Mechanism and Impact of Digital Economy on Urban Economic Resilience under the Carbon Emission Scenarios: Evidence from China’s Urban Development

Abstract

1. Introduction

2. Literature Review

3. Theoretical Model

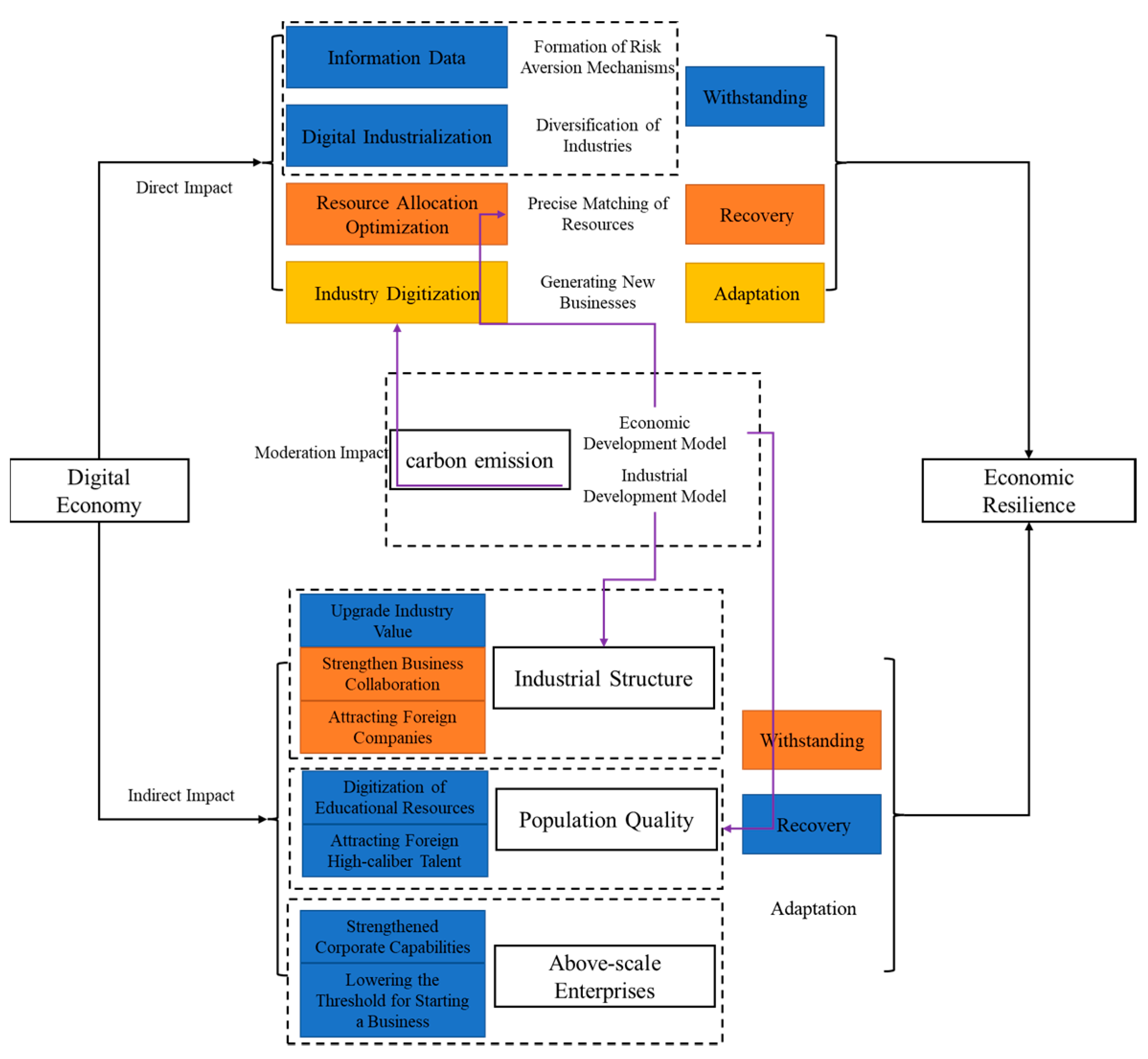

3.1. Direct Impact Mechanism of Digital Economy on Urban Economic Resilience

3.2. The Indirect Effect Mechanism of Digital Economy on Urban Resilience

3.2.1. Industrial Structure

3.2.2. Population Quality

3.2.3. Scale Enterprise

3.3. The Moderating Effect of the Digital Economy on Urban Economic Resilience

4. Materials and Methods

4.1. Empirical Model Construction

4.2. Data Description

5. Results and Discussion

5.1. The Direct Impact of the Digital Economy on Urban Economic Resilience

5.1.1. Benchmark Regression

5.1.2. Heterogeneity Test

5.1.3. Stability Test

5.2. Further Analysis: Moderated Mediation Effect

6. Conclusions and Recommendations

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- UNDRR. Resilience. Available online: https://www.undrr.org/terminology/resilience (accessed on 15 January 2023).

- UNISDR. How to Make Cities More Resilient: A Handbook for Local Government Leaders; United Nations: Geneva, Switzerland, 2012. [Google Scholar]

- Bank World. Building Urban Resilience: Principles, Tools, and Practice; World Bank Publications: Washington, DC, USA, 2013. [Google Scholar]

- China. Outline of the People’s Republic of China 14th Five-Year Plan for National Economic and Social Development and Long-Range Objectives for 2035. Available online: http://www.gov.cn/xinwen/2021-03/13/content_5592681.htm (accessed on 17 January 2023).

- Li, G.; Kou, C.; Wang, Y.; Yang, H. System dynamics modelling for improving urban resilience in Beijing, China. Resour. Conserv. Recycl. 2020, 161, 104954. [Google Scholar] [CrossRef]

- NACO. What is Economic Resilience? Available online: http://cedr.gatech.edu/what-is-economic-resilience (accessed on 15 January 2023).

- UNCDF. What is Urban Economic Resilience? Available online: https://urbanresiliencehub.org/economicresilience (accessed on 15 January 2023).

- Kretschmer, T. Information and Communication Technologies and Productivity Growth: A Survey of the Literature. OECD Digit. Econ. Pap. 2012, 195, 1–26. [Google Scholar]

- United Nations. Transforming Our World: The 2030 Agenda for Sustainable Development. Available online: https://digitallibrary.un.org/record/3923923 (accessed on 15 January 2023).

- Manioudis, M.; Meramveliotakis, G. Broad strokes towards a grand theory in the analysis of sustainable development: A return to the classical political economy. New Political Econ. 2022, 27, 866–878. [Google Scholar] [CrossRef]

- Klarin, T. The Concept of Sustainable Development: From its Beginning to the Contemporary Issues. Zagreb Int. Rev. Econ. Bus. 2018, 21, 67–94. [Google Scholar] [CrossRef]

- CAICT. China Digital Economy Development Report; CAICT: Shantou, China, 2022. [Google Scholar]

- Dong, F.; Hu, M.; Gao, Y.; Liu, Y.; Zhu, J.; Pan, Y. How does digital economy affect carbon emissions? Evidence from global 60 countries. Sci. Total Environ. 2022, 852, 158401. [Google Scholar] [CrossRef]

- Wu, H.; Hao, Y.; Ren, S.; Yang, X.; Xie, G. Does Internet Development Improve Green Total Factor Energy Efficiency? Evidence from China. Energy Policy 2021, 153, 112247. [Google Scholar] [CrossRef]

- Liu, J.; Bai, J.; Deng, Y.; Chen, X.; Liu, X. Impact of energy structure on carbon emission and economy of China in the scenario of carbon taxation. Sci. Total Environ. 2021, 762, 143093. [Google Scholar] [CrossRef]

- Holling, C.S. Resilience and stability of ecological systems. Annu. Rev. Ecol. Syst. 1973, 4, 1–23. [Google Scholar] [CrossRef]

- Ron, M. Regional economic resilience, hysteresis and recessionary shocks. J. Econ. Geogr. 2012, 12, 1–32. [Google Scholar]

- Martin, R.; Sunley, P.; Tyler, P. Local growth evolutions: Recession, resilience and recovery. Camb. J. Reg. Econ. Soc. 2015, 8, 141–148. [Google Scholar] [CrossRef]

- Gong, H.; Hassink, R. Exploring the clustering of creative industries. Eur. Plan. Stud. 2018, 25, 583–600. [Google Scholar] [CrossRef]

- Kitsos, A.; Carrascal-Incera, A.; Ortega-Argiles, R. The Role of Embeddedness on Regional Economic Resilience: Evidence from the UK. Sustainability 2019, 11, 3800. [Google Scholar] [CrossRef]

- Martin, R.; Sunley, P.; Gardiner, B.; Tyler, P. How Regions React to Recessions: Resilience and the Role of Economic Structure. Reg. Stud. 2016, 50, 561–585. [Google Scholar] [CrossRef]

- Brakman, S.; Garretsen, H.; Marrewijk, C.V. Regional resilience across Europe: On urbanisation and the initial impact of the Great Recession. Camb. J. Reg. Econ. Soc. 2015, 8, 309–312. [Google Scholar] [CrossRef]

- Briguglio, L.; Cordina, G.; Farrugia, N.; Vella, S. Economic Vulnerability and Resilience: Concepts and Measurements. Oxf. Dev. Stud. 2009, 37, 229–247. [Google Scholar] [CrossRef]

- Brown, L.; Greenbaum, R.T. The role of industrial diversity in economic resilience: An empirical examination across 35 years. Urban Stud. 2017, 54, 1347–1366. [Google Scholar] [CrossRef]

- Xu, Y.; Warner, M.E. Understanding employment growth in the recession: The geographic diversity of state rescaling. Camb. J. Reg. Econ. Soc. 2015, 8, 359–377. [Google Scholar] [CrossRef]

- Hauser, C.; Tappeiner, G.; Walde, J. The learning region: The impact of social capital and weak ties on innovation. Reg. Stud. 2007, 41, 75–88. [Google Scholar] [CrossRef]

- Christopherson, S.; Michie, J.; Tyler, P. Regional resilience: Theoretical and empirical perspectives. Camb. J. Reg. Econ. Soc. 2010, 3, 3–10. [Google Scholar] [CrossRef]

- Boschma, R. Towards an evolutionary perspective on regional resilience. Reg. Stud. 2015, 49, 733–751. [Google Scholar] [CrossRef]

- Huggins, R.; Thompson, P. Local entrepreneurial resilience and culture: The role of social values in fostering economic recovery. Camb. J. Reg. Econ. Soc. 2015, 8, 313–330. [Google Scholar] [CrossRef]

- Tapscott, D. The digital economy: Promise and peril in the age of networked intelligence. Educom Rev. 1996, 10, 69–71. [Google Scholar]

- Turcan, R.V.; Juho, A. What happens to international new ventures beyond start-up: An exploratory study. J. Int. Entrep. 2014, 12, 129–145. [Google Scholar] [CrossRef]

- G20. G20 Digital Economy Development and Cooperation Initiative. Available online: http://www.g20.utoronto.ca/2016/160905-digital.html (accessed on 15 January 2023).

- OECD. OECD Digital Economy Outlook 2015; OECD Publishing: Paris, France, 2015. [Google Scholar]

- STATS NZ. Valuing New Zeland’s Digital Economy. Available online: https://www.oecd.org/officialdocuments/publicdisplaydocumentpdf/?cote=STD/CSSP/WPNA(2017)3&docLanguage=En (accessed on 15 January 2023).

- Eurostat. Digital Economy & Society in the EU—A Browse Through Our Online World in Figures; Eurostat: Luxembourg, 2017.

- ABS. Australian National Accounts—Information and Communication Technology Satellite Account. Available online: https://www.abs.gov.au/ausstats/abs@.nsf/products/9AB6AB31699718F4CA256CDF00790444?OpenDocument (accessed on 15 January 2023).

- Song, X.; Tian, Z.; Ding, C.; Liu, C.; Wang, W.; Zhao, R.; Xing, Y. Digital Economy, Environmental Regulation, and Ecological Well-Being Performance: A Provincial Panel Data Analysis from China. Int. J. Environ. Res. Public Health 2022, 19, 11801. [Google Scholar] [CrossRef] [PubMed]

- Li, J.; Chen, L.; Chen, Y.; He, J. Digital economy, technological innovation, and green economic efficiency—Empirical evidence from 277 cities in China. Manag. Decis. Econ. 2022, 43, 616–629. [Google Scholar] [CrossRef]

- Linbo, J. The Theoretical Connotation, Operational Logic and New Opportunities of Resilient Cities in the Context of Digital Economy. Guizhou Soc. Sci. 2021, 2021, 108–115. [Google Scholar]

- Yan, H.U.; Chen, Y.; Yan, L.I. The Impact of Digital Economy on Urban Economic Resilience in the Yangtze River Delta Region. J. East China Norm. Univ. (Humanit. Soc. Sci.) 2022, 54, 143–154+175–176. [Google Scholar]

- Jinhe, Z.; Hongxue, S. Did the digital economy improve the resilience of the city’s economy? Mod. Econ. Res. 2021, 2021, 1–13. [Google Scholar]

- Che, S.; Wang, J. Digital economy development and haze pollution: Evidence from China. Environ. Sci. Pollut. Res. 2022, 29, 73210–73226. [Google Scholar] [CrossRef]

- Su, J.; Su, K.; Wang, S. Does the Digital Economy Promote Industrial Structural Upgrading?—A Test of Mediating Effects Based on Heterogeneous Technological Innovation. Sustainability 2021, 13, 10105. [Google Scholar] [CrossRef]

- Zhou, J.; Hu, L.; Yu, Y.; Zhang, J.Z.; Zheng, L.J. Impacts of IT capability and supply chain collaboration on supply chain resilience: Empirical evidence from China in COVID-19 pandemic. J. Enterp. Inf. Manag. 2022, 1. [Google Scholar] [CrossRef]

- Goldfarb, A.; Tucker, C. Digital economics. J. Econ. Lit. 2019, 57, 3–43. [Google Scholar] [CrossRef]

- de Graaf-Zijl, M.; van der Horst, A.; van Vuuren, D.; Erken, H.; Luginbuhl, R. Long-term unemployment and the Great Recession in the Netherlands: Economic mechanisms and policy implications. Economist 2015, 163, 415–434. [Google Scholar] [CrossRef]

- Artero, J.M.; Borra, C.; Gomez-Alvarez, R. Education, inequality and use of digital collaborative platforms: The European case. Econ. Labour Relat. Rev. 2020, 31, 364–382. [Google Scholar] [CrossRef]

- Forés, B.; Camisón, C. Does incremental and radical innovation performance depend on different types of knowledge accumulation capabilities and organizational size? J. Bus. Res. 2016, 69, 831–848. [Google Scholar] [CrossRef]

- Guo, Q.; Ding, C.; Wu, Z.; Guo, B.; Xue, Y.; Li, D. The impact of digital economy and industrial structure distortion on Xinjiang’s energy intensity under the goal of “double carbon”. Front. Environ. Sci. 2020, 10, 1036740. [Google Scholar] [CrossRef]

- Meng, S.Y.; Zhang, X. Translog function in government development of low-carbon economy. Appl. Math. Nonlinear Sci. 2022, 7, 223–238. [Google Scholar] [CrossRef]

- Andersson, M.; Larsson, J.P.; Wernberg, J. The economic microgeography of diversity and specialization externalities—Firm-level evidence from Swedish cities. Res. Policy 2019, 48, 1385–1398. [Google Scholar] [CrossRef]

- Hayes, A.F.; Rockwood, N.J. Conditional Process Analysis: Concepts, Computation, and Advances in the Modeling of the Contingencies of Mechanisms. Am. Behav. Sci. 2019, 64, 000276421985963. [Google Scholar] [CrossRef]

- Baron, R.M.; Kenny, D.A. The moderator-mediator variable distinction in social psychological research: Conceptual, strategic, and statistical considerations. Chapman Hall 1986, 51, 1173–1182. [Google Scholar] [CrossRef]

- Zhonglin, W.; Lei, Z.; Jietai, H. Mediating variables and mediating variables. Acta Psychol. Sin. 2006, 2006, 448–452. [Google Scholar]

- Zhonglin, W.; Baojuan, Y. Moderated mediation model test: Competition or substitution? Acta Psychol. Sin. 2014, 46, 714–726. [Google Scholar]

- Jianjun, D.; Zhang, W.; Yanhong, L.; Fangwei, Y. Measurement of economic resilience and analysis of influencing factors of contiguous poverty-stricken areas in China. Prog. Geogr. Sci. 2020, 39, 924–937. [Google Scholar]

- Shaohua, W.; Yujia, L. Study on Evaluation of urban competitiveness in Western China based on principal component analysis. Econ. Probl. 2021, 2021, 115–120. [Google Scholar]

- Tao, Z.; Zhi, Z.; Shangkun, L. Digital Economy, Entrepreneurship, and High-Quality Economic Development: Empirical Evidence from Urban China. Manag. World 2020, 36, 65–76. [Google Scholar]

- Linghui, F. An empirical study on the relationship between the upgrading of industrial structure and economic growth in China. Stat. Res. 2010, 27, 79–81. [Google Scholar]

- Liu, G.; Shen, L. Characteristics and mechanism of Tibet’s industrial structure evolution from 1951 to 2004. Acta Geogr. Sin. 2007, 62, 364–376. [Google Scholar]

- Guangbi, C.; Chun, Y. Study on Evaluation and Affecting Factors of Regional Industrial Integration Level: Take the Yangtze River Economic Belt as an Example. East China Econ. Manag. 2020, 34, 100–107. [Google Scholar]

- Chen, J.; Gao, M.; Cheng, S.; Hou, W.; Song, M.; Liu, X.; Liu, Y.; Shan, Y. County-level CO2 emissions and sequestration in China during 1997–2017. Sci. Data 2020, 7, 391. [Google Scholar] [CrossRef]

- Phillips, P.C.B.; Moon, H.R. Nonstationary Panel Data Analysis: An Overview of Some Recent Developments. Econom. Rev. 2000, 19, 263–286. [Google Scholar] [CrossRef]

- Weibing, L.; Kaixia, Z. Influence of air pollution on enterprise productivity—Evidence from Chinese Industrial Enterprises. Manag. World 2019, 35, 95+112–119. [Google Scholar]

- Xuenan, J.; Xuankai, Z.; Baowen, S. What trade costs have cross-border e-commerce platforms overcome—Empirical evidence from “Dunhuang website” data. Econ. Res. J. 2020, 55, 181–196. [Google Scholar]

- Xun, Z.; Tong, Y.; Chen, W.; Guanghua, W. The development of digital finance and the growth of household consumption: Theory and practice in China. Manag. World 2020, 36, 48–63. [Google Scholar]

- Yu, K. Analysis of the impact of trade openness on haze—A spatial econometric study based on China’s Provincial Panel Data. Econ. Sci. 2016, 2016, 114–125. [Google Scholar]

| The Dimension | Indicators | Indicator Description | Attribute | |

|---|---|---|---|---|

| Urban economic resilience | Resistance and resilience | Dependence on foreign trade | Total imports and exports/GDP | − |

| Per capita disposable income | Per capita disposable income | + | ||

| Labor productivity of the whole society | GDP/Number of employees in urban units at the end of the period | + | ||

| GDP per capita | GDP/total population at year-end | + | ||

| Share of unemployed population in urban areas | Number of registered unemployed persons in urban areas/total population at year-end | + | ||

| Ability to adapt and adjust | Retail sales of consumer goods per capita | Total retail sales of consumer goods/total population at year-end | + | |

| Fiscal self-sufficiency rate | Budgeted revenue/budgeted expenditure | + | ||

| Per capita local fiscal expenditure | Budgeted revenue/total population at year-end | + | ||

| Fixed asset investment per capita | Social fixed asset investment/total population at year-end | + | ||

| Innovation and transformation capability | Per capita fiscal expenditure on education | Education expenditure/total population at year-end | + | |

| Regional innovation and entrepreneurship index | Overall Innovation Index | + | ||

| Advanced industrial structure | Index of advanced industrial structure [59] | + | ||

| Per capita fiscal expenditure on science | Science expenditure/total population at year-end | + | ||

| Scientific research industry employment index | Number of persons employed in scientific research, technical services and geological survey | + | ||

| Digital economy level | Digital infrastructure | Internet penetration | Number of Internet broadband access users/total population at year-end | + |

| Mobile Internet penetration | Year-end mobile phone users/Number of employees in urban units at the end of the period | + | ||

| Digital industrialization | Internet industry Employment index | Number of employees in information transmission, computer services and software industries/Number of employees in urban units at the end of the period | + | |

| Postal business revenue | Postal business revenue | + | ||

| Software business revenue | Telecom business revenue | + |

| Categories | Name | Symbol | Size | Min | Max | Mean | Std |

|---|---|---|---|---|---|---|---|

| Explanatory | Digital economy | DIG | 3612 | 0.009 | 0.635 | 0.082 | 0.056 |

| Explained | Economic resilience | RES | 3612 | −0.809 | 4.424 | 0.000 | 0.537 |

| Mediator | Industrial structure | IS | 3612 | 2.866 | 3.141 | 2.992 | 0.074 |

| Population quality | PQ | 3612 | 343 | 1311.241 | 166.865 | 225.968 | |

| Scale enterprise | MC | 3612 | 0.128 | 36.346 | 2.928 | 3.685 | |

| Moderator | Carbon emissions | CR | 3612 | 1.562 | 129.601 | 25.388 | 19.160 |

| Control | Economic density | ED | 3612 | 6.302 | 116,576.224 | 2083.547 | 4927.616 |

| Population density | PD | 3612 | 4.700 | 2661.540 | 437.951 | 312.676 | |

| Economic openness | EO | 3612 | 20.255 | 8,602,702.688 | 409,033.206 | 800,922.551 | |

| Food security | FS | 3612 | 144.508 | 402,818.753 | 3537.549 | 8190.788 |

| Variable | RES | RES | RES | RES | RES |

|---|---|---|---|---|---|

| 1 | 2 | 3 | 4 | 5 | |

| DIG | 1.927 *** | 0.934 *** | 0.876 *** | 0.744 *** | 0.743 *** |

| (0.321) | (0.198) | (0.189) | (0.183) | (0.183) | |

| ED | 3.806 *** | 4.105 *** | 3.882 *** | 3.885 *** | |

| (0.749) | (0.714) | (0.654) | (0.655) | ||

| PD | −0.553 *** | −0.533 *** | −0.533 *** | ||

| (0.105) | (0.104) | (0.104) | |||

| EO | 0.569 *** | 0.569 *** | |||

| (0.123) | (0.123) | ||||

| FS | 0.090 *** | ||||

| (0.034) | |||||

| Constant term | −0.579 *** | −0.546 *** | −0.459 *** | −0.468 *** | −0.469 *** |

| (0.023) | (0.012) | (0.02) | (0.021) | (0.021) | |

| Individual fixed effects | Yes | Yes | Yes | Yes | Yes |

| Time fixed effects | Yes | Yes | Yes | Yes | Yes |

| Number of city | 258 | 258 | 258 | 258 | 258 |

| R2 | 0.87 | 0.903 | 0.904 | 0.908 | 0.908 |

| Variable | RES | RES | RES | RES | RES |

|---|---|---|---|---|---|

| Core of Urban | Non-Core Metropolitan | East | Middle | West | |

| DIG | 0.555 ** | 0.383 * | 1.307 *** | 0.007 | 0.237 |

| (0.217) | (0.216) | (0.216) | (0.364) | (0.187) | |

| ED | 3.074 *** | 9.378 *** | 3.386 *** | 7.434 *** | 9.084 *** |

| (0.27) | (1.599) | (0.525) | (2.121) | (2.926) | |

| PD | −0.470 *** | −0.582 *** | −0.373 *** | −0.758 *** | −2.635 |

| (0.126) | (0.113) | (0.112) | (0.232) | (2.374) | |

| EO | 0.371 *** | 0.818 * | 0.545 *** | 0.744 * | −0.158 |

| (0.115) | (0.42) | (0.089) | (0.448) | (0.221) | |

| FS | −0.077 | 0.104 ** | 0.085 ** | 0.066 | −13.597 * |

| (0.048) | (0.045) | (0.042) | (2.682) | (6.762) | |

| Constant term | −0.127 ** | −0.529 *** | −0.437 *** | −0.474 *** | −0.265 |

| (0.051) | (0.02) | (0.03) | (0.037) | (0.264) | |

| Individual fixed effects | Yes | Yes | Yes | Yes | Yes |

| Time fixed effects | Yes | Yes | Yes | Yes | Yes |

| Number of city | 45 | 213 | 109 | 106 | 43 |

| R2 | 0.965 | 0.893 | 0.933 | 0.893 | 0.899 |

| Variable | Dummy Variable Method | Shortening Time Windows | Subsample | Instrumental | |||

|---|---|---|---|---|---|---|---|

| Provinces Effect | Interaction Effect | Common Sample | Before Eighteenth | After Eighteenth | Non-Provincial Capital | Distance | |

| DIG | 0.743 *** | 0.684 *** | 0.510 *** | 0.367 *** | 0.517 *** | 0.724 *** | 2.141 * |

| (0.183) | (0.195) | (0.169) | (0.131) | (0.187) | (0.227) | (1.261) | |

| Control | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| provinces | Yes | Yes | |||||

| Province × Year | Yes | ||||||

| Instrumental | Yes | ||||||

| Individual fixed | Yes | Yes | Yes | Yes | Yes | Yes | |

| Time fixed | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| city | 258 | 258 | 258 | 258 | 258 | 232 | 258 |

| period | 14 | 14 | 7 | 8 | 6 | 14 | 14 |

| R2 | 0.908 | 0.941 | 0.754 | 0.885 | 0.673 | 0.905 | 0.334 (Centered) |

| Check the Name | The Results of |

|---|---|

| The first stage | |

| Underidentification tests | |

| Anderson can.corr.n * CCEV LM Statistic (Chi-SQ) | 14.810 *** |

| Weak identification test | |

| Cragg-Donald Wald F statistic | 13.730 |

| Anderson-rubin Wald Test (F Test) | 3.080 * |

| Anderson-rubin Wald Test (Chi-SQ) | 3.340 * |

| Stock-wright LM S Statistic (Chi-SQ) | 3.330 * |

| The second stage | |

| Underidentification test | |

| Anderson canon. corr. LM statistic | 12.545 *** |

| Variable | Equation (2) | IS | PQ | MC | |||

|---|---|---|---|---|---|---|---|

| RES | MED | RES | MED | RES | MED | RES | |

| DIG | 0.073 * (0.042) | −0.145 ** (0.068) | 0.101 ** (0.041) | 0.075 (0.066) | 0.063 * (0.037) | 0.031 (0.044) | 0.081 * (0.043) |

| CR | 0.120 * (0.07) | −0.093 (0.088) | −0.279 *** (0.095) | 0.035 (0.048) | 0.121 (0.079) | 0.080 ** (0.039) | 0.08 (0.003) |

| CR × DIG | 0.334 ** (0.129) | −0.082 (0.165) | 0.149 (0.13) | 0.276 (0.182) | 0.321 ** (0.137) | −0.278 *** (0.103) | 0.251 ** (0.117) |

| MED | 0.015 (0.016) | 0.118 ** (0.051) | −0.191 * (0.114) | ||||

| MED × CR | 0.540 *** (0.118) | −0.032 (0.125) | 0.514 * (0.293) | ||||

| Individual effect | Yes | ||||||

| Time effect | Yes | ||||||

| Control variables | Yes | ||||||

| Bootstrap (Resampling Times: 1000) | ||||||

|---|---|---|---|---|---|---|

| Path | IS | PQ | MC | |||

| Coefficient | Confidence Interval | Coefficient | Confidence Interval | Coefficient | Confidence Interval | |

| −0.078 ** (0.002) | [−0.144, −0.034] | −0.002 (0.000) | [−0.018, 0.004] | 0.016 (0.003) | [−0.019, 0.078] | |

| −0.001 (0.000) | [−0.007, 0.001] | 0.032 ** (0.000) | [0.010, 0.064] | 0.053 ** (0.003) | [0.017, 0.106] | |

| 0.044(0.004) | [−0.157, 0.063] | −0.009(0.001) | [−0.052, 0.019] | −0.143 **(0.010) | [−0.331, −0.059] | |

| Moderated mediation effect | −0.126 ** (0.002) | [−0.222, −0.06] | 0.03 ** (0.001) | [0.003, 0.065] | −0.08 ** (0.004) | [−0.223, −0.030] |

| Moderated direction effect | 0.25 ** (0.002) | [0.149, 0.379] | 0.387 ** (0.000) | [0.272, 0.507] | 0.332 ** (0.003) | [0.241, 0.432] |

| Proportion of mediation effect | 33.5% | 7.2% | 19.4% | |||

| Individual effect | Yes | |||||

| Time effect | Yes | |||||

| Control variables | Yes | |||||

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

He, S.; Yang, S.; Razzaq, A.; Erfanian, S.; Abbas, A. Mechanism and Impact of Digital Economy on Urban Economic Resilience under the Carbon Emission Scenarios: Evidence from China’s Urban Development. Int. J. Environ. Res. Public Health 2023, 20, 4454. https://doi.org/10.3390/ijerph20054454

He S, Yang S, Razzaq A, Erfanian S, Abbas A. Mechanism and Impact of Digital Economy on Urban Economic Resilience under the Carbon Emission Scenarios: Evidence from China’s Urban Development. International Journal of Environmental Research and Public Health. 2023; 20(5):4454. https://doi.org/10.3390/ijerph20054454

Chicago/Turabian StyleHe, Songtao, Shuigen Yang, Amar Razzaq, Sahar Erfanian, and Azhar Abbas. 2023. "Mechanism and Impact of Digital Economy on Urban Economic Resilience under the Carbon Emission Scenarios: Evidence from China’s Urban Development" International Journal of Environmental Research and Public Health 20, no. 5: 4454. https://doi.org/10.3390/ijerph20054454

APA StyleHe, S., Yang, S., Razzaq, A., Erfanian, S., & Abbas, A. (2023). Mechanism and Impact of Digital Economy on Urban Economic Resilience under the Carbon Emission Scenarios: Evidence from China’s Urban Development. International Journal of Environmental Research and Public Health, 20(5), 4454. https://doi.org/10.3390/ijerph20054454