The Global Legal Entity Identifier System: How Can It Deliver? †

Abstract

:1. Introduction

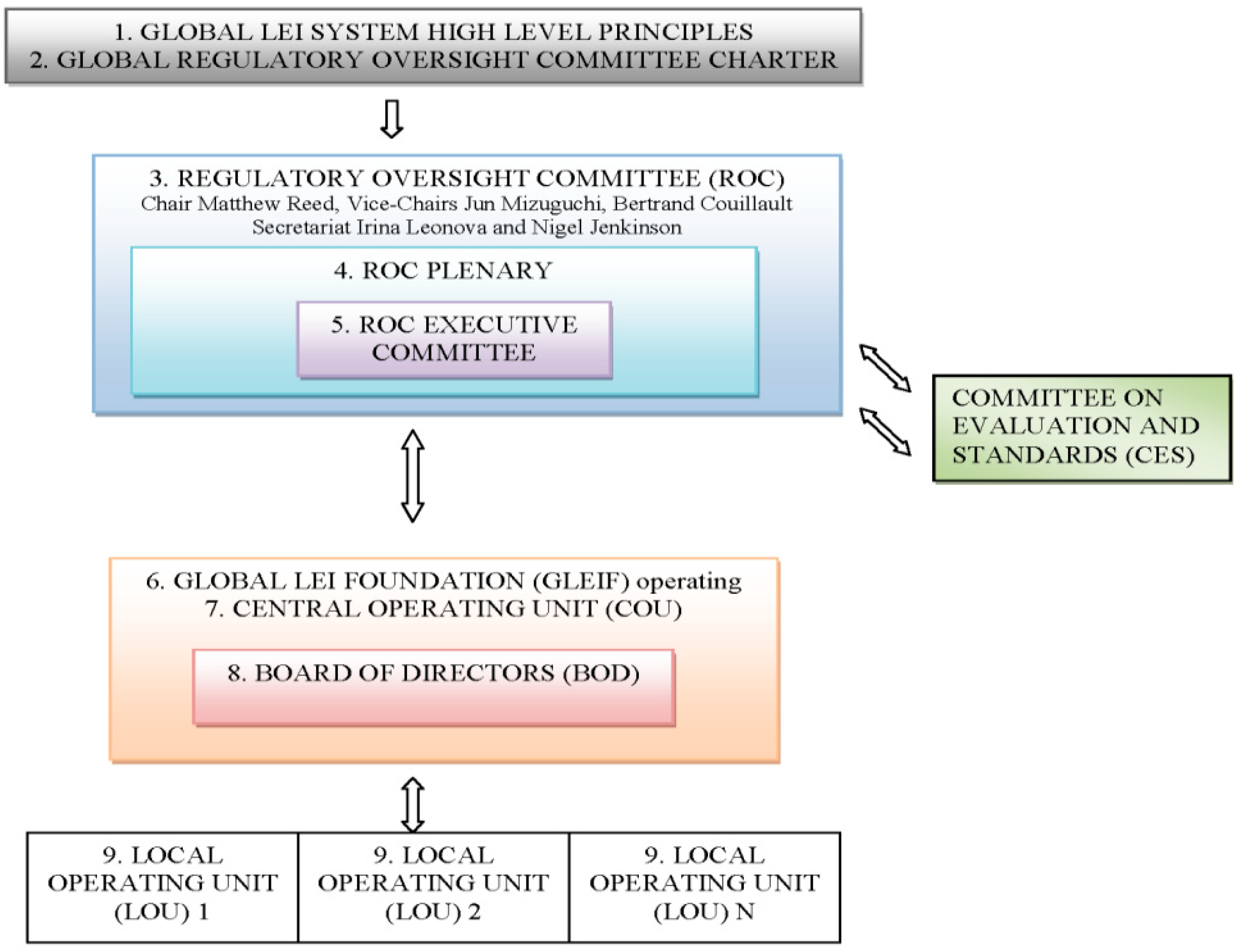

2. The Development of the Global LEI System

2.1. The Creation of the Global LEI System

2.2. Key Issues in the Design of the Global LEI System

2.3. The Identification Problem

2.4. Reporting Immediate and Ultimate Parents

3. Efficiency Gains

3.1. Improved Client Data Management

- Client on-boarding. The process of ‘client on-boarding’ absorbs a substantial amount of resources. Creating a new client account requires the establishment and validation of a range of information, and this process is often repeated unnecessarily in different jurisdictions and across different business lines (trading desks, whether fixed-income, equities, foreign exchange or derivatives; credit and cash management relationships with large corporates; prime brokerage for hedge funds), often starting again from scratch.

- Updating of client information. Compliance with ‘know your customer’ (KYC) regulations requires not just the initial on-boarding, but also the updating of information on clients. Internal information systems need to take account of corporate actions such as takeovers, and this is still a largely manual process. Major firms can have 1000 or more staff working full-time on KYC processing. Standardized identification can help to automate these processes.

- Observation of anti-money laundering (AML) regulations. This requires going through a regular ‘check-list’, and a large part of this effort remains manual rather than automated, and is often repeated more than once in different parts of the same firm. Standardized identification can help to automate these processes.

- Better client relationship management. There has been a lot of discussion—in both the financial and non-financial industries—about the using customer relationship management (CRM) systems to provide better customer service and more effective marketing. In financial services, the practical implementation of CRM is hampered by inaccuracies and inconsistencies in client identification. While this is a bigger problem in retail financial services, accurate and reliable client identification can help to improve customer relationship management for all types of customers.

3.2. Straight-Through Processing

- 5.

- Reducing failures in post-trade order matching, clearing, and settlement. These trade failures occur with both the securities and derivative markets, typically because of inconsistencies in the data recorded on the two sides of the trade. The most common data inconsistency is about the identity of the counterparty (Grody et al. 2007), and this can be helped by using standardized legal entity identification; i.e., a unique and universal identifier that is machine-readable, and that removes all ambiguity in automated processing when referring to a trading or financial counterparty. The LEI can serve this purpose.

3.3. Tax, Management and Regulatory Reporting

- 6.

- Compliance with tax reporting requirements, such as the US FATCA, which requires “foreign financial institutions (FFIs) to report to the IRS on information about financial accounts held by U.S. taxpayers, or by foreign entities in which U.S. taxpayers hold a substantial ownership interest.”17 This is another situation where substantial manual processing costs arise, because of a lack of standardized identifiers. For this purpose, the US authorities have introduced their own global financial intermediaries identification system (GIIN), which is totally separate from the global LEI.18

- 7.

- Complying with new regulatory reporting requirements. Regulators are, after a crisis, imposing much more demanding requirements for detailed information on credit and market exposures; for example, those arising from Dodd-Frank, the European Market Infrastructure Regulation (EMIR), and other regulations. This is challenging in the large part, because most firms still have their data recorded in a number of different internal systems, each with its own identifier (one interview with a global institution revealed that one firm has “six or seven different systems” just for the recording of interest rate swaps.) Even within a single system, it is typically not straightforward to provide all that is required by regulators, especially with regard to the detailed breakdown of counterparty exposures. We believe that similar benefits facilitating the aggregation of positions, should arise in internal management reporting; but this was not specifically mentioned in any of our interviews.

- 8.

- Monitoring and complying with large exposure limits. This is another situation where considerable manual intervention is required in order to take account of the impacts of corporate actions, such as takeovers or divestments, on exposures to specific counterparties.

3.4. Buyside Services

- 9.

- The allocation of cash and securities from block or automated trades to individual client accounts. For buy-side firms, a single trade is often conducted in several pieces, and it must then be reassembled, with the proceeds being allocated between several cash or security accounts. Here again, automatic processing can fail because of discrepancies in client identifiers, resulting in manual interventions which could be reduced by reliable standardized identifiers.

- 10.

- Complying with ethical and other investment mandates. Another issue for buy side-firms is that funds are sometimes limited to particular types of assets; for example, ‘ethical’ or ‘green’ funds that are not supposed to invest in particular types of assets. Monitoring compliance with these mandates is challenging, especially when corporate actions such as takeovers lead to a change in the business profiles of security issuers.

- 11.

- Identification of investors for security underwriting. One interview mentioned a need for manual interventions, to ensure that underwritten securities are credited correctly, to identified client accounts.

- 12.

- Maintaining the separation of client accounts. A major problem revealed by the failure of Lehman Brothers was the failure to comply with regulations (such as the CASS regulations in London) requiring the separation of client and proprietary assets. Accurate client entity identification is a prerequisite for both obeying such requirements, and for imposing an appropriate compliance and audit trail, to ensure that this is done.

4. Corporate Hierarchies

4.1. Background: The Challenge of Understanding Corporate Hierarchies

- There are a very wide range of patterns of share ownership. Instead of every subsidiary being wholly owned by a single parent, ownership of a subsidiary is often shared between several entities within the same corporate group, and sometimes also with outside shareholders. There can also be cross- and circular shareholdings (e.g., A holding shares in subsidiary B which in turn holds shares C which holds shares in A). As a result, it is impossible to identify a cleanly layered ownership hierarchy. Instead the owners of subsidiaries can be found at several degrees of separation from the top of the company, or entirely outside of the company. Real-world hierarchies, far from being clean, are tangled webs of interconnections.

- The ownership of a subsidiary is not the same thing as its control. In the case of corporate subsidiaries, this is both because of different legal rights for different shareholders (different voting rights or reserved powers such as might be held by a ‘golden share’), and because the relationships amongst shareholders may give effective control to a shareholder or group of shareholders, even though they do not own a majority of the shares.

- Many subsidiaries are established as non-corporate legal structures without shareholders; for example, financial firms frequently establish trusts as investment vehicles; for example, in structured- and project- finance. The trustees, with the responsibility for operating the trust according to stated mandate and objectives, are appointed by the firm that establishes the trust, so that they have formal control, but the degree of control is limited by the mandates and objectives of the trust. While there is no ownership of a trust, there are still ‘beneficial interests’; i.e., interests in the proceeds from the assets and investments of the trust. Such beneficial interest may be held by legal entities within the corporate group, by outside investors, or by both.

- Subsidiaries and other entities within the same group are also linked by other financial relationships, such as secured and unsecured loans, cash and security deposits, guarantees, and sometimes derivative contracts. Such financial relationships are not normally regarded as being part of corporate hierarchies, but they can be critical in the context of corporate default, when such internal financial arrangements are a critical determinant of the enforceability of creditor’s legal claims.

- Information about the various dimensions of corporate interrelationships (ownership, control, beneficial interest, financial commitments) is not always within the public domain. In some jurisdictions, the ownership of public companies is disclosed in public registers, but in other jurisdictions, this is not required, and companies may deliberately create subsidiaries in these jurisdictions, in order to make their corporate structure opaque. Information on the other dimensions of corporate interrelationships can be even harder to obtain.

4.2. Views of Our Interviewees

4.3. Using Hierarchies to Improve inRisk Management

5. The Magnitude of the Benefits, and Barriers to Adoption

5.1. Quantification of Benefits

- To an ‘order of magnitude’, there are more than $1 bn per annum of potential operational cost savings from the establishment of the global LEI in wholesale financial markets. By ‘order of magnitude’, we mean that the savings are certainly over $1bn, and they could be considerably higher.

- Further indirect private benefits can be expected, especially as more efficient processing allows the industry to extend its services to a wider range of customers, especially in emerging markets.

- The extension of the LEI in making a universal standard, not just in wholesale financial market transactions, but also in corporate banking and trade finance, could yield further private benefits.

- There is also a bigger picture. Legal entity identification addresses only entity identification, which is one specific aspect of financial services operations. The potential gains from the standardization of all aspects of financial services are very much larger than from the LEI alone.

- Expenditure on external data. Inside Market Data Reference, Market Size and Share Analysis, 2006 Edition (reported in Grody et al. 2007), it was found that the total external spend on of data and information in the industry was $13.6 bn in 2004 (this figure was based on an analysis of the revenues of the major vendors, amongst which Bloomberg, Reuters and Standard, and Poor’s, together, had a market share of 53%); An updated analysis would result in a higher figure, in part because of the great increase in security market activities in emerging markets, for which the data is relatively weak. One part of this expenditure is based on entity reference data, which would be considerably cheaper with a universal standard.

- Internal data management costs. To this external expenditure on reference data and other information, the internal costs of data management must be added, with all the major firms having to devote a substantial headcount towards acquiring and maintaining consistent information on their customers and counterparties, for KYC and AML, and for trade execution and processing. We believe (from our interviews, and also from various industry reports) that the headcount in larger firms that is devoted to these activities is well in excess of 1000 employees, across both the sell-side and buy-side institutions. We are not aware of any research that aggregates these costs, but they can be expected to average over $100 mn per firm (if the all-in costs per employee are $100,000), and hence, they can easily reach $5 bn across the buy and sell sides of the industry. (Grody et al. 2007) (p. 27) conduct some similar calculations, suggesting that these costs in the early 2000s could have amounted to as much as $12 bn per year.

- Operational automation A third element of cost saving comes from a reduction in trade fails and other operational failures i.e., the long-pursued goal of ‘straight-through processing’. (Grody et al. 2007) quote a Tower Group (2006) report, which estimated that in 2004, around 60% of trade failures were due to problems with reference data (5.1% of trades that failed to settle was due to faulty reference data, 37% were due to inaccurate or incomplete reference data, and 20% were due to disparities in referential data bases.) (Grody et al. 2007) also provide some quantification of costs, referring to a variety of studies from the early 2000s, and citing a SWIFT estimate where fails in repairing trade cost the industry as much as $12 bn per year. Additional costs also arise for asset managers as a result of the faulty processing of corporate actions. Their own calculations on operational risk costs, from trade and corporate action failures (Grody et al. 2007) Exhibit I, p. 49,), taking account of interest and other costs of delay, are at around $3 bn in the largest 15 US firms.

5.2. Additional Direct and Indirect Benefits

- Regulatory and other reporting. The industry is facing new and more demanding requirements from regulators for ‘granular’ data that is broken down along several dimensions, including counterparty, instrument, currency, jurisdiction, and maturity.

- Development of new markets and services. The adoption of a global LEI will make it easier for major international firms to develop wholesale financial market services in emerging markets, avoiding the difficulties of creating their own internal identification systems for each jurisdiction from scratch. Over time, this could considerably enhance their revenues.

- Customer relationship management. Considerable effort has been made, in many industries, and not just financial services, to develop effective systems for managing customer relationships, giving staff a full view of each customer, rather than always seeing them through the lens of a single account. Such a complete view of the customer has the potential to enhance revenues, by allowing firms to offer additional products, to more effectively price products and services based on the relationship as a whole, and to offer a more effective and complete service. The LEI should, with additional further investment, help firms to achieve more effective customer relationship management for their wholesale market clients.

- Extension to corporate banking. The LEI is being established for it use in wholesale financial markets. However, similar challenges of managing reference data apply across the entire financial services industry. We can therefore see substantial further benefits from an eventual broadening of the scope of the LEI. The most obvious extension will be in corporate banking, so that it can be used in the full range of corporate financial services, including term loans, cash management, lines of credit, syndicate lending, trade finance, and project finance.31

6. Barriers to Adoption

- One view that was expressed to us, was that the responsibility for application for LEI, and for the validation of associated reference data should always lie with the registered firm itself. The concern here is that if a third party is applying for an LEI on behalf of someone else, then quality assurance is problematic. This issue has been discussed by the ROC and PSPG. The current approach is that third-party registration will be possible, with ‘explicit permission’ of the entity concerned, which will retain responsibility for data quality.

- It can be argued that a corporate group should apply for LEIs in bulk for its own subsidiaries (for large corporate groups, this will be the most efficient, and in many cases, only practical possibility for LEI applications, many subsidiaries have a legal, rather than an operational existence, and they will not have the capacity for making such applications themselves).

- Another issue involves maintaining the integrity of LEI numbering and the associated reference data, following a corporate action, such as a merger or takeover. This issue is being carefully addressed by both the ROC and the PSPG; an acceptable and cost-effective means of keeping reference data should be achievable.

- (i)

- At the technological level, firms must be persuaded that the LEI offers a more cost-effective identification solution than the existing identification solutions already incorporated into their existing systems.

- (ii)

- If the perception is that the use of the global LEI is essentially a matter of regulatory compliance, and that it will be primarily used for regulatory reporting in a few markets; e.g., OTC derivatives, then a business case for the widespread use of the LEI is relatively weak.This suggests a need for commitment, as soon as practically feasible and at a global level, to using the LEI in all aspects of regulatory compliance and reporting. Perhaps the strongest criticism that we heard in our interviews was the lack of clarity on what the system would be used in the medium-term, such as three to four years from now. Firms understand what is required of them in the immediate future, but beyond this, the development and application of the global LEI system remain unclear. This lack of clarity about the path ahead seems to us to be one of the biggest threats to the success of the global LEI.

- (iii)

- The wider benefits of LEI, for example, in data aggregation and risk reporting, require quite substantial accompanying investments in internal systems. The challenge here is that, while the potential cost savings from the global LEI and other data standards are clearly very large and can easily justify these investments, only a part of these benefits will come from LEI alone.

7. Conclusions and Policy Recommendations

- (i)

- The development of a road map and timetable, setting out how the global LEI will move forward from its current relatively limited range of applications, towards full use across the full range of capital market and corporate banking transactions.

- (ii)

- Discussion and agreements between regulators and the industry on the use of LEI in regulatory reporting in all business areas, including equity, money market and bond trading, post-trade processing, corporate lending, and cash management, foreign exchange trading, insurance exposures, and all other contexts where the LEI could be used.

- (iii)

- Further guidance on the use of the LEI in KYC or AML regulation, and in all aspects of prudential risk and tax reporting. In particular, there needs to be clarification on the relationship between the LEI and the competing identifier, the GINN, introduced as part of the US FACTA tax regime on foreign companies.

- (iv)

- Detailed guidance on the use of LEI or other data standards in the regulation of counterparty risk, or in the development of recovery and resolution plans for systemically important institutions.

Author Contributions

Conflicts of Interest

Appendix A. Interview Questions and Interview Summary

Appendix A.1. Conduct of the Interviews

- What are the major costs, efficiencies and risk-reductions that could be achieved from using LEI?

- How important is it to have good hierarchy reference data as part of the LEI, in order to achieve these benefits? Should this ownership hierarchy be provided by the LEI system?

- Current regulations (Dodd Frank in the US, European Market Infrastructure Regulation EMIR in Europe) are imposing quite challenging requirements on firms’ OTC businesses. Can LEI be helpful in meeting these challenges, and is it being developed in an appropriate way? Are other elements of the current re-regulation of global financial institutions being developed in a form that is consistent with the business adoption of LEI, or are other regulatory initiatives actually an impediment to adoption?

Appendix A.2. Summary of Interviews

Other Issues Raised by the Interviewees

References

- A-Team_Group. 2009. Business Entity Identifiers: The Crucial Foundation for Accurate Risk Management. Available online: http://finetik.files.wordpress.com/2009/05/business_entity_identifiers_wp_a-team_mar09.pdf (accessed on 17 December 2018).

- Alexander, L. 2010. Statement on Legal Entity Identification for Financial Contracts. Federal Register 75: 74146–48. [Google Scholar]

- Alexander, Lewis, Sanjiv R. Das, Zachary Ives, H. V. Jagadish, and Claire Monteleoni. 2017. Research Challenges in Financial Data Modeling and Analysis. Big Data 5: 177–88. [Google Scholar] [CrossRef] [PubMed]

- Bailey, Andrew, Mervyn King, and Paul Tucker. 2011. Uncorrected Oral Evidence Taken before the Joint Committee on the Draft Financial Services Bill. London: Hansard, Available online: http://www.parliament.uk/documents/joint-committees/Draft-Financial-Services-Bill/Ucjcdfsb031111ev11.pdf (accessed on 17 December 2018).

- Bottega, John A., and Linda F. Powell. 2011. Creating a linchpin for financial data: Toward a universal legal entity identifier. Journal of Economics and Business 64: 105–15. [Google Scholar] [CrossRef]

- Braswell, Jefferson, Larry Lannom, Alistair Milne, Jim Northey, Norman Paskin, and Ken Traub. 2012. Response to the Financial Stability Board’s Request for an Engineering Study on the Best Approach to Managing the Structure and Issuance of Legal Entity Identifiers (LEIs). Available online: http://papers.ssrn.com/sol3/papers.cfm?abstract_id=2197269 (accessed on 17 December 2018).

- Buch, Claudia. 2017. Data needs and statistics compilation for macroprudential analysis. Paper presented at the Irving Fisher Committee–National Bank of Belgium Workshop, Brussels, Belgium, May 18–19. [Google Scholar]

- Carmassi, Jacopo, and Richard Herring. 2016. The corporate complexity of global systemically important banks. Journal of Financial Services Research 49: 175–201. [Google Scholar] [CrossRef]

- Chan, Ka Kei, and Alistair Milne. 2013. The Global Legal Entity Identifier System: Will It Deliver? (Economics Working Papers). Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2325889 (accessed on 17 December 2018).

- Draghi, Mario. 2009. Re-establishment of the FSF as the Financial Stability Board. Available online: http://www.fsb.org/wp-content/uploads/r_090402.pdf (accessed on 17 December 2018).

- EDM Council. 2018. The EDM Council Resource Links Webpage. Available online: http://www.edmcouncil.org/page/resourcelinks (accessed on 17 December 2018).

- Fan, Liju, and Mark D. Flood. 2018. An Ontology of Ownership and Control Relations for Bank Holding Companies. Paper presented at the Fourth International Workshop on Data Science for Macro-Modeling with Financial and Economic Datasets, Houston, TX, USA, June 10–15; New York, NY, USA: ACM, p. 3. [Google Scholar]

- Flood, Mark D., H. V. Jagadish, and Louiqa Raschid. 2016. Big data challenges and opportunities in financial stability monitoring. Banque de France, Financial Stability Review 20: 129–42. [Google Scholar]

- FSB. 2009. Financial Stability Forum Re-Established as the Financial Stability Board. Basel. Available online: http://www.fsb.org/2009/04/financial-stability-forum-re-established-as-the-financial-stability-board/ (accessed on 17 December 2018).

- FSB. 2012a. A Global Legal Entity Identifier for Financial Markets. Available online: http://www.financialstabilityboard.org/publications/r_120608.pdf (accessed on 17 December 2018).

- FSB. 2012b. Charater of the Regulatory Oversight Committee for the Global Legal Entity Identifier (LEI) System. Available online: http://www.financialstabilityboard.org/publications/r_121105c.pdf (accessed on 17 December 2018).

- FSB. 2012c. Formation and Launch of FSB Legal Entity Identifier (LEI) Private Sector Preparatory Group (PSPG). Available online: http://www.financialstabilityboard.org/publications/r_120803.pdf (accessed on 17 December 2018).

- FSB. 2012d. Fourth Progress Note on the Global LEI Initiative. Available online: http://www.financialstabilityboard.org/publications/r_121211.pdf (accessed on 17 December 2018).

- FSB. 2013. Fifth Progress Note on the Global LEI Initiative. Available online: http://www.financialstabilityboard.org/publications/r_130111a.pdf (accessed on 17 December 2018).

- FSB. 2017. Governance Arrangements for the Unique Transaction Identifier (UTI): Conclusions and Implementation Plan. Basel. Available online: http://www.fsb.org/2017/12/governance-arrangements-for-the-unique-transaction-identifier-uti-conclusions-and-implementation-plan/ (accessed on 17 December 2018).

- FSB. 2018. Governance Arrangements for the Unique Product Identifier (UPI)—Second Consultation Document. Basel. Available online: http://www.fsb.org/2018/04/governance-arrangements-for-the-unique-product-identifier-upi-second-consultation-document/ (accessed on 17 December 2018).

- FSOC. 2012. 2012 Annual Report. Available online: https://www.treasury.gov/initiatives/fsoc/Pages/annual-report.aspx (accessed on 17 December 2018).

- Global LEI Foundation, and McKinsey and Company. 2017. The Legal Entity Identifier: The Value of the Unique Counterparty ID. Available online: https://www.mckinsey.com/~/media/McKinsey/Industries/Financial Services/Our Insights/The legal entity identifier The value of the unique counterparty ID/Legal-Entity-Identifier-McKinsey-GLEIF-2017.ashx (accessed on 17 December 2018).

- Gregory, J. 2012. Counterparty Credit Risk and Credit Value Adjustment: A Continuing Challenge for Global Financial Markets, 2nd ed.The Wiley Finance Series; Hoboken: John Wiley & Sons. [Google Scholar]

- Grody, Allan D. 2018. Can a globally endorsed business identity code be the answer to risk data aggregation? Journal of Risk Management in Financial Institutions 11: 308–27. [Google Scholar]

- Grody, Allan D., Fotios Harmantzis, and Gregory J. Kaple. 2007. Operational Risk and Reference Data: Exploring Costs, Capital Requirements and Risk Mitigation. Journal of Operational Risk 1. Available online: http://papers.ssrn.com/sol3/papers.cfm?abstract_id=849224 (accessed on 17 December 2018).

- Harrell, Margaret C., and Melissa A. Bradley. 2009. Data Collection Methods. Semi-Structured Interviews and Focus Groups. Santa Monica: Rand National Defense Research Institute. [Google Scholar]

- Hille, Erich. 2013. Recent developments in restructuring the Austrian banking reporting system. Journal of Banking Regulation 14: 269–84. [Google Scholar] [CrossRef]

- Houstoun, Kevin, Alistair Milne, and Paul Parboteeah. 2015. Preliminary Report on Standards in Global Financial Markets. London: The SWIFT Institute. [Google Scholar]

- Hygate, Justin. 2012. Our Number’s Up…. Available online: https://www.slideshare.net/CorporateRegistersForum/new-zealand-lei-registry-numbering-in-the-future-justin-hygate (accessed on 17 December 2018).

- Jegher, Jacob, Gareth Lodge, and Hua Zhang. 2013. IT Spending in Banking: A Global Prespective. London: Celent, Available online: https://www.celent.com/insights/750407076 (accessed on 17 December 2018).

- Jenner, B., Uwe Flick, Ernst von Kardoff, and Ines Steinke. 2004. A Companion to Qualitative Research. London: Sage. [Google Scholar]

- LEI ROC. 2013. LEI Regulatory Oversight Committee (ROC): 1st Progress Note on the Global LEI Initiative. Available online: http://www.leiroc.org/publications/gls/roc_20130308.pdf (accessed on 17 December 2018).

- LEI ROC. 2015. The Global LEI System and Regulatory Uses of the LEI: Progress Report. Available online: https://www.leiroc.org/publications/gls/lou_20151105-1.pdf (accessed on 17 December 2018).

- LEI ROC. 2016. Collecting Data on Direct and Ultimate Parents of Legal Entities in the Global LEI System—Phase 1. Basel. Available online: https://www.leiroc.org/publications/gls/lou_20161003-1.pdf (accessed on 17 December 2018).

- LEI ROC. 2018. The Global LEI System and Regulatory Uses of the LEI: Progress Report. Available online: https://www.leiroc.org/publications/gls/roc_20180502-1.pdf (accessed on 17 December 2018).

- Milne, Alistair. 2006. What is in it for us? Network effects and bank payment innovation. Journal of Banking & Finance 30: 1613–30. Available online: http://ideas.repec.org/a/eee/jbfina/v30y2006i6p1613-1630.html (accessed on 17 December 2018).

- Piechocki, Michal. 2017. Overview of international experiences with data standards and identifiers applicable for big data analysis. Paper presented at the IFC-Bank Indonesia Satellite Seminar on “Big Data” at the ISI Regional Statistics Conference 2017, Bali, Indonesia, March 21. [Google Scholar]

- Powell, Linda F., Mark Montoya, and Elena Shuvalov. 2011. Legal Entity Identifier: What Else Do You Need to Know? Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=1956664 (accessed on 17 December 2018).

- PWC. 2009. Lehman Brothers’ Bankruptcy: Lessons Learned for the Survivors. Available online: https://www.pwc.com/jg/en/events/lessons-learned-for-the-survivors.pdf (accessed on 17 December 2018).

- ROC. 2013. LEI Regulatory Oversight Committee Makes Progress in the Establishment of the Global LEI System and Produces Key Decision for Interim Global System. Available online: http://www.leiroc.org/publications/gls/roc_20130619.pdf (accessed on 17 December 2018).

| 1 | We are unable to offer a detailed quantitative analysis, because to date, the LEI has been mainly used in a relatively narrow context, that of reporting to derivative trade repositories; only when applied to address a much wider range of problems of entity identification in global financial markets will full quantitative analysis of the benefits of the GLEI be possible. |

| 2 | We do not offer a separate literature review. This is because there is not a great deal of literature on the global LEI system, whether in peer-reviewed journal articles, working papers or policy and consultancy reports. We refer to other research where it relates closely to our own, mostly in footnotes. The paper closest to our own is (Grody 2018) who endorses the value to be had from the global LEI but emphasises the challenge of data governance and maintaining data standards. |

| 3 | |

| 4 | |

| 5 | (FSOC 2012), p. 140, describes this role as follows ‘The Office of Financial Research (OFR), established in Title I of the Dodd-Frank Act, is tasked with improving the quality of financial data and data analytics along multiple dimensions, including LEI implementation and enhancement.’ |

| 6 | Progress reports on the various FSB initiatives are available from http://www.financialstabilityboard.org/list/fsb_publications/tid_178/index.htm. |

| 7 | A list of members and observers can be found at www.leiroc.org/about/membersandobservers/index.htm. |

| 8 | The list of LOUs is available via https://www.gleif.org/en/about-lei/get-an-lei-find-lei-issuing-organizations. |

| 9 | The standard itself can be purchased via http://www.iso.org/iso/catalogue_detail?csnumber=59771. See http://www.iso.org/iso/home/news_index/news_archive/news.htm?refid=Ref1449 for description. |

| 10 | (Powell et al. 2011) refers to the surprisingly large number of US banks with identical names: no less than 14 legally separated US banks, all called City National Bank. |

| 11 | (FSB 2012a) refers to the wide number of different naming conventions for many institutions. |

| 12 | One of our interviewees referred to the example of Stichting in Dutch, or Stiftung in German, a term that could be translated as the equivalent of a UK ‘charitable trust’. It remains a common mistake in manual data processing to assume that Stichting is the name of a company. |

| 13 | (A-Team_Group 2009) provide an insightful discussion in relation to the crisis of 2008. |

| 14 | This is a far from complete list. (Bottega and Powell 2011) mention several more: ‘A number of vendors and industry utilities issue entity identification numbers today, including but not limited to: Standard & Poor’s, Avox, Omgeo, FactSet, Bloomberg, Thomson Reuters, Dun & Bradstreet, Telekurs, Markit (red code), SWIFT, and Alacra.’ |

| 15 | See (LEI ROC 2018), who report that “As of 31 December 2017, 41,656 direct parents and 46,372 ultimate parents had been identified with an LEI in the GLEIS. In addition, 443,211 entities had reported that there are no parents meeting the GLEIS definition: for example (i) the entity is controlled by natural person(s) without any intermediate legal entity meeting the definition of parent in the GLEIS; (ii) the entity is controlled by legal entities not subject to preparing consolidated financial statements (given the definition of parents in the GLEIS, e.g., a number of investment funds) (iii) there is no known person controlling the entity (e.g., diversified shareholding). Similarly, 444,301 reported the absence of an ultimate parent. For both types of parent relationships, some 18,000 entities declared that legal obstacles prevented them from providing or publishing this information, or that the disclosure of this information would be detrimental to the legal entity or the relevant parent.” The ROC continues with a pilot on hierarchy reporting, and it is also examining extensions to include the reporting of large international branches. There is clearly some way to go, however, before the LEI system adequately handles complications such as these. |

| 16 | The FSB announcement of the global LEI system (FSB 2012a) pp. 26–27, classifies these under only two headings (“operational efficiency” and “enhanced regulatory reporting”), compared to our four. |

| 17 | |

| 18 | See http://www.irs.gov/irm/part3/irm_03-021-112.html#d0e850 for a description of the GIIN. The GIIN allows for the possibility of branch identification rather than legal entity identification. Section 5 below discusses this problem of competing systems of identification numbers, and how it might be resolved. |

| 19 | Some recent contributions to the literature (Alexander et al. 2017; Fan and Flood 2018; Flood et al. 2016; Piechocki 2017) explore the ‘big data challenge’ in financial stability monitoring, highlighting the role of standard identifiers, such as the LEI, for effective financial stability analysis, but also stressing the limitations of the LEI in supporting the analysis of corporate hierarchies, and hence, the systemic risk. |

| 20 | See (Bailey et al. 2011). |

| 21 | This last point is emphasized by (FSB 2012a). |

| 22 | Restated for example in (Buch 2017) who summarizes the ongoing ‘data gaps initiative’, which seeks to promote better global data on real estate exposures, shadow banking, and granular market data (including the LEI), to support better macroprudential modelling and monitoring. |

| 23 | (FSB 2012a) page 26, describes these benefits as follows ‘The LEI provides a powerful foundational tool to enhance the monitoring and management of systemic risks. Among the potential benefits are: Improved data aggregation and analysis … Enhanced prudential supervision … Support for orderly resolution … Protection against market abuse.’ The FSB notes in particular, the scope for better supervision of firms that are active in multiple jurisdictions. |

| 24 | Mappings of several corporate structures, including Barclays, Pearson’s, Goldman Sachs, Gap, and Starbucks, are available on the website www.opencorporates.com. OpenCorporates announced the initial phase of this work, financed, like our paper, by the Alfred P. Sloan Foundation, here: http://blog.opencorporates.com/2013/07/11/open-corporate-network-data-not-just-good-but-better/. |

| 25 | Source (together with accompanying illustration) from the www.opencorporates.com mapping tool. |

| 26 | Source: (PWC 2009). Page 6 summarizes the wide range of Lehman credit and counterparty exposures. |

| 27 | Internal systems for management of client reference data were already fairly well advanced in the early 2000s. (Grody et al. 2007) refers to a 2002 A-Team/Reuter’s study that found that 65% of firms had their own central reference data system. |

| 28 | (Grody et al. 2007) summarize (see in particular, Figure 5, p. 27) a number of industry reports into various aspects of operating costs, conducted in the early 2000s. |

| 29 | (Global LEI Foundation and McKinsey and Company 2017) suggests a lower figure of around $150 million per year. This is based on their survey-based estimate (p. 16)) that around one-third of global capital market industry operating costs of $5 bn are spent on client on-boarding, client trade, reconciliations trade, allocations to clients, and verification of client reference data, which in turn could be reduced by around 10%, through the widespread use of LEIs. |

| 30 | See (Hille 2013) for a discussion of the changes being required for banks in Austria. |

| 31 | (Global LEI Foundation and McKinsey and Company 2017) suggest that savings from the LEI in trade finance could amount to $500mn per year, across the industry. |

| 32 | The resource links provided by (EDM Council 2018) for an EDM Council perspective on what such full standardizations might mean. |

| 33 | See (Milne 2006) for discussion of the theory and evidence relating to retail payments. The cost of retail payments ranges from around 0.5% of national income in the most efficient systems, to around 2% in the lest efficient. |

| 34 | In more technical economic jargon, the LEI is ‘non-rival’; its use by one market participant does not limit its use by any other market participant. |

| 35 | There is an extensive list of research literature on both network goods (in which the benefits to one user depends on the number of other users of the goods) and the economics of standards setting, highlighting such co-ordination failures and many possible various network externalities. See (Houstoun et al. 2015) for a review. |

| 36 | For a related view, see (Hygate 2012). |

| 37 | For a short description of these data requirements, see http://www.clevelandfed.org/Banking/Financial_Reporting_and_Data/lcb2012/FRY-14.pptx. |

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Chan, K.K.; Milne, A. The Global Legal Entity Identifier System: How Can It Deliver? J. Risk Financial Manag. 2019, 12, 39. https://doi.org/10.3390/jrfm12010039

Chan KK, Milne A. The Global Legal Entity Identifier System: How Can It Deliver? Journal of Risk and Financial Management. 2019; 12(1):39. https://doi.org/10.3390/jrfm12010039

Chicago/Turabian StyleChan, Ka Kei, and Alistair Milne. 2019. "The Global Legal Entity Identifier System: How Can It Deliver?" Journal of Risk and Financial Management 12, no. 1: 39. https://doi.org/10.3390/jrfm12010039

APA StyleChan, K. K., & Milne, A. (2019). The Global Legal Entity Identifier System: How Can It Deliver? Journal of Risk and Financial Management, 12(1), 39. https://doi.org/10.3390/jrfm12010039