Assessing the Effects of a Tobacco Tax Reform on the Industry Price-Setting Strategy

Abstract

:1. Introduction

2. Materials and Methods

2.1. Data and Sources

2.2. Methodology

2.2.1. Price Elasticity Estimation

2.2.2. Tax Reform Simulations

2.2.3. Baseline Scenario

2.2.4. Scenario I—Minimum Price Adjustment

2.2.5. Scenario II—Average Pre-Reform Markup Price-Adjustment

2.2.6. Scenario III—Maximum Pre-Reform Markup Price-Adjustment

3. Results and Discussion

3.1. Price Elasticity of Cigarette Consumption

3.2. Tax Reform Simulations

3.3. Scenario I—Minimum Price Adjustment

3.4. Scenario II—Average Pre-Reform Markup Price-Adjustment

3.5. Scenario III—Maximum Pre-Reform Markup Price-Adjustment

4. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- São José, B.P.; Corrêa, R.D.A.; Malta, D.C.; Passos, V.M.D.A.; França, E.B.; Teixeira, R.A.; Camargos, P.A.M. Mortality and disability from tobacco-related diseases in Brazil, 1990 to 2015. Rev. Bras. Epidemiol. 2017, 20 (Suppl. 1), 75–89. [Google Scholar]

- Brazilian Health Ministry. Vigitel Brasil 2019: Vigilância de Fatores de Risco e Proteção para Doenças Crônicas por Inquérito Telefônico: Estimativas Sobre Frequência e Distribuição Sociodemográfica de Fatores de Risco e Proteção para Doenças Crônicas nas Capitais dos 26 Estados Brasileiros e no Distrito Federal em 2019; Ministério da Saúde: Brasília, Brazil, 2020. Available online: https://bvsms.saude.gov.br/bvs/publicacoes/vigitel_brasil_2019_vigilancia_fatores_risco.pdf (accessed on 7 August 2020).

- Szklo, A.S.; de Almeida, L.M.; Figueiredo, V.C.; Autran, M.; Malta, D.; Caixeta, R.; Szklo, M. A snapshot of the striking decrease in cigarette smoking prevalence in Brazil between 1989 and 2008. Prev. Med. 2012, 54, 162–167. [Google Scholar] [CrossRef] [PubMed]

- Szklo, A.S.; de Souza, M.C.; Szklo, M.; de Almeida, L.M. Smokers in Brazil: Who are they? Tob. Control 2016, 25, 564–570. [Google Scholar] [CrossRef] [PubMed]

- Divino, J.A.; Ehrl, P.; Candido, O.; Valadão, M. An Extended Cost-Benefit-Analysis of Tobacco Taxation in Brazil; Catholic University of Brasilia: Brasília, Brazil, 2019; Available online: https://ucb.catolica.edu.br/portal/wp-content/uploads/2020/05/Research-Report-UCB-UIC-Cost-Benefit-Analysis-Tobacco.pdf (accessed on 17 January 2021).

- Chaloupka, F.; Warner, K.E. The economics of smoking. In Handbook of Health Economics; Culyer, A.J., Newhouse, J.P., Eds.; Elsevier: Amsterdam, The Netherlands, 2000; Volume 1, pp. 1539–1627. [Google Scholar]

- Chaloupka, F.J.; Yurekli, A.; Fong, G.T. Tobacco Taxes as a Tobacco Control Strategy. Tob. Control 2012, 21, 172–180. [Google Scholar] [CrossRef] [Green Version]

- Freitas-Lemos, R.; Keith, D.R.; Tegge, A.N.; Stein, J.F.; Cummings, M.K.; Bickel, W.K. Estimating the Impact of Tobacco Parity and Harm Reduction Tax Proposals Using the Experimental Tobacco Marketplace. Int. J. Environ. Res. Public Health 2021, 18, 7835. [Google Scholar] [CrossRef] [PubMed]

- Brazilian Health Ministry. Vigitel Brasil 2018: Vigilância de Fatores de Risco e Proteção para Doenças Crônicas por Inquérito Telefônico: Estimativas Sobre Frequência e Distribuição Sociodemográfica de Fatores de Risco e Proteção Para Doenças Crônicas nas Capitais dos 26 Estados Brasileiros e no Distrito Federal em 2018; Ministério da Saúde: Brasília, Brazil, 2019. Available online: https://portalarquivos2.saude.gov.br/images/pdf/2019/julho/25/vigitel-brasil-2018.pdf (accessed on 7 August 2020).

- Szklo, A.S.; Iglesias, R.M.; Stoklosa, M.; Figueiredo, C.V.; Welding, K.; de Souza Junior, P.R.B.; Machado, A.T.; Martins, L.F.L.; Nascimento, H.; Drope, J. Cross-validation of four different survey methods used to estimate illicit cigarette consumption in Brazil. Tob. Control 2020, 1–8. [Google Scholar] [CrossRef]

- Iglesias, R.M.; Szklo, A.S.; Souza, M.C.; de Almeida, L.M. Estimating the size of illicit tobacco consumption in Brazil: Findings from the global adult tobacco survey. Tob. Control 2017, 26, 53–59. [Google Scholar] [CrossRef]

- Ballester, L.S.; Auchincloss, A.H.; Robinson, L.F.; Mayne, S.L. Exploring Impacts of Taxes and Hospitality Bans on Cigarette Prices and Smoking Prevalence Using a Large Dataset of Cigarette Prices at Stores 2001–2011, USA. Int. J. Environ. Res. Public Health 2017, 14, 318. [Google Scholar] [CrossRef] [Green Version]

- Scollo, M.; Younie, S.; Wakefield, M.; Freeman, J.; Icasinao, F. Impact of tobacco tax reforms on tobacco prices and tobacco use in Australia. Tob. Control 2003, 12 (Suppl. II), ii59–ii66. [Google Scholar] [CrossRef] [Green Version]

- López-Nicolás, Á.; Branston, J.R. Promoting convergence and closing gaps: A blueprint for the revision of the European Union Tobacco Tax Directive. Tob. Control 2021, 1–6. [Google Scholar]

- Licht, A.S.; Hyland, A.J.; O’Connor, R.J.; Chaloupka, F.J.; Borland, R.; Fong, G.T.; Nargis, N.; Cummings, K.M. How do price minimizing behaviors impact smoking cessation? Findings from the International Tobacco Control (ITC) Four Country Survey. Int. J. Environ. Res. Public Health 2011, 8, 1671–1691. [Google Scholar] [CrossRef] [Green Version]

- Betzner, A.; Boyle, R.G.; Claire, A.W. Price-Minimizing Behaviors in a Cohort of Smokers before and after a Cigarette Tax Increase. Int. J. Environ. Res. Public Health 2016, 13, 608. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Zhang, Z.; Zheng, R. The Impact of Cigarette Excise Tax Increases on Regular Drinking Behavior: Evidence from China. Int. J. Environ. Res. Public Health 2020, 17, 3327. [Google Scholar] [CrossRef]

- Fuchs, A.; Gonzalez Icaza, M.F.; Paz, D.P. Distributional Effects of Tobacco Taxation: A Comparative Analysis; Policy Research Working Paper Series, 8805; The World Bank: Washington, DC, USA, 2019; Available online: https://openknowledge.worldbank.org/handle/10986/31534 (accessed on 7 June 2021).

- Salti, N.; Chaaban, J.; Nakkash, R.; Alaouie, H. The effect of taxation on tobacco consumption and public revenues in Lebanon. Tob. Control 2015, 24, 77–81. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Shang, C.; Chaloupka, F.J.; Fong, G.T.; Thompson, M.; O’Connor, R.J. The association between tax structure and cigarette price variability: Findings from the ITC Project. Tob. Control 2015, 24 (Suppl. 3), iii88–iii93. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Rodriguez-Iglesias, G.; Blecher, E. Tax Structures are Key in Raising Tobacco Taxes & Revenues. A Tobacconomics Policy Brief; Health Policy Center, Institute for Health Research and Policy, University of Illinois: Chicago, IL, USA, 2018; Available online: https://tobacconomics.org/files/research/469/Tobacco-Tax-Structures-Policy-Brief_FINAL-Web-Version.pdf (accessed on 13 May 2021).

- WHO (World Health Organization). Technical Manual on Tobacco Tax Administration. Reprinted in 2011; World Health Organization: Geneva, Switzerland, 2011; Available online: https://tobacconomics.org/files/research/469/Tobacco-Tax-Structures-Policy-Brief_FINAL-Web-Version.pdf (accessed on 17 July 2021).

- Blecher, E.; Drope, J. The rewards, risks and challenges of regional tobacco tax harmonization. Tob. Control 2014, 23, e7–e11. [Google Scholar] [CrossRef] [PubMed]

- Goodchild, M.; Thu, L.T.; The Son, D.; Tuan, L.N.; Totanes, R.; Paul, J.; Park, K. Modelling the expected impact of cigarette tax and price increases under Vietnam’s excise tax law 2015–2020. Tob. Control 2020, 1–5. [Google Scholar] [CrossRef]

- Hu, T.W.; Mao, Z.; Shi, J.; Chen, W. The role of taxation in tobacco control and its potential economic impact in China. Tob. Control 2010, 19, 58–64. [Google Scholar] [CrossRef]

- Hu, X.; Wang, Y.; Huang, J.; Zheng, R. Cigarette Affordability and Cigarette Consumption among Adult and Elderly Chinese Smokers: Evidence from A Longitudinal Study. Int. J. Environ. Res. Public Health 2019, 16, 4832. [Google Scholar] [CrossRef] [Green Version]

- López-Nicolás, Á.; Cobacho, M.B.; Fernández, E. The Spanish tobacco tax loopholes and their consequences. Tob. control 2013, 22, e21–e24. [Google Scholar] [CrossRef] [Green Version]

- Brazilian Institute of Geography and Statistics (IBGE). National Household Sample Survey (PNAD) 2008. Available online: https://ftp.ibge.gov.br/Trabalho_e_Rendimento/Pesquisa_Nacional_por_Amostra_de_Domicilios_anual/2008/Documentacao_pnad2008/Dados.zip (accessed on 14 July 2020).

- Brazilian Institute of Geography and Statistics (IBGE). Pesquisa Nacional de Saúde (PNS) 2013: Percepção do Estado de Saúde, Estilos de Vida e Doenças Crônicas Brasil, Grandes Regiões e Unidades da Federação; IBGE: Rio de Janeiro, Brazil, 2014. Available online: https://ftp.ibge.gov.br/PNS/2013/Microdados/Dados/PNS_2013.zip (accessed on 12 June 2020).

- Population Per State—Brazilian Institute of Geography and Statistics—IBGE. Available online: https://www.ibge.gov.br/estatisticas/sociais/populacao.html (accessed on 10 July 2020).

- Cigarette Tax Revenue at National Level, Federal Revenue Service (Brazil). Available online: https://www.gov.br/receitafederal/pt-br (accessed on 12 July 2020).

- Gallet, C.A.; List, J.A. Cigarette demand: A meta-analysis of elasticities. Health Econ. 2003, 12, 821–835. [Google Scholar] [CrossRef] [PubMed]

- Ribeiro, L.; Pinto, V. Accelerating Effective Tobacco Taxes in Brazil: Trends and Perspectives. Red Sur Country Studies Series Tobacco Taxes in Latin America, Country Study n. 3. 2019. Available online: https://tobacconomics.org/files/research/555/EP3_FUNCEX_2019_comp_0.pdf (accessed on 3 June 2021).

- Andreeva, T.; Kharchenko, N.M.; Krasovsky, K.; Korol, N.; Lea, V.; Lee, J.; Warren, C.; Zakhozha, V. Global Adult Tobacco Survey (GATS) Ukraine 2010. Report Ukraine 2010; Ministry of Health of Ukraine: Kiev, Ukraine, 2010. [Google Scholar]

- Little, M.; Ross, H.; Bakhturidze, G.; Kachkachishvili, I. Illicit tobacco trade in Georgia: Prevalence and perceptions. Tob. Control 2020, 29 (Suppl. 4), 227–233. [Google Scholar] [CrossRef]

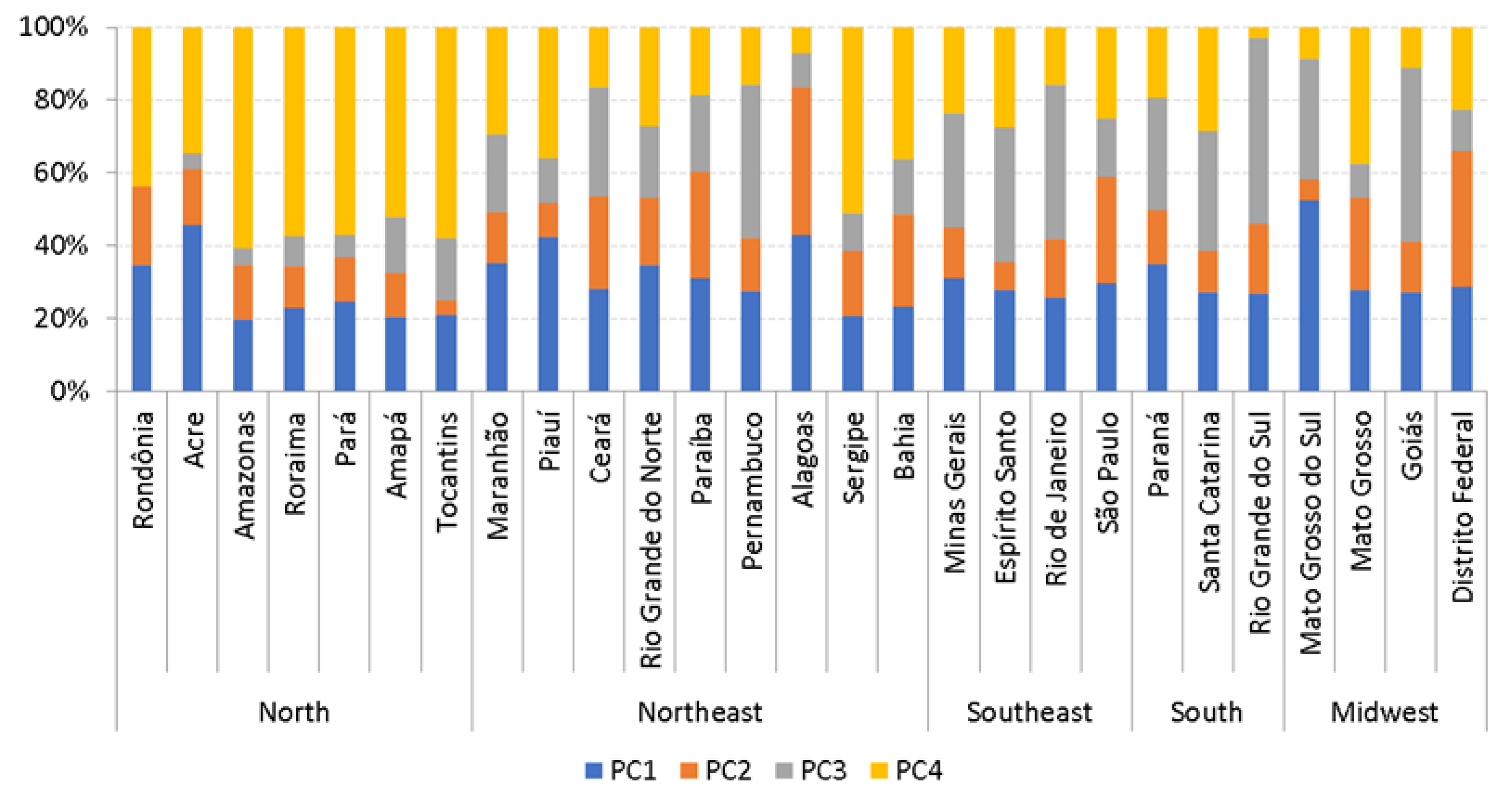

| Region | Prevalence | Total | |||

|---|---|---|---|---|---|

| PC1 | PC2 | PC3 | PC4 | ||

| Northeast | −0.26 | −0.86 | −0.68 | −0.62 | −0.57 |

| North | −0.24 | −0.73 | −0.68 | −0.50 | −0.48 |

| Southeast | −0.24 | −0.56 | −0.68 | −0.46 | −0.42 |

| South | −0.21 | −0.51 | −0.66 | −0.40 | −0.39 |

| Midwest | −0.23 | −0.69 | −0.67 | −0.42 | −0.47 |

| Feature | Baseline | Scenario I | Scenario II | Scenario III |

|---|---|---|---|---|

| Tax collection (BRL Bi per year) | 17.75 | 23.20 | 21.92 | 20.53 |

| Change (Baseline ref) | --- | 30.7% | 23.5% | 15.7% |

| PC2: Low price brands (BRL) | 5.38 | 8.40 | 10.03 | 11.06 |

| Tax burden | 78.3% | 92.3% | 87.3% | 84.9% |

| Share in tax collection | 24.06% | 21.89% | 19.63% | 18.1% |

| Consumption (% change) | --- | −38.1% | −58.6% | −71.50% |

| PC3: Medium price (BRL) | 7.90 | 8.40 | 13.15 | 14.87 |

| Tax burden | 69.4% | 92.3% | 81.2% | 78.9% |

| Share in tax collection | 35.75% | 37.28% | 37.56% | 38.21% |

| Consumption (% change) | --- | −3.2% | −33.5% | −44.6% |

| PC4: Premium brands (BRL) | 12.84 | 15.23 | 19.42 | 23.38 |

| Tax burden | 62.2% | 78.5% | 74.8% | 72.5% |

| Share in tax collection | 40.19% | 40.83% | 42.81% | 43.7% |

| Consumption (% change) | --- | −9.6% | −25.5% | −40.50% |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Divino, J.A.; Ehrl, P.; Candido, O.; Valadao, M.A.P. Assessing the Effects of a Tobacco Tax Reform on the Industry Price-Setting Strategy. Int. J. Environ. Res. Public Health 2021, 18, 10376. https://doi.org/10.3390/ijerph181910376

Divino JA, Ehrl P, Candido O, Valadao MAP. Assessing the Effects of a Tobacco Tax Reform on the Industry Price-Setting Strategy. International Journal of Environmental Research and Public Health. 2021; 18(19):10376. https://doi.org/10.3390/ijerph181910376

Chicago/Turabian StyleDivino, Jose Angelo, Philipp Ehrl, Osvaldo Candido, and Marcos Aurelio Pereira Valadao. 2021. "Assessing the Effects of a Tobacco Tax Reform on the Industry Price-Setting Strategy" International Journal of Environmental Research and Public Health 18, no. 19: 10376. https://doi.org/10.3390/ijerph181910376

APA StyleDivino, J. A., Ehrl, P., Candido, O., & Valadao, M. A. P. (2021). Assessing the Effects of a Tobacco Tax Reform on the Industry Price-Setting Strategy. International Journal of Environmental Research and Public Health, 18(19), 10376. https://doi.org/10.3390/ijerph181910376