Abstract

Prior studies found that analyst forecast dispersion predicts future market returns. Some prior studies attribute this predictability to the short-sale constraints in the market according to the overpricing theory. Using the U.S. data from 1981 to 2014, we find that the return predictive power of aggregate dispersion only exists prior to 2005. The investor sentiment index, as a proxy of short-sale constraints used by many studies, can only explain the dispersion effect prior to 2005. The investor sentiment index and other proxies such as institutional ownership and put options cannot explain the significant weakening of the dispersion effect after the global financial crisis. We argue that the dispersion-return relation is partly driven by the correlation between dispersion and conditional equity premium. Our evidence suggests that the short-sale constrained stocks do not experience a higher dispersion effect, which is contrary to what the overpricing theory predicts.

1. Introduction

One of the intriguing anomalies in stock market is the dispersion effect, which is the phenomenon where stocks with higher dispersion in analysts’ forecasts earn lower returns subsequently (see, Diether et al. 2002). Many studies have attempted to provide explanations for a negative dispersion-return relationship. One strand of literature provides a risk-based story. Johnson (2004) argues that the dispersion effect is not necessarily a result of the market frictions or irrationality. Instead he argues that the dispersion proxies for the idiosyncratic risk when fundamentals of the firm are unobservable. The increased uncertainty increases the option value of the firm, and thus causes lower future returns. Barron et al. (2009) demonstrate that forecast dispersion can be separated into two components, the levels and changes in dispersion, and these two components capture different information contents. The levels of dispersion reflect unsystematic uncertainty and result in lower future returns, while the changes in dispersion however reflect changes in information asymmetry among investors, thus being positively associated with future returns. The authors demonstrate that it is the uncertainty component of dispersion levels that explains the negative association between dispersion levels and future stock returns. Other studies, such as Ali et al. (2019) relate the dispersion effect to the corporate disclosure.

Another strand of literature attributes the dispersion anomaly to Miller’s overpricing hypothesis. According to Miller (1977), stock prices will reflect a more optimistic valuation when pessimistic investors are not able to trade due to the short-sale restriction. Thus, the higher disagreement among investors about the value of a stock, the higher the price of the stock relative to its true value. The overvaluation of the stock will cause the lower subsequent returns.

In line of Miller (1977), Yu (2011) examines the dispersion effects in the context of stock portfolios. By employing a portfolio disagreement measurement from individual-stock analysts forecast dispersion, the author finds that the market portfolio disagreement is negatively related to ex post expected market return. Similar to Diether et al. (2002), Yu presents the aggregate dispersion as a proxy for divergence of investor opinions. He argues that his empirical evidence supports Miller’s (1977) theory that overpricing occurs in a stock market with short-sale constraints and divergence in investor opinions. The overpricing will be eventually corrected in the long-run as investors observe future news and realize their errors, which thus causes the lower subsequent returns.

Further, Kim et al. (2014) study the dispersion effect by employing the investor sentiment as a proxy for short-sale constraints. Using the sentiment index of Baker and Wurgler (2006), Kim et al. (2014) show that the negative relation between the aggregate analyst forecast dispersion and future market returns is significant only when investor sentiment is high. They thus argue that this is consistent with Miller’s theory in which short-sale constraints is a necessary condition of the overpricing.

In addition, Leippold and Lohre (2014) study the dispersion effect cross-sectionally in the U.S. and Europe. They find that the effect is most pronounced during the mid-to-late 1990s and 2000–2003 around the burst of the Internet bubble. The effect is difficult to be exploited to arbitrage because it concentrates on stocks with high arbitrage costs such as high information uncertainty and high illiquidity.

Despite strong evidence of the dispersion effect at the level of individual stock and the aggregate market, the explanation and interpretation of dispersion-return relation remain a debate. In this study, we adopt both a risk-based and an overpricing-based approach to examine the dispersion effect. We aim to bring new insights into this argument through examining the role of conditional equity premium (Guo and Savickas 2008; Guo and Qiu 2017). Guo and Savickas (2008) propose that stock market variance (MV) and average Capital Asset Pricing Model (CAPM)-based idiosyncratic variance (IV) are proxies for conditional equity premium, as they jointly have significant predictive power for future stock market returns. Guo and Qiu (2017) show that MV and IV can in fact drive out standard market return predictors commonly used in the literature, such as the ones developed by Welch and Goyal (2008). Further, the market return predictive power of aggregate investment is driven by its correlation with conditional equity premium (MV and IV). According to this line of research, we re-examine the dispersion effect with consideration of condition equity premium.

Interestingly, we find that the negative relationship between the aggregate dispersion and future stock return has not only disappeared post 2005 but also become positive in the longer horizon. By adopting the conditional equity premium proxies MV and IV, we find that the market return predictive power of aggregate dispersion is partly driven by its correlation with conditional equity premium in both prior and post 2005 periods. After we decompose the dispersion into two components, one related to the conditional equity premium and the other one unrelated to it, we find that the related component is negatively and significantly correlated with returns in both sub-periods, while the unrelated component is negatively significant only in the first period.

Although we employ MV and IV jointly as proxies for conditional equity premium, there are other ways to calculate its proxy. For example, Bansal and Yaron (2004) show that the conditional equity premium is a linear function of conditional consumption and market return volatilities, which can be estimated by various Generalized Autoregressive Conditional Heteroskedasticity (GARCH) and Stochastic Volatility (SV) models. Fung et al. (2014) find that conditional consumption and market volatilities are capable of explaining cross-sectional return differences.

To test Miller’s overpricing hypothesis, apart from using the investor sentiment as a conventional proxy for short-sale constraints, we also adopt institutional ownership as well as put options to examine the dispersion-return relationship. We again find that the dispersion-return relationship is only negatively significant in the first sub-period. Furthermore, the dispersion-return relation becomes positive for longer-term horizon in the post 2005 period. We do not find that the decline of dispersion predictability is driven by the global financial crisis (GFC) in more recent years. Thus, our results in general do not support Miller’s short-sale constraints story.

The measure of investor sentiment employed in this paper is Baker and Wurgler’s investor sentiment index, which is the most popularly used sentiment proxy. A recent study using this measure is Ding et al. (2019). They decompose Baker and Wurgler investor sentiment index into long- and short-run components and find a negative relationship between the long-run sentiment component and subsequent stock returns, and a positive association between the short-run sentiment component and contemporaneous stock returns. In addition to the Baker and Wurgler investor sentiment index, there are also other measures of investor sentiment in the literature. For example, Guijarro et al. (2019) use sentiment analysis extracted from Twitter to proxy for investor opinions to study its impact on liquidity and trading costs.

2. Data and Methodology

The data used in this study are from various sources covering our sample period from December 1981 to November 2014. The U.S. monthly stock closing prices and shares outstanding data are obtained from CRSP. The data for market return predictors are obtained from Amit Goyal’s website. The one-month Treasury bill rates are obtained from Professor Kenneth R. French’s website. The mean and standard deviation of analyst forecasts of the individual stock earnings-per-share (EPS) long-term growth (LTG) data are obtained from the unadjusted IBES summary database. To construct the stock market variance and average idiosyncratic variance, the daily individual stock returns and market returns were also obtained from CRSP.

Additionally, the Baker and Wurgler (2006) investor sentiment index (BW) were obtained from Jeffrey Wurgler’s website. The institutional ownership data were obtained from Thomson Reuters and the put option data were obtained from Option Metrics.

We computed all varaibles as follows. The aggregate mean of analyst forecasts is the value-weighted average of individual stock means shown below:

where denotes the market capitalization of stock i in month t. μi,t denotes the mean of analyst forecast for EPS long term growth for stock i in month t. Following Yu (2011), the aggregate dispersion of analyst forecast is the value-weighted average of individual stock standard deviations, as shown in Equation (2):

where σi,t denotes the standard deviation of analyst forecast for EPS long term growth for stock i in month t.

Monthly market variance (MV) and average idiosyncratic variance (IV) were calculated as the last available quarterly observation for MV and IV, respecitvely. Following Merton (1980) and Guo and Savickas (2008), we defined realized quarterly stock market variance (MV) as the sum of squared daily excess market return in a quarter. Daily excess market return is calculated as value-weighted CRSP stock market returns minus the risk-free rate. The equation for calculating quarterly MV is

where is the excess stock market return in day d of quarter t. is the number of trading days in quarter t.

To construct the quarterly IV, we first used the daily individual stock return data in a quarter to estimate the daily CAPM-based idiosyncratic returns following Guo and Savickas (2008). We regressed daily excess individual stock returns , on daily excess market returns, :

The residuals is daily idiosyncratic returns for stock i in day d. Then we summed up squared daily idiosyncratic returns in a quarter to get realized quarterly idiosyncratic variance for all CRSP common stocks that have at least 51 daily return observations in that quarter. The aggregate idiosyncratic variance measure is then the value-weighted average of individual stock idiosyncratic variance. The equation for calculating aggregate idiosyncratic variance is:

where is the number of stocks in quarter t, is the number of trading days for stock i in quarter t., and is the market capitalization of stock i in quarter t − 1. To be consistent with prior literature, we only included the largest 500 stocks in the aggregation.

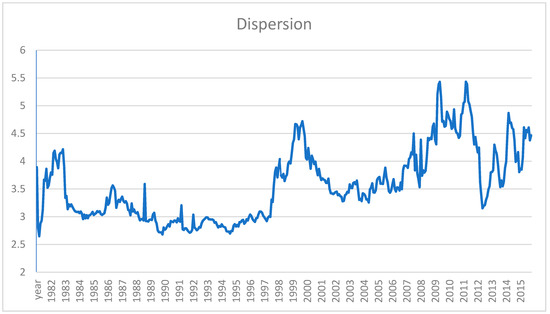

Figure 1 depicts the time series of our dispersion measure. The plot in Figure 1 seems to suggest a structural change in the dispersion measure shown by an obvious increase in both level and deviation of dispersion measure post 2005. To make our results more comparable to Yu (2011), we divided our sample into two sub-periods, December 1981 to December 2005 and January 2006 to November 2014. The summary statistics of the variables are reported in Table 1. Panel A and B report statistics for the two sub-periods and Panel C reports statistics for the whole sample period. The statistics of aggregate dispersion (adist), aggregate mean forecast (mean forecastt), and excess market returns (Rmt) in the first sub-period are similar to those reported by Yu (2011), as expected. In the second sub-period, aggregate dispersion, BW sentiment index (bw) and market variance (MV) have greater means and standard deviations than those in the first sub-period. The average idiosyncratic variance (IV) has lower mean value in the second sub-period than in the first sub-period.

Figure 1.

Time series of monthly aggregate analyst forecast dispersion (in percentage), which is the cross-sectional value-weighted average of analyst forecast standard deviations of long-term EPS growth rate. The sample period is December 1981–November 2014.

Table 1.

Summary Statistics.

3. Results

3.1. The Dispersion-Return Relation

Firstly, we examine the dispersion-return relationship by conducting a univariate regression of future market returns on dispersion. The regression model is as follows.

where is the excess market return from month t to t + h. Excess market returns are value-weighted returns of all the common stocks listed on the NYSE/AMEX/NASDAQ minus one-month Treasury-bill rate. The horizon h ranges from one month to three years. is the aggregate analyst forecast dispersion at month t. The results of regression (6) are shown in Table 2. We report Newey West t-statistics adjusted for auto-correlation with number of lags equal to return horizons unless otherwise stated. Panel A of Table 2 reports the results for whole sample period and Panel B and C report the results for two sub-sample periods. We find that the negative dispersion-return relation is only marginally significant for horizons of 6 and 12 months and is insignificant for all other horizons in the whole sample period (see Panel A).

Table 2.

Univariate regressions of future excess market returns on aggregate dispersion.

In our sub-period analyses, we find dispersion is negatively significant from Dec. 1981 to Dec. 2005 for each horizon except for the one-month horizon (see Panel B). However, dispersion becomes insignificant for the short horizons in the period after 2005 and becomes positively significant for horizons of 24 and 36 months (see Panel C).

Next, we controlled for aggregate mean of analyst forecasts and other market return predictors following Yu (2011). These variables include:

The price-earnings ratio (PE), consumption-wealth ratio (CAY), dividend-price ratio(DP), smoothed earnings-price ratio (SMOOTHEP), book-to-market ratio (BM), short-term interest rate (SHORTYIELD), long-term bond yield (LONGYIELD), the term spread between long- and short-term Treasury yields (TMSPREAD), the default spread between corporate and Treasury bond yields (DFSPREAD), the lagged rate of inflation (INFLATION), and the equity share of new issues (EQUITYSHARE).

The details of these control variables are provided in Appendix A.

The multivariate regression model we used in matrix notation is:

where Control is a vector of control variables. Table 3 shows the multivariate regression results. After adding control variables, we find the dispersion variable is still negatively significant for 6, 12, and 24 months’ horizon for the whole sample period as shown in Panel A. Two control variables CAY and LONGYIELD are significant in all horizons. The results here indicate that the consumption-wealth ratio and long-term bond yield significantly predict the future stock returns, in particular, the consumption-wealth ratio leads to positive returns in the future and higher long-term government bond yield reduces returns in the future we report sub-period analysis in Panel B and C, respectively. We found that the negative dispersion-return relationship is stronger in the first sub-period but seems to be much weaker in the second sub-period. In the first sub-period for the 12-month horizon, the coefficient of dispersion is −0.303 and is highly significant (t-stat = −5.676). This indicates a one-standard-deviation increase in dispersion is associated with a decrease in return of 13.9% in the next 12-month. This figure is economically significant, considering that the mean and standard deviation of one-year market returns in the first period is 8.99% and 16.3%, respectively. In the second sub-period shown in Panel C, the dispersion is negatively significant for the 6 months (short term) horizon, negative but insignificant for 12 and 24 months (medium term) returns, and positively significant for 36 months (long term) returns. The differences in results from two sub-periods seem to suggest that there is a break-down in the dispersion-return relationship after 2005. The regression results in Panel C indicate that variables relating bond market, such as long-term government yield, terms spread and default spread significantly predict returns. This result is not surprising, given the fact that GFC was caused by the credit market crisis. Furthermore, the equity share of new issues also became important in the second sub-period.

Table 3.

Multivariate regressions of future excess market returns on dispersion.

In summary, the results from our univariate and multivariate analyses show that the dispersion effect at the aggregate level has declined since 2005. Furthermore, the dispersion-return relationship has changed from being negative to being positive at the longer horizon post 2005.

3.2. Conditional Equity Premium and Dispersion Effect

It is interesting to study what has caused the significant change in the dispersion-return relationship after 2005. According to Guo and Savickas (2008) and Guo and Qiu (2017), stock market variance (MV) and average idiosyncratic variance (IV) as proxies for conditional equity premium jointly have significant predictive power for future stock market returns. In particular, according to their studies, MV is positively and IV is negatively associated with future market returns. So we first examined whether the change in dispersion-return relationship is associated with the conditional equity premium.

We used MV and IV as proxies for conditional equity premium to investigate if the return predictive power of dispersion is driven by its correlation with conditional equity premium. It is natural to think that aggregate dispersion may be correlated with aggregate idiosyncratic variance because both of them has been used as proxies for divergence of investor opinions in the literature (For example, Diether et al. (2002) and Boehme et al. (2006)).

Firstly, we investigated the relation between dispersion and conditional equity premium with the following regression of dispersion on concurrent MV and IV:

The results are shown in Table 4. As the monthly MV and IV are the last available quarterly measures, we reported the Newey West t-statistics adjusted for auto-correlation with 3 lags. In the whole period (shown in Column 1), IV is positively and significantly associated with dispersion and MV is insignificant. This is also the case for the first sub-period. In the second sub-period, MV is positively and significantly related to dispersion, and IV is negatively and significantly related to dispersion. These results suggest that, in the first sub-period, dispersion is more like a measure of divergence of investor opinions, and in the second sub-period, dispersion is more like a measure of risk, given that Guo and Savickas (2008) show MV and IV jointly are risk factors predicting future market returns. In the first sub-period, the adjusted R-squared is very high (49%) compared to the second sub-period (5.7%) and the whole sample period (7.4%). This suggests that the dispersion has strong correlation with conditional equity premium in the first sub-period but this relation weakens in the second period.

Table 4.

Regression results of dispersion on MV and IV.

We then studied whether the return predictive power of dispersion reflects its co-movement with conditional equity premium. Following Guo and Qiu (2017), we regressed the dispersion on concurrent MV and IV for the whole period and two sub-periods, respectively. We decomposed dispersion into a component related to conditional equity premium (the fitted value) and a component unrelated to it (the residual). We then regressed the next 12-month market returns on the dispersion, and the fitted and residual components of dispersion obtained from the last step, while controlling for all other market return predictors. The regression model is:

where and are the fitted and residual components of dispersion, respectively. Control is the same vector for all control variables. The results are shown in Table 5. Columns 1–4 report results for the whole sample period followed by results for the two sub-periods in columns 5–8 and 9–12. In the first sub-period, both the fitted and residual components of dispersion are negatively and significantly associated with future returns. Dropping the residual component from the regression reduces the adj. R-squared from 46% to 28%. Dropping the fitted component decreases the adj. R-squared from 46% to 38%. This suggests both components have considerable return predictive power. The residual component likely has greater power than the fitted component. The return predictive power of dispersion is partially driven by its correlation with conditional equity premium.

Table 5.

Return on dispersion and its two components.

In the second sub-period, the fitted component is negatively and significantly correlated with return and the magnitude of the coefficient is close to that in the first sub-period. The residual component is negative but insignificant. Dropping the fitted component decreases the adj. R-squared from 86% to 82%, while dropping the residual component has no effect on the adj. R-squared. This suggests in the second sub-period, the return predictive power of dispersion is partially driven by its correlation with conditional equity premium.

In summary, in both periods the fitted component of dispersion has return predictive power. This indicates at least part of the return predictive power of dispersion is driven by its correlation with conditional equity premium. Dispersion does not have significant predictive power for future 12-month returns in the second period, likely because its residual component has no power and brings noises into the dispersion as a whole.

3.3. Investor Sentiment and Dispersion Effect

As Kim et al. (2014) show that the dispersion effect is negatively significant only in high investor sentiment periods as investor sentiment can proxy the short-sale constraints. To examine the role of short-sale constraints, we added additional sentiment variables into our regression. We added an investor sentiment dummy variable (bw_h) and its interaction term with dispersion to the regression. The dummy is set to 1 if the investor sentiment in that month is higher than the median value of the full sample or 0 otherwise. The regression model is:

Table 6 reports the results. Columns 1–3 report results for the whole sample period followed by results for two sub-periods in columns 4–6 and 7–9. In the first sub-period, dispersion is negatively and significantly related to future returns, in both high- and low-sentiment periods (see Column 4). The negatively significant interaction term means that the effect is stronger in high-sentiment periods. Adding dispersion to the regression greatly increases the adj. R2 from 29% to 47% (compare Column 5 and 6). The mean analyst forecast is positively correlated with future returns.

Table 6.

Investor sentiment and the dispersion effect.

In the second sub-period, the coefficients of dispersion and its interaction term with sentiment dummy are negative and insignificant (Column 7). This means dispersion has no return predictive power in the second sub-period whenever the investor sentiment is high or low. Comparison of Column 8 and 9 shows that adding dispersion has no effect on the adj. R-squared. The mean analyst forecast is negatively correlated with future returns in contrast with the first period.

In summary, the results in this subsection indicate that dispersion has return predictive power in the first sub-period but no power in the second sub-period. High sentiment strengthens the dispersion effect in the first sub-period but not in the second sub-period. This thus suggests that the impact of short-sale constrains, as proxied by the investor sentiment on the dispersion effect proposed in Kim et al. (2014), is not robust in periods after 2005.

3.4. The Global Financial Crisis (GFC) and Dispersion Effect

The change in the dispersion-return relationship is not surprising given the fact that the second sub-period covers GFC period. Figure 1 depicts that dispersion increases significantly from 2005 and throughout the GFC period. It is natural to wonder whether the change in the dispersion effect is caused by the crisis, such as the changes in market conditions, policies, regulations, and investor sentiment around the crisis period. To examine the impact of GFC, we construct a dummy variable (d_gfc) which is set to one from September 2008 onwards or zero otherwise. The regression model with the GFC dummy is as follows:

where bw is the Baker and Wurgler sentiment index.

Table 7 presents the results from regression with additional GFC dummy. Column 1 shows that adis is negatively significant and the interaction term d_gfc * adis is positively significant. The coefficient of dispersion is −0.266 in pre-GFC period and −0.076 (−0.266 + 0.190) in post GFC period. This result shows that dispersion effect becomes weaker after the recent financial crisis begun. Column 2 shows the results after controlling for the Baker and Wurgler (BW) sentiment index and its interaction term with the dispersion. The significance of the GFC dummy and its interaction term with dispersion remains largely unchanged, and the sentiment and its interaction term with dispersion however are insignificant. The results here suggest that investor sentiment cannot drive out the effect of the GFC dummy on the dispersion effect. Sentiment is not the main cause of the change in dispersion effect occurring after GFC. In Column 3 of Table 7, we regressed 12-month-ahead market returns on dispersion, in the second subperiod January 2006–December 2015 excluding the GFC period September 2008–December 2009. The coefficient of dispersion is positive and insignificant, which means the dispersion effect still disappears when we exclude the crisis period.

Table 7.

The Global Financial Crisis and dispersion effect.

3.5. Subsample Analyses Based on Institutional Ownership and Put Option

In Miller’s theory short-sale constraints are necessary conditions of overpricing and the subsequent lower returns of high-dispersion stocks. Therefore, the dispersion effect should be stronger for stocks with higher short-sale constraints. As alternative measures to the investor sentiment, we use two proxies for short-sale constraints: Institutional Ownership (IO) and Put option. The short sellers need to borrow stocks to sell short and the institutional investors are the main lenders of stocks. Lower IO thus implies higher short-sale constraints. Put options of the stock enable investors to profit when the underlying stock’s price falls, therefore the stocks without put options have higher short-sale constraints. Miller’s theory therefore predicts that the dispersion effect should be stronger in stocks with lower IO or without put options. We then tested if these predictions are supported in our following analyses.

In each month we divided all the stocks in our sample into two groups, a high IO group and a low IO group, based on the median IO in that month. We then calculated the value-weighted returns, value-weighted analyst forecast dispersion, and value-weighted mean analyst forecasts for two groups respectively and run regression (7) within each group, respectively. We formally tested the difference between the coefficients of dispersion in the two subsamples. The results are shown in Table 8. The coefficients of dispersion in high IO stocks tend to be more negative than those in low IO stocks, especially in the first sub-period. Panel A shows that the difference of coefficients of dispersion for low IO stocks and high IO stocks is positively significant for 6-month horizon. Panel B shows that the difference of coefficients of dispersion is positively significant for 12-month horizon. In the second sub-period, the coefficients of dispersion are similar in the two groups of stocks, as the difference of coefficients is insignificant for all the horizons. These results are inconsistent with Miller’s short-sale constraints story.

Table 8.

Comparison of dispersion effect between low and high IO stocks.

Next, we conducted similar subsample analysis for stocks with and without put options. Our data of put options are obtained from Option Metrics and begin from January 1996, so the sample size is smaller in this analysis. The results are shown in Table 9. We found that the dispersion effect tends to be stronger in stocks with put options than stocks without put options, in the first sub-period. In the second sub-period, the coefficients of dispersion are similar in the two groups of stocks. Again, our results do not support Miller’s theory.

Table 9.

Comparison of the dispersion effect between stocks with and without put options.

4. Robustness Checks

Our analyses so far use the value-weighted average of the standard deviations of analyst forecasts for individual stocks as the dispersion measure, while Diether et al. (2002) and Leippold and Lohre (2014) use the analyst forecast standard deviation divided by the mean analyst forecasts for individual stocks. Though the dispersion measures calculated by these two methods have high correlation of 0.8, we used the scaled dispersion measure asdmn and continuous BW sentiment index for robustness checks in Table 10. Column 1 reports that in the whole sample period, dispersion has no predictive power for return. Column 2 reports that the interaction of dispersion and BW sentiment has negative return predictive power. Column 4 reports that after controlling for MV and IV, all the regressors have return predictive power. Higher sentiment makes the dispersion-return relation more negative, consistent with Kim et al. (2014). Our result is different from theirs in that we used continuous sentiment levels rather than the two sentiment regimes and in our result dispersion itself is still significant, while in their result dispersion becomes insignificant after controlling for sentiment.

Table 10.

Returns on an alternative dispersion measure and continuous sentiment values.

Columns 5 and 7 show results of two subperiods, respectively. Sentiment itself is insignificant and has no effect on the return predictive power of dispersion in either of the two subperiods. MV and IV have return predictive power in both subperiods, with greater magnitudes in the later period. Dispersion has return predictive power in the early period and no return predictive power in the later one. These results show that Kim et al.’s results are not robust to using continuous levels of sentiment measure.

In addition, we also used the University of Michigan consumer confidence index to proxy for investor sentiment and construct a dummy variable michigan_h which equals one when the Michigan consumer confidence index is higher than the median value in the sample period. The results are shown in Table 11. Dispersion is negatively related to market returns only when investor sentiment is high.

Table 11.

Robustness check using Michigan consumer confidence index.

5. Conclusions

According to Miller (1977)’s overpricing theory, the stocks experience higher disagreement among investors will be likely overvalued due to the short-sale restrictions thus consequently suffer lower returns. We re-examine the dispersion effect in this study utilizing different proxies for short-sale constraints such as the investor sentiment, institutional ownership and put options. We find that the dispersion effects documented in prior studies has weakened significantly post 2005. Our study also demonstrates that the market return predictive power of aggregate dispersion is partly driven by its correlation with conditional equity premium. Furthermore, the dispersion-return relation is negatively significant for the short-term horizon and positively significant for the long-term horizon in the post 2005 period, and this change is not driven by the changes in investor sentiment. In addition, there is no significant difference on dispersion effect among stocks divided by institutional ownership and put options, respectively. Our results thus raise questions about the validity of Miller’s short-sale constraints story.

There are some limitations of this study. We find some evidence indicating that part of the return predictive power of dispersion is driven by its correlation with conditional equity premium, but not all of it. Thus, it remains an interesting question why the return predictive power of dispersion disappears during more recent periods. We leave this question for future research.

Author Contributions

S.L. conceived and designed the paper. He acquired, analyzed, and interpreted the data of this paper. The drafting of the paper was done by him. J.Y. rewrote and revised the paper critically for the key intellectual content including literature, results, discussion, and conclusion. S.S. revised the paper and insured the accuracy and integrity of the work. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Acknowledgments

We thank the helpful comments and suggestions from the discussants and participants at 2017 Australasian Finance and Banking Conference, 2017 Auckland Finance Meeting and 2018 China Financial Market Conference. All remaining errors are our own.

Conflicts of Interest

The authors declare no conflict of interest.

Appendix A

Table A1.

Control Variable Description.

Table A1.

Control Variable Description.

| Variable | Definition |

|---|---|

| price-earnings ratio PE | The difference between the log of prices and the log of earnings. Earnings are 12-month moving sums of earnings on the S&P 500 index (Welch and Goyal 2008). |

| consumption-wealth ratio CAY | The Consumption, wealth, income ratio (cay) estimated by Lettau and Ludvigson (2001) |

| dividend-price ratio DP | The difference between the log of dividends and the log of prices. Dividends are 12-month moving sums of dividends paid on the S&P 500 index (Welch and Goyal 2008). |

| smoothed earnings-price ratio SMOOTHEP | Moving ten-year average of earnings divided by price (Welch and Goyal 2008). |

| book-to-market ratio BM | The ratio of book value to market value for the Dow Jones Industrial Average. For the months from March to December, this is computed by dividing book value at the end of the previous year by the price at the end of the current month. For the months of January and February, this is computed by dividing book value at the end of two years ago by the price at the end of the current month (Welch and Goyal 2008). |

| short-term interest rate SHORTYIELD | The U.S. Treasury bill rates. |

| long-term bond yield LONGYIELD | Long-term government bond yield |

| term spread TMSPREAD | The difference between the long term yield on government bonds and the Treasury-bill rate (Welch and Goyal 2008). |

| default spread DFSPREAD | The difference between long-term corporate bond and long-term government bond returns (Welch and Goyal 2008.) |

| the lagged rate of inflation INFLATION | Inflation is the Consumer Price Index (All Urban Consumers) from the Bureau of Labor Statistics. |

| the equity share of new issues EQUITYSHARE | The ratio of 12-month moving sums of net issues by NYSE listed stocks divided by the total end-of-year market capitalization of NYSE stocks (Welch and Goyal 2008). |

All the control variables below are constructed by Welch and Goyal (2008). The data are obtained from Amit Goyal’s website.

References

- Ali, A., M. Liu, D. Xu, and T. Yao. 2019. Corporate Disclosure, Analyst Forecast Dispersion, and Stock Returns. Journal of Accounting, Auditing & Finance 34: 54–73. [Google Scholar]

- Baker, Malcolm, and Jeffrey Wurgler. 2006. Investor Sentiment and the Cross-Section of Stock Returns. The Journal of Finance 61: 1645–80. [Google Scholar] [CrossRef]

- Bansal, Ravi, and Amir Yaron. 2004. Risks for long-run: A potential resolution of asset pricing puzzles. The Journal of Finance 59: 1481–509. [Google Scholar] [CrossRef]

- Barron, Orie E., Mary Harris Stanford, and Yong Yu. 2009. Further Evidence on the Relation between Analysts’ Forecast Dispersion and Stock Returns. Contemporary Accounting Research 26: 329–57. [Google Scholar] [CrossRef]

- Boehme, Rodney D., Bartley R. Danielsen, and Sorin M. Sorescu. 2006. Short-Sale Constraints, Differences of Opinion, and Overvaluation. Journal of Financial and Quantitative Analysis 41: 455–87. [Google Scholar] [CrossRef]

- Diether, Karl B., Christopher J. Malloy, and Anna Scherbina. 2002. Differences of Opinion and the Cross Section of Stock Returns. The Journal of Finance 57: 2113–41. [Google Scholar] [CrossRef]

- Ding, Wenjie, Khelifa Mazouz, and Qingwei Wang. 2019. Investor sentiment and the cross-section of stock returns: New theory and evidence. Review of Quantitative Finance and Accounting 53: 493–525. [Google Scholar] [CrossRef]

- Fung, Ka Wai Terence, Chi Keung MarcoLau, and Kwok HoChan. 2014. The conditional equity Premium, cross-sectional returns and stochastic volatility. Economic Modelling 38: 316–27. [Google Scholar] [CrossRef][Green Version]

- Guijarro, Francisco, Ismael Moya-Clemente, and Jawad Saleemi. 2019. Liquidity Risk and Investors’ Mood: Linking the Financial Market Liquidity to Sentiment Analysis through Twitter in the S&P500 Index. Sustainability 11: 7048. [Google Scholar]

- Guo, Hui, and Buhui Qiu. 2017. Conditional Equity Premium and Aggregate Investment: Is the Stock Market a Sideshow? (23 March 2017). Available online: https://ssrn.com/abstract=2940884 (accessed on 15 May 2020). [CrossRef]

- Guo, Hui, and Robert Savickas. 2008. Average Idiosyncratic Volatility in G7 Countries. The Review of Financial Studies 21: 1259–96. [Google Scholar] [CrossRef]

- Johnson, Timothy C. 2004. Forecast Dispersion and the Cross Section of Expected Returns. The Journal of Finance 59: 1957–78. [Google Scholar] [CrossRef]

- Kim, Jun Sik, Doojin Ryu, and Sung Won Seo. 2014. Investor sentiment and return predictability of disagreement. Journal of Banking & Finance 42: 166–78. [Google Scholar]

- Leippold, Markus, and Harald Lohre. 2014. The dispersion effect in international stock returns. Journal of Empirical Finance 29: 331–42. [Google Scholar] [CrossRef]

- Lettau, Martin, and Sydney Ludvigson. 2001. Consumption, Aggregate Wealth, and Expected Stock Returns. The Journal of Finance 56: 815–49. [Google Scholar] [CrossRef]

- Merton, Robert C. 1980. On estimating the expected return on the market: An exploratory investigation. Journal of Financial Economics 8: 323–61. [Google Scholar] [CrossRef]

- Miller, Edward M. 1977. Risk, uncertainty, and divergence of opinion. The Journal of Finance 32: 1151. [Google Scholar] [CrossRef]

- Welch, Ivo, and Amit Goyal. 2008. A Comprehensive Look at the Empirical Performance of Equity Premium Prediction. The Review of Financial Studies 21: 1455–508. [Google Scholar] [CrossRef]

- Yu, Jialin. 2011. Disagreement and return predictability of stock portfolios. Journal of Financial Economics 99: 162–83. [Google Scholar] [CrossRef]

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).