Abstract

We analyze the effect of fisheries subsidy negotiations on financial markets and aggregate demand in developed and developing countries. We examine the plausible scenarios that are likely to emerge in the event of elimination or reduction of subsidies, and the subsequent effect on the financial markets and the fish production. We use the Keynesian macroeconomic static framework, which is based on an extended well-known investment-savings (IS) and liquidity preference–money supply (LM) model for analysis. Our analysis shows that the impact of a reduction in fisheries subsidies would reduce the exploitation of fish and marine resources in developing countries, thus leading to a general increase in fish prices and quantity stabilizing at lower levels. We also find that this effect would transfer to financial markets, leading to a decline in interest rates for fish exporting developing countries, but interest rates tend to stabilize at higher levels for fish importing developed countries.

1. Introduction

On the one hand, fish, a major source of protein for a large portion of the world’s population, not only supports economic growth but contributes to solving problems of global food shortages and insecurities (FAO 2020). Additionally, the growth and expansion of the fisheries sector is vital for the economic development of small and developing economies. Trade in fish and fish products increases fish consumption and connects producers to distant markets for which local supply may be insufficient and hence supports the global food security. The sector also provides employment and generates income for millions of people (http://www.fao.org/state-of-fisheries-aquaculture). Therefore, exports of fish and fish products promote productive activity and increase overall economic activity for many coastal, riverine, insular and lacustrine countries and regions.

On the other hand, overfishing is a real threat for nearly 80 percent of all fish stocks and coastal ecosystems (see Jackson et al. 2001, https://oceana.org/press-center/press-releases/new-report-finds-more-80-world%E2%80%99s-fisheries-danger-overfishing;http://www.fao.org/newsroom/common/ecg/1000505/en/stocks.pdf; https://unctad.org/news/90-fish-stocks-are-used-fisheries-subsidies-must-stop; https://www.theworldcounts.com/challenges/planet-earth/oceans/overfishing-statistics/story). Around a third of the commercially fished fish stocks are overfished, and around 60 percent of the fish stocks are fully fished (FAO 2020, p. 64). The fish may be endangered due to the overfishing by commercial fisheries.

To emphasize the economic role of fisheries, it can be summarized that at the global level, world fisheries capture increased from 89.6 million tons in 2016 to 96.4 million tons in 2018, an increase of 2.5 percent annually. Moreover, trade in fish as a share of exports in total production has remained stable between 34–38 percent since 1986 (FAO 2020). Further, while fish consumption in developed countries peaked at 26.4 kg per capita in 2007, and plateaued around 24.4 kg per capita in 2017, fish consumption continues to grow in developing countries, reaching 19.4 kg per capita, with an annual average growth of 2.4 percent.

According to FAO (2020, p. 73), fish and fish product exports make at least 40 percent of the total value of merchandise trade in small economies like Cape Verde, Faroe Islands, Greenland, Iceland, Maldives, Seychelles and Vanuatu. At a global level, trade in fish and fish products stands at around 11 percent of the total agricultural exports excluding forest products.

FAO (2020, p. 3) estimates indicate that around 75 percent of global fish production is for human consumption, and the remainder is used as inputs in the global production of other goods such as fishmeal, animal feed for livestock and fish oil which is a rich source of omega-3. The growing trade in fishmeal and fish oil is driven by the increase in demand for aquaculture, quality fish and fish-related pharmaceutical products. Statistics for 2016 from ReportLinker (2017) reveal that fishmeal and fish oil were widely consumed in the pharmaceutical industry for the production of omega-3 fatty acids, antibiotics and the production of medicines. In 2015, North America was the largest supplier of pharmaceutical drugs (31.5% of market share) followed by Europe and India (22.8% of market share). Since the worldwide market for generic drugs is expected to grow at 9.8 percent, the global market for fishmeal and fish oil is subsequently projected to reach USD 14.3 billion by 2022 (ReportLinker 2017).

As noted above, fish is a renewable resource and can be depleted in the near future due to overexploitation and climate change (Kahn 2005, p. 376). However, the main reason for the overfishing is subsidies which are provided all over the world (Sumaila et al. 2010, 2016, 2019a, 2019b) which were around USD 35.4 billion in 2018. This money is, according to Arnason et al. (2009) or Arthur et al. (2019), wasted money, and hence reform of existing fisheries policy is needed.

Noting the importance of the fisheries sector, the members of the WTO have been steadfast in obtaining an outcome in relation to the disciplines on fisheries subsidies negotiations. There are different views on the rationale for disciplines on fisheries subsidies. While some members are determined to have ambitious commitments on disciplines in relation to fisheries subsidies with concerns of environmental sustainability, others, especially developing countries, are concerned about the development perspective of low income and poorly resourced fishermen. Developed countries have three main objectives: (i) to address the negative impact of subsidies on fish stocks, (ii) to address the distorting impact of subsidies on shared resources (ocean fisheries), and (iii) to establish a well-defined framework for the subsidies which support the provision of public goods (e.g., fisheries management). However, as noted by the Organization of African, Caribbean and Pacific States (http://www.acp.int/content/acp-group-keen-secure-robust-multilateral-rules-fisheries-subsidies) (Pacific Network on Globalisation 2017), developing countries still have an interest in developing further their fishing capacity because of the fact that the fisheries sector is a relatively important economic sector in developing countries.

One aim of this paper to show, theoretically, why developing countries have a strong interest in subsidizing their fishing industry. We examine this by considering the link between the fisheries sector and the other sectors of the economy. Accordingly, we examine the implications of fisheries subsidies on the goods and the financial sector markets of developed and developing economies. It must be noted that developing countries are the major holders of fish resources or are marine capture producers. Despite being custodians of fisheries resources, most of the developing countries have a small fisheries sector. In this regard, the provision of fisheries subsidies for the low income and resource-poor fishermen is important for sustaining the fisheries sector and for overall socio-economic development. We examine the plausible scenarios that are likely to emerge in the event of elimination or reduction of subsidies, and the subsequent effect on the financial markets and fish production. For the analysis, we have used the Keynesian investment-savings (IS) and liquidity preference–money supply (LM) or IS-LM model, which is extended by considering the aggregate supply and aggregate demand of the economy. Hence, we are analyzing the consequences of subsidy reduction in a static macroeconomic framework.

1.1. State of Play of Fisheries Subsidies Disciplines in the WTO

Subsidies are a major economic policy tool, used to promote economic development. In general, according to mainstream economics the provision of subsidies is justified when it helps to eliminate market failures, for example those caused by positive externalities, public good characteristics or imperfect credit markets or other credit market restrictions. However, subsidies are also used to influence international trade, and typically policymakers justify these subsidies by arguing that they promote national interests. The general problem economists have with subsidies is caused by the conjecture that they must be financed by taxes, which creates economic inefficiencies, and subsidies, in many cases, directly create economic inefficiencies (Nur 2019). Unfortunately, this definition of subsidies is not unique. In the context of the multilateral trading rules, as per the Agreement on Subsidies and Countervailing Measures, subsidies are defined as a financial contribution by a government or any public body within the territory of a member. These include (i) direct transfer of funds (e.g., loans, grants, and equity infusion); (ii) potential direct transfer of funds or liabilities (e.g., loan guarantees); (iii) government revenue that is otherwise due is foregone or not collected (e.g., fiscal incentives such as tax credits); (iv) government provision of goods other than general infrastructure and (v) government making payments to a funding mechanism to enact the granting of subsidies in the identified criteria. In addition, income or price support cover enshrined under Article XVI of GATT 1994 is also covered (Grynberg 2003).

Fisheries subsidies can also be defined regarding their impact on the environment and fish stocks as proposed by Munro and Sumaila (2002) or Sumaila et al. (2010). The authors introduced three categories of fisheries—’beneficial’, ‘capacity-enhancing’ and ‘ambiguous’ subsidies. The first category represents subsidies such as programs that lead to investments in natural resources, fisheries management and R&D in fisheries to enhance fish stocks. These subsidies may lead to sustainable fish stocks and sustainable fisheries. The second category represents all subsidies which lead to an increase in the fishing capacity, like fuel subsidies, subsidies for renewal of vessels, subsidies for fishing port constructions and so on. These subsidies lead to the reduction of fish stocks and endanger the fisheries in the long run. The third category includes ambiguous subsidies which represent all subsidies with undetermined impacts for the fishery resource. These are, for example, fisher assistance programs, which support fishermen financially, or vessel buyback programs, which are aimed to reduce fishing capacity, or rural fishers’ community development programs, which are aimed to support communities that are strongly dependent on the fisheries sector. Unfortunately, around 60 percent of all fishery subsidies fall in the category of capacity-enhancing subsidies (Sumaila 2015).

Regarding development policies, (export) subsidies are also used to increase exports to reduce trade balance deficits and to generate income in foreign currency to finance unavoidable imports. In relation to the fisheries sector, Grynberg (2003) reveals the motives of developed countries in the fisheries subsidies negotiation. He notes that the countries that are proponents of fisheries subsidies disciplines have differing interests. There are some with commercial interests and those that believe that the disciplines would lead to environmental sustainability. For the friends of the fish group—a group of countries which includes Argentina, Australia, Chile, Colombia, Ecuador, Iceland, New Zealand, Norway, Pakistan, Peru, USA—there has been a clearly demonstrated commercial interest which is at stake for Iceland and New Zealand. Both countries have big vessel capacity in relation to the size of their economies and because of huge ownership of fishing grounds, their fisheries industries are highly productive and they do not need subsidies. For Iceland, since fisheries comprise 75 percent of export earnings, they have a strong interest in abolishing all fisheries subsidies. Moreover, because of the high competitiveness of their fisheries in the long run, the fisheries of these two countries can increase their market share.

The bargaining process regarding the disciplines on fisheries subsidies has been a long-standing issue at the WTO. In 2001, at the launch of the Doha Ministerial Conference, WTO Members were inter alia mandated to “clarify and improve” the existing WTO disciplines on fisheries subsidies. Further, the Hong Kong Ministerial Conference in 2005 called for a prohibition of certain forms of fisheries subsidies that contribute to overcapacity and overfishing. The momentum on fisheries subsidies negotiations has been developing ever since. At the 10th Ministerial Conference of the WTO (MC10), in Nairobi, members insisted on continuing the negotiations on fisheries subsidies despite the divergence in views. This resulted in wide-ranging discussions on various issues related to fisheries subsidies, such as overfishing, overcapacity, transparency, illegal, unreported and unregulated fishing, overfished stock, and special and differential treatment, among others.

In 2017, WTO members intensified their efforts with respect to negotiating disciplines on fisheries subsidies. Initially, members had tabled common positions as groups. However, these proposals remained far from generating consensus. In the lead up to the 11th Ministerial Conference in 2017 (MC11), a total of seven proposals were tabled before the Negotiating Group on Rules (NGR) by the European Union, Indonesia, Norway, ACCPU, African Caribbean Pacific, Least Developed Countries, New Zealand, Iceland, Pakistan and China. There was wide variation in the proposed approaches viz. disciplining fisheries subsidies (Table 1).

Table 1.

List of Fisheries Subsidies Proposals.

The divergence of views on disciplining fisheries subsidies persisted until the 11th Ministerial Conference of the WTO held at Buenos Aires in 2017. While members failed to arrive at a concrete outcome, they agreed to constructively engage in the fisheries subsidy negotiations. The mandate of MC11 is to eliminate certain forms of fisheries subsidies that contribute towards overcapacity, overfishing and illegal unreported and unregulated (IUU) fishing, while also recognizing the importance of appropriate and effective special and differential treatment for developing and least developed country members.

Following the MC11 decision on fisheries subsidies, the chair of the negotiating group on rules (NGR) has been organizing meetings in the form of clusters to discuss specific issues in relation to fisheries subsidies since 2018. Members have been working on the consolidated text on fisheries subsidies, which comprises seven proposals along with additional views from other members. The discussions range from issues relating to overfished stock, overfishing, overcapacity, IUU fishing, transparency, fisheries management and special and differential treatment. However, members have yet to concede to a set of agreed disciplines on fisheries subsidies in the multilateral forum.

As negotiations continue in 2020, a number of additional proposals have been put forward by member countries in relation to fisheries subsidies disciplines. The United States and Australia have a joint proposal on a member-specific fisheries subsidies cap. A similar proposal on a subsidies cap is also proposed by the Philippines. Australia has tabled the proposal on prohibiting subsidies for fish stock in overfished condition, and India’s proposal on the inclusion of fuel subsidies, but these are non-specific. The negotiating countries, who are all members of the WTO, are also discussing a consolidated chair’s text on fisheries subsidies with a view toward a conclusion by the end of 2020 which includes disciplines in relation to IUU, overfishing and fish stocks in overfished conditions.

1.2. Fisheries Global Governance

In the consolidated text on the fisheries subsidies, certain WTO members are advocating fisheries management measures as a precondition for special and differential treatment to developing countries. On the other hand, developing countries such as the African Caribbean Pacific Group, argue that fisheries management measures should be outside the purview of the WTO as there exist alternate forums to deal with such matters (c.f. United Nations 1961). For example, under the United Nations Convention on the Law of the Sea (UNCLOS), member states have the sovereign right to explore, exploit, conserve and manage fisheries within their EEZ. A contentious issue in the ongoing fisheries negotiations is the geographical limitations/territorial boundaries to which the disciplines should apply. Some members, such as the European Union are demanding that the disciplines on fisheries subsidies should extend up to the Exclusive Economic Zone (EEZ) Additionally, they require subsidizing members to adhere to a list of management measures which can be challenged later under the WTO’s dispute settlement system. Most developing countries which are coastal states must exercise caution in the fisheries negotiations by particularly ensuring that their obligations with regard to fisheries management must not compromise their sovereign rights as enshrined under Article 61 of the UNCLOS titled “Conservation of Living Resources”, which highlights:

The coastal state, taking into account the best scientific evidence available to it, shall ensure through proper conservation and management measures that maintenance of living resources in the exclusive economic zone is not endangered by over-exploitation. As appropriate, the coastal state and competent international organizations, whether subregional, regional or global are required to cooperate.

… [that] such measures shall also be designed to maintain or restore populations of harvested species at levels which can produce the maximum sustainable yield, as qualified by relevant environmental and economic factors, including the economic needs of coastal fishing communities and the special requirements of developing states …

In practice, the management of resources within the EEZ is conducted through the formulation and development of national fisheries legislation and policies. In doing so, various economic, social, and environmental factors are given due regard. Member states cooperate with regional or sub-regional agencies to assist them through the training of observers and providing scientific advice. On the basis of the said scientific advice, states develop national regulations for issuing licenses or permits to the local and foreign vessels for fishing in their EEZ.

Sub-regional systems of collaboration are present in different regions. For example, in the Pacific region, the regulation of fisheries in the EEZ is achieved through the assistance of sub-regional organizations such as the Forum Fisheries Agency (FFA), the South Pacific Community (SPC), and the Parties to the Nauru Agreement (PNA for per seine fisheries). The coastal states within a certain region are members of these sub-regional organizations. These organizations have the skills and expertise to provide management advice to the coastal states.

In relation to the management of the high seas, Article 118 of the UNCLOS stipulates that:

States have a duty to cooperate with each other for the conservation and management of living resources in the high seas. States, whose nationals exploit identical living resources or different living resources in the same area, shall enter into negotiations with a view to taking necessary measures for the conservation of the concerned living resources. They shall, as appropriate, cooperate to establish sub-regional or regional fisheries organizations to this end.

This cooperation has resulted in the establishment of regional fisheries management organizations (RFMOs). In addition to UNCLOS, the UN Fish Stock Agreement is a legally binding agreement that ensures the long-term conservation and sustainable use of straddling fish stocks and highly migratory stocks. Certain WTO members are further obligating other members to implement the International Plan of Action-Illegal, Unreported and Unregulated fishing (IPOA-IUU), as a precondition for allowing the grant of subsidies by developing countries. The implementation of the IPOA-IUU would be possible only if members were able to implement the other voluntary codes of conduct such as the Voluntary Code of Conduct for Responsible Fishing. This instrument which is aimed at responsible fishing has certain obligatory provisions that will give effect to other instruments such as the Agreement to Promote Compliance with International Conservation and Management Measures by Fishing Vessels in High Seas. In addition, the Code of Conduct for Responsible Fishing mandates certain compliance measures by both flag states as well as port states. In other words, members will be additionally obliged to implement the Guidelines for Flag State Responsibilities and the Agreement on Port State Measures to prevent, deter and eliminate IUU Measures.

The issues outlined above have been of contention for developing countries. First, in order to grant subsidies, developing and least developed countries are being required to implement a list of voluntary guidelines. These guidelines are constantly evolving, and are often agreed to by members in forums other than the WTO. Certain WTO members aim to lend a binding legal effect to these voluntary guidelines. Second, the cost of implementing these instruments can outweigh the benefits of sustaining a fisheries sector. In developing countries, the majority of fisherfolk are low income and poorly resourced. As a result, the twin problems of the inability of the state to grant subsidies, and stringent conditions, would result in the demise of the fisheries sector. On the other hand, the proponents of stringent conditions such as the EU are in a position to implement these guidelines which will provide the developed countries with a competitive edge in terms of the growth of their fisheries sector.

Apart from the existing agreements and policies, there are also private standards in the fisheries sector that influence the governance of fisheries. Although the WTO concentrates on disciplines in relation to public standards, private standards are another major hurdle for developing countries. For example, the Marine Stewardship Council (MSC) harnesses the consumers’ purchasing power to generate changes and promotes environmentally responsible stewardship. However, to reward environmentally responsible fisheries management and fishing practices, a product label is developed on the basis of specific standards defining sustainable fisheries. After an extensive certification process, the label may be awarded for five years and subsequently renewed. The latter implies that the high cost of certification acts as a barrier to market entry, in favor of fisheries from developed countries (Kumar et al. 2019).

2. A Brief Review of Fisheries Related Issues and Fisheries Subsidies

There have been numerous studies conducted on fisheries and fisheries related issues pertaining to trade, economics and the environment. In highlighting the declining state of global marine ecosystems, Eggert and Greaker (2009) attribute unsustainable fishing practices to the following: (i) poverty; (ii) inadequate knowledge; (iii) ineffective governance; (iv) high demand for limited resources; and (v) interactions between the fishery sector and other aspects of the environment. They highlight the detrimental impact of trade liberalization and poor property rights on sustainable fisheries. The study proceeds on the assumption that developed countries have better fisheries management than developing countries. This assumption is well founded if we consider the research efforts and expenditures for research of developed countries in terms of the size of fish stocks, the water quality and the state of the natural environment. Developing countries are usually not able to afford the same level of fisheries management. The increasing exports of fisheries from the Global South, therefore, run the risk of reduced stock and welfare. Case in point is the liberalization of fisheries trade in Tanzania and Argentina, which has resulted in marked economic gains for the two countries but is accompanied by rapidly deteriorating fish stocks. Accordingly, Eggert and Greaker (2009) emphasize the need to promote more sustainable fishing practices by providing fishers with economic rights and accompanying responsibilities, by improving fisheries governance and by having effective trade negotiation and facilitation, and fisheries subsidies thus underscore the role of WTO in the process. However, the study questions the harmful fisheries subsidies provided by OECD countries (Japan, the EU, Russia, Poland, the Republic of Korea and Taiwan), and underscores the importance of adjustment programs that encourage developing countries to abandon subsidy exemptions. An example is the support provided by Norway to Namibia with respect to improving the latter’s monitoring and enforcement systems. The study proposes that support from developed countries to the fisheries sector in developing countries should target capacity building in fisheries management. The study also critiques the distributional concerns stemming from the acquisition of fishing rights in developing countries. The study establishes that open access fishing rewards the government while artisanal fishers lose out due to the fierce competition they have to face from the industrialized fishing fleets making illegal, unregulated and unreported landings.

Hanich et al. (2018) study the impact of climate change on small-scale fisheries in the Pacific Island region. They make case for small-scale fishing communities to address the threat of climate change by effectively managing their own fisheries at sustainable levels. They emphasize the importance of marine customary tenure, which in some cases has been adversely impacted by colonial governments, overpopulation and migration. The study also suggests substantial improvements in economic tools to strengthen the measures of coastal fisheries management. They argue that coastal fisheries management plans should prioritize food security and livelihood, and allocate the ministerial budget towards sustainably managing a specific fishery. In light of the impending threat of climate change on inter-generational equity, the study suggests that the Pacific Island States should appreciate the trade-off between competing uses of their fisheries resources and the relative benefits. Reflecting on the 46th Pacific Islands Forum held in 2015, the study endorses new strategies for coastal fisheries management; namely: The Regional Roadmap for Sustainable Pacific Fisheries, and A New Song for Coastal Fisheries - Pathways to Change. The latter focuses on community-based approaches for fisheries management as opposed to centralized models.

Kuo and Vincent (2018) assess the impact of the Convention on International Trade in Endangered Species of Wild Fauna and Flora (CITES) on regulating the international trade in fully marine fisheries by specifically focusing on trade in seahorses. Notably, seahorses are the first fully marine fishes to be listed in CITES Appendix II. The study concludes that since the implementation of the CITES, there has been an increase in the import prices of seahorses resulting in a sharp decline in the volume of trade, with trade being concentrated between fewer countries. The enforcement of the CITES led to the suspension of exports of seahorses from Senegal and Guinea, and termination from the Philippines, Malaysia, Thailand and Vietnam. This created a situation where 96 percent of the previous global trade in seahorses was outlawed. However, this diverted the illegal importation of seahorses to other countries. Hong Kong, which is a major importer of seahorses, now imports seahorses from new sources, namely African and South American countries. This accentuates the need to invest in conservation efforts in the new source countries as well.

Furthermore, Kuo and Vincent note that China also has emerged as a major importer of seahorses from the new source countries. The study further revealed that the volume of trade in seahorses was higher between countries that were closer geographically, had a lower per capita GDP or had a higher demersal catch. According to them, these trends demonstrate that the mere listing of seahorses in Annex II of the CITES provides no guarantee of conservation. The listing must be followed by effective implementation of conservation and management measures. They underscore the need to address illegal, unreported and unregulated trade in marine fisheries.

Pettersen et al. (2018) examine the relationship between input markets for cod in the regional ex-vessel markets for cod in Norway. The study reveals that the law of one price (LOP) holds in regions supplying 96 percent of the total catch in Norway, which indicates integration of regional markets in Norway. The study highlights that markets for fresh cod are integrated but not all regions adhere to the LOP. The study also provides evidence of frozen cod prices leading the fresh cod prices.

Asche et al. (2018) examine the trade dynamics and duration with respect to six different product forms of cod exports from Norway. They conclude that trade dynamics and the duration of trade relationships vary substantially for different forms of cod exports. Despite the significant variation observed across different commodity forms, they highlight that trade relationships mainly remain short. They note that 45 percent of trade relationships fail after the first year, and less than 10 percent of the relationships last as long as ten years. The trade relationship is especially short for highly perishable products like fresh cod fillets compared to dried and salted cod. The study highlights that exports of wild fish like cod tend to follow traditional food supply chains where only the physical product matters. The study concludes that the increase in the share of whole cod exports, both frozen and fresh, stems from the high labor costs in Norway and the increased demand for cod products.

Anderson et al. (2018) focus on the transformation of the seafood market. They present two important observations. First, increased trade in fisheries has facilitated the creation of a global market for seafood. Second, the stagnating landings of wildlife fisheries, accompanied by a corresponding increase in trade, has provided an impetus to the aquaculture industry. The combined effect of these two developments is the rapid commoditization of certain fish species. This has resulted in an increase in the per capita consumption of seafood globally, growing economies of scale and the introduction of modern marketing practices. However, commoditization of seafood is likely to be restricted to large species groups and would be dominated by aquaculture products rather than wildlife fisheries.

Zhang et al. (2018) appraise the Individual Transferable Quotas (ITQs), a popular fisheries management system, as a means of addressing the overcapacity afflicting the Norwegian fishing fleet. The ITQ system aims to reduce active fishing vessels by scrapping or selling vessels out of the fishery and transferring their quotas to the remaining vessels. The system is expected to reduce fleet overcapacity and improve financial performance. The study tests this hypothesis in the context of the Norwegian ocean-going cod trawlers. The findings verify that the capacity adjustment due to the ITQ system positively impacts profitability. The study also demonstrates that the lower profitability of the Norwegian fishing fleet in the period 2011–2015 is attributable to factors like capital structure and operating cost.

Kumar and Chakradhar (2019) explore the relationship between fisheries subsidies and vessel capacity. The findings suggest that fisheries subsidies have a negative relationship to vessel capacity. As countries improve vessel capacity the subsidies are reduced. For vessel capacity below 23.9 m, this is justified, as the small-scale fisheries sector requires subsidies for the sector to develop.

Extensive research by Sumaila et al. (2010), Sumaila et al. (2016), Sumaila et al. (2019a), Sumaila et al. (2019b) was made to produce data on fisheries subsidies and to categorize these subsidies. For 2003, the authors estimated subsidies of $25–29 billion worldwide; for 2009 and 2018, it was $35 billion. Thus, considering inflation, the total subsidies have slightly declined. Additionally, Sumaila et al. (2016) state that 65 percent of all subsidies are provided by the developed countries and 35 percent by the developing countries, although the latter produce more than 50 percent of the worldwide catch.

Sala et al. (2018) conclude in their study of high sea fisheries, that the fisheries of Russia and China are not profitable, even when they receive subsidies. In a study which investigates the effects on small-scale fisheries, Schuhbauer et al. (2017) conclude that 90 percent of all capacity-enhancing subsidies go to large scale fisheries.

Teh and Pauly (2018) investigated for Cambodia, Malaysia, Thailand and Vietnam the contribution of small-scale fisheries to food security. The authors found out that small scale fishers have contributed more than 50 percent of the total fish catch for human food production. Squires et al. (2014) investigated fisheries subsidies in the Western and Central Pacific region and emphasized that some subsidies have the character of Pigouvian subsidies, which may increase society’s welfare when there are public goods with external benefits and free riding, like new technology and knowledge which leads to reduced adverse impacts on “bycatch”. In summary, it can be argued that although large-scale fisheries receive the most subsidies, their contribution to fish catch is over estimated and obviously relatively less profitable than small-scale fisheries. The parallels to the agricultural sector in developed countries is obvious.

3. Fisheries Subsidies Policy Analysis in the Goods and Financial Sector Market

Subsidies are a major trade policy tool for socio-economic development. There are different definitions of subsidies and the impact varies across countries and various sectors. In the context of the multilateral trading rules, as per the Agreement on Subsidies and Countervailing Measures, subsidies are defined as a financial contribution by a government or any public body within the territory of a member. These include (i) direct transfer of funds (e.g., loans, grants, and equity infusion); (ii) potential direct transfer of funds or liabilities (e.g., loan guarantees); (iii) government revenue that is otherwise due is foregone or not collected (e.g., fiscal incentives such as tax credits); (iv) government provision of goods other than general infrastructure and (v) government making payments to a funding mechanism to enact the granting of subsidies in the identified criteria. In addition, income or price support cover enshrined under Article XVI of GATT 1994 is also covered.

On the other hand, enterprises that received subsidies increased investment in R&D by around 4 percent. Enterprises in the Czech Republic and Slovakia would carry out more than one-third of the projects without receiving any form of subsidies. Sufficiently high subsidies encouraged enterprises to increase their exports and operate in foreign markets more efficiently (Žampa and Bojnec 2017).

In order to understand the broader effects of fisheries subsidies as a trade policy tool, the following factors are taken into account:

- (i)

- Developed countries including the “friends of fish”, have adequate fishing vessel capacity but limited fisheries resources.

- (ii)

- Developing countries including the small island and least developed countries are holders of fisheries resources. Major countries, such as India and China, are amongst the key global players in marine capture production.

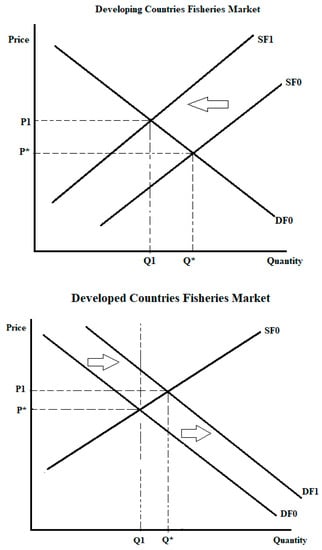

Figure 1 below shows the impact of the disciplines on the fisheries market of the developing and developed countries. It is pertinent to note that the disciplines on fisheries subsidies under the WTO pertain to capacity-enhancing subsidies. Interestingly, developed countries are the major providers of specific subsidies that are directly related to production (Sumaila et al. 2016). On the other hand, developed countries such as the EU and the “friends of fish” have already undertaken reforms, and shifted to the provision of beneficial and ambiguous subsidies in the fisheries sector. Another critical element to note is that in relation to the size of the fisheries sector vis-à-vis technology and production, developed countries are relatively more advanced and also hold major vessel capacity (Schuhbauer et al. 2017). Kumar et al. (2019) reveal that South Korea has the largest fishing vessel per gross tonnage (FVGT) of 606,628 t and the total number of the vessel (NFV) is 75,629, followed by Norway (FVGT of 392,468 t and NFV of 5939), Spain (FVGT of 379,209 t and NFV of 9895), Argentina (FVGT of 179,806 and NFV of 902), New Zealand (FVGT of 119,620 and NFV of 1334), Australia (FVGT of 40,741 and NFV of 309) and Sweden (FVGT of 30,831 and NFV of 1362). These countries have a high fishing capacity in relation to the gross tonnage of their respective fishing vessels, thus forming the demand for fisheries’ resource extraction.

Figure 1.

Impact of Fisheries Subsidies Disciplines on the Goods Market of Developing and Developed Countries.

In relation to the assessment of fisheries subsidies disciplines, an analysis of the domestic market of developing and developed countries and synergy to the financial market is considered. Therefore, in the event of the elimination or reduction of specific subsidies, without disciplines on the same on non-specific subsidies, the following scenario is likely to emerge in the fisheries’ goods market (see Figure 1):

- (i)

- Initially, the developing countries fisheries market is operating at a given quantity and price . The equilibrium revenue generated is therefore equal to the area . Note that this is the revenue which the developing countries’ fisheries sector generates with specific subsidies. The developing countries are able to attain the initial level with subsidies which are direct in nature. Also important to note is that most developing countries have limited vessel capacity. We show that with the provision of specific subsidies, some of the major developing countries who are also marine capture producers are able to compete with the developed countries’ fisheries market. Thus, both developed and developing countries are able to produce at their competitive of and based on the respective initial supply (SF0) and initial demand (DF0).

- (ii)

- However, with the removal of specific subsidies, developing countries’ marginal cost of the fisher is likely to increase and thus, the supply, production and catch of fisheries will reduce from Q* to Q1, as noted by the shift from SF0 to SF1, holding the other things constant. In the figure we see two supply curves, SF1 and SF0 and one demand curve DF. Both supply curves are derived from the marginal cost functions and the demand curve from the willingness to pay of the consumers. Obviously, a shift from SF0 to SF1 is caused by an increase of the marginal costs.

- (iii)

- On the other hand, developed countries who hold fishing vessel capacity and provide non-specific subsidies have a competitive edge on the decline in the production of fisheries in developing countries. With the reduction of specific subsidies, the production of fish in developed countries will remain at Q1 if they have undergone fisheries reform. However, with the global market exit of fisheries from the developing countries, and hence an additional increase in the demand for fish of developed countries, this will shift the demand curve DF0 to DF1. Therefore, the price charged by developed countries for fisheries will be P1 holding other things constant in the short-term, but the production of developed countries is expected to move to over time. As such, developed countries through the fisheries subsidies’ discipline will capture the global market share for fisheries, and can potentially dictate the price at which fish is sold. Developing countries, in order to meet the domestic demand, are likely to shift positions and hence become net importers, while developed countries would turn out as net exporters of the fisheries production.

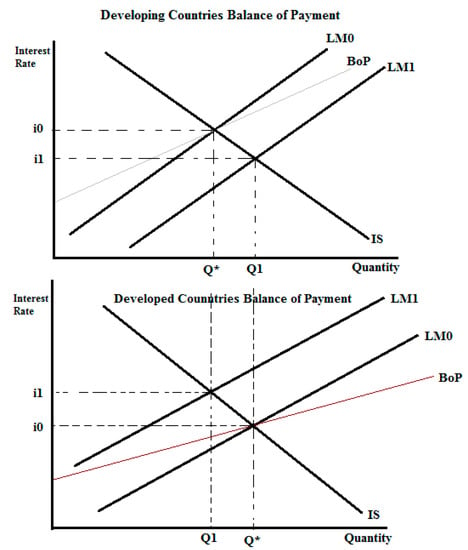

Figure 2 shows the resulting effect of the fisheries subsidies’ disciplines on financial markets. Owing to the likely effects of fisheries subsidies in the goods market, the subsidies would affect the balance of payments (BOP) and global financial markets by influencing the developed and developing countries’ exchange rates. For developing countries, the reduction of fisheries subsidies and the inability to produce an initial in the goods market would trigger import demand for fisheries products. The developed countries in the goods market would still produce at and be able to charge a higher price at P1.

Figure 2.

Impact of Fisheries Subsidies in the Developed and Developing Countries Financial Market.

- (i)

- Initially, we assume that the developing countries’ BOP position is at with an interest rate of i0. However, as the import demand for fisheries products increases, the importers from developing countries will purchase more foreign currency in exchange for domestic currency to mobilize imports. Hence, the money supply denoted by LM0 curve will shift to LM1 and interest rate to i1. As the money supply increases, the more domestic currency would be circulating in the market and the interest rates in the domestic market of developing countries will decrease. The decline in interest rates would mean that the value of the domestic currency has declined. This will result in a depreciation of the domestic currency in the developing countries and consequently, an outflow of capital to the developed countries where the return on investment (interest rates) is high. However, where developing countries have fixed exchange rates, central bank interventions in the money market through controls on interest rates may control some of the effects in the long run. Developing countries exports will decline on aggregate, with the possibility of them becoming net importers.

- (ii)

- For developing countries, including small island states and least developed countries, the import base is usually small and they are heavily dependent on a few products as exports. Thus, it is likely that the reduction of fisheries subsidies will add to a further balance of payment deficit for these countries. If subsides are reduced in developing countries and alternative taxes are imposed for income purposes, there is likely to be greater income inequality thus disproportionally affecting the most vulnerable, including poor resourced fishermen.

- (iii)

- Due to their existing capacity and ability to dictate market share and price with the reduction of subsidies, it is likely that developed countries’ exports of fisheries and production would increase. Even though the quantity may remain at , the price P1 would increase inflows of foreign exchange into the developed countries. As a result, the money demand will increase from domestic traders in developed countries, and foreign exchange reserves would increase. This would increase interest rates and increase capital inflows to developed countries. The developed countries’ currency is also likely to appreciate the increase in import demands from developing countries. The developed countries would, therefore, benefit from a balance of the payment surplus situation.

4. Conclusions

The developed, developing and least developed countries are at different levels of development and subsidization. A situation therefore prevails where the developed countries are now in a position to dominate the global fisheries market after building their fishing capacity on the basis of generous subsidies from their respective governments. The elimination of fisheries subsidies will decapitate the developing countries from utilizing their own fisheries resources. The developing and least developed countries rely on fisheries for food security and livelihood. Some coastal states aim to domesticate their fisheries industry, but the elimination of subsidies will derail such aspirations. In addition, if developing countries are prohibited from providing subsidies for capacity enhancement, then they are unlikely to develop fishing fleets to exploit their own marine resources in the future.

With the elimination of fisheries subsidies, developing countries that possess fishing vessels and provide specific subsidies may be compelled to exit the market over time due to high operating costs. However, the developed countries that are vessel owners and have undertaken fisheries reforms (and have a commercial interest), will remain. There will be few demanders of fish access rights in the market, that is, the EU and the “friends of fish”. The coastal states and other developing countries may not be able to develop their fisheries sector given the constraints of disciplining fishery subsidies. As a result, the developed countries with large fishing fleets will dictate the price of the fishery access rights to the small coastal states and there will be a shift in the bargaining power for fish access rights to a few developed countries. The developed countries can then dictate the price of the access rights, that is, purchase the rights to fish at a lower price, thereby monopolizing the entire fisheries market. This would stifle the future commercial fisheries sector development in developing countries. The effect could also extend to the financial market. The developing countries could become net importers of fish and hence demand foreign currency from their trade partners, which would mean a real depreciation of domestic currency. The developing countries, in particular the small island states and the least developed countries, have a low export base. This can put additional pressure on the trade balance of countries who are currently net importers.

While noting these plausible outcomes, it is important to note that we have assumed the developing and developed countries as a homogeneous set. However, there are some pertinent structural and socio-economic differences even within developed and developing countries that could influence the country-specific outcomes related to fisheries subsidies. We do note this as an important consideration for future research. Furthermore, it would be interesting to have reliable and consistent data available to empirically examine the impacts of fisheries subsidies on output and subsequent spillover effects on other critical sectors.

Author Contributions

Conceptualization, R.K. and P.A.; methodology, R.K., R.K. and P.J.S.; software, R.K. and R.R.K.; validation, all authors; formal analysis, R.K. and P.J.S.; writing—original draft preparation, R.K. and P.A.; writing—review and editing, R.R.K. and P.J.S.; supervision, R.R.K. and P.J.S.; project administration, R.R.K. All authors have read and agreed to the published version of the manuscript. © 2020 World Health Organization. Licensee MDPI, Basel, Switzerland. This is an open access article distributed under the terms of the Creative Commons Attribution IGO License (http://creativecommons.org/licenses/by/3.0/igo/legalcode), which permits unrestricted use, distribution, and reproduction in any medium, provided the original work is properly cited. In any reproduction of this article there should not be any suggestion that WHO or this article endorse any specific organisation or products. The use of the WHO logo is not permitted. This notice should be preserved along with the article’s original URL. The authors alone are responsible for the views expressed in this article and they do not necessarily represent the views, decisions or policies of the institutions with which they are affiliated.

Funding

This research received no external funding.

Acknowledgments

Peter Stauvermann thanks the Changwon National University for financially supporting his ongoing research work and collaboration. The usual disclaimer applies.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Anderson, James L., Frank Asche, and Taryn Garlock. 2018. Globalization and commoditization: The transformation of the seafood market. Journal of Commodity Markets 12: 2–8. [Google Scholar] [CrossRef]

- Arnason, Ragnar, Kieran Kelleher, and Rolf Willmann R. 2009. The Sunken Billions: The Economic Justification for Fisheries Reform. Washington, DC: World Bank. Available online: https://openknowledge.worldbank.org/handle/10986/2596 (accessed on 3 October 2020).

- Arthur, Robert, Stephanie Heyworth, John Pearce, and William Sharkey. 2019. The Cost of Harmful Fishing Subsidies. IIED Working Paper. London: International Institute for Environment and Development. Available online: https://pubs.iied.org/pdfs/16654IIED.pdf (accessed on 3 October 2020).

- Asche, Frank, Andreea L. Cojocaru, Ivar Gaasland, and Hans-Martin Straume. 2018. Cod stories: Trade dynamics and duration for Norwegian cod exports. Journal of Commodity Markets 12: 71–79. [Google Scholar] [CrossRef]

- Eggert, Håkan, and Mads Greaker. 2009. Effects of Global Fisheries on Developing Countries Possibilities for Income and Threat of Depletion. Working Papers in Economics 393. Gothenburg: University of Gothenburg. Available online: https://gupea.ub.gu.se/bitstream/2077/21492/1/gupea_2077_21492_1.pdf (accessed on 3 October 2020).

- FAO. 2020. The State of World Fisheries and Aquaculture 2020. Sustainability in Action. Rome. Available online: http://www.fao.org/3/ca9229en/ca9229en.pdf (accessed on 3 October 2020).

- Grynberg, Roman. 2003. WTO fisheries subsidies negotiations: Implications for fisheries access arrangements and sustainable management. Marine Policy 27: 499–511. [Google Scholar] [CrossRef]

- Hanich, Quentin, Colette C. C. Wabnitz, Yoshitaka Ota, Moses Amos, Connie Donato-Hunt, and Andrew Hunt. 2018. Small-scale fisheries under climate change in the Pacific Islands region. Marine Policy 88: 279–84. [Google Scholar] [CrossRef]

- Jackson, Jeremy B. C., Michael X. Kirby, Wolfgang H. Berger, Karen A. Bjorndal, Louis W. Botsford, Bruce J. Bourque, Roger H. Bradbury, Richard Cooke, Jon Erlandson, James A. Estes, and et al. 2001. Historical overfishing and the recent collapse of coastal ecosystems. Science 293: 629–37. [Google Scholar] [CrossRef] [PubMed]

- Kahn, James R. 2005. The Economic Approach to Environmental and Resource Management. Orlando: Dryden Press. [Google Scholar]

- Kumar, Radika, and Jadhav Chakradhar. 2019. An Assessment of Fishing Vessel Capacity on Subsidies, Non-Tariff Measures, and Attaining Sustainable Development Goals. ARTNeT Working Paper Series; No. 184. Bangkok: Economic and Social Council Asia Pacific, May, Available online: https://www.unescap.org/sites/default/files/AWP184.pdf (accessed on 12 March 2020).

- Kumar, Radika, Ronald Ravinesh Kumar, Peter Josef Stauvermann, and Jadhav Chakradhar J. 2019. The effectiveness of fisheries subsidies as a trade policy tool to achieving sustainable development goals at the WTO. Marine Policy 100: 132–40. [Google Scholar] [CrossRef]

- Kuo, Ting-Chun, and Amanda Vincent. 2018. Assessing the changes in international trade of marine fishes under CITES regulations—A case study of seahorses. Marine Policy 88: 48–57. [Google Scholar] [CrossRef]

- Munro, Gordon, and Ussif R. Sumaila. 2002. The impact of subsidies upon fisheries management and sustainability: The case of the North Atlantic. Fish and Fisheries 3: 233–50. [Google Scholar] [CrossRef]

- Nur, Muhammad. 2019. Bridging a new concept of fisheries subsidies policy to support sustainable fisheries in Indonesia. In IOP Conference Series: Earth and Environmental Science. Bristol: IOP Publishing, vol. 370, pp. 1–11. [Google Scholar] [CrossRef]

- Pacific Network on Globalisation. 2017. Fisheries Subsidies Negotiations: Key Concerns for Pacific Island Countries (PICs). November. Available online: https://ourworldisnotforsale.net/2017/PANG_Fisheries.pdf (accessed on 21 January 2020).

- Pettersen, Ingrid Kristine, Eivind Hestvik Brækkan, and Øystein Myrland. 2018. Are Norwegian fishermen selling in the same market? Journal of Commodity Markets 12: 9–18. [Google Scholar] [CrossRef]

- ReportLinker. 2017. Fishmeal & Fish Oil Market by Source, Livestock Application, Industrial Application, and Region—Forecast to 2022. Available online: https://www.reportlinker.com/p04884888/Fishmeal-Fish-Oil-Market-by-Source-Livestock-Application-Industrial-Application-and-Region-Forecast-to.html (accessed on 21 January 2020).

- Sala, Enric, Juan Mayorga, Christopher Costello, David Kroodsma, Maria L. D. Palomares, Daniel Pauly, U. Rashid Sumaila, and Dirk Zeller. 2018. The economics of fishing the high seas. Science Advances 4: 1–9. [Google Scholar] [CrossRef] [PubMed]

- Schuhbauer, Anna, Ratana Chuenpagdee, William W. L. Cheung, Krista Greer, and U. Rashid Sumaila. 2017. How subsidies affect the economic viability of small-scale fisheries. Marine Policy 82: 114–21. [Google Scholar] [CrossRef]

- Squires, Dale, Raymond Clarke, and Valerie Chan. 2014. Subsidies, public goods, and external benefits in fisheries. Marine Policy 45: 222–27. [Google Scholar] [CrossRef]

- Sumaila, U. Rashid, Ahmed S. Khan, Andrew J. Dyck, Reg Watson, Gordon Munro, Peter Tydemers, and Daniel Pauly. 2010. A bottom-up re-estimation of global fisheries subsidies. Journal of Bioeconomics 12: 201–25. [Google Scholar] [CrossRef]

- Sumaila, U. Rashid, Daniel Skerritt, Anna Schuhbauer, Naazia Ebrahim, Yang Li, Hong Sik Kim, Tabitha Grace Mallory, Vicky W. L. Lam, and Daniel Pauly. 2019a. A global dataset on subsidies to the fisheries sector. Data in Brief 27: 104706. [Google Scholar] [CrossRef] [PubMed]

- Sumaila, U. Rashid, Naazia Ebrahim, Anna Schuhbauer, Daniel Skerritt, Yang Li, Hong Sik Kim, Tabitha Grace Mallory, Vicky W. L. Lam, and Daniel Pauly. 2019b. Updated estimates and analysis of global fisheries subsidies. Marine Policy 109: 103695. [Google Scholar] [CrossRef]

- Sumaila, U. Rashid, Vicky Lam, Frédéric Le Manach, Wilf Swartz, and Daniel Pauly. 2016. Global fisheries subsidies: An updated estimate. Marine Policy 69: 189–93. [Google Scholar] [CrossRef]

- Sumaila, U. Rashid. 2015. The race to the fish: How fishing subsidies are emptying our oceans. The Conversation. October 19. Available online: https://theconversation.com/the-race-to-fish-how-fishing-subsidies-are-emptying-our-oceans-48227 (accessed on 9 November 2020).

- Teh, Lydia C. L., and Daniel Pauly. 2018. Who brings in the fish? The relative contribution of small-scale and industrial fisheries to food security in Southeast Asia. Frontiers in Marine Science 5: 44. [Google Scholar] [CrossRef]

- United Nations. 1961. United Nations Convention on the Law of the Seas. San Francisco: UN. Available online: https://www.wto.org/english/tratop_e/rulesneg_e/fish_e/1982_unclos.pdf (accessed on 21 January 2020).

- World Trade Organization. 2019a. Negotiations on Fisheries Subsidies. Geneva: WTO. Available online: https://www.wto.org/english/tratop_e/rulesneg_e/fish_e/fish_e.htm (accessed on 21 January 2020).

- World Trade Organization. 2019b. WTO Members Discuss Draft Text on Fisheries Subsidies Caps and Other Approaches. Geneva: WTO. Available online: https://www.wto.org/english/news_e/news19_e/fish_29mar19_e.htm (accessed on 21 January 2020).

- Žampa, Sabina, and Štefan Bojnec. 2017. The impact of subsidies on production innovation and sustainable growth. Management and Production Engineering Review 8: 54–63. [Google Scholar] [CrossRef]

- Zhang, Dengjun, Marius Sikveland, and Øystein Hermansen. 2018. Fishing fleet capacity and profitability. Marine Policy 88: 116–21. [Google Scholar] [CrossRef]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).