1. Introduction

The relationship between diversification and risk is a recurrent and relevant research topic within theoretical and empirical financial studies. This line of research has been intensified since the global 2007–2008 financial crisis. A common argument is that when banks diversify their portfolios to reduce their exposure to risk, the probability of joint failure (or systemic failure) increases because as diversification becomes larger, the portfolios of banking institutions become more similar (

Allen et al. 2012;

Allen and Carletti 2006;

Ibragimov et al. 2011;

Yang et al. 2020). This phenomenon has been called the dark side of diversification, and

Wagner (

2010) developed an important theoretical framework using linear diversification strategies to illustrate this point.

Later,

van Oordt (

2014) extended the model by adding securitization, which consists of tranching the loan’s portfolio into different levels of seniority. Securitization is built into the model by using two different tranches: one senior tranche and one junior tranche. The senior tranche is served first, and the junior tranche is served later if there is a residual payment available.

van Oordt (

2014) found that if a bank keeps the junior tranche and exchanges the senior with other banks (a strategy we call retaining the junior tranche: RJT), then the dark side of diversification can be avoided. He also showed that securitization comes at a cost for banks, as it introduces non-linear effects in the financial system.

Some empirical studies have suggested that, under certain conditions, there seems to be a positive and significant impact of securitization (or diversification) on systemic risk (

Abdelsalam et al. 2022;

Altunbas et al. 2022;

Bégin et al. 2019;

Ben Salah and Fedhila 2012;

De Jonghe 2010;

Ivanov and Jiang 2020;

Slijkerman et al. 2013). According to a systemic review of the literature by

Deku et al. (

2019), securitization is not a destabilizing tool per se and, at least up to 2019, the empirical literature in the post 2007–2009 crisis on bank securitization behavior tends to be extremely limited due to important data gaps in many relevant markets of the world. Given the predominance of empirical studies around this topic and some of its data limitations, we think that theoretical work can potentially contribute to gain a better understanding with regards to how securitization instruments are designed and used; and to how they affect the stability of the banking system.

In

Cadenas and Gzyl (

2021), we extended the theoretical results of the model developed by

van Oordt (

2014) by allowing short positions. In this paper, we extend further the implications of the model by allowing banks to exchange any portion of both tranches in their long positions to further understand the implications in terms of incentives and the risk of failure of the banking system as a whole. We first show that linear diversification can be easily derived from securitization (we call it vertical distribution). We then develop full results for the optimal strategy of retaining the senior tranche (RST), which was not shown in

van Oordt’s (

2014) paper, and present results for the case when banks exchange some portion of both tranches (mixed strategy). We compare our results in the light of diversification and systemic risk, and we study the non-linear effects in the financial system for all possible cases (no diversification, linear diversification, RJT, RST and mixed strategy).

Section 2 describes the basic setup of the model. In

Section 3, we describe how each diversification strategy works and show their corresponding optimal solutions in terms of minimizing the risk of individual failure and its effects on systemic risk.

Section 4 analyzes and presents our results in the light of the non-linear effects in the financial system that arise from sudden shocks in depositors’ confidence.

Section 5 concludes and contrasts some of our results in the light of the most recent literature on securitization and the banking crisis. The analytical proofs and computational details are included in

Appendix A and

Appendix B.

2. Basic Setup of the Model

Our framework builds upon

Wagner (

2010)’s seminal model and

van Oordt’s (

2014) important extension. There are two banks, each obtaining one unit of funds from risk-neutral investors. A fraction

d of the funds is in the form of deposits and the rest is equity capital. Two assets,

X and

which can be considered as loan portfolios, provide investment opportunities. The assets’ gross returns,

x and

are identically and independently distributed with a probability density function

, which has full support on

It is further assumed the expected gross return of each portfolio is not less than

d; that is, we suppose that

1:

There are three periods in the investment horizon. At date 1, bank 1 invests its funds in asset

X and bank 2 invests its funds in asset

At date 2, the asset returns

x and

y are revealed and become public information. If the return is less than d and hence is insufficient to pay the creditors, the bank becomes insolvent, and it will experience a run

2. Consequently, its assets have to be liquidated. The other bank, as long as it is not in distress, purchases the liquidated assets at a discount

However, if the other bank is also insolvent, the situation can be characterized as a systemic failure, in which case a nonbank firm, as an outside bidder, purchases the liquidated assets at a larger discount

with

due to the nonbank firm’s lack of knowledge and skill in managing loan portfolio. At date 3, the asset returns are realized.

Denote the bank

i’s gross return, if not liquidated, by

and the probability of a run on bank

i by

and the probability of a systemic crisis by

Then, the bank

i’s total expected value is expressed as

Bank

i makes investment decisions that maximize

which effectively maximizes the expected return to its investors, who provided the funds, deposits and equity

3. Notice that the probability of bank

i’s failure (

) is the sum of the probability of individual failure (

) plus the probability of systemic failure (

), i.e.,

More precisely, the individual and systemic failures are taken as mutually exclusive events. The economy’s total welfare is the sum of the two banks’ expected value:

Now, without diversification, loan portfolio

X would be the only asset of bank 1, and loan portfolio

Y would be the only asset of bank 2. Hence, the gross return of each of the banks, if not liquidated, would simply be

and

respectively. Since a bank becomes insolvent and experiences a run whenever the gross return on the bank’s asset is insufficient to cover

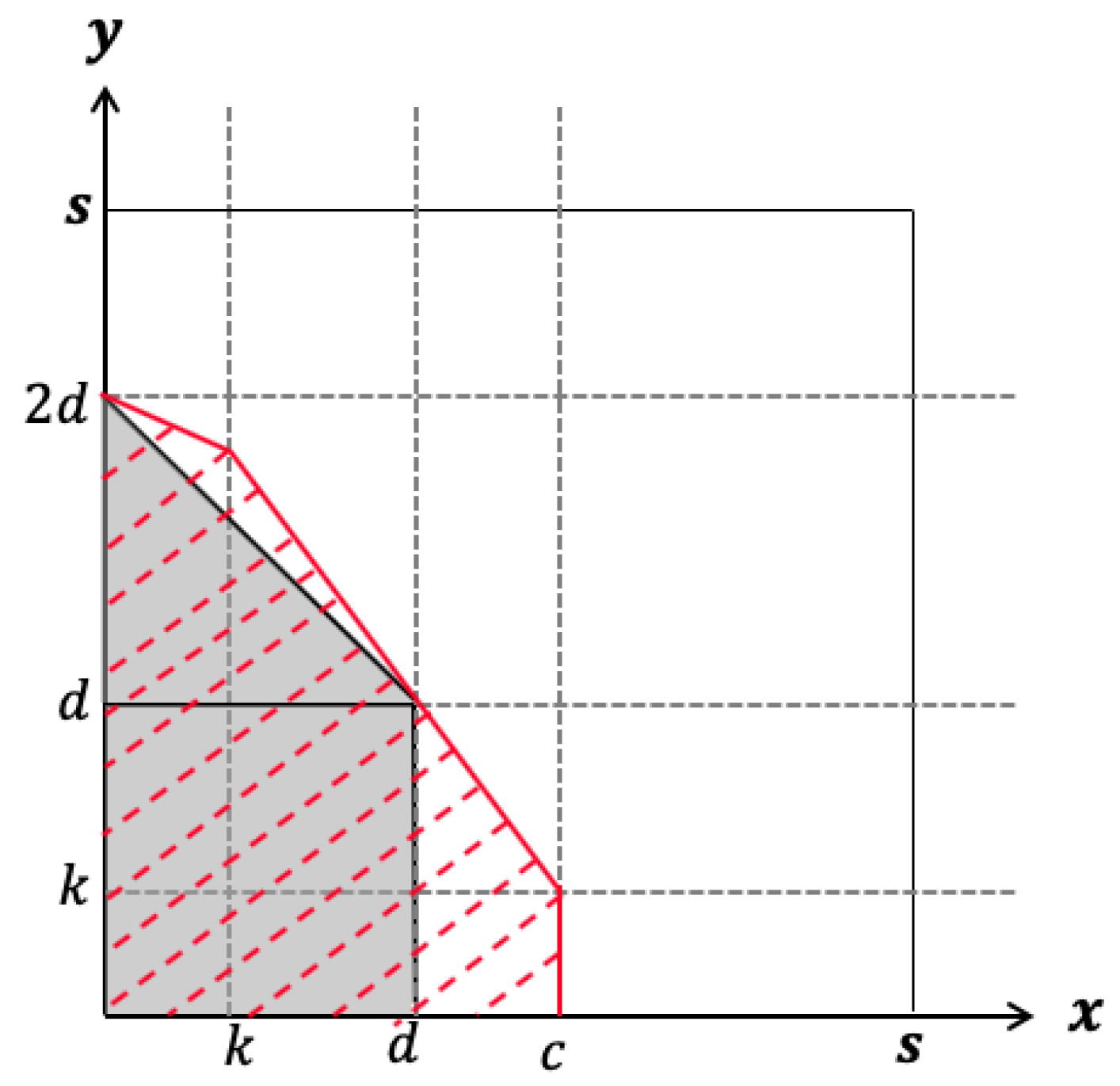

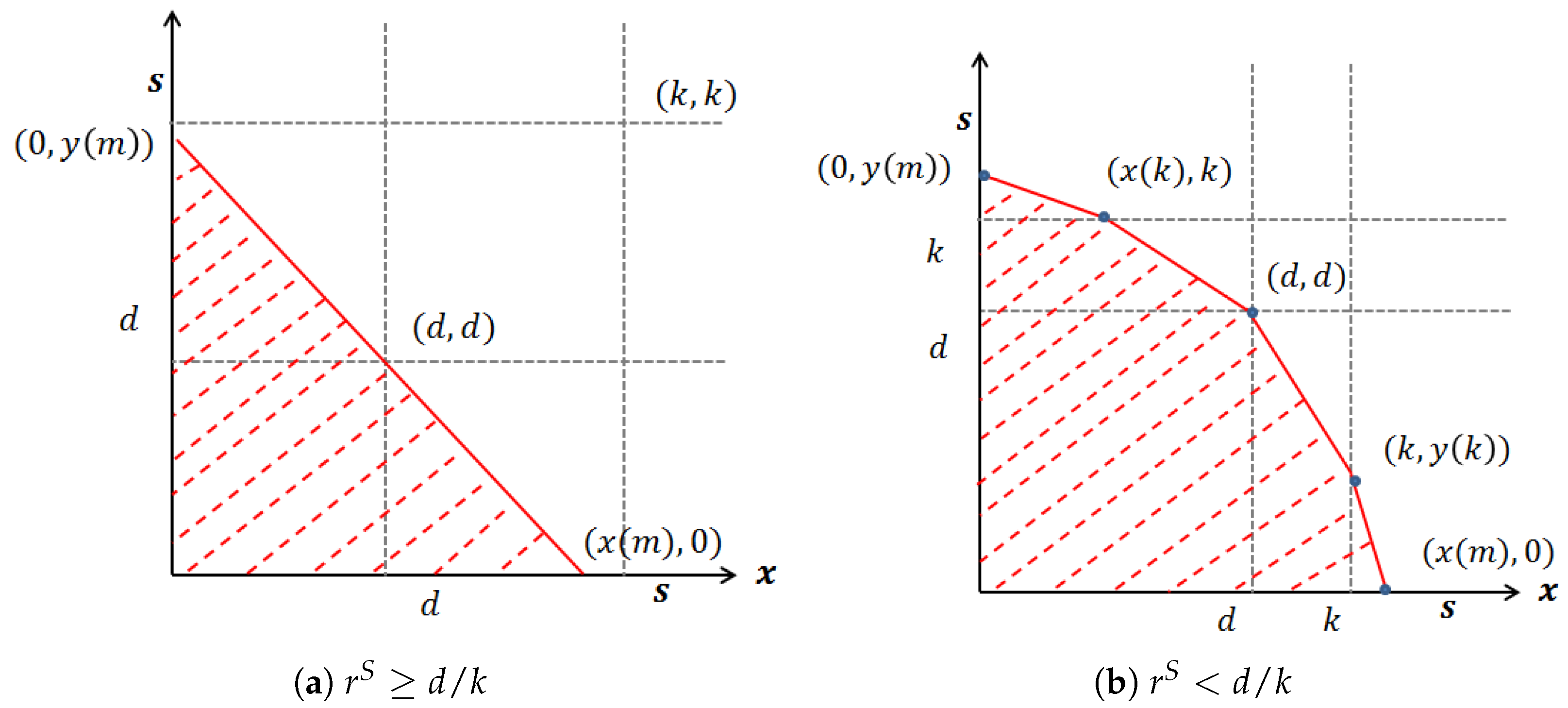

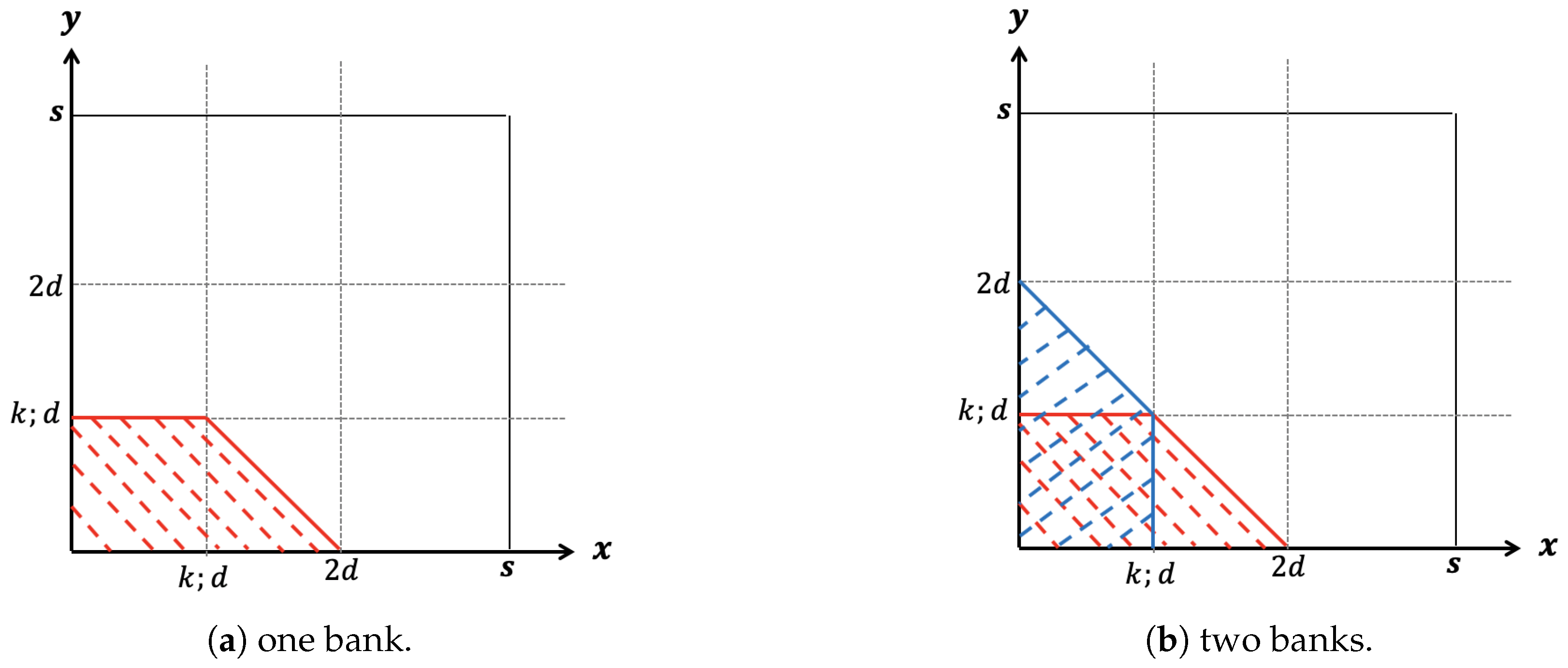

the bank run condition for bank 1 can be displayed as in

Figure 1a; the dashed area represents the set of outcomes for bank 1’s failure. Bank 2’s case is added in

Figure 1b, where the double dashed square represents the set of outcomes for a joint bank failure.

However, once banks diversify by investing in both loan portfolios in various ways, the gross returns would change and, more importantly, the probabilities of individual and systemic bank failures would also change. This can be graphically verified by noting that a change in would change the border line, which divides bank run outcomes and no-bank run outcomes, which eventually would modify the probabilities of individual and join bank failures. The point is that a bank’s asset diversification affects not only the risk at the level of the individual bank but also the systemic risks of the entire banking sector. Let us now discuss each of the possible diversification strategies.

3. Diversification Strategies

To extend

van Oordt (

2014)’s model, we first present a general case of securitization, where the diversification strategies suggested in

Wagner (

2010) and

van Oordt (

2014) can be considered special cases. Suppose banks tranche the loan portfolio into securities with two different seniority levels and can sell these trenches to the other bank. On date 3, when the return on the bank asset is realized, the senior tranche is served first, up to the maximum

set by the bank, whereas the junior tranche obtains the residual. Accordingly, the senior tranche on asset

X has the payoff equal to

, and the junior tranche has the payoff equal to

. Similarly, each of the senior and junior tranches on asset

Y has the payoff equal to

and

, respectively.

Bank

i can choose to exchange fraction

of the senior tranche and fraction

of the junior tranche. The remaining portions

and

of the senior and junior tranches are kept on bank

i’s balance sheet. Then, bank 1’s and bank 2’s respective returns on investment, if not liquidated, would be obtained as,

In this setup, different diversification strategies could emerge from the various combinations of

and

The simplest case would be no diversification, i.e.,

which would generate bank run outcomes described in

Figure 1a,b. As mentioned before, in the rest of this section, we consider four diversification strategies: linear diversification without securitization, securitization with exchanging senior tranches only, securitization with exchanging junior tranches only, securitization with vertical distribution (which derives in linear diversification) and exchanging a portion of both tranches (mixed strategy).

3.1. Linear Diversification without Securitization

A bank can simply exchange a portion of its asset with the other bank without tranching. This type of diversification, which can be called linear diversification, is considered in

Wagner (

2010), and we recall it here for completeness. Since there is no tranching, we can have

without the superscript

S and

denoting the fraction of bank

i’s portfolio that is exchanged. Bank

i’s return on investment, if not liquidated, is then

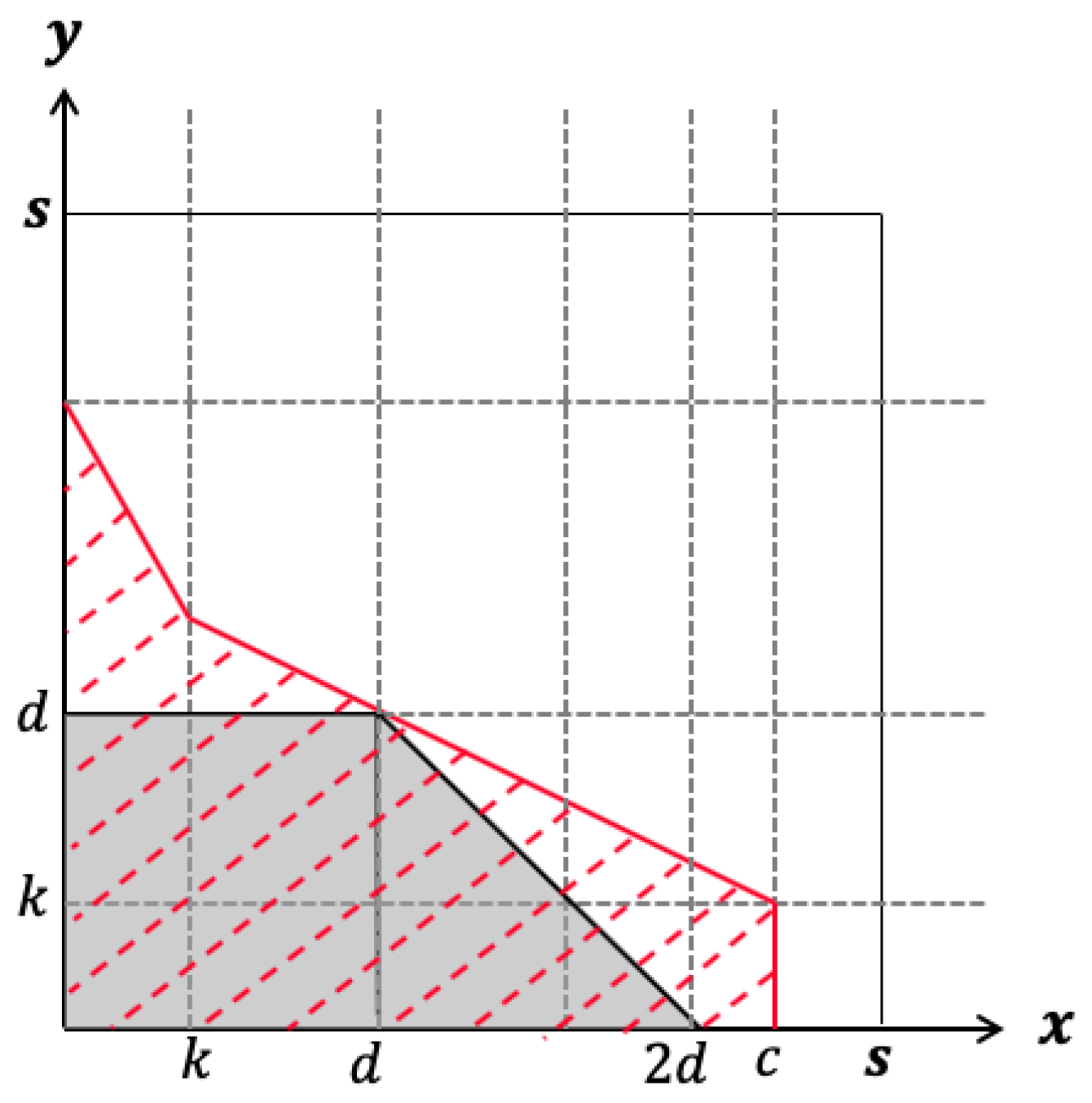

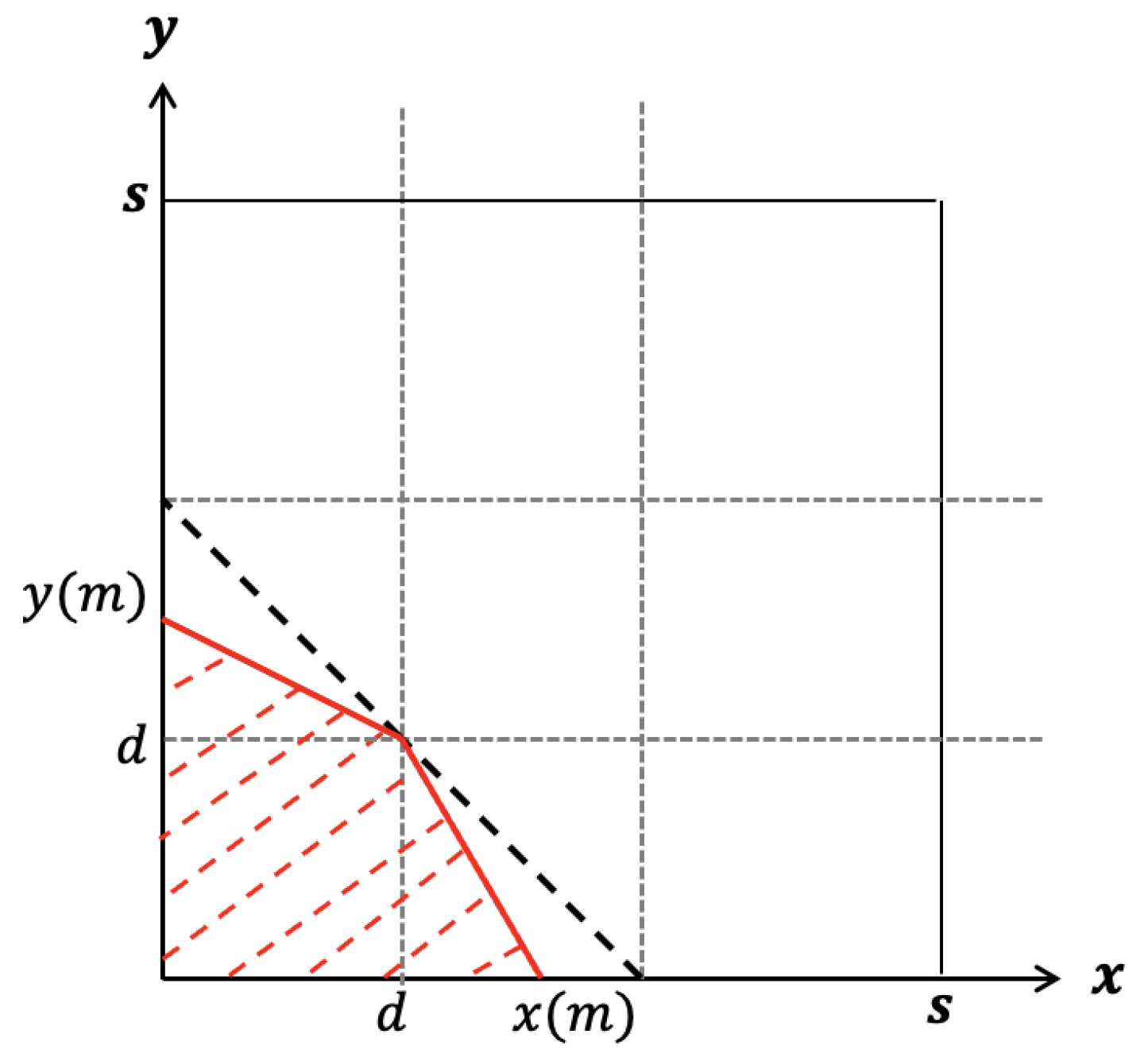

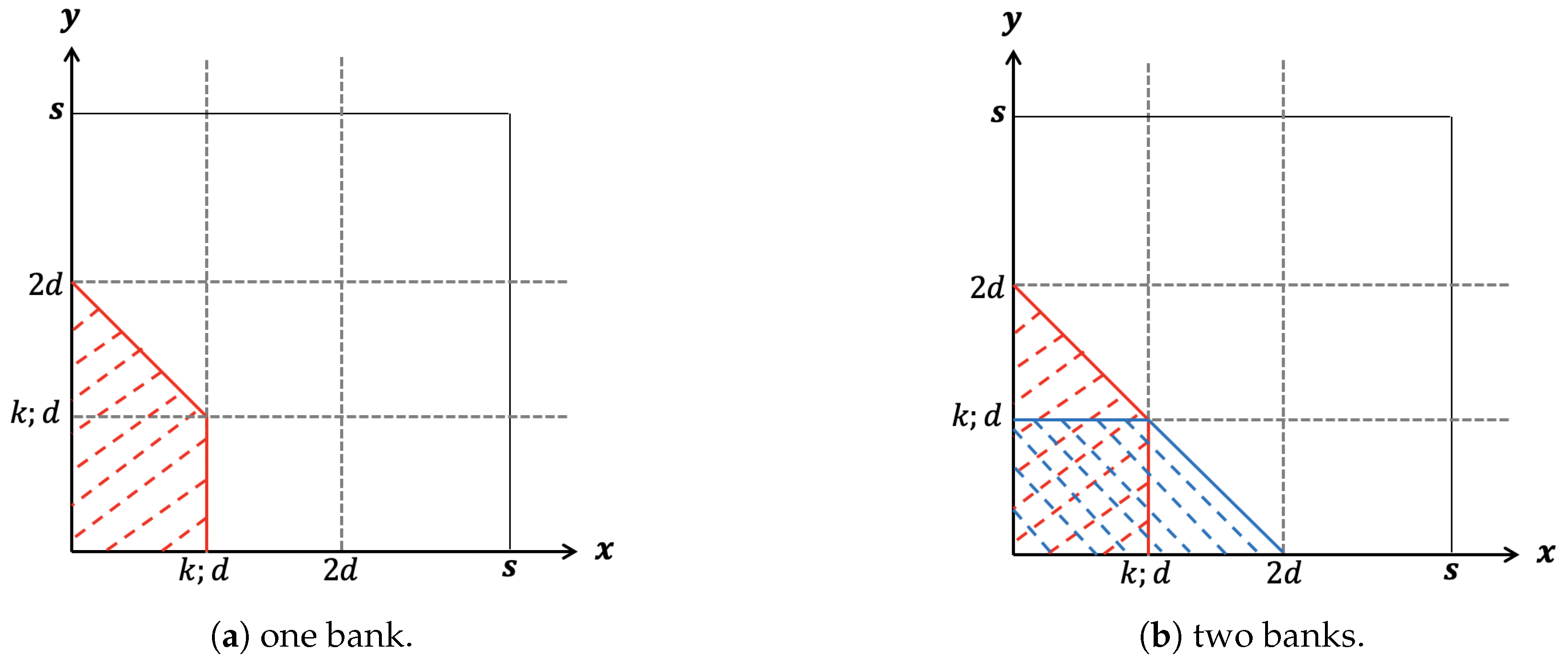

In this case, the bank run outcomes for bank 1 are represented by the dashed line in

Figure 2a. The bank 2 failure outcomes are added in

Figure 2b where the double dashed area represents the outcomes for a systemic crisis.

Wagner shows that linear diversification may reduce the probability of bank run on an individual bank when compared with no diversification, but it increases the probability of a systemic crisis. One can see this by observing

Figure 2. For a formal proof, see

Wagner (

2010). This point illustrates the dark side of diversification

4.

3.2. Securitization Retaining Junior Tranche (RJT)

In comparison to

Wagner (

2010)’s linear diversification,

van Oordt (

2014) introduces a non-linear diversification where banks securitize the loan portfolio into tranches and sell the senior tranche only. We call this strategy Retaining the Junior Tranche (RJT), and it corresponds to setting

In this case, bank

i’s return on investment in Equation (

4), if not liquidated, becomes

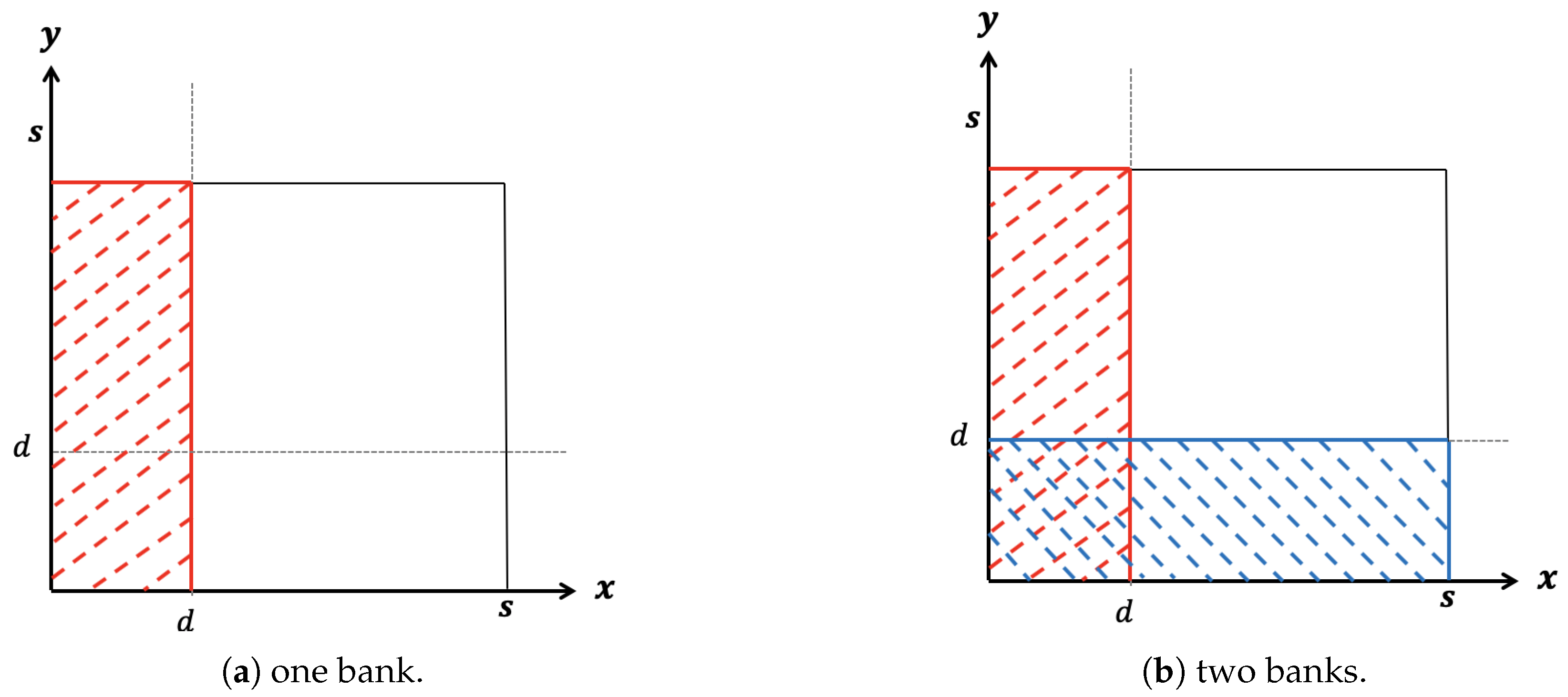

In this case, obtaining the bank run outcomes becomes complicated as it depends on the level of

k vis-à-vis the level of

van Oordt (

2014) finds the different classes for the bank run outcomes and proves that for securitization that entails exchanging only the senior tranches, it holds that: (i) the probability of a systemic crisis cannot be decreased even with the RJT securitization; (ii) bank

i’s optimal diversification strategy is the RJT securitization with

and

(individual optimality); and (iii) both banks adopting the strategy described in part (ii) is socially optimal (social optimality)

5. If banks follow the optimal strategy suggested by

van Oordt (

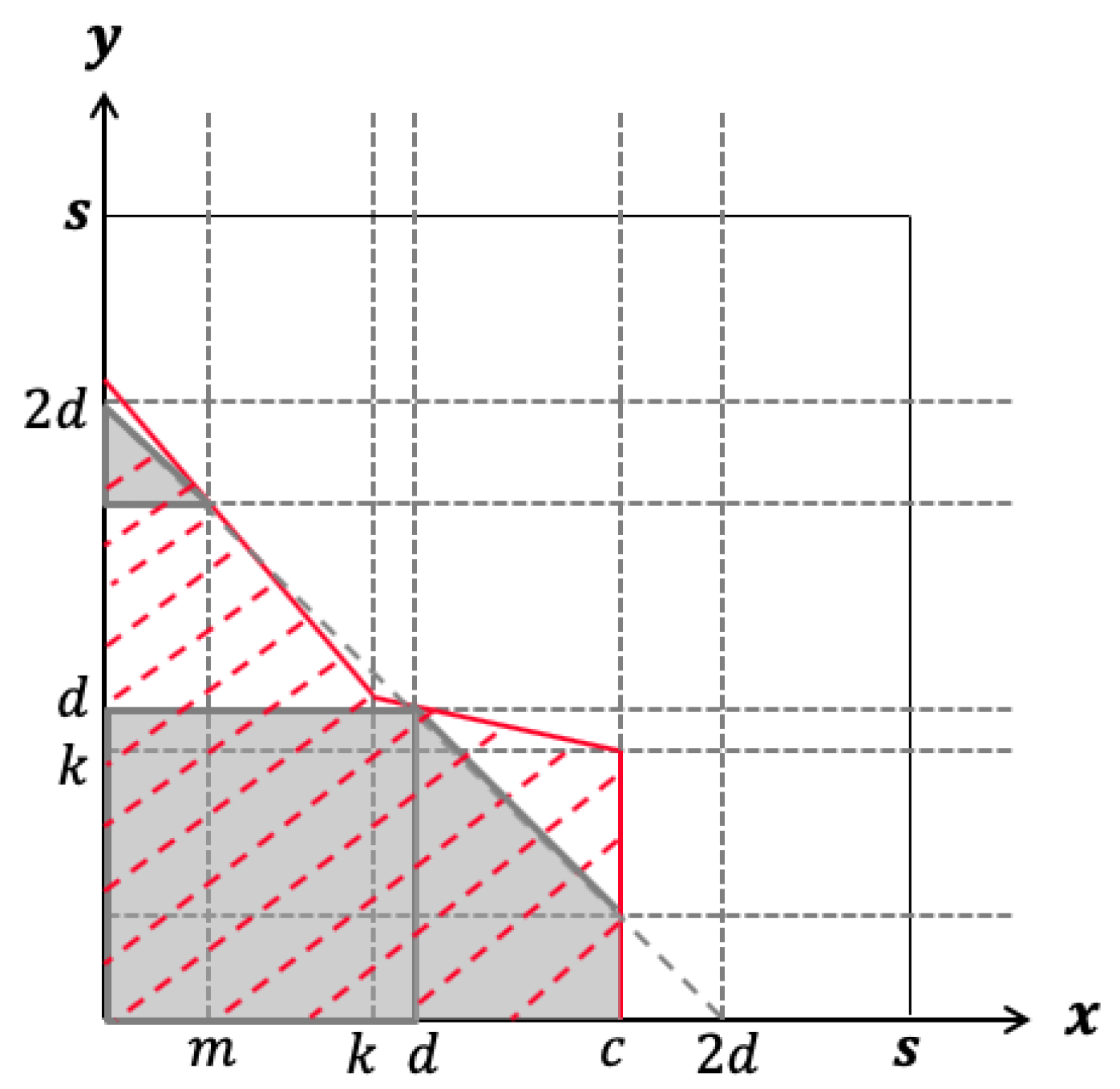

2014), then the probabilities of failure would look as in

Figure 3:

3.3. Securitization with Vertical Distribution

If bank

i sells the same portion of each tranche, i.e.,

, what we called vertical distribution, its investment return will be the same as that of the linear diversification strategy examined in

Section 3.1. Hence, we obtain the following result,

Proposition 1. Setting makes the securitization with vertical distribution effectively identical to the linear diversification strategy.

Proof. makes Equation (

4) effectively identical to Equation (

5). □

3.4. Securitization with Keeping Senior Tranche (RST)

When introducing the securitization with tranching into

Wagner (

2010)’s original model,

van Oordt (

2014) assumed that banks keep the junior tranche on their own balance sheet and exchange a fraction of the senior tranches. Although he states on a footnote that “

It is irrelevant to the results whether we assume that banks exchange senior tranches and keep the junior tranche or vice versa”, we explore the validity of this assertion here. Our results are in agreement with

van Oordt (

2014), but we are interested in briefly exploring the implications of this result for the case of the non-linear effects in the financial system. As a further justification,

van Oordt (

2014) briefly mentioned asymmetric information between originators and buyers of securities as a potential mechanism that makes the strategy of exchanging senior tranches only an optimal structure. The information asymmetry may possibly arise when the buyers are outsiders such as institutional investors or nonbank firms without an understanding of the nature and composition of the securities they are purchasing. However, in the current model, the buyers of the securities are banks who themselves are securities originators and therefore may be better positioned than the outsiders when bidding for the tranches.

In this section, as mentioned before, we explicitly explore the possibility of the alternative strategy of keeping the senior tranche and selling the junior tranche only. We do this within the confines of the given model. The alternative securitization strategy we suggest corresponds to setting

In this case, bank

i’s return on investment is rewritten, if not liquidated, as

Taking we find the no-bank run border for bank 1 to be:

Class 1: conditional on

we have

Class 2: conditional on

we have

The set of bank run outcomes for a single bank within each of the two classes are displayed in the following

Figure 46.

Results

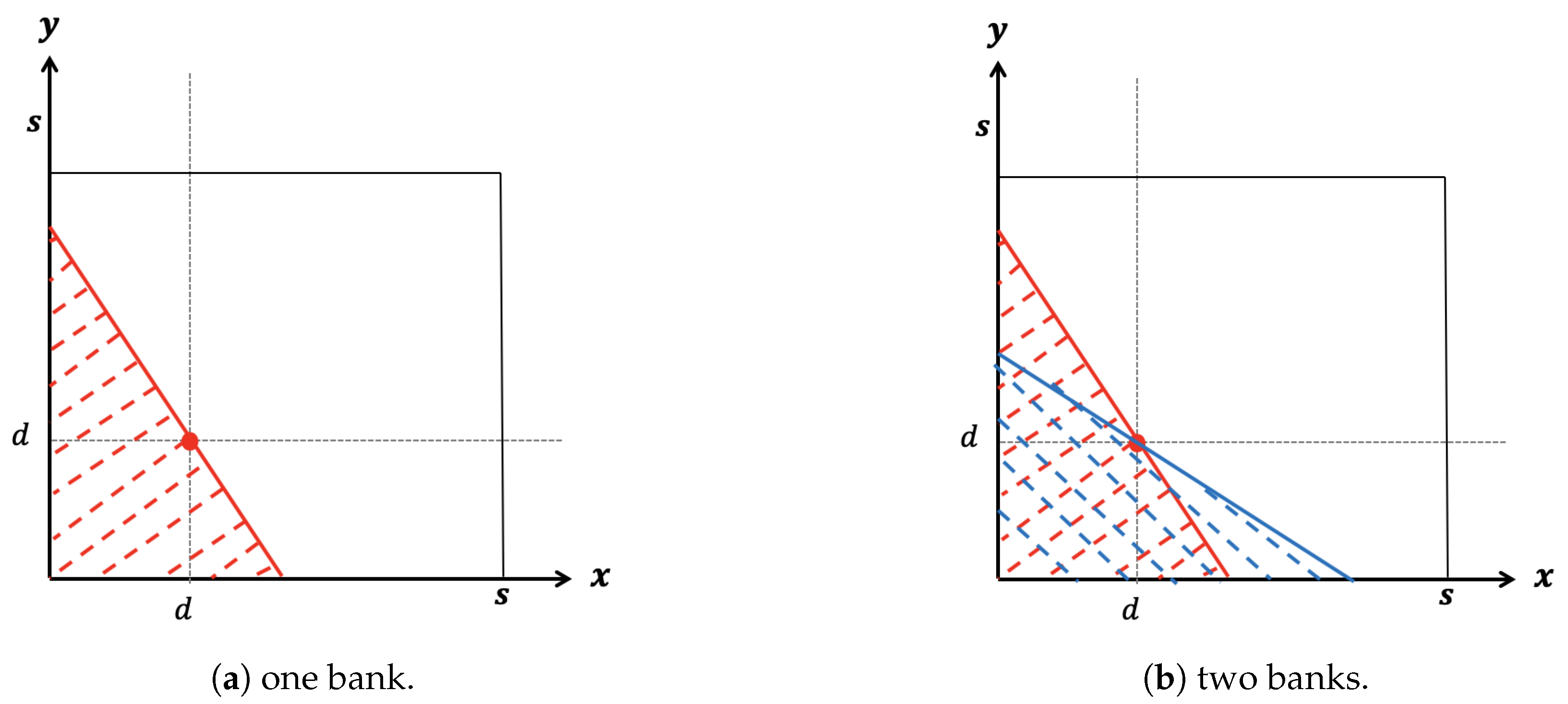

Proposition 2. If banks maintain the senior tranches only, as in (7), or if they keep both tranches in the same proportion (linear diversification), the probability of a joint failure cannot be decreased when compared to the no diversification case. Although tranching does not decrease the probability of a joint failure, it does decrease the probability of a run on each individual bank.

van Oordt (

2014) shows this to be true for retaining the junior tranche only, and it will be shown in Proposition 3 to be true also for retaining the senior tranche in full.

Proposition 3. The probability of a run on bank i is minimized if and only if bank i sets the maximum payoff of the senior tranche equal to its level of deposits, i.e., and exchanges its junior tranche entirely ().

We illustrate the effectiveness of Proposition 3 in

Figure 5a,b. Following (

9), the no bank-run border for bank 1 under Proposition 3 is given by,

The probability of bank 1 becoming insolvent under the strategy proposed is,

The expression in (

11) is the outcome for the dashed area in

Figure 5a. As it can be observed, the probability of a simultaneous bank run (

Figure 5b) is not increased by trenching as defined in Proposition 3. As a consequence, minimizing the bank run probability also minimizes the expected costs of liquidation.

Proposition 4. The optimal investment strategy that maximizes the total welfare in the economy, when exchanging only the junior tranche, is to set the maximum payoff of the senior tranche equal to its level of deposits, i.e., while exchanging its junior tranche entirely (). Since this strategy is the same when exchanging only the senior tranche, whether banks follow the optimal strategy from exchanging only the junior tranche or follow the optimal strategy from exchanging only the senior tranche, the total welfare of the economy is the same.

In other words, the total welfare of the economy does not change in situations where only the senior tranche, or only the junior tranche, is exchanged.

3.5. Securitization without Keeping Senior or Junior Tranche (Mixed)

In this section, we study the case in which none of the banks keeps the senior or junior tranche in full. As mentioned in

Section 3, the returns for bank 1 and bank 2 if not liquidated are given by,

where in this particular case,

and

. Notice that zero and one are excluded from the set of options. These extreme cases are dealt with at the end. This case was not explored in

van Oordt (

2014). In

Appendix B, we study the default region in the case (

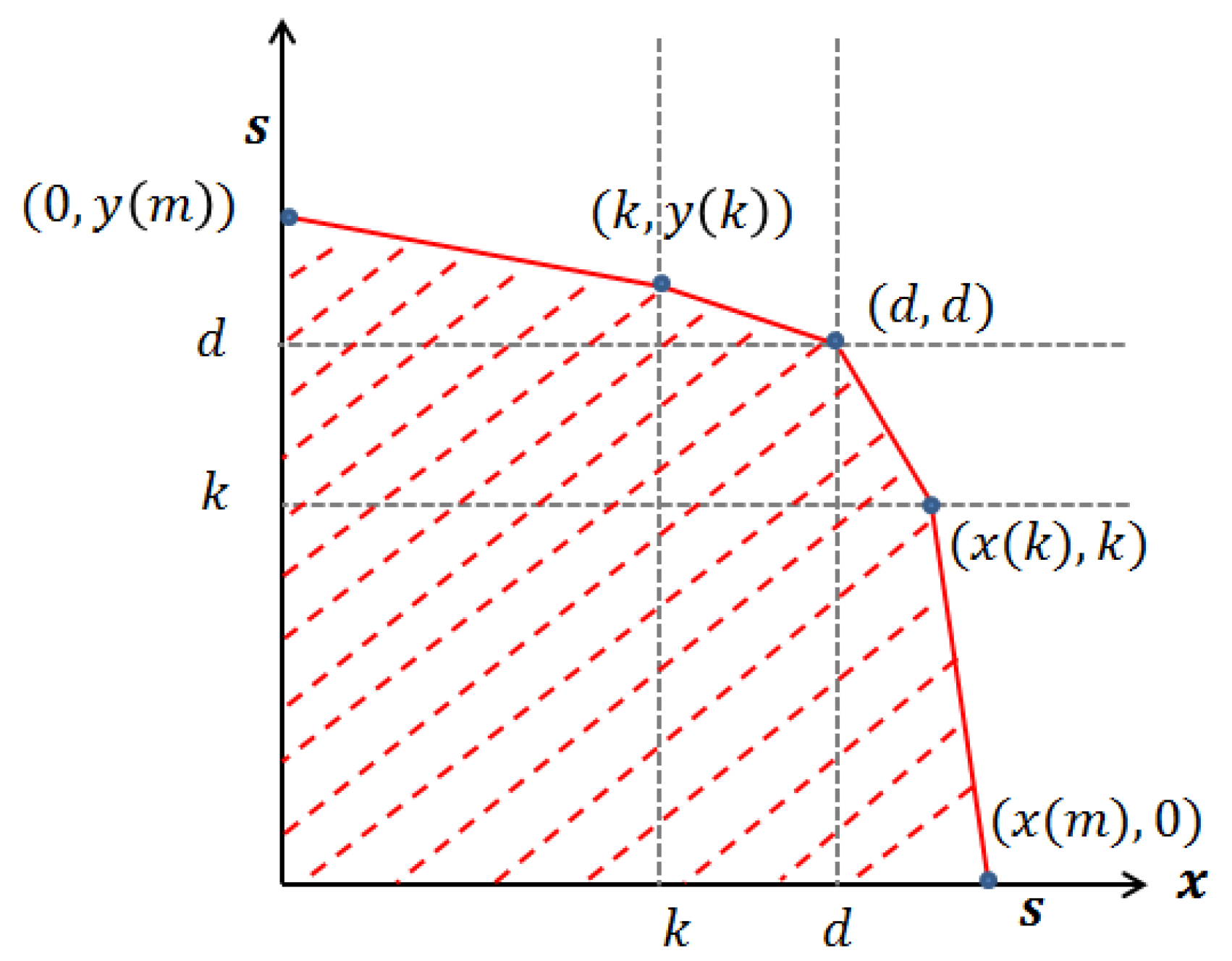

). From this geometric analysis, we gain intuition about how to move the parameters to minimize the size of the default probability. That analysis leads us to concentrate on case

where the best hedging portfolios come up.

As the

is a piecewise linear function, the default boundary is determined by the obvious break points The analysis in

Appendix B is split into the cases

and

and this last case is further split into two cases according to whether

or

In addition to finding the breakpoints at the boundary, we determined how the points move when

and

vary. When the distribution of assets is uniform, the probability of default is the (normalized) area of the default region and it is not difficult to compute. Certainly, when

the top and lateral breakpoints move to

In this case, the position of the bank is given by:

Note that when

or when

that is along the diagonal and along the anti-diagonal in the parameter space, the hedges reduce to the linear diversification case. However, in the general case, there are two free parameters, and this allows us to move the default boundary to further decrease the default probability. It is in

Appendix B.2.4 of

Appendix B where we collect the computational details. Here, we mention that when

and

and the assets are uniformly distributed, the probability of default is given by (

A26), that is, by:

Note that at

, we obtain that the probability of individual failure is given by

It is shown in

Appendix B.2.5 of

Appendix B that the point

is a saddle point for

given by (

13). This drops out of the fact that the

—Hessian matrix of

has a positive and a negative eigenvalue. We denote by

the negative eigenvalue and by

its eigenvector. When a small enough

is chosen, so that

then

This explains why the bi-parametric hedge offers more possibilities for controlling default probability than the mono-parametric hedge. To sum up, we have the following result.

Theorem 1. With the notations and under the assumptions introduced above, when each bank keeps the junior and the senior tranches, each bank may choose parameters (respectively, ) in in such a way that their individual default probabilities become (13) and satisfy (14); i.e., they are smaller than the individual default probability of the optimal linear hedge. It is important to observe that the intersection of the individual default regions (i.e., the systemic risk) may have a larger probability of default than if no hedging is implemented. Hence, the dark side of diversification cannot be avoided when

) in

. The dark side of diversification can only be avoided in the extreme cases: that is, when

and

or when

and

. The two-parametric dependence allows us two extreme cases, such that each bank can adopt one of them and lower the individual default probability without increasing the probability of joint default. This is discussed in

Appendix B.2.6. The result is summed up in the following theorem. The result is stated without referring to any particular bank.

Theorem 2. Suppose that the hedges of each bank are such that their returns are given by (12). For each bank, there are two extreme cases corresponding to or In the two cases, the default regions are as depicted in Figure A7a,b. In the first case, for , and in the second, for the probabilities of individual default satisfy When the two banks adopt complementary hedges, their common region of default coincides with the no hedge region of default. Therefore, the dark side of diversification is avoided.

Controlling the Probability of Default

The results obtained above bring up the themes developed in

Cadenas et al. (

2021) or in

Cadenas and Gzyl (

2021). In the latter, we showed that one can control the individual and the systemic probability of default by considering short positions, whereas in the former, we discussed how and why the probability of default and loss level are complementary. If one assigns a probability of default, this determined what the default level is. The underlying reason is that risk involves two complementary aspects: frequency and severity.

The next result follows the approach in

Cadenas et al. (

2021). The idea is to fix the default rate and determine the default level so that the probability of default is at most the chosen probability. Let us denote that by

p and note that if we equate the right hand side of (

14) to

p, we obtain

which allows us to choose an appropriate default level

d if

p is preassigned. When

d is preassigned, a similar calculation allows us to choose the value of the parameter

a as to lower the individual default probability to a value less than

4. Securitization and Confidence Shocks

Following

van Oordt (

2014), we analyze the results of retaining the senior tranche in the context of confidence shocks.

van Oordt (

2014) found that the benefits of securitization, when compared with linear diversification strategies, which consist of decreasing the probability of individual failures without increasing the probability of systemic risk, come at a cost. In other words, although structuring claims on loan portfolios using different seniority levels does not necessarily increase the probability of joint failures, it introduces non-linear effects in the financial system. Once banking institutions adopt the optimal strategy, small unanticipated shocks in confidence can increase considerably the risk of systemic failures. Given that banks do not have the knowledge to perfectly calibrate the payoffs of the tranches by setting

the effects of confidence shocks become relevant to the analysis of trenching.

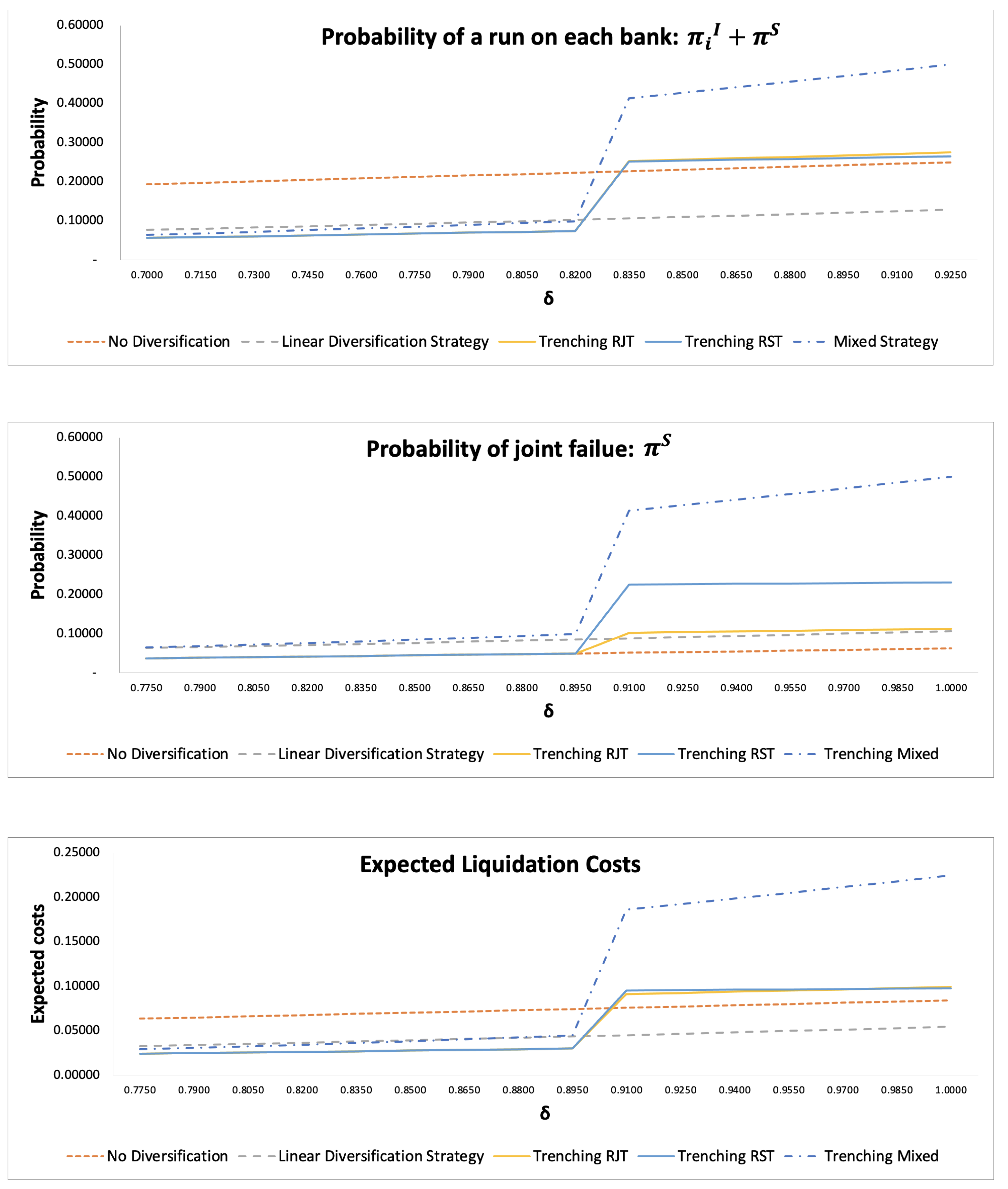

In this section, we compare the non-linear effects of different strategies: no diversification, linear diversification, retaining the junior tranche (RJT), retaining the senior tranche (RST), and exchanging a portion of both tranches (Mixed). We are particularly interested in comparing the RST, RJT and Mixed strategies, since this analysis has not been completed within the model. The shock in depositor’s confidence is modeled in the same way as in

van Oordt (

2014). The shock in depositors confidence occurs after the banks define their investment strategy at date 1. Depositors participate in a bank run if the return on the bank’s investments at date 2 is smaller than

Therefore, if

, a bank run may take place in a solvent bank.

We show here the expected liquidation costs for the four strategies mentioned and for specific levels of

The expected default costs in the case of no tranching and no diversification are given by,

If banks follow the social optimal strategy with linear diversification as defined by

Wagner (

2010) where

, the expected default costs are equal to,

If banks adopt the tranching strategy by retaining the junior tranche, the expected default costs are,

If banks adopt the tranching strategy by retaining the senior tranche, we find the expected default costs to be,

where

, and

Finally, we explore what would happen if banks adopt the Mixed trenching strategy with

, and we find the expected default costs to be,

Figure 6 shows the results of expected liquidation costs, joint probability failure and individual bank failure for different levels of

7. We found that when there is a sudden loss of confidence from depositors, the strategy based on retaining the senior tranche creates a considerable increase in the probability of both bank failings when compared with RJT. However, when retaining the senior tranche, the probability of individual failures becomes slightly better than the RJT strategy. Notice how the expected default costs are lower for both RST and RJT when compared with the no tranche and linear diversification strategy whenever

As soon as this changes, that is after a confidence shock takes place, the expected default costs for both tranching strategies become considerably higher. One contribution of our simulation to the analysis of expected liquidation costs lies in showing that evaluating which strategy is considered “superior” depends on the magnitude of the shock. By observing the bottom graph in

Figure 6, we see that RJT generates lower expected liquidation costs right after the shock takes place (i.e., for values of

relatively close to 0.90) and that RST generates lower expected liquidation whenever

It then follows, in the case of relatively “big” surprises in depositor’s confidence (we can measure the size of the surprise as the difference between

and

d), that the total welfare of the economy would be better managed by banks if they use the RST strategy over the RJT strategy.

Although, as it can be observed in

Figure 6, the RST strategy leads to a considerably higher probability of systemic failure than the RJT strategy after the shock, RST does make the probability of individual failure smaller. In the case of securitization, as argued by

Ordoñez (

2018), the growth and collapse of securitization depend critically on the growth and collapse conditions that determine confidence in the system. Confidence, in turn, depends on reputation.

Ordoñez (

2018) defines reputation as the probability assigned by the market that a given firm is financially healthy. This generates incentives for banks to avoid bankruptcy whenever possible. It follows that a reasonable strategy for banks to avoid confidence shocks would be to avoid bankruptcy which, in this model, can be achieved by minimizing the probability of a banking institution failing. Under this assumption, banks will try to minimize the probability of a run by choosing the RST strategy. Such a decision would be even more clear if governments provide liquidity and support in the case of systemic crisis as the consequences of increasing the probability of a systemic failure would be mitigated; and the reputation problem of a bank failure will be carried by the entire banking system and not by one single institution.

The intuition of why the RST strategy seems to reduce the probability of individual failure comes from the fact that whenever the returns of the bank’s asset (say asset X) are very low, the return on the senior tranche that was exchanged in the case of the RJT strategy is bounded by Hence, even if the return of asset Y is quite high, the bank can only achieve in this case a return of In contrast, the return on the junior tranche that was exchanged with the other bank in the case of the RST strategy is not bounded by a minimum value, and it may leave open the possibility of no failure whenever y is sufficiently high.

Securitization strategies that exchange both tranches illustrate, along with vertical distribution, the dark side of diversification. It may be worth emphasizing the point that the mixed strategy can reduce the probability of individual failure when compared with the linear diversification strategy, but it does so at the cost of considerably increasing the probability of joint failure and the expected liquidation costs of banks in the case of confidence shocks. The analysis of confidence shocks reinforces the point that, from the perspective of managing risk, banks are better off by only exchanging one of the tranches rather than exchanging two.

5. Discussion

Banks can construct portfolios that are identical to linear diversification by using securitization strategies. That is to say, linear diversification is actually a subcase of securitization strategies designed around senior and junior tranches. As it has been argued by

Wagner (

2010) and

van Oordt (

2014), with linear strategies comes the problem of the dark side of diversification. In other words, linear diversification strategies have the problem that as banks reduce the probability of individual failure, then the failure of the entire banking system becomes more likely. Similar points have been illustrated in other theoretical and empirical studies (

Acharya 2009;

Allen et al. 2012;

Allen and Carletti 2006;

Ibragimov et al. 2011;

Wagner 2010;

Yang et al. 2020).

One way to avoid the dark side of diversification, as discussed by

van Oordt (

2014), is to keep the junior tranche and exchange the senior tranche (RJT). However, what about all other theoretical possibilities that are available within the securitization scheme? The present study provides an answer to this question by generalizing

van Oordt’s (

2014) model for long positions and studying the problem of diversification and systemic risk. In particular, it shows that the dark side of diversification can be also avoided by exchanging the entire junior tranche and keeping in full the senior (RST). We also showed that, in this case, there is no difference from the point of view of the welfare of the entire system. However, the strategy of keeping the senior tranche and exchanging the junior leads to worst outcomes, from the point of view of systemic risk, when confidence shocks are being considered. From the point of view of expected liquidation costs, we did not find major differences between RST and RJT. Regulators could potentially contribute to reduce confidence shocks by providing liquidity support in the case of a systemic failure.

When it comes to the use of a mixed strategy (i.e., exchanging a portion of both tranches), it is possible to reduce the probability of individual failure when compared to linear diversification. Nevertheless, such a strategy does not avoid the dark side of diversification. From the point of view of confidence shocks, mixed strategies that are close or equal to exchanging portions of both tranches in the same proportion result in worst outcomes than all other possible strategies. Hence, mixed strategies are problematic and should be avoided by banks. Accordingly, the benefits of securitization can only be felt at the extremes. By exchanging one of the tranches in its entirety, banks can reduce the risk of individual failure without increasing systemic risk, reduce social costs, and minimize idiosyncratic and systemic risks in the case of confidence shocks when compared with other securitization strategies.

The theoretical suggestion that banks are better off by adopting securitization strategies that exchange only one tranche seems to be in accordance with the idea that transparency is central in avoiding systemic crisis. After all, exchanging only one portion makes the banks portfolios less complicated, easier to track and, consequently, more transparent. As it has been argued by

Klein et al. (

2021), poor transparency of asset-backed securities exacerbated the latest subprime lending crisis. Our theoretical results do not contradict the importance of transparency in the banking system. In fact, it reinforces the relevance of this idea for banking institutions and regulators. In addition, our theoretical results are in line with the empirical work of

Deku et al. (

2019) in the sense that securitization is not a destabilizing tool per se. The destabilizing forces that are introduced by securitization depend on how the instruments are designed and used. Regulation, in turn, can eliminate undesired outcomes by, for example, enforcing the design of securitization instruments that don’t allow the exchange of both tranches.

We believe that both theoretical and empirical work are necessary for a better understanding of securitization, diversification and the fragility of the banking system. Theory can help illuminate the extent and detail of empirical studies, and empirical studies can guide the questions posed in theoretical work. To the best of our knowledge, most of the recent research in this area (during the past four years) has been predominantly empirical in its approach. Part of our contribution is based on the idea that theory may provide further sources for understanding the use of securitization tools and to better inform policy makers and regulators.

One direction that remains to be explored is to investigate if the conclusions of the theoretical framework presented in the present study hold when more banks and assets are considered.