1. Introduction

Investment under uncertainty is one of the most critical decisions for a firm (

Trigeorgis and Tsekrekos 2018;

Lu and Meng 2017). The level of uncertainty in terms of prices has a significant impact in determining the proper timing for an investment (

Castillo Oscar Enrique Miranda 2017). Valuation of capital investment projects is a real challenge for many companies, especially for those whose cash flows depend on price volatility (

Castillo Oscar Enrique Miranda 2017). Today, due to the COVID-19 virus pandemic, the real estate market has been hit hard again across Europe: “… the outbreak of the supposedly insurmountable Covid-19 out-break has proved to be a stumbling block for European Real Estate markets” (

Global Property Guide 2020, p. 1). To be on the safe side, real estate should be all prepared to deal with the worst.

One common solution in such circumstances is to mandate this investment as a firm obligation in construction contracts either just now, or after a set number of years, or when demand reaches capacity (

Marques et al. 2021a). In this vein, the real option valuation approach becomes the main tool for evaluating investment projects (

Marques et al. 2021a). Real options theory that associated with the decision-making under uncertainty helped real estate developers to address those macroeconomic changes and to manage uncertainty.

Real options theory views investments as rights but not obligations, thereby whenever real options valuation (ROV) is conducted it values the seemingly invaluable—managerial flexibility to optimally invest time so that its value is maximized. At a more macroeconomic level, the efficiency of financial management rests primarily on proper risk assessment and management of uncertainty of project’s return. Real option logic has been applied in a wide variety of industry and strategic settings.

“The theoretical prerequisites of option pricing have not entirely been solved in the literature which hinders the frictionless transfer of the concept to real estate projects. To bridge the gap between theoretical real options valuation and real estate project valuation, substantial research must be conducted” (

Lucius 2001, p. 78). This paper aims to test empirically the real options valuation (ROV) application for real estate development projects as a financial risk management tool. Existing research has used ROV theory to study investment in energy, oil and gas, and pharmaceutical sectors, yet little works have empirically examined ROV theory to study investment in a real estate market.

Lucius argued that the application of real options in real estate projects still stands at the beginning (

Lucius 2001). Costantino et al. justified that due to the “determinism” of the traditional appraisal discounted free cash flow methods used in real estate and lack of data about the future, the developer usually decides based on their intuition and judgment. “These estimates are disputable, not verifiable, and have all the limits of subjective consideration” (

Costantino et al. 2009, p. 15). In this vein, Costantino et al. had recommended standardizing the decision-making process of developers, based on the real options approach which can be useful in estimating projects’ value by real estate operators (

Costantino et al. 2009, p. 15).

Furthermore,

Mao and Wu (

2011) found that the common evaluation methods of real estate investment usually fail to analyze the influence of the risk factors on the value of development project, while the real options method provides a better tool to solve the problem (

Mao and Wu 2011). Moreover, Monte Carlo simulation enables one to overcome the traditional limit of financial models when they are adopted in complex projects like real estate (

Lander and Pinches 1998;

Pellegrino et al. 2019).

Thereby, this research contributes to those scientific requests and empirically advances the application of real options in real estate projects. Particularly, this empirical paper’s contributions are two-fold. First, there are relatively fewer empirical studies carried out regarding real options. The reasons for this are a massive amount of data is necessary to be collected and that managers do not formally address managerial problems as real options problems (

Philippe 2005;

Reuer and Tong 2007). In this vein, the paper contributes to empirical studies on the real option by adding fresh and useful financial decision-making insights for real estate developers of the EU faced with uncertain economic prospects and calls for the need to account for real options reasoning.

Second, regarding managerial contribution, the presented step-by-step application of real options’ methodology can be served as a “road map” for the executives of similar real estate development projects in European countries struggling to decide on investment in estate projects in the Covid-19 pandemic period.

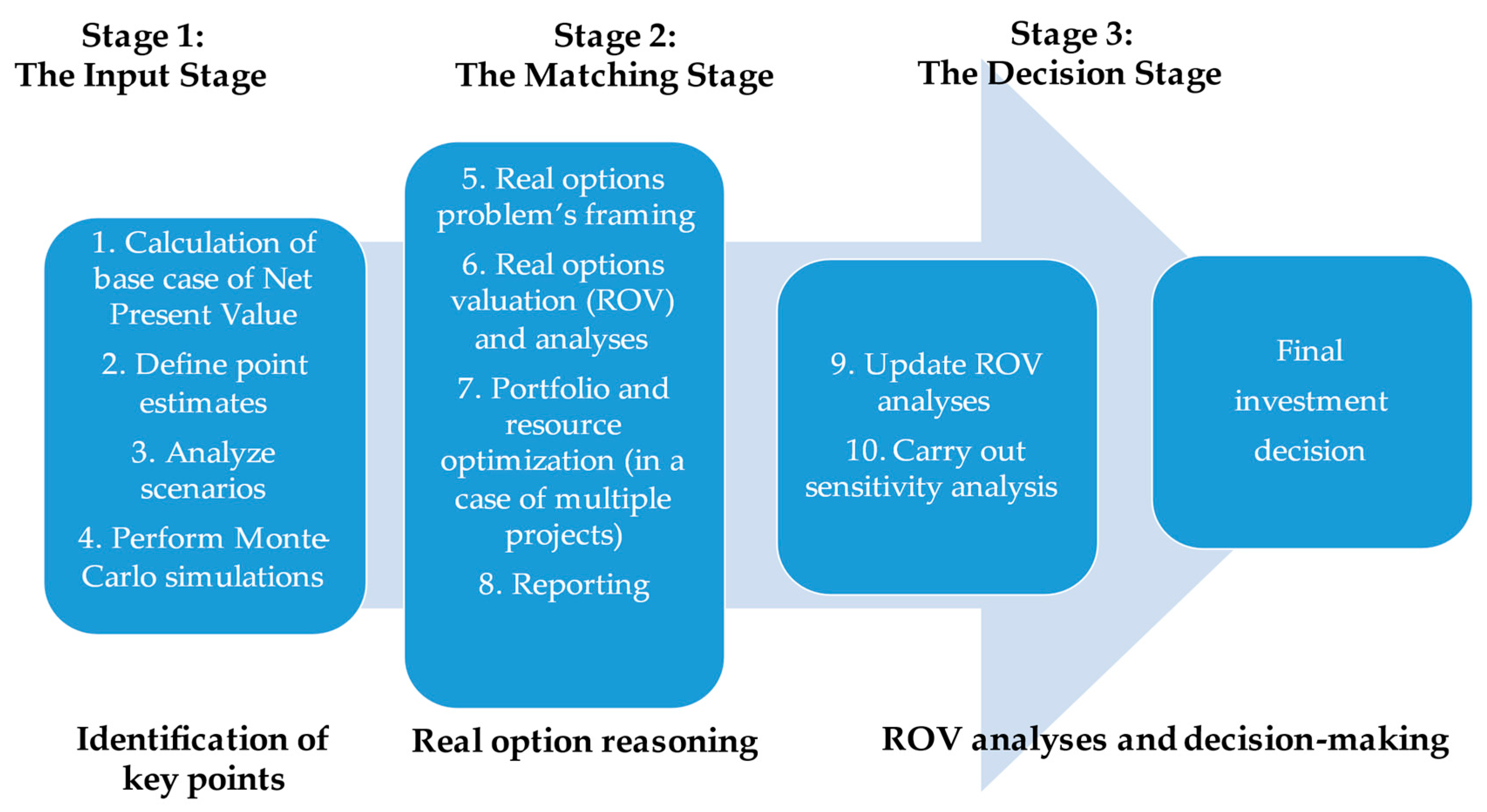

The paper proceeds as follows. The chapter “Literature Review” is devoted to the relevant literature and introduces real options application frameworks to value real estate projects: Black-Sholes option pricing model (BSOP), binomial option pricing model (BOPM), and Monte Carlo simulations (MCS). The next chapter “Method and Data” describes case study methodology. The chapter “Data analysis and interpretation” present the results and findings of this empirical case study research. Finally, the paper discusses theoretical contribution and managerial implications and concludes research limitations and future work.

4. Case Study “Project “Sun Village”: Analysis of Results and Interpretation

By responding it is important and useful to use this particular Latvian case, the Baltic states’ housing bubble was one of the biggest economic bubbles involving major cities in Estonia, Latvia, and Lithuania. The Baltic States had enjoyed a significant strong economic growth within the first decade of the new century, and the real estate sectors had recorded a sharp jump of the house price index of 104.6%, 134.3%, and 106.7% in comparison with the house price index for Euro Area increased by 11.8% for a similar period (

Eurostat 2021). The synthesis of external factors (growth potential, high inflation, and availability of EU funds) was singled out as causes behind the overheating economy in the Baltic States. “This resulted in houses reaching record prices in 2007, up by 400% since 2000. Such prices proved unsustainable …” (

Lamine 2009. p. 1).

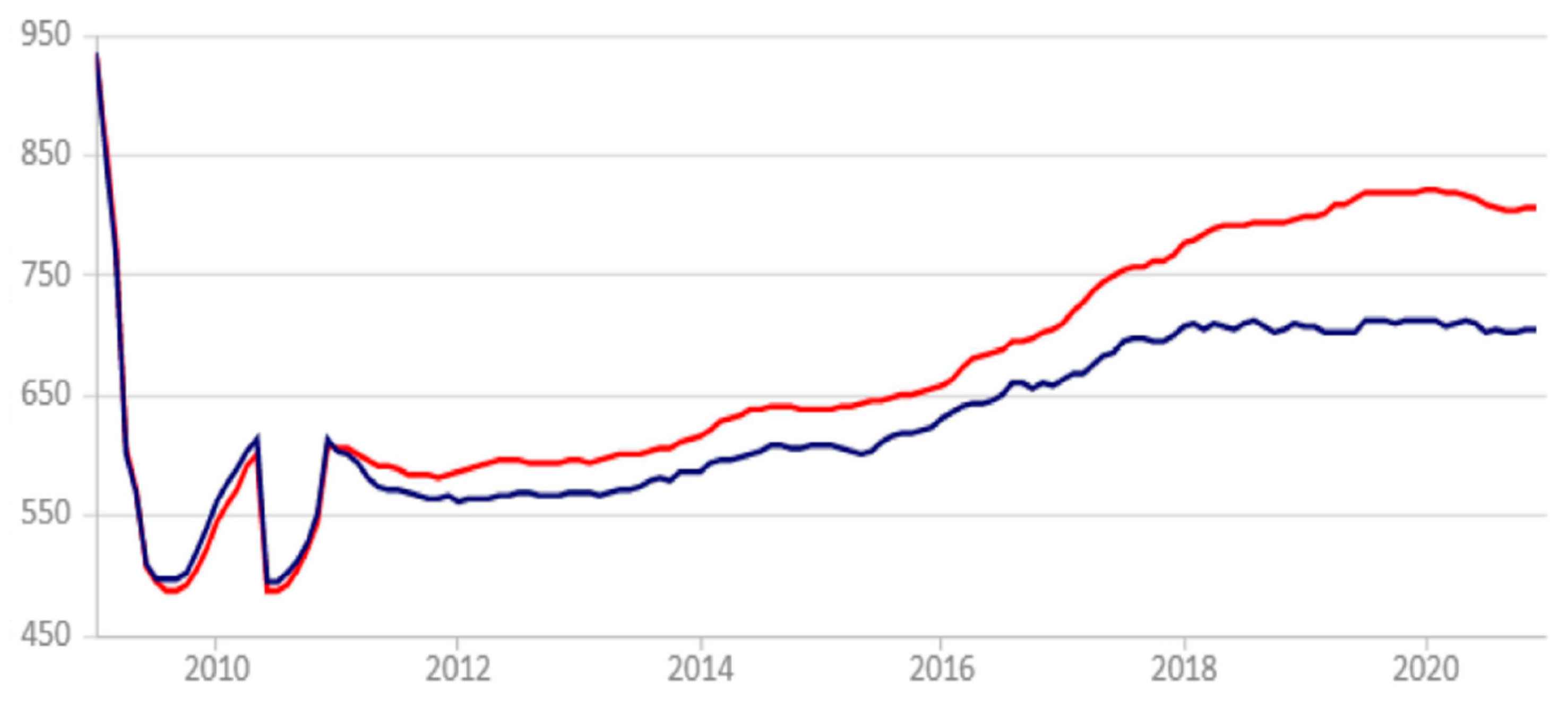

However, the impact of the crisis of 2008–2009 years on the Latvian real estate industry was one of the hardest among others in the Baltic States. Within 2009–2011 Latvia house prices fall almost twice as shown in

Figure 3. During the restoration of the real estate business in the 2010–2013 years, the new economic uncertainty was put in place. Due to immigration legislation’s changes (the cancellation of the program of permanent residence permit for the foreign real estate investors) and Latvia’s adoption of the euro on 1 January 2014, uncertainty concerning future real estate demand and house prices had increased dramatically. Therefore, in such “the ideal storm” circumstances, ABC Project Ltd considered several options concerning the project.

Today in the COVID-19 pandemic period, many real estate investors opt to wait, observe, and only in case of positive development invest in the project. It is like several years ago, the investment project “Sun Village” of Latvian real estate developer ABC Projects, Ltd has faced the same challenges whose problems and solutions are presented below in the case study research. As a numerical application, the case study was applied to a typical Latvian real estate project. Nevertheless, the current research can be generalized as a “road map” for similar projects in the EU struggling to attract buyers in the COVID-19 pandemic and post-pandemic periods.

The case study investigated the investment project “Sun Village” of company ABC Project Ltd. into an unfinished real estate project in the Riga region (Latvia) that was acquired by a company Calvus Ltd., which had to sell the unfinished project to cover its debt to the Bank in 2013. The project included the construction of 16 houses, 15 of which were available for sale, however, without proper territory infrastructure in terms of electricity, roads, canalization, etc. Therefore, there were located 16 unfinished houses which were frozen in 2009 due to the global financial crisis.

Sun Village is a residential village in the near suburb of the Latvian capital, in Babite Municipality, which is between Riga and Jurmala, a popular resort. Nearby are located nature reserves and parks of national importance, several lakes, and the Lielupe river. The total area of the land plot is 1500 m². Initially, the new owner ABC Projects, Ltd. company has planned to finish “Sun Village” the project and sell houses as soon as possible. However, in September 2014, Immigration Law amendments increased the threshold for obtaining a residence permit and introduced other conditions and costs (

Global Property Guide 2021). Due to immigration legislation’s changes and Latvia’s adoption of the euro on 1 January 2014, uncertainty concerning future demand and prices increased dramatically. ABC Project Ltd was considering several options concerning the project.

The first option was to finish construction and sell finished houses to the buyers as soon as possible (expansion option), the second option was to wait for two years until uncertainty concerning the future real estate sector will become clearer and make investment decision later (deferral option), the third option suggested abandoning the project, namely, to sell immediately the acquired property to other real estate development company (abandon option).

Investors were willing to evaluate each option in terms of profitability. At that time, the company has invested 237,327 € into the purchase of land and 423,833 € in the purchase of the unfinished houses in 2013. All prices are without Latvian Value added taxes. ABC Project Ltd was considering hiring a construction company for project development in case of choosing the first option (expansion option). The construction company’s management had also provided information for the current research on estimated construction costs.

Step one, the discounted free cash flow of the project (DFCF) or present value of a project to be acquired was 5,620,930.44 €. Overall investment into the project was estimated to be 4,912,024.43 €. ABC Project Ltd. founders decided to invest the amount required for project development as a zero percent borrowing. Meanwhile, Latvian Bank stated in the 2014 year that “… in the case of new household loans for house purchase, the annual percentage rate of charge, comprising fees for considering loan applications, loan administration costs, and similar costs, was close to the respective annualized agreed rate” about three percent in 2014 (

Latvijas Banka 2014, p. 29). European Central Bank defined an annualized agreed rate as “the interest rate that is individually agreed between the reporting agent and the household or non-financial corporation for a deposit or loan, converted to an annual basis and quoted in percentages per annum” (

European Central Bank 2003, p. 13).

Even though the project financing was considered as hundred percent debt financing as free-of-interest charges, the annualized agreed rate adjusted by Latvian corporate withholding tax was employed (

Atrill 2020) as the discount rate of free cash flow (FCF) of the current project, and it was equaled 2.55% = 3.00% × (1.00 − 0.15). Thereby, the net present value (NPV) of the investment project as estimated through discounted cash flow approach was 708 906,01 €. The internal rate of return (IRR) of the project was estimated at 9.21% and corresponded with the expected required rate of return of the founders of the company.

Even though in other European countries such IRR value is too low for a real estate investment, the owners did not reject a project. Although the IRR and the NPV methods give consistent accept-reject decisions, they may not rank projects identically. In general, the NPV method is theoretically superior (

Titman et al. 2014) and the investors were satisfied with a positive NPV result.

Next, the deferral option to wait for two years until uncertainty concerning the future real estate sector will become clearer and make investment decisions later had to be explored. Thus, in Step two, uncertain variables that influence the bottom line (DFCF value) were estimated which are discussed next in terms of prices and expenses. Step three, pessimistic, optimistic, and most likely scenario developments affecting future cash flows were analyzed. The optimistic, most likely, and pessimistic real estate square meter prices were provided by ABC Project Ltd management based on their managerial assumptions. The pessimistic scenario means that real estate prices would decrease by approximately 41.6 percent by the end of 2016. The optimistic scenario assumed that prices on real estate objects would continue to grow.

Therefore, for the first 2014 year’s revenues forecast assumptions were provided as follows: pessimistic—1273 €; optimistic—1624 €, and most likely 1478 €; for second 2015-year forecast assumptions were provided as follows: pessimistic—1068 €; optimistic—1624 €, and most likely 1478 €; and for third 2016 year: pessimistic—863 €; optimistic—1624 €, and most likely 1478 €.

Step four, Monte Carlo simulation was done because the standard DFCF model produces only one static estimated result, not taking into account the future events that highly affect forecasted cash flow. According to

Cobb and Charnes (

2007), the preciseness of the distribution is increased, when more simulation trials are executed. Therefore, Oracle Crystal Ball (OCB) software was used to estimate project return volatility. Triangle distribution was used for the expected square meter price variation assumptions mentioned above. The construction company assumed that construction costs may increase or decrease by approximately 5 percent. Thus, OCB software was used again to find a normal distribution of material costs.

The management of ABC Project, Ltd also provided their expectation on the volatility of additional administration expenses including management salary and associated taxes as well as other operating expenses. Inflation trends on construction costs were also taken into account in the study.

Then, the OCB software simulation ran 2,000,000 times. At each simulation, OCB has randomly taken numbers following probability distribution on square meter’s price, construction costs, administrative and operating expenses that were set and calculated previously. Besides, the present value of future cash flows for the base case DFCF model was used as the initial underlying asset value in real options modeling according to

Mun (

2002).

Preliminary implied volatility of the DFCF of Sun Village project was forecasted at 62.72 percent (

Čirjevskis and Tatevosjans 2015, p. 56). Today in the 2021 year, it should be admitted that the assumptions on implied volatility were unnecessarily radical. The Latvia house prices have been stabilized after the boom and bust of 2009–2013 years and further have demonstrated moderate volatility dynamic as shown in

Figure 3.

In this vein, having explored the value of deferral option for the period from April 2014 until May 2016 of this project, the volatility of DFCF (period) has been re-estimated according to the recently published date of

Global Property Guide (

2021) as given in

Table 3.

To measure the volatility of DFCF, the coefficient of variation (CV) was applied to expresses the standard deviation of DFCF as a percentage of what is being measured relative to the forecast of DFCF’s mean. “In investing, the coefficient of variation is used to measure the volatility (represented by the standard deviation) to the expected return on an investment” (

Farlex Financial Dictionary 2009, p. 1). For the period of the “Sun Village” project, the average house price in Latvia was 614.19 € per sq. m., and the standard deviation of the house price for that period was 105.05 €. Thereby, the volatility of DFCF was at 17.10% which is significantly lower than the preliminary volatility estimation of the “Sun Village” project.

Step five, the company had to consider several options regarding the project. One of these options is to wait (deferral option) two years until uncertainty concerning the project will decrease and decide and the other is to sell (abandonment option) acquired property to another development company. In case the company decides to finish construction (expansion option), it would also have to adapt the territory in terms of electricity, roads, canalization. Moreover, the company would construct an additional administration house to serve this property in the future in terms of security, small repairs, and other miscellaneous services.

Step six. To justify the proposition and to provide an estimation of managerial flexibility’s value by putting off an investment decision for two years till May 2016, three ROV methods were employed as follows: Black-Scholes option pricing model (

Table 4 and

Table 5), Monte Carlo simulation (

Table 6), and binomial option pricing model (

Table 7 and

Figure 4) by assuming that all methods would give approximately the same result. Following input variables were required for real options valuation by Black-Scholes option pricing model as shown in

Table 4.

As can be observed in

Table 4, having applied Equation (1) of the Black-Scholes option pricing model, the value of the project (eNPV) may increase by 1,141,111.71 €, in the case of waiting for two years (deferral option) before making an investment decision.

Then, applying the Monte Carlo simulation, Excel forecasted the call option value for the “Sun Village” project calculated as shown in

Table 6. The option life was divided into six time steps, the same as for binominal lattices below, and the number of simulations was 1,000,000 times. The simulation results from a custom-made spreadsheet show a real option value of 1,141,609.78 €.

As can be observed from

Table 4 and

Table 5, in the case of waiting two years before making an investment decision (deferral option), the NPV of the project may increase to 1,141,111.71 € according to the BSOP approach and 1,141,609.78 € according to the MCS approach and, thus, additionally adding the value more than one and a half million EUR.

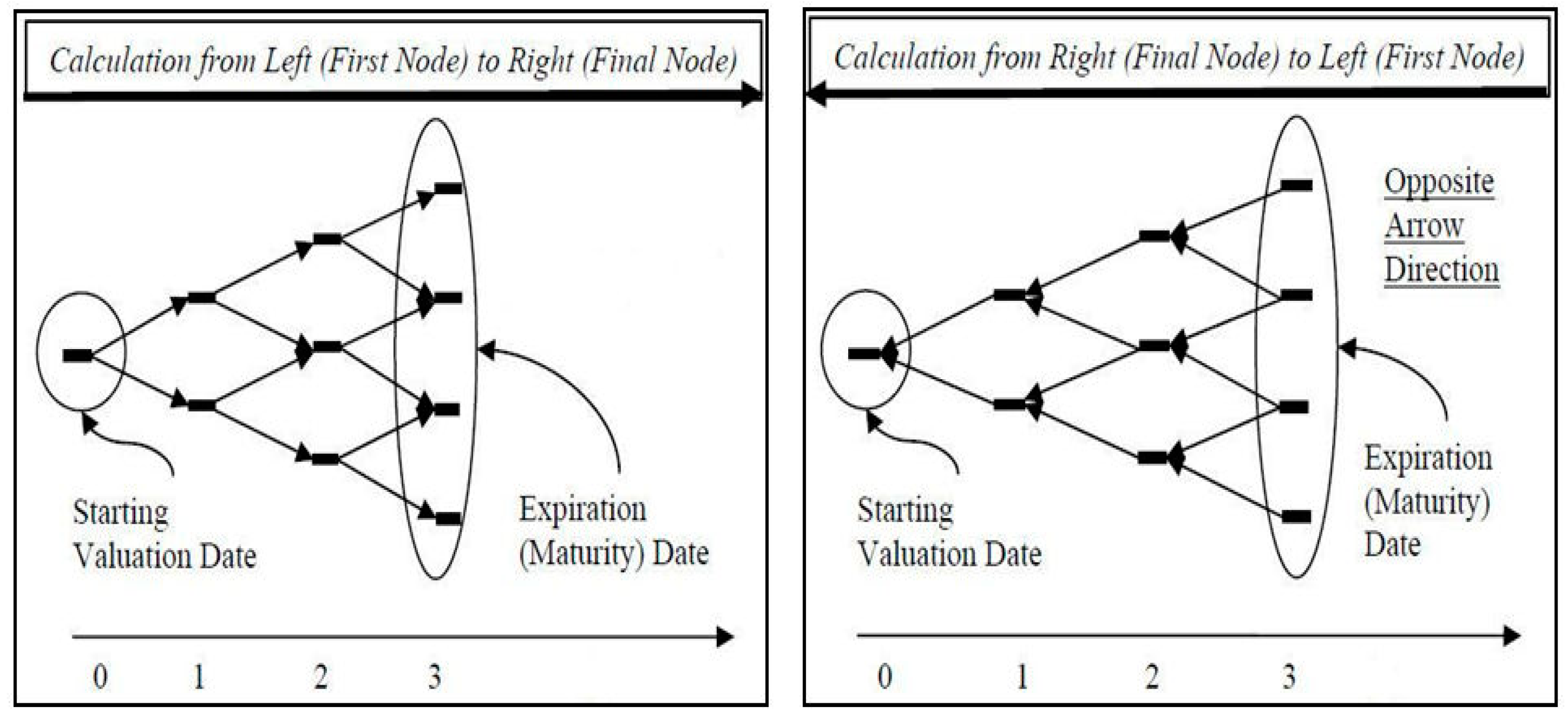

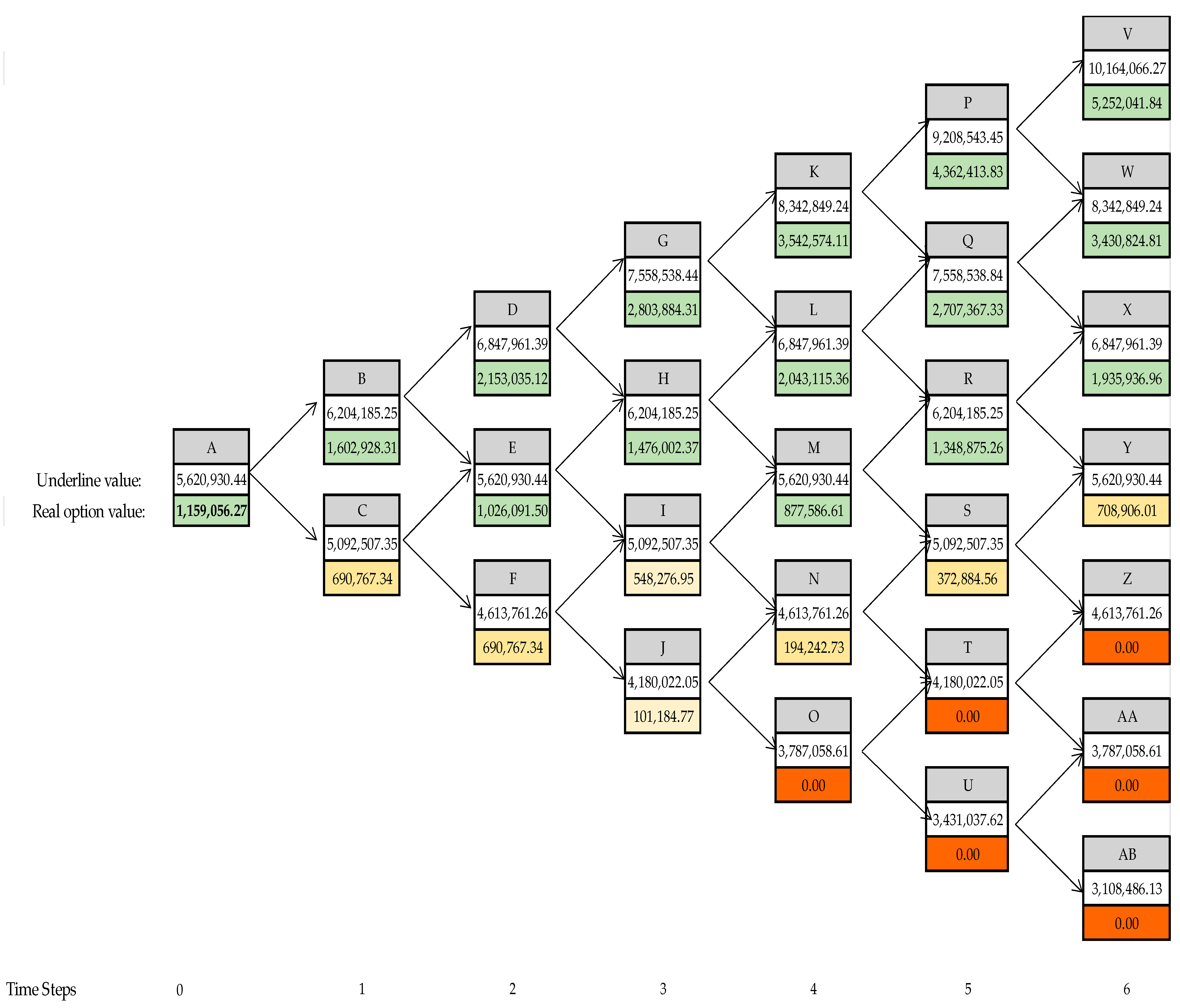

To estimate the value added that may be provided by postponing investment decisions for two years (deferral option), binomial option pricing model approaches have been used as shown in

Figure 4. The underlying lattice (event tree) was constructed by beginning with the starting upper node and proceeding left to right till options expiration. Then, the real option valuation lattice was constructed in the opposite direction backing to the starting down node. For descriptive appeal, both lattices were merged into one lattice as shown in

Figure 4.

Zero steps in

Figure 4 represent the current period of the project (April 2014 year). The time till expiration was divided into six-time increments for the decision tree construction. The recombining binomial lattices parameters are given in

Table 7.

One-time increment represents 0.33 of a year. At each time step, the previous tree cell is multiplied by the up and down factor until six steps are made. At step number six possible project values in two years were calculated and can be observed in

Figure 4. Up and down factors were used as a multiplier during the one-time increment step in a binomial tree; up factor (u) = 1.104 and down factor (d) = 0.526. The present value of the expected DFCF is estimated at 5,620,930.44€ and therefore is used as a starting point in the binomial tree.

Then backward induction’s steps were required to identify if the deferral option to wait for two years would be in the money. The results for each of these potential outcomes were calculated by deducting initial investment from each of these results. In cases when there were losses, they were shown as a zero since in these cases options would not be exercised. The values of intermediate nodes for each time step increment during this process was calculated by using Excel as follows: intermediate node value = (risk-neutral probability*(previous up factor cell) + (1-risk-neutral probability)*(previous down factor cell))*EXP(-risk-free rate of return*time increment) = (0.526*(previous up factor cell) + (1-0.526)*(previous down factor cell))*EXP(-3.00%*0.33) as shown in

Table 7 and

Figure 4.

Now, the result of the BOPM simulation can be compared with the results of BSOP and MCS. Received with binomial approach real option value differs from that suggested by Black-Scholes and Monte Carlo approach by approximately 1.5 percent: BSOP—1,141,111.71€, MCS –1,141,609.78 € versus BOPM—1,159,056.27 €. Such difference appeared due to a relatively low number of time step increments producing just six possible investment outcomes in BOPM as can be observed in

Figure 4. On the other hand, BOPM provides a more straightforward understanding and visualizes how project uncertainty represented by volatility influences option value during its lifetime.

In point of fact, in case of waiting for two years before making a further investment decision, the value of project NPV might increase to about from 708,906 € to 1,141,500 € according to BSOP and MCS approaches to 1,159,000 € according to BOPM and, therefore, add a value about a half of million € in comparison with a static NPV 708,906 €. Therefore, from the discussion above, it can be determined that if the investors would indeed make a value-maximizing decision over the next two years, it would have augmented the value of the Sun Village project by about 450,000 € and the ROV premium would be 20.6% ([eNPV-NPV]/NPV) (

Mun 2002).

Because the “Syn Village” project did not depend on other projects of company ABC Project Ltd and the portfolio resource optimization was not required, seven–nine steps were missed in the research.

Step ten. Luehrman suggested performing sensitivity analysis after the real options valuation as it will serve as a further strategy as the project develops

Luehrman (

1998). In this vein, the conduction of sensitivity analysis has shaped the decision-making on value maximization of real estate development project “Sun Village”. Sensitivity analysis was produced by the OCB simulation. It was observed that the variance of free cash flows (FCF) is mostly affected by the first and second house type prices—by 60.7% and 17.4% consequently. Construction costs variation has affected FCF by 14.4%. Administration and operating expenses have almost no effect on free cash flow variation. However, Brealey and Myers criticized the sensitivity analysis and argued that the disadvantage of the analysis relates to the fact that it does not account for interrelated underlying variables (

Brealey and Myers 2000).

Thus, the case study has provided a better understanding of phenomena of real options hybrid applications on concrete real estate project in economic uncertainty context, helped to make a value-maximizing decision by choosing deferral option, and the research result can be generalized in the current COVID-19 pandemic period for similar real estate projects as discussed below.

6. Conclusions, Limitations, and Future Work

The case study research has justified the proposition “Real options valuation approach is an opportunity to adapt real estate investments to changing circumstances and to decide to what extent it is worth to develop the real estate project and when to sell the real estate”. The paper illustrates how the hybrid methods’ combination of BOPM, BSOP, and MCS ROV models can contribute to the economic analysis of investments in new projects in the real estate market, supporting the process of decision-making by managers. When it comes to comparative appropriateness of different methods of real options valuation, the BSOP model and MCS are exact, quick, but are difficult to explain to practitioners because they require highly technical stochastic calculus mathematics (

Mun 2002). BOPM lattices are in contrast, easy to explain and implement, but require significant computing power and time-steps to obtain good approximations (

Mun 2002).

There are three categories of limitations of the ROV research. The first deals with the validity of data provided to the researcher. It must be noted that the results of the analysis are only as good as the figures behind them. All conclusions and subsequent recommendations made are based on the premise that the financial data provided to the researcher represent a realistic situation of the business. In case the data are subject to a change (which is most likely due to the continual nature of ROV), the analysis becomes void. Thus, the recommendations are valid at the time of research; any update of data after the mentioned date is beyond the scope of this paper.

Second, the analytical approach used is subject to certain limitations. Real options analysis applied was that of risk-neutral probabilities—inevitably this approach has to make certain assumptions most of which are based on implied volatility outlined in

Table 1. Any estimation includes assumptions. Since they have a major impact on the implied volatility estimation, financial results should be interpreted and perceived as approximations only.

Last but not least, it should be stressed that due to the mathematical complexity involved, real options problems are far better solved using specialist software. In this vein, to align management incentives and to develop user-friendly real options software (

Marques et al. 2021a), practitioners can use other packages such as the DerivaGem software that accompanies Hull publication (

Hull 2018) and that can be found online free of charge that can be also a good solution for calculating real options value (

Marques et al. 2021b).

Finally, the real estate investment decisions of firms are, in most cases, taken within a strategic competition with other firms in the industry, where the competitive actions of one company affect the decisions of the others (

De Almeida et al. 2019). In this vein, having contributed to the literature by bridging three real options valuation approach in the cohesive whole model in the current paper, the future work can provide more robust economic analyses and interpretations regarding the demand for real estate, showing quantitatively how competition can impact strategic decisions (

De Almeida et al. 2019).

Furthermore, a least squares Monte Carlo simulation-based real options (

Longstaff and Schwartz 2001) should be discussed in comparison with the Black and Scholes, Monte Carlo, and binomial trees. “…By its nature, simulation is a promising alternative to traditional finite difference and binomial techniques and has many advantages as a framework for valuing, risk managing, and optimally exercising American option” (

Longstaff and Schwartz 2001, p. 114).

Gamba (

2003) suggested that this approach is more suited to evaluate complex investments with many interacting options.

This simulation method has been recently applied by

Dehghan-Eshratabad and Albadvi (

2018) to value start-ups by venture capitalists in the first round of financing.

Zheng and Negenborn (

2017) applied the simulation for a Chinese steel cargo terminal investment decision in a competitive setting with uncertainty. Thus, least squares Monte Carlo simulation-based real options (

Longstaff and Schwartz 2001) can overcome some limitations of traditional ROV approaches. Hence, this is a promising area for future research.