Wireless Sensor Network-Based Service Provisioning by a Brokering Platform

Abstract

:1. Introduction

2. Business Model

2.1. Wireless Sensor Infrastructure Providers

2.2. Users

2.3. Service Provider

3. Analysis

3.1. Expressions for the Expected Number of Customers (m) and WSIPs (n)

- Now:and:

- Now:and:

- (a)

- (b)

- and:

- (c)

3.2. Maximization of the Provider’s Profit Πp(p,q)

4. Results and Discussion

4.1. Optimum Analysis for a Large Users’ Basin (B > 1)

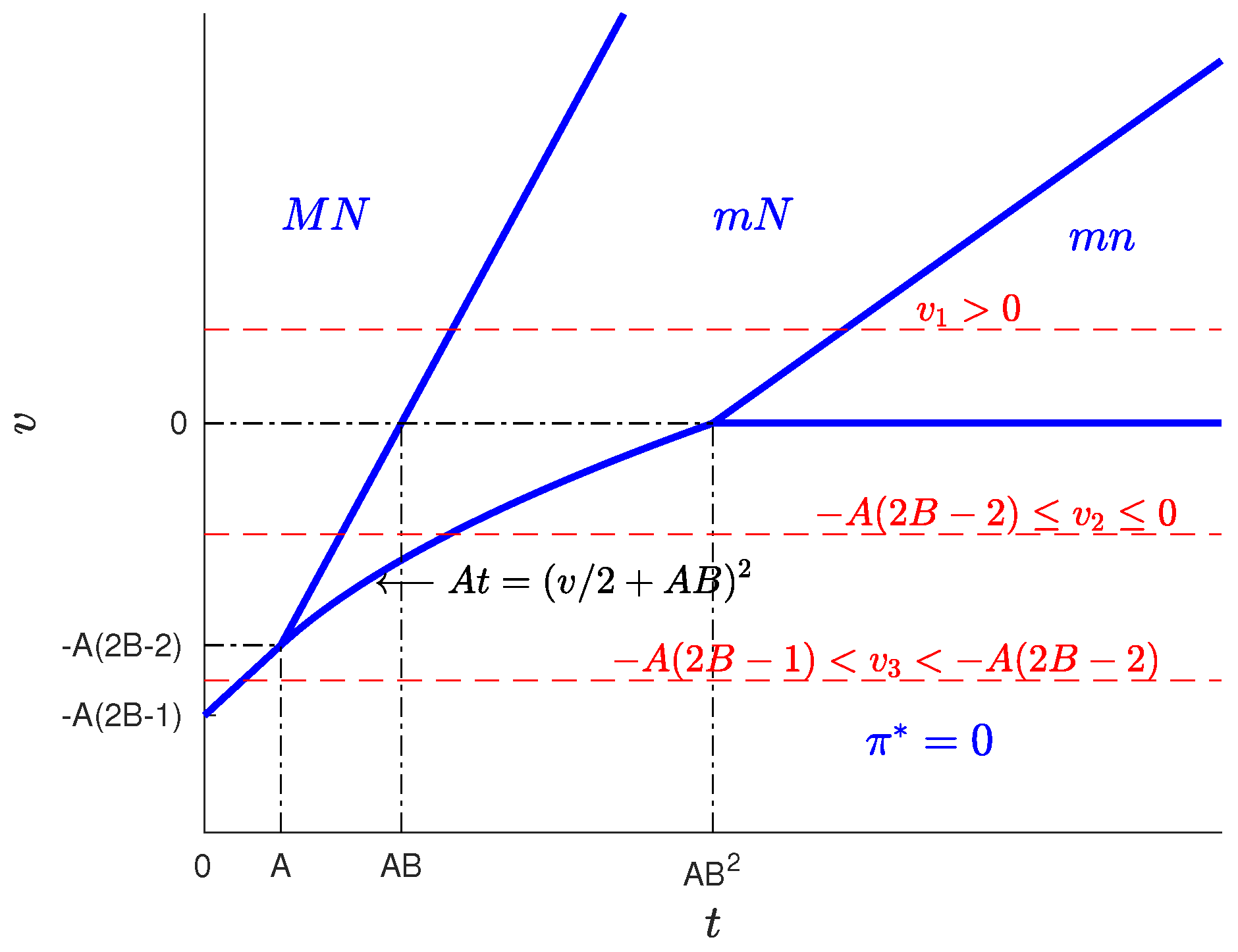

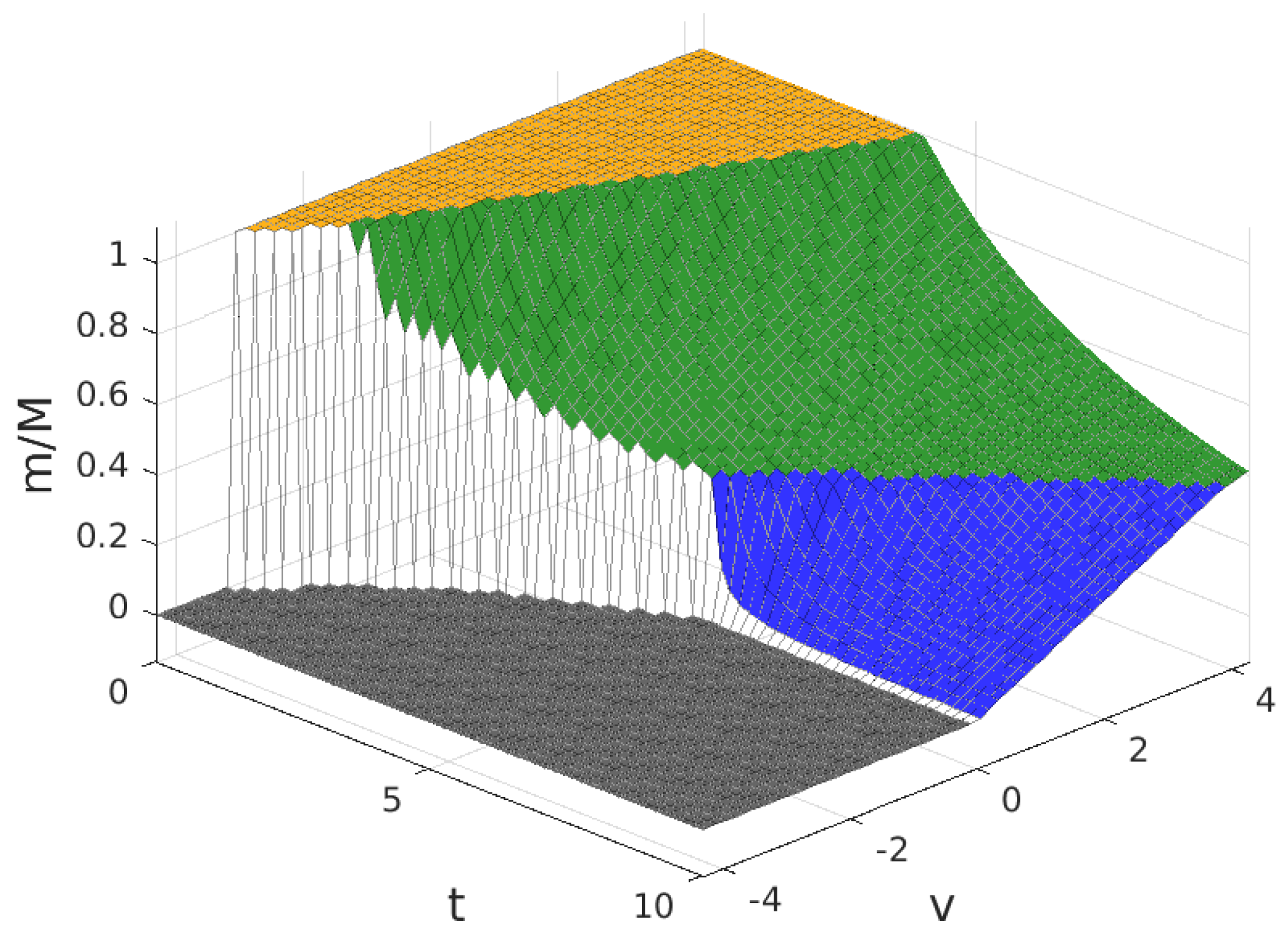

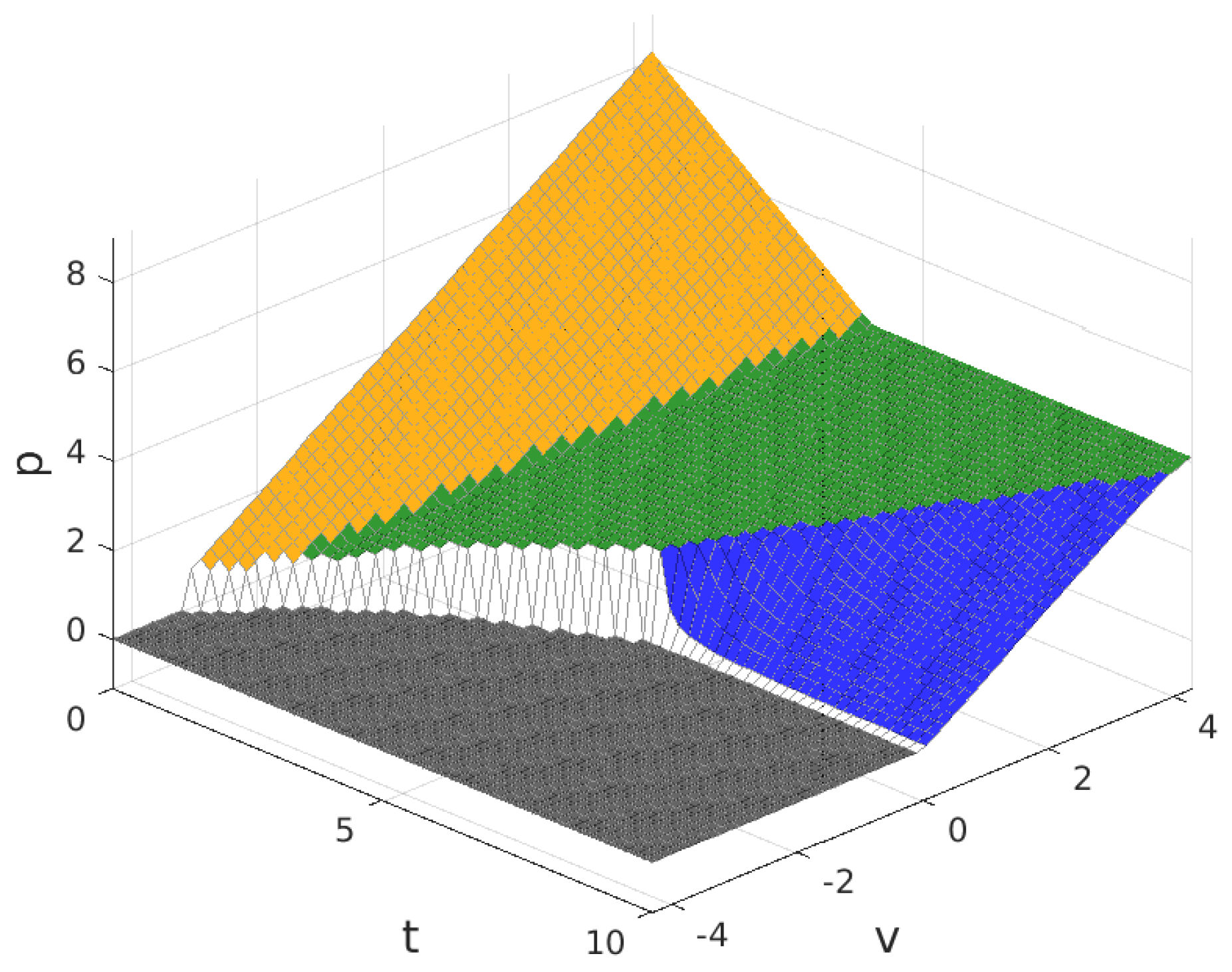

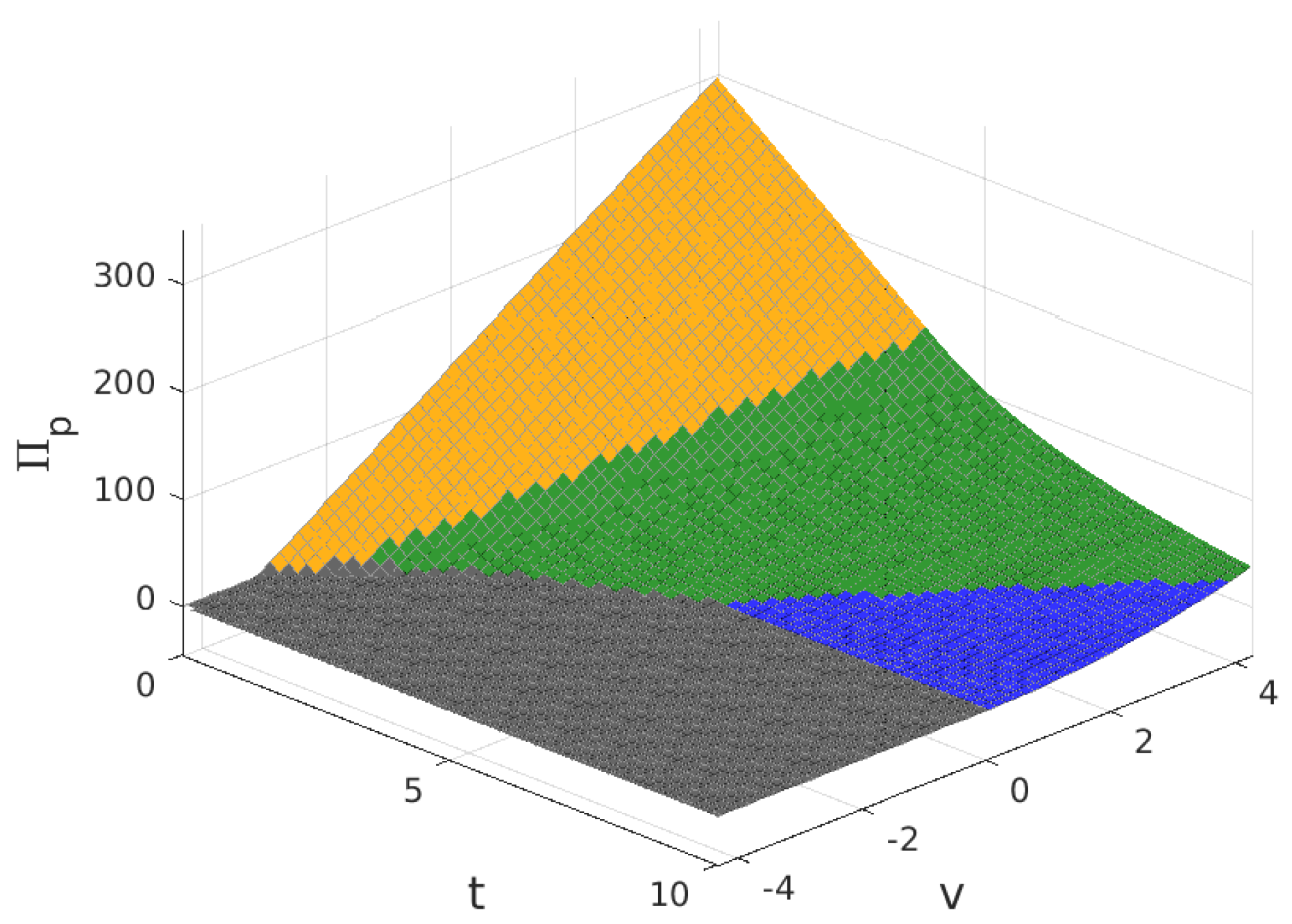

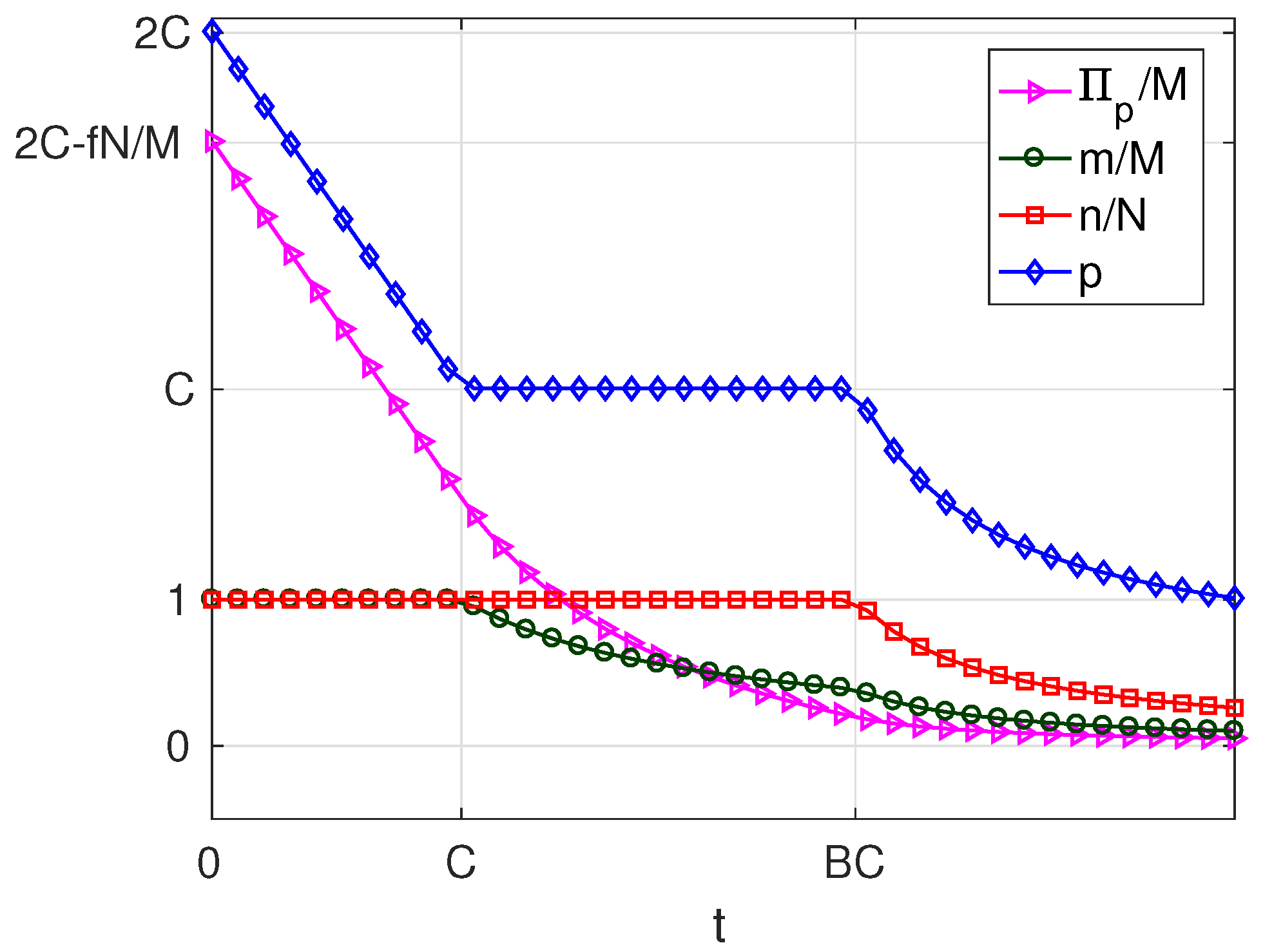

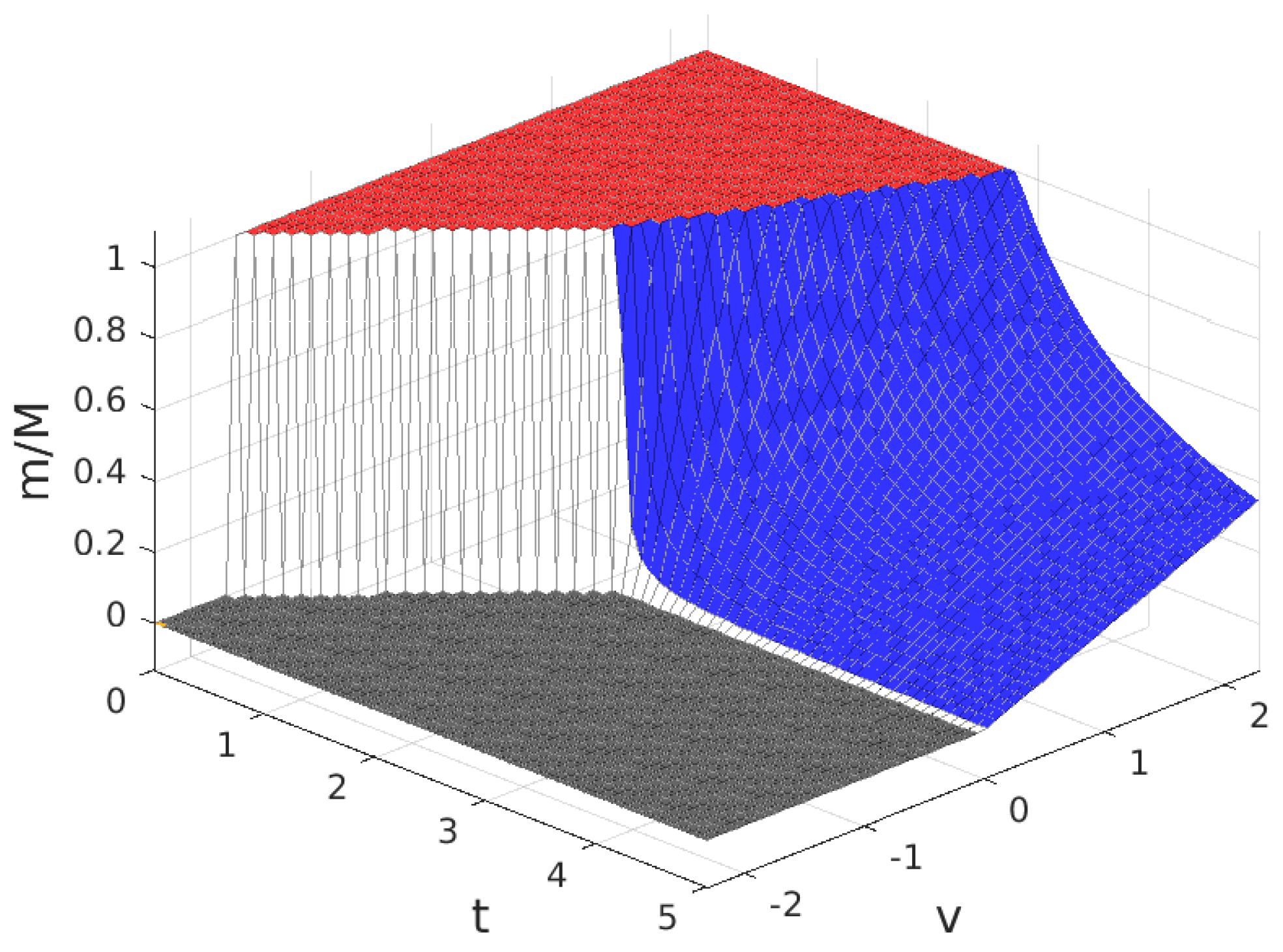

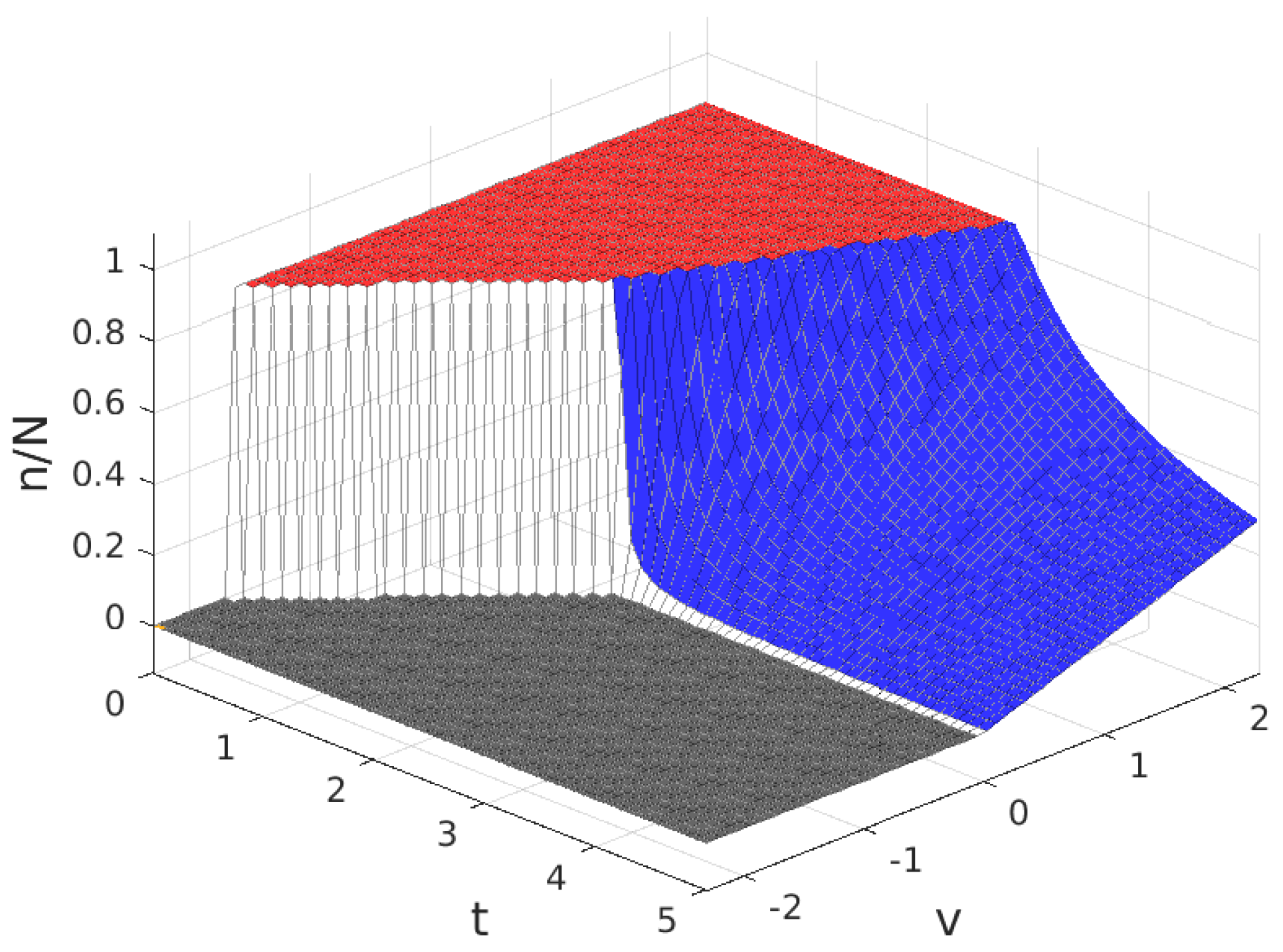

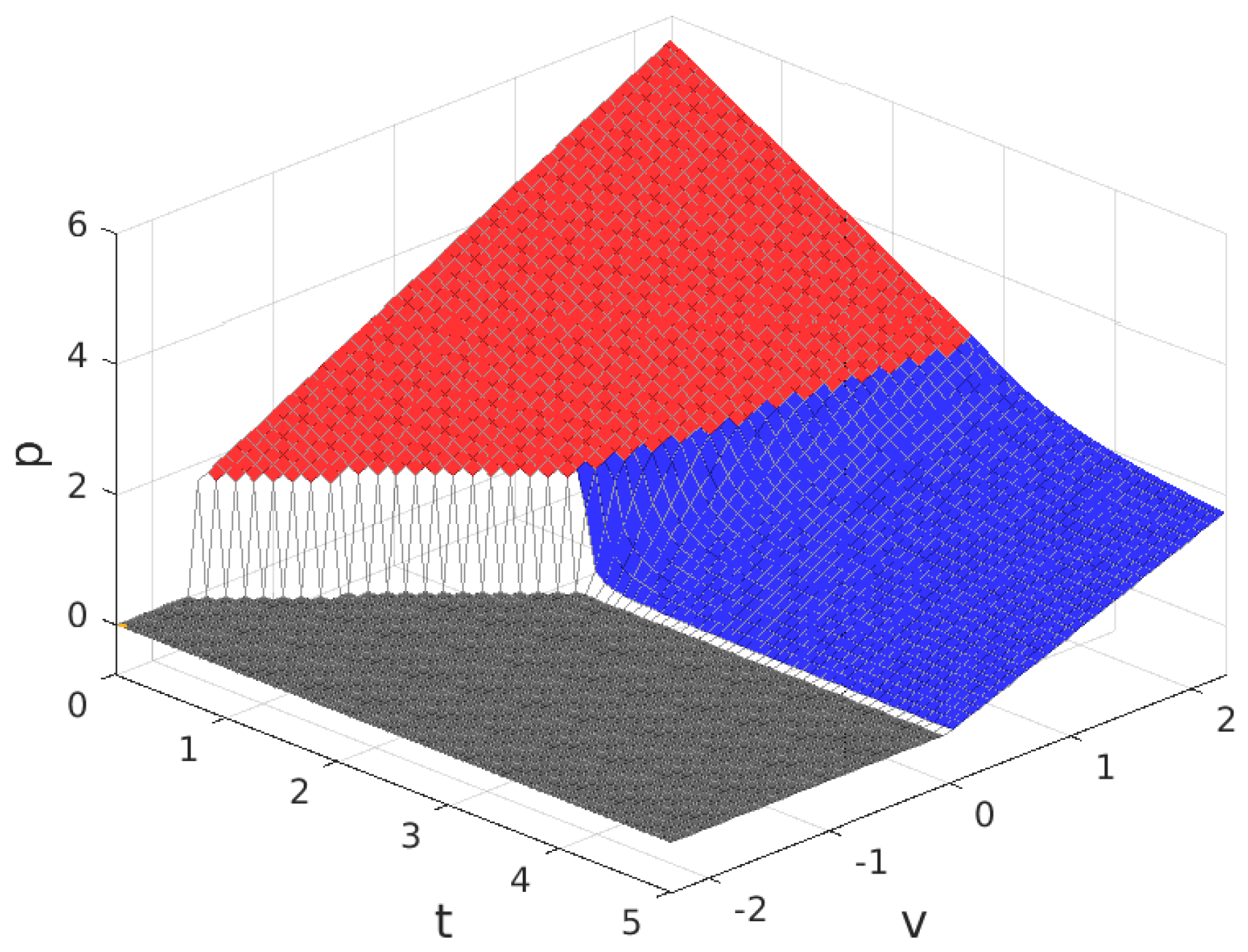

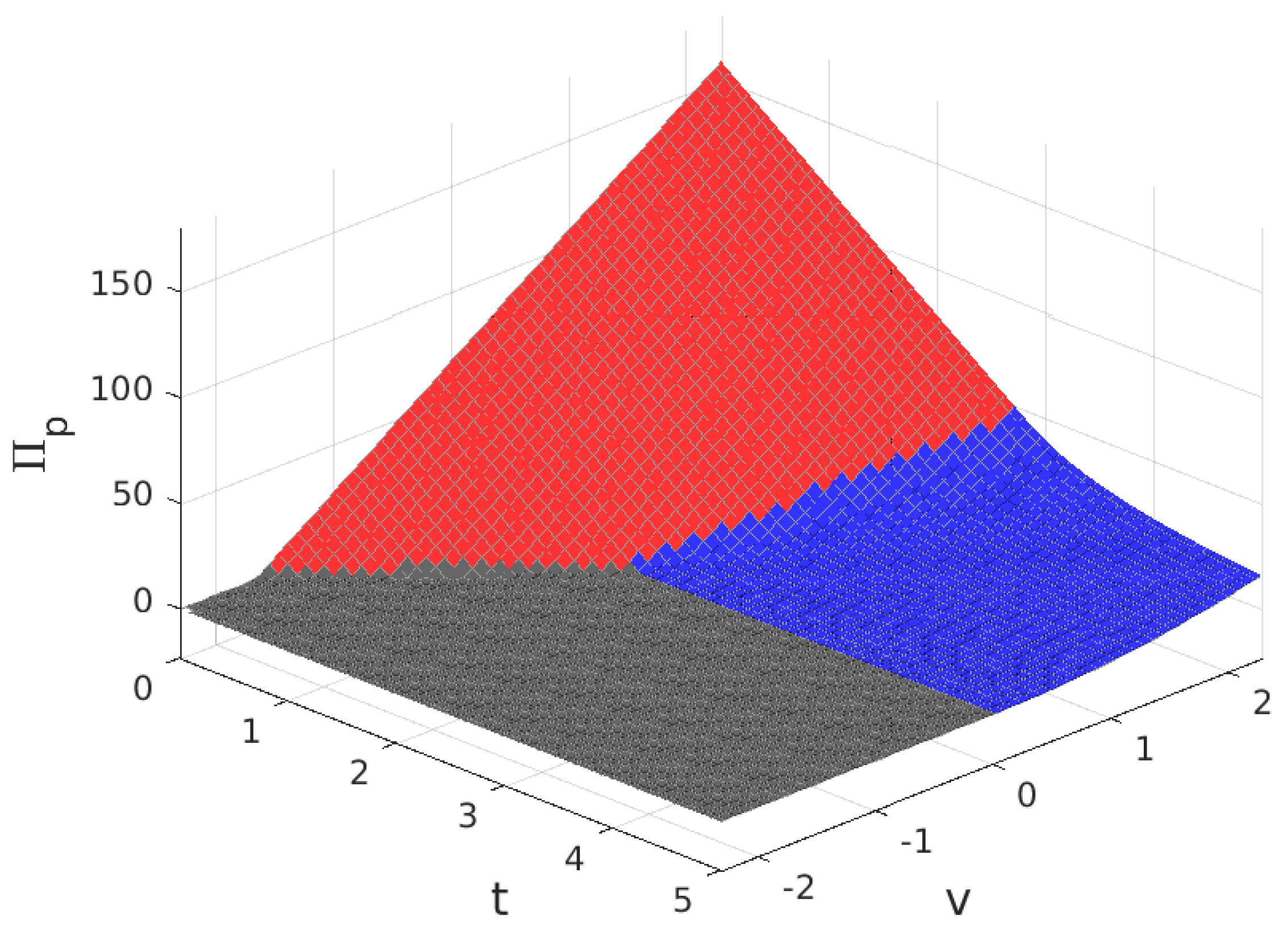

- If , i.e., when subscribers receive a positive net value from accessing the platform irrespective of the amount of service received, we can state the following facts (Figure 7):

- If , i.e., if the user costs are small compared with a quantity that increases with the number of WSIPs N and the strength of the externality b,

- –

- in the optimum, all users subscribe () and all WSIPs connect ();

- –

- for , the price and the server provider’s profit are maximum ( and );

- –

- as t increases, which means higher costs borne by the users, the platform chooses a lower p in order to compensate for the increase in t; and it succeeds in keeping , but decreases.

- When , i.e., the user cost is maintained at an intermediate value,

- –

- the platform can no longer avoid that m decreases, so that it has no incentive to lower p, and p remains constant and equal to C;

- –

- is maintained constant (by raising ), so that all WSIPs remain connected () and their profit unaltered;

- –

- the decrease in m causes that service provider’s profit decreases.

- As t increases beyond , i.e., a quantity that increases almost linearly with M and ,

- –

- the platform chooses a lower price p and a lower q to try to compensate for the increase in t, but it cannot avoid that both m and n decrease asymptotically to zero;

- –

- the decrease in n causes both and to decrease;

- –

- the decreases in m and in n cause to decrease.

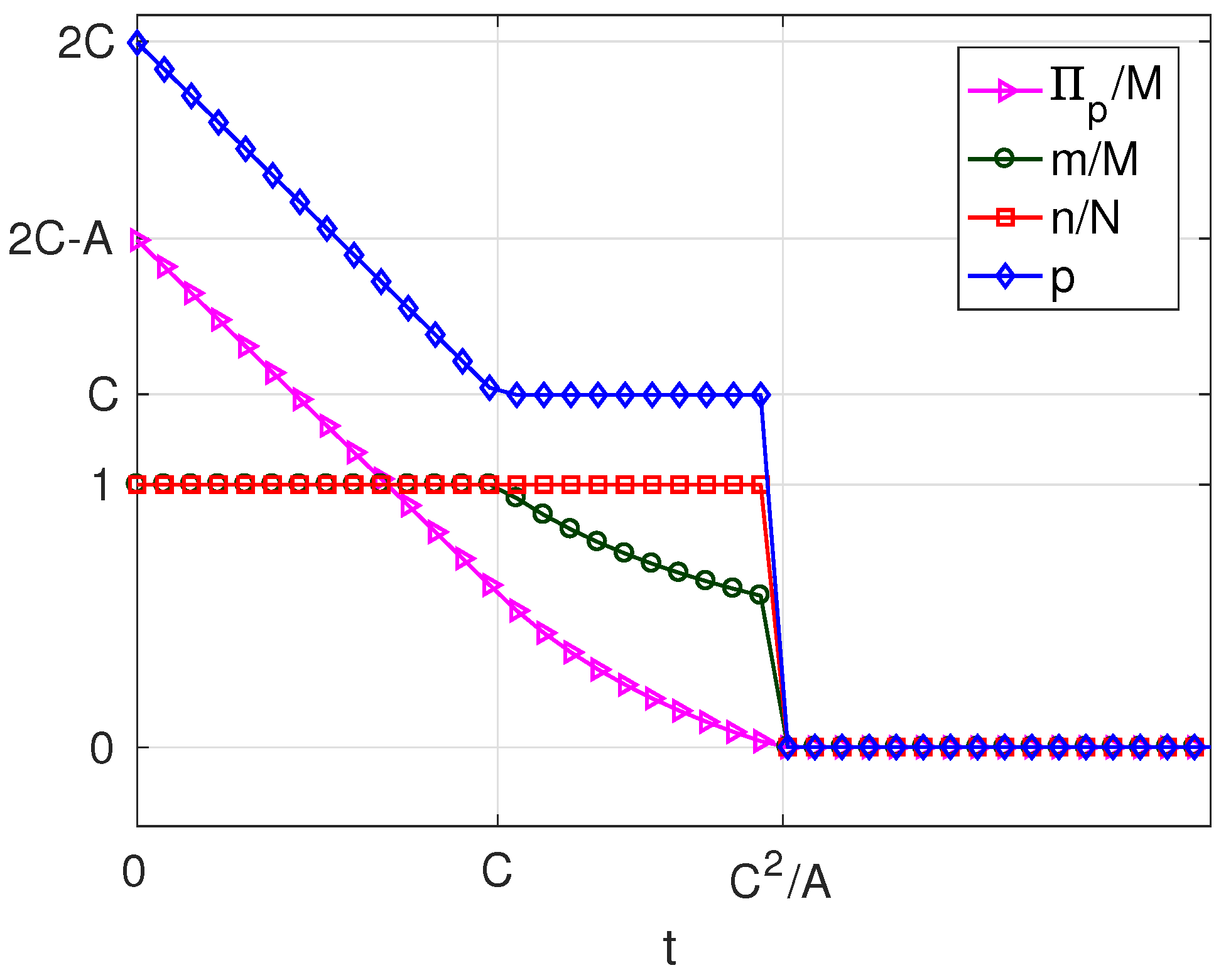

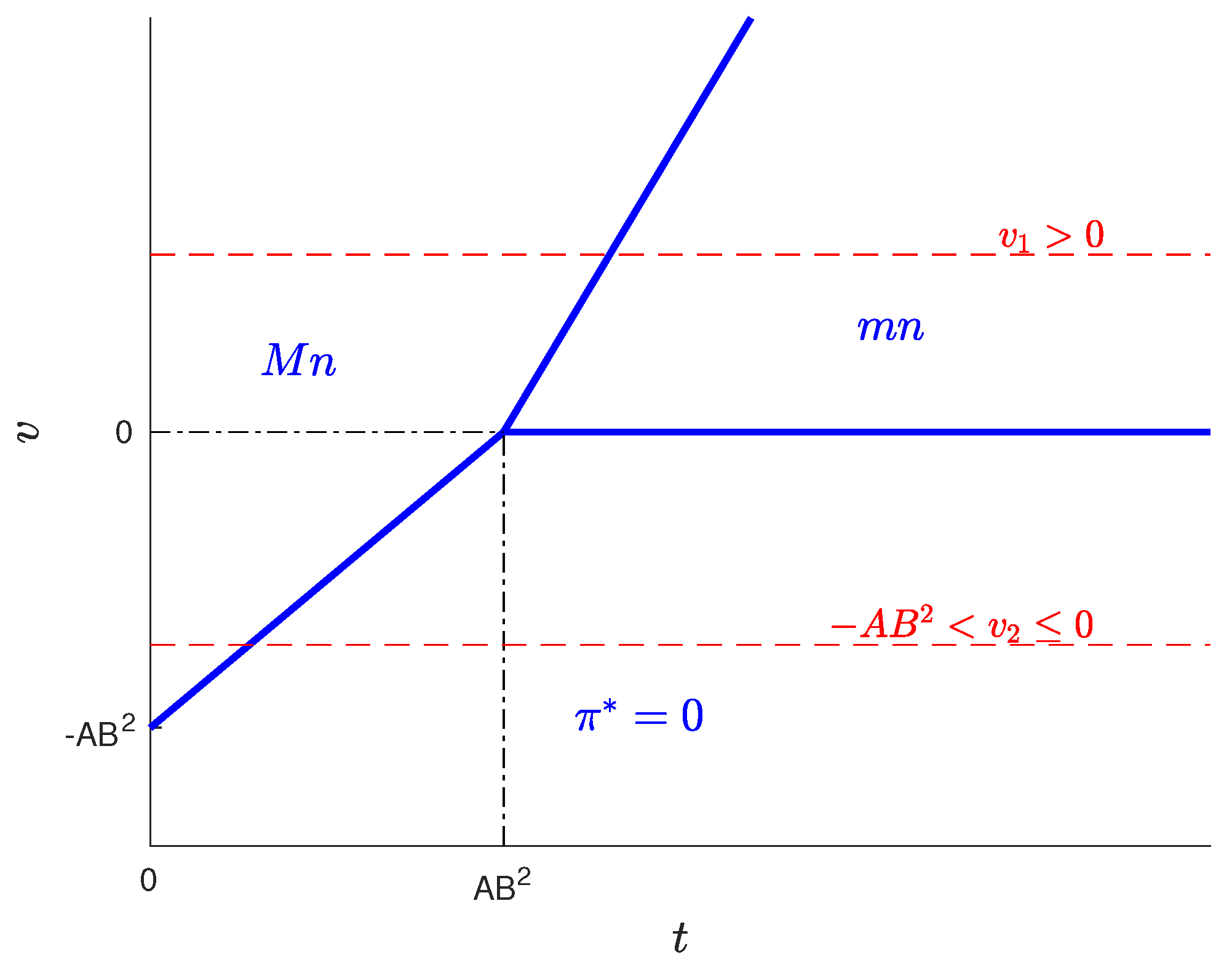

The above facts show that, if , there is a first user cost ceiling C, below which the take-ups m and n are maximum and above which m decreases while n is still maximum, and a second user cost ceiling above which both m and n decrease. Note that high values for C can be achieved in scenarios with a high availability of WSIPs and with a strong externality b. - If , i.e., when subscribers do not receive a positive net value from accessing the platform, but they pay a network access fee, which is higher than the value from accessing the platform, and v is below the threshold , we can state the following facts (Figure 8):

- If , the solution has the same characteristics as in the case of and .

- When , the solution has the same characteristics as in the case of and , but now, the ceiling of this interval is minor ().

- As t increases beyond , m and n drop sharply to zero, which means that in this scenario, the mn-type solution is no longer possible, but instead, it passes directly from solution type mN to solution type .

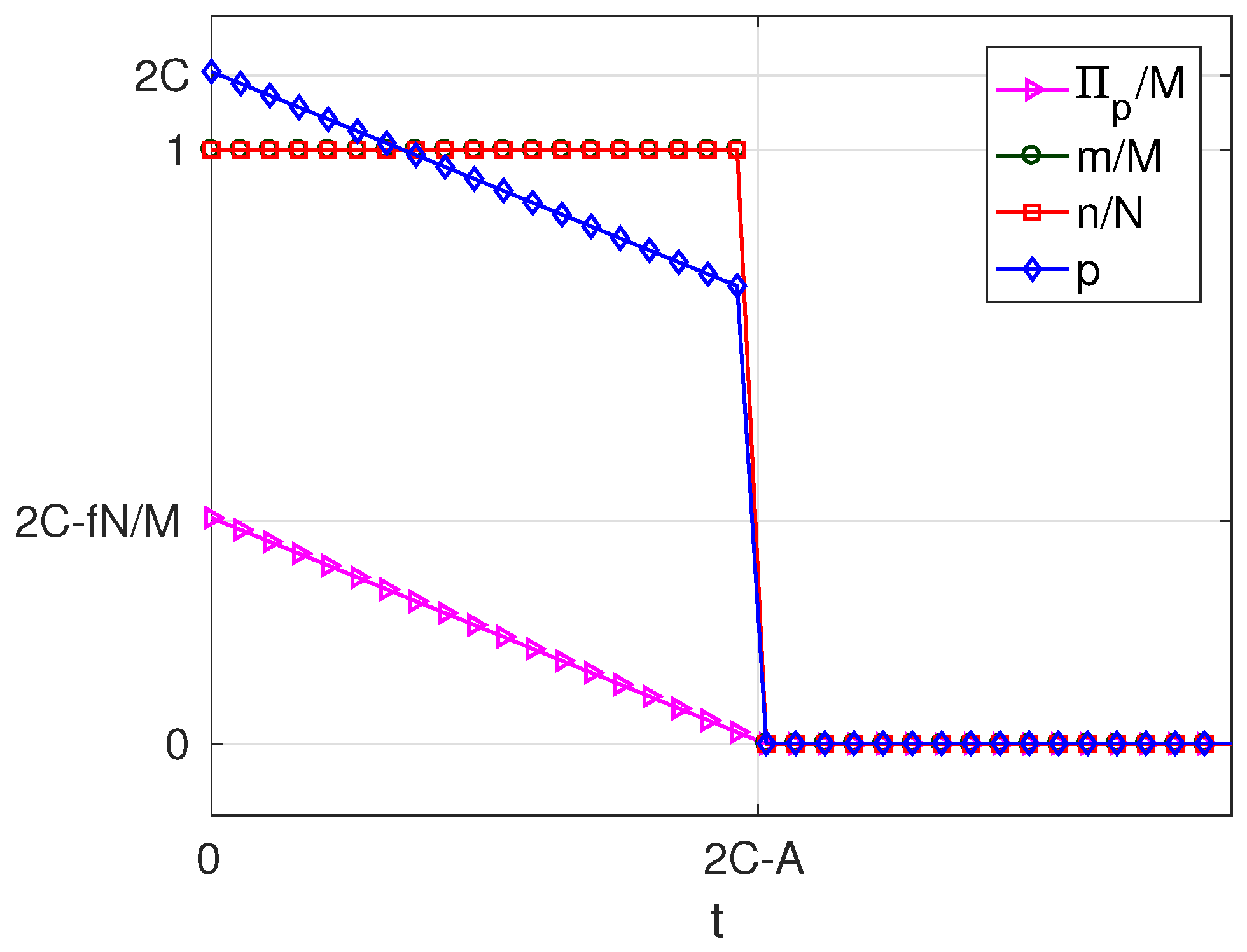

The above facts show that, if , there is a user cost ceiling C, below which the take-ups m and n are maximum. Beyond this cost ceiling and up to , the take-ups decrease, and above , all users unsubscribe. - If , i.e., when the value of v is higher than in the previous case, but below the threshold , we can state that (Figure 9):

- The only possible solution other than is of type MN, and it exists only if .

- When , the solution has the same characteristics as in the previous case for .

4.2. Optimum Analysis for a Small Users’ Basin (B < 1)

- If , i.e., when subscribers receive a positive net value from accessing the platform, we can state the following facts (Figure 15):

- If , i.e., if the user costs are small compared with a quantity that increases with v, the number of providers M and the strength of the cross externality b,

- –

- in the optimum, all users subscribe () and a fraction B of WSIPs connect ();

- –

- for , the price and the server provider’s profit are maximum ( and );

- –

- as t increases, the platform reduces p in order to compensate for the increase in t; and it succeeds in keeping , but decreases.

- When ,

- –

- the platform chooses a lower price p and a lower q to try to compensate for the increase in t, but it cannot avoid that both m and n decrease asymptotically to zero;

- –

- the decrease in n causes both and to decrease;

- –

- the decrease in m and in n causes to decrease.

The above facts show that, if , there is a user cost ceiling , below which the take-up m is maximum and n is maintained at a constant value . Beyond this cost ceiling, the take-ups decrease. - If , i.e., when users pay a positive net cost from accessing the platform (), and this net cost is below the threshold , we can state the following facts (Figure 16):

- If , the solution has the same characteristics as in the previous case for .

- As t increases beyond a threshold given by , m and n drop sharply to zero, which means that in this scenario, the mn-type solution is no longer possible, but instead, it passes directly from type Mn to type .

The above facts show that, if , there is a user cost ceiling , below which the take-up m is maximum and n is maintained at a constant value . Beyond this cost ceiling, all users unsubscribe.

5. Conclusions

Acknowledgments

Author Contributions

Conflicts of Interest

Abbreviations

| WSN | Wireless Sensor Network |

| IoT | Internet of Things |

| WSIP | Wireless Sensor Infrastructure Provider |

References

- Evans, D. The Internet of Things. How the Next Evolution of the Internet Is Changing Everything. White Pap. 2017, 2011, 1–11. [Google Scholar]

- Armstrong, M. Competition in two-sided markets. RAND J. Econ. 2006, 37, 668–691. [Google Scholar] [CrossRef]

- Rochet, J.C.; Tirole, J. Two-sided markets: A progress report. RAND J. Econ. 2006, 37, 645–667. [Google Scholar] [CrossRef]

- Economides, N.; Tåg, J. Network neutrality on the Internet: A two-sided market analysis. Inf. Econ. Policy 2012, 24, 91–104. [Google Scholar] [CrossRef]

- Bohli, J.M.; Sorge, C.; Westhoff, D. Initial observations on economics, pricing, and penetration of the internet of things market. ACM SIGCOMM Comput. Commun. Rev. 2009, 39, 50–55. [Google Scholar] [CrossRef]

- Fleisch, E.; Weinberger, M.; Wortmann, F. Business Models and the Internet of Things. In Interoperability and Open-Source Solutions for the Internet of Things; Springer: Split, Croatia, 2014; pp. 6–10. [Google Scholar]

- Keskin, T.; Kennedy, D. Strategies in Smart Service Systems Enabled Multi-Sided Markets: Business Models for the Internet of Things. In Proceedings of the 2015 48th Hawaii International Conference on System Sciences (HICSS), Grand Hyatt, HI, USA, 5–8 January 2015; pp. 1443–1452. [Google Scholar]

- Niyato, D.; Hoang, D.T.; Luong, N.C.; Wang, P.; Kim, D.I.; Han, Z. Smart data pricing models for the internet of things: A bundling strategy approach. IEEE Netw. 2016, 30, 18–25. [Google Scholar] [CrossRef]

- Niyato, D.; Lu, X.; Wang, P.; Kim, D.I.; Han, Z. Economics of Internet of Things: An Information Market Approach. IEEE Wirel. Commun. 2016, 23, 136–145. [Google Scholar] [CrossRef]

- Guijarro, L.; Pla, V.; Vidal, J.; Naldi, M. Maximum-profit two-sided pricing in service platforms based on Wireless Sensor Networks. IEEE Wirel. Commun. Lett. 2016, 5, 8–11. [Google Scholar] [CrossRef]

- Guijarro, L.; Pla, V.; Vidal, J.R.; Naldi, M. Game Theoretical Analysis of Service Provision for the Internet of Things Based on Sensor Virtualization. IEEE J. Sel. Areas Commun. 2017, 35, 691–706. [Google Scholar] [CrossRef]

- Zhang, B.; Simon, R.; Aydin, H. Maximum utility rate allocation for energy harvesting wireless sensor networks. In Proceedings of the 14th ACM International Conference on Modeling, Analysis and Simulation of Wireless and Mobile Systems, Miami, FL, USA, 31 October–4 November 2011. [Google Scholar]

- Katz, M.L.; Shapiro, C. Network externalities, competition, and compatibility. In The American Economic Review; American Economic Association: Nashville, TN, USA, 1985; pp. 424–440. [Google Scholar]

- Shy, O. The Economics of Network Industries; Cambridge University Press: Cambridge, UK, 2001. [Google Scholar]

| n = 0 | 0 < n < N | n = N | |

|---|---|---|---|

| 0 | |||

| B | v | t | Type of Solution |

|---|---|---|---|

| Mn | |||

| Mn | |||

| mn | |||

| MN | |||

| MN | |||

| mN | |||

| MN | |||

| mN | |||

| mn |

| Type | m | n | ||||

|---|---|---|---|---|---|---|

| mn | ||||||

| mN | N | C | ||||

| Mn | M | |||||

| MN | M | N |

© 2017 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Guijarro, L.; Pla, V.; Vidal, J.R.; Naldi, M.; Mahmoodi, T. Wireless Sensor Network-Based Service Provisioning by a Brokering Platform. Sensors 2017, 17, 1115. https://doi.org/10.3390/s17051115

Guijarro L, Pla V, Vidal JR, Naldi M, Mahmoodi T. Wireless Sensor Network-Based Service Provisioning by a Brokering Platform. Sensors. 2017; 17(5):1115. https://doi.org/10.3390/s17051115

Chicago/Turabian StyleGuijarro, Luis, Vicent Pla, Jose R. Vidal, Maurizio Naldi, and Toktam Mahmoodi. 2017. "Wireless Sensor Network-Based Service Provisioning by a Brokering Platform" Sensors 17, no. 5: 1115. https://doi.org/10.3390/s17051115

APA StyleGuijarro, L., Pla, V., Vidal, J. R., Naldi, M., & Mahmoodi, T. (2017). Wireless Sensor Network-Based Service Provisioning by a Brokering Platform. Sensors, 17(5), 1115. https://doi.org/10.3390/s17051115