | Associated British Foods | GB | CSTAP |

| AZN.L | AstraZeneca Plc | GB | HC |

| ATL.MI | Atlantia SpA | IT | IND |

| ATO.PA | AtoS SE | FR | IT |

| AV.L | Aviva | GB | FIN |

| CS.PA | AXA | FR | FIN |

| BA.L | BAE Systems Plc | GB | IND |

| BBVA.MC | Banco Bilbao Vizcaya Argentaria SA | ES | FIN |

| SAB.MC | Banco de Sabadell SA | ES | FIN |

| SAN.MC | Banco Santander SA | ES | FIN |

| BIRG.IR | Bank of Ireland Group | IE | FIN |

| BARC.L | Barclays | GB | FIN |

| BDEV.L | Barratt Developments | GB | CDISC |

| BAS.DE | BASF SE | DE | MAT |

| BAYN.DE | Bayer AG | DE | HC |

| BMW.DE | Bayer Motoren Werke AG (BMW) | DE | CDISC |

| BEI.DE | Beiersdorf AG | DE | CSTAP |

| BKG.L | Berkeley Group Holdings Plc | GB | CDISC |

| Ticker | Firm | Country Code | Sector Code |

|---|---|---|---|

| BHP.L | BHP Group Plc | GB | MAT |

| BNP.PA | BNP Paribas | FR | FIN |

| BOL.ST | Boliden AB | SE | MAT |

| EN.PA | Bouygues | FR | IND |

| BP.L | BP p.l.c | GB | ENG |

| BNR.DE | Brenntag AG | DE | IND |

| BATS.L | British American Tobacco Plc | GB | CSTAP |

| BLND.L | British Land Co | GB | REST |

| BT-A.L | BT Group | GB | COMM |

| BNZL.L | Bunzl | GB | IND |

| BRBY.L | Burberry Group | GB | CDISC |

| CABK.MC | CaixaBank | ES | FIN |

| CARL-B.CO | Carlsberg AS B | DK | CSTAP |

| CCL.L | Carnival Plc | GB | CDISC |

| CNA.L | Centrica | GB | UTIL |

| CLN.SW | Clariant AG Reg | CH | MAT |

| CNHI.MI | CNH Industrial NV | IT | IND |

| CBK.DE | Commerzbank AG | DE | FIN |

| CPG.L | Compass Group | GB | CDISC |

| CON.DE | Continental AG | DE | CDISC |

| 1COV.DE | Covestro AG | DE | MAT |

| ACA.PA | Credit Agricole SA | FR | FIN |

| CRH | CRH Plc | IE | MAT |

| CRDA.L | Croda Intl | GB | MAT |

| BN.PA | Danone | FR | CSTAP |

| DANSKE.CO | Danske Bank A/S | DK | FIN |

| DCC.L | DCC | IE | IND |

| DB | Deutsche Bank AG | DE | FIN |

| DB1.DE | Deutsche Boerse AG | DE | FIN |

| LHA.DE | Deutsche Lufthansa AG | DE | IND |

| DPW.DE | Deutsche Post AG | DE | IND |

| DTE.DE | Deutsche Telekom AG | DE | COMM |

| DGE.L | Diageo Plc | GB | CSTAP |

| DLG.L | Direct Line Insurance Group | GB | FIN |

| DNB.OL | DNB ASA | NO | FIN |

| DSV.CO | Dsv Panalpina A/s | DK | IND |

| EOAN.DE | E.ON SE | DE | UTIL |

| EZJ.L | Easyjet | GB | IND |

| EDEN.PA | Edenred | FR | IT |

| FGR.PA | Eiffage | FR | IND |

| EDF.PA | Electricite de France | FR | UTIL |

| ELISA.HE | Elisa Corporation | FI | COMM |

| ENG.MC | Enagas SA | ES | UTIL |

| ELE.MC | Endesa SA | ES | UTIL |

| ENEL.MI | Enel SpA | IT | UTIL |

| ENGI.PA | Engie | FR | UTIL |

| ENI.MI | ENI SpA | IT | ENG |

| EQNR.OL | Equinor ASA | NO | ENG |

| ERIC-B.ST | Ericsson L.M. Telefonaktie B | SE | IT |

| Ticker | Firm | Country Code | Sector Code |

|---|---|---|---|

| EBS.VI | Erste Group Bank AG | AT | FIN |

| EL.PA | EssilorLuxottica | FR | CDISC |

| EXPN.L | Experian Plc | GB | IND |

| FERG.L | Ferguson PLC | GB | IND |

| RACE.MI | Ferrari NV | IT | CDISC |

| FER.MC | Ferrovial SA | ES | IND |

| FLTR.L | Flutter Entertainment plc | IE | CDISC |

| FORTUM.HE | Fortum Oyj | FI | UTIL |

| FME.DE | Fresenius Medical Care AG | DE | HC |

| GALP.LS | Galp Energia SGPS SA | PT | ENG |

| GEBN.SW | Geberit AG Reg | CH | IND |

| GFC.PA | Gecina | FR | REST |

| GMAB.CO | Genmab AS | DK | HC |

| GIVN.SW | Givaudan AG | CH | HC |

| GSK.L | GlaxoSmithKline | GB | HC |

| GLEN.L | Glencore Plc | GB | MAT |

| GRF.MC | Grifols SA | ES | HC |

| GBLB.BR | Groupe Bruxelles Lambert | BE | FIN |

| HLMA.L | Halma | GB | IT |

| HL.L | Hargreaves Lansdown Plc | GB | FIN |

| HEI.DE | HeidelbergCement AG | DE | MAT |

| HEIA.AS | Heineken NV | NL | CSTAP |

| HM-B.ST | Hennes & Mauritz AB B | SE | CSTAP |

| HEXA-B.ST | Hexagon AB | SE | IT |

| HSBA.L | HSBC Holdings Plc | GB | FIN |

| IBE.MC | Iberdrola SA | ES | UTIL |

| IMB.L | Imperial Brands Plc | GB | CSTAP |

| INDU-A.ST | Industrivarden AB A | SE | FIN |

| IFX.DE | Infineon Technologies AG | DE | IT |

| INF.L | Informa PLC | GB | COMM |

| INGA.AS | ING Groep NV | NL | FIN |

| IHG.L | InterContinental Hotels Group Plc | GB | CDISC |

| IAG.L | International Consolidated Airlines Group SA | GB | IND |

| ITRK.L | Intertek Group PLC | GB | IND |

| ISP.MI | Intesa SanPaolo | IT | FIN |

| INVE-B.ST | Investor AB B | SE | FIN |

| ITV.L | ITV Plc | GB | COMM |

| JMAT.L | Johnson, Matthey | GB | MAT |

| KBC.BR | KBC Group NV | BE | FIN |

| KER.PA | Kering | FR | CDISC |

| KYGA.L | Kerry Group A | IE | CSTAP |

| KGP.L | Kingspan Group Plc | IE | IND |

| KINV-B.ST | Kinnevik Investment AB B | SE | FIN |

| LI.PA | Klepierre | FR | REST |

| KNEBV.HE | Kone Corp B | FI | IND |

| Ticker | Firm | Country Code | Sector Code |

|---|---|---|---|

| DSM.AS | Koninklijke DSM NV | NL | MAT |

| KPN.AS | Koninklijke KPN NV | NL | COMM |

| PHIA.AS | Koninklijke Philips Electronics NV (Royal Philips Electronics) | NL | HC |

| KNIN.SW | KUEHNE & NAGEL INTL AG-REG | CH | IND |

| OR.PA | L’Oreal | FR | CSTAP |

| LAND.L | Land Securities Group PLC | GB | REST |

| LXS.DE | Lanxess AG | DE | MAT |

| LGEN.L | Legal & General Group | GB | FIN |

| LDO.MI | Leonardo S.p.a. | IT | IND |

| LISN.SW | Lindt & Sprungli AG Reg | CH | CSTAP |

| LLOY.L | Lloyds Banking Group Plc | GB | FIN |

| LOGN.SW | Logitech International SA | CH | IT |

| MC.PA | LVMH-Moet Vuitton | FR | CDISC |

| MKS.L | Marks & Spencer Group | GB | CSTAP |

| MRO.L | Melrose Industries PLC | GB | IND |

| MRK.DE | MERCK KGaA | DE | HC |

| MONC.MI | Moncler SpA | IT | CDISC |

| MNDI.L | Mondi Plc | GB | MAT |

| MOWI.OL | Mowi ASA | NO | CSTAP |

| MTX.DE | MTU Aero Engines AG | DE | IND |

| NG.L | National Grid PLC | GB | UTIL |

| NTGY.MC | Naturgy Energy Group SA | ES | UTIL |

| NESN.SW | Nestle SA Reg | CH | CSTAP |

| NXT.L | Next | GB | CSTAP |

| NN.AS | NN Group N.V. | NL | FIN |

| NOKIA.HE | Nokia OYJ | FI | IT |

| NDA-FI.HE | Nordea Bank Abp | FI | FIN |

| NHY.OL | Norsk Hydro AS | NO | MAT |

| NOVN.SW | Novartis AG Reg | CH | HC |

| NZYM-B.CO | Novozymes AS B | DK | MAT |

| OMV.VI | OMV AG | AT | ENG |

| ORA.PA | Orange | FR | COMM |

| ORK.OL | Orkla AS | NO | CSTAP |

| PNDORA.CO | Pandora A/S | DK | CDISC |

| PGHN.SW | Partners Group Hldg | CH | REST |

| PSON.L | Pearson | GB | COMM |

| RI.PA | Pernod-Ricard | FR | CSTAP |

| PSN.L | Persimmon | GB | CDISC |

| PROX.BR | Proximus | BE | IND |

| PRU.L | Prudential Plc | GB | FIN |

| PRY.MI | Prysmian SpA | IT | IND |

| PUB.PA | Publicis Groupe | FR | COMM |

| QIA.DE | QIAGEN NV | DE | HC |

| Ticker | Firm | Country Code | Sector Code |

|---|---|---|---|

| RAND.AS | Randstad NV | NL | IND |

| REE.MC | Red Electrica Corporacion SA | ES | UTIL |

| REL.L | RELX Plc | GB | IND |

| RNO.PA | Renault SA | FR | CDISC |

| RTO.L | Rentokil Initial | GB | IND |

| REP.MC | Repsol SA | ES | ENG |

| CFR.SW | Richemont, Cie Financiere A Br | CH | CDISC |

| RIO.L | Rio Tinto Plc | GB | MAT |

| ROG.SW | Roche Hldgs AG Ptg Genus | CH | HC |

| RR.L | Rolls-Royce Holdings Plc | GB | IND |

| SAF.PA | Safran SA | FR | IND |

| SGE.L | Sage Group | GB | IT |

| SBRY.L | Sainsbury (J) | GB | CSTAP |

| SGO.PA | Saint-Gobain, Cie de | FR | IND |

| SAND.ST | Sandvik AB | SE | IND |

| SAN.PA | Sanofi-Aventis | FR | HC |

| SAP.DE | SAP SE | DE | IT |

| SCHN.SW | Schindler-Hldg AG Reg | CH | IND |

| SU.PA | Schneider Electric SE | FR | IND |

| SDR.L | Schroders Plc | GB | FIN |

| SGRO.L | SEGRO Plc | GB | REST |

| SVT.L | Severn Trent | GB | UTIL |

| SIE.DE | Siemens AG | DE | IND |

| SKA-B.ST | SKANSKA AB-B | SE | IND |

| SN.L | Smith & Nephew | GB | HC |

| SMIN.L | Smiths Group | GB | IND |

| SK3.IR | Smurfit Kappa Group PLC | IE | MAT |

| SRG.MI | Snam SpA | IT | UTIL |

| GLE.PA | Societe Generale | FR | FIN |

| SW.PA | Sodexo | FR | CDISC |

| SOLB.BR | Solvay | BE | MAT |

| SOON.SW | Sonova Holding AG | CH | HC |

| SPX.L | Spirax-Sarco Engineering | GB | IND |

| STJ.L | St James’s Place | GB | FIN |

| STAN.L | Standard Chartered | GB | FIN |

| STM.MI | STMicroelectronics NV | IT | IT |

| STERV.HE | Stora Enso OYJ R | FI | MAT |

| SHB-A.ST | Svenska Handelsbanken A | SE | FIN |

| UHR.SW | Swatch Group AG-B | CH | CDISC |

| SWED-A.ST | Swedbank AB | SE | FIN |

| SWMA.ST | Swedish Match AB | SE | CSTAP |

| SLHN.SW | Swiss Life Reg | CH | FIN |

| SPSN.SW | Swiss Prime Site AG | CH | REST |

| Ticker | Firm | Country Code | Sector Code |

|---|---|---|---|

| SCMN.SW | Swisscom AG Reg | CH | COMM |

| SY1.DE | Symrise AG | DE | MAT |

| TATE.L | Tate & Lyle | GB | CSTAP |

| TEL2-B.ST | Tele2 AB B | SE | COMM |

| TIT.MI | Telecom Italia SpA | IT | COMM |

| TEF.MC | Telefonica SA | ES | COMM |

| TEL.OL | Telenor ASA | NO | COMM |

| TELIA.ST | Telia Company AB | SE | COMM |

| TEN.MI | Tenaris SA | IT | ENG |

| TSCO.L | Tesco | GB | CSTAP |

| HO.PA | Thales | FR | IND |

| TKA.DE | ThyssenKrupp AG | DE | IND |

| TPK.L | Travis Perkins | GB | IND |

| TUI1.DE | TUI AG | DE | CDISC |

| UCB.BR | UCB SA | BE | HC |

| UMI.BR | Umicore | BE | MAT |

| URW.AS | Unibail Rodamco Westfield | FR | REST |

| UCG.MI | Unicredit SpA Ord | IT | FIN |

| UTDI.DE | United Internet AG Reg | DE | COMM |

| UU.L | United Utilities Group Plc | GB | UTIL |

| UPM.HE | UPM-Kymmene Oyj | FI | MAT |

| FR.PA | Valeo | FR | CDISC |

| VIE.PA | Veolia Environnement | FR | UTIL |

| VWS.CO | Vestas Wind Systems AS | DK | IND |

| VIFN.SW | Vifor Pharma Group | CH | HC |

| DG.PA | Vinci | FR | IND |

| VOD.L | Vodafone Group | GB | COMM |

| VOW.DE | Volkswagen AG | DE | CDISC |

| VOLV-B.ST | Volvo AB B | SE | CDISC |

| VNA.DE | Vonovia SE | DE | REST |

| WEIR.L | Weir Group | GB | IND |

| WTB.L | Whitbread | GB | CDISC |

| WKL.AS | Wolters Kluwer NV | NL | IND |

| WPP.L | WPP Plc | GB | COMM |

| YAR.OL | Yara International ASA | NO | MAT |

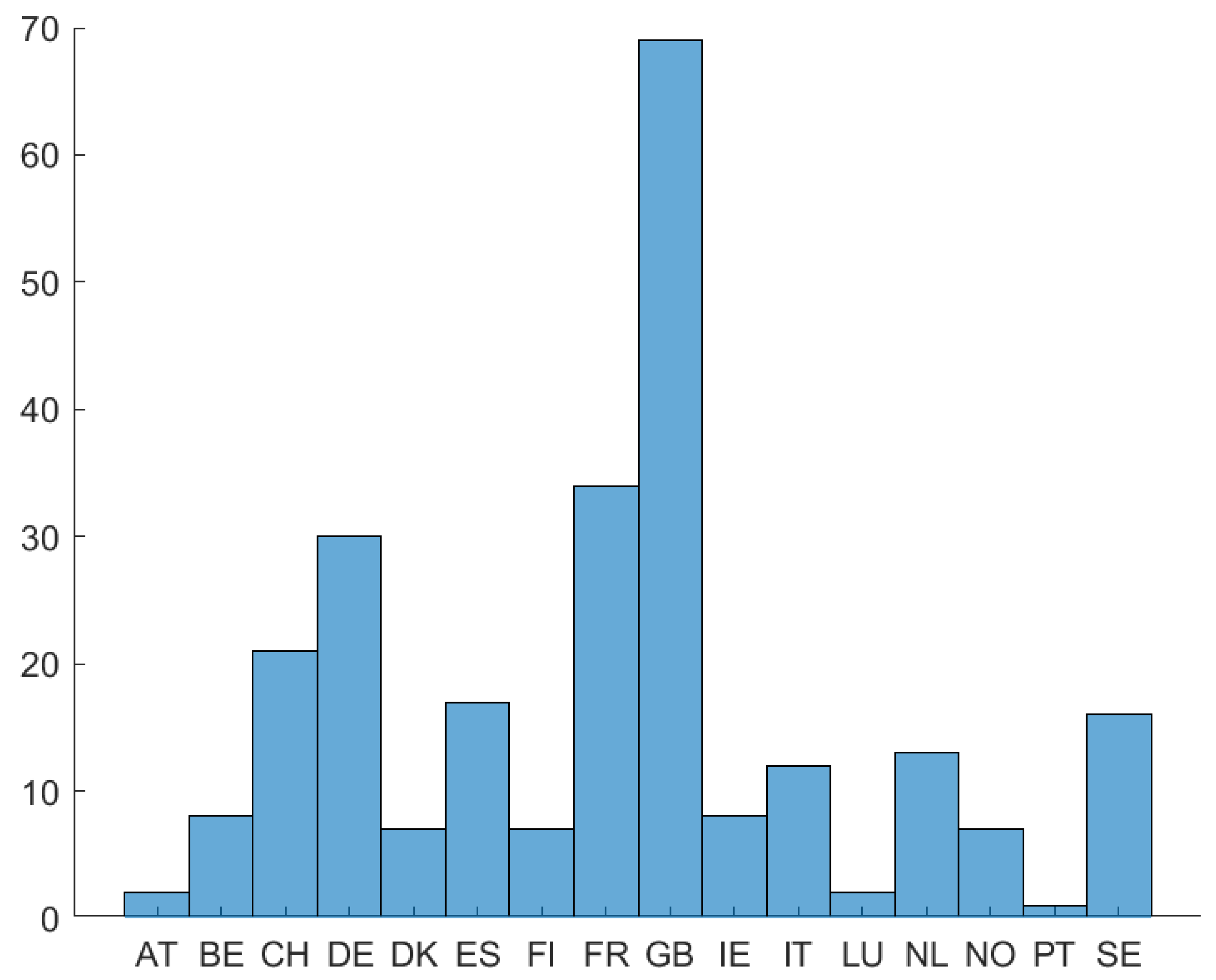

| Country Code | Country | No. of Firms |

|---|---|---|

| AT | Austria | 2 |

| BE | Belgium | 8 |

| CH | Switzerland | 21 |

| DE | Germany | 30 |

| DK | Denmark | 7 |

| ES | Spain | 17 |

| FI | Finland | 7 |

| FR | France | 34 |

| GB | Great Britain | 69 |

| IE | Ireland | 8 |

| IT | Italy | 12 |

| LU | Luxembourg | 2 |

| NL | Netherlands | 13 |

| NO | Norway | 7 |

| PT | Portugal | 1 |

| SE | Sweden | 16 |

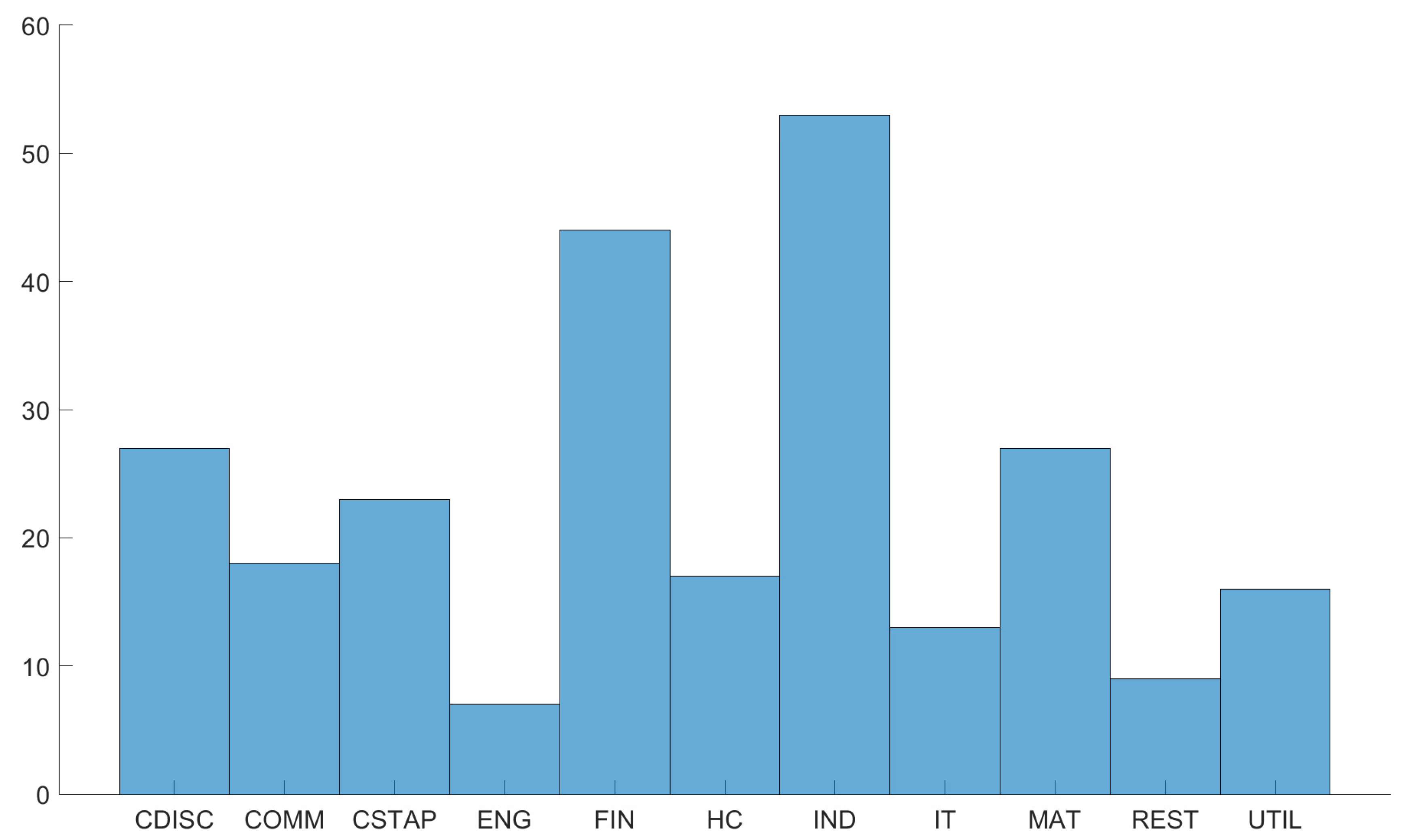

| Sector Code | Sector | No. of Firms |

|---|---|---|

| CDISC | Consumer Discretionary | 27 |

| COMM | Communication Services | 18 |

| CSTAP | Consumer Staples | 23 |

| ENG | Energy | 7 |

| FIN | Financials | 44 |

| HC | Healthcare | 17 |

| IND | Industrials | 53 |

| IT | Information Technology | 13 |

| MAT | Materials | 27 |

| REST | Real Estate | 9 |

| UTIL | Utilities | 16 |

| 1 | Since we do not remove outliers, but control for them using dummy variables, using this outlier detection method does not affect the results. |

| 2 | https://www.kevinsheppard.com/code/matlab/mfe-toolbox/ (accessed on 27 May 2022). |

| 3 | https://joshuachan.org/code/code_GARCH_SV.html (obtained on 21 May 2022). |

| 4 | We refer to years 2016–2019 as “before COVID-19” and to years 2020–2021 as “after COVID-19”. |

| 5 | https://www.spglobal.com/esg/scores (accessed on 25 March 2021 and 5 May 2022). |

| 6 | Asset-based solvency ratios are defined as (Shareholders’ funds/Total assets) × 100. |

| 7 | https://www.bvdinfo.com/en-gb/our-products/data/international/orbis (accessed on 17 May 2022). |

| 8 | The marginal effect at the mean is calculated as 0.00285 + 0.0421 × 0.9744 − 0.00006 × 35.139, using the sample means from Table 2. |

| 9 | We calculated the marginal effects at sample means using the statistically significant coefficients only, even if they are significant at 10%. |

| 10 | https://www.stata.com/manuals13/xtxtreg.pdf (accessed on 5 June 2022). |

| 11 | An increase in the dependent variable means less leverage effect for the SVL models. |

References

- Adrian, Tobias, and Hyun Song Shin. 2010. Liquidity and leverage. Journal of Financial Intermediation 19: 418–37. [Google Scholar] [CrossRef]

- Aharon, David Yechiam, and Yossi Yagil. 2019. The impact of financial leverage on the variance of stock returns. International Journal of Financial Studies 7: 14. [Google Scholar] [CrossRef]

- Allison, Paul D. 2009. Fixed Effects Regression Models. Thousand Oaks: SAGE Publications. [Google Scholar]

- Anderson, Theodore Wilbur, and Cheng Hsiao. 1981. Estimation of dynamic models with error components. Journal of the American Statistical Association 76: 598–606. [Google Scholar] [CrossRef]

- Arellano, Manuel. 1987. Computing robust standard errors for within-groups estimators. Oxford Bulletin of Economics and Statistics 49: 431–34. [Google Scholar] [CrossRef]

- Arellano, Manuel, and Stephen Bond. 1991. Some tests of specification for panel data: Monte carlo evidence and an application to employment equations. The Review of Economic Studies 58: 277–97. [Google Scholar] [CrossRef]

- Asai, Manabu, and Michael McAleer. 2011. Alternative asymmetric stochastic volatility models. Econometric Reviews 30: 548–64. [Google Scholar] [CrossRef]

- Asai, Manabu, Michael McAleer, and Jun Yu. 2006. Multivariate stochastic volatility: A review. Econometric Reviews 25: 145–75. [Google Scholar] [CrossRef]

- Bae, JinCheol, Xiaotong Yang, and Myung-In Kim. 2021. Esg and stock price crash risk: Role of financial constraints. Asia-Pacific Journal of Financial Studies 50: 556–81. [Google Scholar] [CrossRef]

- Balcilar, Mehmet, Riza Demirer, and Rangan Gupta. 2017. Do sustainable stocks offer diversification benefits for conventional portfolios? An empirical analysis of risk spillovers and dynamic correlations. Sustainability 9: 1799. [Google Scholar] [CrossRef]

- Becker, Janis, and Christian Leschinski. 2021. Estimating the volatility of asset pricing factors. Journal of Forecasting 40: 269–78. [Google Scholar] [CrossRef]

- Bekaert, Geert, and Guojun Wu. 2000. Asymmetric volatility and risk in equity markets. The Review of Financial Studies 13: 1–42. [Google Scholar] [CrossRef]

- Bekiros, Stelios, Mouna Jlassi, Kamel Naoui, and Gazi Salah Uddin. 2017. The asymmetric relationship between returns and implied volatility: Evidence from global stock markets. Journal of Financial Stability 30: 156–74. [Google Scholar] [CrossRef]

- Bellemare, Marc F., Takaaki Masaki, and Thomas B. Pepinsky. 2017. Lagged explanatory variables and the estimation of causal effect. The Journal of Politics 79: 949–63. [Google Scholar] [CrossRef]

- Black, Fischer. 1976. Studies of Stock Market Volatility Changes. Washington, DC: American Statistical Association Business and Economic Statistics Section. [Google Scholar]

- Bollerslev, Tim, and Hao Zhou. 2006. Volatility puzzles: A simple framework for gauging return-volatility regressions. Journal of Econometrics 131: 123–50. [Google Scholar] [CrossRef]

- Bollerslev, Tim, and Jeffrey M. Wooldridge. 1992. Quasi-maximum likelihood estimation and inference in dynamic models with time-varying covariances. Econometric Reviews 11: 143–72. [Google Scholar] [CrossRef]

- Bolton, Patrick, and Marcin Kacperczyk. 2021. Do investors care about carbon risk? Journal of Financial Economics 142: 517–49. [Google Scholar] [CrossRef]

- Boubaker, Sabri, Alexis Cellier, Riadh Manita, and Asif Saeed. 2020. Does corporate social responsibility reduce financial distress risk? Economic Modelling 91: 835–51. [Google Scholar] [CrossRef]

- Braun, Phillip A., Daniel B. Nelson, and Alain M. Sunier. 1995. Good news, bad news, volatility, and betas. The Journal of Finance 50: 1575–603. [Google Scholar] [CrossRef]

- Campbell, John Y., and Ludger Hentschel. 1992. No news is good news: An asymmetric model of changing volatility in stock returns. Journal of Financial Economics 31: 281–318. [Google Scholar] [CrossRef]

- Carnero, M. Angeles, and M. Hakan Eratalay. 2014. Estimating var-mgarch models in multiple steps. Studies in Nonlinear Dynamics & Econometrics 18: 339–365. [Google Scholar]

- Carr, Peter, and Liuren Wu. 2017. Leverage effect, volatility feedback, and self-exciting market disruptions. Journal of Financial and Quantitative Analysis 52: 2119–56. [Google Scholar] [CrossRef]

- Cerqueti, Roy, Rocco Ciciretti, Ambrogio Dalò, and Marco Nicolosi. 2021. Esg investing: A chance to reduce systemic risk. Journal of Financial Stability 54: 100887. [Google Scholar] [CrossRef]

- Chan, Joshua C. C., and Angelia L. Grant. 2016. Modeling energy price dynamics: Garch versus stochastic volatility. Energy Economics 54: 182–89. [Google Scholar] [CrossRef]

- Cheng, Hsiao. 1996. Analysis of Panel Data. Cambridge: Cambridge University Press. [Google Scholar]

- Cho, Young-Hye, and Robert F. Engle. 1999. Time-Varying Betas and Asymmetric Effect of News: Empirical Analysis of Blue Chip Stocks. Working Paper 7330. Cambridge, MA: NBER National Bureau of Economic Research. Available online: http://www.nber.org/papers/w7330 (accessed on 13 June 2022).

- Choi, Jaewon, and Matthew Richardson. 2016. The volatility of a firm’s assets and the leverage effect. Journal of Financial Economics 121: 254–77. [Google Scholar] [CrossRef]

- Christie, Andrew A. 1982. The stochastic behavior of common stock variances: Value, leverage and interest rate effects. Journal of Financial Economics 10: 407–32. [Google Scholar] [CrossRef]

- Clark, Gordon L., Andreas Feiner, and Michael Viehs. 2015. From the Stockholder to the Stakeholder: How Sustainability Can Drive Financial Outperformance. Available online: https://ssrn.com/abstract=2508281 (accessed on 13 June 2022).

- Degiannakis, Stavros, and Evdokia Xekalaki. 2004. Autoregressive conditional heteroscedasticity (arch) models: A review. Quality Technology & Quantitative Management 1: 271–324. [Google Scholar]

- Ding, Zhuanxin, Clive W. J. Granger, and Robert F. Engle. 1993. A long memory property of stock market returns and a new model. Journal of Empirical Finance 1: 83–106. [Google Scholar] [CrossRef]

- Durnev, Art, Randall Morck, and Bernard Yeung. 2004. Value enhancing capital budgeting and firm-specific stock returns variation. Journal of Finance 59: 2013–611. [Google Scholar] [CrossRef]

- England, Paula, Paul Allison, and Yuxiao Wu. 2007. Does bad pay cause occupations to feminize, does feminization reduce pay, and how can we tell with longitudinal data? Social Science Research 36: 1237–56. [Google Scholar] [CrossRef]

- Engle, Robert F., and Victor K. Ng. 1993. Measuring and testing the impact of news on volatility. The Journal of Finance 48: 1749–78. [Google Scholar] [CrossRef]

- Eratalay, Mustafa Hakan, and Ariana Paola Cortés Ángel. 2022. The impact of esg ratings on the systemic risk of european blue-chip firms. Journal of Risk and Financial Management 15: 153. [Google Scholar] [CrossRef]

- Friede, Gunnar, Timo Busch, and Alexander Bassen. 2015. Esg and financial performance: Aggregated evidence from more than 2000 empirical studies. Journal of Sustainable Finance & Investment 5: 210–33. [Google Scholar]

- Ghysels, Eric, Andrew C. Harvey, and Eric Renault. 1996. 5 Stochastic Volatility. In Handbook of Statistics Vol. 14: Statistical Methods in Finance. Edited by S. Maddala. Amsterdam: Elsevier, pp. 119–91. [Google Scholar]

- Giese, Guido, Linda-Eling Lee, Dimitris Melas, Zoltán Nagy, and Laura Nishikawa. 2019. Foundations of esg investing: How esg affects equity valuation, risk, and performance. The Journal of Portfolio Management 45: 69–83. [Google Scholar] [CrossRef]

- Glosten, Lawrence R., Ravi Jagannathan, and David E. Runkle. 1993. On the relation between the expected value and the volatility of the nominal excess return on stocks. The Journal of Finance 48: 1779–801. [Google Scholar] [CrossRef]

- Greene, William H., Abigail S. Hornstein, and Lawrence J. White. 2009. Multinationals do it better: Evidence on the efficiency of corporations’ capital budgeting. Journal of Empirical Finance 16: 703–20. [Google Scholar] [CrossRef][Green Version]

- Gregory, Richard Paul. 2022. Esg scores and the response of the s&p 1500 to monetary and fiscal policy during the COVID-19 pandemic. International Review of Economics & Finance 78: 446–56. [Google Scholar]

- Harvey, Andrew C., and Neil Shephard. 1996. Estimation of an asymmetric stochastic volatility model for asset returns. Journal of Business & Economic Statistics 14: 429–34. [Google Scholar]

- Hens, Thorsten, and Sven C Steude. 2009. The leverage effect without leverage. Finance Research Letters 6: 83–94. [Google Scholar] [CrossRef]

- Hentschel, Ludger. 1995. All in the family nesting symmetric and asymmetric garch models. Journal of Financial Economics 39: 71–104. [Google Scholar] [CrossRef]

- Hornstein, Abigail S., and William H. Greene. 2012. Usage of an estimated coefficient as a dependent variable. Economics Letters 116: 316–18. [Google Scholar] [CrossRef]

- Ionescu, George H., Daniela Firoiu, Ramona Pirvu, and Ruxandra Dana Vilag. 2019. The impact of esg factors on market value of companies from travel and tourism industry. Technological and Economic Development of Economy 25: 820–49. [Google Scholar] [CrossRef]

- Jacquier, Eric, Nicholas G. Polson, and Peter E. Rossi. 2004. Bayesian analysis of stochastic volatility models with fat-tails and correlated errors. Journal of Econometrics 122: 185–212. [Google Scholar] [CrossRef]

- Khan, Muhammad Arif. 2022. Esg disclosure and firm performance: A bibliometric and meta analysis. In Research in International Business and Finance. Amsterdam: Elsevier, p. 101668. [Google Scholar]

- Koopman, Siem Jan, Andre Lucas, and Marcel Scharth. 2016. Predicting time-varying parameters with parameter-driven and observation-driven models. Review of Economics and Statistics 98: 97–110. [Google Scholar] [CrossRef]

- Kuzey, Cemil, Ali Uyar, Mirgul Nizaeva, and Abdullah S. Karaman. 2021. Csr performance and firm performance in the tourism, healthcare, and financial sectors: Do metrics and csr committees matter? Journal of Cleaner Production 319: 128802. [Google Scholar] [CrossRef]

- Lai, Chi-Shiun, Chih-Jen Chiu, Chin-Fang Yang, and Da-Chang Pai. 2010. The effects of corporate social responsibility on brand performance: The mediating effect of industrial brand equity and corporate reputation. Journal of Business Ethics 95: 457–69. [Google Scholar] [CrossRef]

- Lee, Darren D., Robert W. Faff, and Saphira A. C. Rekker. 2013. Do high and low-ranked sustainability stocks perform differently? International Journal of Accounting & Information Management 21: 116–32. [Google Scholar]

- Leszczensky, Lars. 2013. Do national identification and interethnic friendships affect one another? A longitudinal test with adolescents of turkish origin in germany. Social Science Research 42: 775–88. [Google Scholar] [CrossRef]

- Leszczensky, Lars, and Tobias Wolbring. 2022. How to deal with reverse causality using panel data? recommendations for researchers based on a simulation study. Sociological Methods & Research 51: 837–65. [Google Scholar]

- Li, Han, Kai Yang, and Dehui Wang. 2019. A threshold stochastic volatility model with explanatory variables. Statistica Neerlandica 73: 118–38. [Google Scholar] [CrossRef]

- Lööf, Hans, Maziar Sahamkhadam, and Andreas Stephan. 2021. Is corporate social responsibility investing a free lunch? The relationship between esg, tail risk, and upside potential of stocks before and during the COVID-19 crisis. In Finance Research Letters. Amsterdam: Elsevier, p. 102499. [Google Scholar]

- Lopez-de Silanes, Florencio, Joseph A. McCahery, and Paul C. Pudschedl. 2020. Esg performance and disclosure: A cross-country analysis. Singapore Journal of Legal Studies 2020: 217–41. [Google Scholar]

- Lundgren, Amanda Ivarsson, Adriana Milicevic, Gazi Salah Uddin, and Sang Hoon Kang. 2018. Connectedness network and dependence structure mechanism in green investments. Energy Economics 72: 145–53. [Google Scholar] [CrossRef]

- Luo, Di. 2022. Esg, liquidity, and stock returns. Journal of International Financial Markets, Institutions and Money 78: 101526. [Google Scholar] [CrossRef]

- Michelon, Giovanna. 2011. Sustainability disclosure and reputation: A comparative study. Corporate Reputation Review 14: 79–96. [Google Scholar] [CrossRef]

- Moreira, Alan, and Tyler Muir. 2017. Volatility-managed portfolios. The Journal of Finance 72: 1611–44. [Google Scholar] [CrossRef]

- Nelson, Daniel B. 1991. Conditional heteroskedasticity in asset returns: A new approach. Econometrica: Journal of the Econometric Society 59: 347–70. [Google Scholar] [CrossRef]

- Newey, Whitney K., and Frank Windmeijer. 2009. Generalized method of moments with many weak moment conditions. Econometrica 77: 687–719. [Google Scholar]

- Oikonomou, Ioannis, Chris Brooks, and Stephen Pavelin. 2012. The impact of corporate social performance on financial risk and utility: A longitudinal analysis. Financial Management 41: 483–515. [Google Scholar] [CrossRef]

- Reed, William Robert. 2015. On the practice of lagging variables to avoid simultaneity. Oxford Bulletin of Economics and Statistics 77: 897–905. [Google Scholar] [CrossRef]

- Revelli, Christophe, and Jean-Laurent Viviani. 2015. Financial performance of socially responsible investing (sri): What have we learned? a meta-analysis. Business Ethics: A European Review 24: 158–85. [Google Scholar] [CrossRef]

- Schwert, G. William. 1989. Business cycles, financial crises, and stock volatility. In Carnegie-Rochester Conference Series on Public Policy. Amsterdam: Elsevier, vol. 31, pp. 83–125. [Google Scholar]

- So, Mike K. P., Wai Keung Li, and K. Lam. 2002. A threshold stochastic volatility model. Journal of Forecasting 21: 473–500. [Google Scholar] [CrossRef]

- Sonnenberger, David, and Gregor N. F. Weiss. 2021. The Impact of Corporate Social Responsibility on Firms’ Exposure to Tail Risk: The Case of Insurers. Available online: https://ssrn.com/abstract=3764041 (accessed on 14 June 2022).

- Stavroyiannis, Stavros. 2018. A note on the nelson-cao inequality constraints in the gjr-garch model: Is there a leverage effect? International Journal of Economics and Business Research 16: 442–52. [Google Scholar] [CrossRef]

- Sun, Wenbin, and Kexiu Cui. 2014. Linking corporate social responsibility to firm default risk. European Management Journal 32: 275–87. [Google Scholar] [CrossRef]

- Teräsvirta, Timo. 2009. An introduction to univariate garch models. In Handbook of Financial Time Series. Berlin and Heidelberg: Springer, pp. 17–42. [Google Scholar]

- Vaisey, Stephen, and Andrew Miles. 2017. What you can—And can’t—Do with three-wave panel data. Sociological Methods & Research 46: 44–67. [Google Scholar]

- Wagner, Marcus. 2003. How Does It Pay to Be Green?: An Analysis of the Relationship between Environmental and Economic Performance at the Firm Level and the Influence of Corporate Environmental Strategy Choice. Marburg: Tectum Verlag DE. [Google Scholar]

- Yu, Jun. 2002. MCMC Methods for Estimating Stochastic Volatility Models with Leverage Effects: Comments on Jacquier, Polson and Rossi. Working Paper. Auckland, New Zealand: Department of Economics, University of Auckland. [Google Scholar]

- Zakoian, Jean-Michel. 1994. Threshold heteroskedastic models. Journal of Economic Dynamics and Control 18: 931–55. [Google Scholar] [CrossRef]

| Variables | Description | Source |

|---|---|---|

| Asymmetric effects coefficients | Estimated coefficients of asymmetry from the GJR-GARCH, AGARCH, NAGARCH, and SVL models | Author’s calculations |

| Market beta | A stock’s exposure to market risk, calculated as the covariance of a stock return with the market return, divided by the variance of the market return | Author’s calculations |

| Solvency ratio | Asset-based solvency ratios of the firms to proxy the inverse of firms’ leverage positions | Orbis Europe |

| ESG ratings | ESG ratings of the firms | S&P Global |

| COVID-19 | Dummy variable for years 2020 and 2021 to account for the COVID-19 effect |

| Beta | ESG | Solvency R. | |

|---|---|---|---|

| All firms | 0.9744 | 56.1548 | 35.1390 |

| Southern | 1.0489 | 68.7552 | 27.9963 |

| Non-southern | 0.9493 | 51.9105 | 37.5450 |

| Beta | ESG | Solvency R. | |

|---|---|---|---|

| COMM | 0.7601 | 56.7778 | 33.9336 |

| CDISC | 1.0899 | 55.4444 | 42.4017 |

| CSTAP | 0.6300 | 48.9275 | 39.4335 |

| ENG | 1.0837 | 53.4286 | 45.4547 |

| FIN | 1.1801 | 58.4356 | 16.6283 |

| HC | 0.7450 | 57.6373 | 47.9136 |

| IND | 1.0494 | 50.8899 | 31.4282 |

| IT | 1.1006 | 58.7949 | 43.4659 |

| MAT | 1.1212 | 60.4444 | 47.6497 |

| REST | 0.7339 | 50.5556 | 52.4499 |

| UTIL | 0.6825 | 71.5938 | 25.5615 |

| Years | GJR-GARCH | AGARCH | NAGARCH | SVL |

|---|---|---|---|---|

| 2016 | 0.1496 | 0.2598 | 0.1063 | 0.4843 |

| 2017 | 0.2559 | 0.1496 | 0.1181 | 0.4764 |

| 2018 | 0.1772 | 0.1772 | 0.1024 | 0.5433 |

| 2019 | 0.2362 | 0.1378 | 0.1142 | 0.5118 |

| 2020 | 0.2205 | 0.3346 | 0.0787 | 0.3661 |

| 2021 | 0.2638 | 0.1299 | 0.1181 | 0.4882 |

| AB-GLS | AGARCH | NAGARCH | ||||

|---|---|---|---|---|---|---|

| All Firms | Southern | Non-Southern | All Firms | Southern | Non-Southern | |

| .Lag1 | −0.10829 ** | 0.02209 | −0.14772 *** | −0.01884 *** | 0.06169 | −0.01953 *** |

| Beta | 0.00127 | −0.00024 | 0.00132 | −1.39361 * | −0.26217 | −1.48509 * |

| ESG | 0.00000 | 0.00002 | 0.00000 | −0.00456 * | −0.00402 | −0.00473 * |

| Solvency R. | −0.00003 | 0.00008 | −0.00003 | 0.05820 * | 0.01749 | 0.06152 * |

| Beta.ESG | −0.00002 | −0.00001 | −0.00002 | 0.01814 * | 0.00832 | 0.01951 * |

| ESGSolv | 0.00000 | −0.00000 | 0.00000 | −0.00062 * | −0.00041 | −0.00067 * |

| COVID | 0.00285 * | −0.00916 * | 0.00305 | −1.11383 * | −1.15177 * | −0.11889 |

| ESG.COVID | −0.00002 | 0.00004 | −0.00002 | 0.01782 * | 0.01073 | 0.00176 |

| Beta.COVID | 0.00421 *** | 0.00740 ** | 0.00469 *** | 0.26539 | 0.13665 | 0.59359 |

| SolvCOVID | −0.00006 *** | 0.00008 | −0.00008 *** | −0.01599 * | 0.01528 ** | −0.02699 * |

| N. obs. | 1016 | 256 | 760 | 1016 | 256 | 760 |

| N. groups | 254 | 64 | 190 | 254 | 64 | 190 |

| Ftest_Pval | 0.00000 | 0.00000 | 0.00000 | 0.00000 | 0.00000 | 0.00000 |

| BC.MEM. ESG | 0 | 0 | 0 | −0.00867 | 0 | −0.01136 |

| AC.MEM. ESG | 0 | 0 | 0 | 0.00915 | 0 | −0.00960 |

| AB-GLS | GJR-GARCH | SVL | ||||

|---|---|---|---|---|---|---|

| All Firms | Southern | Non-Southern | All Firms | Southern | Non-Southern | |

| .Lag1 | −0.00857 | 0.11726 | −0.00244 | −0.06767 * | 0.00277 | −0.10420 ** |

| Beta | 0.03774 | 0.01383 | 0.06094 | −0.35202 *** | −0.62741 *** | −0.27979 *** |

| ESG | −0.00332 *** | −0.00044 * | −0.00437 *** | −0.00815 *** | −0.00797 *** | −0.00757 *** |

| Solvency R. | −0.00047 | −0.00041 | 0.00068 | −0.00244 | −0.00653 | −0.00218 |

| Beta.ESG | 0.00245 ** | 0.00013 | 0.00033 | 0.00334 ** | 0.00717 *** | 0.00202 |

| ESGSolv | −0.00002 | 0.00001 | 0.00005 *** | 0.00007 * | 0.00012 | 0.00005 |

| COVID | −0.15843 | −0.09645 | −0.03549 | −0.02563 | 0.01659 | 0.03359 |

| ESG.COVID | 0.00267 * | 0.00065 | 0.00338 *** | 0.00136 | −0.00243 | 0.00146 |

| Beta.COVID | −0.02997 | 0.08343 *** | 0.02110 | −0.04560 | 0.11494 | −0.11083 * |

| SolvCOVID | 0.00486 *** | −0.00001 | −0.00171 ** | −0.00086 | 0.00053 | −0.00067 |

| N. obs. | 1016 | 256 | 760 | 1016 | 256 | 760 |

| N. groups | 254 | 64 | 190 | 254 | 64 | 190 |

| Ftest_Pval | 0.00000 | 0.00000 | 0.00000 | 0.00000 | 0.00000 | 0.00000 |

| BC.MEM. ESG | −0.00093 | −0.00044 | −0.00249 | −0.00244 | −0.00045 | −0.00757 |

| AC.MEM. ESG | 0.00174 | −0.00044 | 0.00089 | −0.00244 | −0.00045 | −0.00757 |

| Sectors | ESG | Beta.ESG | ESG.Solv. | ESG.Covid | Obs./Gr. | MEM. of ESG |

|---|---|---|---|---|---|---|

| AGARCH: CSTAP ENG IND IT MAT REST UTIL | . −0.00013 ** 0.00038 *** 0.00013 * −0.00028 ** −0.00012 ** 0.00023 ** . | . . . . 0.00024 ** . −0.00043 ** 0.00046 *** | . . . . . . . . | . . . . 0.00043 *** . . . | . 92/23 28/7 212/53 52/13 108/27 36/9 64/16 | . −0.00013 0.00038 0.00013 −0.00002/0.00041 −0.00012 −0.00009 0.00031 |

| NAGARCH: CDISC HC IND IT MAT | . −0.01730 * . 0.00158 * −0.04358 *** −0.01045 * | . . 0.02484 ** . 0.03469 *** −0.03264 * | . −0.00057 *** . . . 0.00122 * | . . . . . . | . 108/27 68/17 212/53 52/13 108/27 | . −0.04147 0.01851 0.00158 −0.00540 0.01109 |

| GJR-GARCH: ENG IT UTIL | . . . −0.00709 *** | . 0.00626 *** 0.00186 ** . | . −0.00018 * . 0.00029 *** | . . . . | . 28/7 52/13 64/16 | . −0.00139 0.00205 0.00032 |

| SVL: COMM CDISC CSTAP ENG FIN HC IND REST UTIL | . −0.01129 ** −0.00757 *** . −0.01435 * −0.01005 *** . −0.01267 *** −0.01126 ** −0.00855 * | . 0.01365 ** . 0.00833 * . 0.00771 ** −0.01054 ** 0.00456 * 0.01995 * . | . . 0.00011 ** . . . 0.00015 * . . . | . . . . . . . . . . | . 72/18 108/27 92/23 28/7 176/44 68/17 212/53 36/9 64/16 | . −0.00091 −0.00291 0.00525 −0.01435 −0.00095 −0.00067 −0.00788 −0.00791 −0.00855 |

| Sectors | ESG Ratings Increase Asymmetry/Leverage | ESG Ratings Decrease Asymmetry/Leverage |

|---|---|---|

| COMM | SVL | - |

| CDISC | SVL | NAGARCH |

| CSTAP | - | AGARCH, SVL |

| ENG | AGARCH, SVL | GJR-GARCH |

| FIN | SVL | - |

| HC | NAGARCH, SVL | - |

| IND | AGARCH, NAGARCH, SVL | - |

| IT | AGARCH, GJR-GARCH | AGARCH(vs), NAGARCH |

| MAT | NAGARCH | AGARCH |

| REST | SVL | AGARCH(vs) |

| UTIL | AGARCH, GJR-GARCH, SVL | - |

| Sectors | ESG Ratings Increase Asymmetry/Leverage | ESG Ratings Decrease Asymmetry/Leverage |

|---|---|---|

| COMM | SVL | - |

| CDISC | NAGARCH | SVL |

| CSTAP | NAGARCH | - |

| ENG | SVL | - |

| FIN | - | NAGARCH |

| HC | SVL | SVL(vs) |

| IND | AGARCH, GJR-GARCH | NAGARCH, SVL(vs) |

| IT | GJR-GARCH | SVL |

| MAT | - | - |

| REST | - | - |

| UTIL | - | NAGARCH |

| Sectors | AB-GLS | LFD-GLS |

|---|---|---|

| COMM | increase | increase |

| CDISC | increase (?) | decrease (?) |

| CSTAP | decrease | increase |

| ENG | increase (?) | increase |

| FIN | increase | decrease |

| HC | increase | increase |

| IND | increase | not clear |

| IT | not clear | decrease (?) |

| MAT | not clear | no result |

| REST | increase (?) | no result |

| UTIL | increase | decrease |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Zarafat, H.; Liebhardt, S.; Eratalay, M.H. Do ESG Ratings Reduce the Asymmetry Behavior in Volatility? J. Risk Financial Manag. 2022, 15, 320. https://doi.org/10.3390/jrfm15080320

Zarafat H, Liebhardt S, Eratalay MH. Do ESG Ratings Reduce the Asymmetry Behavior in Volatility? Journal of Risk and Financial Management. 2022; 15(8):320. https://doi.org/10.3390/jrfm15080320

Chicago/Turabian StyleZarafat, Hashem, Sascha Liebhardt, and Mustafa Hakan Eratalay. 2022. "Do ESG Ratings Reduce the Asymmetry Behavior in Volatility?" Journal of Risk and Financial Management 15, no. 8: 320. https://doi.org/10.3390/jrfm15080320

APA StyleZarafat, H., Liebhardt, S., & Eratalay, M. H. (2022). Do ESG Ratings Reduce the Asymmetry Behavior in Volatility? Journal of Risk and Financial Management, 15(8), 320. https://doi.org/10.3390/jrfm15080320