Application of Artificial Intelligence in Stock Market Forecasting: A Critique, Review, and Research Agenda

Abstract

1. Introduction

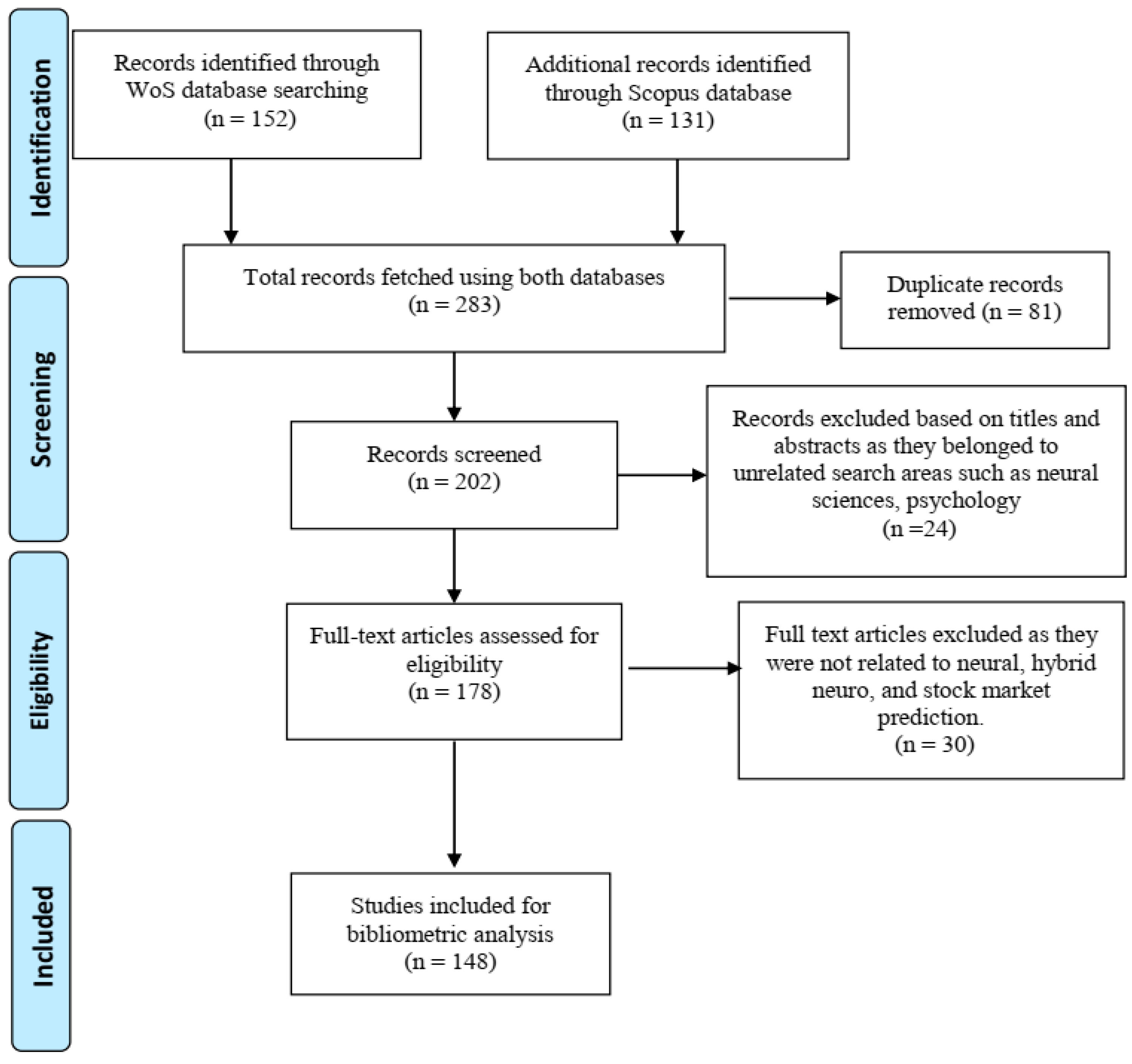

2. Methodology

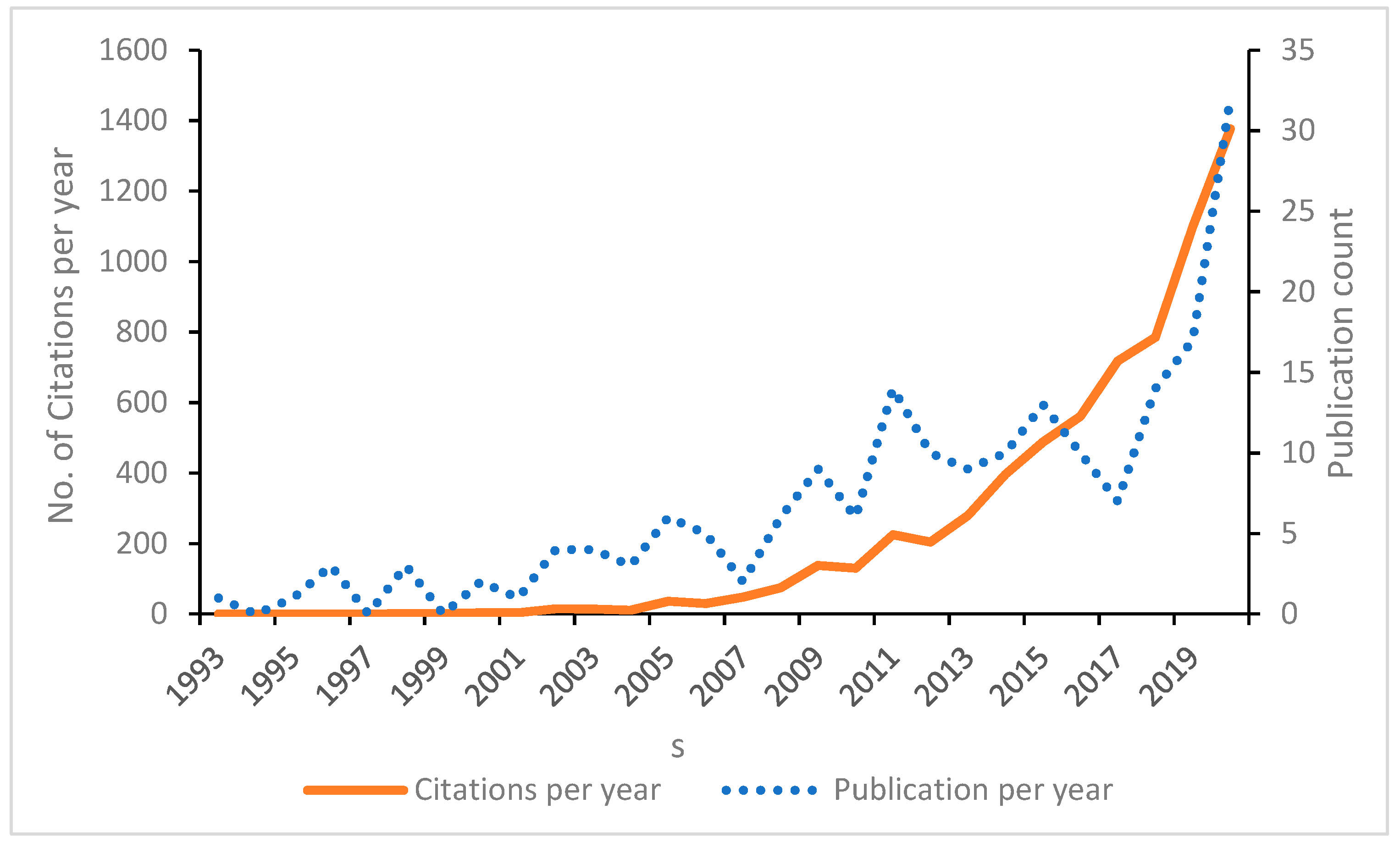

3. Trends and General Description of the Existing Literature

3.1. Publication Output and Growth Trend

3.2. Most Contributing Countries

| Country | Articles | SCP | MCP | Citations |

|---|---|---|---|---|

| China | 42 | 35 | 7 | 1173 |

| India | 16 | 14 | 2 | 307 |

| USA | 16 | 12 | 4 | 714 |

| Japan | 9 | 9 | 0 | 126 |

| Turkey | 7 | 6 | 1 | 571 |

| Greece | 6 | 3 | 3 | 516 |

| Iran | 6 | 6 | 0 | 351 |

| Korea | 5 | 5 | 0 | 425 |

| Brazil | 4 | 4 | 0 | 182 |

| Australia | 3 | 3 | 0 | 17 |

3.3. Most Relevant Authors and Publications

| Rank | Author | h_index | g_index | m_index | Total Citations | No. of Publications | Publication Year Start |

|---|---|---|---|---|---|---|---|

| 1 | Atsalakis, G. S. | 4 | 4 | 0.308 | 473 | 4 | 2009 |

| 2 | Valavanis, K. P. | 3 | 3 | 0.231 | 443 | 3 | 2009 |

| 3 | Kim, K. J. | 2 | 2 | 0.091 | 361 | 2 | 2000 |

| 4 | Han, I. | 1 | 1 | 0.045 | 325 | 1 | 2000 |

| 5 | Hadavandi, E. | 3 | 3 | 0.25 | 303 | 3 | 2010 |

| 6 | Baykan, O. K. | 1 | 1 | 0.091 | 219 | 1 | 2011 |

| 7 | Boyacioglu, M. A. | 1 | 1 | 0.091 | 219 | 1 | 2011 |

| 8 | Kara, Y. | 1 | 1 | 0.091 | 219 | 1 | 2011 |

| 9 | Daim, T. U. | 1 | 1 | 0.091 | 212 | 1 | 2011 |

| 10 | Guresen, E. | 1 | 1 | 0.091 | 212 | 1 | 2011 |

| Rank | Publication | Total Citations (TC) | TC per Year |

|---|---|---|---|

| 1 | (Kim and Han 2000) | 325 | 14.7727 |

| 2 | (Atsalakis and Valavanis 2009b) | 295 | 22.6923 |

| 3 | (Kara et al. 2011) | 219 | 19.9091 |

| 4 | (Guresen et al. 2011) | 212 | 19.2727 |

| 5 | (Chen et al. 2003) | 204 | 10.7368 |

| 6 | (Enke and Thawornwong 2005) | 187 | 11 |

| 7 | (Yudong and Wu 2009) | 186 | 14.3077 |

| 8 | (Hadavandi et al. 2010) | 176 | 14.6667 |

| 9 | (Ticknor 2013) | 173 | 19.2222 |

| 10 | (Hsieh et al. 2011) | 173 | 15.7273 |

3.4. Most Relevant Sources

| Rank | Source | h_index | g_index | m_index | Total Citations | No. of Publications | Publication Year Start |

|---|---|---|---|---|---|---|---|

| 1 | Expert Systems with Applications | 20 | 23 | 0.909 | 2414 | 23 | 2000 |

| 2 | Applied Soft Computing | 8 | 10 | 0.727 | 472 | 10 | 2011 |

| 3 | Computers & Operations Research | 2 | 2 | 0.105 | 280 | 2 | 2003 |

| 4 | Knowledge-Based Systems | 2 | 2 | 0.167 | 252 | 2 | 2010 |

| 5 | Neurocomputing | 4 | 4 | 0.154 | 140 | 4 | 1996 |

| 6 | International Journal of Forecasting | 2 | 2 | 0.083 | 122 | 2 | 1998 |

| 7 | Journal of Business Research | 1 | 1 | 0.056 | 79 | 1 | 2004 |

| 8 | Neural Computing & Applications | 4 | 8 | 0.041 | 64 | 8 | 1996 |

| 9 | Journal of Retailing | 1 | 1 | 0.038 | 61 | 1 | 1996 |

| 10 | Plos One | 2 | 4 | 0.286 | 53 | 4 | 2015 |

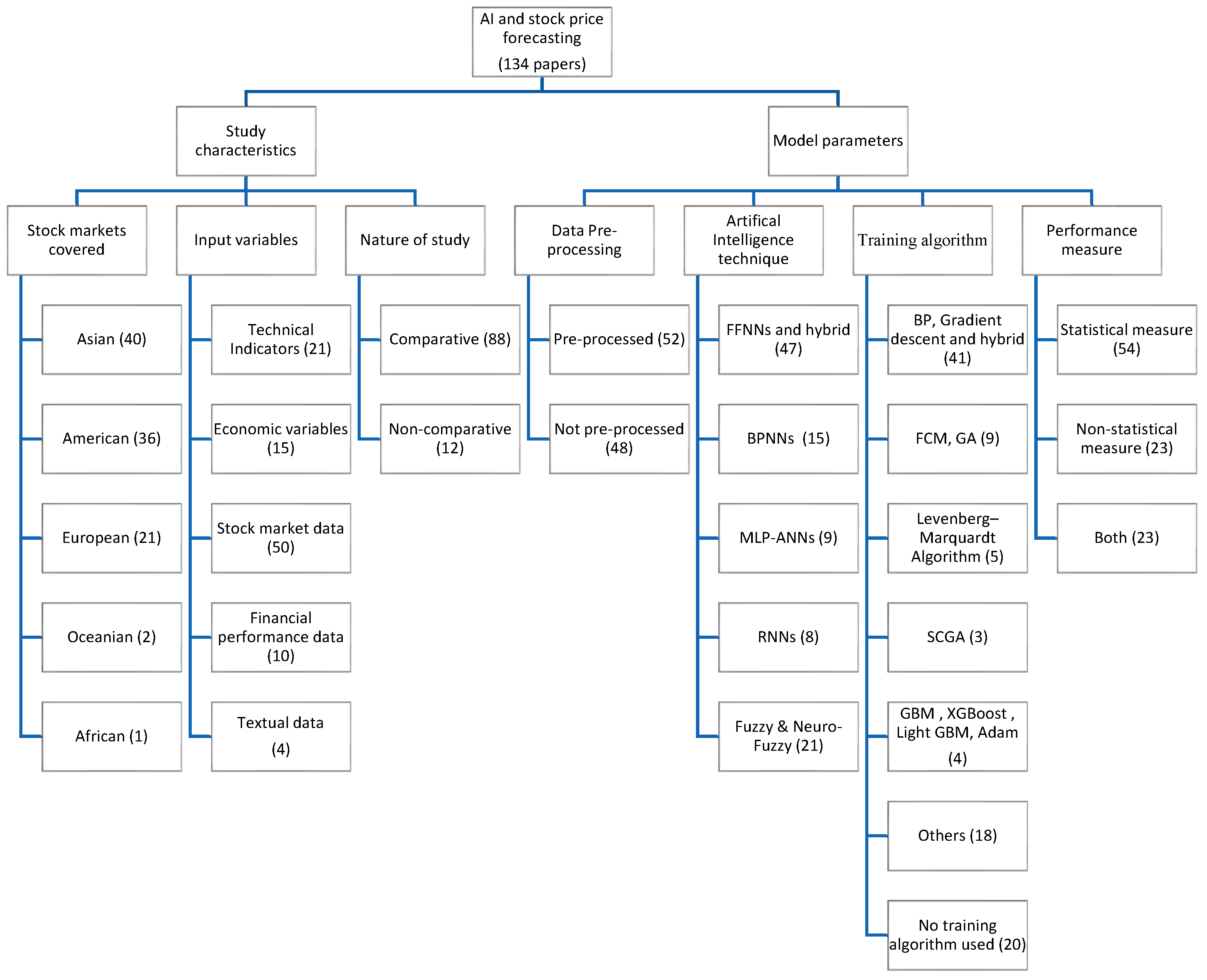

4. Thematic Discussion

4.1. Study Characteristics

4.1.1. Stock Markets Covered

4.1.2. Input Variables

4.1.3. Nature of Study

4.2. Model Characteristics

4.2.1. Data Pre-Processing

4.2.2. Artificial Intelligence Technique

4.2.3. Training Algorithm

4.2.4. Performance Measure

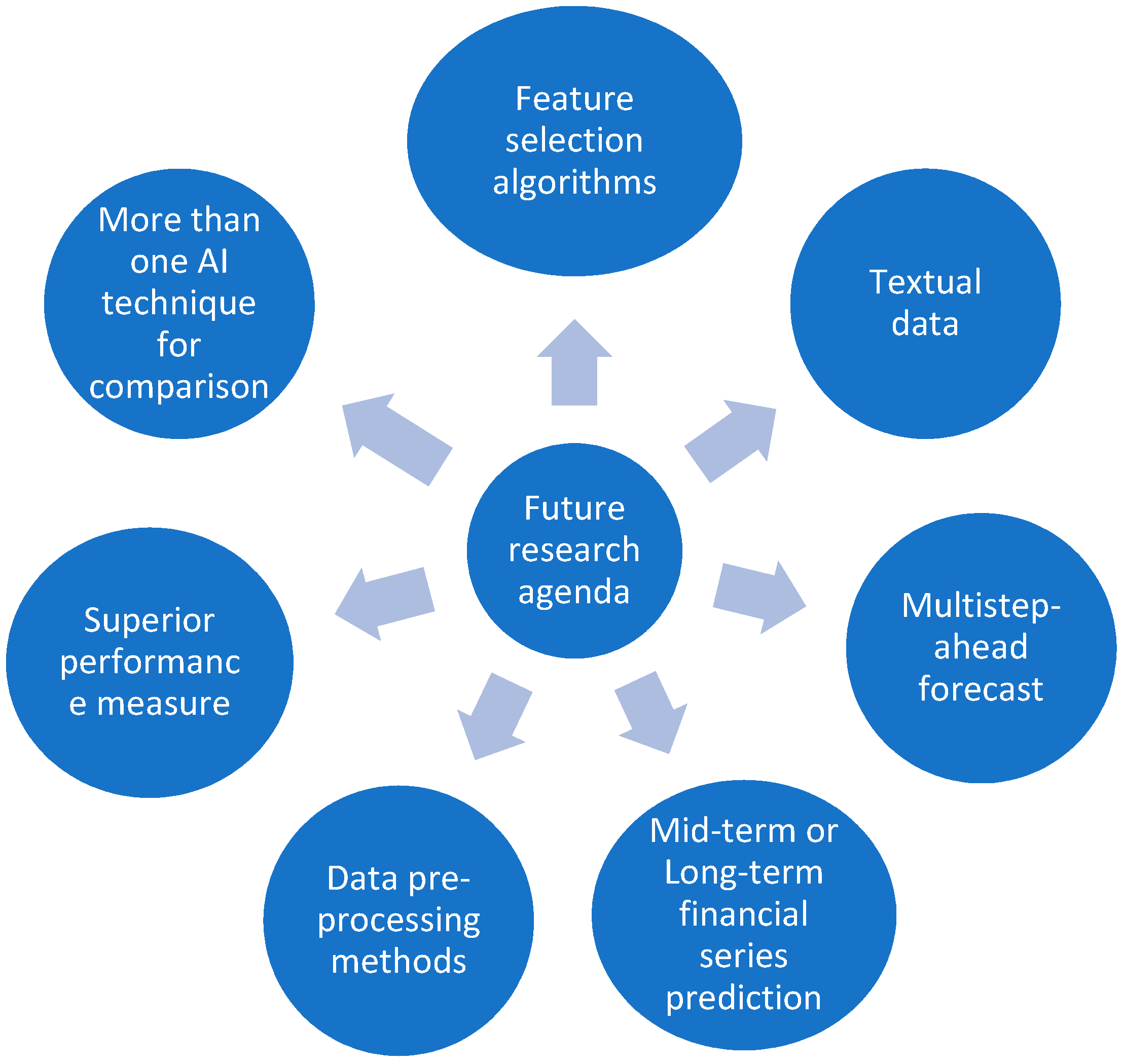

5. Gaps in the Extant Literature

6. Future Research Agenda

7. Conclusions

Author Contributions

Funding

Data Availability Statement

Acknowledgments

Conflicts of Interest

Appendix A

| 1 | BPNN: Back-Propagation Neural Network. |

| 2 | Adam: Adaptive Moment Estimation. |

| 3 | AdaBoost: Adaptive Boosting. |

| 4 | GBM: Gradient Boosting Method. |

| 5 | XGBoost: Extreme Gradient Boosting. |

References

- Abdelaziz, Fouad Ben, Mohamed Amer, and Hazim El-Baz. 2014. An Epsilon Constraint Method for selecting Indicators for use in Neural Networks for Stock Market Forecasting. INFOR 52: 116–25. [Google Scholar] [CrossRef]

- Abdel-Kader, Rehab F. 2011. Hybrid discrete PSO with GA operators for efficient QoS-multicast routing. Ain Shams Engineering Journal 2: 21–31. [Google Scholar] [CrossRef]

- Abraham, Ajith, Baikunth Nath, and P. K. Mahanti. 2001. Hybrid intelligent systems for stock market analysis. In Lecture Notes in Computer Science (Including Subseries Lecture Notes in Artificial Intelligence and Lecture Notes in Bioinformatics). Berlin/Heidelberg: Springer, vol. 2074, pp. 337–45. [Google Scholar] [CrossRef]

- Abraham, Ajith, Ninan Sajith Philip, and Paramasivan Saratchandran. 2004. Modeling Chaotic Behavior of Stock Indices Using Intelligent Paradigms. arXiv arXiv:0405018. [Google Scholar]

- Adebiyi, Ayodele Ariyo, Aderemi Oluyinka Adewumi, and Charles Korede Ayo. 2014. Comparison of ARIMA and artificial neural networks models for stock price prediction. Journal of Applied Mathematics 2014: 614342. [Google Scholar] [CrossRef]

- Althelaya, Khaled A., Salahadin A. Mohammed, and El-Sayed M. El-Alfy. 2021. Combining deep learning and multiresolution analysis for stock market forecasting. IEEE Access 9: 13099–111. [Google Scholar] [CrossRef]

- Anderson, Nicola, and Joseph Noss. 2013. The Fractal Market Hypothesis and Its Implications for the Stability of Financial Markets. Bank of England Financial Stability Paper, No. 23. London: Bank of England. [Google Scholar]

- Andreou, Andreas S., Constantinos. C. Neocleous, Christos. N. Schizas, and Costas Toumpouris. 2000. Testing the Predictability of the Cyprus Stock Exchange: The Case of an Emerging Market. Paper presented at the IEEE-INNS-ENNS International Joint Conference on Neural Networks, Como, Italy, July 27; Piscataway: Institute of Electrical and Electronics Engineers (IEEE), pp. 360–65. [Google Scholar] [CrossRef]

- Ansari, Tanvir, Manoj Kumar, Anupam Shukla, Joydip Dhar, and Ritu Tiwari. 2010. Sequential combination of statistics, econometrics and Adaptive Neural-Fuzzy Interface for stock market prediction. Expert Systems with Applications 37: 5116–25. [Google Scholar] [CrossRef]

- Aria, Massimo, and Corrado Cuccurullo. 2017. bibliometrix: An R-tool for comprehensive science mapping analysis. Journal of Informetrics 11: 959–75. [Google Scholar] [CrossRef]

- Armano, Giuliano, Andrea Murru, and Fabio Roli. 2002. Stock market prediction by a mixture of genetic-neural experts. International Journal of Pattern Recognition and Artificial Intelligence 16: 501–26. [Google Scholar] [CrossRef]

- Armano, Giuliano, Michele Marchesi, and Andrea Murru. 2005. A hybrid genetic-neural architecture for stock indexes forecasting. Information Sciences 170: 3–33. [Google Scholar] [CrossRef]

- Asadi, Shahrokh, Esmaeil Hadavandia, Farhad Mehmanpazirb, and Mohammad Masoud Nakhostin. 2012. Hybridization of evolutionary Levenberg-Marquardt neural networks and data pre-processing for stock market prediction. Knowledge-Based Systems 35: 245–58. [Google Scholar] [CrossRef]

- Asktraders. 2020. How Many Traders Can Be Found Globally? Available online: https://www.asktraders.com/how-many-traders-can-be-found-globally/ (accessed on 15 July 2021).

- Aslam, Faheem, Paulo Ferreira, Haider Ali, and Sumera Kauser. 2021. Herding behavior during the COVID-19 pandemic: A comparison between Asian and European stock markets based on intraday multifractality. Eurasian Economic Review 20: 1–27. [Google Scholar]

- Atiya, Amir, Noha Talaat, and Samir Shaheen. 1997. An Efficient Stock Market Forecasting Model Using Neural Networks. Paper presented at the IEEE International Conference on Neural Networks, Houston, TX, USA, June 12; pp. 2112–15. [Google Scholar] [CrossRef]

- Atsalakis, George S. 2014. Surveying stock market forecasting techniques. Journal of Computational Optimization in Economics and Finance 2: 45–92. [Google Scholar]

- Atsalakis, George S., and Kimon P. Valavanis. 2006a. A Neuro-Fuzzy Controller for Stock Market Forecasting, Working Paper. Chania: Technical University of Crete.

- Atsalakis, George S., and Kimon P. Valavanis. 2006b. Neuro-Fuzzy and Technical Analysis for Stock Prediction, Working Paper. Chania: Technical University of Crete.

- Atsalakis, George S., and Kimon P. Valavanis. 2009a. Forecasting stock market short-term trends using a neuro-fuzzy based methodology. Expert Systems with Applications 36: 10696–707. [Google Scholar] [CrossRef]

- Atsalakis, George S., and Kimon P. Valavanis. 2009b. Surveying stock market forecasting techniques—Part II: Soft computing methods. Expert Systems with Applications 36: 5932–41. [Google Scholar] [CrossRef]

- Atsalakis, George S., Eftychios E. Protopapadakis, and Kimon P. Valavanis. 2016. Stock trend forecasting in turbulent market periods using neuro-fuzzy systems. Operational Research 16: 245–69. [Google Scholar] [CrossRef]

- Atsalakis, George S., Emmanouil M. Dimitrakakis, and Constantinos D. Zopounidis. 2011. Elliott Wave Theory and neuro-fuzzy systems, in stock market prediction: The WASP system. Expert Systems with Applications 38: 9196–206. [Google Scholar] [CrossRef]

- Baba, Norio, and Hidetsugu Suto. 2000. Utilization of artificial neural networks and the TD-learning method for constructing intelligent decision support systems. European Journal of Operational Research 122: 501–8. [Google Scholar] [CrossRef][Green Version]

- Baba, Norio, and Motokazu Kozaki. 1992. An Intelligent Forecasting System of Stock Price Using Neural Networks. Paper presented at the [Proceedings 1992] IJCNN International Joint Conference on Neural Networks, Baltimore, MD, USA, June 7–11; pp. 371–77. [Google Scholar] [CrossRef]

- Baek, Jinwoo, and Sungzoon Cho. 2001. Time to Jump in? Long Rising Pattern Detection in KOSPI 200 Future Using an Auto-Associative Neural Network. Paper presented at the ICONIP, Shanghai, China, November 14–17. [Google Scholar]

- Baek, Yujin, and Ha Young Kim. 2018. ModAugNet: A new forecasting framework for stock market index value with an overfitting prevention LSTM module and a prediction LSTM module. Expert Systems with Applications 113: 457–480. [Google Scholar] [CrossRef]

- Bahrammirzaee, Arash. 2010. A comparative survey of artificial intelligence applications in finance: Artificial neural networks, expert system and hybrid intelligent systems. Neural Computing and Applications 19: 1165–95. [Google Scholar] [CrossRef]

- Bansal, Sanchita, Isha Garg, and Gagan Deep Sharma. 2019. Social entrepreneurship as a path for social change and driver of sustainable development: A systematic review and research agenda. Sustainability 11: 1091. [Google Scholar] [CrossRef]

- Baruník, Jozef. 2008. How do neural networks enhance the predictability of central European stock returns? Czech Journal of Economics and Finance 58: 359–76. [Google Scholar]

- Bautista, Carlos C. 2001. Predicting the Philippine Stock Price Index Using Artificial Neural Networks. Philippines: UPCBA Discuss, p. 107. [Google Scholar]

- Bekiros, Stelios D. 2007. A neurofuzzy model for stock market trading. Applied Economics Letters 14: 53–57. [Google Scholar] [CrossRef]

- Bildirici, Melike, and Özgür Ersin. 2009. Improving forecasts of GARCH family models with the artificial neural networks: An application to the daily returns in Istanbul Stock Exchange. Expert Systems with Applications 36: 7355–62. [Google Scholar] [CrossRef]

- Bildirici, Melike, and Özgür Ersin. 2014a. Modeling markov switching ARMA-GARCH neural networks models and an application to forecasting stock returns. The Scientific World Journal 2014: 497941. [Google Scholar] [CrossRef]

- Bildirici, Melike, and Özgür Ersin. 2014b. Asymmetric power and fractionally integrated support vector and neural network GARCH models with an application to forecasting financial returns in ise100 stock index. Economic Computation and Economic Cybernetics Studies and Research 48: 1–22. [Google Scholar]

- Bisoi, Ranjeeta, and Pradipta K. Dash. 2014. A hybrid evolutionary dynamic neural network for stock market trend analysis and prediction using unscented Kalman filter. Applied Soft Computing 19: 41–56. [Google Scholar] [CrossRef]

- Bornmann, Lutz, Rüdiger Mutz, and Hans-Dieter Daniel. 2008. Are there better indices for evaluation purposes than the h index? A comparison of nine different variants of the h index using data from biomedicine. Journal of the American Society for Information Science and Technology 59: 830–37. [Google Scholar] [CrossRef]

- Brownstone, David. 1996. Using percentage accuracy to measure neural network predictions in Stock Market movements. Neurocomputing 10: 237–50. [Google Scholar] [CrossRef]

- Cao, Jiasheng, and Jinghan Wang. 2019. Stock price forecasting model based on modified convolution neural network and financial time series analysis. International Journal of Communication Systems 32: 1–13. [Google Scholar] [CrossRef]

- Cao, Qing, Karyl B. Leggio, and Marc J. Schniederjans. 2005. A comparison between Fama and French’s model and artificial neural networks in predicting the Chinese stock market. Computers & Operations Research 32: 2499–512. [Google Scholar] [CrossRef]

- Cao, Qing, Mark E. Parry, and Karyl B. Leggio. 2011. The three-factor model and artificial neural networks: Predicting stock price movement in China. Annals of Operations Research 185: 25–44. [Google Scholar] [CrossRef]

- Caporale, Guglielmo Maria, Menelaos Karanasos, Stavroula Yfanti, and Aris Kartsaklas. 2021. Investors’ trading behaviour and stock market volatility during crisis periods: A dual long-memory model for the Korean Stock Exchange. International Journal of Finance & Economics 26: 4441–61. [Google Scholar] [CrossRef]

- Carta, Salvatore M., Sergio Consoli, Luca Piras, Alessandro Sebastian Podda, and Diego Reforgiato Recupero. 2021. Explainable Machine Learning Exploiting News and Domain-Specific Lexicon for Stock Market Forecasting. IEEE Access 9: 30193–205. [Google Scholar] [CrossRef]

- Casas, C. Augusto. 2001. Tactical asset allocation: An artificial neural network based model. Paper presented at the International Joint Conference on Neural Network, Shenzhen, China, July 18–22, Vol. 3, pp. 1811–16. [Google Scholar]

- Chakravarty, Sreejit, and Pradipta K. Dash. 2012. A PSO based integrated functional link net and interval type-2 fuzzy logic system for predicting stock market indices. Applied Soft Computing 12: 931–41. [Google Scholar] [CrossRef]

- Chang, Pei-Chann, Di-di Wang, and Chang-le Zhou. 2012. A novel model by evolving partially connected neural network for stock price trend forecasting. Expert Systems with Applications 39: 611–20. [Google Scholar] [CrossRef]

- Chaturvedi, Animesh, and Samanvaya Chandra. 2004. A Neural Stock Price Predictor Using Quantitative Data. Paper presented at the Sixth International Conference on Information Integrationand Web-Based Applications Services, iiWAS, Jakarta, Indonesia, September 27–29; Vienna: Östereichische Computer Gesellschaft. [Google Scholar]

- Chen, An-Sing, Mark T. Leung, and Hazem Daouk. 2003. Application of neural networks to an emerging financial market: Forecasting and trading the Taiwan Stock Index. Computers & Operations Research 30: 901–23. [Google Scholar] [CrossRef]

- Chen, Lin, Zhilin Qiao, Minggang Wang, Chao Wang, Ruijin Du, and Harry Eugene Stanley. 2018. Which Artificial Intelligence Algorithm Better Predicts the Chinese Stock Market? IEEE Access 6: 48625–33. [Google Scholar] [CrossRef]

- Chen, Mu-Yen, Da-Ren Chen, Min-Hsuan Fan, and Tai-Ying Huang. 2013a. International transmission of stock market movements: An adaptive neuro-fuzzy inference system for analysis of TAIEX forecasting. Neural Computing and Applications 23: 369–78. [Google Scholar] [CrossRef]

- Chen, Mu-Yen, Min-Hsuan Fan, Young-Long Chen, and Hui-Mei Wei. 2013b. Design of experiments on neural network’s parameters optimization for time series forecasting in stock markets. Neural Network World 23: 369–93. [Google Scholar] [CrossRef]

- Chen, Yuehui, and Ajith Abraham. 2006. Hybrid-Learning Methods for Stock Index Modeling. In Artificial Neural Networks in Finance and Manufacturing. Hershey: IGI Global, pp. 64–79. [Google Scholar] [CrossRef]

- Chen, Yuehui, Xiaohui Dong, and Yaou Zhao. 2005. Stock Index Modeling Using EDA Based Local Linear Wavelet Neural Network. Paper presented at the 2005 International Conference on Neural Networks Brain, ICNNB’05, Beijing, China, October 13–15, vol. 3, pp. 1646–50. [Google Scholar] [CrossRef]

- Cheng, Pao L., and M. King Deets. 1971. Portfolio returns and the random walk theory. The Journal of Finance 26: 11–30. [Google Scholar] [CrossRef]

- Cheng, Philip, Chai Quek, and M. L. Mah. 2007. Predicting the impact of anticipatory action on U.S. Stock Market—An event study using ANFIS (A Neural Fuzzy Model). Computational Intelligence 23: 117–41. [Google Scholar] [CrossRef]

- Chenoweth, Tim, and Zoran Obradović. 1996. A multi-component nonlinear prediction system for the S & P 500 index. Neurocomputing 10: 275–90. [Google Scholar] [CrossRef]

- Chun, Se-Hak, and Yoon-Joo Park. 2005. Dynamic adaptive ensemble case-based reasoning: Application to stock market prediction. Expert Systems with Applications 28: 435–43. [Google Scholar] [CrossRef]

- Chung, Hyejung, and Kyung-shik Shin. 2020. Genetic algorithm-optimized multi-channel convolutional neural network for stock market prediction. Neural Computing and Applications 32: 7897–914. [Google Scholar] [CrossRef]

- Constantinou, Eleni, Robert Georgiades, Avo Kazandjian, and Georgios P. Kouretas. 2006. Regime switching and artificial neural network forecasting of the Cyprus Stock Exchange daily returns. International Journal of Finance & Economics 11: 371–83. [Google Scholar] [CrossRef]

- Dai, Wensheng, Jui-Yu Wu, and Chi-Jie Lu. 2012. Combining nonlinear independent component analysis and neural network for the prediction of Asian stock market indexes. Expert Systems with Applications 39: 4444–52. [Google Scholar] [CrossRef]

- Dami, Sina, and Mohammad Esterabi. 2021. Predicting stock returns of Tehran exchange using LSTM neural network and feature engineering technique. Multimedia Tools and Applications 80: 19947–70. [Google Scholar] [CrossRef]

- Dar, Arif Billah, Niyati Bhanja, and Aviral Kumar Tiwari. 2017. Do global financial crises validate assertions of fractal market hypothesis? International Economics and Economic Policy 14: 153–65. [Google Scholar] [CrossRef]

- Dash, Rajashree, and PradiptaKishore Dash. 2016. Efficient stock price prediction using a self evolving recurrent neuro-fuzzy inference system optimized through a modified differential harmony search technique. Expert Systems with Applications 52: 75–90. [Google Scholar] [CrossRef]

- Dash, Rajashree, Pradipta Kishore Dash, and Ranjeeta Bisoi. 2015. A differential harmony search based hybrid interval type2 fuzzy EGARCH model for stock market volatility prediction. International Journal of Approximate Reasoning 59: 81–104. [Google Scholar] [CrossRef]

- de Faria, E. L., Marcelo P. Albuquerque, J. L. Gonzalez, J. T. P. Cavalcante, and Marcio P. Albuquerque. 2009. Predicting the Brazilian stock market through neural networks and adaptive exponential smoothing methods. Expert Systems with Applications 36: 12506–9. [Google Scholar] [CrossRef]

- De Oliveira, Fagner A., Cristiane N. Nobre, and Luis E. Zárate. 2013. Applying Artificial Neural Networks to prediction of stock price and improvement of the directional prediction index–Case study of PETR4, Petrobras, Brazil. Expert Systems with Applications 40: 7596–606. [Google Scholar] [CrossRef]

- De Souza, Alberto F., Fabio Daros Freitas, and André Gustavo Coelho de Almeida. 2012. Fast learning and predicting of stock returns with virtual generalized random access memory weightless neural networks. Concurrency Computation Practice and Experience 24: 921–33. [Google Scholar] [CrossRef]

- Deng, Li, and Dong Yu. 2013. Deep learning: Methods and applications. Foundations and Trends in Signal Processing 7: 197–387. [Google Scholar] [CrossRef]

- Desai, Vijay S., and Rakesh Bharati. 1998a. A comparison of linear regression and neural network methods for predicting excess returns on large stocks. Annals of Operations Research 78: 127–63. [Google Scholar] [CrossRef]

- Desai, Vijay S., and Rakesh Bharati. 1998b. The efficacy of neural networks in predicting returns on stock and bond indices. Decision Sciences 29: 405–23. [Google Scholar] [CrossRef]

- Dey, Shubharthi, Yash Kumar, Snehanshu Saha, and Suryoday Basak. 2016. Forecasting to Classification: Predicting the Direction of Stock Market Price Using Xtreme Gradient Boosting. Bengaluru: PESIT South Campus. [Google Scholar]

- Dhenuvakonda, Padmaja, R. Anandan, and N. Kumar. 2020. Stock price prediction using artificial neural networks. Journal of Critical Reviews 7: 846–850. [Google Scholar]

- Di Persio, Luca, and Oleksandr Honchar. 2016. Artificial neural networks architectures for stock price prediction: Comparisons and applications. International Journal of Circuits, Systems and Signal Processing 10: 403–13. [Google Scholar]

- Doeksen, Brent, Ajith Abraham, Johnson Thomas, and Marcin Paprzycki. 2005. Real Stock Trading Using Soft Computing Models. Paper presented at the International Conference on Information Technology: Coding and Computing (ITCC’05), Las Vegas, NV, USA, April 4–6; Piscataway: Institute of Electrical and Electronics Engineers (IEEE), vol. II, pp. 162–67. [Google Scholar] [CrossRef]

- Donaldson, R. Glen, and Mark Kamstra. 1999. Neural network forecast combining with interaction effects. Journal of the Franklin Institute 336: 227–36. [Google Scholar] [CrossRef]

- Dong, Ming, and Xu-Shen Zhou. 2002. Exploring the Fuzzy Nature of Technical Patterns of US Stock Market. Paper presented at the 1st International Conference on Fuzzy Systems and Knowledge Discovery: Computational Intelligence for the E-Age, Singapore, November 18–22; pp. 324–28. [Google Scholar]

- Duch, Włodzisław, and Norbert Jankowski. 1999. Survey of neural transfer functions. Neural Computing Surveys 2: 163–212. [Google Scholar]

- Egeli, B., M. Ozturan, and B. Badur. 2003. Stock Market Prediction Using Artificial Neural Networks. Paper presented at the 3rd Hawaii International Conference on Business, Honolulu, HI, USA, June 18–21; pp. 1–8. [Google Scholar]

- Enke, David, and Nijat Mehdiyev. 2013. Stock market prediction using a combination of stepwise regression analysis, differential evolution-based fuzzy clustering, and a fuzzy inference neural network. Intelligent Automation & Soft Computing 19: 636–48. [Google Scholar] [CrossRef]

- Enke, David, and Suraphan Thawornwong. 2005. The use of data mining and neural networks for forecasting stock market returns. Expert Systems with Applications 29: 927–40. [Google Scholar] [CrossRef]

- Esfahanipour, Akbar, and Werya Aghamiri. 2010. Adapted neuro-fuzzy inference system on indirect approach TSK fuzzy rule base for stock market analysis. Expert Systems with Applications 37: 4742–48. [Google Scholar] [CrossRef]

- Ettes, Dennis. 2000. Trading the stock markets using genetic fuzzy modeling. Paper presented at the IEEE/IAFE Conference on Computational Intelligence for Financial Engineering—Proceedings (CIFEr), New York, NY, USA, March 26–28; pp. 22–25. [Google Scholar]

- Fama, Sharpe William. 1970. Efficient capital markets: A review of theory and empirical work: Discussion. The Journal of Finance 25: 383–417. [Google Scholar] [CrossRef]

- Fernández-López, Sara, Lucía Rey-Ares, and Milagros Vivel-Búa. 2018. The role of internet in stock market participation: Just a matter of habit? Information Technology & People 31: 869–85. [Google Scholar] [CrossRef]

- Fernández-Rodríguez, Fernando, Christian Gonzalez-Martel, and Simon Sosvilla-Rivero. 2000. On the profitability of technical trading rules based on artificial neural networks:: Evidence from the Madrid stock market. Economics Letters 69: 89–94. [Google Scholar] [CrossRef]

- Fong, Bernard, A. C. M. Fong, G. Y. Hong, and L. Wong. 2005. An empirical study of volatility predictions: Stock market analysis using neural networks. In Lecture Notes in Computer Science (Including Subseries Lecture Notes in Artificial Intelligence and Lecture Notes in Bioinformatics). Berlin: Springer, pp. 473–80. [Google Scholar] [CrossRef]

- Fouroudi, Pantea, Philip J. Kitchen, Reza Marvi, Tugra Nazli Akarsu, and Helal Uddin. 2020. A bibliometric investigation of service failure literature and a research agenda. European Journal of Marketing 54: 2575–619. [Google Scholar] [CrossRef]

- Gandhmal, Dattatray P., and K. Kumar. 2019. Systematic analysis and review of stock market prediction techniques. Computer Science Review 34: 100190. [Google Scholar] [CrossRef]

- Gao, Tingwei, and Yueting Chai. 2018. Improving stock closing price prediction using recurrent neural network and technical indicators. Neural Computation 30: 2833–54. [Google Scholar] [CrossRef]

- Garg, Harish. 2016. A hybrid PSO-GA algorithm for constrained optimization problems. Applied Mathematics and Computation 274: 292–305. [Google Scholar] [CrossRef]

- Ghai, Ambica, Pradeep Kumar, and Samrat Gupta. 2021. A deep-learning-based image forgery detection framework for controlling the spread of misinformation. Information Technology & People. [Google Scholar] [CrossRef]

- Ghasemiyeh, Rahim, Reza Moghdani, and Shib Sankar Sana. 2017. A hybrid artificial neural network with metaheuristic algorithms for predicting stock price. Cybernetics and Systems 48: 365–92. [Google Scholar] [CrossRef]

- Göçken, Mustafa, Mehmet Özçalıcı, Aslı Boru, and Ayşe Tuğba Dosdoğruc. 2016. Integrating metaheuristics and artificial neural networks for improved stock price prediction. Expert Systems with Applications 44: 320–31. [Google Scholar] [CrossRef]

- Gradojevic, Nikola, Jing Yang, and Toni Gravelle. 2002. Neuro-Fuzzy Decision-Making in Foreign Exchange Trading and Other Applications. Paper presented at the CEA 36th Annual Meetings, Calgary, AB, Canada, May 30–Jun 2. [Google Scholar]

- Dong, Guanqun, Kamaladdin Fataliyev, and Lipo Wang. 2013. One-Step and Multi-Step Ahead Stock Prediction Using Backpropagation Neural Networks. Paper presented at the ICICS 2013—the 9th International Conference on Information, Communications and Signal Processing, Tainan, Taiwan, December 10–13. [Google Scholar]

- Guo, Zhiqiang, Huaiqing Wang, Jie Yang, and David J. Miller. 2015. A stock market forecasting model combining two-directional two-dimensional principal component analysis and radial basis function neural network. PLoS ONE 10: e0122385. [Google Scholar] [CrossRef] [PubMed]

- Guresen, Erkam, Gulgun Kayakutlu, and Tugrul U. Daim. 2011. Using artificial neural network models in stock market index prediction. Expert Systems with Applications 38: 10389–97. [Google Scholar] [CrossRef]

- Hadavandi, Esmaeil, Hassan Shavandi, and Arash Ghanbari. 2010. Integration of genetic fuzzy systems and artificial neural networks for stock price forecasting. Knowledge-Based Systems 23: 800–8. [Google Scholar] [CrossRef]

- Hafezi, Reza, Jamal Shahrabi, and Esmaeil Hadavandi. 2015. A bat-neural network multi-agent system (BNNMAS) for stock price prediction: Case study of DAX stock price. Applied Soft Computing 29: 196–210. [Google Scholar] [CrossRef]

- Halliday, R. 2004. Equity trend prediction with neural networks. Research Letters in the Information and Mathematical Sciences 6: 15–29. [Google Scholar]

- Hamid, Alain, and Moritz Heiden. 2015. Forecasting volatility with empirical similarity and Google Trends. Journal of Economic Behavior & Organization 117: 62–81. [Google Scholar] [CrossRef]

- Hao, Pei-Yi, Chien-Feng Kung, Chun-Yang Chang, and Jen-Bing Ou. 2021. Predicting stock price trends based on financial news articles and using a novel twin support vector machine with fuzzy hyperplane. Applied Soft Computing 98: 106806. [Google Scholar] [CrossRef]

- Hao, Yaping, and Qiang Gao. 2020. Predicting the trend of stock market index using the hybrid neural network based on multiple time scale feature learning. Applied Sciences 10: 3961. [Google Scholar] [CrossRef]

- Harvey, Campbell R. 1995. Predictable risk and returns in emerging markets. The Review of Financial Studies 8: 773–816. [Google Scholar] [CrossRef]

- Harvey, Campbell R., Kirsten E. Travers, and Michael J. Costa. 2000. Forecasting emerging market returns using neural networks. Emerging Markets Quarterly 4: 1–12. [Google Scholar]

- Hassan, Rania, Babak Cohanim, Olivier de Weck, and Gerhard Venter. 2005. A Comparison of Particle Swarm Optimization and the Genetic Algorithm. Paper presented at the AIAA/ASME/ASCE/AHS/ASC Structures,Structural Dynamics and Materials Conference, Austin, TX, USA, April 18–21; pp. 1138–1897. [Google Scholar] [CrossRef]

- Hirsch, Jorge E. 2005. An index to quantify an individual’s scientific research output. Proceedings of the National Academy of Sciences USA 102: 16569–72. [Google Scholar] [CrossRef]

- Hsieh, Tsung-Jung, Hsiao-Fen Hsiao, and Wei-Chang Yeh. 2011. Forecasting stock markets using wavelet transforms and recurrent neural networks: An integrated system based on artificial bee colony algorithm. Applied Soft Computing 11: 2510–25. [Google Scholar] [CrossRef]

- Hu, Hongping, Tang Li, Shuhua Zhang, and Haiyan Wang. 2018. Predicting the direction of stock markets using optimized neural networks with Google Trends. Neurocomputing 285: 188–95. [Google Scholar] [CrossRef]

- Huang, W., S. Wang, L. Yu, Y. Bao, and L. Wang. 2006. A new computational method of input selection for stock market forecasting with neural networks. In Lecture Notes in Computer Science (Including Subseries Lecture Notes in Artificial Intelligence and Lecture Notes in Bioinformatics). Edited by V. N. Alexandrov, G. D. Van Albada, P. M. A. Sloot and J. Dongarra. Berlin/Heidelberger: Springer, pp. 308–15. [Google Scholar] [CrossRef]

- Huang, Wei, Yoshiteru Nakamori, and Shou-Yang Wang. 2005. Forecasting stock market movement direction with support vector machine. Computers & Operations Research 32: 2513–22. [Google Scholar] [CrossRef]

- Huarng, Kunhuang. 2001. Effective lengths of intervals to improve forecasting in fuzzy time series. Fuzzy Sets and Systems 123: 387–94. [Google Scholar] [CrossRef]

- Huarng, Kunhuang, and Hui-Kuang Yu. 2005. A type 2 fuzzy time series model for stock index forecasting. Physica A: Statistical Mechanics and its Applications 353: 445–62. [Google Scholar] [CrossRef]

- Hui, Siu Cheung, M. T. Yap, and P. Prakash. 2000. A hybrid time lagged network for predicting stock prices. International Journal of the Computer, Internet and Management 8: 26–40. [Google Scholar]

- Inthachot, Montri, Veera Boonjing, and Sarun Intakosum. 2016. Artificial neural network and genetic algorithm hybrid intelligence for predicting thai stock price index trend. Computational Intelligence and Neuroscience 2016: 3045254. [Google Scholar] [CrossRef]

- Jain, Mansi, Gagan Deep Sharma, and Mandeep Mahendru. 2019. Can I sustain my happiness? A review, critique and research agenda for economics of happiness. Sustainability 11: 6375. [Google Scholar] [CrossRef]

- Gholamreza, Jandaghi, Reza Tehrani, Davoud Hosseinpour, Rahmatollah Gholipour, and Seyed Amir Shahidi Shadkam. 2010. Application of Fuzzy-neural networks in multi-ahead forecast of stock price. African Journal of Business Management 4: 903–14. [Google Scholar]

- Jang, Gia-Shuh, Feipei Lai, Bor-Wei Jiang, and Li-Hua Chien. 1991. An Intelligent Trend Prediction and Reversal Recognition System Using Dual-Module Neural Networks. Paper presented at the First International Conference on Artificial Intelligence Applications on Wall Street, New York, NY, USA, October 9–11; Piscataway: IEEE, pp. 42–51. [Google Scholar] [CrossRef]

- Jaruszewicz, Marcin, and Jacek Mańdziuk. 2004. One day prediction of NIKKEI index considering information from other stock markets. In Lecture Notes in Artificial Intelligence (Subseries of Lecture Notes in Computer Science). Berlin/Heidelberg: Springer, pp. 1130–35. [Google Scholar] [CrossRef]

- Schoenmakers, Kevin, Hepeng Jia, and Sian Powell. 2021. Towards new frontiers. Nature 593: S24–S27. [Google Scholar]

- Johari, AJohari Aayushi. 2020. AI Applications: Top 10 Real World Artificial Intelligence Applications. Available online: https://www.edureka.co/blog/artificial-intelligence-applications/ (accessed on 20 July 2021).

- Kakinaka, Shinji, and Ken Umeno. 2021. Cryptocurrency market efficiency in short- and long-term horizons during COVID-19: An asymmetric multifractal analysis approach. Finance Research Letters 42: 102319. [Google Scholar] [CrossRef]

- Kanas, Angelos. 2001. Neural network linear forecasts for stock returns. International Journal of Finance & Economics 6: 245–54. [Google Scholar] [CrossRef]

- Kanas, Angelos, and Andreas Yannopoulos. 2001. Comparing linear and nonlinear forecasts for stock returns. International Review of Economics & Finance 10: 383–98. [Google Scholar] [CrossRef]

- Kara, Yakup, Melek Acar Boyacioglu, and Ömer Kaan Baykan. 2011. Predicting direction of stock price index movement using artificial neural networks and support vector machines: The sample of the Istanbul Stock Exchange. Expert Systems with Applications 38: 5311–19. [Google Scholar] [CrossRef]

- Karp, A., and G. Van Vuuren. 2019. Investment Implications of the Fractal Market Hypothesis. Annals of Economics and Finance 14: 1950001. [Google Scholar] [CrossRef]

- Kearney, Colm, and Sha Liu. 2014. Textual sentiment in finance: A survey of methods and models. International Review of Financial Analysis 33: 171–85. [Google Scholar] [CrossRef]

- Khan, W., M. A. Ghazanfar, M. A. Azam, A. Karami, K. H. Alyoubi, and A. S. Alfakeeh. 2020a. Stock market prediction using machine learning classifiers and social media, news. Journal of Ambient Intelligence and Humanized Computing. [Google Scholar] [CrossRef]

- Khan, W., U. Malik, M. A. Ghazanfar, M. A. Azam, K. H. Alyoubi, and A. S. Alfakeeh. 2020b. Predicting stock market trends using machine learning algorithms via public sentiment and political situation analysis. Soft Computing 24: 11019–43. [Google Scholar] [CrossRef]

- Khansa, Lara, and Divakaran Liginlal. 2011. Predicting stock market returns from malicious attacks: A comparative analysis of vector autoregression and time-delayed neural networks. Decision Support Systems 51: 745–59. [Google Scholar] [CrossRef]

- Kim, G. H., and S. H. Kim. 2019. Variable Selection for Artificial Neural Networks with Applications for Stock Price Prediction. Applied Artificial Intelligence 33: 54–67. [Google Scholar] [CrossRef]

- Kim, Hyun-jung, and Kyung-shik Shin. 2007. A hybrid approach based on neural networks and genetic algorithms for detecting temporal patterns in stock markets. Applied Soft Computing 7: 569–76. [Google Scholar] [CrossRef]

- Kim, Kyoung-jae, and Won Boo Lee. 2004. Stock market prediction using artificial neural networks with optimal feature transformation. Neural Computing & Applications 13: 255–60. [Google Scholar] [CrossRef]

- Kim, Kyoung-jae, and Ingoo Han. 2000. Genetic algorithms approach to feature discretization in artificial neural networks for the prediction of stock price index. Expert Systems with Applications 19: 125–32. [Google Scholar] [CrossRef]

- Kim, Kyoung-jae, Ingoo Han, and Jonh S. Chandler. 1998. Extracting Trading Rules from the Multiple Classifiers and Technical Indicators in Stock Market. Paper presented at the Korea Society of Management Information Systems’ 98 International Conference on IS Paradigm Reestablishment, Vienna, Austria; Available online: https://koasas.kaist.ac.kr/bitstream/10203/5359/1/1998-100.pdf (accessed on 15 July 2021).

- Kim, Sung-Suk. 1998. Time-delay recurrent neural network for temporal correlations and prediction. Neurocomputing 20: 253–63. [Google Scholar] [CrossRef]

- Kimoto, Takashi, K. Asakawa, M. Yoda, and M. Takeoka. 1990. Stock Market Prediction System with Modular Neural Networks. Paper presented at the IJCNN International Joint Conference on Neural Networks, San Diego, CA, USA, June 17–21; Piscataway: Institute of Electrical and Electronics Engineers (IEEE), pp. 1–6. [Google Scholar] [CrossRef]

- Kingma, Diederik P., and Jimmy Ba. 2014. Adam: A Method for Stochastic Optimization. arXiv arXiv:1412.6980. [Google Scholar]

- KKnill, April, Kristina Minnick, and Ali Nejadmalayeri. 2012. Experience, information asymmetry, and rational forecast bias. Review of Quantitative Finance and Accounting 39: 241–72. [Google Scholar] [CrossRef]

- Kohara, Kazuhiro, Yoshimi Fukuhara, and Yukihiro Nakamura. 1996. Selective presentation learning for neural network forecasting of stock markets. In Neural Computing and Applications. New York: Springer, Vol. 4, pp. 143–48. [Google Scholar]

- Kosaka, M., H. Mizuno, T. Sasaki, R. Someya, and N. Hamada. 1991. Applications of Fuzzy Logic/Neural Network to Securities Trading Decision Support System. Paper presented at the 1991 IEEE International Conference on Systems, Man, and Cybernetics, Charlottesville, VA, USA, October 13–16; pp. 1913–18. [Google Scholar] [CrossRef]

- Koulouriotis, Dimitris E. 2004. Investment analysis & decision making in markets using adaptive fuzzy causal relationships. Operational Research 4: 213–33. [Google Scholar] [CrossRef]

- Koulouriotis, Dimitris E., Ioannis E. Diakoulakis, and Dimitris M. Emiris. 2001. A fuzzy cognitive map-based stock market model: Synthesis, analysis and experimental results. Paper presented at the 10th IEEE International Conference on Fuzzy Systems, Melbourne, Australia, December 2; pp. 465–68. [Google Scholar] [CrossRef]

- Koulouriotis, D. E., I. E. Diakoulakis, D. M. Emiris, and C. D. Zopounidis. 2005. Development of dynamic cognitive networks as complex systems approximators: Validation in financial time series. Applied Soft Computing 5: 157–79. [Google Scholar] [CrossRef]

- Kumar, Anoop S., Chaithanya Jayakumar, and Bandi Kamaiah. 2017. Fractal market hypothesis: Evidence for nine Asian forex markets. Indian Economic Review 52: 181–92. [Google Scholar] [CrossRef]

- Kuo, Ren Jie. 1998. A decision support system for the stock market through integration of fuzzy neural networks and fuzzy Delphi. Applied Artificial Intelligence 12: 501–20. [Google Scholar] [CrossRef]

- Kyriakou, Ioannis, Parastoo Mousavi, Jens Perch Nielsen, and Michael Scholz. 2021. Forecasting benchmarks of long-term stock returns via machine learning. Annals of Operations Research 297: 221–40. [Google Scholar] [CrossRef]

- Laboissiere, Leonel A., Ricardo A. S. Fernandes, and Guilherme G. Lage. 2015. Maximum and minimum stock price forecasting of Brazilian power distribution companies based on artificial neural networks. Applied Soft Computing 35: 66–74. [Google Scholar] [CrossRef]

- Lam, S. S. 2001. A genetic fuzzy expert system for stock market timing. Paper presented at the IEEE Conference on Evolutionary Computation—ICEC, Seoul, Korea, May 27–30; pp. 410–17. [Google Scholar]

- Lee, Ching-Hung, Jang-Lee Hong, Yu-Ching Lin, and Wei-Yu La. 2003. Type-2 fuzzy neural network systems and learning. International Journal of Computational Cognition 1: 79–90. [Google Scholar]

- Lee, Ming-Che, Jia-Wei Chang, Jason C. Hung, and Bae-Ling Chen. 2021. Exploring the effectiveness of deep neural networks with technical analysis applied to stock market prediction. Computer Science and Information Systems 18: 401–18. [Google Scholar] [CrossRef]

- Lei, Lei. 2018. Wavelet neural network prediction method of stock price trend based on rough set attribute reduction. Applied Soft Computing 62: 923–32. [Google Scholar] [CrossRef]

- Leigh, William, M. Paz, and R. Purvis. 2002. An analysis of a hybrid neural network and pattern recognition technique for predicting short-term increases in the NYSE composite index. Omega 30: 69–76. [Google Scholar] [CrossRef]

- Lendasse, Amaury, E. de Bodt, V. Wertz, and M. Verleysen. 2000. Non-linear financial time series forecasting—Application to the Bel 20 stock market index. European Journal of Economic and Social Systems 14: 81–91. [Google Scholar] [CrossRef]

- Li, Yelin, Hui Bu, Jiahong Li, and Junjie Wu. 2020. The role of text-extracted investor sentiment in Chinese stock price prediction with the enhancement of deep learning. International Journal of Forecasting 36: 1541–62. [Google Scholar] [CrossRef]

- Lin, Chin-Tsai, and Hsin-Yi Yeh. 2009. Empirical of the Taiwan stock index option price forecasting model–applied artificial neural network. Applied Economics 41: 1965–72. [Google Scholar] [CrossRef]

- Liu, Chih-Feng, Chi-Yuan Yeh, and Shie-Jue Lee. 2012. Application of type-2 neuro-fuzzy modeling in stock price prediction. Applied Soft Computing 12: 1348–58. [Google Scholar] [CrossRef]

- Liu, Fajiang, and Jun Wang. 2012. Fluctuation prediction of stock market index by Legendre neural network with random time strength function. Neurocomputing 83: 12–21. [Google Scholar] [CrossRef]

- Liu, Haifan, and Jun Wang. 2011. Integrating independent component analysis and principal component analysis with neural network to predict Chinese stock market. Mathematical Problems in Engineering 2011: 382659. [Google Scholar] [CrossRef]

- Liu, Suhui, Xiaodong Zhang, Ying Wang, and Guoming Feng. 2020. Recurrent convolutional neural kernel model for stock price movement prediction. PLoS ONE 15: e0234206. [Google Scholar] [CrossRef] [PubMed]

- Lu, Chi-Jie. 2010. Integrating independent component analysis-based denoising scheme with neural network for stock price prediction. Expert Systems with Applications 37: 7056–64. [Google Scholar] [CrossRef]

- Ma, Shangchen. 2020. Predicting the SP500 Index Trend Based on GBDT and LightGBM Methods. E3S Web of Conferences 214: 02019. [Google Scholar] [CrossRef]

- Mabu, Shingo, Yan Chen, Dongkyu Sohn, Kaoru Shimada, and Kotaro Hirasawa. 2009. Stock price prediction using neural networks with RasID-GA. IEEJ Transactions on Electrical and Electronic Engineering 4: 392–403. [Google Scholar] [CrossRef]

- Mahmud, Mohammad Sultan, and Phayung Meesad. 2016. An innovative recurrent error-based neuro-fuzzy system with momentum for stock price prediction. Soft Computing 20: 4173–91. [Google Scholar] [CrossRef]

- Maknickiene, Nijole, Indre Lapinskaite, and Algirdas Maknickas. 2018. Application of ensemble of recurrent neural networks for forecasting of stock market sentiments. Equilibrium Quarterly Journal of Economics and Economic Policy 13: 7–27. [Google Scholar] [CrossRef]

- Malagrino, Luciana S., Norton T. Roman, and Ana M. Monteiro. 2018. Forecasting stock market index daily direction: A Bayesian Network approach. Expert Systems with Applications 105: 11–22. [Google Scholar] [CrossRef]

- Marček, Dušan. 2004. Stock price forecasting: Statistical, classical and fuzzy neural network approach. In Lecture Notes in Artificial Intelligence (Subseries of Lecture Notes in Computer Science). Edited by V. Torra and Y. Narukawa. Berlin/Heidelberger: Springer, pp. 41–48. [Google Scholar] [CrossRef]

- Matilla-García, Mariano, and Carlos Argüello. 2005. A hybrid approach based on neural networks and genetic algorithms to the study of profitability in the spanish stock market. Applied Economics Letters 12: 303–8. [Google Scholar] [CrossRef]

- Matsubara, Takashi, Ryo Akita, and Kuniaki Uehara. 2018. Stock price prediction by deep neural generative model of news articles. IEICE TRANSACTIONS on Information and Systems E101D: 901–8. [Google Scholar] [CrossRef]

- Mazurek, Jiri. 2017. A modification to Hirsch index allowing comparisons across different scientific fields. arXiv arXiv:1703.05485. [Google Scholar]

- Mehta, Pooja, Sharnil Pandya, and Ketan Kotecha. 2021. Harvesting social media sentiment analysis to enhance stock market prediction using deep learning. PeerJ Computer Science 7: e476. [Google Scholar] [CrossRef]

- Melin, Patricia, Jesus Soto, Oscar Castillo, and Jose Soria. 2012. A new approach for time series prediction using ensembles of ANFIS models. Expert Systems with Applications 39: 3494–506. [Google Scholar] [CrossRef]

- Michalak, Krzysztof, and Piotr Lipinski. 2005. Prediction of high increases in stock prices using neural networks. Neural Network World 15: 359–66. [Google Scholar]

- Mizuno, Hirotaka, Michitaka Kosaka, and Hiroshi Yajima. 1998. Application Of Neural Network To Technical Analysis Of Stock Market Prediction. Architecture 7: 1–14. [Google Scholar]

- Mizuno, H., M. Kosaka, H. Yajima, and N. Komoda. 2001. Application of neural network to technical analysis of stock market prediction. Studies in Informatics and Control 7: 111–20. [Google Scholar]

- Mo, Haiyan, and Jun Wang. 2013. Volatility degree forecasting of stock market by stochastic time strength neural network. Mathematical Problems in Engineering 2013: 436795. [Google Scholar] [CrossRef]

- Moher, David, Alessandro Liberati, Jennifer Tetzlaff, and Douglas G. Altman. 2009. Preferred reporting items for systematic reviews and meta-analyses: The PRISMA statement. PLoS Medicine 62: 1006–12. [Google Scholar] [CrossRef]

- Moradi, Mahdi, Mehdi Jabbari Nooghabi, and Mohammad Mahdi Rounaghi. 2021. Investigation of fractal market hypothesis and forecasting time series stock returns for Tehran Stock Exchange and London Stock Exchange. International Journal of Finance & Economics 26: 662–78. [Google Scholar] [CrossRef]

- Motiwalla, Luvai, and Mahmoud Wahab. 2000. Predictable variation and profitable trading of US equities: A trading simulation using neural networks. Computers & Operations Research 27: 1111–29. [Google Scholar] [CrossRef]

- Müller, Sebastian. 2019. Economic links and cross-predictability of stock returns: Evidence from characteristic-based “styles”. Review of Finance 23: 363–95. [Google Scholar] [CrossRef]

- Nabi, Rebwar M., Ab M. Saeed Soran, and Habibollah Harron. 2020. A Novel Approach for Stock Price Prediction Using Gradient Boosting Machine with Feature Engineering (GBM-wFE). Kurdistan Journal of Applied Research 5: 28–48. [Google Scholar] [CrossRef]

- Nabipour, Mojtaba, Pooyan Nayyeri, Hamed Jabani, S. Shahab, and Amir Mosavii. 2020. Predicting Stock Market Trends Using Machine Learning and Deep Learning Algorithms Via Continuous and Binary Data, A Comparative Analysis. IEEE Access 8: 150199–212. [Google Scholar] [CrossRef]

- Naeem, Muhammad Abubakr, Elie Bouri, Zhe Peng, Syed Jawad Hussain Shahzad, and Xuan Vinh Vo. 2021. Asymmetric efficiency of cryptocurrencies during COVID19. Physica A: Statistical Mechanics and its Applications 565: 125562. [Google Scholar] [CrossRef]

- Nayak, Sarat Chandra, Bijan Bihari Misra, and Himansu Sekhar Behera. 2016. An adaptive second order neural network with genetic-algorithm-based training (ASONN-GA) to forecast the closing prices of the stock market. International Journal of Applied Metaheuristic Computing 7: 39–57. [Google Scholar] [CrossRef]

- Neuhierl, Andreas, and Michael Weber. 2017. Monetary policy and the stock market: Time-series evidence. National Bureau of Economic Research 44: 1–25. [Google Scholar] [CrossRef][Green Version]

- Obthong, Mehtabhorn, Nongnuch Tantisantiwong, Watthanasak Jeamwatthanachai, and Gary Wills. 2020. A Survey on Machine Learning for Stock Price Prediction: Algorithms and Techniques. Paper presented at the FEMIB 2020—2nd International Conference on Finance, Economics, Management and IT Business, Prague, Czech Republic, May 5–6; pp. 63–71. [Google Scholar] [CrossRef]

- Oh, Kyong Joo, and Kyoung-jae Kim. 2002. Analyzing stock market tick data using piecewise nonlinear model. Expert Systems with Applications 22: 249–55. [Google Scholar] [CrossRef]

- Olson, Dennis, and Charles Mossman. 2003. Neural network forecasts of Canadian stock returns using accounting ratios. International Journal of Forecasting 19: 453–65. [Google Scholar] [CrossRef]

- Ortega, Luis, and Khaldoun Khashanah. 2014. A neuro-wavelet model for the short-term forecasting of high-frequency time series of stock returns. Journal of Forecasting 33: 134–46. [Google Scholar] [CrossRef]

- Pai, Ping-Feng, and Chih-Sheng Lin. 2005. A hybrid ARIMA and support vector machines model in stock price forecasting. Omega 33: 497–505. [Google Scholar] [CrossRef]

- Pan, Heping, Chandima Tilakaratne, and John Yearwood. 2005. Predicting Australian stock market index using neural networks exploiting dynamical swings and intermarket influences. Journal of Research and Practice in Information Technology 37: 43–54. [Google Scholar] [CrossRef]

- Pang, Xiongwen, Yanqiang Zhou, Pan Wang, Weiwei Lin, and Victor Chang. 2020. An innovative neural network approach for stock market prediction. The Journal of Supercomputing 76: 2098–118. [Google Scholar] [CrossRef]

- Pantazopoulos, Konstantinos N., L. H. Tsoukalas, N. G. Bourbakis, M. J. Brün, and E. N. Houstis. 1998. Financial prediction and trading strategies using neurofuzzy approaches. IEEE Transactions on Systems, Man, and Cybernetics, Part B (Cybernetics) 28: 520–31. [Google Scholar] [CrossRef]

- Patalay, S., and M. R. Bandlamudi. 2020. Stock price prediction and portfolio selection using artificial intelligence. Asia Pacific Journal of Information Systems 30: 31–52. [Google Scholar] [CrossRef]

- Pérez-Rodríguez, Jorge V., Salvador Torra, and Julian Andrada-Félix. 2005. STAR and ANN Models: Forecasting Performance on the Spanish Ibex-35 Stock Index. Hoboken: John Wiley & Sons, vol. 24. [Google Scholar]

- Peters, Edgar E. 1994. Fractal Market Analysis: Applying Chaos Theory to Investment and Economics. New York: John Wiley & Sons, Vol. 24. [Google Scholar]

- Qi, Min. 1999. Nonlinear predictability of stock returns using financial and economic variables. Journal of Business & Economic Statistics 17: 419–29. [Google Scholar] [CrossRef]

- Qiu, Jiayu, Bin Wang, and Changjun Zhou. 2020. Forecasting stock prices with long-short term memory neural network based on attention mechanism. PLoS ONE 15: e0227222. [Google Scholar] [CrossRef] [PubMed]

- Qiu, Mingyue, and Yu Song. 2016. Predicting the direction of stock market index movement using an optimized artificial neural network model. PLoS ONE 11: e0155133. [Google Scholar] [CrossRef]

- Qiu, Mingyue, Yu Song, and Fumio Akagi. 2016. Application of artificial neural network for the prediction of stock market returns: The case of the Japanese stock market. Chaos, Solitons and Fractals 85: 1–7. [Google Scholar] [CrossRef]

- Quah, Tong-Seng. 1999. Improving returns on stock investment through neural network selection. Artificial Neural Networks in Finance and Manufacturing 17: 295–301. [Google Scholar] [CrossRef]

- Rajab, Sharifa, and Vinod Sharma. 2019. An interpretable neuro-fuzzy approach to stock price forecasting. Soft Computing—A Fusion of Foundations, Methodologies and Applications 23: 921–36. [Google Scholar] [CrossRef]

- Raposo, R. de C. T., and A. J. D. O. Cruz. 2002. Stock market prediction based on fundamentalist analysis with fuzzy-neural networks. Paper presented at the 3rd WSES International Conference on Fuzzy Sets, Interlaken, Switzerland, February 11–14. [Google Scholar]

- Rast, Martin. 1999. Forecasting with fuzzy neural networks: A case study in stock market crash situations. Paper presented at the Annual Conference of the North American Fuzzy Information Processing Society—NAFIPS, New York, NY, USA, June 10–12; Piscataway: Institute of Electrical and Electronics Engineers (IEEE), pp. 418–20. [Google Scholar] [CrossRef]

- Rather, Akhter Mohiuddin, Arun Agarwal, and V. N. Sastry. 2015. Recurrent neural network and a hybrid model for prediction of stock returns. Expert Systems with Applications 42: 3234–41. [Google Scholar] [CrossRef]

- Rech, Gianluigi. 2002. Forecasting with Artificial Neural Network Models. Stockholm: Stockholm School of Economics. [Google Scholar]

- Refenes, Apostolos Nikolaos, M. Azema-Barac, and A. D. Zapranis. 1993. Stock Ranking: Neural Networks vs. Multiple Linear Regression. Paper presented at the 1993 IEEE International Conference on Neural Networks, San Francisco, CA, USA, March 28–April 1; Piscataway: Institute of Electrical and Electronics Engineers, pp. 1419–26. [Google Scholar] [CrossRef]

- Richard, Mark, and Jan Vecer. 2021. Efficiency testing of prediction markets: Martingale approach, likelihood ratio and bayes factor analysis. Risks 9: 31. [Google Scholar] [CrossRef]

- Rihani, V., and S. K. Garg. 2006. Neural networks for the prediction of stock market. IETE Technical Review (The Institution of Electronics and Telecommunication Engineers India) 23: 113–17. [Google Scholar] [CrossRef]

- Rosado-Serrano, Alexander, Justin Paul, and Desislava Dikova. 2018. International franchising: A literature review and research agenda. Journal of Business Research 85: 238–57. [Google Scholar] [CrossRef]

- Roy, Sanjiban Sekhar, Rohan Chopra, Kun Chang Lee, Concetto Spampinato, and Behnam Mohammadi-ivatlood. 2020. Random forest, gradient boosted machines and deep neural network for stock price forecasting: A comparative analysis on South Korean companies. International Journal of Ad Hoc and Ubiquitous Computing 33: 62–71. [Google Scholar] [CrossRef]

- Rumelhart, David E., Geoffrey E. Hinton, and Ronald J. Williams. 1986. Learning representations by back-propagating errors. Nature 323: 533–36. [Google Scholar] [CrossRef]

- Ruxanda, Gheorghe, and Laura Maria Badea. 2014. Configuring artificial neural networks for stock market predictions. Technological and Economic Development of Economy 20: 116–32. [Google Scholar] [CrossRef]

- Safi, Samir K., and Alexander K. White. 2017. Short and long-term forecasting using artificial neural networks for stock prices in Palestine: A comparative study. Electronic Journal of Applied Statistical Analysis 10: 14–28. [Google Scholar] [CrossRef]

- Safer, Alan M., and Bogdan M. Wilamowski. 1999. Using neural networks to predict abnormal returns of quarterly earnings. Proceedings of the International Joint Conference on Neural Networks, Washington, DC, USA, July 10–16, Vol. 6, pp. 3840–43. [Google Scholar]

- Sagir, Abdu Masanawa, and Saratha Sathasivan. 2017. The use of artificial neural network and multiple linear regressions for stock market forecasting. MATEMATIKA: Malaysian Journal of Industrial and Applied Mathematics 33: 1–10. [Google Scholar] [CrossRef]

- Samuelson, Paul A. 1973. Proof that properly discounted present values of assets vibrate randomly. The Bell Journal of Economics and Management Science 4: 369. [Google Scholar] [CrossRef]

- Schumann, Matthias, and T. Lohrbach. 1993. Comparing Artificial Neural Networks with Statistical Methods within the Field of Stock Market Prediction. Paper presented at the Twenty-Sixth Hawaii International Conference on System Sciences, Wailea, HI, USA, January 8; Piscataway: Institute of Electrical and Electronics Engineers (IEEE), pp. 597–606. [Google Scholar] [CrossRef]

- Selvin, Sreelekshmy, R. Vinayakumar, E. A. Gopalakrishnan, V. K. Menon, and K. P. Soman. 2017. Stock Price Prediction Using LSTM, RNN and CNN-Sliding Window Model. Paper presented at the 2017 International Conference on Advances in Computing,Communications and Informatics (ICACCI), Udupi, India, September 13–16; pp. 1643–47. [Google Scholar] [CrossRef]

- Setnes, Magne, and O. J. H. van Drempt. 1999. Fuzzy Modeling in Stock-Market Analysis. Paper presented at the IEEE/IAFE Conference on Computational Intelligence for Financial Engineering (CIFEr), New York, NY, USA, April 27; Piscataway: Institute of Electrical and Electronics Engineers (IEEE), pp. 250–58. [Google Scholar] [CrossRef]

- Shah, Dev, Haruna Isah, and Farhana Zulkernine. 2019. Stock market analysis: A review and taxonomy of prediction techniques. International Journal of Financial Studies 7: 26. [Google Scholar] [CrossRef]

- Shah, Habib, Nasser Tairan, Harish Garg, and Rozaida Ghazali. 2018. A Quick Gbest Guided Artificial Bee Colony algorithm for stock market prices prediction. Symmetry 10: 292. [Google Scholar] [CrossRef]

- Sharma, Gagan Deep, Anshita Yadav, and Ritika Chopra. 2020. Artificial intelligence and effective governance: A review, critique and research agenda. Sustainable Futures 2: 100004. [Google Scholar] [CrossRef]

- Siekmann, Stefan, Rudolf Kruse, Jörg Gebhardt, Franck Van Overbeek, and Roger Cooke. 2001. Information fusion in the context of stock index prediction. International Journal of Intelligent Systems 16: 1285–98. [Google Scholar] [CrossRef]

- Singh, Krishna Kumar, Priti Dimri, and Madhu Rawat. 2013. Fractal Market Hypothesis in Indian Stock Market. International Journal 3: 11. [Google Scholar]

- Situngkir, Hokky, and Yohanes Surya. 2004. Neural network revisited: Perception on modified Poincare map of financial time-series data. Physica A: Statistical Mechanics and its Applications 344: 100–3. [Google Scholar] [CrossRef]

- Škrinjarić, Tihana, and Zrinka Orlović. 2020. Economic policy uncertainty and stock market spillovers: Case of selected CEE markets. Mathematics 8: 1077. [Google Scholar] [CrossRef]

- Slim, Chokri. 2010. Forecasting the Volatility of Stock Index Returns: A Stochastic Neural Network Approach. In Computational Science and Its Applications–ICCSA 2004. Lecture Notes in Computer Science. Berlin/Heidelberg: Springer, pp. 935–44. [Google Scholar] [CrossRef]

- Smales, Lee A. 2017. The importance of fear: Investor sentiment and stock market returns. Applied Economics 49: 3395–421. [Google Scholar] [CrossRef]

- Soto, Jesus, Oscar Castillo, Patricia Melin, and Witold Pedrycz. 2019. A New Approach to Multiple Time Series Prediction Using MIMO Fuzzy Aggregation Models with Modular Neural Networks. International Journal of Fuzzy Systems 21: 1629–48. [Google Scholar] [CrossRef]

- Soto, Jesus, Patricia Melin, and Oscar Castillo. 2016. Time series prediction using ensembles of ANFIS models with genetic optimization of interval type-2 and type-1 fuzzy integrators. International Journal of Hybrid Intelligent Systems 11: 211–26. [Google Scholar] [CrossRef]

- Steiner, Manfred, and Hans-Georg Wittkemper. 1997. Portfolio optimization with a neural network implementation of the coherent market hypothesis. European Journal of Operational Research 100: 27–40. [Google Scholar] [CrossRef]

- Strader, Troy J., John. J. Rozycki, Thomas. H. Root, and Yu-Hsiang (John) Huang. 2020. Machine Learning Stock Market Prediction Studies: Review and Research Directions. Journal of International Technology and Information Management 28: 63–83. [Google Scholar]

- Sugumar, Rajendran, Alwar Rengarajan, and Chinnappan Jayakumar. 2014. A technique to stock market prediction using fuzzy clustering and artificial neural networks. Computing and Informatics 33: 992–1024. [Google Scholar]

- Tabrizi, H. A., and H. Panahian. 2000. Stock Price Prediction by Artificial Neural Networks: A Study of Tehran’s Stock Exchange (TSE) [WWW Document]. Available online: http://www.handresearch.org (accessed on 13 May 2021).

- Takahama, Tetsuyuki, Setsuko Sakai, Akira Hara, and Noriyuki Iwane. 2009. Predicting stock price using neural networks optimized by differential evolution with degeneration. International Journal of Innovative Computing, Information and Control 5: 5021–31. [Google Scholar]

- Tealab, Ahmed. 2018. Time series forecasting using artificial neural networks methodologies: A systematic review. Future Computing and Informatics Journal 3: 334–40. [Google Scholar] [CrossRef]

- Tetlock, Paul C. 2007. Giving content to investor sentiment: The role of media in the stock market. The Journal of Finance 62: 1139–68. [Google Scholar] [CrossRef]

- Tetlock, Paul. C., M. Saar-Tsechansky, and S. Macskassy. 2008. More than words: Quantifying language to measure firms’ fundamentals. The Journal of Finance 63: 1437–67. [Google Scholar] [CrossRef]

- Thawornwong, Suraphan, and David Enke. 2004. The adaptive selection of financial and economic variables for use with artificial neural networks. Neurocomputing 56: 205–32. [Google Scholar] [CrossRef]

- Ticknor, Jonathan L. 2013. A Bayesian regularized artificial neural network for stock market forecasting. Expert Systems with Applications 40: 5501–6. [Google Scholar] [CrossRef]

- Tilfani, Oussama, Paulo Ferreira, and My Youssef El Boukfaoui. 2020. Multiscale optimal portfolios using CAPM fractal regression: Estimation for emerging stock markets. Post-Communist Economies 32: 77–112. [Google Scholar] [CrossRef]

- Tranfield, David, David Denyer, and Palminder Smart. 2003. Towards a methodology for developing evidence-informed management knowledge by means of systematic review. British Journal of Management 14: 207–22. [Google Scholar] [CrossRef]

- Tsaih, Ray, Yenshan Hsu, and Charles C. Lai. 1998. Forecasting S&P 500 stock index futures with a hybrid AI system. Decision Support Systems 23: 161–74. [Google Scholar] [CrossRef]

- Twomey, J. M., and A. E. Smith. 1995. Performance measures, consistency, and power for artificial neural network models. Mathematical and Computer Modelling 21: 243–58. [Google Scholar] [CrossRef]

- Van Horne, James C., and George G. C. Parker. 1967. The random-walk theory: An empirical test. Financial Analysts Journal 23: 87–92. [Google Scholar] [CrossRef]

- van Nunen, K., J. Li, G. Reniers, and K. Ponnet. 2018. Bibliometric analysis of safety culture research. Safety Science 108: 248–58. [Google Scholar] [CrossRef]

- Vanstone, Bruce J., Gavin R. Finnie, and Clarence N. W. Tan. 2005. Evaluating the Application of Neural Networks and Fundamental Analysis in the Australian Stockmarket. Paper presented at the IASTED International Conference on Computational Intelligence, Calgary, AB, Canada, July 4–6; pp. 62–67. [Google Scholar]

- Vella, Vince, and Wing Lon Ng. 2014. Enhancing risk-adjusted performance of stock market intraday trading with neuro-fuzzy systems. Neurocomputing 141: 170–87. [Google Scholar] [CrossRef]

- Versace, Massimiliano, Massimiliano Versace, Rushi Bhatt, Oliver Hinds, and Mark Shiffer. 2004. Predicting the exchange traded fund DIA with a combination of genetic algorithms and neural networks. Expert Systems with Applications 27: 417–25. [Google Scholar] [CrossRef]

- Wah, Benjamin W., and Ming-Lun Qian. 2006. Constrained formulations and algorithms for predicting stock prices by recurrent FIR neural networks. International Journal of Information Technology & Decision Making 5: 639–58. [Google Scholar] [CrossRef]

- Walczak, Steven. 1999. Gaining competitive advantage for trading in emerging capital markets with neural networks. Journal of Management Information Systems 16: 177–92. [Google Scholar] [CrossRef]

- Wang, Jie, and Jun Wang. 2015. Forecasting stock market indexes using principle component analysis and stochastic time effective neural networks. Neurocomputing 156: 68–78. [Google Scholar] [CrossRef]

- Wang, Jun, Huopo Pan, and Fajiang Liu. 2012. Forecasting crude oil price and stock price by jump stochastic time effective neural network model. Journal of Applied Mathematics 2012: 1–15. [Google Scholar] [CrossRef]

- Wang, Y.-F. 2002. Predicting stock price using fuzzy grey prediction system. Expert Systems with Applications 22: 33–38. [Google Scholar] [CrossRef]

- Wang, Yi-Hsien. 2009. Using neural network to forecast stock index option price: A new hybrid GARCH approach. Quality & Quantity 43: 833–43. [Google Scholar] [CrossRef]

- Watada, J. 2006. Structural learning of neural networks for forecasting stock prices. In Lecture Notes in Computer Science (Including Subseries Lecture Notes in Artificial Intelligence and Lecture Notes in Bioinformatics). Edited by B. Gabrys, R. J. Howlett and L. C. Jain. Berlin/Heidelberger: Springer, pp. 972–79. [Google Scholar] [CrossRef]

- Wei, Liang-Ying. 2011. An expanded Adaptive Neuro-Fuzzy Inference System (ANFIS) model based on AR and causality of multi-nation stock market volatility for TAIEX forecasting. African Journal of Business Management 5: 6377–87. [Google Scholar] [CrossRef]

- Wei, Liang-Ying, and Ching-Hsue Cheng. 2012. A hybrid recurrent neural networks model based on synthesis features to forecast the Taiwan stock market. International Journal of Innovative Computing, Information and Control 8: 5559–71. [Google Scholar]

- Witkowska, Dorota. 1995. Neural networks as a forecasting instrument for the polish stock exchange. International Advances in Economic Research 90: 577–88. [Google Scholar] [CrossRef]

- Wong, F. S., P. Z. Wang, T. H. Goh, and B. K. Quek. 1992. Fuzzy Neural Systems for Stock Selection. Financial Analysts Journal 48: 47–52. [Google Scholar] [CrossRef]

- Wu, Binghui, and Tingting Duan. 2017. A performance comparison of neural networks in forecasting stock price trend. International Journal of Computational Intelligence Systems 10: 336–46. [Google Scholar] [CrossRef]

- Wu, Jimmy Ming-Tai, Zhongcui Li, Gautam Srivastava, Meng-Hsiun Tasi, and Jerry Chun-Wei Lin. 2021. A graph-based convolutional neural network stock price prediction with leading indicators. Software: Practice and Experience 51: 628–44. [Google Scholar] [CrossRef]

- Wu, Xiaodan, Ming Fung, and Andrew Flitman. 2001. Forecasting Stock Market Performance Using Hybrid Intelligent System. In Computational Science—ICCS 2001. Lecture Notes in Computer Science. Berlin/Heidelberg: Springer, pp. 447–56. [Google Scholar] [CrossRef]

- Xi, Lu, Hou Muzho, Moon Ho Lee, Jun Li, Duan Wei, Han Hai, and Yalin Wu. 2014. A new constructive neural network method for noise processing and its application on stock market prediction. Applied Soft Computing 15: 57–66. [Google Scholar] [CrossRef]

- Yamashita, Takashi, Kotaro Hirasawa, and Jinglu Hu. 2005. Multi-branch neural networks and its application to stock price prediction. In Lecture Notes in Computer Science (Including Subseries Lecture Notes in Artificial Intelligence and Lecture Notes in Bioinformatics). Edited by R. Khosla, R. J. Howlett and L. C. Jain. Berlin/Heidelberger: Springer, pp. 1–7. [Google Scholar] [CrossRef]

- Yim, Juliana. 2002. A Comparison of Neural Networks with Time Series Models for Forecasting Returns on a Stock Market Index. In Developments in Applied Artificial Intelligence. IEA/AIE 2002. Lecture Notes in Computer Science. Berlin/Heidelberg: Springer, pp. 25–35. [Google Scholar] [CrossRef]

- Yiwen, Y., L. Guizhong, and Z. Zongping. 2000. Stock Market Trend Prediction Based on Neural Networks, Multiresolution Analysis and Dynamical Reconstruction. Paper presented at the IEEE/IAFE Conference on Computational Intelligence for Financial Engineering (CIFEr), New York, NY, USA, March 28; Piscataway: Institute of Electrical and Electronics Engineers (IEEE), pp. 155–57. [Google Scholar] [CrossRef]

- Zhang, Yudong, and Lenan Wu. 2009. Stock market prediction of S&P 500 via combination of improved BCO approach and BP neural network. Expert Systems with Applications 36: 8849–54. [Google Scholar] [CrossRef]

- Yumlu, M. Serdar, Fikret S. Gurgen, and Nesrin Okay. 2004. Turkish stock market analysis using mixture of experts. Paper presented at the Fourth International ICSC Symposium on Engineering of Intelligent Systems (EIS), Madeira, Portugal, February 29–March 2. [Google Scholar]

- Yümlü, Serdar, Fikret S. Gürgen, and Nesrin Okay. 2005. A comparison of global, recurrent and smoothed-piecewise neural models for Istanbul stock exchange (ISE) prediction. Pattern Recognition Letters 26: 2093–103. [Google Scholar] [CrossRef]

- Zahedi, Javad, and Mohammad Mahdi Rounaghi. 2015. Application of artificial neural network models and principal component analysis method in predicting stock prices on Tehran Stock Exchange. Physica A: Statistical Mechanics and Its Applications 438: 178–87. [Google Scholar] [CrossRef]

- Zavadskaya, Alexandra. 2017. Artificial intelligence in finance: Forecasting stock market returns using artificial neural networks. Hanken School of Economics, 1–154. [Google Scholar]

- Zhang, Dayong, Min Hu, and Qiang Ji. 2020. Financial markets under the global pandemic of COVID-19. Finance Research Letters 36: 101528. [Google Scholar] [CrossRef]

- Zhang, Defu, Qingshan Jiang, and Xin Li. 2004. Application of neural networks in financial data mining. Paper presented at the International Conference on Computational Intelligence—ICCI 2004, Istanbul, Turkey, December 17–19; pp. 392–95. [Google Scholar]

- Zhang, Dehua, and Sha Lou. 2021. The application research of neural network and BP algorithm in stock price pattern classification and prediction. Future Generation Computer Systems 115: 872–79. [Google Scholar] [CrossRef]

- Zhang, Yongjie, Gang Chu, and Dehua Shen. 2021. The role of investor attention in predicting stock prices: The long short-term memory networks perspective. Finance Research Letters 38: 101484. [Google Scholar] [CrossRef]

- Zhao, J., D. Zeng, S. Liang, H. Kang, and Q. Liu. 2021. Prediction model for stock price trend based on recurrent neural network. Journal of Ambient Intelligence and Humanized Computing 12: 745–53. [Google Scholar] [CrossRef]

- Zhongxing, Ye, and Liting Gu. 1993. A Hybrid Cognition System: Application to Stock Market Analysis. Paper presented at the 1993 International Conference on Neural Networks, Nagoya, Japan, October 25–29; pp. 3000–3. [Google Scholar] [CrossRef]

- Zhou, Feng, Hao-Min Zhou, Zhi-Hua Yang, and Li-Hua Yang. 2019. EMD2FNN: A strategy combining empirical mode decomposition and factorization machine based neural network for stock market trend prediction. Expert Systems with Applications 115: 136–51. [Google Scholar] [CrossRef]

- Zhuge, Qun, Lingyu Xu, and Gaowei Zhang. 2017. LSTM Neural Network with Emotional Analysis for prediction of stock price. Engineering Letters 25: 64–72. [Google Scholar]

- Zorin, A., and A. Borisov. 2007. Modelling Riga Stock Exchange Index Using Neural Networks. Available online: http://citeseerx.ist.psu.edu/viewdoc/download?doi=10.1.1.20.3706&rep=rep1&type=pdf (accessed on 2 June 2021).

| S No. | Theme | Papers | References | S No. | Theme | Papers | References |

|---|---|---|---|---|---|---|---|

| 1 | algorithm | 111 | 609 | 23 | price | 121 | 1224 |

| 2 | analysis | 106 | 524 | 24 | problem | 91 | 362 |

| 3 | daily | 105 | 481 | 25 | process | 108 | 506 |

| 4 | data | 125 | 1489 | 26 | rate | 98 | 401 |

| 5 | error | 105 | 459 | 27 | results | 104 | 404 |

| 6 | financial | 69 | 380 | 28 | returns | 82 | 452 |

| 7 | forecasting | 106 | 890 | 29 | set | 98 | 492 |

| 8 | function | 121 | 955 | 30 | stock | 126 | 1684 |

| 9 | fuzzy | 58 | 450 | 31 | stock market | 101 | 536 |

| 10 | index | 99 | 550 | 32 | stock price | 98 | 407 |

| 11 | information | 96 | 466 | 33 | system | 101 | 692 |

| 12 | input | 120 | 711 | 34 | test | 101 | 356 |

| 13 | layer | 111 | 663 | 35 | time | 116 | 864 |

| 14 | learning | 105 | 484 | 36 | time series | 106 | 544 |

| 15 | market | 116 | 1076 | 37 | trading | 104 | 426 |

| 16 | method | 113 | 651 | 38 | training | 113 | 478 |

| 17 | model | 123 | 1633 | 39 | using | 85 | 338 |

| 18 | network | 124 | 885 | 40 | value | 119 | 854 |

| 19 | neural | 119 | 585 | 41 | variables | 100 | 656 |

| 20 | output | 119 | 615 | 42 | vector | 95 | 375 |

| 21 | parameters | 91 | 367 | 43 | weight | 93 | 350 |

| 22 | prediction | 122 | 1298 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Chopra, R.; Sharma, G.D. Application of Artificial Intelligence in Stock Market Forecasting: A Critique, Review, and Research Agenda. J. Risk Financial Manag. 2021, 14, 526. https://doi.org/10.3390/jrfm14110526

Chopra R, Sharma GD. Application of Artificial Intelligence in Stock Market Forecasting: A Critique, Review, and Research Agenda. Journal of Risk and Financial Management. 2021; 14(11):526. https://doi.org/10.3390/jrfm14110526

Chicago/Turabian StyleChopra, Ritika, and Gagan Deep Sharma. 2021. "Application of Artificial Intelligence in Stock Market Forecasting: A Critique, Review, and Research Agenda" Journal of Risk and Financial Management 14, no. 11: 526. https://doi.org/10.3390/jrfm14110526

APA StyleChopra, R., & Sharma, G. D. (2021). Application of Artificial Intelligence in Stock Market Forecasting: A Critique, Review, and Research Agenda. Journal of Risk and Financial Management, 14(11), 526. https://doi.org/10.3390/jrfm14110526