Complementary Currencies for Humanitarian Aid

Abstract

1. Introduction

2. Why Try Something New?

2.1. Unconditional Cash Transfers

“… the provision of assistance in the form of money—either physical currency or e-cash—to recipients (individuals, households or communities). Cash transfers are by definition unrestricted in terms of use and distinct from restricted modalities including vouchers and in-kind assistance”.

2.2. Vouchers or Conditional Cash Transfers

“… a paper, token or e-voucher that can be exchanged for a set quantity or value of goods or services, denominated either as a cash value (e.g., $15) or predetermined commodities (e.g., 5 kg maize) or specific services (e.g., milling of 5 kg of maize), or a combination of value and commodities. … They are redeemable with preselected vendors or in ‘fairs’ created by the implementing agency”.

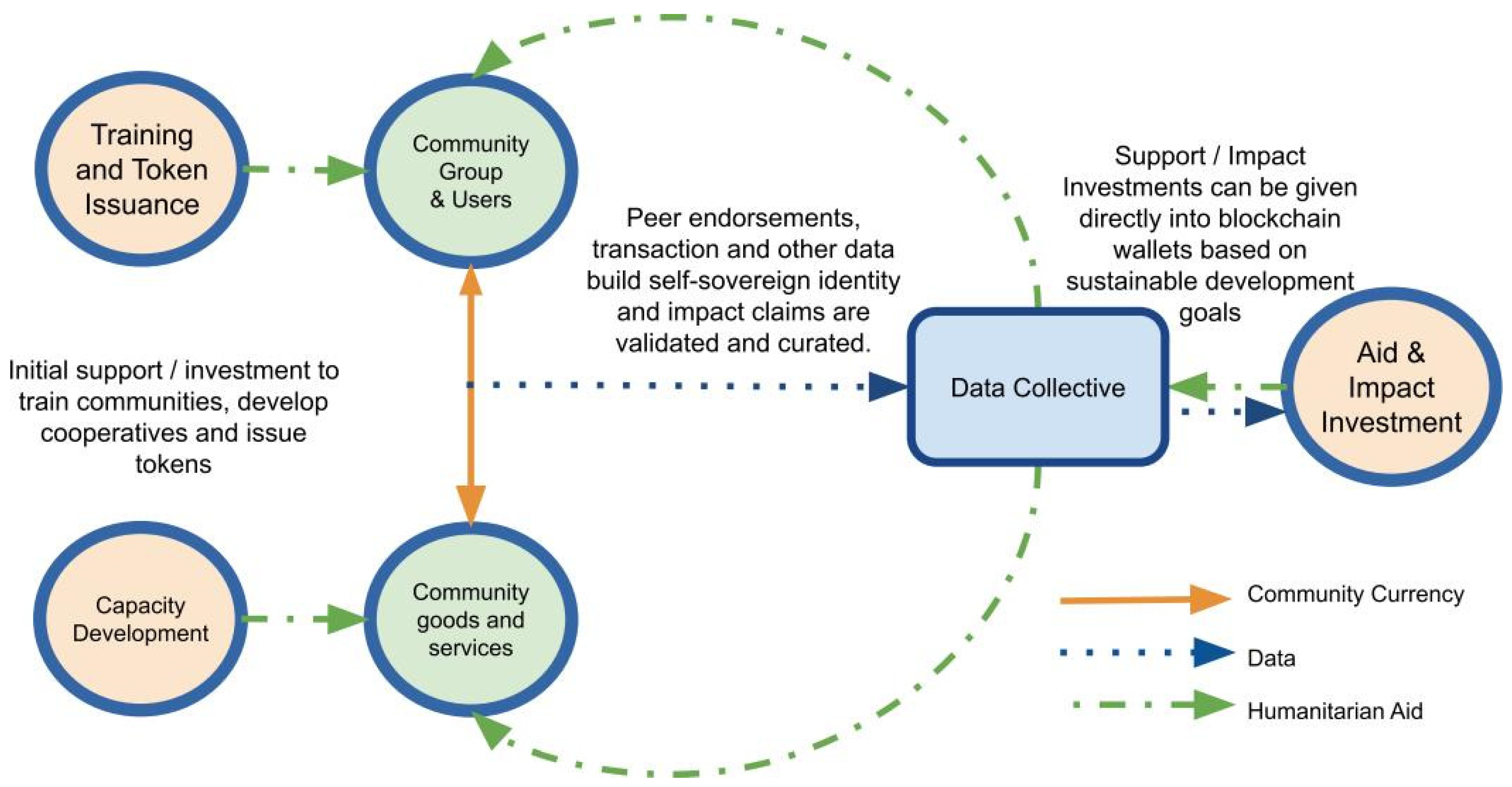

2.3. Complementary Currency Systems

3. Backward and Forward Production Linkages

- backward linkages: demand-side stimuli, formed when a new activity, e.g., import replacement, generates effective demand for local inputs, making viable (new) upstream activities that feed into it by supplying inputs.

- forward linkages: supply-side stimuli formed when new activities emerge downstream as a result of a plant or business coming into operation, and intermediate goods become available for local producers that previously did not exist.

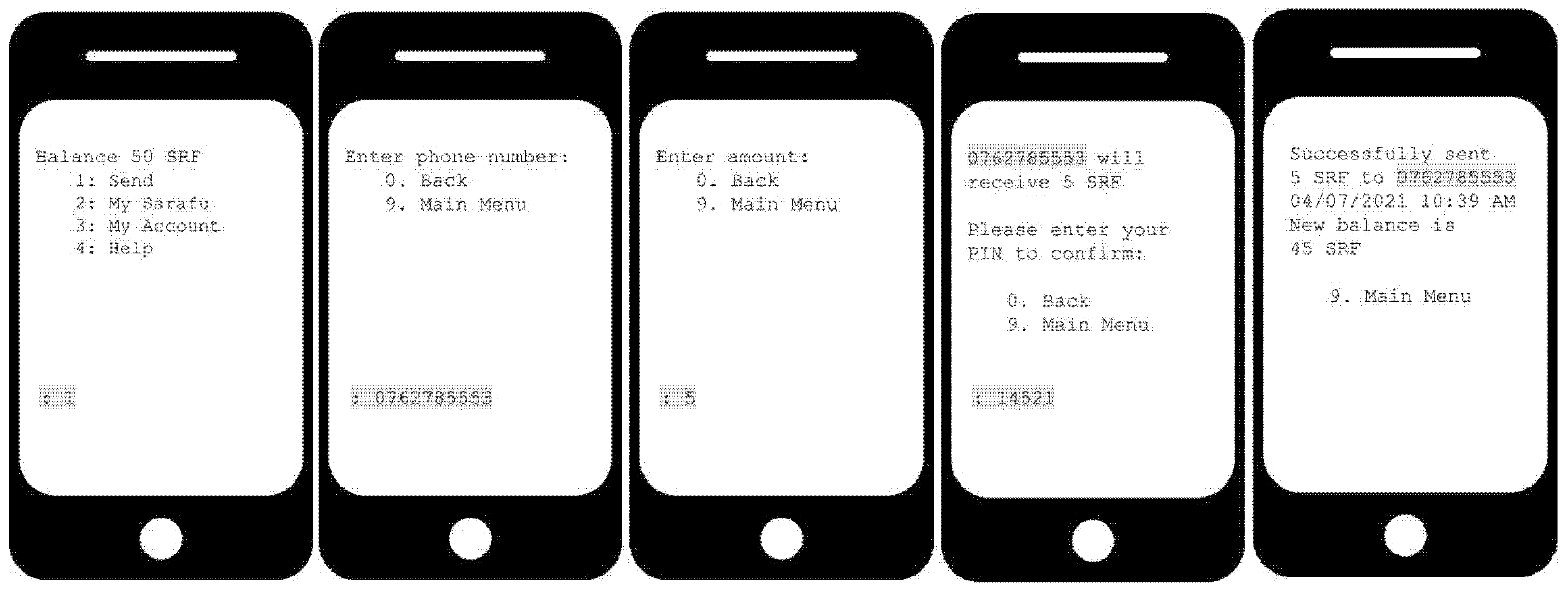

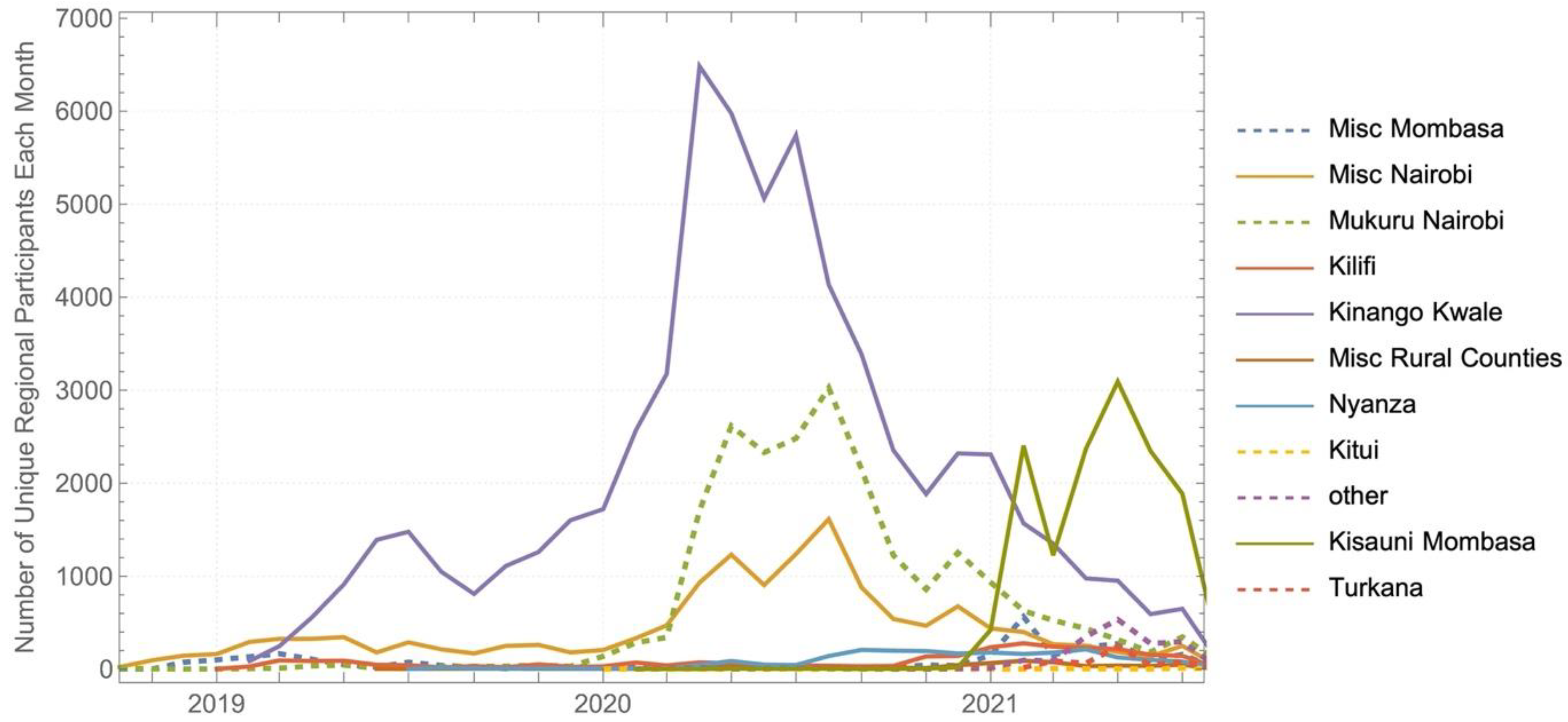

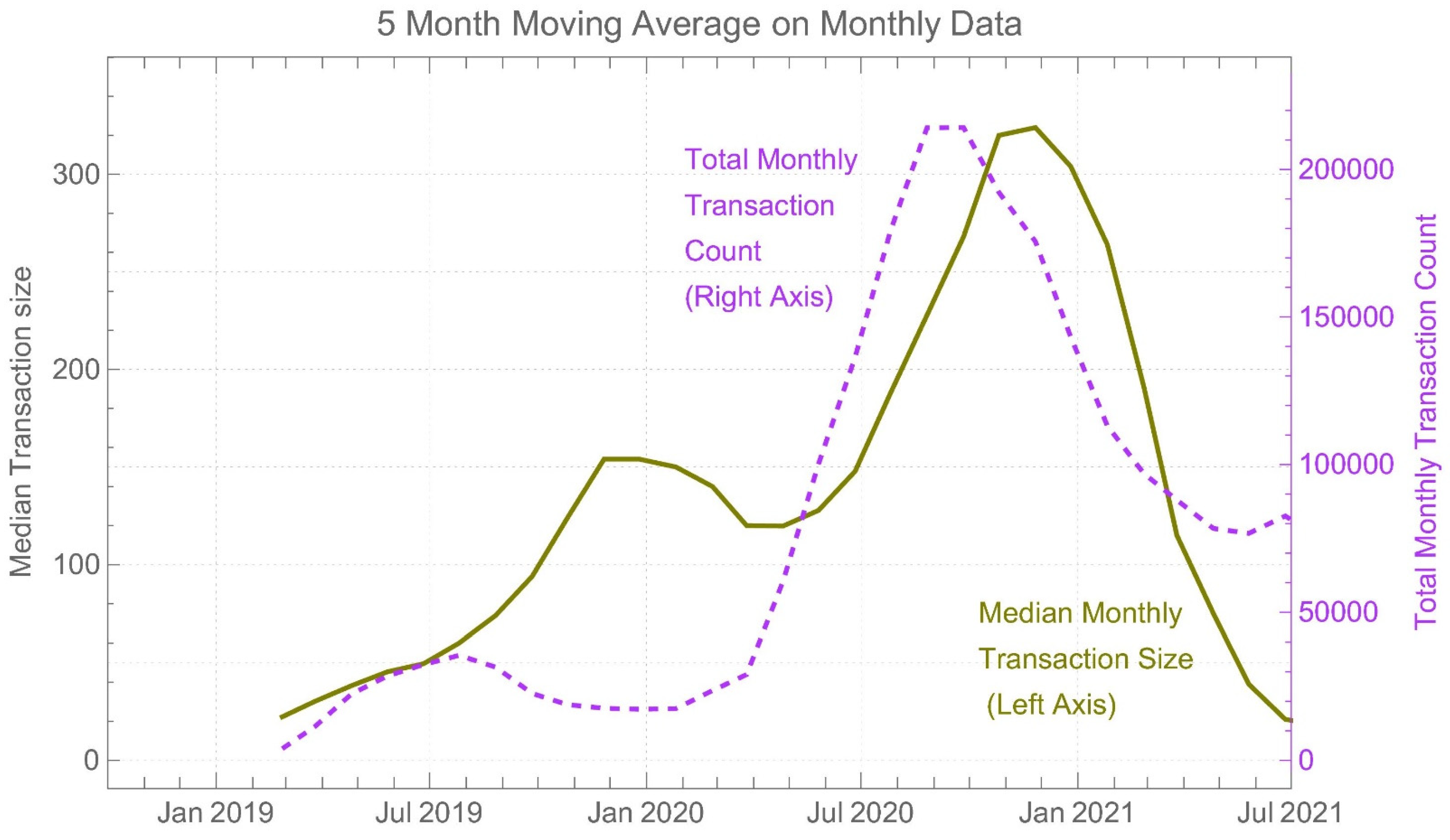

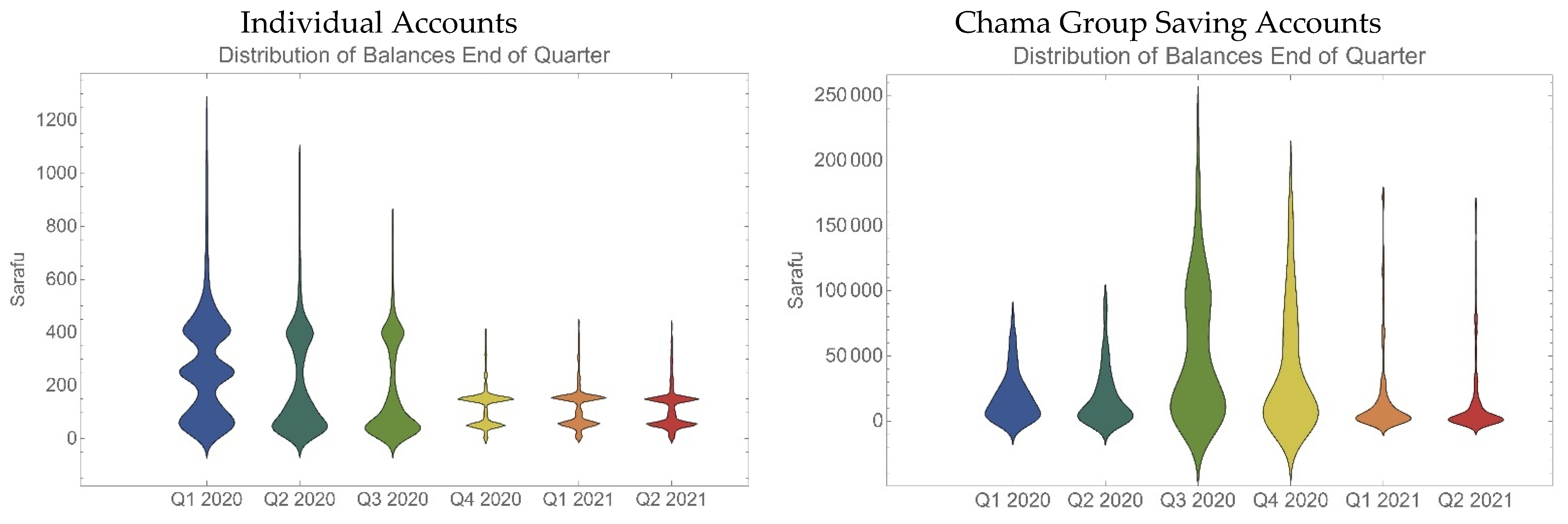

4. Community Currencies in Kenya

4.1. A Short History

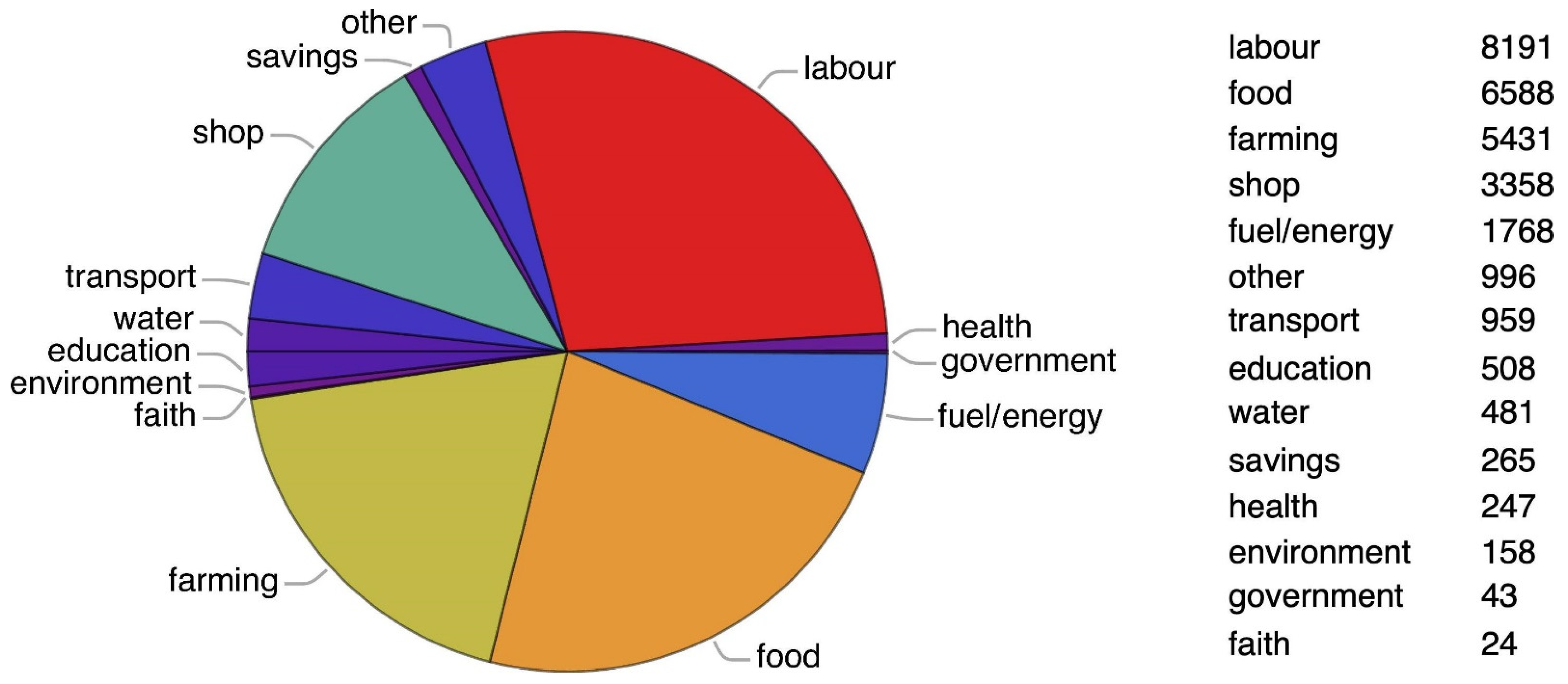

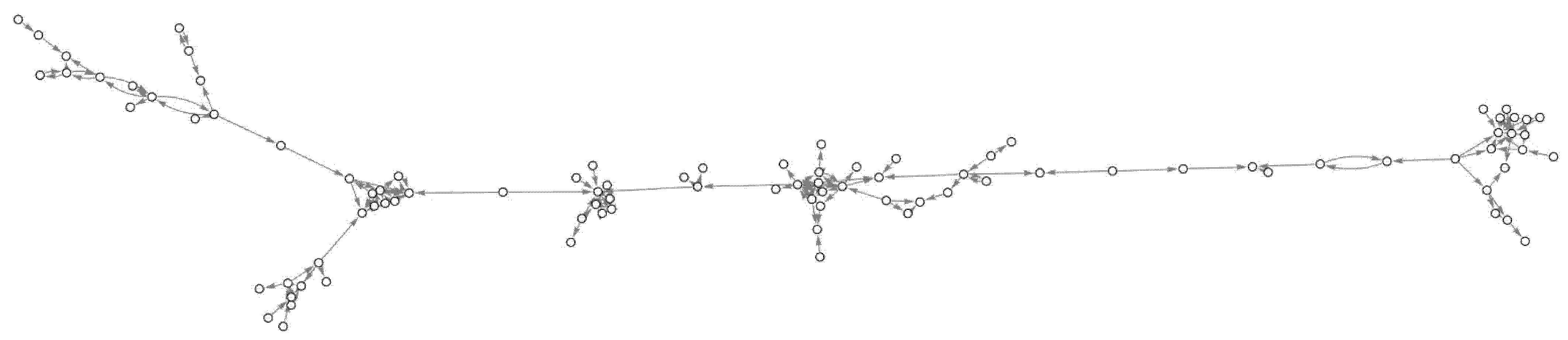

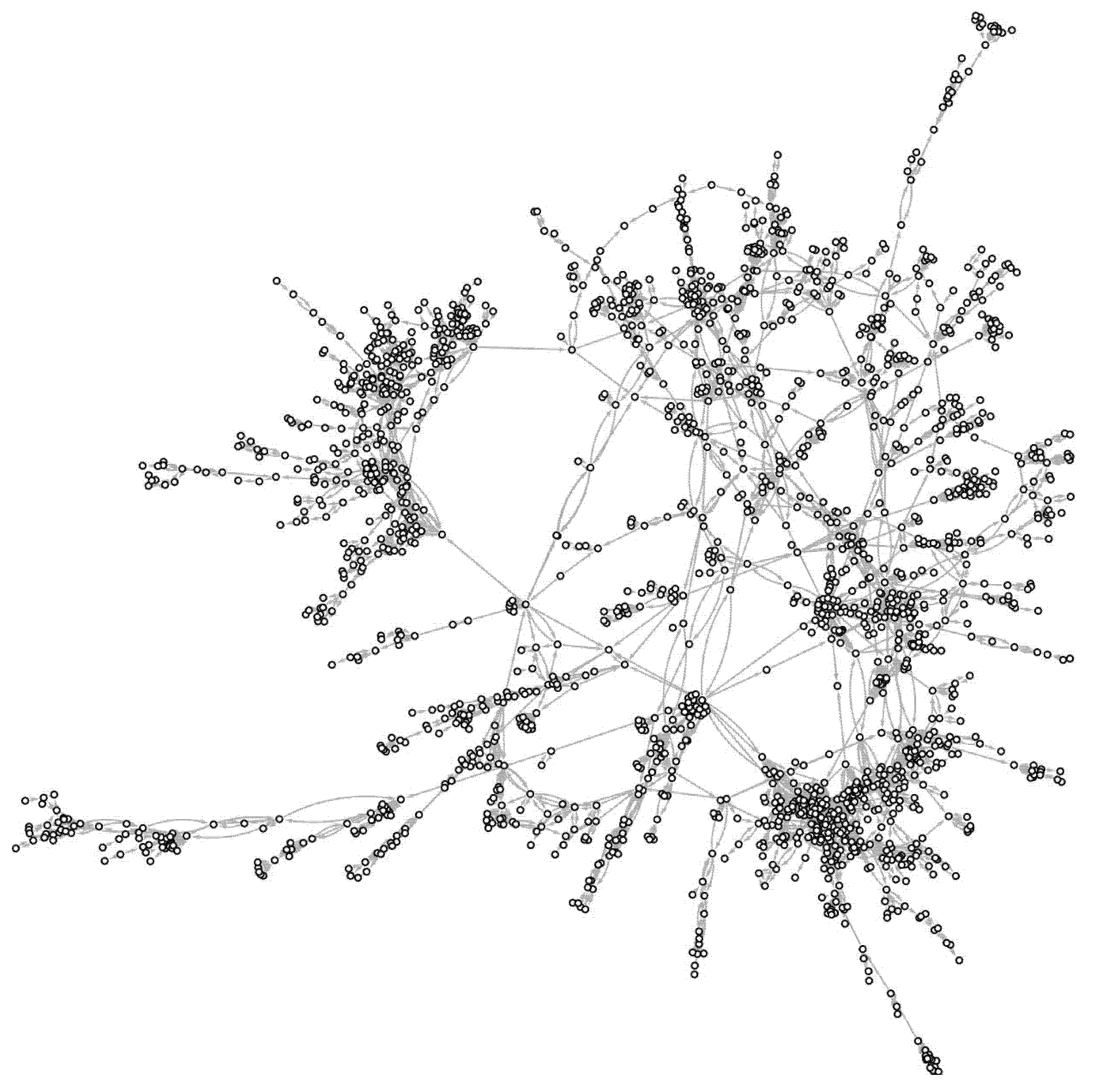

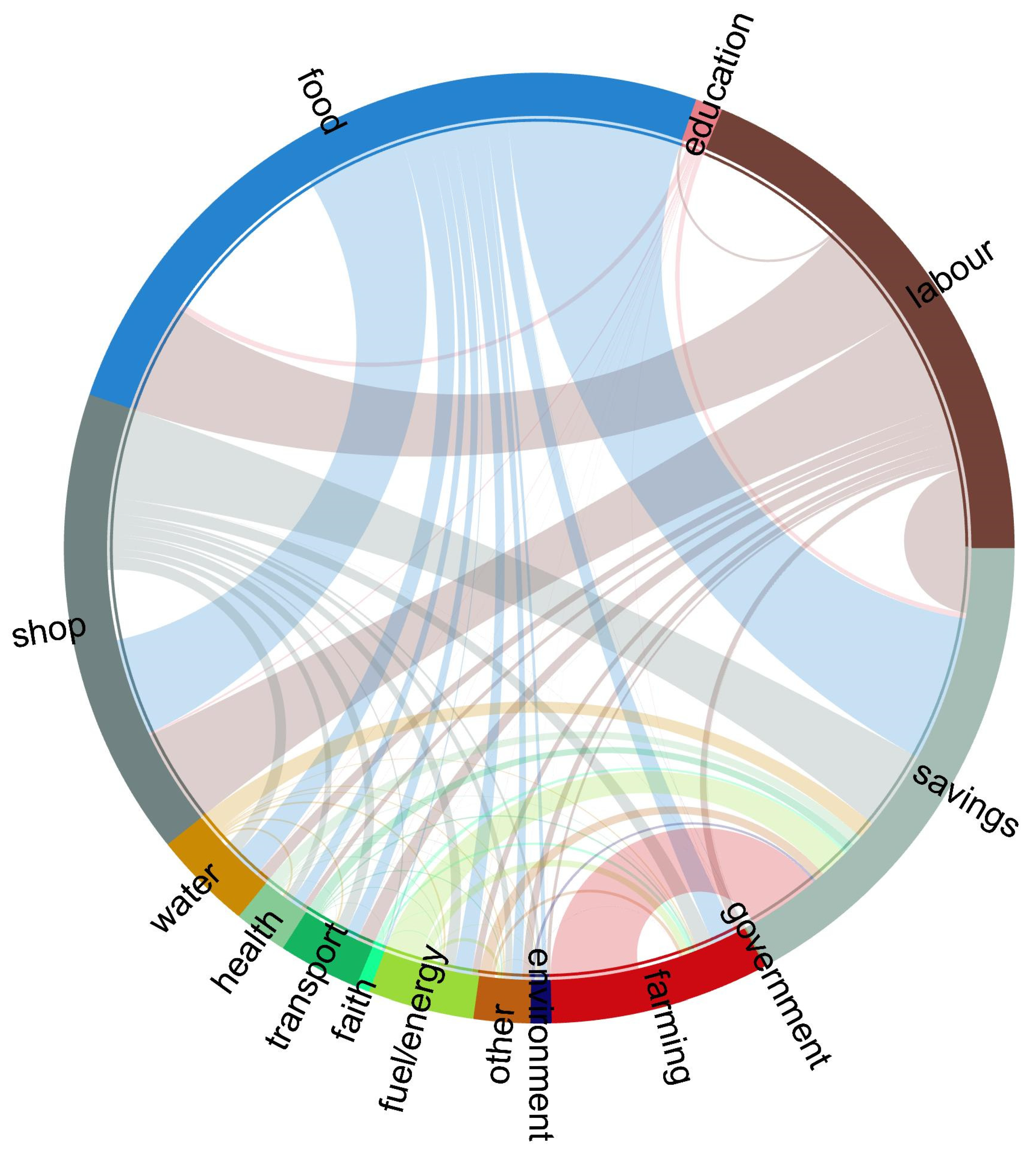

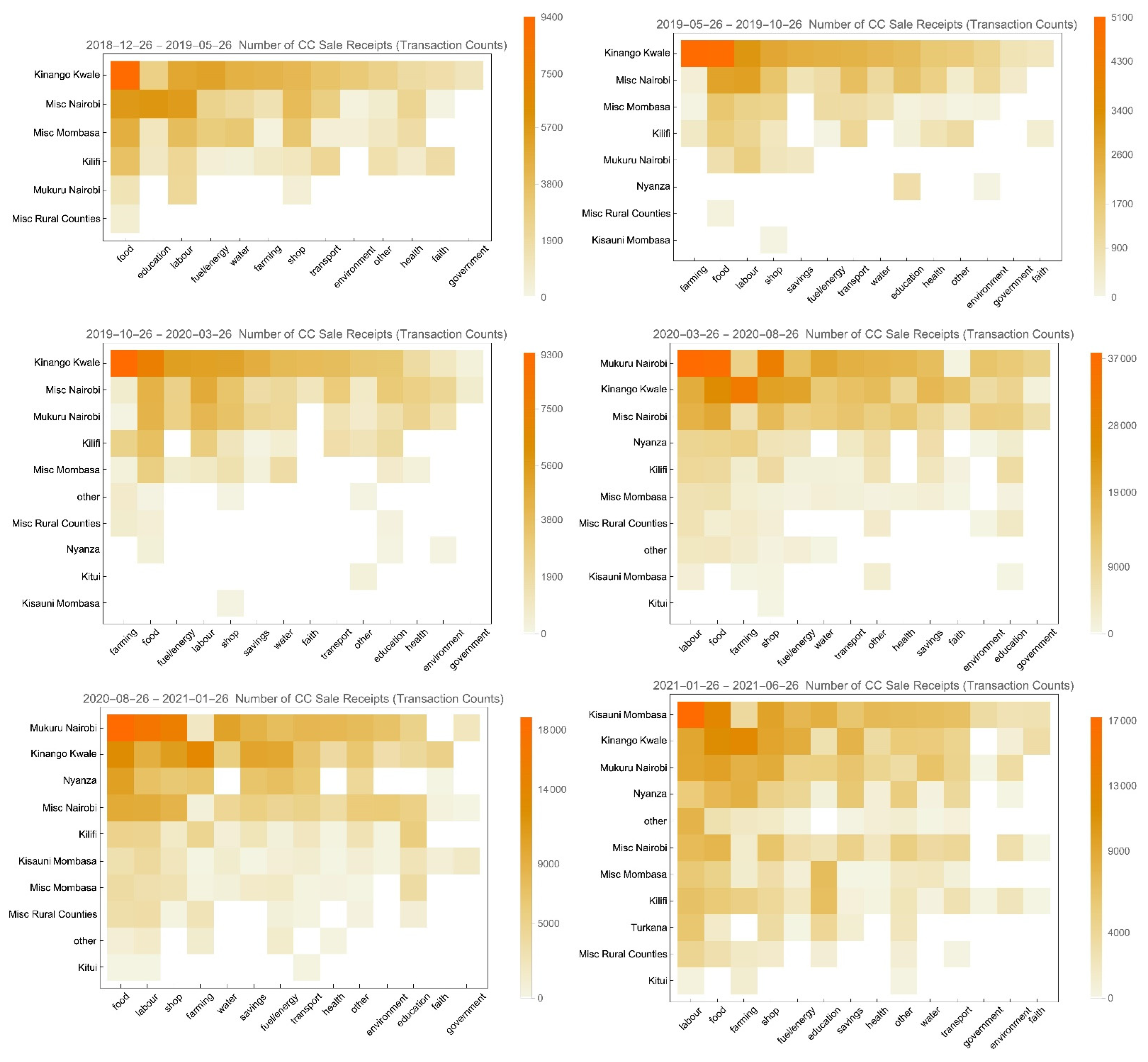

4.2. Real Trade Network

“We always save money in our table banking group [chama] and then exchange it for Sarafu. Everyone gets a share according to their savings. All our phones always have Sarafu which we use for various uses; to buy food and supplies for my pastry business”.—Female, Kinango Kwale

5. Conclusions

Author Contributions

Funding

Data Availability Statement

Acknowledgments

Conflicts of Interest

| 1 | https://www.grassrootseconomics.org/about (accessed on 27 July 2021). |

| 2 | https://innovation.wfp.org/project/building-blocks (accessed on 27 July 2021). |

| 3 | https://www.unicef.org/press-releases/unicef-launches-cryptocurrency-fund (accessed on 27 July 2021). |

| 4 | https://www.unicef.org/innovation/stories/grantee-macro-eyes (accessed on 27 July 2021). |

| 5 | |

| 6 | In the Berkshires of Massachusetts local banks will sell 100 Berkshares for 95 USD, and buy 95 USD for 100 Berkshares. https://centerforneweconomics.org/apply/local-currencies-program/#BerkShares (accessed on 27 July 2021). |

| 7 | https://www.community-exchange.org/ (accessed on 27 July 2021). |

| 8 | https://www.sardexpay.net/ (accessed on 27 July 2021). |

| 9 | For example the Hudson Valley CC in the United States converts its currency into business advertising in a local newspaper (see Ussher et al. 2019). |

| 10 | The complicated history of GE and its CCs is summarized in this section with a focus on the CC design and its integration with humanitarian donor foundations. More details can be found in the papers cited and on the GE website https://www.grassrootseconomics.org/research (accessed on 27 July 2021). |

| 11 | Regardless of how good intentions might be, such wealth transfers are common among mutual credits that fail to match trades and exclude the option of conversion as discussed above in Section 2.3. This is true regardless of whether they begin with a balance of zero or some positive number. At some point all platforms are forced to clear their imbalances else/when their membership stops growing. |

| 12 | Despite being named in honor of Keynes’s famous international multilateral clearing proposal of 1941, which failed to be implemented at Bretton Woods, the Bancor protocol and its Bonding curve design could only be described as a distant cousin. However, it did have a multilateral clearing currency that was separate from each community currency. Imbalances, rather than being remedied by Keynes’ ‘fixed but adjustable exchange rates’, had programmable continuous exchange rates via a bonding curve that would adjust to balance trade deficits and surpluses (for details regarding the bonding curve see Hertzog et al. 2018). |

| 13 | Like gold or bitcoin, the creation (or mining) of crypto currencies have equity rather than debt as their balance sheet counterpart. |

| 14 | This paper for the most part is focused on transactions between members and chamas, and excludes data analysis of financial transactions or the impact of exchange rate fluctuations in the 2019 period, leaving this to future research. More specifics on the entire ecosystem can be found at https://grassrootseconomics.org/blog (accessed on 27 July 2021). |

| 15 | See Ruddick (2020a) CIC white paper https://gitlab.com/grassrootseconomics/cic-docs/-/blob/master/CIC-White-Paper.pdf (accessed on 27 July 2021). |

| 16 | All the data analysis in Section 4 combines time series for both the 2018/2019 POA blockchain data and the 2020/21 xDai blockchain data. We have excluded all: transfers that are disbursements and conversions or reclamations; business-types that are system, administration, or enrolment agents; smart contract transactions during the POA period; and members with missing region-types presumed to be one of the prior entities. Data included are ‘standard’ transactions that are assumed to be in exchange for real goods or services by the CC members (‘beneficiaries’) and chamas (‘group accounts’). The only caveat is that individual saving deposits and withdrawals with chamas which are not in exchange for goods or services, have not been removed even though they would be considered an internal financial transfer. The full dataset (Ruddick 2021) and its description are available at https://reshare.ukdataservice.ac.uk/855142/ (accessed on 27 July 2021). |

| 17 | https://www.grassrootseconomics.org/post/crisis-supply-chains (accessed on 27 July 2021). |

| 18 | https://data.worldbank.org/indicator/NY.GDP.MKTP.KD.ZG?locations=KE (accessed on 27 July 2021). |

| 19 | |

| 20 | Several new blockchains have been piloted by Grassroots Economics, but due to erratic fees (gas) a future move is planned to the bloxberg.org blockchain. Bloxberg is an Ethereum Virtual Machine—Proof of Authority blockchain developed and run by universities and research organizations like the Max Planck Digital Library. |

References

- Adriano, Andreas. 2021. Innovation Sparks Community Currencies—IMF F&D. Finance and Development, International Monetary Fund. Available online: https://www.imf.org/external/pubs/ft/fandd/2021/03/technological-innovation-fueling-community-currencies-adriano.htm (accessed on 9 July 2021).

- Allende López, Marcos. 2020. Self-Sovereign Identity: The Future of Identity: Self-Sovereignty, Digital Wallets, and Blockchain. Washington: Inter-American Development Bank (IADB) Publications. Available online: https://publications.iadb.org/publications/english/document/Self-Sovereign-Identity-The-Future-of-Identity-Self-Sovereignity-Digital-Wallets-and-Blockchain.pdf (accessed on 9 July 2021).

- Amato, Massimo, and Luca Fantacci. 2012. The End of Finance. Cambridge: Polity Press. [Google Scholar]

- Amato, Massimo, and Luca Fantacci. 2014. Saving the Market from Capitalism: Ideas for an Alternative Finance. Cambridge: Polity Press. [Google Scholar]

- Arur, Aneesa, Nelson Gitonga, Barbara O’Hanlon, Francis Kundu, Maggie Senkaali, and Richard Ssemujju. 2009. Insights from Innovations: Lessons from Designing and Implementing Family Planning/Reproductive Health Voucher Programs in Kenya and Uganda; Bethesda: Private Sector Partnerships-One Project, Abt Associates Inc. Available online: https://pdf.usaid.gov/pdf_docs/Pnadp185.pdf (accessed on 9 July 2021).

- Baird, Sarah, Craig McIntosh, and Berk Özler. 2019. When the Money Runs Out: Do Cash Transfers Have Sustained Effects on Human Capital Accumulation? Journal of Development Economics 140: 169–85. [Google Scholar] [CrossRef]

- Barinaga, Ester. 2020. A Route to Commons-Based Democratic Monies? Embedding the Governance of Money in Traditional Communal Institutions. Frontiers in Blockchain 3: 575851. [Google Scholar] [CrossRef]

- Barinaga, Ester, Maria Jose Zapata, and William Ruddick. 2019. Malleable Grassroots Infrastructures for the Interstices: The Case of the Kenyan Community Currencies. Paper presented at the WINIR Conference in the Special Themed Session “Multiple Currency Systems: Blessing and Curse”, Lund University, Lund, Sweden, September 19–22. [Google Scholar]

- Blanc, Jerome. 2012. Thirty Years of Community and Complementary Currencies: A Review of Impacts, Potential and Challenges. International Journal of Community Currency Research 16: 1–4. [Google Scholar]

- CaLP. 2020. Definition of Cash Transfer. Cash Learning Partnership. Available online: https://www.calpnet-work.org/resources/glossary-of-terms/ (accessed on 9 July 2021).

- Center for Global Development. 2015. Doing Cash Differently: How Cash Transfers Can Transform Humanitarian Aid: Report of the High Level Panel on Humanitarian Cash Transfers. Available online: https://www.cgdev.org/publication/doing-cash-differently-how-cash-transfers-can-transform-humanitarian-aid (accessed on 9 July 2021).

- Clemens, Michael A., Steven Radelet, Rikhil R. Bhavnani, and Samuel Bazzi. 2004. Counting Chickens When They Hatch: Timing and the Effects of Aid on Growth. CGD Working Paper 44. Washington D.C. Available online: www.cgdev.org (accessed on 9 July 2021).

- Creti, Pantaleo, and Suzanne Jaspars. 2006. Cash-Transfer Programming in Emergencies. Oxford: Oxfam. [Google Scholar]

- Cunha, Jesse, Giacomo De Giorgi, and Seema Jayachandran. 2019. The Price Effects of Cash versus In-Kind Transfers. The Review of Economic Studies 86: 240–81. [Google Scholar] [CrossRef]

- Dhameja, Gautam. 2019. UN World Food Programme Uses Parity Ethereum to Aid 100,000 Refugees. London: Parity Technologies, February 18, Available online: https://www.parity.io/blog/un-world-food-programme-uses-parity-ethereum-to-aid-100-000-refugees (accessed on 9 July 2021).

- Dissaux, Tristan, and William Ruddick. 2017. Challenges of Collective Organization and Institution Building around Community Currencies in Kenyan Slums. Paper presented at the IV Conferencia Internacional Monedas Sociales y Complementarias, Barcelona, Spain, May 10–14; Available online: https://1fce7114-8e4a-43c5-bcbd-d2b877364fde.filesusr.com/ugd/ce30dd_587aac7d67c24846a1fe747c036d4db8.pdf (accessed on 9 July 2021).

- Ellerman, David. 2005. How Do We Grow?: Jane Jacobs on Diversification and Specialization. Challenge 48: 50–83. [Google Scholar] [CrossRef]

- Fare, Marie, and Pepita Ould Ahmed. 2014. The Complementary Currency Systems: A Tricky Issue for Economists. Le Centre pour la Communication Scientifique Directe (CCSD). Available online: https://hal.ird.fr/ird-01081350 (accessed on 9 July 2021).

- Gentilini, Ugo. 2016. Revisiting the “Cash versus Food” Debate: New Evidence for an Old Puzzle? The World Bank Research Observer 31: 135–67. [Google Scholar] [CrossRef][Green Version]

- Gentilini, Ugo, Mohamed Almenfi, Ian Orton, and Pamela Dale. 2020. Social Protection and Jobs Responses to COVID-19: A Real-time Review of Country Measures. Living Paper, version 5. April 17. Available online: https://openknowledge.worldbank.org/bitstream/handle/10986/33635/Social-Protection-and-Jobs-Responses-to-COVID-19-A-Real-Time-Review-of-Country-Measures-April-17-2020.pdf?sequence=1&isAllowed=y (accessed on 9 July 2021).

- Ghosh, B. N., ed. 2019. Dependency Theory Revisited, 1st ed. London: Routledge. [Google Scholar] [CrossRef]

- Gómez, Georgina, ed. 2019. Monetary Plurality in Local, Regional and Global Economies. London: Routledge. ISBN 9780367587598. [Google Scholar] [CrossRef]

- Gómez, Georgina, and Bert Helmsing. 2008. Selective Spatial Closure and Local Economic Development: What Do We Learn from the Argentine Local Currency Systems? World Development 36: 2489–511. [Google Scholar] [CrossRef]

- Greco, Thomas, Jr. 1990. Money and Debt: A Solution to the Global Crisis. Tuscon: Thomas Greco, Jr. Publisher. Available online: https://reinventingmoney.com/money-and-debt-a-solution-to-the-global-crisis/ (accessed on 9 July 2021).

- Greco, Thomas, Jr. 2018. Local Currencies—What Works; What Doesn’t? Beyond Money Blog. Available online: https://beyondmoney.files.wordpress.com/2018/02/local-currenciese28094what-works.pdf (accessed on 9 July 2021).

- Handa, Sudhanshu, and Benjamin Davis. 2006. The Experience of Conditional Cash Transfers in Latin America and the Caribbean. ESA Working Paper No. 06-07. Available online: https://www.fao.org/3/ag429t/ag429t.pdf (accessed on 9 July 2021).

- Davis, Benjamin, and Sudhanshu Handa. 2015. How Much Do Programmes Pay? Transfer Size in Selected National cash Transfer Programmes in Sub-Saharan Africa. Office of Research-Innocenti Research Papers. Florence: UNICEF. [Google Scholar] [CrossRef]

- Hausmann, Ricardo, and César Hidalgo. 2010. Country Diversification, Product Ubiquity, and Economic Divergence. HKS Faculty Research Working Paper Series RWP10-045; Cambridge: John F. Kennedy School of Government, Harvard University. [Google Scholar]

- Hausmann, Ricardo, and César Hidalgo. 2011. The Network Structure of Economic Output. Journal of Economic Growth 16: 309–42. Available online: https://growthlab.cid.harvard.edu/publications/network-structure-economic-output (accessed on 9 July 2021). [CrossRef]

- Hausmann, Ricardo, César Hidalgo, Sebastián Bustos, Michele Coscia, Alexander Simoes, and Muhammed Yildirim. 2013. The Atlas of Economic Complexity: Mapping Paths to Prosperity. Cambridge: MIT Press, Center for International Development, Harvard University. [Google Scholar]

- Hertzog, Eyal, Gail Benartzi, and Guy Benartzi. 2018. Bancor Protocol: Continuous Liquidity for Cryptographic Tokens through Smart Contracts. Available online: https://storage.googleapis.com/website-bancor/2018/04/01ba8253-bancor_protocol_whitepaper_en.pdf (accessed on 9 July 2021).

- Hirschman, Albert Otto. 1958. The Strategy of Economic Development. New Haven: Yale University Press. [Google Scholar]

- Holguín-Veras, Jose, Miguel Jaller, and Tricia Wachtendorf. 2012a. Comparative Performance of Alternative Humanitarian Logistic Structures after the Port-au-Prince Earthquake: ACEs, PIEs, and CANs. Transportation Research Part A: Policy and Practice 46: 1623–40. [Google Scholar] [CrossRef]

- Holguín-Veras, Jose, Miguel Jaller, Luk N. Van Wassenhove, Noel Pérez, and Tricia Wachtendorf. 2012b. On the unique features of post-disaster humanitarian logistics. Journal of Operations Management 30: 494–506. [Google Scholar] [CrossRef]

- Huber, Lucas, and Jens Martignoni. 2013. Improving Complementary Currency Interchange by a Regional Hub Solution. International Journal of Community Currency Research 17: 1–7. [Google Scholar] [CrossRef]

- Hunink, Yvo. 2019. Fighting Hunger—Blockchain for Change. Available online: https://blockchainforchange.thespindle.org/6090/fighting-hunger (accessed on 9 July 2021).

- IASC. 2021. Grand Bargain 2.0 Framework and Annexes. Inter-Agency Standing Committee. Available online: https://interagencystandingcommittee.org/grand-bargain-official-website/grand-bargain-20-framework-and-annexes-deenesfr-0 (accessed on 9 July 2021).

- Ingram, George. 2020. Civil Society: An Essential Ingredient of Development. Washington: Brookings, April 6, Available online: https://www.brookings.edu/blog/up-front/2020/04/06/civil-society-an-essential-ingredient-of-development/ (accessed on 9 July 2021).

- International Monetary Fund. 2021. World Economic Outlook. Managing Divergent Recoveries. Available online: https://www.imf.org/en/Publications/WEO/Issues/2021/03/23/world-economic-outlook-april-2021 (accessed on 9 July 2021).

- Jacobs, Jane. 2000. The Nature of Economies. New York: Random House. [Google Scholar]

- Jodar, Jose, Anna Kondakhchyan, Ruth McCormack, Karen Peachey, Laura Phelps, and Gabby Smith. 2020. The State of the World’s Cash 2020: Cash and Voucher Assistance in Humanitarian Aid. The Cash Learning Partnership. Available online: https://www.calpnetwork.org/publication/the-state-of-the-worlds-cash-2020-full-report/ (accessed on 9 July 2021).

- Kabonga, Itai. 2017. Dependency Theory and Donor Aid: A Critical Analysis. Africanus: Journal of Development Studies 46: 29–39. [Google Scholar] [CrossRef]

- Kenyan Central Bank. 2019. 2019 Financial Access (FinAccess) Household Survey: Access, Usage, Quality, Impact. April. Also Created by Kenya National Bureau of Statistics (KNBS) and Financial Sector Deepening (FSD) Kenya. Available online: https://www.centralbank.go.ke/finaccess/2019FinAccesReport.pdf (accessed on 9 July 2021).

- Kripke, Gawain. 2005. Food Aid or Hidden Dumping?: Separating Wheat from Chaff (No. 71; Oxfam Briefing Paper). Available online: https://policy-practice.oxfam.org/resources/food-aid-or-hidden-dumping-separating-wheat-from-chaff-114492/ (accessed on 9 July 2021).

- Linton, Michael, and Angus Soutar. 1994. The LETSystem Design Manual. Version No 1.3. Courtenay: Landsman Community Services. [Google Scholar]

- Lucarelli, Stefano, and Lucio Gobbi. 2016. Local Clearing Unions as Stabilizers of Local Economic Systems: A Stock Flow Consistent Perspective. Cambridge Journal of Economics 40: 1397–420. [Google Scholar] [CrossRef]

- Mas, Ignacio, and Olga Morawczynski. 2009. Designing Mobile Money Services: Lessons from M-PESA. Innovations: Technology, Governance, Globalization 4: 77–91. [Google Scholar] [CrossRef]

- Mehrling, Perry. 2011. The New Lombard Street: How the Fed Became the Dealer of Last Resort. Princeton: Princeton University Press. [Google Scholar]

- Meyer, Camille, and Marek Hudon. 2017. Alternative Organizations in Finance: Commoning in Complementary Currencies. Organization 24: 629–47. [Google Scholar] [CrossRef]

- Michel, James. 2016. Beyond Aid. The Integration of Sustainable Development in a Coherent International Agenda. Available online: www.csis.org (accessed on 9 July 2021).

- Moyo, Dambisa. 2010. Dead Aid: Why Aid Makes Things Worse and How There Is Another Way for Africa. London: Penguin Books. [Google Scholar]

- North, Peter. 2007. Money and Liberation. The Micropolitics of Alternative Currency Movements. Minneapolis and London: University of Minnesota Press. [Google Scholar]

- Pelling, Mark, and Chris High. 2005. Understanding Adaptation: What can Social Capital Offer Assessments of Adaptive Capacity? Global Environmental Change 15: 308–19. [Google Scholar] [CrossRef]

- Riegel, Edwin Clarence. 1944. Private Enterprise Money: A Non-Political Money System. Available online: http://www.newapproachtofreedom.info/documents/pem.pdf (accessed on 9 July 2021).

- Ruddick, William. 2011. Eco-Pesa: An Evaluation of a Complementary Currency Programme in Kenya’s Informal Settlements. International Journal of Community Currency Research 15: 1–12. [Google Scholar]

- Ruddick, William O. 2020a. Community Inclusion Currency White Paper. Available online: https://gitlab.com/grassrootseconomics/cic-docs/-/blob/master/CIC-White-Paper.pdf (accessed on 9 July 2021).

- Ruddick, William. 2020b. Red Cross (Kenya) CIC Program Survey. Available online: https://www.grassrootseconomics.org/post/red-cross-cic-pilot-survey-mukuru-kenya (accessed on 9 July 2021).

- Ruddick, William. 2021. Sarafu Community Inclusion Currency, 2020–2021. [Data Collection]. Colchester: UK Data Service. [Google Scholar] [CrossRef]

- Ruddick, William, Morgan A. Richards, and Jem Bendell. 2015. Complementary Currencies for Sustainable Development in Kenya: The Case of the Bangla-pesa. International Journal of Community Currency Research 19: 18–30. [Google Scholar]

- Ryan-Collins, Josh. 2011. Building Local Resilience: The Emergence of the UK Transition Currencies. International Journal of Community Currency Research 15: 61–67. [Google Scholar]

- Santos, Milton. 1979. Shared Space: The Two Circuits of the Urban Economy in Underdeveloped Countries. London: Routledge. [Google Scholar]

- Scott Cato, Molly, and Marta Suárez. 2012. Stroud Pound: A Local Currency to Map, Measure and Strengthen the Local Economy. International Journal of Community Currency Research 16: 106–15. [Google Scholar] [CrossRef]

- Slater, Matthew, and Tim Jenkin. 2016. The Credit Commons: A Money for the Solidarity Economy. Available online: http://creditcommons.net/assets/credit-commons.pdf (accessed on 9 July 2021).

- Tay, Selassie. 2020. Expansion of Mobile Money in Africa: The Transaction Fee Concern in Ghana and Uganda. Available online: https://www.linkedin.com/pulse/expansion-mobile-money-africa-transaction-fee-concern-selassie-tay (accessed on 9 July 2021).

- The Economist. 2018. Cash to the Poor: Pennies from Heaven. October 26. Available online: https://www.economist.com/international/2013/12/12/pennies-from-heaven (accessed on 9 July 2021).

- Thirlwall, Anthony Philip. 2012. Balance of Payments Constrained Growth Models: History and Overview. In Models of Balance of Payments Constrained Growth. Edited by Elias Soukiazis and Pedro Cerqueira. London: Palgrave Macmillan. [Google Scholar] [CrossRef]

- Thome, Karen, Edward Taylor, Mateusz Filipski, Benjamin Davis, and Sudhanshu Handa. 2016. The Local Economy Impacts of Social Cash Transfers. Rome: Food and Agriculture Organization of the United Nations (FAO). [Google Scholar]

- UN Office for Disaster Risk Reduction. 2020. Integrating Disaster Risk Reduction and Climate Change Adaptation in the UN Sustainable Development Cooperation Framework. Guidance Notes. Available online: https://unsdg.un.org/resources/integrating-disaster-risk-reduction-and-climate-change-adaptation-un-sustainable (accessed on 9 July 2021).

- United Nations OCHA. 2019. Global Humanitarian Overview 2019. Available online: https://reliefweb.int/sites/reliefweb.int/files/resources/GHO2019.pdf (accessed on 9 July 2021).

- Ussher, Leanne J., Armin Haas, Klaus Töpfer, and Carlo Jaeger. 2018. Keynes and the international monetary system: Time for a tabular standard? The European Journal of the History of Economic Thought 25: 1–35. [Google Scholar] [CrossRef]

- Ussher, Leanne, Chris Hewitt, David Cagan, and Robert Nachbar. 2019. Network Analysis and Management of the Hudson Valley Current. Paper presented at the 5th Biennial RAMICS International Congress in Japan, Hida-Takayama, Japan, September 11–15; Available online: https://easychair.org/publications/preprint_open/SNmg (accessed on 9 July 2021).

- Ward, Bernie, and Julie Lewis. 2002. Plugging the Leaks: Making the Most of Every Pound that Enters Your Local Economy. London: New Economics Foundation. [Google Scholar]

- WFP Innovation Accelerator. 2019. Building Blocks|WFP Innovation. Available online: https://innovation.wfp.org/project/building-blocks (accessed on 9 July 2021).

- World Bank. 2016. World Development Report 2016: Digital Dividends. Available online: https://www.worldbank.org/en/publication/wdr2016 (accessed on 9 July 2021).

- Young, Allyn A. 1928. Increasing Returns and Economic Progress. The Economic Journal 38: 527–42. [Google Scholar] [CrossRef]

- Zambrano, Raul, Andrew Young, and Stefaan Verhulst. 2018. Connecting Refugees to Aid through Blockchain-Enabled ID Management: World Food Programme’s Building Blocks. World Food Programme. Available online: https://www.irisguard.com/media/laglvgzk/building-blocks-case-study.pdf (accessed on 12 July 2021).

| Approx. Dates | Regist. Users | Type | Token(s) | Main Actors & Technology | Official Exchange to National Currency |

|---|---|---|---|---|---|

| 2010–2011 | 100 | Convertible Aid + Payments | Eco-Pesa Single Currency | GE, Paper money | Convertible into KSh (monthly limits) |

| 2013–2017 | 500 | Mutual Credit Promise of reciprocity | Bangla-Pesa + Multiple Local Currencies | Community Business Groups + GE, Paper money with expiration date | Not convertible into KSh. Reciprocity enforced through cancellation of the currency after one year. |

| 2017–2018 | 4000 | Producer Credit Promise of reciprocity | Sarafu-Credit Single Currency | Community Business Cooperatives + GE, Paper money with expiration date | Cooperative Business Profits and Donor Aid used to purchase selective ‘excess balances’ |

| 2019 | 20,000 | Producer Credit + Aid (airdrop) | Bangla Token + Multiple Digital Tokens | Business Cooperatives + Chamas + GE, Blockchain + Bonding Curve | Select vendors could sell a percentage of their balance with an upper limit. Conversion with a bonding curve safeguard with M-Pesa Agents. |

| 2020–2021 | 30,000 | Producer Credit + Aid (airdrop) + rewards/demurrage | Sarafu Single Token | Business Cooperatives + Chamas + GE, Blockchain | Donor purchases in KSh of 50% Sarafu balance from selected chama’s (once a month). |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Ussher, L.; Ebert, L.; Gómez, G.M.; Ruddick, W.O. Complementary Currencies for Humanitarian Aid. J. Risk Financial Manag. 2021, 14, 557. https://doi.org/10.3390/jrfm14110557

Ussher L, Ebert L, Gómez GM, Ruddick WO. Complementary Currencies for Humanitarian Aid. Journal of Risk and Financial Management. 2021; 14(11):557. https://doi.org/10.3390/jrfm14110557

Chicago/Turabian StyleUssher, Leanne, Laura Ebert, Georgina M. Gómez, and William O. Ruddick. 2021. "Complementary Currencies for Humanitarian Aid" Journal of Risk and Financial Management 14, no. 11: 557. https://doi.org/10.3390/jrfm14110557

APA StyleUssher, L., Ebert, L., Gómez, G. M., & Ruddick, W. O. (2021). Complementary Currencies for Humanitarian Aid. Journal of Risk and Financial Management, 14(11), 557. https://doi.org/10.3390/jrfm14110557