Impacts of Endogenous Sunk-Cost Investment on the Islamic Banking Industry: A Historical Analysis

Abstract

1. Introduction

2. Modelling Endogenous Sunk-Cost Investment for the Islamic Banking Industry

2.1. Endogenous Sunk-Cost Investment and Imperfect Appropriability

2.2. Detection of the Sunk-Cost Investment

2.3. Efficiency Frontiers to Measure Profitability: The Cost Function Approach to Islamic Banks

+ ½ ∑k∑l δkl ln(Ykt) ln(Ylt) + ∑j∑k ρik ln(wjt) ln(Ykt) + ηit + vit

- Cit—the total costs of bank i in year t;

- Yijt—the vector of the outputs of bank i at date t; output (labelled j) are (i) the total loan, (ii) investment, and (iii) other earning assets at date t;

- Wijt—the vector of input prices facing bank i; j is input types which are (i) the price of labour, (ii) price of physical capital, and (iii) price of financial capital inputs computed as

Price of physical capital = wiA = (non-interest and non-personal expenses)/(fixed assets)

Price of financial capital = wiF = (total interest costs)/(total deposits)

2.4. Efficiency Frontiers to Measure Profitability: The Profit Function Approach

+ Σn Σm βnmw lnYn Pm + ηit + μit

- Yn is the vector of the outputs of bank in year , which are (i) total loans, (ii) investment and (iii) other earning assets;

- Xmt is the vector of input uses (labour, capital, and financial capital) as a function of input prices and output;

- Pm is the price of inputs (PL: price of labour (wage), PK: price of capital, PF: price of financial capital);

- nit is the measure of inefficiency in terms of forfeited profits;

- μit is the error term.

2.5. Historical Dataset (1993–2010) and Relevant Variables

2.6. Implications of Competition for the Banking Industry

[T]here is clearly some tension between financial stability goals and the tenets of competition policy, which hold that oligopolies are inefficient and serve consumers badly … many policymakers seem to think that some curbs on competition may be a price worth paying to improve stability.

3. Determinants of Profitability and Endogenous Sunk-Cost Investment of Islamic Banks of Jordon: The ARDL Approach

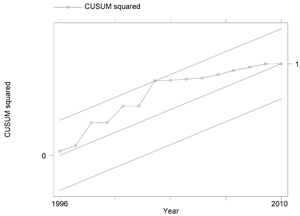

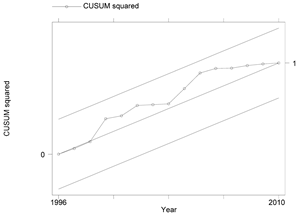

3.1. Stationarity (Unit Root) Tests

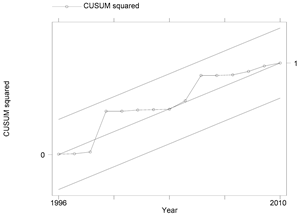

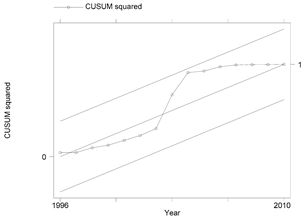

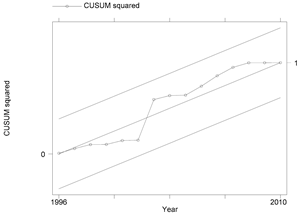

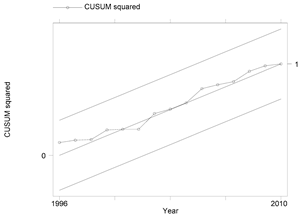

3.2. Postulated Models to Unravel the Effects of IT Capital as Sunk-Cost Capital on Efficiency Scores of Islamic Banks

4. Findings

5. Conclusions

Author Contributions

Funding

Conflicts of Interest

Appendix A

| Bank Name | Jarque–Bera Test | ||

|---|---|---|---|

| Normality | |||

| CES | PES | lnITK | |

| AB | 12.82 *** | 2.52 | 6.38 *** |

| AEB | 1.57 | 1.79 | 7.38 *** |

| CAB | 1.63 | 3.47 | 0.03 |

| HB | 4.39 | 1.75 | 0.45 |

| JB | 9.80 *** | 4.27 | 3.92 |

| JCB | 2.24 | 7.35 *** | 11.41 *** |

| JIB | 0.71 | 0.45 | 7.50 *** |

| JKB | 1.49 | 0.45 | 4.51 |

| UB | 1.49 | 0.31 | 0.12 |

| Bank Name | Breusch–Godfrey | |

|---|---|---|

| Serial Correlation | ||

| CES & lnITK | PES & lnITK | |

| AB | 0.08 | 3.43 * |

| AEB | 7.85 *** | 0.29 |

| CAB | 3.28 * | 0.1 * |

| HB | 13.00 *** | 0 |

| JB | 3.07 * | 2.07 |

| JCB | 6.67 *** | 0.06 |

| JIB | 6.88 *** | 0.09 |

| JKB | 0.04 | 0.18 |

| UB | 0.511 | 2.04 |

| Bank Name | Breusch–Pagan | |

|---|---|---|

| Heteroskedasticity | ||

| CES & lnITK | PES & lnITK | |

| AB | 0.64 | 0.07 |

| AEB | 0.001 | 0.08 |

| CAB | 2.17 | 1.21 |

| HB | 1.63 | 0.01 |

| JB | 1.78 | 0.72 |

| JCB | 0.16 | 1.1 |

| JIB | 0.43 | 0.63 |

| JKB | 1.04 | 0.03 |

| UB | 1.93 | 0.01 |

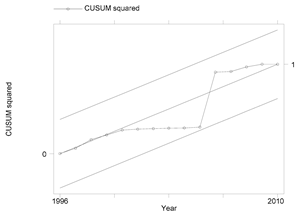

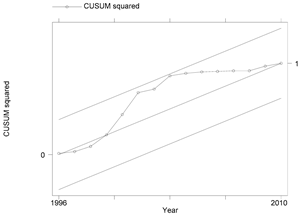

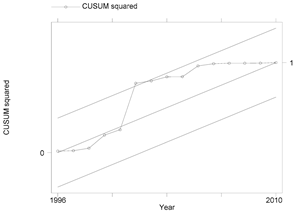

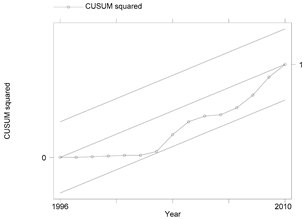

| Bank | CES | PES |

|---|---|---|

| AB |  |  |

| AEB |  |  |

| CAB |  |  |

| HB |  |  |

| JB |  |  |

| JCB |  |  |

| JIB |  |  |

| JKB |  |  |

| UB |  |  |

References

- Alam, Intekhab, and Pouya Seifzadeh. 2020. Marketing Islamic Financial Services: A Review, Critique, and Agenda for Future Research. Journal of Risk and Financial Management 13: 12. [Google Scholar] [CrossRef]

- Almarzoqi, Raja, Sami Ben Naceur, and Alessandro Scopelliti. 2015. How Does Bank Competition Affect Solvency, Liquidity and Credit Risk? Evidence from the MENA Countries. IMF Working Papers 15/210. Washington, DC: International Monetary Fund. [Google Scholar]

- Ariss, Rima Turk. 2010. On the implications of market power in banking: Evidence from developing countries. Journal of Banking & Finance 34: 765–75. [Google Scholar]

- Banihani, Muntaha, and Jawad Syed. 2020. Gendered work engagement: Qualitative insights from Jordan. The International Journal of Human Resource Management 31: 611–37. [Google Scholar] [CrossRef]

- Basov, Suren, and M. Ishaq Bhatti. 2016. Islamic Finance in the Light of Modern Economic Theory. Berlin/Heidelberg: Springer. [Google Scholar]

- Battese, George, and Tim J. Coelli. 1988. Prediction of firm-level technical efficiencies with a generalized frontier production function and panel data. Journal of Econometrics 38: 387–99. [Google Scholar] [CrossRef]

- Battese, George, and Tim J. Coelli. 1992. Frontier production functions, technical efficiency, and panel data: With application to paddy farmers in India. In International Applications of Productivity and Efficiency. Edited by Thomas Gulledge and Knox Lovell. Dordrecht: Springer, pp. 181–90. [Google Scholar]

- Berger, Allen N., and Loretta J. Mester. 1997. Inside the black box: What explains differences in the efficiencies of financial institutions? Journal of Banking and Finance 21: 895–947. [Google Scholar] [CrossRef]

- Berger, Allen N., and Loretta J. Mester. 2003. Explaining the dramatic changes in performance of US banks: Technological change, deregulation, and dynamic changes in competition. Journal of Financial Intermediation 12: 57–95. [Google Scholar] [CrossRef]

- Bhatti, Maria. 2020a. Resolving Islamic finance disputes through arbitration in the Middle East. In The Growth of Islamic Finance and Banking: Innovation, Governance and Risk Mitigation. Abingdon: Routledge, pp. 254–61. [Google Scholar]

- Bhatti, Maria. 2020b. Managing Shariah Non-Compliance Risk via Islamic Dispute Resolution. Journal of Risk and Financial Management 13: 2. [Google Scholar] [CrossRef]

- Breusch, Trevor S., and Adrian R. Pagan. 1979. A simple test for heteroscedasticity and random coefficient variation. Econometrica: Journal of the Econometric Society, 1287–94. [Google Scholar] [CrossRef]

- Christensen, Laurits R., Dale W. Jorgenson, and Lawrence Lau. 1973. Transcendental Logarithmic Production Frontiers. Review of Economics and Statistics 55: 28–45. [Google Scholar] [CrossRef]

- Clemente, Jesus, Antonio Montañés, and Marcelo Reyes. 1998. Testing for a unit root in variables with a double change in the mean. Economics Letters 59: 175–82. [Google Scholar] [CrossRef]

- Coelli, Timothy J., Dodla Sai Prasada Rao, Christopher J. O’Donnell, and George Edward Battese. 2005. An Introduction to Efficiency and Productivity Analysis, 2nd ed. New York and Christiansen: Springer Science and Business Media Inc. [Google Scholar]

- Cohen, Wesley, and Steven Klepper. 1996. A Reprise of Size and R&D. The Economic Journal 106: 925–51. [Google Scholar]

- Cohen, Wesley, Richard Nelson, and John Walsh. 2000. Protecting Their Intellectual Assets: Appropriability Conditions and Why U.S. Manufacturing Firms Patent (or Not). Working Paper No. 7552. Cambridge: NBER. [Google Scholar]

- Diallo, Boubacar. 2015. Bank competition and crises revisited: New results. Economics Letters 129: 81–86. [Google Scholar] [CrossRef]

- Dick, Astrid. 2007. Market Size, Service Quality, and Competition in Banking. Journal of Money, Credit and Banking 39: 49–81. [Google Scholar] [CrossRef]

- Engle, Robert F., and Clive W. J. Granger. 1987. Co-integration and error correction: Representation, estimation, and testing. Econometrica: Journal of the Econometric Society 55: 251–76. [Google Scholar] [CrossRef]

- Fiordelisi, Franco, and Davide Salvatore Mare. 2014. Competition and financial stability in European cooperative banks. Journal of International Money and Finance 45: 1–16. [Google Scholar] [CrossRef]

- Forssbæck, Jens, and Choudhry Tanveer Shehzad. 2015. The conditional effects of market power on bank risk—Cross-country evidence. Review of Finance 19: 1997–2038. [Google Scholar] [CrossRef]

- Freixas, Xavier, and Jean-Charles Rochet. 2008. Microeconomics of Banking. Cambridge: MIT Press. [Google Scholar]

- Friedman, Milton, and Anna Jacobson Schwartz. 1963. A Monetary History of the United States, 1867-1960. Princeton: National Bureau of Economic Research and Princeton University Press. [Google Scholar]

- Fu, Xiaoqing Maggie, Yongjia Rebecca Lin, and Philip Molyneux. 2014. Bank competition and financial stability in Asia Pacific. Journal of Banking & Finance 38: 64–77. [Google Scholar]

- Fungáčová, Zuzana, and Laurent Weill. 2013. Does competition influence bank failures? Economics of Transition 21: 301–22. [Google Scholar] [CrossRef]

- Gangopadhyay, Partha, and Siddharth Jain. 2019. Understanding subnational conflicts in Myanmar. IGDR. [Google Scholar] [CrossRef]

- Gangopadhyay, Partha, and Rahul Nilakantan. 2018. Estimating the effects of climate shocks on collective violence: ARDL evidence from India. The Journal of Development Studies 54: 441–56. [Google Scholar] [CrossRef]

- Gerschenkron, Alexander. 1962. Economic Backwardness in Historical Perspective: A Book of Essays. Cambridge: The Belknap Press of Harvard University Press. [Google Scholar]

- Herzer, Dierk, and Holger Strulik. 2017. Religiosity and income: A panel cointegration and causality analysis. Applied Economics 49: 2922–38. [Google Scholar] [CrossRef]

- Humphrey, David B., and Lawrence B. Pulley. 1997. Banks’ Responses to Deregulation: Profits, Technology, and Efficiency. Journal of Money, Credit and Banking 29: 73–93. [Google Scholar] [CrossRef]

- Ijtsma, Pieter, Laura Spierdijk, and Sherrill Shaffer. 2017. The concentration–stability controversy in banking: New evidence from the EU-25. Journal of Financial Stability 33: 273–84. [Google Scholar] [CrossRef]

- Jarque, Carlos, and Anil Kumar. Bera. 1980. Efficient Tests for Normality, Homoscedasticity and Serial Independence of Regression Residuals. Economics Letters 6: 255–59. [Google Scholar] [CrossRef]

- Jeon, Jin Q., and Kwang Kyu Lim. 2013. Bank competition and financial stability: A comparison of commercial banks and mutual savings banks in Korea. Pacific-Basin Finance Journal 25: 253–72. [Google Scholar] [CrossRef]

- Jeon, Bang Nam, María Pía Olivero, and Ji Wu. 2011. Do foreign banks increase competition? Evidence from emerging Asian and Latin American banking markets. Journal of banking & Finance 35: 856–75. [Google Scholar]

- Jiang, Liangliang, Ross Levine, and Chen Lin. 2016. Competition and Bank Opacity. Review of Financial Studies 29: 1911–42. [Google Scholar] [CrossRef]

- Jiang, Liangliang, Ross Levine, and Chen Lin. 2018. Does Competition Affect Bank Risk? NBER Working Paper No. 23080. Cambridge: NBER. [Google Scholar]

- Jiang, Liangliang, Ross Levine, and Chen Lin. 2019. Competition and Bank Liquidity Creation. Journal of Financial and Quantitative Analysis 54: 513–38. [Google Scholar] [CrossRef]

- Jiménez, Gabriel, Jose A. Lopez, and Jesús Saurina. 2013. How does competition affect bank risk-taking? Journal of Financial Stability 9: 185–95. [Google Scholar] [CrossRef]

- Kasman, Saadet, and Adnan Kasman. 2015. Bank Competition, Concentration and Financial Stability in the Turkish Banking Industry. Economic Systems 39: 502–17. [Google Scholar] [CrossRef]

- Kay, John. 1995. Foundation of Corporate Success: How Business Strategies Add Value. Oxford: Oxford University Press. [Google Scholar]

- Kick, Thomas, and Esteban Prieto. 2015. Bank Risk and Competition: Evidence from Regional Banking Markets. Review of Finance 19: 1185–222. [Google Scholar] [CrossRef]

- Kouki, Imen, and Amjad Al-Nasser. 2017. The Implication of Banking Competition: Evidence from African Countries. Research in International Business and Finance 39: 878–95. [Google Scholar] [CrossRef]

- Lapteacru, Ion. 2014. Do More Competitive Banks have Less Market Power? The Evidence from Central and Eastern Europe. Journal of International Money and Finance 46: 41–60. [Google Scholar] [CrossRef]

- Leroy, Aurélien, and Yannick Lucotte. 2017. Is There a Competition-Stability Trade-off in European Banking? Journal of International Financial Markets, Institutions and Money 46: 199–215. [Google Scholar] [CrossRef]

- Levin, Richard, Alvin Klevorick, Richard Nelson, and Sidney Winter. 1987. Appropriating the Returns from Industrial Research and Development. Brookings Papers on Economic Activity 1987: 783–831. [Google Scholar] [CrossRef]

- Misman, Faridah Najuna, and M Ishaq Bhatti. 2020. The Determinants of Credit Risk: An Evidence from ASEAN and GCC Islamic Banks. Journal of Risk and Financial Management 13: 89. [Google Scholar] [CrossRef]

- Molyneux, Philip, Yener Altunbas, and E. P. M. Gardener. 1996. Efficiency in European Banking. Chichester: John Wiley & Sons Ltd. [Google Scholar]

- Ng, Serena, and Pierre Perron. 2001. Lag Length Selection and the Construction of Unit Root Tests with Good Size and Power. Econometrica 69: 1519–54. [Google Scholar] [CrossRef]

- Oliner, Stephen D., and Daniel E. Sichel. 2000. The Resurgence of Growth in the Late 1990s: Is Information Technology the Story? Journal of Economic Perspectives 14: 3–22. [Google Scholar] [CrossRef]

- Pesaran, M. Hashem, Yongcheol Shin, and Richard J. Smith. 2001. Bounds testing approaches to the analysis of level relationships. Journal of Applied Econometrics 16: 289–326. [Google Scholar] [CrossRef]

- Polius, Tracy, and Wendell Samuel. 2000. Banking Efficiency in the Eastern Caribbean Currency Union: An Examination of the Structure-Conduct-Performance Parading and the Efficiency Hypothesis. Money Affairs 15: 75–92. [Google Scholar]

- Shaked, Avner, and John Sutton. 1983. Natural Oligopolies. Econometrica 51: 1469–84. [Google Scholar] [CrossRef]

- Shaked, Avner, and John Sutton. 1987. Product Differentiation and Industrial Structure. The Journal of Industrial Economics 36: 131–46. [Google Scholar]

- Soedarmono, Wahyoe, Fouad Machrouh, and Amine Tarazi. 2013. Bank Competition, Crisis and Risk Taking: Evidence from Emerging Markets in Asia. Journal of International Financial Markets, Institutions and Money 23: 196–221. [Google Scholar] [CrossRef]

- Sutton, John. 1991. Sunk Costs and Market Structure. Cambridge: MIT Press. [Google Scholar]

- Sutton, John. 1997a. Game Theoretic Models of Market Structure. In Advances in Economics and Econometrics, Proceedings of the World Congress of the Econometric Society, Tokyo 1995. Edited by David Kreps and Kenneth Wallis. Cambridge: Cambridge University Press, pp. 66–86. [Google Scholar]

- Sutton, John. 1997b. Gibrat’s Legacy. Journal of Economics Literature 35: 40–59. [Google Scholar]

- Sutton, John. 1998. Technology and Market Structure. Cambridge: MIT Press. [Google Scholar]

- Sutton, John. 2001a. Rich Trades, Scarce Capabilities: Industrial Development Revisited, (Keynes Lecture 2000). In Proceedings of the British Academy, vol. III (2000 Lectures and Memoirs). Oxford: Oxford University Press, pp. 245–73, Reprinted in Economic and Social Review 2002: 33: 1–22. [Google Scholar]

- Sutton, John. 2001b. The Variance of Firm Growth Rates: The Scaling Puzzle. Physica A 312: 577–90. [Google Scholar] [CrossRef]

- Sutton, John. 2007. Market Structure: Theory and Evidence. In Handbook of Industrial Organization. Cambridge: Elsevier, vol. 3, Chapter 35. pp. 2301–68. [Google Scholar]

- Tabak, Benjamin M., Dimas M. Fazio, and Daniel O. Cajueiro. 2012. The relationship between banking market competition and risk-taking: Do size and capitalization matter? Journal of Banking & Finance 36: 3366–81. [Google Scholar]

- Tabak, Benjamin M., Dimas M. Fazio, and Daniel O. Cajueiro. 2013. Systemically important banks and financial stability: The case of Latin America. Journal of Banking & Finance 37: 3855–66. [Google Scholar]

- Tabak, Benjamin M., Guilherme M. R. Gomes, and Maurício da Silva Medeiros, Jr. 2015. The impact of market power at bank level in risk-taking: The Brazilian case. International Review of Financial Analysis 40: 154–65. [Google Scholar] [CrossRef]

- Tarullo, Daniel. 2012. Financial stability regulation. Paper presented at Distinguished Jurist Lecture, University of Pennsylvania Law School, Philadelphia, PA, USA, October 10. [Google Scholar]

- Teece, David J. 2000. Managing Intellectual Capital. Oxford: Oxford University Press. [Google Scholar]

- Thadewald, Thorsten, and Herbert Büning. 2007. Jarque–Bera test and its competitors for testing normality—A power comparison. Journal of Applied Statistics 34: 87–105. [Google Scholar] [CrossRef]

- The Economist. 2009. Deliver us from Competition. Economic Focus, June 25. [Google Scholar]

- Turner, John D. 2014a. Financial history and financial economics. In The Oxford Handbook of Banking and Financial History. Oxford: Oxford University Press. [Google Scholar]

- Turner, John D. 2014b. Banking in Crisis: The Rise and Fall of British Banking Stability, 1800 to the Present. Cambridge: Cambridge University Press. [Google Scholar]

- Vives, Xavier. 2010. Competition and stability in banking. Economia Chilena 13: 85–112. [Google Scholar] [CrossRef][Green Version]

| 1 | At the outset, the selection of the country and its industry begs the question of whether it is justified to consider Jordon’s Islamic banking industry for a detailed analysis like this. In the Middle East, Jordon’s banking industry has consistently posted an excellent record since the early 1990s, as policy makers launched a series of banking liberalization measures to fight financial repression in Jordan. Such measures were meant to intensify competition among banks for delivering efficiency gains. As a result, the banking sector became one of the largest economic sectors in Jordon; by 2019, the banking industry contributed 18.8% of Jordon’s GDP. As another indicator of its relevance, in 2017, the total assets of Jordon’s banks stood at 114% of its GDP, while the global average stood at 64%. Despite mounting economic challenges in the region, Jordon’s banks have maintained excellent profit figures with adequate stocks of liquid assets and healthy capital adequacy ratios (17.2% in 2019). The banking sector has enforced a strong compliance system to contain the NPL ratio under 6%. Hence, Jordon fulfils all Basel III requirements. Jordon thus stands out as a prime example of how competition can promote efficiency in banking without risking financial instability. Additionally, in Section 2, we will also highlight that the Islamic banks have become a major player in Jordon. There are two important sources of growth in Islamic banking in Jordon. First, investors came to hold a shared perception that Islamic banks adopt more responsible business practices (see Alam and Seifzadeh 2020). Second, it is widely held that Islamic banks’ better financing quality lowers their credit risks (see Misman and Bhatti 2020). We hence choose Jordon as a prime example of successful banking reforms, with the strong presence of Islamic banks, for understanding if endogenous sunk-cost investments can propel efficiencies, which will, in turn, create stability for Islamic banking. |

| 2 | |

| 3 | The other type of sunk-cost investment is comprised of a firm’s expenses to grab market shares from its rivals, like advertisement, without any impact on its relative efficiency. |

| 4 | At the textbook level, appropriability is defined by Kay (1995) as the capacity of a business entity to capture the value added—through its rivalry with its competitors in the market—that it creates for its own profits. The value added is created and captured either by innovating better products or better processes than their rivals. The appropriability critically depends on the structure of the market in which it operates (see Cohen et al. 2000). |

| 5 | There will be little effects on their profits if a bank improves its product quality or technology of production, which is easily imitable or reproducible by others. The appropriability regime is defined as weak. On the other hand, some quality improvements involve sticky knowledge, which are intimately ingrained in a particular organization, so that they cannot be easily imitated and replanted elsewhere in a meaningful way. The market/system has strong appropriability (see Teece 2000). |

| 1. Arab Bank | 2. Arab Egyptian Bank | 3. Cairo Amman Bank |

| 4. Housing Bank | 5. Jordan Bank | 6. Jordon Commercial Bank |

| 7. Jordon Islamic Bank | 8. Jordan | 9. Kuwait Bank |

| Yn: Vector of Output (Y1: Loans, Y2: Investment, Y3: Other Earning Assets) |

| Pn: Prices of Output |

| Xm: Vector of Inputs (X1: Labour input, X2: Capital Input, X3: Financial Capital Input) |

| Pm: Price of Inputs (PL: Price of Labour (Wage) |

| PK: Price of Capital, PF: Price of Financial Capital) |

| Cit: Cost of production of bank i at date t |

| ITK: IT Budget Allocated to Acquiring only IT Capital (in $) |

| Πit: Profit of Bank i at date t |

| ηit: Measures inefficiency in terms of profits/costs |

| CES: Cost Efficiency Scores |

| PES: Profit Efficiency Scores |

| Variable | Mean | Std. Dev. | Min | Max | Observations | |

|---|---|---|---|---|---|---|

| CES | overall | 0.800 | 0.096 | 0.600 | 1.000 | N = 162 |

| between | 0.083 | 0.726 | 0.983 | n = 9 | ||

| within | 0.056 | 0.659 | 1.009 | T = 18 | ||

| PES | overall | 0.860 | 0.091 | 0.540 | 1.000 | N = 162 |

| between | 0.028 | 0.825 | 0.910 | n = 9 | ||

| within | 0.087 | 0.539 | 1.023 | T = 18 | ||

| ITK(Million) | overall | 7.307 | 10.782 | 0.530 | 65.118 | N = 162 |

| between | 9.518 | 2.137 | 32.335 | n = 9 | ||

| within | 5.934 | −20.170 | 40.090 | T = 18 |

| Bank Name | Variables | ADF (AIC) | PP | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Level | 1st Difference | Level | 1st Difference | ||||||

| Intercept | Intercept & Trend | Intercept | Intercept & Trend | Intercept | Intercept & Trend | Intercept | Intercept & Trend | ||

| Arab Bank | CES | −3.53 ** | −3.46 * | −3.17 *** | −3.03 | −3.57 ** | −3.54 * | −9.94 *** | −10.11 *** |

| PES | −3.42 ** | −3.49 * | −3.81 ** | −3.68 * | −2.44 | −2.35 | −4.53 *** | −4.82 *** | |

| ITK | −2.18 | 0.16 | −0.88 | −1.64 | −4.41 *** | −4.91 *** | −5.36 *** | −5.03 *** | |

| Arab Egyptian Bank | CES | −1.79 | −1.63 | −3.70 ** | −3.61 * | −1.86 | −1.76 | −3.70 ** | −3.61 * |

| PES | −1.65 | −5.62 *** | −3.99 ** | −3.87 ** | −3.58 ** | −5.64 *** | −7.47 *** | −7.34 *** | |

| ITK | −3.92 *** | −1.27 | −9.54 *** | −8.53 *** | −3.39 ** | −5.87 *** | −9.54 *** | −8.28 *** | |

| Cairo Amman Bank | CES | −1.35 | −1.93 | 3.11 ** | −4.65 ** | −1.32 | −2.25 | −4.62 *** | −4.91 *** |

| PES | −3.82 ** | −3.46 ** | −5.32 *** | −5.13 *** | −2.77 * | −2.80 | −5.32 *** | −5.13 *** | |

| ITK | −1.58 | −2.15 | −1.84 | −1.91 | −2.31 | −2.68 | −3.75 ** | −3.57 * | |

| Housing Bank | CES | −1.64 | −1.90 | −1.96 | −2.09 | −1.43 | −0.88 | −2.02 | −2.09 |

| PES | −2.73 * | −3.62 * | −5.67 *** | −4.06 ** | −2.69 * | −3.58 * | −10.80 *** | −12.87 *** | |

| ITK | −0.22 | −2.81 | −4.56 *** | −4.34 ** | −1.66 | −2.70 | −4.28 *** | −4.17 ** | |

| Jordan Bank | CES | −1.55 | −2.12 | −4.28 *** | −6.86 *** | −2.19 | −2.22 | −5.50 *** | −5.24 *** |

| PES | −1.96 | −1.86 | −4.60 *** | −4.77 *** | −1.88 | −1.89 | −4.74 *** | −5.19 *** | |

| ITK | −2.62 | −4.17 ** | −1.60 | −1.05 | −3.40 ** | −8.54 *** | −7.01 *** | −7.26 *** | |

| Jordan Commercial Bank | CES | −2.80 * | −3.17 | −3.16 ** | −3.05 | −1.88 | −1.83 | −3.18 ** | −3.08 |

| PES | −4.09 *** | −3.98 ** | −5.53 *** | −5.29 *** | −4.19 *** | −4.05 ** | −11.73 *** | −11.62 *** | |

| ITK | −2.11 | −0.35 | −2.26 | −2.81 | −4.37 *** | −4.15 ** | −6.48 *** | −6.22 *** | |

| Jordan Islamic Bank | CES | −2.91 * | −2.97 | −3.56 ** | −3.63 * | −1.97 | −1.97 | −2.48 | −2.44 |

| PES | −3.57 ** | −4.53 ** | −5.10 *** | −5.09 *** | −3.62 ** | −4.52 ** | −16.58 *** | −18.96 *** | |

| ITK | −3.99 *** | −1.38 | −9.37 *** | −8.38 *** | −3.46 ** | −5.97 *** | −9.37 | −8.22 | |

| Jordan Kuwait Bank | CES | −4.09 *** | −4.05 ** | −4.67 *** | −3.55 * | −4.14 *** | −4.07 ** | −14.14 *** | −15.78 *** |

| PES | −3.45 ** | −3.15 | −6.35 *** | −6.13 *** | −3.45 ** | −3.35 * | −6.35 *** | −6.13 *** | |

| ITK | −1.67 | −1.83 | −2.51 | −2.42 | −3.18 ** | −3.17 | −4.73 *** | −4.21 ** | |

| Union Bank | CES | −4.50 *** | −4.43 ** | −6.15 *** | −6.07 *** | −3.38 ** | −3.27 | −6.19 *** | −6.15 *** |

| PES | −5.09 *** | −5.46 *** | −6.00 *** | −5.75 *** | −5.09 *** | −5.50 *** | −18.74 *** | −18.04 *** | |

| ITK | −1.38 | −1.67 | −2.02 | −1.71 | −1.91 | −2.75 | −3.34 ** | −3.22 | |

| Banks | Variables | Order of Integration |

|---|---|---|

| Arab Bank | CES | I(0) |

| PES | I(1) | |

| ITK | I(1) | |

| Arab Egyptian Bank | CES | I(1) |

| PES | I(0) | |

| ITK | I(0) | |

| Cairo Amman Bank | CES | I(1) |

| PES | I(0) | |

| ITK | I(1) | |

| Housing Bank | CES | I(2) * |

| PES | I(1) | |

| ITK | I(1) | |

| Jordan Bank | CES | I(1) |

| PES | I(1) | |

| ITK | I(1) | |

| Jordan Commercial Bank | CES | I(1) |

| PES | I(0) | |

| ITK | I(1) | |

| Jordan Islamic Bank | CES | I(1) |

| PES | I(0) | |

| ITK | I(0) | |

| Jordan Kuwait Bank | CES | I(0) |

| PES | I(0) | |

| ITK | I(1) | |

| Union Bank | CES | I(0) |

| PES | I(0) | |

| ITK | I(1) |

| AB | AEB | CAB | HB | JB | JCB | JIB | JKB | UB | |

|---|---|---|---|---|---|---|---|---|---|

| Adjustment | |||||||||

| CESL1 | −1.90 ** | −1.04 ** | 0.91 | 2.21 | −2.40 ** | −0.50 | −0.79 *** | −1.23 *** | −1.67 |

| LONG-RUN | |||||||||

| lnITK | −0.02 | 0.07 | −0.39 | 0.60 ** | −0.20 | 0.06 | 0.24 *** | 0.02 | −0.06 |

| SHORT-RUN | |||||||||

| ΔCESLD | 0.84 | −0.56 | −1.25 | −3.84 | 1.17 * | 0.38 | − | − | 0.19 |

| ΔCESL2D | 0.53 | −0.20 | −1.23 | −5.50 | − | 0.49 | − | − | 0.54 |

| ΔCESL3D | − | −0.17 | −1.27 | −5.46 | − | −0.60 | − | − | 0.45 |

| ΔlnITKD1 | 0.15 | 0.28 | −0.43 | 2.90 | 0.90 * | −0.22 | 0.72 *** | − | 0.33 |

| ΔlnITKLD | −0.06 | 0.75 | −0.51 | 4.77 | 0.23 | 0.31 | − | − | 0.11 |

| ΔlnITKL2D | 0.38 ** | 0.36 ** | −0.25 | 4.16 | 0.14 | −0.60 * | − | − | 0.17 |

| ΔlnITKL3D | −0.08 | 0.07 | −0.09 | −0.20 | 0.18 | 0.17 | − | − | −0.11 |

| CONSTANT | 2.42 ** | −0.42 ** | −5.95 | 17.36 | 2.36 * | −0.08 | −2.16 ** | 0.71 | 2.86 |

| Adj R squared | 0.73 | 0.96 | 0.01 | 0.64 | 0.39 | 0.89 | 0.80 | 0.53 | 0.94 |

| F statistic for no cointegration | 8.52 | 5.82 | 0.68 | 3.83 | 4.85 | 11.09 | 16.42 | 7.26 | 6.99 |

| Cointegration | Yes ** | Yes ** | No | No | Yes * | Yes *** | Yes *** | Yes ** | Yes ** |

| AB | AEB | CAB | HB | JB | JCB | JIB | JKB | UB | |

|---|---|---|---|---|---|---|---|---|---|

| Adjustment | |||||||||

| PESL1 | 9.681 | −1.067 | −1.577 *** | −2.929 ** | 2.143 | −1.09 *** | −2.127 *** | −2.493 *** | −1.425 *** |

| LONG-RUN | |||||||||

| lnITK | 0.442 *** | 0.288 | 0.0153 | −0.02 | 0.381 ** | 0.095 | 0.009 | 0.035 * | 0.262 ** |

| SHORT-RUN | |||||||||

| ΔPESLD | −10.389 | −0.699 | 0.448 | 1.175 * | −2.271 | − | 0.412 | 1.607 ** | − |

| ΔPESL2D | −6.806 | −0.746 | 0.554 | 0.802 | −1.717 | − | − | 1.319 ** | − |

| ΔPESL3D | 4.927 ** | −0.308 | 0.519 * | − | −0.525 | − | − | 0.634 ** | − |

| ΔlnITKD1 | 35.84 * | −1.214 ** | − | −0.853 * | 1.299 | − | − | 0.276 ** | −0.998 ** |

| ΔlnITKLD | 5.549 | −0.642 | − | − | −1.312 | − | − | −0.124 | −0.423 |

| ΔlnITKL2D | −0.623 | 0.505 | − | − | 2.236 | − | − | 0.419 *** | −0.791 ** |

| ΔlnITKL3D | −4.516 * | 0.295 * | − | − | −0.479 * | − | − | − | − |

| CONSTANT | 62.569 * | −3.596 | 0.907 | 3.479 * | 10.76 | −0.578 | 1.395 | 0.931 | −4.183 ** |

| Adj R squared | 0.886 | 0.954 | 0.575 | 0.582 | 0.741 | 0.442 | 0.751 | 0.912 | 0.798 |

| F statistic for no cointegration | 31.576 | 21.512 | 7.694 | 5.791 | 7.72 | 5.349 | 9.469 | 27.303 | 20.569 |

| Cointegration | Yes *** | Yes *** | Yes ** | Yes ** | Yes ** | Yes * | Yes *** | Yes *** | Yes *** |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Jain, S.; Gangopadhyay, P. Impacts of Endogenous Sunk-Cost Investment on the Islamic Banking Industry: A Historical Analysis. J. Risk Financial Manag. 2020, 13, 108. https://doi.org/10.3390/jrfm13060108

Jain S, Gangopadhyay P. Impacts of Endogenous Sunk-Cost Investment on the Islamic Banking Industry: A Historical Analysis. Journal of Risk and Financial Management. 2020; 13(6):108. https://doi.org/10.3390/jrfm13060108

Chicago/Turabian StyleJain, Siddharth, and Partha Gangopadhyay. 2020. "Impacts of Endogenous Sunk-Cost Investment on the Islamic Banking Industry: A Historical Analysis" Journal of Risk and Financial Management 13, no. 6: 108. https://doi.org/10.3390/jrfm13060108

APA StyleJain, S., & Gangopadhyay, P. (2020). Impacts of Endogenous Sunk-Cost Investment on the Islamic Banking Industry: A Historical Analysis. Journal of Risk and Financial Management, 13(6), 108. https://doi.org/10.3390/jrfm13060108