Incorporating Credit Quality in Bank Efficiency Measurements: A Directional Distance Function Approach

Abstract

:1. Introduction

2. Review of Literature

3. Methodology

3.1. Directional Distance Functions with Undesirable Outputs

3.2. Non-Parametric Regression

4. Data

5. Results

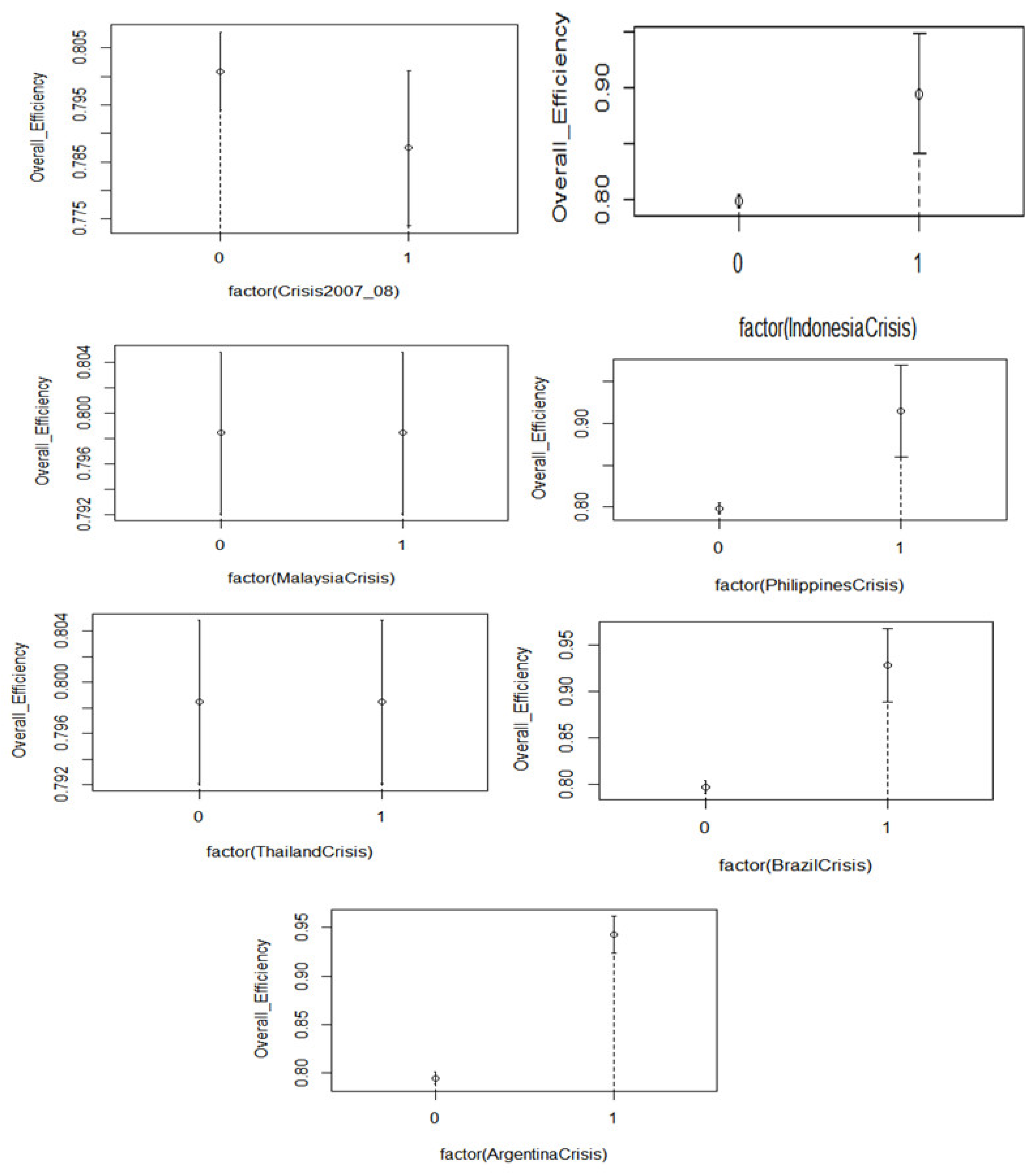

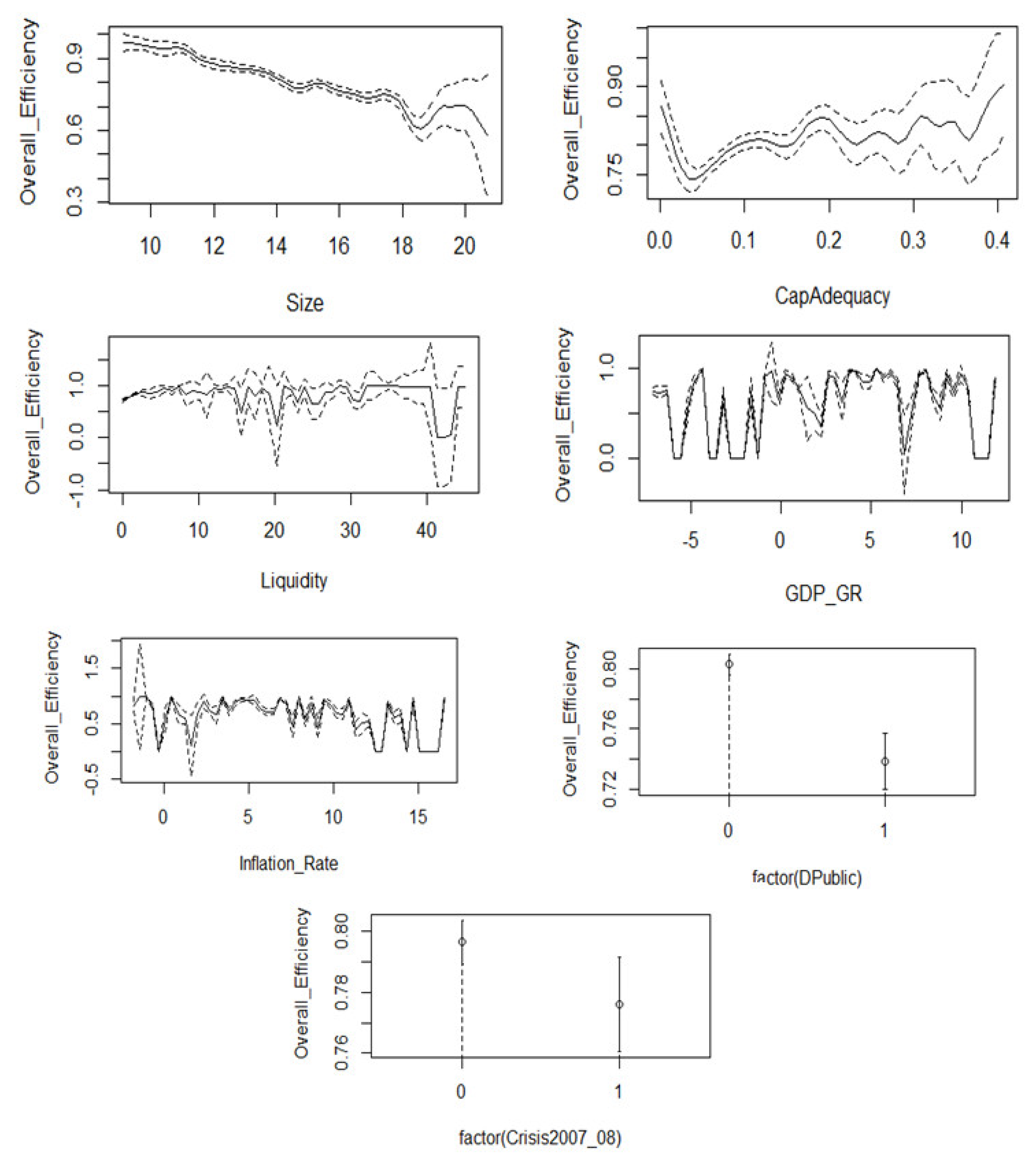

Non-Parametric Regression

6. Concluding Remarks

Policy Implications

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

Appendix

References

- Acharya, Viral, and Hassan Naqvi. 2012. The seeds of a crisis: A theory of bank liquidity and risk taking over the business cycle. Journal of Financial Economics 106: 349–66. [Google Scholar] [CrossRef]

- Akther, Syed, Hirofumi Fukuyama, and William L. Weber. 2013. Estimating two-stage network slacks-based inefficiency: An application to Bangladesh banking. Omega 41: 88–96. [Google Scholar] [CrossRef]

- Ashraf, Badar Nadeem, Sidra Arshad, and Liang Yan. 2017. Trade openness and bank risk-taking behavior: Evidence from emerging economies. Journal of Risk and Financial Management 10: 15. [Google Scholar] [CrossRef]

- Baily, Martin Neil, and Douglas J. Elliott. 2009. The US Financial and Economic Crisis: Where Does It Stand and Where Do We Go from Here. Brookings Institution, Jun. Available online: https://www.brookings.edu/wp-content/.../0615_economic_crisis_baily_elliott.pdf (accessed on 20 July 2018).

- Banker, Rajiv D., Abraham Charnes, and William Wager Cooper. 1984. Some models for estimating technical and scale inefficiencies in data envelopment analysis. Management Science 30: 1078–92. [Google Scholar] [CrossRef]

- Banker, Rajiv D., Zhiqiang Eric Zheng, and Ram Natarajan. 2010. DEA-based hypothesis tests for comparing two groups of decision making units. European Journal of Operational Research 206: 231–38. [Google Scholar] [CrossRef]

- Barros, Carlos Pestana, Shunsuke Managi, and Roman Matousek. 2012. The technical efficiency of the Japanese banks: non-radial directional performance measurement with undesirable output. Omega 40: 1–8. [Google Scholar] [CrossRef]

- Barth, James R., Gerard Caprio Jr., and Ross Levine. 2008. Bank Regulations Are Changing: For Better or Worse? The World Bank. Available online: https://openknowledge.worldbank.org/handle/10986/6664 (accessed on 8 September 2018).

- Barth, James R., Gerard Caprio Jr., and Ross Levine. 2013. Bank Regulation and Supervision in 180 Countries from 1999 to 2011. Journal of Financial Economic Policy 5: 111–219. [Google Scholar] [CrossRef]

- Batir, Tugba Eyceyurt, David A. Volkman, and Bener Gungor. 2017. Determinants of bank efficiency in Turkey: Participation banks versus conventional banks. Borsa Istanbul Review 17: 86–96. [Google Scholar] [CrossRef]

- Bholat, David M., Rosa M. Lastra, Sheri M. Markose, Andrea Miglionico, and Kallol Sen. 2016. Non-Performing Loans: Regulatory and Accounting Treatments of Assets. Available online: https://papers.ssrn.com/abstract=2768865 (accessed on 15 July 2018).

- Charnes, Abraham, William W. Cooper, and Edwardo Rhodes. 1978. Measuring the efficiency of decision making units. European Journal of Operational Research 2: 429–44. [Google Scholar] [CrossRef]

- Charnes, A., W. W. Cooper, B. Golany, B. Kirby, J. McGahan, and D. Semple. 1988. Measuring the Impact of National Advertising on Recruiting by Data Envelopment Analysis Methods (No. CCS-595). Texas Univ at Austin Center for Cybernetic Studies. Available online: www.dtic.mil/dtic/tr/fulltext/u2/a191591.pdf (accessed on 7 November 2018).

- Chung, Yangho H., Rolf Färe, and Shawna Grosskopf. 1997. Productivity and undesirable outputs: A directional distance function approach. Journal of Environmental Management 51: 229–40. [Google Scholar] [CrossRef]

- Drigă, Imola, and Codruţa Dura. 2014. The Financial Sector and the Role of Banks in Economic Development. Paper presented at the 6th International Multidisciplinary Symposium “Universitaria SIMPRO”, University of Petrosani, Petroșani, Romania, October 10–11. [Google Scholar]

- Emrouznejad, Ali, and Guo-liang Yang. 2017. A survey and analysis of the first 40 years of scholarly literature in DEA: 1978–2016. Socio-Economic Planning Sciences 61: 4–8. [Google Scholar] [CrossRef]

- Färe, Rolf, and Shawna Grosskopf. 2000. Network dea. Socio-Economic Planning Sciences 34: 35–49. [Google Scholar] [CrossRef]

- Färe, Rolf, Shawna Grosskopf, C. A. Knox Lovell, and Carl Pasurka. 1989. Multilateral productivity comparisons when some outputs are undesirable: a nonparametric approach. The Review of Economics and Statistics 71: 90–98. [Google Scholar] [CrossRef]

- Fries, Steven, and Anita Taci. 2005. Cost efficiency of banks in transition: Evidence from 289 banks in 15 post-communist countries. Journal of Banking & Finance 29: 55–81. [Google Scholar]

- Fukuyama, Hirofumi, and William L. Weber. 2008. Japanese banking inefficiency and shadow pricing. Mathematical and Computer Modelling 48: 1854–67. [Google Scholar] [CrossRef]

- Fukuyama, Hirofumi, and William L. Weber. 2010. A slacks-based inefficiency measure for a two-stage system with bad outputs. Omega 38: 398–409. [Google Scholar] [CrossRef]

- Gropp, Reint, and Florian Heider. 2010. The determinants of bank capital structure. Review of Finance 14: 587–622. [Google Scholar] [CrossRef]

- Hamid, Nurhayati, Noor Asiah Ramli, and Siti Aida Sheikh Hussin. 2017. Efficiency measurement of the banking sector in the presence of non-performing loan. In AIP Conference Proceedings. Melville: AIP Publishing, vol. 1795, no. 1. p. 020001. [Google Scholar]

- Hayfield, Tristen, and Jeffrey S. Racine. 2008. Nonparametric econometrics: The np package. Journal of Statistical Software 27: 1–32. [Google Scholar] [CrossRef]

- Huang, Jianhuan, Juanjuan Chen, and Zhujia Yin. 2014. A network DEA model with super efficiency and undesirable outputs: An application to bank efficiency in China. Mathematical Problems in Engineering 2014: 14. [Google Scholar] [CrossRef]

- Illueca, Manuel, José M. Pastor, and Emili Tortosa-Ausina. 2009. The effects of geographic expansion on the productivity of Spanish savings banks. Journal of Productivity Analysis 32: 119–43. [Google Scholar] [CrossRef]

- Johnes, Jill, Marwan Izzeldin, and Vasileios Pappas. 2014. A comparison of performance of Islamic and conventional banks 2004–2009. Journal of Economic Behavior & Organization 103: 93–107. [Google Scholar]

- Kleff, Volker, and Martin Weber. 2008. How do banks determine capital? Evidence from Germany. German Economic Review 9: 354–72. [Google Scholar] [CrossRef]

- Kumar, Sunil, and Rachita Gulati. 2014. A Survey of Empirical Literature on Bank Efficiency Deregulation and Efficiency of Indian Banks. New Delhi: Springer, pp. 119–65. [Google Scholar]

- Liu, John S., Louis Y. Y. Lu, Wen-Min Lu, and Bruce J. Y. Lin. 2013. A survey of DEA applications. Omega 41: 893–902. [Google Scholar] [CrossRef]

- McDonald, John. 2009. Using least squares and tobit in second stage DEA efficiency analyses. European Journal of Operational Research 197: 792–98. [Google Scholar] [CrossRef]

- Moyo, Jennifer, Boaz Nandwa, Dubai Economic Council, Jacob Oduor, and Anthony Simpasa. 2014. Financial Sector Reforms, Competition and Banking System Stability in Sub-Saharan Africa. Available online: https://www.imf.org/external/np/seminars/eng/2014/lic/pdf/Moyo.pdf (accessed on 3 August 2018).

- Office of the Comptroller of the Currency, United States. 1988. Bank failure: An Evaluation of the Factors Contributing to the Failure of National Banks: Office of the Comptroller of the Currency. Available online: https://www.occ.treas.gov/publications/publications-by-type/other-publications-reports/pub-other-bank-failure.pdf (accessed on 5 August 2018).

- Racine, Jeff. 1997. Consistent significance testing for nonparametric regression. Journal of Business & Economic Statistics 15: 369–78. [Google Scholar]

- Racine, Jeffrey S. 2008. Nonparametric econometrics: A primer. Foundations and Trends® in Econometrics 3: 1–88. [Google Scholar] [CrossRef]

- Racine, Jeffery S., Jeffrey Hart, and Qi Li. 2006. Testing the significance of categorical predictor variables in nonparametric regression models. Econometric Reviews 25: 523–44. [Google Scholar] [CrossRef]

- Rosenblatt, Murray. 1956. Remarks on some nonparametric estimates of a density function. The Annals of Mathematical Statistics 1: 832–37. [Google Scholar] [CrossRef]

- Saini, Priyanka, and Jyoti Sindhu. 2014. Role of Commercial Bank in the Economic Development of India. International Journal of Engineering and Management Research 4: 27–31. [Google Scholar]

- Seiford, Lawrence M., and Joe Zhu. 1999. Profitability and marketability of the top 55 US commercial banks. Management science 45: 1270–88. [Google Scholar] [CrossRef]

- Titko, Jelena, Jelena Stankevičienė, and Nataļja Lāce. 2014. Measuring bank efficiency: DEA application. Technological and Economic Development of Economy 20: 739–57. [Google Scholar] [CrossRef]

- Tobin, James. 1985. Estimation of relationships for limited dependent variables. Econometrica: Journal of the Econometric Society, 24–36. [Google Scholar] [CrossRef]

- Tone, Kaoru, and Miki Tsutsui. 2009. Network DEA: A slacks-based measure approach. European Journal of Operational Research 197: 243–52. [Google Scholar] [CrossRef]

- Vu, Ha, and Daehoon Nahm. 2013. The determinants of profit efficiency of banks in Vietnam. Journal of the Asia Pacific Economy 18: 615–31. [Google Scholar] [CrossRef]

- Wang, Ke, Wei Huang, Jie Wu, and Ying-Nan Liu. 2014. Efficiency measures of the Chinese commercial banking system using an additive two-stage DEA. Omega 44: 5–20. [Google Scholar] [CrossRef]

- Wanke, Peter, and Carlos Barros. 2014. Two-stage DEA: An application to major Brazilian banks. Expert Systems with Applications 41: 2337–44. [Google Scholar] [CrossRef]

- Weill, Laurent. 2003. Banking efficiency in transition economies: The role of foreign ownership. Economics of Transition 11: 569–92. [Google Scholar] [CrossRef]

- Xiaoqing Maggie, F. U., and Shelagh Heffernan. 2007. Cost X-efficiency in China’s banking sector. China Economic Review 18: 35–53. [Google Scholar]

- Yang, Chyan, and Hsian-Ming Liu. 2012. Managerial efficiency in Taiwan bank branches: A network DEA. Economic Modelling 29: 450–61. [Google Scholar] [CrossRef]

- Zago, Angelo, and Paola Dongili. 2011. Credit quality and technical efficiency in banking. Empirical Economics 40: 537–38. [Google Scholar] [CrossRef]

- Zhu, Ning, Bing Wang, and Yanrui Wu. 2015. Productivity, efficiency, and non-performing loans in the Chinese banking industry. The Social Science Journal 52: 468–80. [Google Scholar] [CrossRef]

| 1 | Most previous studies used either the production or the intermediation approach to model bank efficiency. |

| 2 | It may be argued that, instead of the non-performing loans (NPLs), the loan loss provisions are an alternative representation of the undesirable output in the model. Note, however, that the loan loss provisions are also calculated on the basis of non-performing loans (Bholat et al. 2016). The previous studies employed non-performing loans as an undesirable output in measuring efficiency through directional distance functions. See, for example, (Akther et al. 2013; Barros et al. 2012; Zhu et al. 2015). We followed the same convention and used NPLs to represent undesirable outputs in this study. |

| 3 | We would like to thank an anonymous referee for this point. |

| 4 | The surveys contain a wealth of information that, when suitably combined with other sources of bank-level data, could offer rich possibilities for further research. We hope to explore some of these possibilities in our own future research. Models I and II that incorporated country fixed effects in an attempt to capture the individual country regulatory environment, while not fully capturing the dynamics of the regulatory regimes, were motivated by Barth et al. (2008). |

| 5 | In our sample, the economies of countries such as Greece, Hungary, Czech Republic, Turkey, and UAE experienced negative growth rates and poor bank efficiency during various sub-periods. |

| 6 | In our sample, the economies of countries such as Turkey, Argentina, Indonesia, Malaysia, and Pakistan experienced high inflation at various sub-periods and highly volatile technical efficiency scores for banks. |

| 7 | The negative impact on efficiency of banks was due to generating higher NPLs and administrative expenses faced by banks as a result of crises in the regions of South Asia and emerging Europe. |

| 8 | For example, if a small bank is merged with a large bank, then it is an empirical question whether or not the effect of the larger size on efficiency would outweigh the effect of improved capital adequacy. This study helps answer such empirical questions. |

| Process | Variables | Method | |

|---|---|---|---|

| Inputs | Outputs | ||

| Deposit mobilization stage | • Personnel expenses | • Total deposits | Directional distance function based on network DEA |

| • Other administrative expenses | |||

| • User cost of fixed assets | |||

| Loan financing stage | • Total deposits | ||

| • Personnel expenses | • Total loans • Other earning assets • Non-performing loans2 | ||

| • Other administrative expenses | |||

| • User cost of fixed assets | |||

| Variable | Skewness | Kurtosis | Mean | Std. Deviation |

|---|---|---|---|---|

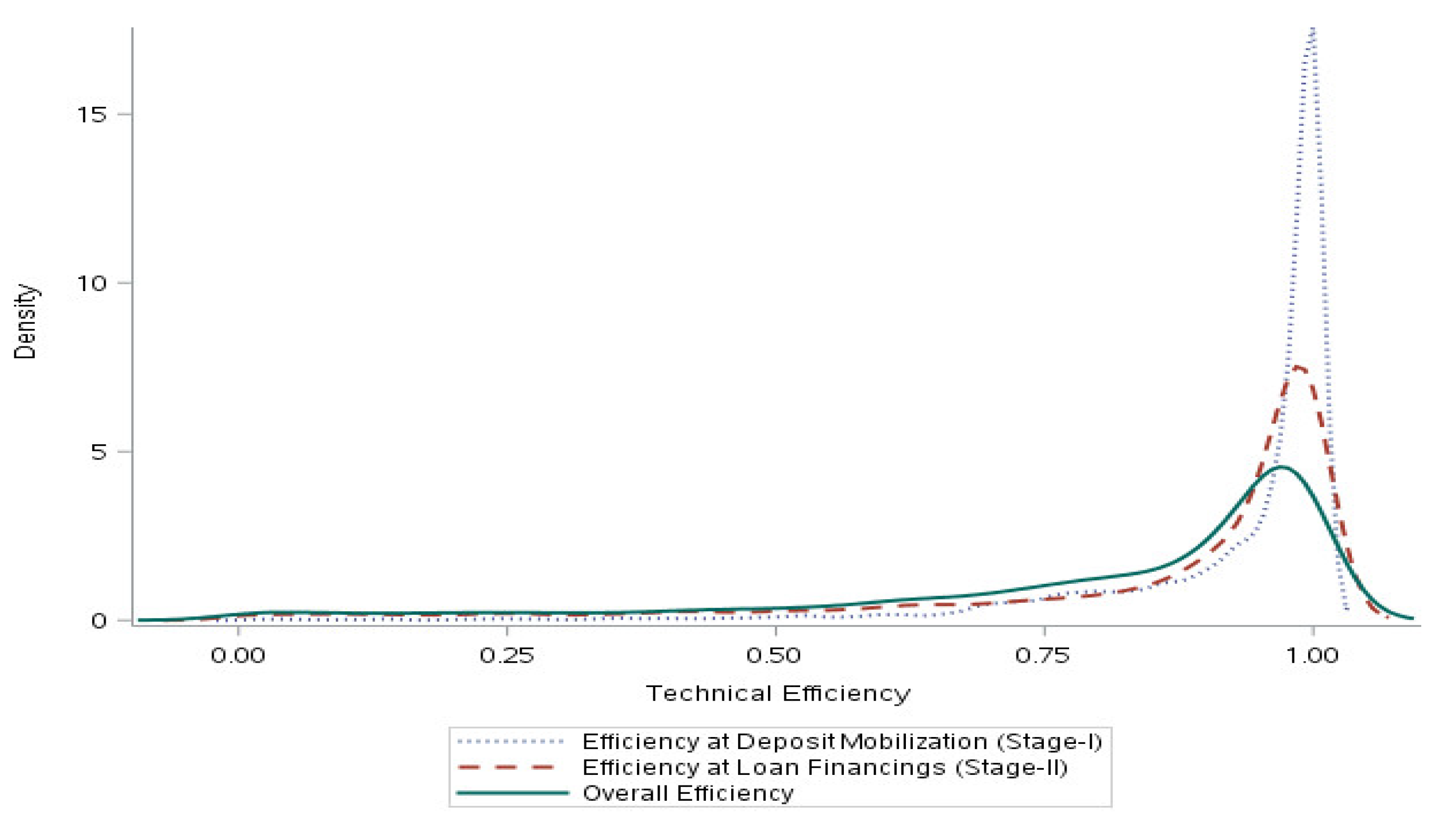

| Efficiency of deposit mobilization (Stage I) | −3.11 | 12.51 | 0.93 | 0.1293 |

| Efficiency of loan financings (Stage II) | −1.98 | 3.21 | 0.85 | 0.2311 |

| Overall efficiency | −1.60 | 1.79 | 0.80 | 0.2463 |

| Region | Country Name | Number of Banks | Number of Observations | Stage I | Stage II | Overall Average Efficiency Scores | |

|---|---|---|---|---|---|---|---|

| Southeast Asia | Indonesia | 80 | 562 | 1.00 | 0.86 | 0.86 | 0.83 |

| Malaysia | 46 | 137 | 0.99 | 0.64 | 0.64 | ||

| Philippines | 32 | 191 | 1.00 | 0.94 | 0.94 | ||

| Thailand | 6 | 54 | 1.00 | 0.69 | 0.68 | ||

| South Asia | India | 69 | 587 | 0.93 | 0.72 | 0.69 | 0.67 |

| Pakistan | 26 | 219 | 0.91 | 0.65 | 0.61 | ||

| Latin America | Argentina | 57 | 506 | 0.96 | 0.98 | 0.95 | 0.93 |

| Brazil | 96 | 640 | 0.96 | 0.97 | 0.93 | ||

| Chile | 30 | 134 | 0.91 | 0.96 | 0.89 | ||

| Colombia | 14 | 93 | 0.95 | 1.00 | 0.95 | ||

| Mexico | 32 | 225 | 0.93 | 0.97 | 0.90 | ||

| Peru | 15 | 124 | 0.91 | 0.99 | 0.90 | ||

| Emerging Europe | Czech Republic | 25 | 148 | 0.69 | 0.73 | 0.54 | 0.68 |

| Greece | 16 | 99 | 0.75 | 0.91 | 0.69 | ||

| Hungary | 13 | 94 | 0.80 | 0.93 | 0.74 | ||

| Poland | 33 | 173 | 0.83 | 0.86 | 0.72 | ||

| Turkey | 39 | 276 | 0.86 | 0.83 | 0.71 | ||

| East Asia | China | 151 | 744 | 0.98 | 0.85 | 0.84 | 0.85 |

| South Korea | 15 | 61 | 1.00 | 0.91 | 0.91 | ||

| Taiwan | 47 | 164 | 0.97 | 0.94 | 0.91 | ||

| Africa and the Middle East | Egypt | 22 | 91 | 0.60 | 0.52 | 0.37 | 0.55 |

| Morocco | 12 | 57 | 0.91 | 0.79 | 0.72 | ||

| South Africa | 18 | 91 | 0.85 | 0.70 | 0.65 | ||

| UAE | 24 | 215 | 0.87 | 0.60 | 0.55 | ||

| Average | 918 | 5685 | 0.93 | 0.85 | 0.80 | 0.80 | |

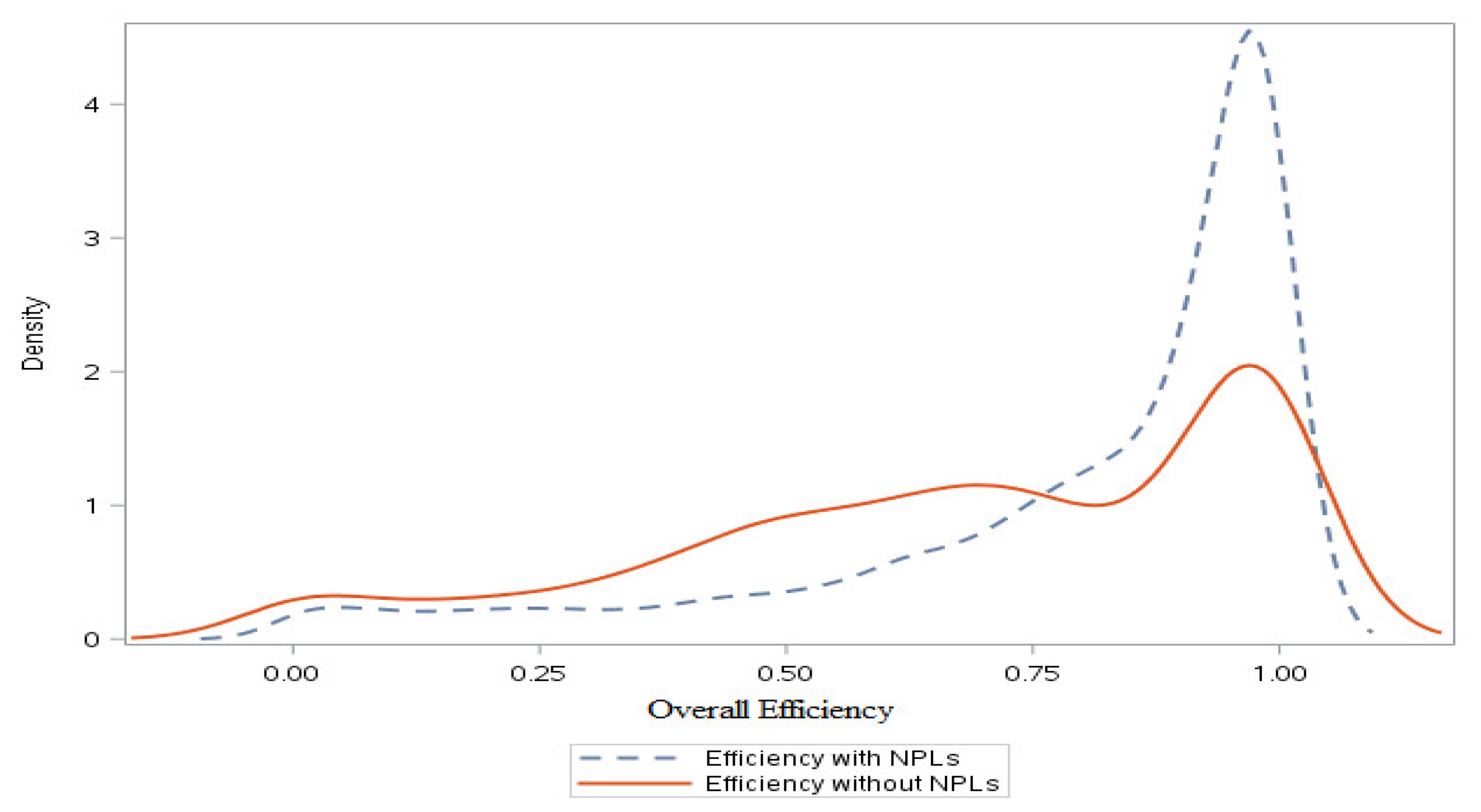

| Region | Share of NPLs | Efficiency Scores | |

|---|---|---|---|

| With NPLs | Without NPLs | ||

| Southeast Asia | 9.76 | 0.83 | 0.61 |

| South Asia | 7.29 | 0.67 | 0.51 |

| Latin America | 3.97 | 0.93 | 0.94 |

| Emerging Europe | 10.74 | 0.68 | 0.54 |

| East Asia | 4.11 | 0.85 | 0.71 |

| Africa and the Middle East | 8.98 | 0.55 | 0.41 |

| Average | 7.48 | 0.80 | 0.69 |

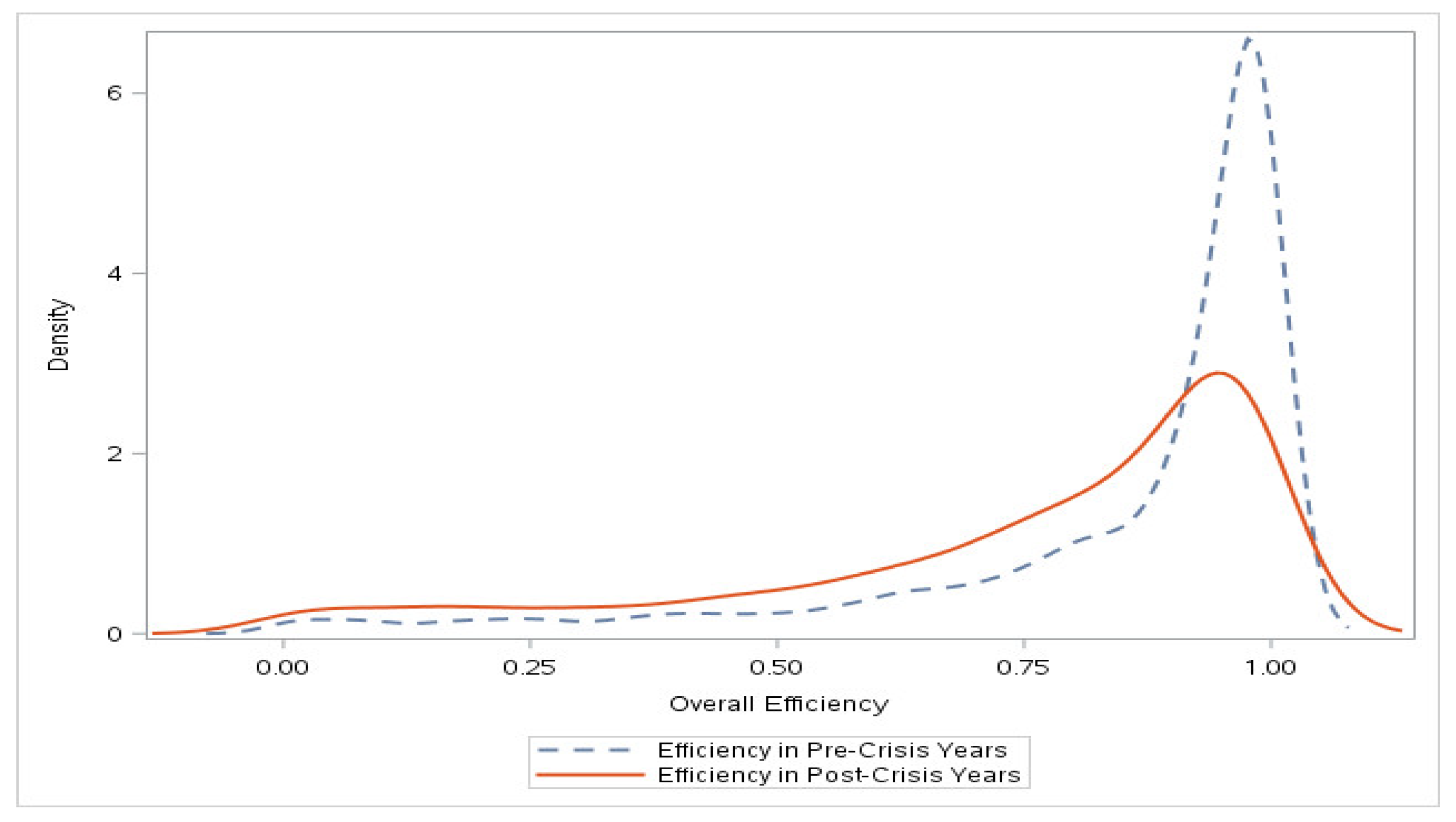

| Classification | Southeast Asia | South Asia | Latin America | Emerging Europe | East Asia | Africa and the Middle East | Overall Efficiency of Banks |

|---|---|---|---|---|---|---|---|

| Efficiency pre-crisis | |||||||

| Deposit mobilization stage | 1.00 | 0.94 | 0.96 | 0.83 | 0.98 | 0.83 | 0.85 |

| Loan financing stage | 0.87 | 0.76 | 0.97 | 0.82 | 0.94 | 0.59 | |

| Overall | 0.87 | 0.73 | 0.94 | 0.68 | 0.93 | 0.53 | |

| Efficiency post-crisis | |||||||

| Deposit mobilization stage | 1.00 | 0.91 | 0.92 | 0.78 | 0.98 | 0.81 | 0.74 |

| Loan financing stage | 0.78 | 0.63 | 0.98 | 0.86 | 0.83 | 0.65 | |

| Overall | 0.78 | 0.60 | 0.90 | 0.68 | 0.81 | 0.56 | |

| Share of non-performing loans (%) | |||||||

| Pre-crisis | 12.44 | 8.15 | 4.12 | 9.41 | 5.99 | 7.95 | |

| Post-crisis | 6.24 | 6.19 | 3.63 | 11.85 | 2.98 | 9.57 |

| Model I | Model II | Model III | ||||

|---|---|---|---|---|---|---|

| Variable | Band Width | p-Value | Band Width | p-Value | Band Width | p-Value |

| Size | 0.2853 | 0.07518 | 1.6045 | 0.06767 | 0.2852 | 0.41353 |

| Capital adequacy | 0.0177 | 0.21303 | 69358 | <0.0001 | 0.0143 | 0.06015 |

| Liquidity | 0.1325 | 0.26566 | 17.1520 | 0.38346 | 0.1264 | 0.54386 |

| GDP growth rate | 7.3452 | 0.84962 | 0.01462 | 0.37093 | 4.9081 | 0.06516 |

| Inflation gate | 3.1927 | 0.02005 | 0.3356 | 0.75188 | 3.6092 | 0.02256 |

| Public banks | 0.0746 | <0.0001 | 0.4999 | 0.02757 | 0.0463 | <0.0001 |

| Financial crisis of 2007–2008 | 0.4293 | <0.00251 | 0.2600 | 0.0802 | 0.4474 | <0.0001 |

| East Asia | – | – | – | – | 0.02753 | <0.0001 |

| Southeast Asia | – | – | – | – | 0.000073 | <0.0001 |

| South Asia | – | – | – | – | 0.01635 | <0.0001 |

| Latin America | – | – | – | – | 0.00037 | <0.0001 |

| Emerging Europe | – | – | – | – | 0.00059 | <0.0001 |

| Indonesian crisis dummy | – | – | 0.5 | 0.48622 | – | – |

| Malaysian crisis dummy | – | – | 0.49999 | 0.74686 | – | – |

| Philippines crisis dummy | – | – | 0.49999 | 0.28070 | – | – |

| Thailand crisis dummy | – | – | 0.3107 | 0.08521 | – | – |

| Brazil crisis dummy | – | – | 0.49999 | 0.44611 | – | – |

| Argentina crisis dummy | – | – | 0.5 | 0.99749 | – | – |

| Colombia crisis dummy | – | – | 0.40188 | 0.97744 | – | – |

| Turkey crisis dummy | – | – | 0.46401 | 0.89724 | – | – |

| Egypt crisis dummy | – | – | 0.12138 | 0.01253 | – | – |

| Morocco crisis dummy | – | – | 0.49999 | 0.89474 | – | – |

| Czech Republic crisis dummy | – | – | 0.49999 | 0.58897 | – | – |

| Greece crisis dummy | – | – | 0.49999 | 0.59398 | – | – |

| R2 = 0.80 | R2 = 0.48 | R2 = 0.78 | ||||

| Dependent variable: overall efficiency scores | ||||||

© 2018 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Qayyum, A.; Riaz, K. Incorporating Credit Quality in Bank Efficiency Measurements: A Directional Distance Function Approach. J. Risk Financial Manag. 2018, 11, 78. https://doi.org/10.3390/jrfm11040078

Qayyum A, Riaz K. Incorporating Credit Quality in Bank Efficiency Measurements: A Directional Distance Function Approach. Journal of Risk and Financial Management. 2018; 11(4):78. https://doi.org/10.3390/jrfm11040078

Chicago/Turabian StyleQayyum, Abdul, and Khalid Riaz. 2018. "Incorporating Credit Quality in Bank Efficiency Measurements: A Directional Distance Function Approach" Journal of Risk and Financial Management 11, no. 4: 78. https://doi.org/10.3390/jrfm11040078

APA StyleQayyum, A., & Riaz, K. (2018). Incorporating Credit Quality in Bank Efficiency Measurements: A Directional Distance Function Approach. Journal of Risk and Financial Management, 11(4), 78. https://doi.org/10.3390/jrfm11040078