Changes in Package Sizes of Savoury Snacks through Exploration of Euromonitor and Industry Perspectives

Abstract

:1. Introduction

2. Methods

2.1. Trends in Sales Data of Savoury Snacks According to Package Size

2.1.1. Definitions and Data Collection for Savoury Snack Package Sizes

2.1.2. Data Analysis and Graphing

2.2. Food Industry Perspectives on Changing Savoury Snack Package Sizes

2.2.1. Inclusion and Exclusion Criteria for Search Strategy

2.2.2. Search and Screening Strategy for Articles, Reports and Other Literature

3. Results

3.1. Trends in Sales Sata of Savoury Snacks According to Package Size

3.1.1. Total Sales per Capita

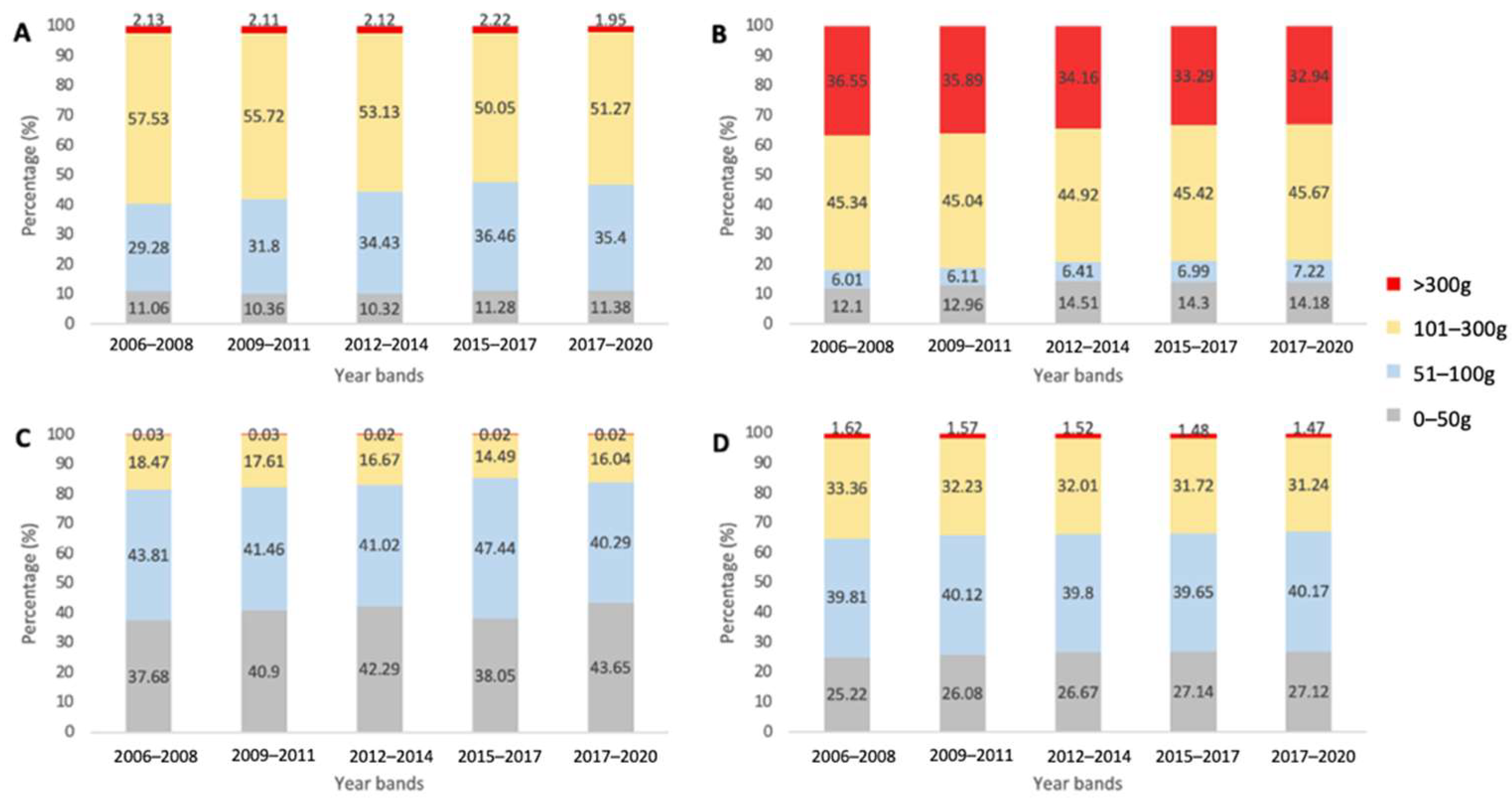

3.1.2. Proportion of Total Sales per Capita by Package Size Band

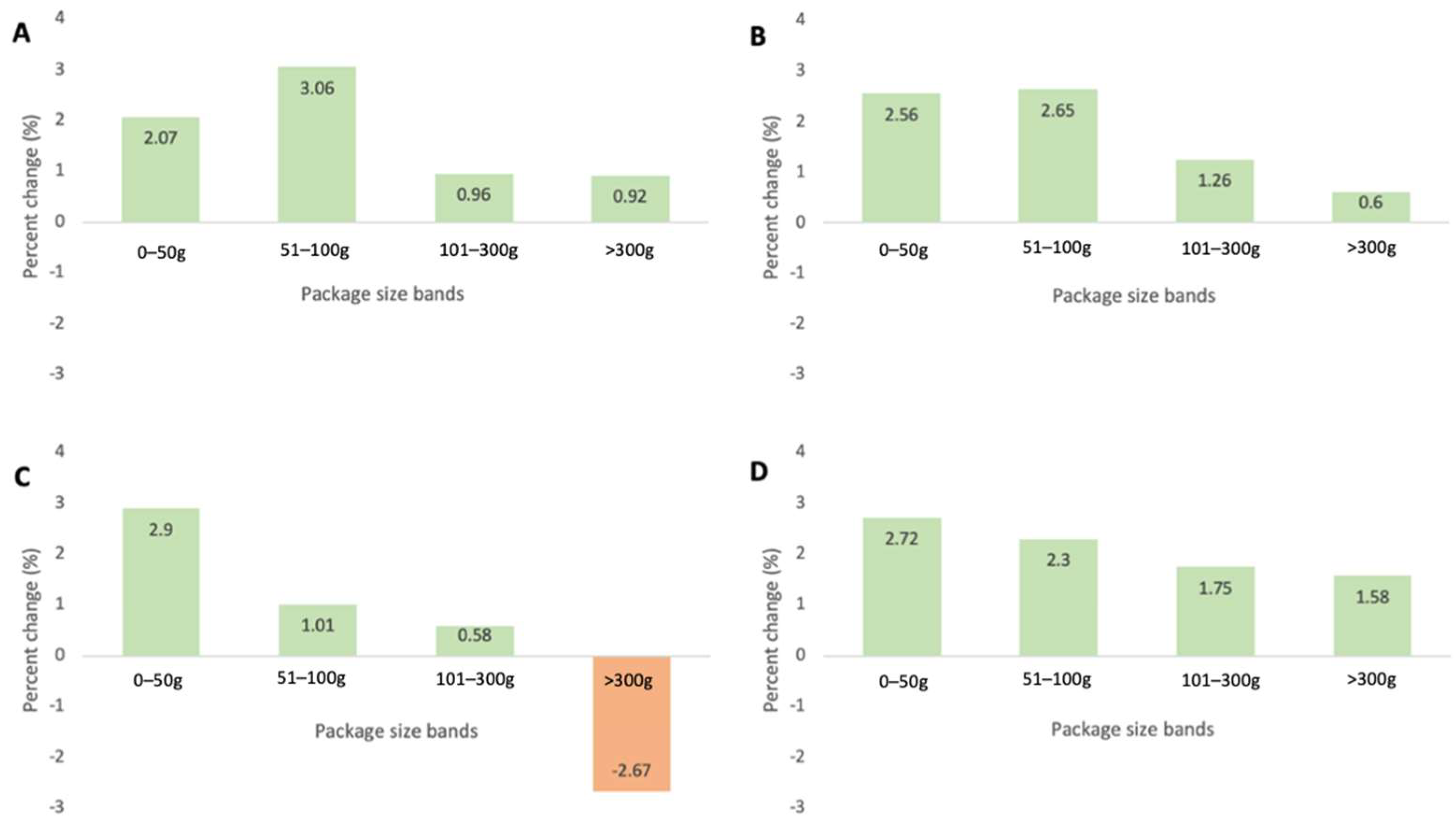

3.1.3. CAGR of Different Package Size Bands of Savoury Snacks

3.1.4. CAGR per Capita of Different Categories of Savoury Snacks

3.2. Food Industry Perspectives on Changing Savoury Snack Package Sizes

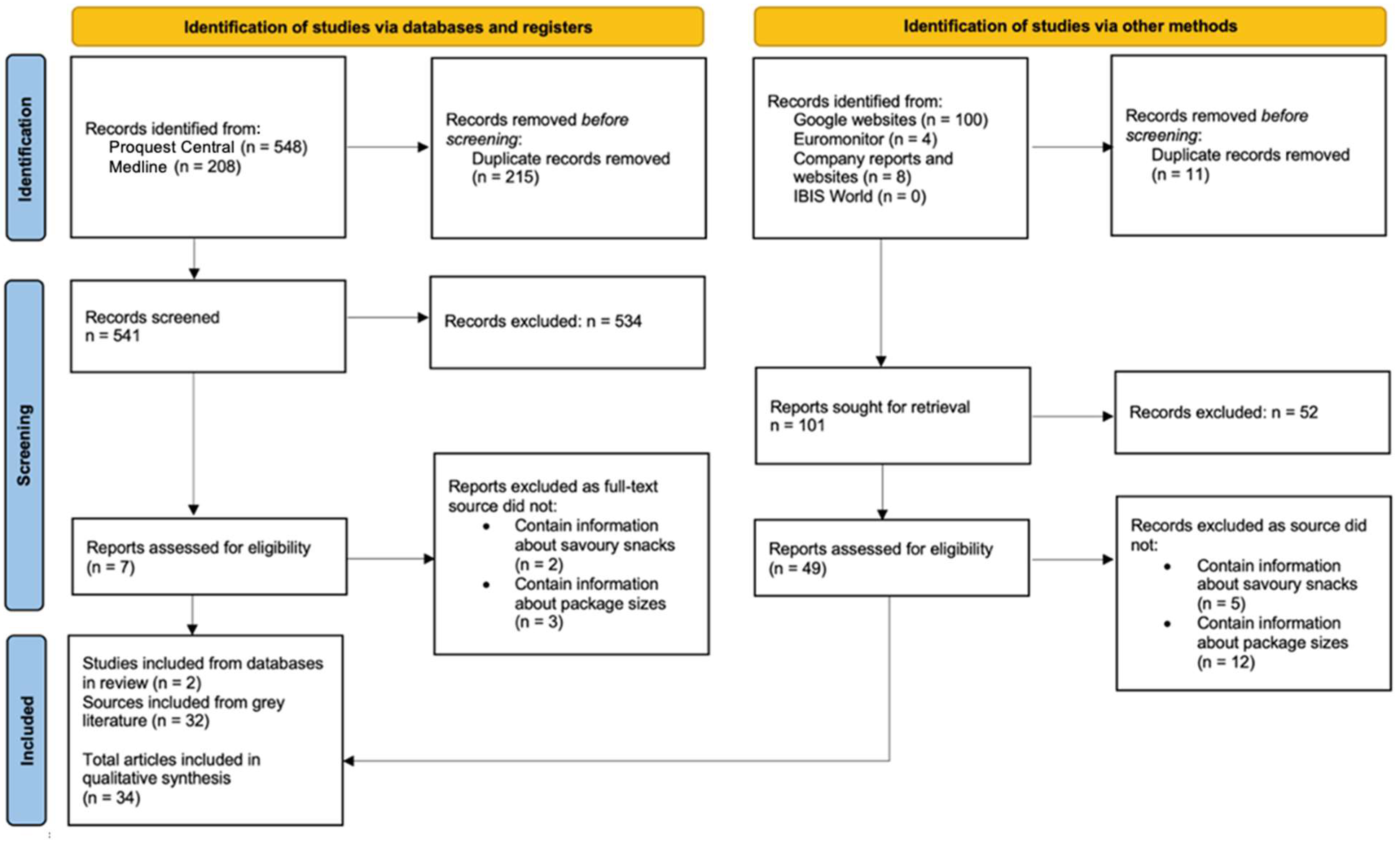

3.2.1. PRISMA Search and Screening Results

3.2.2. Food Industry Perspectives for Changes in Savoury Snack Package Sizes

4. Discussion

5. Strength and Limitations

6. Conclusions

Supplementary Materials

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Zheng, M.; Rangan, A.; Meertens, B.; Wu, J. Changes in Typical Portion Sizes of Commonly Consumed Discretionary Foods among Australian Adults from 1995 to 2011–2012. Nutrients 2017, 9, 577. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Chandon, P.; Ordabayeva, N. Supersize in One Dimension, Downsize in Three Dimensions: Effects of Spatial Dimensionality on Size Perceptions and Preferences. J. Mark. Res. 2009, 46, 739–753. [Google Scholar] [CrossRef] [Green Version]

- Marion, N. Food Politics: How the Food Industry Influences Nutrition and Health. California Studies in Food and Culture, 1st ed.; University of California Press: Auckland, CA, USA, 2002; Volume 1. [Google Scholar]

- Marchiori, D.; Papies, E.; Klein, O. The Portion Size Effect on Food Intake. An Anchoring and Adjustment Process. Appetite 2014, 81, 108–115. [Google Scholar] [CrossRef] [PubMed]

- Rolls, B.; Roe, L.; Kral, T.; Meengs, J.; Wall, D. Increasing the Portion Size of a Packaged Snack Increases Energy Intake in Men and Women. Appetite 2004, 42, 63–69. [Google Scholar] [CrossRef]

- Wang, D.; Jacquier, E.; Afeiche, M.; Eldridge, A. Snacking Patterns in Children: A Comparison between Australia, China, Mexico, and the US. Nutrients 2018, 10, 198. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Tajima, R.; Murakami, K.; Asakura, K.; Fujiwara, A.; Uechi, K.; Sugimoto, M.; Wang, H.C.; Masayasu, S.; Sasaki, S. Snacking in Japanese Nursery School Children Aged 3–6 Years: Its Characteristics and Contribution to Overall Dietary Intake. Public Health Nutr. 2020, 24, 1042–1051. [Google Scholar] [CrossRef] [PubMed]

- Hui, L.L.; Nelson, E.A.S. Dietary Characteristics of Hong Kong Young Children: Implications for Nutrition Education. Hong Kong J. Paediatr. 2006, 11, 255–262. [Google Scholar]

- Conick, H. Global Savory Snacks to Hit $166.6bn by 2020. Available online: https://www.bakeryandsnacks.com/Article/2015/08/04/Global-savory-snacks-to-hit-166.6bn-by-2020 (accessed on 25 August 2021).

- Global Savory Snacks Market by Product, by Distribution Channel, by Flavor, by Regional Outlook, COVID-19 Impact Analysis Report and Forecast, 2021-2027. Available online: https://www.researchandmarkets.com/reports/5411384/global-savory-snacks-market-by-product-by (accessed on 15 August 2021).

- Roy Morgan. Nearly 9 in 10 Australian Adults Eat Packaged Snacks in an Average Week. Available online: http://www.roymorgan.com/findings/8272-packaged-snack-foods-february-2020-202002030503#:~:text=Nearly%209%20in%2010%20Australian%20adults%20eat%20packaged%20snacks%20in%20an%20average%20week,Share%20This%20Link&text=New%20research%20from%20Roy%20Morgan,food%20in%20an%20average%20week (accessed on 25 August 2021).

- Statista. U.S. Snack Foods Industry—Statistics & Facts. Available online: https://www.statista.com/topics/1496/snack-foods/#topicHeader__wrapper (accessed on 25 August 2021).

- Statista. Snack Foods in Japan—Statistics and Facts. Available online: https://www.statista.com/topics/5181/snack-foods-in-japan/ (accessed on 25 August 2021).

- Euromonitor. Savoury Snacks in Hong Kong, China. Euromonitor International. Available online: https://www.euromonitor.com/savoury-snacks-in-hong-kong-china/report (accessed on 25 August 2021).

- Fitch Solutions. Asia Monitor—Australasia and South Pacific. Available online: https://store.fitchsolutions.com/all-products/asia-monitor-australasia-and-south-pacific (accessed on 25 August 2021).

- Jensen, C.; Fang, K.; Grech, A.; Rangan, A. Trends in Sales and Industry Perspectives of Package Sizes of Carbonates and Confectionery Products. Foods 2021, 10, 1071. [Google Scholar] [CrossRef] [PubMed]

- Robinson, E.; Kersbergen, I. Portion Size and Later Food Intake: Evidence on the “Normalizing” Effect of Reducing Food Portion Sizes. Am. J. Clin. Nutr. 2018, 107, 640–646. [Google Scholar] [CrossRef] [PubMed]

- Tricco, A.C.; Lillie, E.; Zarin, W.; O’Brien, K.K.; Colquhoun, H.; Levac, D.; Moher, D.; Peters, M.D.J.; Horsley, T.; Weeks, L.; et al. PRISMA Extension for Scoping Reviews (PRISMA-ScR): Checklist and Explanation. Ann. Intern. Med. 2018, 169, 467–473. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Fayet-Moore, F.; Peters, V.; McConnell, A.; Petocz, P.; Eldridge, A.L. Weekday Snacking Prevalence, Frequency, and Energy Contribution Have Increased While Foods Consumed During Snacking Have Shifted among Australian Children and Adolescents; 1995, 2007 and 2011-12 National Nutrition Surveys. Nutr. J. 2017, 16, 65. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Diep, C. Consumption Frequency of Snacks in Japan as of June 2020. Statista, 2021. Available online: https://www.statista.com/statistics/860462/japan-snack-food-consumption-frequency/ (accessed on 11 November 2021).

- Wang, Z.; Zhai, F.; Zhang, B.; Popkin, B.M. Trends in Chinese Snacking Behaviors and Patterns and the Social-Demographic Role between 1991 and 2009. Asia Pac. J. Clin. Nutr. 2018, 21, 253–262. [Google Scholar]

- U.S. Department of Agriculture. Snacking Patterns of U.S. Adults. US Department of Agriculture. Available online: https://www.ars.usda.gov/ARSUserFiles/80400530/pdf/dbrief/4_adult_snacking_0708.pdf (accessed on 11 November 2021).

- Ferdman, R.A. The Definitive Guide to How People around the World Snack. The Washington Post 2014. Available online: https://www.washingtonpost.com/news/wonk/wp/2014/09/30/the-wacky-world-of-international-snacking/ (accessed on 11 November 2021).

- Lorenzi, N. Sealing the Deal; Snack Food & Wholesale Bakery: Miami, FL, USA, 2007. [Google Scholar]

- Why Home Sizes Are Shrinking in Asia. Institutional Real Estate Inc. 2019. Available online: https://irei.com/news/home-sizes-shrinking-asia/ (accessed on 1 November 2021).

- Thompson, C. How Japanese Snacks Differ from American Snacks. Available online: https://www.bokksu.com/blogs/news/how-japanese-snacks-differ-from-american-snacks (accessed on 14 November 2021).

- Datta, Y. The U.S. Potato Chip Market: A Competitive Profile. JEPF 2020, 6, 96. [Google Scholar] [CrossRef]

- Calbee. Calbee Report; Calbee Inc.: Tokyo, Japan, 2020. [Google Scholar]

- Mondelez. 2020 Annual Report; Mondelez International Inc.: Chicago, IL, USA, 2020. [Google Scholar]

- Nuts.com. Veggie Chips. Available online: https://nuts.com/snacks/fruit-veggie-chips/veggie-chips.html (accessed on 14 May 2022).

- Frito-Lay North America In. Lay’s. Available online: https://www.lays.com/products/lays-classic-potato-chips (accessed on 14 May 2022).

- Euromonitor International. Savoury Snacks in Australia; Euromonitor International: London, UK, 2022. [Google Scholar]

- Euromonitor International. Savoury Snacks in Hong Kong; Euromonitor International: London, UK, 2022. [Google Scholar]

- International Food information Council. 2020 Food & Health Survey. Available online: https://foodinsight.org/2020-food-and-health-survey/ (accessed on 5 November 2021).

- Mondelez. 2021 Snacking Made Right Report. Available online: https://www.mondelezinternational.com/Snacking-Made-Right/Reporting-and-Disclosure (accessed on 5 November 2021).

- Wong, F. The Rise of Snackification in Asia-Pacific. Food and Beverage Insider. Available online: https://www.foodbeverageinsider.com/snacks/rise-snackification-asia-pacific (accessed on 5 November 2021).

- Mondelez. Mondelēz International Progresses ‘Snacking Made Right’ Agenda Towards 2025 Esg Targets. Available online: https://ir.mondelezinternational.com/node/25386/pdf (accessed on 5 November 2021).

- Lavoipierre, A. Tiny Teddies Downsizing by Arnott’s Has Consumers up in Arms. The World Today. Available online: https://www.abc.net.au/news/2017-07-27/tiny-teddies-downsize-part-of-wider-problem:-choice/8748712 (accessed on 5 November 2017).

- Kollmorgen, A. Shrinking Pack Sizes, CHOICE. Available online: https://www.choice.com.au/shopping/packaging-labelling-and-advertising/packaging/articles/shrinking-pack-sizes-081715 (accessed on 5 November 2021).

- Sutton, C. Pringles Lovers Furious after the Popular Potato Chips Brand Are Secretly Shrunk in Size. Daily Mail Australia. Available online: https://www.dailymail.co.uk/news/article-3646095/Pringles-lovers-furious-popular-potato-chips-brand-secretly-SHRUNK-size.html (accessed on 11 November 2021).

- Calbee. Calbee Report; Calbee Inc.: Tokyo, Japan, 2018. [Google Scholar]

- Calbee. Calbee Report; Calbee Inc.: Tokyo, Japan, 2019. [Google Scholar]

- Dussimon, K. Global Snacks Packaging: Staying Relevant through Pack Sizing Strategies; Euromonitor International: London, UK, 2018. [Google Scholar]

- Aptean. How the Pandemic Has Forced the Snack Industry to Evolve. Available online: https://www.foodware365.com/en/news/knowledge-base/2021/how-the-pandemic-has-forced-the-snack-industry-to-evolve/ (accessed on 6 October 2021).

- Wyatt, S.L. How America Eats: The Snacking Frenzy in 2021. Available online: https://www.iriworldwide.com/IRI/media/Library/How-America-Eats-The-Snacking-Frenzy-Webinar.pdf (accessed on 6 October 2021).

- Prosweets Cologne. Packaging Trends and the Influence of COVID-19. Available online: https://www.prosweets.com/blog/packaging-trends-2021.php (accessed on 6 October 2021).

- Day, B. The State of the Snack Industry in 2020. Available online: https://www.bakingbusiness.com/articles/51777-the-state-of-the-snack-industry-in-2020 (accessed on 6 October 2021).

- Benton, D. Portion Size: What We Know and What We Need to Know. Crit. Rev. Food Sci. Nutr. 2015, 55, 988–1004. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Lewis, M.; Lee, A. Effective Portion Size Strategies: A Rapid Review of Evidence; The Australian Prevention Partnership Centre: Sydney, Australia, 2017. [Google Scholar]

- Liu, Q.; Tam, L.Y.; Rangan, A. The Effect of Downsizing Packages of Energy-Dense, Nutrient-Poor Snacks and Drinks on Consumption, Intentions, and Perceptions—A Scoping Review. Nutrients 2022, 14, 9. [Google Scholar] [CrossRef] [PubMed]

- IGD. Working Group Report: Portion Size of Pre-Packaged Foods and Drink and Consumption Behaviour; Institute of Grocery Distribution (IGD): London, UK, 2012. [Google Scholar]

- Marteau, T.M.; Hollands, G.J.; Shemilt, I.; Jebb, S.A. Downsizing: Policy Options to Reduce Portion Sizes to Help Tackle Obesity. BMJ 2015, 351, 586. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Healthy Food Partnership—Industry Best Practice Guide Working Group. Available online: https://www.health.gov.au/committees-and-groups/healthy-food-partnership-industry-best-practice-guide-working-group (accessed on 20 October 2021).

- Barata-Cavalcanti, O.; Ty, D.; Novelli, W.; Costa, S.; Huang, T.K. Informing a Roadmap for Cross-Sectoral Collaboration on Portion Size Management as a National Strategy to Improve Population Nutrition—A Delphi Study. Obes. Sci. Pract. 2019, 5, 189–202. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Durand, M.; Petticrew, M.; Goulding, L.; Eastmure, E.; Knai, C.; Mays, N. An Evaluation of the Public Health Responsibility Deal: Informants’ Experiences and Views of the Development, Implementation and Achievements of a Pledge-Based, Public-Private Partnership to Improve Population Health in England. Health Policy 2015, 119, 1506–1514. [Google Scholar] [CrossRef] [PubMed]

- Snack Food and Wholesale Bakery. Variety Packs; Snack Food and Wholesale Bakery: Miami, FL, USA, 2009. [Google Scholar]

- Walsh, D. Snack Industry Overview. Pro Food World. Available online: https://www.profoodworld.com/PEC-2020/article/21202169/snack-industry-overview (accessed on 9 November 2020).

- Downey, R.; Smaller, I.S. Better as Global Packaging Growth Is Shaped by Variation in Pack Sizes. 2016. Available online: https://www.euromonitor.com/article/smaller-is-better-as-global-packaging-growth-is-shaped-by-variation-in-pack-sizes (accessed on 6 October 2021).

- Fruit Grower News, Produce-Based Snack Foods on the Rise. Available online: https://fruitgrowersnews.com/article/produce-based-snack-foods-on-the-rise/ (accessed on 5 November 2021).

- Convenience store, Doritos Unveils New Variant and Larger 230g Bags. Available online: https://www.conveniencestore.co.uk/products/doritos-unveils-new-variant-and-larger-230g-bags/575455.article (accessed on 6 October 2021).

- Roesler, N. Downsizing to Compete with Snacks. Food Business News. Available online: https://www.foodbusinessnews.net/articles/9333-downsizing-to-compete-with-snacks (accessed on 6 October 2021).

- Wojick, L. Hummus Plus Chicken Adds Smaller Snacking Sizes. Available online: https://www.winsightgrocerybusiness.com/fresh-food/hummus-plus-chicken-adds-smaller-snacking-sizes (accessed on 7 October 2021).

- Bhushan, R. Pepsico Cuts Sodium Content in Lay’s, Shrinks Pack Sizes of 2 Salty Snacks. The Economic Times (India). Available online: https://economictimes.indiatimes.com/industry/cons-products/fmcg/pepsico-india-to-reduce-salt-in-snacks-to-pilot-plant-based-packaging/articleshow/65043674.cms (accessed on 6 October 2021).

- Roesler, N. Demand for Unique Snacks Breeds Creativity in Single-Serve Packaging. Available online: https://www.bakingbusiness.com/articles/32696-demand-for-unique-snacks-breeds-creativity-in-single-serve-packaging (accessed on 6 October 2021).

- Berry, D. Experts Predict Post-Pandemic Flavor Trends. Available online: https://www.foodbusinessnews.net/articles/17626-experts-predict-post-pandemic-flavor-trends (accessed on 6 October 2021).

- Johnson, T. How the Latest in Food Processing and Packaging Technology Can Help Sustain Consumer Appetite for Savory Snacks. Snack Food & Wholesale Baker. Available online: https://www.snackandbakery.com/articles/94214-how-the-latest-in-food-processing-and-packaging-technology-can-help-sustain-consumer-appetite-for-savory-snacks (accessed on 5 November 2021).

- Ohl, D. Snack Food Industry Trends: Small Is the New Big in Snack Packaging, Viking Masek. Available online: https://vikingmasek.com/packaging-machine-resources/packaging-machine-blog/how-snackification-is-shrinking-food-packaging (accessed on 5 November 2021).

- Watson, E. Watch: Consumer Behavior Post the Coronavirus ‘Surge’. What to Expect over the Next Three to Four Weeks, Iri, Bcg. Available online: https://www.foodnavigator-usa.com/Article/2020/04/10/Consumer-behavior-post-the-coronavirus-surge-What-to-expect-over-the-next-three-to-four-weeks-IRI-BCG (accessed on 5 November 2021).

- Springer, J. Smaller Pack Sizes Drive Sales for Pepsico. Available online: https://www.cspdailynews.com/beverages/smaller-pack-sizes-drive-sales-pepsico (accessed on 5 November 2021).

- The Australian Government Department of Health. Guidelines for Healthy Foods and Drinks Supplied in School Canteens; The Australian Government Department of Health: Canberra, Australia, 2014.

- Euromonitor International. Savoury Snacks in the US; Euromonitor International: London, UK, 2021. [Google Scholar]

- Euromonitor International. Savoury Snacks in Japan; Euromonitor International: London, UK, 2021. [Google Scholar]

- PepsiCo. Annual Report 2021; PepsiCo: Westchester, TX, USA, 2021. [Google Scholar]

- Crawford, E. Rebranding Meat Jerky as Health Food Drives Sales as Category Nears Saturation, Ibisworld Reports. Available online: https://www.foodnavigator-usa.com/Article/2015/01/26/Rebranding-meat-jerky-as-health-food-drives-sales-IBISWorld-reports (accessed on 5 November 2021).

| 2006–2008 | 2009–2011 | 2012–2014 | 2015–2017 | 2018–2020 | Proportion of Increase over Time, % | |

|---|---|---|---|---|---|---|

| Australia | 229.66 | 239.93 | 259.36 | 277.31 | 286.33 | 24.68 |

| USA | 172.92 | 174.96 | 184.66 | 189.32 | 201.14 | 16.32 |

| Japan | 229.64 | 244.09 | 254.11 | 267.35 | 280.7 | 22.23 |

| Hong Kong | 64.49 | 73.59 | 79.65 | 83.76 | 86.45 | 34.05 |

| Increase in Package Size | Decrease in Package Size | |

|---|---|---|

| Country/region | ||

| USA | 6 | 14 |

| Australia | 1 | 4 |

| Hong Kong | 0 | 1 |

| Japan | 0 | 3 |

| Global | 2 | 2 |

| Reasons 1 | ||

| Health consciousness trends | 0 | 15 |

| Convenience | 1 | 9 |

| Portion control | 0 | 8 |

| COVID-19 snacking behaviour | 6 | 2 |

| Value for money | 5 | 0 |

| Increasing profit and product line expansion | 1 | 4 |

| Social sharing behaviour | 3 | 0 |

| Standardizing production and costs | 0 | 3 |

| International recommendations 2 | 0 | 2 |

| Snacking as meal replacements | 1 | 2 |

| Affordability issues | 0 | 2 |

| Corporate responsibility | 0 | 1 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Ng, H.M.E.; Xu, J.; Liu, Q.; Rangan, A. Changes in Package Sizes of Savoury Snacks through Exploration of Euromonitor and Industry Perspectives. Int. J. Environ. Res. Public Health 2022, 19, 9359. https://doi.org/10.3390/ijerph19159359

Ng HME, Xu J, Liu Q, Rangan A. Changes in Package Sizes of Savoury Snacks through Exploration of Euromonitor and Industry Perspectives. International Journal of Environmental Research and Public Health. 2022; 19(15):9359. https://doi.org/10.3390/ijerph19159359

Chicago/Turabian StyleNg, Hei Man Emily, Jessica Xu, Qingzhou Liu, and Anna Rangan. 2022. "Changes in Package Sizes of Savoury Snacks through Exploration of Euromonitor and Industry Perspectives" International Journal of Environmental Research and Public Health 19, no. 15: 9359. https://doi.org/10.3390/ijerph19159359

APA StyleNg, H. M. E., Xu, J., Liu, Q., & Rangan, A. (2022). Changes in Package Sizes of Savoury Snacks through Exploration of Euromonitor and Industry Perspectives. International Journal of Environmental Research and Public Health, 19(15), 9359. https://doi.org/10.3390/ijerph19159359