Does Green Finance Contribute to Corporate Technological Innovation? The Moderating Role of Corporate Social Responsibility

Abstract

:1. Introduction

2. Literature Review and Hypotheses

2.1. Green Finance and Corporate Technological Innovation

2.2. Role of CSR in Corporate Technological Innovation and Green Finance

3. Research Design

3.1. Sample Selection and Data Sources

3.2. Variable Selection

3.2.1. Explained Variable: Corporate Technological Innovation

3.2.2. Explanatory Variable: Green Finance

3.2.3. Moderating Variable

3.2.4. Control Variables

3.3. Model Specification

4. Empirical Results

4.1. Descriptive Statistics

4.2. Benchmark Test

4.3. Moderating Effect Test

5. Robustness Tests

5.1. Replacement of Explained Variable

5.2. Heterogeneity Analysis

5.2.1. Subsample Regression on Companies of Different Sizes

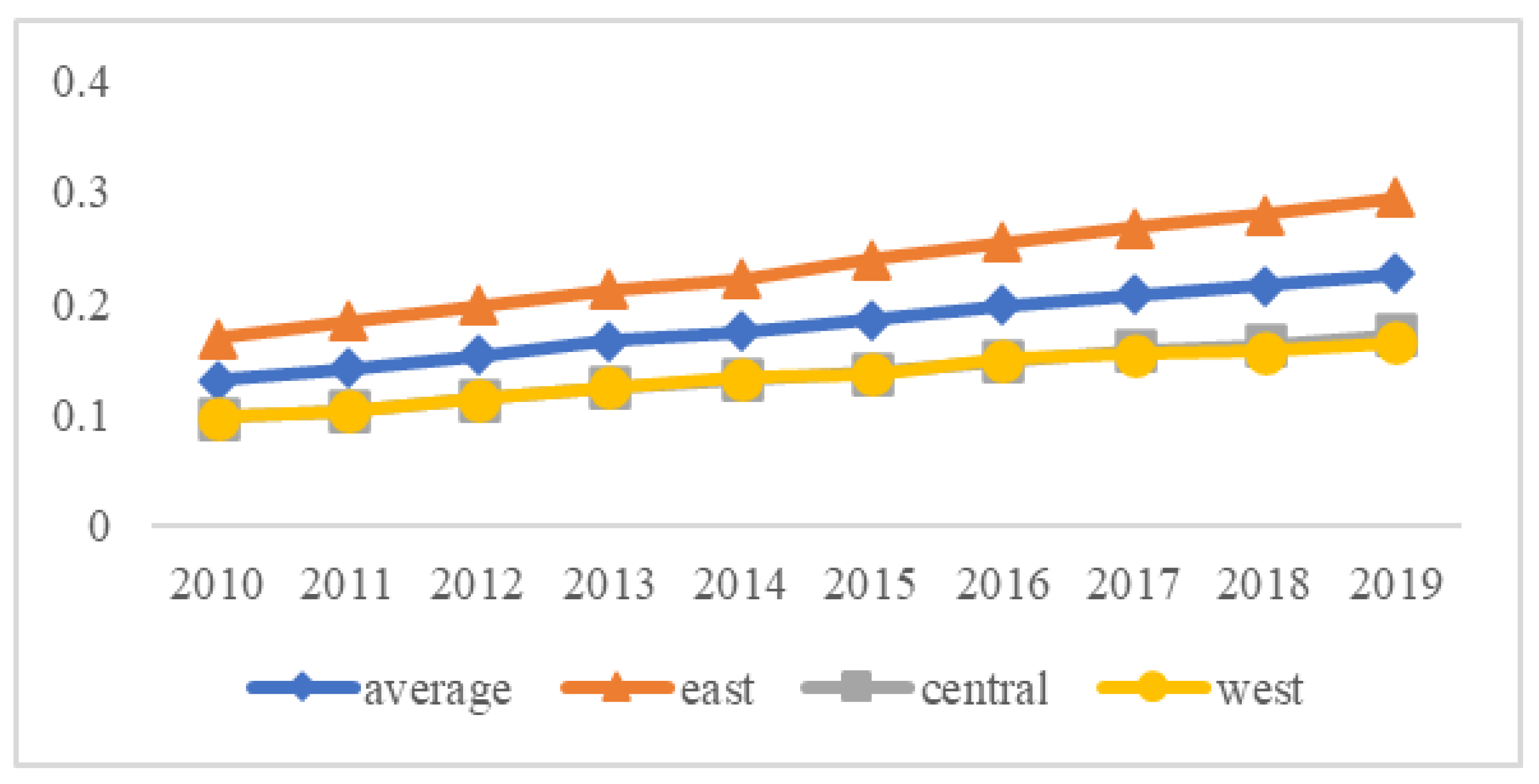

5.2.2. Subsample Regression of Companies in the Eastern, Western, and Central Regions

5.2.3. Subsample Regression with 2016 as the Cutoff Point

6. Conclusions, Limitations, and Future Research

6.1. Conclusions

6.2. Limitations and Future Research

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Lee, J.W. Green finance and sustainable development goals: The case of China. J. Asian. Financ. Econ. Bus. 2020, 7, 577–586. [Google Scholar] [CrossRef]

- Li, D.; Zheng, M.; Cao, C.; Chen, X.; Ren, S.; Huang, M. The impact of legitimacy pressure and corporate profitability on green innovation: Evidence from China top 100. J. Clean. Prod. 2017, 141, 41–49. [Google Scholar] [CrossRef] [Green Version]

- Hazarika, N.; Zhang, X. Evolving theories of eco-innovation: A systematic review. Sustain. Prod. Consum. 2019, 19, 64–78. [Google Scholar] [CrossRef]

- Lee, J.; Kim, S.-J. Curvilinear relationship between corporate innovation and environmental sustainability. Sustainability 2017, 9, 1267. [Google Scholar] [CrossRef] [Green Version]

- Fang, Z.; Kong, X.; Sensoy, A.; Cui, X.; Cheng, F. Government’s awareness of environmental protection and corporate green innovation: A natural experiment from the new environmental protection law in China. Econ. Anal. Pol. 2021, 70, 294–312. [Google Scholar] [CrossRef]

- Lv, M.; Bai, M. Evaluation of China’s carbon emission trading policy from corporate innovation. Financ. Res. Lett. 2021, 39, 101565. [Google Scholar] [CrossRef]

- Xia, L.; Gao, S.; Wei, J.; Ding, Q. Government subsidy and corporate green innovation—Does board governance play a role? Energy Policy 2021, 161, 112720. [Google Scholar] [CrossRef]

- Blichfeldt, H.; Faullant, R. Performance effects of digital technology adoption and product & service innovation—A process-industry perspective. Technovation 2021, 105, 102275. [Google Scholar] [CrossRef]

- Lam, P.T.I.; Law, A.O.K. Crowdfunding for renewable and sustainable energy projects: An exploratory case study approach. Renew. Sust. Energy Rev. 2016, 60, 11–20. [Google Scholar] [CrossRef] [Green Version]

- Liu, S.; Du, J.; Zhang, W.; Tian, X. Opening the box of subsidies: Which is more effective for innovation? Eurasian Bus. Rev. 2021, 11, 421–449. [Google Scholar] [CrossRef]

- Cao, S.; Nie, L.; Sun, H.; Sun, W.; Taghizadeh-Hesary, F. Digital finance, green technological innovation and energy-environmental performance: Evidence from China’s regional economies. J. Clean. Prod. 2021, 327, 129458. [Google Scholar] [CrossRef]

- He, Y.; Ding, X.; Yang, C. Do environmental regulations and financial constraints stimulate corporate technological innovation? Evidence from China. J. Asian Econ. 2021, 72, 101265. [Google Scholar] [CrossRef]

- Ang, J.S.; Cheng, Y.; Wu, C. Does enforcement of intellectual property rights matter in China? Evidence from financing and investment choices in the high-tech industry. Rev. Econ. Stat. 2014, 96, 332–348. [Google Scholar] [CrossRef]

- Yuan, G.; Ye, Q.; Sun, Y. Financial innovation, information screening and industries’ green innovation—Industry-level evidence from the OECD. Technol. Forecast. Soc. Chang. 2021, 171, 120998. [Google Scholar] [CrossRef]

- Meo, M.S.; Karim, M.Z.A. The role of green finance in reducing CO2 emissions: An empirical analysis. Borsa Istanbul Rev. 2022, 22, 169–178. [Google Scholar] [CrossRef]

- Zhang, Y.; Li, X.; Xing, C. How does China’s green credit policy affect the green innovation of high polluting enterprises? The perspective of radical and incremental innovations. J. Clean. Prod. 2022, 336, 130387. [Google Scholar] [CrossRef]

- Wang, Y.; Li, M. Credit policy and its heterogeneous effects on green innovations. J. Financ. Stab. 2022, 58, 100961. [Google Scholar] [CrossRef]

- Zhang, Y.; Xing, C.; Wang, Y. Does green innovation mitigate financing constraints? Evidence from China’s private enterprises. J. Clean. Prod. 2020, 264, 121698. [Google Scholar] [CrossRef]

- Tolliver, C.; Fujii, H.; Keeley, A.R.; Managi, S. Green innovation and finance in Asia. Asian Econ. Pol. Rev. 2021, 16, 67–87. [Google Scholar] [CrossRef]

- Yin, X.; Xu, Z. An empirical analysis of the coupling and coordinative development of China’s green finance and economic growth. Res. Pol. 2022, 75, 102476. [Google Scholar] [CrossRef]

- Liu, N.; Liu, C.; Xia, Y.; Ren, Y.; Liang, J. Examining the coordination between green finance and green economy aiming for sustainable development: A case study of China. Sustainability 2020, 12, 3717. [Google Scholar] [CrossRef]

- Long, J.; Zhong, C.; Bilal, A.; Muhammad, I.; Rabia, N. How do green financing and green logistics affect the circular economy in the pandemic situation: Key mediating role of sustainable production. Econ. Res. Istraz. 2021. [Google Scholar] [CrossRef]

- Wang, F.; Wang, R.; He, Z. The impact of environmental pollution and green finance on the high-quality development of energy based on spatial Dubin model. Resour. Pol. 2021, 74, 102451. [Google Scholar] [CrossRef]

- Qi, R.; Qi, L. Can synergy effect exist between green finance and industrial structure upgrade in China? Open J. Soc. Sci. 2020, 8, 215–226. [Google Scholar] [CrossRef]

- Wang, X.; Wang, Q. Research on the impact of green finance on the upgrading of China’s regional industrial structure from the perspective of sustainable development. Resour. Pol. 2021, 74, 102436. [Google Scholar] [CrossRef]

- Xu, H.; Mei, Q.; Shahzad, F.; Liu, S.; Long, X.; Zhang, J. Untangling the impact of green finance on the enterprise green performance: A meta-analytic approach. Sustainability 2020, 12, 9085. [Google Scholar] [CrossRef]

- Yu, C.-H.; Wu, X.; Zhang, D.; Chen, S.; Zhao, J. Demand for green finance: Resolving financing constraints on green innovation in China. Energy Policy 2021, 153, 112255. [Google Scholar] [CrossRef]

- Tan, X.; Yan, Y.; Dong, Y. Peer effect in green credit induced green innovation: An empirical study from China’s Green Credit Guidelines. Resour. Pol. 2022, 76, 102619. [Google Scholar] [CrossRef]

- Wang, H.; Qi, S.; Zhou, C.; Zhou, J.; Huang, X. Green credit policy, government behavior and green innovation quality of enterprises. J. Clean. Prod. 2022, 331, 129834. [Google Scholar] [CrossRef]

- Hong, M.; Li, Z.; Drakeford, B. Do the green credit guidelines affect corporate green technology innovation? Eempirical research from China. Int. J. Environ. Res. Public Health 2021, 18, 1682. [Google Scholar] [CrossRef]

- Zhao, T.; Zhou, H.; Jiang, J.; Yan, W. Impact of green finance and environmental regulations on the green innovation efficiency in China. Sustainability 2022, 14, 3206. [Google Scholar] [CrossRef]

- Fang, Y.; Shao, Z. Whether green finance can effectively moderate the green technology innovation effect of heterogeneous environmental regulation. Int. J. Environ. Res. Public Health 2022, 19, 3646. [Google Scholar] [CrossRef] [PubMed]

- Taghizadeh-Hesary, F.; Yoshino, N. The way to induce private participation in green finance and investment. Financ. Res. Lett. 2019, 31, 98–103. [Google Scholar] [CrossRef]

- Jeucken, M.H.A.; Bouma, J.J. The changing environment of banks. Greener Manag. Int. 1999, 27, 20–35. [Google Scholar] [CrossRef]

- Peng, H.; Feng, T.; Zhou, C. International experiences in the development of green finance. Am. J. Ind. Bus. Manag. 2018, 8, 385–392. [Google Scholar] [CrossRef] [Green Version]

- Falcone, P.M.; Sica, E. Assessing the opportunities and challenges of green finance in Italy: An analysis of the biomass production sector. Sustainability 2019, 11, 517. [Google Scholar] [CrossRef] [Green Version]

- Zhou, H.; Xu, G. Research on the impact of green finance on China’s regional ecological development based on system GMM model. Resour. Pol. 2022, 75, 102454. [Google Scholar] [CrossRef]

- Lv, C.; Bian, B.; Lee, C.-C.; He, Z. Regional gap and the trend of green finance development in China. Energy Econ. 2021, 102, 105476. [Google Scholar] [CrossRef]

- Zhang, S.; Wu, Z.; Wang, Y.; Hao, Y. Fostering green development with green finance: An empirical study on the environmental effect of green credit policy in China. J. Environ. Manag. 2021, 296, 113159. [Google Scholar] [CrossRef]

- Ren, X.; Shao, Q.; Zhong, R. Nexus between green finance, non-fossil energy use, and carbon intensity: Empirical evidence from China based on a vector error correction model. J. Clean. Prod. 2020, 277, 122844. [Google Scholar] [CrossRef]

- Muganyi, T.; Yan, L.; Sun, H.-P. Green finance, fintech and environmental protection: Evidence from China. Environ. Sci. Ecotechnol. 2021, 7, 100107. [Google Scholar] [CrossRef]

- Zhang, A.; Wang, S.; Liu, B. How to control air pollution with economic means? Exploration of China’s green finance policy. J. Clean. Prod. 2022, 353, 131664. [Google Scholar] [CrossRef]

- Khalil, M.A.; Nimmanunta, K. Conventional versus green investments: Advancing innovation for better financial and environmental prospects. J. Sustain. Financ. Investig. 2022. [Google Scholar] [CrossRef]

- Owen, R.; Brennan, G.; Lyon, F. Enabling investment for the transition to a low carbon economy: Government policy to finance early stage green innovation. Curr. Opin. Environ. Sustain. 2018, 31, 137–145. [Google Scholar] [CrossRef]

- Zhang, W.K.; Luo, Q.; Liu, S. Is government regulation a push for corporate environmental performance? Evidence from China. Econ. Anal. Policy 2022, 74, 105–121. [Google Scholar] [CrossRef]

- Sinha, A.; Mishra, S.; Sharif, A.; Yarovaya, L. Does green financing help to improve environmental & social responsibility? Designing SDG framework through advanced quantile modelling. J. Environ. Manag. 2021, 292, 112751. [Google Scholar] [CrossRef]

- Xing, C.; Zhang, Y.; Tripe, D. Green credit policy and corporate access to bank loans in China: The role of environmental dis-closure and green innovation. Int. Rev. Financ. Anal. 2021, 77, 101838. [Google Scholar] [CrossRef]

- Zhou, X.; Du, J. Does environmental regulation induce improved financial development for green technological innovation in China? J. Environ. Manag. 2021, 300, 113685. [Google Scholar] [CrossRef]

- Dahlsrud, A. How corporate social responsibility is defined: An analysis of 37 definitions. Corp. Soc. Responsib. Environ. Manag. 2008, 15, 1–13. [Google Scholar] [CrossRef]

- Russo, M.V.; Fouts, P.A. A resource-based perspective on corporate environmental performance and profitability. Acad. Manag. J. 1997, 40, 534–559. [Google Scholar] [CrossRef] [Green Version]

- Ye, N.; Kueh, T.-B.; Hou, L.; Liu, Y.; Yu, H. A bibliometric analysis of corporate social responsibility in sustainable development. J. Clean. Prod. 2020, 272, 122679. [Google Scholar] [CrossRef]

- Cheng, B.; Ioannou, I.; Serafeim, G. Corporate social responsibility and access to finance. Strategic Manag. J. 2014, 35, 1–23. [Google Scholar] [CrossRef]

- Liu, B.; Sun, P.-Y.; Zeng, Y. Employee-related corporate social responsibilities and enterprise technological innovation: Evidence from China. Int. Rev. Econ. Financ. 2020, 70, 357–372. [Google Scholar] [CrossRef]

- Broadstock, D.C.; Matousek, R.; Meyer, M.; Tzeremes, N.G. Does corporate social responsibility impact firms’ innovation capacity? The indirect link between environmental & social governance implementation and innovation performance. J. Bus. Res. 2020, 119, 99–110. [Google Scholar] [CrossRef]

- Forcadell, F.J.; Úbeda, F.; Aracil, E. Effects of environmental corporate social responsibility on innovativeness of Spanish industrial SMEs. Technol. Forecast. Soc. Chang. 2021, 162, 120355. [Google Scholar] [CrossRef]

- Kraus, S.; Rehman, S.U.; García, F.J.S. Corporate social responsibility and environmental performance: The mediating role of environmental strategy and green innovation. Technol. Forecast. Soc. Chang. 2020, 160, 120262. [Google Scholar] [CrossRef]

- Tsang, A.; Wang, K.T.; Liu, S.; Yu, L. Integrating corporate social responsibility criteria into executive compensation and firm innovation: International evidence. J. Corp. Financ. 2021, 70, 102070. [Google Scholar] [CrossRef]

- Javeed, S.A.; Latief, R.; Jiang, T.; Ong, T.S.; Tang, Y. How environmental regulations and corporate social responsibility affect the firm innovation with the moderating role of chief executive officer (CEO) power and ownership concentration? J. Clean. Prod. 2021, 308, 127212. [Google Scholar] [CrossRef]

- Abbas, J. Impact of total quality management on corporate sustainability through the mediating effect of knowledge management. J. Clean. Prod. 2020, 244, 118806. [Google Scholar] [CrossRef]

- Chuang, S.P.; Huang, S.J. The effect of environmental corporate social responsibility on environmental performance and business competitiveness: The mediation of green information technology capital. J. Bus. Ethics. 2018, 150, 991–1009. [Google Scholar] [CrossRef]

- Deng, X.; Lu, J. The environmental performance, corporate social responsibility, and food safety of food companies from the perspective of green finance. Revista Cercetare Soc. 2017, 58, 178–200. [Google Scholar]

- Li, Z.; Tang, Y.; Wu, J.; Zhang, J.; Lv, Q. The interest costs of green bonds: Credit ratings, corporate social responsibility, and certification. Emerg. Mark. Financ. Trade 2019, 56, 2679–2692. [Google Scholar] [CrossRef]

- Wartick, S.L.; Cochran, P.L. The evolution of the corporate social performance model. Acad. Manag. Rev. 1985, 10, 758–769. [Google Scholar] [CrossRef]

- Ji, H.; Miao, Z. Corporate social responsibility and collaborative innovation: The role of government support. J. Clean. Prod. 2020, 260, 121028. [Google Scholar] [CrossRef]

- Hamamoto, M. Environmental regulation and the productivity of Japanese manufacturing industries. Resour. Energy Econ. 2006, 28, 299–312. [Google Scholar] [CrossRef]

- Yang, C.-H.; Tseng, Y.-H.; Chen, C.-P. Environmental regulations, induced R&D, and productivity: Evidence from Taiwan’s manufacturing industries. Resour. Energy Econ. 2012, 34, 514–532. [Google Scholar] [CrossRef]

- Hall, B.H.; Harhoff, D. Recent research on the economics of patents. Annu. Rev. Econ. 2012, 4, 541–565. [Google Scholar] [CrossRef] [Green Version]

- Rubashkina, Y.; Galeotti, M.; Verdolini, E. Environmental regulation and competitiveness: Empirical evidence on the Porter Hypothesis from European manufacturing sectors. Energy Pol. 2015, 83, 288–300. [Google Scholar] [CrossRef] [Green Version]

- Zhang, W.; Tian, X.; Yu, A. Is high-speed rail a catalyst for the fourth industrial revolution in China? Story of enhanced technology spillovers from venture capital. Technol. Forecast. Soc. Chang. 2020, 161, 120286. [Google Scholar] [CrossRef]

- Shao, Q.; Li, J.; Zhao, L. A four-dimensional evaluation of the urban comprehensive carrying capacity of the Yangtze River Delta, China. Sustainability 2019, 11, 6816. [Google Scholar] [CrossRef] [Green Version]

- Pan, X.; Sinha, P.; Chen, X. Corporate social responsibility and eco-innovation: The triple bottom line perspective. Corp. Soc. Responsib. Environ. Manag. 2021, 28, 214–228. [Google Scholar] [CrossRef]

- Jiang, Z.; Wang, Z.; Lan, X. How environmental regulations affect corporate innovation? The coupling mechanism of man-datory rules and voluntary management. Technol. Soc. 2021, 65, 101575. [Google Scholar] [CrossRef]

| Indicators | Descriptions | Measurements | Properties |

|---|---|---|---|

| Green credit | Percentages of interest expenses in energy-intensive industries | Interest expenses of six energy-intensive industries divided by the total industrial interest expenses | − |

| Green investment | Percentages of environmental pollution control investment in GDP | Environmental pollution control investment divided by the GDP | + |

| Green insurance | Agricultural insurance penetration | Income from agricultural insurance divided by the total value of agricultural output | + |

| Government support | Percentages of expenditure regarding financial environmental protection | Financial environmental protection expenditure divided by the general financial budget expenditure | − |

| Variables | Descriptions | Measurements | Attributes |

|---|---|---|---|

| Apply | The number of patent applications | Natural logarithm form of the number of patent applications + 1 | Explained variables |

| RD | The number of R&D investment | Natural logarithm form of R&D investment + 1 | |

| Green | Green financial development | Indicator for green financial development at the provincial level | Explanatory variable |

| CSR | Corporate social responsibility | Natural logarithm form of the total score of CSR rating published on HeXun | Moderating variable |

| Age | Operating years of the company | Natural logarithm form of the company’s operating years | Control variables |

| Growth | Business revenue growth rate | Annual growth rate of business revenue | |

| Tobin | The value of Tobin’s Q | The value of Tobin’s Q | |

| Own_con | Ownership concentration | Shareholding ratio of the first majority shareholder | |

| Gov_con | Company nature | If the company is state owned, Gov_con = 1; otherwise, Gov_con = 0 | |

| Pergdp | Regional development level | Natural logarithm form of GDP per capita |

| Variables | Mean | Std | Min | Median | Max |

|---|---|---|---|---|---|

| Apply | 3.7188 | 2.1374 | 0.0000 | 4.0604 | 8.4167 |

| RD | 17.8848 | 1.2370 | 14.9859 | 17.7807 | 21.6423 |

| Green | 0.2503 | 0.1328 | 0.0890 | 0.2289 | 0.6272 |

| CSR | 4.4661 | 2.6722 | 0.4000 | 3.7300 | 15.0000 |

| Age | 1.6234 | 0.9370 | 0.0000 | 1.6094 | 3.1781 |

| Growth | 0.3260 | 0.4751 | 0.0037 | 0.1613 | 2.8523 |

| Own_con | 0.3465 | 0.1426 | 0.0878 | 0.3326 | 0.7306 |

| Tobin | 2.0347 | 1.1001 | 0.9090 | 1.6795 | 6.9076 |

| Gov_con | 0.0923 | 0.2894 | 0.0000 | 0.0000 | 1.0000 |

| Pergdp | 11.1337 | 0.4528 | 10.0356 | 11.1586 | 12.0110 |

| (1) | (2) | (3) | (4) | (5) | (6) | (7) | |

|---|---|---|---|---|---|---|---|

| Green | 0.7474 *** | 0.7080 *** | 0.8381 *** | 0.8338 *** | 0.8462 *** | 0.8308 *** | 1.3483 *** |

| (2.5986) | (2.5818) | (3.0494) | (3.0337) | (3.0576) | (3.0029) | (3.5225) | |

| Gov_con | 0.3075 *** | 0.2721 *** | 0.2724 *** | 0.2728 *** | 0.2663 *** | 0.2594 *** | |

| (4.2915) | (3.8001) | (3.8053) | (3.7406) | (3.6453) | (3.5471) | ||

| Age | 0.2588 *** | 0.2808 *** | 0.2900 *** | 0.2985 *** | 0.2913 *** | ||

| (8.5422) | (8.8290) | (8.9988) | (9.1591) | (8.8856) | |||

| Growth | 0.0841 ** | 0.0750 ** | 0.0797 ** | 0.0786 ** | |||

| (2.2799) | (1.9873) | (2.1039) | (2.0754) | ||||

| Tobin | −0.0469 ** | −0.0461 ** | −0.0452 ** | ||||

| (−2.2883) | (−2.2518) | (−2.2054) | |||||

| Own_con | 0.3638 * | 0.3697 * | |||||

| (1.6873) | (1.7151) | ||||||

| Pergdp | −0.2501 * | ||||||

| (−1.9552) | |||||||

| Constant | 3.4126 *** | 0.8032 | 0.6007 | 0.4965 | 0.5921 | 0.4504 | 2.9584 ** |

| (42.0722) | (1.4153) | (1.0523) | (0.8670) | (1.0293) | (0.7754) | (2.1011) | |

| Year fixed effect | NO | YES | YES | YES | YES | YES | YES |

| Enterprise fixed effect | NO | YES | YES | YES | YES | YES | YES |

| Industry fixed effect | NO | YES | YES | YES | YES | YES | YES |

| Obs. | 8852 | 8852 | 8852 | 8852 | 8852 | 8852 | 8852 |

| Adj. R2 | 0.0000 | 0.0942 | 0.0931 | 0.0936 | 0.0944 | 0.0940 | 0.0936 |

| (1) | (2) | |

|---|---|---|

| Green | 1.3501 *** | 0.7708 * |

| (3.2518) | (1.5096) | |

| CSR | 0.0043 ** | 0.0349 * |

| (0.4329) | (1.8520) | |

| Green * CSR | 0.1147 ** | |

| (2.0960) | ||

| Gov_con | 0.2595 *** | 0.2577 *** |

| (3.2617) | (3.2460) | |

| Age | 0.2927 *** | 0.2926 *** |

| (8.6478) | (8.6391) | |

| Growth | 0.0785 ** | 0.0779 ** |

| (2.1263) | (2.1079) | |

| Tobin | −0.0457 ** | −0.0458 ** |

| (−2.0969) | (−2.1018) | |

| Own_con | 0.3712 | 0.3736 |

| (1.4365) | (1.4464) | |

| Pergdp | −0.2495 ** | −0.2426 * |

| (−1.9932) | (−1.9353) | |

| Constant | 2.9720 ** | 3.0503 ** |

| (2.2106) | (2.2690) | |

| Year fixed effect | YES | YES |

| Enterprise fixed effect | YES | YES |

| Industry fixed effect | YES | YES |

| Obs. | 8852 | 8852 |

| Adj. R2 | 0.0936 | 0.0943 |

| (1) | (2) | (3) | (4) | (5) | (6) | (7) | |

|---|---|---|---|---|---|---|---|

| Green | 1.2264 *** | 1.0287 *** | 1.1779 *** | 1.1770 *** | 1.2364 *** | 1.2258 *** | 1.0993 *** |

| (6.8631) | (5.9385) | (7.1046) | (7.1000) | (7.5615) | (7.5210) | (5.0658) | |

| Gov_con | 0.2089 *** | 0.2030 *** | 0.2031 *** | 0.1808 *** | 0.1793 *** | 0.1800 *** | |

| (7.8598) | (7.7122) | (7.7174) | (6.7593) | (6.7003) | (6.7223) | ||

| Age | 0.2896 *** | 0.2975 *** | 0.3168 *** | 0.3239 *** | 0.3252 *** | ||

| (20.4930) | (19.9598) | (21.0253) | (21.3013) | (21.3009) | |||

| Growth | 0.0214 * | 0.0057 | 0.0091 | 0.0093 | |||

| (1.6581) | (0.4306) | (0.6898) | (0.7058) | ||||

| Tobin | −0.0553 *** | −0.0550 *** | −0.0552 *** | ||||

| (−7.4835) | (−7.4338) | (−7.4557) | |||||

| Own_con | 0.2865 *** | 0.2860 *** | |||||

| (2.9540) | (2.9484) | ||||||

| Pergdp | 0.0619 | ||||||

| (0.8837) | |||||||

| Constant | 17.4994 *** | 16.0786 *** | 15.7922 *** | 15.7629 *** | 15.8720 *** | 15.7516 *** | 15.1294 *** |

| (347.1124) | (50.2322) | (50.3617) | (50.1930) | (51.2347) | (50.5546) | (19.6573) | |

| Year fixed effect | NO | YES | YES | YES | YES | YES | YES |

| Enterprise fixed effect | NO | YES | YES | YES | YES | YES | YES |

| Industry fixed effect | NO | YES | YES | YES | YES | YES | YES |

| Obs. | 8852 | 8852 | 8852 | 8852 | 8852 | 8852 | 8852 |

| Adj. R2 | 0.0002 | 0.5141 | 0.5109 | 0.5109 | 0.5133 | 0.5127 | 0.5127 |

| (1) | (2) | |

|---|---|---|

| Small Companies | Large Companies | |

| Green | 0.1548 | 2.6459 *** |

| (0.2875) | (4.2557) | |

| Gov_con | 0.3016 | 0.2105 * |

| (1.2993) | (1.9584) | |

| Age | 0.1279 ** | 0.1855 ** |

| (2.1286) | (2.4373) | |

| Growth | 0.0322 | −0.2287 ** |

| (0.5988) | (−2.3201) | |

| Tobin | 0.0108 | 0.0591 |

| (0.3101) | (1.0651) | |

| Own_con | −0.3691 | 0.8847 ** |

| (−0.9967) | (2.1801) | |

| Pergdp | −0.1454 | −0.3241 * |

| (−0.7965) | (−1.6579) | |

| Constant | 1.4611 | 3.2363 |

| (0.8211) | (1.5485) | |

| Year fixed effect | YES | YES |

| Enterprise fixed effect | YES | YES |

| Industry fixed effect | YES | YES |

| Obs. | 2254 | 2407 |

| Adj. R2 | 0.0646 | 0.0770 |

| (1) | (2) | (3) | |

|---|---|---|---|

| Eastern | Central | Western | |

| Green | 1.1969 *** | −4.0285 | 2.9369 |

| (2.7334) | (−1.1811) | (0.9704) | |

| Gov_con | 0.2501 ** | 0.3686 ** | 0.0737 |

| (2.4175) | (2.2670) | (0.3603) | |

| Age | 0.3147 *** | 0.2500 *** | 0.1494 |

| (7.9170) | (2.9448) | (1.5705) | |

| Growth | 0.0819 ** | 0.0183 | 0.0910 |

| (1.9726) | (0.1971) | (0.5788) | |

| Tobin | −0.0169 | −0.2068 *** | −0.0275 |

| (−0.6988) | (−3.5081) | (−0.3820) | |

| Own_con | 0.1897 | 1.6214 ** | 0.1525 |

| (0.6369) | (2.2374) | (0.2056) | |

| Pergdp | −0.1742 | 1.5134 ** | −0.5825 |

| (−0.8979) | (2.1576) | (−0.9806) | |

| Constant | 3.0077 | −15.0589 ** | 5.7087 |

| (1.4496) | (−2.2285) | (0.9512) | |

| Year fixed effect | YES | YES | YES |

| Enterprise fixed effect | YES | YES | YES |

| Industry fixed effect | YES | YES | YES |

| Obs. | 6677 | 1299 | 876 |

| Adj. R2 | 0.0978 | 0.1149 | 0.1370 |

| (1) | (2) | |

|---|---|---|

| Before 2016 | After 2016 | |

| Green | 1.7121 *** | 1.4667 *** |

| (5.6835) | (3.8839) | |

| Gov_con | 0.2405 ** | 0.5073 *** |

| (2.5209) | (3.8104) | |

| Age | 0.3579 *** | 0.4449 *** |

| (9.9537) | (11.0026) | |

| Growth | 0.0865 | 0.0468 |

| (1.4751) | (0.4835) | |

| Tobin | −0.1143 *** | −0.0140 |

| (−4.3082) | (−0.3543) | |

| Own_con | 0.7483 *** | 0.7887 *** |

| (3.7872) | (3.0868) | |

| Pergdp | −0.5503 *** | −0.1498 |

| (−5.2844) | (−1.1866) | |

| Constant | 6.4014 *** | 2.1847 |

| Year fixed effect | YES | YES |

| Enterprise fixed effect | YES | YES |

| Industry fixed effect | YES | YES |

| Obs. | 5026 | 3826 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Li, X.; Yang, Y. Does Green Finance Contribute to Corporate Technological Innovation? The Moderating Role of Corporate Social Responsibility. Sustainability 2022, 14, 5648. https://doi.org/10.3390/su14095648

Li X, Yang Y. Does Green Finance Contribute to Corporate Technological Innovation? The Moderating Role of Corporate Social Responsibility. Sustainability. 2022; 14(9):5648. https://doi.org/10.3390/su14095648

Chicago/Turabian StyleLi, Xiuping, and Ye Yang. 2022. "Does Green Finance Contribute to Corporate Technological Innovation? The Moderating Role of Corporate Social Responsibility" Sustainability 14, no. 9: 5648. https://doi.org/10.3390/su14095648

APA StyleLi, X., & Yang, Y. (2022). Does Green Finance Contribute to Corporate Technological Innovation? The Moderating Role of Corporate Social Responsibility. Sustainability, 14(9), 5648. https://doi.org/10.3390/su14095648