Adaptive and Economically-Robust Group Selling of Spectrum Slots for Cognitive Radio-Based Networks

Abstract

1. Introduction

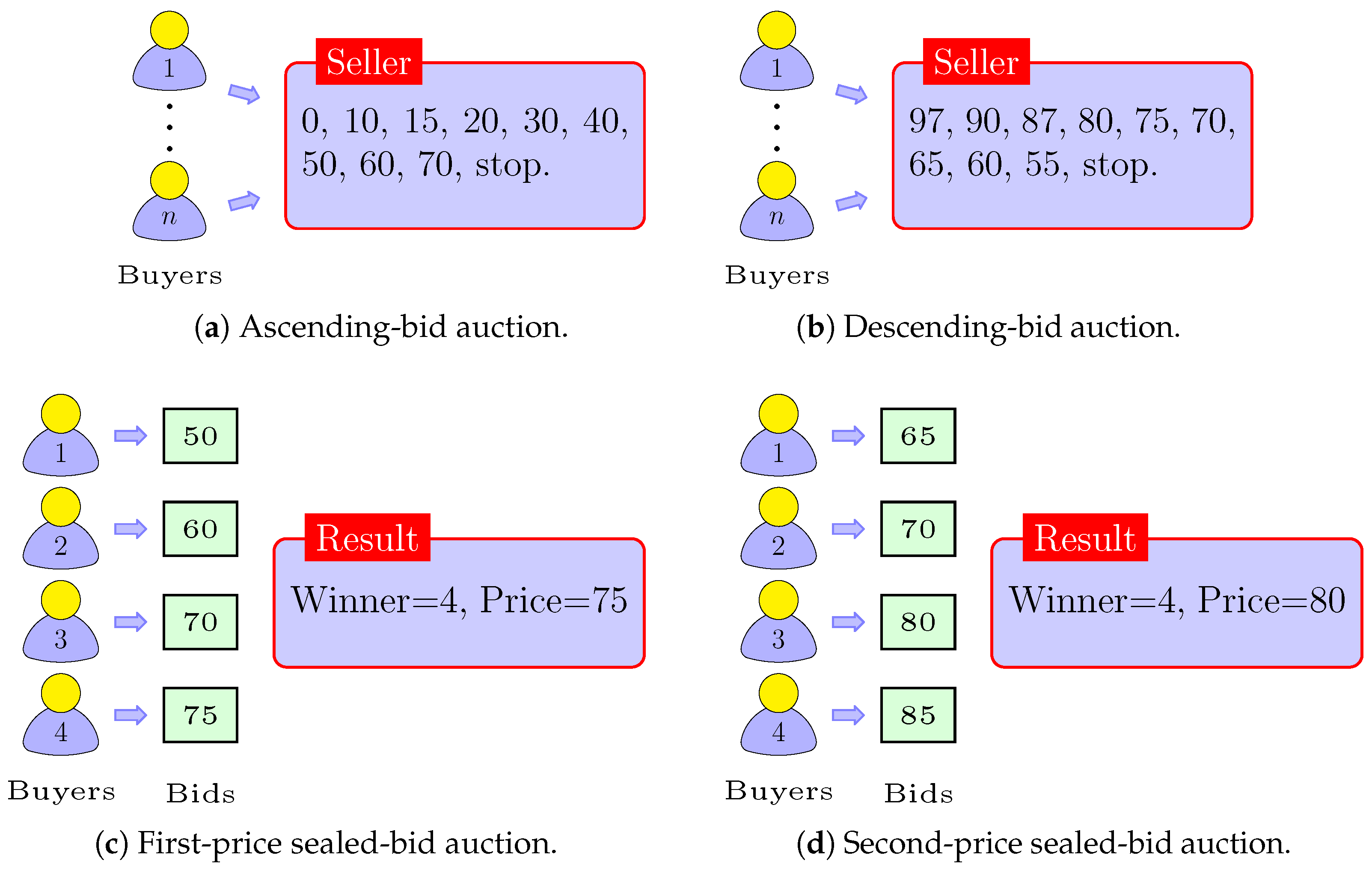

1.1. Ascending-Bid Auction

1.2. Descending-Bid Auction

1.3. First-Price Sealed-Bid Auction

1.4. Second-Price Sealed-Bid Auction

- We explore the key issues of spectrum trading with online auctions that make the implementation of the dynamic access strategy difficult in the secondary market. Using examples from a range of countries, we discuss the ways in which governments and individuals try to deal with the leading issues and highlight their causes and effects on the spectrum trading in the world today.

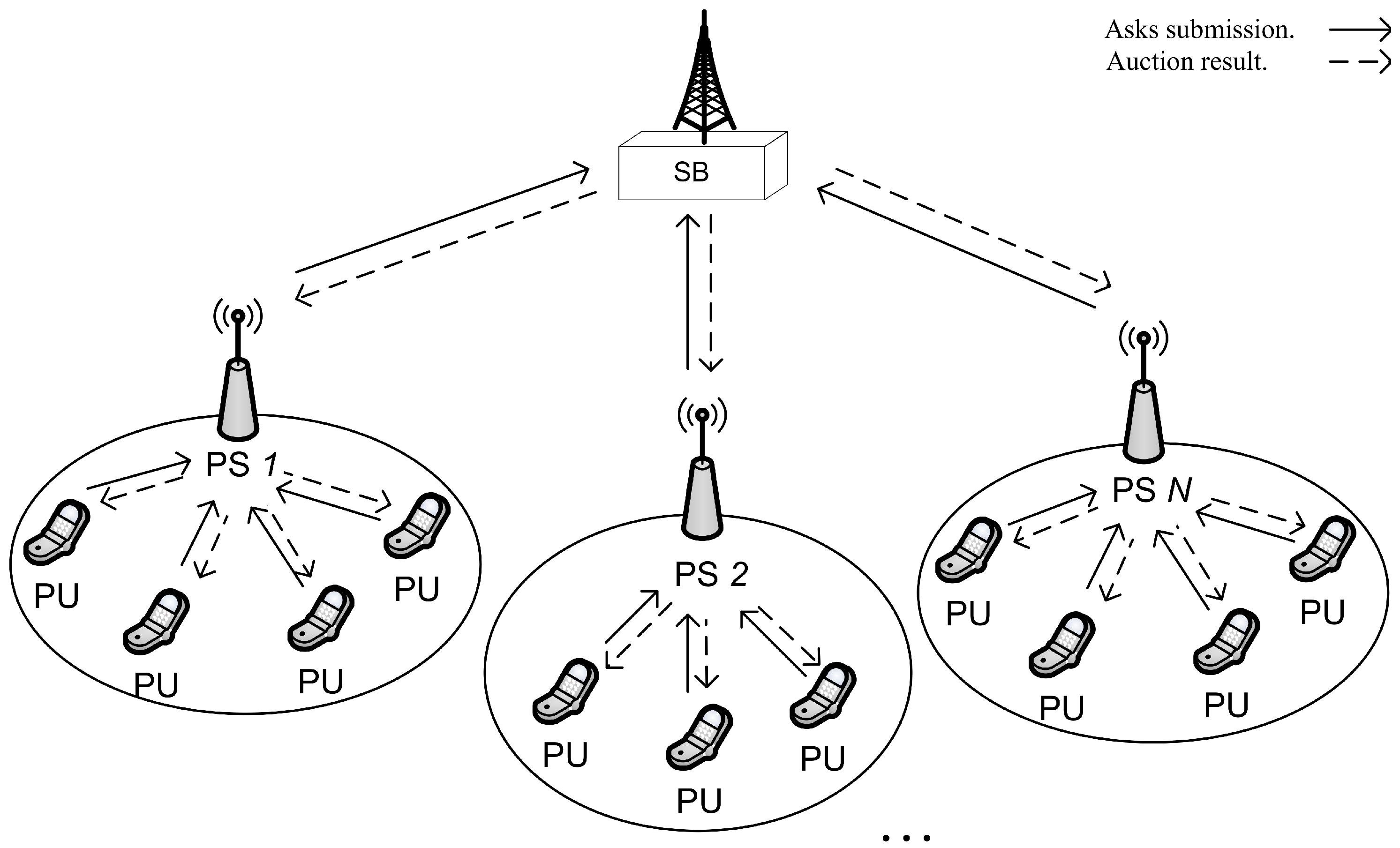

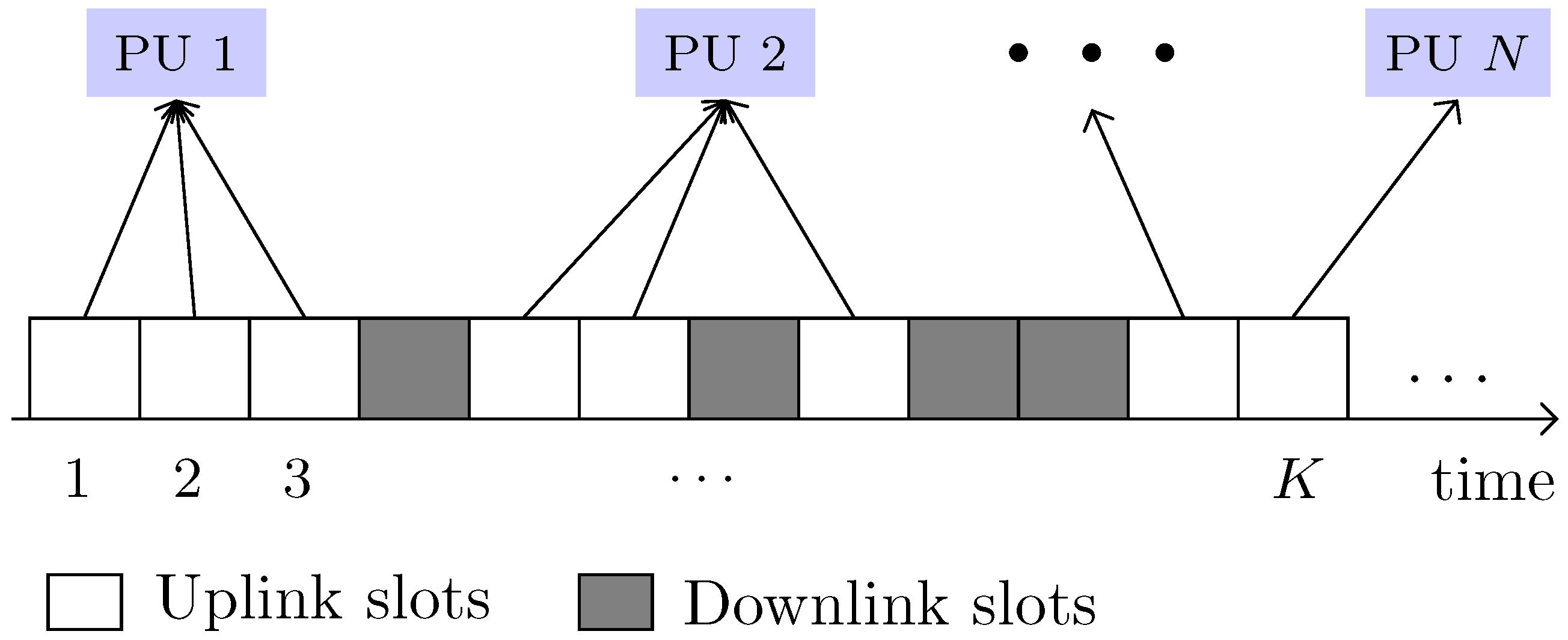

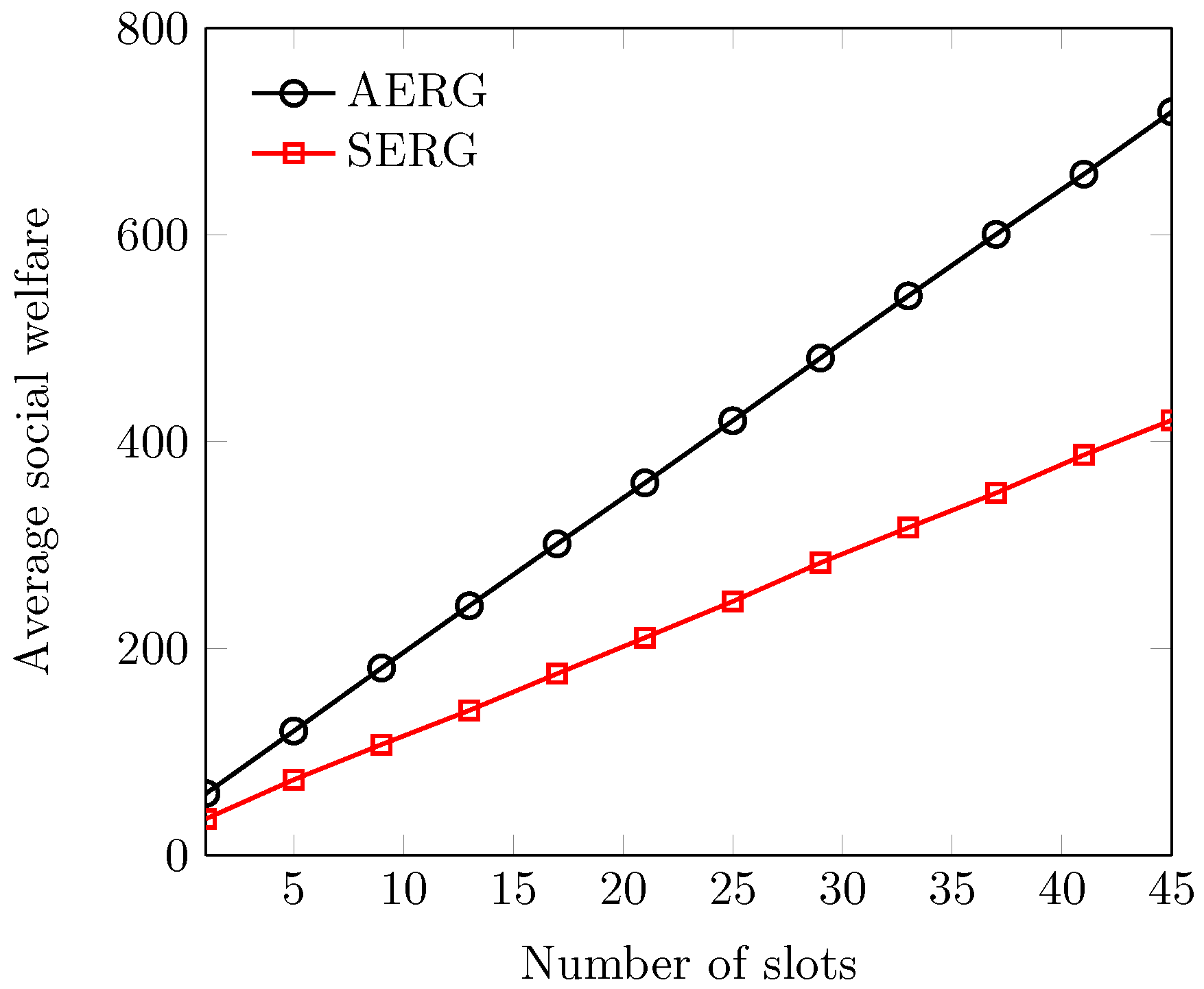

- We first develop a group selling framework of spectrum slots for cognitive radio-based Internet-of-Things. The design of proposed framework is based on the two nested auction algorithms, which is aimed at enabling PUs to sell their uplink slots in the group that otherwise wasted them in the network since they are individually not attractive to the SUs due to auction overhead.

- We develop the slots’ evaluation algorithms that adapt their asks and bid prices considering the dynamics of spectrum trading. The underlying objective is to improve the utilities of the participants such that sellers are motivated to release more and more slots and buyers are encouraged to get more spectrum in return.

2. Issues of Spectrum Leasing in Secondary Markets

2.1. Legislation and Standardization

2.2. Flexible Service Migration

2.3. Reserve Price

2.4. Trustworthy Framework

2.5. Payment Mechanism

2.6. Perceived Risks

2.7. Market Information Management

3. System Model

4. Proposed Auction Framework

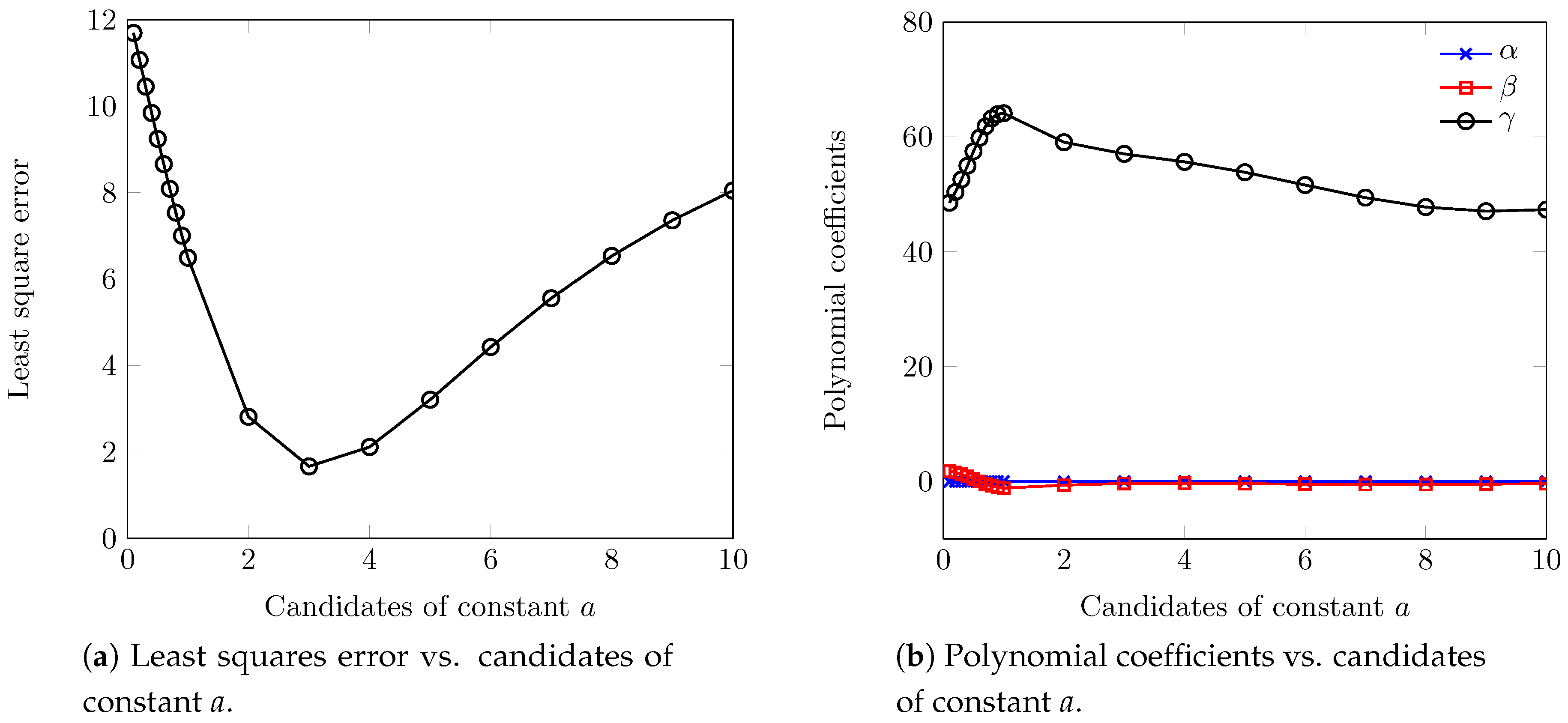

4.1. Adaption Phase

4.1.1. Ask Adaption

4.1.2. Bid Adaption

4.2. Auction Phase

4.2.1. Inner-Auction

| Algorithm 1 Inner-auction algorithm in PS i. |

|

4.2.2. Outer-Auction

| Algorithm 2 Outer-auction algorithm in SB. |

|

4.3. Remuneration Phase

5. Properties of AERG

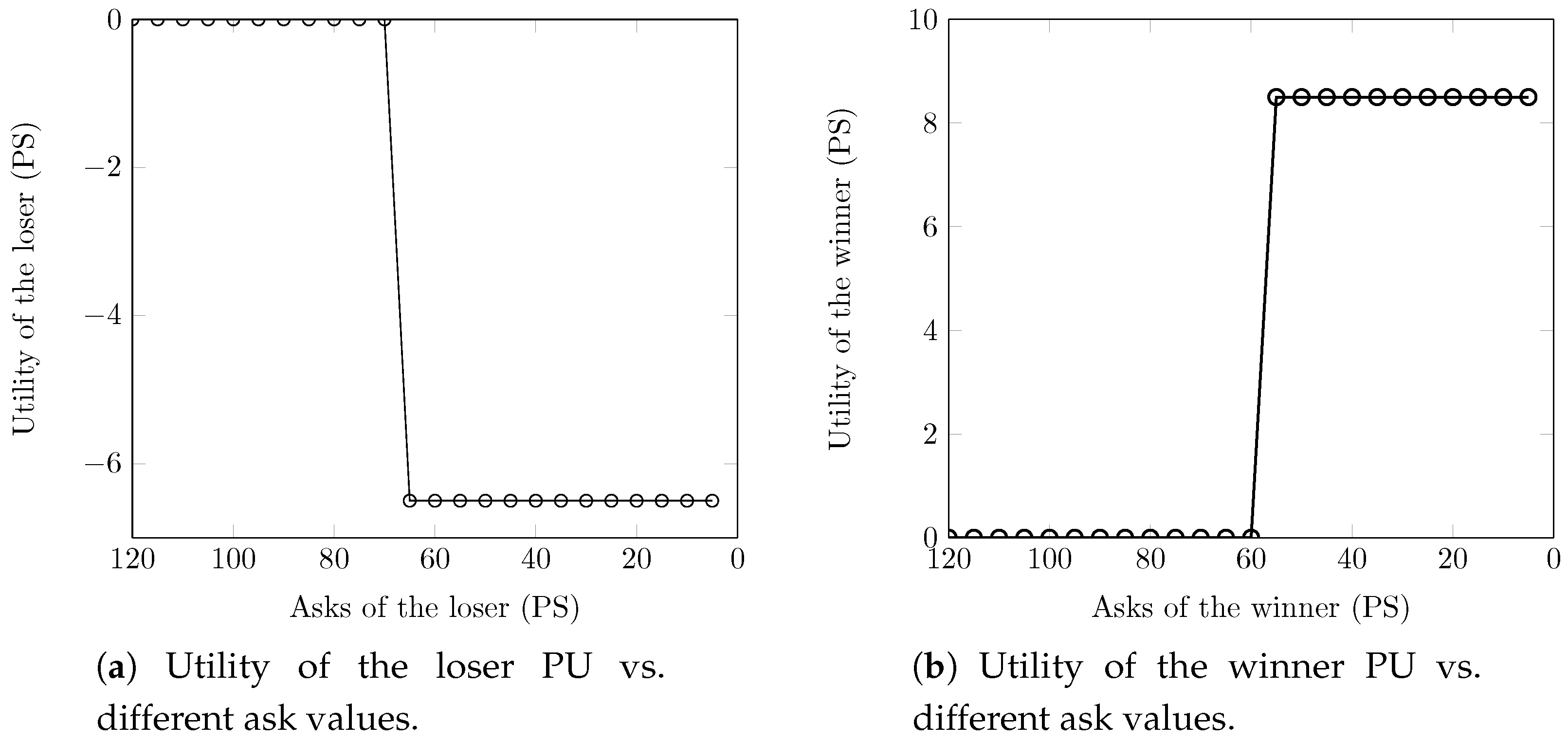

- (i)

- PU j is the looser: The utility of the looser (or sacrificed user) is zero since it cannot sell slots to the secondary market. We henceforth denote the fake asks with a unique symbol as . If the PU submits a fake ask smaller than or equal to the clearing price, i.e., , it can be selected as the seller of slots. However, it is paid then from Equation (12). Therefore, the utility of PU j becomes , and it has no incentive to do so.

- (ii)

- PU j is the winner: The PU j becomes the winner seller of slots, and its maximum revenue is . The utility of PU j is given as . Note that remains unchanged, although PU j submits the fake ask because the clearing price is independent. Hence, the PU i cannot improve its utility with the fake ask.

- (i)

- PS i is not qualified: The utility of PS i is zero because it cannot sell the spectrum slots. Suppose that the PS submits a fake ask smaller than or equal to the reserve-bid, i.e., , it can be selected as the winner. However, PS then gets payment , and its utility becomes . On the other hand, it cannot control the reserve-bid since it is independent of the PS i’s ask and the section of the winner is purely a random process. Therefore, it is guaranteed that no PS can increase its utility with the untruthful ask.

- (ii)

- PS i is qualified, but not the winner: The utility of PS i is zero because it is a loser. If PS i untruthfully submits the lower ask to become a winner, but the gap between its highest ask and the randomly chosen ask is unknown, it remains a loser. Even if PS submits a fake ask smaller than or equal to the reserve-bid, i.e., , it is selected as the winner. However, it is paid then . In that case, the utility becomes . Therefore, PS i cannot increase its utility with the fake ask.

- (iii)

- PS i is the winner: Denoting the other qualified seller as PS 2, the utility of PS i is written as . Suppose that PS i submits the fake ask ; it can increase the price of the spectrum slots to . However, it cannot be a winner anymore due to the highest ask, and its utility becomes zero. Hence, PS i cannot increase its utility by the untruthful ask.

6. Performance Analysis

6.1. Simulation Setup

6.2. Results’ Discussion

7. Conclusions

Author Contributions

Funding

Conflicts of Interest

References

- Palattella, M.R.; Dohler, M.; Grieco, A.; Rizzo, G.; Torsner, J.; Engel, T.; Ladid, L. Internet of Things in the 5G era: Enablers, architecture, and business models. IEEE J. Sel. Areas Commun. 2016, 34, 510–527. [Google Scholar] [CrossRef]

- Whitepaper: “IoT Platforms-Enabling the Internet of Things (2016)”. Available online: https://www.ihs.com/Info0416/internet-of-things.html (accessed on 15 February 2018).

- Mitola, J.; Maguire, G.Q. Cognitive radios: Making software radios more personal. IEEE Pers. Commun. 1999, 6, 13–18. [Google Scholar] [CrossRef]

- Rashid, B.; Rehmani, M.H.; Ahmad, A. Broadcasting strategies for cognitive radio networks: Taxonomy, issues, and open challenges. Comput. Electr. Eng. 2016, 31, 349–361. [Google Scholar] [CrossRef]

- Csurgai-Horvath, L.; Rieger, I.; Kertesz, J. A Survey of the DVB-T Spectrum: Opportunities for Cognitive Mobile Users. Mob. Inf. Syst. 2016, 2016, 3234618. [Google Scholar] [CrossRef]

- Patil, K.; Prasad, R.; Skouby, K. A survey of worldwide spectrum occupancy measurement campaigns for cognitive radio. In Proceedings of the 2011 International Conference on Devices and Communications (ICDeCom), Mesra, India, 24–25 February 2011; pp. 1–5. [Google Scholar]

- Mehdawi, M.; Riley, N.; Paulson, K.; Fanan, A.; Ammar, M. Spectrum occupancy survey in HULL-UK for cognitive radio applications: Measurement and analysis. Int. J. Sci. Technol. Res. 2013, 2, 231–236. [Google Scholar]

- FCC Public Notice News Media Information 202/418-0500, “Advanced Wireless Services (AWS-3) Auction Summary (2015)”. Available online: http://wireless.fcc.gov/auctions/default.htm?job=auction_summary&id=97 (accessed on 10 March 2018).

- Australian 4G Spectrum Auction Results. Ausdroid, Hornsby, Australia. Available online: http://ausdroid.net/2013/05/08/australian-4g-spectrum-auction-results/ (accessed on 25 December 2017).

- Cassady, R. Auctions and Auctioneering; University of California Press: Berkley, CA, USA; Los Angeles, CA, USA, 1967. [Google Scholar]

- Easley, D.; Kleinberg, J. Networks, Crowds, and Markets: Reasoning about a Highly Connected World; Cambridge University Press: Cambridge, UK, 2010. [Google Scholar]

- Cramton, P. Spectrum auction design. Rev. Ind. Organ. 2013, 42, 161–190. [Google Scholar] [CrossRef]

- Vickrey, W. Counterspeculation, Auctions, and Competitive Sealed Tenders. J. Financ. 1961, 16, 8–37. [Google Scholar] [CrossRef]

- Zhu, Y.; Li, B.; Li, Z. Truthful spectrum auction design for secondary networks. In Proceedings of the IEEE INFOCOM, Orlando, FL, USA, 25–30 March 2012; pp. 873–881. [Google Scholar]

- Zhou, X.; Zheng, H. Trust: A general framework for truthful double spectrum auctions. In Proceedings of the IEEE INFOCOM, Rio de Janeiro, Brazil, 19–25 April 2009; pp. 999–1007. [Google Scholar]

- Myerson, R.B.; Satterthwaite, M.A. Efficient mechanisms for bilateral trading. J. Econ. Theory 1983, 29, 265–281. [Google Scholar] [CrossRef]

- Pan, M.; Chen, F.; Yin, X.; Fang, Y. Fair profit allocation in the spectrum Auction using the shapley value. In Proceedings of the 2009 IEEE Global Telecommunications Conference, Honolulu, HI, USA, 30 November–4 December 2009; pp. 1–6. [Google Scholar]

- Zhou, X.; Gandhi, G.; Suri, S.; Zheng, H. eBay in the sky: Strategy-proof wireless spectrum auctions. In Proceedings of the 14th ACM International Conference on Mobile Computing and Networking, San Francisco, CA, USA, 14–19 September 2008; pp. 2–13. [Google Scholar]

- Jia, J.; Zhang, Q.; Zhang, Q.; Liu, M. Revenue generation for truthful spectrum auction in dynamic spectrum access. In Proceedings of the 10th ACM International Symposium on Mobile Ad Hoc Networking and Computing, New Orleans, LA, USA, 18–21 May 2009; pp. 3–12. [Google Scholar]

- Wang, S.; Xu, P.; Xu, X.; Tang, S.; Li, X.; Liu, X. Toda: Truthful online double auction for spectrum allocation in wireless networks. In Proceedings of the 2010 IEEE Symposium on New Frontiers in Dynamic Spectrum (DySPAN), Singapore, 6–9 April 2010; pp. 1–10. [Google Scholar]

- Pan, M.; Sun, J.; Fang, Y. Purging the back-room dealing: Secure spectrum auction leveraging paillier cryptosystem. IEEE J. Sel. Areas Commun. 2011, 29, 866–876. [Google Scholar]

- Wu, F.; Vaidya, N. A strategy-proof radio spectrum auction mechanism in non cooperative wireless networks. IEEE Trans. Mob. Comput. 2013, 12, 885–894. [Google Scholar] [CrossRef]

- Chen, Y.; Zhang, J.; Wu, K.; Zhang, Q. TAMES: A truthful auction mechanism for heterogeneous spectrum allocation. In Proceedings of the IEEE INFOCOM, Turin, Italy, 14–19 April 2013; pp. 180–184. [Google Scholar]

- Abdelhadi, A.; Shajaiah, H.; Clancy, C. A multi-tier wireless spectrum sharing system leveraging secure spectrum auctions. IEEE Trans. Cogn. Commun. Netw. 2015, 1, 217–229. [Google Scholar] [CrossRef]

- Saini, N.; Chatterjee, M. Multi-bid spectrum auctions in dynamic spectrum access networks with spatial reuse. In Proceedings of the 2017 9th International Conference on Communication Systems and Networks, Bangalore, India, 4–8 January 2017; pp. 101–108. [Google Scholar]

- Zhang, Y.; Yang, D.; Lin, J.; Li, M.; Xue, G.; Tang, J.; Xie, L. Spectrum auctions under physical interference model. IEEE Trans. Cogn. Commun. Netw. 2017, 3, 719–728. [Google Scholar] [CrossRef]

- Tehrani, R.H.; Vahid, S.; Triantafyllopoulou, D.; Lee, H.; Moessner, K. Licensed spectrum sharing schemes for mobile operators: A survey and outlook. IEEE Commun. Surv. Tutor. 2016, 18, 2591–2623. [Google Scholar] [CrossRef]

- Zhang, L.; Xiao, M.; Wu, G.; Alam, M.; Liang, Y.-C.; Li, S. A survey of advanced techniques for spectrum sharing in 5G networks. IEEE Wirel. Commun. 2017, 24, 44–51. [Google Scholar] [CrossRef]

- Gandotra, P.; Jha, R.K.; Jain, S. Green communication in next generation cellular networks: A survey. IEEE Access 2017, 5, 11727–11758. [Google Scholar] [CrossRef]

- Xie, R.; Yu, F.R.; Ji, H. Spectrum sharing and resource allocation for energy-efficient heterogeneous cognitive radio networks with femtocells. In Proceedings of the IEEE International Conference on Communications (ICC), Ottawa, ON, Canada, 10–15 June 2012; pp. 1661–1665. [Google Scholar]

- Niyato, D.; Hossain, E.; Han, Z. Dynamics of multiple-seller and multiple-buyer spectrum trading in cognitive radio networks: A game-theoretic modeling approach. IEEE Trans. Mob. Comput. 2009, 8, 1009–1022. [Google Scholar] [CrossRef]

- Nie, N.; Comaniciu, C. Adaptive channel allocation spectrum etiquette for cognitive radio networks. In Proceedings of the First IEEE International Symposium on New Frontiers in Dynamic Spectrum Access Networks (DySPAN), Baltimore, MD, USA, 8–11 November 2005; pp. 269–278. [Google Scholar]

- Zhang, Y.; Song, L.; Pan, M.; Dawy, Z.; Han, Z. Non-cash auction for spectrum trading in cognitive radio networks: Contract theoretical model with joint adverse selection and moral hazard. IEEE J. Sel. Areas Commun. 2017, 35, 643–653. [Google Scholar] [CrossRef]

- Cramton, P. Lessons Learned From the UK 3G Spectrum Auction. Report Commissioned by the National Audit Office of the United Kingdom. 2001. Available online: https://econpapers.repec.org/paper/pccpccumd/01nao.htm (accessed on 27 May 2018).

- Wu, F.; Vaidya, N. SMALL: A strategy-proof mechanism for radio spectrum allocation. In Proceedings of the IEEE INFOCOM, Shanghai, China, 10–15 April 2011; pp. 81–85. [Google Scholar]

- Yang, D.; Fang, X.; Xue, G. Truthful auction for cooperative communications. In Proceedings of the 12th ACM International Symposium on Mobile Ad Hoc Networking and Computing, Paris, France, 16–20 May 2011; p. 9. [Google Scholar]

- Feng, X.; Chen, Y.; Zhang, J.; Zhang, Q.; Li, B. TAHES: Truthful double auction for heterogeneous spectrums. In Proceedings of the IEEE INFOCOM, Orlando, FL, USA, 25–30 March 2012; pp. 3076–3080. [Google Scholar]

- Zheng, Z.; Wu, F.; Chen, G. A strategy-proof combinatorial heterogeneous channel auction framework in noncooperative wireless networks. IEEE Trans. Mob. Comput. 2015, 14, 1123–1137. [Google Scholar] [CrossRef]

- Lin, P.; Feng, X.; Zhang, Q.; Hamdi, M. Groupon in the air: A three-stage auction framework for spectrum group-buying. In Proceedings of the EEE INFOCOM, Turin, Italy, 14–19 April 2013; pp. 2013–2021. [Google Scholar]

- Shafiq, M.; Choi, J.-G. Adaptive Auction Framework for Spectrum Market in Cognitive Radio Networks. J. Netw. Syst. Manag. 2018, 26, 518–546. [Google Scholar] [CrossRef]

- Yang, D.; Xue, G.; Zhang, X. Group buying spectrum auctions in cognitive radio networks. IEEE Trans. Veh. Technol. 2017, 66, 810–817. [Google Scholar] [CrossRef]

- Roy, A.; Midya, S.; Majumder, K.; Phadikar, S.; Dasgupta, A. Optimized secondary user selection for quality of service enhancement of Two-Tier multi-user Cognitive Radio Network: A game theoretic approach. Comput. Netw. 2017, 123, 1–18. [Google Scholar] [CrossRef]

- Cave, M.; Doyle, C.; Webb, W. Essentials of Modern Spectrum Management; Cambridge University Press: Cambridge, UK, 2007. [Google Scholar]

- Working Party on Telecommunication and Information Services Policies (2005), Secondary Markets for Spectrum: Policy Issues. Available online: http://www.oecd.org/dataoecd/59/2/34758854.pdf (accessed on 20 March 2018).

- Stevenson, C.R.; Chouinard, G.; Lei, Z.; Hu, W.; Shellhammer, S.J.; Caldwell, W. IEEE 802.22: The first cognitive radio wireless regional area network standard. IEEE Commun. Mag. 2009, 47, 130–138. [Google Scholar] [CrossRef]

- Tripathi, P.S.; Prasad, R. Spectrum Trading in India and 5G. J. ICT Stand. 2013, 1, 159–174. [Google Scholar] [CrossRef]

- McMillan, J. Selling spectrum rights. J. Econ. Perspect. 1994, 8, 145–162. [Google Scholar] [CrossRef]

- Burguet, R.; Sakovics, J. Imperfect competition in auction design. Int. Econ. Rev. 1999, 40, 231–247. [Google Scholar] [CrossRef]

- Hernando-Veciana, A. Competition among auctioneers in large markets. J. Econ. Theory 2005, 121, 107–127. [Google Scholar] [CrossRef]

- Digital Dividend Australian Auction—Results. Available online: http://www.acma.gov.au/Industry/Spectrum/Digital-Dividend-700MHz-and-25Gz-Auction/Reallocation/digital-dividend-auction-results (accessed on 15 January 2018).

- Cramton, P.; Ockenfels, A. The German 4G spectrum auction: Design and behaviour. Econ. J. 2017, 127, F305–F324. [Google Scholar] [CrossRef]

- Stefan, Z. Available Determining the Criteria for Successful Spectrum Auctions. Available online: http://www.itu.int/en/ITU-D/Partners/Documents/GSMAWorkshopPresoColeago.pdf (accessed on 10 October 2017).

- German Spectrum Auction Ends but Prices Low. Available online: http://www.rethinkwireless.com/2010/05/21/german-spectrum-auction-ends-prices-low.htm (accessed on 25 February 2018).

- Dow, N.J. German Spectrum Auction Gains to Total EUR6 Billion-EUR8 Billion-KPMG (2010). Available online: http://m.foxbusiness.com/quickPage.html?page=19453&content=-37250749&pageNum=-1 (accessed on 20 April 2018).

- Bonatti, P.; Duma, C.; Olmedilla, D.; Shahmehri, N. An integration of reputation-based and policy-based trust management. Networks 2007, 28, 10. [Google Scholar]

- Xu, H.; Shatz, S.M.; Bates, C.K. A framework for agent-based trust management in online auctions. In Proceedings of the IEEE 5th Intnational Conference on Information Technology New Generations (ITNG 2008), Las Vegas, NV, USA, 7–9 April 2008; pp. 149–155. [Google Scholar]

- Kauffman, R.J.; Wood, C.A. Running up the bid: Modeling seller opportunism in Internet auctions. In Proceedings of the 6th Americas Conference on Information Systems (AMCIS 2000), Long Beach, CA, USA, January 2000; p. 376. [Google Scholar]

- Hassan, M.R.; Karmakar, G.; Kamruzzaman, J.; Srinivasan, B. A comprehensive spectrum trading scheme based on market competition, reputation and buyer specific requirements. Comput. Netw. 2015, 84, 17–31. [Google Scholar] [CrossRef]

- Hassan, M.R.; Karmakar, G.; Kamruzzaman, J. Reputation and user requirement based price modeling for dynamic spectrum access. IEEE Trans. Mob. Comput. 2014, 13, 2128–2140. [Google Scholar] [CrossRef]

- Crocioni, P. Is allowing trading enough? Making secondary markets in spectrum work. Telecommun. Policy 2009, 33, 451–468. [Google Scholar] [CrossRef]

- Zahra-Malik, M. Pakistan’s Long Awaited 3G, 4G Auction Draws Disappointing Bids. Available online: http://www.reuters.com/article/pakistan-telecomunications-licences-idUSL3N0N72G620140415 (accessed on 15 May 2018).

- FCC First Reportt and Order in the Matter of Unlicensed Operation in the TV Broadcast Bands. ET Docket No. 04-186; 2006. Available online: http://hraunfoss.fcc.gov/edocs_public/attachmatch/FCC-06-156A1.pdf (accessed on 10 January 2018).

- Washington, J.A. Basic Technical Mathematics with Calculus, 7th ed.; Addison Wesley Longman, Inc.: Boston, MA, USA, 1999; ISBN 0-201-35666-X. [Google Scholar]

- Hunter, J.S. The exponential weighted moving average. J. Qual. Technol. 1986, 18, 203–210. [Google Scholar] [CrossRef]

| Category | Individual-Buying | Group-Buying | Group-Selling | |

|---|---|---|---|---|

| Auctions | ||||

| WERITAS | ✓ | ✗ | ✗ | |

| SMALL | ✓ | ✗ | ✗ | |

| TRUST | ✓ | ✗ | ✗ | |

| TASC | ✓ | ✗ | ✗ | |

| TAHES | ✓ | ✗ | ✗ | |

| SMASHER | ✓ | ✗ | ✗ | |

| TASG | ✗ | ✓ | ✗ | |

| DEAL | ✗ | ✓ | ✗ | |

| TRUBA | ✗ | ✓ | ✗ | |

| AERG | ✗ | ✗ | ✓ | |

| Notation | Description |

|---|---|

| N | Number of PUs |

| Number of PUs served by PS i | |

| C | Number of available channels |

| Number of free uplink slots in channel c at PS i | |

| SB’s projection of PS i’s ask on slots in channel c | |

| PU j’s projected revenue on slots in channel c in PS i | |

| PS i’s ask on slots in channel c | |

| SB’s reserve-bid of slots in channel c | |

| PU j’s ask on slots in channel c (at PS i) | |

| PU j’s reserve-ask of slots in channel c | |

| Availability of slots in channel c at PU j | |

| Slots price of channel c | |

| Winner set of the outer-auction | |

| Winner set of the inner-auction at PS i | |

| Revenue of PS i from the SB | |

| Revenue of PU j from PS i | |

| U | Utility of the SB |

| Utility of the PS i | |

| Utility of the PU j located in PS i | |

| S | Social welfare |

© 2018 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Ahmad, M.; Shafiq, M.; Irshad, A.; Khalil Afzal, M.; Kim, D.W.; Choi, J.-G. Adaptive and Economically-Robust Group Selling of Spectrum Slots for Cognitive Radio-Based Networks. Sensors 2018, 18, 2490. https://doi.org/10.3390/s18082490

Ahmad M, Shafiq M, Irshad A, Khalil Afzal M, Kim DW, Choi J-G. Adaptive and Economically-Robust Group Selling of Spectrum Slots for Cognitive Radio-Based Networks. Sensors. 2018; 18(8):2490. https://doi.org/10.3390/s18082490

Chicago/Turabian StyleAhmad, Maqbool, Muhammad Shafiq, Azeem Irshad, Muhammad Khalil Afzal, Dae Wan Kim, and Jin-Ghoo Choi. 2018. "Adaptive and Economically-Robust Group Selling of Spectrum Slots for Cognitive Radio-Based Networks" Sensors 18, no. 8: 2490. https://doi.org/10.3390/s18082490

APA StyleAhmad, M., Shafiq, M., Irshad, A., Khalil Afzal, M., Kim, D. W., & Choi, J.-G. (2018). Adaptive and Economically-Robust Group Selling of Spectrum Slots for Cognitive Radio-Based Networks. Sensors, 18(8), 2490. https://doi.org/10.3390/s18082490