Forecast Combinations for Structural Breaks in Volatility: Evidence from BRICS Countries

Abstract

1. Introduction

2. Data and Methodology

2.1. In-Sample Analysis

- The detection method is applied to the segment for .

- If no change-point is found in the segment the break at is not considered a change point. If a new change point is detected, it replaces the old one at .

- The procedure is repeated until the number of change points does not change and the points found in each new step are ”close” to those on the previous step.

2.2. Out-of-Sample Analysis

- Expanding win. This method forms out-of-sample forecasts using a recursive (expanding) estimation window. For 1-step-ahead forecasts, an initial sample using data from t = 1 to t = R is used to estimate the model and the 1-step ahead out-of-sample forecast is produced. The sample is increased by one, the model is re-estimated and 1-step ahead forecasts are produced. The procedure continues until the end of the available out-of-sample period. This method ignores possible past breaks for forecasting and it is generally used when a stable GARCH(1,1) is assumed.

- RiskMetrics. This model is defined as:where is a parameter such that This model, also known as exponential variance smoother for its structure, uses the exponentially weighted moving average method that is meant to represent the finite memory of the market. The weights on past squared returns decline to zero.The model has also an interesting formulation which makes it successful in financial applications. It is easy to show that it is equivalent to:Based on the assumption of Normally distributed returns, the RiskMetrics model completely ignores the presence of fat tails in the distribution function, which is an important feature of financial data. Nevertheless, despite the evident over simplification embedded in its formulation, it was commonly found that the model has satisfactory performances in forecasting financial data and it has become widely used in applications.The model depends on a single parameter that has to be estimated. By evaluating a large number of assets, RiskMetrics Group proposed to fix . In this case, no estimation is needed.

- Exp-Roll 0.25. This combination is the average of the forecasts obtained by a GARCH(1,1) expanding window and a GARCH that uses a rolling estimation window equal to 0.25 of the size of the in-sample period. In this second method, an initial sample using data from to is used to estimate the model and the 1-step ahead out-of-sample forecast is produced. The window is moved ahead one time period, the model is re-estimated using data from and 1-step ahead out-of-sample forecast is produced. The procedure continues until the end of the available out-of-sample period. This model is generally used to take potential and unknown breaks in the series into account.

- Exp-Roll 0.50. The forecasts for this combination are generated in the same way as those for the GARCH(1,1) 0.25 rolling window, but with a rolling window equal to one-half of the size of the in-sample period is used. With respect to the previous model, this choice allows for having a trade-off between an accurate estimate of the parameters due to a relative long estimation window and the possibility that the data come from different regimes.

- Exp-Roll 0.75. The forecasts for this method are generated the same as those for the GARCH(1,1) 0.25 rolling window model, with the exception that we use a rolling window equal to one-quarter of the size of the in-sample period. In this case, even if the estimation procedure is based on less observations, the problem of data from different regimes is overcome.

- Exp-Break. This combination is the average of two forecasting methods. The first is the GARCH(1,1) expanding window. In the second, the forecasts are generated by using an estimation window determined by the last break. More precisely, the size of the estimation window is determined by applying the binary segmentation algorithm with the test to the data available at the time the forecast is made. For 1-step-ahead forecasts, an initial sample using data from to is used to detect the breaks’ points. The estimation window for the parameters of the GARCH(1,1) model is comprised of observations from the final break to R. If no breaks are detected over this period, the parameters are estimated using observations from 1 to R. The sample is increased by one and a new break point search is applied to observations from 1 to . The estimation window is formed by observations to the new final break point to . The procedure continues until the end of the viable out-of-sample period. The procedure uses only observations available during the period being analyzed for the detection of the more recent break point; therefore, it does nor suffer from the so-called look-ahead bias. However, if the break is detected near the end of the in-sample period, the parameters of the GARCH(1,1) model are estimated with a relatively short sample.

- Mean-win. This is the average of the five individual forecasting methods using different window sizes: GARCH(1,1) with breaks, GARCH which uses three rolling estimation windows equal to 0.25, 0.50 and 0.75 of the size of the in-sample period and a GARCH(1,1) expanding window. This method (see Pesaran and Timmermann 2007) incorporates the trade-off between the bias and the variance of forecasting errors because windows of earlier data are generally included in computing the combination forecasts.

- Trimmed-Mean-win. This is the average of the individual forecasts that result from excluding the highest and lowest ones from the considered mean-windows’ forecasts. This approach, in the spirit of Ahmad (1989), could be useful since it mitigates the influence of occasional outliers and, as a consequence, it is less sensitive to possible implausible forecasts.

3. Comparing Forecasting Models

4. Conclusions

Funding

Acknowledgments

Conflicts of Interest

References

- Ahmad, Wasim, Sanjay Sehgal, and N. R. Bhanumurthy. 2013. Eurozone crisis and BRIICKS stock markets: Contagion or market interdependence? Economic Modelling 33: 209–25. [Google Scholar] [CrossRef]

- Armstrong, J. Scott. 1989. Combining forecasts: The end of the beginning or the beginning of the end? International Journal of Forecasting 5: 585–88. [Google Scholar] [CrossRef]

- Bhuyan, Rafiqul, Mohammad G. Robbani, Bakhtear Talukdar, and Ajeet Jain. 2016. Information transmission and dynamics of stock price movements: An empirical analysis of BRICS and US stock markets. International Review of Economics & Finance 46: 180–95. [Google Scholar]

- Clark, Todd E., and Michael W. McCracken. 2009. Improving Forecast Accuracy by Combining Recursive and Rolling Forecasts. International Economic Review 50: 363–95. [Google Scholar] [CrossRef]

- De Gaetano, Davide. 2018a. Forecast Combinations in the Presence of Structural Breaks: Evidence from US Equity Markets. Mathematics 6: 34. [Google Scholar] [CrossRef]

- De Gaetano, Davide. 2018b. Forecasting with GARCH models under structural breaks: An approach based on combinations across estimation windows. Communications in Statistics—Simulation and Computation. in press. [Google Scholar]

- Fang, WenShwo, and Stephen M. Miller. 2009. Modeling the volatility of real GDP growth: The case of Japan revisited. Japan and the World Economy 21: 312–24. [Google Scholar] [CrossRef]

- Hammoudeh, Shawkat, and Huimin Li. 2008. Sudden changes in volatility in emerging markets: The case of Gulf Arab stock markets. International Review of Financial Analysis 17: 47–63. [Google Scholar] [CrossRef]

- Hansen, Peter Reinhard, Asger Lunde, and James M. Nason. 2011. The model confidence set. Econometrica 79: 453–97. [Google Scholar] [CrossRef]

- Hansen, Peter Reinhard. 2005. A test for superior predictive ability. Journal of Business & Economic Statistics 23: 365–80. [Google Scholar]

- Inclan, Carla, and George C. Tiao. 1994. Use of Cumulative Sums of Squares for Retrospective Detection of Changes in Variance. Journal of American Statistic Association 89: 913–23. [Google Scholar]

- Li, Ping. 2015. Review of China’s Stock Market from 2002 to 2014. In The Chinese Stock Market Volume I. London: Palgrave Macmillan, pp. 1–38. [Google Scholar]

- MacKinnon, James G. 1994. Approximate asymptotic distribution functions for unit-root and cointegration tests. Journal of Business and Economic Statistics 12: 167–76. [Google Scholar]

- Mensi, Walid, Shawkat Hammoudeh, Juan Carlos Reboredo, and Duc Khuong Nguyen. 2014. Do global factors impact BRICS stock markets? A quantile regression approach. Emerging Markets Review 19: 1–17. [Google Scholar] [CrossRef]

- Morales, Lucía, and Esmeralda Gassie-Falzone. 2011. Structural Breaks and Financial Volatility: Lessons from BRIC Countries. Paper presented at IAMO Forum 2011, Halle (Saale), Germany, June 23–24; pp. 1–31. [Google Scholar]

- Newey, Whitney K., and Kenneth D. West. 1994. Automatic Lag Selection in Covariance Matrix estimation. Review of Economic Studies 61: 631–54. [Google Scholar] [CrossRef]

- Nivorozhkin, Eugene, and Giorgio Castagneto-Gissey. 2016. Russian stock market in the aftermath of the Ukrainian crisis. Russian Journal of Economics 2: 23–40. [Google Scholar] [CrossRef]

- Patton, Andrew J. 2011. Volatility forecast comparison using imperfect volatility proxies. Journal of Econometrics 160: 246–56. [Google Scholar] [CrossRef]

- Pesaran, M. Hashem, and Andreas Pick. 2011. Forecast combination across estimation windows. Journal of Business and Economic Statistics 29: 307–18. [Google Scholar] [CrossRef]

- Pesaran, M. Hashem, and Allan Timmermann. 2007. Selection of estimation window in the presence of breaks. Journal of Econometrics 137: 134–61. [Google Scholar] [CrossRef]

- Pesaran, M. Hashem, Andreas Pick, and Mikhail Pranovich. 2013. Optimal forecasts in the presence of structural breaks. Journal of Econometrics 177: 134–52. [Google Scholar] [CrossRef]

- Rapach, David E., and Jack K. Strauss. 2008. Structural breaks and GARCH models of exchange rate volatility. Journal of Applied Econometrics 23: 65–90. [Google Scholar] [CrossRef]

- Rapach, David E., Jack K. Strauss, and Mark E. Wohar. 2008. Forecasting stock return volatility in the presence of structural breaks. In Forecasting in the Presence of Structural Breaks and Model Uncertainty. Edited by David E. Rapach and Mark E. Wohar. Emerald Series Frontiers of Economics and Globalization; Bingley: Elsevier, pp. 381–416. [Google Scholar]

- Ross, Gordon J. 2013. Modelling financial volatility in the presence of abrupt changes. Physica A: Statistical Mechanics and Its Applications 392: 350–60. [Google Scholar] [CrossRef]

- Sansó, Andreu, Vicent Aragó, and Josep Lluís Carrion. 2004. Testing for Change in the Unconditional Variance of Financial Time Series. Revista de Economia Financiera 4: 32–53. [Google Scholar]

- Tamakoshi, Go, and Shigeyuki Hamori. 2014. Greek sovereign bond index, volatility, and structural breaks. Journal of Economics and Finance 38: 687–97. [Google Scholar] [CrossRef]

- Tian, Jing, and Heather M. Anderson. 2014. Forecast Combinations under Structural Break Uncertainty. International Journal of Forecasting 30: 161–75. [Google Scholar] [CrossRef]

- Tian, Jing, and Qing Zhou. 2016. Improving equity premium forecasts by incorporating structural break uncertainty. Accounting and Finance, 1–38. [Google Scholar] [CrossRef]

- Wang, Ping, and Tomoe Moore. 2009. Sudden changes in volatility: The case of five central European stock markets. Journal of International Financial Markets, Institutions and Money 19: 33–46. [Google Scholar] [CrossRef]

- Zhou, Xiangyi, Weijin Zhang, and Jie Zhang. 2012. Volatility spillovers between the Chinese and world equity markets. Pacific-Basin Finance Journal 20: 247–70. [Google Scholar] [CrossRef]

| 1. | The statistics are reported in the 9th BRICS Summit official site. |

| Brazil | Russia | India | China | South Africa | |

|---|---|---|---|---|---|

| Min | −14.0700 | −25.2800 | −12.0500 | −12.8300 | −8.4480 |

| 1st Quant. | −0.8301 | −0.9287 | −0.6768 | −0.8268 | −0.6103 |

| Median | 0.0000 | 0.0683 | 0.0385 | 0.0111 | 0.0176 |

| Mean | 0.0364 | 0.0369 | 0.0438 | 0.0110 | 0.0456 |

| 3rd Quant. | 0.9455 | 1.1310 | 0.8421 | 0.9111 | 0.7451 |

| Max | 13.4400 | 23.9500 | 16.4200 | 14.0400 | 5.9620 |

| Standard Devation | 1.6507 | 2.3788 | 1.5710 | 1.8429 | 1.2406 |

| Skewness | −0.1283 | −0.2913 | −0.2244 | 0.0086 | −0.1560 |

| Kurtosis | 5.8651 | 13.0661 | 7.4304 | 5.4583 | 3.1091 |

| Jarque–Bera test | 6002.84 | 29786.80 | 9650.02 | 5189.17 | 1701.21 |

| (0.000) | (0.000) | (0.000) | (0.000) | (0.000) |

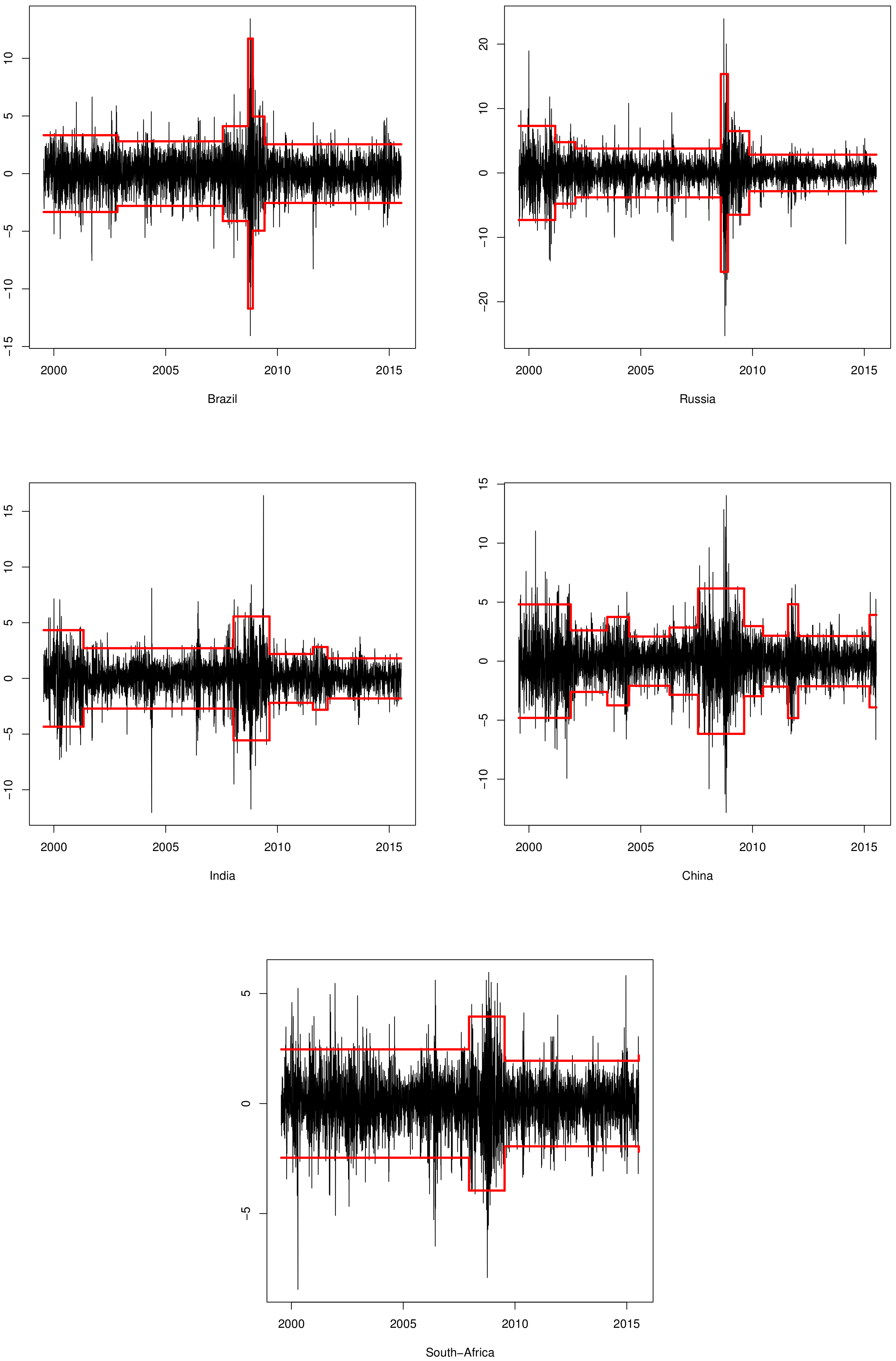

| Brazil | Russia | India | China | South Africa |

|---|---|---|---|---|

| 4 November 2002 | 6 March 2001 | 30 April 2001 | 15 November 2001 | 12 December 2007 |

| 23 July 2007 | 30 January 2002 | 14 January 2008 | 4 July 2003 | 15 July 2009 |

| 8 September 2008 | 1 August 2008 | 24 August 2009 | 24 June 2004 | |

| 24 November 2008 | 25 November 2008 | 3 August 2011 | 17 April 2006 | |

| 4 June 2009 | 9 November 2009 | 30 March 2012 | 26 July 2007 | |

| 17 August 2009 | ||||

| 21 June 2010 | ||||

| 4 August 2011 | ||||

| 17 Janurary 2012 | ||||

| 27 March 2015 |

| Brazil | Russia | India | China | South Africa | |

|---|---|---|---|---|---|

| Full sample | 2.4381 | 5.1029 | 3.0342 | 3.4390 | 1.6642 |

| Subsample 1 | 2.7732 | 14.1344 | 5.2101 | 5.9551 | 1.6023 |

| Subsample 2 | 1.9296 | 5.6764 | 1.7496 | 1.6869 | 3.7474 |

| Subsample 3 | 3.1879 | 3.5846 | 7.7452 | 3.7053 | 0.9962 |

| Subsample 4 | 34.2801 | 58.9268 | 1.2207 | 1.0579 | |

| Subsample 5 | 0* | 9.8722 | 0* | 2.0532 | |

| Subsample 6 | 1.5731 | 1.9922 | 0.7991 | 9.0545 | |

| Subsample 7 | 2.6656 | ||||

| Subsample 8 | 1.5155 | ||||

| Subsample 9 | 5.0387 | ||||

| Subsample 10 | 1.1182 | ||||

| Subsample 11 | 3.8351 |

| 1 Step | Brazil | Russia | India | China | South Africa | |||||

|---|---|---|---|---|---|---|---|---|---|---|

| QLIKE | MSE | QLIKE | MSE | QLIKE | MSE | QLIKE | MSE | QLIKE | MSE | |

| Expanding win | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| RiskMetrics | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Exp-Roll 0.25 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Exp-Roll 0.50 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Exp-Roll 0.75 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Exp-Break | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.01 | 0.01 | 0.00 | 0.00 |

| Mean-win. | 0.29 | 1.00 | 1.00 | 1.00 | 1.00 | 0.99 | 1.00 | 1.00 | 1.00 | 0.65 |

| Trimmed-Mean-win | 1.00 | 0.83 | 0.00 | 0.00 | 0.46 | 1.00 | 0.01 | 0.01 | 0.81 | 1.00 |

| 5 Step | Brazil | Russia | India | China | South Africa | |||||

|---|---|---|---|---|---|---|---|---|---|---|

| QLIKE | MSE | QLIKE | MSE | QLIKE | MSE | QLIKE | MSE | QLIKE | MSE | |

| Expanding win | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| RiskMetrics | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Exp-Roll 0.25 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Exp-Roll 0.50 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Exp-Roll 0.75 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Exp-Break | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.03 | 0.08 | 0.00 | 0.00 |

| Mean-win. | 0.14 | 0.78 | 1.00 | 1.00 | 1.00 | 0.48 | 1.00 | 1.00 | 1.00 | 1.00 |

| Trimmed-Mean-win | 1.00 | 1.00 | 0.00 | 0.00 | 0.50 | 1.00 | 0.01 | 0.00 | 0.71 | 0.61 |

| 20 Step | Brazil | Russia | India | China | South Africa | |||||

|---|---|---|---|---|---|---|---|---|---|---|

| QLIKE | MSE | QLIKE | MSE | QLIKE | MSE | QLIKE | MSE | QLIKE | MSE | |

| Expanding win | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| RiskMetrics | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Exp-Roll 0.25 | 0.00 | 0.01 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Exp-Roll 0.50 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Exp-Roll 0.75 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Exp-Break | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.01 | 0.01 | 0.00 | 0.00 |

| Mean-win. | 1.00 | 1.00 | 1.00 | 1.00 | 0.95 | 0.28 | 1.00 | 1.00 | 0.86 | 0.92 |

| Trimmed-Mean-win | 0.40 | 0.03 | 0.00 | 0.00 | 1.00 | 1.00 | 0.01 | 0.00 | 1.00 | 1.00 |

© 2018 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

De Gaetano, D. Forecast Combinations for Structural Breaks in Volatility: Evidence from BRICS Countries. J. Risk Financial Manag. 2018, 11, 64. https://doi.org/10.3390/jrfm11040064

De Gaetano D. Forecast Combinations for Structural Breaks in Volatility: Evidence from BRICS Countries. Journal of Risk and Financial Management. 2018; 11(4):64. https://doi.org/10.3390/jrfm11040064

Chicago/Turabian StyleDe Gaetano, Davide. 2018. "Forecast Combinations for Structural Breaks in Volatility: Evidence from BRICS Countries" Journal of Risk and Financial Management 11, no. 4: 64. https://doi.org/10.3390/jrfm11040064

APA StyleDe Gaetano, D. (2018). Forecast Combinations for Structural Breaks in Volatility: Evidence from BRICS Countries. Journal of Risk and Financial Management, 11(4), 64. https://doi.org/10.3390/jrfm11040064