Abstract

The Covid-19 pandemic has generated major changes in society, most of them having a negative impact on the quality of life and income obtained by the population and businesses. The negative consequences have been highlighted in the decrease of the GPD level for regions, countries and even continents. Returning to pre-pandemic levels is a considerable effort for both economic and political decision-makers. This article deals with the construction of a mathematical model for economic aspects in the context of variable productivity in time. Through this mathematical model, we propose to maximize revenues in pandemic conditions, in order to limit the economic consequences of the lockdown. One advantage of the proposed model consists in the fact that it is based on units that can be regions, economic branches, economic units or fields of investment. Another strength of the model is determined by the fact that it offers the possibility to choose between two different investment strategies, based on the specific options of the decision makers: the consistent increase of the state revenues or the amelioration of the disparity phenomenon. Furthermore, our model extends previous approaches from the literature by adding some generalization options and the proposed model can be applied in lockdown cases and seasonal situations.

1. Introduction

In the current context in which we are facing a pandemic and given the temporary quarantine measures in certain areas, the world economy is experiencing obvious problems. The COVID-19 pandemic has a serious socio-economic impact at the global scale highlighted in higher unemployment and poverty rates, lower oil prices, altered education sectors, changes in the nature of work, lower GDPs and heightened risks to healthcare workers [] (p. 357). The pandemic has affected to various degrees the industry sectors and most common problems were a decrease in the short-term revenue and an inability to resume work and production due to restrictive measures and decrease of market demand [] (p. 8). The economy was seriously affected by the COVID-19 outbreak, people have lost their jobs, not succeeding to gain a minimum income level [] (p. 2). People in low-paid, self-employed or insecure occupations are the most affected, because in their case, there is a loss of work or a temporary closure of their business [] (p. 147). Studies like the one developed by Truong and Asare [] can prove useful in helping decision making by policymakers, governments and healthcare experts to have more information about vulnerable communities that are affected by the virus [] (p. 13).

The economy as a whole is suffering, and some economic sectors are significantly affected. The economic landscape will experience major changes in the present pandemic situation and some industries will take advantages, while others will be affected [] (p. 5). The unpleasant experience of the coronavirus should be a lesson in the field of health and a stimulus to modify the existing economic and social system, otherwise, new health and social dangers might take place [] (p. 1054). In the context of globalization, the economic interdependences among countries became stronger, so an impact on a national economy is felt on the world economy [] (pp. 1–2). The GDPs nations have been influenced by the lockdown; the GDPs of a few Asian, European and South-American nations have decreased significantly opening the way to negative consequences [] (p. 5). Coccia’s study [] (p. 8) reveals that a longer general lockdown generates uncertain effects on the reduction of COVID-19 infected people and deaths, but also negative effects on economic systems. As there is no previous experience, it could be considered a flexible lockdown based on an approach of trial and error, where the intensity of lockdown measures should depend on the control over the transmission and the demand for economic reactivation [] (p. 3). More strict confinement measures were implemented in those EU Member States where healthcare systems were less resilient to a pandemic, but in the same time the stricter are these measures, the more substantial are impacts on the society and economy are in these countries []. Therefore, overall economic results have declined, and it takes time to reach pre-crisis levels. The question is “how fast and under what conditions”? There is obviously a need for government measures and policies to manage this situation and minimize the negative effects.

As there are intense labour market concerns after the COVID-19 pandemic, the economic recovery needs to be supported by a targeted policy that would limit the risks of unemployment hysteresis [] (p. 16). Although governments aimed at improving supply chain performance, they did not seem to fully manage in focusing their limited resources to ensure enough supplies of essentials and lowering the negative impacts on economic growth [] (p. 17). From the unemployment point of view, the pandemic effects across countries are very heterogeneous: high in the USA and Spain, while in other countries were quite low, as through public programs subsidies were provided to employers and employees to protect existing jobs [] (p. 249). In the short term, the European Union experienced a pandemic-generated symmetrical economic shock, but there can occur asymmetrical economic consequences and the risk of creating a further economic gap between North and South, favorized by the ability of some countries to respond to minimize the negative effects more quickly due to the greater resources at their disposal [] (pp. 312–313). The support needs to cover the industrial production SMEs in order to prevent employee layouts and closures, the interventions must be adjusted according to the labour market estimates [] (p. 821).

Previous studies [] have attempted to bring together issues related to value portfolios with results about specific optimizations and constraints. Optimality restrictions in some cases lead to portfolio segregation. In the same vein, recent studies by [] have shown that the turbulence produced by Covid-19 has generated significant volatility in terms of investments and risky assets. The research also discusses the issue of sustainability in the context of limited resources and their diverse allocation needs. The issue of limited resource allocation was also analyzed by [] based on risk–return models that take into account the practical limitations on available resources.

The efficiency of resource allocation was investigated by [] and in terms of monetary income in pandemic situations of Covid-19. Thus, it was concluded that historical yields are not always confirmed in the event of a crisis situation, such as a global pandemic.

Through a mathematical model, we propose to maximize revenues in pandemic conditions, in order to limit the economic consequences of the lockdown. In conditions of slowdown or closure (partial or total) of the activity in some sectors, less income will be generated. The model offers the possibility to choose between two investment strategies. One possibility is to invest the money obtained where it can produce more results, so the state budget also having more resources from which some can then be directed to support underdeveloped regions or more severely affected economic branches. Another possibility is to invest a minimum amount of money in each region in order to “preserve” the economy. Thus, no disparities will increase, no branches or economic units will disappear from those temporarily affected, we will not have an “economic desert”. The units in the model can be regions, economic branches, economic units or fields of investment.

The organisation of the paper is the following: after an introduction presenting the context and the purpose of this work, we introduce the mathematical model in the second section and we give the analysis to obtain the optimal investment strategy; the third section is concerned with the numerical illustration of this strategy in several cases.

2. Description of the Model and Analysis

This model is a generalization of the work of Pražák (see []) which treats the case of two regions and finds some explicit necessary optimality conditions. In the present work, we did several extensions to the initial model. The first one is a generalization to N regions and the introduction of a time depending function which can account for a lockdown or seasonal effect on the productivity. Another contribution is the choice of a particular form of the control which allows the implementation of different investment strategies. The main purpose is to offer the possibility to choose, if necessary, a strategy which reduces the increase of inequalities among regions. Finally, we introduced a term which ensures that a percent of the income from each region is automatically reinvested in the same region. The approach is original and completely different from the one presented in []. In our situation, it is not easy to find the optimal strategy by direct calculus and, therefore, we used a numerical approach.

2.1. Description of the Model

We shall consider the following optimization problem: Given a final time , find that maximize:

under the following constraints:

This is an optimal control problem which aims at maximising the total income by choosing the optimal investment strategy. The function is the capital stock of the region i at time t. Its evolution in time is driven by the differential equation given as the first constraint of (2). It describes the regional accumulation of capital with the regional output–capital ratio , and the regional saving ratio which are assumed to be positive. Furthermore, a part of the output–capital ratio of region i is directly re-injected in the same region i, whereas the other part can be reallocated in any region.

The control variables should be understood as a proportion of the total investment that is allocate to a region i, which explains the second constraint in (2). The parameter corresponds to the minimal part of the total investment injected in each region. In other words, it depends on the global policy we wish to adopt. In particular, taking would correspond to equally distribute the profit between regions, and therefore would contribute to the reduction of disparities. On the other hand, if we choose we have the situation where nothing is did in order to ensure a minimal investment in each region and therefore to avoid the increase of inequalities between regions.

Finally, the function is assumed to be piecewise continuous and describes in each region i the impact of, for instance, a lockdown which alters the productivity.

2.2. The Necessary Conditions for Optimal Solution

We shall use the Pontryagin maximum principle to determine the optimal allocation of investments. For more details see []. To this purpose, we shall first consider the Hamiltonian associated to the problem .

If we denote the vectors , , and we have the following form of the Hamiltonian

where are the adjoint functions of the optimal control problem.

The corresponding adjoint equations can be written as

for . We can easily see that each function is decreasing since it’s derivative is negative, the adjoint functions being positives.

By using the Pontryagin maximum principle we get for the optimal state and the optimal control, that

which implies that

By an elementary calculus we have that

and since the first sum is always positive, we get that

Keeping in mind that

and

we obtain by replacing in the previous inequality that

This is the necessary condition for the optimal solution we are looking for.

By using the relation above we can now discuss the optimal policy. We shall consider an arbitrary moment t and the region where is the biggest at this moment t. Let us emphasize that depends on the moment t.

This implies that for all and therefore we have the necessary condition (3) with satisfied only if

Due to the complexity of the model, the necessary conditions of optimality are difficult to obtain by direct calculus. Therefore we shall use the numerical resolution which is presented in the next section.

3. Some Numerical Results

Thanks to the optimality condition (4) on the control function and keeping in mind that , we can rewrite the adjoint system as follows:

where we recall that

Since at final time the adjoint function is known (it does not depend on ), we can numerically solve the above system of differential equation, using here a classical Runge-Kutta scheme. The implementation has been done in Python using Numpy []. Doing so, we are able to compute at each (discretized) time and to determine at each time in which region we shall inject the money. In other words, this gives the optimal funding strategy.

Furthermore, knowing , we can compute since we have:

Two examples of study modelling lockdown: Let us illustrate these results with two examples. In each case, we have taken . We have considered the situation of 5 regions with the same initial capital , and we have chosen the following parameters:

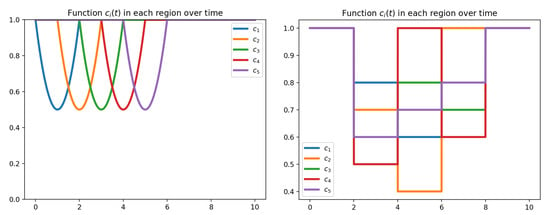

For the first example, each function is given by

This choice of functions is represented on Figure 1 and (in some way) models the fact that the productivity is reduced in each region gradually and then come back to normal. The effect “propagates” over time from the first region to the last one.

Figure 1.

Representation of the function versus time for the first example (on the left) and for the second example (on the right).

In the second case, we have taken the same values for , and but we have changed the functions :

which corresponds to a situation where the effect of the lockdown is much stronger and is applied abruptly in each region.

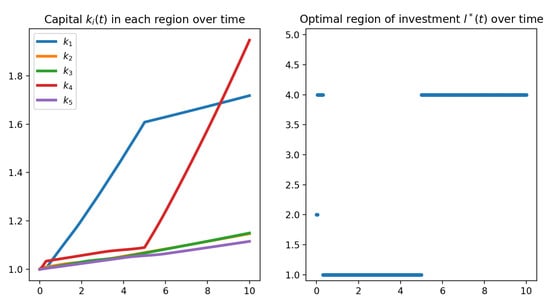

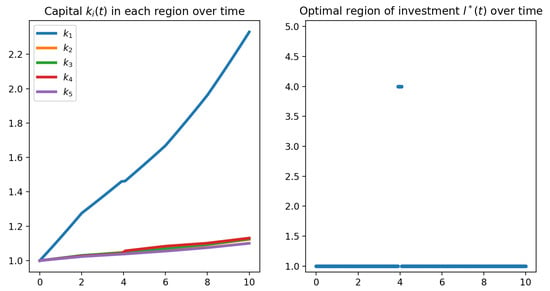

For this first example, we have represented on Figure 2 the obtained results for and taking . We can see that the investment strategy is not obvious. It leads to . Furthermore, we can show that it does not correspond to invest only in the region with the maximum rate at time t. Indeed, Figure 3, where we have represented the function , would suggest to invest first in region 2, then in region 4 and, finally, again in region 2. If we apply this strategy, we get whereas we get with the optimal strategy.

Figure 2.

Evolution of the capital over time (on the left) and optimal index of the region over time (on the right) taking .

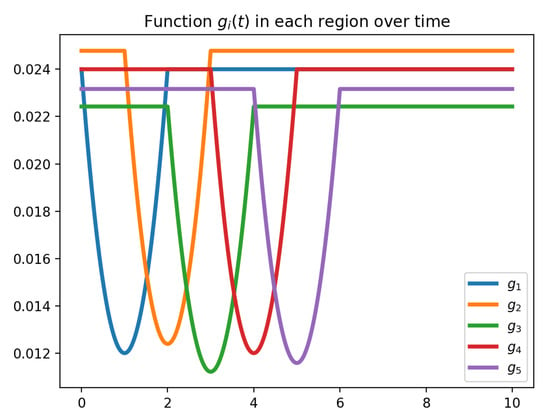

Figure 3.

Representation of the function versus time.

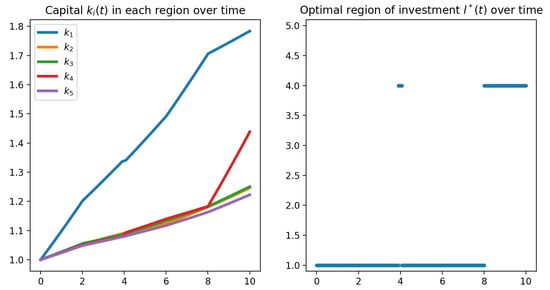

Let us now illustrate the effect of parameter . Taking for the same example , which we recall means that at least a part of the profit is equally distributed between regions, we obtained a different optimal strategy, as shown on Figure 4. Furthermore, as expected, the final income is lower than the one obtained by taking . However, this strategy ensures that every regions receives a minimal support and it considerably reduces disparities.

Figure 4.

Evolution of the capital over time (on the left) and optimal index of the region over time (on the right) taking .

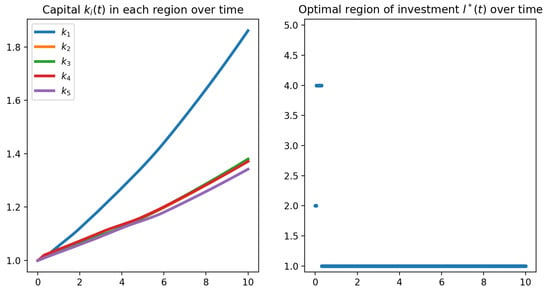

For the second example, we have represented the obtained results on Figure 5, taking . Once again, one can see that the strategy is not obvious. Furthermore, it is clearly not the same as in the first case, for the same , which accounts for the change of function .

Figure 5.

Evolution of the capital over time (on the left) and optimal index of the region over time (on the right) taking .

To emphasize the impact of the parameter , we have computed the optimal strategy taking , see Figure 6. Here again, we can observe that the optimal strategy is changed and increasing alleviates the disparities.

Figure 6.

Evolution of the capital over time (on the left) and optimal index of the region over time (on the right).

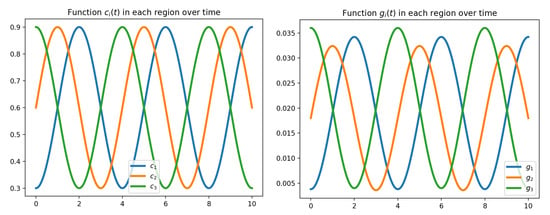

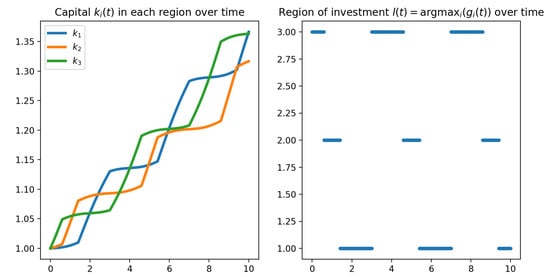

A last example modelling seasonal effect: To end this section, let us consider the case of periodic functions . This can be interpreted as seasonal effect, for instance a region close to the sea will be more attractive in summer, whereas a region with mountains will be more attractive in winter. We have consider the case of three regions characterized by the following parameters:

The function is represented on Figure 7 and is given by:

Figure 7.

Representation of the function versus time (on the left) and the function (on the right).

These three regions can be interpreted as follows: region 1 corresponds to sea region, region 2 to countryside and region 3 to mountain region. When the sea region is more attractive (usually in summer), the mountain region is less attractive. In order to see which region has the best productivity at each time t, we have also represented on Figure 7 the functions . One can see that globally region 1 and region 3 have the highest productivity alternatively, and on a short period region 2 has the best productivity.

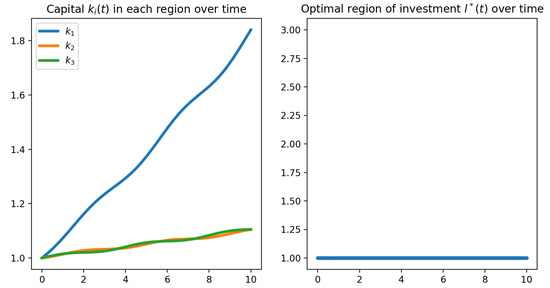

On Figure 8, we have represented the optimal solution of our optimization problem (taking ) and, as we can see, the optimal strategy consists simply in injecting the money in the same region (region 1). In this case, the final value .

Figure 8.

Evolution of the capital over time (on the left) and optimal index of the region over time (on the right).

This result might seem counter-intuitive and one could think that a better strategy consists in injecting money in the most productive region, that is to say, to take:

To compare the two strategies, we have represented on Figure 9 the results obtained following this second strategy. In that case, the final value is smaller than the one obtained by the optimal strategy (which is logical).

Figure 9.

Evolution of the capital over time (on the left) and index over time (on the right). These results have been obtained using strategy (12).

4. Conclusions and Discussion

In this work, we have proposed a mathematical model to describe the impact of a regional lockdown or seasonal effect on the economy. In particular, we have emphasized that constructing the optimal strategy is not obvious and requires numerical methods. Furthermore, one interesting feature of the proposed model is the fact that we can consider a particular policy to avoid keeping or increasing regional disparities. Clearly, if we wish to minimize the disparities and to sustain poor regions, we need to take . Yet, doing so, no strategy can be established (since we no longer have control parameters) and it can quite highly affect the final income , and also slowdown the development of other regions.

A first and direct extension of the model would be to consider a variable in time parameter instead of a constant value . Furthermore, one could consider that the part of the benefit generated by the different regions is not equally distributed among the regions. This implies to consider depending both on time and region i. These two generalisations are straightforward and do not change the analysis.

A second improvement of the model would be to consider another cost-functional, such as

where is a function equal to X if and fastly decreasing when decreases. Doing so, we would penalize the fact that a region does not reach a minimal capital . Another improvement would be to consider an economic growth model more realistic such as logistic growth:

In this model, represents a limit capital that can be reached. Yet, these two improvements leads to much involved difficulties to solve the optimization problem.

As a final extension, let us also mention the addition of a stochastic term in the model. This term would account for random influences on the model. Considering the fact that the stochastic version of Pontryagin’s principle is different from the one used in this work, this extension would be required to fully review the analysis. The numerical part would also be quite different, since the adjoint equation would be a backward stochastic differential equation. In particular, in this future work, it would be very interesting to see the impact of a stochastic term on the optimal policy.

Regarding the usefulness of the proposed model, it can be applied both for situations of prolonged regional lockdown over longer periods, and for temporary situations due to possible natural disasters. From the point of view of managerial implications, the model can be adapted both for companies and for decision makers in the field of public policies: at zonal level (mayors, prefectures) and at regional/national level (local government, national government, ministry of finance). The model can be applied depending on the purpose pursued by the policy maker: maximizing revenues or ameliorating regional disparities.

As a future research direction, the inclusion of other parameters or restrictions in the model can be considered, adapted according to the type of lockdown or interruption of activities. For example, a set of constraints and variables that emulate situations in which all activities in a region are interrupted or only activities in a certain field of activity.

Author Contributions

Conceptualization, A.T., I.C., A.-L.S. and O.D.; methodology, A.T., I.C.; software, A.T., I.C.; validation, A.-L.S. and O.D.; formal analysis, A.T. and I.C.; investigation, A.T., I.C., A.-L.S. and O.D.; resources, I.C. and O.D.; data curation, A.T., I.C., A.-L.S. and O.D.; writing—original draft preparation, A.T., I.C., A.-L.S. and O.D.; writing—review and editing, A.T., I.C., A.-L.S. and O.D.; project administration, O.D. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

Not applicable.

Acknowledgments

The authors thank the anonymous referees for pertinent suggestions which permitted us to improve the paper.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Mofijur, M.; Fattah, I.R.; Alam, M.A.; Islam, A.S.; Ong, H.C.; Rahman, S.A.; Najafi, G.; Ahmed, S.F.; Uddin, M.A.; Mahlia, T.M. Impact of COVID-19 on the social, economic, environmental and energy domains: Lessons learnt from a global pandemic. Sustain. Prod. Consum. 2021, 26, 343–359. [Google Scholar] [CrossRef]

- Lu, L.; Peng, J.; Wu, J.; Lu, Y. Perceived impact of the Covid-19 crisis on SMEs in different industry sectors: Evidence from Sichuan, China. Int. J. Disaster Risk Reduct. 2021, 55, 102085. [Google Scholar] [CrossRef]

- Yoosefi Lebni, J.; Abbas, J.; Moradi, F.; Salahshoor, M.R.; Chaboksavar, F.; Irandoost, S.F.; Nezhaddadgar, N.; Ziapour, A. How the COVID-19 pandemic effected economic, social, political, and cultural factors: A lesson from Iran. Int. J. Soc. Psychiatry 2020, 67, 1–3. [Google Scholar] [CrossRef]

- Alradhawi, M.; Shubber, N.; Sheppard, J.; Ali, Y. Effects of the COVID-19 pandemic on mental well-being amongst individuals in society—A letter to the editor on “The socio-economic implications of the coronavirus and COVID-19 pandemic: A review”. Int. J. Surg. 2020, 78, 147–148. [Google Scholar] [CrossRef] [PubMed]

- Truong, N.; Asare, A.O. Assessing the effect of socioeconomic features of low-income communities and COVID-19 related cases: An empirical study of New York City. Glob. Public Health 2021, 16, 1–16. [Google Scholar] [CrossRef]

- Roy, S.; Dutta, R.; Ghosh, P. Recreational and philanthropic sectors are the worst-hit US industries in the COVID-19 aftermath. Soc. Sci. Humanit. Open 2021, 3, 100098. [Google Scholar] [CrossRef]

- Pizarro Hofer, R. Un paso más allá de la Covid-19. Trimest. Econ. 2020, 87, 1033–1057. [Google Scholar] [CrossRef]

- Wang, Q.; Han, X. Spillover effects of the United States economic slowdown induced by COVID-19 pandemic on energy, economy, and environment in other countries. Environ. Res. 2021, 196, 110936. [Google Scholar] [CrossRef]

- Mishra, N.P.; Das, S.S.; Yadav, S.; Khan, W.; Afzal, M.; Alarifi, A.; Ansari, M.T.; Hasnain, M.S.; Nayak, A.K. Global impacts of pre- and post-COVID-19 pandemic: Focus on socio-economic consequences. Sens. Int. 2020, 1, 100042. [Google Scholar] [CrossRef]

- Coccia, M. The relation between length of lockdown, numbers of infected people and deaths of Covid-19, and economic growth of countries: Lessons learned to cope with future pandemics similar to Covid-19 and to constrain the deterioration of economic system. Sci. Total Environ. 2021, 775, 145801. [Google Scholar] [CrossRef]

- Chen, Y.-T.; Yen, Y.-F.; Yu, S.-H.; Chia-Yu Su, E. A Flexible Lockdown by Integrating Public Health and Economic Reactivation to Response the Crisis of COVID-19: Responses to Comments by Alvaro J Idrovo on “An Examination on the Transmission of COVID-19 and the Effect of Response Strategies: A Comparative Analysis”. Int. J. Environ. Res. Public Health 2020, 17, 8068. [Google Scholar] [CrossRef]

- Aristodemou, K.; Buchhass, L.; Claringbould, D. The COVID-19 crisis in the EU: The resilience of healthcare systems, government responses and their socio-economic effects. Eurasian Econ. Rev. 2021. [Google Scholar] [CrossRef]

- van der Wielen, W.; Barrios, S. Economic sentiment during the COVID pandemic: Evidence from search behaviour in the EU. J. Econ. Bus. 2020, 105970. [Google Scholar] [CrossRef]

- Goel, R.K.; Saunoris, J.W.; Goel, S.S. Supply chain performance and economic growth: The impact of COVID-19 disruptions. J. Policy Model. 2021, 43, 298–316. [Google Scholar] [CrossRef]

- Milani, F. COVID-19 outbreak, social response, and early economic effects: A global VAR analysis of cross-country interdependencies. J. Popul. Econ. 2021, 34, 223–252. [Google Scholar] [CrossRef] [PubMed]

- Perrone, A. COVID-19: Crisi della globalizzazione e “rivincita dei confini”. Le ricadute della pandemia sul futuro economico-politico mondiale. Doc. Geogr. 2020, 307–320. [Google Scholar] [CrossRef]

- Ceylan, R.F.; Ozkan, B.; Mulazimogullari, E. Historical evidence for economic effects of COVID-19. Eur. J. Health Econ. 2020, 21, 817–823. [Google Scholar] [CrossRef] [PubMed]

- Shefrin, H.; Statman, M. Behavioral Portfolio Theory. J. Financ. Quant. Anal. 2000, 35, 127–151. [Google Scholar] [CrossRef]

- Di Persio, L.; Garbelli, M.; Wallbaum, K. Forward-Looking Volatility Estimation for Risk-Managed Investment Strategies during the COVID-19 Crisis. Risks 2021, 9, 33. [Google Scholar] [CrossRef]

- Cesarone, F.; Scozzari, A.; Tardella, F. Linear vs. quadratic portfolio selection models with hard real-world constraints. Comput. Manag. Sci. 2015, 12, 345–370. [Google Scholar] [CrossRef]

- Young, M.N.; Arevalo, G.S.; Mallari, E.C. Portfolio Selection Utilizing Electronic Company Stocks During the Enhance Community Quarantine Period in the Philippines. In Proceedings of the 2020 IEEE International Conference on Industrial Engineering and Engineering Management (IEEM), Singapore, 14–17 December 2020; pp. 519–523. [Google Scholar] [CrossRef]

- Pražák, P. Model of Origin of Regional Disparities. In Mathematical Methods in Economics 2013; Vojáčková, H., Ed.; College of Polytechnics Jihlava: Jihlava, Czech Republic, 2013; pp. 737–742. [Google Scholar]

- Pražák, P. Elimination of Regional Economic Disparities as Optimal Control Problem. In Proceedings of 30th International Conference Mathematical Methods in Economics, Karviná, Czech Republic, 11–13 September 2012; Ramík, J., Stavárek, D., Eds.; School of Business Administration, Silesian University: Karviná, Czech Republic, 2012; Volume 10, pp. 739–744. [Google Scholar]

- Seierstad, A.; Sydsæter, K. Optimal Control Theory with Economic Applications; North-Holland: Amsterdam, The Netherlands, 1986. [Google Scholar]

- Harris, C.R.; Millman, K.J.; van der Walt, S.J.; Gommers, R.; Virtanen, P.; Cournapeau, D.; Wieser, E.; Taylor, J.; Berg, S.; Smith, N.J.; et al. Array programming with NumPy. Nature 2020, 585, 357–362. [Google Scholar] [CrossRef] [PubMed]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).