Can a Greenhouse Gas Emissions Tax on Food also Be Healthy and Equitable? A Systemised Review and Modelling Study from Aotearoa New Zealand

Abstract

:1. Introduction

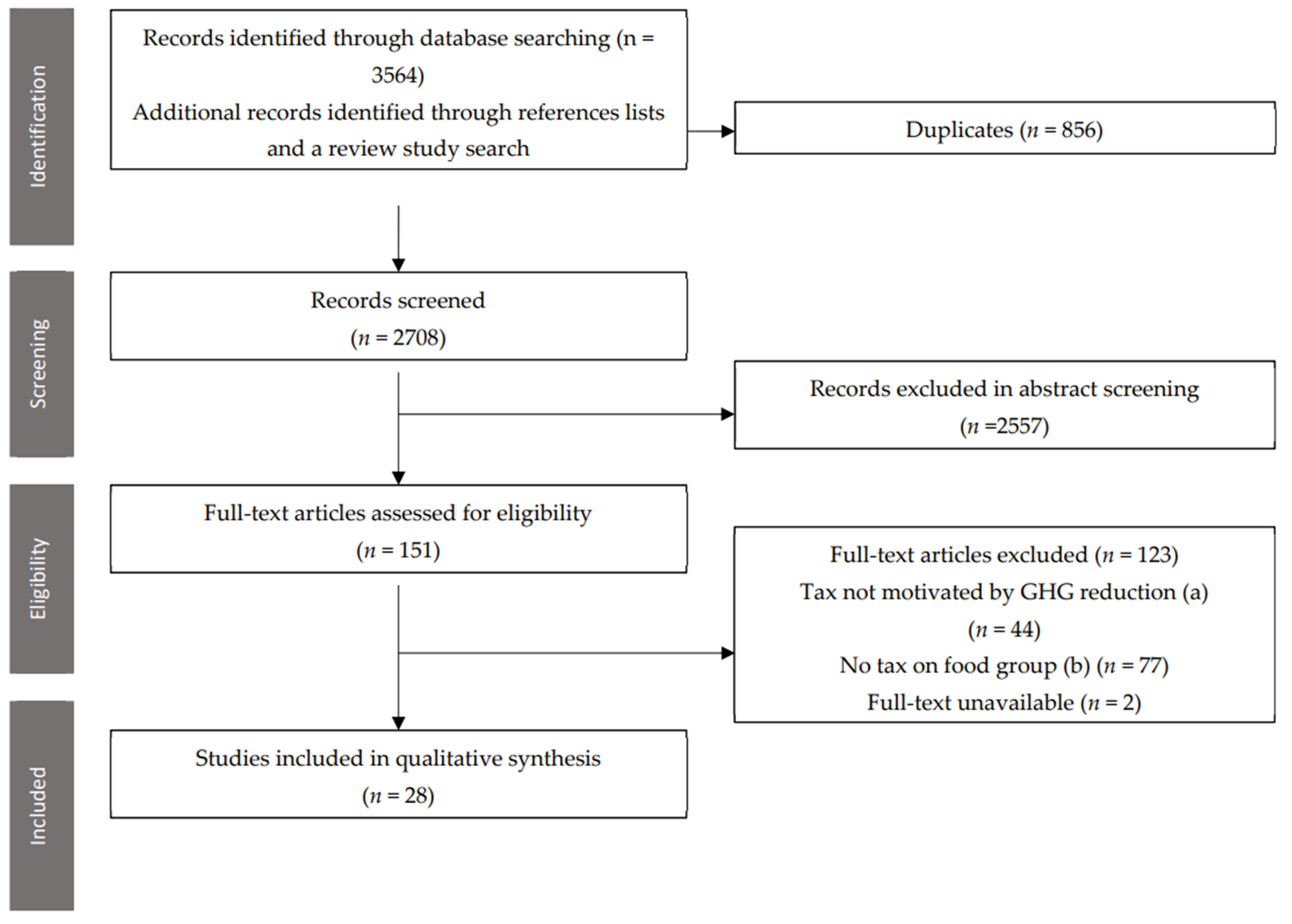

2. Materials and Methods

2.1. Literature Review

- (a)

- Illustrated a tax motivated by reducing GHG emissions.

- (b)

- Allocated a quantifiable tax amount to a defined food group or groups.

- (a)

- Included only a tax on foods which was not motivated by reducing GHG emissions.

- (b)

- Did not allocate a quantifiable tax amount to a defined food group or groups.

- (c)

- Only assessed environmental outcomes other than GHG emissions, e.g., biodiversity loss.

- (d)

- Only related to subsidy policies.

- (e)

- Only included a tax that was not specific to food groups (e.g., fuel tax or electricity tax).

2.2. GHG Tax Scenarios

2.3. Modelling Methods

3. Results

3.1. Review Results

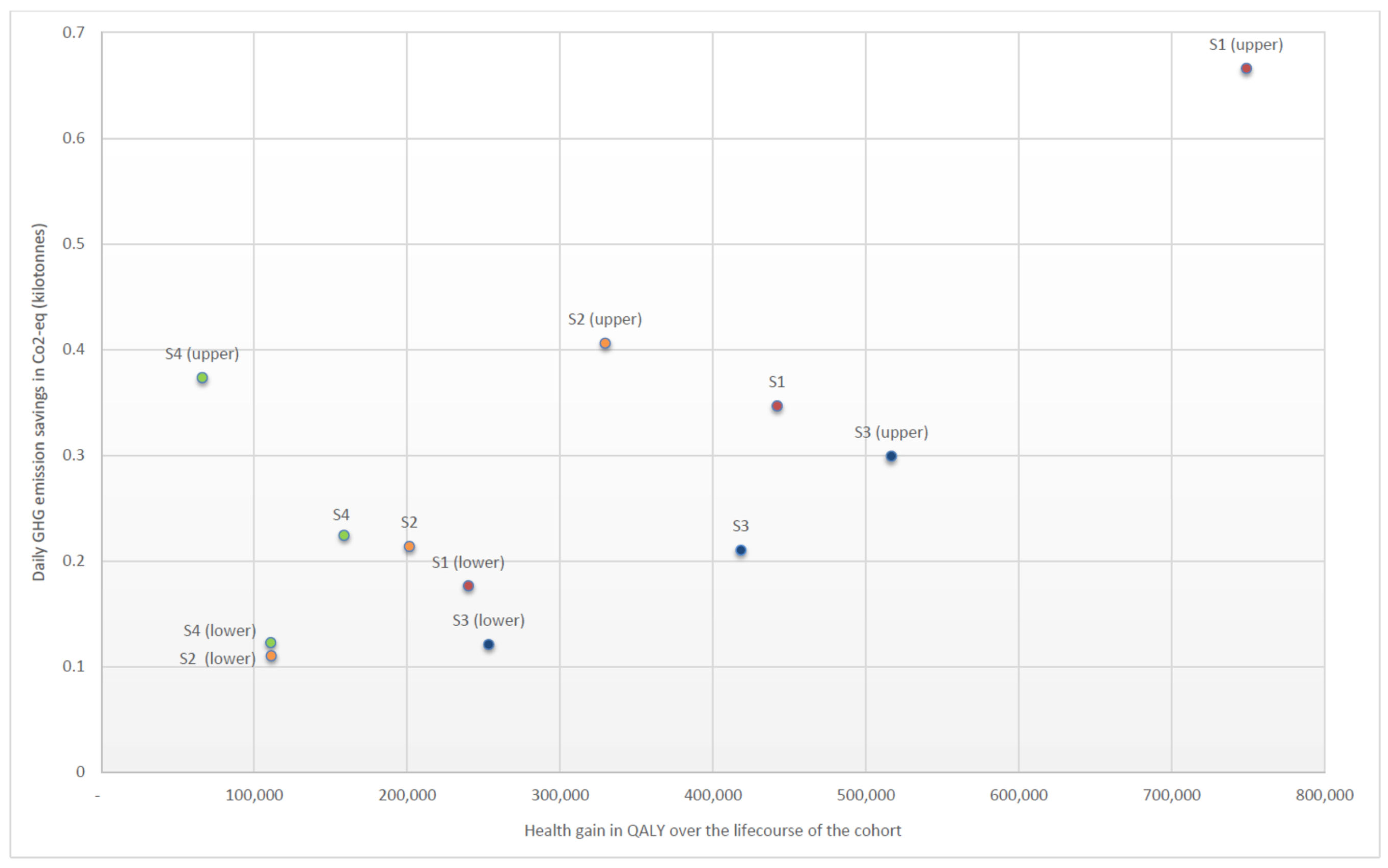

3.2. Modelling Results

3.2.1. Modelled GHG Food Tax Scenarios

3.2.2. Impacts on Modelling Outcomes

4. Discussion

5. Conclusions

Supplementary Materials

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Costello, A.; Abbas, M.; Allen, A.; Ball, S.; Bell, S.; Bellamy, R.; Friel, S.; Groce, N.; Johnson, A.; Kett, M. Managing the health effects of climate change: Lancet and University College London Institute for Global Health Commission. Lancet 2009, 373, 1693–1733. [Google Scholar] [CrossRef]

- Whitmee, S.; Haines, A.; Beyrer, C.; Boltz, F.; Capon, A.G.; de Souza Dias, B.F.; Ezeh, A.; Frumkin, H.; Gong, P.; Head, P. Safeguarding human health in the Anthropocene epoch: Report of The Rockefeller Foundation–Lancet Commission on planetary health. Lancet 2015, 386, 1973–2028. [Google Scholar] [CrossRef]

- Vermeulen, S.J.; Campbell, B.M.; Ingram, J.S. Climate change and food systems. Annu. Rev. Environ. Resour. 2012, 37, 195–222. [Google Scholar] [CrossRef] [Green Version]

- Vandenberghe, D.; Albrecht, J. Tackling the chronic disease burden: Are there co-benefits from climate policy measures? Eur. J. Health Econ. 2018, 19, 1259–1283. [Google Scholar] [CrossRef]

- Panchasara, H.; Samrat, N.H.; Islam, N. Greenhouse gas emissions trends and mitigation measures in australian agriculture sector—A review. Agriculture 2021, 11, 85. [Google Scholar] [CrossRef]

- Lim, S.S.; Vos, T.; Flaxman, A.D.; Danaei, G.; Shibuya, K.; Adair-Rohani, H.; AlMazroa, M.A.; Amann, M.; Anderson, H.R.; Andrews, K.G. A comparative risk assessment of burden of disease and injury attributable to 67 risk factors and risk factor clusters in 21 regions, 1990–2010: A systematic analysis for the Global Burden of Disease Study 2010. Lancet 2013, 380, 2224–2260. [Google Scholar] [CrossRef] [Green Version]

- International Agency for Research on Cancer (World Health Organisation). IARC Monographs Evaluate Consumption of Red Meat and Processed Meat; No. 240 edn; International Agency for Research on Cancer (World Health Organisation): Lyon, France, 2015. [Google Scholar]

- Abete, I.; Romaguera, D.; Vieira, A.R.; Lopez de Munain, A.; Norat, T. Association between total, processed, red and white meat consumption and all-cause, CVD and IHD mortality: A meta-analysis of cohort studies. Br. J. Nutr. 2014, 112, 762–775. [Google Scholar] [CrossRef]

- Feskens, E.J.; Sluik, D.; van Woudenbergh, G.J. Meat consumption, diabetes, and its complications. Curr. Diabetes Rep. 2013, 13, 298–306. [Google Scholar] [CrossRef]

- Forouzanfar, M.H.; Alexander, L.; Anderson, H.R.; Bachman, V.F.; Biryukov, S.; Brauer, M.; Burnett, R.; Casey, D.; Coates, M.M.; Cohen, A. Global, regional, and national comparative risk assessment of 79 behavioural, environmental and occupational, and metabolic risks or clusters of risks in 188 countries, 1990–2013: A systematic analysis for the Global Burden of Disease Study 2013. Lancet 2015, 386, 2287–2323. [Google Scholar] [CrossRef] [Green Version]

- Springmann, M.; Mason-D’Croz, D.; Robinson, S.; Wiebe, K.; Godfray, H.C.J.; Rayner, M.; Scarborough, P. Health-motivated taxes on red and processed meat: A modelling study on optimal tax levels and associated health impacts. PLoS ONE 2018, 13, e0204139. [Google Scholar] [CrossRef] [Green Version]

- Willett, W.; Rockström, J.; Loken, B.; Springmann, M.; Lang, T.; Vermeulen, S.; Garnett, T.; Tilman, D.; DeClerck, F.; Wood, A. Food in the Anthropocene: The EAT–Lancet Commission on healthy diets from sustainable food systems. Lancet 2019, 393, 447–492. [Google Scholar] [CrossRef]

- Elder, R.W.; Lawrence, B.; Ferguson, A.; Naimi, T.S.; Brewer, R.D.; Chattopadhyay, S.K.; Toomey, T.L.; Fielding, J.E. The effectiveness of tax policy interventions for reducing excessive alcohol consumption and related harms. Am. J. Prevent. Med. 2010, 38, 217–229. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Bank, W. Curbing the epidemic: Governments and the economics of tobacco control. Tobacco Control 1999, 8, 196–201. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Teng, A.M.; Jones, A.C.; Mizdrak, A.; Signal, L.; Genç, M.; Wilson, N. Impact of sugar-sweetened beverage taxes on purchases and dietary intake: Systematic review and meta-analysis. Obesity Rev. 2019, 20, 1187–1204. [Google Scholar] [CrossRef] [PubMed]

- Golub, A.A.; Henderson, B.B.; Hertel, T.W.; Gerber, P.J.; Rose, S.K.; Sohngen, B. Global climate policy impacts on livestock, land use, livelihoods, and food security. Proc. Natl. Acad. Sci. USA 2013, 110, 20894–20899. [Google Scholar] [CrossRef] [Green Version]

- Briggs, A.D.; Kehlbacher, A.; Tiffin, R.; Garnett, T.; Rayner, M.; Scarborough, P. Assessing the impact on chronic disease of incorporating the societal cost of greenhouse gases into the price of food: An econometric and comparative risk assessment modelling study. BMJ Open 2013, 3, e003543. [Google Scholar] [CrossRef] [Green Version]

- Edjabou, L.D.; Smed, S. The effect of using consumption taxes on foods to promote climate friendly diets–The case of Denmark. Food Policy 2013, 39, 84–96. [Google Scholar] [CrossRef]

- Macdiarmid, J.I.; Kyle, J.; Horgan, G.W.; Loe, J.; Fyfe, C.; Johnstone, A.; McNeill, G. Sustainable diets for the future: Can we contribute to reducing greenhouse gas emissions by eating a healthy diet? Am. J. Clin. Nutr. 2012, 96, 632–639. [Google Scholar] [CrossRef] [PubMed]

- Reynolds, C.J.; Buckley, J.D.; Weinstein, P.; Boland, J. Are the dietary guidelines for meat, fat, fruit and vegetable consumption appropriate for environmental sustainability? A review of the literature. Nutrients 2014, 6, 2251–2265. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Wilson, N.; Nghiem, N.; Ni Mhurchu, C.; Eyles, H.; Baker, M.G.; Blakely, T. Foods and dietary patterns that are healthy, low-cost, and environmentally sustainable: A case study of optimization modeling for New Zealand. PLoS ONE 2013, 8, e59648. [Google Scholar] [CrossRef] [Green Version]

- University of Otago; Ministry of Health. A Focus on Nutrition: Key findings of the 2008/09 New Zealand Adult Nutrition Survey; Wellington Ministry of Health: Wellington, New Zealand, 2011.

- Mhurchu, C.N.; Eyles, H.; Schilling, C.; Yang, Q.; Kaye-Blake, W.; Genç, M.; Blakely, T. Food prices and consumer demand: Differences across income levels and ethnic groups. PLoS ONE 2013, 8, e75934. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Michelini, C. New Zealand household consumption patterns 1983–1992: An application of the almost-ideal-demand-system. N. Z. Econ. Pap. 1999, 33, 15–26. [Google Scholar] [CrossRef]

- Michelini, C.; Chatterjee, S. Demographic variables in demand systems: An analysis of New Zealand household expenditure 1984–1992. N. Z. Econ. Pap. 1997, 31, 153–173. [Google Scholar] [CrossRef]

- Blakely, T.; Nghiem, N.; Genc, M.; Mizdrak, A.; Cobiac, L.; Mhurchu, C.N.; Swinburn, B.; Scarborough, P.; Cleghorn, C. Modelling the health impact of food taxes and subsidies with price elasticities: The case for additional scaling of food consumption using the total food expenditure elasticity. PLoS ONE 2020, 15, e0230506. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Cleghorn, C.; Blakely, T.; Nghiem, N.; Mizdrak, A.; Wilson, N. Technical Report for BODE³ Intervention and DIET MSLT Models, Version 1. Burden of Disease Epidemiology, Equity and Cost-Effectiveness Programme; Technical Report No. 16; Department of Public Health UoO: Wellington, New Zealand, 2017. [Google Scholar]

- Jacobi, L.; Nghiem, N.; Ramírez-Hassan, A.; Blakely, T. Food Price Elasticities for Policy Interventions: Estimates from a Virtual Supermarket Experiment in a Multistage Demand Analysis with (Expert) Prior Information. Econ. Rec. 2021, 97, 457–490. [Google Scholar] [CrossRef]

- Blakely, T.; Cleghorn, C.; Mizdrak, A.; Waterlander, W.; Nghiem, N.; Swinburn, B.; Wilson, N.; Mhurchu, C.N. The effect of food taxes and subsidies on population health and health costs: A modelling study. Lancet Public Health 2020, 5, e404–e413. [Google Scholar] [CrossRef]

- Ministry of Health. Health Loss in New Zealand: A report from the New Zealand Burden of Diseases, Injuries and Risk Factors Study, 2006–2016; Ministry of Health: Wellington, New Zealand, 2013.

- Salomon, J.A.; Vos, T.; Hogan, D.R.; Gagnon, M.; Naghavi, M.; Mokdad, A.; Begum, N.; Shah, R.; Karyana, M.; Kosen, S. Common values in assessing health outcomes from disease and injury: Disability weights measurement study for the Global Burden of Disease Study 2010. Lancet 2013, 380, 2129–2143. [Google Scholar] [CrossRef]

- Hall, K.D.; Sacks, G.; Chandramohan, D.; Chow, C.C.; Wang, Y.C.; Gortmaker, S.L.; Swinburn, B.A. Quantification of the effect of energy imbalance on bodyweight. Lancet 2011, 378, 826–837. [Google Scholar] [CrossRef] [Green Version]

- Kvizhinadze, G.; Nghiem, N.; Atkinson, J.; Blakely, T. Cost Off-Sets Used in BODE3 Multistate Lifetable Models Burden of Disease Epidemiology, Equity and Cost-Effectiveness Programme (BODE3); Technical Report: Number 15; University of Otago: Wellington, New Zealand, 2016. [Google Scholar]

- Van Baal, P.H.M.; Feenstra, T.L.; Polder, J.J.; Hoogenveen, R.T.; Brouwer, W.B.F. Economic evaluation and the postponement of health care costs. Health Econ. 2011, 20, 432–445. [Google Scholar] [CrossRef] [Green Version]

- Wilson, N.; Nghiem, N.; Foster, R.; Cobiac, L.; Blakely, T. Estimating the cost of new public health legislation. Bull. World Health Organ. 2012, 90, 532–539. [Google Scholar] [CrossRef]

- Hoolohan, C.; Berners-Lee, M.; McKinstry-West, J.; Hewitt, C. Mitigating the greenhouse gas emissions embodied in food through realistic consumer choices. Energy Policy 2013, 63, 1065–1074. [Google Scholar] [CrossRef]

- Drew, J.; Cleghorn, C.; Macmillan, A.; Mizdrak, A. Healthy and Climate-Friendly Eating Patterns in the New Zealand Context. Environ. Health Perspect. 2020, 128, 017007. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- McLeod, M.; Blakely, T.; Kvizhinadze, G.; Harris, R. Why equal treatment is not always equitable: The impact of existing ethnic health inequalities in cost-effectiveness modeling. Popul. Health Metrics 2014, 12, 15. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Broeks, M.J.; Biesbroek, S.; Over, E.A.; van Gils, P.F.; Toxopeus, I.; Beukers, M.H.; Temme, E.H. A social cost-benefit analysis of meat taxation and a fruit and vegetables subsidy for a healthy and sustainable food consumption in the Netherlands. BMC Public Health 2020, 20, 643. [Google Scholar] [CrossRef]

- Briggs, A.D.; Kehlbacher, A.; Tiffin, R.; Scarborough, P. Simulating the impact on health of internalising the cost of carbon in food prices combined with a tax on sugar-sweetened beverages. BMC Public Health 2015, 16, 107. [Google Scholar] [CrossRef] [Green Version]

- Kehlbacher, A.; Tiffin, R.; Briggs, A.; Berners-Lee, M.; Scarborough, P. The distributional and nutritional impacts and mitigation potential of emission-based food taxes in the UK. Clim. Chang. 2016, 137, 121–141. [Google Scholar] [CrossRef] [Green Version]

- Revoredo-Giha, C.; Chalmers, N.; Akaichi, F. Simulating the impact of carbon taxes on greenhouse gas emission and nutrition in the UK. Sustainability 2018, 10, 134. [Google Scholar] [CrossRef] [Green Version]

- Chalmers, N.G.; Revoredo-Giha, C.; Shackley, S. Socioeconomic effects of reducing household carbon footprints through meat consumption taxes. J. Food Prod. Market. 2016, 22, 258–277. [Google Scholar] [CrossRef] [Green Version]

- Key, N.; Tallard, G. Mitigating methane emissions from livestock: A global analysis of sectoral policies. Clim. Change 2012, 112, 387–414. [Google Scholar] [CrossRef]

- Revell, B.J. One man’s meat… 2050? Ruminations on future meat demand in the context of global warming. J. Agric. Econ. 2015, 66, 573–614. [Google Scholar] [CrossRef]

- Springmann, M.; Mason-D’Croz, D.; Robinson, S.; Wiebe, K.; Godfray, H.C.J.; Rayner, M.; Scarborough, P. Mitigation potential and global health impacts from emissions pricing of food commodities. Nat. Clim. Change 2016, 7, 69–74. [Google Scholar] [CrossRef]

- Revell, B. Meat and Milk Consumption 2050: The Potential for Demand-side Solutions to Greenhouse Gas Emissions Reduction. EuroChoices 2015, 14, 4–11. [Google Scholar] [CrossRef]

- Dogbe, W.; Gil, J.M. Effectiveness of a carbon tax to promote a climate-friendly food consumption. Food Policy 2018, 79, 235–246. [Google Scholar] [CrossRef]

- Forero-Cantor, G.; Ribal, J.; Sanjuán, N. Levying carbon footprint taxes on animal-sourced foods. A case study in Spain. J. Clean. Prod. 2020, 243, 118668. [Google Scholar] [CrossRef]

- García-Muros, X.; Markandya, A.; Romero-Jordán, D.; González-Eguino, M. The distributional effects of carbon-based food taxes. J. Clean. Prod. 2017, 140, 996–1006. [Google Scholar] [CrossRef]

- Markandya, A.; Galarraga, I.; Abadie, L.M.; Lucas, J.; Spadaro, J.V. What Role Can Taxes and Subsidies Play in Changing Diets? Finanz-Arch. Z. Für Das Gesamte Finanzwes. 2016, 72, 175. [Google Scholar] [CrossRef]

- Jansson, T.; Säll, S. Environmental consumption taxes on animal food products to mitigate Greenhouse gas emissions from the European Union. Clim. Change Econ. 2018, 9, 1850009. [Google Scholar] [CrossRef]

- Wirsenius, S.; Hedenus, F.; Mohlin, K. Greenhouse gas taxes on animal food products: Rationale, tax scheme and climate mitigation effects. Clim. Change 2011, 108, 159–184. [Google Scholar] [CrossRef]

- Zech, K.M.; Schneider, U.A. Carbon leakage and limited efficiency of greenhouse gas taxes on food products. J. Clean. Prod. 2019, 213, 99–103. [Google Scholar] [CrossRef]

- Bonnet, C.; Bouamra-Mechemache, Z.; Corre, T. An environmental tax towards more sustainable food: Empirical evidence of the consumption of animal products in France. Ecol. Econ. 2018, 147, 48–61. [Google Scholar] [CrossRef] [Green Version]

- Caillavet, F.; Fadhuile, A.; Nichèle, V. Taxing animal-based foods for sustainability: Environmental, nutritional and social perspectives in France. Eur. Rev. Agric. Econ. 2016, 43, 537–560. [Google Scholar] [CrossRef]

- Caillavet, F.; Fadhuile, A.; Nichèle, V. Assessing the distributional effects of carbon taxes on food: Inequalities and nutritional insights in France. Ecol. Econ. 2019, 163, 20–31. [Google Scholar] [CrossRef]

- Moberg, E.; Andersson, M.W.; Säll, S.; Hansson, P.-A.; Röös, E. Determining the climate impact of food for use in a climate tax—Design of a consistent and transparent model. Int. J. Life Cycle Assess. 2019, 24, 1715–1728. [Google Scholar] [CrossRef] [Green Version]

- Säll, S.; Gren, M. Effects of an environmental tax on meat and dairy consumption in Sweden. Food Policy 2015, 55, 41–53. [Google Scholar] [CrossRef]

- Chen, C.; Chaudhary, A.; Mathys, A. Dietary change scenarios and implications for environmental, nutrition, human health and economic dimensions of food sustainability. Nutrients 2019, 11, 856. [Google Scholar] [CrossRef] [Green Version]

- Slade, P. The effects of pricing Canadian livestock emissions. Can. J. Agric. Econ. 2018, 66, 305–329. [Google Scholar] [CrossRef] [Green Version]

- Springmann, M.; Sacks, G.; Ananthapavan, J.; Scarborough, P. Carbon pricing of food in Australia: An analysis of the health, environmental and public finance impacts. Aust. N. Z. J. Public Health 2018, 42, 523–529. [Google Scholar] [CrossRef]

- Abadie, L.; Galarraga, I.; Milford, A.; Gustavsen, G. Using food taxes and subsidies to achieve emission reduction targets in Norway. J. Clean. Prod. 2016, 134, 280–297. [Google Scholar] [CrossRef]

- Wilcock, R.J.; Monaghan, R.M.; Quinn, J.M.; Campbell, A.M.; Thorrold, B.S.; Duncan, M.J.; McGowan, A.W.; Betteridge, K. Land-use impacts and water quality targets in the intensive dairying catchment of the Toenepi Stream, New Zealand. N. Z. J. Mar. Freshw. Res. 2006, 40, 123–140. [Google Scholar] [CrossRef]

- Lucero, A.A.; Lambrick, D.M.; Faulkner, J.A.; Fryer, S.; Tarrant, M.A.; Poudevigne, M.; Williams, M.A.; Stoner, L. Modifiable cardiovascular disease risk factors among indigenous populations. Adv. Prevent. Med. 2014, 2014, 547018. [Google Scholar] [CrossRef]

- Food Balance Sheets. Available online: http://www.fao.org/faostat/en/#data/FBS (accessed on 28 March 2022).

- Barendregt, J.J.; Veerman, J.L. Categorical versus continuous risk factors and the calculation of potential impact fractions. J. Epidemiol. Community Health 2010, 64, 209–212. [Google Scholar]

| ∆ BMI | ∆ Fruit (g/day) | ∆ Vegetables (g/day) | ∆ Red Meat (g/day) | ∆ Processed Meat (g/day) | ∆ SSB (g/day) | ∆ Nuts and Seeds (g/day) | ∆ Sodium (mg/day) | ∆ PUFA (% TE) | |

|---|---|---|---|---|---|---|---|---|---|

| S1: GHG weighted tax, all foods | −0.48 | 3.2 | −1.6 | −4.1 | −5.5 | 1.0 | 0.2 | −52.2 | 0.1% |

| S2: GHG weighted tax, high emitters | −0.10 | 3.8 | 4.0 | −5.5 | −5.9 | 2.8 | 0.2 | −25.4 | 0.0% |

| S3: GHG weighted tax and subsidy | −0.19 | 28.4 | 50.4 | −7.4 | −7.3 | −0.1 | −0.1 | −50.8 | 0.0% |

| S4: Percentage tax on high emitters | 0.03 | 9.7 | 10.2 | −4.7 | −7.8 | 7.0 | 0.5 | −34.6 | 0.0% |

| Non-Māori | Māori | Māori | Ethnic Groups Combined | ||

|---|---|---|---|---|---|

| Health Gains: QALYs | Health Gains: QALYs | Equity Analysis [38] Health Gains: QALYs | Health Gains: QALYs | Net Health System Cost Savings (NZD Billion) | |

| S1: GHG weighted tax, all foods | |||||

| Total | 327,300 (226,500 to 467,800) | 104,700 (70,700 to 153,400) | 138,100 (94,100 to 202,200) | 432,000 (298,200 to 615,000) | NZD 8.2 (5.4 to 12.4) |

| Men | 184,000 | 58,200 | 77,100 | 242,200 | NZD 4.7 |

| Women | 143,300 | 46,400 | 61,000 | 189,700 | NZD 3.6 |

| Per capita * | 87.7 (113.6) | 155.2 (201.3) | 204.9 (266.4) | 98.1 | NZD 1866.8 |

| S2: GHG weighted tax, highest emitters | |||||

| Total | 143,700 (92,000 to 219,500) | 53,200 (32,400 to 84,000) | 69,700 (44,200 to 107,600) | 196,900 (125,000 to 303,000) | NZD 3.6 (2.1 to 5.8) |

| Men | 84,700 | 28,800 | 37,900 | 113,500 | NZD 2.1 |

| Women | 59,000 | 24,400 | 31,800 | 83,300 | NZD 1.5 |

| Per capita * | 38.5 (49.6) | 78.9 (102.4) | 103.4 (134.4) | 44.7 | NZD 816.6 |

| S3: GHG weighted tax and subsidy | |||||

| Total | 322,000 (259,800 to 391,300) | 88,400 (74,000 to 104,900) | 118,900 (99,400 to 141,400) | 410,400 (336,200 to 492,000) | NZD 6.4 (4.9 to 8.2) |

| Men | 175,500 | 44,500 | 59,800 | 220,000 | NZD 3.6 |

| Women | 146,500 | 44,000 | 59,100 | 190,400 | NZD 2.8 |

| Per capita * | 86.3 (106.5) | 131.2 (170.6) | 176.3 (229.6) | 93.2 | NZD 1451.8 |

| S4: Percentage tax on highest emitters | |||||

| Total | 118,500 (4900 to 296,200) | 34,300 (−8300 to 100,100) | 46,600 (−8000 to 126,900) | 152,800 (−3000 to 396,600) | NZD 2.4 (−0.7 to 7.2) |

| Men | 63,200 | 13,200 | 18,500 | 76,400 | NZD 1.2 |

| Women | 55,200 | 21,100 | 28,200 | 76,400 | NZD 1.2 |

| Per capita * | 31.7 (39.9) | 50.9 (66.7) | 69.2 (90.7) | 34.7 | NZD 549.8 |

| Sensitivity/Scenario Analyses | Health Gains: QALYs (Millions) | Net Health System Cost Savings (NZD Billion) | Change in kgCO2-eq per Person per Day | Cost of Diet per Person per Day (% Change from Baseline Diets) |

|---|---|---|---|---|

| S1: GHG weighted tax, all foods | ||||

| Base case analysis * | 0.44 | NZD 8.5 | −0.35 | 3.8% |

| S1 (lower) | 0.24 | NZD 4.6 | −0.18 | 1.9% |

| S1 (upper) | 0.75 | NZD 14.2 | −0.67 | 7.6% |

| Undiscounted | 1.62 | NZD 23.7 | ||

| S2: GHG weighted tax, high emitters | ||||

| Base case analysis * | 0.20 | NZD 3.7 | −0.21 | 1.9% |

| S2 (lower) | 0.11 | NZD 2.1 | −0.11 | 1.0% |

| S2 (upper) | 0.33 | NZD 5.9 | −0.41 | 3.9% |

| Undiscounted | 0.74 | NZD 10.0 | ||

| S3: GHG weighted tax and subsidy | ||||

| Base case analysis * | 0.42 | NZD 6.5 | −0.21 | −0.5% |

| S3 (lower) | 0.25 | NZD 4.1 | −0.12 | −0.3% |

| S3 (upper) | 0.52 | NZD 6.7 | −0.30 | −1.0% |

| Undiscounted | 1.55 | NZD 16.8 | ||

| S4: Percentage tax on high emitters | ||||

| Base case analysis * | 0.16 | NZD 2.5 | −0.22 | 4.7% |

| S4 (lower) | 0.11 | NZD 1.9 | −0.12 | 2.4% |

| S4 (upper) | 0.07 | NZD 0.0 | −0.37 | 9.5% |

| Undiscounted | 0.59 | NZD 6.5 | ||

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Cleghorn, C.; Mulder, I.; Macmillan, A.; Mizdrak, A.; Drew, J.; Nghiem, N.; Blakely, T.; Ni Mhurchu, C. Can a Greenhouse Gas Emissions Tax on Food also Be Healthy and Equitable? A Systemised Review and Modelling Study from Aotearoa New Zealand. Int. J. Environ. Res. Public Health 2022, 19, 4421. https://doi.org/10.3390/ijerph19084421

Cleghorn C, Mulder I, Macmillan A, Mizdrak A, Drew J, Nghiem N, Blakely T, Ni Mhurchu C. Can a Greenhouse Gas Emissions Tax on Food also Be Healthy and Equitable? A Systemised Review and Modelling Study from Aotearoa New Zealand. International Journal of Environmental Research and Public Health. 2022; 19(8):4421. https://doi.org/10.3390/ijerph19084421

Chicago/Turabian StyleCleghorn, Christine, Ingrid Mulder, Alex Macmillan, Anja Mizdrak, Jonathan Drew, Nhung Nghiem, Tony Blakely, and Cliona Ni Mhurchu. 2022. "Can a Greenhouse Gas Emissions Tax on Food also Be Healthy and Equitable? A Systemised Review and Modelling Study from Aotearoa New Zealand" International Journal of Environmental Research and Public Health 19, no. 8: 4421. https://doi.org/10.3390/ijerph19084421

APA StyleCleghorn, C., Mulder, I., Macmillan, A., Mizdrak, A., Drew, J., Nghiem, N., Blakely, T., & Ni Mhurchu, C. (2022). Can a Greenhouse Gas Emissions Tax on Food also Be Healthy and Equitable? A Systemised Review and Modelling Study from Aotearoa New Zealand. International Journal of Environmental Research and Public Health, 19(8), 4421. https://doi.org/10.3390/ijerph19084421