Troubles with the Chf Loans in Croatia: The Story of a Case Still Waiting to Be Closed

Abstract

1. Introduction

2. Literature Review

2.1. Croatian Banking Market—A Look at the Severity of CHF Loans Issues

2.2. Related Studies

3. Empirical Evidence for Croatia

- What explains the supply and demand of the FX-linked loans in the Croatian banking sector?

- What were the attitudes of Croatian financial experts regarding the issues connected with the CHF case?

- How was the CHF debt crisis resolved in Croatia?

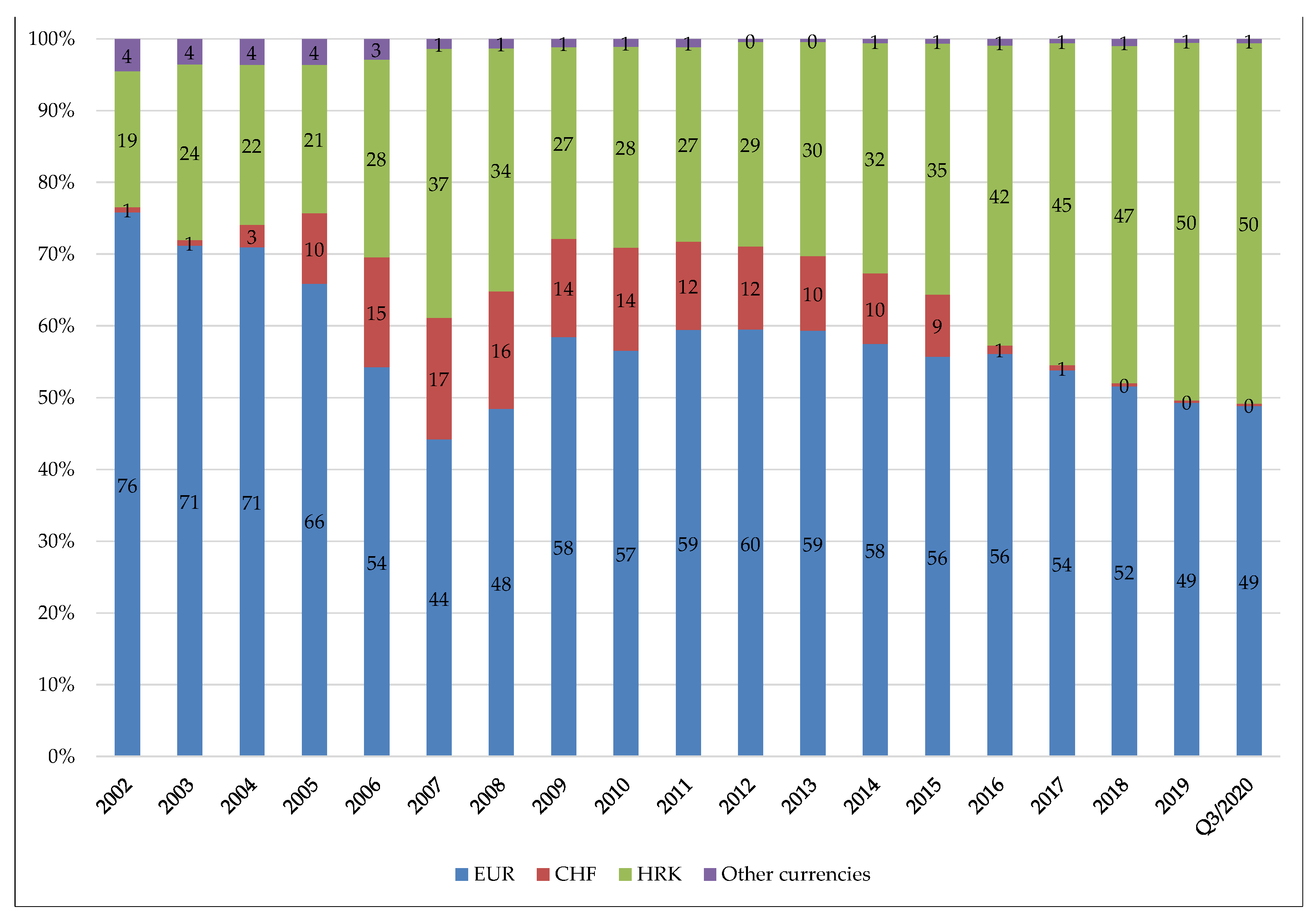

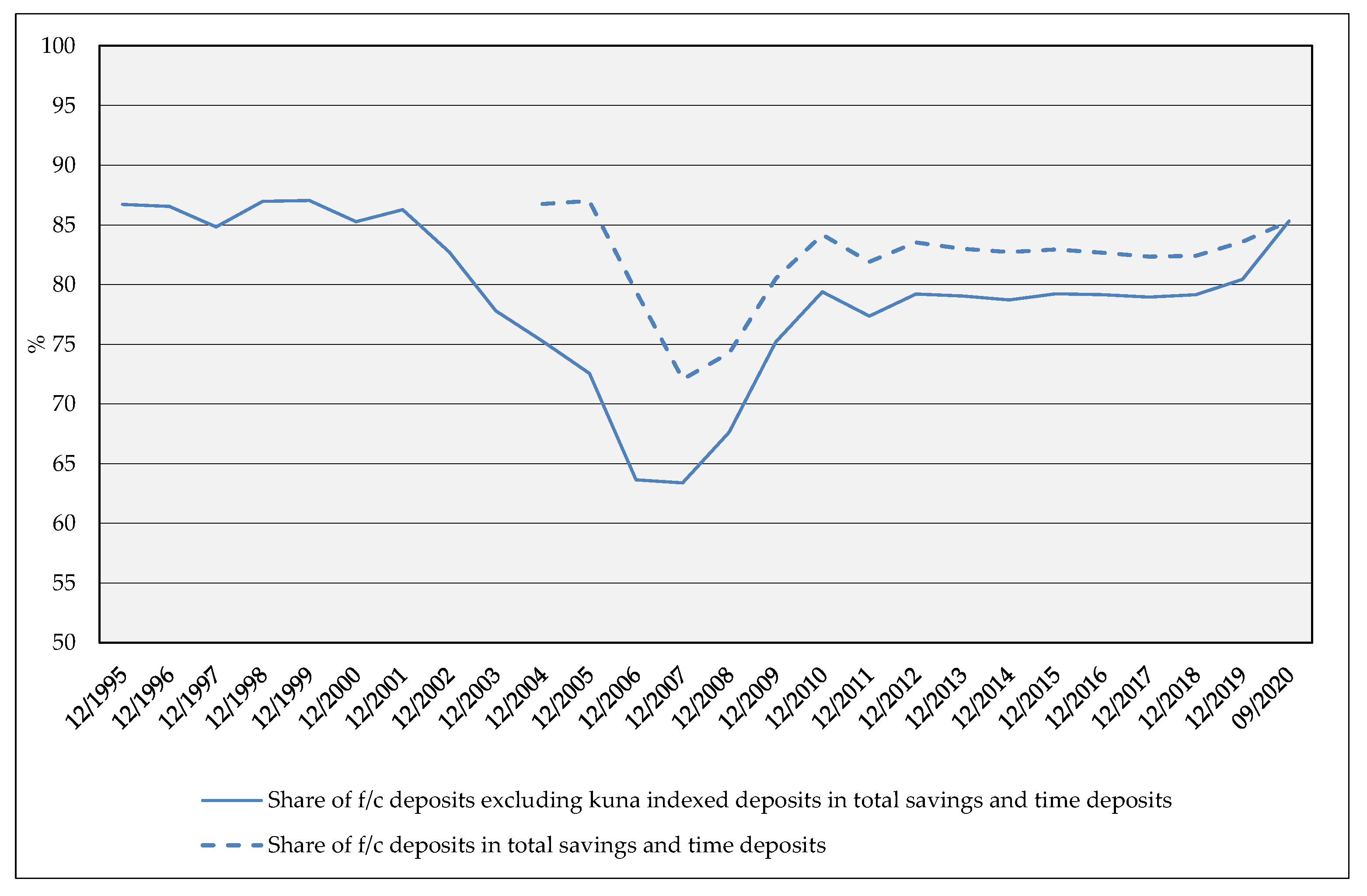

3.1. Supply-Driven Factors of FX Loans Acceptance

- Speed up and record higher credit growth (and consequently increase their market share),

- Partly reduce their credit risk (due to a more favorable credit price to borrowers when compared to domestic currency loans), and

- Improve their market risk management.

3.2. Demand-Driven Factors of FX Loans Acceptance

3.3. Financial Experts’ Opinions about FX Loans Terms

3.4. Debt Crisis Resolution

4. Lessons Learned

5. Conclusions

Funding

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Akerlof, George A. 1970. The Market for “Lemons”: Quality Uncertainty and the Market Mechanism. The Quarterly Journal of Economics 84: 488–500. [Google Scholar] [CrossRef]

- Andrieş, Alin M., and Simona Nistor. 2018. Systemic Risk and Foreign Currency Positions of Banks: Evidence from Emerging Europe. Eastern European Economics 56: 382–421. [Google Scholar] [CrossRef]

- Basso, Henrique S., Oscar Calvo-Gonzalez, and Marius Jurgilas. 2011. Financial Dollarization: The Role of Foreign-Owned Banks and Interest Rates. Journal of Banking and Finance 35: 794–806. [Google Scholar] [CrossRef]

- Beckmann, Elisabeth. 2017. How Does Foreign Currency Debt Relief Affect Households’ Loan Demand? Evidence from the OeNB Euro Survey in CESEE. Focus on European Economic Integration, Oesterreichische Nationalbank 1: 8–32. [Google Scholar]

- Beckmann, Elisabeth, and Helmut Stix. 2012. The Impact of the Crisis on Foreign Currency Borrowing of Households in CESEE–Implications for Economic Policy. East-West Journal of Economics and Business 15: 37–47. [Google Scholar]

- Beckmann, Elisabeth, and Helmut Stix. 2015. Foreign Currency Borrowing and Knowledge about Exchange Rate Risk. Journal of Economic Behavior and Organization 112: 1–16. [Google Scholar] [CrossRef][Green Version]

- Beer, Christian, Steven Ongena, and Marcel Peter. 2010. Borrowing in Foreign Currency: Austrian Households as Carry Traders. Journal of Banking and Finance 34: 2198–211. [Google Scholar] [CrossRef][Green Version]

- Berger, Allen N., and Gregory F. Udell. 2004. The Institutional Memory Hypothesis and the Procyclicality of Bank Lending Behavior. Journal of Financial Intermediation 13: 458–95. [Google Scholar] [CrossRef]

- Brown, Martin, and Ralph de Haas. 2012. Foreign Banks and Foreign Currency Lending in Emerging Europe. Economic Policy 27: 57–98. [Google Scholar] [CrossRef]

- Croatian National Bank. 2006. Smjernice za Upravljanje Valutno Induciranim Kreditnim Rizikom [Guidelines for Managing the Currency-Induced Credit Risk]. Available online: https://www.hnb.hr/-/smjernice-za-upravljanje-valutno-induciranim-kreditnim-rizikom (accessed on 3 December 2020).

- Croatian National Bank. 2010a. Decision on the Classification of Placements and Off-Balance Sheet Liabilities of Credit Institutions. Print Version. [Google Scholar]

- Croatian National Bank. 2010b. Financial Stability. July 5. Available online: https://www.hnb.hr/en/-/financijska-stabilnost-5 (accessed on 3 December 2020).

- Croatian National Bank. 2015. Some facts about loans in swiss francs and some options for government intervention. Press Release. January 21. Available online: https://www.hnb.hr/en/-/neke-cinjenice-o-kreditima-u-svicarskim-francima-i-nekim-mogucnostima-drzavne-intervenci-1 (accessed on 3 December 2020).

- Csajbók, Attila, András Hudecz, and Bálint Tamási. 2010. Foreign Currency Borrowing of Households in New EU Member States. Occasional Papers, No. 87. Budapest: Magyar Nemzeti Bank. Available online: http://www.mnb.hu/letoltes/op-87-1.pdf (accessed on 8 February 2021).

- Deković, Željko. 2013. Ugovaranje varijabilnih kamatnih stopa na potrošačke kredite u 2013. godini [Contracting Variable Interest Rates on Consumer Loans in 2013]. Računovodstvo i financije [Accounting and Finance] 1: 280–86. [Google Scholar]

- Đeno, Snježana, Zrinka Lukač, and Boško Šego. 2009. Usporedba kredita s valutnom klauzulom [Comparison of Loans with a Foreign Currency Clause]. Računovodstvo i financije [Accounting and Finance] 1: 193–201. [Google Scholar]

- Dewatripont, Mathias, and Jean Tirole. 1994. The Prudential Regulation of Banks. London: Palgrave Macmillan. [Google Scholar]

- Diamond, Douglas W. 1984. Financial Intermediation and Delegated Monitoring. The Review of Economic Studies 51: 393–414. [Google Scholar] [CrossRef]

- Fidrmuc, Jarko, Mariya Hake, and Helmut Stix. 2013. Households’ Foreign Currency Borrowing in Central and Eastern Europe. Journal of Banking and Finance 37: 1880–97. [Google Scholar] [CrossRef]

- Fischer, Andreas M., and Pinar Yeşin. 2019. Foreign Currency Loan Conversions and Currency Mismatches. Working Paper, No. 4. Zurich: Swiss National Bank. Available online: https://www.snb.ch/n/mmr/reference/working_paper_2019_04/source/working_paper_2019_04.n.pdf (accessed on 28 December 2020).

- Francišković, Drago. 2011. Analiza potpune kompenzacije povećanja anuiteta zbog valutne klauzule produljenjem razdoblja otplate [The Analysis of Total Compensation of the Increase in Installments of the Loan with Currency Clause by Extending Payment Period]. Ekonomska misao i praksa [Economic Thought and Practice] 20: 313–34. [Google Scholar]

- Giunio, Miljenko. 2005. Usklađivanje ugovorne cijene—Indeksna i valutna klauzula te klauzula klizne skale [Adjustment of Contract Price–Index and Foreign Currency Clause and Moving Scale Clause]. Računovodstvo, revizija i financije [Accounting, Auditing and Finance] 9: 78–85. [Google Scholar]

- Hake, Mariya, Fernando Lopez-Vicente, and Luis Molina. 2014. Do the Drivers of Loan Dollarization Differ between CESEE and Latin America? A Meta-Analysis. Focus on European Economic Integration, Oesterreichische Nationalbank 1: 8–35. [Google Scholar]

- Ivanov, Marijana. 2009. Utjecaj psiholoških čimbenika na djelotvornost financijskih tržišta [The Influence of Psychological Factors on the Efficiency of Financial Markets]. Zbornik radova Ekonomskog fakulteta Sveučilišta u Mostaru [Journal of Economy and Business published by Faculty of Economics, University of Mostar] 15: 7–30. [Google Scholar]

- Kordić, Gordana, and Igor Živko. 2011. Monetary Sovereignty in Context of European Integrations: Comparative Study upon a Student Population in Croatia and Bosnia and Herzegovina. Economic Research-Ekonomska Istraživanja 24: 122–33. [Google Scholar] [CrossRef]

- Koški, Dražen. 2012. Interdependence of Euroization and Currency Clauses in the Republic of Croatia. In Electronic Proceedings of the 6th International Conference “An Enterprise Odyssey: Corporate Governance and Public Policy–Path to Sustainable Future”, Šibenik, Croatia, 13–16 June. Edited by L. Galetić and J. Šimurina. Zagreb: University of Zagreb, Faculty of Economics and Business, pp. 443–53. [Google Scholar]

- Kraft, Evan, and Tomislav Galac. 2011. Macroprudential Regulation of Credit Booms and Busts–The Case of Croatia. Policy Research Working Paper, No. 5772. Washington, DC: The World Bank. Available online: https://elibrary.worldbank.org/doi/abs/10.1596/1813-9450-5772 (accessed on 28 December 2020).

- Kundid, Ana, and Roberto Ercegovac. 2011. Credit Rationing in Financial Distress: Croatia SMEs’ Finance Approach. International Journal of Law and Management 53: 62–84. [Google Scholar] [CrossRef]

- Ozsoz, Emre, Erick W. Rengifo, and Dominick Salvatore. 2010. Deposit Dollarization as an Investment Signal in Transitional Economies: The Case of Croatia, the Czech Republic, and Slovakia. Emerging Markets Finance and Trade 46: 5–22. [Google Scholar] [CrossRef]

- Rodik, Petra. 2015. The Impact of the Swiss Franc Loans Crisis on Croatian Households. In Social and Psychological Dimensions of Personal Debt and the Debt Industry. Edited by S. M. Değirmencioğlu and C. Walker. London: Palgrave Macmillan, pp. 61–83. [Google Scholar] [CrossRef]

- Škrabić Perić, Blanka, Ana Rimac Smiljanić, and Zdravka Aljinović. 2018. Credit Risk of Subsidiaries of Foreign Banks in CEE Countries: Impacts of the Parent Bank and Home Country Economic Environment. North American Journal of Economics and Finance 46: 49–69. [Google Scholar] [CrossRef]

- Slakoper, Zvonimir. 2002. Utjecaj eura na valutne klauzule i klauzule strane valute [The Impact of Euro on Currency Clause and Foreign Currency Clause]. Računovodstvo, revizija i financije [Accounting, Auditing and Finance] 1: 201–203. [Google Scholar]

- Sorić, Petar, and Mirjana Čižmešija. 2013. Price Sentiment of Croatian Consumers: The Upward Bias of Collective Memories. Društvena istraživanja: Journal for General Social Issues 22: 1–21. [Google Scholar] [CrossRef]

- Stiglitz, Joseph E., and Andrew Weiss. 1981. Credit Rationing in Markets with Imperfect Information. The American Economic Review 71: 393–410. Available online: https://www.jstor.org/stable/1802787 (accessed on 30 December 2020).

- Stix, Helmut. 2013. Why do People Save in Cash? Distrust, Memories of Banking Crises, Weak Institutions and Dollarization. Journal of Banking and Finance 37: 4087–106. [Google Scholar] [CrossRef]

- Šverko, Ivan. 2007. Upravljanje Nekreditnim Rizicima u Hrvatskim Financijskim Institucijama [Non-Credit Risk Management in the Croatian Financial Institutions]. Zagreb: Hrvatski institut za bankarstvo i osiguranje [The Croatian Institute for Banking and Insurance]. [Google Scholar]

- van der Cruijsen, Carin, Jakob de Haan, David-Jan Jansen, and Robert Mosch. 2013. Knowledge and Opinions about Banking Supervision: Evidence from a Survey in Dutch Households. Journal of Financial Stability 9: 219–29. [Google Scholar] [CrossRef]

- Vassileva, Radosveta. 2020. Monetary Appreciation and Foreign Currency Mortgages: Lessons from the 2015 Swiss Franc Surge. European Review of Private Law 28: 173–200. [Google Scholar]

- Yeşin, Pinar. 2013. Foreign Currency Loans and Systemic Risk in Europe. Federal Reserve Bank of St. Louis Review, 219–36. [Google Scholar] [CrossRef]

| 1 | It is important to point out that the administrative or discretionary interest rate is different from a variable interest rate, as a variable interest rate is linked to a transparent market benchmark (for instance LIBOR, EURIBOR etc.). Contrary to that, the administrative interest rate adjusts occasionally according to a one-sided or unilateral decision of the bank management, without clear interbank market interest rate. Changes in the administrative interest rates were not transparent, nor communicated properly to bank clients until the financial consumer protection was improved in Croatia at the beginning of 2013. After amendments to the Consumer Credit Act in January 2013, changes in those rates had to be explained with a certain financial model and legally acceptable parameters, and if their change worsens the bank clients’ position, they have the right to the earlier loan repayment, without the usual transaction costs applied in such case (Deković 2013). |

| 2 | (CHF mismatch index = (CHF liabilities–(CHF assets–CHF loans to resident households and nonfinancial corporations))/Total assets × 100 (Yeşin 2013, p. 225). |

| 3 | (for an insightful review of the CHF debt relief programs in other CEE countries see, e.g., Fischer and Yeşin (2019) and Vassileva (2020)). |

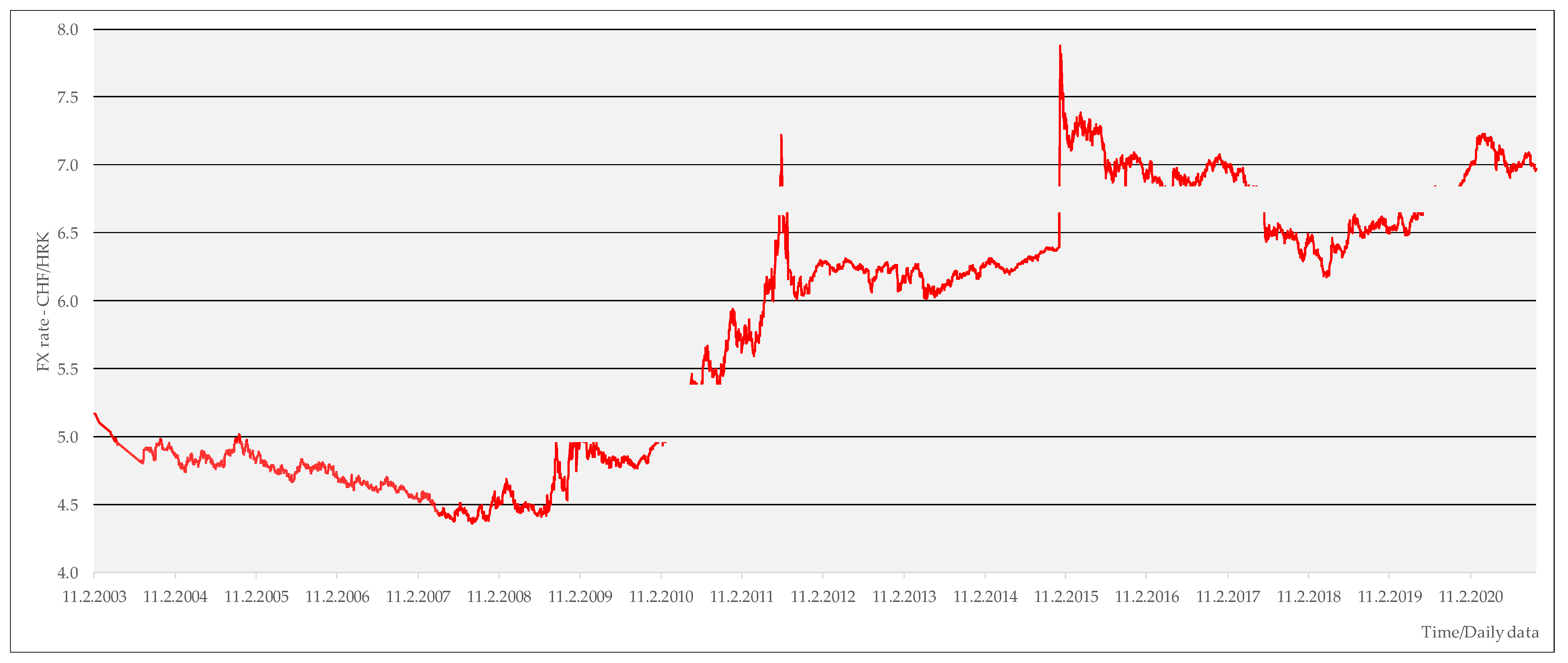

| CHF/HRK Mid-Rate (Daily Data) | Mean | Standard Deviation | Minimum | Maximum |

|---|---|---|---|---|

| 11 February 2003–31 December 2008 | 4.678464 | 0.1687972 | 4.3591 | 5.1710 |

| 1 January 2009–3 December 2020 | 6.311169 | 0.6729954 | 4.7451 | 7.8812 |

| Overall time period | 5.808714 | 0.9435556 | 4.3591 | 7.8812 |

| NPLs as of Total Loans (%) | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | June 2016 |

|---|---|---|---|---|---|---|---|

| Total | 11.23 | 12.43 | 13.93 | 15.70 | 17.06 | 16.65 | 14.99 |

| Kuna | 15.90 | 16.81 | 16.65 | 17.91 | 19.02 | 17.58 | 15.10 |

| Euro | 9.85 | 11.08 | 12.93 | 14.53 | 15.82 | 15.39 | 13.73 |

| Households | 6.57 | 6.93 | 7.46 | 9.15 | 10.71 | 11.20 | 10.87 |

| Mortgages | 3.01 | 3.29 | 3.67 | 4.88 | 5.58 | 6.05 | 6.74 |

| Swiss franc | 8.82 | 11.16 | 13.16 | 16.19 | 18.51 | 21.78 | 66.11 |

| Households | 6.05 | 8.00 | 9.98 | 13.31 | 15.50 | 18.33 | 65.48 |

| Mortgages | 5.73 | 7.27 | 9.15 | 12.36 | 13.12 | 16.63 | 63.43 |

| Car loans | 2.44 | 1.77 | 2.77 | 6.75 | 23.49 | 79.12 | 99.15 |

| Other loans | 15.25 | 23.44 | 25.98 | 30.22 | 54.92 | 52.27 | 81.23 |

| Corporates | 27.12 | 40.24 | 49.93 | 52.94 | 58.99 | 73.39 | 76.16 |

| Other sectors | 25.53 | 12.41 | 14.30 | 24.60 | 29.45 | 27.56 | 30.82 |

| Other currencies | 4.90 | 7.13 | 15.12 | 31.57 | 33.09 | 30.35 | 24.67 |

| Supply-Driven Factors | Demand-Driven Factors |

|---|---|

| Risk shifting behavior of banks (avoiding currency mismatch on a bank’s balance sheet) | Carry trading behavior (interest rate differentials) |

| Foreign bank ownership (low-cost FX funding from parent banks) | Low credit capacity for domestic currency loans (liquidity constraints due to insufficient disposable income or suitable collateral) |

| Credit rationing (avoiding credit price increase and potentially credit rejection due to an inflation premium in domestic currency loans in case of low credibility of domestic monetary policy) | Low credibility of domestic monetary policy for pursuing price stability, lack of trust in domestic financial institutions, macroeconomic uncertainty |

| Improving bank profitability through the net interest margin due to interest rate differentials between foreign funds and loans to domestic borrowers | Expectations of medium-term euro adoption |

| Intensive competition in the banking sector | Hedging factors: remittances and household income in foreign currency |

| Behavioral biases: anchoring, excessive optimism, disaster myopia, herding | Behavioral biases: overconfidence, anchoring, excessive optimism |

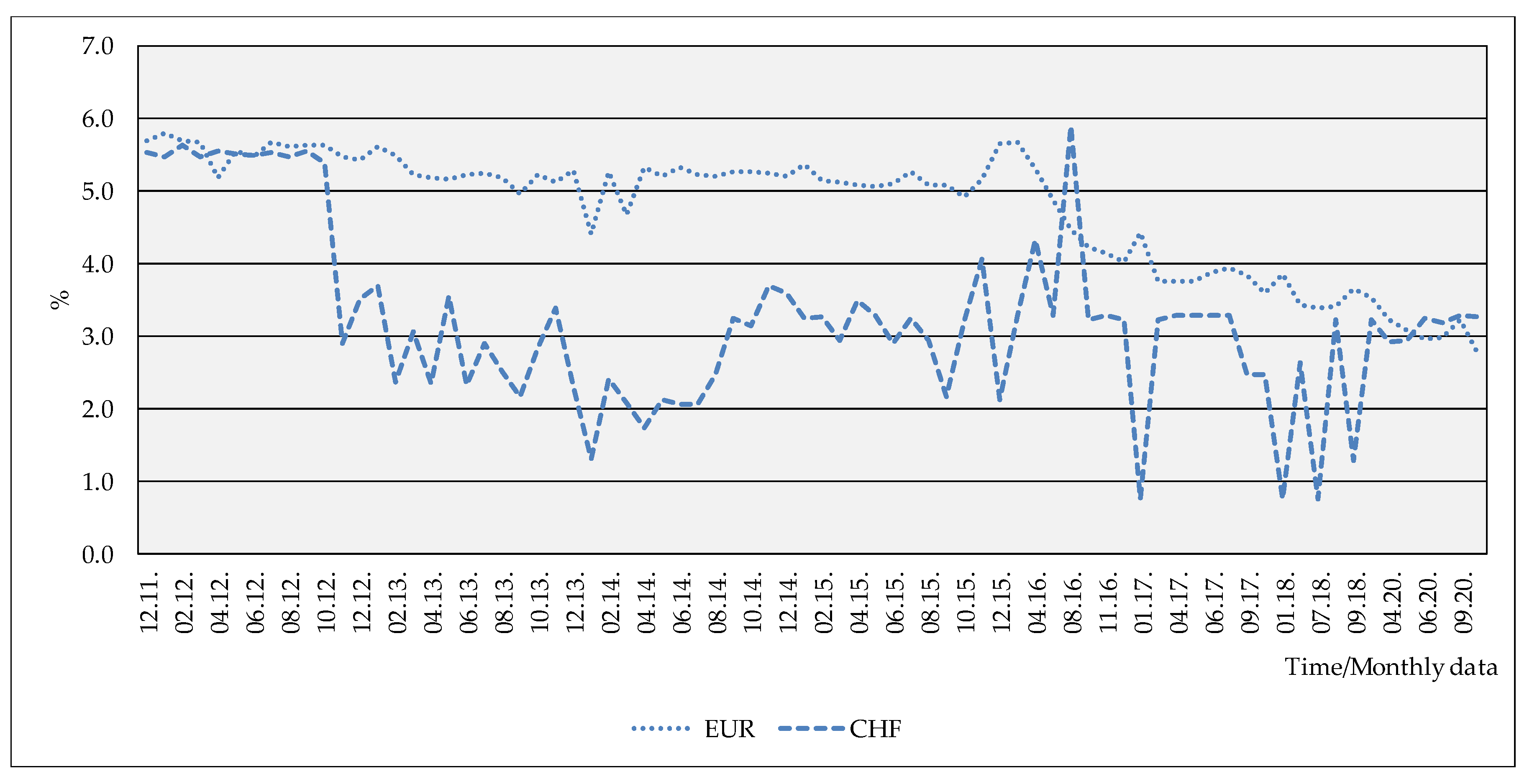

| EUR | CHF | USD | ||

|---|---|---|---|---|

| EUR | Pearson correlation | 1 | ||

| Sig. (2-tailed) | ||||

| CHF | Pearson correlation | 0.957 ** | 1 | |

| Sig. (2-tailed) | 0.000 | |||

| USD | Pearson correlation | 0.637 ** | 0.671 ** | 1 |

| Sig. (2-tailed) | 0.000 | 0.000 |

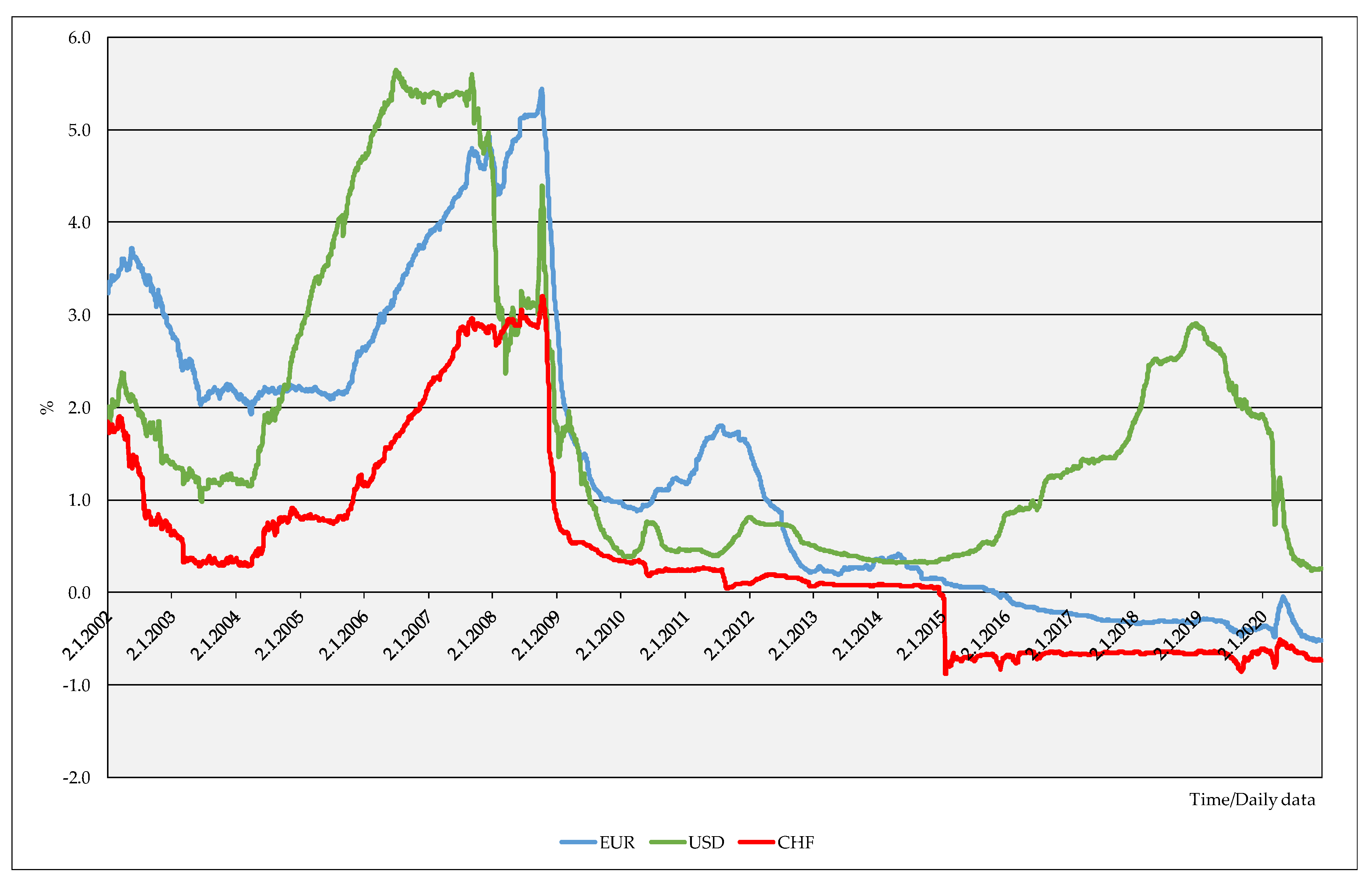

| 6-Month LIBOR (Daily Data) | EUR | CHF | USD |

|---|---|---|---|

| Mean | 1.3865647 | 0.3891227 | 1.8134682 |

| Standard deviation | 1.61680594 | 1.04836317 | 1.54114657 |

| Minimum | −0.52586 | −0.88360 | 0.23375 |

| Maximum | 5.43750 | 3.20167 | 5.64000 |

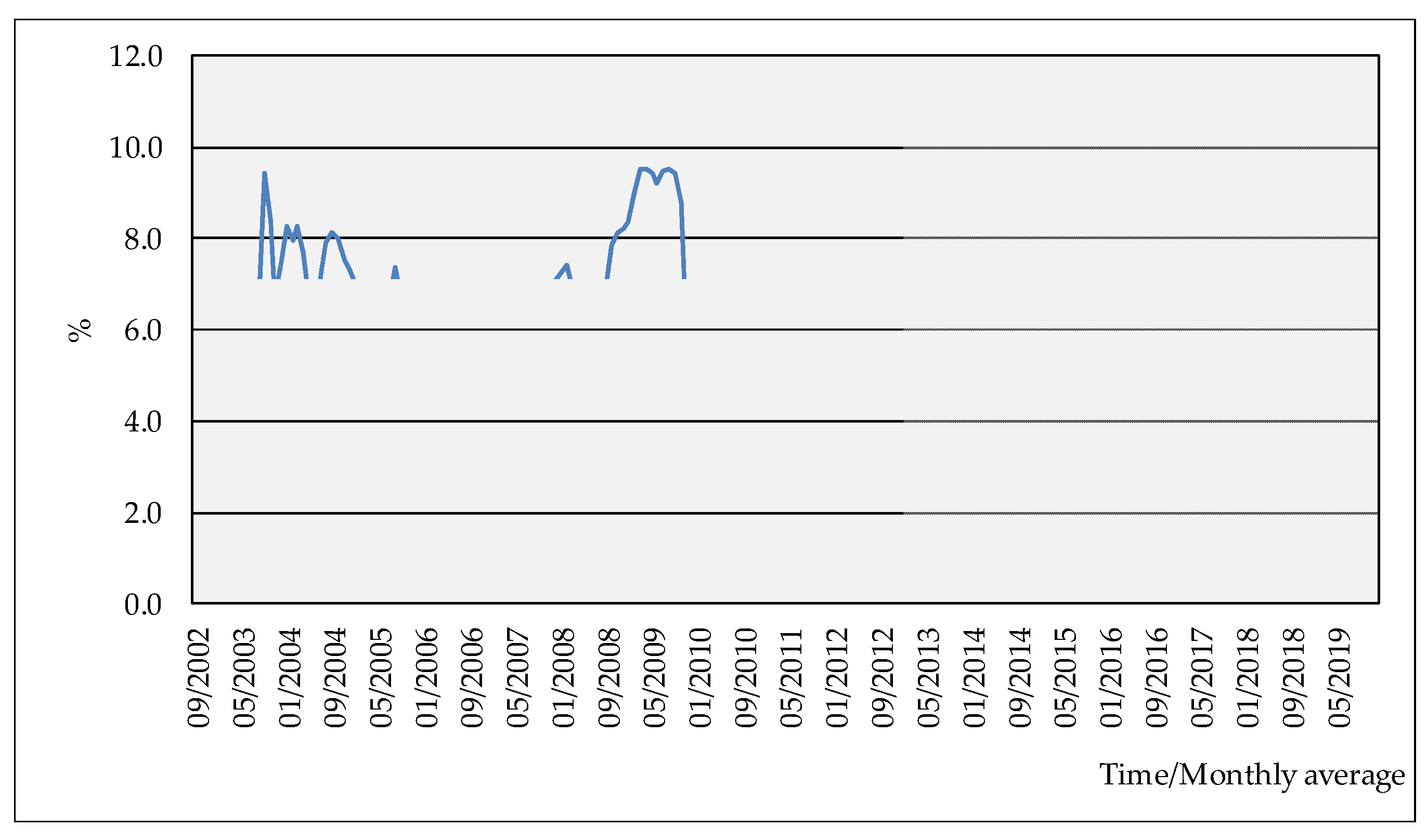

| 6-Month ZIBOR (Monthly Average) | HRK |

|---|---|

| Mean | 3.82 |

| Standard deviation | 2.72 |

| Minimum | 0.42 |

| Maximum | 9.53 |

| Test Value = 0 | ||||||

|---|---|---|---|---|---|---|

| 95% Confidence Interval of the Difference | ||||||

| t | df | Sig. (2-tailed) | Mean Difference | Lower | Upper | |

| EUR | 59.317 | 4783 | 0.000 | 1.38656466 | 1.3407378 | 1.4323915 |

| CHF | 25.673 | 4783 | 0.000 | 0.38912270 | 0.3594078 | 0.4188376 |

| FX Mid-Rate (Daily Data) | EUR/HRK | CHF/HRK | USD/HRK |

|---|---|---|---|

| Mean | 7.388957 | 4.678464 | 5.757688 |

| Standard deviation | 0.1334565 | 0.1687972 | 0.5662856 |

| Minimum | 7.0681 | 4.3591 | 4.5340 |

| Maximum | 7.7671 | 5.1710 | 7.2409 |

| Statement | N | Sum | Mean |

|---|---|---|---|

| Currency clause is justifiable due to a high level of household savings in foreign currency. | 46 | 115 | 2.50 |

| Currency clause transfers foreign exchange risk from banks to borrowers. | 47 | 210 | 4.47 |

| Currency clause excessively protects banks from foreign exchange risk. | 47 | 197 | 4.19 |

| Currency clause is unnecessary due to a stable EUR/HRK foreign exchange rate. | 46 | 158 | 3.43 |

| Currency clause disregards the possibility of foreign currency-induced credit risk. | 44 | 167 | 3.80 |

| Currency clause needs to be abolished, as banks must show their risk management capabilities. | 47 | 182 | 3.87 |

| Currency clause needs to be abolished, as government should protect financial consumers/borrowers and not banks. | 46 | 161 | 3.50 |

| Statement | N | Sum | Mean |

|---|---|---|---|

| Administrative interest rates are not recognized in the public as a problem for bank customers (borrowers and depositors). | 47 | 185 | 3.94 |

| Administrative interest rates are not recognized as a problem as they are presented as variable (referent-market) interest rates. | 47 | 187 | 3.98 |

| Administrative interest rates are not a fair banking practice as financial consumers are usually not familiar with their presence in contracts. | 47 | 194 | 4.13 |

| Administrative interest rates should be more clearly pointed towards the loan/deposit contracts. | 47 | 217 | 4.62 |

| Administrative interest rates protect banks’ interests and put them in a favorable position in comparison to their customers. | 47 | 221 | 4.70 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Kundid Novokmet, A. Troubles with the Chf Loans in Croatia: The Story of a Case Still Waiting to Be Closed. J. Risk Financial Manag. 2021, 14, 75. https://doi.org/10.3390/jrfm14020075

Kundid Novokmet A. Troubles with the Chf Loans in Croatia: The Story of a Case Still Waiting to Be Closed. Journal of Risk and Financial Management. 2021; 14(2):75. https://doi.org/10.3390/jrfm14020075

Chicago/Turabian StyleKundid Novokmet, Ana. 2021. "Troubles with the Chf Loans in Croatia: The Story of a Case Still Waiting to Be Closed" Journal of Risk and Financial Management 14, no. 2: 75. https://doi.org/10.3390/jrfm14020075

APA StyleKundid Novokmet, A. (2021). Troubles with the Chf Loans in Croatia: The Story of a Case Still Waiting to Be Closed. Journal of Risk and Financial Management, 14(2), 75. https://doi.org/10.3390/jrfm14020075