Health and Non-Health Determinants of Consumer Behavior toward Private Label Products—A Systematic Literature Review

Abstract

1. Introduction

1.1. Health Aspects in Consumer Behavior

1.2. Evolution of PL Products and Consumer Perceptions

1.3. Aim of the Study

- What PL product categories have been studied in terms of consumer behavior?

- What are the non-health factors considered by consumers when choosing PL products?

- How often are health factors considered by consumers when purchasing PL products?

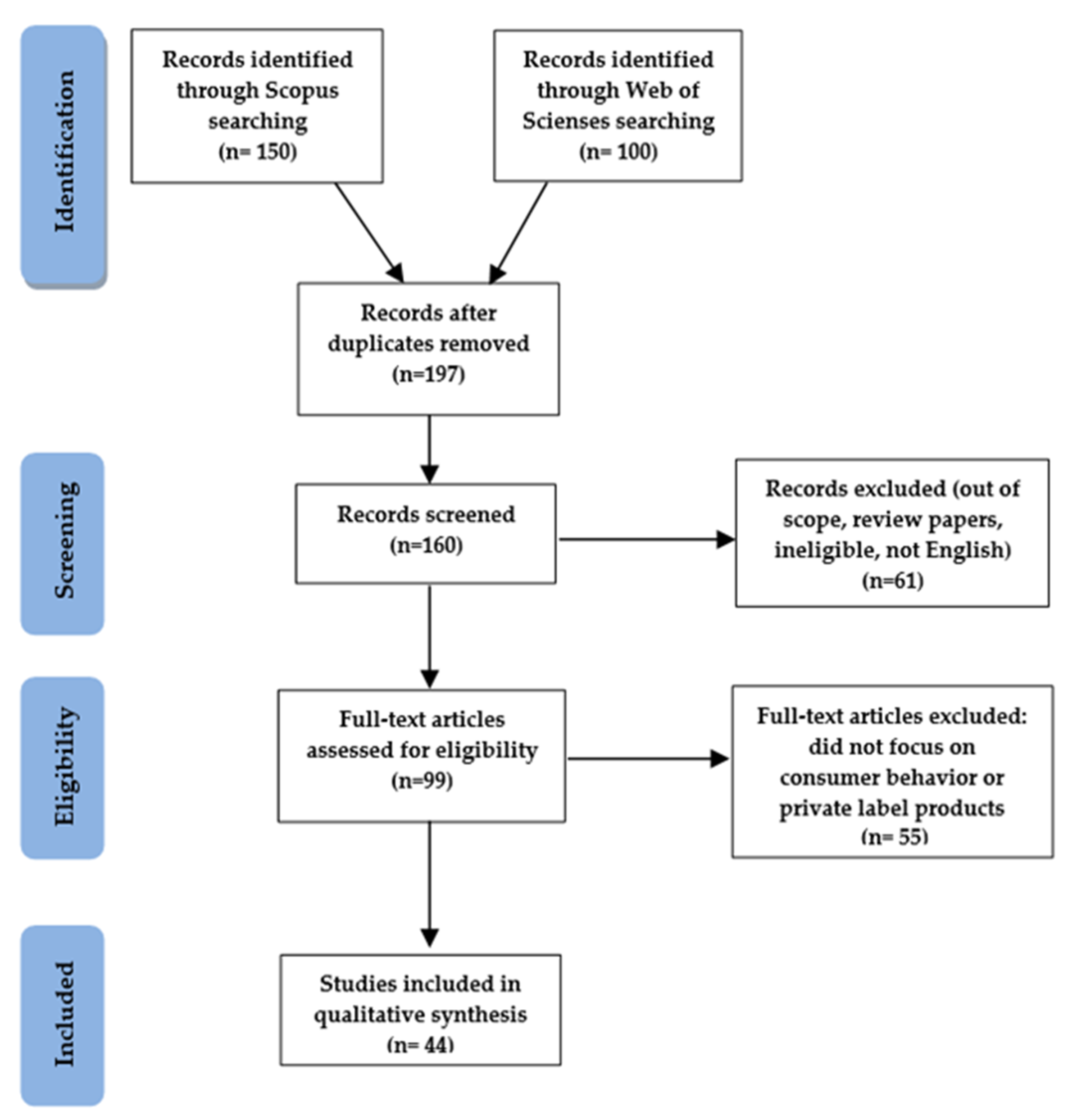

2. Materials and Methods

2.1. Study Design

2.2. Inclusion/Exclusion Criteria

2.3. Search Strategy

3. Results

3.1. General Information

3.2. Research Specifications

3.3. General Findings and Practical Implications

4. Discussion

5. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Appendix A

| Author, Year | Objective | Measurement Items |

|---|---|---|

| Temmerman, et al. (2021) [54] | To analyze the impact of the presence of the Nutri-Score and its five categories on consumers’ perceived healthiness perceptions and purchase intention. To analyze the impact of the Nutri-Score on perceived quality, perceived healthiness, and purchase intentions (national brands vs. PLs). | Study 1: 6 items in a 7-point semantic differential (SD) scale: PQ: 1 item; PH: 5 items 9 items on a 7-point Likert scale: PT: 5 items, PI: 4 items Study 2: 4 items on a 7-point SD scale: PH: 1 item; FNS: 3 items 20 items on a 7-point Likert scale: PI: 4 items; NK: 8 items; PhF: 5 items; Db: 3 items |

| Kadekova, et al. (2020) [55] | To analyze the impact of packaging on consumer purchasing decisions in the yoghurt segment. | Questionnaire: 17 items, scale of 1 to 5 Blind test: on a scale of 1 to 5, with 1 being the best rating and 5 the worst The first test: tasting yoghurts without knowing it The second test: already-known packaging |

| Czeczotko, et al. (2020) [43] | To analyze the behavior of British and Polish consumers towards PL products, i.e., the frequency of purchasing PLs, the motives for purchasing products offered under PLs, the consumers’ opinions on PL development, and the length of the period of purchasing PL products. | 36 items: PP: 5 items (single answer) FP: 8 items (5-point Likert scale) OCD: 6 items (5-point Likert scale) FPC: 10 items (5-point scale) SPL: 7 items (% scale) |

| Anitha and Krishnan (2020) [57] | To examine the impulse purchase behavior of PL products in modern retail outlets and the major factors influencing it. | 26 items, 5-point Likert scale |

| Košičiarová, et al. (2020) [58] | To analyze customer preferences in the context of loyalty to the brand of selected food products in the segment of yoghurts. | Questionnaire: 10 items (5-point Likert scale) Blind test: on a scale of 1 to 5, with 1 being the best rating and 5 the worst |

| Singh and Singhal (2020) [59] | To understand consumers’ attitudes and preferences, as well as behavior, focusing on 3 types of PLs. To investigate how the grocery retailers are motivated to market the PLs. | 23 items (5-point Likert scale) |

| Košičiarová, et al. (2020) [56] | To analyze the influence of packaging and marketing communication tools on consumer purchasing decisions in the dairy segment. | Questionnaire: 10 items (5-point Likert scale), Blind test: on a scale of 1 to 5, with 1 being the best and 5 the worst: -1st round–-5 items: color, flavor, fragrance, consistency, and the chocolate ratio -2nd round—7 items: color, flavor, fragrance, consistency, chocolate ratio, the attractiveness of the packaging, and grammage |

| Prediger, et al. (2019) [60] | To explain how store flyer features affect the store traffic and the consumers’ intentions to buy PLs. To analyze the moderating effect of consumers’ perceptions on the retailer’s assortment and the store. | Experiment: Factor 1: brand promoted on the cover page (+1 = NB, or −1 = PL) Factor 2: the page length of the store flyer (+1=20 pages, or −1=8 p.) Factor 3: use of an institutional slogan on the cover page (+1 = presence or −1 = absence) Online survey: 2 items (7-point Likert scale) |

| Gómez-Suárez, et al. (2019) [61] | To find out the extent to which smart shopping and its effect on consumer attitudes towards PLs and national brands is influenced by consumers’ cultural values. | Study 1: 18 items on a 9-point Likert scale—“guiding principle of my life” Study 2: 18 items on a 7-point Likert scale—smart shopper concept, attitude |

| Salazar-Ordóñez et al. (2018) [62] | To examine value for consumers of own-label or PLs. | 7-point Likert scale for 13 items: AE: 4 items; AR: 4 items; PV: 5 items |

| Liu et al. (2018) [63] | To examine consumers’ preference for national brands and PLs and their tendency to include brands as part of their self-concept. | Study 1: 12 items (7-point Likert scale) Study 2: 7-point scale Study 3: 3 items on an SD 7-point scale |

| Valaskova et al. (2018) [16] | To determine factors and variables that significantly influence and shape the consumer’s perception and attitude towards the purchase of PL products. | 6 items: 5-point Likert scale: choice from 10 categories of PLs |

| Vázquez- Casielles and Cachero-Martinez (2018) [64] | To analyze how the introduction of economy and premium PLs affects national brands and standard PLs for different customer segments. | 18 items: 5-point Likert scale |

| Garczarek-Bąk (2018) [65] | To investigate the factors affecting PL products’ possible purchase decisions for different retailers. To analyze how motivation, measured by total fixation duration using EEG asymmetry over the frontal hemisphere of the brain, predicts PL purchase. | PPE: 6-point scale, from 1 (poor) to 6 (high) PI: The Juster scale, from 0 (not at all) to 11 (for sure) QA: 8 items on a 6-point scale |

| Meliana (2018) [66] | To explain how PLs can create an attractive store image and become a shopping preference for consumers. | 8 items (5-point Likert scale) |

| Modica et al. (2018) [67] | To investigate the reactions of the EEG and the autonomic activities, as elicited by the cross-sensory interaction (sight and touch) across several different products. To investigate whether the brand (major brand or PL), familiarity (foreign or local brand), and hedonic value of products (comfort food or daily food) influence the reaction during their interaction with the products. | Each phase with eyes closed for 15 s and rating on the scale from −5 to +5: Experiment 1: VE, VTE; Experiment 2: TE, VE, VTE |

| Schouteten et al. (2017) [68] | To analyze the role of the research setting and brand information on the overall acceptance and sensory and emotional profiling of 5 strawberry yogurts. | 1. Emotional profiling—18 emotional terms: -8 positive terms (contented, friendly, good, happy, interested, pleasant, surprised, satisfied) -8 negative terms (bored, disappointed, discontented, disgust, dissatisfied, frustrated, stressed) -2 neutral terms (calm, steady) 2. Overall liking: 5-point scale (from 1 = slightly to 5 = extremely) 3. Sensory profiling: 12 sensory terms (aftertaste, creamy, dark color, firm, fruity, milky flavor, sour, liquid, homogeneous, smooth, sweet, and thick) |

| Jara et al. (2017) [69] | To analyze PL equity by considering two PL’s positioning strategies: those with high perceived added value (the organic store brands), as opposed to economic brands. | 11 items (5-point Likert scale) Respondents to look at an A3-sized image of a pack of four |

| Gomez-Suarez et al. (2016) [70] | To analyze the relationships between the different phases of the evaluation of PLs (attitude, preference, and purchase intention) in an international context. | 1 item: scale (0 = NB and 1 = SB) 8 items: 7-point Likert scale |

| Marques dos Santos et al. (2016) [71] | To explore brain-based differences in perception of national brands and PLs. To study the influence of price as a differentiating characteristic of national brands and PLs. | 15 explanatory variables (EVs): -12 items: type of brand (national and PLs), exhibited price (real market price and manipulated price), and the stage in the stimulus sequence (product, price, and decision) - 3 items: product, price, and decision for the overseas branded products |

| Thanasuta (2015) [72] | To investigate the relationship between consumer decision-making styles and actual purchases of PL products, using price consciousness, quality consciousness, brand consciousness, value consciousness, and risk perception. | 7-point Likert scale for 23 items: PLs purchase: 1 item; QC: 4 items QC: 4 items; BC: 4 items; VC: 6 items; RP: 4 items |

| Schnittka (2015) [38] | To identify the moderating impact of the store, category, and PL characteristics on consumers’ preferences for premium vs. economy PLs. | 7-point Likert scale: Study 1: 2 items Study 2a: 9 items Study 2b: 9 items |

| Monnot et al. (2015) [73] | To examine how eliminating overpackaging influences consumers’ perception of products sold under generic and mimic PL and purchase intention. | 1. 5-point Likert scale for 17 items: PS: 3 items; PQ: 3 items EC: 3 items; PE: 2 items; PI: 2 items; PEF: 2 items; PC: 2 items 2. OP: 4 items (5-point Likert scale) |

| Diallo et al. (2015) [74] | To investigate the role of image and consumer factors in influencing the choice of PLs between two retail chains (Carrefour and Extra). | 7-point Likert scale for 28 items: SIP: 9 items; SPI: 6 items; VP: 4 items A: 4 items; PI: 4 items; PL choice: 1 item |

| Zielke and Komor (2015) [75] | To extend cross-national research on price role orientations by focusing on culturally similar but economically different countries, relating differences to preferences for PLS and low-price store formats, and analyzing these effects for functional vs. hedonic and low- vs. high-price products. | 1. 7 items (7-point Lichtenstein’s scale) 2. 12 items (7-point Lichtenstein’s scale scale) |

| Fall-Diallo et al. (2015) [76] | To investigate how previous experience with PLs and marketing policy variables affect PL purchasing behavior in two specific periods (expansion and crisis). | Variables to each product and period: price, feature, display, loyalty (0 (no) or 1 (yes)) |

| Delgado-Ballester et al. (2014) [77] | To develop and test a conceptual model of the moderating effect of customers’ value consciousness on the relationship of store image with four dimensions of the perceived risk associated with the purchase of a PL over a manufacture brand, and the direct effect of those variables on the perceived unfairness of manufacture brand prices. | For each factor, a 10-point scale: SI: 7 items; FR: 3 items; FiR: 3 items; SR: 4 items; PR: 3 items; PU: 3 items; VC: 5 items |

| Bauer et al. (2013) [29] | To analyze if an organic labeled product generates positive consumer brand perceptions and, thus, influences consumers’ food buying intentions. To investigate how various types of brands’ benefit differently from organic labeling in the retail market. | Study 1: 12 German consumers using the laddering technique Study 2: 7-point Likert scale for 12 items: PH: 4 items; PHe: 4 items; EF: 4 items FS: 4 items Study 3: 7-point Likert scale for 2 items: PI: 1 item; WP: 1 item |

| Fall Diallo et al. (2013) [78] | To investigate how consumer and image factors, as well as store familiarity, influence PL purchase behavior. | 7-point Likert scale for 24 items: SIP: 4 items; SB PI: 4 items; VC: 4 items; A: 4 items; PIn: 4 items; PL choice: 4 items |

| Herstein et al. (2012) [79] | To investigate the association between 3 personality traits (individualism, materialism, and the “need for cognition”) and 2 characteristics of shoppers who buy PLs, and the importance they attach to the “brand dimensions”. | 5-point Likert scale: Study 1: 10 items (5 food and 5 non-food products) Study 2: 2 items Study 3: 33 items: VI: 4 items; HI: 4 items; M: 7 items; NC: 18 items |

| Wyma et al. (2012) [80] | To explore and describe consumers’ preferences for different PLs and national brands in a South African context. To determine and describe a possible relationship between consumers’ psychographic and demographic characteristics and their preferences for PLs/national brands. | 25 items, choose the brand which fits one’s preference 5-point Likert scale 8 items + living standard measure |

| Tifferet and Herstein (2010) [81] | To analyze whether individualism affects consumers’ preference for PLs vs. national brands; assess the effect of individualism on the perceived importance of brand image dimensions (country of origin, packaging design, and manufacturer reputation); and assess the degree of cross-cultural differences in individualism. | 5-point Likert scale: Study 1: 10 items Study 2: 30 items Study 3: 8 items |

| Glynn and Chen (2009) [82] | To examine the differences in the level category of risk perception and brand loyalty effects on consumer proneness towards buying PLs. | 5-point Likert scale for 16 items: PM: 2 items; QV: 3 items; S vs. E: 2 items PC: 3 items; PQP: 3 items; BL: 3 items PL purchase: buy NBs (1) or PLs (5) |

| Anchor and Kourilová (2009) [83] | To show how relatively little is known about the consumer perceptions of PLs in the newly emerging markets of Central and Eastern Europe. To investigate various aspects of consumer perceptions of Tesco PLs in the Czech Republic. | 3 items: 7-point semantic differential (SD) scale 2 brands x 4 items: 7-point SD scale |

| Kara et al. (2009) [84] | To examine consumers’ behavior with regard to PL purchasing by using a conceptual model, which incorporates factors such as brand, price and risk perceptions, involvement, experience, and familiarity, as well as psychographic and demographic factors. | 27 items (5-point Likert scale) |

| Albayrak and Aslan (2009) [85] | To identify the attitudes toward PL products and demographic features of PL consumers and of manufacturer brand consumers. To determine whether any differences exist between the two consumer groups. | 5-point Likert scale: 4 × 16 items |

| Cheng et al. (2007) [86] | To investigate the differences in the consumer perceptions of product quality, price, leadership, and personality brand among national brands, international and local PLs. | 2 products x 3 types of brand x 4 items for 1 product 7-point Likert scale: PQ: 3 items BL: 3 items PP: 1 item BP: 3 items |

| Mieres et al. (2006) [87] | To analyze the effects that a set of variables related to purchasing behavior have on the difference in perceived risk between PLs and national brands. | Each item for kitchen rolls and shampoo: A: 7-point Likert scale: PQ: 4 items; REA: 7 items; SSC: 5 items FSB: 4 items; EPC: 4 items B: 7-point Likert scale: FR: 4 items; FiR: 3 items; SR: 4 items PR: 4 items; PsR: 4 items; TR: 4 items |

| Akbay and Jones (2005) [88] | To determine whether purchase patterns are differ for two income groups, and whether these differences are consistent with economic theory. To analyze the relationship between income and shopping behavior. | A: 1. 9 items: % scales 2. 9 items: cents per ounce B: 1. 9 items: % scales 2. 9 items: cents per ounce C: 1. 18 items: the LA/AIDS model 2. 18 items: the LA/AIDS model D: 1. 8 items: the LA/AIDS model 2. 18 items: the LA/AIDS model 3. 18 items: the LA/AIDS model |

| Kurtulus et al. (2005) [89] | To construct a model to determine the effect of the psychographics of consumers on their tendency to purchase PLs. To analyze the role of consumer attitudes and behaviors in consumer preferences for PLs. | 5-point Likert scale: PC: 4 items; FC: 4 items QC: 4 items; SL: 4 items SM: 3 items; TL: 3 items BL: 3 items; T: 3 items |

| Semeijn et al. (2004) [90] | To investigate how store image and the perceived risk associated with product attributes affect the consumer evaluation of PLs. To determine the structural relationships between store image, the perceived risk associated with product attributes, and consumer attitude towards PLs. | Study 1: 11 items on a 7-point Likert scale Study 2: 7-point scale Study 3: 3 stores x 4 products 12 items: 7-point Likert scale |

| Veloutsou et al. (2004) [91] | To compare the importance of choice criteria when purchasing PLs and national brands, and the perceived characteristics of the products under PLs and manufacturer brands in two regions at different stages of PL development. To rate the change in the behavior towards PLs and supermarkets and product attributes (perceived quality, value for money, appealing packaging, perceived taste, and the importance of these values for PLs and national brands). | Study 1: 4 items on a 5-point Likert scale Study 2: average of the 5 categories of products; 5-point semantic differential scales (SEM) A: 4 items B: 5 items C: 5 items Study 3: 5 items on a 5-point SEM |

| Miquel et al. (2002) [92] | To model the decision process involved in a purchase when choosing PLs over national brands, and investigate why the same consumer may choose a store brand in one product category and not in another. | (1) 2 items: 5-point Likert scale (2) 2 items: 5-point Likert scale (3) 2 items: do not buy SB (0)/buy SB (1) |

| Vaidyanathan and Aggarwal (2000) [93] | To examine how a national brand’s extension to a PL product (through ingredient branding) affects the evaluation of national brands and PLs. | PA: 10 items on a 7-point SEM scale QP: 5 items on a 7-point quality scale VP: 6 items on a 7-point scale VC: 7 items on a 7-point value scale |

References

- Rana, J.; Paul, J. Consumer behavior and purchase intention for organic food: A review and research agenda. J. Retail. Consum. Serv. 2017, 38, 157–165. [Google Scholar] [CrossRef]

- Wang, R.; Liaukonyte, J.; Kaiser, H.M. Does Advertising Content Matter? Impacts of Healthy Eating and Anti-Obesity Advertising on Willingness to Pay by Consumer Body Mass Index. Agric. Resour. Econ. Rev. 2018, 47, 1–31. [Google Scholar] [CrossRef]

- Ali, T.; Ali, J. Factors affecting the consumers’ willingness to pay for health and wellness food products. J. Agric. Food Res. 2020, 2, 1–8. [Google Scholar] [CrossRef]

- Pindus, N.; Hafford, C. Food security and access to healthy foods in Indian country: Learning from the Food Distribution Program on Indian Reservations. J. Public Aff. 2019, 19, 1–8. [Google Scholar] [CrossRef]

- Bandara, W. Consumer Decision-Making Styles and Local Brand Biasness: Exploration in the Czech Republic. J. Compet. 2014, 6, 3–17. [Google Scholar]

- Antonić, B.; Jančíková, S.; Dordević, D.; Tremlová, B. Grape pomace valorization: A systematic review and meta-analysis. Foods 2020, 9, 1627. [Google Scholar] [CrossRef]

- Sproles, E.K.; Sproles, G.B. Consumer Decision-Making Styles as a Function of Individual Learning Styles. J. Consum. Aff. 1990, 24, 134–147. [Google Scholar] [CrossRef]

- Sprotles, G.B.; Kendall, E.L. A Methodology for Profiling Consumers’ Decision-Making Styles. J. Consum. Aff. 1986, 20, 267–279. [Google Scholar] [CrossRef]

- Hafstrom, J.L.; Chae, J.S.; Chung, Y.S. Consumer Decision-Making Styles: Comparison Between United States and Korean Young Consumers. J. Consum. Aff. 1992, 26, 146–158. [Google Scholar] [CrossRef]

- Walsh, G.; Mitchell, V.W.; Hennig-Thurau, T. German consumer decision-making styles. J. Consum. Aff. 2001, 35, 73–95. [Google Scholar] [CrossRef]

- Leo, C.; Bennett, R.; Härtel, C.E. Cross cultural differences in consumer decision making styles. Cross Cult. Manag. Int. J. 2005, 12, 32–62. [Google Scholar] [CrossRef]

- Fan, J.X.; Xiao, J.J. Consumer decision-making styles of young-adult Chinese. J. Consum. Aff. 1998, 32, 275–294. [Google Scholar] [CrossRef]

- Rezaei, S. Segmenting consumer decision-making styles (CDMS) toward marketing practice: A partial least squares (PLS) path modeling approach. J. Retail. Consum. Serv. 2015, 22, 1–15. [Google Scholar] [CrossRef]

- Shim, S.; Koh, A. Profiling Adolescent Consumer Decision-Making Styles: Effects of Socialization Agents and Social-Structural Variables. Cloth. Text. Res. J. 1991, 15, 50–59. [Google Scholar] [CrossRef]

- Hiu, A.S.Y.; Siu, N.Y.M.; Wang, C.C.L.; Chang, L.M.K. An Investigation of Decision-Making Styles of Consumers in China. J. Consum. Aff. 2001, 35, 326–345. [Google Scholar] [CrossRef]

- Valaskova, K.; Kliestikova, J.; Krizanova, A. Consumer Perception of Private Label Products: An Empirical Study. J. Compet. 2018, 10, 149–163. [Google Scholar]

- Kotler, P.; Keller, K.L. Marketing Management, 14th ed.; Pearson Education: London, UK, 2012; ISBN 9780132102926. [Google Scholar]

- Kumar, A.; Roy, S. Store Attribute and Retail Format Choice. Adv. Manag. 2013, 6, 27–33. [Google Scholar]

- Coelho, D.C.; Meneses, R.F.C.; Moreira, M.R.A. Factors Influencing Purchase Intention of Private Label Products: The Case of Smartphones. In Proceedings of the International Conference on Exploring Services Science, Porto, Portugal, 7–8 February 2013; João Falcão, C., Mehdi, S., Nóvoa, H., Eds.; Springer: Berlin/Heidelberg, Germany, 2013; Volume 7, pp. 939–945. [Google Scholar]

- Geyskens, I.; Gielens, K.; Gijsbrechts, E. Proliferating Private-Label Portfolios: How Introducing Economy and Premium Private Labels Influences Brand Choice. J. Mark. Res. 2010, 47, 791–807. [Google Scholar] [CrossRef]

- Steenkamp, J.B.E.M.; Geyskens, I. Manufacturer and retailer strategies to impact store brand share: Global integration, local adaptation, and worldwide learning. Mark. Sci. 2014, 33, 6–26. [Google Scholar] [CrossRef]

- Cristini, G.; Laurini, F. Growth factors of store brands in different store formats in Italy. Int. Rev. Retail. Distrib. Consum. Res. 2017, 27, 109–125. [Google Scholar] [CrossRef]

- Ali, B.J. Consumer attitudes towards healthy and organic food in the Kurdistan region of Iraq. Manag. Sci. Lett. 2021, 11, 2127–2134. [Google Scholar] [CrossRef]

- Roosen, J.; Marette, S.; Blanchemanche, S.; Verger, P. The effect of product health information on liking and choice. Food Qual. Prefer. 2007, 18, 759–770. [Google Scholar] [CrossRef]

- Annunziata, A.; Pascale, P. Consumer behaviour and attitudes towards healthy food products: Organic and functional foods. In Proceedings of the A Resilient European Food Industry in a Challenging World, Chania, Greece, 3–6 September 2009; pp. 1–14. [Google Scholar]

- Private Label Market (PLMA). Private Label Popular across Europe. Available online: https://www.plmainternational.com/industry-news/private-label-today (accessed on 15 October 2020).

- De Wulf, K.; Odekerken-Schröder, G.; Goedertier, F.; Van Ossel, G. Consumer perceptions of store brands versus national brands. J. Consum. Mark. 2005, 22, 223–232. [Google Scholar] [CrossRef]

- Amrouche, N.; Rhouma, T.B.; Zaccour, G. Branding Decisions for Retailers’ Private Labels. J. Mark. Channels 2014, 21, 100–115. [Google Scholar] [CrossRef]

- Bauer, H.H.; Heinrich, D.; Schäfer, D.B. The effects of organic labels on global, local, and private brands. More hype than substance? J. Bus. Res. 2013, 66, 1035–1043. [Google Scholar] [CrossRef]

- Calvo-Porral, C.; Lévy-Mangin, J.P. Private label brands: Major perspective of two customer-based brand equity models. Int. Rev. Retail. Distrib. Consum. Res. 2014, 24, 431–452. [Google Scholar] [CrossRef]

- Beristain, J.J.; Zorrilla, P. The relationship between store image and store brand equity: A conceptual framework and evidence from hypermarkets. J. Retail. Consum. Serv. 2011, 18, 562–574. [Google Scholar] [CrossRef]

- Collins-Dodd, C.; Lindley, T. Store brands and retail differentiation: The influence of store image and store brand attitude on store own brand perceptions. J. Retail. Consum. Serv. 2003, 10, 345–352. [Google Scholar] [CrossRef]

- Ibarra Consuegra, O.; Kitchen, P. Own labels in the United Kingdom: A source of competitive advantage in retail business. Pensam. Gestión 2006, 21, 114–161. [Google Scholar]

- Walsh, G.; Mitchell, V.W. Consumers’ intention to buy private label brands revisited. J. Gen. Manag. 2010, 36, 3–24. [Google Scholar] [CrossRef]

- Cyran, K. The perception of private labels of food products vs. the prospects for their development. Res. Pap. Wrocław Univ. Econ. 2016, 450, 114–124. [Google Scholar]

- Laaksonen, H.; Reynolds, J. Own brands in food retailing across Europe. J. Brand Manag. 1994, 2, 37–46. [Google Scholar] [CrossRef]

- Górska-Warsewicz, H.; Czeczotko, M.; Kudlińska-Chylak, A. Consumer Behaviours towards Private Labels. Handel Wewnętrzny 2018, 2, 54–64. [Google Scholar]

- Schnittka, O. Are they always promising? An empirical analysis of moderators influencing consumer preferences for economy and premium private labels. J. Retail. Consum. Serv. 2015, 24, 94–99. [Google Scholar] [CrossRef]

- Kumar, N.; Steenkamp, J. Private Label Strategy: How to Meet the Store Brand Challenge, 1st ed.; Harvard Business School Press: Boston, MA, USA, 2007. [Google Scholar]

- Helmig, B.; Huber, J.-A.; Leeflang, P. Explaining behavioural intentions toward co-branded products. J. Mark. Manag. 2007, 23, 285–304. [Google Scholar] [CrossRef]

- Kilian, T.; Walsh, G.; Buxel, H. Measurement of Attitude Toward Private Labels: A Replication and Extension. Eur. Retail Res. 2008, 22, 69–85. [Google Scholar]

- Kowalska, M. Development and significance of private label in Poland. Stud. Pract. WNEiZ 2015, 39, 353–365. [Google Scholar]

- Czeczotko, M.; Górska-Warsewicz, H.; Laskowski, W. Towards sustainable private labels-What is the consumer behavior relating to private labels in the UK and Poland? Sustainability 2020, 12, 6035. [Google Scholar] [CrossRef]

- Czeczotko, M.; Górska-Warsewicz, H.; Laskowski, W.; Rostecka, B. Towards sustainable private labels in an autonomous community during covid-19—Analysis of consumer behavior and perception on the example of Tenerife. Sustainability 2021, 13, 7467. [Google Scholar] [CrossRef]

- Retnawati, B.B.; Ardyan, E.; Farida, N. The important role of consumer conviction value in improving intention to buy private label product in Indonesia. Asia Pac. Manag. Rev. 2017, 23, 193–200. [Google Scholar] [CrossRef]

- Wang, J.J.; Torelli, C.J.; Lalwan, A.K. The interactive effect of power distance belief and consumers’ status on preference for national (vs. private-label) brands. J. Bus. Res. 2020, 107, 1–12. [Google Scholar] [CrossRef]

- Arnould, E.J.; Price, L.; Zinkhan, G.M. Consumers, 2nd ed.; McGraw-Hill/Irwin: Boston, MA, USA, 2004. [Google Scholar]

- Liberati, A.; Altman, D.G.; Tetzlaff, J.; Mulrow, C.; Gøtzsche, P.C.; Ioannidis, J.P.A.; Clarke, M.; Devereaux, P.J.; Kleijnen, J.; Moher, D. The PRISMA statement for reporting systematic reviews and meta-analyses of studies that evaluate health care interventions: Explanation and elaboration. J. Clin. Epidemiol. 2009, 62, e1–e3. [Google Scholar] [CrossRef] [PubMed]

- Moher, D.; Liberati, A.; Tetzlaff, J.; Altman, D.G.; Altman, D.; Antes, G.; Atkins, D.; Barbour, V.; Barrowman, N.; Berlin, J.A.; et al. Preferred reporting items for systematic reviews and meta-analyses: The PRISMA statement. PLoS Med. 2009, 6, e1000097. [Google Scholar] [CrossRef] [PubMed]

- Górska-Warsewicz, H.; Kulykovets, O. Hotel brand loyalty—A systematic literature review. Sustainability 2020, 12, 4810. [Google Scholar] [CrossRef]

- Głąbska, D.; Guzek, D.; Groele, B.; Gutkowska, K. Fruit and vegetable intake and mental health in adults: A systematic review. Nutrients 2020, 12, 115. [Google Scholar] [CrossRef]

- Del Prete, M.; Samoggia, A. Chocolate consumption and purchasing behaviour review: Research issues and insights for future research. Sustainability 2020, 12, 5586. [Google Scholar] [CrossRef]

- Górska-Warsewicz, H.; Dębski, M.; Fabuš, M.; Kováč, M. Green brand equity—Empirical experience from a systematic literature review. Sustainability 2021, 13, 11130. [Google Scholar] [CrossRef]

- De Temmerman, J.; Heeremans, E.; Slabbinck, H.; Vermeir, I. The impact of the Nutri-Score nutrition label on perceived healthiness and purchase intentions. Appetite 2021, 157, 1–11. [Google Scholar] [CrossRef]

- Kadekova, Z.; Kosiciarová, I.; Vavrecka, V.; Dzupina, M. The impact of packaging on consumer behavior in the private label market—The case of Slovak consumers under 25 years of age. Innov. Mark. 2020, 16, 62–73. [Google Scholar] [CrossRef]

- Košičiarová, I.; Kádeková, Z.; Kubicová, Ľ.; Predanocyová, K.; Rybanská, J.; Džupina, M.; Bulanda, I. Rational and irrational behavior of slovak consumers in the private label market. Potravin. Slovak J. Food Sci. 2020, 14, 402–411. [Google Scholar] [CrossRef]

- Anitha, V.; Krishnan, A.R. Situational factors ascendant impulse purchase behavior of private label brands with special reference to modern trade retail outlets in Chennai. Int. J. Manag. 2020, 11, 178–187. [Google Scholar]

- Košičiarová, I.; Kádeková, Z.; Holotová, M.; Kubicová, L.; Predanocyová, K. Consumer preferences in the content of loyalty to the yoghurt brand. Agris Online Pap. Econ. Inform. 2020, 12, 37–48. [Google Scholar] [CrossRef]

- Singh, A.; Singhal, R.K. Emerging third generation private label brands: Retailers’ and consumers’ perspectives towards leading Indian retail chains. Int. J. Bus. Emerg. Mark. 2020, 12, 179–203. [Google Scholar] [CrossRef]

- Prediger, M.; Huertas-Garcia, R.; Gázquez-Abad, J.C. Store flyer design and the intentions to visit the store and buy: The moderating role of perceived variety and perceived store image. J. Retail. Consum. Serv. 2019, 51, 202–211. [Google Scholar] [CrossRef]

- Gómez-Suárez, M.; Quinõnes, M.; Yaguë, M.J. How individual value structures shape smart shopping experience and brand choices: An international perspective. Eur. J. Int. Manag. 2019, 13, 515–532. [Google Scholar]

- Salazar-Ordóñez, M.; Schuberth, F.; Cabrera, E.R.; Arriaza, M.; Rodríguez-Entrena, M. The effects of person-related and environmental factors on consumers’ decision-making in agri-food markets: The case of olive oils. Food Res. Int. 2018, 112, 412–424. [Google Scholar] [CrossRef] [PubMed]

- Liu, R.L.; Sprott, D.E.; Spangenberg, E.R.; Czellar, S.; Voss, K.E. Consumer preference for national vs. private brands: The influence of brand engagement and self-concept threat. J. Retail. Consum. Serv. 2018, 41, 90–100. [Google Scholar] [CrossRef]

- Vázquez-Casielles, R.; Cachero-Martínez, S. Multi-tiered private labels portfolio strategies: Effects on consumer behavior. J. Mark. Channels 2018, 25, 36–46. [Google Scholar] [CrossRef]

- Garczarek-Bąk, U. Explicit and Implicit Factors That Determine Private Labels’ Possible Purchase: Eyetracking and EEG Research. Int. J. Manag. Econ. 2018, 54, 36–49. [Google Scholar] [CrossRef]

- Meliana, V. Private Label Brand as Better Competitive Advantage for Local Retailers. Bus. Manag. Res. 2019, 74, 170–173. [Google Scholar]

- Modica, E.; Cartocci, G.; Rossi, D.; Martinez Levy, A.C.; Cherubino, P.; Maglione, A.G.; Di Flumeri, G.; Mancini, M.; Montanari, M.; Perrotta, D.; et al. Neurophysiological responses to different product experiences. Comput. Intell. Neurosci. 2018, 2018, 9616301. [Google Scholar] [CrossRef] [PubMed]

- Schouteten, J.J.; De Steur, H.; Sas, B.; De Bourdeaudhuij, I.; Gellynck, X. The effect of the research setting on the emotional and sensory profiling under blind, expected, and informed conditions: A study on premium and private label yogurt products. J. Dairy Sci. 2017, 100, 169–186. [Google Scholar] [CrossRef] [PubMed]

- Jara, M.; Cliquet, G.; Robert, I. A comparison between economic and organic store brands: Packaging as a key factor of store brand equity. Int. J. Retail Distrib. Manag. 2017, 45, 1298–1316. [Google Scholar] [CrossRef]

- Gómez-Suárez, M.; Quinones, M.; Yagúe, M.J. Store brand evaluative process in an international context. Int. J. Retail Distrib. Manag. 2016, 44, 754–771. [Google Scholar] [CrossRef]

- Marques dos Santos, J.P.; Martins, M.; Ferreira, H.A.; Ramalho, J.; Seixas, D. Neural imprints of national brands versus own-label brands. J. Prod. Brand Manag. 2016, 25, 184–195. [Google Scholar] [CrossRef]

- Thanasuta, K. Thai consumers’ purchase decisions and private label brands. Int. J. Emerg. Mark. 2015, 10, 102–121. [Google Scholar] [CrossRef]

- Monnot, E.; Parguel, B.; Reniou, F. Consumer responses to elimination of overpackaging on private label products. Int. J. Retail Distrib. Manag. 2015, 43, 329–349. [Google Scholar] [CrossRef]

- Diallo, M.F.; Burt, S.; Sparks, L. The influence of image and consumer factors on store brand choice in the brazilian market: Evidence from two retail chains. Eur. Bus. Rev. 2015, 27, 495–512. [Google Scholar] [CrossRef]

- Zielke, S.; Komor, M. Cross-national differences in price–role orientation and their impact on retail markets. J. Acad. Mark. Sci. 2015, 43, 159–180. [Google Scholar] [CrossRef]

- Fall-Diallo, M.; Kaswengi, J.; Gázquez-Abad, J.C. The Role of Previous Experience and Marketing Policy on Consumer Behaviour Towards Different Private Label Categories. In Advances in National Brand and Private Label Marketing; Springer: Cham, Switzerland, 2015; pp. 193–201. [Google Scholar]

- Delgado-Ballester, E.; Hernandez-Espallardo, M.; Rodriguez-Orejuela, A. Store image influences in consumers’ perceptions of store brands: The moderating role of value consciousness. Eur. J. Mark. 2014, 48, 1850–1869. [Google Scholar] [CrossRef]

- Fall Diallo, M.; Chandon, J.L.; Cliquet, G.; Philippe, J. Factors influencing consumer behaviour towards store brands: Evidence from the French market. Int. J. Retail Distrib. Manag. 2013, 41, 422–441. [Google Scholar] [CrossRef]

- Herstein, R.; Tifferet, S.; Abrantes, J.L.; Lymperopoulos, C.; Albayrak, T.; Caber, M. The effect of personality traits on private brand consumer tendencies: A cross-cultural study of Mediterranean countries. Cross Cult. Manag. 2012, 19, 196–214. [Google Scholar] [CrossRef]

- Wyma, L.; Van der Merwe, D.; Bosman, M.J.C.; Erasmus, A.C.; Strydom, H.; Steyn, F. Consumers’ preferences for private and national brand food products. Int. J. Consum. Stud. 2012, 36, 432–439. [Google Scholar] [CrossRef]

- Tifferet, S.; Herstein, R. The effect of individualism on private brand perception: A cross-cultural investigation. J. Consum. Mark. 2010, 27, 313–323. [Google Scholar] [CrossRef]

- Glynn, M.S.; Chen, S. Consumer-factors moderating private label brand success: Further empirical results. Int. J. Retail Distrib. Manag. 2009, 37, 896–914. [Google Scholar] [CrossRef]

- Anchor, J.R.; Kouřilová, T. Consumer perceptions of own brands: International differences. J. Consum. Mark. 2009, 26, 439–451. [Google Scholar] [CrossRef]

- Kara, A.; Rojas-Méndez, J.I.; Kucukemiroglu, O.; Harcar, T. Consumer preferences of store brands: Role of prior experiences and value consciousness. J. Target. Meas. Anal. Mark. 2009, 17, 127–137. [Google Scholar] [CrossRef][Green Version]

- Albayrak, M.; Aslan, Z. A comparative study of consumer preferences for manufacturer or private labelled food products. Afr. J. Bus. Manag. 2009, 3, 764–772. [Google Scholar]

- Ming-Sung Cheng, J.; Shui-Lien Chen, L.; Shih-Tse Wang, E.; Ying-Chao Lin, J. Do consumers perceive differences among national brands, international private labels and local private labels? The case of Taiwan. J. Prod. Brand Manag. 2007, 16, 368–376. [Google Scholar] [CrossRef]

- Mieres, C.G.; Martín, A.M.D.; Gutiérrez, J.A.T. Antecedents of the difference in perceived risk between store brands and national brands. Eur. J. Mark. 2006, 40, 61–82. [Google Scholar] [CrossRef]

- Akbay, C.; Jones, E. Food consumption behavior of socioeconomic groups for private labels and national brands. Food Qual. Prefer. 2005, 16, 621–631. [Google Scholar] [CrossRef]

- Kurtuluş, K.; Kurtuluş, S.; Yeniçeri, T.; Yaraş, E. The role of psychographics in explaining store brand buying behavior. Bogazici J. 2005, 19, 99–113. [Google Scholar] [CrossRef]

- Semeijn, J.; van Riel, A.C.R.; Ambrosini, A.B. Consumer evaluations of store brands: Effects of store image and product attributes. J. Retail. Consum. Serv. 2004, 11, 247–258. [Google Scholar] [CrossRef]

- Veloutsou, C.; Gioulistanis, E.; Moutinho, L. Own labels choice criteria and perceived characteristics in Greece and Scotland: Factors influencing the willingness to buy. J. Prod. Brand Manag. 2004, 13, 228–241. [Google Scholar] [CrossRef]

- Miquel, S.; Caplliure, E.M.; Aldas-Manzano, J. The effect of personal involvement on the decision to buy store brands. J. Prod. Brand Manag. 2002, 11, 6–18. [Google Scholar] [CrossRef]

- Vaidyanathan, R.; Aggarwal, P. Strategic brand alliances: Implications of ingredient branding for national and private label brands. J. Prod. Brand Manag. 2000, 9, 214–228. [Google Scholar] [CrossRef]

- Eales, T. Private Label in Western Economies. Available online: https://www.iriworldwide.com/en-GB/News/Media-Coverage/Private-label-in-Europe-Tailor-your-growth-strategy-per-country,-says-IRI (accessed on 20 May 2021).

- Statistica.com. Sales Share of Private Labels Food in USA in 2019, by Category. Available online: Statistica.com/statistics/1100038/sale-share-of-private-label-food-us-by-category/ (accessed on 25 May 2020).

- Górska-Warsewicz, H.; Żakowska-Biemans, S.; Czeczotko, M.; Świątkowska, M.; Stangierska, D.; Świstak, E.; Bobola, A.; Szlachciuk, J.; Krajewski, K. Organic Private Labels as Sources of Competitive Advantage—The Case of International Retailers Operating on the Polish Market. Sustainability 2018, 10, 2338. [Google Scholar] [CrossRef]

- The Rise and Rise Again of Private Label. 2018. Available online: http://www.nielsen.com/us/en/insights/reports/2018/the-riseand-rise-again-of-private-label.html (accessed on 9 June 2019).

- Nielsen the State of Private Label Around the World. Available online: https://www.nielsen.com/wp-content/uploads/sites/3/2019/04/state-of-private-label-around-the-world-nov-2014.pdf (accessed on 5 October 2020).

- IRI Share of Private-Label-Price-Level-in-Europe-2018-by-Country. 2019. Available online: https://www.statista.com/statistics/383455/private-label-price-level-by-european-countries/ (accessed on 22 May 2020).

- Abotorabi, O. Private Label in Western Economies IRI Special Report. Available online: https://www.iriworldwide.com/site/IRI/media/IRI-Clients/International/IRI-PL-Report_July-2018.pdf (accessed on 12 May 2020).

- Ipek, I.; Aşkin, N.; Ilter, B. Private label usage and store loyalty: The moderating impact of shopping value. J. Retail. Consum. Serv. 2016, 31, 72–79. [Google Scholar] [CrossRef]

- Nenycz-Thiel, M.; Romaniuk, J. Understanding premium private labels: A consumer categorisation approach. J. Retail. Consum. Serv. 2016, 29, 22–30. [Google Scholar] [CrossRef]

- Peter, J. Boyle and E. Scott Lathrop the value of private label brands to U.S. consumers: An objective and subjective assessment. J. Retail. Consum. Serv. 2007, 20, 80–86. [Google Scholar]

- do Vale, R.C.; Verga Matos, P.; Caiado, J. The impact of private labels on consumer store loyalty: An integrative perspective. J. Retail. Consum. Serv. 2016, 28, 179–188. [Google Scholar] [CrossRef]

- Wanjiku, M. Consumer Perception towards Private Label Brands of Four Key Supermarkets in Kenya; University of Nairobi: Nairobi, Kenya, 2015; pp. 1–55. [Google Scholar]

- Olbrich, R.; Jansen, H.C.; Hundt, M. Effects of pricing strategies and product quality on private label and national brand performance. J. Retail. Consum. Serv. 2017, 34, 294–301. [Google Scholar] [CrossRef]

- Ciurzyńska, A.; Cieśluk, P.; Barwińska, M.; Marczak, W.; Ordyniak, A.; Lenart, A.; Janowicz, M. Eating Habits and Sustainable Food Production in the Development of Innovative “Healthy” Snacks (Running Title: Innovative and “Healthy” Snacks). Sustainability 2019, 11, 2800. [Google Scholar] [CrossRef]

- Lesakova, D. Health perception and food choice factors in predicting healthy consumption among elderly. Acta Univ. Agric. Silvic. Mendel. Brun. 2018, 66, 1527–1534. [Google Scholar] [CrossRef]

- Sajdakowska, M.; Gębski, J.; Żakowska-Biemans, S.; Jeżewska-Zychowicz, M. Willingness to eat bread with health benefits: Habits, taste and health in bread choice. Public Health 2019, 167, 78–87. [Google Scholar] [CrossRef]

- Borowska, A.; Rejman, K. The Use of Nutrition and Health Information on the Bakery Market to Increase the Demand for its Products (in Polish). Med. Sport. Pract. 2009, 10, 79–87. [Google Scholar]

- Giboreau, A.; Fleury, H. A new research platform to contribute to the pleasure of eating and healthy food behaviors through academic and applied Food and Hospitality research. Food Qual. Prefer. 2009, 20, 533–536. [Google Scholar] [CrossRef]

- Ghvanidze, S.; Velikova, N.; Dodd, T.; Oldewage-Theron, W. A discrete choice experiment of the impact of consumers’ environmental values, ethical concerns, and health consciousness on food choices. Br. Food J. 2017, 119, 863–881. [Google Scholar] [CrossRef]

- Gheorghe, I.-R.; Liao, M.-N. Investigating Romanian Healthcare Consumer Behaviour in Online Communities: Qualitative Research on Negative eWOM. Procedia—Soc. Behav. Sci. 2012, 62, 268–274. [Google Scholar] [CrossRef]

- Levy, A.S.; Stokes, R.C. Effects of a health promotion advertising campaign on sales of ready-to-eat cereals. Public Health Rep. 1987, 102, 398. [Google Scholar]

- Dean, M.; Shepherd, R.; Arvola, A.; Vassallo, M.; Winkelmann, M.; Claupein, E.; Lähteenmäki, L.; Raats, M.M.; Saba, A. Consumer perceptions of healthy cereal products and production methods. J. Cereal Sci. 2007, 46, 188–196. [Google Scholar] [CrossRef]

- Mattila-Sandholm, T.; Myllärinen, P.; Crittenden, R.; Mogensen, G.; Fondén, R.; Saarela, M. Technological challenges for future probiotic foods. Int. Dairy J. 2002, 12, 173–182. [Google Scholar] [CrossRef]

| Database | Search String |

|---|---|

| Scopus | TITLE-ABS-KEY (“private labels” OR “private label” OR “private label brands” OR “private brand” OR “own label brand” OR “own brand” OR “store brand”) AND TITLE-ABS-KEY (“consumer behaviour” OR “consumer behavior” OR “consumer preferences”) |

| Web of Science | TOPIC (“private labels” OR “private label” OR “private label brands” OR “private brand” OR “own label brand” OR “own brand” OR “store brand”) AND TOPIC (“consumer behaviour” OR “consumer behavior” OR “consumer preferences”) |

| Author, Year | Research Method | Country | Sample Population | Product Category |

|---|---|---|---|---|

| Temmerman et al. (2021) [54] | Online experiment, survey | Belgium | 796 respondents (students and employers of university) Study 1: pretest n = 52 and main study: n = 303 Study 2: n = 441 | Study 1: 3 ready-to-eat meals Study 2: 20 products, including beverages, cookies, dairy products, meat and cereal products, fish, preserves |

| Kadekova et al. (2020) [55] | Study 1: survey with questionnaires Study 2: blind test 2 traditional + 3 PL yogurts | Slovakia | Adults ≤25 years Study 1: n = 549 respondents Study 2: n = 20 respondents | Dairy products: yogurts |

| Czeczotko et al. (2020) [43] | Survey with questionnaires distributed in a consumer panel, computer-assisted web interview (CAWI) method | Poland, UK | Adults ≥18 years declared to purchase PL food products n = 1000: 500 in Poland and 500 in the UK | Food products: dairy, grain products, sweets, biscuits, bakery products, meat products, fruit and vegetable products, frozen food, beverages, water, alcohol |

| Anitha and Krishnan (2020) [57] | Questionnaire survey, quota sampling method | India | Adults ≥18 years n = 200 respondents | n.a. |

| Košičiarová et al. (2020) [58] | Questionnaire survey, CAWI method, blind test: 2 traditional yogurts and 2 PL yogurts | Slovakia | Adults ≥18 years Survey: n = 693 respondents Blind test: n = 100 | Dairy products: yogurts |

| Singh and Singhal (2020) [59] | Survey | India | Adults ≥18 years from 325 households who visited Big Bazaar Store | Sauces, preserves, ketchup, atta, mustard oil |

| Košičiarová et al. (2020) [56] | Questionnaire survey, blind test | Slovakia | Survey: n = 1116, ≥18 years Blind test: n = 20, ≤25 years | Dairy products: yogurts |

| Prediger et al. (2019) [60] | Half-factorial laboratory experiment, online survey | Spain | Adults ≥18 years n = 406 respondents | Fruit, vegetables, meat, fish, olives, cereals, bread, chips, sausages, beverages, gels, perfumes, detergents |

| Gómez-Suárez et al. (2019) [61] | Online survey based on Schwartz’s value conceptual framework model | USA, France, Germany, UK, Italy, Spain | Adults ≥18 years, n = 1272 shoppers buying FMCGs | n.a. |

| Salazar-Ordóñez et al. (2018) [62] | Online survey (household panel) | Spain | Buyers aged ≥19 years n = 1029 consumers | Olive oil |

| Liu et al. (2018) [63] | Study 1: simulated shopping, Study 2: questionnaires, Positive and Negative Affect Schedule scale, Study 3: behavioral lab | USA | Students: 570 respondents Study 1: n = 88; Study 2: n = 228; Study 3: n = 254 | Fruit juice, canned vegetables, peanut butter, canned fruit, pasta, salad dressing, cereal products |

| Valaskova et al. (2018) [16] | Online survey | Slovakia | Adults ≥18 years n = 347 respondents purchasing PL products in one of the retail chains’ markets | Dairy products, baby food, durable goods, beverages, frozen food, cosmetics, sweets, detergents, animal food |

| Vázquez- Casielles and Cachero-Martinez (2018) [64] | Panel data with information about customers, data set: 187 weeks | Spain | Adults ≥18 years n = 254 regular customers | Fruit products: jam, 3 PL tiers (standard, economy, and premium) and NBs with share >5% |

| Garczarek-Bąk (2018) [65] | Eye tracking, electroencephalography, survey, CAWI method | Poland | n = 16 healthy right-handed respondents (8 female, 8 male) 21–30 years | 10 (product categories) × 6 (brands) × 2 (variants): 7 categories of food and 3 categories of body care products and 6 products from different retailers |

| Meliana (2018) [66] | Questionnaire survey | Indonesia | 260 shoppers in Indomaret and Alfamart | Groceries and household PL product category |

| Modica et al. (2018) [67] | Tactile exploration, visual exploration, visual and tactile exploration | Italy | Experiment 1: n = 19 Experiment 2: n = 13 | 2 daily food items (1 major brand and 1 PL) and 2 comfort food items (1 foreign product and 1 local product) 4 different comfort foods (e.g., chocolate bars) and 4 different daily foods (e.g., rice): 2 local and 2 foreign products of NBs and PLs |

| Schouteten et al. (2017) [68] | Sensory analysis, 3 sessions, online questionnaires | Belgium | Adults ≥18 years, n = 99 volunteers for sensory and consumer research (45 males and 54 females) | 5 strawberry-flavored yogurts |

| Jara et al. (2017) [69] | Questionnaire survey | France | Adults ≥18 years Total n = 568 respondents: group A: n = 142, group B: n = 179, group C: n = 95, group D: n=152 | Plain yogurts or a face cream |

| Gomez-Suarez et al. (2016) [70] | Online survey | Spain, Germany, France, UK, Italy, USA | Adults ≥18 years 1118 consumers of FMCGs from 6 countries (each n = 200) | Cosmetics: shampoo |

| Marques dos Santos et al. (2016) [71] | Save Holdings or Purchase task with functional magnetic resonance imaging, 64 blocks | Portugal | Adults ≥18 years n = 22 respondents buying NB and PL products (6 males and 16 females) | n.a. |

| Thanasuta (2015) [72] | Questionnaire survey | Thailand | Adults ≥18 years n = 240 shoppers of 5 hypermarkets and supermarkets in Bangkok | Cooking oil, tissue paper, body lotion, instant noodles |

| Schnittka (2015) [38] | Questionnaire survey | Germany | Adults ≥18 years n = 238 German consumers who were aware about PL products | Mineral water, detergents, juice, shower gel |

| Monnot et al. (2015) [73] | Experiment: 2 (overpackaging: present vs. absent) × 2 (brand concept: generic vs. mimic PL), face-to-face survey | France | Adults ≥18 years n = 217 consumers | Dairy products: yogurts |

| Diallo et al. (2015) [74] | Questionnaires from two retail chains during the shopping | Brazil | Adults ≥18 years n = 600 shoppers from 2 retail chains (Carrefour, Extra) | Cosmetics: shampoo |

| Zielke and Komor (2015) [75] | Online questionnaire | Germany, Poland | Adults ≥18 years n = 500 students (250 from Germany and 250 from Poland) | Groceries, consumer electronics, cosmetics, clothes |

| Fall-Diallo et al. (2015) [76] | Marketing scan behavior panels, purchase records, lasting 286 weeks: initial period (weeks 1–130), expansion period (weeks 131–208), and crisis period (weeks 209–286) | France | Carrefour customers who made at least two purchases in the analyzed period, butter data of 94 households: 869 purchases (expansion) and 888 purchases (crisis) yogurt data of 169 households: 2604 purchases (expansion) and 3368 purchases (crisis) | Dairy products: butter and yogurt |

| Delgado-Ballester et al. (2014) [77] | Mall intercept questionnaire survey | Colombia | Adults ≥18 years n = 600 shoppers who bought PL products during last 2 months (Carrefour and Éxito supermarkets) | Sugar, shampoo, facial cream, fabric conditioner, antibacterial gel, sunflower oil |

| Bauer et al. (2013) [29] | Study 1: in-depth interviews: main purchasing motives for organic food, Study 2: experiment: impact of organic label (OL) on consumer perception, Questionnaire: purchase intentions of buying organic PL products, Study 3: impact of OL on variables of behavioral intention analysis of OLs. | Germany | Adults ≥18 years Study 1: n = 12 German consumers using the laddering technique, Study 2 and 3: n = 630 | Cereals |

| Fall Diallo et al. (2013) [78] | Self-administered questionnaires | France | Adults ≥20 years n = 266 respondents responsible for purchasing | n.a. |

| Herstein et al. (2012) [79] | Survey: questionnaire online | Greece, Israel, Portugal, Turkey | n = 683 undergraduate college students who purchase PL products | Chocolate, cooking oil, biscuits, rice, frozen meat, detergent, shampoo, toothpaste, liquid soap, and dishwasher liquid |

| Wyma et al. (2012) [80] | Survey: a structured questionnaire | South Africa | Adults ≥18 years n = 620, 4 supermarkets in an urban area | 25 products, including dairy and cereal products, canned vegetables, frozen vegetables, beverages, sweets, oil, toiletries |

| Tifferet and Herstein (2010) [81] | Paper questionnaires | Israel | Adults ≥18 years n = 400 PL customers: students from 8 universities and colleges | Chocolate, laundry powder, oil, toothpaste, hummus, shampoo, frozen meat, liquid soap, rice, barrage bags |

| Glynn and Chen (2009) [82] | Mall intercept survey in city supermarket, screening question about purchase of 1 of 10 product categories with a PL offering | New Zealand | Adults ≥18 years n = 600 shoppers buying PL products | Canned fruit, toilet tissue, fresh milk, cheese, fruit juice, potato chips, biscuits, bread breakfast cereal, pet food |

| Anchor and Kourilová (2009) [83] | Structured questionnaires | Czech, Republic, UK | Adults ≥18 years n = 200 Tesco supermarket customers in the Czech Republic (n = 100) and the UK (n = 100) | n.a. |

| Kara et al. (2009) [84] | Self-administered questionnaires hand-delivered to respondents | USA | Adults ≥18 years n = 799 shoppers responsible for grocery shopping in the household | Grocery products |

| Albayrak and Aslan (2009) [85] | Face-to-face questionnaires on consumer preferences regarding private and manufacturer brand products | Turkey | Adults ≥18 years n = 217 consumers divided into 2 groups as those who buy PL products and those who buy NB products | Meat and dairy products, fruit and vegetables, sweets, oil products, wine |

| Cheng et al. (2007) [86] | Questionnaire survey | Taiwan | Adults ≥16 years n = 254 respondents | Various types of product categories |

| Mieres et al. (2006) [87] | Personal interviews | Spain | Adults ≥18 years n = 436 respondents buying kitchen rolls, n = 422 respondents buying shampoo | Kitchen rolls and shampoo |

| Akbay and Jones (2005) [88] | Supermarket scanner data, 65 weeks of observations | USA | 100,000 consumers buying in 6 supermarkets: 3 stores chosen for primarily lower-income shoppers, and 3 stores that primarily serve consumers with higher income | Milk, breakfast cereals, ice cream, cooking oil, salty snacks, salad dressing, pasta, frozen vegetable, mayonnaise |

| Kurtulus et al. (2005) [89] | Face-to-face interviews with consumers who shop at the four major retailers | Turkey | Adults ≥20 years n = 514 | n.a. |

| Semeijn et al. (2004) [90] | Experiment, online questionnaire consisting of 110 statements | The Netherlands | Students ≥18 years n = 128 | Wine, toothpaste, potato chips, canned tomatoes |

| Veloutsou et al. (2004) [91] | Self-administered questionnaires, in-depth interviews with 5 consumers in each country to better interpret the results | Greece, UK (Scotland) | Adults ≥25 years n = 328 respondents: 104 from Greece and 224 from Scotland | Coffee, biscuits, toothpaste, liquid, shampoo |

| Miquel et al. (2002) [92] | Questionnaires in the form of personal interviews, each of the interviewed was valuing 2 of the 6 product categories | Spain | Adults ≥18 years n = 400 household shoppers | Milk, sliced white bread, oil, beer, bleach, toilet paper |

| Vaidyanathan and Aggarwal (2000) [93] | Experiment in 2 versions: visual stimulus with added branded or no-branded raisins; questionnaire booklet | USA | Adults ≥18 years Total sample: n = 175, n = 67 students and shoppers | Breakfast cereal with raisins |

| Author, Year | Factor/Variable | Hypotheses |

|---|---|---|

| Temmerman et al. (2021) [54] | Study 1: Perceived quality (PQ) Perceived tastiness (PT) Perceived healthiness (PH) Purchase intentions (PI) Study 2: Perceived healthiness (PH) Purchase intentions (PI) Nutritional knowledge (NK) Perceptions of healthy food (PhF) Dieting behavior (DB) Familiarity with Nutri-Score (NS) (FNS) | n.a. |

| Kadekova et al. (2020) [55] | Questionnaire: perception of PL product quality Blind test: sensory evaluation of yogurt, including color, aroma, consistency or density, taste and proportion of chocolate, the size of the packaging and its attractiveness | Gender (G) → buying PLs (–) G → quality rating of PLs (+) G → perception of PL product packaging (–) G → purchase of PLs (–) G → decisive factor to buying PLs (+) G → discouragement from buying PLs (–) |

| Czeczotko et al. (2020) [43] | Period of purchase of PL products (PP) Factors for purchasing PL products (FP) Opinions on the current development of PL products (OCD) Frequency of PL product purchasing (FPC) Share of PL products to total food purchases (SPL) | n.a. |

| Anitha and Krishnan [57] | Personal factor (PF) Impulse buying behavior (IBB) Store factor (SF) Urge to buy (UB) | PF → IBB (+); PF → UB (+) SF → IBB (–) SF → UB (+) UB → IBB (+) |

| Košičiarová et al. (2020) [58] | Purchase and frequency of purchase Brand loyalty Brand preference (traditional or PL) Motives for purchase Sensory properties of yogurts | Age → kind of preferred brand of purchased yogurts (+) Gender → kind of preferred brand of yogurts (+) A statistically significant difference in the purchasing preferences based on packaging (–) A statistically significant difference in the evaluation of yogurt flavors (+) |

| Singh and Kumar Singhal (2020) [59] | Perceived quality of PLs (PQ) Price consciousness (PC) Perceived value of PLs (PV) Store loyalty (SL) Quality consciousness (QC) Loyalty to PLs (PLL) Price sensitivity (PS) Willingness to pay for PLs (WP) | PQ → WP (+) PS → WP (–) PQ → PLL (+) PV → PLL (+) PV → the store’s overall image, in terms of brand and value (+) PLL → SL (+) PQ → SL (+) |

| Košičiarová et al. (2020) [56] | Questionnaire: Frequency of PL purchase (FPL) Purchases of PLs (P) Perception of quality (PQ) Consumer perception and consciousness about Product categories (CPC) Evaluation of packaging attractiveness (EPA) Factors of PL purchase (FP) Blind test: 7 chocolate-flavored yogurt samples; traditional brands vs. PL; investigated identical products | Gender (G) → PQ (+) G → P (+) Economic activity of respondents I → P (–) G → perception of PL product packaging (–) G → perception of facts that influence respondents to buy PLs (–) Age (A) → perception of facts that influence to buy PLs (–) G → decisive factor when buying PLs (+) R → decisive factor when buying PLs (–) G → facts that discourage from buying PLs (+) A → facts that discourage from buying PLs (+) |

| Prediger et al. (2019) [60] | Creating fictitious flyers and supermarket, featuring real NBs and fictitious PLs Different flyer designs (scenarios): (1) Store flyer page length; (2) Brand (NB or PL) on the cover page; and (3) An institutional slogan on the cover page as an incentive advertising Consumers received the flyers and answered an online survey Intentions to buy PL products | Four models:

|

| Gómez-Suárez et al. (2019) [61] | Category: (1) Self-enhancement: self-transcendence, openness; conservation (2) Smart shopper self-concept (SSSC): smart-shopper behaviors, smart-shopper feelings, brand attitude (NB/PL) | Value structure (+) → attitude toward NBs (–) Value structure (+) → attitude toward PLs (–) SSSC (+) → attitude toward NBs (+) SSSC (+) → attitude toward PLs (+) Effect of SSSC on attitude → more positive for NBs than for PLs (+) |

| Salazar- Ordóñez et al. (2018) [62] | Attitude toward extra-virgin olive oil (EVOO) (AE) Attitude toward refined olive oil (AR) Perceived value of PLs (PV) | PV → AE (–) PV → AR (+) |

| Liu et al. (2018) [63] | Study 1: BESC (brand engagement in the self-concept); PL attitude; value consciousness; price consciousness Study 2: manipulated test in laboratory Study 3: manipulating brand engagement | Consumers with higher BESC prefer NBs over PLs (+) Consumers with lower BESC show increased preference for NBs relative to PLs (–) Consumers with higher BESC show reduced preference for NBs relative to PLs (+) |

| Valaskova et al. (2018) [16] | Consumer’s attitude (CA) and preferences in the choice of 10 categories of PL products | CA and individual demographic determinants (–) CA and factors leading to the purchase of PL products (–) CA and a particular type of the purchased product (–) |

| Vázquez- Casielles and Cachero- Martinez (2018) [64] | Information about products’ category (jam) and purchase situation: purchased brand, sale format of the purchased brand, purchased quantity, sale price, the product was on promotion, assortment size, and date of the last purchase | Economy PLs (EPL) → a negative brand-type similarity effect → decreases the choice of standard PLs (SPL) (–) EPLs → positive attraction effect → increases the choice probability of SPLs (+) EPLs → positive compromise effect → increases the choice probability of second-tier NB and SPLs (–) Premium PLs (PPL) → negative brand-type similarity effect → decreases the choice probability of EPLs and SPLs (+) PPLs → negative quality-tier similarity effect → decreases the choice probability of premium-quality NBs and second-tier NBs (+) PPLs → positive attraction effect → increases the choice probability of premium-quality NBs (+) |

| Garczarek-Bąk (2018) [65] | Perceived product esthetic (PPE) Perceived likelihood of buying the product (PI) Quality assessment (QA) Variants without showing the price and with normal price to control for the meaning of this factor | Women possess a relatively greater esthetic sensitivity to the appearance of PL products than men (–) The price knowledge will not affect the purchase decision of PL products within retailers (+) Young customers’ behavior in the process of buying PL products of distributive networks can be highly affected not by declared, but by latent factors (+) |

| Meliana (2018) [66] | Factors: logo, color, policy, cost, large stock, promo variations, complete products, and others | PL products have a significant effect on customers’ shopping preference PLs have a significant effect on store image |

| Modica et al. (2018) [67] | Comfort food vs. daily food Major brand vs. PLs Foreign vs. local Tactile, visual, and visual and tactile exploration | Major brand products present more attractive packaging than other products, and therefore elicit a higher approach tendency than the PL items (–) |

| Schouteten et al. (2017) [68] | Yogurt brands: two premium brands and three PLs Experiment: central location tests (n = 53) and home-use tests (n = 46) 3 test sessions (blind, expected, and informed) | - |

| Jara et al. (2017) [69] | Attitude (A) Perceived quality (PQ) Perceived price (PP) Packaging (P) Intent to buy (IB) Economic store brand (ESB) Organic store brand (OSB) Purchase intentions (PI) | PQ of PL products varies according to the type of P (+) Reinforced P → PQ of EPLs (+) Simplified P → PQ of EPLs (–) Simplified P → PQ of OPLs (+) Reinforced P → PQ of OPLs (+) Influence of PQ on the customers’ IB varies based on P (+) PQ of EPLs → PI due to a reinforced P (+) PQ of EPLs → PI due to a simplified P (–) PQ of OPLs → PI due to P (+) HPQ of OPLs → PI due to P (–) The more the type of P corresponds to a PL products’ positioning, the more it strengthens the customers’ IB (+) EPLs can increase customers’ IB via reinforced P (+) OPLs can increase customers’ IB via simplified packaging (+) |

| Gomez-Suarez et al. (2016) [70] | Two shampoo brands (NB and PL); different prices Preference (P) Attitude (A) Purchase intention (PI) Consumer preferences (CP) Quality inferences (QI) Smart shopper self-perception (SSSP) Consciousness (C) | A of PL products → preference for PL products (–) CP for PL products → PL products (–) C → A of PL products (+) SSSP → A of PLs (+) Familiarity with the NBs negatively(-) affects A of PLs (+) Perceived risk has a (−) impact on CP for PLs (+) C propensity for exploration has a (–) effect on PL product P (+) Impulsiveness has a (+) impact on PL product PI (+) QI made from price have a (–) impact on PL product A (+) QI made from brand image have a (–) impact on PL product A (–) QI made from brand reputation have a (–) impact on PL product A (–) QI made from product efficiency have (+) impact on PL product A (+) |

| Marques dos Santos et al. (2016) [71] | Analysis: product, price, decision, and interval 7 categories of food products (4 retailers × 7 categories = 28 different products × 2 brands (NB or PL)) Price manipulation applied | - |

| Thanasuta (2015) [72] | PL purchase Price consciousness (PC) Quality consciousness (QC) Brand consciousness (BC) Value consciousness (VC) Risk perception (RP) | PC → PL purchase (+) QC → PL purchase (−) BC → PL purchase (−) VC → PL purchase (+) RP → PL purchase (−) Product differentiation, risk level → PL purchase (+) |

| Schnittka (2015) [38] | 1. Perceived brand (in low and high category) 2. Price preference 2 × 3 × 3: (a) Economy PLs (EPLs): low-priced store, high-priced store, and overall, for each category: manufacturer, retailer, overall (EPL) (b) Premium PLs (PPLs): low-priced store, high-priced store, and overall, for each category: manufacturer, retailer, overall (PPL) Consumer preferences (CP) | In low-priced grocery stores, EPLs evoke more favorable CP than PPLs (+) In high-priced stores, EPLs evoke less favorable CP than PPLs (+) In product categories of low brand relevance, EPLs evoke more favorable CP than PPLs (+) In product categories of high brand relevance, EPLs evoke less favorable CP than PPLs (+) If consumers believe that the PLs are produced by a well-known manufacturer, EPLs evoke more favorable CP than PPLs (–) If consumers believe that the PLs are produced by the corresponding retailer itself, EPL products evoke less favorable CP than PPLs (–) |

| Monnot et al. (2015) [73] | 1. Price sensitivity (PS) Perceived quality (PQ) Environmental consciousness (EC) Perceived expensiveness (PE) Product involvement (PI) Perceived environmental friendliness (PEF) Perceived convenience (PC) 2. Mean with overpackaging (OP) and without overpackaging for mimic or generic PL products (yogurt) | Eliminating OP reduces PQ (–), reduces PE (+), increases PEF (+), and reduces the PC of the product (+) The influence of eliminating OP on the product’s PQ (+), PE (–), PEF (+), and PC depends on the PL concept: it should be stronger for a mimic PL product than for a generic PL product (+) The influence of eliminating OP on purchase intention is mediated by the product’s PQ (+), PE (–), PEF (–), and PC (+) |

| Diallo et al. (2015) [74] | Store image perceptions (SIP) PL price image (SPI) PL perceived value (PV) PL attitude (A) PL purchase intention (PI) PL choice | SIP → PL purchase (+) SIP → PI (+) PI → PL choice (+) PL product SPI → PI (+) PL product PV → PL choice (–) PL product PV → A (+) A → PL choice PI → PL choice |

| Zielke and Komor (2015) [75] | 1. Price consciousness: value consciousness, price–quality schema, prestige sensitivity, preference toward Ps and discounter preference Hypermarket preference 2. Preference toward PLs: discounter preference and hypermarket preference | The negative role (price and value consciousness) increases preferences for PLs, discounters, and hypermarkets (+) The positive role (price–quality schema, prestige sensitivity) decreases preferences for PL products and discounters but increases preferences for hypermarkets in low-price categories (+) |

| Fall-Diallo et al. (2015) [76] | Butter (3 types of PLs: standard (S), organic (O), local (L)) Yogurt (3 types of PLs: S, O, L) | - |

| Delgado- Ballester et al. (2014) [77] | Store image (SI) Functional risk (FR) Financial risk (FiR) Social risk (SR) Psychological risk (PR) Price unfairness (PU) Value consciousness (VC) Consumer perceptions (CP) | + SI reduces CP of the FR and FiR of PLs to a greater (lesser) degree with diminishing (rising) levels of VC (+) + SI reduces CP of the SR of PLs to a greater (lesser) degree with rising (diminishing) levels of consumer VC (–) + SI increases CP of the PR of PLs to a greater (lesser) degree with diminishing (rising) levels of consumer VC (–) Perceptions of FR, FiR, SR, and PR associated with PLs diminish the perception of the price unfairness of an alternative manufacturer’s brand (+) |

| Bauer et al. (2013) [29] | Study 1: main purchasing motives Study 2: (a) Experiment: 6 groups of PL products: local, global, or organic cereal products and nonorganic cereal products (b) Purchasing motives: Healthiness (PH) Hedonism (PHe) Environmental friendliness (EF) Food safety (FS) Study 3: the same 6 groups of products: Purchase intention (PI) Price premium (willingness to pay price premium) (WP) | Organic label (OL) of global (G)/local (L)/PLs causes a higher degree of PH than the respective G/L/PL brand without an OL (+) OL of G/L/PLs causes a higher degree of PHe than the respective G/L/PLs without OL (+) OL of G/L/PLs causes a higher degree of perceived EF than the respective G/L/PLs without OL (+) OL of G/L/PLs causes a higher degree of perceived FS than the respective G/L/PLs without an OL (+) OL of G/L/PL products leads to a higher PI than the respective G/L/PL products without an OL (+) OL of G/L/PLs leads to a higher WP a price premium than the respective G/L/PLs without an OL (+) |

| Fall Diallo et al. (2013) [78] | Store image perceptions (SIP) PL price image (PI) Value consciousness (VC) Attitude toward PLs (A) PL purchase intention (PIn) PL choice | SIP → PIn (+) SIP → PI (+) PIn → PL choice (+) SIP → PI (+) PI → PIn (+) PL product PI → PL choice (+) PI → PIn → PL choice (+) VC → PIn (+) VC → PL choice (+) VC → A (+) PIn → PL choice (+) VC → A (+) A → PL choice (+) PIn → PL choice (+) |

| Herstein et al. (2012) [79] | Choice of 2 types of brands (NB and PL), 5 food and 5 nonfood products Brand dimensions: brand name, packaging, country of origin Individualism (I): vertical (VI) and horizontal (HI) individualism Measure of materialism (M) Need for cognition (NC) | I is correlated with the inclination to purchase PLs M is correlated with the inclination to purchase PLs The need for cognition is correlated with the inclination to purchase PLs There will be cross-cultural differences in the inclination to purchase PLs Culture moderates the effect of personality on preference for PLs vs. NBs |

| Wyma et al. (2012) [80] | Brand preference (25 products available in NB and PLs) Psychographic statements related to brands Demographic characteristics | - |

| Tifferet and Herstein (2010) [81] | Willingness to purchase (NB or PL) for 10 types of products (5 food products and 5 nonfood products) Brand image, 3 factors: importance of packaging design, manufacturer’s brand name reputation, and country of origin Individualism and collectivism | Does individualism affect consumers’ preference for PLs vs. NBs? Do consumers with high levels of individualism show a lower inclination to purchase PLs? Does individualism affect consumers’ perceived importance of brand image dimensions? Do consumers with high levels of individualism attribute greater importance to brand image dimensions, such as packaging design, country of origin, and PL reputation? Are there cross-cultural differences within a specific country, namely, Israel? |

| Glynn and Chen (2009) [82] | 1. Factors: Purchase mistake (PM) Quality variability (QV) Search vs. experience (S vs. E) Price consciousness (PC) Price–quality perception (PQP) Brand loyalty (BL) PL purchase 2. Average scores by PL product category (factors as above): canned fruit, toilet tissue, fresh milk, cheese, fruit juice, potato chips, biscuits, bread breakfast cereal, pet food | Are consumers more likely to buy PLs where they perceive lower consequences of making a mistake in brand selection (–)/variability in quality between brands (–)? Is it possible to accurately assess product quality of important attributes and benefits based on written descriptions only (–)/are consumers more price-conscious (+)? Consumers are less likely to buy Ps if they have an elevated perception of quality relative to price (+) Brand loyalty reduces consumers’ propensity to buy PLs (+) Consumers’ propensity to buy PL products is determined by gender/age (–) Consumers are less likely to buy PLs if they have more household income/formal education qualifications (+) Large households are more likely to buy PLs (+) Purchase of PLs is moderated by differences in PL category share (–) |

| Anchor and Kourilová (2009) [83] | Study 1: Importance of price Importance of quality Importance of confidence Study 2: perception of the Tesco PL category: Tesco Value, Tesco Standard Purchase frequency (PF) Perceived quality (PQ) Perceived price (PP) Confidence (C) | In both countries, the Tesco brands have the same PF (–) In both countries, the PQ of the Tesco brands is of the same level (–) In both countries, the PP of the Tesco brands is of the same level (–) In both countries, the C in the Tesco brands is of the same level (–) In both countries, a significant relationship between gender and perception of measured characteristics exists (–) In both countries, a significant relationship between age and perception of measured characteristics exists (–) In both countries, a significant relationship between income and perception of measured characteristics exists (+) In both countries, a significant relationship between purchase frequency and perception of measured characteristics exists (0) |

| Kara et al. (2009) [84] | Perceptions about manufacturers vs. PLs: budget conscious, value conscious, price conscious, discount conscious Consumer’s previous experience, sensory perception Content perception, PL purchase/use | Consumers’ consciousness (+) → PL perceptions (+) Consumers’ previous experience (+) → PL perceptions (+) Consumers’ consciousness (+) → consumers’ previous experience (+) BS perceptions (+) → PL purchase/use (+) |

| Albayrak and Aslan (2009) [85] | Brand preferences: NB food product preference analysis of NB food consumers PL food product preference analysis of NB food consumers PL food product preference analysis of PL food product consumers NB food product preference analysis of PL food product consumers | - |

| Cheng et al. (2007) [86] | 2 categories of products for NB: international PL (IPL), and local PL (LPL) Perceived quality (PQ) Brand leadership (BL) Price perception (PP) Brand personality (BP) | The quality of NB products is perceived to be superior to that of IPL products, while the quality of IPL products is perceived to be superior to that of LPL products (+) Consumers perceive the price of NB products to be being significantly higher than IPL products, and the price of IPL products to be higher than LPL products (+) Consumers count on NBs for better brand leadership, on IPLs for worse brand leadership, and LPLs for nonbrand leadership (+) Consumers perceive the brand personality of NBs to be significantly superior to IPLs, and the brand personality of IPLs to be superior to local PLs (+) Product categories moderate the interaction of PQ (–)/PP (–)/BL (–)/BP (+) across NBs, IPLs, and LPLs |

| Mieres et al. (2006) [87] | A. Difference in perceived risk between PLs and NBs Perceived quality of PLs/NBs (PQ) Reliance on the extrinsic attributes of a product (REA) Specific self-confidence (SSC) Familiarity with PLs (FPL) Experience with product category (EPC) B. Perceived risk (PR): Functional risk (FR) Financial risk (FiR) Social risk (SR) Physical risk (PR) Psychological risk (PsR) Time risk (TR) | PO → Difference in PR (–) REA → Difference in PR (+) REA → PQ (+) SSC → Difference in PR (–) SSC → REA (–) FPL → REA (–) FPL → PQ (+) EPC → Difference in PR (–) EPC → SSC (+) EPC → REA (–) EPC → FPL (+) EPC → PQ (+) |

| Akbay and Jones (2005) [88] | A. Lower-income consumers 1. PB share/NB share 2. PB price/NB price B. Higher-income consumers 1. PB share/NB share 2. PB price/NB price C. Demand equations of 9 food categories for PLs and NBs in lower- and higher-income areas D. Demand elasticities for 9 food product categories for PLs and NBs in lower- and higher-income areas: Expenditure elasticity Price elasticity Promotion elasticity | - |

| Kurtulus et al. (2005) [89] | Price consciousness (PC) Financial constraints (FC) Quality consciousness (QC) Store loyalty (SL) Shopping mavenism (SM) Time limitation (TL) Brand loyalty (BL) Tendency to purchase PBs (T) | T → PC (+) T → FC (–) T → QC (–) T → SL (+) T → SM (+) T → TL (–) T → BL (–) |

| Semeijn et al. (2004) [90] | 1. Store image (layout, merchandise, service) (SI) 2. Consumer attitude toward PLs (CA) (a) Perceived overall quality of PLs (PQ) (b) Likelihood of purchasing PLs (LP) 3. Risk factors: functional (FuR), psychosocial (PR) and financial (FR) | A positive relationship exists between perceived SI and CA (+) CA is inversely related to FuR associated with the perceived difficulty for the retailer to produce that product (+) The effect of SI on consumer attitude toward PLs is mediated by FuR associated with the perceived difficulty for the retailer to produce that product (+) CA is inversely related to the perceived PR associated with the usage of the product (+) The relationship between SI and CA is mediated by PR of usage (+) CA is inversely related to perceived FR associated with quality variance in the product category (+) The relationship between SI and CA is mediated by the perceived FR of usage (–) |

| Veloutsou et al. (2004) [91] | 1. Change of behavior toward PLs and supermarkets 2. Product attributes: (A) Brands (PLs and NBs) Perceived quality Value for money Appealing packaging Perceived taste (B) Brands (for PLs and NBs) Importance of price Quality Packaging Advertising Fulfillment of expectations (C) Country: factors same as in A point (D) Country: factors same as in B point 3. In-depth interviews with 5 consumers in each country | Consumers give similar emphasis to choice criteria when purchasing PL and NB products (–) Consumers evaluate PLs and NBs similarly (–) Greek (G) and Scottish (S) consumers have similar degree of familiarity with buying PLs (–) G and S consumers give similar emphasis (mental weighting) to choice criteria when purchasing PLs (–) G and S consumers evaluate the PLs (quality, value for money, appealing packaging, and taste) similarly (–) G and S consumers have similar readiness to purchase PLs (–) G and S consumers have similar readiness to change their behavior toward PLs (–) Habits toward the product category are influential on the willingness to buy PLs (+) PL choice criteria are influential on the willingness to buy PLs (+) Consumers’ demographic characteristics are influential on the willingness to buy PLs (+) Satisfaction with PLs from a certain supermarket will increase the consumers’ loyalty to that supermarket (+) |

| Miquel et al. (2002) [92] | PL product purchase: (1) Knowledge of the category (2) Perception of differences (3) Willingness to buy PL products | Greater knowledge of the category leads to prefer NBs (+) The greater the belief that differences exist between the different alternatives, the less likely the possibility of the individual buying PLs (–) |

| Vaidyanathan and Aggarwal (2000) [93] | Product attitude (PA) Quality perceptions (QP) Value perceptions (VP) Value consciousness (VC) | PA toward unfamiliar PL products with a familiar NB ingredient will be more favorable than that toward unfamiliar PL products with an unbranded ingredient (+) QP of unfamiliar PL products with a familiar NB ingredient will be more favorable than that of unfamiliar PL products with an unbranded ingredient (+) PA toward a familiar NB name (ingredient) will not be unfavorably affected by an association with an unfamiliar PL product (+) QP of a familiar NB name (ingredient) will not be unfavorably affected by an association with an unfamiliar PL product (+) |

| Author, Year | Key Findings | Practical Implications |

|---|---|---|

| Temmeman et al. (2021) [54] |

|

|

| Kadekova et al. (2020) [55] |

|

|

| Czeczotko et al. (2020) [43] |

|

|

| Anitha and Krishnan [57] |

|

|

| Košičiarová et al. (2020) [58] |

|

|

| Singh and Singhal (2020) [59] |

|

|

| Košičiarová et al. (2020) [56] |

|

|

| Prediger et al. (2019) [60] |

|

|

| Gómez-Suárez et al. (2019) [61] |

|

|

| Salazar-Ordóñez et al. (2018) [62] |

|

|

| Liu et al. (2018) [63] |

|

|

| Valaskova et al. (2018) [16] |

|

|

| Vázquez-Casielles and Cachero-Martinez (2018) [64] |

|

|

| Garczarek-Bąk (2018) [65] |

|

|

| Meliana (2018) [66] |

|

|