Has ‘Too Big To Fail’ Been Solved? A Longitudinal Analysis of Major U.S. Banks

Abstract

:1. Introduction

2. Proposed Solutions, Regulatory Initiatives, and Analysis of Major U.S. Banks

2.1. Breakup of Big Banks

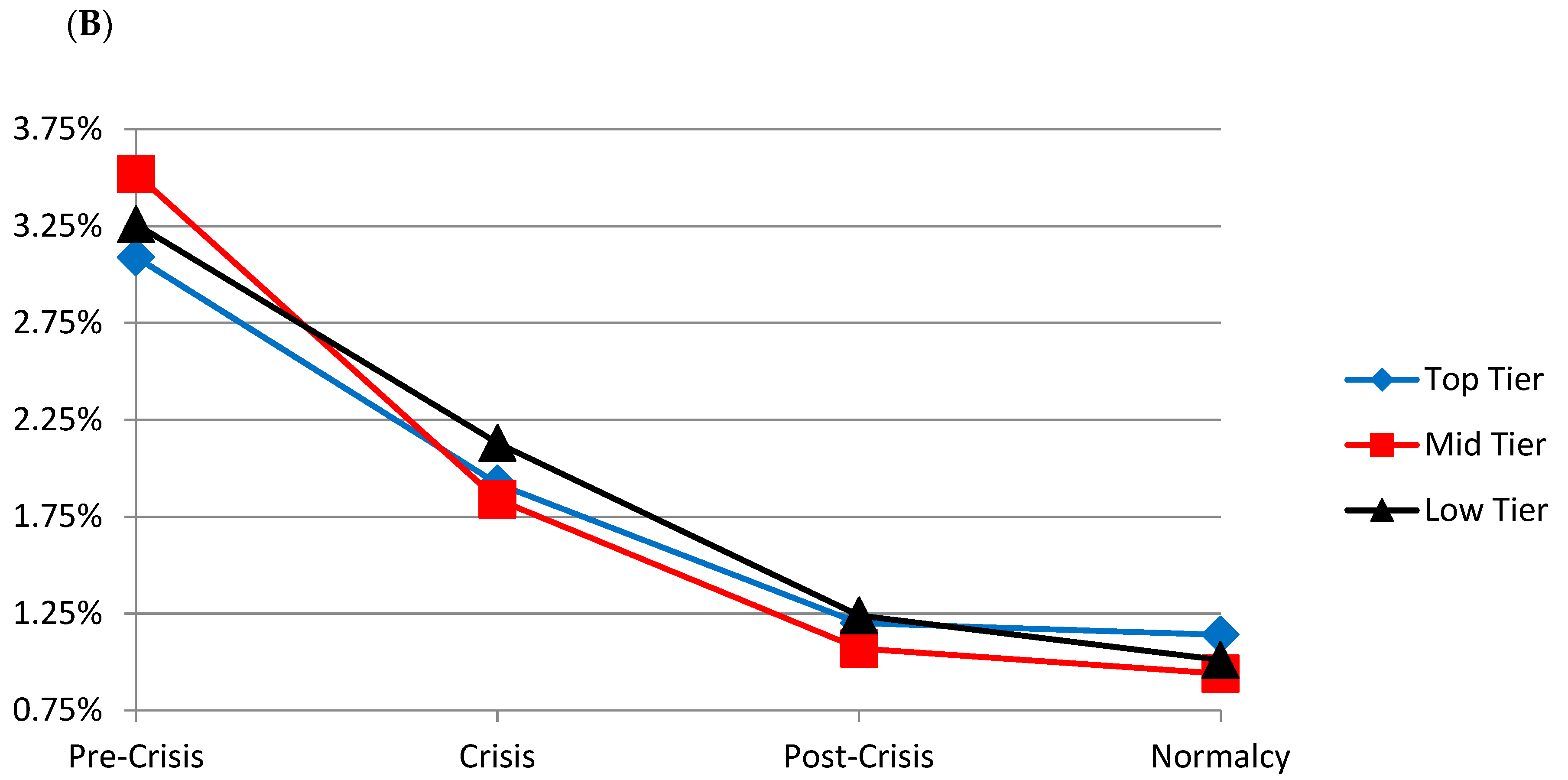

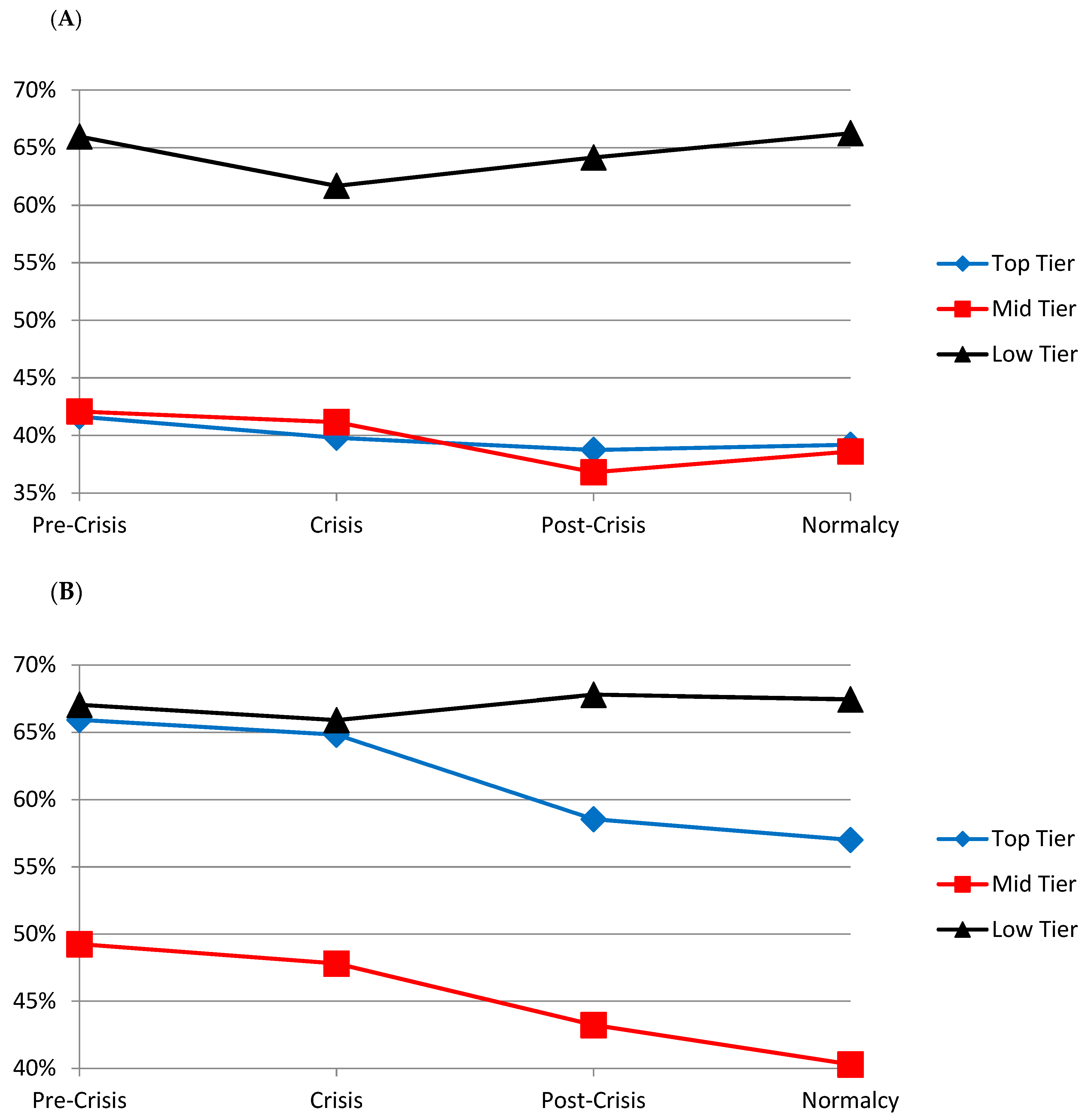

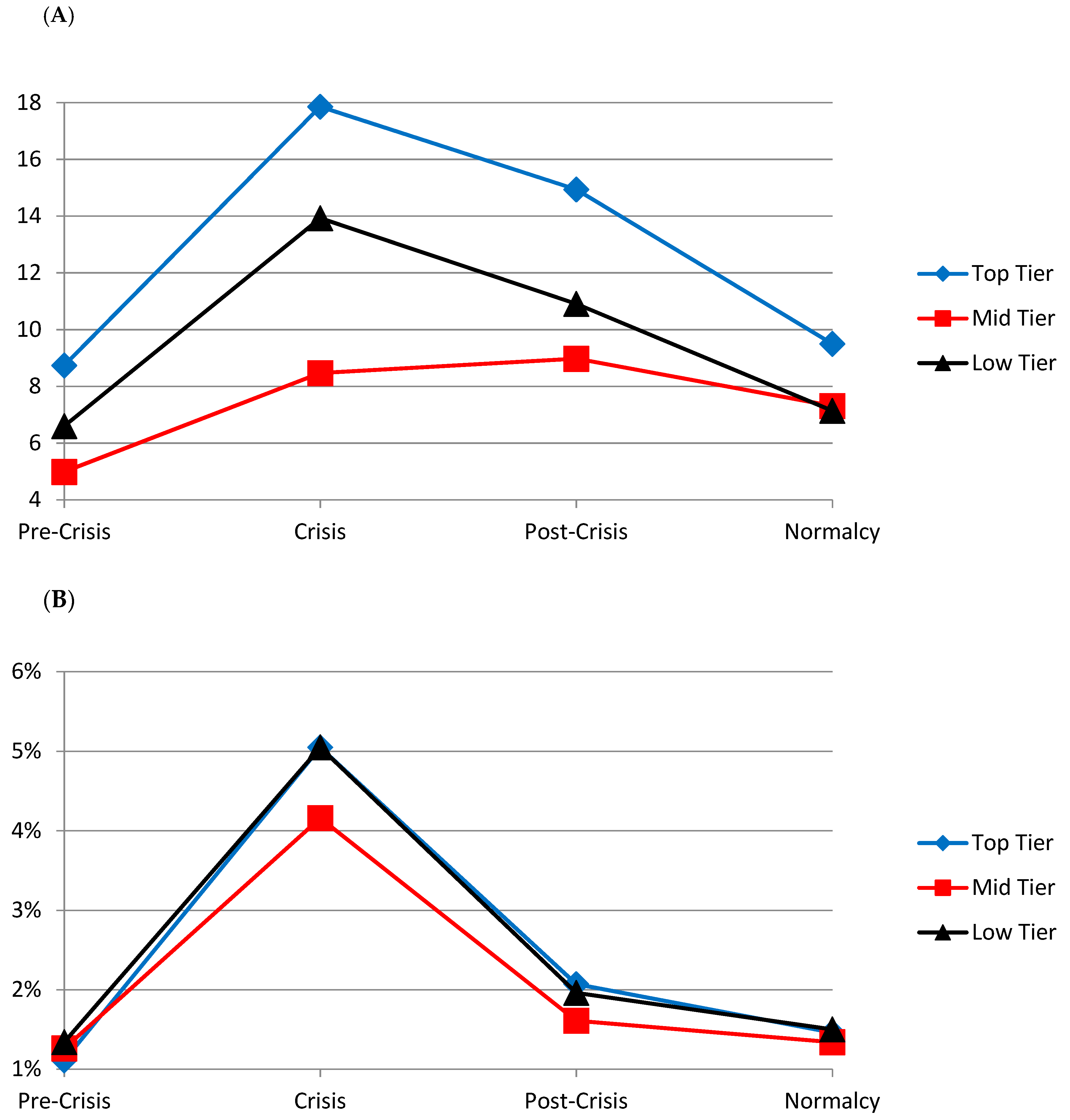

2.2. Higher Equity (or Tier 1) Capital Requirements

2.3. Inducing Banks to Forgo Riskier Practices

2.4. Other Measures

3. Conclusions

Author Contributions

Funding

Conflicts of Interest

References

- Acharya, Viral V., Lasse H. Pedersen, Thomas Philippon, and Matthew Richardson. 2017. Measuring systemic risk. Review of Financial Studies 30: 1–47. [Google Scholar] [CrossRef]

- Admati, Anat, and Martin Hellwig. 2013. The Bankers’ New Clothes: What’s Wrong with Banking and What to Do about It. Princeton: Princeton University Press. [Google Scholar]

- Barth, James R., and Clas Wihlborg. 2017. Too big to fail: Measures, remedies, and consequences for efficiency and stability. Financial Markets, Institutions & Instruments 26: 175–245. [Google Scholar]

- Barth, James R., Apanard P. Prabha, and Phillip Swagel. 2012. Just how big is the too-big-too-fail problem? Journal of Banking Regulation 13: 265–99. [Google Scholar] [CrossRef]

- Bhagat, Sanjai. 2017. Precrisis Executive Compensation and Misaligned Incentives. In Financial Crisis, Corporate Governance, and Bank Capital. Cambridge: Cambridge University Press, chp. 3. pp. 24–29. [Google Scholar]

- Brooke, Martin, Oliver Bush, Robert Edwards, Jas Ellis, Bill Francis, Rashmi Harimohan, Katherine Neiss, and Caspar Siegert. 2015. Measuring the Macroeconomic Costs and Benefits of Higher UK Bank Capital Requirements. Financial Stability Paper No. 25. London: Bank of England. [Google Scholar]

- Brownlees, Christian T., and Robert F. Engle. 2016. SRISK: A Conditional Capital Shortfall Measure of Systemic Risk. Available online: https://ssrn.com/abstract=1611229 (accessed on 25 November 2018).

- Carmassi, Jacopo, and Richard Herring. 2013. Living wills and cross-border resolution of systemically important banks. Journal of Financial Economic Policy 5: 361–87. [Google Scholar] [CrossRef]

- Cetorelli, Nicola, and James Traina. 2018. Resolving ‘Too Big to Fail’. Federal Reserve Bank of New York, Liberty Street Economics (blog). Available online: https://libertystreeteconomics.newyorkfed.org/2018/10/resolving-too-big-to-fail.html (accessed on 24 November 2018).

- Chousakos, Kyriakos T., and Gary B. Gorton. 2017. Bank Health Post-Crisis. NBER Working Paper 23167. Cambridge: National Bureau of Economic Research. [Google Scholar]

- Cochrane, John H. 2014. Toward a run-free financial system. In Across the Great Divide: New Perspectives on the Financial Crisis. Edited by Martin Neil Baily and John B. Taylor. Stanford: Hoover Institution, Stanford University, chp. 10. [Google Scholar]

- Engle, Robert F., and Tianyue Ruan. 2018. How Much SRISK is Too Much? Available online: https://ssrn.com/abstract=3108269 (accessed on 29 October 2018).

- Flannery, Mark. 2014. Maintaining adequate bank capital. Journal of Money, Credit and Banking 46: 157–80. [Google Scholar] [CrossRef]

- Hughes, Joseph P., and Loretta J. Mester. 2013. Who said large banks don’t experience scale economies? Evidence from a risk-return-driven cost function. Journal of Financial Intermediation 22: 559–85. [Google Scholar] [CrossRef]

- Jaggia, Sanjiv, and Satish Thosar. 2017. Pay-for-performance incentives in the finance sector and the financial crisis. Managerial Finance 43: 646–62. [Google Scholar] [CrossRef]

- Johnson, Simon, and James Kwak. 2011. 13 Bankers: The Wall Street Takeover and the Next Financial Meltdown. New York: Vintage Books. [Google Scholar]

- Kisin, Roni, and Asaf Manela. 2016. The shadow cost of bank capital requirements. Review of Financial Studies 29: 1780–20. [Google Scholar] [CrossRef]

- Kovner, Anna, and Peter Van Tassel. 2018. Regulatory Changes and the Cost of Capital for Banks. Staff Report No. 854. New York: Federal Reserve Bank of New York. [Google Scholar]

- Milne, Alistair. 2014. Distance to default and the financial crisis. Journal of Financial Stability 12: 26–36. [Google Scholar] [CrossRef]

- Modigliani, Franco, and Merton H. Miller. 1958. The cost of capital, corporation finance and the theory of investment. American Economic Review 48: 261–97. [Google Scholar]

- Molyneux, Philip. 2017. Are banks public utilities? Evidence from Europe. Journal of Economic Policy Reform 20: 199–213. [Google Scholar] [CrossRef]

- Noss, Joseph, and Rhiannon Sowerbutts. 2012. The Implicit Subsidy of Banks. Financial Stability Paper No. 15. London: Bank of England. [Google Scholar]

- Sarin, Natasha, and Lawrence H. Summers. 2016. Have Big Banks Gotten Safer? BPEA Conference Draft, Washington D.C. Available online: https://www.brookings.edu/bpea-articles/have-big-banks-gotten-safer/ (accessed on 20 October 2018).

- Slovik, Patrick, and Boris Cournede. 2011. Macroeconomic Impact of Basel III. In OECD Economics Departmen. Working Paper 844. Paris: OECD. [Google Scholar]

- Stern, Gary, and Ron Feldman. 2004. Too Big to Fail: The Hazards of Bank Bailouts. Washington, DC: Brookings Institution Press. [Google Scholar]

- White, Alan M. 2016. Banks as utilities. Tulane Law Review 90. Available online: https://ssrn.com/abstract=2847815 (accessed on 25 November 2018).

| 1 | https://www.federalreserve.gov/newsevents/testimony/bernanke20100902a.htm. See also Stern and Feldman (2004) for an early comprehensive discussion of the Too Big to Fail (TBTF) issue. |

| 2 | See page 18 of the annual report which also outlines the factors and analysis leading up to the cited remark about TBTF. |

| 3 | See also Chousakos and Gorton (2017) who state that “Post-crisis regulatory changes have aimed at restoring bank health, but measuring bank health by Tobin’s Q, we find that the ill health of banks in the recent U.S. financial crisis and the Euro crisis has persisted, especially compared to other crises in advanced economies.” |

| 4 | In this regard, our discussion and analysis is primarily based on the U.S. experience. |

| 5 | All four are considered to be global systemically important banks (G-SIBs) per the 16 November 2018 list published by the Financial Stability Board in consultation with the Basel Committee on Banking Supervision. |

| 6 | Of these: Bank of New York Mellon and State Street are G-SIBs, while the other two are large enough in terms of assets to be considered domestic SIFIs or Systemically Important Financial Institutions. |

| 7 | See, for example, the outputs produced by the Volatility Lab at New York University. https://vlab.stern.nyu.edu/. |

| 8 | In the U.S., this primarily refers to the Dodd–Frank Wall Street Reform and Consumer Protection Act (2010) though this has been partially scaled back by the Economic Growth, Regulatory Relief and Consumer Protection Act (2018). |

| 9 | See “Breaking Up Four Big Banks” and “Break Up the Big Banks” in the New York Times dated 10 May 2012 and 29 June 2016, respectively, and “The End of Big Banks” in Project Syndicate dated 29 February 2016. |

| 10 | |

| 11 | https://www.sanders.senate.gov/newsroom/press-releases/sanders-sherman-introduce-legislation-to-break-up-too-big-to-fail-financial-institutions. It is worth noting that both Sanders and Sherman were in the minority in the Senate and House, respectively, and it is extremely unlikely that this legislation will pass (or even be taken up for consideration) in the near future. |

| 12 | Hughes and Mester (2013) suggest that significant economies of scale exist in the banking sector, which are not driven by TBTF considerations. |

| 13 | Expressed in 2015 dollars. |

| 14 | Work on Basel IV is underway. See the McKinsey and Company (2017) report, titled: Basel “IV”: What’s Next for Banks? https://www.mckinsey.com/~/media/mckinsey/business%20functions/risk/our%20insights/basel%20iv%20whats%20next%20for%20european%20banks/basel-iv-whats-next-for-banks.ashx. |

| 15 | See “From Basel to the Volcker Rule” for a Useful Glossary of Financial Regulation Terms. https://www.moneyandbanking.com/commentary/2018/11/18/from-basel-to-the-volcker-rule-a-finreg-glossary. |

| 16 | |

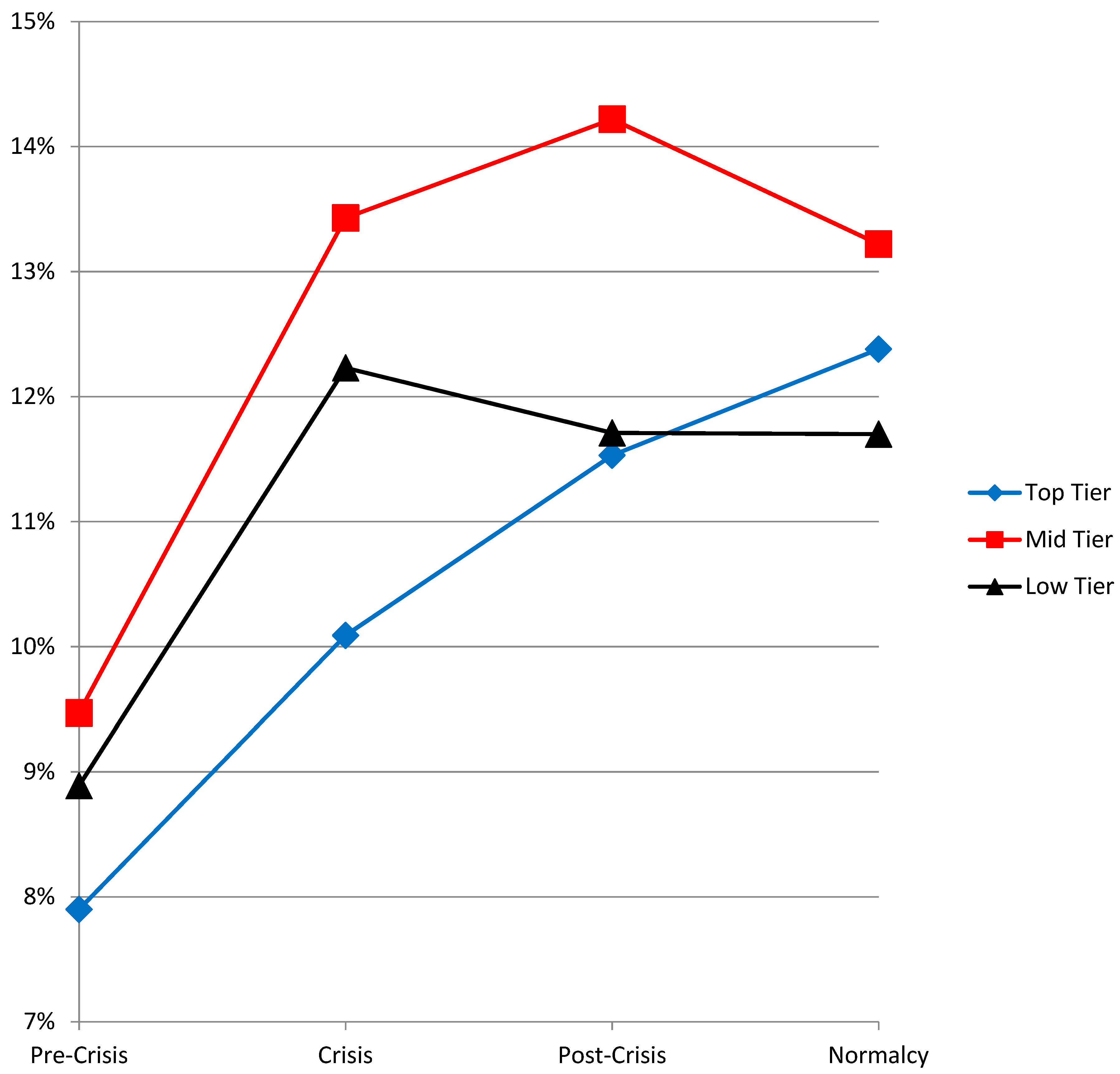

| 17 | The Tier 1, capital ratio is the ratio of a bank’s core equity capital to its total risk-weighted assets. Risk-weighted assets are the total of all assets held by the bank weighted by credit risk according to a formula determined by the regulator (usually the country’s central bank). |

| 18 | This is akin to a borrower taking out a home mortgage loan being required to put up a 20 percent down payment. |

| 19 | See Brooke et al. (2015) and Kovner and Van Tassel (2018) for detailed analyses. Estimates of increases in cost of capital vary from modest (Kisin and Manela 2016) to high (Slovik and Cournede 2011). |

| 20 | These ratios are based on published annual reports using U.S. Generally Accepted Accounting Principles (GAAP). Basel III’s recommended exposure measure includes off balance sheet items (such as derivatives, loan commitments) in the denominator whose inclusion would shrink the ratio. |

| 21 | |

| 22 | See Noss and Sowerbutts (2012). |

| 23 | |

| 24 | See the Financial Crisis Inquiry Report (Part II, pp. 27–82). https://www.gpo.gov/fdsys/pkg/GPO-FCIC/pdf/GPO-FCIC.pdf. |

| 25 | “Should Big Banks Be Regulated as Utilities” dated 14 April 2011 in The Atlantic magazine. |

| 26 | “Who’s Bullish on Banks as Utilities?” in the American Banker dated 18 April 2016. |

| 27 | |

| 28 | |

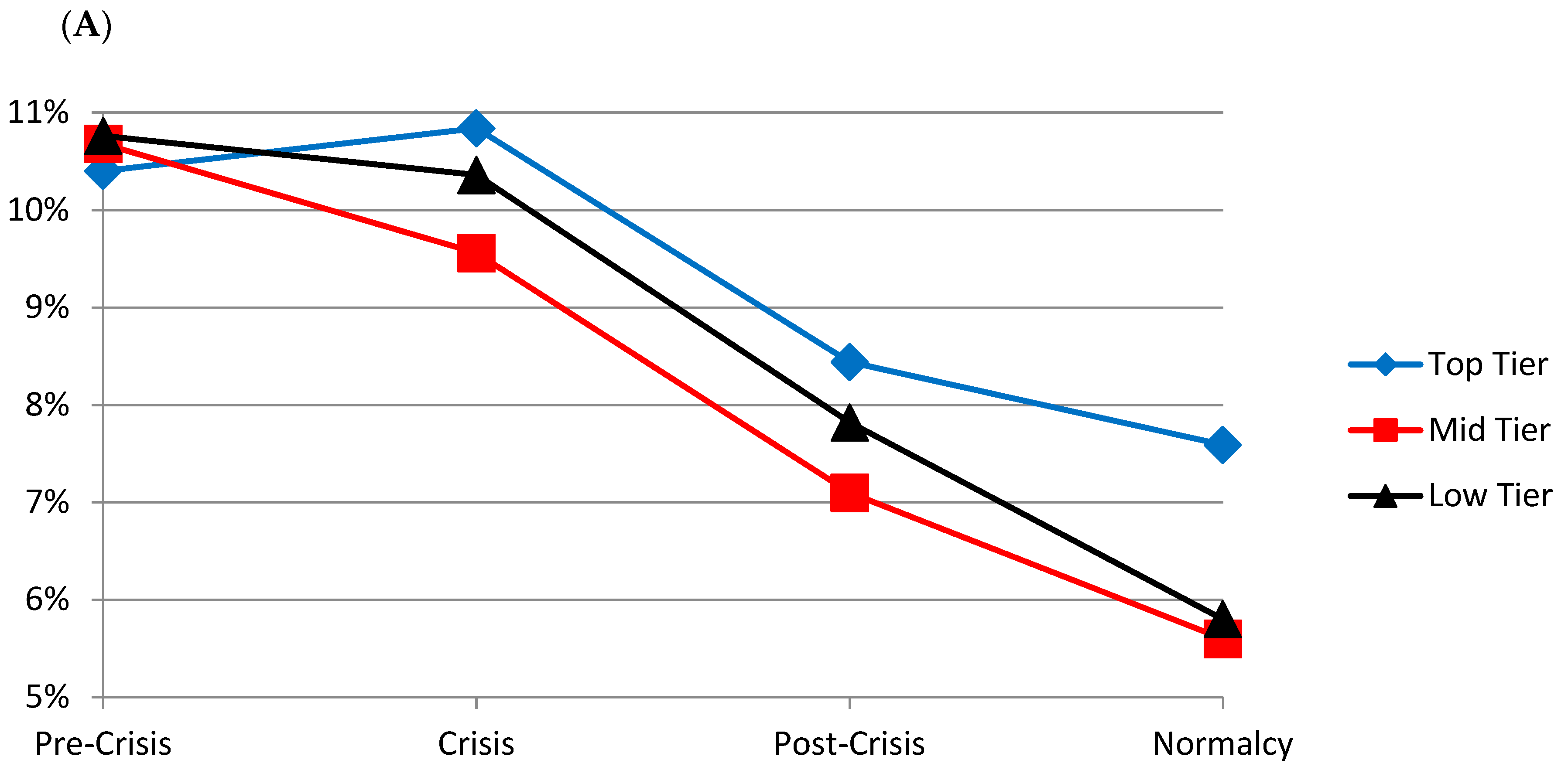

| 29 | This is based on a standard approximation of leverage. See, for example, Acharya et al. (2017, p. 15). |

| 30 | See Barth et al. (2012) for a more comprehensive treatment. |

| 31 | See Cetorelli and Traina (2018) for an analysis of the impact of living wills. |

| 32 | “Those of us who have looked to the self-interest of lending institutions to protect shareholders’ equity, myself included, are in a state of shocked disbelief” said Alan Greenspan, former Federal Reserve chairman in testifying before the House Committee on Oversight and Government Reform. See New York Times article: “Greenspan Concedes Error on Regulation” dated 23 October 2008. |

| 33 | See for example: Acharya et al. (2017), Brownlees and Engle (2016), Engle and Ruan (2018) and the real-time analyses at the Volatility Lab, New York University. |

| 34 |

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Thosar, S.; Schwandt, B. Has ‘Too Big To Fail’ Been Solved? A Longitudinal Analysis of Major U.S. Banks. J. Risk Financial Manag. 2019, 12, 24. https://doi.org/10.3390/jrfm12010024

Thosar S, Schwandt B. Has ‘Too Big To Fail’ Been Solved? A Longitudinal Analysis of Major U.S. Banks. Journal of Risk and Financial Management. 2019; 12(1):24. https://doi.org/10.3390/jrfm12010024

Chicago/Turabian StyleThosar, Satish, and Bradley Schwandt. 2019. "Has ‘Too Big To Fail’ Been Solved? A Longitudinal Analysis of Major U.S. Banks" Journal of Risk and Financial Management 12, no. 1: 24. https://doi.org/10.3390/jrfm12010024

APA StyleThosar, S., & Schwandt, B. (2019). Has ‘Too Big To Fail’ Been Solved? A Longitudinal Analysis of Major U.S. Banks. Journal of Risk and Financial Management, 12(1), 24. https://doi.org/10.3390/jrfm12010024