A Wavelet-Based Analysis of the Co-Movement between Sukuk Bonds and Shariah Stock Indices in the GCC Region: Implications for Risk Diversification

Abstract

1. Introduction

2. Literature Review

2.1. Theoretical Literature

2.2. Empirical Literature

3. Methodology

3.1. Continuous Wavelet Transform (CWT)

3.2. Multivariate Wavelet Methods

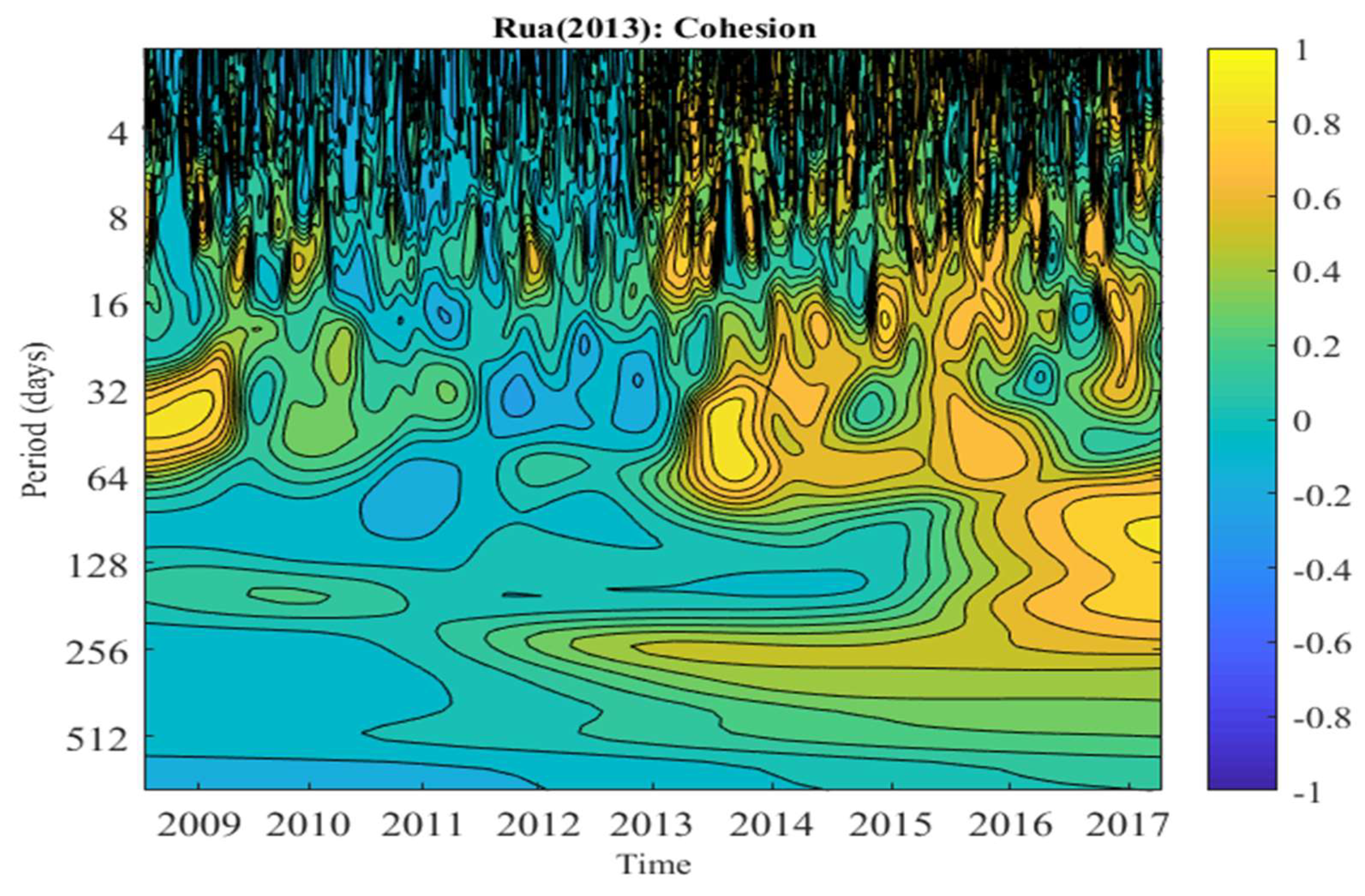

3.2.1. The Wavelet Cohesion

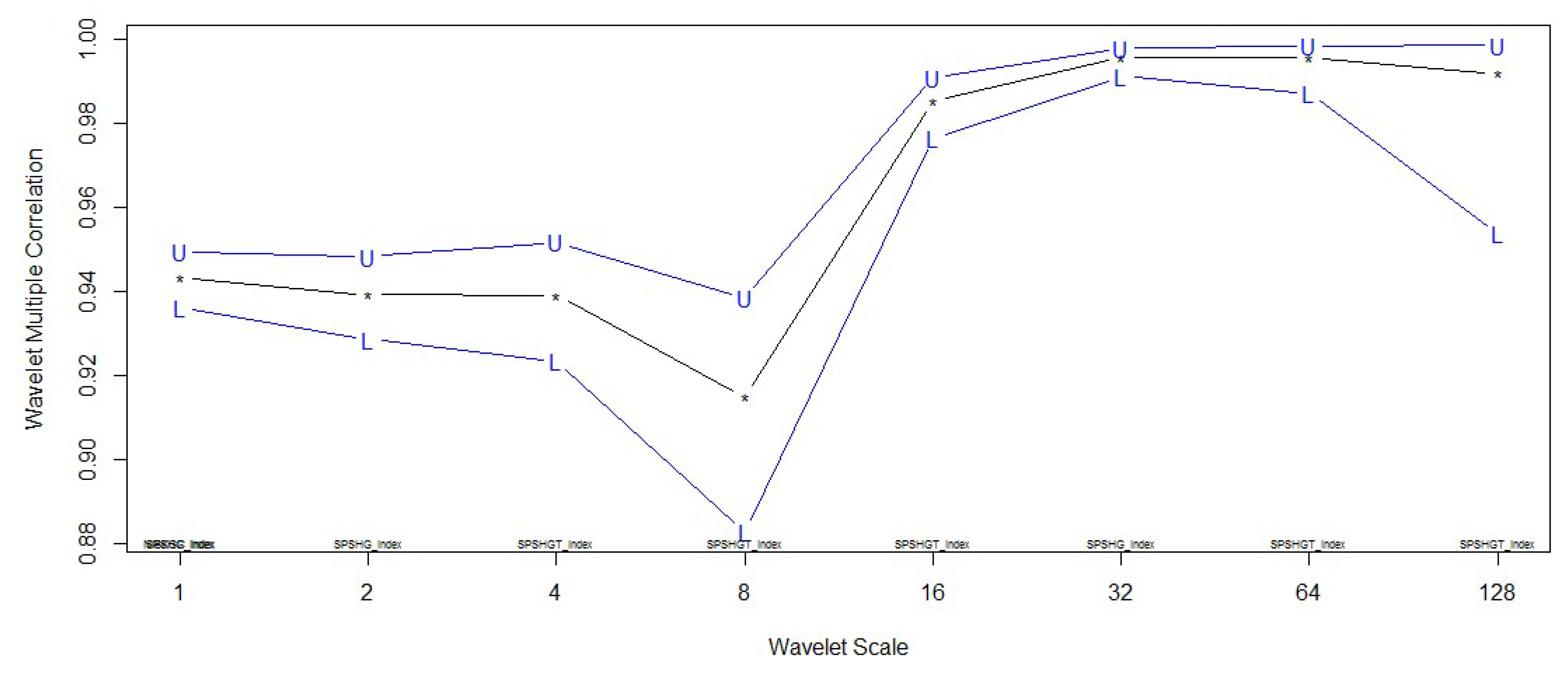

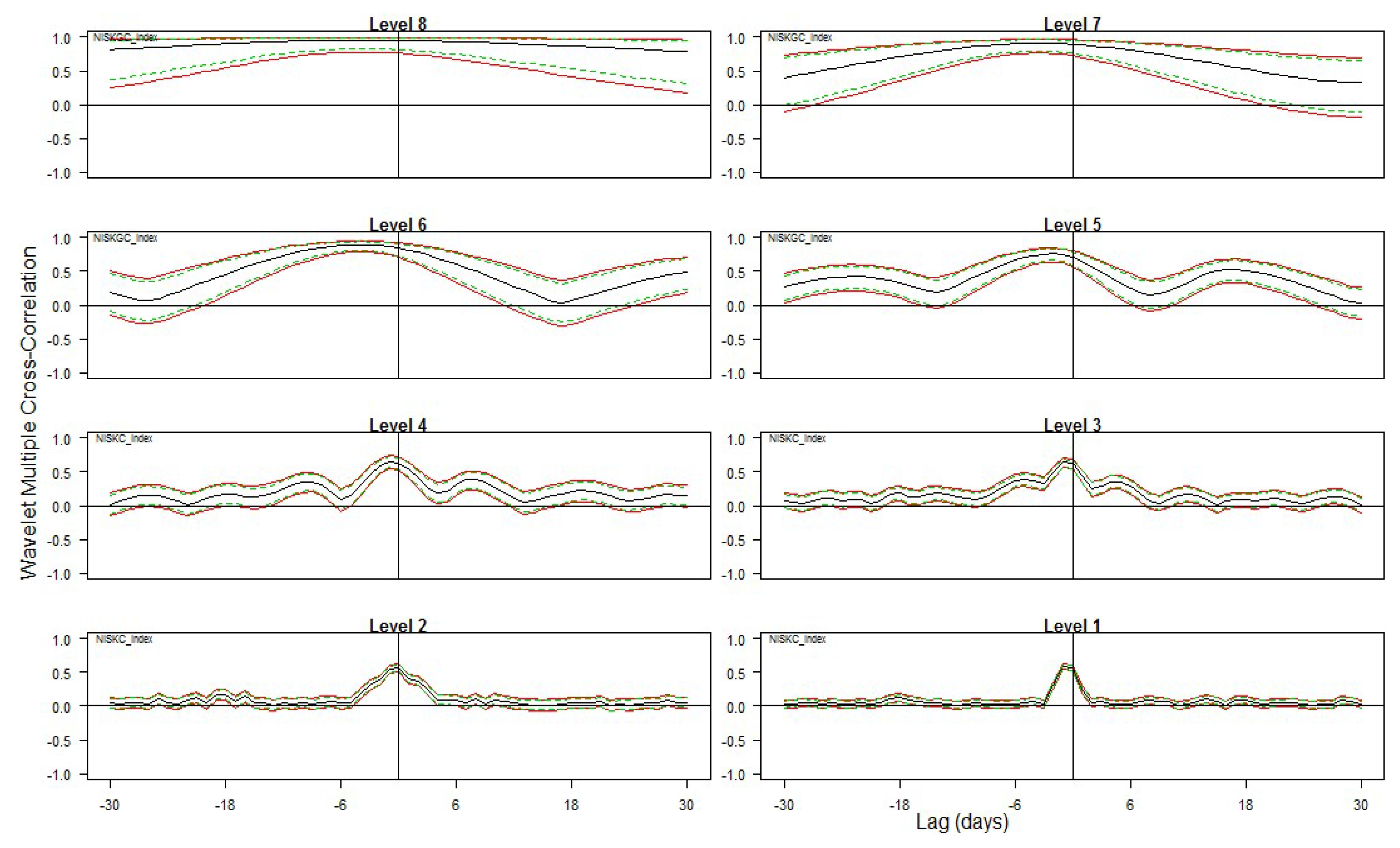

3.2.2. Wavelet Multiple Correlation (WMC) and Wavelet Multiple Cross-Correlation (WMCC)

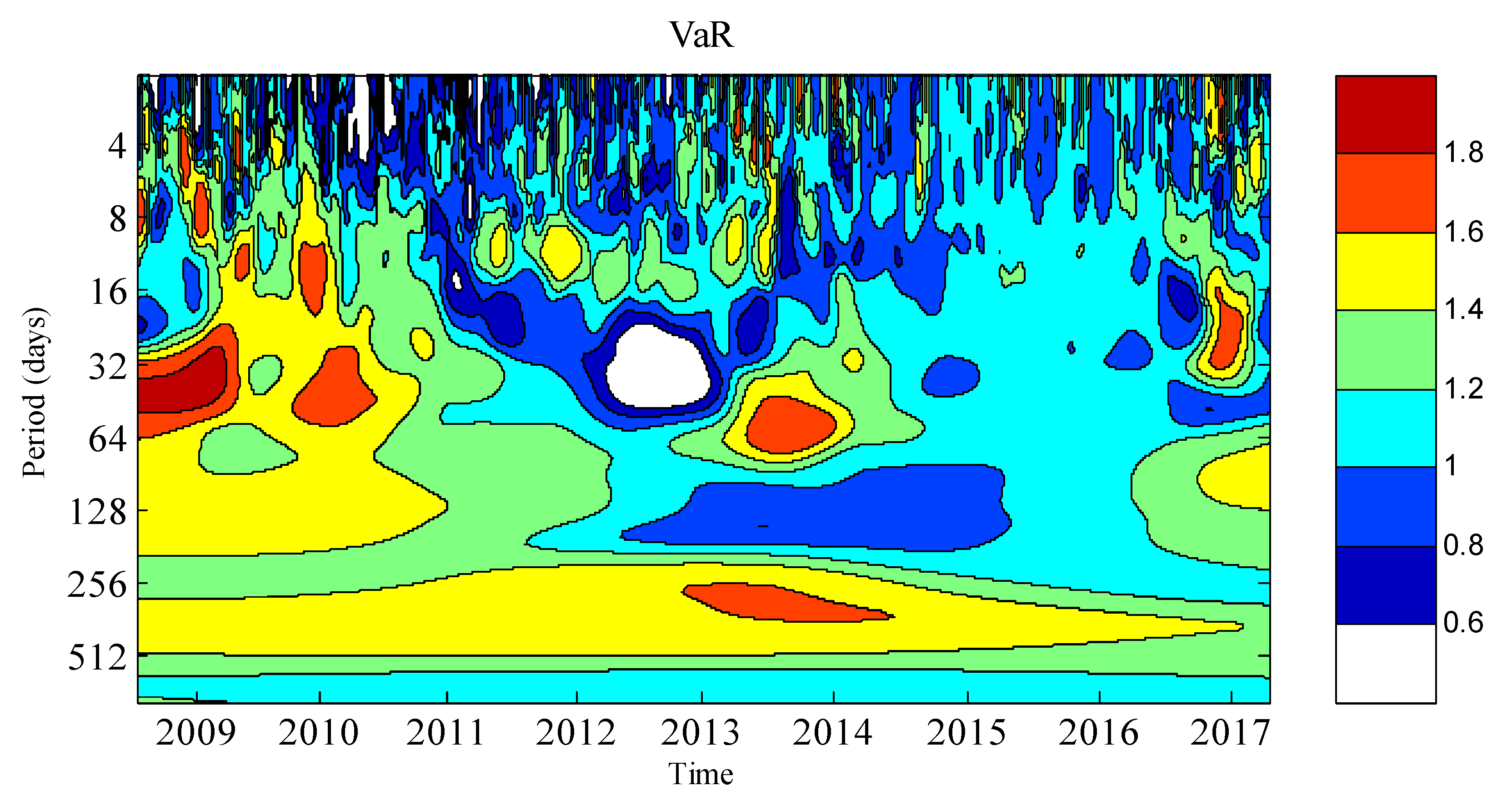

3.2.3. Value at Risk Analysis (VaR)

4. Data Description

5. Empirical Findings and Discussion

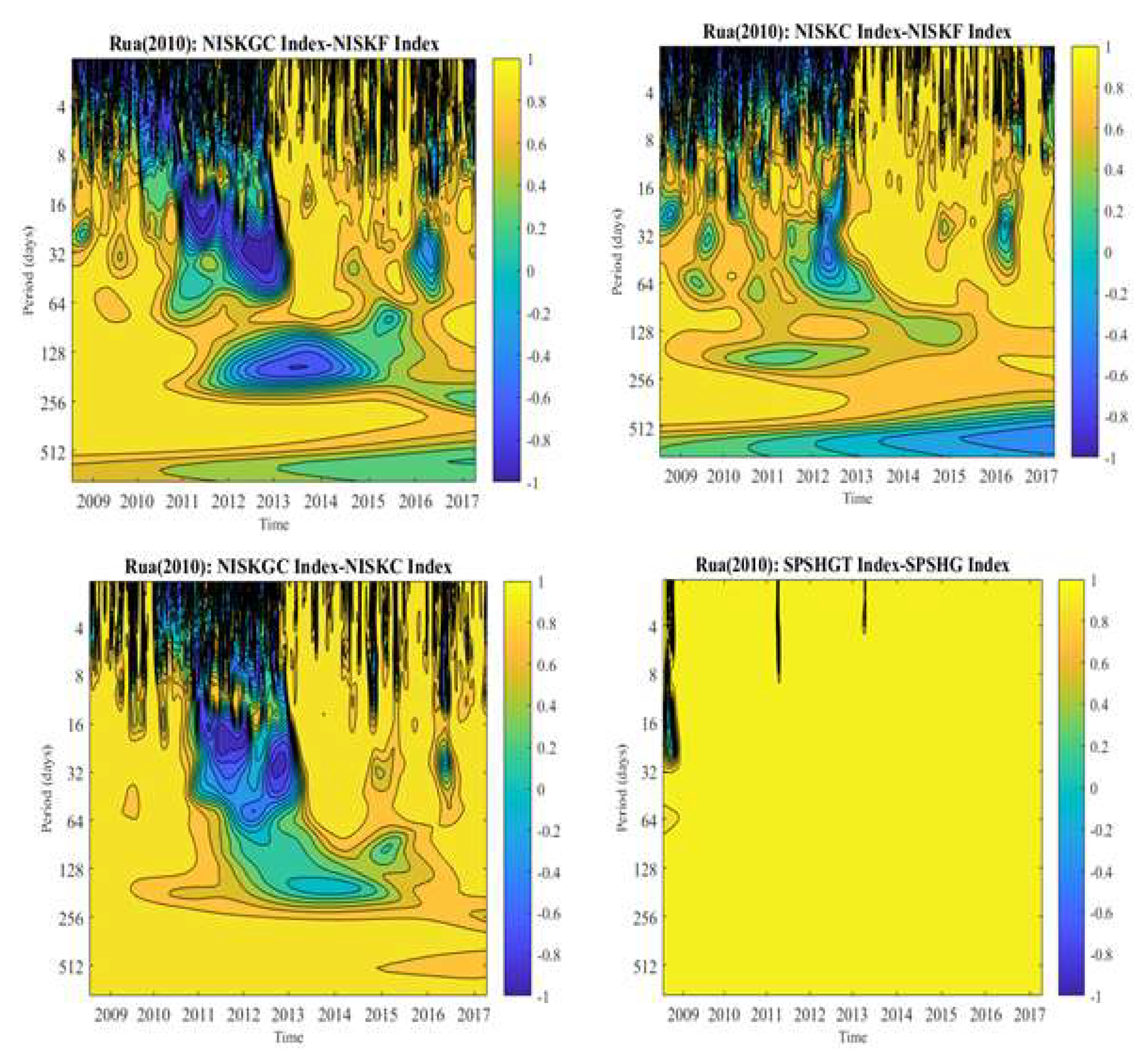

5.1. The Wavelet Coherence (WC) Analysis

5.1.1. Co-Movement between Sukuk Sub-Indices and between Shariah Stocks

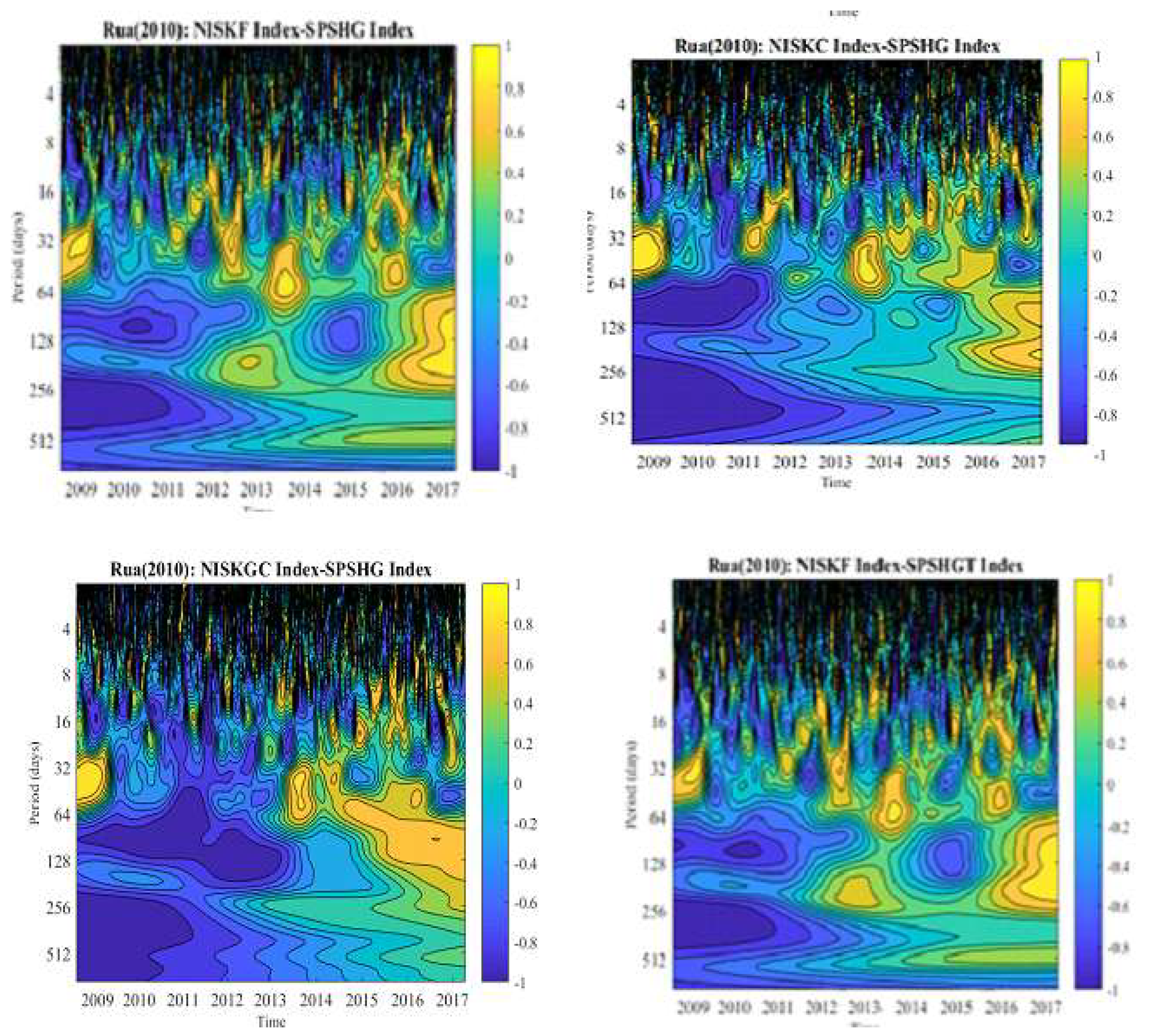

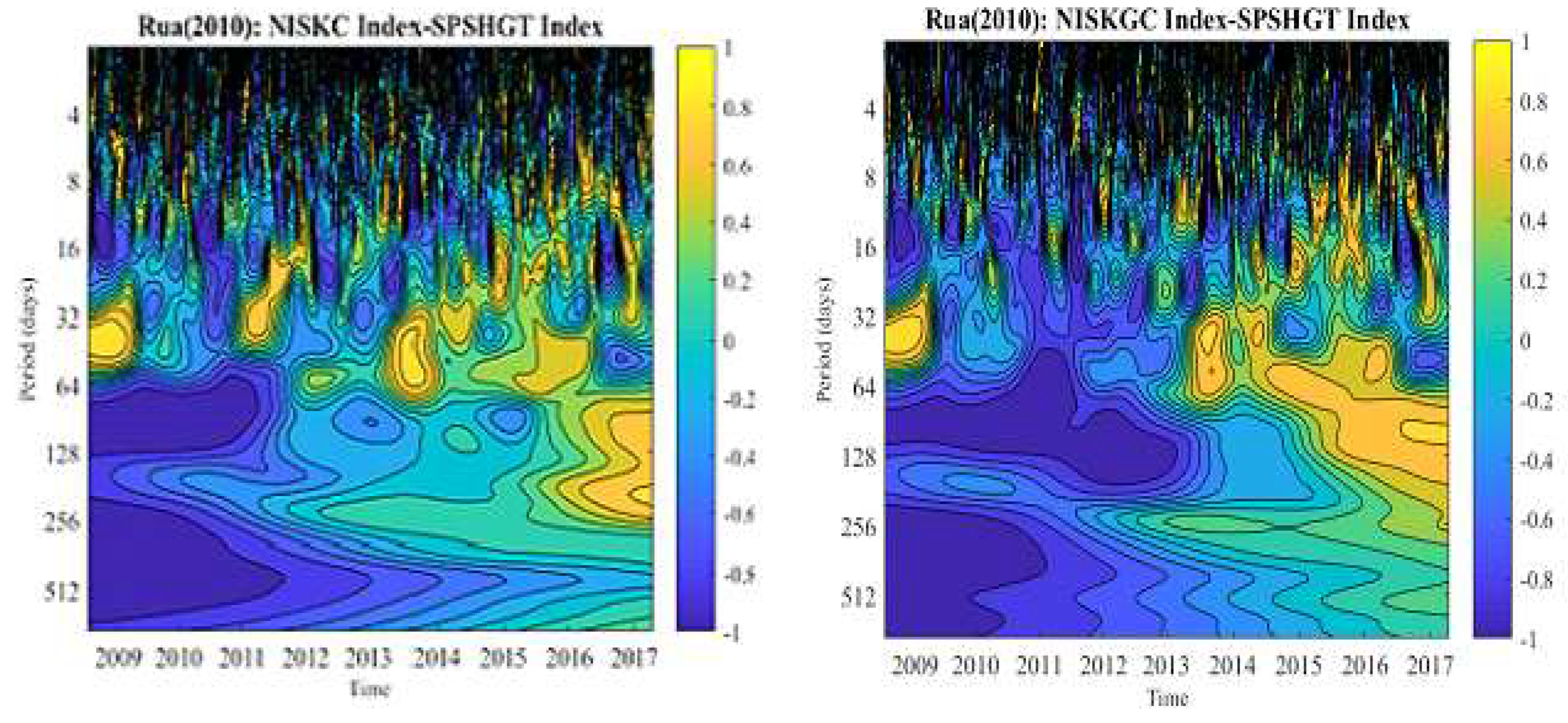

5.1.2. Co-Movement between Sukuk Sub-Indices and Shariah Stocks

5.2. Wavelet Cohesion Analysis

5.3. Wavelet Multiple Correlation Analysis

5.4. Wavelet Multiple Cross-Correlation Analysis (WMCC)

5.5. Value at Risk Sukuk-Shariah Stocks Portfolio Analysis

6. Conclusions and Policy Implications

Author Contributions

Funding

Conflicts of Interest

Appendix A

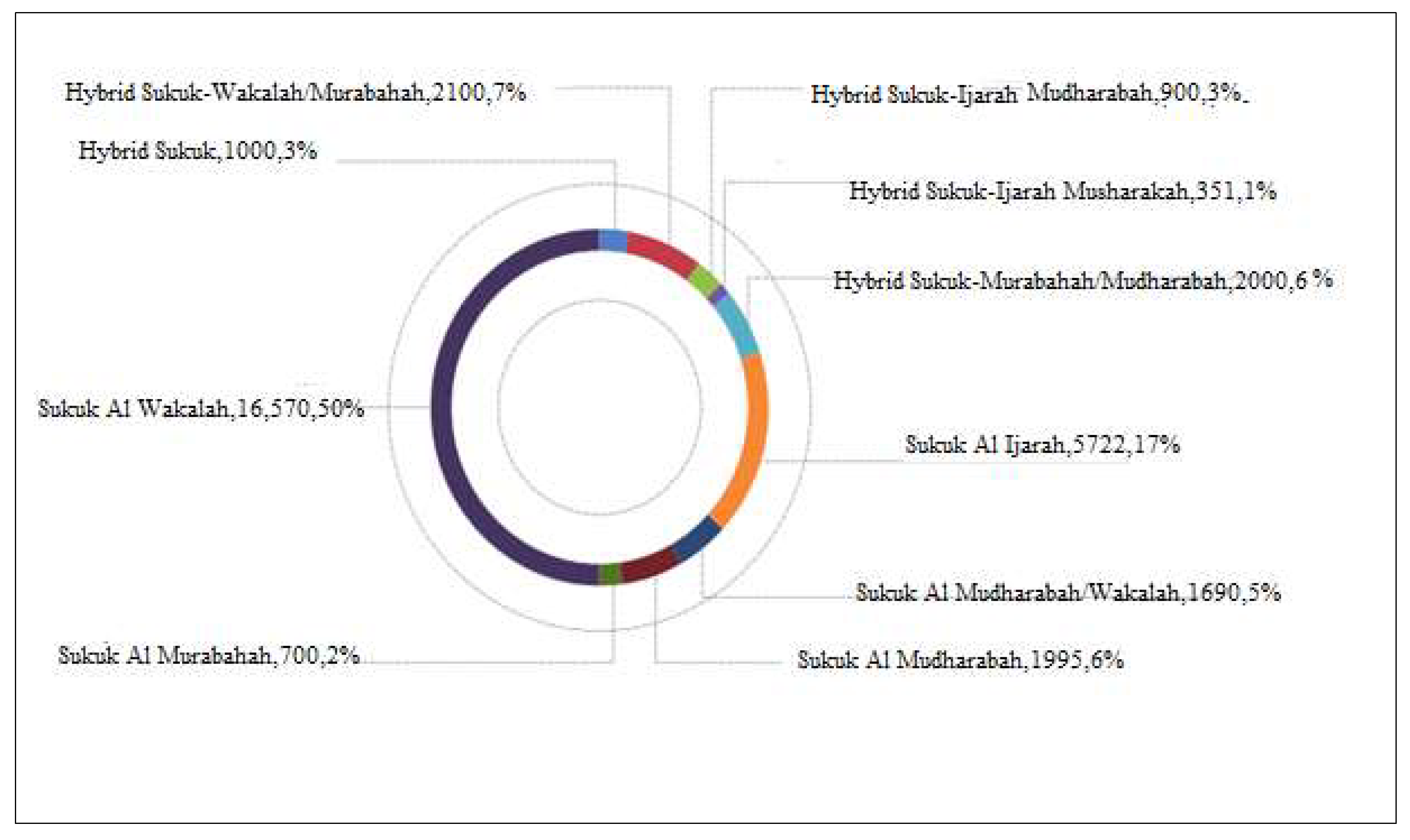

Appendix A.1. Composition of Global Sukuk Market

Appendix A.2. Composition of S&P Shariah Indices

References

- Abdullah, Ahmad Monir, Buerhan Saiti, and Mansur Masih. 2016. The impact of crude oil price on Islamic stock indices of South East Asian countries: Evidence from MGARCH-DCC and wavelet approaches. Borsa Istanbul Review 16: 219–32. [Google Scholar] [CrossRef]

- Akhtar, Shumi M., Farida Akhtar, Maria Jahromi, and Kose John. 2017. Intensity of Volatility Linkages in Islamic and Conventional Markets. Available online: https://ssrn.com/abstract=2906546 (accessed on 2 March 2019).

- Aloui, Chaker, and Besma Hkiri. 2014. Co-movements of GCC emerging stock markets: New evidence from wavelet coherence analysis. Economic Modelling 36: 421–31. [Google Scholar] [CrossRef]

- Aloui, Chaker, Shawkat Hammoudeh, and Hela Ben Hamida. 2015a. Co-movement between sharia stocks and sukuk in the GCC markets: A time-frequency analysis. Journal of International Financial Markets, Institutions and Money 34: 69–79. [Google Scholar] [CrossRef]

- Aloui, Chaker, Shawkat Hammoudeh, and Hela Ben Hamida. 2015b. Price discovery and regime shift behaviour in the relationship between shariah stocks and sukuk: A two state markov switching analysis. Pecific Basin Finance Journal 32: 21–35. [Google Scholar]

- Aloui, Chaker, Rania Jammazi, and Hela Ben Hamida. 2018. Multivariate Co-movement Between Islamic Stock and Bond Market among the GCC: A Wavelet-Based View. Computational Economics 52: 603–26. [Google Scholar] [CrossRef]

- Ariff, Mohamed, and Meysam Safari. 2012. Are sukuk securities the same as conventional bonds? Afro Eurasian Studies 1: 101–25. [Google Scholar]

- Batten, Jonathan A., Cetin Ciner, and Brian M. Lucey. 2010. The macroeconomic determinants of volatility in precious metals. Resource Policy 35: 65–71. [Google Scholar] [CrossRef]

- Bhuiyan, Rubaiyat Ahsan, Maya Puspa Rahman, Buerhan Saitib, and Gairuzazmi Bin Mat Ghani. 2019. Does the Malaysian Sovereign sukuk market offer portfolio diversification opportunities for global fixed-income investors? Evidence from wavelet coherence and multivariate-GARCH analyses. North American Journal of Economics and Finance 47: 675–87. [Google Scholar] [CrossRef]

- Buriev, Abdul Aziz, Ginanjar Dewandaru, Mohd-Pisal Zainal, and Mansur Masih. 2018. Portfolio diversification benefits at different investment horizons during the Arab uprisings: Turkish perspectives based on MGARCH–DCC and wavelet approaches. Emerging Markets Finance and Trade 54: 3272–93. [Google Scholar] [CrossRef]

- Cai, Xiao Jing, Shuairu Tian, Nannan Yuan, and Shigeyuki Hamori. 2017. Interdependence between oil and East Asian stock markets: Evidence from wavelet coherence analysis. Journal of International Financial Markets, Institutions and Money 48: 206–23. [Google Scholar] [CrossRef]

- Cakir, Selim, and Faezeh Raei. 2007. Sukuk and Eurobonds: Is There a difference in Value at Risk? International Monetary Fund Working Paper, WP/07/237. Washington: International Monetary Fund. [Google Scholar]

- Candelon, Bertrand, Jan Piplack, and Stefan Straetmans. 2008. On measuring synchronizing of bulls and bears: The case of East Asia. Journal of Banking and Finance 32: 1022–35. [Google Scholar] [CrossRef]

- Chen, W. D., and H. C. Li. 2016. Wavelet decomposition of heterogeneous investment horizon. Journal of Economics and Finance 40: 714–43. [Google Scholar] [CrossRef]

- Dewandaru, Ginanjar, Syed Aun R. Rizvi, Rumi Masih, Mansur Masiha, and Syed Othman Alhabshi. 2014. Stock market co-movements: Islamic versus conventional equity indices with multi-timescales analysis. Economic Systems 38: 553–71. [Google Scholar] [CrossRef]

- Duqi, Andi, and Hussein Al-Tamimi. 2019. Factors affecting investors’ decision regarding investment in Islamic Sukuk. Qualitative Research in Financial Markets 11: 60–72. [Google Scholar] [CrossRef]

- Fathurahman, Heri, and Rachma Fitriati. 2013. Comparative analysis of return on sukuk and conventional bonds. American Journal of Economics 3: 159–63. [Google Scholar]

- Fernandez-Macho, Javier. 2012. Wavelet multiple correlation and cross-correlation: A multiscale analysis Eurozone stock markets. Physica A: Statistics Mechanics and Its Applications 391: 1097–104. [Google Scholar] [CrossRef]

- Fleming, Jeff, Chris Kirby, and Barbara Ostdiek. 1998. Information and volatility linkage in the stock bond and money market. Journal of Finance and Economics 49: 111–37. [Google Scholar] [CrossRef]

- Gencay, Ramazan, Faruk Selçuk, and Brandon J. Whitcher. 2002. An Introduction to Wavelet and Other Filtering Methods in Finance and Economics. San Diego: Academic Press. [Google Scholar]

- GIFR. 2019. Global Islamic Finace Report. Cambridge: Institute of Islamic Finance. [Google Scholar]

- Godlewski, Christophe J., Rima Turk-Ariss, and Laurent Weill. 2013. Sukuk vs conventional bonds: A stock market perspective. Journal of Comparative Economics 41: 745–61. [Google Scholar] [CrossRef]

- Goupillaud, Pierre, Alex Grossmann, and Jean Morlet. 1984. Cycle-octave and related transforms in seismic signal analysis. Geoxploration 23: 85–102. [Google Scholar] [CrossRef]

- Haile, Fasika, and Susan Pozo. 2008. Currency crisis contagion and the identification of transmission channels. International Review of Economics and Finance 17: 572–88. [Google Scholar] [CrossRef]

- Hassan, M. Kabir, Andrea Paltrinieri, Alberto Dreassi, Stefano Miani, and Alex Sclip. 2018. The determinants of co-movement dynamics between sukuk and conventional bonds. The Quarterly Review of Economics and Finance 68: 73–84. [Google Scholar] [CrossRef]

- IIFM Sukuk Report. 2019. A Comprehensive Study of the Global Sukuk Market, 8th ed. Behrain: International Islamic Finance Market. [Google Scholar]

- In, Francis, and Sangbae Kim. 2013. An Introduction to Wavelet Theory in Finance: A Wavelet Multiscale Approach. Singapore: World Scientific. [Google Scholar]

- In, Francis, Sangbae Kim, and Ramazan Gençay. 2011. Investment horizon effect on asset allocation between value and growth strategies. Economic Modelling 28: 1489–97. [Google Scholar] [CrossRef]

- Junaidi, Junaidi, Abd Jamal, and Sofyan Syahnur. 2019. Sukuk and Endogenous Growth in Indonesia: Generalized Method of Moments Approach. Paper presented at 1st Aceh Global Conference (AGC 2018), Banda Aceh, Indonesia, October 17–18. [Google Scholar]

- Khartabiel, Ghadeer, Ahmad Abu-Alkheil, Tunku Salha Ahmad, and Walayet Khan. 2019. Shari’ah-compliant Sukuk versus conventional bond announcements: Is there a wealth effect? Review of Quantitative Finance and Accounting, 1–15. Available online: https://link.springer.com/article/10.1007/s11156-019-00799-3 (accessed on 2 March 2019). [CrossRef]

- Kim, Sangbae, and Francis In. 2007. On the relationship between changes in stock prices and bond yields in the G7 countries: Wavelet analysis. Journal of International Financial Markets, Institutions and Money 17: 167–79. [Google Scholar] [CrossRef]

- Kim, Sangbae, and Francis In. 2010. Portfolio allocation and the investment horizon: A multi-scaling approach. Quantitative Finance 10: 443–53. [Google Scholar] [CrossRef]

- Kristoufek, Ladislav. 2015. What are the main drivers of the Bitcoin price? Evidence from wavelet coherence analysis. PLoS ONE 10: e0123923. [Google Scholar] [CrossRef]

- Lahsasna, Ahcene, and Lee Sze Lin. 2012. Issues in Islamic capital markets: Islamic bond/Sukuk. Paper presented at 3rd International Conference on Business and Economic Research (3rd ICBER 2012), Bandung, Indonesia, March 12–13. [Google Scholar]

- Miller, Neil D., John Challoner, and Aziza Atta. 2007. UK welcomes the sukuk. International Financial Law Review 26: 24–25. [Google Scholar]

- Mimouni, Karim, Houcem Smaoui, Akram Temimi, and Moh’d Hasan Al-Azzam. 2019. The impact of Sukuk on the performance of conventional and Islamic banks. Pacific-Basin Finance journal 54: 42–54. [Google Scholar] [CrossRef]

- Naifar, Nader, Shawkat Hammoudeh, and Mohamed S. Al-Dohaiman. 2016. Dependence structure between sukuk (Islamic bonds) and stock market conditions: An empirical analysis with Archimedean copulas. Journal of International Financial Markets, Institutions and Money 44: 148–65. [Google Scholar] [CrossRef]

- Naifar, Nader, Mourad Mroua, and Slah Bahloul. 2017. Do regional and global uncertainty factors affect differently the conventional bonds and sukuk? New evidence. Pacific-Basin Finance Journal 41: 65–74. [Google Scholar] [CrossRef]

- Najeeb, Syed Faiq, Obiyathulla Bacha, and Mansur Masih. 2015. Does heterogeneity in investment horizons affect portfolio diversification? Some insights using M-GARCH-DCC and wavelet correlation analysis. Emerging Markets Finance and Trade 51: 188–208. [Google Scholar] [CrossRef]

- Paltrinieri, Andrea, Alberto Dreassi, Stefano Miani, and Alex Sclip. 2015. In search of zero beta assets: Evidence from the sukuk market. International Journal of Social, Behavioral, Educational, Economic and Management Engineering 9: 67–75. [Google Scholar]

- Percival, Donald, and Andrew T. Walden. 2000. Wavelet Methods for Time Series Analysis. Cambridge: Cambridge Press. [Google Scholar]

- Phillips, Ross C., and Denise Gorse. 2018. Cryptocurrency price drivers: Wavelet coherence analysis revisited. PLoS ONE 13: e0195200. [Google Scholar] [CrossRef]

- Qizam, Ibnu, and Michelle Fong. 2019. Developing financial disclosure quality in sukuk and bond market: Evidence from Indonesia, Malaysia, and Australia. Borsa Istanbul Review 19: 228–48. [Google Scholar] [CrossRef]

- Rua, António. 2010. Measuring co-movement in the time-frequency space. Journal of Macroeconomics 32: 685–91. [Google Scholar] [CrossRef]

- Rua, António. 2013. Worldwide synchronization since the nineteenth century: A wavelet-based view. Applied Economic Letters 20: 773–76. [Google Scholar] [CrossRef]

- Rua, António, and Luís C. Nunes. 2009. International co-movement of stock market returns: A wavelet analysis. Journal of Empirical Finance 16: 632–39. [Google Scholar] [CrossRef]

- Saad, Noriza Mohd, Mohd Nizal Haniff, and Norli Ali. 2018. Long Term Conventional Bonds versus Long Term Sukuk Issuances and Their Determinants in Malaysia. International Journal of Business and Management 2: 17–25. [Google Scholar]

- Suciningtias, Siti Aisiyah. 2019. Macroeconomic Impacts on Sukuk Performance in Indonesia: Co-integration and Vector Error Correction Model Approach. Journal of Islamic Finance 8: 117–30. [Google Scholar]

- Thuronyi, Victor. 2007. A level tax playing field in Islamic finance. Paper presented at the International Monetary Fund Spring Meeting, Washington, DC, USA, April 14–15. [Google Scholar]

- Tian, Fenghua, Takashi Tarumi, Hanli Liu, Rong Zhang, and Lina Chalak. 2016. Wavelet coherence analysis of dynamic cerebral autoregulation in neonatal hypoxic–ischemic encephalopathy. NeuroImage: Clinical 11: 124–32. [Google Scholar] [CrossRef]

- Torrence, Christopher, and Gilbert P. Compo. 1998. A practical guide to wavelet analysis. Bulletin of the American Meteorological Society 79: 61–78. [Google Scholar] [CrossRef]

- Torrence, Christopher, and Peter J. Webster. 1999. Inter-decadal changes in the ENSO-monsoon system. Journal of Climate 12: 2679–90. [Google Scholar] [CrossRef]

- Wilson, Rodney. 2008. Innovation in structuring of sukuk securities. Humanomics 24: 170–81. [Google Scholar] [CrossRef]

- Yang, Jian. 2005. International bond market linkages: A structural VAR analysis. International Financial Markets. Institutions and Money 15: 39–54. [Google Scholar] [CrossRef]

- Zin, Mohamad Zaid Mohd, Ahaamad Asmadi Sakat, Nurfahiratul Azlina Ahmad, Mohd Roslan Mohd Nor, Azri Bhari, Saurdi Ishak, and Mohd Sapawi. 2011. The effectiveness of Sukuk in Islamic finance market. Australian Journal of Basic and Applied Sciences 5: 472–78. [Google Scholar]

- Zulkhibri, Muhamed. 2015. A synthesis of theoretical and empirical research on sukuk. Borsa Istanbul Review 15: 237–48. [Google Scholar] [CrossRef]

| 1 | Global Islamic Finance Report. |

| 2 | |

| 3 | Oman, Bahrain, Saudi Arabia, Kuwait, Abu Dhabi, and Dubai. |

| Variables | Description |

|---|---|

| NISKGC index | NASDAQ Dubai IdealRatings USD GCC SUKUK index |

| NISKC Index | NASDAQ Dubai IdealRatings USD Corporate SUKUK index |

| NISKF Index | NASDAQ Dubai IdealRatings USD Financials SUKUK index |

| SPSHGT Index | S&P GCC Composite Shariah Total Stock Returns Index |

| SPSHG Index | S&P GCC Composite Shariah Stock Index |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Nasreen, S.; Naqvi, S.A.A.; Tiwari, A.K.; Hammoudeh, S.; Shah, S.A.R. A Wavelet-Based Analysis of the Co-Movement between Sukuk Bonds and Shariah Stock Indices in the GCC Region: Implications for Risk Diversification. J. Risk Financial Manag. 2020, 13, 63. https://doi.org/10.3390/jrfm13040063

Nasreen S, Naqvi SAA, Tiwari AK, Hammoudeh S, Shah SAR. A Wavelet-Based Analysis of the Co-Movement between Sukuk Bonds and Shariah Stock Indices in the GCC Region: Implications for Risk Diversification. Journal of Risk and Financial Management. 2020; 13(4):63. https://doi.org/10.3390/jrfm13040063

Chicago/Turabian StyleNasreen, Samia, Syed Asif Ali Naqvi, Aviral Kumar Tiwari, Shawkat Hammoudeh, and Syed Ale Raza Shah. 2020. "A Wavelet-Based Analysis of the Co-Movement between Sukuk Bonds and Shariah Stock Indices in the GCC Region: Implications for Risk Diversification" Journal of Risk and Financial Management 13, no. 4: 63. https://doi.org/10.3390/jrfm13040063

APA StyleNasreen, S., Naqvi, S. A. A., Tiwari, A. K., Hammoudeh, S., & Shah, S. A. R. (2020). A Wavelet-Based Analysis of the Co-Movement between Sukuk Bonds and Shariah Stock Indices in the GCC Region: Implications for Risk Diversification. Journal of Risk and Financial Management, 13(4), 63. https://doi.org/10.3390/jrfm13040063