Some Dynamic and Steady-State Properties of Threshold Auto-Regressions with Applications to Stationarity and Local Explosivity

Abstract

:1. Introduction

2. Moment-Generating Functions of TAR(1) Models with Exogenous Markov-Triggers

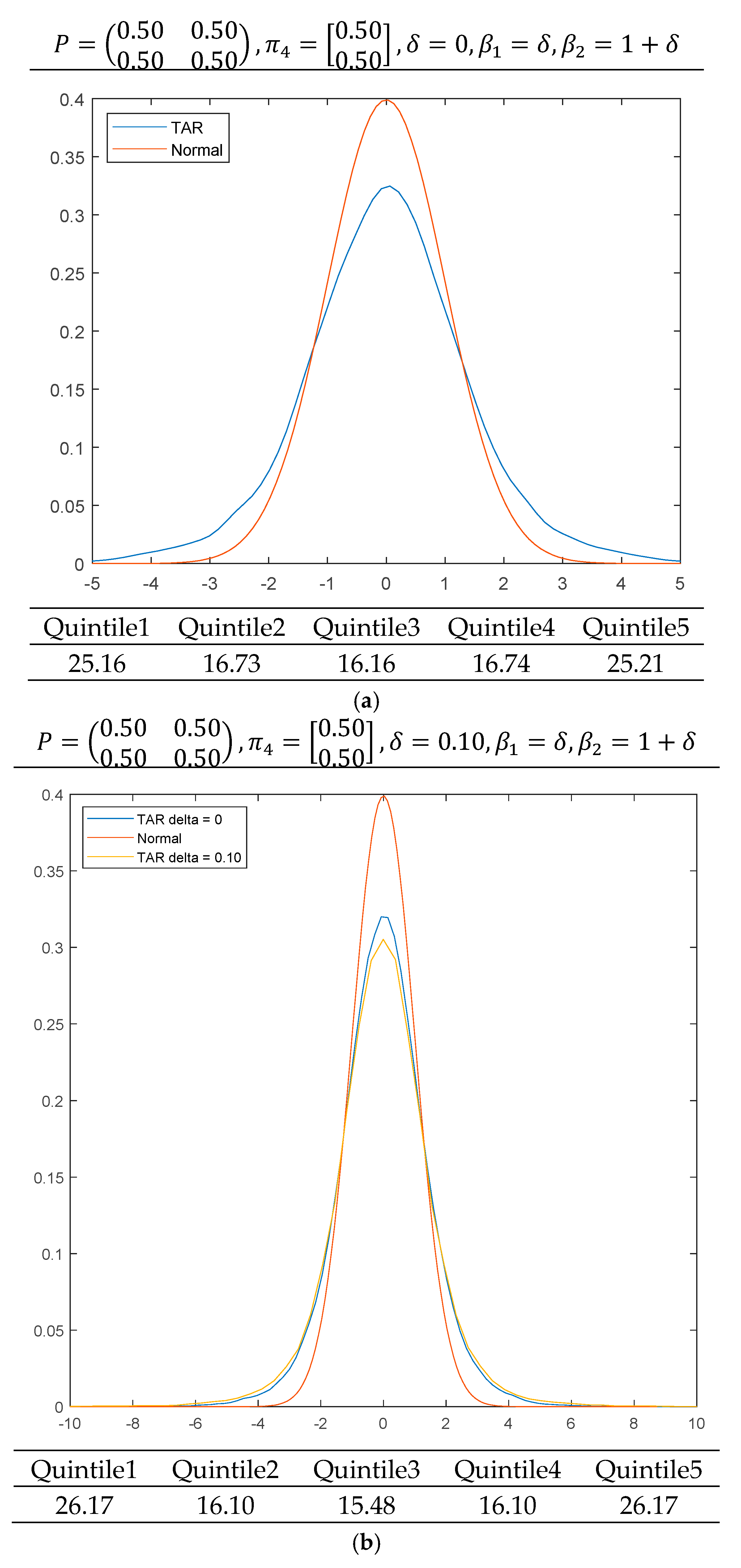

Steady-State Distribution under Markovian States

3. A Caveat on Simulating the Steady State

4. Simulation Results

5. Conclusions

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

References

- Ahmed, Muhammad Farid, and Stephen E. Satchell. 2018. What Proportion of Time is a Particular Market Inefficient? … A Method for Analysing the Frequency of Market Efficiency when Equity Prices follow Threshold Autoregression. Journal of Time Series Econometrics 10. [Google Scholar] [CrossRef]

- Aleem, Abdul, and Amine Lahiani. 2014. A Threshold Vector Auto-regression Model of Exchange-rate pass-through in Mexico. Research in International Business and Finance 30. [Google Scholar] [CrossRef]

- Caner, Mehmet, and Bruce E. Hansen. 2001. Threshold Autoregression with a Unit Root. Econometrica 69: 1555–96. Available online: http://www.jstor.org/stable/2692267 (accessed on 10 December 2018).

- Engel, Charles. 1994. Can the Markov switching model forecast exchange rates? Journal of International Economics 36: 151–65. [Google Scholar] [CrossRef]

- Foerster, Andrew, Juan Rubio-Ramirez, Daniel F. Waggoner, and Tao Zha. 2016. Perturbation methods for Markov-Switching DSGE Models. Quantitative Economics 7: 637–69. [Google Scholar] [CrossRef]

- Gaver, Donald P., and P. A. W. Lewis. 1980. First-Order Autoregressive Gamma sequences and Point Processes. Advanced Applied Probability 12: 727–45. [Google Scholar] [CrossRef]

- Goldfeld, S. M., and R. E. Quandt. 1973. A Markov Model for Switching Regressions. Journal of Econometrics 1: 3–16. [Google Scholar] [CrossRef]

- Gonzalo, Jesus, and Martin Gonzalez-Rozada. 1997. Threshold Unit Root Models. DES—Working Papers. Statistics and Econometrics. WS. Madrid: Universidad Carlos III de Madrid. [Google Scholar]

- Goodwin, Barry K., and Daniel C. Harper. 2000. Price Transmission, threshold behaviour and asymmetric adjustment in the U.S. pork sector. Journal of Agricultural and Applied Economics 32: 543–53. [Google Scholar] [CrossRef]

- Grynkiv, Galyna, and Lars Stentoft. 2018. Stationary Threshold Vector Autoregressive Models. Journal of Risk and Financial Management 11: 45. [Google Scholar] [CrossRef]

- Hamilton, J. D. 1989. A New Approach to the Economic Analysis of Nonstationary Time Series and the Business Cycle. Econometrica 57: 319–52. [Google Scholar] [CrossRef]

- Hamilton, James D. 1990. Analysis of Time Series Subject to Regime Changes. Journal of Econometrics 45: 39–70. [Google Scholar] [CrossRef]

- Hamilton, James D. 2010. Regime switching models. In Macroeconometrics and Time Series Analysis. Edited by Steven N. Durlauf and Lawrence E. Blume. London: Palgrave Macmillan. [Google Scholar]

- Hansen, Bruce E. 2011. Threshold autoregression in Economics. Statistics and Its Interface 4: 123–7. [Google Scholar] [CrossRef]

- Kapetanios, George, and Yongcheol Shin. 2006. Unit root tests in three-regime SETAR models. The Econometrics Journal 9: 252–78. [Google Scholar] [CrossRef]

- Knight, John, and Stephen E. Satchell. 2011. Some New Results for Threshold AR(1) Models. Journal of Time Series Econometrics 3. [Google Scholar] [CrossRef]

- Knight, John, Stephen E. Satchell, and Nandini Srivastava. 2014. Steady State Distributions for Models of Locally Explosive Regimes: Existence and Econometric Implications. Economic Modelling 41: 281–8. [Google Scholar] [CrossRef]

- Pourahmadi, Mohsen. 1988. Stationarity of the solution of and analysis of non-Gaussian dependent random variable. Journal of Time Series Analysis 9: 225–30. [Google Scholar] [CrossRef]

- Rosenthal, Jeffrey S. 1995. Convergence Rates for Markov Chains. SIAM Review 37: 387–405. [Google Scholar] [CrossRef]

- Schmitt-Grohe, Stephanie, and Martin Uribe. 2004. Solving Dynamic General Equilibrium Models using a Second-order approximation to the Policy Function. Journal of Economic Dynamics and Control 28. [Google Scholar] [CrossRef]

- Stuart, Alan, and Keith Ord. 1994. Kendall’s Advanced Theory of Statistics: Distribution Theory: 1, 6th ed. London: Wiley-Blackwell, chps. 3–4. [Google Scholar]

- Timmermann, Allan. 2000. Moments of Markov Switching Models. Journal of Econometrics 96: 75–111. [Google Scholar] [CrossRef]

- Tong, Howell. 1978. On a Threshold Model. In Pattern Recognition and Signal Processing. Edited by Chun Hsien Chen. Amsterdam: Tijhthoff and Noordhoff. [Google Scholar]

| 1 | These results have not been included but are available upon request. |

| 2 | We have checked that the kurtosis exist by verifying that Indeed, for our most extreme case , the kurtosis does exist as the criterion for its existence is satisfied: . |

| Steady State Vector | Transition Matrix | Mean | Stdev | Skewness | Kurtosis | |

|---|---|---|---|---|---|---|

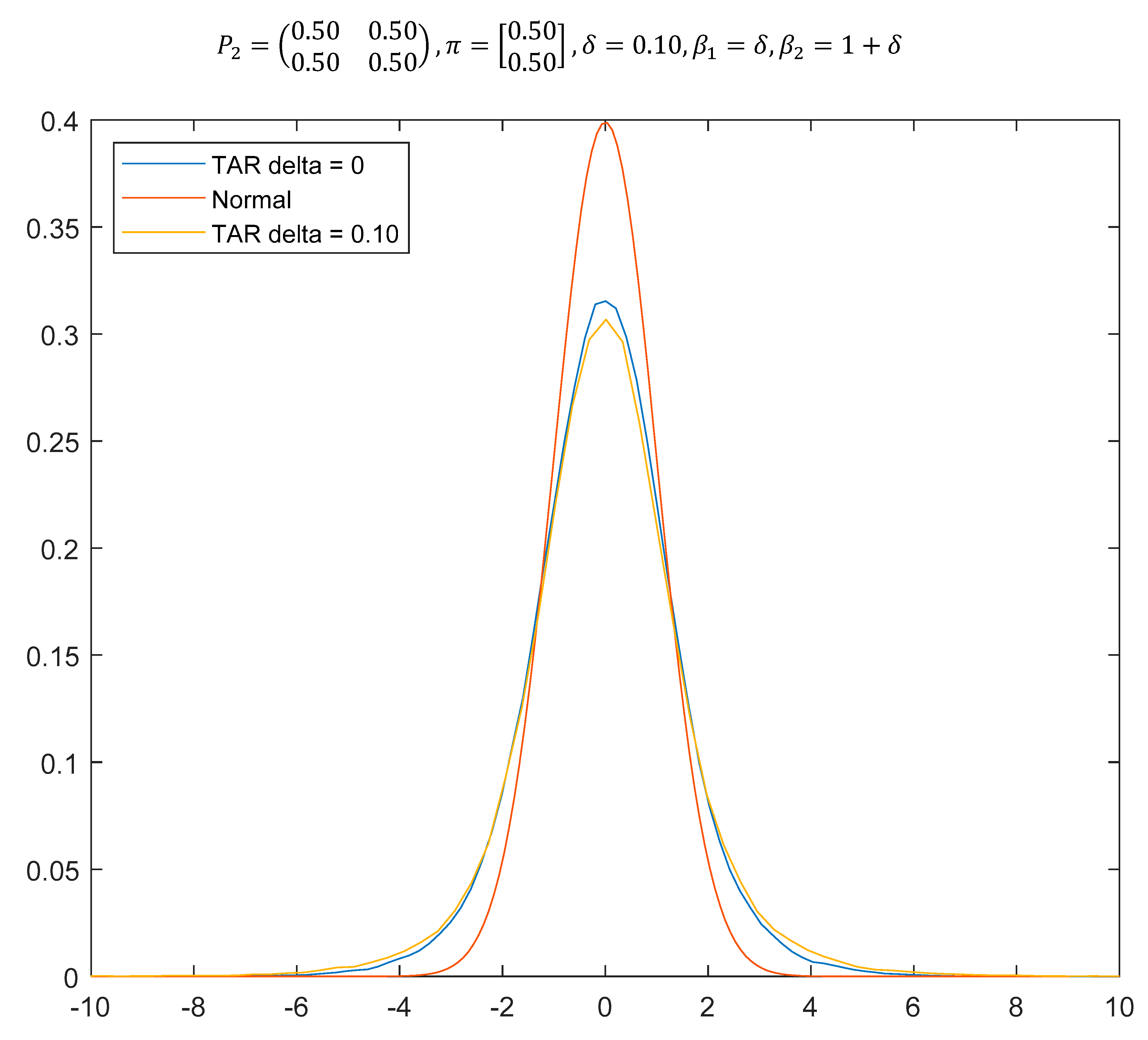

| [0.50 0.50] | 0 | 0.0004 | 2.450 | 0.00289 | 8.786 | |

| [0.50 0.50] | 0.10 | −0.170 | 78.17 | 0.2761 | 424.7 | |

| [0.50 0.50] | 0 | −0.0001 | 1.4139 | −0.0004 | 4.480 | |

| [0.50 0.50] | 0.10 | 0.0000 | 1.6014 | −0.0012 | 6.837 |

| Steady State Vector | Mean | Stdev | Skewness | Kurtosis | ||

|---|---|---|---|---|---|---|

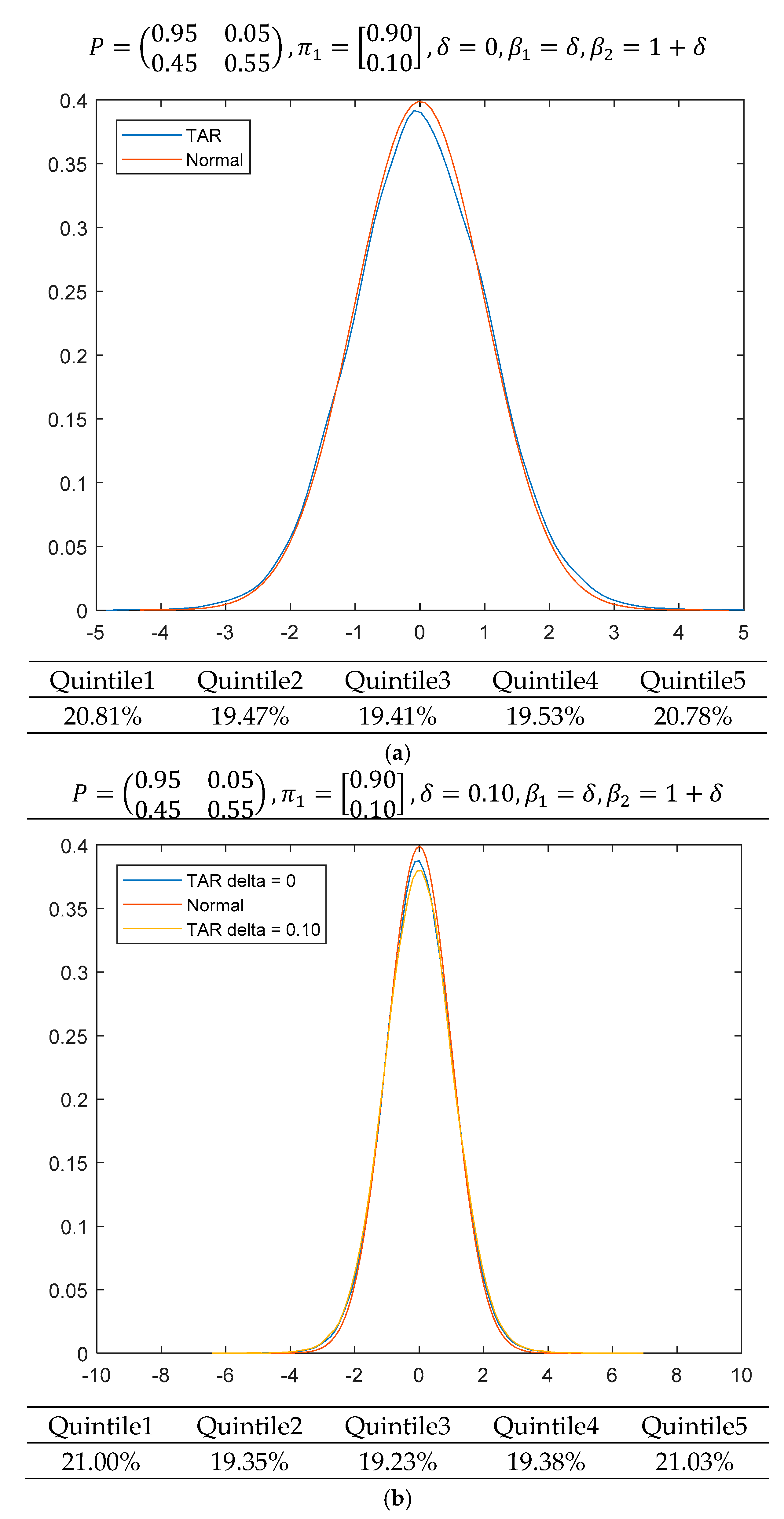

| [0.90 0.10] | 0 | 0.0001 | 1.0544 | −0.0012 | 3.306 | |

| [0.90 0.10] | 0.01 | −0.0007 | 1.0552 | 0.0004 | 3.311 | −4.1437 |

| [0.90 0.10] | 0.03 | 0.0001 | 1.0583 | −0.0008 | 3.336 | −3.1529 |

| [0.90 0.10] | 0.05 | 0.0007 | 1.0608 | −0.0006 | 3.362 | −2.6913 |

| [0.90 0.10] | 0.10 | 0.0007 | 1.0714 | −0.0007 | 3.442 | −2.0628 |

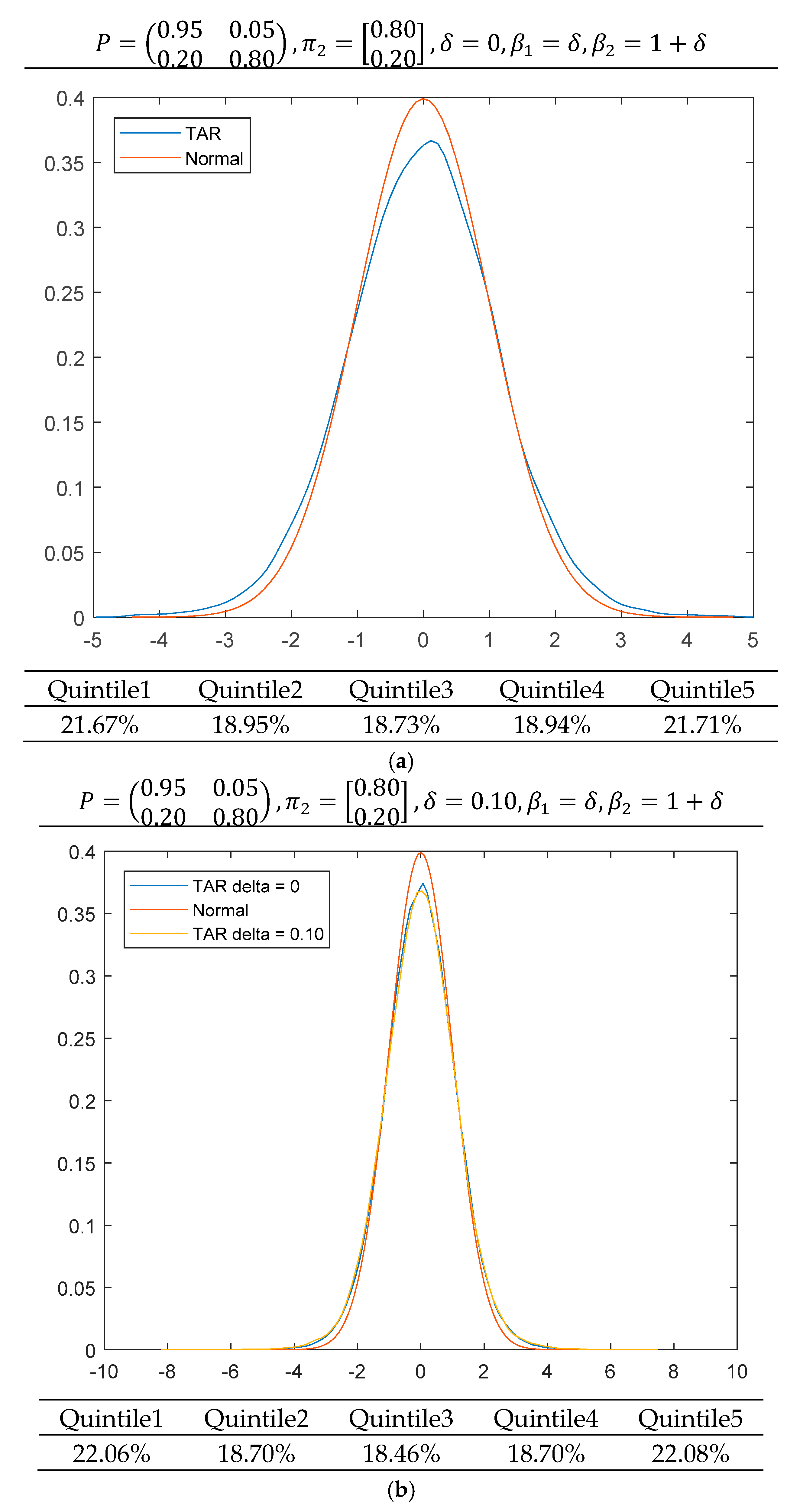

| [0.80 0.20] | 0 | 0.0004 | 1.118 | −0.002 | 3.597 | |

| [0.80 0.20] | 0.01 | −0.0000 | 1.121 | −0.0007 | 3.630 | −3.6821 |

| [0.80 0.20] | 0.03 | 0.0001 | 1.128 | −0.0016 | 3.705 | −2.7993 |

| [0.80 0.20] | 0.05 | 0.0005 | 1.134 | 0.003 | 3.762 | −2.3868 |

| [0.80 0.20] | 0.10 | 0.0001 | 1.152 | 0.0003 | 3.967 | −1.8230 |

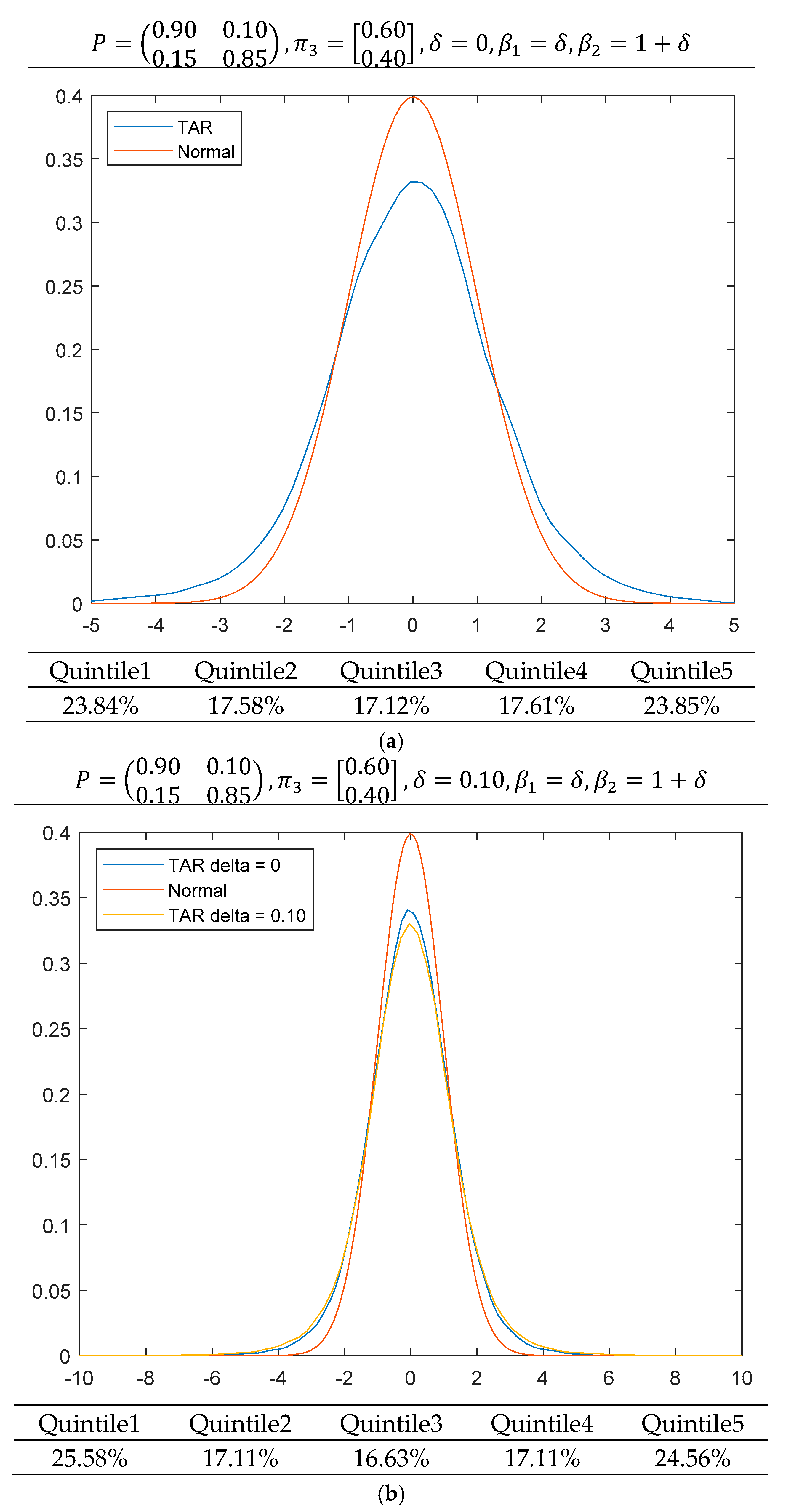

| [0.60 0.40] | 0 | 0.0004 | 1.291 | −0.003 | 4.195 | |

| [0.60 0.40] | 0.01 | −0.0011 | 1.300 | −0.001 | 4.277 | −2.7591 |

| [0.60 0.40] | 0.03 | −0.0001 | 1.316 | −0.005 | 4.421 | −2.0921 |

| [0.60 0.40] | 0.05 | −0.0007 | 1.339 | −0.002 | 4.660 | −1.7779 |

| [0.60 0.40] | 0.10 | −0.0004 | 1.400 | 0.002 | 5.410 | −1.3434 |

| [0.50 0.50] | 0 | 0.0017 | 1.413 | 0.0026 | 4.470 | |

| [0.50 0.50] | 0.01 | −0.0004 | 1.428 | −0.0042 | 4.612 | −2.2976 |

| [0.50 0.50] | 0.03 | −0.0006 | 1.460 | −0.0001 | 4.915 | −1.7385 |

| [0.50 0.50] | 0.05 | −0.0004 | 1.494 | −0.0021 | 5.302 | −1.4735 |

| [0.50 0.50] | 0.10 | 0.001 | 1.601 | 0.0227 | 6.720 | −1.1036 |

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Ahmed, M.F.; Satchell, S. Some Dynamic and Steady-State Properties of Threshold Auto-Regressions with Applications to Stationarity and Local Explosivity. J. Risk Financial Manag. 2019, 12, 123. https://doi.org/10.3390/jrfm12030123

Ahmed MF, Satchell S. Some Dynamic and Steady-State Properties of Threshold Auto-Regressions with Applications to Stationarity and Local Explosivity. Journal of Risk and Financial Management. 2019; 12(3):123. https://doi.org/10.3390/jrfm12030123

Chicago/Turabian StyleAhmed, Muhammad Farid, and Stephen Satchell. 2019. "Some Dynamic and Steady-State Properties of Threshold Auto-Regressions with Applications to Stationarity and Local Explosivity" Journal of Risk and Financial Management 12, no. 3: 123. https://doi.org/10.3390/jrfm12030123

APA StyleAhmed, M. F., & Satchell, S. (2019). Some Dynamic and Steady-State Properties of Threshold Auto-Regressions with Applications to Stationarity and Local Explosivity. Journal of Risk and Financial Management, 12(3), 123. https://doi.org/10.3390/jrfm12030123