The Effect of Exit Time and Entropy on Asset Performance Evaluation

Abstract

1. Introduction

2. Mathematical Definitions and Formulas

2.1. Risk Measures (VaR and CVaR)

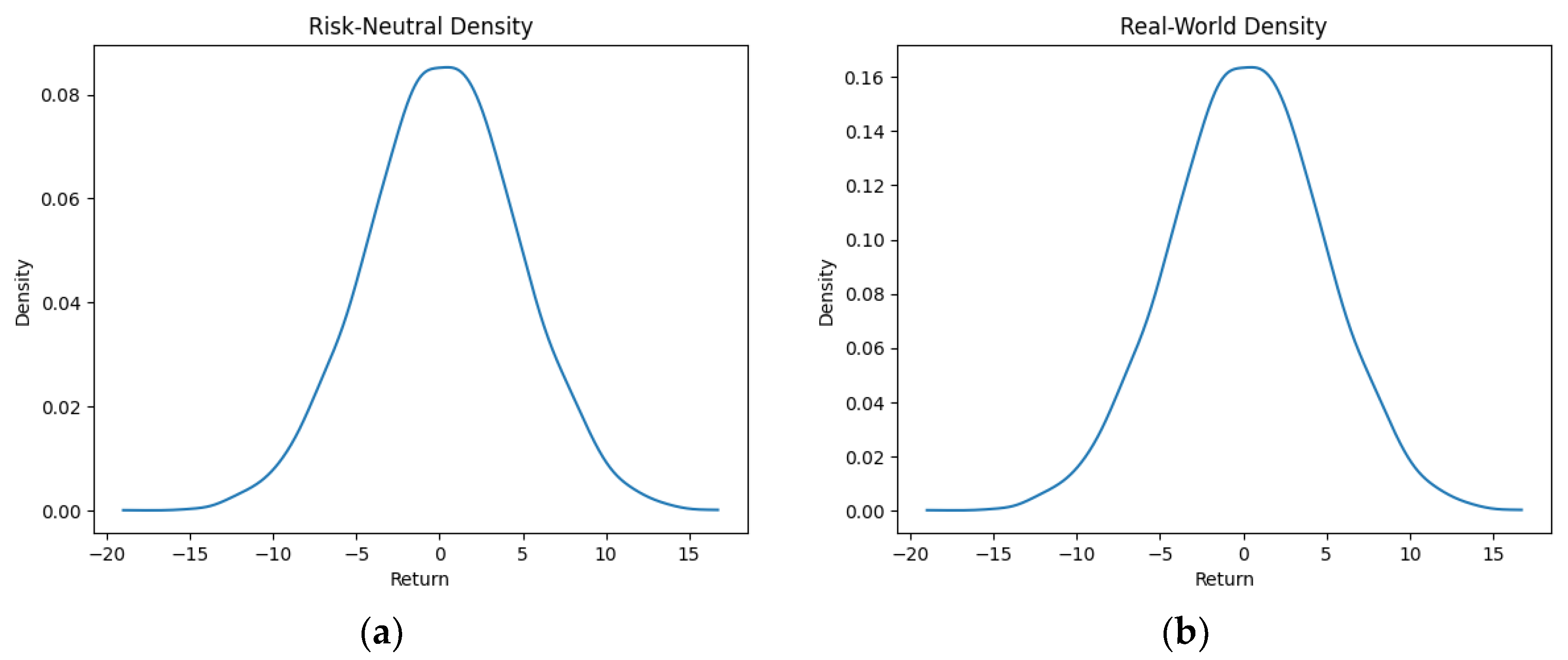

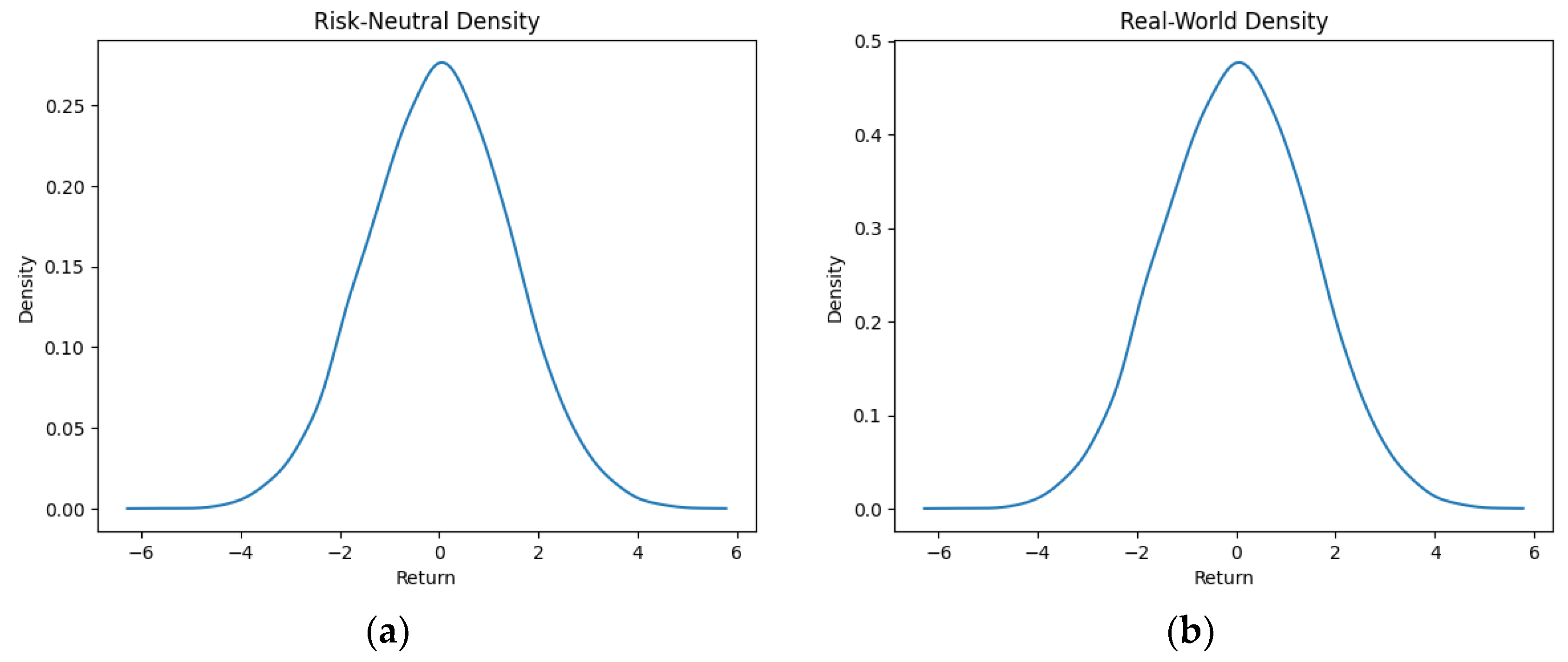

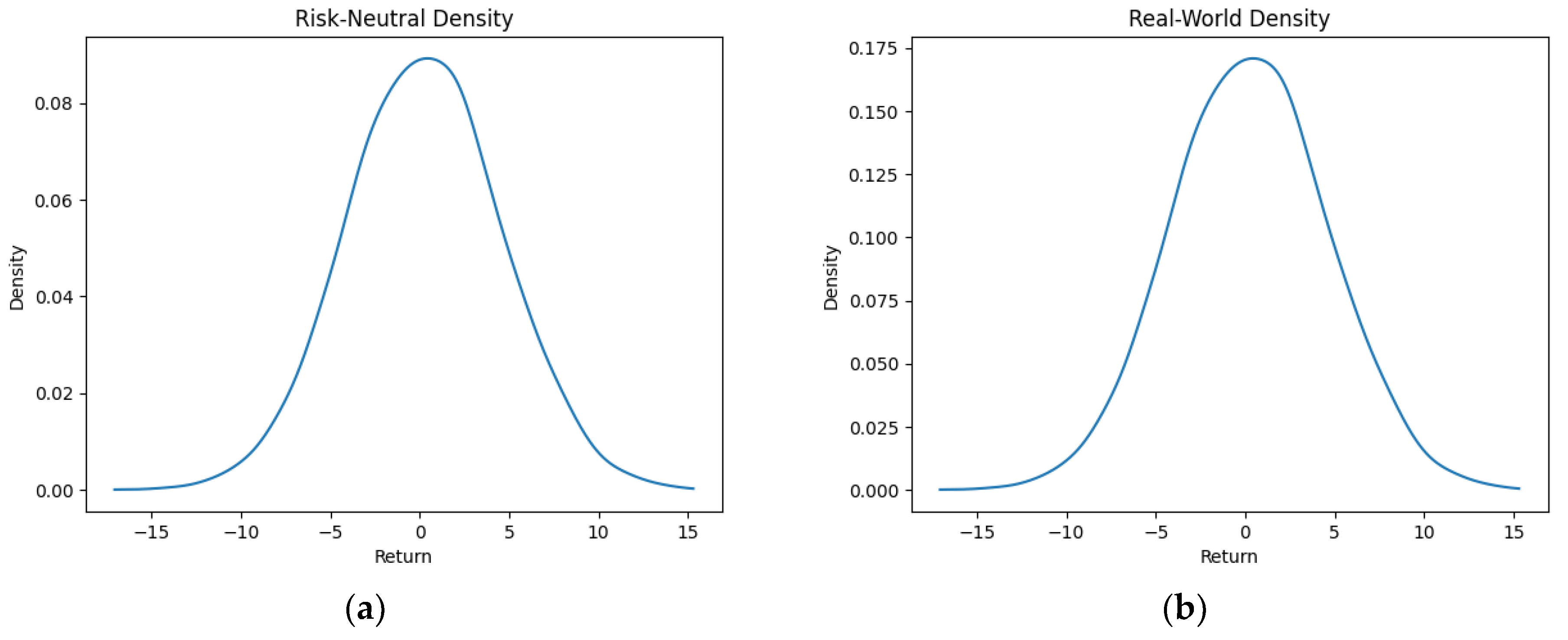

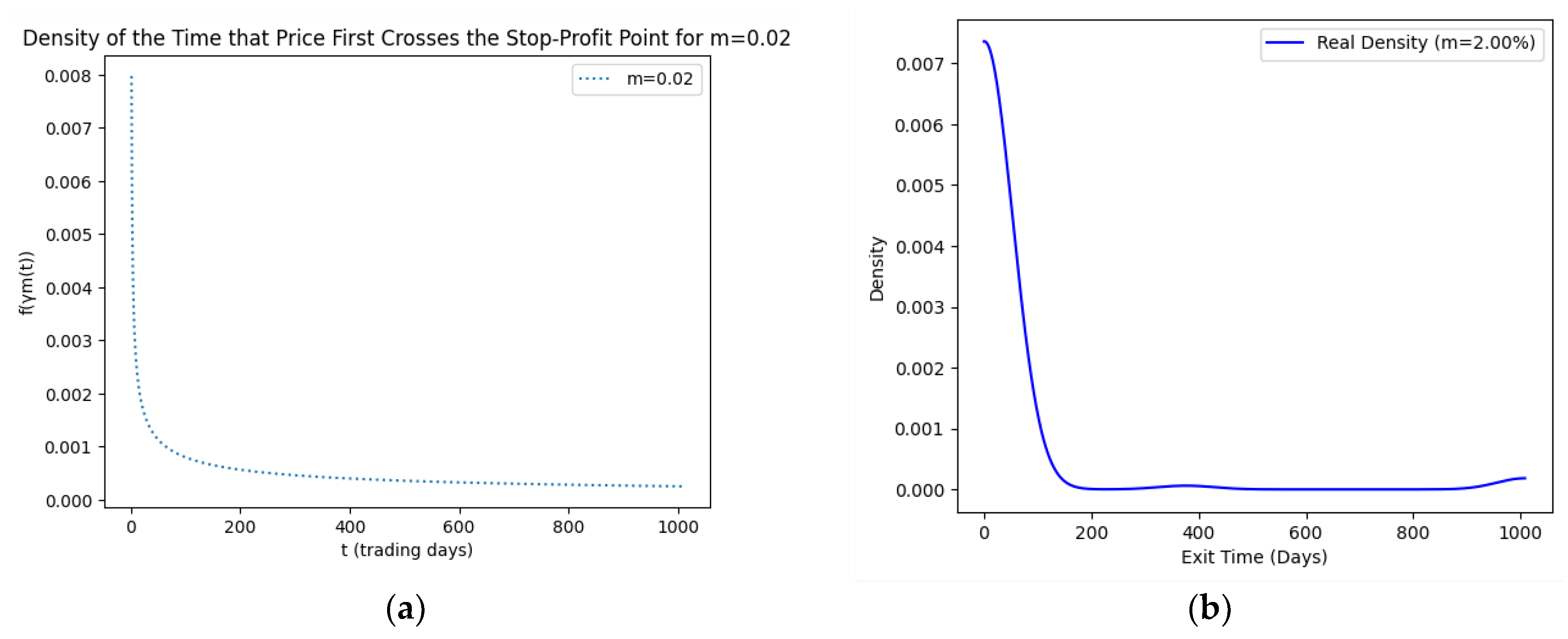

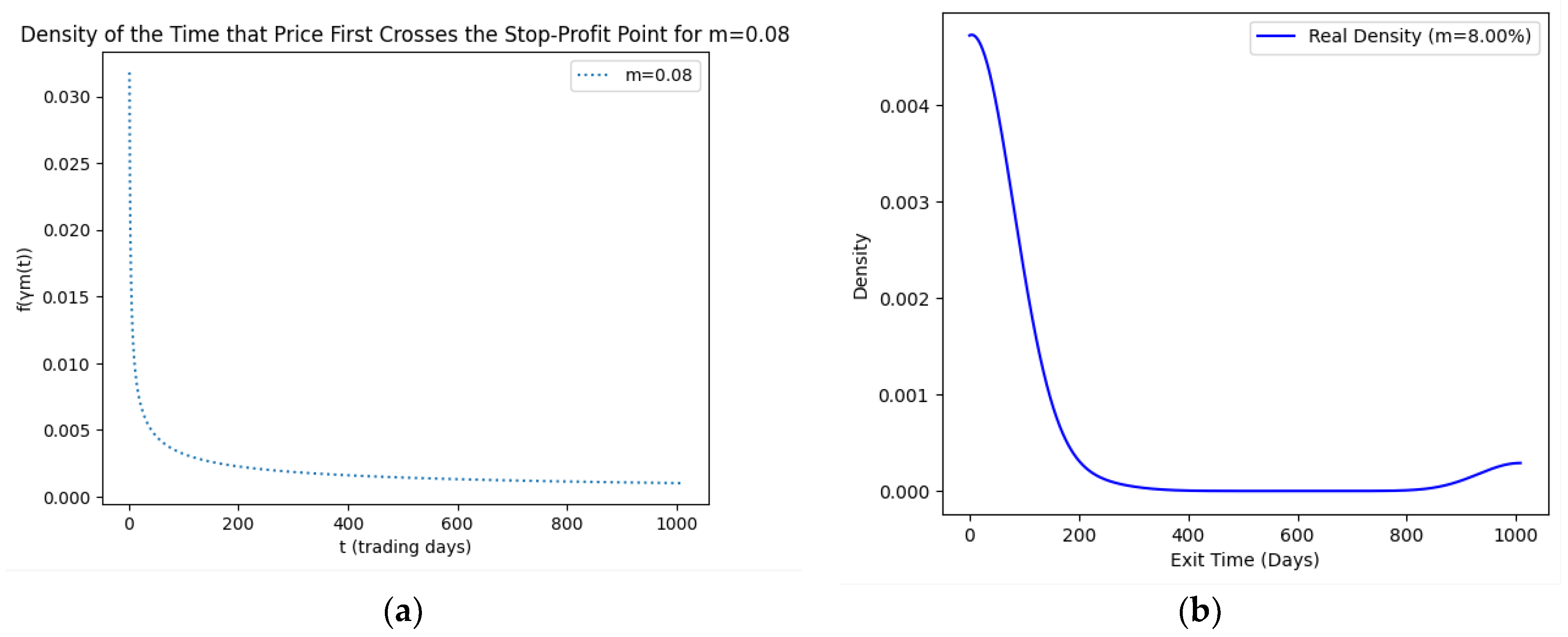

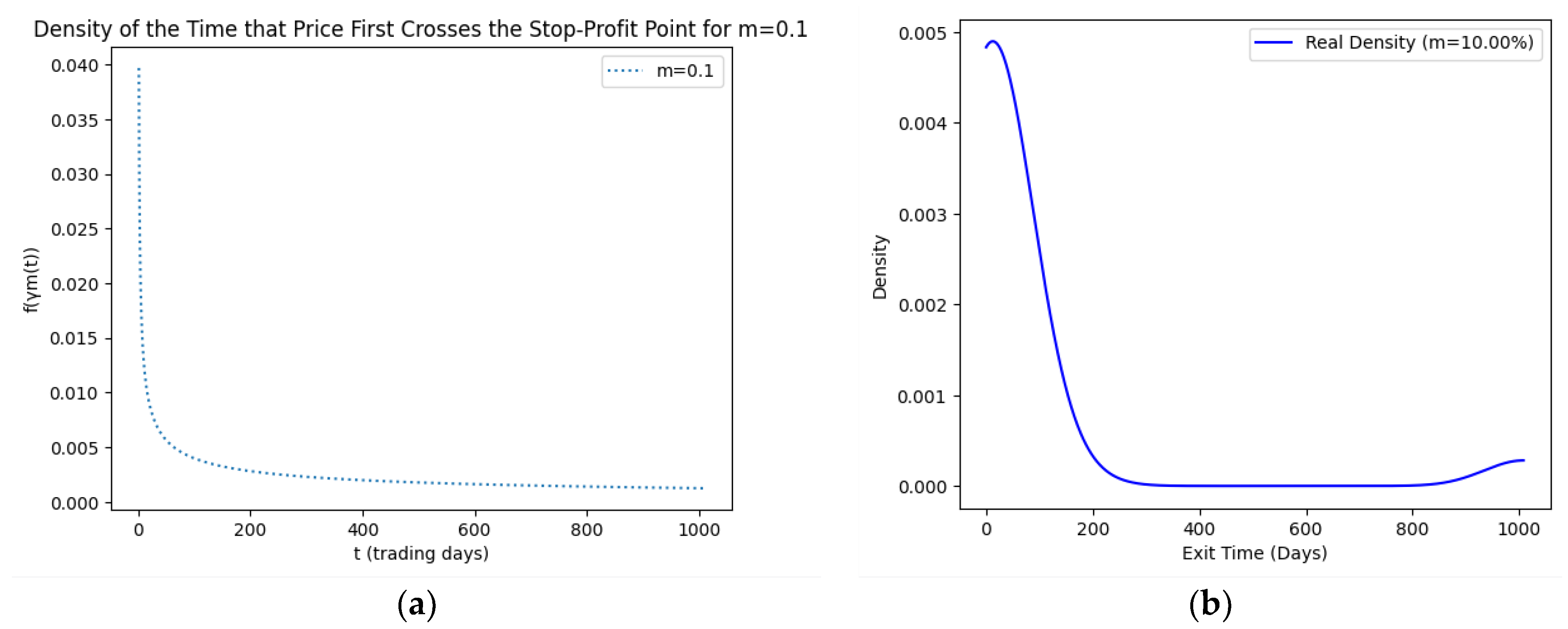

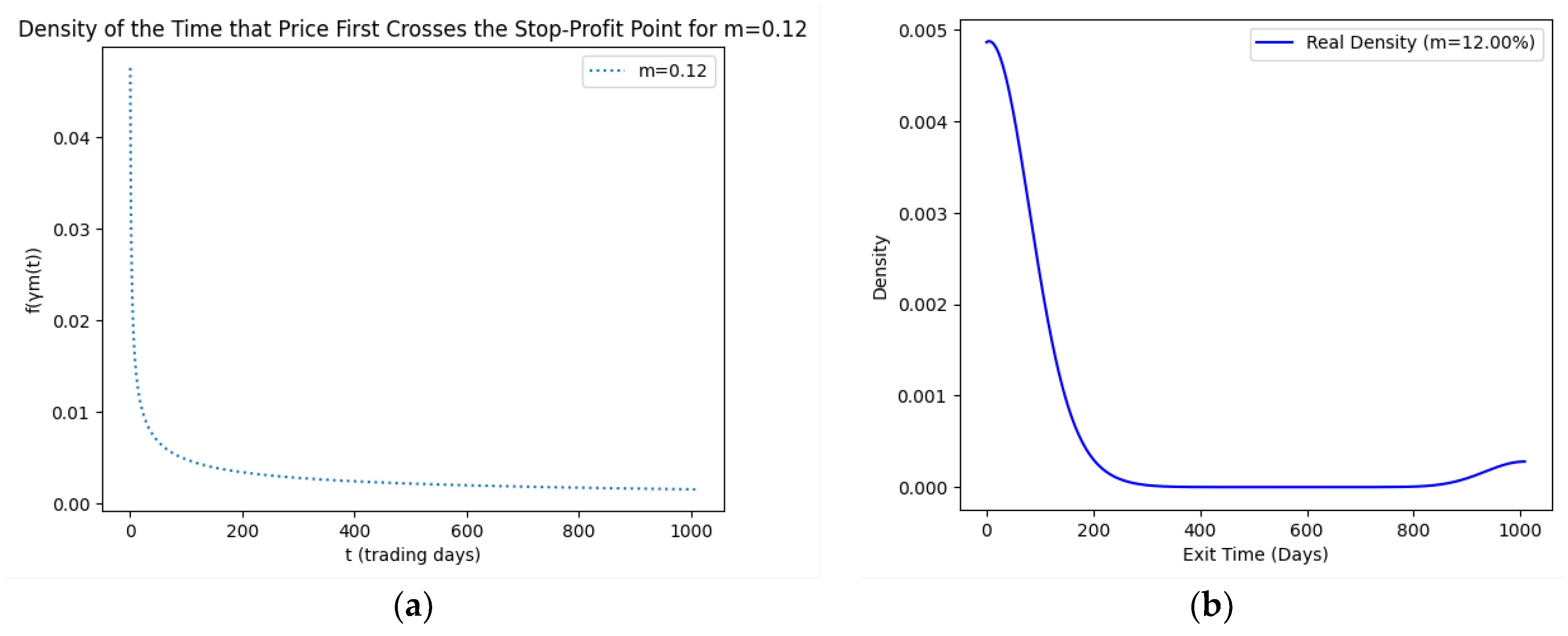

2.2. SPP-CVaR Risk Measure

2.3. Shannon Entropy

3. DEA-Based Evaluation Model of Assets’ Performance

3.1. Evaluation of Assets’ Performance over the Entire Time Horizon Using Traditional Risk Measures

3.2. SPP-CVaR-Based Evaluation of Portfolios’ Performance

4. Empirical Application

4.1. The Data Analysis

4.2. Portfolio Selection

5. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Eiteman, D.K. The S.E.C. Special Study and the Exchange Markets. J. Financ. 1966, 21, 311–323. [Google Scholar] [CrossRef]

- Tschoegl, A.E. The source and consequences of stop orders: A conjecture. Manag. Decis. Econ. 1988, 9, 83–85. [Google Scholar] [CrossRef][Green Version]

- Osler, C.L. Currency Orders and Exchange Rate Dynamics: An Explanation for the Predictive Success of Technical Analysis. J. Financ. 2003, 58, 1791–1819. [Google Scholar] [CrossRef]

- Bensaid, B.; Olivier, D.B. Les Stratégies” Stop-Loss”: Théorie et Application au Contrat Notionnel du Matif; Annales d’Economie et de Statistique. 2000, pp. 21–56. Available online: https://www.banque-france.fr/ (accessed on 9 February 2023).

- Markowitz, H.M. Portfolio selection. J. Financ. 1952, 7, 77–91. [Google Scholar]

- Magill, M.J.P.; Constantinides, G.M. Portfolio selection with transactions costs. J. Econ. Theory 1976, 13, 245–263. [Google Scholar] [CrossRef]

- Merton, R.C. Lifetime Portfolio Selection under Uncertainty: The Continuous-Time Case. Rev. Econ. Stat. 1969, 51, 247. [Google Scholar] [CrossRef]

- Merton, R.C. Optimum consumption and portfolio rules in a continuous-time model. J. Econ. Theory 1971, 3, 373–413. [Google Scholar] [CrossRef]

- Davis, M.H.A.; Norman, A.R. Portfolio selection with transaction costs. Math. Oper. Res. 1990, 15, 676–713. [Google Scholar] [CrossRef]

- Bin, L. A new risk measure and its application in portfolio optimization: The SPP–CVaR approach. Econ. Model. 2015, 51, 383–390. [Google Scholar] [CrossRef]

- Konno, H.; Shirakawa, H. Existence of A Nonnegative Equilibrium Price Vector in The Mean-Variance Capital Market. Math. Financ. 1995, 5, 233–246. [Google Scholar] [CrossRef]

- Morgan, J.P. Risk Metrics Technical Documents, 4th ed.; Morgan Guaranty Trust Company: New York, NY, USA, 1996. [Google Scholar]

- Baumol, W.J. An Expected Gain-Confidence Limit Criterion for Portfolio Selection. Manag. Sci. 1963, 10, 174–182. [Google Scholar] [CrossRef]

- Artzner, P.; Delbaen, F.; Eber, J.M.; Heath, D. Coherent measures of risk. Math. Financ. 1999, 9, 203–228. [Google Scholar] [CrossRef]

- Mausser, H.; Rosen, D. Beyond VaR: From Measuring Risk to Managing Risk. ALGO Res. Q. 1998, 1, 5–20. [Google Scholar]

- Rockafellar, R.T.; Uryasev, S. Conditional value-at-risk for general loss distributions. J. Bank. Financ. 2002, 26, 1443–1471. [Google Scholar] [CrossRef]

- Pflug, G.; Swietanowski, A. Selected parallel optimization methods for financial management under uncertainty. Parallel Comput. 2000, 26, 3–25. [Google Scholar] [CrossRef]

- Ogryczak, W.; Ruszczynski, A. Dual Stochastic Dominance and Quantile Risk Measures. Int. Trans. Oper. Res. 2002, 9, 661–680. [Google Scholar] [CrossRef]

- Chekhlov, A.; Uryasev, S.; Zabarankin, M. Portfolio optimization with drawdown constraints. In Supply Chain and Finance; World Scientific: Singapore, 2004; pp. 209–228. [Google Scholar]

- Philippatos, G.C.; Wilson, C.J. Entropy, market risk, and the selection of efficient portfolios. Appl. Econ. 1972, 4, 209–220. [Google Scholar] [CrossRef]

- Huang, X. Portfolio Analysis: From Probabilistic to Credibilistic and Uncertain Approaches; Springer: Berlin/Heidelberg, Germany, 2010; ISBN 978-3-642-11213-3. [Google Scholar] [CrossRef]

- Eberlein, E.; Keller, U. Hyperbolic Distributions in Finance; Bernoulli: Groningen, The Netherlands, 2023; pp. 281–299. [Google Scholar]

- Banihashemi, S.; Navidi, S. Portfolio performance evaluation in Mean-CVaR framework: A comparison with non-parametric methods value at risk in Mean-VaR analysis. Oper. Res. Perspect. 2017, 4, 21–28. [Google Scholar] [CrossRef]

- Portela, M.C.A.S.; Thanassoulis, E.; Simpson, G. Negative data in DEA: A directional distance approach applied to bank branches. J. Oper. Res. Soc. 2004, 55, 1111–1121. [Google Scholar] [CrossRef]

- Shannon, C.E. A Mathematical theory of communication. Bell Syst. Tech. J. 1948, 27, 379–423. [Google Scholar] [CrossRef]

- Bakry, W.; Rashid, A.; Al-Mohamad, S.; El-Kanj, N. Bitcoin and portfolio diversification: A portfolio optimization approach. J. Risk Financ. Manag. 2021, 14, 282. [Google Scholar] [CrossRef]

| Asset | CVaR | Mean Return | Efficiency Score |

|---|---|---|---|

| Coca-Cola | 0.03745 | 0.00018 | 0.79 |

| Amazon | 0.05365 | 0.00018 | 0.68 |

| Pfizer | 0.03969 | 0.0000865 | 0.75 |

| Tesla | 0.09969 | 0.00229 | 1 |

| Oil | 0.11004 | 0.00038 | 0.47 |

| Gold | 0.02453 | 0.00035 | 1 |

| Meta | 0.06882 | 0.00007469 | 0.58 |

| Bitcoin | 0.11175 | 0.00178 | 0.7 |

| Asset | Stop-Profit Point | Exit Time | SPP-CVaR | Mean Return | Efficiency Score with Exit Time | Efficiency Score with Exit Time and Entropy | ||

|---|---|---|---|---|---|---|---|---|

| θ = 0.75 | θ = 1.5 | θ = 2.2 | ||||||

| Coca-Cola | 2% | 2 | 0.000230 | 0.00494 | 0.04 | 0.21 | 0.81 | 1 |

| Coca-Cola | 4% | 8 | 0.0007 | 0.0031 | 0.02 | 0.14 | 0.36 | 0.76 |

| Amazon | 2% | 8 | 0.000916 | −0.0002 | 0.01 | 0.11 | 0.29 | 0.63 |

| Amazon | 6% | 9 | 0.00096 | 0.0053 | 0.03 | 0.15 | 0.4 | 0.88 |

| Pfizer | 2% | 1 | 0.00016 | 0.00461 | 1 | 1 | 1 | 1 |

| Pfizer | 4% | 2 | 0.0001615 | 0.0189 | 1 | 1 | 1 | 1 |

| Oil | 2% | 2 | 0.00064 | −0.0229 | 0.01 | 0.06 | 0.18 | 0.63 |

| Oil | 4% | 3 | 0.0012 | 0.01119 | 0.05 | 0.26 | 0.71 | 1 |

| Meta | 2% | 8 | 0.00088 | −0.0003 | 0.01 | 0.11 | 0.29 | 0.62 |

| Meta | 6% | 7 | 0.000297 | 0.00453 | 0.03 | 0.19 | 0.54 | 1 |

| Asset | Stop-Profit Point | Exit Time | SPP-CVaR | Mean Return | Efficiency Score with Exit Time | Efficiency Score with Exit Time and Entropy | ||

|---|---|---|---|---|---|---|---|---|

| θ = 0.75 | θ = 1.5 | θ = 1.7 | ||||||

| Coca-Cola | 6% | 16 | 0.001613 | 0.002759 | 0.05 | 0.09 | 0.3 | 0.47 |

| Amazon | 8% | 10 | 0.0010479 | 0.00777 | 1 | 1 | 1 | 1 |

| Amazon | 10% | 12 | 0.002868 | 0.00758 | 0.35 | 0.54 | 0.65 | 0.65 |

| Meta | 8% | 14 | 0.001187 | 0.003991 | 0.27 | 0.28 | 0.5 | 0.68 |

| Bitcoin | 2% | 21 | 0.0000577 | 0.00068 | 1 | 1 | 1 | 1 |

| Bitcoin | 6% | 21 | 0.0000622 | 0.00267 | 1 | 1 | 1 | 1 |

| Asset | Stop-Profit Point | Exit Time | SPP-CVaR | Mean Return | Efficiency Score with Exit Time | Efficiency Score with Exit Time and Entropy | ||

|---|---|---|---|---|---|---|---|---|

| θ = 0.75 | θ = 1.2 | θ = 1.5 | ||||||

| Coca-Cola | 8% | 22 | 0.003711 | 0.002831 | 0.78 | 0.8 | 1 | 1 |

| Coca-Cola | 10% | 24 | 0.003532 | 0.003301 | 1 | 1 | 1 | 1 |

| Tesla | 2% | 26 | 0.001274 | −0.0022 | 0.38 | 0.4 | 0.43 | 0.64 |

| Tesla | 6% | 27 | 0.001165 | 0.0008237 | 0.82 | 0.84 | 0.9 | 1 |

| Gold | 2% | 28 | 0.0008493 | 0.0005553 | 1 | 1 | 1 | 1 |

| Gold | 6% | 29 | 0.000928 | 0.001130 | 1 | 1 | 1 | 1 |

| Asset | Stop-Profit Point | Exit Time | SPP-CVaR | Mean Return | Efficiency Score with Exit Time | Efficiency Score with Exit Time and Entropy | ||

|---|---|---|---|---|---|---|---|---|

| θ = 0.75 | θ = 1.2 | θ = 2.01 | ||||||

| Amazon | 12% | 96 | 0.01394 | 0.00114 | 0.19 | 0.21 | 0.48 | 0.94 |

| Pfizer | 6% | 74 | 0.01018 | 0.000794 | 0.21 | 0.22 | 0.36 | 0.68 |

| Pfizer | 8% | 79 | 0.01262 | 0.000767 | 0.18 | 0.19 | 0.34 | 0.66 |

| Tesla | 10% | 74 | 0.00333 | −0.000459 | 0.22 | 0.24 | 0.51 | 1 |

| Tesla | 12% | 76 | 0.006018 | 0.00120 | 0.36 | 0.37 | 0.58 | 1 |

| Gold | 8% | 43 | 0.001068 | 0.001377 | 1 | 1 | 1 | 1 |

| Gold | 10 | 98 | 0.0010646 | 0.000916 | 1 | 1 | 1 | 1 |

| Meta | 12% | 43 | 0.004394 | 0.002012 | 1 | 1 | 1 | 1 |

| Asset | Stop-Profit Point | Exit Time | SPP-CVaR | Mean Return | Efficiency Score with Exit Time | Efficiency Score with Exit Time and Entropy | |

|---|---|---|---|---|---|---|---|

| θ = 0.75 | θ = 1.5 | ||||||

| Pfizer | 10% | 140 | 0.02169 | 0.000705 | 1 | 1 | 1 |

| Pfizer | 12% | 142 | 0.02233 | 0.00068 | 0.82 | 0.85 | 0.92 |

| Oil | 8% | 218 | 0.02490 | 0.000151 | 0.03 | 0.03 | 0.12 |

| Oil | 10% | 219 | 0.01765 | 0.000428 | 0.05 | 0.05 | 0.2 |

| Oil | 12% | 222 | 0.01308 | 0.000329 | 0.07 | 0.07 | 0.22 |

| Gold | 12% | 363 | 0.000915 | 0.000324 | 0.94 | 0.94 | 1 |

| Bitcoin | 10% | 177 | 0.000845 | 0.000205 | 1 | 1 | 1 |

| Bitcoin | 12% | 179 | 0.000885 | 0.000542 | 1 | 1 | 1 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Ghasemi Doudkanlou, M.; Chandro, P.; Banihashemi, S. The Effect of Exit Time and Entropy on Asset Performance Evaluation. Entropy 2023, 25, 1252. https://doi.org/10.3390/e25091252

Ghasemi Doudkanlou M, Chandro P, Banihashemi S. The Effect of Exit Time and Entropy on Asset Performance Evaluation. Entropy. 2023; 25(9):1252. https://doi.org/10.3390/e25091252

Chicago/Turabian StyleGhasemi Doudkanlou, Mohammad, Prokash Chandro, and Shokoofeh Banihashemi. 2023. "The Effect of Exit Time and Entropy on Asset Performance Evaluation" Entropy 25, no. 9: 1252. https://doi.org/10.3390/e25091252

APA StyleGhasemi Doudkanlou, M., Chandro, P., & Banihashemi, S. (2023). The Effect of Exit Time and Entropy on Asset Performance Evaluation. Entropy, 25(9), 1252. https://doi.org/10.3390/e25091252