1. Introduction

It is a well established fact that financial market volatility exhibits long-range dependence independent of the asset class be it foreign exchange rates, stocks or bonds and independent of the market be it European, Asian, or American. An intensive investigation of the fractional integration properties of different asset classes and many countries can be found among others in

Wenger et al. (

2018) using up to date estimators which also account for possible biases due to low frequency contaminations such as structural changes or trends.

Nguyen et al. (

2020) investigate the long memory behavior of stock market volatility for a huge range of countries and find that developed markets have stronger memory than developing markets. As a higher memory parameter leads to more persistence in the volatility and thus to a better predictability of the risk of a stock they interpret the memory of the volatility as a measure for the stability of the stock.

Besides fractional integration in single assets it is also of interest to see whether there are links between assets, asset classes or markets meaning that there is a common factor driving the volatilities. In an early study,

Andersen et al. (

2003) developed a framework for integration of high-frequency data for modeling and forecasting realized volatilities. In their empirical application, they heuristically tested for fractional cointegration between the realized logarithmic volatility series of three foreign exchange markets (U.S., Germany and Japan) and found no evidence of long-run linkages.

Clements et al. (

2016) looked for foreign exchange rates, stocks and bonds in different markets and questions whether the volatilities of these assets have co-movements in the sense that they are fractionally cointegrated. They, in a first step, estimated the memory parameter of the individual assets by the R/S statistic and the GPH-estimator of

Geweke and Porter-Hudak (

1983). They found a nonstationary memory of the volatility in most cases. Afterwards they fit a parametric fractional VAR model to discover fractional cointegration between the asset classes and markets.

Clements et al. (

2016) found linkages in the asset classes between markets and discovered that they are fractionally cointegrated.

However, these results are in contradiction with other findings.

Wenger et al. (

2018) found lower memory parameters mainly in the stationary region which makes the concept of fractional cointegration questionable for these asset classes. This may be due to accounting for low frequency contaminations which lead to an upwards bias in the memory estimates.

Nguyen et al. (

2020) found different memory parameters in different markets. This would exclude fractional cointegration as equal memory parameters is a key assumption for fractional cointegration.

As the volatilities of an asset are commonly seen as a measure of the risk if this asset long memory in volatility describes the persistence of this risk. The higher the memory the more persistent the series is and the better are long-term forecasts. Therefore, the persistence of the volatility can be interpreted as a measure of stability of the asset. The higher the memory in the volatility the more stable is the asset. This interpretation of long memory in volatilities goes along with the findings in

Nguyen et al. (

2020) who find higher memory in more stable stocks. As fractional cointegration describes common equilibria between assets the finding of fractional cointegration between volatilities indicates the assets have a similar predictability of risk and thus stability. Therefore, from an economic point of view looking at fractional cointegration between different markets and asset classes is comparing the stability of these markets and asset classes.

At the same time, many studies focus on the impact of financial crises on the volatility spillover. A recent study by

Karanasos et al. (

2014) points out that volatility persistence and volatility spillovers in stock market returns show significant time variation. The authors find breaks in variance for all series connected to main economic events with global impact. For the cases of FTSE-DAX and NIKKEI-Hand Seng volatility spillovers are found, which are more pronounced in the latest financial crisis.

In this paper, we therefore reexamine the paper by

Clements et al. (

2016) believing that their results are driven by the combination of a semiparametric estimation of the memory parameters and a parametric modelling of the fractional cointegration relation. We follow a purely semiparametric approach by using Whittle-based estimators for the memory parameters and semiparametric tests for fractional cointegration, namely (

Chen and Hurvich (

2006);

Souza et al. (

2018);

Wang et al. (

2015)). By doing so we cannot confirm the results by

Clements et al. (

2016) for several reasons. First, our estimated memory parameters are stationary and thus volatilities do not have any stochastic trend. This is in line with the findings in

Wenger et al. (

2018). Second, a semiparametric test by

Robinson and Yajima (

2002) for equality of the memory parameters rejects this null in most cases and thus excludes fractional cointegration and third our semiparametric tests reject the null of fractional cointegration in most of the remaining cases.

Motivated by

Karanasos et al. (

2014) we extend our analysis by investigating potential breaks in persistence. We therefore apply the regression-based Lagrange Multiplier test introduced by

Martins and Rodrigues (

2014) to test for structural breaks in the memory of the volatility series. Our results exhibit breakpoints in all series during the global financial crisis and European debt crisis. We, then, apply rolling window regressions to gain further information of the persistence dynamics, which indicates a change of persistence over time. Therefore, we re-apply the persistence testing according to the estimated breakpoints and observe shifts in the order of integration during different periods.

This confirms previous findings in the literature.

Chowdhury et al. (

2016) study the news transmission between developed and emerging markets, namely equities, bonds and futures in different time zones. They corroborate strong time-varying characteristics in long-term cointegration and volatility spillover among equity markets from all three trading zones.

The rest of the paper is organized as follows. In

Section 2, the fractional cointegration methodology is presented.

Section 3 describes the data selection for the analysis. In

Section 4 the empirical results are presented, while

Section 5 concludes.

2. Methodology

In general, (fractional) cointegration is an equilibrium concept where the persistence of the cointegrating residual

determines the speed of adjustment towards the cointegration equilibrium

, and shocks have no permanent influence on the equilibrium as long as

holds. We therefore allow for fractional cointegration and consider a bivariate system of the form

where the coefficients

, and

are finite,

,

L is the lag-operator, the fractional differences

are defined in terms of generalized binomial coefficients such that

and

and

are martingale difference sequences. The memory of both

and

is determined by

so that they are integrated of the same order

d, denoted by

, where the memory parameter is restricted to

and

. Since it is assumed that

for all

, the processes under consideration are fractionally integrated of type-II. For a detailed discussion of type-I and type-II processes refer to

Marinucci and Robinson (

1999). The spectral density of

can be approximated by

where

G is a real, symmetric, finite, and positive definite matrix,

is a

diagonal matrix and

is its complex conjugate transpose. The periodogram of a process

is defined through the discrete Fourier transform

as

, with Fourier frequencies

for

, where the operator

returns the integer part of its argument.

The two series

and

are said to be fractionally cointegrated, if there exists a linear combination

so that the cointegrating residuals

are fractionally integrated of order

for some

. Obviously, for the model in Equations (

1)–(

3), this is the case for every multiple of the vector

and

.

We restrict ourselves to a bivariate set-up as is common in the literature to avoid identification problems.

Here, we conclude that the financial markets, which are fractionally cointegrated with each other, are considered to be financially integrated. From the definition above, this is the case if there exists an equilibrium relationship between the financial series ( and ), such that the persistence of deviations from the equilibrium denoted by is reduced compared to that of the individual series. The degree of long memory in the cointegrating residuals then determines the persistence of deviations from the long-run equilibrium. This implies that series, which show a high degree of long memory in the cointegrating residuals are less firmly integrated than series with a low .

3. Data

We collect high frequency (5 min) data from Thomson Reuters Tick History (TRTH) provided by SIRCA (The Securities Industry Research Centre of the Asia Pacific), covering the period from 22 July 1998 to 29 December 2016 for three financial markets. The data concern daily closing prices for foreign exchange, equity and bond markets for Japan, Europe and U.S. Following

Clements et al. (

2016), for all series we eliminate the days where one of the markets is closed or when we find that trading is significantly curtailed. Then, minimum realized volatility is formed according to

Andersen et al. (

2012), for a total of 3436 observations. Specifically, the dataset is constructed from the following series:

Yen-Dollar spot exchange contracts in each trading zone for the foreign exchange rate market,

NIKKEI (N225) for Japan, GDAX for Europe and S&P 500(SPX) for U.S. in equity markets,

Japanese (JPY), German Bund (EUR) and United States (USD) Treasury note 10-year bond future contracts in bond markets.

The time zone set up follows

Clements et al. (

2016) suggestions for a global trading day, where the Japan trading zone is defined from 00:00 to 07:00 a.m., the European as 7:00 a.m. to 12:30 p.m. and United States as 12:30 p.m. to 9:00 p.m.

The minRV estimator of integrated variance is based on high frequency return observations that rely on nearest neighbor truncation. The good jump robustness properties the estimator shares are also suitable for practical applications. Using Equation (

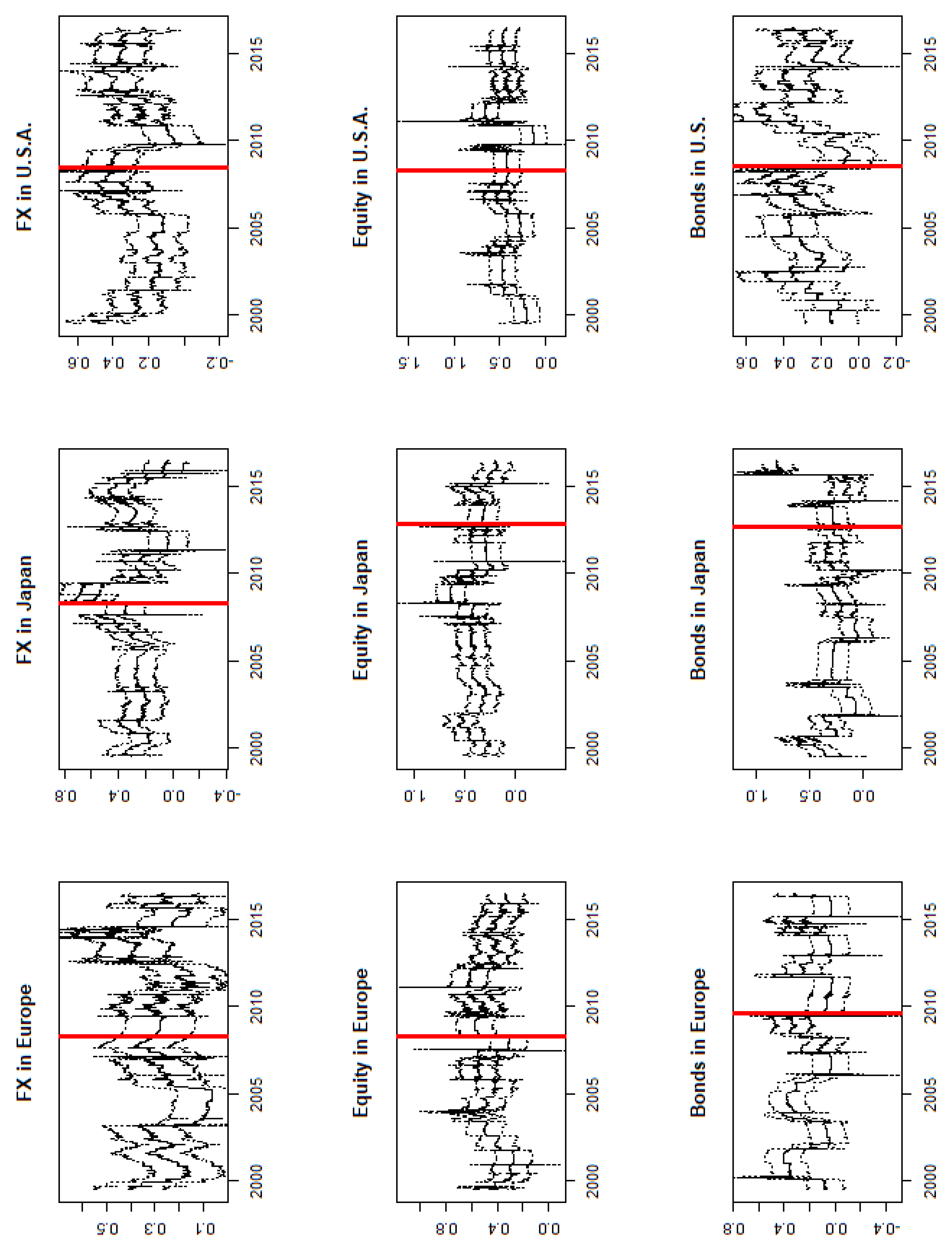

5) to calculate each series for each trading zone, we then plot them in

Figure 1.

Roughly,

Figure 1 displays the existence of a similar pattern on the estimates of realized volatility in foreign exchange and equity data, across the three trading zones. However, foreign exchange volatility in the U.S appears to be more pronounced compared to other trading zones. On the contrary, the similarity pattern across trading zones is less pronounced in bond markets. In this scenario, the bond volatility in the U.S seems to experience more volatility events than any other trading zone. For comparison,

Table 1 reports the summary of descriptive statistics for the minimized realized volatility multiplied by 1000.

In

Table 1, we observe that the equity market provides the highest mean volatility, then the foreign exchange market, and lastly the bond market. The standard deviation volatility in the equity and bond market is highest during trading in the European countries, where the data are less reliable while Japan experiences the lowest standard deviation volatility, meaning that the data are more reliable. However, we observe quite the opposite in the foreign exchange market. The coefficients of both skewness and kurtosis could tell us, which financial asset market across trading zones is more interesting to the investors. Most of the investors prefer the most highest value among all, the reason being that investors would be willing to pay premium to markets, whose realized volatility are on the positive side. For our case, we observe that the Japanese bonds appear to be the most interesting financial asset market due to its highest values and U.S Foreign Exchange come last.

4. Testing for Fractional Cointegration in and across Financial Markets

We start our analysis by estimating the order of fractional integration for each series. Memory parameters are shown in

Table 2. The exact local Whittle estimator of

Shimotsu (

2010) is used with a

bandwidth

. As a direct extension of

Shimotsu and Phillips (

2005), this estimator has the advantage of allowing for non-zero means, while the properties of consistency and asymptotically normal distribution for all values of d continue to hold.

Table 2 suggests the existence of long memory in all series under examination. All time series are stationary and the equity market is the most persistent with memory parameters between 0.4 and 0.44. Equity markets therefore seem to be more stable than exchange rate and bond markets for all areas.

We apply several semiparametric tests for the null hypothesis of no fractional cointegration. The advantage of semiparametric methods is that we do not impose any assumptions on the short-run behavior of the series, apart from mild regularity conditions. Thus, we can avoid spurious findings that might arise due to misspecification. Research on semiparametric tests for fractional cointegration has been an active field in recent years and there exist a variety of competing approaches. Whereas some approaches rely on the spectral representation of multivariate long memory processes and test whether the spectral matrix G has full rank or not, other tests are residual-based and test for the strength of integration of the cointegration residuals. To make sure that our results are robust to the way of testing, we apply tests from both strands of the literature.

Souza et al. (

2018) use the fractionally differenced process

and the fact that the determinant

of

is of the form

, where

is a scalar constant and

. An estimate of

b can therefore be obtained via a log-periodogram regression and the null hypothesis that

can be tested based on the resulting estimate. We denote this spectral-based test in the following as SRFB18.

The test of

Wang et al. (

2015) (denoted by WWC15) is based on the sum over the fractionally differenced process

, where

is an estimate of the memory from the cointegrating residuals obtained using a consistent estimator for the cointegrating vector

such as the narrow-band least squares estimator of

Robinson (

1994);

Robinson and Marinucci (

2003), and

Christensen and Nielsen (

2006), among others. In contrast to that, the test of

Chen and Hurvich (

2006) (denoted by CH06) is directly based on

, but the cointegrating space is estimated by the eigenvectors of the averaged and tapered periodogram matrix local to the origin. Obviously, these two tests are residual-based.

Leschinski et al. (

2020) suggest that the three testing procedures have best performance among a group of eight semiparametric tests, particularly when testing for fractional cointegration. In bivariate cases, SRFB18 presents the best performance. Following their finding, we perform all tests at the 5% significance level. The bandwidth is selected as

for all three testing procedures. The trimming parameter r is set to 3 for SRFB18 and the integer for averaging the periodogram is 25 for CH06.

In our analysis, we test the full sample for stationary fractional cointegration as the order of integration for all series is less than 0.5. As fractional cointegration needs as a core assumption that the order of integration is equal between the series, we use pairwise tests as suggested by

Robinson and Yajima (

2002) to test for the equality of the memory parameters. The results shown in

Table 3 suggest that the hypothesis of a common memory parameter is rejected for most of the cases.

Given the results in

Table 4, we proceed our analysis by testing for fractional cointegration under the null hypothesis of no fractional cointegration. First, we test in each of the financial markets. Specifically, we are allowed to test between the pairs, Japanese bonds (JPY)- Japanese Foreign Exchange (FX-JP), European Bonds (EUR)-European Foreign Exchange (FX-EU) and U.S. Foreign Exchange (FX-US) and S&P 500 index (SPX).

Table 4 suggests the existence of fractional cointegration for the Japanese and U.S. financial markets. The European market is not rejecting the null hypothesis for all three testing procedures.

Next we investigate the cointegrating relationships across the three trading zones by testing all possible cases. We take pairwise combinations for all series and present them in three sections. First, we consider the markets of Japan and Europe.

In

Table 5, cointegration exists between European Foreign Exchange and the Nikkei index, as well as for the pair of equities, N225 and GDAX. For the case of Japanese bonds and European Foreign Exchange, evidence of cointegration is only suggested by WWC15. No fractional cointegration is found for the case of the Japanese Foreign Exchange/European bonds and the pairwise case of bonds’ market.

We continue then testing between European and U.S. market in

Table 6. Two testing procedures suggest cointegration for the pair of equities. The

Chen and Hurvich (

2006) testing procedure additionally rejects for the cases between the bond markets and among the U.S index and European Foreign Exchange markets.

Last, in

Table 7, U.S-Japanese markets show evidence of cointegration for all four pairs. Equity markets and FX-U.S./N225 pairs are rejecting in all three testing procedures. Both SRFB18 and WWC15, reject the pair of U.S. bonds and Japanese Foreign Exchange. The Bond’s market pair is rejected only by the WWC15 test.

As a next step, we estimate the cointegration vector

as well as the memory parameters of the residuals

by using Narrow Band Least Squares estimation.

Robinson (

1994) shows that NBLS estimation is consistent under stationary cointegration whereas an OLS approach might not retain consistency.

Table 8 displays the estimated values of the memory of the residuals. We include the pairs for which the hypothesis of a common memory parameter is not rejected and at least one of the testing procedures for no cointegration rejects. Results in bold indicate the cases where the memory of

is less than both of the individuals series. Here, the likelihood of fractional cointegration is fulfilled in the cases of all three equity markets, as well as between U.S bonds and European bonds.

In addition to our analysis of fractional cointegration, we investigate further the existence of breaks in persistence. Hence, we perform a regression-based Lagrange Multiplier Test introduced by

Martins and Rodrigues (

2014) that generalizes the conventional integration approaches to the fractional integrated process context. In what follows we will denote by

the estimated point of the persistence shift and by

the order of integration before the shift and by

the order of integration after the break.

Table 9 suggests evidence of a break in volatility persistence for all financial series. The overwhelming majority suggests a decrease in persistence during the global financial crisis. For four out of nine financial series, the memory reduction shift occurs in October, 2008 which are also the earliest memory shifts while the latest take place during the second trimester of 2013. Additionally, we find evidence for an increase in the memory parameter for the Japanese equity and bonds’ market in October, 2008 and April, 2013 respectively. Comparing

and

the majority of the shifts is within the stationary region

, suggesting lower levels of volatility persistence following the breakpoints. The stronger shift in terms of fractional integration is found for Japanese bonds which jump from 0.23 to 0.67 suggesting mean reverting non-stationarity for the second sub-sample. In general, equity markets appear to be more persistent and marginally non-stationary before the estimated memory shifts.

Taking into account the memory reduction for most cases in October, 2008, we test for fractional cointegration during the corresponding subperiods. The results are illustrated in

Table 10 and

Table 11, respectively. For the period before the beginning of the financial crisis we find more cointegrating relationships, compared to the full sample period and the second subperiod, that do not reject the common memory hypothesis. However, five pairs do reject the null hypothesis of fractional cointegration and exhibit a memory of residuals less than the individual series. Here, markets appear to return to equilibrium with relative persistence, except in the case of the Japanese/European foreign exchange. For this case, the residuals are close to 0. On contrary, the subperiod concerning the financial crisis rejects for most cases the common memory hypothesis. Finally, cointegration is found only between the U.S. and Europe, for the cases of foreign exchange, as well as for their equity markets.

In order to gain further insights into the dynamics of volatility persistence among the financial series and the respective trading zones, we apply a rolling window estimation. Our rolling window approach estimates the memory parameter d by using a window size set of 250 observations, which corresponds to one trading year. As before, we use the ELW estimator of

Shimotsu (

2010) based on the bandwidth parameter of

.

Figure 2 presents the results of the rolling window fractional integration estimations for each of the nine financial series along with their 95% confidence bands. The bold vertical line corresponds to the respective estimated breakpoint. For the European and U.S. markets, we observe a downward trend after the corresponding breaks in persistence which shifts upwards again around 2013. This fluctuation may reflect the duration of the global financial crisis. Japanese equity market exhibit shifts of persistence in both directions. A marginal increase in October, 2008 followed by minor declines which finally decays after the break in June, 2013. Foreign exchange follows a similar pattern, decreasing in October, 2008, increasing in 2013 and finally remains in lower levels of integration. Japanese bonds do not exhibit significant shifts until 2013 and then show levels of higher persistence in the end of the sample. Here, a profound change in persistence does not always synchronize with the indicated breakpoint line. However, we consider that change/movement within a one year band coincides with the estimated breakpoint.

To conclude our analysis, we re-apply the rolling window estimation to the subsamples indicated by the breaks. We find a second breakpoint for all series in the first subsample and for the majority during the second subperiod. We find evidence of memory parameters in the lower stationary region in bond markets before 2005 and shifts from the high stationary to the low non-stationary range and vice versa for the rest of the cases. Results are shown in

Table 12.