Abstract

This study aimed to examine the relationship between risk and return using the Sharia Compliant Assets Pricing Model (SCAPM) with the profit-sharing approach (mudharabah) variable as a substitute for the risk-free rate (Rf) in energy sector companies in Indonesia as an empirical test object. The analytical tool used is univariate time series analysis using the ARX-GARCH model to determine validity of the model and forecast for the next 7 days. The findings showed a significant relationship between risk and return in a mining company in Indonesia. In addition, in terms of stock volatility, which is higher than market volatility, the shares of mining companies are shown to be in demand by investors compared to other average stocks in the Indonesian market. So, it can be concluded that the mudharabah variable can be used as a risk-free alternative rate (Rf).

1. Introduction

One of the analytical tools used to explain the relationship between risk and return of a security is the Capital Assets Pricing Model (CAPM) proposed by Sharpe (1964), Lintner (1969), and Mossin (1966), which explains the existence of a linear and significant relationship between returns security with a systematic risk level with a beta coefficient (β) and a return premium, namely the market return value after deducting the risk-free rate.

Several empirical studies support a positive and significant relationship between risk and return in the CAPM theoretical framework, including Pettengill et al. (1995) in Colombo, Lam (2001) in Hong Kong, Tang and Shum (2003), Sandoval and Saens (2004) in Latin America, and Xiao (2016) in the American stock market. In Indonesia, research that supports the CAPM theory or the significance of risk and return was put forward by Kisman and Restiyanita (2015) and Sembiring et al. (2016). However, research by Febrian and Herwany (2010), and Sutrisno and Nasri (2018) does not support the CAPM.

This difference in testing has also encouraged Islamic economic practitioners to examine the relevance of the CAPM model to Islamic investments. However, the use of a risk-free rate in CAPM model has caused debate among Islamic economics because it is considered usury (riba) and violates the principle of no profit without risk (al-ghunam bil ghurm). Therefore, they have tried to develop not only forms of sharia investment but also models of analysis and calculations that are subject to sharia principles, namely, eliminating the element of interest as a form of fixed income, which is considered usury or riba, as well as the imposition of zakat on income that is obtained.

Among the analyses that practitioners try to develop using these assumptions is an asset pricing model using the Sharia Compliant Assets Pricing Model (SCAPM) method. Previous researchers have tried several alternative methods by eliminating the element of usury, including Tomkins and Karim (1987) who proposed removing all components of interest in all economic analysis and practice. This model was empirically tested by Hakim et al. (2016) in Malaysia, which compared the zero beta SCAPM and non-Rf SCAPM models with the classical CAPM model. This study found that both SCAPM models could explain sharia returns as conventional CAPM explained returns on all stocks.

Then, El-Ashker (1987) and Derbali et al. (2017) tried to develop the CAPM theory by replacing the risk-free rate with the zakat rate, which acts as the minimum rate of investment income or risk benchmark and purification of market returns. Furthermore, Shaikh (2010) proposes the use of the gross domestic product (GDP) rate as a substitute for the risk-free rate (Rf) because it is considered to represent the productivity of the community in an area. Islam recommends that everyone work productively and produce better values than previously. This productivity value can be used as an exposure risk of the expected profit resulting from work.

Next, Hanif (2011) proposes explicitly using the inflation rate to substitute for the risk-free rate (Rf) in the CAPM. This model is considered the most relevant model and approaches the classical CAPM model because the Rf component is formed by considering inflation in its determination. This model was then retested by Hanif and Dar (2013) by comparing the CAPM and SCAPM models, by using KSE-100 data for the period July 2001–June 2010. The findings are that there are no significant results for the high and low capitalization portfolio data in both models. Meanwhile, for portfolios with medium capitalization, the explanatory power of SCAPM is slightly better than CAPM.

Several other previous empirical studies that supported this research were also conducted by Subekti et al. (2020) who conducted research in Indonesia on the JII-70 index for the period January 2014 to December 2019. Using five SCAPM models, namely zero Rf, inflation, zakat, NGDP, and rate sukuk, this study found that SCAPM by using rate-sukuk was able to explain the level of the expected return is higher than other models. However, a significant test for comparing all sharia models has not been provided. Furthermore, Subekti and Rosadi (2022) also conducted an empirical test using the inflation SCAPM to test the performance of the sharia index stock portfolio in Indonesia during the COVID-19 period. Using the Black-Litterman (BL) method, this study compares the performance between BL-SCAPM and BL-CAPM with the result that during the COVID-19 period, the portfolio formed using BL-SCAPM is better than B-CAPM which is characterized by the impact of Sharpe ratio B-SCAPM is more significant, and portfolio losses are lower for the BL-SCAPM model. Furthermore, Rehan et al. (2021) conducted a comparison test between four SCAPM models, namely without risk free-rate, zakat, NGDP, and inflation, with conventional CAPM on the Pakistan Stock Exchange (PSX) for the period January 2001–December 2018 using the General Method of Moments. The test also considers the presence of an impact of size anomaly. The results of this study indicate that the SCAPM model with GDP and inflation has a larger significant value of explanatory power (R-square) and F-statistics compared to the conventional CAPM. Therefore, the two SCAPM models can be used to replace the CAPM in analyzing expected returns.

Although the model that was previously developed fulfilled several sharia principles, several things should be discussed, especially in its empirical application. The Askher and Derbali models that use zakat are considered to show a fundamental difference between zakat as a function of expenditure and Rf, which is a function of income. In addition, the provisions of the haul and nisab on zakat make this model difficult to apply. Likewise, the GDP model by Shaikh has several obstacles, namely, the difference in the principle of using the interest or risk-free rate as risk exposure, which is clearly different from GDP, where interest can be used as a monetary instrument to stabilize the economy; for example, when the government wants the economy to move more productively, then interest will be lowered, and vice versa, so that the movement between public interest and production (GDP) will be in the opposite direction. The inflation model by Hanif is considered a weakness because inflation is only one component in the formation of Rf, in addition to the cost of capital and the level of business risk. If only using inflation as a substitute for Rf, the Expected Return (E(R)s) value of the Islamic CAPM will always be smaller than the classic CAPM.

Based on these criticisms, this study proposes the use of equivalent return of profit-sharing (mudharabah), which is a popular return on Islamic finance contracts, to substitute risk-free rate in the Sharia Compliance Assets Pricing Model or SCAPM. The SCAPM model using mudharabah has been proposed by Faisol et al. (2022) by comparing 6 SCAPM mudharabah models with conventional CAPM using the Mann–Whitney difference test. The findings obtained are that there is no significant difference in expected returns between the six variations of the SCAPM mudharabah model and the CAPM, so it can be concluded that mudharabah can be used in the asset pricing model.

Furthermore, this study will conduct an empirical test of the use of the SCAPM mudharabah model subject to zakah (SCAPMRMDZ) to analyze the relationship between the risk and return relationship using ADRO from an energy company as a sample. The test was carried out using the ARX GARCH model, to form an optimal model for the relationship between risk and return. The data used are the return from the deposit of mudharabah contracts over a period of 12 months in Islamic banking in Indonesia. In addition, the calculation will also be subject to zakat as an instrument of purification assets, with the assumption that zakat is imposed on all income earned.

The scope of this research is limited to Islamic financial model, mostly in the asset pricing model.

2. Literature Review

2.1. Sharia Principle in Sharia Compliance Asset Pricing Model (SCAPM)

Sharia Compliance Asset Pricing Model (SCAPM) is an alternative model developed from the Capital Asset Pricing Model (CAPM) but assumes compliance with Islamic Sharia principles. These sharia principles include:

- No interest chargesThe rule in Islamic economics prohibits the active practice of levy interest called usury (riba). The absence of this interest instruments creates its own problems in financial modeling based on sharia economics. On the other hand, interest can function as a return on investment. However, interest also acts as a risk measure for various investment alternatives which the projections are in the form of a risk-free rate (Rf). Based on the assumption that all investments are risky, the risk benchmark is the Islamic banking industry’s return on the mudharabah contract. This legal contract fulfils the element of fairness in sharing profits and risks between related parties in an investment.

- Imposition of zakat for incomeZakat is the only financial instrument whose existence is ordered direct from God, as an obligation payment to pay net assets as well as a form of distributing wealth from people who have excess assets to those in need with certain criteria. Therefore, the SCAPM model will include zakat as an element of its calculation. The amount of zakat used is 2.5% of the profits obtained by a person.

2.2. Development of the SCAPM

The existence of the sharia principle has encouraged several researchers and practitioners of sharia economics to develop alternative models of CAPM that meet these rules. Several previous researchers have proposed instruments that can replace interest, including Tomkin and Karim, who proposed removing all components of fixed interest from the Islamic economy because the conventional economy has different traditions and laws from Islamic economics. Islamic economics prohibits fixed interest (riba), which adds to loans and certainty of profits on risky investments. Therefore, they propose that Islamic economic practices do not use fixed interest, and consequently, the CAPM model is considered invalid.

Ashker suggested replacing interest with zakat as the minimum return that investors must earn in investment to pay their obligations to their property. No minimum return investors will prefer to spend their money on consumption rather than investment. By developing Ashker’s notion of zakat, Derbali et al., with some modifications, reconstructed the SCAPM model by using a Sukuk or Islamic bonds as a risk-free replacement rate with the imposition of zakat on Sukuk and market returns as a fee charged for cleaning up assets treasure as required in the third rule.

Although the non-risk-free exchange rate model developed by Tomkin and Karim has complied with sharia principles by eliminating the risk-free exchange rate (Rf) function as a minimum return measure, there is no other alternative so it must be assumed that all asset investments are risky. Therefore, the CAPM model using beta is irrelevant.

So as with Ashker and Dirbali models, the difference between the functions Rf as income and zakat as a function of obligations or expenses also causes the zakat model to have weak assumptions.

Similarly, in the model developed by Dirbali, the use of the rate Sukuk as a substitute for Rf has a weakness because the nature of the Sukuk rate remains constant throughout the life of the Sukuk. So, its use cannot accommodate changes in economic and market conditions that occur during the economic life of the Sukuk. This situation causes the use of Sukuk can cause its own risk in its calculations.

Further, Shaikh argued that the use of interest with the principle of the time value of money is contrary to Islamic economics, which considers the increase in the value of money as a result of economic activity and not time. In addition, because every job, especially business, will always experience a business cycle, process risk-taking becomes commonplace. The use of interest that has provided certainty of return in investment is contrary to this principle.

Furthermore, Shaikh also stated that the use of interest in the economy would cause an imbalance in the market because interest can cause a shortage of capital. Therefore, it is essential to bring changes to practical finance according to Islamic economic principles. Shaikh proposed to replace the interest. Components with obligatory wealth, such as zakat, can be used as incentives for loans or other financing models so that creditors will still obtain a minimum return in wealth tax exemption. In addition, the elimination of interest also has the opportunity to increase trading activity because it can make money productive through trade and not loans so that investment increases and public debt decreases.

Another finding put forward by Shaikh is that there are indications that interest rates affect nominal GDP in the same direction. Therefore, GDP growth can be used as an assessment tool in Islamic finance models, including in the CAPM.

Shaikh’s findings were later adopted by Mulyawan (2015), who used production growth (GDP) instead of Rf in its function as an exposed risk, with the argument that every investment is said to be productive when the income from an investment is above the growth of production/GDP in a region. This argument aligns with the belief that Islam recommends that income is the result of productivity and encourages everyone to work productively and provide better results than the previous time.

Although Shaikh stated that nominal GDP can be used instead of interest because it has the same direction as interest value. In theory, the focus of the work of the two is the opposite. With the increase in interest, the market will respond by reducing its products so that the value of GDP will fall, and vice versa. So, the use of GDP as a replacement no risk-free rate yet can be considered raw and still need tested level its validity with research other.

Next, Hanif tried to develop the SCAPM model by replacing the risk-free rate (Rf) with the inflation rate. The argument presented is because Rf contains two components: inflation and interest (actual Rf). Interest is forbidden in sharia principles. Therefore, inflation should be considered in predicting the level of profit in practical Islamic finance. Hanif calls his modified CAPM model Sharia Compliant Asset Pricing Model (SCAPM) with inflation.

Although considered the most relevant model, the model that uses inflation developed by Hanif has some weaknesses. The existing reality is that inflation is only one component in the formation of Rf besides the cost of capital and rate risk business. So, if the only use of inflation is a replacement Rf, then the expected return value of SCAPM will always be smaller than the expected return of classic E(R) CAPM and not describe existing assets.

A brief explanation of the development of the previously proposed SCAPM model and some criticisms of it can be seen in Table 1.

Table 1.

Development of the SCAPM.

2.3. State-of-the-Art

Several criticisms of the previously developed SCAPM model have led this research to be interested in compiling the SCAPM using the average return equivalent to mudharabah as a risk-free replacement rate as a novelty. This mudharabah SCAPM modeling is built based on assumptions adopted from sharia economic principles.

The first assumption in model building is no risk-free rate in system Islamic economics which means all investments must be considered risky. Rf component in the CAPM must also be replaced with score payback other results that describe principle Islamic economics. This set average equivalent return mudharabah (RMD) as replacement Rf.

Based on the second assumption, the existence of the obligation of zakat on the value of the return, so the model of SCAPM mudharabah will become:

Ri: Stock return on time i, RMDZ: return mudharabah with zakat on t period, β: beta or systemic risk, Rm − RMDZ: risk premium.

Ri = RMDZt + β (Rm − RMDZt),

3. Materials and Methods

In this study, the data used were data on the stock returns of the Adaro energy company engaged in the field of energy from 2016 to 2020. In addition, daily return data from the JKSE market index and the equivalent return of profit-sharing (mudharabah) of Islamic banking in Indonesia are used for the same period. In conducting the analysis, the first step was to plot the time series data to see the behavior of the data. Then, in the second step, if the data were not stationary, data differencing was carried out, namely, changing the non-stationary data into stationary data. For stationary data, the Augmented Dickey-Fuller (ADF) test can also be used (Brockwell and Davis 2016; Tsay 2005). After the stationary assumptions were met, data modeling was carried out to obtain the best model. Before selecting the best model, we first found the optimal lag for the best model using the Akaike information criterion corrected (AICC) (Wei 2006). Based on the results of the AICC lag, the best model was determined based on the smallest value of the AICC. After the optimal lag was obtained for the best model, then model formation, parameter estimation, and hypothesis testing were carried out on the best model that was accepted. This study will also examine the behavior of data return volatility. It will determine whether there is an autoregressive conditional heteroscedastic (ARCH) effect using the Lagrange Multiplier (LM) test (Tsay 2005). If there is an ARCH effect, then the modeling will be developed by including the residual modeling by applying the Generalized Autoregressive Conditional Heteroscedasticity (GARCH) so that the final model obtained is ARX(p,s)-GARCH(l,m) model. Based on this model, further analysis was developed to forecast the return data for Adaro Energy, Tbk stock.

3.1. Model Determination

The first step for analyzing the relationship between risk and return using the mudharabah SCAPM approach is to determine the suitable model for connecting both. A standard method for testing the relationship between risk and return is linear regression. However, this model must meet the assumption that homoscedasticity has no autocorrelation. If these two assumptions are violated, another model can be used, namely Autoregressive Conditional Heteroscedasticity (ARCH). For starters, Equation (1) can be converted into its linear regression model as follows:

Ri − RMDZ: excess stock return considering the mudharabah subject to zakat. Next will be called in notation Excess_RMDZ; Rm − RMDZ: risk premium considering the mudharabah subject to zakat. Next will be called in notation RISK_PRMDZ.

Ri − RMDZt = α + β(Rm − RMDZt),

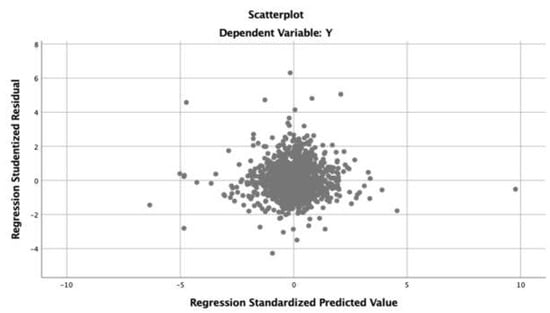

Furthermore, heteroscedasticity testing was carried out using scatterplots. The results of the calculations using can be seen in Figure 1.

Figure 1.

Heteroscedasticity test using a scatterplot.

Based on Figure 1, it can be seen that the scatterplot points are gathered around the zero line. Therefore, it can be concluded that there is heteroscedasticity, and a simple linear regression model cannot be used. Another model that can be used is the ARCH model.

3.2. Model ARX(p,s)-GARCH(l,m)

Based on Figure 1, the characteristics of stock returns are that their value is around zero, therefore it contains heteroscedasticity. Due to this, the model that will be used next is the ARCH model. Furthermore, it has been explained in Equation (2) that excess stock return considering mudharabah subject to zakat is denoted by Excess_RMDZ and risk premium considering mudharabah subject to zakat is denoted by Risk_PRMDZ.

RISK_PRMDZ1, RISK_PRMDZ2..., RISK_PRMDZn are the time series data and Excess_RMDZt following model ARX(p,s) with mean (µ), p is a lag from AR, and s is a lag from exogenous variable X. The mathematical model for the value of p = 1 and q = 1 could be written as follows:

where is white noise with mean 0 and variance and , also is the parameter.

Model GARCH for l = 1 and m = 1 will be written as follows (GARCH (1,1)):

3.3. ARCH Effect Test

The autoregressive conditional heteroscedastic (ARCH) model was first introduced by Bollerslev (1986), where ARCH and GARCH predict variance is not constant depending on fluctuations in previous data. The GARCH model is a development of the ARCH model, which is widely used to estimate volatility (Engle 1982). The Lagrange Multiplier (LM) test is used to see if there is an ARCH effect on the return of PT. Adaro Energy tbk. The ARCH(p) model can be written as follows:

where t is the return on day t, is the variance on day t, and and are positive constant values.

3.4. Forecasting

Forecasting data for the next 7-days was to be generated based on the best model obtained from the ARX(p,s)-GARCH(l,m) model.

4. Result and Discussion

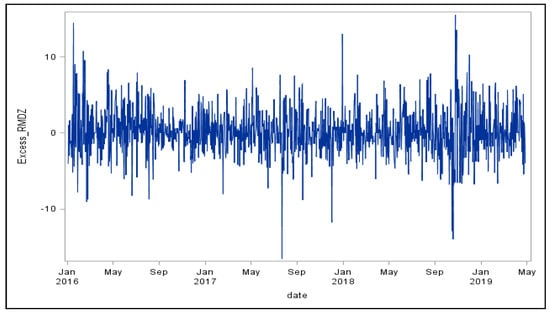

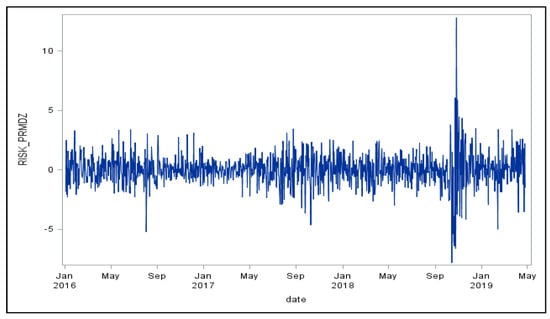

However, it can be seen in Figure 2 and Figure 3 that the excess return considering the mudharobah return subject to zakat or Excess_RMDZ (Figure 2) and the market risk premium considering the mudharobah subject to zakat or Risk_PRMDZ (Figure 3) shows that ADRO’s stock return volatility fluctuated more than JKSE’s market return. This fluctuation indicates that stock trading in the energy sector is quite high, causing high volatility. Next, if it is related to the concept of CAPM or SCAPM, the high volatility of the stock compared to the market indicates that the beta of the stock has a value of more than one, which means the stock has a high risk with the possibility of obtaining a high return.

Figure 2.

Excess return volatility data considering the return of mudharabah subject to zakat in 2016–2020.

Figure 3.

Risk premium market risk volatility data considering the return of mudharabah subject to zakat in 2016–2020.

Furthermore, Figure 2 shows that the Excess_RMDZ data fluctuate around zero indicating the data are stationary. So as Figure 3 shows, the data fluctuated slightly from 2016 to 2019, and in 2000 the risk premium was quite high. Risk premium data also fluctuates around zero, indicating that risk premium data are stationary. From Table 2 and Table 3, the ADF test, the null hypothesis that the data are nonstationary was rejected, so based on the results of the ADF-test for data, Excess_RMDZt and Excess_RMt are stationary. Therefore, the assumption stationary is fulfilled.

Table 2.

ADF test Excess_RMDZ.

Table 3.

ADF test Risk_PRMDZ.

Table 1 and Table 2 show the results of the ADF test (Table 2 and Table 3). It can be seen that the Excess_RMDZ and Risk_PRMDZ data are stationary because the p-values (<0.0001) are both less than 0.05.

Table 4 using the Ljung-Box test, shows that the Excess_RMDZ data has autocorrelation up to lag 18. This suggests that the Excess_RMDZ data modeling should involve autoregressive modeling.

Table 4.

Autocorrelation check for white noise of Excess_RMDZ.

4.1. Autoregression Modeling

The selection of model using Akaike Information Criterion Corrected (AICC) Criteria to check the optimum lag, Akaike’s Information Criterion corrected (AICC) is carried out. Based on the results of the AICC analysis, the optimum lag for the AR(p) model is p = 1 (Table 5) because the value is smaller than the other values.

Table 5.

AICC criteria.

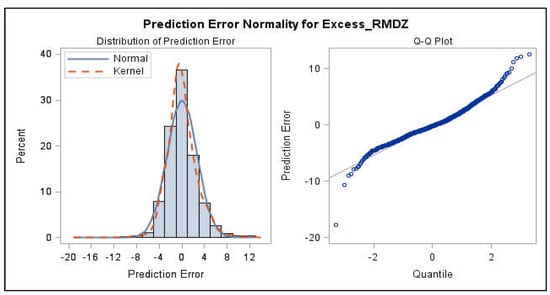

4.2. ARCH Effect Testing

A lot of data in the financial sector generally have a variance that is not constant over time. If the residual has a non-constant variance, then autoregressive modeling should also involve ARCH or GARCH modeling for the residuals (Tsay 2005; Wei 2006). Table 5 shows the results of the ARCH test with the null hypothesis that there are no ARCH effects. The test shows that the null hypothesis is rejected with F-test = 12.55 and p-value = 0.0004. Table 6 also shows the normality test using the Jarque_Bera (JB) test with the null hypothesis that the residual has a normal distribution. The results of the test show Chi-square = 563.14 with p-value < 0.0001, so the null hypothesis was rejected and the residuals are not normally distributed. However, Figure 4 shows that the distribution of error predictions and Q-Q plots shows that the deviation from the normal distribution is low, even though the statistical test shows that the null hypothesis was rejected.

Table 6.

ARCH test for data Excess_RMDZ Adaro Energi Tbk.

Figure 4.

Normality error prediction for data Excess_RMDZ Adaro Energi Tbk.

4.3. ARX(p,x)–GARCH(p,q) Model

Based on the results from the forecasting of the ARX (1.1) model in Table 7, the constant value of Excess_RMDZ is 0.08199, which means that if the other variables are zero (0), then the value of Excess_RMDZ is 0.08199. If the RISK_PRMDZt value increases by one unit, then Excess_RMDZ will increase by 1.14766. If the value of RISK_PRMDZt-1 increases by one unit, then Excess_RMDZ will increase by 0.01754, and lastly, if the value of Excess_RMDZt-1 increases by one unit, then Excess_RMDZ will increase by 0.01360.

Table 7.

Parameter estimation model of ARX (1,1) data Excess_RMDZ Adaro Energi Tbk.

Based on the results of the analysis of the ARX (1,1)-GARCH (1,1), the forecasting model can be written using Equation (1): Average Model of ARX (1,1) based on Table 6:

Excess_RMDZt = 0.08199 + 1.14766 RISK_PRMDZt + 0.01754 RISK_PRMDZt−1 + 0.01360 Excess_RMDZt−1,

Variance model of GARCH based on Table 8:

Table 8.

Parameter estimation model of GARCH (1,1) data Excess_RMDZ Adaro Energi Tbk.

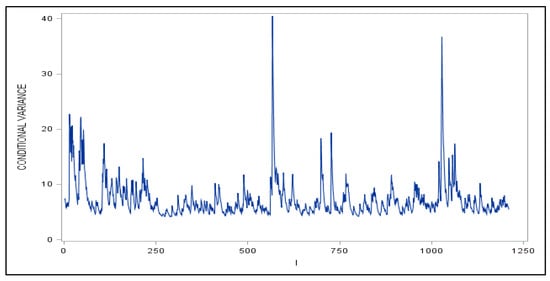

From the parameter estimation of the GARCH model (Table 8), it can be seen that all the p-values are less than 0.05, so all the parameters are significant. Figure 5 shows conditional variance data Excess_RMDZ where conditional variance is highly relative in 2016, April 2018, November to December 2018, and relatively high on January to March 2020.

Figure 5.

Conditional variance of data Excess_RMDZ.

4.4. Forecasting for Data Excess_RMDZ Adaro Energi Tbk

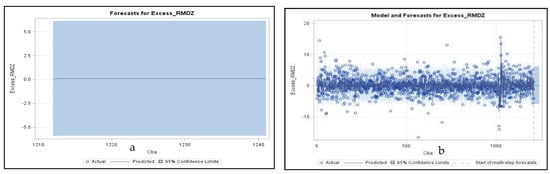

Forecasting for the next 7-days of Excess_RMDZ data on Adaro Energi Tbk shares tends to be constant and there was no significant change (Figure 6). Table 9 shows that the first day up to the third day has increased. Meanwhile, for the 4th day to the 7th day, the forecasting value was constant. On the first day, the forecast value was 0.08105, on the second day, the forecast value was 0.11820, on the third day, the forecast value was 0.11988, while for the fourth day and so on, it was 0.1195.

Figure 6.

(a) Forecasting for data Excess_RMDZ and (b) model and forecasts for Excess_RMDZ Adaro Energy, Tbk.

Table 9.

Data prediction of Excess_RMDZ Adaro Energi Tbk for 7 Days.

5. Conclusions

The results of testing the relationship between risk and return on ADRO energy sector stocks, as shown by a p-value of less than 0.05, indicate that by using the mudharabah SCAPM approach, the relationship between risk and return is significant. Thus, it can be concluded that mudharabah can replace the risk-free rate in the assets pricing model.

Meanwhile, the volatility of ADRO’s stock is high compared to the volatility of its market return, which indicates that investors’ interest in ADRO’s stock is higher than the market average. Similarly, the results of the 7-day forecast post-calculation ending in December 2020 show that ADRO shares will experience high volatility in the first 3 days of forecasting; then, stock transactions will move to a constant condition. This means that not many stock transactions are carried out. It is possible that, in the first 3 days, investors hoped for a January effect from ADRO’s stock returns, but in the following days, investors’ responses returned to normal. The constant shape of the market is probably due to investors considering the effects of the COVID-19 pandemic on the market and refraining from making transactions.

6. Study Limitation

Although the SCAPM mudharabah model has been tested empirically in this study, there are some limitations in testing the model, including the use of the mudharabah variable, causing this model to only be used in countries that provide Islamic banking mudharabah equivalent data. Without it, mudharabah data needs require complicated calculations and take extra time.

Author Contributions

Conceptualization, A.F., S.R.N. and A.H.; methodology, A.F. and S.R.N.; software, A.F.; validation, S.R.N. and A.H.; formal analysis, A.F.; investigation, A.F.; resources, A.F.; data curation, A.F.; writing original draft preparation, A.F.; writing—review and editing, A.F.; visualization, A.F.; supervision, S.R.N. and A.H.; project administration, A.F.; funding acquisition, A.F. All authors have read and agreed to the published version of the manuscript.

Funding

The research received no external funding.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

Not applicable.

Acknowledgments

The authors would like to thank Universitas Lampung and Universitas Padjadjaran for the support with this postgraduate research study. The authors would like to thank to id.investing.com for providing data for this research. All authors acknowledge that this research has not been published in any journal or publication. In addition, this research is a self-funded research and has no conflict of interest with copyrights and other researchers. All authors respectfully participated in sharing ideas, methodology, and model enrichment of this research.

Conflicts of Interest

The author declare no conflict of interest.

References

- Bollerslev, Tim. 1986. Generalized Autoregressive Conditional Heteroskedasticity. Journal of Econometrics 31: 307–27. [Google Scholar] [CrossRef]

- Brockwell, Peter J., and Richard A. Davis. 2016. Introduction to Time Series and Forecasting. Berlin: Springer. [Google Scholar]

- Derbali, Abdelkader, Abderrazek el Khaldi, and Fathi Jouini. 2017. Shariah-Compliant Capital Asset Pricing Model: New Mathematical Modeling. Journal of Asset Management 18: 527–37. [Google Scholar] [CrossRef][Green Version]

- El-Ashker, Ahmed Abdel-Fatah. 1987. Islamic Business Enterprise. Beckenham: Cromm Helm Limited, Provident House. [Google Scholar]

- Engle, Robert F. 1982. Autoregressive Conditional Heteroscedasticity with Estimates of the Variance of United Kingdom Inflation. Econometrica: Journal of the Econometric Society 50: 987–1007. [Google Scholar] [CrossRef]

- Faisol, Ahmad, Sulaeman Rahman Nidar, and Aldrin Herwany. 2022. Is Reasonable to Use Mudharabah in Sharia Pricing Assets? In ICEBE 2021, Proceedings of the 4th International Conference of Economics, Business, and Entrepreneurship, ICEBE 2021, Lampung, Indonesia, 7 October 2021. Ghent: European Alliance for Innovation. [Google Scholar]

- Febrian, Erie, and Aldrin Herwany. 2010. The Performance of Asset Pricing Models before, during, and after an Emerging Market Financial Crisis: Evidence from Indonesia. The International Journal of Business and Finance Research 4: 85–97. [Google Scholar]

- Hakim, Shabir Ahmad, Zarinah Hamid, and Ahamed Kameel Mydin Meera. 2016. Capital Asset Pricing Model and Pricing of Islamic Financial Instruments. Journal of King Abdulaziz University, Islamic Economics 29: 21–39. [Google Scholar] [CrossRef]

- Hanif, Muhammad. 2011. Risk and Return under Shari’a Framework: An Attempt to Develop Shari’a Compliant Asset Pricing Model (SCAPM). Pakistan Journal of Commerce and Social Sciences (PJCSS) 5: 283–92. [Google Scholar]

- Hanif, Muhammad, and Abubakar Javaid Dar. 2013. Comparative Testing of Capital Asset Pricing Model (CAPM) and Shari’a Compliant Asset Pricing Model (SCAPM): Evidence from Karachi Stock Exchange—Pakistan. SSRN Electronic Journal, 1–14. [Google Scholar] [CrossRef]

- Kisman, Zainul, and Shintabelle M. Restiyanita. 2015. The Validity of Capital Asset Pricing Model (CAPM) and Arbitrage Pricing Theory (APT) in Predicting the Return of Stocks in Indonesia Stock Exchange. American Journal of Economics, Finance and Management 1: 184–89. [Google Scholar]

- Lam, Keith S. K. 2001. The Conditional Relation between Beta and Returns in the Hong Kong Stock Market. Applied Financial Economics 11: 669–80. [Google Scholar] [CrossRef]

- Lintner, John. 1969. The Valuation of Risk Assets and the Selection of Risky Investments in Stock Portfolios and Capital Budgets: A Reply. The Review of Economics and Statistics 51: 222–24. [Google Scholar] [CrossRef]

- Mossin, Jan. 1966. Equilibrium in a Capital Asset Market. Econometrica: Journal of the Econometric Society 34: 768–83. [Google Scholar] [CrossRef]

- Mulyawan, Setia. 2015. Analisis Karakteristik Dan Kinerja Reksa Dana Syariah Di Indonesia Menggunakan Sharia Compliant Asset Pricing Model. Bandung: Universitas Padjadjaran. [Google Scholar]

- Pettengill, Glenn N., Sridhar Sundaram, and Ike Mathur. 1995. The Conditional Relation between Beta and Returns. The Journal of Financial and Quantitative Analysis 30. Available online: http://www.jstor.org/stable/2331255 (accessed on 4 March 2020). [CrossRef]

- Rehan, Raja, Imran Umer Chhapra, Salman Mithani, and Abdul Qadir Patoli. 2021. Capital Asset Pricing Model and Shariah-Compliant Capital Asset Pricing Model: Evidence from Pakistan Stock Exchange. Journal of Contemporary Issues in Business and Government 27: 2074–89. [Google Scholar]

- Sandoval, Eduardo A., and Rodrigo N. Saens. 2004. The Conditional Relationship between Portfolio Beta And Return: Evidence from Latin America. Cuadernos de Economía 41: 65–89. [Google Scholar]

- Sembiring, Ferikawita M., Sulaeman Rahman, Nury Effendi, and Rachmat Sudarsono. 2016. Capital Asset Pricing Model in Market Overreaction Conditions: Evidence from Indonesia Stock Exchange. Polish Journal of Management Studies 14: 182–91. [Google Scholar] [CrossRef]

- Shaikh, Salman. 2010. Corporate Finance in an Interest Free Economy: An Alternate Approach to Practiced Islamic Corporate Finance. Journal of Islamic Banking and Finance 27: 11–27. [Google Scholar]

- Sharpe, William F. 1964. Capital Asset Prices: A Theory of Market Equilibrium Under Conditions of Risk. The Journal of Finance 19: 425–42. [Google Scholar] [CrossRef]

- Subekti, R., Abdurakhman, and D. Rosadi. 2020. Modified Capital Asset Pricing Model (CAPM) into Sharia Framework. Journal of Physics: Conference Series 1581: 012021. [Google Scholar] [CrossRef]

- Subekti, Retno, and Dedi Rosadi. 2022. Toward the Black–Litterman with Shariah-Compliant Asset Pricing Model: A Case Study on the Indonesian Stock Market during the COVID-19 Pandemic. International Journal of Islamic and Middle Eastern Finance and Management 15. [Google Scholar] [CrossRef]

- Sutrisno, Bambang, and Rifzaldi Nasri. 2018. Is More Always Better? An Empirical Investigation of the CAPM and the Fama-French Three-Factor Model in Indonesia. In N International Conference on Economics, Business and Economic Education. Semarang: KnE Publishing, pp. 454–68. [Google Scholar]

- Tang, Gordon Y. N., and Wai C. Shum. 2003. The Conditional Relationship between Beta and Returns: Recent Evidence from International Stock Markets. International Business Review 12: 109–26. [Google Scholar] [CrossRef]

- Tomkins, Cyril, and Rifat Ahmed’Abdel Karim. 1987. The Shari’ah and Its Implications for Islamic Financial Analysis: An Opportunity to Study Interactions Among Society, Organizations, and Accounting. American Journal of Islamic Social Sciences 4: 101. [Google Scholar] [CrossRef]

- Tsay, Ruey S. 2005. Analysis of Financial Time Series. Hoboken: John Wiley & Sons. [Google Scholar]

- Wei, William W. S. 2006. Time Series Analysis. In The Oxford Handbook of Quantitative Methods in Psychology: Vol. 2. New York: Oxford University Press. [Google Scholar]

- Xiao, Bing. 2016. Conditional Relationship Between Beta and Return in the US Stock Market. Expert Journal of Business and Management 4: 46–55. [Google Scholar]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).