Zero-Debt Policy under Asymmetric Information, Flexibility and Free Cash Flow Considerations

Abstract

1. Introduction

2. Literature Review

2.1. Debt Overhang

Flexibility Theory of Capital Structure

2.2. Free Cash Flow Theory

2.3. Signalling under Asymmetric Information

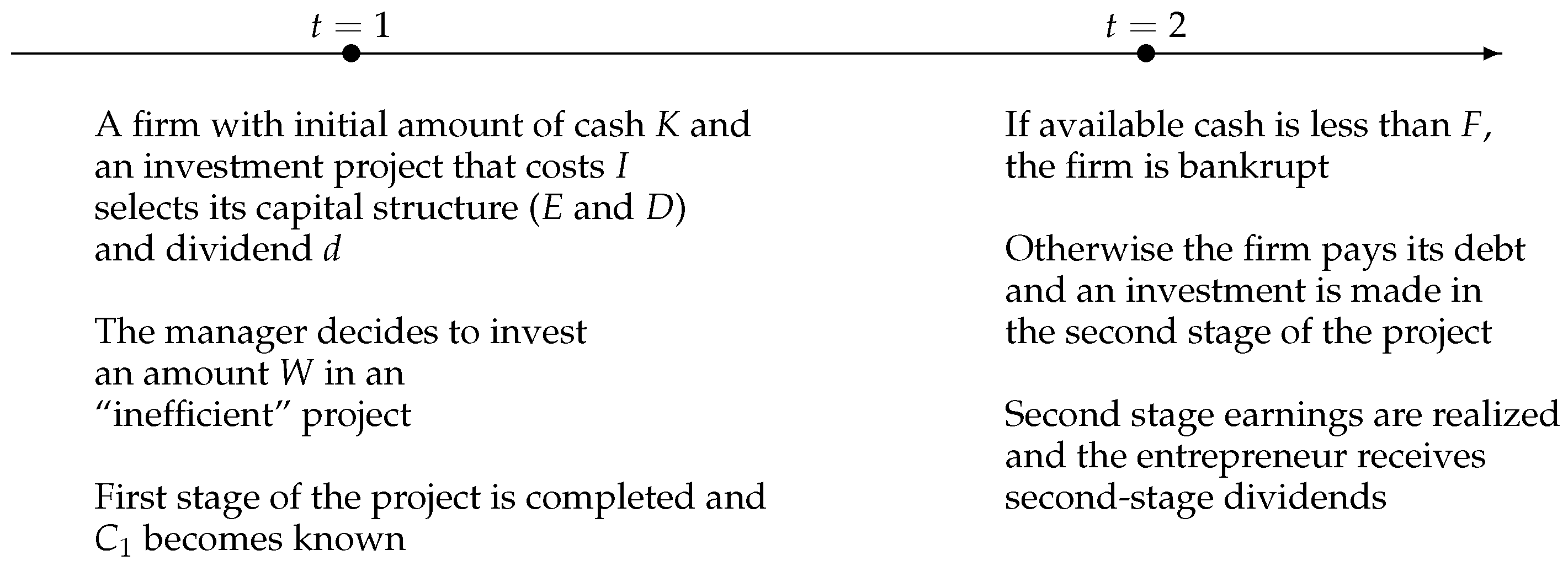

3. The Model and Basic Results

3.1. Model Description

3.2. No Free Cash Flow Problem and No Financial Constraints

3.3. Financially Constraint Firm with Free Cash Flow Problem

3.3.1. Manager’s Decision at the End of T = 1

3.3.2. Entrepreneur’s Dividend Decision at T = 1

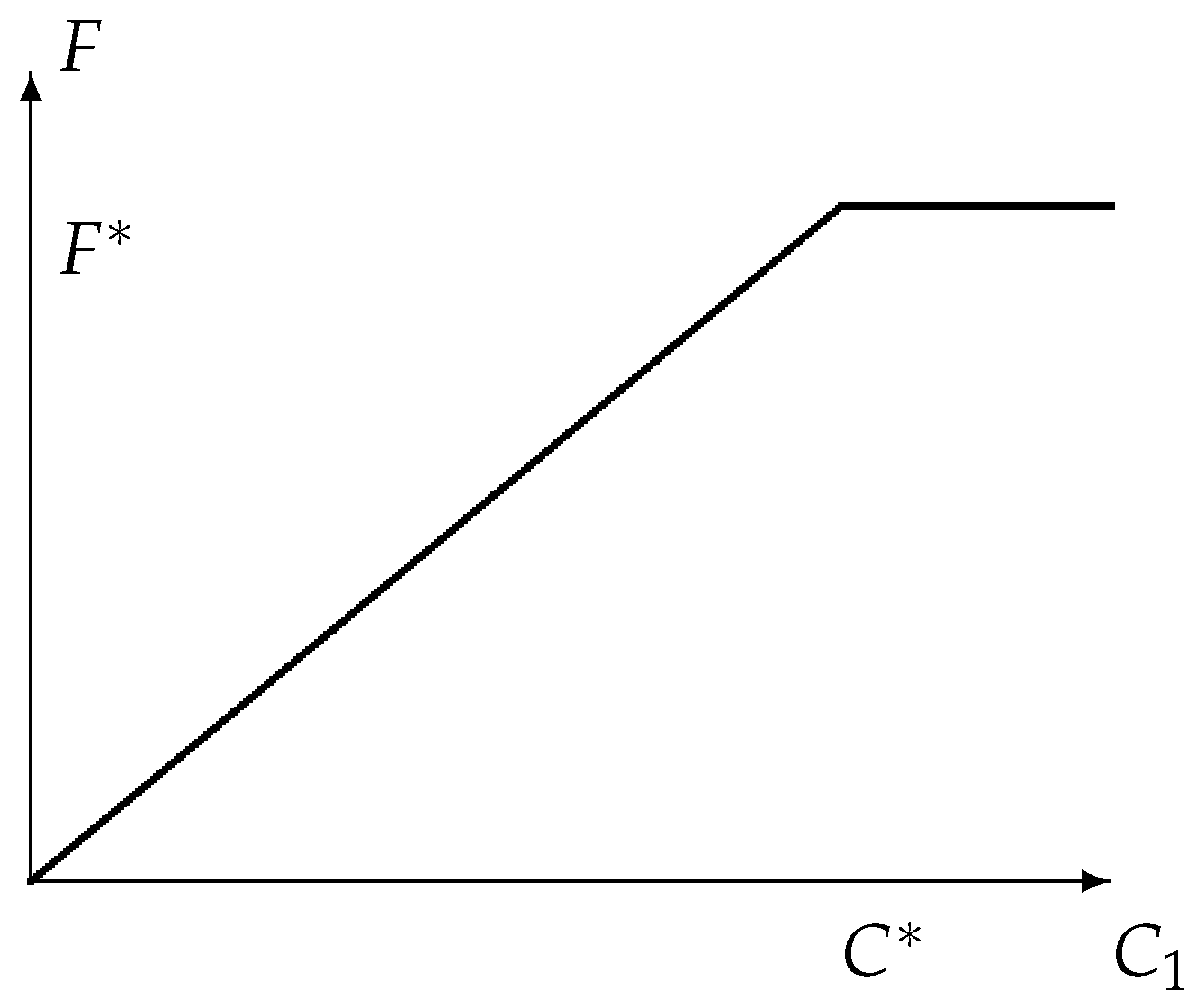

3.3.3. Entrepreneur’s Capital Structure Decision at T = 1

4. Comparative Statics

5. Asymmetric Information about Firm’s Investment Opportunities/Performance

5.1. Separating Equilibrium

5.2. Pooling Equilibrium

6. Model Implications

7. Model Extensions and Robustness

8. Summary and Conclusions

Funding

Acknowledgments

Conflicts of Interest

Appendix A

References

- Benartzi, Shlomo, Roni Michaely, and Richard Thaler. 1997. Do Changes in Dividends Signal the Future or the Past? Journal of Finance 52: 1007–34. [Google Scholar] [CrossRef]

- Bernanke, Ben, and Mark Gertler. 1989. Agency Costs, Net Worth, and Business Fluctuations. The American Economic Review 79: 14–31. [Google Scholar]

- Berkovich, Elazar, and E. Han Kim. 1990. Financial Contracting and Leverage Induced Over- and Under-Investment Incentives. The Journal of Finance 45: 765–94. [Google Scholar] [CrossRef]

- Bessler, Wolfgang, Wolfgang Drobetz, Rebekka Haller, and Iwan Meier. 2013. The International Zero-leverage Phenomenon. Journal of Corporate Finance 23: 196–221. Available online: http://www.sciencedirect.com/science/article/pii/S0929119913000783 (accessed on 27 November 2020). [CrossRef]

- Bhattacharya, Sudipto. 1979. Imperfect Information, Dividend Policy, and the ‘Bird in the Hand’ Fallacy. Bell Journal of Economics 10: 259–70. [Google Scholar] [CrossRef]

- Brav, Alon, John Graham, Campbell Harvey, and Roni Michaely. 2005. Payout policy in the 21st century. Journal of Financial Economics 77: 483–527. [Google Scholar] [CrossRef]

- Brennan, Michael, and Alan Kraus. 1987. Effcient financing under asymmetric information. The Journal of Finance 42: 1225–43. [Google Scholar] [CrossRef]

- Byoun, Soku. 2011. Financial Flexibility and Capital Structure Decision. Working Paper. Available online: https://ssrn.com/abstract=1108850 (accessed on 27 November 2020). [CrossRef]

- Byoun, Soku, and Zhaoxia Xu. 2013. Why Do Some Firms Go Debt-Free? Asia-Pacific Journal of Financial Studies 41: 1–38. Available online: https://ssrn.com/abstract=891346 (accessed on 27 November 2020). [CrossRef]

- Byoun, Soku, Jaemin Kim, and Sean Sehyun Yoo. 2013. Risk Management with Leverage: Evidence from Project Finance. Journal of Financial and Quantitative Analysis 48: 549–77. [Google Scholar] [CrossRef]

- Cho, In-Koo, and David Kreps. 1987. Signaling Games and Stable Equilibria. The Quarterly Journal of Economics 102: 179–221. [Google Scholar] [CrossRef]

- Collins, Robert, and Edward Gbur. 1991. Borrowing Behavior of the Proprietary Firm: Do Some Risk-Averse Expected Utility Maximizers Plunge? Western Journal of Agricultural Economics 16: 251–58. [Google Scholar]

- Dang, Viet. 2013. An Empirical Analysis of Zero-leverage Firms: New Evidence from the UK. International Review of Financial Analysis 30: 189–202. [Google Scholar] [CrossRef]

- DeMarzo, Peter, and Michael Fishman. 2007. Optimal Long-Term Financial Contracting. Review of Financial Studies 20: 2079–28. [Google Scholar] [CrossRef]

- Diamond, Douglas. 1991. Monitoring and Reputation: The Choice between Bank Loans and Directly Placed Debt. Journal of Political Economy 99: 689–721. [Google Scholar] [CrossRef]

- Diamond, Douglas, and Zhiguo He. 2014. A Theory of Debt Maturity: The Long and Short of Debt Overhang. The Journal of Finance 69: 719–62. [Google Scholar] [CrossRef]

- Easterbrook, Frank. 1984. Two Agency-Cost Explanations of Dividends. The American Economic Review 74: 650–59. [Google Scholar]

- Ebrahimi, Tahera. 2018. Why Do Some Firms Follow Zero Leverage Policy? Working Paper. Available online: https://efmaefm.org/0EFMAMEETINGS/EFMA%20ANNUAL%20MEETINGS/2018-Milan/papers/EFMA2018_0194_fullpaper.pdf (accessed on 27 November 2020).

- Edmans, Alex. 2011. Short-Term Termination Without Deterring Long-Term Investment: A Theory of Debt and Buyouts. Journal of Financial Economics 102: 81–101. Available online: https://ssrn.com/abstract=906331 (accessed on 27 November 2020). [CrossRef]

- Fudenberg, Drew, and Jean Tirole. 1991. Game Theory. Cambridge: MIT Press. [Google Scholar]

- Gale, Douglas, and Martin Hellwig. 1985. Incentive-Compatible Debt Contracts: The One-Period Problem. The Review of Economic Studies 52: 647–63. [Google Scholar] [CrossRef]

- Gamba, Andrea, and Alexander Triantis. 2008. The value of financial flexibility. Journal of Finance 63: 2263–96. [Google Scholar] [CrossRef]

- Gertner, Robert, and David Scharfstein. 1991. A Theory of Workouts and the Effects of Reorganization Law. Journal of Finance 46: 1189–222. [Google Scholar]

- Graham, John. 2000. How Big Are the Tax Benefits of Debt? The Journal of Finance 55: 1901–41. [Google Scholar] [CrossRef]

- Graham, John, and Campbell Harvey. 2001. The theory and practice of corporate finance: Evidence from the field. Journal of Financial Economics 60: 187–243. [Google Scholar] [CrossRef]

- Grinblatt, Mark, and Titman Sheridan. 2001. Financial Markets & Corporate Strategy, 2nd ed. New York: McGraw-Hill/Irwin. [Google Scholar]

- Grossman, Sanford, and Oliver Hart. 1982. Corporate Financial Structure and Managerial Incentives. In The Economics of Information and Uncertainty. Edited by John J. McCall. Chicago: University of Chicago Press, pp. 107–40. ISBN 0-226-55559-3. [Google Scholar]

- Haddad, Kamal, and Babak Lotfaliei. 2019. Trade-off Theory and Zero Leverage. Finance Research Letters 31: 335–49. [Google Scholar] [CrossRef]

- Hart, Oliver, and John Moore. 1994. A Theory of Debt Based on the Inalienability of Human Capital. The Quarterly Journal of Economics 109: 841–79. [Google Scholar] [CrossRef]

- Hoskisson, Robert, Francesco Chirico, Jinyong (Daniel) Zyung, and Eni Gambeta. 2017. Managerial Risk Taking: A Multitheoretical Review and Future Research Agenda. Journal of Management 43: 137–69. [Google Scholar] [CrossRef]

- Hirth, Stefan, and Marliese Uhrig-Homburg. 2010. Investment Timing when External Financing is Costly. Journal of Business Finance 37: 929–49. [Google Scholar] [CrossRef]

- Jensen, Michael. 1986. Agency Costs of Free Cash Flow, Corporate Finance, and Takeovers. American Economic Review 76: 323–29. [Google Scholar]

- Jensen, Michael. 1989. Active Investors, LBOs, and the Privatization of Bankruptcy. Journal of Applied Corporate Finance 2: 35–44. [Google Scholar] [CrossRef]

- Jensen, Michael, and William Meckling. 1976. Theory of the Firm: Managerial Behavior, Agency Costs and Ownership Structure. Journal of Financial Economics 3: 305–60. [Google Scholar] [CrossRef]

- Kiyotaki, Nobuhiro, and John Moore. 1997. Credit Cycles. Journal of Political Economy 105: 211–48. [Google Scholar] [CrossRef]

- Lambrinoudakis, Costas. 2016. Adjustment Cost Determinants and Target Capital Structure. Multinational Finance Journal 20: 1–39. Available online: https://ssrn.com/abstract=2746378 (accessed on 27 November 2020). [CrossRef]

- Lazonick, William. 2017. Innovative Enterprise Solves the Agency Problem: The Theory of the Firm, Financial Flows, and Economic Performance. Institute for New Economic Thinking Working Paper. Available online: https://www.ineteconomics.org/uploads/papers/WP_62-Lazonick-IESAP.pdf (accessed on 27 November 2020).

- Leary, Mark, and Michael Roberts. 2005. Do Firms Rebalance Their Capital Structures? Journal of Finance 60: 2575–619. [Google Scholar] [CrossRef]

- Lee, Hei Wai, and Patricia Ryan. 2002. Dividends and Earnings Revisited: Cause or Effect? American Business Review 20: 117–22. [Google Scholar]

- Lotfaliei, Babak. 2018. Zero Leverage and The Value in Waiting to Issue Debt. Journal of Banking and Finance 97: 335–49. [Google Scholar] [CrossRef]

- Leland, Hayne, and David Pyle. 1977. Informational Asymmetries, Financial Structure, and Financial Intermediation. Journal of Finance 32: 371–87. [Google Scholar] [CrossRef]

- Miglo, Anton. 2016a. Capital Structure in the Modern World, 1st ed. London: Palgrave Macmillan. [Google Scholar]

- Miglo, Anton. 2016b. Financing of Entrepreneurial Firms in Canada: An Overview. Working Paper. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2793613 (accessed on 27 November 2020).

- Miglo, Anton. 2011. Trade-Off, Pecking Order, Signaling, and Market Timing Models. In Capital Structure and Corporate Financing Decisions: Theory, Evidence, and Practice. Edited by H. Kent Baker and Gerald S. Martin. Hoboken: Wiley, chp. 10. [Google Scholar]

- Miller, Merton, and Kevin Rock. 1985. Dividend Policy under Asymmetric Information. Journal of Finance 40: 1031–51. [Google Scholar] [CrossRef]

- Modigliani, Franco, and Merton Miller. 1958. The cost of capital, corporation finance and the theory of investment. American Economic Review 48: 261–97. [Google Scholar]

- Myers, Stewart. 1977. Determinants of corporate borrowing. Journal of Financial Economics 5: 147–75. [Google Scholar] [CrossRef]

- Myers, Stewart. 1984. The Capital structure puzzle. The Journal of Finance 39: 574–92. [Google Scholar] [CrossRef]

- Myers, Stewart, and Nicholas Majluf. 1984. Corporate Financing Decisions When Firms Have Information Investors Do Not Have. Journal of Financial Economics 13: 187–221. [Google Scholar] [CrossRef]

- Nachman, David, and Thomas Noe. 1994. Optimal Design of Securites under Asymmectric Information. Review of Financial Studies 7: 1–44. [Google Scholar] [CrossRef]

- Ross, Stephen. 1977. The Determination of Financial Structure: The Incentive-Signalling Approach. Bell Journal of Economics 8: 23–40. [Google Scholar] [CrossRef]

- Strebulaev, Ilya, and Baozhong Yang. 2013. The mystery of zero-leverage firms. Journal of Financial Economics 109: 1–23. [Google Scholar] [CrossRef]

- Sundaresan, Suresh, Neng Wang, and Jinqiang Yang. 2015. Dynamic investment, capital structure, and debt overhang. Review of Corporate Finance Studies 4: 1–42. [Google Scholar] [CrossRef]

- Townsend, Robert. 1979. Financial Structures as Communication Systems. Journal of Economic Theory 21: 265–93. [Google Scholar] [CrossRef]

- Warr, Richard, William B. Elliott, Johanna Koëter-Kant, and Özde Öztekin. 2012. Equity Mispricing and Leverage Adjustment Costs. Journal of Financial and Quantitative Analysis 47: 589–616. [Google Scholar] [CrossRef]

- Williams, Joseph. 1987. Efficient Signalling with Dividends, Investment, and Stock Repurchases. The Journal of Finance 43: 737–47. [Google Scholar] [CrossRef]

- Ximénez, J. Nicolás Marin, and Luis J. Sanz. 2014. Financial decision-making in a high-growth company: The case of Apple incorporated. Management Decision 52: 1591–610. [Google Scholar] [CrossRef]

- Zhang, Yilei. 2009. Are Debt and Incentive Compensation Substitutes in Controlling the Free Cash Flow Agency Problem? Financial Management 38: 507–41. [Google Scholar] [CrossRef]

| 1. | See, for example, Strebulaev and Yang (2013), Dang (2013), Bessler et al. (2013), Sundaresan et al. (2015), and Byoun and Xu (2013). |

| 2. | See, for example, https://www.macrotrends.net/stocks/charts/AAPL/apple/debt-equity-ratio. |

| 3. | |

| 4. | |

| 5. | Hart and Moore (1994) show that long-term debt has its advantages in dealing with the debt overhang problem. |

| 6. | See also Haddad and Lotfaliei (2019). |

| 7. | |

| 8. | A related result is the costly state-verification theory (see Townsend 1979; Gale and Hellwig 1985). It considers an environment where a firm’s earnings are unobservable by investors, the verification of earnings is costly, and managers can report earnings at their discretion (ex-post moral hazard). |

| 9. | High payout policy is often considered to be an alternative tool for disciplining managers (Easterbrook 1984; Brav et al. 2005), but usually not in combination with zero-debt policy. |

| 10. | In Section 7, we discuss the model’s robustness with regard to this assumption as well as other assumptions. |

| 11. | Later, we discuss other strategies. |

| 12. | Throughtout the model’s solution F and not D is used as the main variable in our model to describe the amount of debt. Technically, F is a better variable, since it includes the interest amount and does not affect any results while simplifying the solution presentation. Obviously, in equilibrium, D and F are connected with each other. |

| 13. | |

| 14. | The assumption about the existence of is quite natural. One can assume that, if the amount of debt raised by the firm goes beyond some threshold, then the debt becomes very costly/impossible to bear. It can be related to expected bankruptcy costs, credit rating problems, relationship with banks, etc. Note that this assumption is technically not crucial, but it helps to generate some interesting comparative static results. |

| 15. | These assumptions will be discussed in Section 7. |

| 16. | Corporate bankruptcy costs are not considered. It complicates mathematics without adding significantly new intuitions. |

| 17. | See Grinblatt and Sheridan (2001) for an example of calculations for the present value of tax shield. |

| 18. | Hart and Moore (1994) formally show how the use of long-term debt can mitigate managerial incentives for ineffcient investments. |

| 19. | The following cases are consistent with the spirit of our results (we discussed the Apple 2012 case previously). As we mentioned, this company had a lot of cash at that time, had no debt, and paid relatively high dividends. SEI Investments Company is a financial services company that is headquartered in Oaks, Pennsylvania, United States, with offices in Indianapolis, Toronto, London, Dublin, The Netherlands, Hong Kong, South Africa, and Dubai (see https://en.wikipedia.org/wiki/SEI_Investments_Company) SEI manages, advises or administers $809 billion in hedge funds, private equity, mutual funds, and other managed assets. This includes $307 billion in assets under management and $497 billion in client assets under administration. The company has no debt and it pays steady dividends (https://seic.com/investor-relations). In addition to its large amounts of cash available, the company has had agency problems that are related to some of its managers. Note the case of Allen Stanford, for example, (https://www.businessreport.com/article/stanford-group-money). Another example is the multinational corporation Amdocs that specializes in software and services for communications, media and financial service providers, and digital enterprises. The company is quite successful and consistently pays stable dividends (https://en.wikipedia.org/wiki/Amdocs). Additionally, it constantly penetrates new markets, develops new projects etc. Accordingly, one can assume that, on one hand, the company needs flexibility, since it is often involved in important investments projects. Additionally, the moral hazard and agency problems seem to be quite important, since the company often creates new legal entities, replaces management, creates joint ventures with other companies, etc. For more examples of companies with no debt that pay dividends, see https://www.investopedia.com/articles/investing/032116/10-companies-no-debt-doxnhtcpayx.asp. |

| 20. | We have analyzed a model’s variation that included the possibility of using debt-based crowdfunding. Under debt-based crowdfunding, the firm promises to return the inital investments from funders with interest. We found that the main results of the model are not affected. Some slight differences exist. For example, when debt is risk-free (which can be the case without demand uncertainty) debt-based crowdfunding can be used as a signalling tool along with reward-based crowdfunding. However, in a more realistic scenario when demand is uncertain and debt is risky, the main result stands, which favors reward-based crowdfunding. The same holds when modelling moral hazard. |

| 21. | Proofs are available upon demand. Note that the calculations become much longer and technically more complicated, which is very typical for multiple type games with asymmetric information. |

| 22. | The proofs for other cases are available upon demand. |

| 23. | Proofs for other cases are available upon request. |

| 24. | Proofs for other cases are available upon request. |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2020 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Miglo, A. Zero-Debt Policy under Asymmetric Information, Flexibility and Free Cash Flow Considerations. J. Risk Financial Manag. 2020, 13, 296. https://doi.org/10.3390/jrfm13120296

Miglo A. Zero-Debt Policy under Asymmetric Information, Flexibility and Free Cash Flow Considerations. Journal of Risk and Financial Management. 2020; 13(12):296. https://doi.org/10.3390/jrfm13120296

Chicago/Turabian StyleMiglo, Anton. 2020. "Zero-Debt Policy under Asymmetric Information, Flexibility and Free Cash Flow Considerations" Journal of Risk and Financial Management 13, no. 12: 296. https://doi.org/10.3390/jrfm13120296

APA StyleMiglo, A. (2020). Zero-Debt Policy under Asymmetric Information, Flexibility and Free Cash Flow Considerations. Journal of Risk and Financial Management, 13(12), 296. https://doi.org/10.3390/jrfm13120296