Assessing Influence Mechanism of Management Overconfidence, Corporate Environmental Responsibility and Corporate Value: The Moderating Effect of Government Environmental Governance and Media Attention

Abstract

1. Introduction

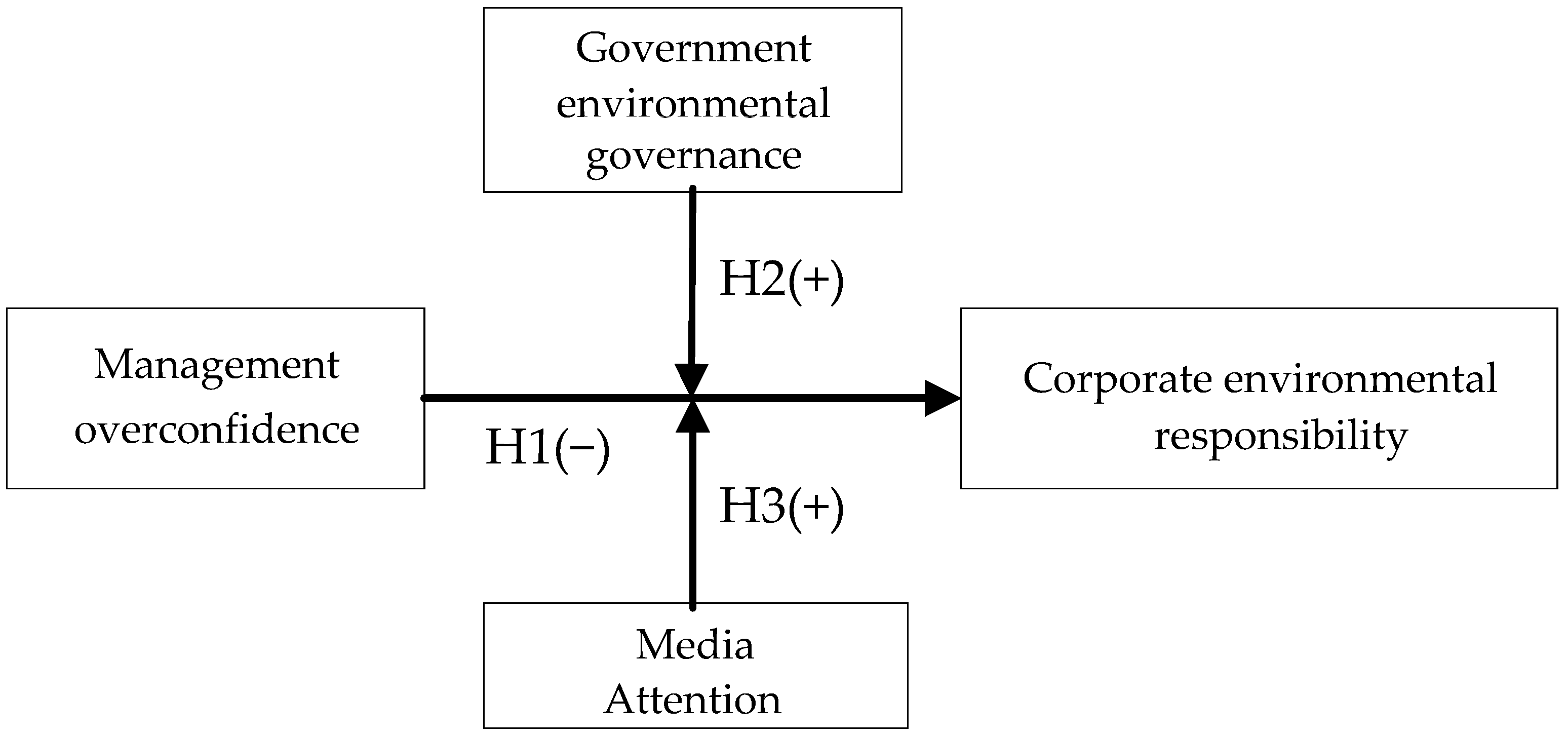

2. Theoretical Analysis and Hypothesis Development

2.1. Influence Mechanism of Corporate Environmental Responsibility

2.2. The Moderating Role of Government Environmental Governance

2.3. The Moderating Effect of the Media Attention

3. Materials and Methods

3.1. Data and Sample Selection

3.2. Variable Definitions

3.2.1. Dependent Variable

3.2.2. Independent Variable

3.2.3. Moderating Variables

3.2.4. Control Variables

3.3. Empirical Model Design

4. Results

4.1. Descriptive Statistics

4.2. Multiple Regression Results

4.3. Robustness

4.3.1. Random Sample

4.3.2. Replace the Independent Variable Measurement Method

4.3.3. Add Control Variables

4.3.4. Endogeneity

4.4. Further Analysis: The Impact of Management Overconfidence and Environmental Responsibility on Corporate Value

5. Conclusions

5.1. Research Conclusions

5.2. Management Implications

5.3. Limitations and Future Research

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Appendix A

| Variables | (1) CER | (2) CER | (3) CER | (4) CER |

|---|---|---|---|---|

| OC | −0.907 *** (−6.80) | −0.941 *** (−6.98) | −1.451 *** (−4.46) | |

| EG | −0.214 ** (−2.22) | |||

| OC × EG | 0.259 ** (2.00) | |||

| Media | 0.224 *** (2.77) | |||

| OC × Media | 0.199 ** (1.96) | |||

| MS | −0.340 *** (−4.63) | −0.371 *** (−5.07) | −0.373 *** (−5.09) | −0.366 *** (−5.01) |

| Independence | 0.120 * (1.79) | 0.147 ** (2.21) | 0.146 ** (2.19) | 0.138 ** (2.08) |

| Lev | 0.708 *** (8.79) | 0.636 *** (7.86) | 0.628 *** (7.75) | 0.605 *** (7.47) |

| ROA | 0.752 *** (8.04) | 0.765 *** (8.21) | 0.770 *** (8.26) | 0.688 *** (7.27) |

| Duality | −0.636 *** (−4.30) | −0.591 *** (−4.01) | −0.580 *** (−3.93) | −0.606 *** (−4.12) |

| EC | 0.016 *** (3.26) | 0.016 *** (3.35) | 0.016 *** (3.30) | 0.015 *** (3.24) |

| Age | 0.024 * (1.69) | 0.028 ** (2.01) | 0.027 * (1.91) | 0.029 ** (2.08) |

| Growth | −0.384 *** (−3.51) | −0.370 *** (−3.39) | −0.372 *** (−3.41) | −0.400 *** (−3.67) |

| Year | Control | Control | Control | Control |

| N | 6312 | 6312 | 6312 | 6312 |

| Adj R2 | 0.092 | 0.099 | 0.099 | 0.102 |

| F | 43.658 | 44.109 | 39.533 | 40.806 |

| Variables | (1) CER | (2) CER | (3) CER | (4) CER |

|---|---|---|---|---|

| OC | −0.522 *** (−8.28) | −0.529 *** (−8.35) | −0.721 *** (−4.80) | |

| EG | −0.095 (−1.44) | |||

| OC × EG | 0.097 * (1.69) | |||

| Media | 0.305 *** (5.04) | |||

| OC × Media | 0.077 * (1.66) | |||

| MS | −0.272 *** (−4.11) | −0.309 *** (−4.68) | −0.310 *** (−4.69) | −0.303 *** (−4.58) |

| Independence | 0.091 (1.52) | 0.124 ** (2.07) | 0.121 ** (2.03) | 0.113 * (1.90) |

| Lev | 0.741 *** (10.17) | 0.664 *** (9.09) | 0.658 *** (8.99) | 0.640 *** (8.75) |

| ROA | 0.781 *** (9.17) | 0.796 *** (9.38) | 0.800 *** (9.43) | 0.718 *** (8.33) |

| Duality | −0.560 *** (−4.21) | −0.498 *** (−3.75) | −0.491 *** (−3.70) | −0.519 *** (−3.91) |

| EC | 0.011 *** (2.61) | 0.011 *** (2.68) | 0.011 *** (2.65) | 0.011 *** (2.61) |

| Age | 0.022 * (1.75) | 0.031 ** (2.49) | 0.030 ** (2.37) | 0.032 ** (2.57) |

| Growth | −0.337 *** (−3.73) | −0.309 *** (−3.44) | −0.310 *** (−3.45) | −0.336 *** (−3.74) |

| Year | Control | Control | Control | Control |

| N | 7890 | 7890 | 7890 | 7890 |

| Adj R2 | 0.085 | 0.093 | 0.093 | 0.096 |

| F | 50.093 | 51.653 | 46.186 | 47.566 |

| Variables | (1) CER | (2) CER | (3) CER | (4) CER |

|---|---|---|---|---|

| OC | −1.125 *** (−7.31) | −1.174 *** (−7.54) | −1.760 *** (−4.75) | |

| EG | −0.236 ** (−2.19) | |||

| OC × EG | 0.323 ** (2.20) | |||

| Media | 0.272 *** (3.05) | |||

| OC × Media | 0.235 ** (2.05) | |||

| MS | 0.176 (1.43) | 0.138 (1.13) | 0.139 (1.13) | 0.137 (1.12) |

| Independence | 0.175 ** (2.30) | 0.203 *** (2.68) | 0.199 *** (2.62) | 0.185 ** (2.45) |

| Lev | 0.497 *** (5.42) | 0.404 *** (4.38) | 0.395 *** (4.28) | 0.360 *** (3.89) |

| ROA | 0.671 *** (6.57) | 0.674 *** (6.63) | 0.681 *** (6.70) | 0.581 *** (5.63) |

| Duality | −0.361 ** (−2.01) | −0.294 (−1.64) | −0.277 (−1.55) | −0.338 * (−1.89) |

| EC | 0.013 ** (2.08) | 0.013 ** (2.14) | 0.013 ** (2.11) | 0.014 ** (2.24) |

| Age | 0.009 (0.56) | 0.016 (0.99) | 0.015 (0.90) | 0.018 (1.06) |

| Growth | −0.208 * (−1.72) | −0.184 (−1.52) | −0.183 (−1.51) | −0.174 (−1.45) |

| PC | 0.552 *** (5.38) | 0.554 *** (5.42) | 0.554 *** (5.42) | 0.522 *** (5.11) |

| Ins_share | 0.268 * (1.75) | 0.266 * (1.75) | 0.272 * (1.79) | 0.212 (1.40) |

| Year | Control | Control | Control | Control |

| N | 5654 | 5654 | 5654 | 5654 |

| Adj R2 | 0.103 | 0.111 | 0.112 | 0.116 |

| F | 39.257 | 40.390 | 36.667 | 38.017 |

| Variables | (1) CER | (2) CER | (3) CER | (4) CER |

|---|---|---|---|---|

| OC | −0.963 *** (−7.85) | −1.001 *** (−8.09) | −1.391 *** (−4.62) | |

| EG | −0.280 *** (−3.12) | |||

| OC × EG | 0.293 ** (2.46) | |||

| Media | 0.244 *** (3.24) | |||

| OC × Media | 0.161 * (1.71) | |||

| MS | −0.302 *** (−4.45) | −0.342 *** (−5.05) | −0.343 *** (−5.06) | −0.333 *** (−4.92) |

| Independence | 0.099 (1.62) | 0.138 ** (2.25) | 0.135 ** (2.21) | 0.126 ** (2.06) |

| Lev | 0.756 *** (10.16) | 0.672 *** (8.97) | 0.661 *** (8.83) | 0.644 *** (8.59) |

| ROA | 0.786 *** (9.04) | 0.789 *** (9.11) | 0.795 *** (9.18) | 0.709 *** (8.07) |

| Duality | −0.533 *** (−3.92) | −0.488 *** (−3.60) | −0.472 *** (−3.48) | −0.504 *** (−3.72) |

| EC | 0.012 *** (2.63) | 0.012 *** (2.72) | 0.012 *** (2.69) | 0.012 *** (2.67) |

| Age | 0.022 * (1.71) | 0.026 ** (2.04) | 0.024 * (1.87) | 0.027 ** (2.15) |

| Growth | −0.326 *** (−3.57) | −0.305 *** (−3.34) | −0.305 *** (−3.35) | −0.332 *** (−3.65) |

| Year | Control | Control | Control | Control |

| N | 7679 | 7679 | 7679 | 7679 |

| Adj R2 | 0.088 | 0.095 | 0.096 | 0.098 |

| F | 50.086 | 51.183 | 46.100 | 47.294 |

References

- Zou, H.; Xie, X.; Qi, G.; Yang, M. The heterogeneous relationship between board social ties and corporate environmental responsibility in an emerging economy. Bus. Strateg. Environ. 2019, 28, 40–52. [Google Scholar] [CrossRef]

- Chen, X.; Zhang, J.; Zeng, H. Is corporate environmental responsibility synergistic with governmental environmental responsibility? Evidence from China. Bus. Strateg. Environ. 2020, 29, 3669–3686. [Google Scholar] [CrossRef]

- Ali, S.; Murtaza, G.; Hedvicakova, M.; Jiang, J.F.; Naeem, M. Intellectual capital and financial performance: A comparative study. Front. Psych. 2022, 13, 967820. [Google Scholar] [CrossRef] [PubMed]

- Loof, H.; Sahamkhadam, M.; Stephan, A. Is Corporate Social Responsibility investing a free lunch? The relationship between ESG, tail risk, and upside potential of stocks before and during the COVID-19 crisis. Financ. Res. Lett. 2022, 46, 102499. [Google Scholar] [CrossRef] [PubMed]

- McWilliams, A.; Siegel, D. Corporate social responsibility: A theory of the firm perspective. Acad. Manag. Rev. 2001, 26, 117–127. [Google Scholar] [CrossRef]

- Dumitrescu, A.; Zakriya, M. Stakeholders and the stock price crash risk: What matters in corporate social performance? J. Corp. Financ. 2021, 67, 101871. [Google Scholar] [CrossRef]

- He, L.; Zhong, T.; Gan, S. Green finance and corporate environmental responsibility: Evidence from heavily polluting listed enterprises in China. Environ. Sci. Poll. Res. 2022, 29, 74081–74096. [Google Scholar] [CrossRef] [PubMed]

- Mattingly, J.E.; Berman, S.L. Measurement of corporate social action: Discovering taxonomy in the Kinder Lydenburg Domini ratings data. Bus. Soc. 2006, 45, 20–46. [Google Scholar] [CrossRef]

- Peng, B.; Tu, Y.; Wei, G. Can environmental regulations promote corporate environmental responsibility? Evidence from the moderated mediating effect model and an empirical study in China. Sustainability 2018, 10, 641. [Google Scholar] [CrossRef]

- Ali, S.; Jiang, J.; Rehman, R.; Khan, M.K. Tournament incentives and environmental performance: The role of green innovation. Environ. Sci. Poll. Res. 2022, 1–11. [Google Scholar] [CrossRef]

- Wu, J. Differentiated Customer Pressures and Environmental Policies in China. Bus. Strateg. Environ. 2015, 24, 175–189. [Google Scholar] [CrossRef]

- Burkhard, B.; Sirén, C.; Essen, M.; Grichnik, D.; Shepherd, D.A. Nothing Ventured, Nothing Gained: A Meta-Analysis of CEO Overconfidence, Strategic Risk Taking, and Performance. J. Manag. 2022, 1–38. [Google Scholar] [CrossRef]

- Chin, M.K.; Hambrick, D.C.; Treviño, L.K. Political ideologies of CEOs: The influence of executives’ values on corporate social responsibility. Adm. Sci. Q. 2013, 58, 197–232. [Google Scholar] [CrossRef]

- Malmendier, U.; Tate, G. CEO overconfidence and corporate investment. J. Financ. 2005, 60, 2661–2700. [Google Scholar] [CrossRef]

- Malmendier, U.; Tate, G. Who makes acquisitions? CEO overconfidence and the market’s reaction. J. Financ. Econ. 2008, 89, 20–43. [Google Scholar] [CrossRef]

- Cragun, O.R.; Olsen, K.J.; Wright, P.M. Making CEO Narcissism Research Great: A Review and Meta-Analysis of CEO Narcissism. J. Manag. 2019, 46, 908–936. [Google Scholar] [CrossRef]

- Chatterjee, A.; Hambrick, D.C. It’s all about me: Narcissistic chief executive officers and their effects on company strategy and performance. Adm. Sci. Q. 2007, 52, 351–386. [Google Scholar] [CrossRef]

- Malmendier, U.; Tate, G.; Yan, J. Overconfidence and early-life experiences: The effect of managerial traits on corporate financial policies. J. Financ. 2011, 66, 1687–1733. [Google Scholar] [CrossRef]

- Hirshleifer, D.; Low, A.; Teoh, S.H. Are overconfident CEOs better innovators? J. Financ. 2012, 67, 1457–1498. [Google Scholar] [CrossRef]

- Galasso, A.; Simcoe, T.S. CEO overconfidence and innovation. Manag. Sci. 2011, 57, 1469–1484. [Google Scholar] [CrossRef]

- Gerstner, W.C.; König, A.; Enders, A.; Hambrick, D.C. CEO narcissism, audience engagement, and organizational adoption of technological discontinuities. Adm. Sci. Q. 2013, 58, 257–291. [Google Scholar] [CrossRef]

- Tang, Y.; Li, J.; Yang, H. What I see, what I do: How executive hubris affects firm innovation. J. Manag. 2015, 41, 1698–1723. [Google Scholar] [CrossRef]

- Tang, Y.; Mack, D.Z.; Chen, G. The differential effects of CEO narcissism and hubris on corporate social responsibility. Strateg. Manag. J. 2018, 39, 1370–1387. [Google Scholar] [CrossRef]

- Deshmukh, S.; Goel, A.M.; Howe, K.M. CEO overconfidence and dividend policy. J. Financ. Intermed. 2013, 22, 440–463. [Google Scholar] [CrossRef]

- He, Y.; Chen, C.; Hu, Y. Managerial overconfidence, internal financing, and investment efficiency: Evidence from China. Res. Int. Bus. Financ. 2019, 47, 501–510. [Google Scholar] [CrossRef]

- Doukas, J.A.; Petmezas, D. Acquisitions, overconfident managers and self-attribution bias. Eur. Financ. Manag. 2007, 13, 531–577. [Google Scholar] [CrossRef]

- Kim, H.J.; Mun, S. Terrorist attacks and corporate investment: The beneficial value of CEO overconfidence. Int. Rev. Financ. Anal. 2022, 84, 102363. [Google Scholar] [CrossRef]

- Schumacher, C.; Keck, S.; Tang, W. Biased interpretation of performance feedback: The role of CEO overconfidence. Strateg. Manag. J. 2020, 41, 1139–1165. [Google Scholar] [CrossRef]

- Dsouza, C.; Ahmed, T.; Khashru, M.F.M.A.; Ahmed, R.; Ratten, V.; Jayaratne, M. The complexity of stakeholder pressures and their influence on social and environmental responsibilities. J. Clean. Prod. 2022, 358, 132038. [Google Scholar] [CrossRef]

- Killins, R.; Ngo, T.; Wang, H. Goodwill impairment and CEO overconfidence. J. Behav. Exp. Financ. 2021, 29, 100459. [Google Scholar] [CrossRef]

- Ikeda, N.; Inoue, K.; Sugitani, S. Managerial optimism and corporate investment behavior. J. Behav. Exp. Financ. 2021, 30, 100492. [Google Scholar] [CrossRef]

- Wong, Y.J.; Lee, C.Y.; Chang, S.C. CEO overconfidence and ambidextrous innovation. J. Leadersh. Organ. Stud. 2017, 24, 414–430. [Google Scholar] [CrossRef]

- Li, J.; Tang, Y.I. CEO hubris and firm risk taking in China: The moderating role of managerial discretion. Acad. Manag. J. 2010, 53, 45–68. [Google Scholar] [CrossRef]

- Suchman, M.C. Managing legitimacy: Strategic and institutional approaches. Acad. Manag. Rev. 1995, 20, 571–610. [Google Scholar] [CrossRef]

- Freeman, R.E. The politics of stakeholder theory: Some future directions. Bus. Ethics Q. 1994, 4, 409–421. [Google Scholar] [CrossRef]

- Sun, Y.; Davey, H.; Arunachalam, M.; Cao, Y. Towards a theoretical framework for the innovation in sustainability reporting: An integrated reporting perspective. Front. Environ. Sci. 2022, 10, 935899. [Google Scholar] [CrossRef]

- Zhao, X.; Jia, M. Sincerity or hypocrisy: Can green M&A achieve corporate environmental goverance. Environ. Sci. Poll. Res. 2022, 29, 27339–27351. [Google Scholar]

- Lee, J.W.; Kim, Y.M.; Kim, Y.E. Antecedents of adopting corporate environmental responsibility and green practices. J. Bus. Ethics 2018, 148, 397–409. [Google Scholar] [CrossRef]

- Liu, Q.; Tang, J.; Tian, G.G. Does political capital create value in the IPO market? Evidence from China. J. Corp. Financ. 2013, 23, 395–413. [Google Scholar] [CrossRef]

- Han, M.; Lin, H.; Wang, J.; Wang, Y.; Jiang, W. Turning corporate environmental ethics into firm performance: The role of green marketing programs. Bus. Strateg. Environ. 2019, 28, 929–938. [Google Scholar] [CrossRef]

- Mohamed, A.S.; David, H.; Van, S.C.J. The influence of culture and corporate governance on corporate social responsibility disclosure: A cross country analysis. J. Clean Prod. 2018, 198, 820–832. [Google Scholar] [CrossRef]

- Li, J.; Tang, Y. The social influence of executive hubris. Manag. Int. Rev. 2013, 53, 83–107. [Google Scholar] [CrossRef]

- Walden, W.D.; Schwartz, B.N. Environmental disclosures and public policy pressure. J. Account. Public Policy 1997, 2, 125–154. [Google Scholar]

- El Ghoul, S.; Guedhami, O.; Kwok, C.C.Y.; Mishra, D. Does corporate social responsibility affect the cost of capital? J. Bank Financ. 2011, 35, 2388–2406. [Google Scholar] [CrossRef]

- Cahan, S.F.; Chen, C.; Chen, L.; Nguyen, N.H. Corporate social responsibility and media coverage. J. Bank Financ. 2015, 59, 409–422. [Google Scholar] [CrossRef]

- Manetti, G.; Bellucci, M. The use of social media for engaging stakeholders in sustainability reporting. Account. Audit Account. 2016, 29, 985–1011. [Google Scholar] [CrossRef]

- Chen, G.; Crossland, C.; Luo, S. Making the same mistake all over again: CEO overconfidence and corporate resistance to corrective feedback. Strateg. Manag. J. 2015, 36, 1513–1535. [Google Scholar] [CrossRef]

- Masulis, R.W.; Reza, S.W. Agency problems of corporate philanthropy. Rev. Financ. Stud. 2015, 28, 592–636. [Google Scholar] [CrossRef]

- Chen, C.C.; Meindl, J.R. The construction of leadership images in the popular press: The case of donald burr and people express. Adm. Sci. Q. 1991, 36, 521–551. [Google Scholar] [CrossRef]

- Hayward, M.L.A.; Rindova, V.P.; Pollock, T.G. Believing one’s own press: The causes and consequences of CEO celebrity. Strateg. Manag. J. 2004, 25, 637–653. [Google Scholar] [CrossRef]

- Zeng, S.; Qin, Y.; Zeng, G. Impact of corporate environmental responsibility on investment efficiency: The moderating roles of the institutional environment and consumer environmental awareness. Sustainability 2019, 11, 4512. [Google Scholar] [CrossRef]

- Brown, R.; Sarma, N. CEO overconfidence, CEO dominance and corporate acquisitions. J. Econ. Bus. 2007, 59, 358–379. [Google Scholar] [CrossRef]

- Hayward, M.L.A.; Hambrick, D.C. Explaining the premiums paid for large acquisitions: Evidence of CEO hubris. Adm. Sci. Q. 1997, 42, 103–127. [Google Scholar] [CrossRef]

- Chen, Z.; Kahn, M.E.; Liu, Y.; Wang, Z. The consequences of spatially differentiated water pollution regulation in China. J. Environ. Econ. Manag. 2018, 88, 468–485. [Google Scholar] [CrossRef]

- Li, J.; Zhou, C.; Zajac, E.J. Control, collaboration, and productivity in international joint ventures: Theory and evidence. Strateg. Manag. J. 2009, 30, 865–884. [Google Scholar] [CrossRef]

- Stulz, R.M. The limits of financial globalization. J. Financ. 2005, 60, 1595–1638. [Google Scholar] [CrossRef]

- Park, J.H.; Kim, C.; Chang, Y.K.; Lee, D.H.; Sung, Y.D. CEO hubris and firm performance: Exploring the moderating roles of CEO power and board vigilance. J. Bus. Ethics 2018, 147, 919–933. [Google Scholar] [CrossRef]

- Gul, F.A.; Krishnamurti, C.; Shams, S.; Chowdhury, H. Corporate social responsibility, overconfident CEOs and empire building: Agency and stakeholder theoretic perspectives. J. Bus. Res. 2020, 111, 52–68. [Google Scholar] [CrossRef]

- Godfrey, P.C. The relationship between corporate philanthropy and shareholder wealth: A risk management perspective. Acad. Manag. Rev. 2005, 30, 777–798. [Google Scholar] [CrossRef]

- Zhu, Y.; Sun, L.Y.; Leung, A.S.M. Corporate social responsibility, firm reputation, and firm performance: The role of ethical leadership. Asia Pac. J. Manag. 2014, 31, 925–947. [Google Scholar] [CrossRef]

- Chen, R.C.Y.; Lee, C.H. Assessing whether corporate social responsibility influence corporate value. Appl. Econ. 2017, 49, 5547–5557. [Google Scholar] [CrossRef]

| Variables | Definition | Code | Index |

|---|---|---|---|

| Dependent Variable | Corporate environmental responsibility | CER | The environmental responsibility scoring data in the social responsibility assessment system published by Hexun in the current year. |

| Independent Variable | Management overconfidence | OC | The ratio of the top three management salaries to the sum of all salaries, which is treated as a 0–1 dummy variable based on the median of the ratios. |

| Moderating Variables | Government environmental governance | EG | Manually collect and sort out the ratio of the frequency of words appearing in the relevant words of the word “environmental protection” in the government work report of each province in China to the full text of the government work report. |

| Media attention | Media | Using the advanced search function of Baidu News, the short name of each listed company’s securities is entered one by one and a time-interval search is performed to obtain the total number of corporate news reports for each year, and then one is added to take the natural logarithm. | |

| Control Variables | Management shareholding | MS | The ratio of the number of shares held by management to the total share capital of the Company. |

| Board independence | Independence | The ratio of the number of independent directors to the total number of directors of the Company. | |

| Capital structure | Lev | Year-end gearing ratio of the Company: total liabilities/total assets. | |

| corporate performance | ROA | Rate of return on assets: net profit after tax/total assets. | |

| Board leadership structure | Duality | “1” for directors concurrently serving as senior management, or “0” for otherwise. | |

| Equity concentration | EC | The shareholding ratio of the top ten shareholders. | |

| Company age | Age | The difference between the year of the current year and the time of establishment of the enterprise. | |

| Growth of the compony | Growth | The year-end asset growth rate of the enterprise. | |

| Year | Year | Annual virtual variable. |

| Variable | Obs | Mean | Std. | P50 | Min | Max |

|---|---|---|---|---|---|---|

| CER | 7890 | 2.047 | 5.511 | 0.000 | 0.000 | 25.000 |

| OC | 7890 | 0.488 | 0.500 | 0.000 | 0.000 | 1.000 |

| EG | 7890 | 0.015 | 0.003 | 0.015 | 0.006 | 0.026 |

| Media | 7890 | 2.927 | 1.289 | 2.996 | 0.000 | 12.660 |

| MS | 7890 | 0.179 | 0.225 | 0.035 | 0.000 | 0.611 |

| Independence | 7890 | 0.373 | 0.052 | 0.333 | 0.333 | 0.571 |

| Lev | 7890 | 0.375 | 0.206 | 0.352 | 0.049 | 1.073 |

| ROA | 7890 | 0.044 | 0.056 | 0.043 | −0.333 | 0.216 |

| Duality | 7890 | 0.318 | 0.466 | 0.000 | 0.000 | 1.000 |

| EC | 7890 | 34.650 | 14.050 | 33.250 | 9.050 | 73.190 |

| Age | 7890 | 14.700 | 5.439 | 15.000 | 3.000 | 30.000 |

| Growth | 7890 | 0.267 | 0.465 | 0.119 | −0.303 | 2.675 |

| Variables | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 1.CER | 1.000 | |||||||||||

| 2.OC | −0.086 | 1.000 | ||||||||||

| 3.EG | −0.110 | 0.030 | 1.000 | |||||||||

| 4.Media | −0.081 | −0.024 | 0.274 | 1.000 | ||||||||

| 5.MS | −0.128 | −0.008 | 0.133 | 0.102 | 1.000 | |||||||

| 6.Independence | 0.002 | 0.052 | 0.012 | 0.057 | 0.044 | 1.000 | ||||||

| 7.Lev | 0.128 | −0.137 | −0.077 | 0.013 | −0.370 | −0.001 | 1.000 | |||||

| 8.ROA | 0.028 | 0.097 | 0.039 | 0.119 | 0.253 | −0.019 | −0.443 | 1.000 | ||||

| 9.Duality | −0.091 | 0.049 | 0.076 | 0.047 | 0.254 | 0.097 | −0.150 | 0.099 | 1.000 | |||

| 10.EC | 0.059 | 0.015 | −0.016 | −0.029 | −0.117 | 0.052 | −0.011 | 0.107 | 0.011 | 1.000 | ||

| 11.Age | 0.001 | 0.025 | 0.045 | 0.231 | −0.255 | −0.008 | 0.183 | −0.104 | −0.106 | −0.094 | 1.000 | |

| 12.Growth | −0.054 | 0.020 | 0.057 | 0.156 | 0.267 | −0.002 | −0.091 | 0.366 | 0.127 | 0.005 | −0.163 | 1.000 |

| Variable | VIF | 1/VIF |

|---|---|---|

| OC | 1.03 | 0.973 |

| EG | 1.07 | 0.933 |

| Media | 1.14 | 0.876 |

| MS | 1.30 | 0.769 |

| Independence | 1.03 | 0.970 |

| Lev | 1.38 | 0.723 |

| ROA | 1.25 | 0.799 |

| Duality | 1.10 | 0.913 |

| EC | 1.04 | 0.964 |

| Age | 1.17 | 0.852 |

| Growth | 1.05 | 0.950 |

| Mean VIF | 1.14 |

| Variables | (1) CER | (2) CER | (3) CER | (4) CER |

|---|---|---|---|---|

| OC | −0.904 *** (−7.51) | −0.933 *** (−7.68) | −1.323 *** (−4.49) | |

| EG | −0.220 ** (−2.52) | |||

| OC × EG | 0.236 ** (2.01) | |||

| Media | 0.244 *** (3.36) | |||

| OC × Media | 0.156 * (1.70) | |||

| MS | −0.272 *** (−4.11) | −0.304 *** (−4.59) | −0.304 *** (−4.59) | −0.297 *** (−4.49) |

| Independence | 0.091 (1.52) | 0.118 ** (1.98) | 0.115 * (1.93) | 0.107 * (1.80) |

| Lev | 0.741 *** (10.17) | 0.670 *** (9.16) | 0.662 *** (9.04) | 0.640 *** (8.74) |

| ROA | 0.781 *** (9.17) | 0.792 *** (9.33) | 0.796 *** (9.38) | 0.711 *** (8.24) |

| Duality | −0.560 *** (−4.21) | −0.522 *** (−3.93) | −0.511 *** (−3.84) | −0.539 *** (−4.06) |

| EC | 0.011 *** (2.61) | 0.012 *** (2.68) | 0.011 *** (2.64) | 0.011 *** (2.61) |

| Age | 0.022 * (1.75) | 0.026 ** (2.09) | 0.024 ** (1.96) | 0.027 ** (2.19) |

| Growth | −0.337 *** (−3.73) | −0.317 *** (−3.53) | −0.318 *** (−3.53) | −0.344 *** (−3.83) |

| Year | Control | Control | Control | Control |

| N | 7890 | 7890 | 7890 | 7890 |

| Adj R2 | 0.085 | 0.092 | 0.092 | 0.095 |

| F | 50.093 | 50.821 | 45.566 | 46.990 |

| Variables | (5) CER | (6) FV | (7) FV | (8) FV |

|---|---|---|---|---|

| OC | −0.904 *** (−7.51) | −0.218 *** (−12.26) | −0.183 *** (−10.64) | |

| CER | 0.040 *** (24.72) | 0.038 *** (23.91) | ||

| MS | −0.304 *** (−4.59) | −0.231 *** (−24.40) | −0.250 *** (−25.60) | −0.238 *** (−25.24) |

| Independence | 0.118 ** (1.98) | 0.010 (1.18) | 0.020 ** (2.31) | 0.016 * (1.86) |

| Lev | 0.670 *** (9.16) | 0.424 *** (40.44) | 0.436 *** (40.42) | 0.410 *** (39.18) |

| ROA | 0.792 *** (9.33) | 0.298 *** (24.38) | 0.332 *** (26.52) | 0.302 *** (24.82) |

| Duality | −0.522 *** (−3.93) | −0.136 *** (−7.15) | −0.149 *** (−7.62) | −0.129 *** (−6.82) |

| EC | 0.012 *** (2.68) | 0.004 *** (7.25) | 0.005 *** (7.87) | 0.005 *** (7.42) |

| Age | 0.026 ** (2.09) | −0.000 (−0.02) | 0.002 (1.00) | 0.001 (0.48) |

| Growth | −0.317 *** (−3.53) | 0.025 ** (1.97) | 0.017 (1.26) | 0.029 ** (2.25) |

| Year | Control | Control | Control | Control |

| N | 7890 | 7890 | 7890 | 7890 |

| Adj R2 | 0.092 | 0.446 | 0.414 | 0.453 |

| F | 50.821 | 397.229 | 348.944 | 385.847 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Bai, G.; Meng, D. Assessing Influence Mechanism of Management Overconfidence, Corporate Environmental Responsibility and Corporate Value: The Moderating Effect of Government Environmental Governance and Media Attention. Int. J. Environ. Res. Public Health 2023, 20, 577. https://doi.org/10.3390/ijerph20010577

Bai G, Meng D. Assessing Influence Mechanism of Management Overconfidence, Corporate Environmental Responsibility and Corporate Value: The Moderating Effect of Government Environmental Governance and Media Attention. International Journal of Environmental Research and Public Health. 2023; 20(1):577. https://doi.org/10.3390/ijerph20010577

Chicago/Turabian StyleBai, Guiyu, and Delin Meng. 2023. "Assessing Influence Mechanism of Management Overconfidence, Corporate Environmental Responsibility and Corporate Value: The Moderating Effect of Government Environmental Governance and Media Attention" International Journal of Environmental Research and Public Health 20, no. 1: 577. https://doi.org/10.3390/ijerph20010577

APA StyleBai, G., & Meng, D. (2023). Assessing Influence Mechanism of Management Overconfidence, Corporate Environmental Responsibility and Corporate Value: The Moderating Effect of Government Environmental Governance and Media Attention. International Journal of Environmental Research and Public Health, 20(1), 577. https://doi.org/10.3390/ijerph20010577