Impact of Readability on Corporate Bond Market

Abstract

1. Introduction

2. Related Literature

2.1. Readability Literature in the Equity Market

2.2. Readability Literature in the Debt Market

2.3. Other Literature Regarding Annual Reports (10-K Filings)

3. Readability Measures and Data

3.1. Readability Measures

3.2. Data

4. Hypotheses and Empirical Results

4.1. Hypotheses

4.2. Multivariate Results for USD Universe

4.2.1. Impact of Readability on OAS

4.2.2. Impact of Readability on OAS Volatility

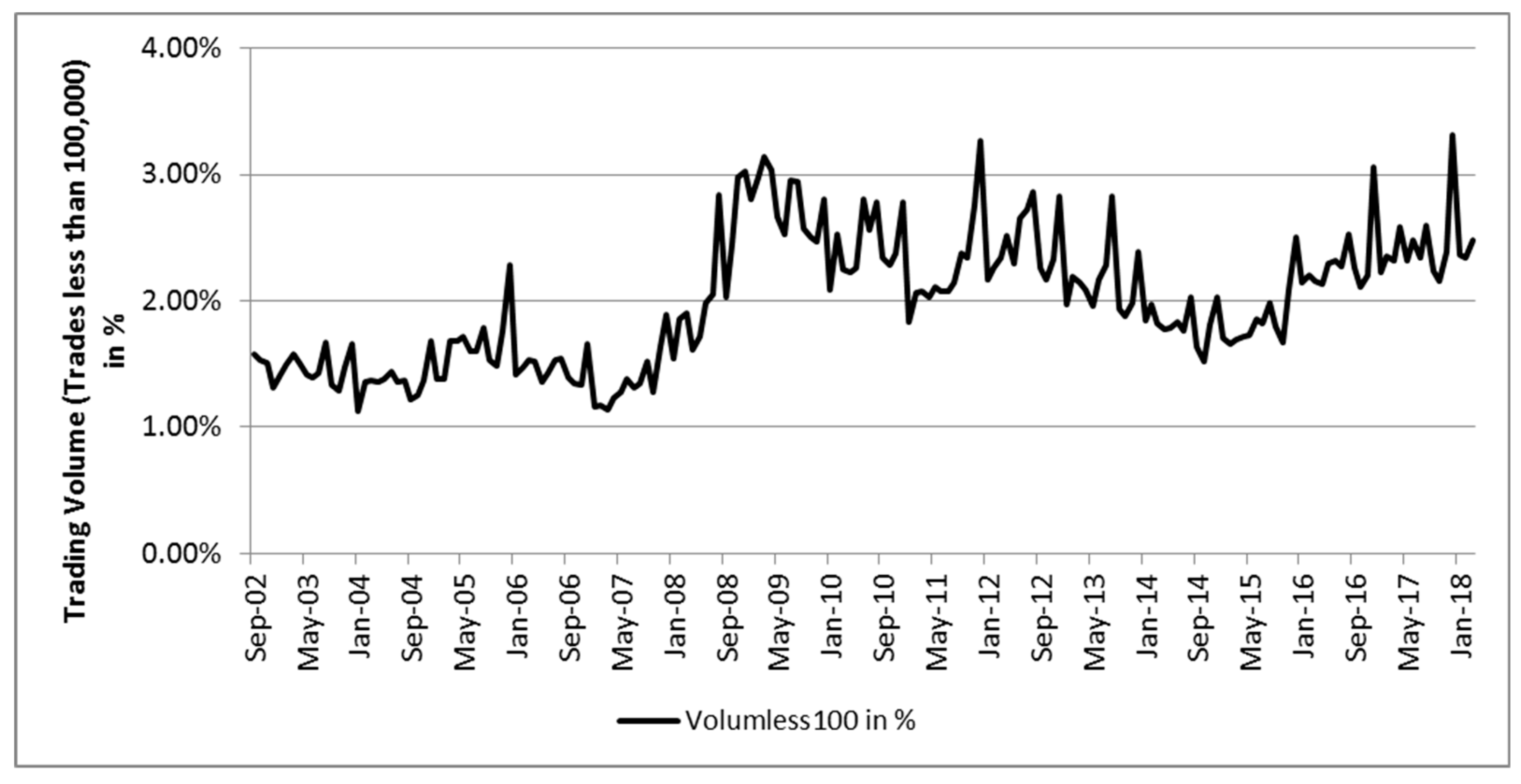

4.2.3. Impact of Readability on Trading Behavior: Transaction Costs (Average Price Spread), Transaction Cost Volatility, Trading Volume, Number of Trades, Trading Volume Volatility and Number of Trades Volatility

4.3. Multivariate Results for EUR Universe

4.3.1. Impact of Readability on OAS

4.3.2. Impact of Readability on OAS Volatility

5. Conclusions

Funding

Acknowledgments

Conflicts of Interest

Appendix A

| Control Variables | Definitions |

|---|---|

| Volatility30D | Volatility of stock return, based on 30 daily returns |

| Log (Market Cap) | Natural logarithm of market capitalisation of stocks |

| Debt/Enterprise Value | Debt to enterprise value ratio |

| Ebidta/Total Assets | Ebitda to total assets ratio |

| Rating Score | Rating scores of corporate bonds |

| Modified Duration | Modified duration of corporate bonds |

| Herfindahl Index | Herfindahl index based on revenues in different industry business segments Herfindahl index = sum of squares of percentage of revenue of individual industry segment in total revenue |

| ExOASdailyVol(t−1,t) | OAS volatility in excess of market OAS volatility based on daily OASs in time period t−1 to t |

| Log (Days Since Issue Date) | Natural logarithm of number of days since issue date of corporate bonds |

| Log (Market Value) | Natural logarithm of market value of corporate bonds |

| Price Spreadt | Average daily price spread of corporate bonds in month t Daily price spread is defined as |

| Price_Spread_STDt | Standard deviation of daily price spreads of corporate bonds in month t |

| TradingVolumet | Total trading volume of corporate bonds in month t |

| NoTradest | Total number of trades of corporate bonds in month t |

| AvgTradeSizet | Total trading volume/total number of trades of corporate bonds in month t |

| VolumeDailyVolt | Standard deviation of daily trading volume of corporate bonds in month t |

| NoTradesDailyVolt | Standard deviation of daily number of trades of corporate bonds in month t |

References

- Beatty, Anne, Lin Cheng, and Haiwen Zhang. 2018. Are risk factor disclosures still relevant? Evidence from market reactions to risk factor disclosures before and after the financial crisis. Contemporary Accounting Research 36: 805–38. [Google Scholar] [CrossRef]

- Biddle, Gary C., Gilles Hilary, and Rodrigo S. Verdi. 2009. How does financial reporting quality relate to investment efficiency? Journal of Accounting and Economics 48: 112–31. [Google Scholar] [CrossRef]

- Bloomfield, Robert J. 2002. The “incomplete revelation hypothesis” and financial reporting. Accounting Horizons: September 16: 233–43. [Google Scholar] [CrossRef]

- Bonsall, Samuel B., and Brian P. Miller. 2017. The impact of narrative disclosure readability on bond ratings and the cost of debt. Review of Accounting Studies 22: 608–43. [Google Scholar] [CrossRef]

- Campbell, John L., Hsinchun Cheng, Dan S. Dhaliwal, Hsin-min Lu, and Logan B. Steele. 2014. The information content of mandatory risk factor disclosures in corporate filings. Review of Accounting Studies 19: 396–455. [Google Scholar] [CrossRef]

- Chakravarty, Sugato, and Asani Sarkar. 2003. Trading costs in three U.S. bond markets. Journal of Fixed Income 13: 39–48. [Google Scholar] [CrossRef]

- Chin, Michael V., Yue Liu, and Kevin Moffitt. 2018. Voluntary Disclosure through the Ranking of Risk Factors in the 10-K. Working Paper. New Brunswick, NJ, USA: Rutgers University. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3142990 (accessed on 30 November 2019).

- Dick-Nielsen, Jens. 2014. How to Clean Enhanced Trace Data. Working Paper. Copenhagen, Denmark: Copenhagen Business School. Available online: https://ssrn.com/abstract=2337908 (accessed on 30 November 2019).

- Edwards, Amy K., Lawrence E. Harris, and Michael S. Piwowar. 2007. Corporate bond market transaction costs and transparency. Journal of Finance 63: 1421–51. [Google Scholar] [CrossRef]

- Ertugrul, Mine, Jin Lei, Jiaping Qiu, and Chi Wan. 2017. Annual report readability, tone ambiguity, and the cost of borrowing. Journal of Financial and Quantitative Analysis 52: 811–36. [Google Scholar] [CrossRef]

- Feldman, Ronen, Suresh Govindaraj, Joshua Livnat, and Benjamin Segal. 2010. Management’s tone change, post earnings announcement drift and accruals. Review of Accounting Studies 15: 915–53. [Google Scholar] [CrossRef]

- Gunning, Robert. 1952. The Technique of Clear Writing. New York: McGraw-Hill, pp. 36–37. [Google Scholar]

- Guo, Liang, Donald Lien, Maggie Hao, and Hongxian Zhang. 2017. Uncertainty and liquidity in corporate bond market. Applied Economics 49: 4760–81. [Google Scholar] [CrossRef]

- Hong, Gwangheon, and Arthur D. Warga. 2000. An empirical study of bond market transactions. Financial Analyst Journal 56: 32–46. [Google Scholar] [CrossRef]

- Hu, Nan, Ling Liu, and Lu Zhu. 2018. Credit default swap spreads and annual report readability. Review of Quantitative Finance and Accounting 50: 1–31. [Google Scholar] [CrossRef]

- Huang, Shirley J., and Jun Yu. 2010. Bayesian analysis of structural credit risk models with microstructure noises. Journal of Economic Dynamics and Control 34: 2259–72. [Google Scholar] [CrossRef]

- Korteweg, Arthur G., and Nicholas Polson. 2010. Corporate Credit Spreads under Parameter Uncertainty. Working Paper. Los Angeles, CA, USA: University of Southern California. Chicago, IL, USA: University of Chicago. Available online: https://faculty.chicagobooth.edu/nicholas.polson/research/papers/Corpo.pdf (accessed on 30 November 2019).

- Kravet, Todd, and Volkan Muslu. 2013. Textual risk disclosures and investors’ risk perceptions. Review of Accounting Studies 18: 1088–122. [Google Scholar] [CrossRef]

- Lawrence, Alastair. 2013. Individual investors and financial disclosure. Journal of Accounting and Economics 56: 130–47. [Google Scholar] [CrossRef]

- Lehavy, Reuven, Feng Li, and Kenneth Merkley. 2011. The effect of annual report readability on analyst following and the properties of their earnings forecasts. The Accounting Review 86: 1087–115. [Google Scholar] [CrossRef]

- Li, Feng. 2006. Do Stock Market Investors Understand the Risk Sentiment of Corporate Annual Reports? Working Paper. Shanghai, China: Shanghai Advanced Institute of Finance, Shanghai Jiaotong University. Available online: https://ssrn.com/abstract=898181 (accessed on 30 November 2019).

- Li, Feng. 2008. Annual report readability, current earnings, and earnings persistence. Journal of Accounting and Economics 45: 221–47. [Google Scholar] [CrossRef]

- Loughran, Tim, and Bill McDonald. 2011. When is a liability not a liability? Textual analysis, dictionaries, and 10-Ks. Journal of Finance 66: 35–65. [Google Scholar] [CrossRef]

- Loughran, Tim, and Bill McDonald. 2014. Measuring readability in financial disclosures. Journal of Finance 69: 1643–71. [Google Scholar] [CrossRef]

- Merton, Robert C. 1974. On the pricing of corporate debt: The risk structure of interest rates. Journal of finance 29: 449–70. [Google Scholar]

- Miller, Brain P. 2010. The effects of reporting complexity on small and large investor trading. The Accounting Review 85: 2107–43. [Google Scholar] [CrossRef]

| 1 | |

| 2 | The reason for using the ultimate parent company is that investors generally consider all companies under the ultimate parent company as sharing the same default risk. |

| 3 | Based on Quoniam Asset Management GmbH’s contracts with data providers I cannot publish the Worldscope data. |

| 4 | Based on Quoniam Asset Management GmbH’s contracts with data providers I cannot publish the FINRA Trace data. |

| 5 | The EUR universe makes up only 11% of the entire senior, unsecured, bullet investment grade EUR-denominated corporate bonds in the Merrill Lynch Global Corporate Index. The reason for this is that I only have 10-K filings for publicly traded firms in US. Annual reports for firms with EUR-denominated bonds and without 10-K filings are not available. |

| 6 | Due to availability of daily OASs I run this regression for the time period 2009–2017. |

| 7 | Other currencies have very small number of observations. Therefore, an analysis with other currencies is not possible here. |

| 8 | Due to availability of daily OASs, I run this regression for the time period 2009–2017. |

| Jan. 1999–Dec. 2017 | USD Universe | EUR Universe |

|---|---|---|

| No. of bond and month: all corporate bonds | 1,366,934 | 417,640 |

| No. of bond and month: investment grade, senior, unsecured, bullet USD corporate bonds | 818,018 | 271,332 |

| No. of bond and month: investment grade, senior, unsecured, bullet USD corporate bonds with mapping filing data/Number of Words ≥ 3000 | 415,890 | 27,946 |

| No. of bonds | 8259 | 640 |

| No. of ultimate parent companies | 748 | 100 |

| No. of companies | 1258 | 138 |

| Year | Number of Ultimate Parent Companies | Total Number of Words | Fog Index |

|---|---|---|---|

| 1999 | 399 | 22,789 | 23.26 |

| 2000 | 426 | 22,216 | 23.10 |

| 2001 | 452 | 25,214 | 23.17 |

| 2002 | 475 | 27,304 | 23.00 |

| 2003 | 492 | 37,036 | 23.39 |

| 2004 | 502 | 39,918 | 23.05 |

| 2005 | 508 | 43,703 | 23.00 |

| 2006 | 519 | 47,363 | 22.96 |

| 2007 | 551 | 49,305 | 22.98 |

| 2008 | 568 | 52,140 | 23.03 |

| 2009 | 581 | 56,707 | 23.06 |

| 2010 | 580 | 57,526 | 23.18 |

| 2011 | 587 | 58,406 | 23.29 |

| 2012 | 595 | 58,834 | 23.38 |

| 2013 | 594 | 58,956 | 23.32 |

| 2014 | 587 | 59,571 | 23.45 |

| 2015 | 575 | 59,260 | 23.45 |

| 2016 | 545 | 60,859 | 23.50 |

| 2017 | 512 | 61,488 | 24.45 |

| OASit | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 |

|---|---|---|---|---|---|---|---|---|---|

| Readability Measures: | |||||||||

| Log (Number of Words) | 3.60 (5.81) | 3.00 (4.78) | |||||||

| Fog Index | 0.39 (1.91) | 0.31 (1.42) | |||||||

| Average Sentence Length | 0.21 (2.50) | 0.21 (2.29) | |||||||

| Percentage Complex Words | −0.64 (−1.90) | −0.83 (−2.59) | |||||||

| Control Variables | |||||||||

| Volatility30D | 2.78 (15.54) | 2.77 (15.44) | 2.78 (15.54) | 2.78 (15.53) | 2.78 (15.51) | 2.80 (15.39) | 2.81 (15.53) | 2.81 (15.52) | 2.81 (15.48) |

| Log (MarketCap) | −16.98 (−16.75) | −17.39 (−17.20) | −16.99 (−16.76) | −16.98 (−16.74) | −16.92 (−16.40) | −17.76 (−16.27) | −17.42 (−15.87) | −17.42 (−15.87) | −17.37 (−15.67) |

| Debt/Enterprise Value | 74.73 (18.76) | 73.63 (18.53) | 74.93 (18.86) | 74.84 (18.82) | 74.26 (18.51) | 73.51 (17.88) | 74.56 (18.14) | 74.54 (18.12) | 73.88 (17.83) |

| Ebidta/Total Assets | −72.11 (−7.24) | −68.24 (−6.93) | −71.63 (−7.24) | −71.88 (−7.24) | −73.37 (−7.24) | −62.49 (−6.03) | −65.04 (−6.25) | −65.17 (−6.24) | −66.91 (−6.28) |

| Rating Score | 10.62 (33.42) | 10.33 (32.44) | 10.62 (33.39) | 10.60 (33.15) | 10.58 (33.90) | 10.43 (32.22) | 10.68 (32.95) | 10.66 (32.70) | 10.62 (33.28) |

| Modified Duration | 5.77 (47.09) | 5.75 (46.79) | 5.77 (47.11) | 5.77 (47.07) | 5.77 (46.61) | 5.66 (44.86) | 5.67 (45.06) | 5.67 (45.03) | 5.68 (44.64) |

| Herfindahl Index | −14.23 (−5.51) | −14.67 (−5.70) | −14.78 (−5.77) | −15.17 (−6.11) | |||||

| Fixed Effect: Month | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Fixed Effect: Industry Sector | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| R-squared | 62.79% | 62.82% | 62.79% | 62.79% | 62.79% | 62.51% | 62.48% | 62.49% | 62.49% |

| Observations | 415,890 | 415,890 | 415,890 | 415,890 | 415,890 | 399,008 | 399,008 | 399,008 | 399,008 |

| ExOASdailyVol(t,t+1) | 1 | 2 |

|---|---|---|

| Readability Measures: | ||

| Log (Number of Words) | 0.36 (1.64) | |

| Control Variables | ||

| ExOASdailyVol(t-1,t) | 0.66 (20.79) | 0.66 (20.76) |

| Log (Days Since Issue Date) | 0.10 (1.28) | 0.10 (1.28) |

| Log (Market Value) | 0.26 (1.11) | 0.21 (0.93) |

| Rating Score | 0.21 (1.95) | 0.18 (1.86) |

| Fixed Effect: Month | Yes | Yes |

| Fixed Effect: Industry Sector | Yes | Yes |

| R-squared | 52.99% | 53.01% |

| Observations | 16,587 | 16,587 |

| Price Spreadt+1 | 1 | 2 |

|---|---|---|

| Readability Measures: | ||

| Log (Number of Words) | 0.03 (2.72) | |

| Control Variables | ||

| Price Spreadt | 0.01 (1.11) | 0.01 (1.12) |

| Log (Days Since Issue Date) | 0.05 (10.38) | 0.05 (10.47) |

| Log (Market Value) | −0.09 (−7.27) | −0.09 (−7.45) |

| Volatility30D | 0.01 (6.02) | 0.01 (5.96) |

| Rating Score | −0.004 (−0.82) | −0.01 (−1.61) |

| Modified Duration | 0.03 (19.03) | 0.03 (19.03) |

| Fixed Effect: Month | Yes | Yes |

| Fixed Effect: Industry Sector | Yes | Yes |

| R-squared | 27.88% | 27.94% |

| Observations | 13,008 | 13,008 |

| Price_Spread_STDt+1 | 1 | 2 |

|---|---|---|

| Readability Measures: | ||

| Log (Number of Words) | 0.02 (1.92) | |

| Control Variables | ||

| Price_Spread_STDt | 0.001 (1.37) | 0.001 (1.42) |

| Log (Days Since Issue Date) | 0.03 (5.44) | 0.03 (5.46) |

| Log (Market Value) | −0.06 (−4.84) | −0.06 (−4.94) |

| Volatility30D | 0.01 (6.83) | 0.01 (6.77) |

| Rating Score | 0.0005 (0.11) | −0.001 (−0.23) |

| Modified Duration | 0.03 (17.40) | 0.03 (17.26) |

| Fixed Effect: Month | Yes | Yes |

| Fixed Effect: Industry Sector | Yes | Yes |

| R-squared | 20.45% | 20.51% |

| Observations | 8719 | 8719 |

| Dependent Variables: | TradingVolumet+1 | NoTradest+1 | AvgTradeSizet+1 |

|---|---|---|---|

| Readability Measures: | |||

| Log (Number of Words) | 0.50 (0.45) | 3.82 (1.68) | −0.02 (−1.68) |

| Control Variables | |||

| TradingVolumet | 0.58 (7.89) | ||

| NoTradest | 0.84 (17.75) | ||

| AvgTradeSizet | 0.03 (1.76) | ||

| Log (Days Since Issue Date) | −5.94 (−2.50) | −0.80 (−0.52) | −0.20 (−16.96) |

| Log (Market Value) | 38.40 (7.43) | 29.41 (5.43) | 0.12 (7.82) |

| Volatility30D | 0.13 (1.62) | 0.19 (1.39) | −0.0001 (−0.19) |

| Rating Score | 1.19 (2.27) | −1.86 (−1.05) | 0.09 (11.12) |

| Modified Duration | −0.35 (−2.44) | −1.40 (−3.97) | 0.03 (9.70) |

| Fixed Effect: Month | Yes | Yes | Yes |

| Fixed Effect: Industry Sector | Yes | Yes | Yes |

| R-squared | 57.05% | 71.46% | 9.23% |

| Observations | 27,428 | 27,428 | 26,148 |

| Dependent Variable: | VolumeDailyVolt+1 | NoTradesDailyVolt+1 |

|---|---|---|

| Readability Measures: | ||

| Log (Number of Words) | 0.08 (0.82) | 0.15 (1.76) |

| Control Variables | ||

| VolumeDailyVolt | 0.08 (2.92) | |

| NoTradesDailyVolt | 0.46 (8.33) | |

| Log (Days Since Issue Date) | −1.19 (−12.68) | 0.004 (0.07) |

| Log (Market Value) | 4.43 (21.67) | 1.34 (7.61) |

| Volatility30D | 0.02 (2.08) | 0.01 (1.85) |

| Rating Score | 0.18 (4.85) | −0.06 (−0.90) |

| Modified Duration | −0.03 (−2.34) | −0.07 (−4.42) |

| Fixed Effect: Month | Yes | Yes |

| Fixed Effect: Industry Sector | Yes | Yes |

| R-squared | 17.32% | 40.88% |

| Observations | 27,233 | 27,233 |

| OASit | 1 | 2 | 3 | 4 | 5 |

|---|---|---|---|---|---|

| Readability Measures: | |||||

| Log (Number of Words) | 4.80 (4.11) | 4.85 (4.00) | |||

| Fog Index | 0.38 (0.58) | 0.37 (0.54) | |||

| Control Variables | |||||

| Volatility30D | 2.68 (13.38) | 2.64 (13.04) | 2.68 (13.39) | 2.63 (12.83) | 2.67 (13.20) |

| Log (MarketCap) | −16.83 (−6.10) | −18.33 (−6.29) | −16.87 (−6.08) | −19.79 (−5.88) | −18.23 (−5.70) |

| Debt/Enterprise Value | 40.71 (4.91) | 39.08 (4.74) | 41.21 (5.01) | 40.61 (4.72) | 42.93 (5.02) |

| Ebidta/Total Assets | −242.65 (−6.07) | −236.78 (−5.96) | −243.01 (−6.06) | −248.07 (−5.71) | −253.38 (−5.77) |

| Rating Score | 8.40 (10.19) | 7.76 (8.89) | 8.40 (10.22) | 7.70 (8.37) | 8.36 (9.68) |

| Modified Duration | 5.36 (20.27) | 5.35 (20.27) | 5.36 (20.26) | 5.25 (19.28) | 5.26 (19.30) |

| Herfindahl Index | −10.93 (−1.78) | −11.63 (−1.88) | |||

| Fixed Effect: Month | Yes | Yes | Yes | Yes | Yes |

| Fixed Effect: Industry Sector | Yes | Yes | Yes | Yes | Yes |

| R-squared | 63.74% | 63.79% | 63.74% | 63.89% | 63.83% |

| Observations | 27,946 | 27,946 | 27,946 | 27,350 | 27,350 |

| ExOASdailyVol(t,t+1) | 1 | 2 |

|---|---|---|

| Readability Measures: | EUR | EUR |

| Log (Number of Words) | 0.79 (1.19) | |

| Control Variables | ||

| ExOASdailyVol(t−1, t) | 1.42 (19.04) | 1.41 (19.20) |

| Log (Days Since Issue Date) | 0.60 (3.00) | 0.56 (2.95) |

| Log (Market Value) | −1.31 (−1.09) | −1.46 (−1.17) |

| Rating Score | −0.29 (−0.86) | 0.23 (0.68) |

| Fixed Effect: Month | Yes | Yes |

| Fixed Effect: Industry Sector | Yes | Yes |

| R-squared | 60.96% | 60.99% |

| Observations | 1182 | 1182 |

© 2019 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Fang-Klingler, J. Impact of Readability on Corporate Bond Market. J. Risk Financial Manag. 2019, 12, 184. https://doi.org/10.3390/jrfm12040184

Fang-Klingler J. Impact of Readability on Corporate Bond Market. Journal of Risk and Financial Management. 2019; 12(4):184. https://doi.org/10.3390/jrfm12040184

Chicago/Turabian StyleFang-Klingler, Jieyan. 2019. "Impact of Readability on Corporate Bond Market" Journal of Risk and Financial Management 12, no. 4: 184. https://doi.org/10.3390/jrfm12040184

APA StyleFang-Klingler, J. (2019). Impact of Readability on Corporate Bond Market. Journal of Risk and Financial Management, 12(4), 184. https://doi.org/10.3390/jrfm12040184