The Impact of Cigarette Excise Tax Increases on Regular Drinking Behavior: Evidence from China

Abstract

1. Introduction

2. Materials and Methods

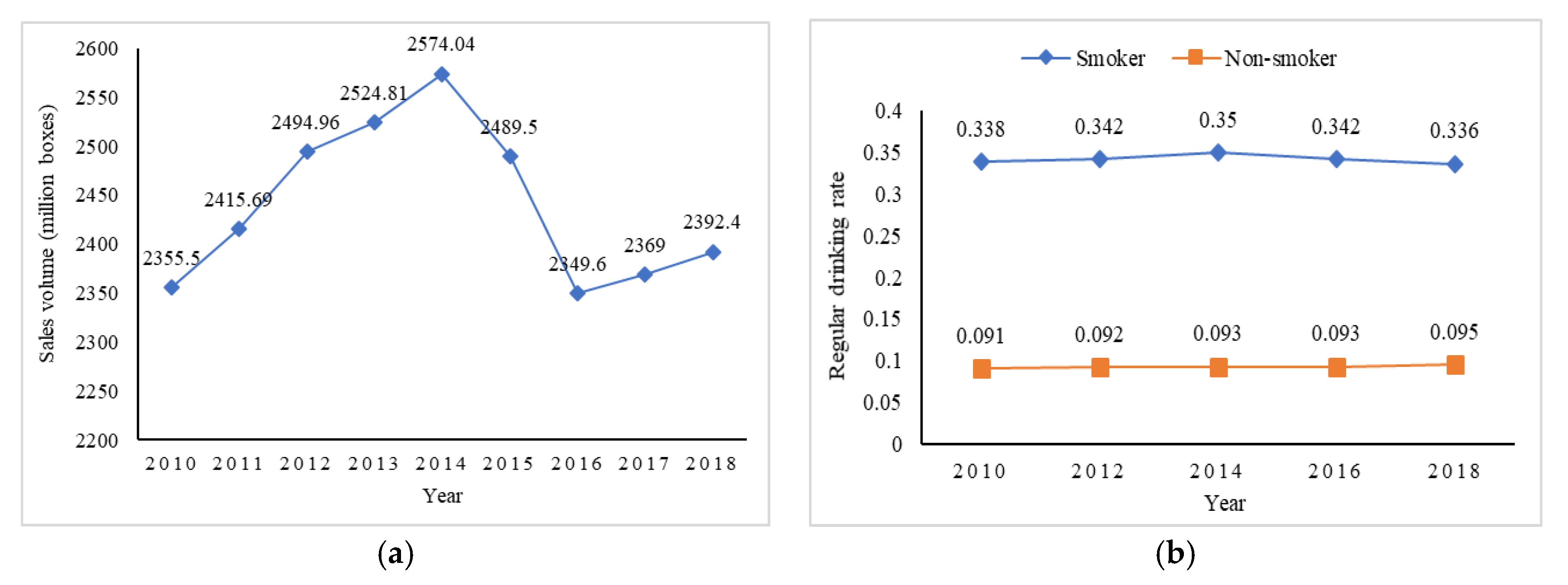

2.1. Background

2.2. Data

2.3. Methods

2.3.1. Theoretical Analysis of the Model Setting

2.3.2. Baseline Model

2.3.3. Model for the Mechanism Test

3. Results

3.1. t-Test for Data before and after the PSM

3.2. Estimation Results of PSM-DID

3.3. Mechanism Analysis

3.4. Heterogeneity Analysis

4. Discussion

5. Conclusions

Author Contributions

Funding

Conflicts of Interest

References

- Ali, H.M.; James, S.M.; Donna, F.S.; Julie, L.G. Actual Causes of Death in the United States, 2000. JAMA 2004, 291, 1238–1245. [Google Scholar]

- Harwood, H. Updating Estimates of the Economic Costs of Alcohol Abuse in the United States Estimates, Update Methods, and Data; National Institute on Alcohol Abuse and Alcoholism: Rockville, MD, USA, 2000. [Google Scholar]

- Pelucchi, C.; Gallus, S.; Garavello, W.; Bosetti, C.; La Vecchia, C. Cancer risk associated with alcohol and tobacco use: Focus on upper aero-digestive tract and liver. Alcohol Res. Health 2006, 29, 193–198. [Google Scholar] [PubMed]

- Centers for Disease Control and Prevention. Annual smoking-attributable mortality, years of potential life lost, and economic costs—United States, 1995–1999. MMWR Morb. Mortal Wkly Rep. 2002, 51, 300–302. [Google Scholar]

- Medicine, I.O. Improving the Quality Ofhealth Care for Mental and Substance-Use Conditions; National Academy Press: Washington, DC, USA, 2006. [Google Scholar]

- Goodchild, M.; Zheng, R. Early assessment of China’s 2015 tobacco tax increase. Bull. World Health Organ. 2018, 96, 506–512. [Google Scholar] [CrossRef] [PubMed]

- Bask, M.; Melkersson, M. Rationally addicted to drinking and smoking? Appl. Econ. 2004, 36, 373–381. [Google Scholar] [CrossRef]

- Lisa, C.; Jenny, W. Cannabis, Alcohol and Cigarettes: Substitutes or Complements. Econ. Rec. 2001, 77, 19–34. [Google Scholar]

- Krauss, M.J.; Cavazos-Rehg, P.A.; Plunk, A.D.; Bierut, L.J.; Grucza, R.A. Effects of state cigarette excise taxes and smoke-free air policies on state per capita alcohol consumption in the United States, 1980 to 2009. Alcohol. Clin. Exp. Res. 2014, 38, 2630–2638. [Google Scholar] [CrossRef]

- Lee, J.M. The synergistic effect of cigarette taxes on the consumption of cigarettes, alcohol and betel nuts. BMC Public Health 2007, 121, 1–7. [Google Scholar] [CrossRef]

- Pierpaolo, P.; Silvia, T. Addiction and interaction between alcohol and tobacco consumption. Empir. Econ. 2009, 37, 1–23. [Google Scholar]

- Young-Wolff, K.C.; Hyland, A.J.; Desai, R.; Sindelar, J.; Pilver, C.E.; McKee, S.A. Smoke-free policies in drinking venues predict transitions in alcohol use disorders in a longitudinal U.S. sample. Drug Alcohol Depend. 2013, 128, 214–221. [Google Scholar] [CrossRef]

- Rajeev, K.G.; Mathew, J.M. The Interdependence of Cigarette and Liquor Demand. South. Econ. Assoc. 1995, 62, 9. [Google Scholar]

- Sandra, L.D.; Amy, E.S. Cigarettes and Alcohol: Substitutes or Complements? NBER Working Paper No. 7535; National Bureau of Economic Research: Cambridge, MA, USA, 2000. [Google Scholar]

- Picone, G.A.; Sloan, F.; Trogdon, J.G. The effect of the tobacco settlement and smoking bans on alcohol consumption. Health Econ. 2004, 13, 1063–1080. [Google Scholar] [CrossRef] [PubMed]

- Avram, A.; Nicolescu, A.-C.; Avram, C.D.; Dan, R.L. Financial Communication in the Context of Corporate Social Responsibility Growth. Amfiteatru Econ. 2019, 21, 623. [Google Scholar] [CrossRef]

- Cetin, T. The effect of taxation and regulation on cigarette smoking: Fresh evidence from Turkey. Health Policy 2017, 121, 1288–1295. [Google Scholar] [CrossRef] [PubMed]

- Heckman, J.J.; Ichimura, H.; Todd, P. Matching as an Econometric Evaluation Estimator. Rev. Econ. Stud. 1998, 65, 261–294. [Google Scholar] [CrossRef]

- Beck, T.; Levine, R.; Levkov, A. Big Bad Banks? The Winners and Losers from Bank Deregulation in the United States. J. Financ. 2010, 5, 1637–1667. [Google Scholar] [CrossRef]

- Marianne, B.; Esther, D.; Sendhil, M. How Much Should We Trust Differences-in-Differences Estimates? Q. J. Econ. 2004, 119, 1–27. [Google Scholar]

- James, C.A.; Fernando, E.-W. Epidemiologic analysis of alcohol and tobacco use. Alcohol Res. Health 2000, 24, 1–11. [Google Scholar]

- Lin, H.; Chang, C.; Liu, Z.; Zheng, Y. Subnational smoke-free laws in China. Tob. Induc. Dis. 2019, 17, 1–9. [Google Scholar] [CrossRef]

- Bobo, J.K.; Husten, C. Sociocultural influences on smoking and drinking. Alcohol Res. Health 2000, 24, 1–18. [Google Scholar]

- Grant, B.F.; Hasin, D.S.; Chou, S.P.; Stinson, F.S.; Dawson, D.A. Nicotine Dependence and Psychiatric Disorders in the United States. Arch. Gen. Psychiatry 2004, 61, 1107–1115. [Google Scholar] [CrossRef] [PubMed]

- Chinese Center for Disease Controland Prevention, China Adult Tobacco Survey Report. 2015. Available online: http://www.tcrc.org.cn/UploadFiles/2016-03/318/201603231215175500.pdf (accessed on 28 July 2019).

- Pampel, F.C. Cigarette use and the narrowing sex differential in mortality. Popul. Dev. Rev. 2002, 28, 77–104. [Google Scholar] [CrossRef]

- Silles, M. The causal effect of schooling on smoking behavior. Econ. Educ. Rev. 2015, 48, 102–116. [Google Scholar] [CrossRef]

- Mirowsky, J.; Ross, C.E. Education, learned effectiveness and health1. Lond. Rev. Educ. 2005, 3, 205–220. [Google Scholar] [CrossRef]

- Aristei, D.; Pieroni, L. Addiction, social interactions and gender differences in cigarette consumption. Empirica 2008, 36, 245–272. [Google Scholar] [CrossRef]

- Aristei, D.; Pieroni, L. Habits, Complementarities and Heterogeneity in Alcohol and Tobacco Demand: A Multivariate Dynamic Model. Oxf. Bull. Econ. Stat. 2010, 72, 428–457. [Google Scholar] [CrossRef]

- Ferrer, R.; Orehek, E.; Scheier, M.F.; O’Connell, M.E. Cigarette tax rates, behavioral disengagement, and quit ratios among daily smokers. J. Econ. Psychol. 2018, 66, 13–21. [Google Scholar] [CrossRef]

- Nesson, E. Heterogeneity in Smokers‘ Responses to Tobacco Control Policies. Health Econ. 2017, 26, 206–225. [Google Scholar] [CrossRef]

- Deborah, L.M.; Dominic, H.; Pebbles, F.; Sharon, R.; Constance, M.H. Unintended consequences of cigarette price changes for alcohol drinking behaviors across age groups_ evidence from pooled cross sections. Subst. Abus. Treat. Prev. Policy 2012, 7, 1–10. [Google Scholar]

| Variables | N | Mean | Std. Dev. | Min | Max |

|---|---|---|---|---|---|

| Regulardrinker | 71,570 | 0.164 | 0.370 | 0 | 1 |

| Currentsmoker | 71,570 | 0.289 | 0.453 | 0 | 1 |

| Tax | 71,570 | 0.4 | 0.490 | 0 | 1 |

| Daysmokenum | 71,402 | 4.739 | 9.248 | 0 | 100 |

| Smokefree | 71,570 | 0.058 | 0.233 | 0 | 1 |

| Smokeyear | 71,570 | 9.017 | 15.518 | 0 | 76 |

| Male | 71,570 | 0.469 | 0.499 | 0 | 1 |

| Age | 71,570 | 49.752 | 13.769 | 16 | 94 |

| Urban | 71,216 | 0.456 | 0.498 | 0 | 1 |

| Marriage | 71,569 | 0.884 | 0.320 | 0 | 1 |

| Lnincome | 30,590 | 8.902 | 1.827 | 0 | 14.4 |

| Edu | 71,549 | 2.525 | 1.281 | 1 | 7 |

| Chronic | 71,557 | 0.177 | 0.382 | 0 | 1 |

| Part A. Test the Balancing Property for Each Observed Covariate | |||||||

| Variable | Unmatched | Mean | Bias% | t-Test | |||

| Matched | Smoker | Non-Smoker | Bias% | Reductbias% | t-Value | p-Value | |

| Gender | U | 0.965 | 0.247 | 216.9 | 80.47 | 0.000 | |

| M | 0.965 | 0.965 | 0.0 | 100.0 | −0.00 | 1.000 | |

| Age | U | 45.984 | 45.392 | 4.8 | 2.00 | 0.045 | |

| M | 45.987 | 46.116 | −1.0 | 78.2 | −0.38 | 0.706 | |

| Age2 | U | 2259.1 | 2223.1 | 3.2 | 1.32 | 0.187 | |

| M | 2259.8 | 2272.1 | −1.1 | 65.9 | −0.39 | 0.695 | |

| Edu | U | 2.619 | 2.537 | 6.7 | 2.76 | 0.006 | |

| M | 2.619 | 2.631 | −1.0 | 85.3 | −0.36 | 0.715 | |

| Lnincome | U | 8.925 | 8.428 | 33.9 | 13.73 | 0.000 | |

| M | 8.926 | 8.941 | −1.0 | 97.0 | −0.40 | 0.69 | |

| Urban | U | 0.406 | 0.454 | −9.7 | −4.13 | 0.000 | |

| M | 0.406 | 0.420 | −2.9 | 70.0 | −1.04 | 0.300 | |

| Marriage | U | 0.889 | 7.601 | −5.2 | −2.26 | 0.024 | |

| M | 0.889 | 7.671 | 1.2 | 77.2 | 0.40 | 0.686 | |

| Chronic | U | 0.118 | 0.156 | −10.9 | −4.51 | 0.000 | |

| M | 0.118 | 0.100 | 5.4 | 50.6 | 2.09 | 0.037 | |

| Part B. Test the overall balance | |||||||

| Sample | LR χ2 | p > χ2 | Meanbias | Medbias | |||

| Unmatched | 4482.79 | 0.000 | 36.4 | 8.2 | |||

| Matched | 6.27 | 0.617 | 1.7 | 1.1 | |||

| Variable | (1) | (2) | (3) | (4) | (5) |

|---|---|---|---|---|---|

| Regulardrinker | Regulardrinker | Regulardrinker | Regulardrinker | Regulardrinker | |

| Tax × Currentsmoker | 0.133 ** | −0.00466 | −0.754 ** | −0.746 ** | −0.747 ** |

| (0.0672) | (0.200) | (0.354) | (0.355) | (0.359) | |

| Smokeyear | 0.0478 | 0.0943 * | 0.0903 * | 0.0861 * | |

| (0.0345) | (0.0493) | (0.0495) | (0.0501) | ||

| Smokefree | 0.720 | 1.081 * | 1.059 | 1.032 | |

| (0.455) | (0.654) | (0.654) | (0.661) | ||

| Lnincome | 0.0816 *** | 0.0582 ** | 0.0616 ** | ||

| (0.0287) | (0.0306) | (0.0310) | |||

| Age | 0.0218 | 0.0579 | |||

| (0.437) | (0.443) | ||||

| Age2 | −0.00170 *** | −0.00198 *** | |||

| (0.000601) | (0.000631) | ||||

| Edu | 0.0389 | ||||

| (0.160) | |||||

| Urban | −0.409 | ||||

| (0.266) | |||||

| Marriage | −0.484 * | ||||

| (0.263) | |||||

| Chronic | −0.476 *** | ||||

| (0.147) | |||||

| Individual Fixed | N | Y | Y | Y | Y |

| Time Fixed | N | Y | Y | Y | Y |

| N | 15815 | 6565 | 2549 | 2549 | 2530 |

| LR chi2 | 3.92 | 16.06 | 21.54 | 29.77 | 46.20 |

| Prob > chi2 | 0.0478 | 0.0246 | 0.0058 | 0.0009 | 0.0000 |

| Variable | (1) | (2) | (3) | (4) | (5) |

|---|---|---|---|---|---|

| Regulardrinker | Regulardrinker | Regulardrinker | Regulardrinker | Regulardrinker | |

| Daysmokenum | 0.0904 *** | 0.0364 *** | 0.0400 *** | 0.0390 *** | 0.0394 *** |

| (0.0027) | (0.0033) | (0.0052) | (0.0053) | (0.0054) | |

| Tax | −0.0443 | −0.0388 | 0.0689 | 0.937 | 0.443 |

| (0.0380) | (0.0661) | (0.108) | (1.416) | (1.469) | |

| Daysmokenum × Tax | 0.0058 * | 0.0041 | −0.0163 ** | −0.0154 ** | −0.0162 ** |

| (0.0031) | (0.0036) | (0.00667) | (0.00670) | (0.0068) | |

| Smokeyear | 0.00362 | 0.0300 | 0.0301 | 0.0296 | |

| (0.0129) | (0.0206) | (0.0207) | (0.0210) | ||

| Smokefree | 0.164 | 0.301 | 0.302 | 0.312 | |

| (0.268) | (0.424) | (0.424) | (0.426) | ||

| Lnincome | 0.0738 *** | 0.0570 ** | 0.0583 ** | ||

| (0.0244) | (0.0255) | (0.0257) | |||

| Age | −0.0266 | 0.0607 | |||

| (0.181) | (0.187) | ||||

| Age2 | −0.000911 ** | −0.00120 *** | |||

| (0.000389) | (0.000411) | ||||

| Edu | −0.00901 | ||||

| (0.100) | |||||

| Urban | −0.418 ** | ||||

| (0.176) | |||||

| Marriage | −0.504 *** | ||||

| (0.174) | |||||

| Chronic | −0.388 *** | ||||

| (0.0924) | |||||

| Individual Fixed | N | Y | Y | Y | Y |

| Time Fixed | N | Y | Y | Y | Y |

| N | 71570 | 18390 | 6083 | 6083 | 5984 |

| LR chi2 | 143 | 90.01 | 89.25 | 95.15 | 125.01 |

| Prob > chi2 | 0.0000 | 0.0000 | 0.0000 | 0.0000 | 0.0000 |

| Variable | Gender | Age Groups | |||

|---|---|---|---|---|---|

| (1) | (2) | (3) | (4) | (5) | |

| Male | Female | 16–34 | 35–54 | 55– | |

| Currentsmoker × Tax | −0.780 ** | 0.119 | −0.0808 | −1.143 *** | −0.644 |

| (0.3630) | (0.0869) | (1.000) | (0.024) | (0.744) | |

| Control Variables | Y | Y | Y | Y | Y |

| Individual Fixed | Y | Y | Y | Y | Y |

| Time Fixed | Y | Y | Y | Y | Y |

| N | 2394 | 135 | 398 | 1065 | 594 |

| Wald chi2 | 47.56 | 5.41 | 18.54 | 37.72 | 25.10 |

| Prob > chi2 | 0.0000 | 0.0914 | 0.1832 | 0.0051 | 0.0336 |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Zhang, Z.; Zheng, R. The Impact of Cigarette Excise Tax Increases on Regular Drinking Behavior: Evidence from China. Int. J. Environ. Res. Public Health 2020, 17, 3327. https://doi.org/10.3390/ijerph17093327

Zhang Z, Zheng R. The Impact of Cigarette Excise Tax Increases on Regular Drinking Behavior: Evidence from China. International Journal of Environmental Research and Public Health. 2020; 17(9):3327. https://doi.org/10.3390/ijerph17093327

Chicago/Turabian StyleZhang, Zili, and Rong Zheng. 2020. "The Impact of Cigarette Excise Tax Increases on Regular Drinking Behavior: Evidence from China" International Journal of Environmental Research and Public Health 17, no. 9: 3327. https://doi.org/10.3390/ijerph17093327

APA StyleZhang, Z., & Zheng, R. (2020). The Impact of Cigarette Excise Tax Increases on Regular Drinking Behavior: Evidence from China. International Journal of Environmental Research and Public Health, 17(9), 3327. https://doi.org/10.3390/ijerph17093327