EggBlock: Design and Implementation of Solar Energy Generation and Trading Platform in Edge-Based IoT Systems with Blockchain

Abstract

:1. Introduction

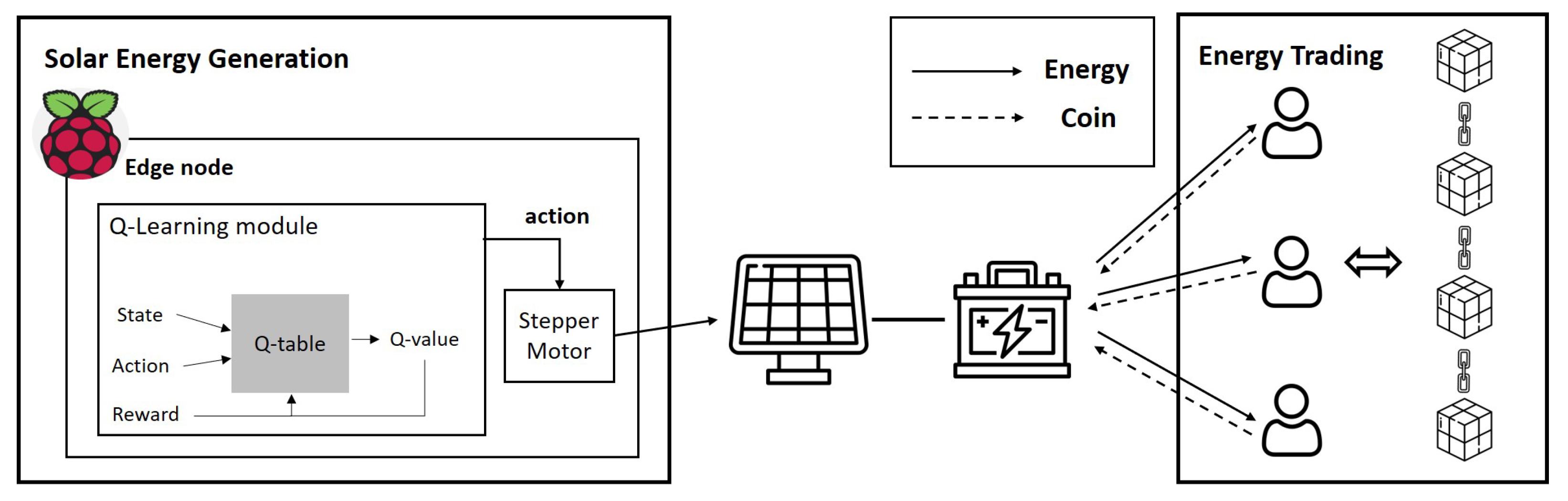

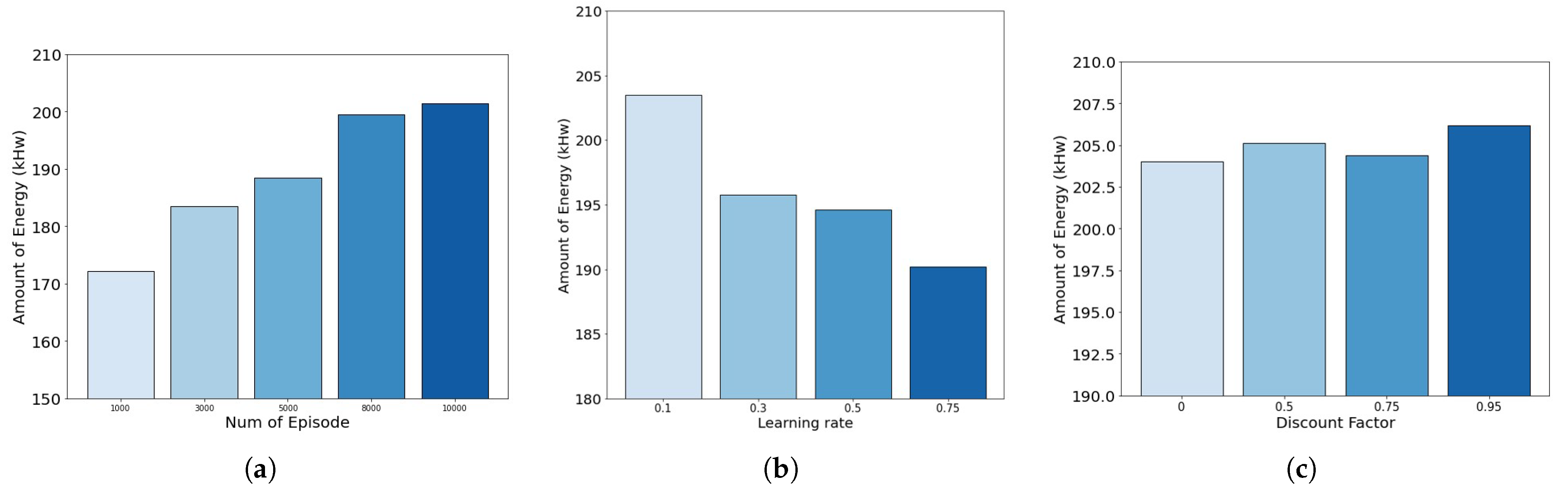

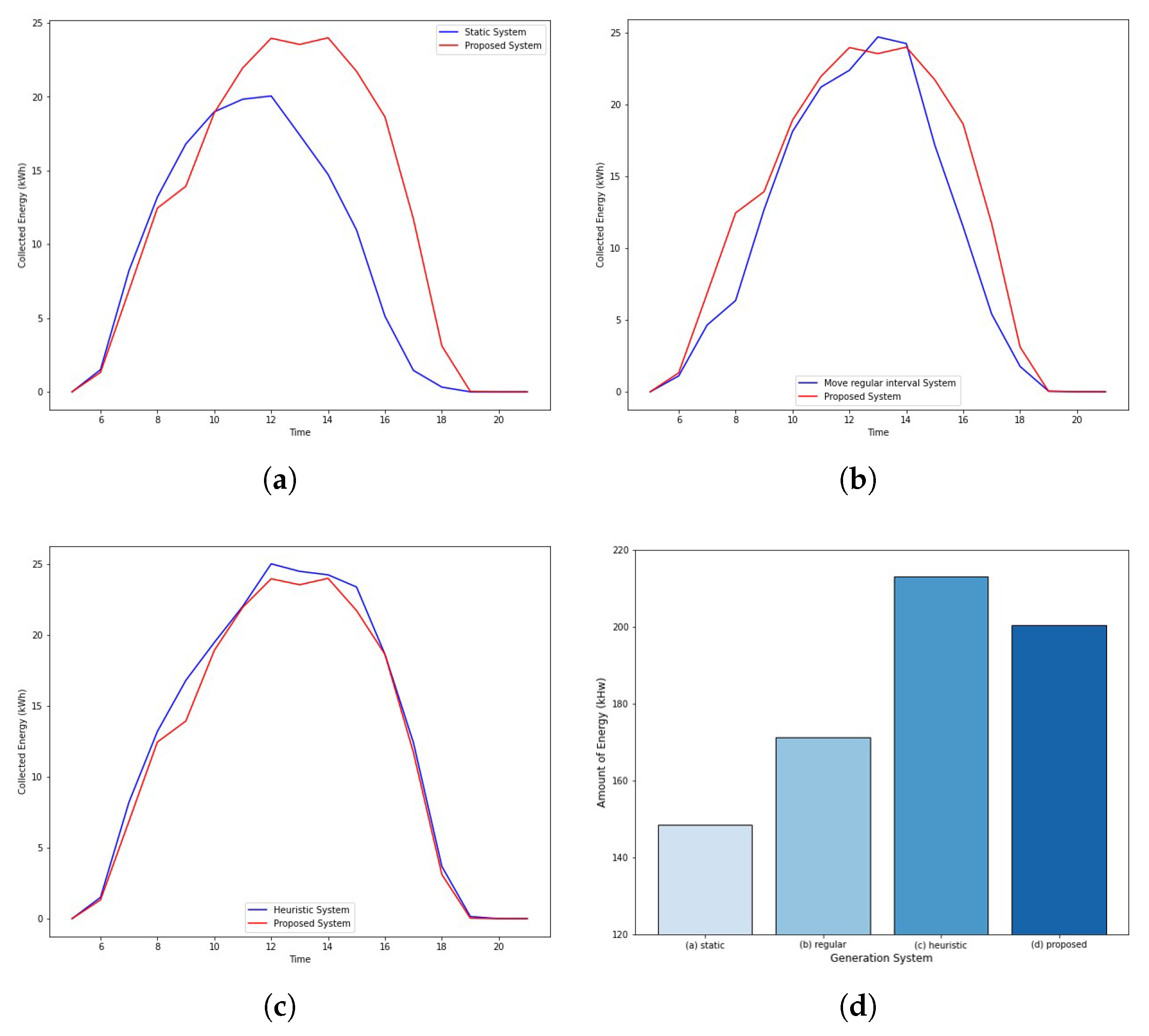

- To support reliable energy trading among users without the participation of a centralized broker, the EggBlock platform using Ethereum for blockchain is proposed in this paper. In order to determine a reasonable transaction of the generated renewable energy, we infer the determination of transaction price and the amount of energy in the market according to the second price sealed-bid auction mechanism. Furthermore, for efficient generation of solar energy, the EggBlock proposes the Q-learning based dynamic panel control mechanism. Specifically, we consider a model-free-based Q-learning algorithm, where the state and the action are the current position of the solar panel and the angle at which the solar panel will move to the next time step, respectively. Finally, the reward is designed as the amount of solar power that the solar panels can obtain under the given state.

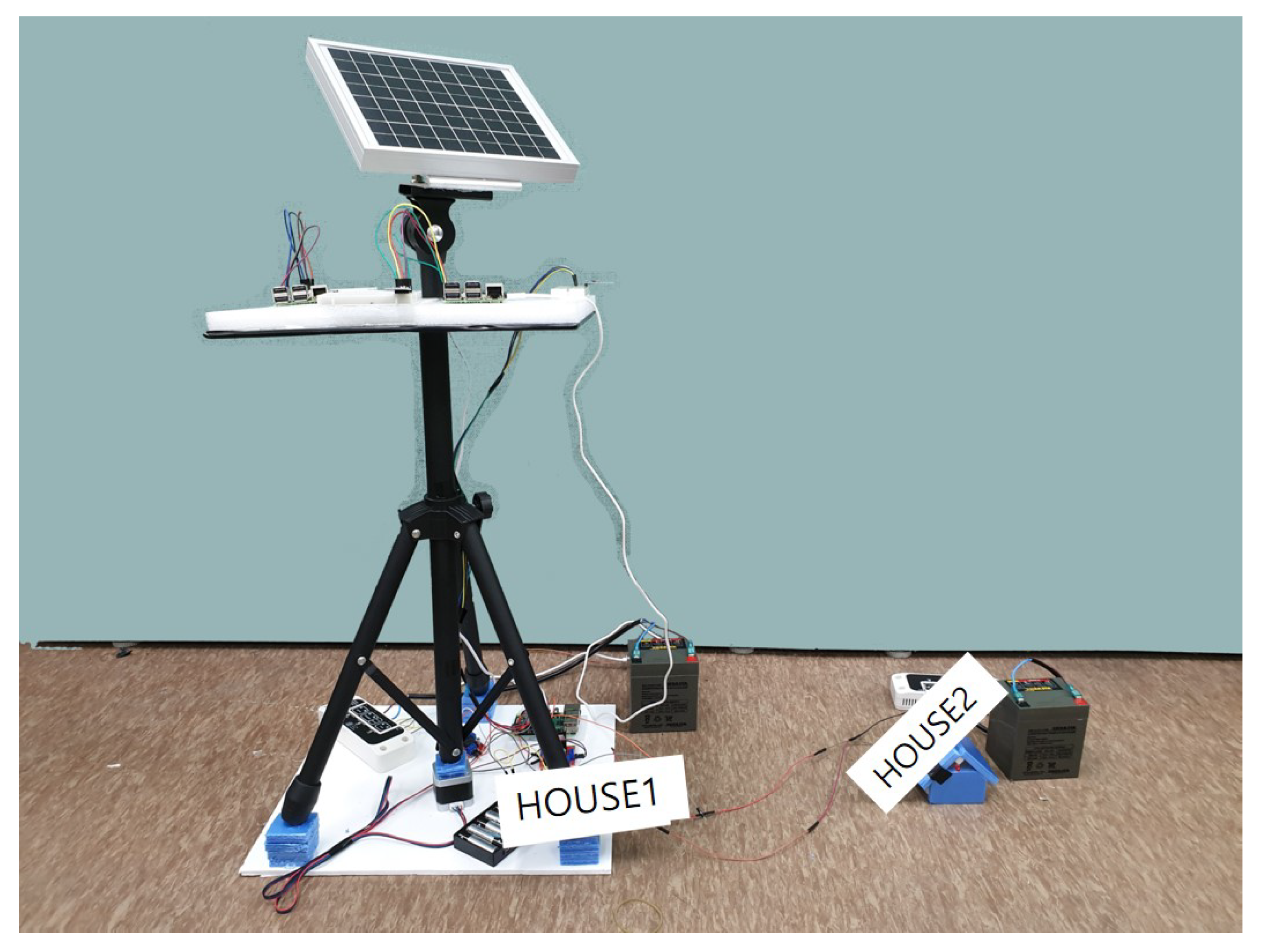

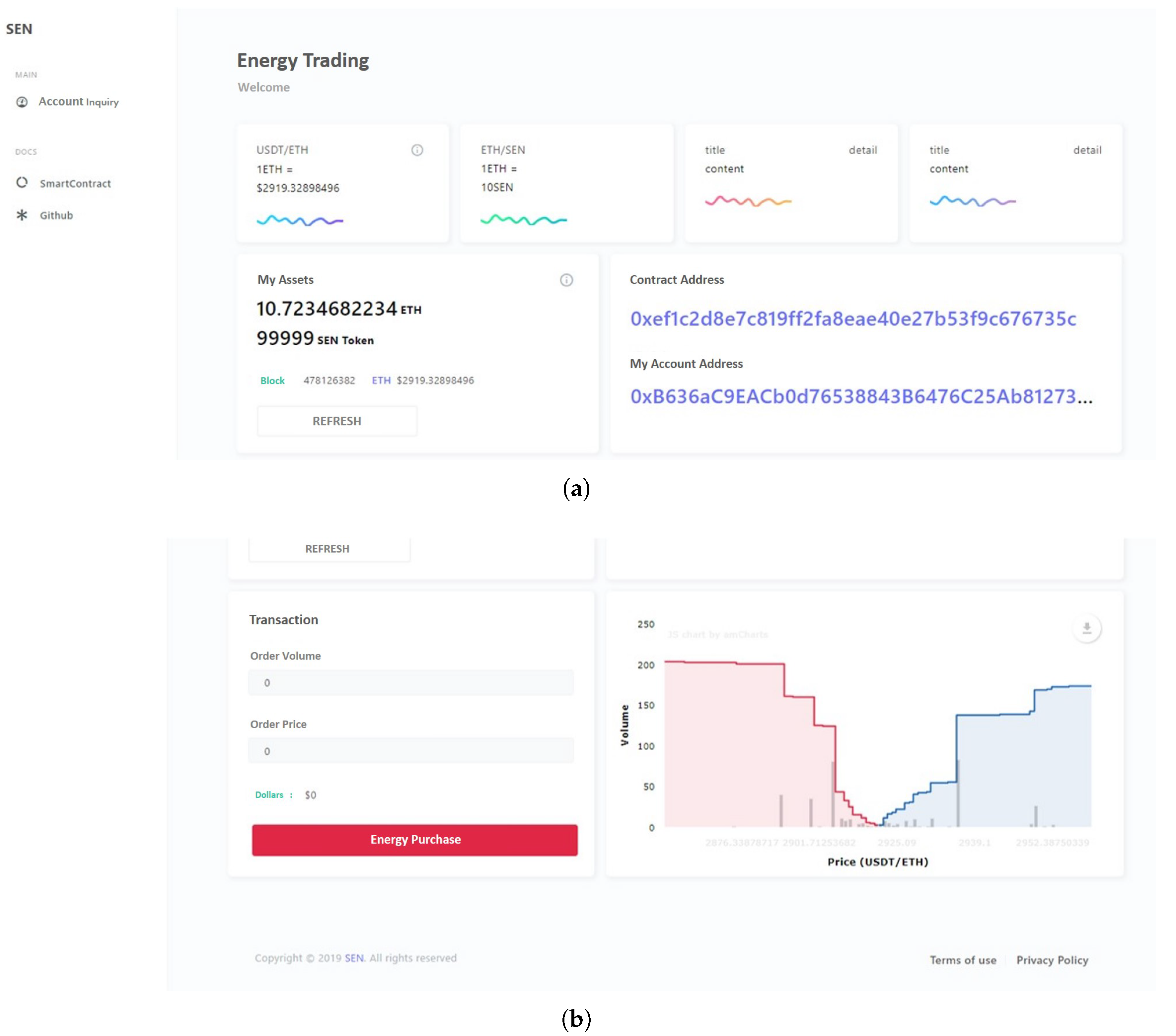

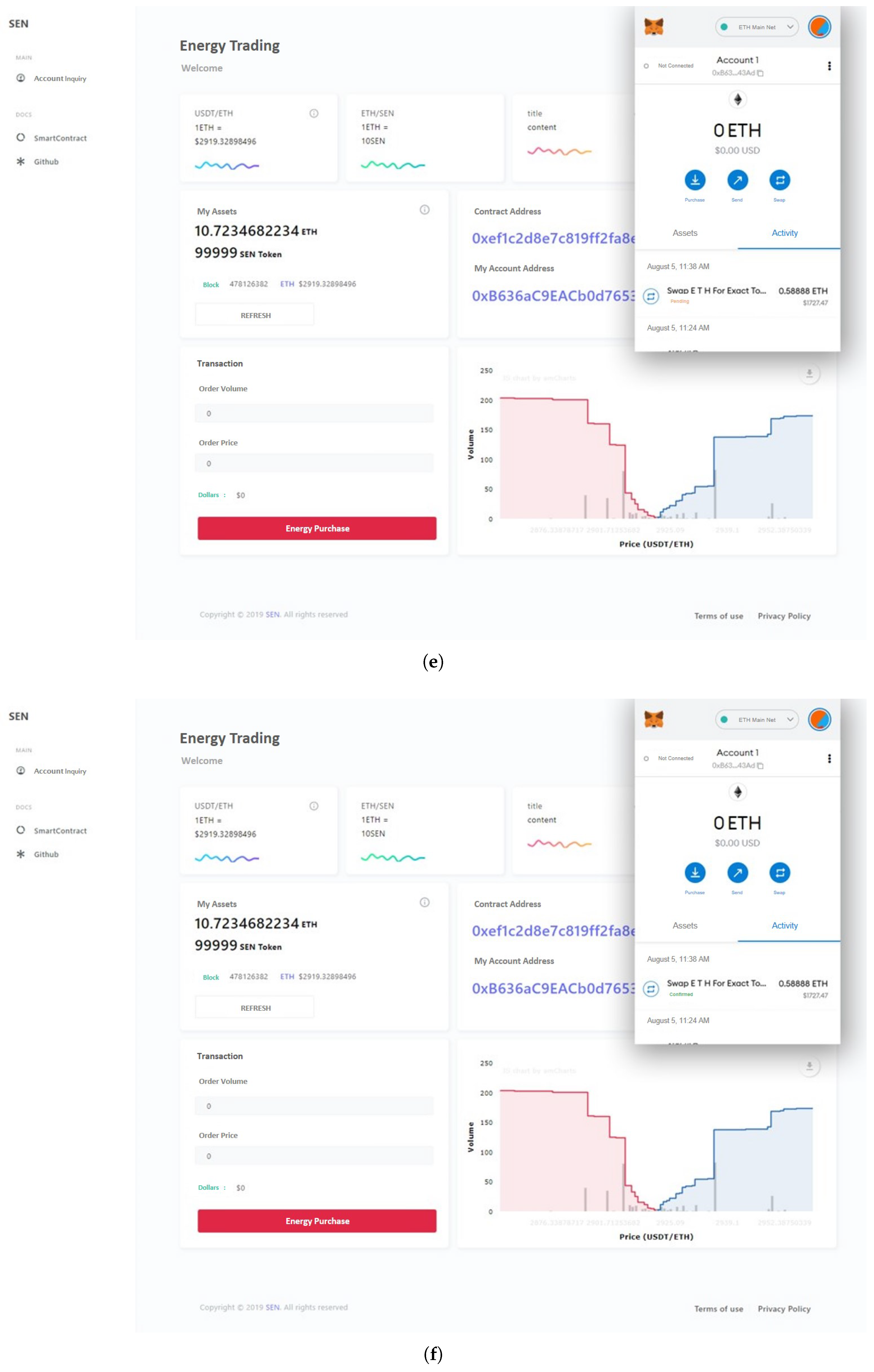

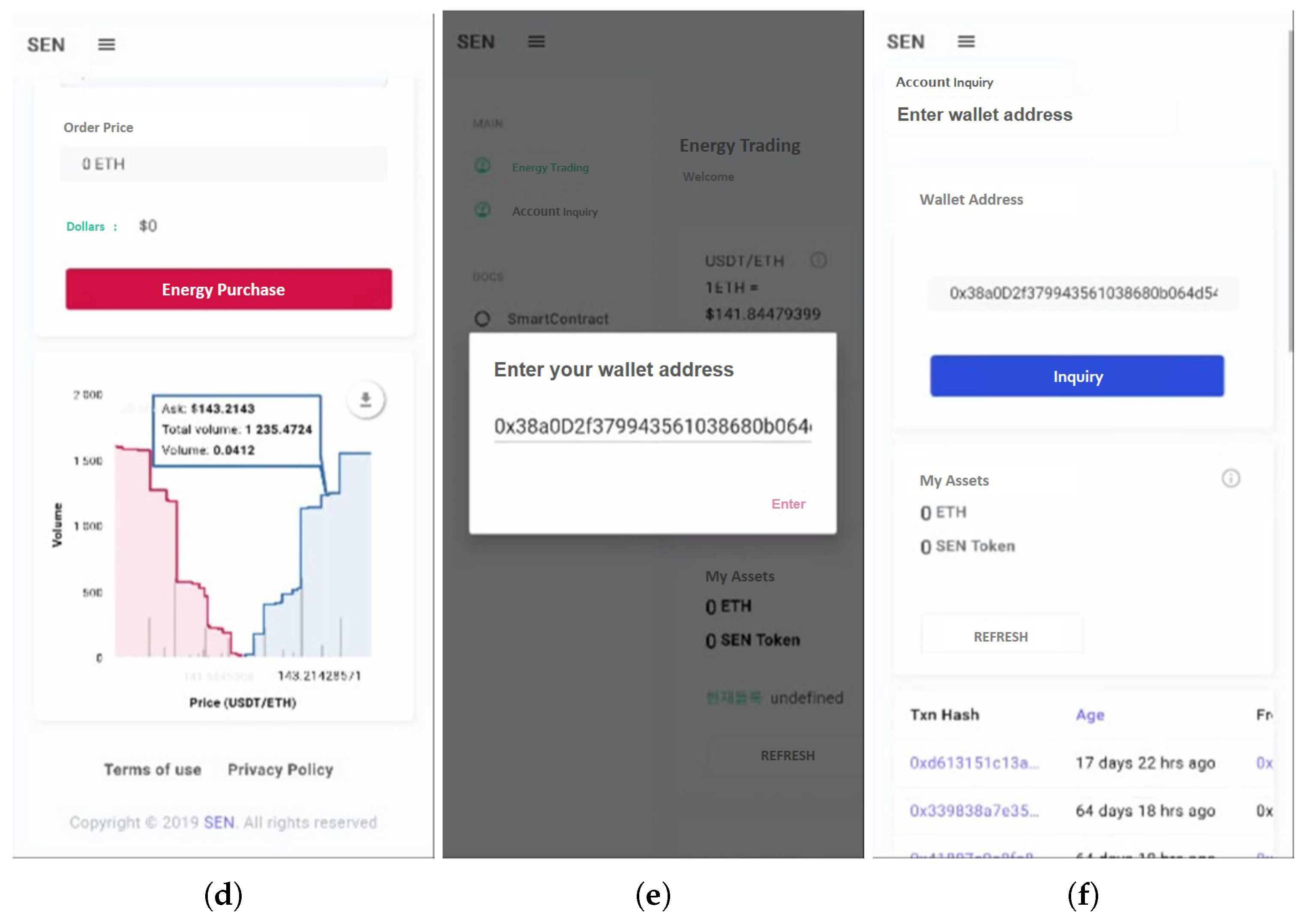

- We implement the proposed EggBlock platform using Ethereum for blockchain, which enables Android smartphones to monitor contracts of energy trading in a real-time manner. Furthermore, we build an IoT hardware testbed equipped with a solar panel to generate and deliver energy for trading.

- The measurement-based experiments in the testbed show that the proposed EggBlock achieves reliable and transparent energy trading using blockchain, and it converges to the optimal direction with short-iterations. Finally, the results of the study show that an average energy generation gain of 35% is obtained.

2. Related Works

3. Proposed System

3.1. Energy Generation

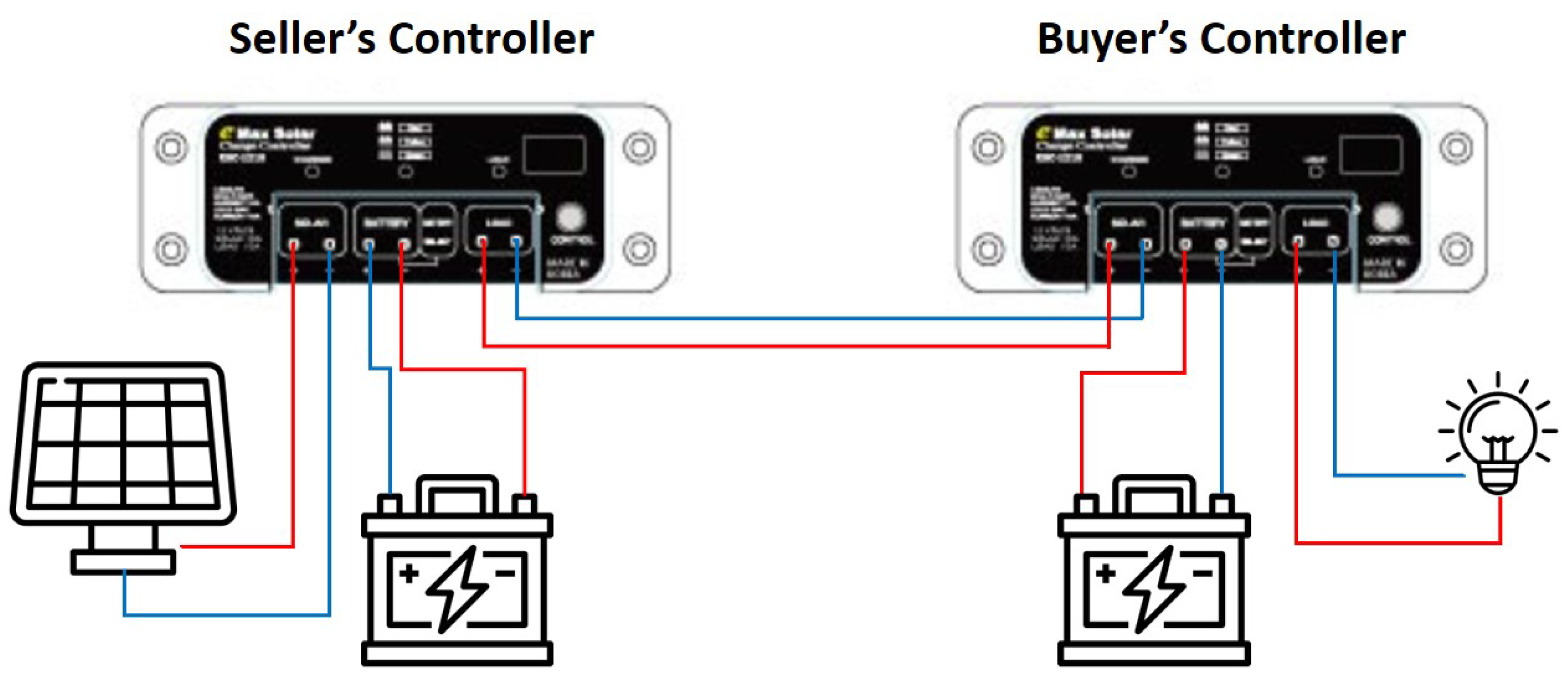

3.2. Energy Trading

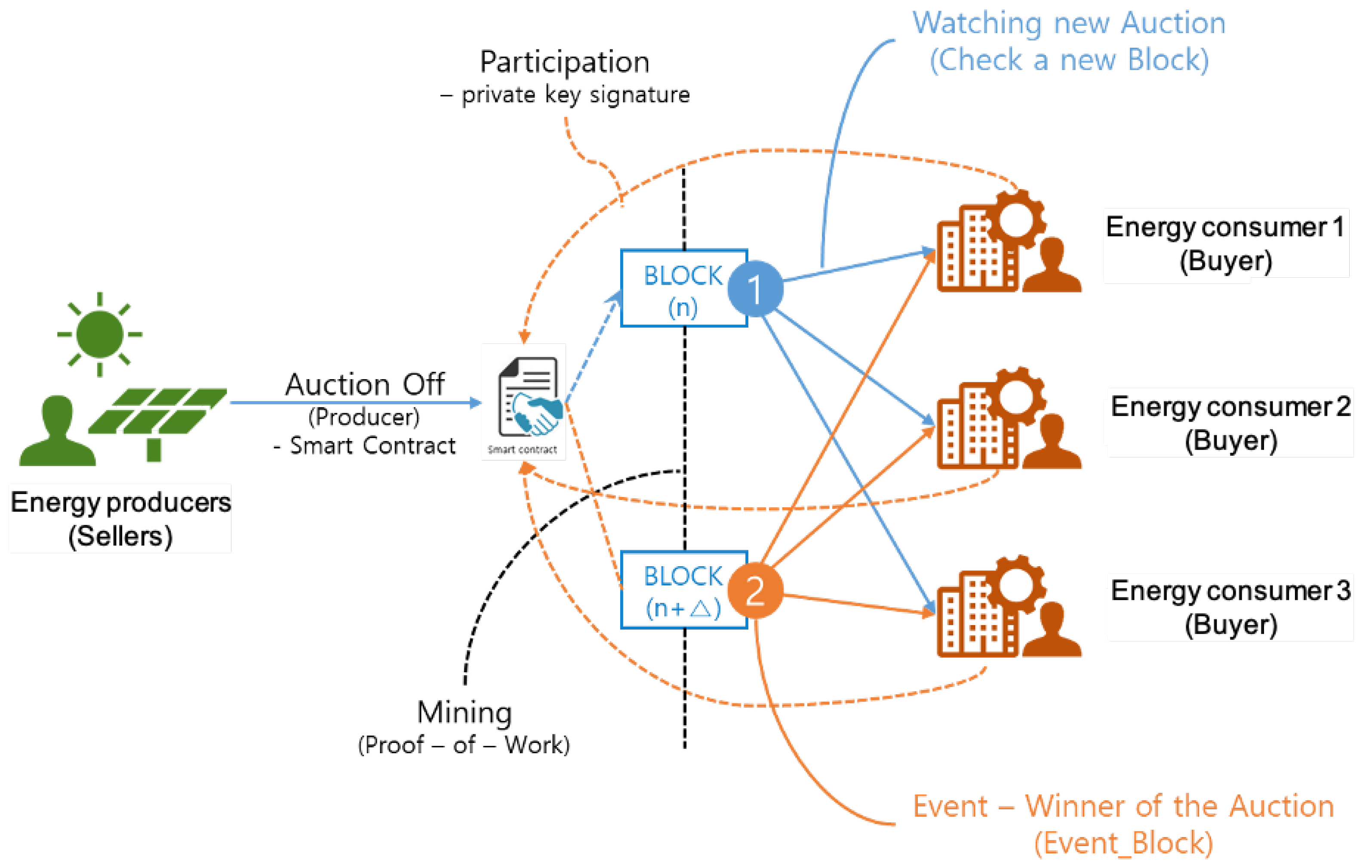

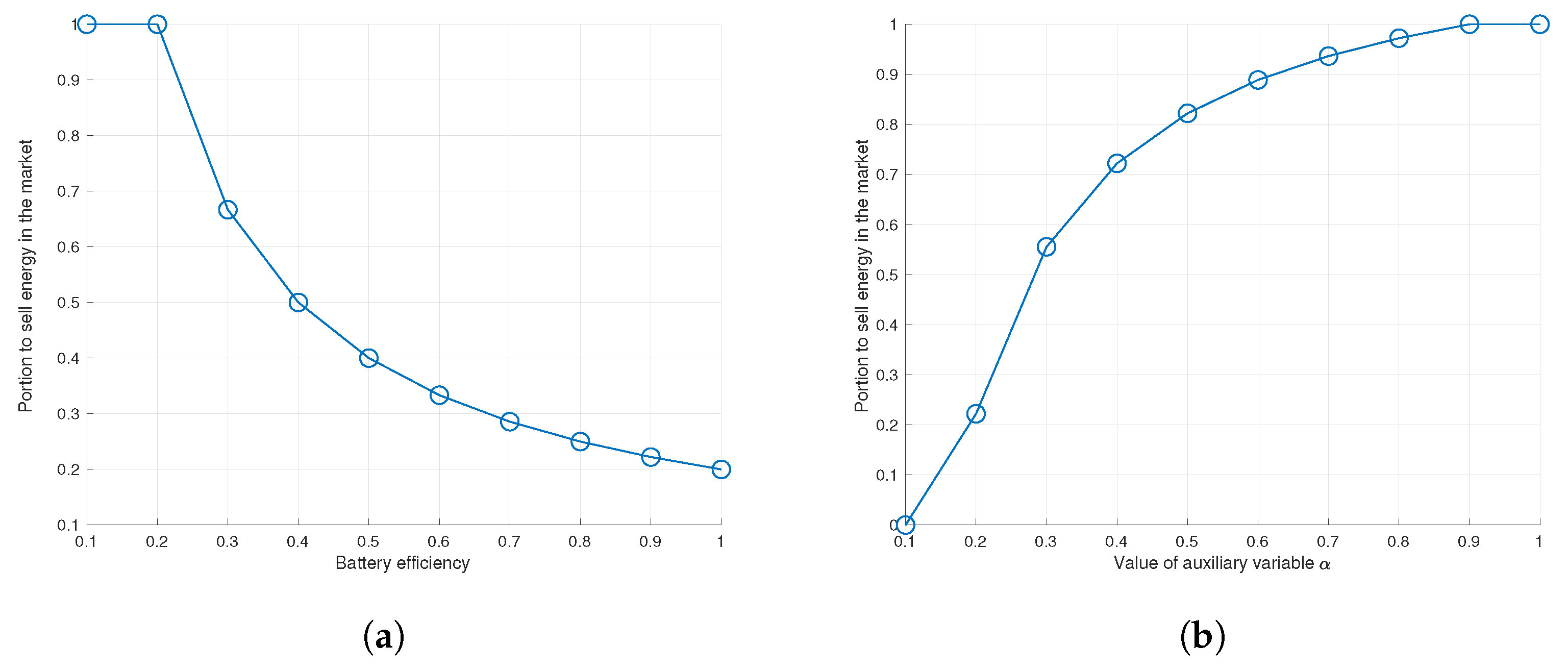

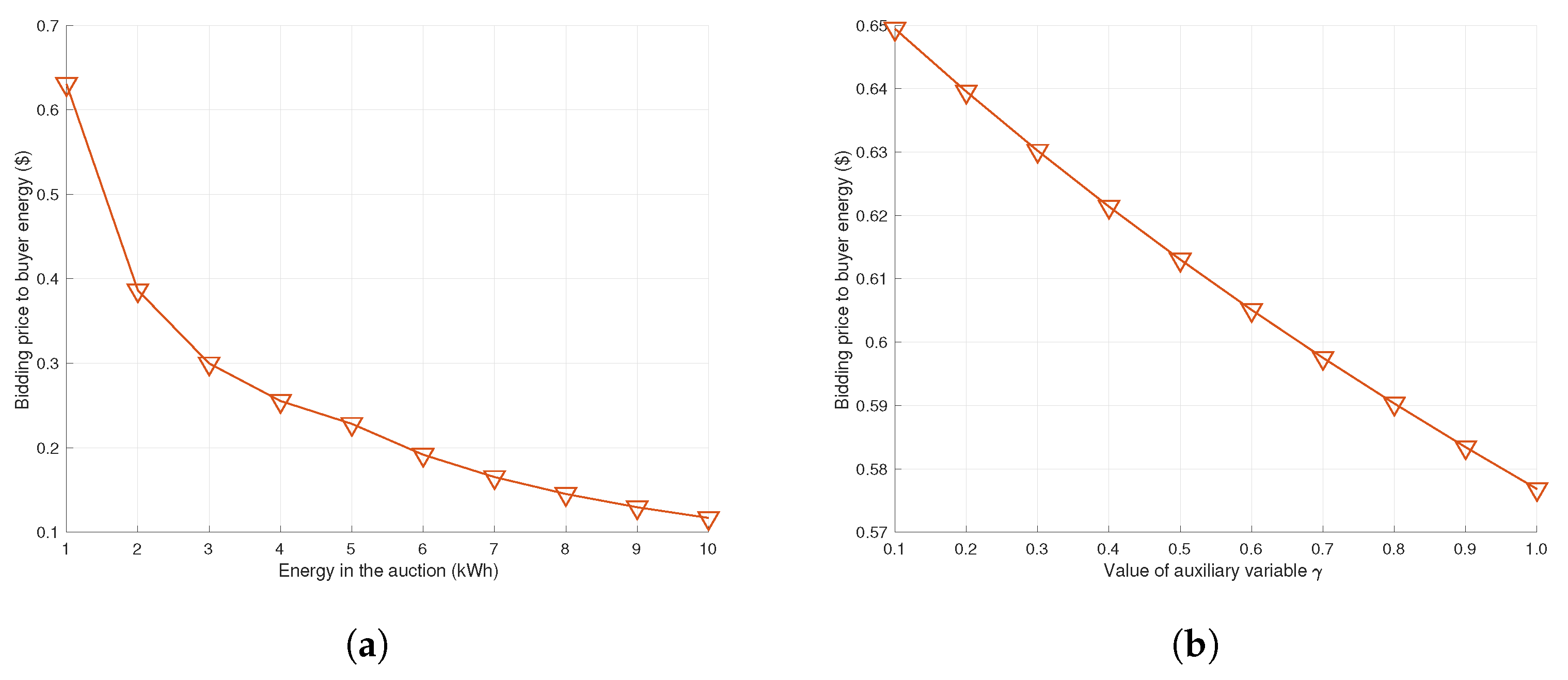

3.2.1. Determination of Transaction Based on Sealed-Bid Auction Mechanism

3.2.2. Architecture of Smart Contract

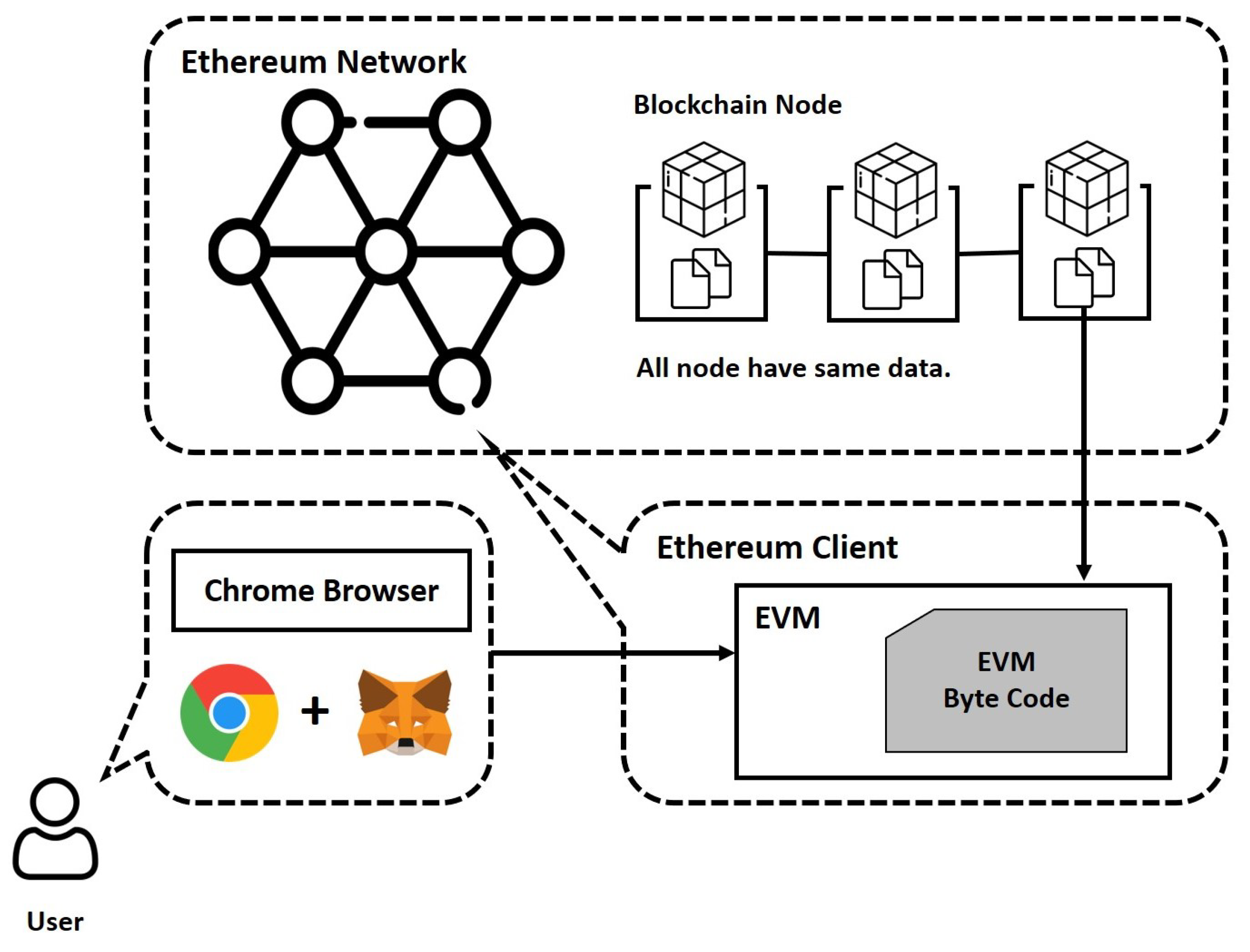

- Smart contract coding: Code the contents of the contract you want to include in the smart contract.

- Connect with Ethereum client: The written code is placed on the Ethereum virtual machine (EVM) of the Ethereum client.

- Compile the implemented code: EVM byte code will provide the compilation result.

- Smart contract distribution: Add the compiled EVM byte code to the block as a transaction and register to the blockchain.

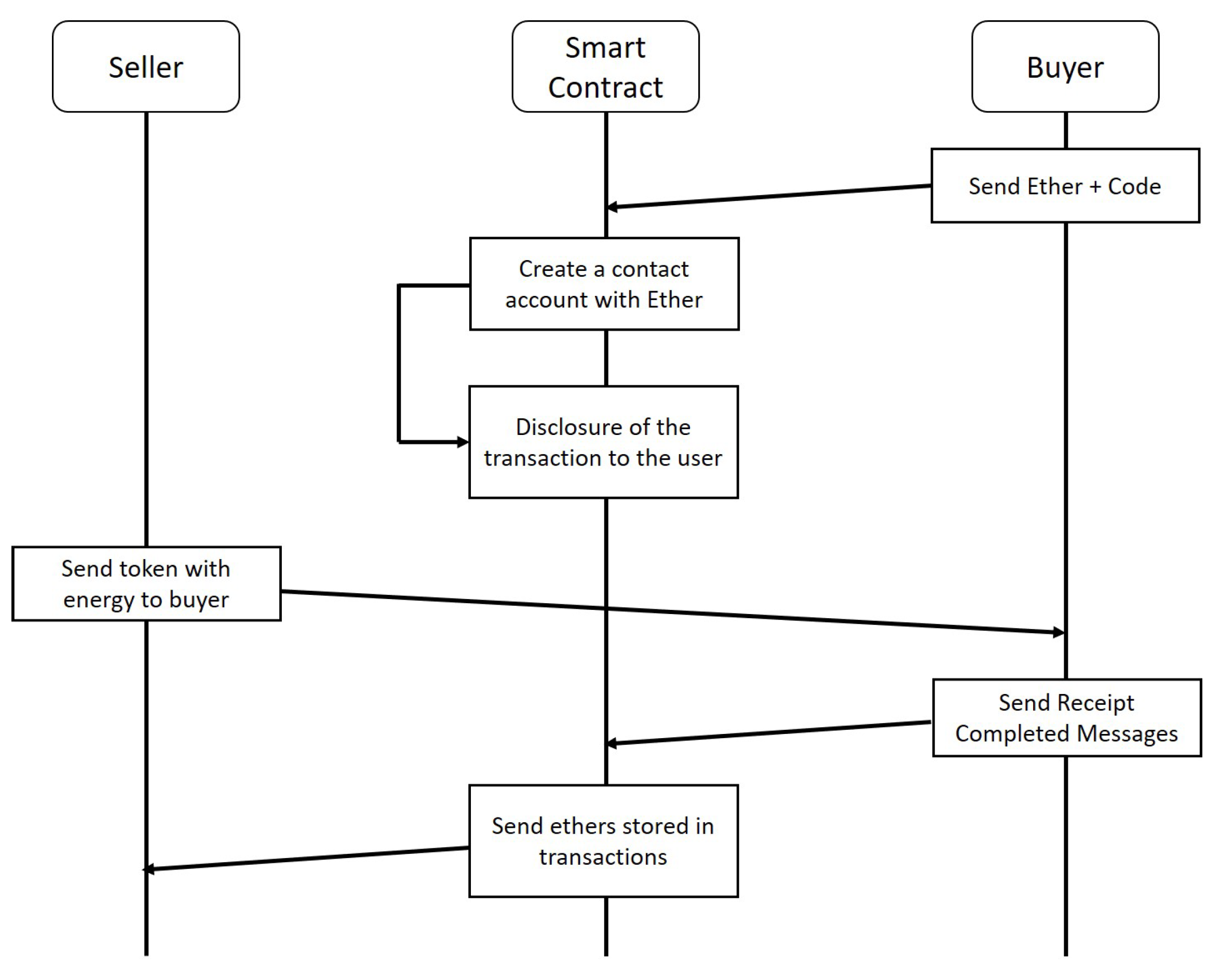

3.2.3. Transaction Process

4. Model-Free Q-Learning

4.1. Markov Decision Process

4.2. Q-Learning

| Algorithm 1 Q-Learning based solar panel control method. |

|

5. Implementation

5.1. Testbed Hardware

5.2. Software

| Algorithm 2 Transaction Condition in Smart Contract. |

|

6. Evaluation

7. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- SEIA. Solar Energy Introduction; Technical Report; SEIA: Washington, DC, USA, 2017. [Google Scholar]

- Leeton, U.; Uthitsunthorn, D.; Kwannetr, U.; Sinsuphun, N.; Kulworawanichpong, T. Power loss minimization using optimal power flow based on particle swarm optimization. In Proceedings of the ECTI-CON2010: The 2010 ECTI International Confernce on Electrical Engineering/Electronics, Computer, Telecommunications and Information Technology, Chiang Mai, Thailand, 19–21 May 2010; pp. 440–444. [Google Scholar]

- Detyniecki, M.; Marsala, C.; Krishnan, A.; Siegel, M. Weather-based solar energy prediction. In Proceedings of the 2012 IEEE International Conference on Fuzzy Systems, Brisbane, QLD, Australia, 10–15 June 2012; pp. 1–7. [Google Scholar]

- Rodríguez, F.; Fleetwood, A.; Galarza, A.; Fontán, L. Predicting solar energy generation through artificial neural networks using weather forecasts for microgrid control. Renew. Energy 2018, 126, 855–864. [Google Scholar] [CrossRef]

- Lee, J.; Guo, J.; Choi, J.K.; Zukerman, M. Distributed energy trading in microgrids: A game-theoretic model and its equilibrium analysis. IEEE Trans. Ind. Electron. 2015, 62, 3524–3533. [Google Scholar] [CrossRef]

- Zhang, C.; Wu, J.; Zhou, Y.; Cheng, M.; Long, C. Peer-to-Peer energy trading in a Microgrid. Appl. Energy 2018, 220, 1–12. [Google Scholar] [CrossRef]

- Pei, W.; Du, Y.; Deng, W.; Sheng, K.; Xiao, H.; Qu, H. Optimal bidding strategy and intramarket mechanism of microgrid aggregator in real-time balancing market. IEEE Trans. Ind. Inform. 2016, 12, 587–596. [Google Scholar] [CrossRef]

- Mihaylov, M.; Jurado, S.; Moffaert, K. NRG-X-change. In Proceedings of the 3rd International Conference on Smart Grids and Green IT Systems, Barcelona, Spain, 3–4 April 2014; pp. 101–106. [Google Scholar]

- Mengelkamp, E.; Notheisen, B.; Beer, C.; Dauer, D.; Weinhardt, C. A blockchain-based smart grid: Towards sustainable local energy markets. Comput. Sci. Res. Dev. 2018, 33, 207–214. [Google Scholar] [CrossRef]

- Zhang, T.; Pota, H.; Chu, C.C.; Gadh, R. Real-time renewable energy incentive system for electric vehicles using prioritization and cryptocurrency. Appl. Energy 2018, 226, 582–594. [Google Scholar] [CrossRef]

- Murdock, H.E.; Gibb, D.; André, T.; Appavou, F.; Brown, A.; Epp, B.; Kondev, B.; McCrone, A.; Musolino, E.; Ranalder, L.; et al. Renewables 2019 Global Status Report. 2019. Available online: https://repository.usp.ac.fj/11648/1/gsr_2019_full_report_en.pdf (accessed on 18 March 2022).

- Kuik, O.; Branger, F.; Quirion, P. Competitive advantage in the renewable energy industry: Evidence from a gravity model. Renew. Energy 2019, 131, 472–481. [Google Scholar] [CrossRef]

- Furukakoi, M.; Adewuyi, O.B.; Matayoshi, H.; Howlader, A.M.; Senjyu, T. Multi objective unit commitment with voltage stability and PV uncertainty. Appl. Energy 2018, 228, 618–623. [Google Scholar] [CrossRef]

- Cole, W.J.; Frazier, A. Cost Projections for Utility-Scale Battery Storage; Technical Report; National Renewable Energy Lab. (NREL): Golden, CO, USA, 2019.

- Hassija, V.; Chamola, V.; Garg, S.; Krishna, D.N.G.; Kaddoum, G.; Jayakody, D.N.K. A blockchain-based framework for lightweight data sharing and energy trading in V2G network. IEEE Trans. Veh. Technol. 2020, 69, 5799–5812. [Google Scholar] [CrossRef]

- Chen, X.; Zhang, T.; Ye, W.; Wang, Z.; Iu, H.H.C. Blockchain-based electric vehicle incentive system for renewable energy consumption. IEEE Trans. Circuits Syst. II Express Briefs 2020, 68, 396–400. [Google Scholar] [CrossRef]

- Hassan, M.U.; Rehmani, M.H.; Chen, J. DEAL: Differentially private auction for blockchain-based microgrids energy trading. IEEE Trans. Serv. Comput. 2019, 13, 263–275. [Google Scholar] [CrossRef]

- Gramoli, V. From blockchain consensus back to Byzantine consensus. Future Gener. Comput. Syst. 2020, 107, 760–769. [Google Scholar] [CrossRef]

- Zhu, S.; Song, M.; Lim, M.K.; Wang, J.; Zhao, J. The development of energy blockchain and its implications for China’s energy sector. Resour. Policy 2020, 66, 101595. [Google Scholar] [CrossRef]

- Watkins, C.J.; Dayan, P. Q-learning. Mach. Learn. 1992, 8, 279–292. [Google Scholar] [CrossRef]

- Wang, Q.; Zhu, X.; Ni, Y.; Gu, L.; Zhu, H. Blockchain for the IoT and industrial IoT: A review. Internet Things 2020, 10, 100081. [Google Scholar] [CrossRef]

- Levin, J. Auction Theory. 2004, Volume 20286. Available online: http://www.mohamedelafrit.com/education/CNAM/ESD208-Incitations-et-Design-Economique/Lectures/MOOCs/Stanford-Econ286/Stanford-Auction_Theory-Jonathan_Levin.pdf (accessed on 18 March 2022).

- Kim, J.; Park, H.; Lee, G.H.; Choi, J.K.; Heo, Y. Seal-bid renewable energy certification trading in power system using blockchain technology. In Proceedings of the 2020 International Conference on Information and Communication Technology Convergence (ICTC), Jeju Islan, Korea, 21–23 October 2020; pp. 1752–1756. [Google Scholar]

- Kim, J.; Lee, J.; Park, S.; Choi, J.K. Battery-wear-model-based energy trading in electric vehicles: A naive auction model and a market analysis. IEEE Trans. Ind. Inform. 2018, 15, 4140–4151. [Google Scholar] [CrossRef]

- Google. Introduction of Metamask; Technical Report; Google Inc.: Mountain View, CA, USA, 2020. [Google Scholar]

- Sutton, R.S.; Barto, A.G. Reinforcement Learning: An Introduction; MIT Press: Cambridge, MA, USA, 2018. [Google Scholar]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Kwak, S.; Lee, J.; Kim, J.; Oh, H. EggBlock: Design and Implementation of Solar Energy Generation and Trading Platform in Edge-Based IoT Systems with Blockchain. Sensors 2022, 22, 2410. https://doi.org/10.3390/s22062410

Kwak S, Lee J, Kim J, Oh H. EggBlock: Design and Implementation of Solar Energy Generation and Trading Platform in Edge-Based IoT Systems with Blockchain. Sensors. 2022; 22(6):2410. https://doi.org/10.3390/s22062410

Chicago/Turabian StyleKwak, Subin, Joohyung Lee, Jangkyum Kim, and Hyeontaek Oh. 2022. "EggBlock: Design and Implementation of Solar Energy Generation and Trading Platform in Edge-Based IoT Systems with Blockchain" Sensors 22, no. 6: 2410. https://doi.org/10.3390/s22062410

APA StyleKwak, S., Lee, J., Kim, J., & Oh, H. (2022). EggBlock: Design and Implementation of Solar Energy Generation and Trading Platform in Edge-Based IoT Systems with Blockchain. Sensors, 22(6), 2410. https://doi.org/10.3390/s22062410