Application of Managed Entry Agreements for Innovative Therapies in Different Settings and Combinations: A Feasibility Analysis

Abstract

1. Introduction

2. Materials and Methods

2.1. Systematic Literature Review

2.2. Data Extraction

2.3. Categorization and Clustering of Managed Entry Agreements

2.4. Feasibility Analysis

3. Results

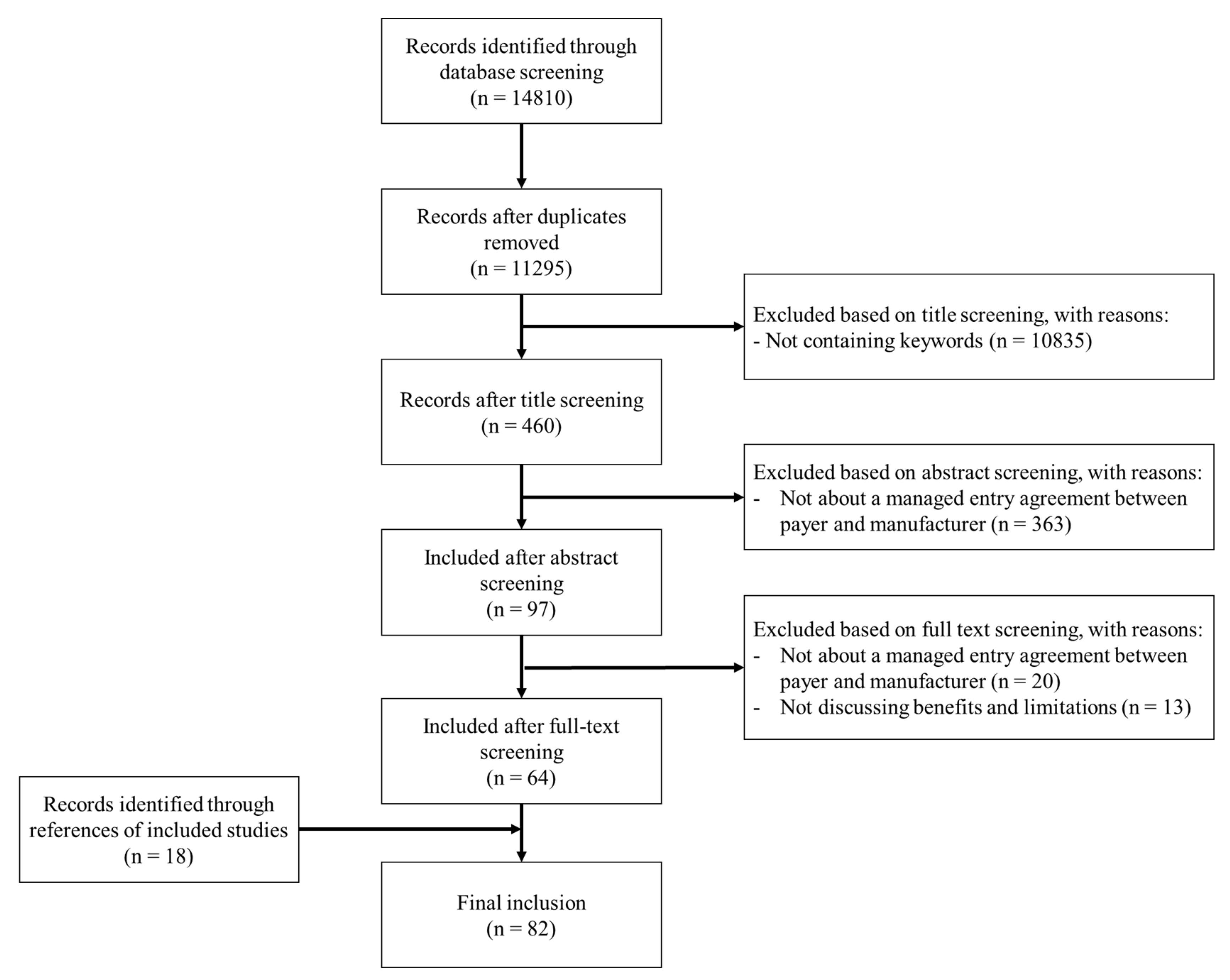

3.1. Literature Inclusion

3.2. Clustered Managed Entry Agreements and Their Benefits and Limitations

3.3. Feasibility Assessment

4. Discussion

4.1. Clustering of Agreements

4.2. Implementation

4.3. Higher- vs. Lower-Income Settings

4.4. Limitations

5. Conclusions

Author Contributions

Funding

Conflicts of Interest

Disclaimer

Appendix A. Search Strategy

Appendix A.1. PubMed Search String

Appendix A.2. Embase Search String

Appendix A.3. Keywords Used in Title/Abstract Screening

Appendix B. Study Inclusion Flowchart

References

- Wenzl, M. Performance-based managed entry agreements for new medicines in OECD countries and EU member states. OECD Health Work. Pap. 2019. [Google Scholar] [CrossRef]

- Hanna, E.; Toumi, M.; Dussart, C.; Borissov, B.; Dabbous, O.; Badora, K.; Auquier, P. Funding breakthrough therapies: A systematic review and recommendation. Health Policy 2018, 122, 217–229. [Google Scholar] [CrossRef] [PubMed]

- Hollis, A. Sustainable Financing of Innovative Therapies: A Review of Approaches. Pharmacoeconomics 2016, 34, 971–980. [Google Scholar] [CrossRef] [PubMed]

- Carlson, J.J.; Sullivan, S.D.; Garrison, L.P.; Neumann, P.J.; Veenstra, D.L. Linking payment to health outcomes: A taxonomy and examination of performance-based reimbursement schemes between healthcare payers and manufacturers. Health Policy 2010, 96, 179–190. [Google Scholar] [CrossRef] [PubMed]

- Adamski, J.; Godman, B.; Ofierska-Sujkowska, G.; Osińska, B.; Herholz, H.; Wendykowska, K.; Laius, O.; Jan, S.; Sermet, C.; Zara, C.; et al. Risk sharing arrangements for pharmaceuticals: Potential considerations and recommendations for European payers. BMC Health Serv. Res. 2010, 10, 153. [Google Scholar] [CrossRef]

- Hanna, E.; Rémuzat, C.; Auquier, P.; Toumi, M. Advanced therapy medicinal products: Current and future perspectives. J. Mark. Access Health Policy 2016, 4. [Google Scholar] [CrossRef]

- Jørgensen, J.; Kefalas, P. Annuity payments can increase patient access to innovative cell and gene therapies under England’s net budget impact test. J. Mark. Access Health Policy 2017, 5, 1355203. [Google Scholar] [CrossRef]

- MIT’s NEW Drug Development ParadIGmS (NEWDIGS) Program. Financing and Reimbursement of Cures in the US. Designing Financial Solutions to Ensure Affordable Access to Cures. An Overview of the MIT FoCUS Project; White Paper MIT; MIT: Cambridge, MA, USA, 2018. [Google Scholar]

- Allen, N.; Pichler, F.; Wang, T.; Patel, S.; Salek, S. Development of archetypes for non-ranking classification and comparison of European National Health Technology Assessment systems. Health Policy 2013, 113, 305–312. [Google Scholar] [CrossRef]

- Liberati, A.; Altman, D.G.; Tetzlaff, J.; Mulrow, C.D.; Gøtzsche, P.C.; Ioannidis, J.P.; Clarke, M.; Devereaux, P.; Kleijnen, J.; Moher, D. The PRISMA statement for reporting systematic reviews and meta-analyses of studies that evaluate health care interventions: Explanation and elaboration. J. Clin. Epidemiol. 2009, 62, e1–e34. [Google Scholar] [CrossRef]

- Gesundheit Österreich GmbH. WHO Collaborating Centre for Pharmaceutical Pricing and Reimbursement Policies. Pharmaceutical Pricing and Reimbursement Information. Glossary. Available online: https://ppri.goeg.at/ppri-glossary (accessed on 7 July 2020).

- Holtorf, A.-P.; Gialama, F.; Wijaya, K.E.; Kaló, Z. External Reference Pricing for Pharmaceuticals—A Survey and Literature Review to Describe Best Practices for Countries with Expanding Healthcare Coverage. Value Health Reg. Issues 2019, 19, 122–131. [Google Scholar] [CrossRef]

- Gandjour, A. Reference Pricing and Price Negotiations for Innovative New Drugs. Pharmacoeconomics 2012, 31, 11–14. [Google Scholar] [CrossRef] [PubMed][Green Version]

- Messori, A. Application of the Price–Volume Approach in Cases of Innovative Drugs Where Value-Based Pricing is Inadequate: Description of Real Experiences in Italy. Clin. Drug Investig. 2016, 36, 599–603. [Google Scholar] [CrossRef] [PubMed]

- Gonçalves, F.R.; Santos, S.; Silva, C.; Sousa, G. Risk-sharing agreements, present and future. Ecancermedicalscience 2018, 12, 823. [Google Scholar] [CrossRef] [PubMed]

- Barry, M.; Tilson, L. Reimbursement of new high cost drugs–funding the unfundable? Ir. Med. J. 2010, 103, 133. [Google Scholar] [PubMed]

- Zaric, G.S.; O’Brien, B.J. Analysis of a pharmaceutical risk sharing agreement based on the purchaser’s total budget. Health Econ. 2005, 14, 793–803. [Google Scholar] [CrossRef] [PubMed]

- Charbonneau, M.; Gagnon, M.-A. Surviving niche busters: Main strategies employed by Canadian private insurers facing the arrival of high cost specialty drugs. Health Policy 2018, 122, 1295–1301. [Google Scholar] [CrossRef]

- Aaltonen, K.; Ragupathy, R.; Tordoff, J.M.; Reith, D.; Norris, P. The Impact of Pharmaceutical Cost Containment Policies on the Range of Medicines Available and Subsidized in Finland and New Zealand. Value Health 2010, 13, 148–156. [Google Scholar] [CrossRef]

- McGuire, A.; Drummond, M.; Martin, M.; Justo, N. End of life or end of the road? Are rising cancer costs sustainable? Is it time to consider alternative incentive and funding schemes? Expert Rev. Pharm. Outcomes Res. 2015, 15, 599–605. [Google Scholar] [CrossRef]

- Mahalatchimy, A. Reimbursement of cell-based regenerative therapy in the UK and France. Med. Law Rev. 2016, 24, 234–258. [Google Scholar] [CrossRef]

- Morgan, S.G.; Vogler, S.; Wagner, A.K. Payers’ experiences with confidential pharmaceutical price discounts: A survey of public and statutory health systems in North America, Europe, and Australasia. Health Policy 2017, 121, 354–362. [Google Scholar] [CrossRef]

- Morgan, S.G.; Daw, J.; Thomson, P. International Best Practices for Negotiating ‘Reimbursement Contracts’ with Price Rebates from Pharmaceutical Companies. Health Aff. 2013, 32, 771–777. [Google Scholar] [CrossRef] [PubMed][Green Version]

- Morgan, S.G.; Bathula, H.S.; Moon, S. Pricing of pharmaceuticals is becoming a major challenge for health systems. BMJ 2020, 368, l4627. [Google Scholar] [CrossRef]

- Morgan, S.G.; Thomson, P.A.; Daw, J.R.; Friesen, M.K. Canadian policy makers’ views on pharmaceutical reimbursement contracts involving confidential discounts from drug manufacturers. Health Policy 2013, 112, 248–254. [Google Scholar] [CrossRef] [PubMed]

- Persson, U.; Jonsson, B. The End of the International Reference Pricing System? Appl. Health Econ. Health Policy 2015, 14, 1–8. [Google Scholar] [CrossRef] [PubMed][Green Version]

- Bach, P.B.; Trusheim, M. The US Government Should Buy Gilead for $156 Billion to Save Money on Hepatitis C. Online, Forbes. 2017. Available online: www.forbes.com/sites/sciencebiz/2017/01/17/the-us-government-should-buy-gilead-for-156-billion-tosave-money-on-hepatitis-c/ (accessed on 7 July 2020).

- Carr, D.R.; Bradshaw, S.E. Gene therapies: The challenge of super-high-cost treatments and how to pay for them. Regen. Med. 2016, 11, 381–393. [Google Scholar] [CrossRef] [PubMed]

- Lybecker, K.M.; Freeman, R.A. Funding pharmaceutical innovation through direct tax credits. Health Econ. Policy Law 2007, 2, 267–284. [Google Scholar] [CrossRef] [PubMed]

- Baran, A.; Czech, M.; Kooiker, C.; Hołownia, M.; Cegielska, J.S. Bridging East with West of Europe—A comparison of orphan drugs policies in Poland, Russia and the Netherlands. Acta Pol. Pharm. Drug Res. 2018, 75, 1409–1422. [Google Scholar] [CrossRef]

- Persson, U.; Svensson, J.; Pettersson, B. Authors’ reply to Godman and Gustafsson: “A new reimbursement system for innovative pharmaceuticals combining value-based and free market pricing”. Appl. Health Econ. Health Policy 2013, 11, 83–84. [Google Scholar] [CrossRef]

- Godman, B.; Gustafsson, L.L. A New Reimbursement System for Innovative Pharmaceuticals Combining Value-Based and Free Market Pricing. Appl. Health Econ. Health Policy 2013, 11, 79–82. [Google Scholar] [CrossRef][Green Version]

- Persson, U.; Persson, P.U.; Svensson, J.; Pettersson, B. A New Reimbursement System for Innovative Pharmaceuticals Combining Value-Based and Free Market Pricing. Appl. Health Econ. Health Policy 2012, 10, 217–225. [Google Scholar] [CrossRef]

- Bekelman, J.E.; Hahn, S.M. Reference Pricing with Evidence Development: A Way forward for Proton Therapy. J. Clin. Oncol. 2014, 32, 1540–1542. [Google Scholar] [CrossRef]

- Hertzman, P.; Miller, P.; Tolley, K. An assessment of innovative pricing schemes for the communication of value: Is price discrimination and two-part pricing a way forward? Expert Rev. Pharm. Outcomes Res. 2017, 18, 5–12. [Google Scholar] [CrossRef] [PubMed]

- Fellows, G.K.; Hollis, A. Funding innovation for treatment for rare diseases: Adopting a cost-based yardstick approach. Orphanet J. Rare Dis. 2013, 8, 180. [Google Scholar] [CrossRef] [PubMed]

- Hasan, S.S.; Kow, C.S.; Dawoud, D.; Mohamed, O.; Baines, D.; Babar, Z.-U.-D. Pharmaceutical Policy Reforms to Regulate Drug Prices in the Asia Pacific Region: The Case of Australia, China, India, Malaysia, New Zealand, and South Korea. Value Health Reg. Issues 2019, 18, 18–23. [Google Scholar] [CrossRef]

- Tu, H.T.; Samuel, D.R. Limited options to manage specialty drug spending. Res. Brief 2012, 22, 1–13. [Google Scholar]

- Danzon, P.M.; Towse, A. Differential Pricing for Pharmaceuticals: Reconciling Access, R&D and Patents. Int. J. Health Care Financ. Econ. 2003, 3, 183–205. [Google Scholar]

- Drummond, M.; Jonsson, B.; Rutten, F.; Stargardt, T. Reimbursement of pharmaceuticals: Reference pricing versus health technology assessment. Eur. J. Health Econ. 2010, 12, 263–271. [Google Scholar] [CrossRef] [PubMed][Green Version]

- Hughes, D.A. Value-based pricing: Incentive for innovation or zero net benefit? Pharmacoeconomics 2011, 29, 731–735. [Google Scholar] [CrossRef] [PubMed]

- Claxton, K. OFT, VBP: QED? Health Econ. 2007, 16, 545–558. [Google Scholar] [CrossRef]

- Faulkner, E.; Annemans, L.; Garrison, L.; Helfand, M.; Holtorf, A.-P.; Hornberger, J.; Hughes, D.; Malone, D.; Payne, K.; Li, T.; et al. Challenges in the Development and Reimbursement of Personalized Medicine—Payer and Manufacturer Perspectives and Implications for Health Economics and Outcomes Research: A Report of the ISPOR Personalized Medicine Special Interest Group. Value Health 2012, 15, 1162–1171. [Google Scholar] [CrossRef]

- Sorenson, C.; Drummond, M.; Burns, L.R. Evolving Reimbursement and Pricing Policies for Devices in Europe and the United States Should Encourage Greater Value. Health Aff. 2013, 32, 788–796. [Google Scholar] [CrossRef] [PubMed][Green Version]

- Claxton, K.; Briggs, A.; Buxton, M.J.; Culyer, A.J.; McCabe, C.; Walker, S.; Sculpher, M.J. Value based pricing for NHS drugs: An opportunity not to be missed? BMJ 2008, 336, 251–254. [Google Scholar] [CrossRef] [PubMed]

- Fuller, R.L.; Goldfield, N. Paying for On-Patent Pharmaceuticals. J. Ambul. Care Manag. 2016, 39, 143–149. [Google Scholar] [CrossRef] [PubMed][Green Version]

- Persson, U.; Norlin, J.M. Multi-indication and Combination Pricing and Reimbursement of Pharmaceuticals: Opportunities for Improved Health Care through Faster Uptake of New Innovations. Appl. Health Econ. Health Policy 2018, 16, 157–165. [Google Scholar] [CrossRef]

- Zettler, P.J.; Brown, E.C.F. The challenge of paying for cost-effective cures. Am. J. Manag. Care 2017, 23, 62–64. [Google Scholar]

- Kiernan, F. The future of pharmacoeconomic policy—Does value-based pricing really have a role? J. Pharm. Health Serv. Res. 2016, 7, 5–9. [Google Scholar] [CrossRef]

- Danzon, P.M. Affordability Challenges to Value-Based Pricing: Mass Diseases, Orphan Diseases, and Cures. Value Health 2018, 21, 252–257. [Google Scholar] [CrossRef]

- Koerber, F.; Rolauffs, B.; Rogowski, W. Early evaluation and value-based pricing of regenerative medicine technologies. Regen. Med. 2013, 8, 747–758. [Google Scholar] [CrossRef]

- Edlin, R.; Hall, P.; Wallner, K.; McCabe, C. Sharing Risk between Payer and Provider by Leasing Health Technologies: An Affordable and Effective Reimbursement Strategy for Innovative Technologies? Value Health 2014, 17, 438–444. [Google Scholar] [CrossRef]

- Pauly, M. The Questionable Economic Case for Value-Based Drug Pricing in Market Health Systems. Value Health 2017, 20, 278–282. [Google Scholar] [CrossRef]

- Dolgin, E. Bringing down the cost of cancer treatment. Nat. Cell Biol. 2018, 555, S26–S29. [Google Scholar] [CrossRef] [PubMed]

- Persson, U.; Willis, M.; Ödegaard, K. A case study of ex ante, value-based price and reimbursement decision-making: TLV and rimonabant in Sweden. Eur. J. Health Econ. 2009, 11, 195–203. [Google Scholar] [CrossRef] [PubMed]

- Dranitsaris, G.; Dorward, K.; Owens, R.; Schipper, H. What is a new drug worth? An innovative model for performance-based pricing. Eur. J. Cancer Care 2014, 24, 313–320. [Google Scholar] [CrossRef] [PubMed]

- Tinghög, G.; Carlsson, P.; Lyttkens, C.H. Individual responsibility for what?—A conceptual framework for exploring the suitability of private financing in a publicly funded health-care system. Health Econ. Policy Law 2010, 5, 201–223. [Google Scholar] [CrossRef] [PubMed]

- Tempero, M. Serving “a la CAR-T”: Value-Based Pricing and Gene Therapy. J. Natl. Compr. Cancer Netw. 2017, 15, 1179. [Google Scholar] [CrossRef] [PubMed]

- Clopes, A.; Gasol, M.; Cajal, R.; Segú, L.; Crespo, R.; Mora, R.; Simon, S.; Cordero, L.A.; Calle, C.; Gilabert, A.; et al. Financial consequences of a payment-by-results scheme in Catalonia: Gefitinib in advanced EGFR-mutation positive non-small-cell lung cancer. J. Med. Econ. 2016, 20, 1–7. [Google Scholar] [CrossRef]

- Barlow, J.; Bens, C.; Brent, T.; Ciarametaro, M.; Conway, C.; Redell, J.F.; George, S.; Harman, M.; Henry, B.; Hoffman, D.; et al. AMCP Partnership Forum: Designing Benefits and Payment Models for Innovative High-Investment Medications. J. Manag. Care Spéc. Pharm. 2019, 25, 156–162. [Google Scholar] [CrossRef]

- Marsden, G.; Towse, A.; Pearson, S.; Dreitlein, B.; Henshall, C. Gene Therapy: Understanding the Science, Assessing the Evidence, and Paying for Value; Research Papers; Office of Health Economics: London, UK, 2017; Volume 48, p. 001811. [Google Scholar]

- Villar, F.A.; Rodríguez-Ibeas, R.; Juárez-Castelló, C.A. Personalized Medicine and Pay for Performance: Should Pharmaceutical Firms be Fully Penalized when Treatment Fails? Pharmacoeconomics 2018, 36, 733–743. [Google Scholar] [CrossRef]

- Towse, A.; Garrison, L.P. Can’t Get No Satisfaction? Will Pay for Performance Help? Pharmacoeconomics 2010, 28, 93–102. [Google Scholar] [CrossRef]

- Raftery, J. Multiple sclerosis risk sharing scheme: A costly failure. BMJ 2010, 340, c1672. [Google Scholar] [CrossRef] [PubMed]

- Schaffer, S.K.; Messner, D.; Mestre-Ferrandiz, J.; Tambor, E.; Towse, A. Paying for Cures: Perspectives on Solutions to the “Affordability Issue”. Value Health 2018, 21, 276–279. [Google Scholar] [CrossRef] [PubMed]

- Goldman, R.S. Payment for Performance: In Sickness and in Health. For Better or for Worse? Blood Purif. 2005, 24, 28–32. [Google Scholar] [CrossRef] [PubMed]

- Seeley, E.; Kesselheim, A.S. Outcomes-Based Pharmaceutical Contracts: An Answer to High U.S. Drug Spending? Issue Briefs Commonw. Fund 2017, 2017, 1–8. [Google Scholar]

- Aviki, E.M.; Schleicher, S.M.; Mullangi, S.; Matsoukas, K.; Korenstein, D. Alternative payment and care-delivery models in oncology: A systematic review. Cancer 2018, 124, 3293–3306. [Google Scholar] [CrossRef] [PubMed]

- Navarria, A.; Drago, V.; Gozzo, L.; Longo, L.; Mansueto, S.; Pignataro, G.; Drago, F. Do the Current Performance-Based Schemes in Italy Really Work? “Success Fee”: A Novel Measure for Cost-Containment of Drug Expenditure. Value Health 2015, 18, 131–136. [Google Scholar] [CrossRef] [PubMed][Green Version]

- Martelli, N.; Brink, H.V.D. Special funding schemes for innovative medical devices in French hospitals: The pros and cons of two different approaches. Health Policy 2014, 117, 1–5. [Google Scholar] [CrossRef]

- Willis, M.; Persson, U.; Zoellner, Y.; Gradl, B. Reducing Uncertainty in Value-Based Pricing Using Evidence Development Agreements. Appl. Health Econ. Health Policy 2010, 8, 377–386. [Google Scholar] [CrossRef]

- Hoffman, J.M.; Gambhir, S.S.; Kelloff, G.J. Regulatory and Reimbursement Challenges for Molecular Imaging. Radiology 2007, 245, 645–660. [Google Scholar] [CrossRef]

- Martelli, N.; Brink, H.V.D.; Borget, I. New French Coverage with Evidence Development for Innovative Medical Devices: Improvements and Unresolved Issues. Value Health 2016, 19, 17–19. [Google Scholar] [CrossRef]

- Trueman, P.; Grainger, D.L.; Downs, K.E. Coverage with Evidence Development: Applications and issues. Int. J. Technol. Assess. Health Care 2010, 26, 79–85. [Google Scholar] [CrossRef] [PubMed]

- Kleinke, J.; McGee, N. Breaking the Bank: Three Financing Models for Addressing the Drug Innovation Cost Crisis. Am. Health Drug Benefits 2015, 8, 118–126. [Google Scholar] [PubMed]

- Salzman, R.; Cook, F.; Hunt, T.; Malech, H.L.; Reilly, P.; Foss-Campbell, B.; Barrett, D. Addressing the Value of Gene Therapy and Enhancing Patient Access to Transformative Treatments. Mol. Ther. 2018, 26, 2717–2726. [Google Scholar] [CrossRef] [PubMed]

- Montazerhodjat, V.; Weinstock, D.M.; Lo, A.W. Buying cures versus renting health: Financing health care with consumer loans. Sci. Transl. Med. 2016, 8, 327ps6. [Google Scholar] [CrossRef][Green Version]

- Brennan, T.A.; Wilson, J.M. The special case of gene therapy pricing. Nat. Biotechnol. 2014, 32, 874–876. [Google Scholar] [CrossRef]

- Cherla, A.; Howard, N.; Mossialos, E. The ‘Netflix plus model’: Can subscription financing improve access to medicines in low- and middle-income countries? Health Econ. Policy Law 2020. [Google Scholar] [CrossRef]

- Goldman, D.P.; Jena, A.B.; Philipson, T.; Sun, E. Drug Licenses: A New Model for Pharmaceutical Pricing. Health Aff. 2008, 27, 122–129. [Google Scholar] [CrossRef][Green Version]

- Carlson, J.J.; Chen, S.; Garrison, L.P. Performance-Based Risk-Sharing Arrangements: An Updated International Review. Pharmacoeconomics 2017, 35, 1063–1072. [Google Scholar] [CrossRef]

- Dabbous, M.; Chachoua, L.; Caban, A.; Toumi, M. Managed Entry Agreements: Policy Analysis from the European Perspective. Value Health 2020, 23, 425–433. [Google Scholar] [CrossRef]

- Makady, A.; Van Veelen, A.; De Boer, A.; Hillege, H.; Klungel, O.; Goettsch, W. Implementing managed entry agreements in practice: The Dutch reality check. Health Policy 2019, 123, 267–274. [Google Scholar] [CrossRef]

- Vreman, R.A.; Naci, H.; Goettsch, W.G.; Mantel-Teeuwisse, A.K.; Schneeweiss, S.G.; Leufkens, H.G.M.; Kesselheim, A.S. Decision Making under Uncertainty: Comparing Regulatory and Health Technology Assessment Reviews of Medicines in the United States and Europe. Clin. Pharmacol. Ther. 2020, 108, 350–357. [Google Scholar] [CrossRef] [PubMed]

- Vreman, R.A.; Mantel-Teeuwisse, A.K.; Hövels, A.M.; Leufkens, H.G.; Goettsch, W.G. Differences in Health Technology Assessment Recommendations among European Jurisdictions: The Role of Practice Variations. Value Health 2020, 23, 10–16. [Google Scholar] [CrossRef] [PubMed]

- Vreman, R.A.; Heikkinen, I.; Schuurman, A.; Sapede, C.; Garcia, J.L.; Hedberg, N.; Athanasiou, D.; Grueger, J.; Leufkens, H.G.; Goettsch, W.G. Unmet Medical Need: An Introduction to Definitions and Stakeholder Perceptions. Value Health 2019, 22, 1275–1282. [Google Scholar] [CrossRef] [PubMed]

- Moon, S.; Erickson, E. Universal Medicine Access through Lump-Sum Remuneration—Australia’s Approach to Hepatitis C. N. Engl. J. Med. 2019, 380, 607–610. [Google Scholar] [CrossRef] [PubMed]

- Bouvy, J.C.; Sapede, C.; Garner, S. Managed Entry Agreements for Pharmaceuticals in the Context of Adaptive Pathways in Europe. Front. Pharmacol. 2018, 9, 280. [Google Scholar] [CrossRef] [PubMed]

- Vreman, R.A.; Leufkens, H.G.M.; Kesselheim, A.S. Getting the Right Evidence after Drug Approval. Front. Pharmacol. 2020, 11, 569535. [Google Scholar] [CrossRef]

- Csanádi, M.; Kaló, Z.; Prins, C.P.; Grélinger, E.; Kiss, A.M.; Fricke, F.-U.; Fuksa, L.; Tesar, T.; Manova, M.; Lorenzovici, L.; et al. The implications of external price referencing on pharmaceutical list prices in Europe. Health Policy Technol. 2018, 7, 243–250. [Google Scholar] [CrossRef]

| Agreement | Description |

|---|---|

| Price–volume agreements | Drug prices are progressively lowered as more patients receive the treatment. |

| Budget threshold/dedicated funds | Maximum amount of spending for an individual innovative treatment (budget threshold) or therapeutic area (dedicated funds) to contain total expenditures. Translates into maximum number of patients treated per year or sharing of costs with the manufacturer or patients after costs have been exceeded. |

| Discounts/rebates | Simple price discounts, publicly or confidentially agreed upon between the payer and manufacturer. |

| Patent buyout/direct funding | Acquisition of the intellectual properties protecting a therapy globally or within a jurisdiction. |

| Cost-plus pricing | Fixed-price covering costs for producing and distribution of a therapy while allowing some profit to be made. Research and development costs can be integrated into this price and the profit margin can be linked to the value a therapy provides. |

| Two-part pricing | Dividing the price of a product into an entry fee and usage price. Paying the entry fee gives buyers the right to buy the product at the usage price, which is substantially lower than the price a monopolist would charge. The entry fee can be calculated based on the value a therapy provides. |

| Reference pricing | External reference pricing: the practice of using the price(s) of a medicine in one or several countries in order to derive a benchmark or reference price for the purposes of setting or negotiating the price of the product in a given country. Internal reference pricing: a reimbursement policy in which identical medicines (ATC 5 level) or similar medicines (ATC 4 level) are clustered (reference group). |

| Value-based pricing | Policy to set the prices of a new medicine and/or decide on reimbursement based on the (societal) therapeutic value that a therapy offers, usually assessed through health technology assessment (HTA). To compare value across healthcare domains incremental cost-effectiveness ratios and willingness-to-pay thresholds can be used. |

| Pay-for-outcome/outcome guarantees | The price level and/or revenue received is related to the future performance of the product in either a research or real-world environment. Therapy costs are eliminated or reduced by the manufacturer if outcomes are not achieved. |

| Conditional treatment continuation/risk sharing | Continuation of coverage for individual patients is conditioned upon meeting short-term treatment goals. |

| Coverage with evidence development | Provisional reimbursement of promising technologies with limited clinical evidence. Temporary reimbursement is granted with an obligation for the manufacturer to obtain and provide additional data. Can be organized either with patients only having access when included in the study (only in research) or with an obligation to generate data and unrestricted access (only with research) |

| Payment structures | Description |

| Upfront payment | Paying treatment costs upfront at the time of delivery of treatment. Can be combined with rebates when a therapy does not achieve predefined outcomes. |

| Pay at outcomes achieved | Paying treatment costs only after results have been achieved. |

| Annuity payments/over-time payments/staggered payment | Spreading payments over multiple years, with an agreement upon amount of treatment or outcomes delivered. |

| Health leasing/subscription | Paying for unlimited use of a therapy during a predefined period. |

| Agreement | Benefits | Limitations |

|---|---|---|

| Price–volume agreements | ||

| Budget threshold/dedicated funds |

| |

| Discounts/rebates | ||

| Patent buyout/direct funding |

| |

| Cost-plus pricing |

| |

| Two-part pricing |

|

|

| Reference pricing |

| |

| Value-based pricing |

|

|

| Pay-for-outcome/outcome guarantees |

|

|

| Conditional treatment initiation/continuation | ||

| Coverage with evidence development (CED) |

| |

| Payment mechanism | Benefits | Limitations |

| Upfront payment | ||

| Payment after achieved outcomes | ||

| Annuity payments |

| |

| Health leasing/subscription |

| Price–Volume Agreements | Budget Threshold/Dedicated Funds | Discounts/Rebates | Patent Buyout | Cost-Plus Pricing | Two-Part Pricing | Reference Pricing | Value-Based Pricing | Pay-for Outcome/Outcome Guarantees | Conditional Treatment Continuation | Coverage with Evidence Development | |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Categorization | |||||||||||

| Outcome-based | |||||||||||

| Purely financial | |||||||||||

| Individual patient level | |||||||||||

| Target population level | |||||||||||

| Combination with payment scheme | |||||||||||

| Upfront payment | |||||||||||

| Payment at outcome achieved | |||||||||||

| Annuity payment | |||||||||||

| Health leasing/subscription | |||||||||||

| Type of treatment | |||||||||||

| One-time treatments | |||||||||||

| Chronic treatments | |||||||||||

| Healthcare payment system | |||||||||||

| Central authority | |||||||||||

| Decentral authority | |||||||||||

| Combination matrix | |||||||||||

| Price–volume agreements | |||||||||||

| Budget threshold/dedicated funds | |||||||||||

| Discounts/rebates | |||||||||||

| Patent buyout | |||||||||||

| Cost-plus pricing | |||||||||||

| Two-part pricing | |||||||||||

| Reference pricing | |||||||||||

| Value-based pricing | |||||||||||

| Pay-for outcome/outcome guarantees | |||||||||||

| Conditional treatment continuation | |||||||||||

| Coverage with evidence development | |||||||||||

| Feasible | |||||||||||

| Feasible but not obvious | |||||||||||

| Not feasible | |||||||||||

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

A Vreman, R.; F Broekhoff, T.; GM Leufkens, H.; K Mantel-Teeuwisse, A.; G Goettsch, W. Application of Managed Entry Agreements for Innovative Therapies in Different Settings and Combinations: A Feasibility Analysis. Int. J. Environ. Res. Public Health 2020, 17, 8309. https://doi.org/10.3390/ijerph17228309

A Vreman R, F Broekhoff T, GM Leufkens H, K Mantel-Teeuwisse A, G Goettsch W. Application of Managed Entry Agreements for Innovative Therapies in Different Settings and Combinations: A Feasibility Analysis. International Journal of Environmental Research and Public Health. 2020; 17(22):8309. https://doi.org/10.3390/ijerph17228309

Chicago/Turabian StyleA Vreman, Rick, Thomas F Broekhoff, Hubert GM Leufkens, Aukje K Mantel-Teeuwisse, and Wim G Goettsch. 2020. "Application of Managed Entry Agreements for Innovative Therapies in Different Settings and Combinations: A Feasibility Analysis" International Journal of Environmental Research and Public Health 17, no. 22: 8309. https://doi.org/10.3390/ijerph17228309

APA StyleA Vreman, R., F Broekhoff, T., GM Leufkens, H., K Mantel-Teeuwisse, A., & G Goettsch, W. (2020). Application of Managed Entry Agreements for Innovative Therapies in Different Settings and Combinations: A Feasibility Analysis. International Journal of Environmental Research and Public Health, 17(22), 8309. https://doi.org/10.3390/ijerph17228309