Clarifying the Response of Gold Return to Financial Indicators: An Empirical Comparative Analysis Using Ordinary Least Squares, Robust and Quantile Regressions

Abstract

1. Introduction

2. Econometric Methodology

2.1. Robust Regression

2.2. Quantile Regression

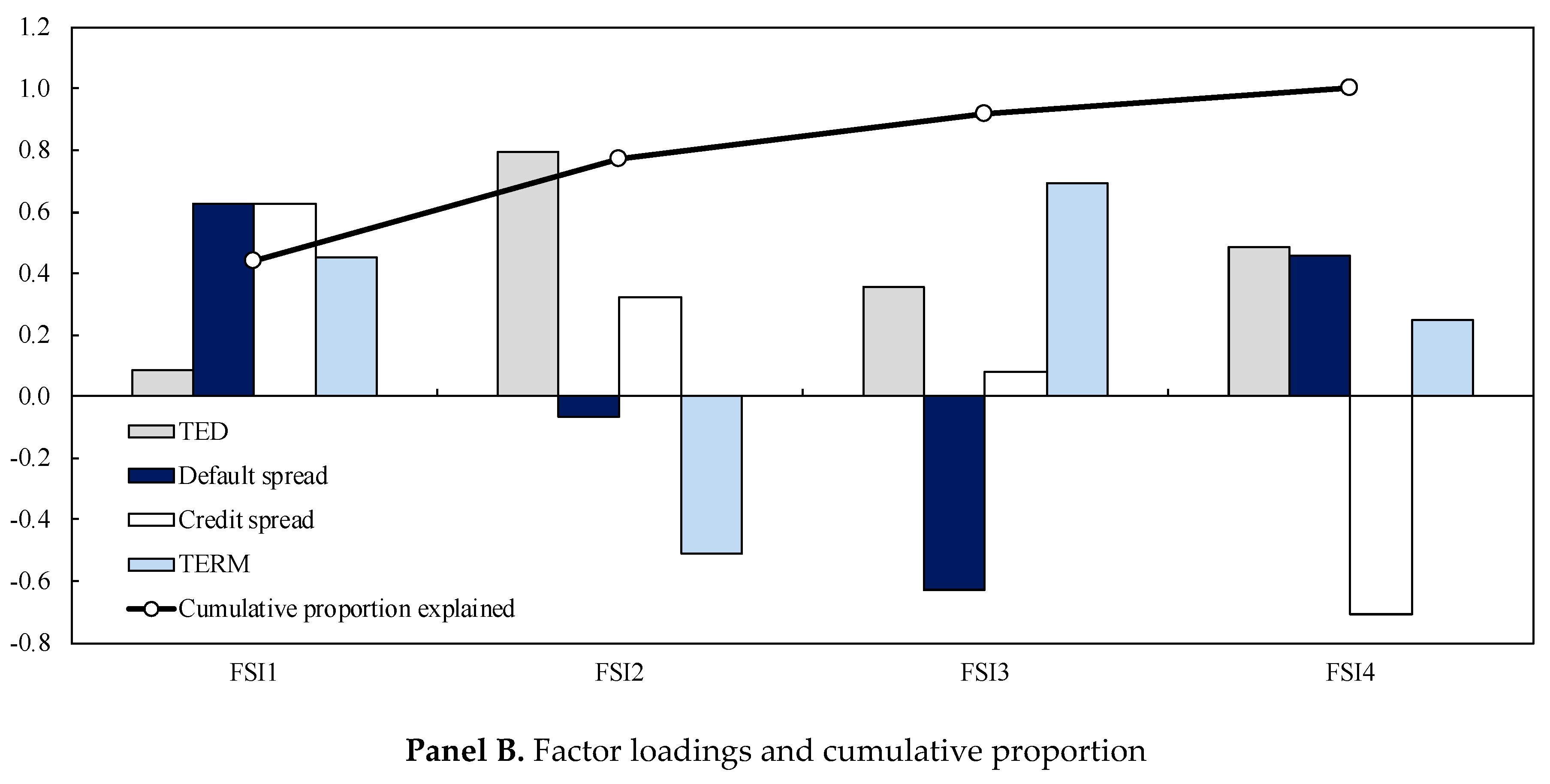

3. Data

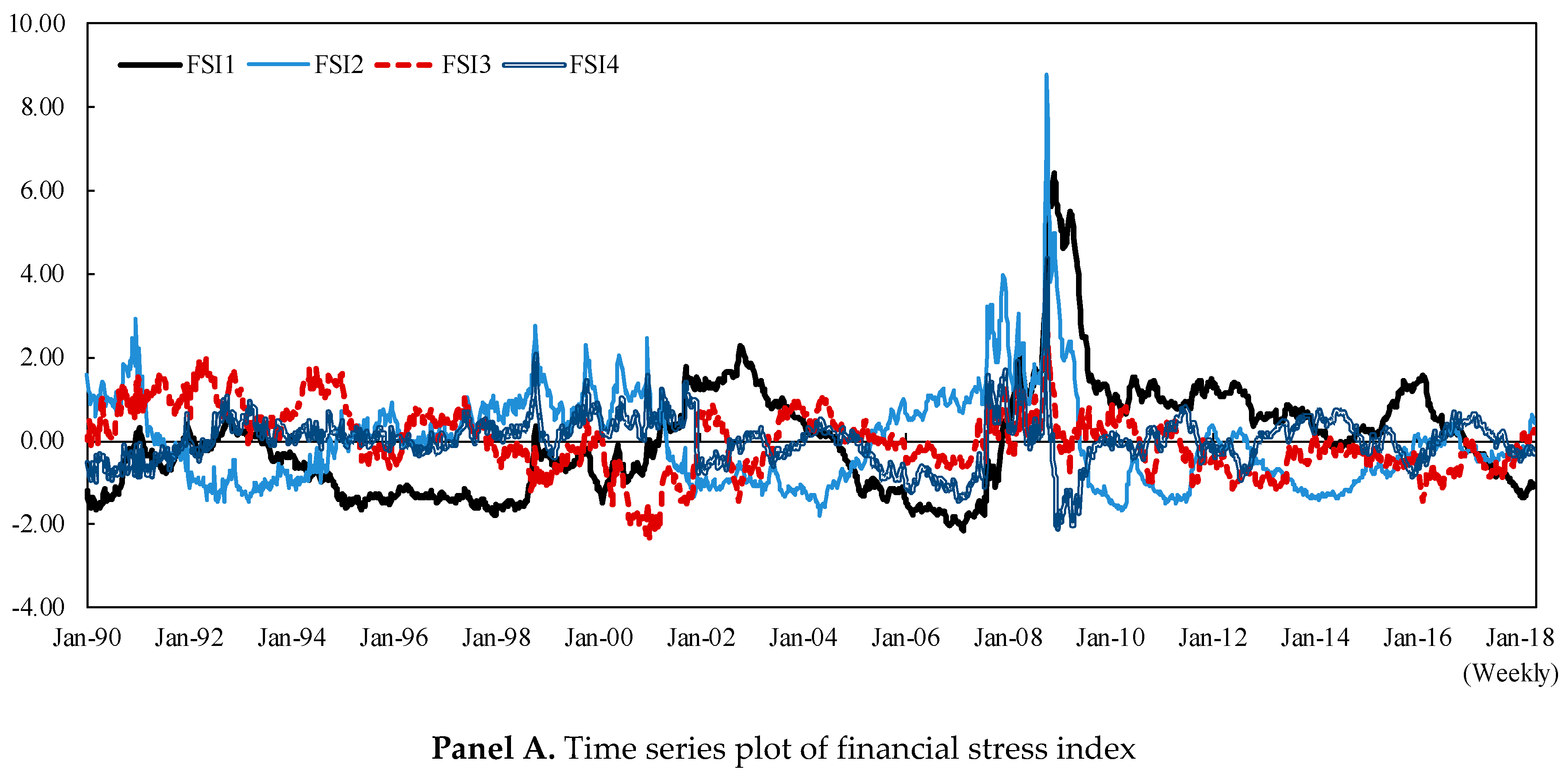

3.1. Measure of Financial Market Stress

3.2. Summary Statistics

4. Empirical Results

4.1. OLS and Robust Regression Results

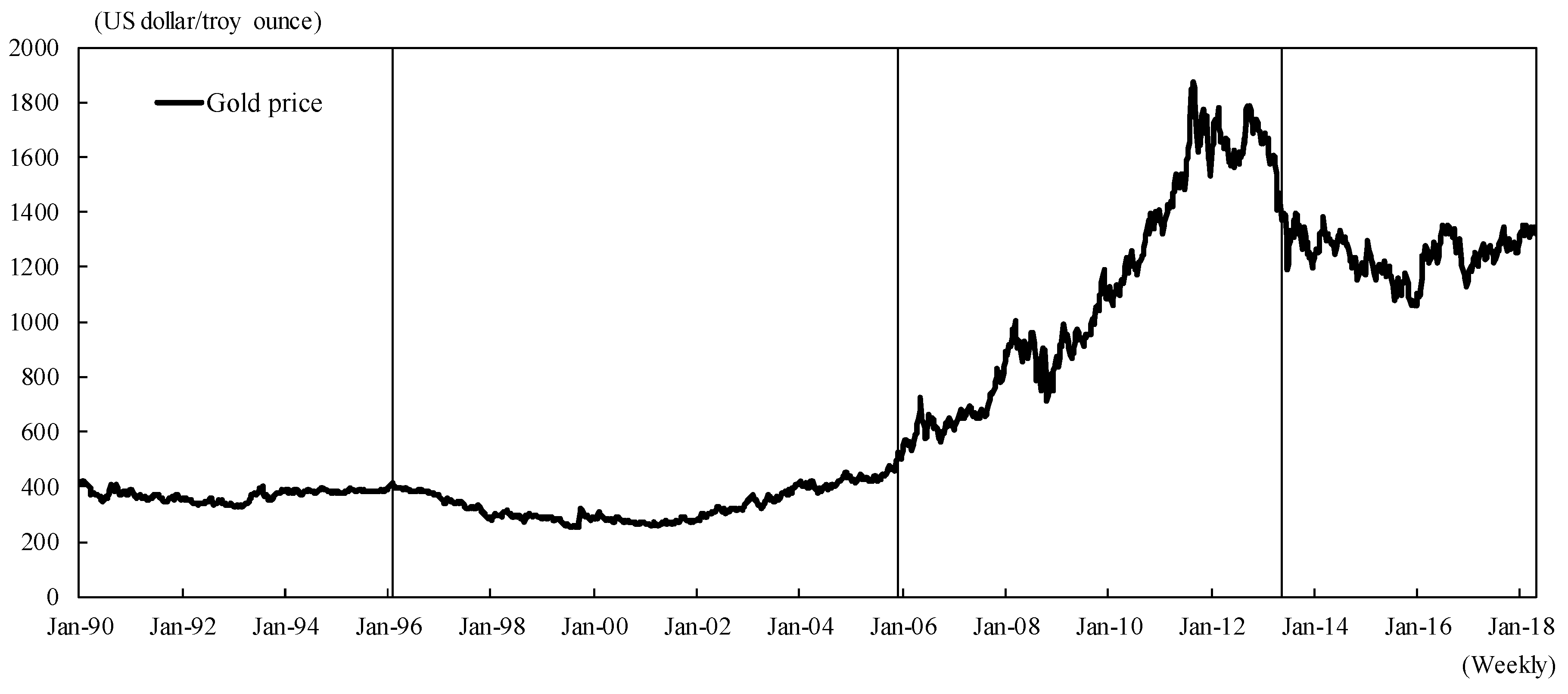

4.2. Quantile Regression Results

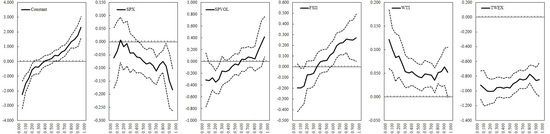

4.2.1. Full Sample Period

4.2.2. Subsample Periods

5. Conclusions

Funding

Acknowledgments

Conflicts of Interest

References

- Agyei-Ampomah, Sam, Dimitrios Gounopoulos, and Khelifa Mazouz. 2014. Does gold offer a better protection against losses in sovereign debt bonds than other metals? Journal of Banking & Finance 40: 507–21. [Google Scholar]

- Akram, Q. Farooq. 2009. Commodity prices, interest rates and the dollar. Energy Economics 31: 838–51. [Google Scholar] [CrossRef]

- Alkhatib, Akram, and Murad Harasheh. 2018. Performance of Exchange Traded Funds during the Brexit referendum: An event study. International Journal of Financial Studies 6: 64. [Google Scholar] [CrossRef]

- Alexander, Carol. 2008. Market Risk Analysis: Practical Financial Econometrics (Vol. II). Hoboken: Wiley. [Google Scholar]

- Bai, Jushan, and Pierre Perron. 1998. Estimating and testing linear models with multiple structural changes. Econometrica 66: 47–78. [Google Scholar] [CrossRef]

- Bai, Jushan, and Pierre Perron. 2003a. Computation and analysis of multiple structural change models. Journal of Applied Econometrics 18: 1–22. [Google Scholar] [CrossRef]

- Bai, Jushan, and Pierre Perron. 2003b. Critical values for multiple structural change tests. The Econometrics Journal 6: 72–78. [Google Scholar] [CrossRef]

- Balcilar, Mehmet, Zeynel Abidin Ozdemir, and Huseyin Ozdemir. 2018. Dynamic Return and Volatility Spillovers among S&P 500, Crude Oil and Gold. Discussion Paper 15–46. Famagusta: Eastern Mediterranean University, Department of Economics. [Google Scholar]

- Basu, Parantap, and William T. Gavin. 2011. What explains the growth in commodity derivatives? Federal Bank of St. Louis Review 93: 37–48. [Google Scholar] [CrossRef]

- Batten, Jonathan A., Cetin Ciner, and Brian M. Lucey. 2010. The macroeconomic determinants of volatility in precious metals markets. Resources Policy 35: 65–71. [Google Scholar] [CrossRef]

- Batten, Jonathan A., Cetin Ciner, and Brian M. Lucey. 2014. Which precious metals spill over on which, when and why? Some evidence. Applied Economics Letters 22: 466–73. [Google Scholar] [CrossRef]

- Baur, Dirk G. 2011. Explanatory mining for gold: Contrasting evidence from simple and multiple regressions. Resources Policy 36: 265–75. [Google Scholar] [CrossRef]

- Baur, Dirk G. 2013. The structure and degree of dependence: A quantile regression approach. Journal of Banking & Finance 37: 786–98. [Google Scholar]

- Baur, Dirk G., and Niels Schulze. 2005. Coexceedances in financial markets—A quantile regression analysis of contagion. Emerging Markets Review 6: 21–43. [Google Scholar] [CrossRef]

- Baur, Dirk G., and Brian M. Lucey. 2010. Is gold a hedge or a safe haven? An analysis of stocks, bonds and gold. Financial Review 45: 217–29. [Google Scholar] [CrossRef]

- Baur, Dirk G., and Thomas K. McDermott. 2010. Is gold a safe haven? International evidence. Journal of Banking & Finance 34: 1886–98. [Google Scholar]

- Bhar, Ramaprasad, and Shawkat Hammoudeh. 2011. Commodities and financial variables: Analyzing relationships in a changing regime environment. International Review of Economics & Finance 20: 469–84. [Google Scholar]

- Bouoiyour, Jamal, Refk Selmi, and Mark Wohar. 2018. Measuring the response of gold prices to uncertainty: An analysis beyond the mean. In Economic Modelling. Amsterdam: Elsevier, in press. [Google Scholar]

- Chan, Kam Fong, Sirimon Treepongkaruna, Robert Brooks, and Stephen Gray. 2011. Asset market linkages: Evidence from financial, commodity and real estate assets. Journal of Banking & Finance 35: 1415–26. [Google Scholar]

- Chao, Shih-Kang, Wolfgang K. Härdle, and Weining Wang. 2012. Quantile Regression in Risk Calibration. SFB 649 Discussion Paper 2012-006. Berlin: Humboldt-Universität. [Google Scholar]

- Cheng, Ing-Haw, and Wei Xiong. 2014. Financialization of commodity markets. Annual Review of Financial Economics 6: 419–41. [Google Scholar] [CrossRef]

- Chevallier, Julien, and Florian Ielpo. 2013. Volatility spillovers in commodity markets. Applied Economics Letters 20: 1211–27. [Google Scholar] [CrossRef]

- Chudik, Alexander, and Marcel Fratzscher. 2011. Identifying the global transmission of the 2007–2009 financial crisis in a GVAR model. European Economic Review 55: 325–39. [Google Scholar] [CrossRef]

- Ciner, Cetin, Constantin Gurdgiev, and Brian M. Lucey. 2013. Hedges and safe havens: An examination of stocks, bonds, gold, oil, and exchange rates. International Review of Financial Analysis 29: 202–11. [Google Scholar] [CrossRef]

- Cohen, Gil, and Mahmod Qadan. 2010. Is gold still a shelter to fear? American Journal of Social and Management Sciences 1: 39–43. [Google Scholar] [CrossRef]

- Connolly, Robert, Chris Stivers, and Licheng Sun. 2005. Stock market uncertainty and the stock-bond return relation. Journal of Financial and Quantitative Analysis 40: 161–94. [Google Scholar] [CrossRef]

- Cont, Rama. 2001. Empirical properties of asset returns: Stylized facts and statistical issues. Quantitative Finance 1: 223–36. [Google Scholar] [CrossRef]

- Diebold, Francis X., and Kamil Yilmaz. 2012. Better to give than to receive: Predictive directional measurement of volatility spillovers. International Journal of Forecasting 28: 57–66. [Google Scholar] [CrossRef]

- Domanski, Dietrich, and Alexandra Heath. 2007. Financial investors and commodity markets. BIS Quarterly Review 3: 53–67. [Google Scholar]

- Ehrmann, Michael, Marcel Fratzscher, and Roberto Rigobon. 2011. Stocks, bonds, money markets, and exchange rates: Measuring international financial transmission. Journal of Applied Econometrics 26: 948–74. [Google Scholar] [CrossRef]

- Erb, Claude B., and Campbell R. Harvey. 2006. The strategic and tactical value of commodity futures. Financial Analysts Journal 62: 69–97. [Google Scholar] [CrossRef]

- Fabozzi, Frank J., Sergio M. Focardi, Svetlozar T. Rachev, and Bala G. Arshanapalli. 2014. The Basics of Financial Econometrics: Tools, Concepts, and Asset Management Applications. Hoboken: John Wiley & Sons, Inc. [Google Scholar]

- Franke, Jürgen, Peter Mwita, and Weining Wang. 2015. Nonparametric estimates for conditional quantiles of time series. AStA Advances in Statistical Analysis 99: 107–30. [Google Scholar] [CrossRef]

- Gorton, Gary, and K. Geert Rouwenhorst. 2006. Facts and fantasies about commodity futures. Financial Analysts Journal 62: 47–68. [Google Scholar] [CrossRef]

- Guo, Feng, Carl R. Chen, and Ying Sophie Huang. 2011. Markets contagion during financial crisis: A regime-switching approach. International Review of Economics & Finance 20: 95–109. [Google Scholar]

- Hammoudeh, Shawkat, Ramazan Sari, and Bradley T. Ewing. 2009. Relationships among strategic commodities and with financial variables: A new look. Contemporary Economic Policy 27: 251–64. [Google Scholar] [CrossRef]

- Hao, Lingxin, and Daniel Q. Naiman. 2007. Quantile Regression. Quantitative Applications in the Social Sciences, No. 149. Thousand Oaks: SAGE Publications, Inc. [Google Scholar]

- Hartmann, Philipp, Stefan Straetmans, and C. G. de Vries. 2004. Asset market linkages in crisis periods. Review of Economics and Statistics 86: 313–26. [Google Scholar] [CrossRef]

- Hillier, David, Paul Draper, and Robert Faff. 2006. Do precious metals shine? An investment perspective. Financial Analysts Journal 62: 98–106. [Google Scholar] [CrossRef]

- Hood, Matthew, and Farooq Malik. 2013. Is gold the best hedge and a safe haven under changing stock market volatility? Review of Financial Economics 22: 47–52. [Google Scholar] [CrossRef]

- IHS Global Inc. 2016. EViews 9 User’s Guide II. California: IHS Global Inc. [Google Scholar]

- Koenker, Roger, and Gilbert Bassett, Jr. 1978. Regression quantiles. Econometrica 46: 33–50. [Google Scholar] [CrossRef]

- Koenker, Roger, and Kevin F. Hallock. 2001. Quantile regression. Journal of Economic Perspectives 15: 143–56. [Google Scholar] [CrossRef]

- Longstaff, Francis A. 2010. The subprime credit crisis and contagion in financial markets. Journal of Financial Economics 97: 436–50. [Google Scholar] [CrossRef]

- Mensi, Walid, Makram Beljid, Adel Boubaker, and Shunsuke Managi. 2013. Correlations and volatility spillovers across commodity and stock markets: Linking energies, food, and gold. Economic Modelling 32: 15–22. [Google Scholar] [CrossRef]

- Mensi, Walid, Shawkat Hammoudeh, Juan C. Reboredo, and Duc K. Nguyen. 2014. Do global factors impact BRICS stock markets? A quantile regression approach. Emerging Markets Review 19: 1–17. [Google Scholar] [CrossRef]

- Miyazaki, Takashi, and Shigeyuki Hamori. 2013. Testing for causality between the gold return and stock market performance: Evidence for “gold investment in case of emergency”. Applied Financial Economics 23: 27–40. [Google Scholar] [CrossRef]

- Miyazaki, Takashi, and Shigeyuki Hamori. 2014. Cointegration with regime shift between gold and financial variables. International Journal of Financial Research 5: 90–97. [Google Scholar] [CrossRef]

- Miyazaki, Takashi, and Shigeyuki Hamori. 2016. Asymmetric correlations in gold and other financial markets. Applied Economics 48: 4419–25. [Google Scholar] [CrossRef]

- Miyazaki, Takashi, and Shigeyuki Hamori. 2018. The determinants of a simultaneous crash in gold and stock markets: An ordered logit approach. Annals of Financial Economics 13: 1850004. [Google Scholar] [CrossRef]

- Miyazaki, Takashi, Yuki Toyoshima, and Shigeyuki Hamori. 2012. Exploring the dynamic interdependence between gold and other financial markets. Economics Bulletin 32: 37–50. [Google Scholar]

- O’Connor, Fergal A., Brian M. Lucey, Jonathan A. Batten, and Dirk G. Baur. 2015. The financial economics of gold—A survey. International Review of Financial Analysis 41: 186–205. [Google Scholar] [CrossRef]

- Piplack, Jan, and Stefan Straetmans. 2010. Comovements of different asset classes during market stress. Pacific Economic Review 15: 385–400. [Google Scholar] [CrossRef]

- Qadan, Mahmod, and Joseph Yagil. 2012. Fear sentiments and gold price: Testing causality in-mean and in-variance. Applied Economics Letters 19: 363–66. [Google Scholar] [CrossRef]

- Raza, Syed Ali, Nida Shah, and Muhammad Shahbaz. 2018. Does economic policy uncertainty influence gold prices? Evidence from a nonparametric causality-in-quantiles approach. Resources Policy 57: 61–68. [Google Scholar] [CrossRef]

- Reboredo, Juan C., and Gazi Salah Uddin. 2016. Do financial stress and policy uncertainty have an impact on the energy and metals markets? A quantile regression approach. International Review of Economics & Finance 43: 284–98. [Google Scholar]

- Renaud, Olivier, and Maria-Pia Victoria-Feser. 2010. A robust coefficient of determination for regression. Journal of Statistical Planning and Inference 140: 1852–62. [Google Scholar] [CrossRef]

- Rodriguez, Robert N., and Yonggang Yao. 2017. Five Things You Should Know about Quantile Regression. Paper SAS525–2017. Cary: SAS Institute Inc. [Google Scholar]

- Sari, Ramazan, Shawkat Hammoudeh, and Ugur Soytas. 2010. Dynamics of oil price, precious metal prices, and exchange rate. Energy Economics 32: 351–62. [Google Scholar] [CrossRef]

- Silvennoinen, Annastiina, and Susan Thorp. 2013. Financialization, crisis, and commodity correlation dynamics. Journal of International Financial Markets, Institutions & Money 24: 42–65. [Google Scholar]

- Straetmans, Stefan T. M., Willem F. C. Verschoor, and Christian C. P. Wolff. 2008. Extreme US stock market fluctuations in the wake of 9/11. Journal of Applied Econometrics 23: 17–42. [Google Scholar] [CrossRef]

- Tang, Ke, and Wei Xiong. 2012. Index investment and the financialization of commodities. Financial Analysts Journal 68: 54–74. [Google Scholar] [CrossRef]

- Wheelock, David C., and Mark E. Wohar. 2009. Can the term spread predict output growth and recessions? A survey of the literature. In Federal Reserve Bank of St. Louis Review 91. St. Louis: Federal Reserve Bank. [Google Scholar]

- World Gold Council. 2010. Gold: Hedging against Tail Risk. London: World Gold Council. [Google Scholar]

| 1 | Previous studies that analyze the financialization of commodities and its background include Basu and Gavin (2011); Cheng and Xiong (2014); Domanski and Heath (2007); Silvennoinen and Thorp (2013); Tang and Xiong (2012). |

| 2 | One of the other ways to disentangle the interdependence of data in the tails of the distribution is a method using extreme value theory. Related research includes Hartmann et al. (2004); Piplack and Straetmans (2010); Straetmans et al. (2008). |

| 3 | See Chapter 8 of Fabozzi et al. (2014). |

| 4 | EViews 9.5 is used for the robust regression in this study. For a more detailed technical description, refer to pp. 405-424 in IHS Global Inc. (2016). |

| 5 | For a succinct explanation of quantile regression, I recommend Koenker and Hallock (2001) and Rodriguez and Yao (2017). For more formal treatments, refer to textbooks such as Chapter II.7.2 of Alexander (2008), Chapter 7 of Fabozzi et al. (2014); Hao and Naiman (2007). For nonparametric approach of the quantile regression, see Chao et al. (2012); Franke et al. (2015). |

| 6 | We recognize its relevance, but exclude bond from our analysis since we consider that information in bond market is included, to some extent, in the financial market stress index constructed below. Existing studies explicitly demonstrating the connection of gold with bond include Agyei-Ampomah et al. (2014); Baur and Lucey (2010); Baur and McDermott (2010); Ciner et al. (2013); Miyazaki and Hamori (2016); Piplack and Straetmans (2010). |

| 7 | TED spread is calculated as the spread between the three-month London interbank offered rate based on US dollars and the three-month Treasury bill rate. |

| 8 | Credit spread is calculated as the yield spread between Baa- and Aaa-ranked corporate bonds. |

| 9 | Default spread is calculated as the yield spread between Aaa-ranked corporate bonds and Treasuries with 10-year constant maturities. |

| 10 | Term spread is calculated as the yield spread between Treasuries of 10-year and three-month constant maturities. |

| 11 | Before carrying out PCA, I standardized to control the variance of these variables. That is, these variables have zero mean and unit variance (standard deviation). Furthermore, according to the augmented Dickey–Fuller test, based on specification without a constant term, the null hypothesis of a unit root for these four variables is rejected at the 1% significance level or higher. |

| 12 | Several existing studies provide evidence that the term spread possesses significant predictive power as a leading indicator of recession. Wheelock and Wohar (2009) is a good survey in this area. |

| 13 | The lag order for both the ARCH and GARCH terms in the EGARCH model is 1, namely, EGARCH (1,1). |

| 14 | Taking into account the autocorrelation of the residuals, we include the autoregressive term up to five lags. For the sake of brevity, we do not explicitly mention the autoregressive term in the empirical analysis below. |

| 15 | The null hypothesis of “no structural break” is also rejected in the Chow test which designated jointly and beforehand three structural breakpoints identified by Bai and Perron’s (1998, 2003a, 2003b) test as a candidate of structural breakpoints. Therefore, these structural breakpoints identified above have robustness. |

| 16 | Miyazaki and Hamori (2014) demonstrate that there is a cointegrating relation with regime shift between gold and the three financial variables, namely US short-term interest rates, US dollar, and S&P 500 Index based on daily data. They identify a structural break date on 13 December 2005. |

| 17 | See also Miyazaki and Hamori (2013). They show that there exists a unilateral causality in not only the mean but the variance from stock return to gold return in the sample period post subprime crisis. |

| 18 | Although we do not dwell in the main text on the details of the results using FSI2, FSI3, and FSI4 as a financial stress index, all results are available from the author upon request. |

| 19 | I would like to thank an anonymous referee for raising this point. |

| Variable | Source |

|---|---|

| Gold price, PM fix (spot) | Bloomberg; originally provided by London Bullion Market Association (LBMA) |

| S&P 500 Index (spot) | Bloomberg; originally provided by S&P Dow Jones Indices |

| TED spread | Federal Reserve Economic Database (FRED) of St. Louis Fed |

| Aaa-10Y spread | Federal Reserve Economic Database (FRED) of St. Louis Fed |

| Baa-Aaa spread | Federal Reserve Economic Database (FRED) of St. Louis Fed |

| West Texas Intermediate (WTI) (spot) | Federal Reserve Economic Database (FRED) of St. Louis Fed; originally provided by US Energy Information Administration (EIA) |

| Trade Weighted US Dollar Index: Major Currencies | Federal Reserve Economic Database (FRED) of St. Louis Fed; originally provided by Board of Governors of the Federal Reserve System (US) |

| Factor Loadings | ||||

|---|---|---|---|---|

| 1st | 2nd | 3rd | 4th | |

| TED | 0.088 | 0.796 | 0.354 | 0.483 |

| Aaa-10Y | 0.628 | −0.068 | −0.626 | 0.458 |

| Baa-Aaa | 0.627 | 0.324 | 0.079 | −0.704 |

| TERM | 0.453 | −0.507 | 0.690 | 0.247 |

| % variance explained | 44.18 | 33.01 | 14.56 | 8.26 |

| Panel A: Descriptive Statistics | ||||||

| GOLD | SPX | SPVOL | FSI1 | WTI | TWEX | |

| Mean | 0.080 | 0.137 | 2.048 | 0.001 | 0.000 | −0.003 |

| Maximum | 14.694 | 11.356 | 9.885 | 6.426 | 25.114 | 4.342 |

| Minimum | −13.790 | −20.084 | 0.862 | −2.136 | −18.972 | −3.851 |

| Std. Dev. | 2.227 | 2.256 | 0.867 | 1.330 | 4.182 | 0.946 |

| Skewness | −0.133 | −0.753 | 2.547 | 1.406 | −0.128 | 0.180 |

| Kurtosis | 7.543 | 9.853 | 15.000 | 6.921 | 6.035 | 4.064 |

| Jarque–Bera | 1274.215 | 3029.719 | 10,459.200 | 1432.904 | 571.023 | 77.579 |

| p-value | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 |

| Num. of obs. | 1477 | 1477 | 1477 | 1477 | 1477 | 1477 |

| Panel B: Correlation Matrix | ||||||

| GOLD | SPX | SPVOL | FSI1 | WTI | TWEX | |

| GOLD | 1.000 | |||||

| SPX | −0.039 | 1.000 | ||||

| SPVOL | −0.032 | 0.029 | 1.000 | |||

| FSI1 | 0.028 | −0.051 | 0.550 | 1.000 | ||

| WTI | 0.113 | 0.076 | −0.077 | −0.055 | 1.000 | |

| TWEX | −0.394 | −0.134 | 0.013 | −0.005 | 0.000 | 1.000 |

| H0 | H1 | Test Statistic | Critical Value | Breakpoint |

|---|---|---|---|---|

| No break | 1 time break | 75.49 ** | 27.03 | 2/02/1996 |

| 1 time break | 2 times break | 52.16 ** | 29.24 | 12/02/2005 |

| 2 times break | 3 times break | 50.21 ** | 30.45 | 5/10/2013 |

| 3 times break | 4 times break | 12.92 | 31.45 |

| Dependent Variable: GOLD | ||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| A. Full Sample: 2/16/1990–4/27/2018 | B. First Sample: 2/16/1990–1/26/1996 | C. Second Sample: 2/02/1996–11/25/2005 | ||||||||||

| Number of Observations: 1472 | Number of Observations: 311 | Number of Observations: 513 | ||||||||||

| OLS | Robust regression | OLS | Robust regression | OLS | Robust regression | |||||||

| Coefficient | S.E. | Coefficient | S.E. | Coefficient | S.E. | Coefficient | S.E. | Coefficient | S.E. | Coefficient | S.E. | |

| SPX | −0.099 ** | 0.036 | −0.055 ** | 0.020 | −0.228 ** | 0.045 | −0.182 ** | 0.047 | 0.004 | 0.028 | −0.011 | 0.026 |

| SPVOL | −0.101 | 0.111 | −0.099 | 0.063 | −0.367 * | 0.165 | −0.672 ** | 0.146 | −0.115 | 0.099 | −0.183 * | 0.093 |

| FSI1 | 0.096 | 0.058 | 0.078 | 0.041 | 0.145 | 0.120 | 0.160 | 0.113 | 0.148 | 0.076 | 0.201 ** | 0.066 |

| WTI | 0.065 ** | 0.015 | 0.046 ** | 0.011 | 0.090 ** | 0.019 | 0.083 ** | 0.018 | 0.015 | 0.016 | 0.018 | 0.014 |

| TWEX | −0.962 ** | 0.082 | −0.892 ** | 0.048 | −0.155 | 0.105 | −0.151 | 0.079 | −0.850 ** | 0.091 | −0.870 ** | 0.070 |

| Constant | 0.312 | 0.231 | 0.302 * | 0.136 | 0.744 * | 0.324 | 1.240 ** | 0.265 | 0.344 | 0.227 | 0.460 * | 0.226 |

| Adj R2 | 0.186 | 0.263 | 0.126 | 0.232 | 0.200 | 0.338 | ||||||

| Breusch–Pagan–Godfrey test | Breusch–Pagan–Godfrey test | Breusch–Pagan–Godfrey test | ||||||||||

| 0.000 | 0.136 | 0.001 | ||||||||||

| White test | White test | White test | ||||||||||

| 0.000 | 0.000 | 0.006 | ||||||||||

| D. Third sample: 12/02/2005–5/03/2013 | E. Fourth sample: 5/10/2013–4/27/2018 | |||||||||||

| Number of observations: 388 | Number of observations: 260 | |||||||||||

| OLS | Robust regression | OLS | Robust regression | |||||||||

| Coefficient | S.E. | Coefficient | S.E. | Coefficient | S.E. | Coefficient | S.E. | |||||

| SPX | −0.267 ** | 0.078 | −0.177 ** | 0.049 | −0.126 | 0.069 | −0.095 | 0.065 | ||||

| SPVOL | −0.063 | 0.249 | 0.157 | 0.149 | 0.222 | 0.163 | 0.092 | 0.210 | ||||

| FSI1 | 0.045 | 0.127 | −0.109 | 0.092 | −0.062 | 0.139 | −0.049 | 0.164 | ||||

| WTI | 0.154 ** | 0.032 | 0.129 ** | 0.030 | −0.052 | 0.027 | −0.046 | 0.029 | ||||

| TWEX | −1.573 ** | 0.182 | −1.513 ** | 0.129 | −1.131 ** | 0.130 | −1.102 ** | 0.117 | ||||

| Constant | 0.437 | 0.513 | 0.060 | 0.322 | −0.329 | 0.297 | −0.116 | 0.361 | ||||

| Adj R2 | 0.316 | 0.401 | 0.299 | 0.381 | ||||||||

| Breusch–Pagan–Godfrey test | Breusch–Pagan–Godfrey test | |||||||||||

| 0.000 | 0.007 | |||||||||||

| White test | White test | |||||||||||

| 0.000 | 0.181 | |||||||||||

| Quantiles | |||||||

|---|---|---|---|---|---|---|---|

| 0.05 | 0.10 | 0.25 | 0.50 | 0.75 | 0.90 | 0.95 | |

| SPXfull | −0.062 | −0.034 | −0.007 | −0.074 ** | −0.088 ** | −0.149 ** | −0.183 ** |

| (0.059) | (0.057) | (0.044) | (0.026) | (0.022) | (0.053) | (0.040) | |

| SPX1 | −0.076 | −0.166 * | −0.262 ** | −0.179 * | −0.155 * | −0.227 * | −0.197 |

| (0.083) | (0.075) | (0.070) | (0.070) | (0.073) | (0.112) | (0.129) | |

| SPX2 | 0.144 * | 0.149 ** | 0.013 | −0.012 | −0.012 | 0.014 | 0.023 |

| (0.073) | (0.055) | (0.046) | (0.032) | (0.029) | (0.056) | (0.137) | |

| SPX3 | −0.061 | −0.163 | −0.082 | −0.167 | −0.337 ** | −0.304 ** | −0.222 ** |

| (0.087) | (0.108) | (0.068) | (0.089) | (0.085) | (0.065) | (0.072) | |

| SPX4 | −0.244 | −0.267 ** | −0.133 | −0.087 | 0.034 | −0.076 | −0.060 |

| (0.174) | (0.102) | (0.116) | (0.075) | (0.097) | (0.101) | (0.081) | |

| SPVOLfull | −0.313 | −0.325 * | −0.302 * | −0.040 | 0.068 | 0.300 | 0.420 * |

| (0.232) | (0.155) | (0.125) | (0.089) | (0.083) | (0.198) | (0.174) | |

| SPVOL1 | −0.716 ** | −0.785 ** | −0.845 ** | −0.564 | −0.202 | 0.508 | 0.924 |

| (0.207) | (0.267) | (0.246) | (0.290) | (0.293) | (0.446) | (1.179) | |

| SPVOL2 | −0.406 ** | −0.352 | −0.230 | −0.139 | −0.104 | 0.044 | 0.189 |

| (0.149) | (0.248) | (0.187) | (0.112) | (0.117) | (0.310) | (0.323) | |

| SPVOL3 | −0.549 | −0.951 ** | −0.378 | 0.116 | 0.382 | 0.593 | 0.341 |

| (0.343) | (0.238) | (0.195) | (0.370) | (0.269) | (0.306) | (0.375) | |

| SPVOL4 | 0.060 | 0.162 | 0.248 | 0.045 | 0.089 | 0.135 | −0.050 |

| (0.492) | (0.288) | (0.206) | (0.215) | (0.231) | (0.364) | (0.283) | |

| FSI1full | −0.195 | −0.196 * | −0.071 | 0.061 | 0.226 ** | 0.251 ** | 0.272 * |

| (0.114) | (0.094) | (0.065) | (0.054) | (0.059) | (0.094) | (0.112) | |

| FSI11 | −0.232 | −0.160 | 0.168 | 0.057 | 0.101 | 0.300 | 0.202 |

| (0.271) | (0.257) | (0.138) | (0.127) | (0.141) | (0.293) | (0.519) | |

| FSI12 | −0.144 | 0.164 | 0.142 | 0.156 | 0.180* | 0.305 | 0.315 |

| (0.199) | (0.117) | (0.104) | (0.086) | (0.087) | (0.172) | (0.320) | |

| FSI13 | 0.138 | 0.219 | −0.026 | −0.120 | −0.068 | −0.088 | −0.034 |

| (0.325) | (0.159) | (0.107) | (0.124) | (0.127) | (0.168) | (0.250) | |

| FSI14 | −0.754 | −0.620 * | −0.545 ** | 0.040 | 0.330 | 0.771 ** | 0.742 ** |

| (0.413) | (0.246) | (0.163) | (0.175) | (0.185) | (0.271) | (0.199) | |

| WTIfull | 0.122 ** | 0.100 ** | 0.071 ** | 0.043 ** | 0.035 ** | 0.064 ** | 0.052 |

| (0.032) | (0.023) | (0.020) | (0.014) | (0.013) | (0.020) | (0.027) | |

| WTI1 | 0.134 ** | 0.114 ** | 0.067 * | 0.078 ** | 0.080 ** | 0.110 ** | 0.171 |

| (0.032) | (0.035) | (0.033) | (0.026) | (0.024) | (0.039) | (0.104) | |

| WTI2 | 0.001 | 0.001 | −0.008 | 0.021 | 0.034 * | 0.006 | 0.046 |

| (0.036) | (0.036) | (0.023) | (0.016) | (0.014) | (0.028) | (0.047) | |

| WTI3 | 0.326 ** | 0.217 ** | 0.159 ** | 0.113 | 0.144 ** | 0.132 ** | 0.080 |

| (0.095) | (0.051) | (0.041) | (0.059) | (0.039) | (0.048) | (0.050) | |

| WTI4 | −0.010 | −0.017 | −0.059 | −0.053 | −0.058 | −0.081 | −0.149 ** |

| (0.080) | (0.049) | (0.040) | (0.034) | (0.051) | (0.107) | (0.055) | |

| TWEXfull | −0.919 ** | −0.961 ** | −1.001 ** | −0.958 ** | −0.837 ** | −0.858 ** | −0.844 ** |

| (0.099) | (0.122) | (0.084) | (0.068) | (0.066) | (0.092) | (0.118) | |

| TWEX1 | −0.170 | −0.204 | −0.067 | −0.150 | −0.159 | −0.180 | −0.255 |

| (0.188) | (0.145) | (0.092) | (0.099) | (0.100) | (0.132) | (0.190) | |

| TWEX2 | −0.644 ** | −0.891 ** | −0.791 ** | −0.917 ** | −0.833 ** | −0.858 ** | −1.046 ** |

| (0.128) | (0.117) | (0.096) | (0.095) | (0.108) | (0.137) | (0.286) | |

| TWEX3 | −1.452 ** | −1.591** | −1.551** | −1.661 ** | −1.320 ** | −1.103 ** | −0.916 ** |

| (0.363) | (0.257) | (0.163) | (0.192) | (0.210) | (0.212) | (0.260) | |

| TWEX4 | −1.323 ** | −1.445 ** | −1.349 ** | −1.167 ** | −1.082 ** | −0.773* | −0.637 ** |

| (0.237) | (0.245) | (0.156) | (0.160) | (0.164) | (0.317) | (0.211) | |

| Constantfull | −2.254 ** | −1.491 ** | −0.371 | 0.204 | 1.021 ** | 1.750 ** | 2.320 ** |

| (0.470) | (0.304) | (0.242) | (0.176) | (0.182) | (0.372) | (0.374) | |

| Constant1 | −0.899 * | −0.390 | 0.851 * | 0.966 * | 1.125* | 1.037 | 1.034 |

| (0.371) | (0.547) | (0.407) | (0.474) | (0.518) | (0.811) | (1.851) | |

| Constant2 | −1.592 ** | −0.956 | −0.330 | 0.393 | 1.162 ** | 1.757 ** | 2.348 ** |

| (0.385) | (0.524) | (0.453) | (0.265) | (0.293) | (0.622) | (0.755) | |

| Constant3 | −2.699 ** | −0.589 | −0.118 | −0.045 | 1.157 | 1.943 ** | 3.243 ** |

| (0.776) | (0.462) | (0.370) | (0.702) | (0.595) | (0.623) | (0.832) | |

| Constant4 | −2.792 ** | −2.255 ** | −1.379 ** | 0.013 | 0.905 * | 2.035 ** | 2.831 ** |

| (0.756) | (0.504) | (0.376) | (0.390) | (0.382) | (0.767) | (0.574) | |

© 2019 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Miyazaki, T. Clarifying the Response of Gold Return to Financial Indicators: An Empirical Comparative Analysis Using Ordinary Least Squares, Robust and Quantile Regressions. J. Risk Financial Manag. 2019, 12, 33. https://doi.org/10.3390/jrfm12010033

Miyazaki T. Clarifying the Response of Gold Return to Financial Indicators: An Empirical Comparative Analysis Using Ordinary Least Squares, Robust and Quantile Regressions. Journal of Risk and Financial Management. 2019; 12(1):33. https://doi.org/10.3390/jrfm12010033

Chicago/Turabian StyleMiyazaki, Takashi. 2019. "Clarifying the Response of Gold Return to Financial Indicators: An Empirical Comparative Analysis Using Ordinary Least Squares, Robust and Quantile Regressions" Journal of Risk and Financial Management 12, no. 1: 33. https://doi.org/10.3390/jrfm12010033

APA StyleMiyazaki, T. (2019). Clarifying the Response of Gold Return to Financial Indicators: An Empirical Comparative Analysis Using Ordinary Least Squares, Robust and Quantile Regressions. Journal of Risk and Financial Management, 12(1), 33. https://doi.org/10.3390/jrfm12010033