Impact of Resource on Green Growth and Threshold Effect of International Trade Levels: Evidence from China

Abstract

:1. Introduction

2. Literature Review

3. Materials and Methods

3.1. Measurement and Decomposition of Green Total Factor Productivity

3.1.1. Super-Efficiency Data Envelopment Analysis (DEA) Model

3.1.2. Luenberger Green Total Factor Productivity Index and Decomposition

3.1.3. Input–Output Data in the Measurement of Green TFP

3.2. Methodology and Data

3.2.1. Model Settings

3.2.2. Data Sources

4. Results and Discussion

4.1. Green Total Factor Productivity Levels in Each Province and Region

4.2. Descriptive Statistics of the Variables in Fixed-Effects Model

4.3. Analysis of the Existence and Regional Differences of the Resource Curse

4.4. Transformation of the Resource Curse Mechanism and Analysis of the Mechanism under the Import Level Threshold

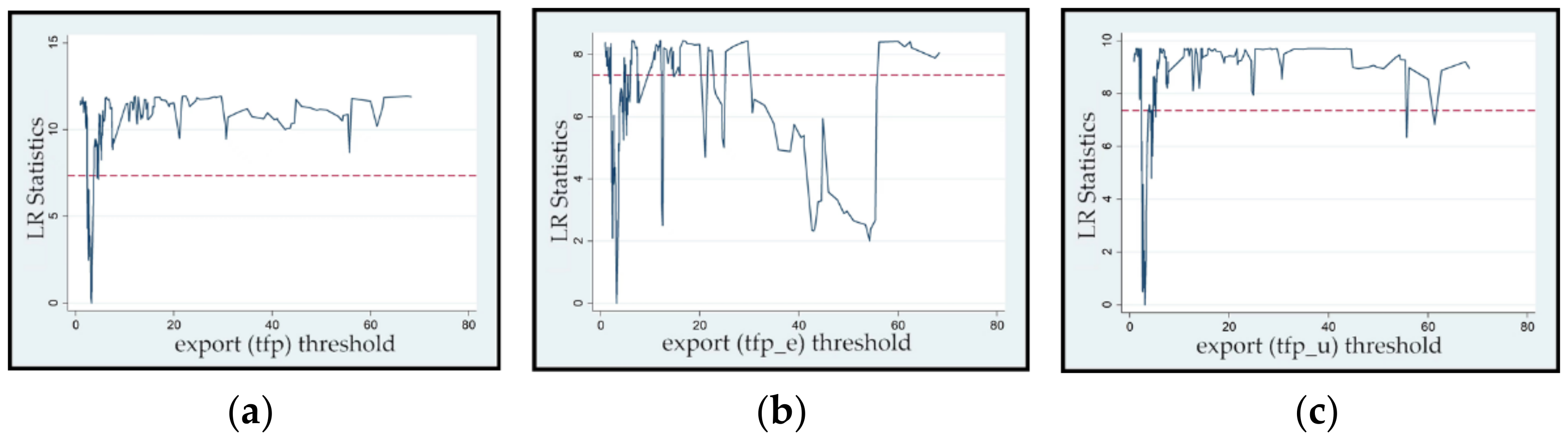

4.5. Transformation of the Resource Curse Mechanism and Analysis of Mechanism under the Export Level Threshold

4.6. Limitations and Future Research

5. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Gylfason, T. Natural Resources, Education, and Economic Development. Eur. Econ. Rev. 2001, 45, 847–859. [Google Scholar] [CrossRef]

- Papyrakis, E.; Gerlagh, R. Resource Abundance and Economic Growth in the United States. Eur. Econ. Rev. 2007, 51, 1011–1039. [Google Scholar] [CrossRef]

- Auty, R.M. Sustaining Development in Mineral Economies: The Resource Curse Thesis; Routledge: London, UK, 1993. [Google Scholar]

- Li, J.; Zhang, J.; Gong, L.; Miao, P. The Spatial and Temporal Distribution of Coal Resource and Its Utilization in China—Based on Space Exploration Analysis Technique ESDA. Energy Environ. 2015, 26, 1099–1113. [Google Scholar] [CrossRef]

- Apergis, N.; Payne, J.E. The Oil Curse, Institutional Quality, and Growth in MENA Countries: Evidence from Time-Varying cointegration. Energy Econ. 2014, 46, 1–9. [Google Scholar] [CrossRef]

- Rosenstein-Rodan, P.N. Problems of Industrialization of Eastern and South-Eastern Europe. Econ. J. 1943, 53, 202–211. [Google Scholar] [CrossRef]

- Matsuyama, K. Agricultural Productivity, Comparative Advantage and Economic Growth. J. Econ. Theory 1992, 58, 317–334. [Google Scholar] [CrossRef] [Green Version]

- Prebisch, R. The Economic Development of Latin America and Its Principal Problem; United Nations Department of Economic Affairs, Economic Commission for Latin America (ECLA): New York, NY, USA, 1950; Available online: http://archivo.cepal.org/pdfs/cdPrebisch/002.pdf (accessed on 21 January 2022).

- Sachs, J.D.; Warner, A.M. Natural Resources Abundance and Economic Growth; National Bureau of Economic Research: Cambridge, MA, USA, 1995. [Google Scholar] [CrossRef]

- Sachs, J.D.; Warner, A.M. The curse of natural resources. Eur. Econ. Rev. 2001, 45, 827–838. [Google Scholar] [CrossRef]

- Cockx, L.; Francken, N. Natural Resources: A Curse on Education Spending? Energy Policy 2016, 92, 394–408. [Google Scholar] [CrossRef] [Green Version]

- Apergis, N.; Katsaiti, M. Poverty and the Resource Curse: Evidence from a Global Panel of Countries. Res. Econ. 2018, 72, 211–223. [Google Scholar] [CrossRef]

- Song, D.; Yang, Q. Does Environmental Regulation Break the Resource Curse. China Popul. Resour. Environ. 2019, 29, 61–69. [Google Scholar]

- Zhang, X.; Xing, L.; Fan, S.; Luo, X. Resource Abundance and Regional Development in China. Econ. Transit. 2008, 16, 7–29. [Google Scholar] [CrossRef]

- Shao, S.; Zhang, Y.; Tian, Z.; Li, D.; Yang, L. The Regional Dutch Disease Effect Within China: A Spatial Econometric Investigation. Energy Econ. 2020, 88, 104766. [Google Scholar] [CrossRef]

- Zhang, H.; Shen, L.; Zhong, S.; Elshkaki, A. Coal Resource and Industrial Structure Nexus in Energy-Rich Area: The Case of the Contiguous Area of Shanxi and Shaanxi Provinces, and Inner Mongolia Autonomous Region of China. Resour. Policy 2020, 66, 101646. [Google Scholar] [CrossRef]

- Qiu, Q.; Chen, J. Natural Resource Endowment, Institutional Quality and China’s Regional Economic Growth. Resour. Policy 2020, 66, 101644. [Google Scholar]

- Ma, Y.; Cheng, D. ‘Resource Gospel’ or “Resource Curse”? On Panel Threshold. Fin. Trade Res. 2017, 1, 13–25. [Google Scholar]

- Zhang, P.; Wu, J. Government Intervention, Resource Curse and Regional Innovation: An Empirical Research Based on the Provincial Panel Data from Mainland China. Sci. Res. Manag. 2017, 38, 61–69. [Google Scholar]

- Yu, X.; Li, Y.; Chen, H.; Li, C. Study on the Impact of Environmental Regulation and Energy Endowment on Regional Carbon Emissions from the Perspective of Resource Curse. China Popul. Resour. Environ. 2019, 29, 52–60. [Google Scholar]

- Hu, Y.; Yan, T. Resource Dependency: Curse on Growth or Poverty? China Popul. Resour. Environ. 2019, 29, 137–146. [Google Scholar]

- Fang, Y.; Ji, K.; Zhao, Y. Does “Resource Curse” Exist in China? J. World Econ. 2011, 4, 144–160. [Google Scholar]

- Jing, X. Natural Resource Exploitation and Economic Growth in China: A Disproof of “Resource Curse” Hypothesis. Econ. Probl. 2012, 3, 4–8. [Google Scholar]

- Kuznets, M. Economy growth and income inequality. Am. Econ. Rev. 1955, 45, 1–28. [Google Scholar] [CrossRef]

- Brock, W.A.; Taylor, M.S. Economic Growth and the Environment: A Review of Theory and Empirics. Handb. Econ. Growth 2005, 1, 1749–1821. [Google Scholar] [CrossRef] [Green Version]

- Mosconi, E.M.; Colantoni, A.; Gambella, F.; Cudlinová, E.; Salvati, L.; Rodrigo-Comino, J. Revisiting the Environmental Kuznets Curve: The Spatial Interaction Between Economy and Territory. Economies 2020, 8, 74. [Google Scholar] [CrossRef]

- Shao, S.; Fan, M.; Yang, L. How Resource Industry Dependence Affects the Efficiency of Economic Development? Test and Explanation of the Conditional Resource Curse Hypothesis. Manag. World 2013, 2, 32–63. [Google Scholar]

- Li, J.; Xu, B. Curse or Blessing: How Does Natural Resource Abundance Affect Green Economic Growth in China? Econ. Res. J. 2018, 9, 151–167. [Google Scholar]

- Cheng, Z.; Li, L.; Liu, J. Natural Resource Abundance, Resource Industry Dependence and Economic Green Growth in China. Resour. Policy 2020, 68, 101734. [Google Scholar] [CrossRef]

- Sachs, J.D.; Warner, A.M. Sources of slow growth in African economies. J. Afr. Econ. 1997, 6, 335–376. [Google Scholar] [CrossRef] [Green Version]

- Sachs, J.D.; Warner, A.M. The big push, natural resource booms and growth. J. Dev. Econ. 1999, 59, 43–76. [Google Scholar] [CrossRef] [Green Version]

- Arezki, R.; Ploeg, F. Can the Natural Resource Curse Be Turned into a Blessing? The Role of Trade Policies and Institutions; Oxcarre Working Papers; University of Oxford: Oxford, UK, 2008; Volume 7. [Google Scholar]

- Dong, L.; Yan, T. Technology Input, Openness Degree and “Resource Curse”: An Examination of Terms of Trade with China’s Provincial Panel Data. J. Int. Trade 2015, 9, 55–65. [Google Scholar]

- Charnes, A.; Cooper, W.W.; Rhodes, E. Measuring the Efficiency of Decision Making Units. Eur. J. Oper. Res. 1978, 2, 429–444. [Google Scholar] [CrossRef]

- Banker, R.D.; Charnes, A.; Cooper, W.W. Some Models for Estimating Technical and Scale Inefficiencies in Data Envelopment Analysis. Manag. Sci. 1984, 30, 1078–1092. [Google Scholar] [CrossRef] [Green Version]

- Andersen, P.; Petersen, N.C. A Procedure for Ranking Efficient Units in Data Envelopment Analysis. Manag. Sci. 1993, 39, 1261–1264. [Google Scholar] [CrossRef]

- Mahlberg, B.; Sahoo, B.K. Radial and Non-Radial Decompositions of Luenberger Productivity Indicator with an Illustrative Application. Int. J. Prod. Econ. 2011, 131, 721–726. [Google Scholar] [CrossRef]

- Chang, T.P.; Hu, J.L.; Chou, R.Y.; Sun, L. The Sources of Bank Productivity Growth in China During 2002–2009: A Disaggregation View. J. Bank. Financ. 2012, 36, 1997–2006. [Google Scholar] [CrossRef]

- Zhang, J.; Wu, G.; Zhang, J. The Estimation of China’s Provincial Capital Stock: 1952–2000. Econ. Res. J. 2004, 10, 23–44. [Google Scholar]

- Hansen, B.E. Threshold Effects in Non-Dynamic Panels: Estimation, Testing, and Inference. J. Econom. 1999, 93, 345–368. [Google Scholar] [CrossRef] [Green Version]

- Shao, S.; Yang, L. Abundance of Natural Resources, Resource Industry Dependence and China’s Regional Economic Growth. Manag. World 2010, 9, 26–44. [Google Scholar]

- Porter, M.E.; Van der Linde, C. Toward a New Conception of the Environment-Competitiveness Relationship. J. Econ. Perspect. 1995, 9, 97–118. [Google Scholar] [CrossRef] [Green Version]

- National Bureau of Statistics of China. China Statistical Yearbook 2018; China Statistics Press: Beijing, China, 2018.

- Wu, H.; Hao, Y.; Ren, S.; Yang, X.; Xie, G. Does internet development improve green total factor energy efficiency? Evidence from China. Energy Policy 2021, 153, 112247. [Google Scholar] [CrossRef]

- Vuong, Q.H. The (Ir)rational Consideration of the Cost of Science in Transition Economies. Nat. Hum. Behav. 2018, 2, 5. [Google Scholar] [CrossRef]

- China Spending on Research and Development to Rise 7% per Year in Push for Major Tech Breakthroughs. Available online: https://www.cnbc.com/2021/03/05/china-to-boost-research-and-development-spend-in-push-for-tech-breakthroughs.html (accessed on 16 February 2022).

- Vuong, Q.H.; Le, T.T.; La, V.P.; Nguyen, H.T.T.; Ho, M.T.; Khuc, Q.V.; Nguyen, M.H. Covid-19 Vaccines Production and Societal Immunization Under the Serendipity-mindsponge-3D Knowledge Management Theory and Conceptual Framework. Humanit. Soc. Sci. Commun. 2022, 9, 22. [Google Scholar] [CrossRef]

- Vuong, Q.H. The Semiconducting Principle of Monetary and Environmental Values Exchange. Econ. Bus. Lett. 2021, 10, 284–290. [Google Scholar] [CrossRef]

| Category | Symbol | Variables | Proxy Indicator |

|---|---|---|---|

| Explained variables | tfp | Green total factor productivity | Calculated by Equation (2) |

| tfp_e | Energy conservation effect | Calculated by Equation (7) | |

| tfp_u | Environmental improvement effect | Calculated by Equation (8) | |

| Explanatory variable | re | Resource endowment | Number of employees in the mining industry |

| Control variables | import | Import | Total import/Gross domestic product (GDP) |

| export | Export | Total export/GDP | |

| govern | Environmental governance | Total investment in environmental pollution control/GDP | |

| rd | Research and development (R&D) investment | R&D capital stock/Gross domestic product | |

| pergdp | Economic development level | GDP per capita | |

| indus | Industrial structure | Secondary industry GDP/Total GDP | |

| urban | Urbanization level | Nonagricultural population/Total population | |

| own | Nationalization level | Number of employees in state-owned units/ Total number of employees |

| Regions | Green Total Factor Productivity tfp (%) | Energy Conservation Effect tfp_e (%) | Environmental Improvement Effect tfp_u (%) | Regions | Green total Factor Productivity tfp (%) | Energy Conservation Effect tfp_e (%) | Environmental Improvement Effect tfp_u (%) |

|---|---|---|---|---|---|---|---|

| Beijing | 7.783 | 1.411 | 6.372 | Henan | −0.176 | −0.237 | 0.061 |

| Tianjin | 0.583 | −0.228 | 0.811 | Hubei | 0.365 | −0.162 | 0.527 |

| Hebei | −0.449 | −0.518 | 0.069 | Hunan | 0.424 | −0.289 | 0.713 |

| Shanxi | 0.058 | 0.084 | −0.026 | Guangdong | −0.032 | −0.587 | 0.555 |

| Inner Mongolia Mongolia | −0.381 | −0.303 | −0.079 | Guangxi | −0.153 | −0.791 | 0.638 |

| Liaoning | −0.808 | −0.587 | −0.222 | Hainan | −1.359 | −1.285 | −0.074 |

| Jilin | 0.330 | 0.215 | 0.115 | Chongqing | 0.296 | −0.291 | 0.587 |

| Heilongjiang | −1.756 | −1.073 | −0.683 | Sichuan | 0.100 | −0.204 | 0.304 |

| Shanghai | 2.510 | −0.698 | 3.208 | Guizhou | 0.743 | 0.465 | 0.278 |

| Jiangsu | −0.367 | −0.965 | 0.598 | Yunnan | −0.638 | −0.369 | −0.269 |

| Zhejiang | −0.707 | −0.913 | 0.205 | Shaanxi | 0.087 | −0.165 | 0.252 |

| Anhui | −0.386 | −0.517 | 0.130 | Gansu | −0.240 | −0.291 | 0.051 |

| Fujian | −0.621 | −1.159 | 0.538 | Qinghai | −0.881 | −0.497 | −0.384 |

| Jiangxi | −0.474 | −0.735 | 0.261 | Ningxia | 0.276 | −0.019 | 0.295 |

| Shandong | −0.979 | −0.702 | −0.278 | Xinjiang | −1.274 | −0.865 | −0.409 |

| Mean | 0.062 | −0.409 | 0.472 |

| Variables | Observations | Mean | Standard Deviation | Minimum | Minimum |

|---|---|---|---|---|---|

| Green total factor productivity (tfp) | 338 | −0.358 | 2.377 | −12.391 | 7.010 |

| Energy conservation effect (tfp_e) | 338 | −0.959 | 2.810 | −15.879 | 7.746 |

| Environmental improvement effect (tfp_u) | 338 | 0.244 | 2.794 | −10.774 | 10.576 |

| Resource endowment (re) | 338 | 20.485 | 20.455 | 0.471 | 103.014 |

| Import (import) | 338 | 11.079 | 12.005 | 0.417 | 72.594 |

| Export (export) | 338 | 13.338 | 16.937 | 0.728 | 92.927 |

| Environmental governance (govern) | 338 | 1.325 | 0.671 | 0.402 | 4.111 |

| R&D investment (rd) | 338 | 7.684 | 7.220 | 0.075 | 46.362 |

| Economic development level (pergdp) | 338 | 1.083 | 0.417 | 0.333 | 2.357 |

| Industrial structure (indus) | 338 | 47.526 | 6.942 | 22.327 | 61.478 |

| Urbanization level (urban) | 338 | 49.191 | 9.538 | 26.870 | 69.850 |

| Nationalization level (own) | 338 | 9.535 | 3.805 | 4.203 | 23.617 |

| Variables | Model 1 (Full Sample) | Model 2 (Full Sample) | Model 3 (Full Sample) | Model 4 (Eastern) | Model 5 (Central) | Model 6 (Western) |

|---|---|---|---|---|---|---|

| Green Total Factor Productivity (tfp) | Energy Conservation Effect (tfp_e) | Environmental Improvement Effect (tfp_u) | Green Total Factor Productivity (tfp) | Green Total Factor Productivity (tfp) | Green Total Factor Productivity (tfp) | |

| Resource endowment (re) | −0.095 *** (−3.16) | −0.098 ** (−2.39) | −0.093 *** (−3.21) | 0.151 ** (2.78) | −0.091 * (−2.37) | 0.009 (0.10) |

| Import (import) | 0.011 (0.17) | −0.031 (−0.54) | 0.014 (0.18) | −0.052 (−0.46) | 0.053 (0.29) | 0.019 (0.37) |

| Export (export) | −0.072 (−1.01) | −0.025 (−0.40) | −0.119 (−1.47) | 0.056 (0.43) | 0.189 (1.62) | −0.186 ** (−2.32) |

| Environmental governance (govern) | −0.665 ** (−2.14) | −0.648 ** (−2.08) | −0.644 * (−1.93) | −0.498 (−1.21) | −1.161 (−1.36) | −0.564 * (−1.90) |

| R&D investment (rd) | 0.121 (0.87) | 0.147 (0.94) | 0.057 (0.42) | 0.711 * (2.16) | 0.664 * (2.03) | 0.058 (0.73) |

| Economic development level (pergdp) | 3.018 (1.04) | 4.074 (1.46) | 1.039 (0.34) | 6.705 * (2.08) | 8.041 (1.76) | −2.927 (−1.55) |

| Industrial structure (indus) | 0.042 (0.83) | −0.011 (−0.19) | 0.111 ** (2.01) | 0.347 ** (2.68) | −0.154 * (−2.10) | 0.258 ** (3.09) |

| Urbanization level (urban) | 0.194 * (1.72) | 0.294 ** (2.50) | 0.085 (0.71) | 0.319 (1.18) | 0.117 (0.61) | −0.002 (−0.01) |

| Nationalization level (own) | −0.244 (−1.30) | −0.212 (−1.14) | −0.250 (−1.17) | −0.484 (−1.76) | 0.115 (0.41) | −0.001 (−0.00) |

| constant | Y | Y | Y | Y | Y | Y |

| year | Y | Y | Y | Y | Y | Y |

| province | Y | Y | Y | Y | Y | Y |

| Prob (F) | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 |

| Observations | 338 | 338 | 338 | 104 | 104 | 130 |

| Models | Threshold Type | F-Statistic | p | Critical Value | ||

|---|---|---|---|---|---|---|

| 1% | 5% | 10% | ||||

| Model 7 (tfp) Green total factor productivity | Single threshold | 13.67 ** | 0.046 | 23.978 | 13.345 | 11.238 |

| Double threshold | 8.98 | 0.132 | 53.122 | 19.254 | 10.539 | |

| Model 8 (tfp_e) Energy conservation effect | Single threshold | 23.04 ** | 0.012 | 23.096 | 14.148 | 11.909 |

| Double threshold | 10.35 | 0.158 | 90.519 | 58.523 | 20.983 | |

| Model 9 (tfp_u) Environmental improvement effect | Single threshold | 4.73 | 0.620 | 16.913 | 13.163 | 10.895 |

| Model 7 (tfp) Green Total Factor Productivity | Model 8 (tfp_e) Energy Conservation Effect | Model 9 (tfp_u) Environmental Improvement Effect | ||||

|---|---|---|---|---|---|---|

| Estimated Value | 95% Confidence Interval | Estimated Value | 95% Confidence Interval | Estimated Value | 95% Confidence Interval | |

| Threshold γ | 50.110 | /47.632, 50.960/ | 50.110 | /42.446, 50.960/ | —— | —— |

| Variables | Model 7 | Model 8 |

|---|---|---|

| Green Total Factor Productivity (tfp) | Energy Conservation Effect (tfp_e) | |

| Resource endowment (import < 50.110) (re_0) | −0.084 *** (−2.72) | −0.043 (−1.24) |

| Resource endowment (import ≥ 50.110) (re_1) | −0.636 *** (−4.03) | −0.846 *** (−4.78) |

| Import (import) | −0.484 (−1.58) | −0.433 (−1.26) |

| Export (export) | 0.073 (1.43) | 0.095 * (1.66) |

| Environmental governance (govern) | −0.078 * (−1.64) | −0.056 (−1.10) |

| R&D investment (rd) | 0.135 (1.18) | 0.188 (1.46) |

| Economic development level (pergdp) | 2.525 (1.53) | 5.172 *** (2.80) |

| Industrial structure (indus) | 0.136 *** (2.83) | 0.146 *** (2.72) |

| Urbanization level (urban) | 0.048 (0.75) | −0.004 (−0.05) |

| Nationalization level (own) | −0.220 * (−1.74) | −0.172 (−1.21) |

| constant | −8.250 *** (−2.82) | −11.844 *** (−3.61) |

| Prob (F) | 0.000 | 0.000 |

| observation | 338 | 338 |

| Models | Threshold Type | F-Statistic | p | Critical Value | ||

|---|---|---|---|---|---|---|

| 1% | 5% | 10% | ||||

| Model 10(tfp) Green total factor productivity | Single threshold | 11.64 * | 0.068 | 17.065 | 12.264 | 10.293 |

| Double threshold | 7.36 | 0.260 | 14.014 | 10.725 | 9.427 | |

| Model 11(tfp_e) Energy conservation effect | Single threshold | 7.77 | 0.304 | 21.419 | 12.834 | 10.811 |

| Model 12(tfp_u) Environmental improvement effect | Single threshold | 9.06 * | 0.096 | 13.446 | 10.381 | 9.025 |

| Double threshold | 4.85 | 0.488 | 19.726 | 11.517 | 9.718 | |

| Model 10 (tfp) Green Total Factor Productivity | Model 11 (tfp_e) Energy Conservation Effect | Model 12 (tfp_u) Environmental Improvement Effect | ||||

|---|---|---|---|---|---|---|

| Estimated Value | 95% Confidence Interval | Estimated Value | 95% Confidence Interval | Estimated Value | 95% Confidence Interval | |

| Threshold γ | 3.232 | /2.781, 3.263/ | —— | —— | 3.076 | /2.683, 3.141/ |

| Variables | Model 10 | Model 12 |

|---|---|---|

| Green Total Factor Productivity (tfp) | Environmental Improvement Effect (tfp_u) | |

| Resource endowment (export < 3.232) (re_0) | −0.184 *** (−4.24) | −0.233 *** (−4.40) |

| Resource endowment (export ≥ 3.232) (re_1) | −0.094 *** (−3.04) | −0.136 *** (−3.63) |

| Import (import) | −0.519 * (−1.70) | −0.506 (−1.37) |

| Export (export) | 0.026 (0.52) | −0.012 (−0.20) |

| Environmental governance (govern) | −0.066 (−1.37) | −0.087 (−1.52) |

| R&D investment (rd) | 0.124 (1.07) | 0.060 (0.43) |

| Economic development level (pergdp) | 4.167 ** (2.44) | 0.777 (0.38) |

| Industrial structure (indus) | 0.105 ** (2.14) | 0.115 ** (1.94) |

| Urbanization level (urban) | 0.015 (0.24) | 0.073 (0.94) |

| Nationalization level (own) | −0.235 * (−1.85) | −0.300 * (−1.96) |

| constant | −6.005 ** (−2.01) | −2.286 (−0.63) |

| Prob (F) | 0.000 | 0.000 |

| observation | 338 | 338 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Liu, H.; Guo, W.; Wang, Y.; Wang, D. Impact of Resource on Green Growth and Threshold Effect of International Trade Levels: Evidence from China. Int. J. Environ. Res. Public Health 2022, 19, 2505. https://doi.org/10.3390/ijerph19052505

Liu H, Guo W, Wang Y, Wang D. Impact of Resource on Green Growth and Threshold Effect of International Trade Levels: Evidence from China. International Journal of Environmental Research and Public Health. 2022; 19(5):2505. https://doi.org/10.3390/ijerph19052505

Chicago/Turabian StyleLiu, Haiying, Wenqi Guo, Yu Wang, and Dianwu Wang. 2022. "Impact of Resource on Green Growth and Threshold Effect of International Trade Levels: Evidence from China" International Journal of Environmental Research and Public Health 19, no. 5: 2505. https://doi.org/10.3390/ijerph19052505

APA StyleLiu, H., Guo, W., Wang, Y., & Wang, D. (2022). Impact of Resource on Green Growth and Threshold Effect of International Trade Levels: Evidence from China. International Journal of Environmental Research and Public Health, 19(5), 2505. https://doi.org/10.3390/ijerph19052505