A Holistic Perspective on Bank Performance Using Regulation, Profitability, and Risk-Taking with a View on Ownership Concentration

Abstract

1. Introduction

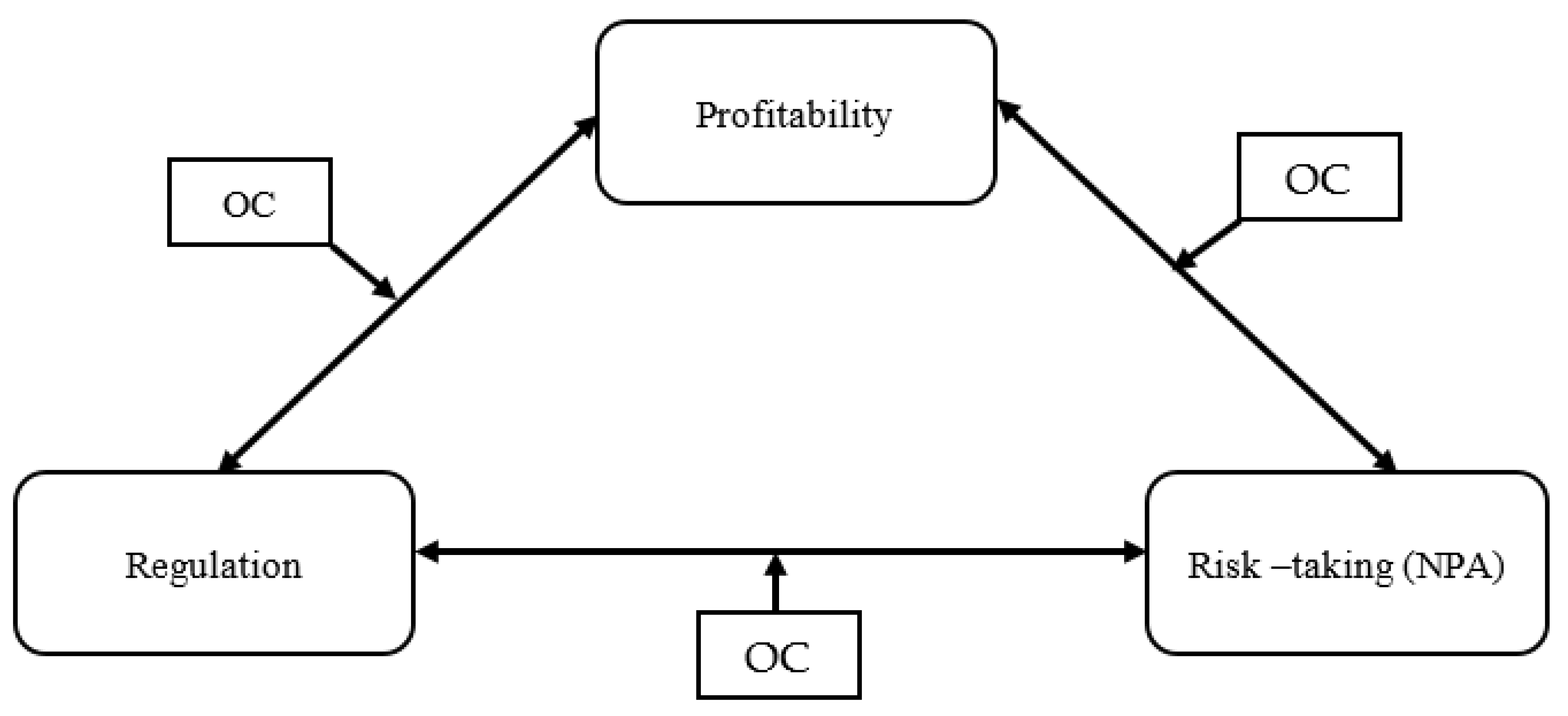

2. Review of Literature and Formulation of Hypotheses

- (a)

- The regulation initiatives should positively impact the level of NPAs in banks (they should reduce the NPA levels).

- (b)

- Regulation should not impact the profitability of banks. The banks should be self-regulated enough that regulation need not adversely impact profitability.

- (c)

- An increase in NPAs should not impact profitability. The risk of NPAs should be estimated in advance, and enough provisioning should have been done to ward off any possible contingency of increased NPAs on profitability.

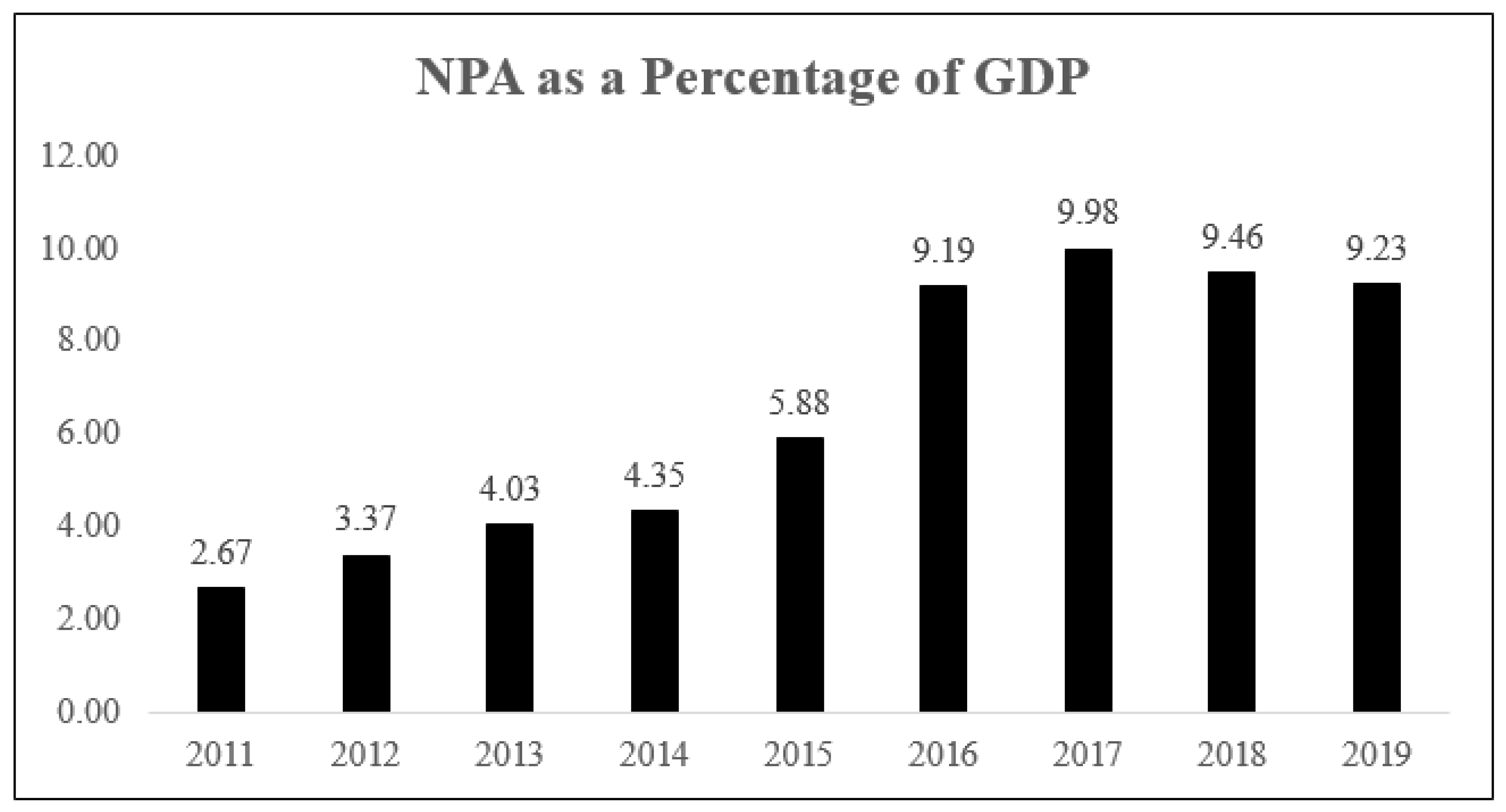

3. Data and Methodology

3.1. Data

3.2. Methodology

4. Results

5. Discussion and Policy Implications

6. Conclusions, Limitations, and Future Scope

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Conflicts of Interest

References

- Abraham, Abraham. 2013. Foreign ownership and bank performance metrics in Saudi Arabia. International Journal of Islamic and Middle Eastern Finance and Management 6: 43–50. [Google Scholar] [CrossRef]

- Agoraki, Maria-Eleni K., Manthos D. Delis, and F. Pasiouras. 2011. Regulations, competition and bank risk-taking in transition countries. Journal of Financial Stability 7: 38–48. [Google Scholar] [CrossRef]

- Al-Busaidi, Kamla Ali, and Saeed Al-Muharrami. 2020. Beyond Profitability: ICT Investments and Financial Institutions Performance Measures in Developing Economies. Journal of Enterprise Information Management. (Paper in Press). Available online: https://www.emerald.com/insight/content/doi/10.1108/JEIM-09-2019-0250/full/pdf (accessed on 4 February 2021). [CrossRef]

- Anderson, Theodore Wilbur, and Cheng Hsiao. 1981. Estimation of dynamic models with error components. Journal of the American Statistical Association 76: 598–606. [Google Scholar] [CrossRef]

- Arellano, Manuel, and Stephen Bond. 1991. Some tests of specification for panel data: Monte Carlo evidence and an application to employment equations. The Review of Economic Studies 58: 277–97. [Google Scholar] [CrossRef]

- Ariss, Rima Turk. 2010. On the implications of market power in banking: Evidence from developing countries. Journal of Banking & Finance 34: 765–75. [Google Scholar]

- Arrawatia, Rakesh, Arun Misra, and Varun Dawar. 2015. Bank competition and efficiency: Empirical evidence from Indian market. International Journal of Law and Management 57: 217. [Google Scholar] [CrossRef]

- Athaley, Chataley, Shailesh Rastogi, Akanksha Goel, and V. M. Bhimavarapu. 2020. Factors Impacting Bank’s Performance: A Literature Review. Test Engineering and Management 83: 7389–98. [Google Scholar]

- Balasubramaniam, C. S. 2012. Non-performing assets and profitability of commercial banks in India: Assessment and emerging issues. National Monthly Refereed Journal of Research in Commerce & Management 1: 41–52. [Google Scholar]

- Baltagi, B. 2008. Econometric Analysis of Panel Data. West Sussex: John Wiley & Sons. [Google Scholar]

- Banerjee, Sreejata, and Malathi Velamuri. 2015. The conundrum of profitability versus soundness for banks by ownership type: Evidence from the Indian banking sector. Review of Financial Economics 26: 12–24. [Google Scholar] [CrossRef]

- Barakat, Ahmed, and Khaled Hussainey. 2013. Bank governance, regulation, supervision, and risk reporting: Evidence from operational risk disclosures in European banks. International Review of Financial Analysis 30: 254–73. [Google Scholar] [CrossRef]

- Barnabas, Nattuvathuckal, and Nandakumar Mekoth. 2010. Autonomy, market orientation and performance in Indian retail banking. Asia Pacific Journal of Marketing and Logistics 22: 330–50. [Google Scholar] [CrossRef]

- Barry, Thierno Amadou, Laetitia Lepetit, and Amine Tarazi. 2011. Ownership structure and risk in publicly held and privately owned banks. Journal of Banking & Finance 35: 1327–340. [Google Scholar]

- Barth, James R., Gerard Caprio, Jr., and Ross Levine. 2004. Bank regulation and supervision: What works best? Journal of Financial Intermediation 13: 205–48. [Google Scholar] [CrossRef]

- Barth, James R., Gerard Caprio, and Ross Levine. 2008. Bank Regulations are Changing: For Better or Worse? Comparative Economic Studies 50: 537–63. [Google Scholar] [CrossRef]

- Baselga-Pascual, Laura, Antonio Trujillo-Ponce, and Clara Cardone-Riportella. 2015. Factors influencing bank risk in Europe: Evidence from the financial crisis. The North American Journal of Economics and Finance 34: 138–66. [Google Scholar] [CrossRef]

- Battaglia, Francesca, and Angela Gallo. 2017. Strong boards, ownership concentration and EU banks’ systemic risk-taking: Evidence from the financial crisis. Journal of International Financial Markets, Institutions and Money 46: 128–46. [Google Scholar] [CrossRef]

- Bauer, Wolfgang, and Marc Ryser. 2004. Risk management strategies for banks. Journal of Banking & Finance 28: 331–52. [Google Scholar]

- Baumann, Ursel, and Erlend Nier. 2004. Disclosure, volatility, and transparency: An empirical investigation into the value of bank disclosure. Economic Policy Review 10: 31–45. [Google Scholar]

- Berger, Allen N., and Robert DeYoung. 1997. Problem loans and cost efficiency in commercial banks. Journal of Banking & Finance 21: 849–70. [Google Scholar]

- Bian, Wenlong, and Chao Deng. 2017. Ownership dispersion and bank performance: Evidence from China. Finance Research Letters 22: 49–52. [Google Scholar] [CrossRef]

- Bitar, Mohammad, Wadad Saad, and Mohammed Benlemlih. 2016. Bank risk and performance in the MENA region: The importance of capital requirements. Economic Systems 40: 398–421. [Google Scholar] [CrossRef]

- Boudriga, Abdelkader, Neila Boulila Taktak, and Sana Jellouli. 2009. Banking supervision and nonperforming loans: A cross-country analysis. Journal of Financial Economic Policy 1: 286–318. [Google Scholar] [CrossRef]

- Buallay, Amina, Richard Cummings, and Allam Hamdan. 2019. Intellectual capital efficiency and bank’s performance. Pacific Accounting Review 31: 672–94. [Google Scholar] [CrossRef]

- Burgess, Robin, and Rohini Pande. 2005. Do rural banks matter? Evidence from the Indian social banking experiment. American Economic Review 95: 780–95. [Google Scholar] [CrossRef]

- Bushman, Robert M. 2016. Transparency, accounting discretion, and bank stability. Economic Policy Review 1: 129–49. [Google Scholar]

- Chen, Jian. 2001. Ownership structure as corporate governance mechanism: Evidence from Chinese listed companies. Economics of Planning 34: 53–72. [Google Scholar] [CrossRef]

- Chockalingam, Arun, Shaunak Dabadghao, and Rene Soetekouw. 2018. Strategic risk, banks, and Basel III: Estimating economic capital requirements. The Journal of Risk Finance 19: 225–46. [Google Scholar] [CrossRef]

- Cornett, Marcia Millon, Lin Guo, Shahriar Khaksari, and Hassan Tehranian. 2010. The impact of state ownership on performance differences in privately-owned versus state-owned banks: An international comparison. Journal of Financial Intermediation 19: 74–94. [Google Scholar] [CrossRef]

- Cornett, Marcia Millon, Jamie John McNutt, Philip E. Strahan, and Hassan Tehranian. 2011. Liquidity risk management and credit supply in the financial crisis. Journal of Financial Economics 101: 297–312. [Google Scholar] [CrossRef]

- Delis, Manthos D., Philip Molyneux, and Fotios Pasiouras. 2011. Regulations and productivity growth in banking: Evidence from transition economies. Journal of Money, Credit and Banking 43: 735–64. [Google Scholar] [CrossRef]

- Delis, Manthos D., Sotirios Kokas, and Steven Ongena. 2017. Bank market power and firm performance. Review of Finance 21: 299–326. [Google Scholar] [CrossRef]

- Demirgüç-Kunt, Asli, and Enrica Detragiache. 2002. Does deposit insurance increase banking system stability? An empirical investigation. Journal of Monetary Economics 49: 1373–406. [Google Scholar] [CrossRef]

- Demirgüç-Kunt, Asli, and Enrica Detragiache. 2011. Basel Core Principles and bank soundness: Does compliance matter? Journal of Financial Stability 7: 179–90. [Google Scholar] [CrossRef]

- Elyasiani, Elyas, and Jingyi Jia. 2010. Distribution of institutional ownership and corporate firm performance. Journal of Banking & Finance 34: 606–20. [Google Scholar]

- Erkens, David H., Mingyi Hung, and Pedro Matos. 2012. Corporate governance in the 2007–2008 financial crisis: Evidence from financial institutions worldwide. Journal of Corporate Finance 18: 389–411. [Google Scholar] [CrossRef]

- Ganguli, Santanu K. 2013. Capital structure-does ownership structure matter? Theory and Indian evidence. Studies in Economics and Finance 30: 56–72. [Google Scholar] [CrossRef]

- Grassa, Rihab, Sherif El-Halaby, and Khaled Hussainey. 2019. Corporate Governance and Multi-corporate Disclosures Evidence from Islamic Banks. In Research in Corporate and Shari’ah Governance in the Muslim World: Theory and Practice. Edited by Toseef Azid, Ali Abdullah, Alnodel and Muhamad Azeem Qureshi. Bingley: Emerald Publishing Limited, pp. 167–87. [Google Scholar]

- Gupta, Neeraj, and Jitendra Mahakud. 2020. CEO characteristics and bank performance: Evidence from India. Managerial Auditing Journal 35: 1057–93. [Google Scholar] [CrossRef]

- Hadad, Muliaman D., Maximilian J. B. Hall, Karligash A. Kenjegalieva, Wimboh Santoso, and Richard Simper. 2011. Banking efficiency and stock market performance: An analysis of listed Indonesian banks. Review of Quantitative Finance and Accounting 37: 1–20. [Google Scholar] [CrossRef]

- Haque, Faizul, and Kym Brown. 2017. Bank ownership, regulation and efficiency: Perspectives from the Middle East and North Africa (MENA) Region. International Review of Economics & Finance 47: 273–93. [Google Scholar]

- Haque, Faizul, and Rehnuma Shahid. 2016. Ownership, risk-taking and performance of banks in emerging economies: Evidence from India. Journal of Financial Economic Policy 8: 282–97. [Google Scholar] [CrossRef]

- Iannotta, Giuliano, Giacomo Nocera, and Andrea Sironi. 2007. Ownership structure, risk and performance in the European banking industry. Journal of Banking & Finance 31: 2127–49. [Google Scholar]

- Iannotta, Giuliano, Giacomo Nocera, and Andrea Sironi. 2013. The impact of government ownership on bank risk. Journal of Financial Intermediation 22: 152–76. [Google Scholar] [CrossRef]

- Inoguchi, Masahiro. 2013. Interbank market, stock market, and bank performance in East Asia. Pacific-Basin Finance Journal 25: 136–56. [Google Scholar] [CrossRef]

- Iqbal, Badar Alam, and Shaista Sami. 2017. Role of banks in financial inclusion in India. Contaduría y administración 62: 644–56. [Google Scholar] [CrossRef]

- Iqbal, Muhammad, Munir Ahmad, and Kalbe Abbas. 2003. The Impact of Institutional Credit on Agricultural Production in Pakistan. The Pakistan Development Review 42: 469–85. [Google Scholar] [CrossRef]

- Joshi, Mahesh, Daryll Cahill, Jasvinder Sidhu, and Monika Kansal. 2013. Intellectual capital and financial performance: An evaluation of the Australian financial sector. Journal of Intellectual Capital 14: 264–85. [Google Scholar] [CrossRef]

- Kabir, Anwarul, and Suman Dey. 2012. Performance analysis through CAMEL rating: A comparative study of selected private commercial banks in Bangladesh. Journal of Politics and Governance 1: 16–25. [Google Scholar]

- Keeley, Michael C. 1990. Deposit insurance, risk, and market power in banking. The American Economic Review, 1183–200. [Google Scholar]

- Khan, Imran, and Syeda Nitasha Zahid. 2020. The impact of Shari’ah and corporate governance on Islamic banks performance: Evidence from Asia. International Journal of Islamic and Middle Eastern Finance and Management 13: 483–501. [Google Scholar] [CrossRef]

- Klomp, Jeroen, and Jakob De Haan. 2015. Bank regulation and financial fragility in developing countries: Does bank structure matter? Review of Development Finance 5: 82–90. [Google Scholar] [CrossRef]

- Konovalova, Natalia, Ineta Kristovska, and Marina Kudinska. 2016. Credit risk management in commercial banks. Polish Journal of Management Studies 13: 90–100. [Google Scholar] [CrossRef]

- Kumar, Sunil. 2010. Measuring efficiency, effectiveness and performance of Indian public sector banks. International Journal of Productivity and Performance Management 59: 51–74. [Google Scholar] [CrossRef]

- Laeven, Luc, and Ross Levine. 2009. Bank governance, regulation and risk taking. Journal of Financial Economics 93: 259–75. [Google Scholar] [CrossRef]

- Laeven, Luc, and Giovanni Majnoni. 2003. Loan loss provisioning and economic slowdowns: Too much, too late? Journal of Financial Intermediation 12: 178–97. [Google Scholar] [CrossRef]

- Lee, Chien-Chiang, and Meng-Fen Hsieh. 2013. The impact of bank capital on profitability and risk in Asian banking. Journal of International Money and Finance 32: 251–81. [Google Scholar] [CrossRef]

- Lee, Chien-Chiang, and Meng-Fen Hsieh. 2014. Bank reforms, foreign ownership, and financial stability. Journal of International Money and Finance 40: 204–24. [Google Scholar] [CrossRef]

- Lee, Jeong Yeon, and Doyeon Kim. 2013. Bank performance and its determinants in Korea. Japan and the World Economy 27: 83–94. [Google Scholar] [CrossRef]

- Lepetit, Laetitia, and Frank Strobel. 2013. Bank insolvency risk and time-varying Z-score measures. Journal of International Financial Markets, Institutions and Money 25: 73–87. [Google Scholar] [CrossRef]

- Lybek, Tonny. 1999. Central bank autonomy, and inflation and output performance in the baltic states, russia, and other countries of the former soviet union, 1995–1997. Russian & East European Finance and Trade 35: 7–44. [Google Scholar]

- Messai, Ahlem Selma, and Fathi Jouini. 2013. Micro and macro determinants of non-performing loans. International Journal of Economics and Financial Issues 3: 852–60. [Google Scholar]

- Mohammed, Sulaiman Abdullah Saif Al-Nasser, and Datin Joriah Muhammed. 2017. Financial crisis, legal origin, economic status and multi-bank performance indicators: Evidence from Islamic banks in developing countries. Journal of Applied Accounting Research 18: 208–22. [Google Scholar] [CrossRef]

- Mohsni, Sana, and Isaac Otchere. 2018. Does regulatory regime matter for bank risk taking? A comparative analysis of US and Canada. Journal of International Financial Markets, Institutions and Money 53: 1–16. [Google Scholar] [CrossRef]

- Moosa, Imad A. 2010. Basel II as a casualty of the global financial crisis. Journal of Banking Regulation 11: 95–114. [Google Scholar] [CrossRef]

- Muhmad, Siti Nurain, and Hafiza Aishah Hashim. 2015. Using the camel framework in assessing bank performance in malaysia. International Journal of Economics, Management and Accounting 23: 109–27. [Google Scholar]

- Nair, Rajiv, Mohammad Muttakin, Arifur Khan, Nava Subramaniam, and V. S. Somanath. 2019. Corporate social responsibility disclosure and financial transparency: Evidence from India. Pacific-Basin Finance Journal 56: 330–51. [Google Scholar] [CrossRef]

- Nguyen, James. 2012. The relationship between net interest margin and noninterest income using a system estimation approach. Journal of Banking & Finance 36: 2429–37. [Google Scholar]

- Nickell, Stephen J. 1981. Biases in Dynamic Models with Fixed Effects. Econometrica 49: 1417–26. [Google Scholar] [CrossRef]

- Niinimäki, Juha-Pekka. 2004. The effects of competition on banks’ risk taking. Journal of Economics 81: 199–222. [Google Scholar] [CrossRef]

- Oino, Isaiah. 2019. Do disclosure and transparency affect bank’s financial performance? Corporate Governance: International Journal of Business in Society 19: 1344–61. [Google Scholar] [CrossRef]

- Ozili, Peterson Kitakogelu, and Olayinka Uadiale. 2017. Ownership concentration and bank profitability. Future Business Journal 3: 159–71. [Google Scholar] [CrossRef]

- Pakravan, Karim. 2014. Bank capital: The case against Basel. Journal of Financial Regulation and Compliance 22: 208–18. [Google Scholar] [CrossRef]

- Pennathur, Anita K., Vijaya Subrahmanyam, and Sharmila Vishwasrao. 2012. Income diversification and risk: Does ownership matter? An empirical examination of Indian banks. Journal of Banking & Finance 36: 2203–15. [Google Scholar]

- Petria, Nicolae, Bogdan Capraru, and Iulian Ihnatov. 2015. Determinants of banks’ profitability: Evidence from EU 27 banking systems. Procedia Economics and Finance 20: 518–24. [Google Scholar] [CrossRef]

- Pradhan, Roli. 2014. Z score estimation for Indian banking sector. International Journal of Trade, Economics and Finance 5: 516. [Google Scholar] [CrossRef]

- Rahman, Nora Azureen Abdul, and B. A. F. Reja. 2015. Ownership structure and bank performance. Journal of Economics, Business and Management 3: 483–88. [Google Scholar] [CrossRef]

- Rahman, Mohammed Mizanur, Changjun Zheng, Badar Nadeem Ashraf, and Mohammad Morshedur Rahman. 2018. Capital requirements, the cost of financial intermediation and bank risk-taking: Empirical evidence from Bangladesh. Research in International Business and Finance 44: 488–503. [Google Scholar] [CrossRef]

- Rajan, Raghuram G. 1994. Why bank credit policies fluctuate: A theory and some evidence. The Quarterly Journal of Economics 109: 399–441. [Google Scholar] [CrossRef]

- Rajaraman, Indira, and Garima Vasishtha. 2002. Non-performing loans of PSU banks: Some panel results. Economic and Political Weekly, 429–35. Available online: https://www.jstor.org/stable/4411688?seq=1 (accessed on 7 March 2021).

- Rastogi, Shailesh. 2014. The financial crisis of 2008 and stock market volatility–analysis and impact on emerging economies pre and post crisis. Afro-Asian Journal of Finance and Accounting 4: 443–59. [Google Scholar] [CrossRef]

- Repullo, Rafael. 2004. Capital requirements, market power, and risk-taking in banking. Journal of Financial Intermediation 13: 156–82. [Google Scholar] [CrossRef]

- Roy, Amitava. 2015. Dividend policy, ownership structure and corporate governance: An empirical analysis of Indian firms. Indian Journal of Corporate Governance 8: 1–33. [Google Scholar] [CrossRef]

- Sarkar, Jayati, and Subrata Sarkar. 2018. Bank ownership, board characteristics and performance: Evidence from commercial banks in India. International Journal of Financial Studies 6: 17. [Google Scholar] [CrossRef]

- Schwerter, Stefan. 2011. Basel III’s ability to mitigate systemic risk. Journal of Financial Regulation and Compliance 19: 337–54. [Google Scholar] [CrossRef]

- Sen, Saurabh, and Ruchi L Sen. 2015. Impact of NPAs on Bank Profitability: An Empirical Study. Banking, Finance, and Accounting: Concepts, Methodologies, Tools, and Applications. Pennsylvania: IGI Global. [Google Scholar]

- Shehzad, Choudhry Tanveer, Jakob de Haan, and Bert Scholtens. 2010. The impact of bank ownership concentration on impaired loans and capital adequacy. Journal of Banking & Finance 34: 399–408. [Google Scholar]

- Srairi, Samir. 2013. Ownership structure and risk-taking behaviour in conventional and Islamic banks: Evidence for MENA countries. Borsa Istanbul Review 13: 115–27. [Google Scholar] [CrossRef]

- Sufian, Fadzlan, and Muzafar Shah Habibullah. 2014. Economic freedom and bank efficiency: Does ownership and origins matter? Journal of Financial Regulation and Compliance 22: 174–207. [Google Scholar] [CrossRef]

- Tabak, Benjamin M., Guilherme M. R. Gomes, and Maurício da Silva Medeiros, Jr. 2015. The impact of market power at bank level in risk-taking: The Brazilian case. International Review of Financial Analysis 40: 154–65. [Google Scholar] [CrossRef]

- Tan, Yong. 2016. The impacts of risk and competition on bank profitability in China. Journal of International Financial Markets, Institutions and Money 40: 85–110. [Google Scholar] [CrossRef]

- Tan, Yong, Christos Floros, and John Anchor. 2017. The profitability of Chinese banks: Impacts of risk, competition and efficiency. Review of Accounting and Finance 16: 86–105. [Google Scholar] [CrossRef]

- Triki, Thouraya, Imen Kouki, Mouna Ben Dhaou, and Pietro Calice. 2017. Bank regulation and efficiency: What works for Africa? Research in International Business and Finance 39: 183–205. [Google Scholar] [CrossRef]

- Ugwu, Daniel S., and Ihechituru O. Kanu. 2012. Effects of agricultural reforms on the agricultural sector in Nigeria. Journal of African Studies and Development 4: 51–59. [Google Scholar]

- Zhang, Yi, Gin Chong, and Ruixin Jia. 2019. Fair value, corporate governance, social responsibility disclosure and banks’ performance. Review of Accounting and Finance 19: 30–47. [Google Scholar] [CrossRef]

- Zheng, Changjun, Syed Moudud-Ul-Huq, Mohammad Morshedur Rahman, and Badar Nadeem Ashrafd. 2017. Does the ownership structure matter for banks’ capital regulation and risk-taking behavior? Empirical evidence from a developing country. Research in International Business and Finance 42: 404–21. [Google Scholar] [CrossRef]

| 1 | CMIE Prowess: CMI Prowess is a wide database of companies in India. The database is popular and carries reliability and authenticity for the data it provides. |

| 2 | RBI: Reserve Bank of India (RBI) is the central bank of India. RBI published statistics of different banks. |

| SN | Name of the Variable | Symbol | Definition | Sources |

|---|---|---|---|---|

| 1 | Nonperforming Assets | NPAs | The proportion of loans that remained unpaid. | (Boudriga et al. 2009; Bian and Deng 2017; Mohsni and Otchere 2018) |

| 2 | Net Interest Margin | NIM | An indicator of profit earned from investing activities. It is measured as the difference between interest earned and interest paid out, divided by average interest-earning assets. | (Tan 2016) |

| 3 | Return on Assets | ROA | A profitability measure of a bank. It is defined as net income divided by assets. | (Boudriga et al. 2009; Lee and Hsieh 2013; Tan 2016) |

| 4 | Capital Adequacy Ratio | CAR | An indicator of capital within the bank that depicts the health of a bank. | (Laeven and Levine 2009; Lee and Hsieh 2013; Zheng et al. 2017) |

| 5 | Leverage Ratio | LR | The ratio of a bank’s core/tier 1 capital and total assets. | (Srairi 2013; Battaglia and Gallo 2017; Mohsni and Otchere 2018) |

| 6 | Promoter Holding | PROM | The percentage of equity holding by promoters. | (Laeven and Levine 2009; Barakat and Hussainey 2013; Haque and Brown 2017; Zheng et al. 2017; Ozili and Uadiale 2017) |

| 7 | Institutional Investor Holding | IIH | The percentage of equity holding by institution. | (Laeven and Levine 2009; Barakat and Hussainey 2013; Haque and Brown 2017; Zheng et al. 2017; Ozili and Uadiale 2017) |

| 8 | Retail Investor Holding | RIH | The percentage of equity holding by retail investors. | (Laeven and Levine 2009; Barakat and Hussainey 2013; Haque and Brown 2017; Zheng et al. 2017; Ozili and Uadiale 2017) |

| Descriptive and Correlation Matrix | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| NPA | NIM | ROA | CAR | LR | PROM | IIH | RIH | Mean | SD | |

| NPA | -- | 4.3236 | 3.1792 | |||||||

| NIM | −0.7023 * | -- | 2.6118 | 0.7198 | ||||||

| ROA | −0.7209 * | 0.6583 * | -- | 0.1479 | 1.1388 | |||||

| CAR | −0.6111 * | 0.4951 * | 0.6485 * | -- | 13.219 | 2.5317 | ||||

| LR | −0.0255 | 0.1349 | 0.0517 * | 0.0696 | -- | 0.1277 | 0.7227 | |||

| PROM | −0.7162 * | −0.5408 * | −0.5682 * | 0.3722 * | −0.1119 | 40.06 | 33.39 | |||

| IIH | −0.5546 * | 0.5369 * | 0.6230 * | 0.6076 * | 0.0416 | 0.6120 * | -- | 34.27 | 23.10 | |

| RIH | −0.4181 * | 0.2130 * | 0.1727 * | −0.0605 | 0.1047 | −0.7255 * | −0.1003 | -- | 25.67 | 26.52 |

| Model 1 (CAR for Regulation) | Model 1 (LR for Regulation) | |||||||

|---|---|---|---|---|---|---|---|---|

| No OC | For PROMP | For IH | For RIH | No OC | For PROMP | For IH | For RIH | |

| NPAs (−1) | −0.7859 | −0.7618 | −0.4459 | −0.8332 | −0.7975 | −0.4799 | −0.4312 | −0.8036 |

| [0.1299] | [0.1720] | [0.1931] | [0.1289] | [0.1606] | [0.1652] | [0.2070] | [0.1527] | |

| (0.0000) | (0.0000) | (0.0210) | (0.0000) | (0.0000) | (0.0040) | (0.0370) | (0.0000) | |

| CAR | −0.3686 | −0.3598 | −0.2844 | −0.4702 | -- | -- | -- | -- |

| [0.1313] | [0.1566] | [0.1154] | [0.1643] | |||||

| (0.0050) | (0.0220) | (0.0140) | (0.0040) | |||||

| LR | -- | -- | -- | -- | 0.0637 | 0.0575 | 0.0719 | 0.0656 |

| [0.0038] | [0.0040] | [0.0062] | [0.0089] | |||||

| (0.0000) | (0.0000) | (0.0000) | (0.0000) | |||||

| PROM | -- | −0.0135 | -- | -- | -- | −0.0586 | -- | -- |

| [0.0346] | [0.0357] | |||||||

| (0.6360) | (0.1010) | |||||||

| IIH | -- | -- | 0.0812 | -- | -- | -- | 0.0811 | -- |

| [0.0403] | [0.0459] | |||||||

| (0.0440) | (0.0780) | |||||||

| RIH | -- | -- | −0.0774 | -- | -- | -- | −0.0090 | |

| [0.0512] | [0.0476] | |||||||

| (0.1300) | (0.8490) | |||||||

| Sargan Test | 7.3808 | 8.1094 | 7.857 | 7.0055 | 9.2586 | 9.1038 | 9.0566 | 9.2619 |

| (0.0250) | (0.0173) | (0.0197) | (0.0301) | (0.0098) | (0.0105) | (0.0108) | (0.0097) | |

| Arellano–Bond AR(1) | −0.3731 | −0.4477 | −1.2620 | −0.2351 | −0.6975 | −1.3485 | −1.4583 | −0.7135 |

| (0.7091) | (0.6544) | (0.2069) | (0.8142) | (0.4855) | (0.1774) | (0.1448) | (0.4755) | |

| KERRYPNX | Model 1 | Model 2 | ||||||

|---|---|---|---|---|---|---|---|---|

| CAR | LR | CAR | LR | |||||

| DV: NIM | PROMP | IIH | RIH | PROMP | IIH | RIH | ||

| NIM (−1) | 0.0403 [0.6456] | 0.5204 [0.7616] | 0.2564 [0.6498] | 0.3179 [0.6416] | −0.2524 [0.4630] | 0.3649 [0.6641] | 0.5583 [0.6887] | −0.0933 [0.4452] |

| (0.9500) | (0.4940) | (0.6930) | (0.6200) | (0.5860) | (0.5830) | (0.4180) | (0.8300) | |

| CAR | −0.0289 [0.0251] | -- | 0.0094 [0.0044] | 0.0090 [0.0265] | 0.0471 [0.0242] | -- | -- | -- |

| (0.2480) | (0.0350) | (0.7340) | (0.0520) | |||||

| LR | -- | 0.0111 [0.0051] | 0.0120 [0.0044] | 0.0070 [0.0060] | 0.0151 [0.0043] | |||

| (0.030) | (0.0070) | (0.2490) | (0.0000) | |||||

| PROM | -- | -- | 0.0050 [0.0260] | -- | -- | 0.0102 [0.0031] | -- | -- |

| (0.8460) | (0.0010) | |||||||

| IIH | -- | -- | -- | −0.0171 [0.1040] | -- | -- | −0.0197 [0.0091] | -- |

| (0.1010) | (0.0310) | |||||||

| RIH | -- | -- | -- | -- | 0.0077 [0.0134] | -- | -- | 0.0004 [0.0119] |

| (0.5640) | (0.9710) | |||||||

| Sargan Test | 2.4558 (0.2929) | 2.9002 (0.2345) | 1.4627 (0.4813) | 1.209 (0.5461) | 2.7488 (0.2530) | 1.7000 (0.4274) | 1.5917 (0.4512) | 4.0142 (0.1344) |

| Arellano–Bond AR(1) | −0.3137 (0.7537) | −0.4632 (0.6432) | −0.6845 (0.4937) | −0.5831 (0.5588) | 0.2798 (0.7643) | −0.7443 (0.4567) | −0.6879 (0.4915) | −0.0441 (0.9648) |

| CAR | LR | PROMP | IIH | RIH | PROMP | IIH | RIH | |

| RoA (−1) | 0.4829 [0.2804] | 0.2817 [0.2417] | 0.5515 [0.3132] | 0.5537 [0.2929] | 0.4412 [0.2983] | 0.3059 [0.2857] | 0.2946 [0.2721] | 0.3210 [0.2665] |

| (0.0920) | (0.2340) | (0.0780) | (0.0590) | (0.1390) | (0.2840) | (0.2790) | (0.2280) | |

| CAR | 0.1675 [0.0774] | -- | 0.21804 [0.0681] | 0.1856 [0.0758] | 0.1900 [0.0783] | -- | -- | -- |

| (0.0310) | (0.0010) | (0.0140) | (0.0150) | |||||

| LR | -- | −0.0219 [0.0062] | -- | -- | -- | 0.0221 [0.0076] | −0.0188 [0.0096] | −0.0246 [0.0062] |

| (0.0000) | (0.0030) | (0.0490) | (0.0000) | |||||

| PROM | -- | -- | 0.0256 [0.0222] | -- | -- | −0.0200 [0.0229] | -- | -- |

| (0.2480) | (0.3820) | |||||||

| IIH | -- | -- | -- | 0.0141 [0.0196] | -- | -- | 0.0163 [0.2054] | -- |

| (0.4710) | (0.4290) | |||||||

| RIH | -- | -- | -- | -- | 0.0271 [0.0278] | -- | -- | 0.0112 [0.0278] |

| (0.3310) | (0.6860) | |||||||

| Sargan Test | 1.8791 (0.3908) | 5.1439 (0.0764) | 2.0789 (0.3536) | 1.9435 (0.3784) | 1.848 (0.3970) | 5.3386 (0.0679) | 5.2742 (0.0716) | 5.7310 (0.0570) |

| Arellano–Bond AR(1) | −1.4827 (0.1382) | −0.7081 (0.4789) | −2.6670 (0.0076) | −2.3175 (0.0205) | −1.3128 (0.1892) | −1.2263 (0.2201) | −0.9663 (0.3332) | −0.8311 (0.4059) |

| Model 1 (Without OC) | Model 2 | |||

|---|---|---|---|---|

| DV: NIM | PROMP | IIH | RIH | |

| NIM (−1) | 0.0489 [1.0301] | −0.1024 [1.030] | −0.0148 [1.0431] | −0.4123 [0.5442] |

| (0.9620) | (0.9210) | (0.9890) | (0.4490) | |

| NPAs | 0.0607 [0.01434] | −0.0571 [0.1306] | −0.0542 [0.0175] | −0.0602 [0.0109] |

| (0.0000) | (0.0000) | (0.0020) | (0.0000) | |

| PROM | -- | 0.0031 [0.0051] | -- | -- |

| (0.5390) | ||||

| IIH | -- | -- | −0.0098 [0.0114] | -- |

| (0.4190) | ||||

| RIH | -- | −0.0030 [0.0109] | ||

| (0.7840) | ||||

| Sargan Test | 2.1202 (0.3464) | 2.2426 (0.3259) | 1.9918 (0.3694) | 1.5850 (0.4528) |

| Arellano–Bond AR(1) | −0.1122 (0.9106) | 0.0205 (0.9833) | 0.0262 (0.9791) | 0.8423 (0.3996) |

| DV: RoA | PROMP | IIH | RIH | |

| RoA (−1) | 0.2916 [0.2101] | 0.2169 [0.2398] | 0.3024 [0.2344] | 0.3099 [0.2270] |

| (0.1650) | (0.3660) | (0.1970) | (0.1720) | |

| NPA | −0.2151 [0.0804] | −0.2266 [0.0785] | −0.2385 [0.0858] | −0.2240 (0.0806) |

| (0.0070) | (0.0040) | (0.0050) | (0.0050) | |

| PROM | -- | −0.0442 [0.0200] | ||

| (0.0270) | ||||

| IIH | 0.03713 [0.0175] | |||

| (0.0340) | ||||

| RIH | 0.0038 [0.0275] | |||

| (0.8910) | ||||

| Sargan Test | 5.8870 (0.0527) | 5.4570 (0.0065) | 0.5412 (0.0668) | 6.1070 (0.0472) |

| Arellano–Bond AR(1) | 0.1221 (0.9026) | −0.4328 (0.6651) | −0.3907 (0.6960) | 0.0605 (0.9517) |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Rastogi, S.; Gupte, R.; Meenakshi, R. A Holistic Perspective on Bank Performance Using Regulation, Profitability, and Risk-Taking with a View on Ownership Concentration. J. Risk Financial Manag. 2021, 14, 111. https://doi.org/10.3390/jrfm14030111

Rastogi S, Gupte R, Meenakshi R. A Holistic Perspective on Bank Performance Using Regulation, Profitability, and Risk-Taking with a View on Ownership Concentration. Journal of Risk and Financial Management. 2021; 14(3):111. https://doi.org/10.3390/jrfm14030111

Chicago/Turabian StyleRastogi, Shailesh, Rajani Gupte, and R. Meenakshi. 2021. "A Holistic Perspective on Bank Performance Using Regulation, Profitability, and Risk-Taking with a View on Ownership Concentration" Journal of Risk and Financial Management 14, no. 3: 111. https://doi.org/10.3390/jrfm14030111

APA StyleRastogi, S., Gupte, R., & Meenakshi, R. (2021). A Holistic Perspective on Bank Performance Using Regulation, Profitability, and Risk-Taking with a View on Ownership Concentration. Journal of Risk and Financial Management, 14(3), 111. https://doi.org/10.3390/jrfm14030111