Technical Analysis of Tourism Price Process in the Eurozone

Abstract

1. Introduction

2. Hypothesis and Conceptual Model Development

3. Materials and Methods

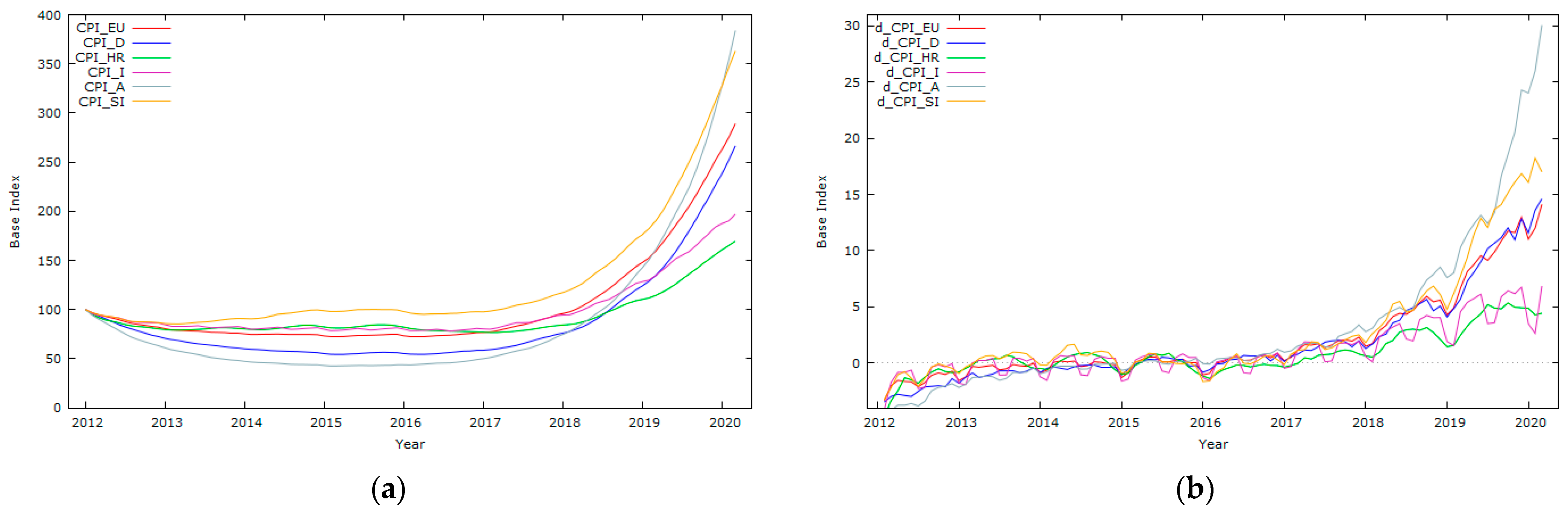

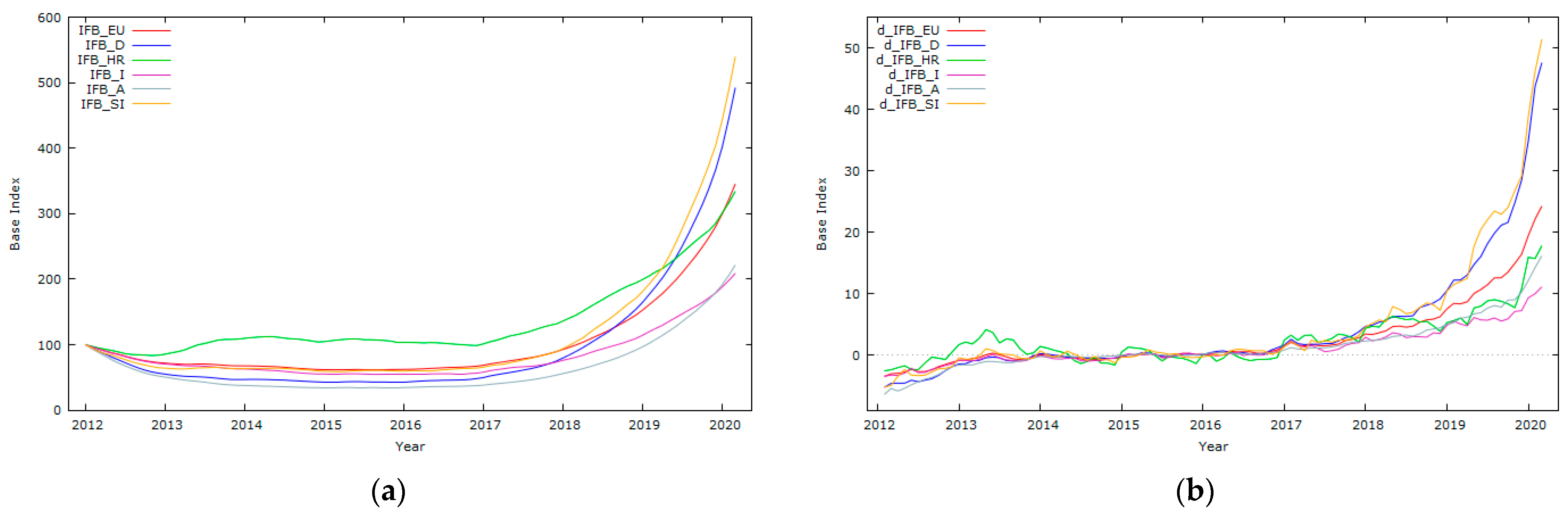

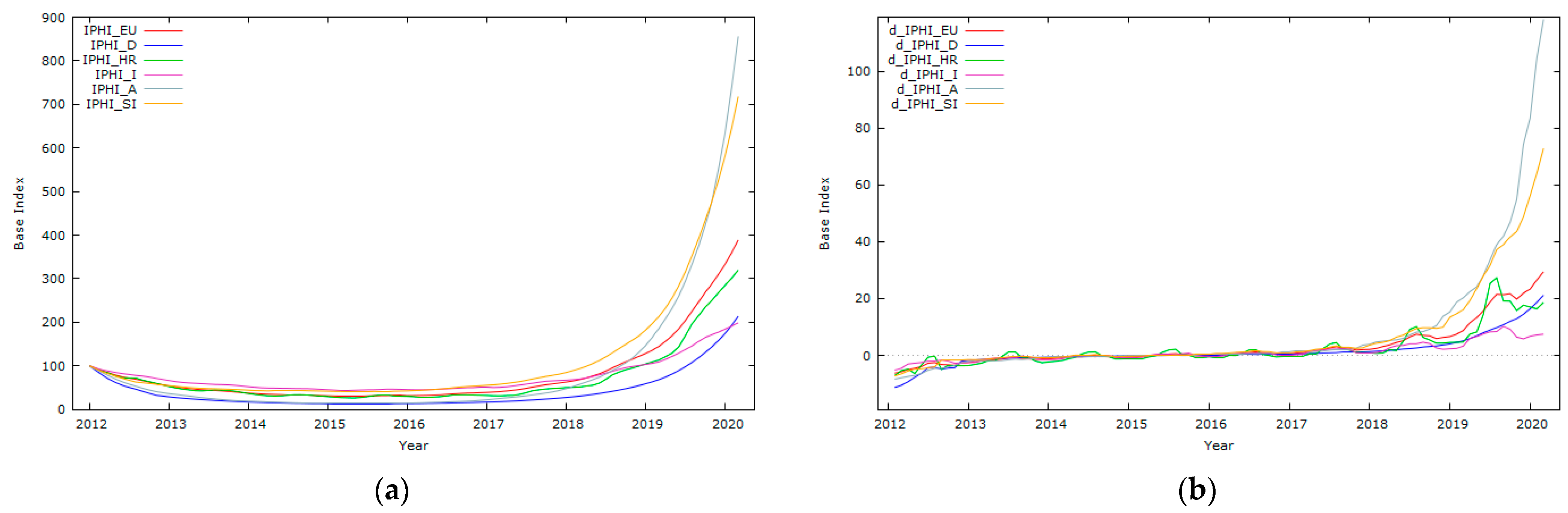

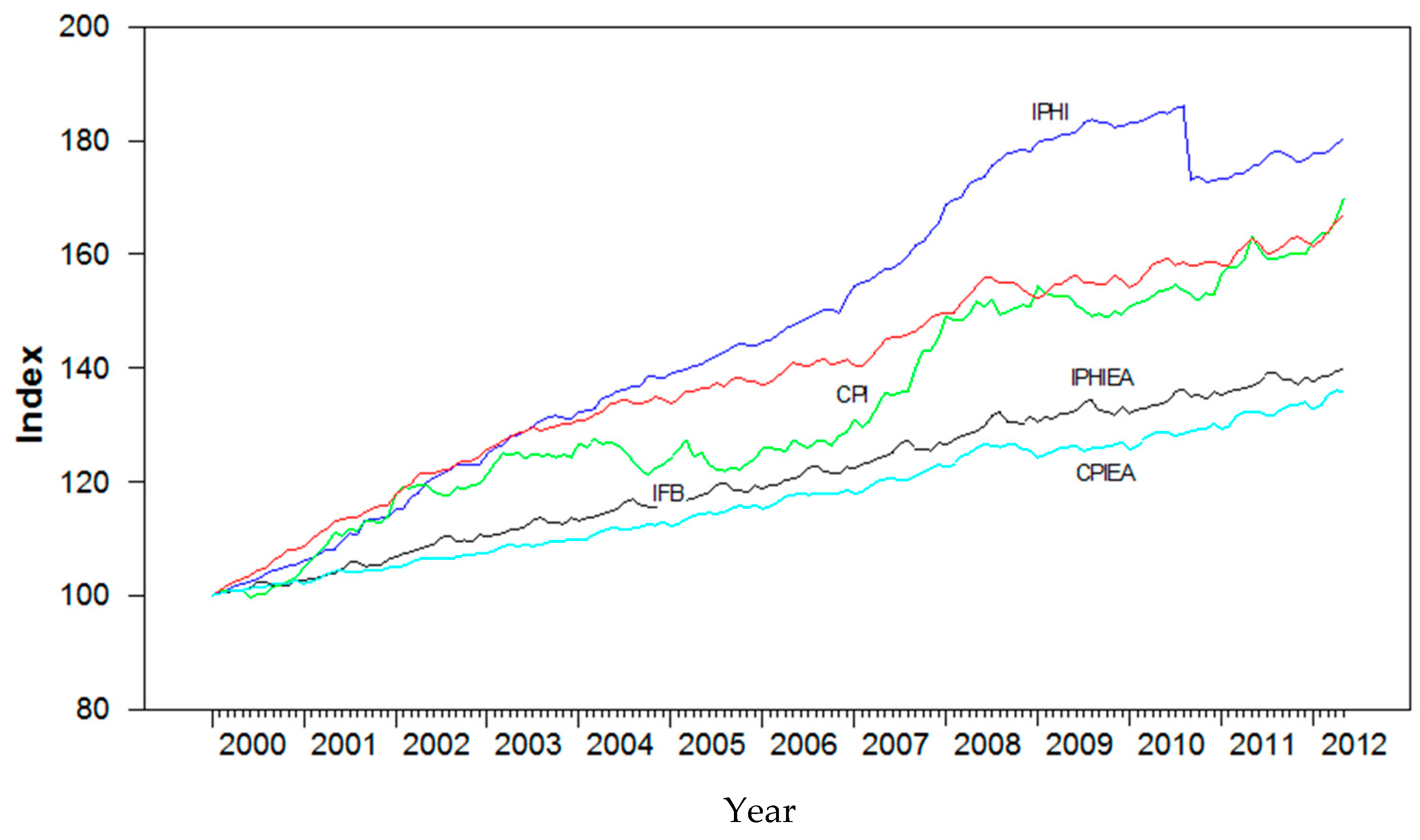

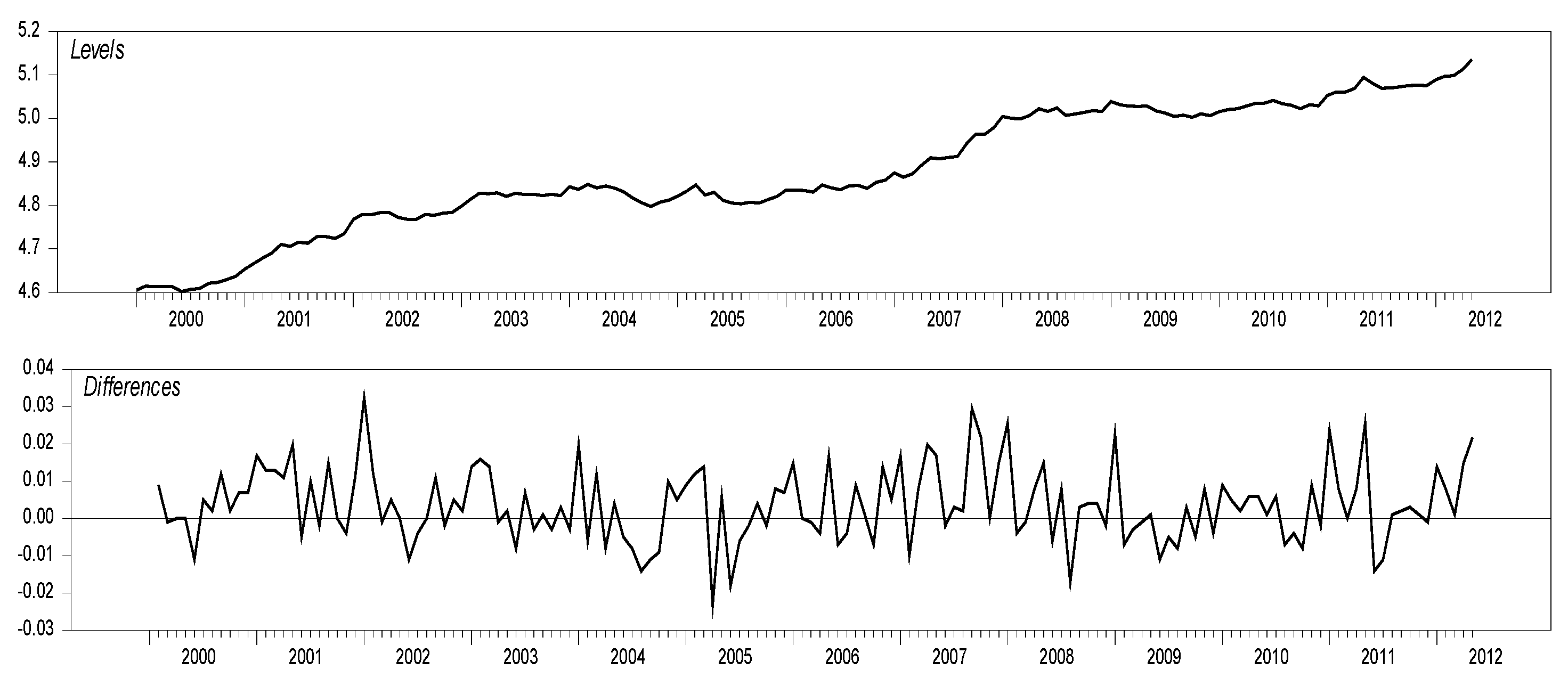

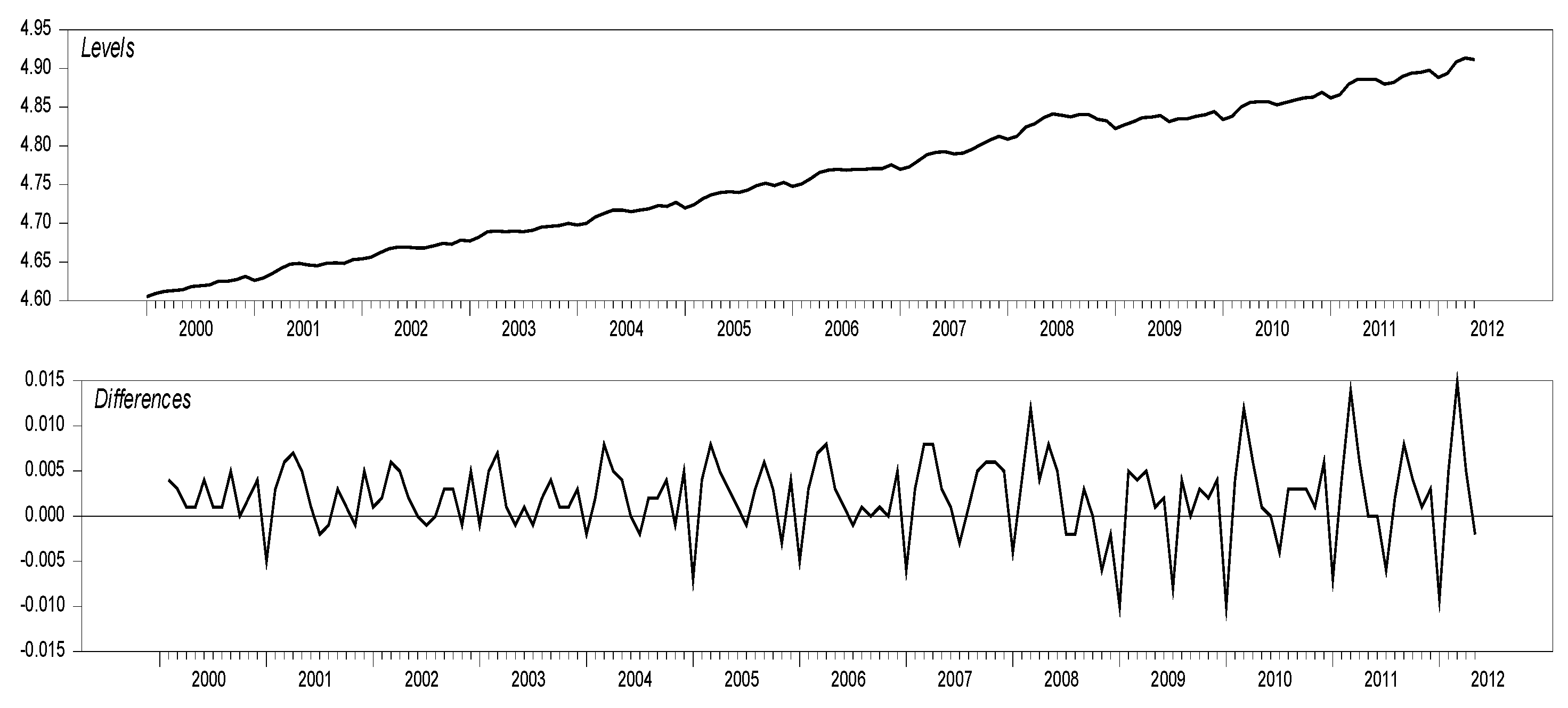

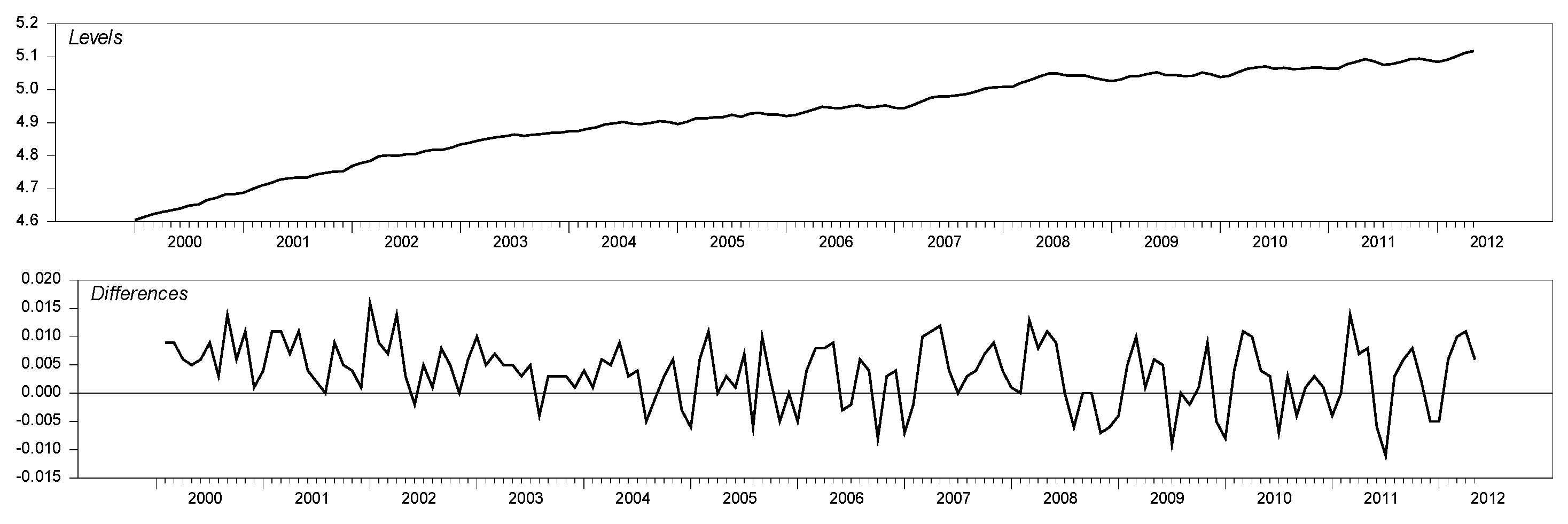

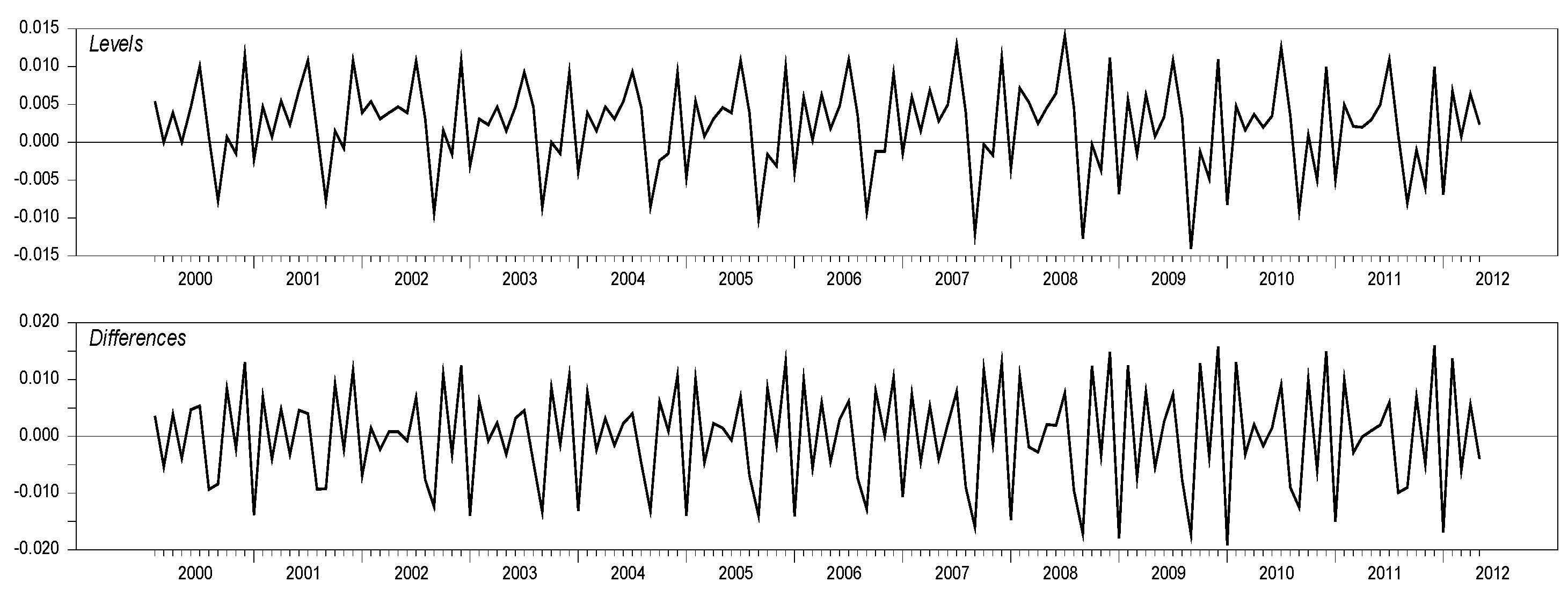

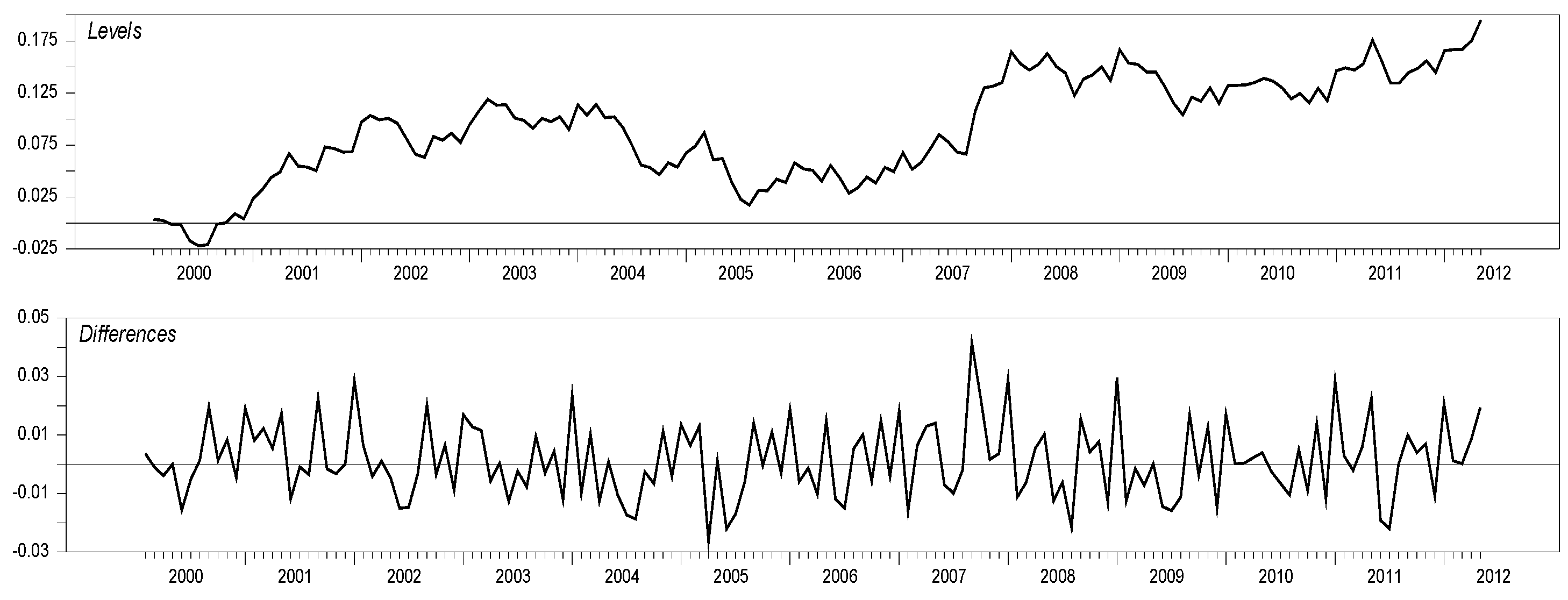

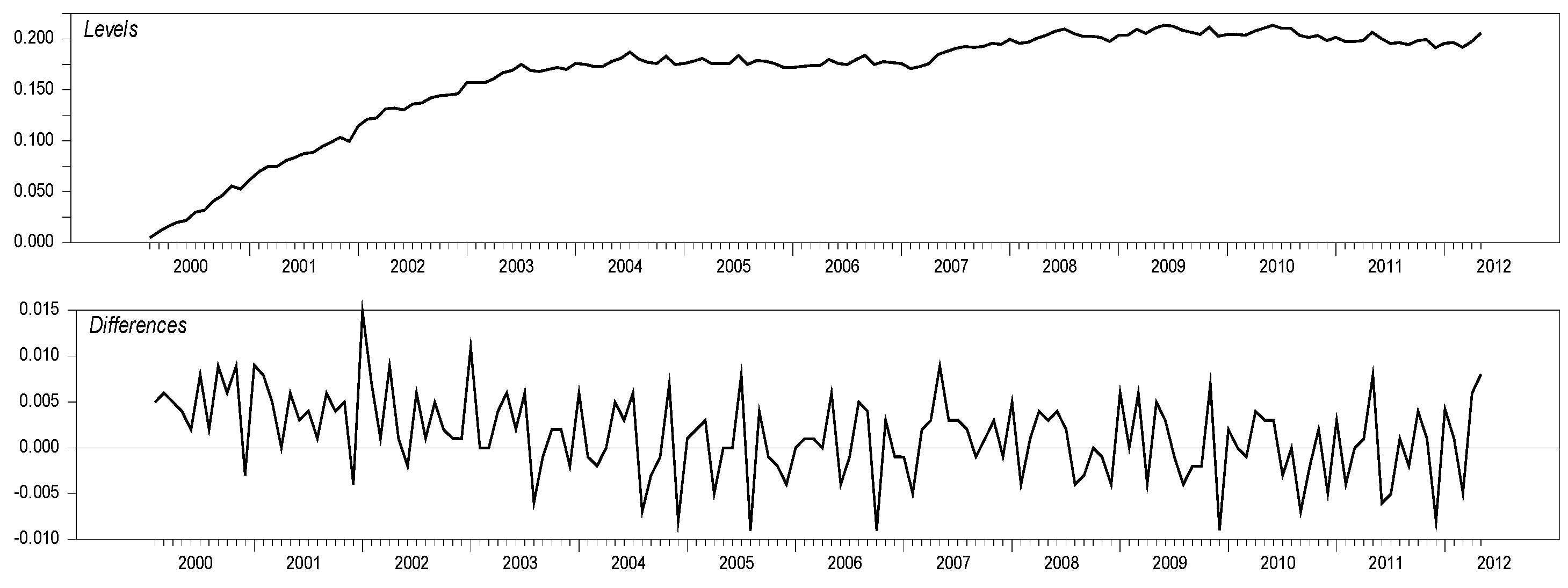

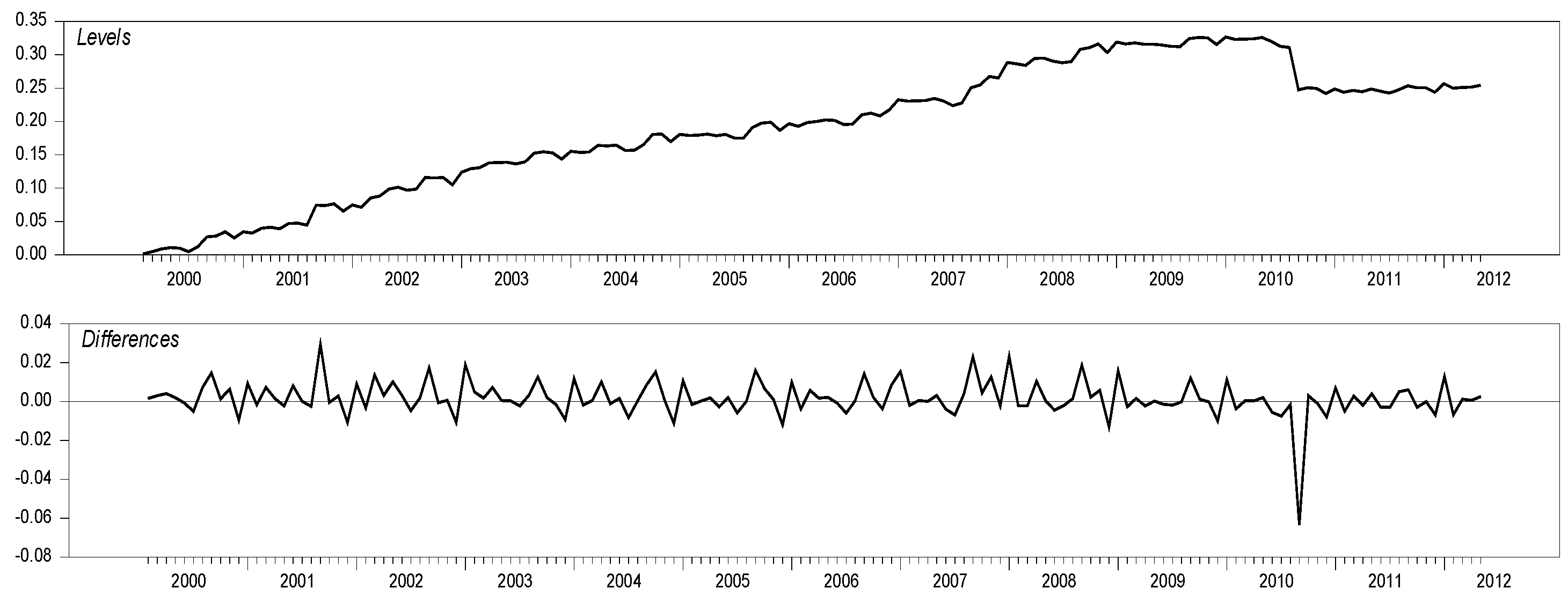

3.1. Descriptive Properties of Time-Series Data

3.2. Misspecification Test of Data Used and Data Transformation

3.3. Data Vector of Real Price Variables

3.4. Robustness Testing of Lagged Comparative Analysis

4. Econometric Results

4.1. Statistical VAR Model

4.2. Deterministic Components

4.3. Cointegration Rank

4.4. Combined Effects in Matrix

4.5. Test of Stationarity

4.6. Hypotheses Testing

4.7. Long-Term Identification

5. Discussion

5.1. Formal Discussion

5.2. User-Friendly Discussion on Technical Analysis

- Think about the problem, not just from theory but from real life;

- Define hypothesis and methodology, although we discuss only the applied time-series;

- Identify strategically important variables;

- Test the variables and find the normalities in the variables. Do not proceed until a solution is found, as technically presented in this study for price variables. This step may take the longest time;

- When normalities are found, and the correlation between them is low, the random walk is solved. One can proceed with the methodology that determines the results;

- The results obtained can now be discussed;

- Test the model for all misspecification cheques. If it is not acceptable, go back to the variables. Something is probably wrong in this step;

- If the normalities are found in the model, which usually takes some time, you can continue to the next step;

- The results, including the predictions, can be presented.

6. Conclusions

6.1. Novelty for Theory

6.2. Implications for Policymakers in Tourism

6.3. Limitations of the Research and Future Research Perspectives

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

Appendix A

| The Roots | Real | Modulus |

|---|---|---|

| root 1 | 1.00 | 1.00 |

| root 2 | 1.00 | 1.00 |

| root 3 | 0.88 | 0.88 |

| root 4 | –0.48 | 0.48 |

| root 5 | 0.11 | 0.40 |

| root 6 | 0.11 | 0.40 |

| root 7 | 0.40 | 0.40 |

| root 8 | –0.09 | 0.09 |

| root 9 | 0.02 | 0.09 |

| root 10 | 0.02 | 0.09 |

Appendix B

| Unit Root Tests | CPI | CPIEA | IPHI | IPHIEA | IFB |

|---|---|---|---|---|---|

| ADF (levels) | 4.64 | 5.58 | 3.21 | 4.23 | 2.06 |

| ADF () | –4.76 *** | –6.12 *** | –5.37 *** | –7.50 *** | –5.04 *** |

Appendix C

| Descriptive Statistics | EU | D | HR | I | A | SI |

|---|---|---|---|---|---|---|

| Mean (levels) | 103.32 | 86.13 | 91.63 | 98.05 | 87.88 | 125.70 |

| N | 99 | 99 | 99 | 99 | 99 | 99 |

| ) | –0.58 | –0.27 | –0.29 | –0.16 | –0.33 | –0.31 |

| ) | –0.44 | –1.02 | –0.68 | –0.93 | –0.94 | –0.21 |

| ) | 4.09 * | 3.00 | 1.87 | 2.70 | 3.19 | 1.23 |

| Descriptive Statistics | EU | D | HR | I | A | SI |

|---|---|---|---|---|---|---|

| Mean (levels) | 100.56 | 96.56 | 134.07 | 81.54 | 63.52 | 113.02 |

| N | 99 | 99 | 99 | 99 | 99 | 99 |

| ) | 2.02 | 2.57 | 1.59 | 1.19 | 1.26 | 2.62 |

| ) | 4.04 | 7.23 | 2.97 | 1.34 | 2.46 | 7.23 |

| ) | 133.19 *** | 320.81 *** | 75.18 *** | 30.39 *** | 50.54 *** | 325.49 *** |

| Descriptive Statistics | EU | D | HR | I | A | SI |

|---|---|---|---|---|---|---|

| Mean (levels) | 78.86 | 39.77 | 68.66 | 73.36 | 89.63 | 111.90 |

| N | 99 | 99 | 99 | 99 | 99 | 99 |

| ) | 2.35 | 2.25 | 2.37 | 1.79 | 3.08 | 2.73 |

| ) | 5.07 | 4.98 | 5.11 | 2.58 | 9.66 | 7.11 |

| ) | 97.54 *** | 89.52 *** | 108.70 *** | 19.15 *** | 709.33 *** | 283.73 *** |

Appendix D

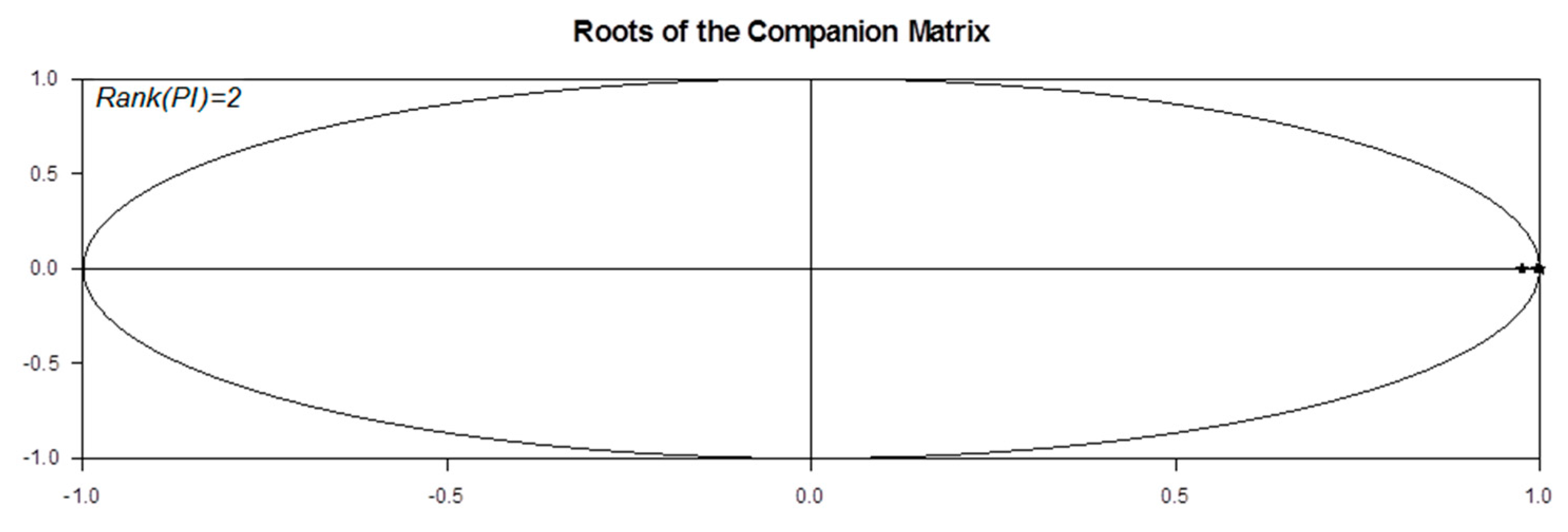

| 1 | Some studies have suggested other conclusions about lag length. Kongsted (2005) proposes the model VAR (2), while the second lag is sufficient in . Juselius (2009, 2021) takes a similar view. On the other hand, for I(2) modelling, Li and Bauer (2020) even say that a higher lag length might be possible. Overall, this study deals with I(1), and the decision on lag length follows previous studies on time-series and cointegration. The results of the unit root tests are reported in Appendix A. Nevertheless, the restrictive lag length follows the solution of range dynamics in a small sample size, which is crucial in this technical analysis. The inclusion of the restricted dummy and other unrestricted dummies in the model provides a technical solution to the normalities (see results in Appendix A, and Table 2). The researchers decided to use the model VAR (2) based on the unit roots, previous research, and misspecification tests listed in Table 2. There are a total of five real unit roots, two of which lie on the circle. The remaining unit roots lie in complex pairs. The third-largest unit root has a modulus of 0.88, and one might wonder if it is significantly different from one. This concern is tested using the LM procedure, and the lag reduction is set to (Table 2) to obtain the normalities in the model, while the likelihood ratio chi-squared is statistically significant of zero (-value 0.96). |

| 2 | According to Juselius (2009, p. 72; 2021), lag length is significant, and one could conclude that lag length could even be higher than two when using different tests. It is of great importance that time-series researchers do not choose the lag length proposed by some tests (AIC or similar) too generously. Therefore, the strict definition of is even more critical for this study. The misspecification tests in Table 2 show that further testing of such a choice and looking for structural outliers was decisive and correct. Overall, instead of specifying a higher lag length, we suggest specifying normalities in the model, which is crucial. In contrast, theory already says that is optimal. Nevertheless, our tests show that the proposal of lag length is from 2 (Schwarz information criterion (SIC)) to 10 (Akaike information criterion (AIC)). We have already recognised (Table A1) that lag length 10 is not possible. |

References

- Archontakis, Fragiskos, and Rocco Mosconi. 2021. Søren Johansen and Katarina Juselius: A bibliometric analysis of citations through multivariate bass models. Econometrics 9: 30. [Google Scholar] [CrossRef]

- Arnastauskaitė, Jurgita, Tomas Ruzgas, and Mindaugas Bražėnas. 2021. An exhaustive power comparison of normality tests. Mathematics 9: 788. [Google Scholar] [CrossRef]

- Bago, Jean-Louis, Koffi Akakpo, Imad Rherrad, and Ernest Ouédraogo. 2021. Volatility spillover and international contagion of housing bubbles. Journal of Risk and Financial Management 14: 287. [Google Scholar] [CrossRef]

- Bakucs, Zoltán, Štefan Bojnec, and Imre Fertő. 2012. Monetary impacts and overshooting of agricultural prices: Evidence from Slovenia. Transformations in Business & Economics 11: 72–83. [Google Scholar]

- Barigozzi, Matteo, Marco Lippi, and Matteo Luciani. 2020. Cointegration and error correction mechanisms for singular stochastic vectors. Econometrics 8: 3. [Google Scholar] [CrossRef]

- Bauer, Dietmar, Lukas Matuschek, Patrick de Matos Ribeiro, and Martin Wagner. 2020. A parameterisation of models for unit root processes: Structure theory and hypothesis testing. Econometrics 8: 42. [Google Scholar] [CrossRef]

- Bianchi, Giuliano, and Yong Chen. 2020. The short- and long-run hotel demand in Switzerland: A weighted macroeconomic approach. Journal of Hospitality & Tourism Research 44: 835–57. [Google Scholar] [CrossRef]

- Błażejowski, Marcin, Jacek Kwiatkowski, and Paweł Kufel. 2020. BACE and BMA variable selection and forecasting for UK money demand and inflation with Gretl. Econometrics 8: 21. [Google Scholar] [CrossRef]

- Braione, Manuela, and Nicolas K. Scholtes. 2016. Forecasting value-at-risk under different distributional assumptions. Econometrics 4: 3. [Google Scholar] [CrossRef]

- Camarero, Mariam, Juan Sapena, and Cecilio Tamarit. 2020. Modelling time-varying parameters in panel data state-space frameworks: An application to the Feldstein–Horioka puzzle. Computational Economics 56: 87–114. [Google Scholar] [CrossRef]

- Cavaliere, Guiseppe, Heino Bohn Nielsen, and Anders Rahbek. 2015. Bootstrap testing of hypotheses on cointegration relations in VAR models. Econometrica 83: 813–31. [Google Scholar] [CrossRef]

- Chang, Yoosoon. 2000. Vector autoregressions with unknown mixtures of I(0), I(1), and I(2) components. Econometric Theory 16: 905–26. [Google Scholar] [CrossRef]

- Chen, Cathy W. S., Hong Than-Thi, and Manabu Asai. 2020. On a bivariate hysteretic AR-GARCH model with conditional asymmetry in correlations. Computational Economics 58: 413–33. [Google Scholar] [CrossRef]

- Chen, Rachel J. C., Peter Bloomfield, and Frederick W. Cubbage. 2008. Comparing forecasting models in tourism. Journal of Hospitality & Tourism Research 32: 3–21. [Google Scholar] [CrossRef]

- Cheng, Yushan, Yongchang Hui, Michael McAleer, and Wing-Keung Wong. 2021. Spurious relationships for nearly non-stationary series. Journal of Risk and Financial Management 14: 366. [Google Scholar] [CrossRef]

- Clark, Todd E., and Francesco Ravazzolo. 2015. Macroeconomic forecasting performance under alternative specifications of time-varying volatility. Journal of Applied Econometrics 30: 551–75. [Google Scholar] [CrossRef]

- Cubadda, Gianluca. 1999. Common cycles in seasonal nonstationary time series. Journal of Applied Econometrics 14: 273–91. [Google Scholar] [CrossRef]

- Desgagné, Alain, and P. Lafaye de Micheaux. 2018. A powerful and interpretable alternative to the Jarque–Bera test of normality based on 2nd-power skewness and kurtosis, using the Rao’s score test on the APD family. Journal of Applied Statistics 45: 2307–27. [Google Scholar] [CrossRef]

- Di Iorio, Francesca, Stefano Fachin, and Riccardo Lucchetti. 2016. Can you do the wrong thing and still be right? Hypothesis testing in I(2) and near-I(2) cointegrated VARs. Applied Economics 48: 3665–78. [Google Scholar] [CrossRef]

- Dritsakis, Nikolaos. 2004. Cointegration analysis of German and British tourism demand for Greece. Tourism Management 25: 111–19. [Google Scholar] [CrossRef]

- European Central Bank (ECB). 2020. Communiqué on Croatia. Available online: https://www.ecb.europa.eu/press/pr/date/2020/html/ecb.pr200710_1~88c0f764e7.en.html (accessed on 28 September 2021).

- European Central Bank (ECB). 2021. Croatian kuna (HRK). Available online: https://www.ecb.europa.eu/stats/policy_and_exchange_rates/euro_reference_exchange_rates/html/eurofxref-graph-hrk.en.html (accessed on 28 September 2021).

- Franchi, Massimo, and Paolo Paruolo. 2021. Cointegration, root functions and minimal bases. Econometrics 9: 31. [Google Scholar] [CrossRef]

- Gjelsvik, Marit, Ragnar Nymoen, and Victoria Sparrman. 2020. Cointegration and structure in Norwegian wage–price dynamics. Econometrics 8: 29. [Google Scholar] [CrossRef]

- Gričar, Sergej. 2014. Implementation of vector auto-regressive model in tourism economics and tourism management. Working paper of MSCA project. [Google Scholar]

- Gričar, Sergej, and Štefan Bojnec. 2012. Price developments in the hospitality industry in Slovenia. Economic Research-Ekonomska Istraživanja 25 Suppl. S2: 139–52. [Google Scholar] [CrossRef]

- Gricar, Sergej, and Štefan Bojnec. 2018. Tourism price causalities: Case of an Adriatic country. International Journal of Tourism Research 20: 82–87. [Google Scholar] [CrossRef]

- Gricar, Sergej, Tea Baldigara, and Violeta Šugar. 2021. Sustainable determinants that affect tourist arrival forecasting. Sustainability 13: 9659. [Google Scholar] [CrossRef]

- Harris, Barbara. 2021. Data-driven internet of things systems and urban sensing technologies in integrated smart city planning and management. Geopolitics, History, and International Relations 13: 53–63. [Google Scholar] [CrossRef]

- Harvey, David I., Stephen J. Leybourne, and A. M. Robert Taylor. 2012. Testing for unit roots in the presence of uncertainty over both the trend and initial condition. Journal of Econometrics 169: 188–95. [Google Scholar] [CrossRef][Green Version]

- Hendry, David. F., and Grayman E. Mizon. 1990. Evaluating econometric models by encompassing the VAR. In Models, Methods and Applications of Econometrics. Edited by Peter Charles Bonest Phillips. Basil: Blackwell. [Google Scholar]

- Hoover, Kevin, and Katarina Juselius. 2015. Trygve Haavelmo˙s experimental methodology and scenario analysis in a cointegrated vector autoregression. Econometric Theory 31: 249–74. [Google Scholar] [CrossRef]

- Hudecová, Šárka, Marie Hušková, and Simos G. Meintanis. 2021. Goodness–of–fit tests for bivariate time series of counts. Econometrics 9: 10. [Google Scholar] [CrossRef]

- Jawadi, Fredj. 2020. Introduction to topics in modelling financial and macroeconomic time series. Computational Economics 56: 1–3. [Google Scholar] [CrossRef]

- Johansen, Søren. 1995. Likelihood-Based Inference in Cointegrated Vector Auto-Regressive Models. Oxford: University Press. [Google Scholar]

- Johansen, Søren. 2012. The analysis of nonstationary time series using regression, correlation and cointegration. Contemporary Economics 6: 40–57. [Google Scholar] [CrossRef]

- Johansen, Søren. 2019. Cointegration and adjustment in the CVAR(∞) representation of some partially observed CVAR(1) models. Econometrics 7: 2. [Google Scholar] [CrossRef]

- Johansen, Søren, and Morten Ørregaard Nielsen. 2018. Testing the CVAR in the fractional CVAR model. Journal of Time Series Analysis 39: 836–49. [Google Scholar] [CrossRef]

- Johansen, Søren, and Morten Nyboe Tabor. 2017. Cointegration between trends and their estimators in state space models and cointegrated vector autoregressive models. Econometrics 5: 36. [Google Scholar] [CrossRef]

- Juselius, Katarina. 2009. The Cointegrated VAR Model. New York: Oxford University Press. [Google Scholar]

- Juselius, Katarina. 2015. Haavelmo’s probability approach and the cointegrated VAR. Econometric Theory 31: 213–32. [Google Scholar] [CrossRef]

- Juselius, Katarina. 2021. Searching for a theory that fits the data: A personal research odyssey. Econometrics 9: 5. [Google Scholar] [CrossRef]

- Kim, Jewoo, Tianshu Zheng, and Susan W. Arendt. 2019. Identification of merger and acquisition waves and their macroeconomic determinants in the hospitality industry. Journal of Hospitality & Tourism Research 43: 249–71. [Google Scholar] [CrossRef]

- Kivedal, Bjørnar Karlsen. 2014. A DSGE model with housing in the cointegrated VAR framework. Empirical Economics 47: 853–80. [Google Scholar] [CrossRef][Green Version]

- Konecny, Vladimir, Colin Barnett, and Miloš Poliak. 2021. Sensing and computing technologies, intelligent vehicular networks, and big data-driven algorithmic decision-making in smart sustainable urbanism. Contemporary Readings in Law and Social Justice 13: 30–39. [Google Scholar] [CrossRef]

- Kongsted, Hans Christian. 2005. Testing the nominal-to-real transformation. Journal of Econometrics 124: 205–25. [Google Scholar] [CrossRef]

- Kristjanpollera, Werner, and Marcel C. Minutolo. 2015. Gold price volatility: A forecasting approach using the Artificial Neural Network–GARCH model. Expert Systems with Applications 42: 7245–51. [Google Scholar] [CrossRef]

- Lewis, Elizabeth. 2021. Smart city software systems and internet of things sensors in sustainable urban governance networks. Geopolitics, History, and International Relations 13: 9–19. [Google Scholar] [CrossRef]

- Li, Yuanyuan, and Dietmar Bauer. 2020. Modeling I(2) processes using vector autoregressions where the lag length increases with the sample size. Econometrics 8: 38. [Google Scholar] [CrossRef]

- Ma, Emily, Yulin Liu, Jinghua Li, and Su Chen. 2016. Anticipating Chinese tourists arrivals in Australia: A time series analysis. Tourism Management Perspectives 23: 41–52. [Google Scholar] [CrossRef]

- Martín Martín, José María, Jose Antonio Salinas Fernández, José Antonio Rodríguez Martín, and María del Sol Ostos Rey. 2020. Analysis of tourism seasonality as a factor limiting the sustainable development of rural areas. Journal of Hospitality & Tourism Research 44: 45–75. [Google Scholar] [CrossRef]

- Martins, Luís Filipe, Yi Gan, and Alexandra Ferreira-Lopes. 2017. An empirical analysis of the influence of macroeconomic determinants on World tourism demand. Tourism Management 61: 248–60. [Google Scholar] [CrossRef]

- Mitchell, Ann. 2021. Autonomous vehicle algorithms, big geospatial data analytics, and interconnected sensor networks in urban transportation systems. Contemporary Readings in Law and Social Justice 13: 50–59. [Google Scholar] [CrossRef]

- Naimoli, Antonio, and Giuseppe Storti. 2021. Forecasting volatility and tail risk in electricity markets. Journal of Risk and Financial Management 14: 294. [Google Scholar] [CrossRef]

- Narayan, Paresh Kumar. 2003. Tourism demand modelling: Some issues regarding unit roots, cointegration and diagnostic tests. International Journal of Tourism Research 5: 369–80. [Google Scholar] [CrossRef]

- Pacifico, Antonio. 2021. Structural panel Bayesian VAR with Multivariate time-varying volatility to jointly deal with structural changes, policy regime shifts, and endogeneity issues. Econometrics 9: 20. [Google Scholar] [CrossRef]

- Polito, Vito, and Mike Wickens. 2012. Optimal monetary policy using an unrestricted VAR. Journal of Applied Econometrics 27: 525–53. [Google Scholar] [CrossRef]

- Pollock, D. Stephen G. 2020. Linear stochastic models in discrete and continuous time. Econometrics 8: 35. [Google Scholar] [CrossRef]

- Ridderstaat, Jorge, and Robertico Croes. 2020. A framework for classifying causal factors of tourism demand seasonality: An interseason and intraseason approach. Journal of Hospitality & Tourism Research 44: 733–60. [Google Scholar] [CrossRef]

- Schild, Karl-Heinz, and Karsten Schweikert. 2019. On the validity of tests for asymmetry in residual-based threshold cointegration models. Econometrics 7: 12. [Google Scholar] [CrossRef]

- Song, Haiyan, Stephen F. Witt, Kevin F. Wong, and Doris C. Wu. 2009. An empirical study of forecast combination in tourism. Journal of Hospitality & Tourism Research 33: 3–29. [Google Scholar] [CrossRef]

- Syriopoulos, Theodore, Michael Tsatsaronis, and Ioannis Karamanos. 2021. Support vector machine algorithms: An application to ship price forecasting. Computational Economics 57: 55–87. [Google Scholar] [CrossRef]

- Taylor, Edward. 2021. Autonomous vehicle decision-making algorithms and data-driven mobilities in networked transport systems. Contemporary Readings in Law and Social Justice 13: 9–19. [Google Scholar] [CrossRef]

- Townsend, Jason. 2021. Interconnected sensor networks and machine learning-based analytics in data-driven smart sustainable cities. Geopolitics, History, and International Relations 13: 31–41. [Google Scholar] [CrossRef]

- Trafimow, David. 2019. A Frequentist alternative to significance testing, p-values, and confidence intervals. Econometrics 7: 26. [Google Scholar] [CrossRef]

- Victor, Vijay, Dibin KK, Meenu Bhaskar, and Farheen Naz. 2021. Investigating the dynamic interlinkages between exchange rates and the NSE NIFTY index. Journal of Risk and Financial Management 14: 20. [Google Scholar] [CrossRef]

- Vougas, Dimitrios V. 2021. Prais–Winsten algorithm for regression with second or higher order autoregressive errors. Econometrics 9: 32. [Google Scholar] [CrossRef]

- Wong, Kevin K. F., and Haiyan Song. 2006. Do macroeconomic variables contain any useful information for predicting changes in hospitality stock indices? Journal of Hospitality & Tourism Research 30: 16–33. [Google Scholar] [CrossRef]

| Descriptive Statistics | CPI | CPIEA | IPHI | IPHIEA | IFB | VAR Model |

|---|---|---|---|---|---|---|

| Mean | 138.35 | 116.95 | 149.15 | 120.64 | 132.88 | |

| N | 149 | 149 | 149 | 149 | 149 | |

| Minimum | 100.00 | 100.00 | 100.00 | 100.00 | 99.69 | |

| Maximum | 166.83 | 136.10 | 186.07 | 139.80 | 169.87 | |

| Skewness | −0.088 | 0.211 | −6.763 | 0.116 | 0.312 | |

| Kurtosis | 2.967 | 3.887 | 71.460 | 4.6323 | 4.301 | |

| ARCH test | 0.052 | 0.021 | 0.001 | 0.630 | 11.953 *** | 234.993 *** |

| Normality test | 0.315 | 6.846 ** | 1070.988 *** | 15.852 *** | 10.708 *** | 1082.693 *** |

| LM test | 48.726 *** | |||||

| Trace or rank test | ||||||

| Number of lags | ||||||

| Miss–Variables | |||||

|---|---|---|---|---|---|

| Skewness | 0.350 | −0.081 | −0.209 | 0.120 | −0.140 |

| Kurtosis | 2.958 | 2.438 | 3.628 | 3.274 | 3.274 |

| ARCH test | 1.275(0.529) | 4.591(0.101) | 0.015(0.992) | 6.005(0.05) | 0.696(0.706) |

| Normality test | 3.399(0.183) | 1.860(0.394) | 4.140(0.126) | 1.531(0.465) | 1.597(0.450) |

| R2 | 0.894 | 0.528 | 0.715 | 0.862 | 0.977 |

| Model | |||||

| Trace or rank test | |||||

| ARCH test | (1): 207.211(0.797) (2): 462.989(0.326) | ||||

| Normality test | 11.570(0.315) | ||||

| Number of lags | |||||

| LM test | (1): 22.767(0.591) (2): 30.705(0.199) | ||||

| Variable | ||||||

|---|---|---|---|---|---|---|

| 0.004 (3.508) *** | 0.006 (3.284) *** | 0 | −10.114 (−6.407) *** | 7.260 (6.645) *** | −3.710 (−5.340) *** | |

| 0 | −0.004 (−3.333) *** | 0 | −10.930 (−6.834) *** | 7.812 (7.058) *** | −3.873 (−5.503) *** | |

| 0 | 0 | −0.005 (−4.209) *** | −5.405 (−1.520) | 4.493 (1.826) ** | −2.356 (−1.506) * | |

| 1 | 1 | −0.866 (−37.782) *** | 1.817 (1.649) | −2.114 (−2.810) *** | 0.679 (1.400) | |

| −0.397 (−23.792) *** | 0 | 1 | 0.175 (0.251) | −0.822 (−1.709) * | −0.824 (−2.694) *** | |

| dummy | 0 | 0 | 0.001 (3.835) *** | |||

| C | 0.002 (−8.473) *** | −0.003 (−7.035) *** | 0 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Gričar, S.; Bojnec, Š. Technical Analysis of Tourism Price Process in the Eurozone. J. Risk Financial Manag. 2021, 14, 517. https://doi.org/10.3390/jrfm14110517

Gričar S, Bojnec Š. Technical Analysis of Tourism Price Process in the Eurozone. Journal of Risk and Financial Management. 2021; 14(11):517. https://doi.org/10.3390/jrfm14110517

Chicago/Turabian StyleGričar, Sergej, and Štefan Bojnec. 2021. "Technical Analysis of Tourism Price Process in the Eurozone" Journal of Risk and Financial Management 14, no. 11: 517. https://doi.org/10.3390/jrfm14110517

APA StyleGričar, S., & Bojnec, Š. (2021). Technical Analysis of Tourism Price Process in the Eurozone. Journal of Risk and Financial Management, 14(11), 517. https://doi.org/10.3390/jrfm14110517