Testing Housing Markets for Episodes of Exuberance: Evidence from Different Polish Cities

Abstract

1. Introduction

2. Literature Review

3. Materials and Methods

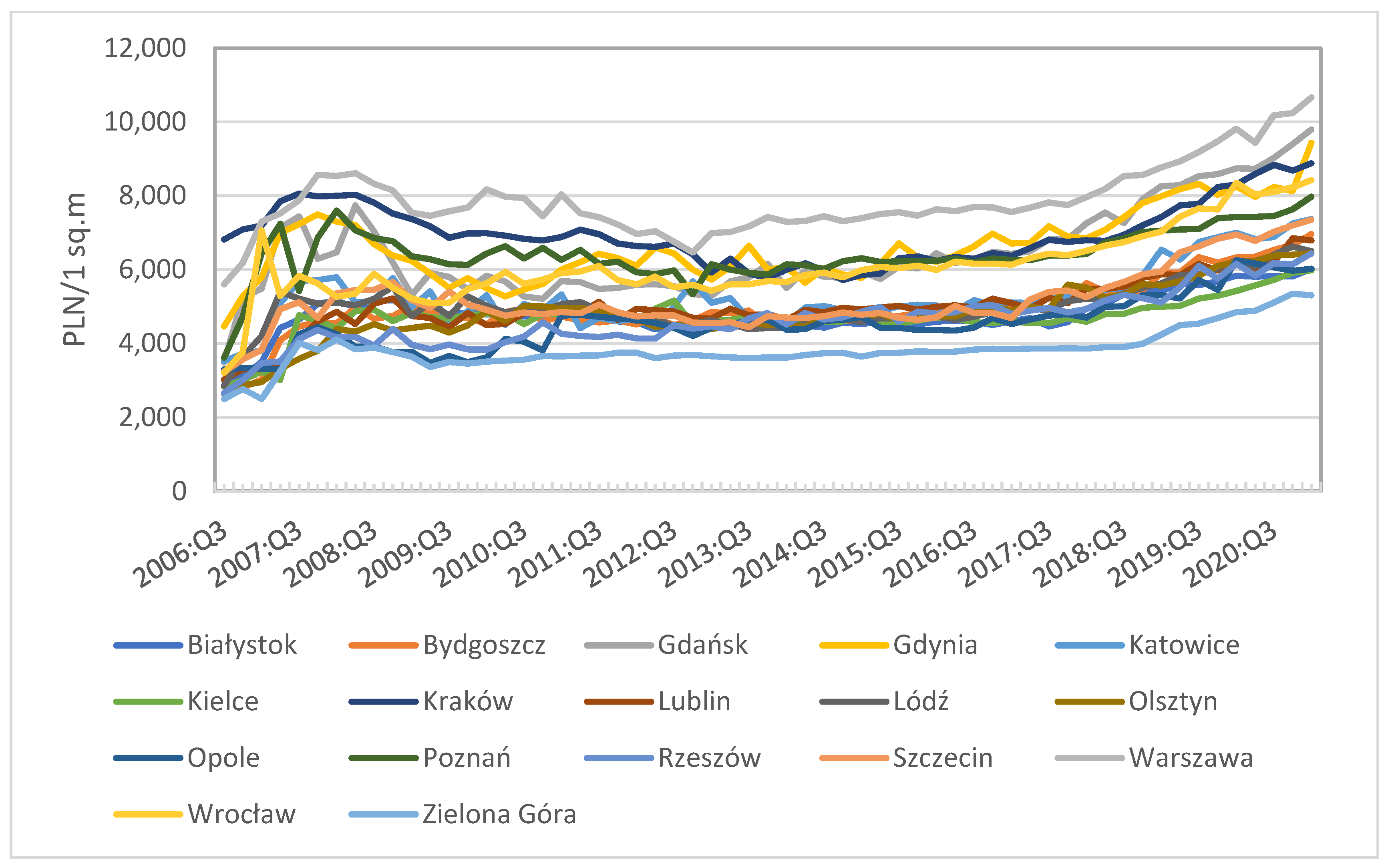

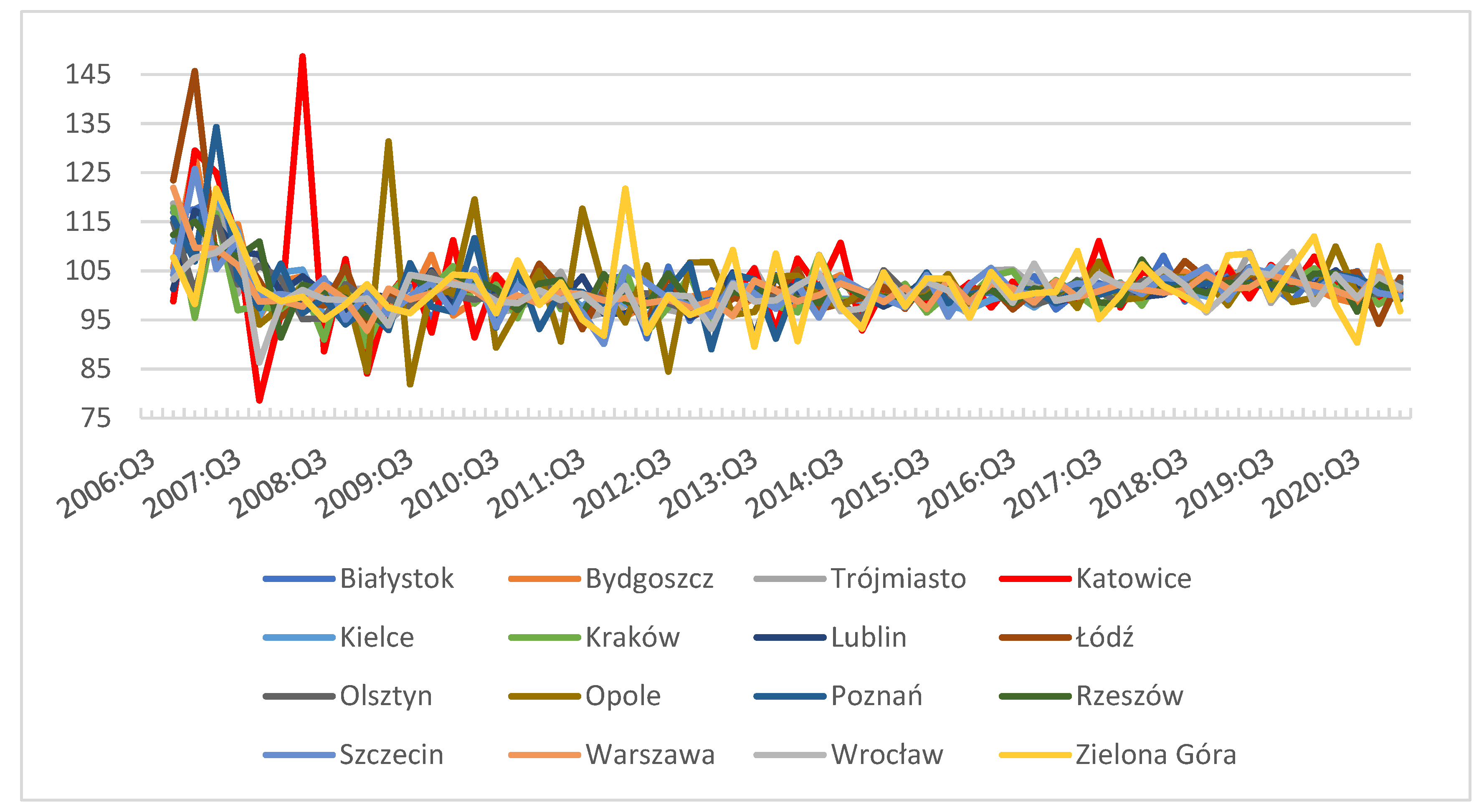

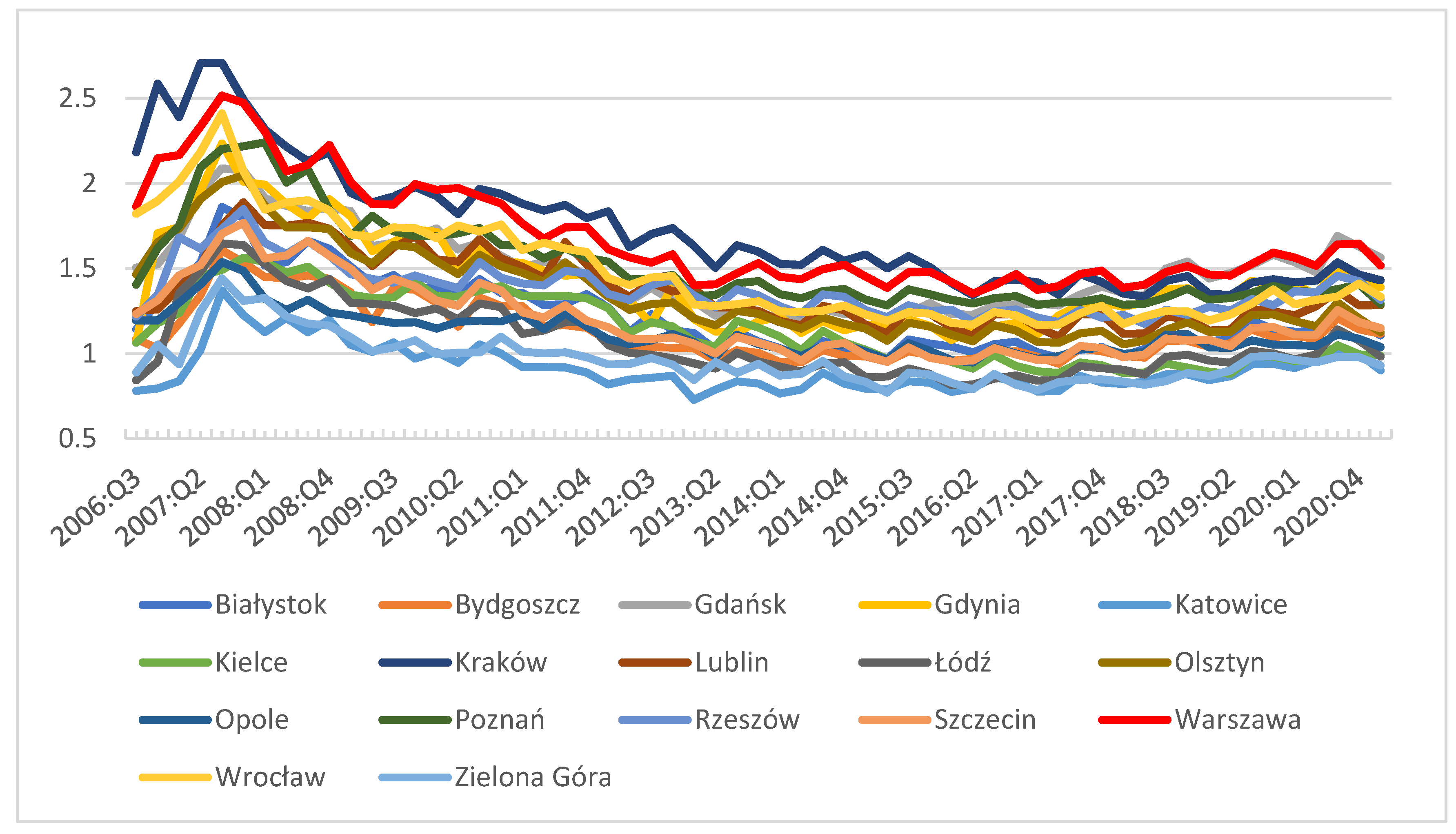

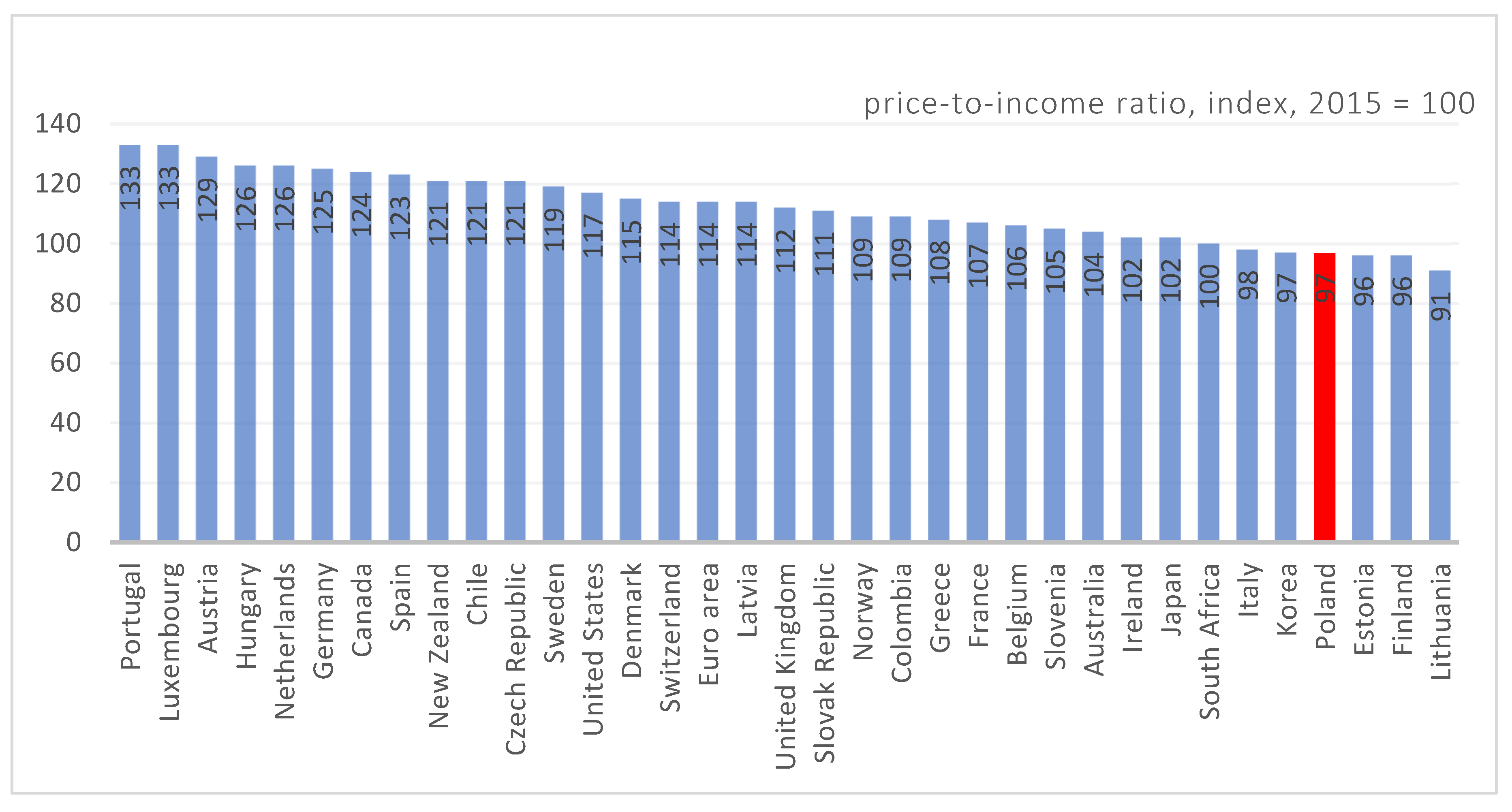

3.1. Data Descritpion

3.2. Different Approaches for Detecting Explosive Dynamics

- log-periodic power law (LPPL) bubble model (Ardila et al. 2013);

- variance bound tests (Shiller 1981; LeRoy and Porter 1981);

- ARDL aproach (Solak and Kabaday 2016; Samirana 2020);

- fixed effects OLS model (Basco 2014);

- right-tailed unit root tests (ADF, SADF, GSADF) (Zeren and Ergüzel 2015; Caspi 2016; Coskun and Jadevicius 2017);

- right-tailed unit root test and co-explosive VAR (Engsted et al. 2016);

- esploratory spatial data analysis ESDA (Martori et al. 2016);

- Markov Regime Switching model (Xiao and Devaney 2016);

- OLS, FMOLS, DOLS, Kalman Filter, ARIMA model (Coskun et al. 2020);

- VAR model (Shi 2017);

- GMM (Vogiazas and Alexiou 2017);

- deviation from the moving average by a certain parameter (Bordo and Jeanne 2002);

- artificial neural network (ANN) (Wang et al. 2016).

3.3. Econometric Research Method

3.3.1. Univariate Right-Tailed Tests: SADF, GSADF and Panel GSADF

3.3.2. The Standard ADF Test

3.3.3. The SADF Test

3.3.4. The Generalized SADF (GSADF) Test

3.3.5. Date-Stamping Strategies

3.3.6. Technical Details

3.3.7. The Panel GSADF Procedure

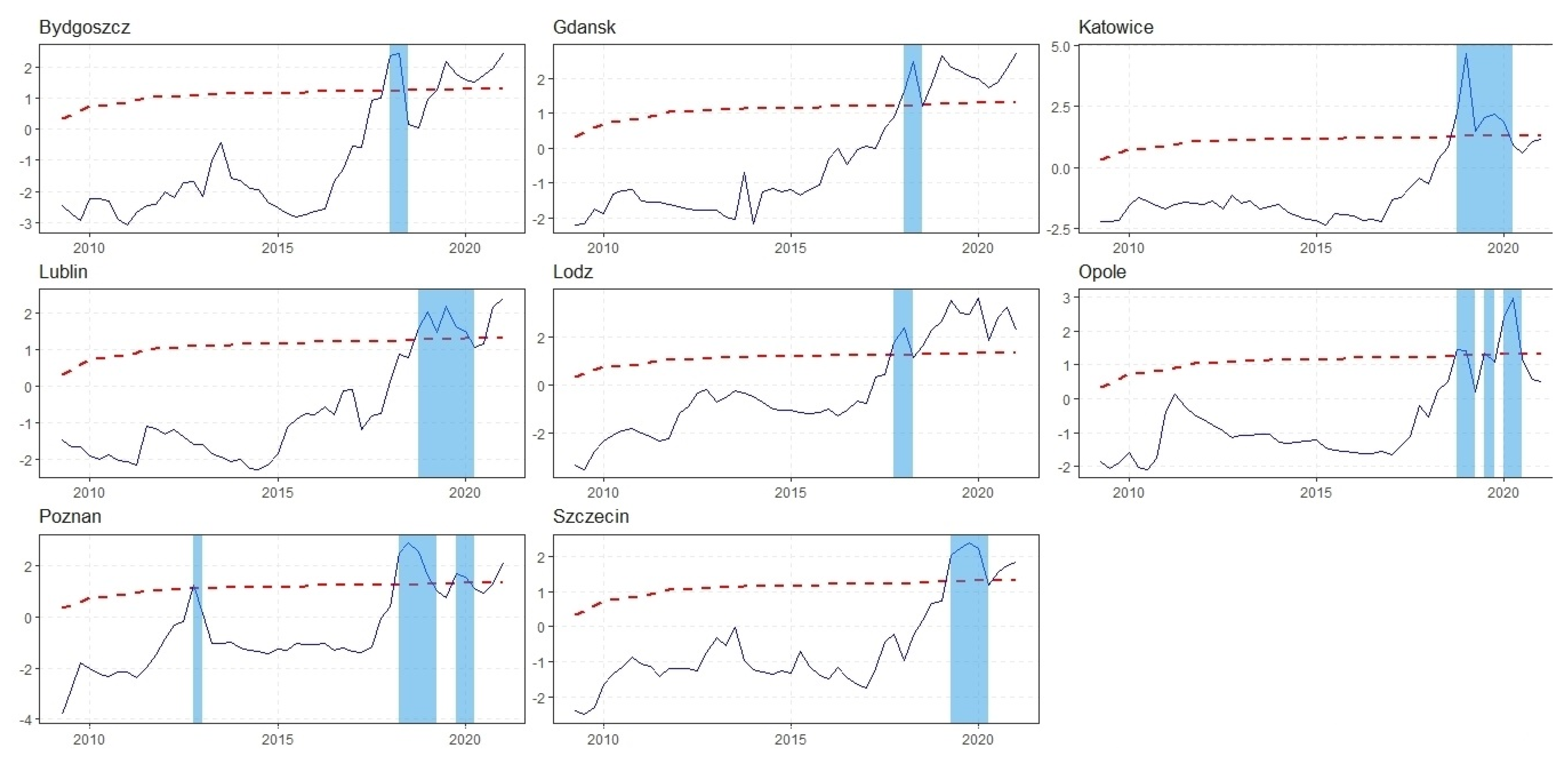

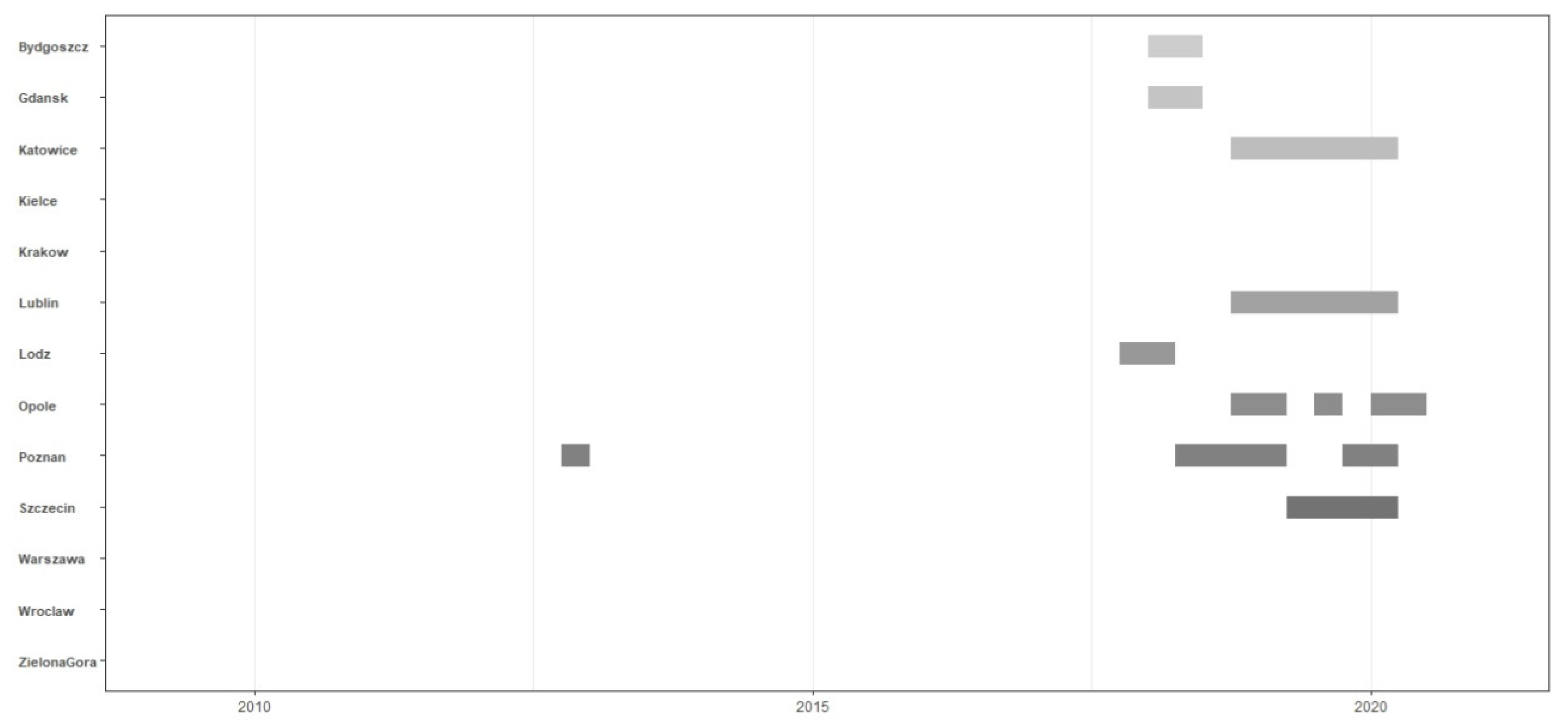

4. Results

5. Discussion

6. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

| 1 | The wealth effect is a behavioral economic theory suggesting that people spend more as the value of their assets rise. The idea is that consumers feel more financially secure and confident about their wealth when their homes or investment portfolios increase in value. |

| 2 | Irrational exuberance is defined as a rise in asset prices to levels that are not fundamentally justified. It happens as a result of investors’ excessive enthusiasm dictated by their inexplicable market optimism, which has no real basis in fundamental valuation. Such excessive enthusiasm is due to psychological factors. |

| 3 | This method is based on recursive ADF regression estimation, employing the Sherman-Morrison-Woodbury formula to efficiently update the least squares estimates as the subsample size changes. |

| 4 | It is recommended that the minimum window size should be (Phillips et al. 2015a, 2015b). |

| 5 | The remaining variables are defined as in the previous sub-section. |

| 6 | The overall assumption is that may vary from panel to panel as opposed to canonical approaches. |

References

- Abolafia, Mitchel Y., and Martin Kilduff. 1988. Enacting market crisis: The social construction of a speculative bubble. Administrative Science Quarterly 1: 177–93. [Google Scholar] [CrossRef]

- Allen, Franklin, and Elena Carletti. 2013. Systemic risk from real estate and macro-prudential regulation. International Journal of Banking, Accounting and Finance 5: 28–48. [Google Scholar] [CrossRef]

- Anderson, Theodore Wilbur, and Cheng Hsiao. 1981. Estimation of Dynamic Models with Error components. Journal of the American Statistical Association 76: 598–606. [Google Scholar] [CrossRef]

- Ardila, Diego, Peter Cauwels, Dorsa Sanadgol, and Didier Sornette. 2013. Is There a Real Estate Bubble in Switzerland? arXiv arXiv:1303.4514. [Google Scholar]

- Arellano, Manuel, and Stephen Bond. 1991. Some tests of specification for panel data: Monte Carlo evidence and an application to employment equations. The Review of Economic Studies 58: 277–97. [Google Scholar] [CrossRef]

- Arellano, Manuel, and Olympia Bover. 1995. Another look at instrumental variable estimation of error component models. Journal of Econometrics 68: 29–51. [Google Scholar] [CrossRef]

- Balcerzak, Aadam P. 2009. Wpływ polityki monetarnej Stanów Zjednoczonych na powstanie przyczyn światowego kryzysu gospodarczego z roku 2008. Acta Universitatis Nicolai Copernici Ekonomia 40: 131–46. [Google Scholar]

- Basco, Sergi. 2014. Globalization and financial development: A model of the Dot-Com and the Housing Bubbles. Journal of International Economics 92: 78–94. [Google Scholar] [CrossRef]

- Blanchard, Olivier, and Mark W. Watson. 1982. Bubbles, Rational Expectations and Financial Markets. In Crises in the Economic and Financial Structure. Edited by Paul Wachter. Lexington: Lexington Books, pp. 295–315. [Google Scholar]

- Bond, Stephen. 2002. Dynamic Panel Data Models: A Guide to Micro Data Methods and Practice. Portuguese Economic Journal 1: 141–62. [Google Scholar] [CrossRef]

- Bordo, Michael D., and Olivier Jeanne. 2002. Boom-Busts in Asset Prices, Economic Instability, and Monetary Policy (National Bureau of Economic Research Working Paper Series no. w8996). Cambridge: NCBR. [Google Scholar]

- Bordo, Michael D., and John Landon-Lane. 2013. Does Expansionary Monetary Policy Cause Asset Price Booms; Some Historical and Empirical Evidence (National Bureau of Economic Research Working Paper Series no. w19585). National Bureau of Economic Research. Cambridge: NCBR. [Google Scholar]

- Brunnermeier, Markus, and Christian Julliard. 2008. Money illusion and housing frenzies. The Review of Financial Studies 21: 135–80. [Google Scholar] [CrossRef]

- Bryx, Marek. 2017. Market Protection of Flat Buyers as a Part of Housing Policy in Poland. World of Real Estate Journal 102: 75–80. [Google Scholar]

- Calem, Paul, and Michael LaCour-Little. 2004. Risk-based capital requirements for mortgage loans. Journal of Banking & Finance 28: 647–72. [Google Scholar]

- Caselli, Francesco, Gerardo Esquivel, and Fernando Lefort. 1996. Reopening the Convergence Debate: A New Look At Cross-Country Growth Empirics. Journal of Economic Growth 1: 363–89. [Google Scholar] [CrossRef]

- Caspi, Itamar. 2016. Testing for a housing bubble at the national and regional level: The case of Israel. Empirical Economics 51: 483–516. [Google Scholar] [CrossRef]

- Ciżkowicz, Piotr, and Adrzej Rzońca. 2010. Stopy procentowe bliskie zera nie muszą być dobrą odpowiedzią na kryzys (BRE Bank—CASE Seminar Proceedings, No. 111). In Banki centralne w zarządzaniu kryzysem finansowym—Strategie wyjścia. Edited by Piotr Ciżkowicz, Andrzej Rzońca and Dobiesła Tymoczko. Warsaw: Center for Social and Economic Research (CASE). [Google Scholar]

- Coskun, Yener, and Arvydas Jadevicius. 2017. Is there a housing bubble in Turkey. Real Estate Management and Valuation 25: 48–73. [Google Scholar] [CrossRef]

- Coskun, Yener, Ünal Seven, Hasan Murat Ertugrul, and Ali Alp. 2020. Housing price dynamics and bubble risk: The case of Turkey. Housing Studies 35: 50–86. [Google Scholar] [CrossRef]

- Czerniak, Adam. 2014. Wpływ cech Społeczno-Kulturowych Społeczeństw na Powstawanie Baniek Cenowych na Rynku Mieszkaniowym. Warsaw: Warsaw School of Economics. [Google Scholar]

- Czerniak, Adam, and Stefan Kawalec. 2020. Is a Bubble Inflating on Poland’s Housing Market? mBank-CASE Seminar Proceedings No. 164/2020. Warsaw: CASE—Centrum Analiz Społeczno-Ekonomicznych—Fundacja Naukowa. [Google Scholar]

- Czerniak, Adam, and Bartosz Witkowski. 2016. Model Wczesnego Ostrzegania Przed Bańkami Cenowymi na Rynku Mieszkaniowym (Materiały i Studia Narodowego Banku Polskiego Numer 326.). Warsaw: NBP (Narodowy Bank Polski). [Google Scholar]

- De Bandt, Olivier, Thomas Knetsch, Juan Peñalosa, and Francesco Zollino. 2010. Housing Markets in Europe: A Macroeconomic Perspective. Berlin: Springer. [Google Scholar]

- Diba, Behzad T., and Herschel I. Grossman. 1984. Rational Bubbles in the Price of Gold (No. w1300). Cambridge: National Bureau of Economic Research. [Google Scholar]

- Diba, Behzad T., and Herschel I. Grossman. 1988. Explosive rational bubbles in stock prices? The American Economic Review 78: 520–30. [Google Scholar]

- Dreger, Christian, and Konstantin A. Kholodilin. 2013. An early warning system to predict speculative house price bubbles. Economics 7: 20130008. [Google Scholar] [CrossRef]

- Elliott, Douglas J., and Martin Neil Baily. 2009. Telling the Narrative of the Financial Crisis: Not Just a Housing Bubble. Washington, DC: Brookings Institution. [Google Scholar]

- Engsted, Tom, and Bent Nielsen. 2012. Testing for rational bubbles in a coexplosive vector autoregression. The Econometrics Journal 15: 226–54. [Google Scholar] [CrossRef]

- Engsted, Tom, Simon Juul Hviid, and Thomas Quistgaard Pedersen. 2016. Explosive bubbles in house prices? Evidence from the OECD countries. Journal of International Financial Markets, Institutions and Money 40: 14–25. [Google Scholar] [CrossRef]

- Escobari, Diego, Damian S. Damianov, and Andres Bello. 2015. A time series test to identify housing bubbles. Journal of Economics and Finance 39: 136–52. [Google Scholar] [CrossRef][Green Version]

- European Central Bank. 2010. Asset Price Bubbles and Monetary Policy Revisited (Monthly Bulletin, November). Frankfurt am Main: European Central Bank. [Google Scholar]

- Eurostat. 2021. House Prices—Quarterly and Annual Rates of Change, 2019Q4-2020Q3 (%). Available online: https://ec.europa.eu/eurostat/statistics-explained/index.php?title=File:House_Prices_%E2%80%93_Quarterly_and_annual_rates_of_change,_2019Q4-2020Q3_(%25).png (accessed on 24 August 2021).

- Evans, George W. 1991. Pitfalls in testing for explosive bubbles in asset prices. The American Economic Review 81: 922–30. [Google Scholar]

- Flotyński, Marcin. 2020. Działania Narodowego Banku Polskiego na rzecz utrzymania stabilności ekonomicznej w czasie kryzysu wywołanego pandemią koronawirusa w świetle uwarunkowań makroekonomicznych. In Przedsiębiorstwo, Gospodarka i Społeczeństwo w Kręgu Zainteresowania Ekonomistów. Edited by Ryszard Kamiński. Poznań: Wydawnictwo Polskiego Towarzystwa Ekonomicznego Oddział w Poznaniu. [Google Scholar]

- Greenaway-McGrevy, Ryan, and Peter C. B. Phillips. 2016. Hot property in New Zealand: Empirical evidence of housing bubbles in the metropolitan centres. New Zealand Economic Papers 50: 88–113. [Google Scholar] [CrossRef]

- Gürkaynak, Refet S. 2008. Econometric tests of asset price bubbles: Taking stock. Journal of Economic Surveys 22: 166–86. [Google Scholar] [CrossRef]

- Hall, Stephen G., Zacharias Psaradakis, and Martin Sola. 1999. Detecting periodically collapsing bubbles: A Markov-switching unit root test. Journal of Applied Econometrics 14: 143–54. [Google Scholar] [CrossRef]

- Hamilton, James D., and Charles H. Whiteman. 1985. The observable implications of self-fulfilling expectations. Journal of Monetary Economics 16: 353–73. [Google Scholar] [CrossRef]

- Holtz-Eakin, Douglas, Whitney Newey, and Harvey S. Rosen. 1988. Estimating vector Autoregressions with panel data. Econometrica: Journal of the Econometric Society 56: 1371–95. [Google Scholar] [CrossRef]

- Homm, Ulrich, and Jörg Breitung. 2012. Testing for speculative bubbles in stock markets: A comparison of alternative methods. Journal of Financial Econometrics 10: 198–231. [Google Scholar] [CrossRef]

- Iacoviello, Matteo. 2010. Housing in DSGE models: Findings and new directions. In Housing Markets in Europe. Berlin/Heidelberg: Springer. [Google Scholar]

- Iacoviello, Matteo, and Stefano Neri. 2010. Housing market spillovers: Evidence from an estimated DSGE model. American Economic Journal: Macroeconomics 2: 125–64. [Google Scholar] [CrossRef]

- Im, Kyung So, Mohammad Hashem Pesaran, and Yongcheol Shin. 2003. Testing for unit roots in heterogeneous panels. Journal of Econometrics 115: 53–74. [Google Scholar] [CrossRef]

- Jadevicius, Arvydas, and Simon Huston. 2015. ARIMA modelling of Lithuanian house price index. International Journal of Housing Markets and Analysis 8: 135–47. [Google Scholar] [CrossRef]

- Kamiński, Maciej. 2019. The Theoretical Model of Polish Housing Policy between 2002 and 2016. Folia Oeconomica Stetinensia 19: 20–30. [Google Scholar] [CrossRef]

- Kholodilin, Konstantin, and Claus Michelsen. 2018. Signs of new housing bubble in many OECD countries: Lower risk in Germany. DIW Weekly Report 8: 275–85. [Google Scholar]

- Kim, Kyung-Hwan. 2004. Housing and the Korean economy. Journal of Housing Economics 13: 321–41. [Google Scholar] [CrossRef]

- Kivedal, Bjørnar Karlsen. 2013. Testing for rational bubbles in the US housing market. Journal of Macroeconomics 38: 369–81. [Google Scholar] [CrossRef]

- Korzeb, Zbigniew. 2019. The Real Estate and Credit Bubble in Spain. Implications for Poland. Problems of World Agriculture 19: 77–88. [Google Scholar] [CrossRef]

- Leijten, Ingrid, and Kaisa de Bel. 2020. Facing financialization in the housing sector: A human right to adequate housing for all. Netherlands Quarterly of Human Rights 38: 94–114. [Google Scholar] [CrossRef]

- LeRoy, Stephen F., and Richard D. Porter. 1981. The Present-Value Relation: Tests Based on Implied Variance Bonds. Econometrica 49: 555–74. [Google Scholar] [CrossRef]

- Lin, Li, Ruoen Ren, and Didier Sornette. 2009. A Consistent Model of’Explosive’Financial Bubbles with Mean-Reversing Residuals. Swiss Finance Institute Research Paper, (09–14). Zürich: Swiss Finance Institute. [Google Scholar]

- Lind, Hans. 2009. Price bubbles in housing markets: Concept, theory and indicators. International Journal of Housing Markets and Analysis. International Journal of Housing Markets and Analysis 2: 78–90. [Google Scholar] [CrossRef]

- Machaj, Mateusz. 2016. Can the Taylor Rule be a good guidance for policy? The case of 2001–2008 real estate bubble. Prague Economic Papers 25: 381–95. [Google Scholar] [CrossRef]

- Maddala, Gangadharrao Soundalyarao, and Shaowen Wu. 1999. A comparative study of unit root tests with panel data and a new simple test. Oxford Bulletin of Economics and Statistics 61: 631–52. [Google Scholar] [CrossRef]

- Malkiel, Burton G. 2010. Bubbles in Asset Prices (CEPS Working Paper No. 200). Brussels: Centre for European Policy Studies. [Google Scholar]

- Martinez-Garcia, Enrique, Efthymios (Themis) Pavlidis, and Kostas Vasilopoulos. 2020. Exuber: Recursive Right-Tailed Unit Root Testing with R (No. w383). Dallas: Globalization and Monetary Policy Institute. [Google Scholar]

- Martori, Joan Carles, Rafa Madariaga, and Ramon Oller. 2016. Real estate bubble and urban population density: Six Spanish metropolitan areas 2001–2011. The Annals of Regional Science 56: 369–92. [Google Scholar] [CrossRef]

- NBP. 2019. Information on Housing Prices and the Situation on the Residential Real Estate Market in Poland in the Second Quarter of 2019. Warsaw: Narodowy Bank Polski (NBP). [Google Scholar]

- NBP. 2021. Cykliczne Materiały Analityczne NBP. Available online: https://www.nbp.pl/home.aspx?f=/publikacje/rynek_nieruchomosci/index2.html (accessed on 21 August 2021).

- Ng, Eric C. 2015. Housing market dynamics in China: Findings from an estimated DSGE model. Journal of Housing Economics 29: 26–40. [Google Scholar] [CrossRef]

- Oust, Are, and Kjartan Hrafnkelsson. 2017. What is a housing bubble? Economics Bulletin 37: 806–36. [Google Scholar]

- Paries, Matthieu Darracq, and Alessandro Notarpietro. 2008. Monetary Policy and Housing Prices in an Estimated DSGE Model for the US and the Euro Area. Frankfurt: European Central Bank. [Google Scholar]

- Pavlidis, Efthymios, Alisa Yusupova, Ivan Paya, David Peel, Enrique Martínez-García, Adrienne Mack, and Valerie Grossman. 2016. Episodes of exuberance in housing markets: In search of the smoking gun. The Journal of Real Estate Finance and Economics 53: 419–49. [Google Scholar] [CrossRef]

- Pedersen, Thomas Quistgaard, and Erik Christian Montes Schütte. 2020. Testing for explosive bubbles in the presence of autocorrelated innovations. Journal of Empirical Finance 58: 207–25. [Google Scholar] [CrossRef]

- Pesaran, Mohammad Hashem, and Yongcheol Shin. 1999. An autoregressive distributed lag modelling approach to cointegration analysis. In Econometrics and Economic Theory in the 20th Century: The Ragnar Frisch Centennial Symposium. Edited by Steinar Strom. Cambridge: Cambridge University Press. [Google Scholar]

- Pesaran, Mohammad Hashem, Yongcheol Shin, and Richard J. Smith. 2001. Bounds testing approaches to the analysis of level relationships. Journal of Applied Econometrics 16: 289–326. [Google Scholar] [CrossRef]

- Phillips, Peter C. B., Yangru Wu, and Jun Yu. 2011. Explosive behavior in the 1990s Nasdaq: When did exuberance escalate asset values? International Economic Review 52: 201–26. [Google Scholar] [CrossRef]

- Phillips, Peter C. B., Shuping Shi, and Jun Yu. 2014. Specification sensitivity in right-tailed unit root testing for explosive behaviour. Oxford Bulletin of Economics and Statistics 76: 315–33. [Google Scholar] [CrossRef]

- Phillips, Peter C. B., Shuping Shi, and Jun Yu. 2015a. Testing for multiple bubbles: Historical episodes of exuberance and collapse in the S&P 500. International Economic Review 56: 1043–78. [Google Scholar]

- Phillips, Peter C. B., Shuping Shi, and Jun Yu. 2015b. Testing for multiple bubbles: Limit theory of real-time detectors. International Economic Review 56: 1079–134. [Google Scholar] [CrossRef]

- Quigley, John M. 2002. Real estate prices and economic cycles. International Real Estate Review 2: 1–20. [Google Scholar]

- Rubio, Margarita, and José A. Carrasco-Gallego. 2016. Liquidity, interest rates and house prices in the euro area: A DSGE analysis. Journal of European Real Estate Research 9: 4–25. [Google Scholar] [CrossRef]

- Said, Rosli, Alaistair Adair, Stanley McGreal, and Rohayu Majid. 2014. Inter-relationship between the housing market and housing finance system: Evidence from Malaysia. International Journal of Strategic Property Management 18: 138–50. [Google Scholar] [CrossRef]

- Samirana, Sanja. 2020. Testing for bubbles in the Indian housing market: And ARDL bounds testing approach. Journal of International Money, Banking and Finance 1: 87–107. [Google Scholar]

- Shi, Shuping. 2013. Specification sensitivities in the Markov-switching unit root test for bubbles. Empirical Economics 45: 697–713. [Google Scholar] [CrossRef]

- Shi, Shuping. 2017. Speculative bubbles or market fundamentals? An investigation of US regional housing markets. Economic Modelling 66: 101–11. [Google Scholar] [CrossRef]

- Shi, Shuping, and Yong Song. 2015. Identifying speculative bubbles using an infinite hidden Markov model. Journal of Financial Econometrics 14: 159–84. [Google Scholar] [CrossRef]

- Shi, Shuping, Abbas Valadkhani, Russell Smyth, and Farshid Vahid. 2016. Dating the timeline of house price bubbles in Australian capital cities. Economic Record 92: 590–605. [Google Scholar] [CrossRef]

- Shiller, Robert J. 1981. Do Stock Prices Move Too Much to be Justified by Subsequent Changes in Dividends? American Economic Review 71: 421–36. [Google Scholar]

- Shiller, Robert J. 2003. From efficient markets theory to behavioral finance. Journal of Economic Perspectives 17: 83–104. [Google Scholar] [CrossRef]

- Siwiński, Włodzimierz. 2011. Globalny kryzys gospodarczy i jego implikacje dla polityki pieniężnej. Master of Business Administration 19: 10–29. [Google Scholar]

- Slavata, David. 2018. The Comparison of Housing Affordability of Czech and Polish Regions. In Development and Administration of Border Areas of the Czech Republic and Poland, Support for Sustainable Development, Proceedings of the 2nd International Scientific Conference (VŠB-TU Ostrava), Ostrava, Czech Republic, 11–12 September 2018. Ostrava: VŠB-TU Ostrava. [Google Scholar]

- Sobieraj, Janusz. 2020. Investment Project Management on the Housing Construction Market. Madrid: Aurum Universitas Grupo Hespérides. [Google Scholar]

- Sobieraj, Janusz, and Dominik Metelski. 2021. Application of the Bayesian New Keynesian DSGE Model to Polish Macroeconomic Data. Engineering Economics 32: 140–53. [Google Scholar] [CrossRef]

- Solak, Ali Osman, and Burhan Kabaday. 2016. Bounds Testing Approaches to Housing Demand in Turkey: Is There a Real Estate Bubble? International Journal of Economics and Financial Issues 6: 1132–35. [Google Scholar]

- Sornette, Didier. 2004. Why stock markets crash: Critical events in complex financial systems. Physics Today 57: 78–79. [Google Scholar]

- Thornton, Mark. 2009. The economics of housing bubbles. In Housing America: Building out of a Crisis. Edited by Randall G. Holcombe and Benjamin Powell. New Brunswick: Transaction Publishers. [Google Scholar]

- Tirole, Jean. 1985. Asset Bubbles and Overlapping Generations. Econometrica 53: 1499–528. [Google Scholar] [CrossRef]

- Tirtiroǧlu, Doǧan. 1992. Efficiency in housing markets: Temporal and spatial dimensions. Journal of Housing Economics 2: 276–92. [Google Scholar] [CrossRef]

- Trojanek, Radosław. 2008. Wahania cen na rynku mieszkaniowym. Poznań: Wydawnictwo Akademii Ekonomicznej w Poznaniu. [Google Scholar]

- Visco, Ignazio. 2005. Comments on Recent Experiences with Asset Prices Bubbles. In Asset Price Bubbles: The Implications for Monetary Policy, Regulatory, and International Policies. Edited by William Curt Hunter, George G. Kaufman and Michael Pomerleano. Cambridge: The MIT Press, pp. 165–71. [Google Scholar]

- Vogiazas, Sofoklis, and Constantinos Alexiou. 2017. Determinants of housing prices and bubble detection: Evidence from seven advanced economies. Atlantic Economic Journal 45: 119–31. [Google Scholar] [CrossRef]

- Wang, Pengfei, and Yi Wen. 2012. Speculative bubbles and financial crises. American Economic Journal: Macroeconomics 4: 184–221. [Google Scholar] [CrossRef]

- Wang, Lipo, Fung Foong Chan, Yaoli Wang, and Qing Chang. 2016. Predicting public housing prices using delayed neural networks. Paper presented at the 2016 IEEE TENCON Region 10 Conference, Singapore, November 22–26. [Google Scholar]

- Wei, Yigang, Yan Li, Jing Li, Yang Wang, and Zeyu Qiang. 2020. Regional and longitudinal disparity of housing bubbles in US markets: Evidence from GSADF tests. Journal of Urban Planning and Development 146: 1–14. [Google Scholar] [CrossRef]

- Widłąk, Marta. 2010. Dostosowanie Indeksów Cenowych do Zmian Jakości. Metoda Wyznaczania Hedonicznych Indeksów Cen i Możliwości Ich Zastosowania dla Rynku Mieszkaniowego (Materiały i Studia NBP, 247). Warsaw: Narodowy Bank Polski (Departament Edukacji i Wydawnictw). [Google Scholar]

- Wijburg, Gertjan. 2020. The de-financialization of housing: Towards a research agenda. Housing Studies, 1–18. [Google Scholar] [CrossRef]

- Winiecki, Jan. 2013. Świat darmowego pieniądza i jego dotychczasowe konsekwencje. BRE Bank-CASE Papers 129: 21–25. [Google Scholar]

- Woźniak, Przemysław, and Jan Winiecki. 2013. Długofalowe Skutki Polityki Niskich Stóp i Poluzowania Polityki Pieniężnej. Warsaw: Center for Social and Economic Research (CASE). [Google Scholar]

- Xiao, Qin, and Steven Devaney. 2016. Are mortgage lenders guilty of the housing bubble? A UK perspective. Applied Economics 48: 4271–90. [Google Scholar] [CrossRef]

- Żelazowski, Konrad. 2018. Identyfikacja baniek cenowych na lokalnych rynkach mieszkaniowych w Polsce z wykorzystaniem testu GSADF. Świat Nieruchomości 2: 5–10. [Google Scholar]

- Zeren, Feyyaz, and Oylum Şehvez Ergüzel. 2015. Testing for bubbles in the housıng market: Further evidence from Turkey. Financial Studies 19: 40–52. [Google Scholar]

- Zhang, Lu, and Dirk Bezemer. 2014. How the Credit Cycle Affects Growth: The Role of Bank Balance Sheets (SOM Research Reports; Vol. 14026-GEM). Groningen: University of Groningen, SOM Research School. [Google Scholar]

- Zhao, Xiaobin, Hongyu Zhan, Yanpeng Jiang, and Wenjun Pan. 2017. How big is China’s real estate bubble and why hasn’t it burst yet? Land Use Policy 64: 153–62. [Google Scholar] [CrossRef]

| Method | Characteristic of the Scientific Method | Applied by Authors |

|---|---|---|

| log-periodic power law (LPPL) | LPPL is the fundamental equation that describes the temporal growth of prices before a crash and it has been proposed in different forms in various papers, see e.g., Sornette (2004) and Lin et al. (2009) and references therein. | Sornette (2004); Lin et al. (2009); Ardila et al. (2013) |

| variance bound tests, e.g., Autoregressive Distributed Lag (ARDL) bound test | Violation of variance bounds could be attributed to the presence of bubbles. ARDL models have come to play an important role in the modelling of non-stationary time-series data. In particular, they are used to implement the so-called “Bounds Tests” (Pesaran and Shin 1999; Pesaran et al. 2001), to see if long-run relationships are present when we have a group of time-series, some of which may be stationary, while others are not. | Shiller (1981); LeRoy and Porter (1981); Blanchard and Watson (1982); Tirole (1985); Pesaran and Shin (1999); Pesaran et al. (2001); Solak and Kabaday (2016); Samirana (2020) |

| fixed effects ordinary least squares (OLS) regression model | OLS regression is a type of linear least squares method for estimating the unknown parameters in a linear regression model. For example, Basco (2014) conducted a linear regression of house prices on the housing supply elasticity for different sub-periods. | Basco (2014) |

| right-tailed unit root tests (ADF, SADF, GSADF) | In statistics, a unit root test tests whether a time series variable is non-stationary and possesses a unit root. The null hypothesis is generally defined as the presence of a unit root and the alternative hypothesis is either stationarity, trend stationarity or explosive root depending on the test used. Right-tailed unit root tests have proved promising for detecting exuberance in economic and financial activities (Phillips et al. 2011, 2014, 2015a, 2015b). Similar to left-tailed tests, the limit theory and test performance are sensitive to the null hypothesis and the model specification used in parameter estimation. | Phillips et al. (2014); Zeren and Ergüzel (2015); Caspi (2016); Coskun and Jadevicius (2017); |

| bivariate coexplosive vector autoregression | The coexplosive model arises as a restriction to the vector autoregressive model. It allows for common random walk trend and a common explosive stochastic component with explosive root . | Engsted and Nielsen (2012); Kivedal (2013); Engsted et al. (2016) |

| esploratory spatial data analysis ESDA | ESDA is a set of tools and techniques that allow you to gain insight into your data and construct better interpolation models. Exploratory spatial data analysis (ESDA) is the extension of exploratory data analysis (EDA) to the problem of detecting spatial properties of data sets where, for each attribute value, there is a locational datum. This locational datum references the point or the area to which the attribute refers. | Martori et al. (2016) |

| Markov Regime Switching model | Markov-switching is introduced to capture asymmetric market behaviours and turning points. | Hall et al. (1999); Shi (2013); Shi and Song (2015); Xiao and Devaney (2016) |

| Ordinary Least Square (OLS), Fully Modified OLS (FMOLS), Dynamic OLS (DOLS) | Ordinary Least Square (OLS), Fully Modified OLS (FMOLS), Dynamic OLS (DOLS) can be used to investigate the long-term static and dynamic coefficients between house prices and its determinants. | Coskun et al. (2020) |

| ARIMA model | ARIMA models and the selection of forecast performances, can be used, for example, to compare actual and fundamental house prices to determine the existence of a bubble formation. Jadevicius and Huston (2015) applied the ARIMA technique to assess Lithuanian house prices and forecasted 8 per cent house price inflation in the coming year. | Jadevicius and Huston (2015); Coskun et al. (2020) |

| Kalman Filter | The Kalman filter is an efficient recursive filter that estimates the internal state of a linear dynamic system from a series of noisy measurements. It is a “state observer” that minimises the mean square estimation error, meaning that the algorithm estimates the internal state of the object based on measurements of its input and output, and the state estimate is statistically optimal. Originally the Kalman filter is designed to work with linear systems, but with minor modifications it is also possible to work with non-stationary (whose model changes in time) and nonlinear systems. | Kim (2004); Coskun et al. (2020) |

| VAR model | Vector autoregression allows modelling the relationship between multiple variables that change over time. This method is used for multivariate forecasting to show how two or more time series affect each other. A VAR can also be considered as a model of a stochastic process. The advantage of this method is that it can take into account information from outside the housing market and account for aggregate economic conditions (Shi 2017). | Shi (2017) |

| generalised method of moments (GMM) | Generalised method of moments (GMM) is a good method especially when dealing with a dynamic dimension of a model. GMM was first introduced by Holtz-Eakin et al. (1988) and further developed by Arellano and Bond (1991) and Arellano and Bover (1995). The GMM methodological framework is known to be very effective when dealing with estimation issues such as: bi-directional causality between variables; the possible endogeneity of explanatory variables, as well as omitted variable biases; time invariant country characteristics (fixed effects), that may be correlated with the explanatory variables; and the presence of autocorrelation (Anderson and Hsiao 1981; Caselli et al. 1996; Bond 2002). In addition to the two-step system GMM, we also generate estimates using the standard ordinary least squares (OLS) and fixed effects (or within) specifications. | Holtz-Eakin et al. (1988); Arellano and Bond (1991); Arellano and Bover (1995); Vogiazas and Alexiou (2017) |

| Deviation from the moving average by a certain parameter | Bordo and Jeanne (2002) proposed a method to detect periods of price exuberance when the three-year moving average of real annual price dynamics exceeds the standard deviation of this moving average multiplied by a parameter of 1.3 for the entire time series. Czerniak (2014), in turn, extended the method of Bordo and Jeanne (2002) by optimising the critical value for the housing market beyond which a price bubble occurs; this value is 1.5% for the 12-quarter moving average of real price dynamics on a quarterly basis. In addition, Bordo and Landon-Lane (2013) developed an indicator that signals the presence of a price bubble when real annualised price growth exceeds 5% for two consecutive years. | Bordo and Jeanne (2002); Czerniak (2014); Bordo and Landon-Lane (2013) |

| Hodrick-Prescott filter | The method based on the Hodrick-Prescott filter can be used to measure whether the deviation of current real housing prices from the trend exceeds a certain critical value. The Hodrick-Prescott filter is one of the most popular mathematical tools in macroeconomics (Sobieraj and Metelski 2021). It can be used to smooth a time series and remove cyclical fluctuations and one-time disturbances from it. For example, Dreger and Kholodilin (2013) developed a method to compute the trend for the logarithm of the real price level using the Hodrick-Prescott filter with a lambda parameter equal to the standard value for a quarterly series (1600), followed by the cyclical component. According to the method of Dreger and Kholodilin (2013), those periods in which the current value of the cyclical component exceeds the standard deviation of the entire time series of this component are called periods of price exuberance. A modification of this method was worked out by Czerniak (2014), who adopted a higher lambda parameter for the Hodrick-Prescott filter, i.e., at the level of 10 to the power of 5. | Dreger and Kholodilin (2013); Czerniak (2014); Czerniak and Kawalec (2020) |

| artificial neural network (ANN) | For static ANNs, the neural network model is able to map the non-linear relationship between resale price and those housing characteristics that influence the housing price. | Wang et al. (2016) |

| City/Region | Real Housing Prices | Price-to-Income Ratio | |||||

|---|---|---|---|---|---|---|---|

| ADF | SADF | GSADF | ADF | SADF | GSADF | ||

| Panel A: Test Statistics (lag length , minimum window size —8, 10, 12, respectively) | |||||||

| Białystok | −2.60 | −2.55 | 1.75 | −1.58 | −1.01 | 0.637 | |

| −2.60 | −2.60 | 1.75 | −1.58 | −1.01 | 0.637 | ||

| −2.60 | −2.60 | 1.75 | −1.58 | −1.01 | 0.637 | ||

| Bydgoszcz | −1.56 | −1.56 | 2.46 ** | −1.77 | −1.32 | 0.548 | |

| −1.56 | −1.56 | 2.46 ** | −1.77 | −1.32 | 0.0622 | ||

| −1.56 | −1.56 | 2.46 ** | −1.77 | −1.32 | 0.0622 | ||

| Gdańsk | −0.297 * | −0.297 | 2.88 ** | −1.51 | −0.804 | 0.926 | |

| −0.297 | −0.297 | 2.74 ** | −1.51 | −0.804 | 0.828 | ||

| −0.297 | −0.297 | 2.74 *** | −1.51 | −0.804 | 0.812 | ||

| Gdynia | −0.580 | −0.580 | 0.862 | −1.44 | −0.429 | 3.81 *** | |

| −0.580 | −0.580 | 0.862 | −1.44 | −0.429 | 0.892 | ||

| −0.580 | −0.580 | 0.862 | −1.44 | −0.429 | 0.892 | ||

| Katowice | −1.14 | −1.14 | 4.67 *** | −2.42 | −1.70 | 0.437 | |

| −1.14 | −1.14 | 4.67 *** | −2.42 | −1.70 | 0.437 | ||

| −1.14 | −1.14 | 3.64 *** | −2.42 | −1.70 | 0.437 | ||

| Kielce | −2.82 | −1.26 | 3.87 *** | −1.07 | −0.624 | 1.44 | |

| −2.82 | −1.60 | 3.87 *** | −1.07 | −0.624 | 1.08 | ||

| −2.82 | −1.91 | 3.87 *** | −1.07 | −0.624 | 0.517 | ||

| Kraków | −0.0327 * | −0.0327 | 2.91 ** | −2.15 | 0.0749 | 0.611 | |

| −0.0327 | −0.0327 | 2.91 ** | −2.15 | 0.0749 | 0.447 | ||

| −0.0327 | −0.0327 | 2.91 *** | −2.15 | −0.472 | 0.447 | ||

| Lublin | −1.11 | −0.478 | 2.41 * | −1.74 | −1.27 | 0.775 | |

| −1.11 | −1.11 | 2.41 ** | −1.74 | −1.27 | −0.259 | ||

| −1.11 | −1.11 | 2.41 ** | −1.74 | −1.27 | −0.259 | ||

| Łódź | −1.66 | −1.51 | 3.61 *** | −1.96 | −1.54 | −0.0511 | |

| −1.66 | −1.51 | 3.61 *** | −1.96 | −1.54 | −0.0511 | ||

| −1.66 | −1.51 | 3.61 *** | −1.96 | −1.54 | −0.0511 | ||

| Olsztyn | −1.62 | −1.15 | 1.38 | −1.40 | −0.745 | 0.0971 | |

| −1.62 | −1.55 | 1.38 | −1.40 | −0.745 | −0.00214 | ||

| −1.62 | −1.55 | 1.38 | −1.40 | −0.745 | −0.00214 | ||

| Opole | −0.949 | −0.564 | 2.98 ** | −1.85 | −1.20 | −0.0125 | |

| −0.949 | −0.564 | 2.98 *** | −1.85 | −1.20 | −0.136 | ||

| −0.949 | −0.564 | 2.98 *** | −1.85 | −1.20 | −0.170 | ||

| Poznań | −3.52 | −3.31 | 2.89 ** | −1.31 | −0.950 | 0.976 | |

| −3.52 | −3.52 | 2.89 ** | −1.31 | −0.950 | 0.976 | ||

| −3.52 | −3.52 | 2.89 *** | −1.31 | −0.950 | 0.976 | ||

| Rzeszów | −1.01 | −1.01 | 1.01 | −2.07 | −1.68 | 3.21 ** | |

| −1.01 | −1.01 | 1.01 | −2.07 | −1.68 | 3.21 ** | ||

| −1.01 | −1.01 | 1.01 | −2.07 | −1.68 | 3.21 *** | ||

| Szczecin | −0.614 | −0.614 | 2.38 * | −1.39 | −0.635 | 0.0582 | |

| −0.614 | −0.614 | 2.38 ** | −1.39 | −0.635 | −0.266 | ||

| −0.614 | −0.614 | 2.38 ** | −1.39 | −0.635 | −0.266 | ||

| Warszawa | −0.347 * | −0.347 | 4.31 *** | −1.73 | −0.462 | 0.507 | |

| −0.347 * | −0.347 | 4.31 *** | −1.73 | −0.462 | 0.507 | ||

| −0.347 * | −0.347 | 4.31 *** | −1.73 | −0.462 | 0.507 | ||

| Wrocław | −1.99 | −1.99 | 4.68 *** | −1.60 | −0.825 | 1.45 | |

| −1.99 | −1.99 | 4.68 *** | −1.60 | −0.825 | 1.45 | ||

| −1.99 | −1.99 | 4.68 *** | −1.60 | −0.825 | 1.45 | ||

| Zielona Góra | −0.760 | −0.592 | 4.89 *** | −1.79 | −1.08 | 0.725 | |

| −0.760 | −0.592 | 4.10 *** | −1.79 | −1.08 | 0.260 | ||

| −0.760 | −0.592 | 4.08 *** | −1.79 | −1.08 | 0.260 | ||

| Panel B: Critical Values | |||||||

| 90% | −0.408 | 1.05 | 2.04 | −0.427 | 1.08 | 2.04 | |

| −0.408 | 1.02 | 1.85 | −0.505 | 0.997 | 1.81 | ||

| −0.371 | 0.814 | 1.55 | −0.489 | 0.938 | 1.63 | ||

| 95% | −0.0325 | 1.35 | 2.42 | −0.0946 | 1.38 | 2.39 | |

| −0.0325 | 1.32 | 2.13 | −0.147 | 1.26 | 2.06 | ||

| −0.0383 | 1.09 | 1.89 | −0.102 | 1.27 | 1.98 | ||

| 99% | 0.735 | 2.15 | 3.61 | 0.359 | 1.91 | 3.19 | |

| 0.735 | 2.13 | 2.96 | 0.537 | 1.90 | 3.05 | ||

| 0.651 | 1.67 | 2.65 | 0.633 | 1.80 | 2.51 | ||

| GSADF Panel Test Statistic | |||

|---|---|---|---|

| Real Housing Prices | 2.18 | ||

| Price-to-Income Ratio | −0.56 | ||

| Critical Value | |||

| 1% | 5% | 10% | |

| GSADF PANEL | 0.347 | 0.234 | 0.218 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Sobieraj, J.; Metelski, D. Testing Housing Markets for Episodes of Exuberance: Evidence from Different Polish Cities. J. Risk Financial Manag. 2021, 14, 412. https://doi.org/10.3390/jrfm14090412

Sobieraj J, Metelski D. Testing Housing Markets for Episodes of Exuberance: Evidence from Different Polish Cities. Journal of Risk and Financial Management. 2021; 14(9):412. https://doi.org/10.3390/jrfm14090412

Chicago/Turabian StyleSobieraj, Janusz, and Dominik Metelski. 2021. "Testing Housing Markets for Episodes of Exuberance: Evidence from Different Polish Cities" Journal of Risk and Financial Management 14, no. 9: 412. https://doi.org/10.3390/jrfm14090412

APA StyleSobieraj, J., & Metelski, D. (2021). Testing Housing Markets for Episodes of Exuberance: Evidence from Different Polish Cities. Journal of Risk and Financial Management, 14(9), 412. https://doi.org/10.3390/jrfm14090412